Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Abbott Laboratories | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Abbott Laboratories

100 Abbott Park Road

Abbott Park, Illinois 60064-6400 U.S.A.

On the Cover: Tyler Walsh, Quality Control Technician, Rapid Diagnostics

By leveraging Abbott's experience in

infectious disease assay development and

research—knowing which regions of the

virus to target and applying proven

development approaches—we were able

to quickly develop a comprehensive array

of highly accurate tests for COVID-19 in a

matter of months, a process that often

takes years.

| | PAGE | |

|---|---|---|

| | | |

Notice of Annual Meeting of Shareholders | 2 | |

Proxy Summary | 3 | |

Information About the Annual Meeting | 12 | |

Notice and Access | 12 | |

How to Attend the Meeting on the Virtual Meeting Platform | 12 | |

How to Attend the Meeting by Phone | 12 | |

Who Can Vote | 12 | |

How To Vote | 13 | |

How to Submit Questions | 13 | |

Technical Support | 13 | |

Revoking a Proxy | 13 | |

Cumulative Voting | 13 | |

Discretionary Voting Authority | 14 | |

Quorum and Vote Required to Approve Each Item on the Proxy | 14 | |

Effect of Withhold Votes, Broker Non-Votes, and Abstentions | 14 | |

Inspectors of Election | 14 | |

Cost of Soliciting Proxies | 15 | |

Abbott Laboratories Stock Retirement Plan | 15 | |

Confidential Voting | 15 | |

Householding of Proxy Materials | 15 | |

Nominees for Election as Directors (Item 1 on Proxy Card) | 16 | |

The Board of Directors and its Committees | 23 | |

The Board of Directors | 23 | |

Leadership Structure | 23 | |

Director Selection | 24 | |

Board Diversity and Composition | 25 | |

Board Evaluation Process | 26 | |

Committees of the Board of Directors | 27 | |

Communicating with the Board of Directors | 29 | |

Corporate Governance Materials | 29 | |

2020 Director Compensation | 30 | |

Security Ownership of Executive Officers and Directors | 32 | |

Executive Compensation | 33 | |

Compensation Discussion and Analysis | 33 | |

Compensation Committee Report | 60 | |

Compensation Risk Assessment | 61 | |

Summary Compensation Table | 63 | |

2020 Grants of Plan-Based Awards | 66 | |

2020 Outstanding Equity Awards at Fiscal Year-End | 67 | |

2020 Option Exercises and Stock Vested | 75 | |

Pension Benefits | 75 | |

Potential Payments Upon Termination or Change in Control | 78 | |

CEO Pay Ratio | 80 |

| | PAGE | |

|---|---|---|

| | | |

Ratification of Ernst & Young LLP as Auditors (Item 2 on Proxy Card) | 81 | |

Report of the Audit Committee | 82 | |

Say on Pay—An Advisory Vote on the Approval of Executive Compensation (Item 3 on Proxy Card) | 83 | |

Approval and Adoption of Amendments to the Articles of Incorporation To Eliminate Statutory Supermajority Voting Standards (Item 4 on Proxy Card) | 85 | |

Shareholder Proposals | 87 | |

Shareholder Proposal on Lobbying Disclosure (Item 5 on Proxy Card) | 88 | |

Shareholder Proposal on Report on Racial Justice (Item 6 on Proxy Card) | 91 | |

Shareholder Proposal on Independent Board Chairman (Item 7 on Proxy Card) | 95 | |

Approval Process for Related Person Transactions | 97 | |

Additional Information | 98 | |

Information Concerning Security Ownership | 98 | |

Date for Receipt of Shareholder Proposals for the 2022 Annual Meeting Proxy Statement | 98 | |

Procedure for Recommendation and Nomination of Directors and Transaction of Business at Annual Meeting | 99 | |

General | 100 | |

Exhibit A—Director Independence Standard | A-1 | |

Exhibit B—Proposed Amendments to | B-1 |

![]() 1

1

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 23, 2021

The Annual Meeting of the Shareholders of Abbott Laboratories will be held at Abbott's headquarters, 100 Abbott Park Road, at the intersection of Route 137 and Waukegan Road, Lake County, Illinois, on Friday, April 23, 2021, at 9:00 a.m.

In light of restrictions and guidelines on group gatherings issued by government and public health officials regarding the ongoing coronavirus pandemic, and to support the health and safety of Abbott's shareholders, employees, and communities, shareholders may only attend the Annual Meeting virtually. Shareholders will not be able to attend the Annual Meeting in person.

Shareholders of record as of the close of business on February 24, 2021 will be able to attend the Annual Meeting at www.meetingcenter.io/290382097. To be admitted to the Annual Meeting, shareholders will be required to enter the meeting password (ABT2021) and a 15-digit control number. Shareholders who wish to attend the meeting on a listen-only phone line should contact Abbott representatives at 224-668-7238 or abbottshareholders@abbott.com to obtain the meeting telephone number in advance of the meeting. Please see pages 12 and 13 for further instructions on how to be admitted to the Annual Meeting.

Shareholders will be asked to vote on the following items of business:

| Agenda | Board Voting Recommendation | |||

| | | | | |

| Item 1 | Election of the 13 director nominees named in this proxy statement to hold office until the next Annual Meeting or until the next meeting of shareholders at which directors are elected | FOR Each Director Nominee | ||

| | | | | |

| Item 2 | Ratification of the appointment of Ernst & Young LLP as auditors of Abbott for 2021 | FOR | ||

| | | | | |

| Item 3 | Approval, on an advisory basis, of executive compensation | FOR | ||

| | | | | |

| Item 4 | Approval and adoption of amendments to the Articles of Incorporation to eliminate statutory supermajority voting standards for: | FOR | ||

| (a) amendments to the Articles of Incorporation, and | ||||

| (b) approval of certain extraordinary transactions | ||||

| | | | | |

| Items 5 – 7 | Three shareholder proposals, if properly presented at the meeting | AGAINST | ||

| | | | | |

Shareholders will also transact such other business as may properly come before the meeting, including any adjournment or postponement thereof.

Abbott's 2021 Proxy Statement and 2020 Annual Report to Shareholders are available at www.abbott.com/proxy.

Please sign and promptly return your proxy or voting instruction form in the enclosed envelope, or vote your shares by telephone or using the Internet.

If you are a registered shareholder (you received your proxy materials from Abbott through Abbott's transfer agent, Computershare), you may vote your shares by telephone (1-800-652-VOTE (8683)) or on the Internet at www.investorvote.com/abt.

If you are a beneficial shareholder (you received your proxy materials from a broker, bank, or other agent), please refer to the voting instructions provided to you by your broker, bank, or other agent.

By order of the Board of Directors.

Hubert L. Allen

Secretary

March 12, 2021

2 ![]()

This summary contains highlights about Abbott and the upcoming 2021 Annual Meeting of Shareholders. This summary does not contain all of the information that you should consider in advance of the meeting, and we encourage you to read the entire proxy statement carefully before voting.

The accompanying proxy is solicited by the Board of Directors on behalf of Abbott for use at the Annual Meeting of Shareholders. The meeting will be held on April 23, 2021, at Abbott's headquarters, 100 Abbott Park Road, at the intersection of Route 137 and Waukegan Road, Lake County, Illinois. This proxy statement and the accompanying proxy card are being mailed to shareholders on or about March 12, 2021.

In light of restrictions and guidelines on group gatherings issued by government and public health officials regarding the ongoing coronavirus pandemic, and to support the health and safety of Abbott's shareholders, employees, and communities, any shareholder who wishes to attend the Annual Meeting may only attend virtually. Shareholders will not be able to attend the Annual Meeting in person. For more information on how to access and participate in the Annual Meeting, please see pages 12 to 13.

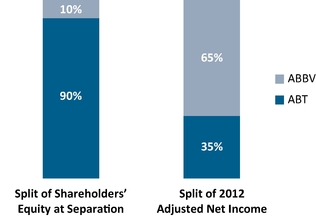

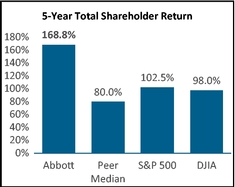

ABBOTT'S DIVERSIFIED BUSINESS MODEL DELIVERS LEADING LONG-TERM GROWTH |

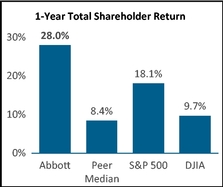

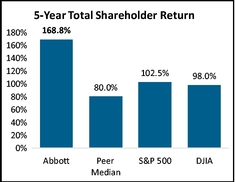

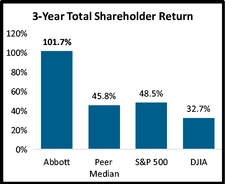

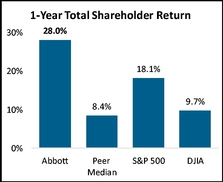

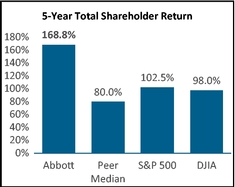

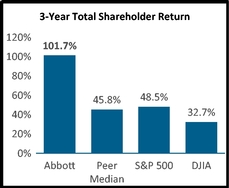

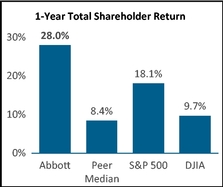

Abbott's sustained strong performance has resulted in total shareholder return (TSR) significantly exceeding the peer median and major market indices on a one-, three-, and five-year basis.

Abbott's three-year TSR of 101.7% is more than twice that of the peer group median and the broader Standard & Poor's 500 (S&P 500) and more than three times that of the Dow Jones Industrial Average (DJIA) market index. These consistent above-market returns are driven by the strength of our diversified business model with leadership positions in some of the largest and fastest growing markets in healthcare and innovative product portfolios across our businesses.

Abbott delivered strong returns for shareholders in 2020, despite the global market challenges from COVID-19, and achieved or exceeded the financial targets that were set before the pandemic in January 2020. Abbott's one-year TSR was 28.0%, more than three times the peer median TSR, and significantly above major market indices, a testament to the strength of our diversified business model and ability to innovate and deliver in this challenging environment.

|  |  |

In addition to delivering significant shareholder returns, Abbott continued to take important steps to position the Company for long-term, sustainable growth.

- •

- Achieved important product approvals in 2020 across our businesses that will be significant contributors to growth in the coming years.

- •

- Increased manufacturing scale and capabilities across several important products, including significant investment in COVID-19 diagnostic test capacity to help meet immediate global testing needs and further accelerate Abbott's leadership position in diagnostic testing.

- •

- Returned $2.6 billion to shareholders through dividends in 2020 and announced a 25% increase to the dividend payable in 2021, demonstrating Abbott's financial strength and commitment to shareholder returns.

- •

- Launched our 2030 Sustainability Plan focused on Abbott's greatest opportunities to make an impact: creating new life-changing technologies and products, expanding the access and affordability of this innovation, and breaking down barriers that prevent people from getting the care they need.

![]() 3

3

COVID-19 RESPONSE |

CONTRIBUTION TO GLOBAL TESTING NEEDS

Abbott quickly responded to the global spread of SARS-CoV-2. We leveraged our expertise in infectious disease diagnostic testing and in a short period time, developed multiple diagnostic tests to meet the various needs in the market. We have launched and scaled significant manufacturing capacity for our tests around the globe and sold over 400 million tests in 2020.

Abbott's rapid response, significant manufacturing scale, and affordable pricing strategy have allowed for broad access to testing and have further positioned Abbott as a world leader in diagnostic testing. The demand for COVID-19 tests remains strong and Abbott will continue to be a leader in supporting global testing needs.

As a healthcare company, Abbott has continued to provide an uninterrupted supply of vital diagnostics, medical devices, medicines and nutritional products to our customers. To help keep our own people safe, Abbott has taken aggressive steps to limit exposure and enhance the safety of facilities for our employees, including implementing mandatory temperature screening and social distancing, providing and requiring the use of personal protective equipment, and at most U.S. facilities, on-site COVID-19 testing.

Abbott has 109,000 employees in more than 160 countries, and throughout 2020, there were no pay cuts and we did not lay off or furlough any employees due to COVID-19. We're also assisting Abbott families whose lives have been disrupted by COVID-19 including, paying people when sick or in quarantine, offering flexible working hours, providing support for employees with children, and expanding employee assistance programs that offer health and wellness resources.

MAINTAINING ACCESS TO OUR TECHNOLOGIES AND PRODUCTS

Throughout the pandemic, we were able to continue providing our essential products to people around the world—even when route closures meant we needed to adapt and identify new delivery pathways. With more than 75,000 suppliers in 120 countries, Abbott's global supply chain enabled our life-changing technologies to get to the millions of people who need them, when they need them. That's why we have spent years building our supply chain resilience to function even under the greatest stresses.

4 ![]()

COMMITMENT TO DIVERSITY AND INCLUSION |

Diversity is fundamental at Abbott—from our people and our mindset to our business model. It's core to fulfilling our purpose, is embedded in our values and key to our long-term growth and success.

Over the years we have received numerous honors related to a diverse and inclusive culture—Fortune 100 Best Workplaces for Diversity, Forbes Best Employers for Diversity, Working Mother, Top Company for Executive Women, DiversityInc, and Best Companies for Multicultural Women. Our Chief Executive Officer heads our Diversity Council and executive leader compensation has been tied to diversity results for several years.

During 2020, we reviewed our practices and took steps to further our commitment to diversity and inclusion, including:

- •

- Communicated our values and our position against racism to our employees and external stakeholders

- •

- Enhanced the structure around Diversity and Inclusion including creating a new dedicated senior-level role, reporting to the global head of human resources

- •

- Initiated a listening process, where our leaders hear from employees about how they see diversity and inclusion at Abbott

Looking ahead, we are committed to further advancing diversity and inclusion across our company, and in our work with others, including:

- •

- Continuing our efforts to hire, develop and retain diverse talent

- •

- Supporting the advancement of underrepresented groups in science, technology, engineering and math (STEM) education through our focus on STEM internships as early as high school

- •

- Increasing transparency through the publication of a Diversity and Inclusion report, which will include detailed information on the composition of our workforce, our programs to support diversity and inclusion, and our progress on our goals

- •

- Committing to increase spend with diverse suppliers

![]() 5

5

EXECUTIVE COMPENSATION |

During 2020, we conducted extensive shareholder outreach to discuss our compensation program, among other topics. In the spring, we engaged shareholders representing over 60% of our outstanding shares to discuss various topics, including Abbott's market-leading disclosures that enhance shareholder understanding of how pay decisions are made and how the metrics we use are linked to business strategy and goals. Their feedback was overwhelmingly positive, which was reflected in the 92% support for Say-on-Pay Vote.

KEY FEATURES OF OUR EXECUTIVE COMPENSATION PROGRAM

The following practices and policies ensure alignment of interests between shareholders and executives, and effective ongoing compensation governance.

| COMPENSATION PRACTICE | | ABBOTT POLICY | | MORE INFORMATION ON PAGE | | |||||||||||

| | | | | | | | | | | | | | | | | |

| | Compensation is Market-Based | | Yes | | Benchmark peers with investment profiles, operating characteristics, and employment and business markets similar to Abbott. Annual incentive plan goals are set to exceed market growth in relevant markets/business segments | | 35-37 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Compensation is Performance-Based | Yes | Short-term and long-term incentive awards are 100% performance based. Annual incentive plan goals are set to exceed market growth in relevant markets/business segments | 36-37 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Double-Trigger Change in Control | | Yes | | Provide change in control benefits under double-trigger circumstances only | | 78-80 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Recoupment Policy | Yes | Forfeiture for misconduct provision in equity grants and recoup compensation when warranted | 60 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Robust Share Ownership Guidelines | | Yes | | Require significant share ownership for officers and directors, and share retention requirements until guidelines are met | | 30-31 and 59 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Capped Incentive Awards | Yes | Incentive award payments are capped | �� | 36 and 61 | ||||||||||||

| | | | | | | | | | | | | | | | | |

| | Independent Compensation Committee Consultant | | Yes | | Committee consultant performs no other work for Abbott | | 28 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Tax Gross Ups | No | No tax gross ups under our executive officer pay program | 58-59 and 79 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Guaranteed Bonuses | | No | | No guaranteed bonuses | | 36 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Employment Contracts | No | No employment contracts | 78 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Excessive Risk Taking | | No | | No highly leveraged incentive plans that encourage excessive risk taking | | 61-62 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Hedging of Company Shares | No | No hedging of Abbott shares is allowed | 60 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Discounted Stock Options | | No | | No discounted stock options are allowed or granted | | 61 | | ||||||||

| | | | | | | | | | | | | | | | | |

Details of the compensation decisions made for our named executive officers are outlined on pages 42 to 57.

6 ![]()

DIRECTOR NOMINEES |

The Board of Directors recommends a vote FOR the election of each of the following nominees for director. All nominees, other than Mr. Roman, are currently serving as directors. Additional information about each director nominee's background and experience can be found beginning on page 16.

| Name | Principal Occupation | | Age | Director Since | Committee Memberships | | |||||||

| | | | | | | | | | | | | | |

| | Robert J. Alpern, M.D. | Professor and Former Dean, | | 70 | 2008 | • Nominations and | | ||||||

| | Yale School of Medicine | | | | Governance | | |||||||

| | | | | | • Public Policy | | |||||||

| | | | | | | | | | | | | | |

| Roxanne S. Austin | President and CEO, | 60 | 2000 | • Compensation (Chair) | |||||||||

| Austin Investment Advisors | • Nominations and | ||||||||||||

| Governance | |||||||||||||

• Executive | |||||||||||||

| | | | | | | | | | | | | | |

| | Sally E. Blount, Ph.D. | CEO, Catholic Charities of the | | 59 | 2011 | • Nominations and | | ||||||

| | | Archdiocese of Chicago, and | | | | Governance | | ||||||

| | | Professor and Former Dean, | | | | • Public Policy | | ||||||

| | | J.L. Kellogg Graduate School | | | | | | ||||||

| | | of Management | | | | | | ||||||

| | | | | | | | | | | | | | |

| Robert B. Ford | President and CEO, | 47 | 2019 | • Executive | |||||||||

| Abbott Laboratories | |||||||||||||

| | | | | | | | | | | | | | |

| | Michelle A. Kumbier | Former Chief Operating Officer, | | 53 | 2018 | • Audit | | ||||||

| | Harley-Davidson Motor Company | | | | • Compensation | | |||||||

| | | | | | | | | | | | | | |

| Darren W. McDew | Retired General, U.S. Air Force, | 60 | 2019 | • Nominations and | |||||||||

| and Former Commander of | Governance | ||||||||||||

| U.S. Transportation Command | • Public Policy | ||||||||||||

| | | | | | | | | | | | | | |

| | Nancy McKinstry | CEO and Chairman of the Executive | | 62 | 2011 | • Audit | | ||||||

| | Board, Wolters Kluwer N.V. | | | | • Nominations and | | |||||||

| | | | | | Governance | | |||||||

| | | | | | | | | | | | | | |

| William A. Osborn | Retired Chairman and CEO, | 73 | 2008 | • Compensation | |||||||||

| (Lead Independent Director) | Northern Trust Corporation | • Nominations and | |||||||||||

| Governance (Chair) | |||||||||||||

• Executive | |||||||||||||

| | | | | | | | | | | | | | |

| | Michael F. Roman | Chairman, President, and CEO, | | 61 | New | | | ||||||

| | | 3M Company | | | Nominee | | | ||||||

| | | | | | | | | | | | | | |

| Daniel J. Starks | Retired Chairman, President and CEO, | 66 | 2017 | • Public Policy | |||||||||

| St. Jude Medical, Inc. | |||||||||||||

| | | | | | | | | | | | | | |

| | John G. Stratton | Retired Executive Vice President and | | 60 | 2017 | • Audit | | ||||||

| | | President of Global Operations, | | | | • Public Policy | | ||||||

| | | Verizon Communications Inc. | | | | | | ||||||

| | | | | | | | | | | | | | |

| Glenn F. Tilton | Retired Chairman, President | 72 | 2007 | • Audit | |||||||||

| and CEO, UAL Corporation | • Public Policy | ||||||||||||

| | | | | | | | | | | | | | |

| | Miles D. White | Executive Chairman, | | 66 | 1998 | • Executive (Chair) | | ||||||

| | | Abbott Laboratories | | | | | | ||||||

| | | | | | | | | | | | | | |

![]() 7

7

CORPORATE GOVERNANCE |

Abbott is committed to strong corporate governance that is aligned with shareholder interests. Our Board spends significant time with Abbott's senior management to understand the dynamics, issues, and opportunities for Abbott. During these interactions, directors provide insights and ask probing questions which guide management decision-making. This collaborative approach to risk oversight and emphasis on long term sustainability begins with our leaders and is engrained in Abbott's culture. The Board also regularly monitors leading practices in governance and adopts measures that it determines are in the best interest of Abbott and its shareholders.

On March 31, 2020, Miles D. White stepped down as Chief Executive Officer, after a remarkable 21-year tenure and became Executive Chairman of the Board. Robert B. Ford, previously President and Chief Operating Officer and a 24-year Abbott veteran, succeeded Mr. White as Abbott's President and Chief Executive Officer.

With this transition, Mr. Ford became the 13th CEO of Abbott in its 132-year history, all having been appointed from within, a testament to Abbott's strong management philosophy and succession-planning discipline.

Lead Independent Director with Distinct Responsibilities |

✓ | Elected annually by independent directors | ✓ | Authority to call meetings of independent directors | |||

✓ | Liaises between chairman and independent directors | ✓ | Reviews matters such as meeting topics and schedules | |||

✓ | Consults and engages directly with major shareholders | ✓ | Regularly presides over executive sessions of independent directors at Board meetings | |||

✓ | Leads annual Board and individual director performance reviews |

Robust Board Evaluation and Refreshment Process |

Other Board Governance Highlights |

- •

- Key standing Board Committees are fully independent: Audit, Compensation, Public Policy and Nominations and Governance

- •

- All directors elected annually by majority vote

- •

- Board conducts annual succession planning review of company management

- •

- Board receives regular updates and has oversight over Abbott's environmental, social and governance practices

8 ![]()

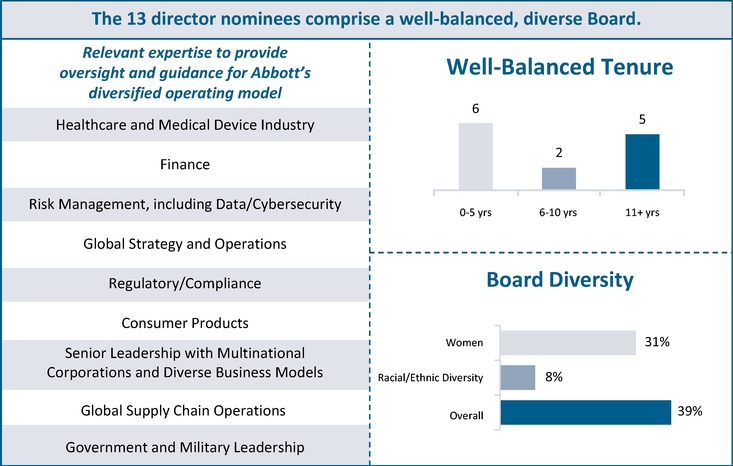

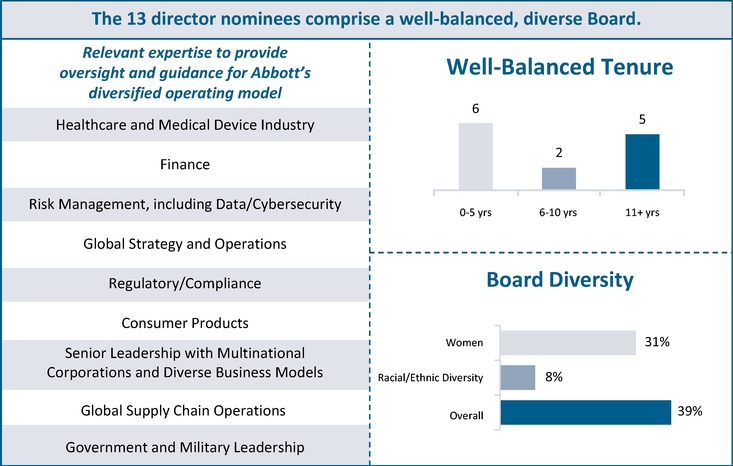

Highly qualified Board, with broad diversity across backgrounds, skills and experiences |

Active shareholder engagement throughout the year is essential to maintaining good corporate governance. We routinely seek investor input on a variety of topics, including corporate governance, executive compensation, sustainability and other strategic matters. During 2020, we conducted outreach with a cross-section of shareholders representing more than 60% of our outstanding shares. Investor sentiment and specific feedback was shared with executive management and the Board of Directors, as appropriate.

![]() 9

9

SUSTAINABILITY |

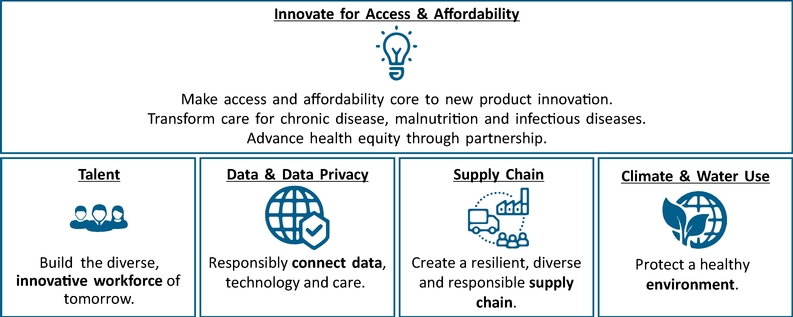

At Abbott, sustainability means managing our company to deliver long-term impact for the people we serve—shaping the future of healthcare and helping the greatest number of people live better and healthier lives.

Our Sustainability efforts are focused on the most relevant industry and company-specific risks and opportunities. In December 2020, we launched our new 2030 Sustainability Plan focused on Abbott's greatest opportunities to make an impact: creating new life-changing technologies and products, expanding the access and affordability of this innovation, and breaking down barriers that prevent people from getting the care they need. That reach and impact requires a strong foundation and sustainable business, which is why we're also taking action in key areas, including building the workforce of tomorrow, responsibly applying data to advance care, building a more resilient, diverse and responsible supply chain and protecting health by safeguarding the environment.

These areas have been identified through an in-depth materiality analysis, directed by executive management, and in partnership with numerous diverse stakeholders. We aim to deliver sustainable, responsible growth that improves lives and creates value in communities around the world.

The Board of Directors and its committees have oversight over Abbott's environmental, social and governance practices. The Board was presented with sustainability objectives and efforts and has regular discussions with management on all the above sustainability matters, as well as workplace, management, and Board diversity, emerging governance practices and trends, global compliance matters, and sustainability reporting. In addition, executive compensation is linked to Sustainability commitments, as discussed in more detail on pages 40 and 41.

To learn more about Abbott's Sustainability efforts, please visit www.abbott.com/responsibility/sustainability.html.

SELECT RECOGNITION BY THIRD-PARTY ORGANIZATIONS |

| • Dow Jones Sustainability Index global Industry Group Leader for 8 consecutive years. • Fortune's Most Admired Top 50 Company and leader in the Medical Products and Equipment sector for the past 8 years, and on Fortune's 2020 "Change the World" list for companies making positive social impacts through their core business. | |

| • Fast Company's 2020 World-Changing Company of the Year. • Recognized by Working Mother, Great Place to Work, DiversityInc, and several other publications for workplace leadership and diversity. • Member of the elite S&P 500 Dividend Aristocrats Index, which recognizes companies who have raised their dividend payout annually for at least 25 consecutive years. In December 2020, Abbott announced a 25% increase to its quarterly dividend. This is the 49th consecutive year that Abbott has increased its quarterly dividend. |

10 ![]()

VOTING MATTERS AND BOARD RECOMMENDATIONS |

| Election of 13 Director Nominees Named in this Proxy Statement: The Board recommends a vote FOR • Highly qualified Board, with diversity in backgrounds, skills and experiences. • Relevant expertise to provide oversight and guidance for Abbott's diversified operating model. See pages 16 to 22 for more information. | |

| Ratification of Ernst & Young as Auditors: The Board recommends a vote FOR • Independent firm with significant industry and financial reporting expertise. • See pages 81 to 82 for more information. | |

| Say on Pay: Advisory Vote on the Approval of Executive Compensation: The Board recommends a vote FOR • Market-based structure producing differentiated awards based on both company and individual performance, managed with independent oversight by the Compensation Committee. • Aligned to drive Abbott's strategic priorities, reflects consistent above-market TSR and upper-quartile Relative 3-year TSR performance vs. Peers. See pages 83 to 84 for more information. | |

| Approval and Adoption of Amendments to the Articles of Incorporation to Eliminate Statutory Supermajority Voting Standards: The Board recommends a vote FOR • Implementing majority voting standards for amendments to the Articles of Incorporation and approval of certain extraordinary transactions. See pages 85 to 86 for more information. | |

| The Board recommends a vote AGAINST • Proposal 5: Lobbying Disclosure • Proposal 6: Report on Racial Justice • Proposal 7: Independent Board Chairman • See pages 87 to 96 for more information. |

![]() 11

11

INFORMATION ABOUT THE ANNUAL MEETING

In accordance with the Securities and Exchange Commission's "Notice and Access" rules, Abbott mailed a Notice of Internet Availability of Proxy Materials (the "Notice") to certain shareholders in mid-March of 2021. The Notice describes the matters to be considered at the Annual Meeting and how the shareholders can access the proxy materials online. It also provides instructions on how those shareholders can vote their shares. If you received the Notice, you will not receive a print version of the proxy materials, unless you request one. If you would like to receive a print version of the proxy materials, free of charge, please follow the instructions on the Notice.

HOW TO ATTEND THE MEETING ON THE VIRTUAL MEETING PLATFORM

Shareholders can attend, vote their shares, and submit questions during the Annual Meeting at www.meetingcenter.io/290382097. Shareholders may log into the Annual Meeting beginning at 8:15 Central Time on April 23, 2021. The Annual Meeting will begin promptly at 9:00 a.m. Central Time.

To be admitted to the Annual Meeting, shareholders will be required to enter the meeting password (ABT2021) and a 15-digit control number.

Registered Shareholders. If you are a registered holder (i.e., you received your proxy materials from Abbott through Abbott's transfer agent, Computershare), you may attend the Annual Meeting without advance registration. Your 15-digit control number is provided on your proxy card, email, or Notice. Please follow the instructions on your proxy card, email, or Notice to attend the meeting. If you no longer have these documents, please contact Computershare at 1-888-332-2268.

Beneficial Shareholders. If you are a beneficial holder (i.e., you received your proxy materials from your broker, bank, or other agent), you must register in advance to receive a 15-digit control number and attend the Annual Meeting. To register, you must submit your name, email address, and one of the following registration materials to Computershare:

- •

- A copy of the voter instruction form contained in the proxy materials mailed to you from your broker;

- •

- A copy of a broker statement evidencing that you are an Abbott shareholder; or

- •

- A legal proxy from your broker reflecting your ownership of Abbott shares.

Please send your registration materials to Computershare at legalproxy@computershare.com, with "Registration Materials" in the subject line. Registration requests must be received by Computershare no later than 5 p.m. Eastern Time on Tuesday, April 20, 2021.

You will receive a confirmation of your registration by email from Computershare, along with a 15-digit control number needed to be admitted to the Annual Meeting. If you have questions, please contact Computershare at the telephone support line provided on the virtual meeting platform at www.meetingcenter.io/290382097.

HOW TO ATTEND THE MEETING BY PHONE

Shareholders who wish to attend the Annual Meeting by phone should contact Abbott representatives at 224-668-7238 or abbottshareholders@abbott.com to obtain the meeting telephone number in advance of the meeting. Shareholders participating by phone will be able to listen to the meeting but will not have the ability to vote or submit questions during the meeting. If you would like to vote your shares or submit questions during the meeting, please follow the instructions above in "How to Attend the Meeting on the Virtual Meeting Platform."

Shareholders of record at the close of business on February 24, 2021 will be entitled to notice of and to vote at the Annual Meeting. As of January 31, 2021, Abbott had 1,771,529,358 outstanding common shares, which are Abbott's only outstanding voting securities. All shareholders have cumulative voting rights in the election of directors and one vote per share on all other matters.

12 ![]()

Whether or not you plan to virtually attend the Annual Meeting, Abbott strongly urges you to submit your proxy or vote your shares in advance of the Annual Meeting.

Registered Shareholders. Registered shareholders may vote by mail by signing and promptly returning their proxy in the enclosed envelope. Abbott's By-Laws provide that a shareholder may authorize no more than two persons as proxies to attend and vote at the meeting. Registered shareholders may also vote their shares:

- •

- by telephone (1-800-652-VOTE (8683)), or

- •

- or on the Internet at www.investorvote.com/abt.

If you vote by telephone or using the Internet, you do not need to return your proxy card. The instructions for voting can be found with your proxy card or on the Notice.

Registered shareholders who have not voted their shares in advance of the meeting may do so at the Annual Meeting by clicking the "Cast Your Vote" link on the meeting center site.

Beneficial Shareholders. Beneficial shareholders should refer to the voting instructions provided by their broker, bank, or other agent to direct the voting of their shares in advance of the meeting.

Beneficial shareholders may vote their shares at the Annual Meeting if they obtain a legal proxy from their broker, bank, or other agent giving the shareholder the right to vote such shares at the Annual Meeting. Please follow the instructions provided above in "How to Attend the Meeting on the Virtual Meeting Platform."

Shareholders participating by phone will not be able to vote their shares at the Annual Meeting.

Following conclusion of the business items on the agenda for the Annual Meeting, Abbott will hold a live question and answer session where questions pertinent to meeting matters will be answered, as time permits. Shareholders participating in the meeting on the virtual meeting platform can submit questions during the Annual Meeting by clicking on the message icon in the upper right-hand corner of the page on the meeting center site. Questions that are substantially similar may be grouped together in a single response to avoid repetition and to allow more time for other questions.

Shareholders participating in the meeting by phone will not be able to submit questions during the meeting.

If you experience technical difficulties accessing the Annual Meeting, a technical support telephone number and additional support information will be available on the virtual meeting platform at www.meetingcenter.io/290382097.

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the Annual Meeting.

You may revoke your proxy by voting in person at the Annual Meeting or, at any time prior to the meeting:

- •

- by delivering a written notice to the Secretary of Abbott,

- •

- by delivering an authorized proxy with a later date, or

- •

- by voting by telephone or using the Internet after you have given your proxy.

Cumulative voting allows a shareholder to multiply the number of shares owned by the number of directors to be elected and to cast the total for one nominee or distribute the votes among the nominees, as the shareholder desires. Shareholders may not cumulate their votes against a nominee. If shares are voted cumulatively and there are more nominees than there are director vacancies, nominees who receive the greatest number of votes will be

![]() 13

13

elected. If you wish to cumulate your votes, you must sign and mail in your proxy card or attend the Annual Meeting.

DISCRETIONARY VOTING AUTHORITY

Unless authority is withheld in accordance with the instructions on the proxy, the persons named in the proxy will vote the shares covered by proxies they receive to elect the 13 nominees named in Item 1 on the proxy card. Should a nominee become unavailable to serve, the shares will be voted for a substitute designated by the Board of Directors, or for fewer than 13 nominees if, in the judgment of the proxy holders, such action is necessary or desirable. The persons named in the proxy may also decide to vote shares cumulatively in their sole discretion so that one or more of the nominees may receive fewer votes than the other nominees (or no votes at all), although they have no present intention of doing so. The proxy holders may not cast your vote for any nominee from whom you have withheld authority to vote.

Where a shareholder has specified a choice for or against the ratification of the appointment of Ernst & Young LLP as auditors, the advisory vote on the approval of executive compensation, the management proposal for approval and adoption of amendments to the Articles of Incorporation, or a shareholder proposal, or where the shareholder has abstained on these matters, the shares represented by the proxy will be voted (or not voted) as specified. Where no choice has been specified, the proxy will be voted FOR the ratification of Ernst & Young LLP as auditors, FOR the approval of executive compensation, FOR the approval and adoption of amendments to the Articles of Incorporation, and AGAINST the shareholder proposals.

Aside from matters set forth in this proxy statement, the Board of Directors is not aware of any other issue which may properly be brought before the meeting. If other matters are properly brought before the meeting, the accompanying proxy will be voted in accordance with the judgment of the proxy holders.

QUORUM AND VOTE REQUIRED TO APPROVE EACH ITEM ON THE PROXY

A majority of the outstanding shares entitled to vote on a matter, represented in person or by proxy, constitutes a quorum for consideration of that matter at the meeting. The affirmative vote of a majority of the shares represented at the meeting and entitled to vote on a matter shall be the act of the shareholders with respect to that matter, except for the management proposal to approve and adopt amendments to Abbott's Articles of Incorporation, which requires the affirmative vote of at least two-thirds of the votes of the shares entitled to vote on such amendments.

EFFECT OF WITHHOLD VOTES, BROKER NON-VOTES, AND ABSTENTIONS

Shares represented by proxies which are present and entitled to vote on a matter but which have elected to withhold authority to vote for one or more directors or to abstain from voting on another matter will have the effect of votes against those directors or that matter. A proxy submitted by an institution, such as a broker or bank that holds shares for the account of a beneficial owner, may indicate that all or a portion of the shares represented by that proxy are not being voted with respect to a particular matter. This could occur, for example, when the broker or bank is not permitted to vote those shares in the absence of instructions from the beneficial owner of the shares. These "non-voted shares" will be considered shares not present and, therefore, not entitled to vote on those matters, although these shares may be considered present and entitled to vote for other purposes. Brokers and banks have discretionary authority to vote shares in the absence of instructions on matters the New York Stock Exchange considers "routine", such as the ratification of the appointment of the auditors. They do not have discretionary authority to vote shares in absence of instructions on "non-routine" matters. The election of directors, the advisory vote on the approval of executive compensation, and management and shareholder proposals are "non-routine" matters. Non-voted shares will not affect the determination of the outcome of the vote on any matter to be decided at the meeting, except for the management proposal to approve and adopt amendments to Abbott's Articles of Incorporation, for which non-voted shares will have the effect of votes against that matter.

The inspectors of election and the tabulators of all proxies, ballots, and voting tabulations that identify shareholders are independent and are not Abbott employees.

14 ![]()

Abbott will bear the cost of making solicitations from its shareholders and will reimburse banks and brokerage firms for out-of-pocket expenses incurred in connection with this solicitation. Proxies may be solicited by mail, telephone, Internet, or in person by directors, officers, or employees of Abbott and its subsidiaries.

Abbott has retained Morrow Sodali LLC to aid in the solicitation of proxies at an estimated cost of $19,500 plus reimbursement for reasonable out-of-pocket expenses.

ABBOTT LABORATORIES STOCK RETIREMENT PLAN

Participants in the Abbott Laboratories Stock Retirement Plan will receive voting instructions for their shares held in the Abbott Laboratories Stock Retirement Trust. The Stock Retirement Trust is administered by both a trustee and an Investment Committee. The trustee of the Trust is The Northern Trust Company. The members of the Investment Committee are Mary K. Moreland, Karen M. Peterson, and Brian P. Wentworth, employees of Abbott. The voting power with respect to the shares is held by and shared between the Investment Committee and the participants. The Investment Committee must solicit voting instructions from the participants and follow the voting instructions it receives. The Investment Committee may use its own discretion with respect to those shares for which no voting instructions are received.

It is Abbott's policy that all proxies, ballots, and voting tabulations that reveal how a particular shareholder has voted be kept confidential and not be disclosed, except:

- •

- where disclosure may be required by law or regulation,

- •

- where disclosure may be necessary in order for Abbott to assert or defend claims,

- •

- where a shareholder provides comments with a proxy,

- •

- where a shareholder expressly requests disclosure,

- •

- to allow the inspectors of election to certify the results of a vote, or

- •

- in other limited circumstances, such as a contested election or proxy solicitation not approved and recommended by the Board of Directors.

HOUSEHOLDING OF PROXY MATERIALS

Shareholders sharing an address may receive only one copy of the proxy materials or the Notice of Internet Availability of Proxy Materials, unless their broker, bank, or other intermediary has received contrary instructions from any shareholder at that address. This is known as "householding." Shareholders wishing to discontinue householding and receive separate copies of the proxy materials or the Notice of Internet Availability of Proxy Materials should notify their broker, bank, or other intermediary.

![]() 15

15

NOMINEES FOR ELECTION AS DIRECTORS

| | ROBERT J. ALPERN, M.D. Director since 2008 Age 70 Ensign Professor of Medicine and Physiology and Professor of Internal Medicine and Cellular and Molecular Physiology, and Former Dean of Yale School of Medicine, New Haven, Connecticut | |

Dr. Alpern has served as the Ensign Professor of Medicine and Professor of Internal Medicine at Yale School of Medicine since June 2004. From June 2004 to January 2020, Dr. Alpern served as Dean of Yale School of Medicine. From July 1998 to May 2004, Dr. Alpern was the Dean of The University of Texas Southwestern Medical Center. Dr. Alpern also serves as a Director of AbbVie Inc. and Tricida, Inc. and served as a Director on the Board of Yale New Haven Hospital from October 2005 through January 2020.

As a result of his long-tenured leadership positions at the Yale School of Medicine and The University of Texas Southwestern Medical Center, and as a former Director on the Board of Yale New Haven Hospital, Dr. Alpern contributes valuable insights to the Board through his medical and scientific expertise and his knowledge of the health care environment and the scientific nature of Abbott's key research and development initiatives.

| | ROXANNE S. AUSTIN Director since 2000 Age 60 President and Chief Executive Officer, Austin Investment Advisors, Newport Coast, California (Private Investment and Consulting Firm) | |

Ms. Austin is President and Chief Executive Officer of Austin Investment Advisors, a private investment and consulting firm, and chairs the U.S. Mid-Market Investment Advisory Committee of EQT Partners. Previously, Ms. Austin also served as the President and Chief Executive Officer of Move Networks, Inc., a provider of Internet television services. Ms. Austin served as President and Chief Operating Officer of DIRECTV, Inc. Ms. Austin also served as Executive Vice President and Chief Financial Officer of Hughes Electronics Corporation and as a partner of Deloitte & Touche LLP. Ms. Austin served on the Board of Directors of Telefonaktiebolaget LM Ericsson from 2008 to 2016 and Target Corporation from 2002 to 2020. Ms. Austin currently serves on the Board of Directors of AbbVie Inc., CrowdStrike Holdings, Inc., Teledyne Technologies Incorporated, and Verizon Communications. Ms. Austin will not stand for re-election at Teledyne Technologies Incorporated's 2021 annual meeting of stockholders.

Through her extensive management and operating roles, including her financial roles, Ms. Austin contributes significant oversight and leadership experience, including financial expertise and knowledge of financial statements, corporate finance and accounting matters.

16 ![]()

| | SALLY E. BLOUNT, PH.D. Director since 2011 Age 59 Chief Executive Officer, Catholic Charities of the Archdiocese of Chicago, and Michael L. Nemmers Professor of Strategy and Former Dean of the J.L. Kellogg Graduate School of Management at Northwestern University, Evanston, Illinois | |

Ms. Blount has served as Chief Executive Officer of Catholic Charities of the Archdiocese of Chicago since August 2020. Ms. Blount also is the Michael L. Nemmers Professor of Strategy and former Dean of the J.L. Kellogg Graduate School of Management at Northwestern University from 2010 to 2018. From 2004 to 2010, she served as the Vice Dean and Dean of the Undergraduate College of New York University's Leonard N. Stern School of Business. Ms. Blount joined the faculty of New York University's Leonard N. Stern School of Business in 2001 and was the Abraham L. Gitlow Professor of Management and Organizations. Prior to joining NYU in 2001, Ms. Blount held academic posts at the University of Chicago's Graduate School of Business from 1992 to 2001. Ms. Blount currently serves on the Board of Directors of Ulta Beauty, Inc. and the Joyce Foundation.

Having served as Dean of the J.L. Kellogg Graduate School of Management at Northwestern University and as the Vice Dean and Dean of the Undergraduate College of New York University's Leonard N. Stern School of Business, Ms. Blount provides Abbott's Board with expertise on business organization, governance and business management matters.

| | ROBERT B. FORD Director since 2019 Age 47 President and Chief Executive Officer, Abbott Laboratories | |

Mr. Ford has served as Abbott's President and Chief Executive Officer since March 2020. Previously, Mr. Ford served as Abbott's President and Chief Operating Officer from 2018 to 2020, Executive Vice President, Medical Devices from 2015 to 2018, Senior Vice President, Diabetes Care from 2014 to 2015, and Vice President, Diabetes Care, Commercial Operations from 2008 to 2014. Prior to 2008, he served in various leadership roles across Abbott's Diagnostics, Nutrition, and Diabetes Care businesses in the U.S. and Latin America. Mr. Ford joined Abbott in 1996.

As Abbott's President and Chief Executive Officer, and having previously held leadership positions across several of Abbott's businesses, and ultimately assuming responsibility for all of Abbott's operating businesses as Chief Operating Officer, Mr. Ford contributes an extensive knowledge of the Company's global operations, a wide breadth of experience in strategy and execution, and valuable insights into global healthcare markets.

![]() 17

17

| | MICHELLE A. KUMBIER Director since 2018 Age 53 Former Senior Vice President and Chief Operating Officer of Harley-Davidson Motor Company, Milwaukee, Wisconsin (Motorcycle and Related Products Manufacturer) | |

Ms. Kumbier served as Senior Vice President and Chief Operating Officer of Harley-Davidson Motor Company from 2017 to 2020. Previously, she served as Senior Vice President of Motor Company Product and Operations from 2015 to 2017, as Senior Vice President of Motorcycle Operations from 2012 to 2015, and as Senior Vice President of Product Development from 2010 to 2012. She started her career with Harley-Davidson in 1997. Prior to Harley-Davidson, Ms. Kumbier was employed with Kohler Company, maker of premium plumbing products, in a variety of positions from 1986 to 1997. Ms. Kumbier currently serves as a Director of Teledyne Technologies Incorporated.

Having served in several executive roles at Harley-Davidson, Ms. Kumbier contributes extensive experience in the management of a multinational public company, including significant manufacturing, product development, business development, and strategic planning experience.

| | DARREN W. MCDEW Director since 2019 Age 60 Retired General, United States Air Force, and Former Commander of U.S. Transportation Command, Scott Air Force Base, Illinois | |

General McDew is a retired four-star general who served for 36 years in the United States military before retiring in October 2018. From August 2015 to August 2018, General McDew served as Commander, U.S. Transportation Command, the single manager for global air, land and sea transportation for the U.S. Department of Defense. Previously, he also served as Vice Director for Strategic Plans and Policy for the Joint Chiefs of Staff, Military Aide to the President, Director of Air Force Public Affairs, and Chief of Air Force Senate Liaison Division. General McDew currently serves on the Board of Directors of Parsons Corporation, Rolls-Royce, North America, Inc., United Services Automobile Association, and Boys & Girls Club of America.

Through his extensive leadership in the U.S. Air Force, General McDew contributes significant experience managing large, complex global operations, including strategic planning, security and risk management, cybersecurity, and supply chain and infrastructure management.

18 ![]()

| | NANCY MCKINSTRY Director since 2011 Age 62 Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V., Alphen aan den Rijn, the Netherlands (Global Information, Software, and Services Provider) | |

Ms. McKinstry has been the Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V. since September 2003 and a member of its Executive Board since June 2001. Ms. McKinstry serves on the Board of Accenture plc, the Board of Overseers of Columbia Business School, and the Board of Directors of Russell Reynolds Associates. Ms. McKinstry is also a member of the European Round Table of Industrialists. Ms. McKinstry served on the Board of Directors of Telefonaktiebolaget LM Ericsson (LM Ericsson Telephone Company) from 2004 to 2012.

As the Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V., Ms. McKinstry contributes global perspectives and management experience, including an understanding of key issues facing a multinational business such as Abbott's.

| | WILLIAM A. OSBORN Lead Independent Director Director since 2008 Age 73 Retired Chairman and Chief Executive Officer of Northern Trust Corporation (Multibank Holding Company) and The Northern Trust Company, Chicago, Illinois (Banking Services Company) | |

Mr. Osborn was Chairman of Northern Trust Corporation from 1995 through 2009 and served as its Chief Executive Officer from 1995 through 2007. Mr. Osborn currently serves as a Director of Caterpillar Inc. and General Dynamics Corporation. Mr. Osborn served on the Board of Directors of Nicor, Inc. from 1999 to 2006 and on the Board of Directors of Tribune Company from 2001 to 2012.

As the Chairman and Chief Executive Officer of Northern Trust Corporation and The Northern Trust Company, Mr. Osborn acquired broad experience in successfully overseeing complex global businesses operating in highly regulated industries.

![]() 19

19

| | MICHAEL F. ROMAN Director Nominee Age 61 Chairman of the Board, President and Chief Executive Officer, 3M Company, St. Paul, Minnesota (Global Manufacturing and Technology Company) | |

Mr. Roman has served as the Chairman of the Board, President and Chief Executive Officer of 3M Company since May 2019. Previously, he served as Chief Executive Officer from July 2018 to May 2019 and as Chief Operating Officer and Executive Vice President from July 2017 to June 2018 with direct responsibilities for 3M's five business groups and its international operations. From June 2014 to July 2017, Mr. Roman served as 3M's Executive Vice President, Industrial Business Group. He served as 3M's Senior Vice President, Business Development, from May 2013 to June 2014 and as Vice President and General Manager of Industrial Adhesives and Tapes Division from September 2011 to May 2013.

As Chairman of the Board, President and Chief Executive Officer of 3M Company, Mr. Roman has extensive experience leading a multinational public company with multiple businesses, contributing significant manufacturing, supply chain, technology, and finance experience, as well as valuable insights into corporate strategy and risk management.

| | DANIEL J. STARKS Director since 2017 Age 66 Retired Chairman, President and Chief Executive Officer of St. Jude Medical, Inc., St. Paul, Minnesota (Medical Device Manufacturer) | |

Mr. Starks served as the Chairman, President and Chief Executive Officer of St. Jude Medical, Inc. from 2004 until his retirement in January 2016, after which he served as its Executive Chairman of the Board until January 2017, when Abbott completed the acquisition of St. Jude Medical. Mr. Starks also served as President and Chief Operating Officer of St. Jude Medical from 2001 to 2004 and as its President and CEO, Cardiac Rhythm Management Business from 1997 to 2001.

Having served as St. Jude Medical's Executive Chairman and its Chairman, President and Chief Executive Officer, and having joined St. Jude Medical in 1996, Mr. Starks contributes not only comprehensive and critical knowledge of the medical devices industry, but also extensive business and management experience operating a global public company in a highly regulated industry.

20 ![]()

| | JOHN G. STRATTON Director since 2017 Age 60 Retired Executive Vice President and President of Global Operations, Verizon Communications Inc., New York, New York (Telecommunications and Media Company) | |

Mr. Stratton served as Executive Vice President and President of Global Operations of Verizon Communications Inc. from February 2015 to December 2018. Previously, he served as Executive Vice President and President of Global Enterprise and Consumer Wireline from April 2014 to February 2015, as President of Verizon Enterprise Solutions from January 2012 to April 2014, and as Chief Operating Officer and Executive Vice President of Verizon Wireless from October 2010 to January 2012. Mr. Stratton currently serves on the Board of Directors of General Dynamics Corporation. Mr. Stratton also served as a member of The President's National Security Telecommunications Advisory Committee from October 2012 to July 2018 and as Director of the Cellular Telecommunications Industry Association from February 2015 to July 2018.

Through his executive leadership at Verizon Communications, Mr. Stratton contributes extensive business and management experience operating a global public company such as Abbott, including valuable insights on corporate strategy and risk management. His service on the National Security Telecommunications Advisory Committee enables him to provide government perspective and experience in a highly regulated industry.

| | GLENN F. TILTON Director since 2007 Age 72 Retired Chairman, President and Chief Executive Officer of UAL Corporation, Chicago, Illinois (Airline Holding Company) | |

Mr. Tilton served as Chairman, President and Chief Executive Officer of UAL Corporation, and Chairman and Chief Executive Officer of United Air Lines, Inc., an air transportation company and wholly owned subsidiary of UAL Corporation, from September 2002 to October 2010. Mr. Tilton also served on the Board of United Continental Holdings, Inc. from 2001 to 2013 and served as its Non-Executive Chairman of the Board from October 2010 to December 2012. Mr. Tilton is also a Director of AbbVie Inc. and Phillips 66. Mr. Tilton also served on the Board of Directors of Lincoln National Corporation from 2002 to 2007, of TXU Corporation from 2005 to 2007, of Corning Incorporated from 2010 to 2012, and as Chairman of the Midwest for JPMorgan Chase & Co. and a member of its companywide Executive Committee from June 2011 to June 2014.

Having previously served as Chief Executive Officer of UAL Corporation and United Air Lines, Non Executive Chairman of the Board of United Continental Holdings, Inc., Chairman of the Midwest for JPMorgan Chase & Co., Chairman, President, and Vice Chairman of Chevron Texaco, and as Interim Chairman of Dynegy, Inc., Mr. Tilton acquired strong management experience overseeing complex multinational businesses operating in highly regulated industries, as well as expertise in finance and capital markets matters.

![]() 21

21

| | MILES D. WHITE Director since 1998 Age 66 Executive Chairman of the Board, Abbott Laboratories | |

Mr. White has served as Abbott's Executive Chairman of the Board since March 2020. Mr. White previously served as Abbott's Chairman of the Board and Chief Executive Officer from 1999 to 2020 and as an Executive Vice President from 1998 to 1999. He joined Abbott in 1984. He currently serves as a Director of Caterpillar Inc. and McDonald's Corporation.

Having joined Abbott in 1984 and having served as Chairman of the Board and Chief Executive Officer for 21 years, Mr. White contributes not only his valuable business, management and leadership experience, but also his extensive knowledge of the Company and its global operations, as well as key insights into strategic, management and operation matters, ensuring the appropriate level of oversight and responsibility is applied to all Board decisions.

22 ![]()

THE BOARD OF DIRECTORS AND ITS COMMITTEES

THE BOARD OF DIRECTORS |

The Board of Directors held 8 meetings in 2020. The average attendance of all directors at Board and committee meetings in 2020 was 98% and each director attended at least 75% of the total number of Board meetings and meetings of the committees on which he or she served. Abbott encourages its Board members to attend the annual shareholders meeting. Last year, all of Abbott's directors attended the annual shareholders meeting.

The Board has determined that each of the following individuals is independent in accordance with the New York Stock Exchange listing standards: R. J. Alpern, R. S. Austin, S. E. Blount, M. A. Kumbier, E. M. Liddy, D. W. McDew, N. McKinstry, P. N. Novakovic, W. A. Osborn, M. F. Roman, S. C. Scott III, D. J. Starks, J. G. Stratton, and G. F. Tilton. To determine independence, the Board applied the categorical standards attached as Exhibit A to this proxy statement. The Board also considered whether a director has any other material relationships with Abbott or its subsidiaries and concluded that none of these directors had a relationship that impaired the director's independence. This included consideration of the fact that some of the directors or their family members are officers or serve on boards of companies or entities to which Abbott sold products or made contributions or from which Abbott purchased products and services during the year. In making its determination, the Board relied on both information provided by the directors and information developed internally by Abbott.

The Board has risk oversight responsibility for Abbott and administers this responsibility both directly and with assistance from its committees.

LEADERSHIP STRUCTURE |

On March 31, 2020, Miles D. White stepped down as Chief Executive Officer, after a remarkable 21-year tenure, and became Executive Chairman of the Board. Robert B. Ford, Abbott's then-President and Chief Operating Officer, succeeded Mr. White as Abbott's President and Chief Executive Officer. With this transition, Mr. Ford became the 13th CEO of Abbott in its 132-year history, all having been appointed from within, a testament to Abbott's strong management philosophy and succession planning.

The Board is actively involved in succession planning and is focused on ensuring leadership continuity. The Board believes that the continuation of Mr. White's service as Executive Chairman is in the best interests of Abbott and its shareholders. Mr. White contributes comprehensive, in-depth knowledge of Abbott's businesses and the global health care industry, as well as valuable insights on leadership and strategy. The Board believes that his advice and guidance to Mr. Ford and the Board will help continue to facilitate a successful leadership transition.

The Board also has a lead independent director that is chosen by and from the independent members of the Board of Directors. Currently, the Chair of the Nominations and Governance Committee, Mr. Osborn, is the lead independent director, whose key functions and responsibilities include:

- •

- Serve as liaison between the Chairman of the Board and the independent directors,

- •

- Facilitate communication with the Board and preside over regularly conducted executive sessions of the independent directors or sessions where the Chairman of the Board is not present,

- •

- Review and approve matters, such as agenda items, schedule sufficiency, and, where appropriate, information provided to other Board members,

- •

- Lead annual performance reviews of individual directors and the full Board,

- •

- Has the authority to call meetings of the independent directors and, if requested by major shareholders, ensures that he or she is available for consultation and direct communication, and

- •

- Communicate regularly with the Chairman of the Board regarding appropriate agenda topics and other Board related matters.

The Board reviews its leadership structure on at least an annual basis. The Board has determined that this leadership structure ensures the appropriate level of oversight, independence and responsibility is applied to all Board decisions, including risk oversight, and is in the best interests of Abbott and its shareholders.

![]() 23

23

DIRECTOR SELECTION |

The Nominations and Governance Committee assists the Board of Directors in identifying individuals qualified to become Board members and recommends to the Board the nominees for election as directors at the next annual meeting of shareholders. The process used by the Nominations and Governance Committee to identify a nominee to serve as a member of the Board of Directors depends on the qualities being sought. From time to time, Abbott engages an executive search firm to assist the Committee in identifying individuals qualified to be Board members. Mr. Roman was recommended as a director nominee by a third-party search firm retained to help identify and evaluate potential director nominees.

Abbott's outline of directorship qualifications, which is part of Abbott's corporate governance guidelines, is available in the corporate governance section of Abbott's investor relations website (www.abbottinvestor.com). These qualifications describe specific characteristics that the Nominations and Governance Committee and the Board take into consideration when selecting nominees for the Board, such as: strong management experience and senior-level experience in medicine, hospital administration, medical and scientific research and development, finance, international business, technology, government, and academic administration. An individual nominee is not required to satisfy all the characteristics listed in the outline of directorship qualifications and there is no requirement that all such characteristics be represented on the Board.

In addition, Board members should have backgrounds that, when combined, provide a portfolio of experience and knowledge that will serve Abbott's governance and strategic needs. Board candidates will be considered on the basis of a range of criteria, including broad-based business knowledge and relationships, prominence, and excellent reputations in their primary fields of endeavor, as well as a global business perspective and commitment to good corporate citizenship. Directors should have demonstrated experience and ability that is relevant to the Board of Directors' oversight role with respect to Abbott's business and affairs. Each director's biography includes the particular experience and qualifications that led the Board to conclude that the director should serve on the Board. The directors' biographies are on pages 16 through 22.

A description of the procedure for the recommendation and nomination of directors, including by proxy access, is on page 99.

24 ![]()

BOARD DIVERSITY AND COMPOSITION |

In the process of identifying nominees to serve as members of the Board of Directors, the Nominations and Governance Committee considers the Board's diversity of relevant experience, areas of expertise, ethnicity, gender, and geography and assesses the effectiveness of the process in achieving that diversity.

The process used to identify and select nominees has resulted in a balanced, diverse, and well-rounded Board of Directors that possesses the skills, experiences, and perspectives necessary for its oversight role. All of Abbott's directors exhibit:

| ✓ | Global business perspective | ✓ | Successful track record | ✓ | Innovative thinking | |||||

✓ | Knowledge of corporate governance requirements and practices | ✓ | High integrity | ✓ | Commitment to good corporate citizenship |

![]() 25

25

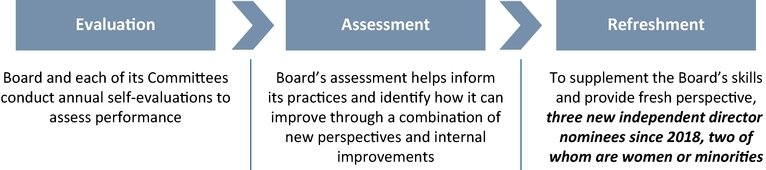

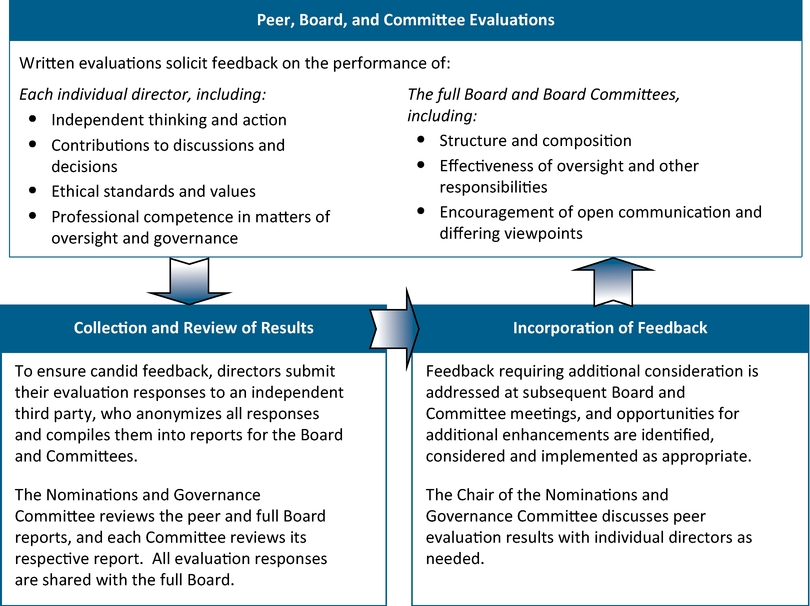

BOARD EVALUATION PROCESS |

Each year, Abbott's directors evaluate the effectiveness of the Board and its Committees in performing its governance and risk oversight responsibilities. Directors assess the performance of their peers, as well as the full Board of Directors and each of the Committees on which they serve, as follows:

26 ![]()

COMMITTEES OF THE BOARD OF DIRECTORS |

The Board of Directors has five committees established in Abbott's By-Laws: Audit Committee, Compensation Committee, Nominations and Governance Committee, Public Policy Committee, and Executive Committee.

All members of the Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee are independent. These Committees are governed by written charters setting forth their respective responsibilities, and each Committee reviews its charter at least annually, with any changes being recommended to the full Board for approval. Copies of the Committee charters are all available in the governance section of Abbott's investor relations website (www.abbottinvestor.com).

| | Current Members | Audit* | Compensation | Nominations and Governance | Public Policy† | Executive | | |||||||

| | | | | | | | | | | | | | | |

| | R. J. Alpern | | | | | | | |||||||

| | R. S. Austin | | | | | | | | | | | | | |

| | S. E. Blount | | | | | | | |||||||

| | | R. B. Ford | | | | | | | | | | | | |

| | M. A. Kumbier | | | | | | | |||||||

| | | E. M. Liddy | | | | | | | | | | | | |

| | D. W. McDew | | | | | | | |||||||

| | | N. McKinstry | | | | | | | | | | | | |

| | P. N. Novakovic | | | | | | | |||||||

| | | W. A. Osborn | | | | | | | | | | | | |

| | D. J. Starks | | | | | | | |||||||

| | | J. G. Stratton | | | | | | | | | | | | |

| | G. F. Tilton | | | | | | | |||||||

| | | M. D. White | | | | | | | | | | | | |

| | Total Meetings Held in 2020 | | 8 | | 4 | | 5 | | 4 | | 0 | | ||

| | | | | | | | | | | | | | | |

![]()

- *

- Each of the committee members is financially literate, as is required of audit committee members by the New York Stock Exchange. The Board of Directors has determined that Edward M. Liddy and Nancy McKinstry are "audit committee financial experts." The Board of Directors will appoint a new Audit Committee chair upon Mr. Liddy's retirement at the Annual Meeting.

- †

- Ms. Novakovic is not standing for re-election at the Annual Meeting. The Board of Directors will appoint a new Public Policy Committee chair upon conclusion of her tenure at the Annual Meeting.

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibility with respect to:

- •

- Abbott's accounting and financial reporting practices and the audit process,

- •

- The quality and integrity of Abbott's financial statements,

- •

- The independent auditors' qualifications, independence, and performance,

- •

- The performance of Abbott's internal audit function and internal auditors,

- •

- Legal and regulatory compliance relating to financial matters, including accounting, auditing, financial reporting, and securities law issues, and

- •

- Enterprise risk management, including major financial and cybersecurity risk exposures.

![]() 27

27

In performing these functions, the Audit Committee meets regularly with the independent auditor, Abbott's management, and Abbott's internal auditors to review the adequacy, effectiveness and quality of Abbott's accounting and financial reporting principles, policies, procedures and controls, as well as Abbott's enterprise risk management, including Abbott's risk assessment and risk management policies.

A copy of the report of the Audit Committee is on page 82.

The Compensation Committee assists the Board of Directors in carrying out the Board's responsibilities relating to the compensation of Abbott's executive officers and directors. Its primary responsibilities include:

- •

- Review director compensation annually and recommend to the full Board both the amount and the allocation between equity-based awards and cash. In recommending director compensation, the Compensation Committee takes comparable director fees into account and reviews any arrangement that could be viewed as indirect director compensation.

- •

- Review, approve, and administer the incentive compensation plans in which any executive officer participates and all of Abbott's equity-based plans. The Compensation Committee may delegate the responsibility to administer and make grants under these plans to management, except to the extent that such delegation would be inconsistent with applicable law or regulation or with the listing rules of the New York Stock Exchange.

- •

- Engage compensation consultants to provide counsel and advice on executive and non-employee director compensation matters. The consultant and its principal report directly to the Chair of the Committee. The principal meets regularly and as needed with the Committee in executive sessions, has direct access to the Chair during and between meetings, and performs no other services for Abbott or its senior executives.

The Committee determines what variables it will instruct the consultant to consider, including peer groups against which performance and pay should be examined, financial metrics to be used to assess Abbott's relative performance, competitive incentive practices in the marketplace, and compensation levels relative to market practice. The Committee negotiates and approves any fees paid to the consultant for these services.

The Compensation Committee engaged Meridian Compensation Partners, LLC as its compensation consultant for 2020. Meridian performs no other work for Abbott. Based on its evaluation of Meridian's independence in accordance with the New York Stock Exchange listing standards and information provided by Meridian, the Committee determined that the work performed by Meridian does not present any conflicts of interest.

A copy of the Compensation Committee report is on page 60.

Nominations and Governance Committee

The Nominations and Governance Committee assists the Board in fulfilling its oversight responsibility with respect to governance matters. Its primary responsibilities include:

- •

- Assist the Board in identifying individuals qualified to become Board members, and recommend to the Board the nominees for election as directors at the next annual meeting of shareholders,

- •

- Recommend to the Board the people to be elected as executive officers of Abbott,

- •

- Develop and recommend to the Board the corporate governance guidelines applicable to Abbott, and

- •

- Serve in an advisory capacity to the Board and the Chairman of the Board on matters of organization, management succession plans, major changes in the organizational structure of Abbott, and the conduct of Board activities.

The process used by this Committee to identify a nominee to serve as a member of the Board of Directors depends on the qualities being sought. From time to time, Abbott engages an executive search firm to assist the Committee in identifying individuals qualified to be Board members. The process used by the Committee to identify nominees is described on page 24 in the section captioned, "Director Selection."

28 ![]()

The Public Policy Committee assists the Board of Directors in fulfilling its oversight responsibility with respect to:

- •

- Certain areas of legal and regulatory compliance, including evaluating Abbott's compliance policies and practices and reviewing Abbott's compliance program,

- •

- Governmental affairs and healthcare compliance issues that affect Abbott, and

- •

- Abbott's public policy, including evaluating Abbott's social responsibility policies and practices and reviewing social, political, economic, and environmental trends and public policy issues that affect or could affect Abbott's business activities, performance, and public image.

The Executive Committee may exercise all the authority of the Board in the management of Abbott, except for matters expressly reserved by law for Board action.

COMMUNICATING WITH THE BOARD OF DIRECTORS |