- ABT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Abbott Laboratories (ABT) DEF 14ADefinitive proxy

Filed: 18 Mar 22, 4:27pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Abbott Laboratories

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS AND

PROXY STATEMENT 2022

| Abbott Laboratories 100 Abbott Park Road Abbott Park, Illinois 60064-6400 U.S.A. | ||

On the Cover: Dr. Veronika Meyer St. Gallen, Switzerland Veronika, a retired professor of chromatography, has been active her entire life, and takes every opportunity she can to go hiking in the mountains – those near her home, and others far afield. Notably, she was the first woman with a mechanical heart valve to reach the summit of Mt. Everest. |

| 1 |

NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 29, 2022

The Annual Meeting of the Shareholders of Abbott Laboratories will be held on Friday, April 29, 2022, at 9:00 a.m. Central Time.

The 2022 Annual Meeting of Shareholders will be held virtually to enable broader and more convenient shareholder participation and to support the health and safety of Abbott’s shareholders, employees, and communities during the ongoing coronavirus pandemic. There will not be a physical location for the Annual Meeting, and shareholders will not be able to attend the Annual Meeting in person.

Shareholders of record as of the close of business on March 2, 2022 will be able to attend the Annual Meeting at meetnow.global/ABT2022. To be admitted to the Annual Meeting, shareholders will be required to enter a 15-digit control number. Shareholders who wish to attend the meeting on a listen-only phone line should contact Abbott representatives at 224-668-7238 or abbottshareholders@abbott.com to obtain the meeting telephone number in advance of the meeting. Please see page 90 for further instructions on how to be admitted to the Annual Meeting.

Shareholders will be asked to vote on the following items of business:

| Agenda | Board Voting Recommendation | |||

| Item 1 | Election of the 12 director nominees named in this proxy statement to hold office until the next Annual Meeting or until the next meeting of shareholders at which directors are elected | FOR Each Director Nominee | ||

| Item 2 | Ratification of the appointment of Ernst & Young LLP as auditors of Abbott for 2022 | FOR | ||

| Item 3 | Approval, on an advisory basis, of executive compensation | FOR | ||

| Items 4-8 | Five shareholder proposals, if properly presented at the meeting | AGAINST |

Shareholders will also transact such other business as may properly come before the meeting, including any adjournment or postponement thereof.

This proxy statement and the accompanying proxy card, and the Notice of Internet Availability of Proxy Materials, are being provided to shareholders on or about March 18, 2022.

Abbott’s 2022 Proxy Statement and 2021 Annual Report to Shareholders are available at www.abbott.com/proxy.

YOUR VOTE IS IMPORTANT

Please sign and promptly return your proxy or voting instruction form in the enclosed envelope, or vote your shares by telephone or using the Internet.

If you are a registered shareholder (you received your proxy materials from Abbott through Abbott’s transfer agent, Computershare), you may vote your shares by telephone (1-800-652-VOTE (8683)) or on the Internet at www.investorvote.com/abt.

If you are a beneficial shareholder (you received your proxy materials from a broker, bank, or other agent), please refer to the voting instructions provided to you by your broker, bank, or other agent.

By order of the Board of Directors.

HUBERT L. ALLEN

Secretary

March 18, 2022

| 2 |  |

This summary contains highlights about Abbott and the upcoming 2022 Annual Meeting of Shareholders. This summary does not contain all of the information that you should consider in advance of the meeting, and we encourage you to read the entire proxy statement carefully before voting.

| ABBOTT’S DIVERSIFIED BUSINESS MODEL DELIVERS LEADING SHAREHOLDER RETURNS |

Abbott’s sustained strong performance has resulted in total shareholder return (TSR) exceeding the peer median and major market indices on a one-, three-, and five-year basis.

Abbott’s three-year TSR of 104% is more than twice that of the peer group median, and Abbott’s five-year TSR of 300% is more than four times that of the peer median. These consistent top-tier returns are driven by strong execution, an effective governance structure, and the strength of our diversified business model with leadership positions in some of the largest and fastest growing markets in healthcare and innovative product portfolios across our businesses.

Abbott delivered strong returns for shareholders in 2021, despite the continued global impact and uncertainty of COVID-19, and exceeded the financial targets that were set at the beginning of the year. Abbott’s one-year TSR was 31%, more than two and a half times the peer median TSR, a testament to the strength of our diversified business model and ability to innovate and deliver in this challenging environment.

In addition to delivering significant shareholder returns, Abbott continued to take important steps to position the Company for long-term, sustainable growth.

| ROBUST INNOVATION PIPELINE | INVESTING FOR FUTURE GROWTH | SHAREHOLDER RETURNS | GLOBAL LEADER IN COVID-19 TESTING | |||

| ● Steady stream of important product approvals across our businesses that will be significant contributors to growth in the coming years. | ● Increased manufacturing scale and capabilities across several important products. ● Nearly $2 billion invested in internal capital projects in the past year.

| ● Returned 50% of operating cash flow to shareholders in 2021 and announced the 50th year of consecutive dividend increases, demonstrating Abbott’s financial strength and commitment to shareholder returns. | ● Delivered 1 billion tests in 2021 to help meet global testing needs. ● Abbott’s rapid response and significant scale have allowed for broad access to testing and further positioned Abbott as a global leader in diagnostics. |

| 3 |

| EXECUTIVE COMPENSATION |

SHAREHOLDER FEEDBACK

In 2021, we met or initiated contact with shareholders representing over 60% of our outstanding shares, including 100% of our top 20 investors, in an open dialogue to discuss our compensation program and various topics, including:

| ● | The pandemic’s impact on our business, our COVID-19 testing response, and the strength and resilience of our diversified business model. | |

| ● | Business and sustainability strategy, including Abbott’s new 2030 Sustainability Plan and its focus on creating new life-changing technologies and products, expanding access and affordability of new product innovations and advancing health equity. | |

| ● | Human capital management and Abbott’s commitment to diversity, equity, and inclusion, including Abbott’s new Diversity, Equity and Inclusion Report which provides goals, our progress against them, and disclosure of EEO-1 data. | |

| ● | Board composition and refreshment, including the addition of four new independent directors since 2018, three of whom are women and/or minorities. | |

| ● | Executive compensation program, including Abbott’s continued enhanced compensation disclosure. |

Their feedback was overwhelmingly positive, which was reflected in the 92% support for our Say-on-Pay Proposal.

KEY FEATURES OF OUR EXECUTIVE COMPENSATION PROGRAM

The following practices and policies ensure alignment of interests between shareholders and executives, and effective ongoing compensation governance.

| Compensation Practice | Abbott Policy | More Information On Page | |

| Compensation is Market-Based | Yes | Benchmark peers with investment profiles, operating characteristics, and employment and business markets similar to Abbott. Annual incentive plan goals are set to exceed market growth in relevant markets/business segments | 30-33 |

| Compensation is Performance-Based | Yes | Short-term and long-term incentive awards are 100% performance based. Annual incentive plan goals are set to exceed market growth in relevant markets/business segments | 31-33 |

| Double-Trigger Change in Control | Yes | Provide change in control benefits under double-trigger circumstances only | 66-67 |

| Recoupment Policy | Yes | Forfeiture for misconduct provision in equity grants and recoup compensation when warranted | 51 |

| Robust Share Ownership Guidelines | Yes | Require significant share ownership for officers and directors, and share retention requirements until guidelines are met | 27 and 50 |

| Capped Incentive Awards | Yes | Incentive award payments are capped | 32 and 53 |

| Independent Compensation Committee Consultant | Yes | Committee consultant performs no other work for Abbott | 22 |

| Tax Gross Ups | No | No tax gross ups under our executive officer pay program | 49-50 |

| Guaranteed Bonuses | No | No guaranteed bonuses | 31 |

| Employment Contracts | No | No employment contracts | 65 |

| Excessive Risk Taking | No | No highly leveraged incentive plans that encourage excessive risk taking | 52-53 |

| Hedging of Company Shares | No | No hedging of Abbott shares is allowed | 51 and 53 |

| Discounted Stock Options | No | No discounted stock options are allowed or granted | 52 |

Details of the compensation decisions made for our named executive officers are outlined on pages 38 to 48.

| 4 |  |

| DIRECTOR NOMINEES |

The Board of Directors recommends a vote FOR the election of each of the following nominees for director. All nominees are currently serving as directors. Additional information about each director nominee’s background and experience can be found beginning on page 10.

| Name | Principal Occupation | Age | Director Since | Committee Memberships | ||||

| ROBERT J. ALPERN, M.D. Independent | Professor and Former Dean, Yale School of Medicine | 71 | 2008 | ● Nominations and Governance ● Public Policy | ||||

| SALLY E. BLOUNT, PH.D. Independent | President and CEO, Catholic Charities of the Archdiocese of Chicago, and Professor and Former Dean, J.L. Kellogg Graduate School of Management | 60 | 2011 | ● Nominations and Governance ● Public Policy | ||||

| ROBERT B. FORD | Chairman of the Board and Chief Executive Officer, Abbott Laboratories | 48 | 2019 | ● Executive (Chair) | ||||

| PAOLA GONZALEZ Independent | Vice President and Treasurer, The Clorox Company | 50 | 2021 | ● Audit | ||||

| MICHELLE A. KUMBIER Independent | President, Turf & Consumer Products, Briggs & Stratton, LLC | 54 | 2018 | ● Audit ● Compensation | ||||

| DARREN W. McDEW Independent | Retired General, U.S. Air Force, and Former Commander of U.S. Transportation Command | 61 | 2019 | ● Nominations and Governance ● Public Policy | ||||

| NANCY McKINSTRY Independent | CEO and Chairman of the Executive Board, Wolters Kluwer N.V. | 63 | 2011 | ● Audit (Chair) ● Compensation ● Executive | ||||

| WILLIAM A. OSBORN Lead Independent Director | Retired Chairman and CEO, Northern Trust Corporation | 74 | 2008 | ● Compensation ● Nominations and Governance (Chair) ● Executive | ||||

| MICHAEL F. ROMAN Independent | Chairman, President, and CEO, 3M Company | 62 | 2021 | ● Audit ● Compensation | ||||

| DANIEL J. STARKS Independent | Retired Chairman, President and CEO, St. Jude Medical, Inc. | 67 | 2017 | ● Public Policy | ||||

| JOHN G. STRATTON Independent | Executive Chairman, Frontier Communications Parent, Inc. | 61 | 2017 | ● Audit ● Public Policy | ||||

| GLENN F. TILTON Independent | Retired Chairman, President and CEO, UAL Corporation | 73 | 2007 | ● Audit ● Public Policy (Chair) ● Executive |

| 5 |

| CORPORATE GOVERNANCE |

Abbott is committed to strong corporate governance that is aligned with shareholder interests. Our Board spends significant time with Abbott’s senior management to understand the dynamics, issues, and opportunities for Abbott, and also regularly monitors leading practices in governance and adopts measures that it determines are in the best interest of Abbott and its shareholders.

LEAD INDEPENDENT DIRECTOR WITH DISTINCT RESPONSIBILITIES

| Elected annually by independent directors |

| Regularly presides over executive sessions of independent directors at Board meetings and provides feedback to management |

| Reviews matters, such as agenda items and schedule sufficiency |

| Leads annual performance review process |

| Oversees process for identifying and evaluating director candidates |

| Authority to call meetings of independent directors |

| Communicate regularly with the Chairman regarding appropriate agenda topics and other Board-related matters |

| Confers with the Nominations and Governance Committee and the CEO regarding management succession planning |

| Liaises between Chairman and independent directors |

| Engages directly with major shareholders as appropriate |

ROBUST BOARD EVALUATION AND REFRESHMENT PROCESS

OTHER BOARD GOVERNANCE HIGHLIGHTS

| ● | Fully independent Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee |

| ● | Committee chairs recommended to the Board by the Nominations and Governance Committee and approved by the full Board |

| ● | All directors elected annually by majority vote |

| ● | Executive sessions of the independent directors, led by the Lead Independent Director, at each regularly scheduled Board meeting |

| ● | Annual anonymous evaluations of the Board, Committees, and each director |

| ● | Strong risk oversight, with areas of focus including business strategy, human capital, cybersecurity and data protection, and Abbott’s sustainability, environmental, and social responsibility practices |

| 6 |  |

HIGHLY QUALIFIED BOARD, WITH BROAD DIVERSITY ACROSS BACKGROUNDS, SKILLS AND EXPERIENCES

| THE 12 DIRECTOR NOMINEES COMPRISE A WELL-BALANCED, DIVERSE BOARD. | ||

| RELEVANT EXPERTISE TO PROVIDE OVERSIGHT AND GUIDANCE FOR ABBOTT’S DIVERSIFIED OPERATING MODEL | TENURE | |

| Healthcare and Medical Device Industry | ||

| Finance | ||

| Risk Management, including Data/Cybersecurity | ||

| Global Strategy and Operations | ||

| Regulatory/Compliance | BOARD DIVERSITY

| |

| Consumer Products | ||

| Senior Leadership with Multinational Corporations and Diverse Business Models | ||

| Global Supply Chain Operations | ||

| Government and Military Leadership | ||

| 7 |

| OUR COMMITMENT TO SUSTAINABILITY |

At Abbott, sustainability means managing our company to deliver long-term positive impact for the people we serve—shaping the future of healthcare and helping the greatest number of people live better and healthier lives.

Our sustainability efforts are focused on the most relevant industry and company-specific risks and opportunities. In December 2020, we launched our new 2030 Sustainability Plan focused on Abbott’s greatest opportunities to make an impact.

These areas have been identified through an in-depth materiality analysis, directed by executive management, and in partnership with numerous diverse external stakeholders, including suppliers, customers, and investors. We aim to deliver sustainable, responsible growth that improves lives and creates value in communities around the world.

2030 SUSTAINABILITY PLAN GOALS

Our work touched 2 billion lives this past year, and by 2030, we intend to reach more than 3 billion lives per year, improving the lives of 1 in every 3 people on the planet by 2030.

INNOVATE FOR ACCESS AND AFFORDABILITY

| Make access and affordability core to new product innovation |  | Transform care for chronic disease, malnutrition and infectious diseases |  | Advance health equity through partnership | ||

| Integrate access, affordability and data insights as design principles into our work and portfolio. | Innovate to transform the standard of care for diabetes and deliver break-through technologies to improve clinical outcomes for people with cardiovascular disease. Deliver scalable, integrated solutions to reduce preventable deaths and infectious diseases with diagnostics, treatment and education programs. | Expand affordable access to healthcare for underserved, diverse and at-risk communities by delivering innovative, decentralized models of care. Partner with stakeholders to improve health outcomes by advancing standards and building access to affordable, integrated solutions. | |||||

BUILD A FOUNDATION FOR THE FUTURE

| CLIMATE Protect a healthy environment Protect our climate and water, including reducing absolute Scope 1 and 2 carbon emissions by 30% from 2018 baseline Reduce product packaging and waste, including addressing 50 million pounds of packaging and using circular economy approach to achieve at least 90% waste diversion rate |  | OUR PEOPLE Build the diverse, innovative workforce of tomorrow Create opportunities in Abbott’s STEM programs and internships for more than 100,000 young people Achieve gender balance across our global management team and ensure one-third of our U.S. leadership roles are held by people from underrepresented groups | |

| SUPPLY CHAIN Ensure a resilient, diverse and responsible supply chain |  | DATA AND DATA PRIVACY Responsibly connect data, technology, and care | |

Certify that 80% of newly contracted direct material spends incorporate social responsibility requirements

Ensure ethical sourcing from suppliers with high-risk sustainability factors through 100% auditing Increase spend with diverse and small businesses 50% | Be a trusted healthcare leader in secure and responsible data collection, use, management and privacy, in order to protect our patients and customers, empower them to make better, more complete decisions about their health, and drive innovation through insights and analytics |

The Board of Directors and its committees have oversight over Abbott’s environmental, social and governance practices. The Board has regular discussions with management on all the above sustainability matters, as well as workplace, management, and Board diversity, emerging governance practices and trends, global compliance matters, and sustainability reporting.

Executive compensation is linked to Sustainability commitments, as discussed in more detail on pages 36 and 37.

To learn more about Abbott’s Sustainability efforts, please visit www.abbott.com/responsibility/sustainability.html.

| 8 |  |

| VOTING MATTERS AND BOARD RECOMMENDATIONS |

| ITEM 1 | Election of 12 Director Nominees Named in this Proxy Statement: The Board recommends a vote FOR each nominee ● Highly qualified Board, with diversity in backgrounds, skills and experiences. ● Relevant expertise to provide oversight and guidance for Abbott’s diversified operating model. See pages 10 to 15 for more information. | |

| ITEM 2 | Ratification of Ernst & Young LLP as Auditors: The Board recommends a vote FOR ● Independent firm with significant industry and financial reporting expertise. ● See pages 69 to 70 for more information. | |

| ITEM 3 | Say on Pay: Advisory Vote on the Approval of Executive Compensation: The Board recommends a vote FOR ● Market-based structure producing differentiated awards based on both company and individual performance, managed with independent oversight by the Compensation Committee. ● Aligned to drive Abbott’s strategic priorities, reflects consistent above-market TSR and upper quartile relative 3-year TSR performance vs. peers, as well as upper quartile 1-year and 5-year TSR. See pages 71 and 72 for more information. | |

SHAREHOLDER PROPOSALS | The Board recommends a vote AGAINST ● Proposal 4: Special Shareholder Meeting Threshold ● Proposal 5: Independent Board Chairman ● Proposal 6: 10b5-1 Plans ● Proposal 7: Lobbying Disclosure ● Proposal 8: Antimicrobial Resistance Report ● See pages 73 to 85 for more information. |

| 9 |

NOMINEES FOR ELECTION AS DIRECTORS

| ROBERT J. ALPERN, M. D. Director Since 2008 Age 71 Ensign Professor of Medicine and Physiology and Professor of Internal Medicine and Cellular and Molecular Physiology, and Former Dean of Yale School of Medicine |

PROFESSIONAL BACKGROUND

| ● | Ensign Professor of Medicine and Professor of Internal Medicine at Yale School of Medicine since June 2004. |

| ● | Dean of Yale School of Medicine from June 2004 to January 2020. |

| ● | Dean of The University of Texas Southwestern Medical Center from July 1998 to May 2004. |

| ● | Served on the Board of Directors of Yale New Haven Hospital from October 2005 to January 2020. |

OTHER PUBLIC COMPANY BOARDS

AbbVie Inc., Tricida, Inc.

KEY QUALIFICATIONS AND EXPERTISE

As a result of his long-tenured leadership positions at the Yale School of Medicine and The University of Texas Southwestern Medical Center, and as a former Director on the Board of Yale New Haven Hospital, Dr. Alpern contributes valuable insights to the Board through his medical and scientific expertise and his knowledge of the health care environment and the scientific nature of Abbott’s key research and development initiatives.

| SALLY E. BLOUNT, PH. D. Director Since 2011 Age 60 President and Chief Executive Officer, Catholic Charities of the Archdiocese of Chicago, and Michael L. Nemmers Professor of Strategy and Former Dean of the J.L. Kellogg Graduate School of Management at Northwestern University |

PROFESSIONAL BACKGROUND

| ● | President and Chief Executive Officer and Board Member of Catholic Charities of the Archdiocese of Chicago since August 2020. |

| ● | Michael L. Nemmers Professor of Strategy and Dean of the J.L. Kellogg Graduate School of Management at Northwestern University from 2010 to 2018. |

| ● | Dean of the New York University Undergraduate College and Vice Dean of its Leonard N. Stern School of Business from 2004 to 2010. |

| ● | Professor at the New York University Leonard School of Business from 2001 to 2010, and became the Abraham L. Gitlow Professor of Management in 2004. |

| ● | Held academic posts at the University of Chicago’s Graduate School of Business from 1992 to 2001. |

| ● | Serves on the Board of Directors of the Joyce Foundation. |

OTHER PUBLIC COMPANY BOARDS

Ulta Beauty, Inc.

KEY QUALIFICATIONS AND EXPERTISE

Having served as Dean of the J.L. Kellogg Graduate School of Management at Northwestern University and as Vice Dean and Dean of the Undergraduate College of New York University’s Leonard N. Stern School of Business, Ms. Blount provides Abbott’s Board with expertise on business organization, governance and business management matters.

| 10 |  |

| ROBERT B. FORD Director Since 2019 Age 48 Chairman of the Board and Chief Executive Officer, Abbott Laboratories |

PROFESSIONAL BACKGROUND

| ● | Chairman of the Board and Chief Executive Officer of Abbott since December 2021. |

| ● | President and Chief Executive Officer of Abbott from March 2020 to December 2021. |

| ● | President and Chief Operating Officer of Abbott from 2018 to 2020. |

| ● | Executive Vice President, Medical Devices of Abbott from 2015 to 2018. |

| ● | Senior Vice President, Diabetes Care of Abbott from 2014 to 2015. |

| ● | Held various leadership roles across Abbott’s Diagnostics, Nutrition, and Diabetes Care businesses in the U.S. and Latin America since joining Abbott in 1996. |

KEY QUALIFICATIONS AND EXPERTISE

As Abbott’s Chairman of the Board and Chief Executive Officer, and having previously held various leadership positions at Abbott, including Chief Operating Officer, where he was responsible for all of Abbott’s operating businesses, Mr. Ford contributes an extensive knowledge of the Company’s global operations, a wide breadth of experience in strategy and execution, and valuable insights into global healthcare markets.

| PAOLA GONZALEZ Director Since 2021 Age 50 Vice President and Treasurer, The Clorox Company |

PROFESSIONAL BACKGROUND

| ● | Vice President and Treasurer of The Clorox Company, a manufacturer and marketer of consumer and professional products, since January 2018. |

| ● | Vice President of Finance, Household and Lifestyle Segments of Clorox from 2010 to 2017. |

| ● | Vice President of Finance, Global Strategic Initiatives of Clorox from 2008 to 2010. |

| ● | Held various leadership roles in finance across Clorox since joining Clorox in 1997. |

| ● | Prior to Clorox, worked in finance for American Airlines in Latin America. |

KEY QUALIFICATIONS AND EXPERTISE

As Vice President and Treasurer of The Clorox Company, Ms. Gonzalez is responsible for treasury, investor relations and real estate matters, and through her prior financial roles in several of its businesses, has considerable experience providing financial leadership to a multinational public company with multiple businesses, contributing significant financial expertise and knowledge of financial statements, corporate finance and accounting matters.

| 11 |

| MICHELLE A. KUMBIER Director Since 2018 Age 54 President, Turf & Consumer Products, Briggs & Stratton, LLC |

PROFESSIONAL BACKGROUND

| ● | Senior Vice President and President, Turf & Consumer Products of Briggs & Stratton, LLC, a manufacturer and marketer of engines and outdoor power equipment, since March 2022. |

| ● | Senior Vice President and Chief Operating Officer of Harley-Davidson Motor Company, a motorcycle and related products manufacturer, from 2017 to 2020. |

| ● | Senior Vice President of Motor Company Product and Operations of Harley-Davidson from 2015 to 2017. |

| ● | Held various other executive roles across Harley-Davidson, from 1997 to 2015. |

| ● | Held various positions at Kohler Company, maker of premium plumbing products, from 1986 to 1997. |

OTHER PUBLIC COMPANY BOARDS

Teledyne Technologies Incorporated, Tenneco Inc. In connection with Tenneco’s publicly announced agreement to be acquired by Apollo Funds, Ms. Kumbier would cease to be a Tenneco Director upon the acquisition closing.

KEY QUALIFICATIONS AND EXPERTISE

Having served in several executive roles at Harley-Davidson, Ms. Kumbier contributes extensive experience in the management of a multinational public company, including significant manufacturing, product development, business development and strategic planning experience.

| DARREN W. MCDEW Director Since 2019 Age 61 Retired General, United States Air Force, and Former Commander of U.S. Transportation Command |

PROFESSIONAL BACKGROUND

| ● | Four-star general who served for 36 years in the United States military before retiring in October 2018. |

| ● | Commander, U.S. Transportation Command, the single manager for global air, land and sea transportation for the U.S. Department of Defense from 2015 to 2018. |

| ● | Held various leadership roles across the U.S. Military, including Vice Director for Strategic Plans and Policy for the Joint Chiefs of Staff, Military Aide to the President, Director of Air Force Public Affairs, and Chief of Air Force Senate Liaison Division. |

| ● | Serves on the Board of Directors of Rolls-Royce, North America, Inc., United Services Automobile Association, and Boys & Girls Club of America. |

OTHER PUBLIC COMPANY BOARDS

Parsons Corporation

KEY QUALIFICATIONS AND EXPERTISE

Through his extensive leadership in the U.S. Air Force, General McDew contributes significant experience managing large, complex global operations, including strategic planning, security and risk management, cybersecurity, and supply chain and infrastructure management.

| 12 |  |

| NANCY MCKINSTRY Director Since 2011 Age 63 Chief Executive Officer and Chairman of the Executive Board, Wolters Kluwer N.V. |

PROFESSIONAL BACKGROUND

| ● | Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V., a global information, software, and services provider, since September 2003, and a member of its Executive Board since June 2001. |

| ● | Member of the European Round Table of Industrialists. |

| ● | Serves on the Board of Directors of Russell Reynolds Associates and the Board of Overseers of Columbia Business School. |

| ● | Served on the Board of Directors of Telefonaktiebolaget LM Ericsson from 2004 to 2012. |

OTHER PUBLIC COMPANY BOARDS

Accenture plc

KEY QUALIFICATIONS AND EXPERTISE

As the Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V., Ms. McKinstry contributes global perspectives and management experience, including an understanding of key issues facing a multinational business such as Abbott’s.

| WILLIAM A. OSBORN Lead Independent Director Director Since 2008 Age 74 Retired Chairman and Chief Executive Officer, Northern Trust Corporation |

PROFESSIONAL BACKGROUND

| ● | Chairman of Northern Trust Corporation, a multibank holding company, from 1995 to 2009 and Chief Executive Officer from 1995 to 2008. |

| ● | President of Northern Trust Corporation and The Northern Trust Company, a banking services company, from 2003 to 2006. |

| ● | Served on the Board of Directors of Nicor, Inc. from 1999 to 2006. |

| ● | Served on the Board of Directors of Tribune Company from 2001 to 2012. |

| ● | Served on the Board of Directors of Caterpillar Inc. from 2000 to 2021. |

| ● | Served on the Board of Directors of General Dynamics Corporation from 2009 to 2021. |

KEY QUALIFICATIONS AND EXPERTISE

Having served as the Chairman and Chief Executive Officer of Northern Trust Corporation, Mr. Osborn acquired broad experience in successfully overseeing complex global businesses operating in highly regulated industries, including oversight of financial, operational, and governance matters facing large public companies.

| 13 |

| MICHAEL F. ROMAN Director Since 2021 Age 62 Chairman of the Board, President and Chief Executive Officer, 3M Company |

PROFESSIONAL BACKGROUND

| ● | Chairman of the Board, President and Chief Executive Officer of 3M Company, a global manufacturing and technology company, since May 2019. |

| ● | Chief Executive Officer of 3M from July 2018 to May 2019. |

| ● | Chief Operating Officer and Executive Vice President of 3M from July 2017 to June 2018 with direct responsibilities for 3M’s five business groups and its international operations. |

| ● | Executive Vice President, Industrial Business Group of 3M from June 2014 to July 2017. |

| ● | Senior Vice President, Business Development of 3M from May 2013 to June 2014. |

| ● | Vice President and General Manager of Industrial Adhesives and Tapes Division of 3M from September 2011 to May 2013. |

OTHER PUBLIC COMPANY BOARDS

3M Company

KEY QUALIFICATIONS AND EXPERTISE

As Chairman of the Board, President and Chief Executive Officer of 3M Company, Mr. Roman has extensive experience leading a multinational public company with multiple businesses, contributing significant manufacturing, supply chain, technology, and finance experience, as well as valuable insights into corporate strategy and risk management.

| DANIEL J. STARKS Director Since 2017 Age 67 Retired Chairman, President and Chief Executive Officer, St. Jude Medical, Inc. |

PROFESSIONAL BACKGROUND

| ● | Executive Chairman of the Board of St. Jude Medical, Inc., a medical device manufacturer, from January 2016 to January 2017, when Abbott completed its acquisition of St. Jude Medical. |

| ● | Chairman, President and Chief Executive Officer of St. Jude Medical from 2004 until his retirement in January 2016. |

| ● | President and Chief Operating Officer of St. Jude Medical from 2001 to 2004. |

| ● | President and CEO, Cardiac Rhythm Management Business of St. Jude Medical from 1997 to 2001. |

KEY QUALIFICATIONS AND EXPERTISE

Having served as St. Jude Medical’s Executive Chairman and its Chairman, President and Chief Executive Officer, and having joined St. Jude Medical in 1996, Mr. Starks contributes not only comprehensive and critical knowledge of St. Jude Medical’s operations, but also extensive business and management experience operating a global public company in a highly regulated industry.

| 14 |  |

| JOHN G. STRATTON Director Since 2017 Age 61 Executive Chairman, Frontier Communications Parent, Inc. |

PROFESSIONAL BACKGROUND

| ● | Executive Chairman of Frontier Communications Parent, Inc., a telecommunications company, since April 2021. |

| ● | Executive Vice President and President of Global Operations of Verizon Communications Inc. from 2015 to 2018. |

| ● | Executive Vice President and President of Global Enterprise and Consumer Wireline of Verizon from 2014 to 2015. |

| ● | President of Verizon Enterprise Solutions from 2012 to 2014. |

| ● | Chief Operating Officer and Executive Vice President of Verizon Wireless from 2010 to 2012. |

| ● | Member of The President’s National Security Telecommunications Advisory Committee from 2012 to 2018. |

| ● | Director of the Cellular Telecommunications Industry Association from 2015 to 2018. |

OTHER PUBLIC COMPANY BOARDS

Frontier Communications Parent, Inc., General Dynamics Corporation

KEY QUALIFICATIONS AND EXPERTISE

Through his executive leadership experience, Mr. Stratton contributes extensive business and management expertise operating a global public company such as Abbott, including valuable insights on corporate strategy and risk management. His service on the National Security Telecommunications Advisory Committee enables him to provide government perspective and experience in a highly regulated industry.

| GLENN F. TILTON Director Since 2007 Age 73 Retired Chairman, President and Chief Executive Officer, UAL Corporation |

PROFESSIONAL BACKGROUND

| ● | Chairman, President and Chief Executive Officer of UAL Corporation, an airline holding company, and Chairman and Chief Executive Officer of United Air Lines, Inc., an air transportation company and wholly owned subsidiary of UAL Corporation, from September 2002 to October 2010. |

| ● | Served on the Board of Directors of United Continental Holdings, Inc. from 2001 to 2013 and served as its Non-Executive Chairman of the Board from October 2010 to December 2012. |

| ● | Served on the Board of Directors of Lincoln National Corporation from 2002 to 2007, TXU Corporation from 2005 to 2007, and Corning Incorporated from 2010 to 2012. |

| ● | Chairman of the Midwest for JPMorgan Chase & Co. and a member of its companywide Executive Committee from June 2011 to June 2014. |

OTHER PUBLIC COMPANY BOARDS

AbbVie Inc., Phillips 66

KEY QUALIFICATIONS AND EXPERTISE

Having previously served as Chief Executive Officer of UAL Corporation and United Air Lines, Non-Executive Chairman of the Board of United Continental Holdings, Inc., Chairman of the Midwest for JPMorgan Chase & Co., Chairman, President, and Vice Chairman of Chevron Texaco, and as Interim Chairman of Dynegy, Inc., Mr. Tilton acquired strong management experience overseeing complex multinational businesses operating in highly regulated industries, as well as expertise in finance and capital markets matters.

| 15 |

THE BOARD OF DIRECTORS AND ITS COMMITTEES

| THE BOARD OF DIRECTORS |

The Board of Directors held 8 meetings in 2021. The average attendance of all directors at Board and committee meetings in 2021 was 95% and each director attended at least 75% of the total number of Board meetings and meetings of the committees on which he or she served. Abbott encourages its Board members to attend the annual shareholders meeting. Last year, all of Abbott’s directors attended the annual shareholders meeting.

The Board has determined that each of following director nominees is independent in accordance with the New York Stock Exchange listing standards: Robert J. Alpern, M.D., Sally E. Blount, Ph.D., Paola Gonzalez, Michelle A. Kumbier, Darren W. McDew, Nancy McKinstry, William A. Osborn, Michael F. Roman, Daniel J. Starks, John G. Stratton, and Glenn F. Tilton, as well as Roxanne S. Austin, who will continue to serve as a director until the 2022 Annual Meeting, and Edward M. Liddy and Phoebe N. Novakovic, who served as directors during a portion of 2021.

To determine independence, the Board applied the categorical standards attached as Exhibit A to this proxy statement. The Board also considered whether a director has any other material relationships with Abbott or its subsidiaries and concluded that none of these directors had a relationship that impaired his or her independence. This included consideration of the fact that some of the directors or their family members are officers or serve on boards of companies or entities to which Abbott sold products or made contributions or from which Abbott purchased products and services during the year. In making its determination, the Board relied on both information provided by the directors and information developed internally by Abbott.

| LEADERSHIP STRUCTURE |

Abbott’s current Board leadership is comprised of the Chairman of the Board and Chief Executive Officer, a Lead Independent Director, and independent Committee chairs.

Robert B. Ford currently serves as Chairman of the Board and Chief Executive Officer. The Board believes this is in the best interests of Abbott and its shareholders, as it provides cohesive leadership and direction for the Board and executive management, as well as clear accountability and unified leadership in the execution of strategic initiatives and business plans. Mr. Ford also has extensive industry expertise and familiarity with Abbott’s global businesses, such that his strategic and operational insights provide the Board with a comprehensive vision, from long-term strategic direction to day-to-day execution.

Abbott’s Board leadership is further strengthened by:

| ● | A strong Lead Independent Director with significant roles and responsibilities who is selected by and from the independent members of the Board. Currently, the Chair of the Nominations and Governance Committee, Mr. Osborn, is the Lead Independent Director. |

| ● | Fully independent Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee, as required by Abbott’s Governance Guidelines. |

| ● | Committee chairs who are recommended to the Board by the Nominations and Governance Committee and approved by the full Board. |

| ● | Executive sessions of the independent directors, led by the Lead Independent Director, that generally take place at each regularly scheduled Board meeting. |

| ● | Annual anonymous evaluations of each director, including the Chairman of the Board and Chief Executive Officer, led by the Lead Independent Director and conducted by all directors. |

| 16 |  |

Key functions and responsibilities of the Lead Independent Director include: ● Preside at regularly conducted executive sessions of the independent directors and provide feedback to the Chairman and CEO and other senior management, as appropriate, ● Preside at all meetings of the Board at which the Chairman is not present, ● Facilitate communication with the Board and serve as liaison between the Chairman and the independent directors, ● Communicate regularly with the Chairman regarding appropriate agenda topics and other Board related matters, ● Review and approve matters, such as agenda items, meeting schedules to assure sufficient time for discussion of all agenda items, and, where appropriate, information provided to the Board, ● Confer with the Nominations and Governance Committee and the CEO regarding management succession planning, ● Lead the annual performance reviews of individual directors, the full Board, and each of its Committees, ● Oversee the process for identifying and evaluating director candidates, ● Work with management on corporate governance issues and developments, ● Has the authority to call meetings of the independent directors, and ● Engage directly with major shareholders as appropriate. |

The Board reviews its leadership structure at least annually and has determined that this structure is in the best interests of Abbott and its shareholders at this time. This structure balances strong, independent oversight with extensive business knowledge and experience. The Board also retains the flexibility necessary to adopt the leadership structure in the best interests of Abbott and its shareholders based on the specific circumstances and needs of the business over time.

| 17 |

| BOARD DIVERSITY AND COMPOSITION |

In the process of identifying nominees to serve as members of the Board of Directors, the Nominations and Governance Committee considers the Board’s diversity of relevant experience, areas of expertise, ethnicity, gender, and geography and assesses the effectiveness of the process in achieving that diversity.

The process used to identify and select nominees has resulted in a balanced, diverse, and well-rounded Board of Directors that possesses the skills, experiences, and perspectives necessary for its oversight role. All of Abbott’s directors exhibit:

| Global business perspective |

| Successful track record |

| Innovative thinking |

| Knowledge of corporate governance requirements and practices |

| High integrity |

| Commitment to good corporate citizenship |

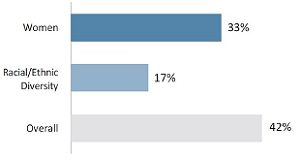

| THE 12 DIRECTOR NOMINEES COMPRISE A WELL-BALANCED, DIVERSE BOARD. | ||

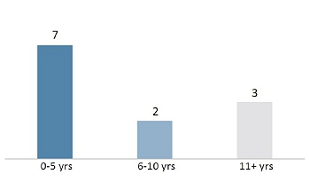

| RELEVANT EXPERTISE TO PROVIDE OVERSIGHT AND GUIDANCE FOR ABBOTT’S DIVERSIFIED OPERATING MODEL | TENURE | |

| Healthcare and Medical Device Industry | ||

| Finance | ||

| Risk Management, including Data/Cybersecurity | ||

| Global Strategy and Operations | ||

| Regulatory/Compliance | BOARD DIVERSITY | |

| Consumer Products |  | |

| Senior Leadership with Multinational Corporations and Diverse Business Models | ||

| Global Supply Chain Operations | ||

| Government and Military Leadership | ||

| 18 |  |

| DIRECTOR SELECTION |

The Nominations and Governance Committee assists the Board of Directors in identifying individuals qualified to become Board members and recommends to the Board the nominees for election as directors at the next annual meeting of shareholders. The process used by the Nominations and Governance Committee to identify a nominee to serve as a member of the Board of Directors depends on the qualities being sought. From time to time, Abbott engages an executive search firm to assist the Committee in identifying individuals qualified to be Board members.

Abbott’s outline of directorship qualifications, which is part of Abbott’s corporate governance guidelines, is available in the corporate governance section of Abbott’s investor relations website (www.abbottinvestor.com). These qualifications describe specific characteristics that the Nominations and Governance Committee and the Board take into consideration when selecting nominees for the Board, such as:

| ● | strong management experience and senior level experience in medicine, | |

| ● | hospital administration, | |

| ● | medical and scientific research and development, | |

| ● | finance, | |

| ● | international business, | |

| ● | technology, | |

| ● | government, and | |

| ● | academic administration. |

An individual nominee is not required to satisfy all the characteristics listed in the outline of directorship qualifications and there is no requirement that all such characteristics be represented on the Board.

In addition, Board members should have backgrounds that, when combined, provide a portfolio of experience and knowledge that will serve Abbott’s governance and strategic needs. Board candidates will be considered on the basis of a range of criteria, including broad based business knowledge and relationships, prominence, and excellent reputations in their primary fields of endeavor, as well as a global business perspective and commitment to good corporate citizenship. Directors should have demonstrated experience and ability that is relevant to the Board of Directors’ oversight role with respect to Abbott’s business and affairs. Each director’s biography includes the particular experience and qualifications that led the Board to conclude that the director should serve on the Board. The directors’ biographies are on pages 10 through 15.

A description of the procedure for the recommendation and nomination of directors, including by proxy access, is on page 88.

| 19 |

| BOARD OVERSIGHT |

Abbott is committed to strong governance that is aligned with shareholder interests. Our Board spends significant time with Abbott’s senior management to understand global dynamics, challenges, and opportunities for Abbott. During these interactions, directors provide insights and ask probing questions which guide management decision making. This collaborative approach to risk oversight and emphasis on long-term sustainability begins with our leaders and is engrained in Abbott’s culture.

OVERSIGHT OF RISK

The Board has risk oversight responsibility for Abbott, which it administers directly and with assistance from its Committees. Throughout the year, the Board and its Committees engage with management to discuss a wide range of enterprise risks, such as risks related to Abbott’s businesses, enterprise and product cybersecurity, litigation, and human capital management, and they confirm the alignment of risk assessment and mitigation with business strategy. The Audit Committee conducts an annual review of the enterprise risk management process, including the program structure, risk assessment, and risk mitigation. The Board and its Committees also consult with advisors, including legal counsel, internal and external auditors, and consultants. Such engagement and consultations are done by the full Board, independent directors in executive sessions, or fully independent Committees, as appropriate.

Specific risk areas of focus for the Board, its Committees, and management include:

BOARD OF DIRECTORS ● Business strategy and operations ● Management development and succession planning ● Human capital and diversity, equity and inclusion ● Litigation | ||||

| ||||

AUDIT COMMITTEE ● Accounting, internal controls, and financial reporting ● Enterprise cybersecurity ● Information security and data protection ● Major financial and business risk exposures | COMPENSATION ● Executive officer compensation, including incentive compensation plans ● Equity-based plans ● Director compensation | NOMINATIONS ● Board composition, refreshment, and succession planning ● Board governance structure ● Governance guidelines and practices | PUBLIC POLICY ● Sustainability, environment, and social responsibility ● Global ethics and compliance programs ● Product quality and cybersecurity, and data privacy | ||||||

| ||||

MANAGEMENT ● Design and execution of Abbott’s enterprise risk management process ● Identification, evaluation, and prioritization of risks ● Development and implementation of mitigating actions ● Regular communication with the Board and its Committees on how risks are being managed | ||||

| 20 |  |

OVERSIGHT OF STRATEGY

One of the Board’s key responsibilities is overseeing and monitoring business strategy. The Board conducts an annual in-depth review of the long-term strategy and areas of focus for Abbott and its businesses. The Board also regularly engages with management throughout the year to review and discuss the strategic planning for Abbott’s businesses, including operating and financial plans, strategic business priorities and initiatives, and key risks and opportunities. These reviews include discussions of matters such as global talent management and succession planning, diversity, equity and inclusion, global market dynamics and changes in regulatory and competitive landscapes, supply chain initiatives and sustainability programs, and significant corporate actions such as acquisitions and capital expenditures.

The Board monitors management’s strategy execution, receiving regular updates to confirm that activities align with such strategies and that progress is made toward strategic objectives. Most years, the Board also visits Abbott facilities and locations around the world to observe business dynamics and strategy execution by the businesses.

| COMMITTEES OF THE BOARD OF DIRECTORS |

The Board of Directors has five committees established in Abbott’s By-Laws: Audit Committee, Compensation Committee, Nominations and Governance Committee, Public Policy Committee, and Executive Committee.

All members of the Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee are independent. These Committees are governed by written charters setting forth their respective responsibilities, and each Committee reviews its charter at least annually, with any changes being recommended to the full Board for approval. Copies of the Committee charters are all available in the governance section of Abbott’s investor relations website (www.abbottinvestor.com).

| COMMITTEE MEMBERSHIPS | |||||||||||

| Current Members | Audit Committee* | Compensation Committee† | Nominations and Governance Committee | Public Policy Committee | Executive Committee | ||||||

| Robert J. Alpern, M.D. |  |  | |||||||||

| Roxanne S. Austin |  |  |  | ||||||||

| Sally E. Blount, Ph.D. |  |  | |||||||||

| Robert B. Ford |  | ||||||||||

| Paola Gonzalez |  | ||||||||||

| Michelle A. Kumbier |  |  | |||||||||

| Darren W. McDew |  |  | |||||||||

| Nancy McKinstry |  |  |  | ||||||||

| William A. Osborn |  |  |  | ||||||||

| Michael F. Roman |  |  | |||||||||

| Daniel J. Starks |  | ||||||||||

| John G. Stratton |  |  | |||||||||

| Glenn F. Tilton |  |  |  | ||||||||

| Total Meetings Held in 2021 | 7 | 4 | 5 | 4 | 0 | ||||||

| Chair |  | Member |

| * | Each of the committee members is financially literate, as is required of audit committee members by the New York Stock Exchange. The Board of Directors has determined that Nancy McKinstry is an “audit committee financial expert.” |

| † | Ms. Austin is not standing for re-election at the Annual Meeting. The Board of Directors will appoint a new Compensation Committee chair upon conclusion of her tenure at the Annual Meeting. |

| 21 |

AUDIT COMMITTEE

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibility with respect to:

| ● | Abbott’s accounting and financial reporting practices and the audit process, | |

| ● | The quality and integrity of Abbott’s financial statements, | |

| ● | The independent auditors’ qualifications, independence, and performance, | |

| ● | The performance of Abbott’s internal audit function and internal auditors, | |

| ● | Legal and regulatory compliance relating to financial matters, including accounting, auditing, financial reporting, and securities law issues, and | |

| ● | Enterprise risk management, including major financial and cybersecurity risk exposures. |

In performing these functions, the Audit Committee meets regularly with the independent auditor, Abbott’s management, and Abbott’s internal auditors to review the adequacy, effectiveness and quality of Abbott’s accounting and financial reporting principles, policies, procedures and controls, as well as Abbott’s enterprise risk management, including Abbott’s risk assessment and risk management policies. The Audit Committee also receives regular reports from management on Abbott’s information security and enterprise cybersecurity risk programs.

A copy of the report of the Audit Committee is on page 70.

COMPENSATION COMMITTEE

The Compensation Committee assists the Board of Directors in carrying out the Board’s responsibilities relating to the compensation of Abbott’s executive officers and directors. Its primary responsibilities include:

| ● | Review, approve, and administer the incentive compensation plans in which any executive officer participates and all of Abbott’s equity-based plans. The Compensation Committee may delegate the responsibility to administer and make grants under these plans to management, except to the extent that such delegation would be inconsistent with applicable law or regulation or with the listing rules of the New York Stock Exchange. | |

| ● | Review director compensation annually and recommend to the full Board both the amount and the allocation between equity-based awards and cash. In recommending director compensation, the Compensation Committee takes comparable director fees into account and reviews any arrangement that could be viewed as indirect director compensation. | |

| ● | Engage compensation consultants to provide counsel and advice on executive and non-employee director compensation matters. The consultant and its principal report directly to the Chair of the Committee. The principal meets regularly and as needed with the Committee in executive sessions, has direct access to the Chair during and between meetings, and performs no other services for Abbott or its senior executives. | |

| The Committee determines what variables it will instruct the consultant to consider, including peer groups against which performance and pay should be examined, financial metrics to be used to assess Abbott’s relative performance, competitive incentive practices in the marketplace, and compensation levels relative to market practice. The Committee negotiates and approves any fees paid to the consultant for these services. |

The Compensation Committee engaged Meridian Compensation Partners, LLC as its compensation consultant for 2021. Meridian performs no other work for Abbott. Based on its evaluation of Meridian’s independence in accordance with the New York Stock Exchange listing standards and information provided by Meridian, the Committee determined that the work performed by Meridian does not present any conflicts of interest.

A copy of the report of the Compensation Committee is on page 51.

| 22 |  |

NOMINATIONS AND GOVERNANCE COMMITTEE

The Nominations and Governance Committee assists the Board in fulfilling its oversight responsibility with respect to governance matters. Its primary responsibilities include:

| ● | Assist the Board in identifying individuals qualified to become Board members, and recommend to the Board the nominees for election as directors at the next annual meeting of shareholders, | |

| ● | Recommend to the Board the people to be elected as executive officers of Abbott, | |

| ● | Develop and recommend to the Board the corporate governance guidelines applicable to Abbott, and | |

| ● | Serve in an advisory capacity to the Board and the Chairman of the Board on matters of organization, management succession plans, major changes in the organizational structure of Abbott, and the conduct of Board activities. |

The process used by this Committee to identify a nominee to serve as a member of the Board of Directors depends on the qualities being sought. From time to time, Abbott engages an executive search firm to assist the Committee in identifying individuals qualified to be Board members. The process used by the Committee to identify nominees is described on page 19 in the section captioned, “Director Selection.”

PUBLIC POLICY COMMITTEE

The Public Policy Committee assists the Board of Directors in fulfilling its oversight responsibility with respect to:

| ● | Legal, regulatory, and healthcare compliance matters, including evaluating Abbott’s compliance policies and practices and reviewing Abbott’s compliance program, | |

| ● | Product quality and cybersecurity matters, | |

| ● | Governmental affairs and political participation, including advocacy priorities, political contributions, lobbying activities, and trade association memberships, | |

| ● | Sustainability and social responsibility policies and practices, and | |

| ● | Social, political, economic, and environmental trends and public policy issues that affect or could affect Abbott’s business activities, performance, and public image. |

EXECUTIVE COMMITTEE

The Executive Committee may exercise all the authority of the Board in the management of Abbott, except for matters expressly reserved by law for Board action.

| 23 |

| SHAREHOLDER ENGAGEMENT |

Active shareholder engagement throughout the year is essential to maintaining good corporate governance. We routinely seek investor input on a variety of topics, including corporate governance, executive compensation, sustainability and other strategic matters. During 2021, we met or initiated contact with shareholders representing over 60% of our outstanding shares, including 100% of our top 20 investors, in an open dialogue to discuss our compensation program and other topics. Investor sentiment and specific feedback was shared with executive management and the Board of Directors, as appropriate.

Topics discussed with our investors included:

| ● | The pandemic’s impact on our business, our COVID-19 testing response, and the strength and resilience of our diversified business model. | |

| ● | Business and sustainability strategy, including Abbott’s new 2030 Sustainability Plan and its focus on creating new life-changing technologies and products, expanding access and affordability of new product innovations and advancing health equity. | |

| ● | Human capital management and Abbott’s commitment to diversity, equity, and inclusion,including Abbott’s new Diversity, Equity and Inclusion Report which provides goals, our progress against them, and disclosure of EEO-1 data. | |

| ● | Board composition and refreshment, including the addition of four new independent directors since 2018, three of whom are women and/or minorities. | |

| ● | Executive compensation program, including Abbott’s continued enhanced compensation disclosure. |

| BOARD EVALUATION PROCESS |

Each year, Abbott’s directors evaluate the effectiveness of the Board and its Committees in performing its governance and risk oversight responsibilities. Directors assess the performance of their peers, as well as the full Board of Directors and each of the Committees on which they serve, as follows:

PEER, BOARD, AND COMMITTEE EVALUATIONS

Written evaluations solicit feedback on the performance of:

| Each individual director, including: | The full Board and Board Committees, including: | |||||

● Independent thinking and action ● Contributions to discussions and decisions | ● Ethical standards and values ● Professional competence in matters of oversight and governance | ● Structure and composition ● Effectiveness of oversight and other responsibilities | ● Encouragement of open communication and differing viewpoints | |||

| COLLECTION AND REVIEW OF RESULTS | INCORPORATION OF FEEDBACK |

| To ensure candid feedback, directors submit their evaluation responses to an independent third party, who anonymizes all responses and compiles them into reports for the Board and Committees. The Nominations and Governance Committee reviews the peer and full Board reports, and each Committee reviews its respective report. All evaluation responses are shared with the full Board. | Feedback requiring additional consideration is addressed at subsequent Board and Committee meetings, and opportunities for additional enhancements are identified, considered and implemented as appropriate. The Chair of the Nominations and Governance Committee discusses peer evaluation results with individual directors as needed. |

| 24 |  |

| COMMUNICATING WITH THE BOARD OF DIRECTORS |

Interested parties may communicate with the Board of Directors by writing a letter to the Chairman of the Board, to the Chair of the Nominations and Governance Committee, who acts as the lead independent director, or to the independent directors c/o Abbott Laboratories, 100 Abbott Park Road, D-364, AP6D, Abbott Park, Illinois 60064, Attention: Corporate Secretary. The General Counsel and Corporate Secretary regularly forwards to the addressee all letters other than mass mailings, advertisements, and other materials not relevant to Abbott’s business. In addition, directors regularly receive a log of all correspondence received by Abbott that is addressed to a member of the Board and may request any correspondence on that log.

| CORPORATE GOVERNANCE MATERIALS |

Abbott’s corporate governance guidelines, outline of directorship qualifications, director independence standards, code of business conduct, and the charters of Abbott’s Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee are all available in the corporate governance section of Abbott’s investor relations website (www.abbottinvestor.com).

| 25 |

| DIRECTOR COMPENSATION |

Mr. Ford is not compensated for serving on the Board or Board committees. Mr. White was not compensated for serving on the Board or Board committees during his tenure as Executive Chairman of the Board. Abbott’s remaining directors, who are all non-employee directors, are compensated for their service under the Abbott Laboratories Non-Employee Directors’ Fee Plan and the Abbott Laboratories 2017 Incentive Stock Program.

The following table sets forth a summary of the non-employee directors’ 2021 compensation.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(4) | All Other Compensation ($)(5) | Total ($) | ||||||

| R. J. Alpern | $ 126,000 | $184,944 | $0 | $53,408 | $25,000 | $389,352 | ||||||

| R. S. Austin | 146,000 | 184,944 | 0 | 0 | 25,000 | 355,944 | ||||||

| S. E. Blount | 126,000 | 184,944 | 0 | 7,590 | 25,000 | 343,534 | ||||||

| P. Gonzalez | 43,500 | 0 | 0 | 0 | 0 | 43,500 | ||||||

| M. A. Kumbier | 132,000 | 184,944 | 0 | 0 | 0 | 316,944 | ||||||

| E. M. Liddy | 50,333 | 0 | 0 | 0 | 0 | 50,333 | ||||||

| D. W. McDew | 126,000 | 184,944 | 0 | 0 | 0 | 310,944 | ||||||

| N. McKinstry | 144,667 | 184,944 | 0 | 0 | 5,000 | 334,611 | ||||||

| P. N. Novakovic | 47,000 | 0 | 0 | 0 | 0 | 47,000 | ||||||

| W. A. Osborn | 156,000 | 184,944 | 0 | 0 | 0 | 340,944 | ||||||

| M. F. Roman | 88,000 | 184,944 | 0 | 0 | 0 | 272,944 | ||||||

| D. J. Starks | 126,000 | 184,944 | 0 | 0 | 0 | 310,944 | ||||||

| J. G. Stratton | 132,000 | 184,944 | 0 | 0 | 0 | 316,944 | ||||||

| G. F. Tilton | 142,000 | 184,944 | 0 | 0 | 25,000 | 351,944 |

| (1) | Under the Abbott Laboratories Non-Employee Directors’ Fee Plan, non-employee directors earn $10,500 for each month of service as a director. Audit Committee members, other than the Audit Committee chair, receive $500 for each month of service on the Audit Committee. Board Committee chairs receive monthly fees of: $2,083.33 for the Audit Committee chair, $1,666.66 for the Compensation Committee chair, $1,250.00 for the Public Policy Committee chair, and $1,250.00 for the chair of any other Board committee. In addition, the lead independent director earns $2,500 for each month of such service and does not receive a fee for service as Nominations and Governance Committee chair. Fees earned under the Abbott Laboratories Non-Employee Directors’ Fee Plan are paid in cash to the director, paid in the form of vested non-qualified stock options (based on an independent appraisal of their fair value), deferred (as a non-funded obligation of Abbott), or paid currently into an individual grantor trust established by the director. The distribution of deferred fees and amounts held in a director’s grantor trust generally commences when the director reaches age 65, or upon retirement from the Board of Directors, if later. The director may elect to have deferred fees and fees deposited in trust credited to either a guaranteed interest account or to a stock equivalent account that earns the same return as if the fees were invested in Abbott shares. If necessary, Abbott contributes funds to a director’s trust so that as of year-end the stock equivalent account balance (net of taxes) is not less than seventy-five percent of the market value of the related common shares at year-end. |

| 26 |  |

| (2) | The amounts reported in this column represent the aggregate grant date fair value of the awards calculated in accordance with Financial Accounting Standards Board ASC Topic 718. Abbott determines the grant date fair value of stock unit awards by multiplying the number of restricted stock units granted by the average of the high and low market prices of an Abbott common share on the date of grant. In addition to the fees described in footnote 1, each non-employee director elected to the Board of Directors at the annual shareholders meeting receives vested restricted stock units having a value of $185,000 (rounded down) under the Abbott Laboratories 2017 Incentive Stock Program). In 2021, this was 1,499 units. The non-employee directors receive cash payments equal to the dividends paid on the shares covered by the units at the same rate as other shareholders. Upon termination, retirement from the Board, death, or a change in control of Abbott, a non-employee director will receive one common share for each restricted stock unit outstanding under the Incentive Stock Program. Each director is required to own, within five years of becoming a director, the number of Abbott shares having a fair market value equal to five times the annual director fees earned or paid in cash. All directors with five years tenure or more meet or exceed the guidelines. The following Abbott restricted stock units were outstanding as of December 31, 2021: R. J. Alpern, 33,879; R. S. Austin, 41,542; S. E. Blount, 27,139; M. A. Kumbier, 5,714; D. W. McDew, 3,473; N. McKinstry, 27,139; W. A. Osborn, 35,796; M. F. Roman, 1,499; D. J. Starks, 12,096; J. G. Stratton, 8,659; and G. F. Tilton, 37,526. |

| (3) | The following options were outstanding as of December 31, 2021: R. S. Austin, 64,718; E. M. Liddy, 58,861; N. McKinstry, 63,391; P. N. Novakovic, 81,381; and W. A. Osborn, 29,567. |

| (4) | The totals in this column include reportable interest credited under Abbott Laboratories Non-Employee Directors’ Fee Plan during the year. |

| (5) | Charitable contributions made by Abbott’s non-employee directors are eligible for a matching contribution (up to $25,000 annually). The amounts reported in this column represent charitable matching grant contributions. |

| 27 |

| COMPENSATION DISCUSSION AND ANALYSIS |

INTRODUCTION

This Compensation Discussion and Analysis (CD&A) describes Abbott’s executive compensation program in 2021. In particular, this CD&A explains how the Compensation Committee (the Committee) and Board of Directors made compensation decisions for the Company’s executives, including the six named officers: Robert B. Ford, Chairman of the Board and Chief Executive Officer effective December 10, 2021 (previously President and Chief Executive Officer); Robert E. Funck, Jr., Executive Vice President, Finance and Chief Financial Officer; Hubert L. Allen, Executive Vice President, General Counsel and Secretary; Daniel G. Salvadori, Executive Vice President and Group President, Established Pharmaceuticals and Nutritional Products effective December 1, 2021 (previously Executive Vice President, Nutritional Products); Andrea F. Wainer, Executive Vice President, Rapid and Molecular Diagnostics; and Miles D. White, Former Executive Chairman of the Board.

The CD&A also describes the process the Committee utilizes to examine performance in the context of executive pay decisions, the performance goals and results for each named officer, and recent updates to our compensation program. This year’s CD&A reflects the feedback from our shareholders gathered during our 2021 shareholder outreach described on page 29.

VALUE CREATION FOR SHAREHOLDERS

Abbott’s sustained strong performance has resulted in total shareholder return (TSR) exceeding the peer median and major market indices on a one, three-, and five-year basis.

Abbott’s three-year TSR of 104% is more than twice that of the peer group median, and Abbott’s five-year TSR of 300% is more than four times that of the peer median. These consistent top-tier returns are driven by strong execution, an effective governance structure, and the strength of our diversified business model with leadership positions in some of the largest and fastest growing markets in healthcare and innovative product portfolios across our businesses.

Abbott delivered strong returns for shareholders in 2021, despite the continued global impact and uncertainty of COVID 19, and exceeded the financial targets that were set at the beginning of the year. Abbott’s one-year TSR was 31%, more than two and a half times the peer median TSR, a testament to the strength of our diversified business model and ability to innovate and deliver in this challenging environment.

| 28 |  |

| CHANGES BASED ON SHAREHOLDER FEEDBACK AND MARKET PRACTICES |

In 2021, we met or initiated contact with shareholders representing over 60% of our outstanding shares, including 100% of our top 20 investors in an open dialogue to discuss our compensation program and various topics, including:

| ● | The pandemic’s impact on our business, our COVID-19 testing response, and the strength and resilience of our diversified business model. | |

| ● | Business and sustainability strategy, including Abbott’s new 2030 Sustainability Plan and its focus on creating new life-changing technologies and products, expanding access and affordability of new product innovations and advancing health equity. | |

| ● | Human capital management and Abbott’s commitment to diversity, equity, and inclusion, including Abbott’s new Diversity, Equity and Inclusion Report which provides goals, our progress against them, and disclosure of EEO-1 data. | |

| ● | Board composition and refreshment, including the addition of four new independent directors since 2018, three of whom are women and/or minorities. | |

| ● | Executive compensation program, including Abbott’s continued enhanced compensation disclosure. |

Their feedback was overwhelmingly positive, which was reflected in the 92% support for our Say-on-Pay Proposal.

As illustrated in the table below, over the past several years we have made numerous changes to our program and our proxy statement based on feedback from our shareholders as well as a review of market practices.

| CHANGES BASED ON SHAREHOLDER FEEDBACK | ||

● Increased disclosure related to Abbott’s 2030 Sustainability Plan goals and linkage to executive pay ● Revised annual cash incentive plan goals and weighting ● Significantly increased disclosure related to payouts for both annual and long term incentives ● Changed performance-based restricted stock awards to vest only over a 3-year term with no more than one-third of the award vesting in any one year | ● Introduced new long-term incentive measures to reflect sustained performance over a three-year period ● Increased director share ownership guidelines ● Increased the target for vesting of performance restricted shares ● Updated our peer group to reflect increased size and complexity of business ● Implemented a strengthened recoupment policy | |

| 29 |

| ABBOTT’S PEER GROUP FOR PAY AND COMPANY PERFORMANCE BENCHMARKING |

To determine the competitiveness of our compensation and benefit programs, the Committee, in consultation with its independent consultant, annually compares the level of compensation, pay practices, and our relative performance to those of peer companies. Our Compensation Committee reviewed our peer group in 2021 and determined that the existing peer group strikes the appropriate balance between size (revenue and market capitalization between approximately one-third and three-times Abbott’s), growth and return profiles, geographic breadth, and management and operating structure. This approach has been overwhelmingly supported by our investors during shareholder outreach.

The peer group is summarized below, showing the primary characteristics for each company selected, including the Abbott business segment(s) represented by the peer company.

| Company Name | Sales/ Rev.(1) (billions) | Market Cap(1) (billions) | % Rev. Outside U.S. | Similar # Employees | Mfg. Driven/ Consumer- Facing | Abbott Business Segment(s)/ Characteristics Represented | ||||||

| 3M Company | $35.4 | $102.4 | ✓ | ✓ | ✓ | Diagnostics | ||||||

| Becton Dickinson | $20.2 | $ 71.7 | ✓ | ✓ | ✓ | Diagnostics, Medical Devices | ||||||

| Boston Scientific | $11.5 | $ 60.5 | ✓ | ✓ | Medical Devices | |||||||

| Bristol-Myers Squibb | $45.5 | $138.4 | ✓ | ✓ | Established Pharmaceuticals | |||||||

| Cisco | $50.8 | $267.3 | ✓ | ✓ | ✓ | Diagnostics, Medical Devices | ||||||

| The Coca-Cola Company | $37.8 | $255.8 | ✓ | ✓ | ✓ | Consumer | ||||||

| Danaher Corporation | $29.5 | $235.1 | ✓ | ✓ | ✓ | Diagnostics | ||||||

| Honeywell International | $34.6 | $143.5 | ✓ | ✓ | ✓ | Diagnostics, Medical Devices | ||||||

| Johnson & Johnson | $93.8 | $450.4 | ✓ | ✓ | ✓ | Consumer, Diagnostics, Established Pharmaceuticals, Medical Devices | ||||||

| Medtronic | $31.8 | $139.1 | ✓ | ✓ | ✓ | Medical Devices | ||||||

| Merck | $49.2 | $193.6 | ✓ | ✓ | ✓ | Established Pharmaceuticals | ||||||

| Mondelez International | $28.7 | $ 92.5 | ✓ | ✓ | ✓ | Consumer | ||||||

| Nike | $46.3 | $263.8 | ✓ | ✓ | ✓ | Consumer | ||||||

| Procter & Gamble | $78.3 | $395.9 | ✓ | ✓ | ✓ | Consumer | ||||||

| Reckitt Benckiser(2) | $24.6 | $ 60.7 | ✓ | ✓ | Nutrition | |||||||

| Stryker Corporation | $17.1 | $100.9 | ✓ | Medical Devices | ||||||||

| Thermo Fisher Scientific | $39.1 | $262.9 | ✓ | ✓ | ✓ | Diagnostics | ||||||

| Peer Group Median | $35.4 | $143.5 | ||||||||||

| Abbott | $43.1 | $248.9 | ✓ | ✓ | ✓ | |||||||

| Abbott Percentile Rank | 65th | 65th |

| (1) | Data source: Nasdaq IR Insight database reflects most recently disclosed (as of January 31, 2022) trailing 12-month sales/revenue. The market cap reflects values on December 31, 2021. |

| (2) | Revenue/Market Cap converted to USD for companies outside the U.S. |

| 30 |  |

| BASIS FOR COMPENSATION DECISIONS |

Abbott and its Compensation Committee have designed a compensation program that balances short- and long-term objectives to focus our executives on actions that create value today, while building for sustainable future success. Approximately 90% of our pay is performance-based, directly tying a significant portion of executive compensation to Company performance and shareholder returns.

Our compensation program is market-based (to ensure our ability to attract and retain talented executives) and produces compensation outcomes that are performance-based (to incent the achievement of profitable growth that increases shareholder value).

COMPENSATION PROGRAM IS MARKET-BASED

All components of total direct compensation are market-based. Each year, the Compensation Committee reviews market data with the independent compensation consultant to ensure our programs are aligned and our officers are positioned appropriately relative to the market.

Base Salary

Base salary targets are initially set using the median of the peer group as a benchmark. Base salaries then vary depending on the officer’s experience, expertise, and performance. The average base salary of our executive officers is approximately at the market median.

Annual Incentive Plan

Annual incentive targets are initially set using the median of the peer group as a benchmark. The targets may vary based on other factors, including internal pay comparisons. Further linkage to the market is achieved by setting targets that require our officers to exceed the anticipated growth of the market in which they compete in order to achieve a target payout of their annual incentives.

Long-Term Incentive Plan (LTI)

To set annual LTI award guidelines, the Committee first reviews LTI grants made by peer companies to identify the competitive market range. Each year the guidelines are set at the appropriate level within the competitive market range based on Abbott’s relative performance, as described on pages 32 and 33. To recognize the continued growth focus of Abbott and to directly align the interests of executive officers with the interests of our shareholders, the Compensation Committee grants long-term incentive awards in the form of 50% stock options and 50% performance restricted shares. This mix of incentive awards is consistent with our peers.

COMPENSATION OUTCOMES ARE PERFORMANCE-BASED