Exhibit 99.2

Disclaimer 2 Confidentiality and Disclosures This presentation has been prepared for use by Social Capital Hedosophia Holdings Corp . II (“Social Capital”) and Opendoor Labs Inc . (“Opendoor”) in connection with their proposed business combination . This presentation is for information purposes only and is being provided to you solely in your capacity as a potential investor in considering an investment in Social Capital and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Social Capital and Opendoor . Neither Social Capital nor Opendoor makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation . This presentation is not intended to be all - inclusive or to contain all the information that a person may desire in considering an investment in Social Capital and is not intended to form the basis of any investment decision in Social Capital . You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and must make your own investment decision and perform your own independent investigation and analysis of an investment in Social Capital and the transactions contemplated in this presentation . This presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction . Forward - Looking Statements Certain statements in this presentation may constitute “forward - looking statements” within the meaning of the federal securities laws . Forward - looking statements include, but are not limited to, statements regarding Social Capital’s or Opendoor’s expectations, hopes, beliefs, intentions or strategies regarding the future . In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward - looking statements . The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward - looking statements, but the absence of these words does not mean that a statement is not forward - looking . Forward - looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties . You should carefully consider the risks and uncertainties described in the “Risk Factors” section of Social Capital’s registration statement on Form S - 1 , the proxy statement/prospectus on Form S - 4 relating to the business combination, which is expected to be filed by Social Capital with the Securities and Exchange Commission (the “SEC”) and other documents filed by Social Capital from time to time with the SEC . These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements . Forward - looking statements speak only as of the date they are made . Readers are cautioned not to put undue reliance on forward - looking statements, and Social Capital and Opendoor assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise . Neither Social Capital nor Opendoor gives any assurance that either Social Capital or Opendoor will achieve its expectations . Use of Projections The financial projections, estimates and targets in this presentation are forward - looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Social Capital’s and Opendoor’s control . While all financial projections, estimates and targets are necessarily speculative, Social Capital and Opendoor believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation . The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets . The inclusion of financial projections, estimates and targets in this presentation should not be regarded as an indication that Social Capital and Opendoor, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events . Use of Data The data contained herein is derived from various internal and external sources . No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein . Any data on past performance or modeling contained herein is not an indication as to future performance . Social Capital and Opendoor assume no obligation to update the information in this presentation . Further, these financials were prepared by the Company in accordance with private Company AICPA standards . The Company is currently in the process of uplifting its financials to comply with public company and SEC requirements . Use of Non - GAAP Financial Metrics This presentation includes certain non - GAAP financial measures (including on a forward - looking basis) such as Adjusted Gross Profit, Contribution Profit, Adjusted EBITDA and Adjusted Net Income . Opendoor defines Adjusted Gross Margin as GAAP Gross Profit less Net Impairment, Contribution Profit defined as GAAP Gross Profit less selling and holding costs associated with the sale of a home, Adjusted EBITDA defined as net income (loss), adjusted for interest expense, interest income, income taxes, depreciation and amortization and Adjusted Net Income defined as GAAP Net Income less Stock Based Compensation, Warrant Expense, Net Impairment, Intangible Amortization Expense, Restructuring costs and Other . These non - GAAP measures are an addition, and not a substitute for or superior to measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP . Reconciliations of non - GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation . Opendoor believes that these non - GAAP measures of financial results (including on a forward - looking basis) provide useful supplemental information to investors about Opendoor . Opendoor’s management uses forward looking non - GAAP measures to evaluate Opendoor’s projected financial and operating performance . However, there are a number of limitations related to the use of these non - GAAP measures and their nearest GAAP equivalents . For example other companies may calculate non - GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Opendoor’s non - GAAP measures may not be directly comparable to similarly titled measures of other companies . Participants in Solicitation Social Capital and Opendoor and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of Social Capital’s shareholders in connection with the proposed business combination . Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of Social Capital’s directors and officers in Social Capital’s filings with the Securities and Exchange Commission (the “SEC”), including Social Capital’s registration statement on Form S - 1 , which was originally filed with the SEC on February 28 , 2020 . To the extent that holdings of Social Capital’s securities have changed from the amounts reported in Social Capital’s registration statement on Form S - 1 , such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Social Capital’s shareholders in connection with the proposed business combination is set forth in the proxy statement/prospectus on Form S - 4 for the proposed business combination, which is expected to be filed by Social Capital with the SEC . Investors and security holders of Social Capital and Opendoor are urged to read the proxy statement/prospectus and other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed business combination . Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about Social Capital and Opendoor through the website maintained by the SEC at www . sec . gov . Copies of the documents filed with the SEC by Social Capital can be obtained free of charge by directing a written request to Social Capital Hedosophia Holdings Corp . II, 317 University Ave, Suite 200 , Palo Alto, California 94301 .

“Incredible upgrade opportunity” My journey started at 2004 Mitchell Street

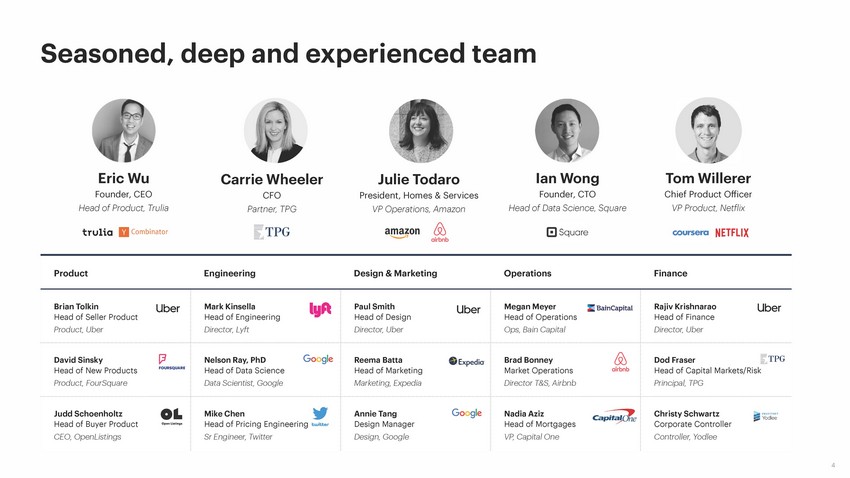

4 Product Engineering Design & Marketing Operations Finance Brian Tolkin Head of Seller Product Product, Uber Mark Kinsella Head of Engineering Director, Lyft Paul Smith Head of Design Director, Uber Megan Meyer Head of Operations Ops, Bain Capital Rajiv Krishnarao Head of Finance Director, Uber David Sinsky Head of New Products Product, FourSquare Nelson Ray, PhD Head of Data Science Data Scientist, Google Reema Batta Head of Marketing Marketing, Expedia Brad Bonney Market Operations Director T&S, Airbnb Dod Fraser Head of Capital Markets/Risk Principal, TPG Judd Schoenholtz Head of Buyer Product CEO, OpenListings Mike Chen Head of Pricing Engineering Sr Engineer, Twitter Annie Tang Design Manager Design, Google Nadia Aziz Head of Mortgages VP, Capital One Christy Schwartz Corporate Controller Controller, Yodlee Eric Wu Founder, CEO Head of Product, Trulia Ian Wong Founder, CTO Head of Data Science, Square Tom Willerer Chief Product Officer VP Product, Netflix Julie Todaro President, Homes & Services VP Operations, Amazon Carrie Wheeler CFO Partner, TPG Seasoned, deep and experienced team

Buy, sell & move 5 at the tap of a button Unlock homeownership for millions of Americans

6 An Opendoor story Charlisa’s next chapter Read and watch her story www.opendoor.com/w/stories/charlisa - boyd

18,799 Homes sold (2019) #2 Competitor #3 Competitor 7 We are the innovator and market leader 2017 2019 Revenue ($B) $0.7 $1.8 $4.7 21 $10B 80K Markets Homes sold Homeowners served Key metrics Markets, Homeowners served and Homes sold metrics since Company inception through August 31, 2020; Homeowners served defined as number of home transactions Competitors shown inclusive of iBuyer category, not all market competitors Note: 4.4x larger than the next closest competitor

Significant upside ahead Revenue growth and margin improvement expected via market penetration and adjacent services Investment highlights 8 Massive, fragmented market U.S. real estate industry is ripe for disruption Superior consumer experience Digital experience transforming a highly inefficient process Strong unit economics Proven, replicable margins across multiple markets Rapid growth and scale Demonstrated ability to grow rapidly and efficiently Market leader with low cost transaction platform Highly efficient platform to buy and sell real estate

4% 50+ annual transactions 66% 0 - 15 annual transactions 31% 15 - 50 annual transactions Real estate Used autos Food $1.0T/yr $841B/yr 68% of Americans are homeowners 5 million homes sold annually Fragmented incumbents $1.6T/yr 9 Massive market Data sourced from public company filings, U.S. Bureau of Labor Statistics, U.S. Census Bureau and National Association of Rea lto rs The largest, undisrupted market in the U.S. 2 million realtors 28% of realtors have another occupation Note:

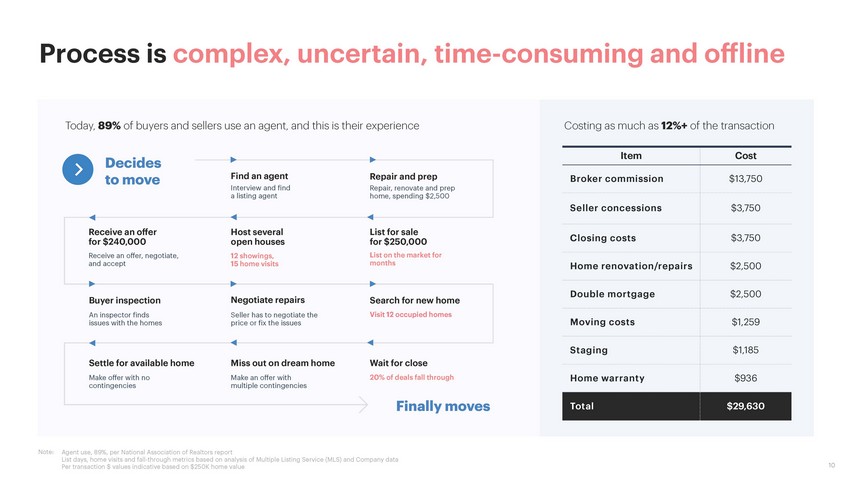

Today, 89% of buyers and sellers use an agent, and this is their experience Agent use, 89%, per National Association of Realtors report List days, home visits and fall - through metrics based on analysis of Multiple Listing Service (MLS) and Company data Per transaction $ values indicative based on $250K home value Note: Costing as much as 12%+ of the transaction Item Cost Broker commission $13,750 Seller concessions $3,750 Closing costs $3,750 Home renovation/repairs $2,500 Double mortgage $2,500 Moving costs $1,259 Staging $1,185 Home warranty $936 Total $29,630 Process is complex, uncertain, time - consuming and offline 10 Finally moves Decides to move Find an agent Interview and find a listing agent Repair and prep Repair, renovate and prep home, spending $2,500 List for sale for $250,000 List on the market for months Host several open houses 12 showings, 15 home visits Receive an offer for $240,000 Receive an offer, negotiate, and accept Negotiate repairs Seller has to negotiate the price or fix the issues Search for new home Visit 12 occupied homes Buyer inspection An inspector finds issues with the homes Wait for close 20% of deals fall through Miss out on dream home Make an offer with multiple contingencies Settle for available home Make offer with no contingencies

11 Online cash offer Flexible close date Digital closing Receive an offer and sell on your timeline

New experience to search, visit and buy thousands of homes 12 Self - tour homes Financing in - app Digital offer process

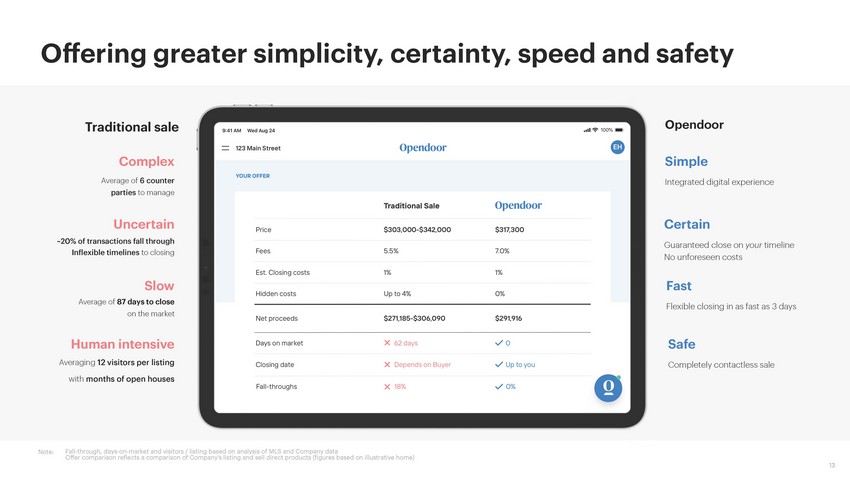

Offering greater simplicity, certainty, speed and safety 13 Complex Slow Uncertain Human intensive Average of 6 counter parties to manage ~20% of transactions fall through Inflexible timelines to closing Average of 87 days to close on the market Averaging 12 visitors per listing with months of open houses Traditional sale Simple Integrated digital experience Fast Flexible closing in as fast as 3 days Certain Guaranteed close on your timeline No unforeseen costs Safe Completely contactless sale Opendoor Fall - through, days - on - market and visitors / listing based on analysis of MLS and Company data Offer comparison reflects a comparison of Company’s listing and sell direct products (figures based on illustrative home) Note:

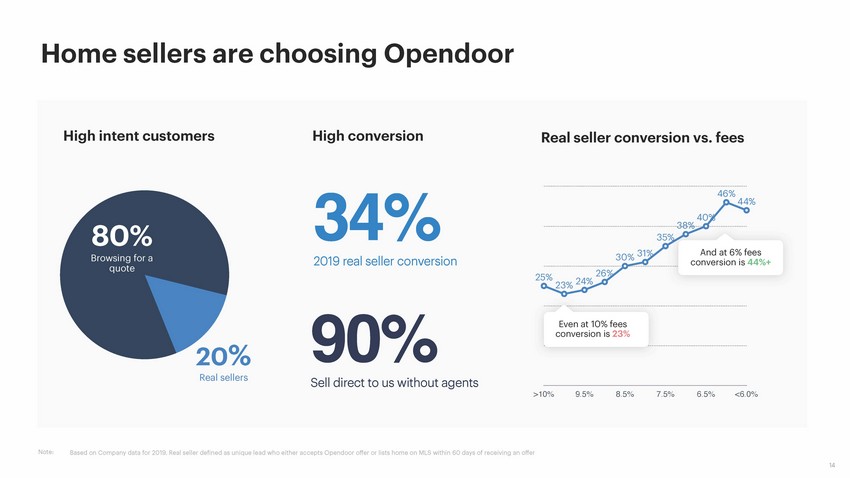

20 % Real sellers High intent customers 80% Browsing for a quote 14 34% 2019 real seller conversion High conversion 25% 23% 24% 26% 30% 31% 35% 38% 40% 46% 44% >10% 9.5% 8.5% 7.5% 6.5% <6.0% Even at 10% fees conversion is 23% And at 6% fees conversion is 44%+ Real seller conversion vs. fees Based on Company data for 2019. Real seller defined as unique lead who either accepts Opendoor offer or lists home on MLS wit hin 60 days of receiving an offer Home sellers are choosing Opendoor 90% Sell direct to us without agents Note:

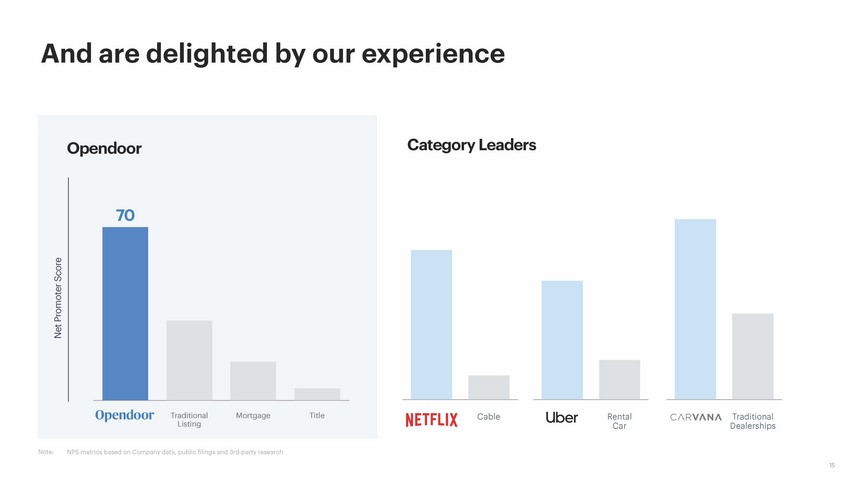

Rental Car Traditional… Category Leaders 15 Traditional… Mortgage Title Opendoor 70 Net Promoter Score NPS metrics based on Company data, public filings and 3rd - party research Note: And are delighted by our experience

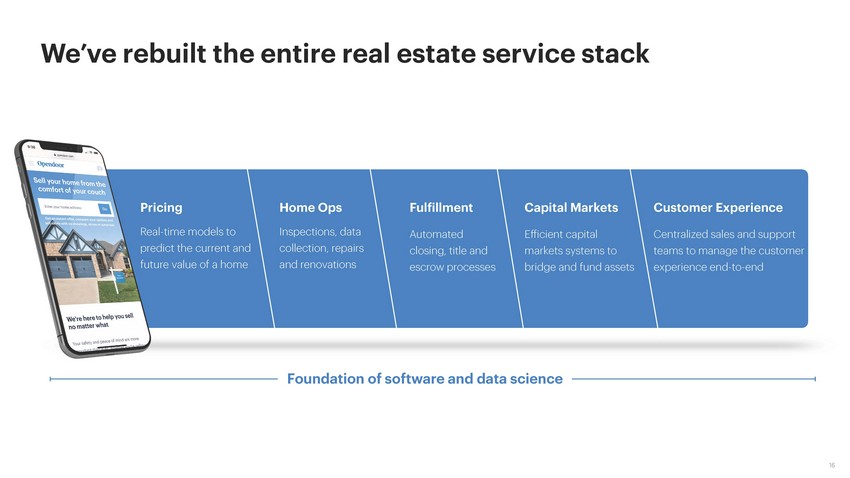

Foundation of software and data science Pricing Real - time models to predict the current and future value of a home Home Ops Inspections, data collection, repairs and renovations Fulfillment Automated closing, title and escrow processes Customer Experience Centralized sales and support teams to manage the customer experience end - to - end Capital Markets Efficient capital markets systems to bridge and fund assets 16 We’ve rebuilt the entire real estate service stack

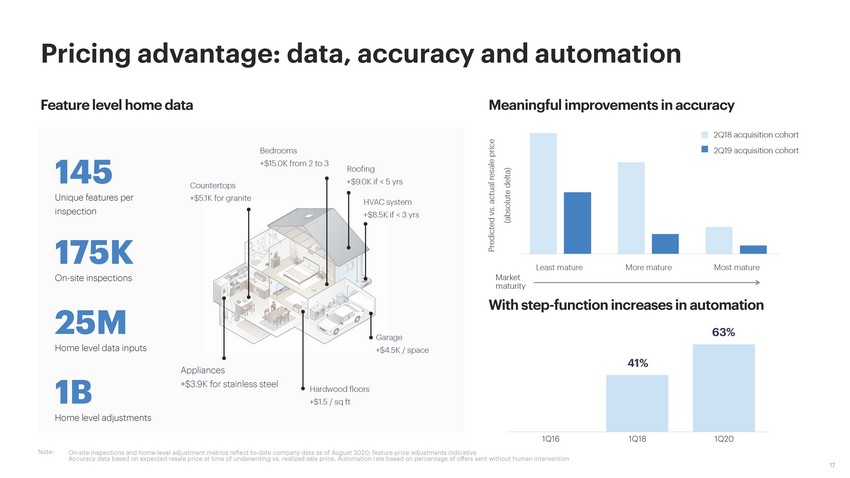

Feature level home data 145 Unique features per inspection 175K On - site inspections 25M Home level data inputs 1B Home level adjustments 17 1Q16 1Q18 1Q20 41% 63% With step - function increases in automation Meaningful improvements in accuracy 2Q18 acquisition cohort 2Q19 acquisition cohort Predicted vs. actual resale price (absolute delta) Least mature More mature Most mature On - site inspections and home - level adjustment metrics reflect to - date company data as of August 2020; feature price adjustments indicative Accuracy data based on expected resale price at time of underwriting vs. realized sale price. Automation rate based on percen tag e of offers sent without human intervention Pricing advantage: data, accuracy and automation Countertops +$5.1K for granite HVAC system +$8.5K if < 3 yrs Bedrooms +$15.0K from 2 to 3 Roofing +$9.0K if < 5 yrs Hardwood floors +$1.5 / sq ft Garage +$4.5K / space Appliances +$3.9K for stainless steel Note: Market maturity

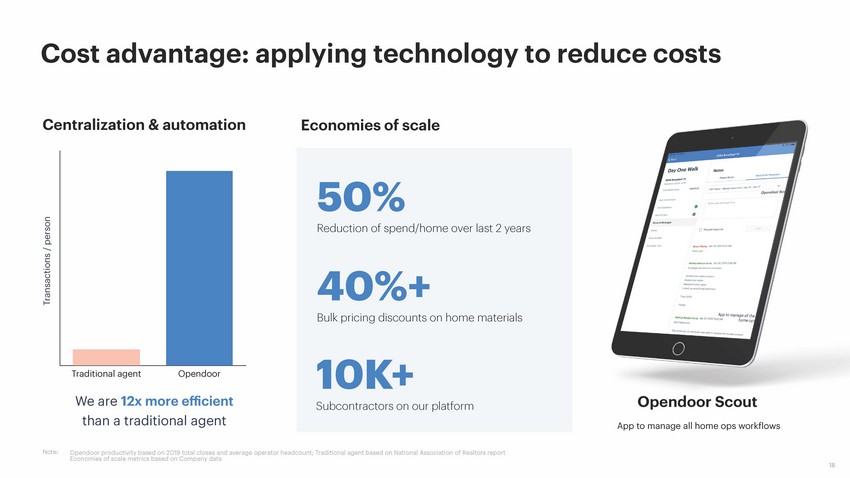

18 Centralization & automation Traditional agent Opendoor We are 12x more efficient than a traditional agent Transactions / person App to manage all home ops workflows Opendoor Scout Opendoor productivity based on 2019 total closes and average operator headcount; Traditional agent based on National Associat ion of Realtors report Economies of scale metrics based on Company data Cost advantage: applying technology to reduce costs Economies of scale 40%+ Bulk pricing discounts on home materials 10K+ Subcontractors on our platform 50% Reduction of spend/home over last 2 years Note:

Growth 19

Phoenix Dallas - Fort Worth Las Vegas Atlanta Raleigh - Durham Orlando $1.0B run - rate revenue 4.2% market share $206M run - rate revenue 1.9% market share $329M run - rate revenue 1.7% market share $664M run - rate revenue 4.6% market share $388M run - rate revenue 5.5% market share $166M run - rate revenue 1.5% market share 20 Market share based on Company resales and MLS transaction data for respective markets as of 1Q20. 1Q20 run rates do not refle ct the full impact of COVID - 19; see Summary Financials for full - year 2020 projections Our first 6 markets reached $2.7B run - rate revenue in 1Q20 $2.7B 1Q20 Run - rate revenue 3.2% Market share 6 Markets Note:

Phoenix Dallas - Fort Worth Las Vegas Atlanta Raleigh - Durham Orlando Charlotte San Antonio Sacramento Houston Tampa Portland Denver Nashville Jacksonville Austin Minneapolis - St.Paul Riverside Tucson Los Angeles Salt Lake City 21 $5.0B 1Q20 Run - rate revenue 2.0% Market share 21 Markets Today, we are in 21 markets and just scratching the surface Market share based on Company resales and MLS transaction data for respective markets as of 1Q20. 1Q20 run rates do not refle ct the full impact of COVID - 19; see Summary Financials for full - year 2020 projections Note:

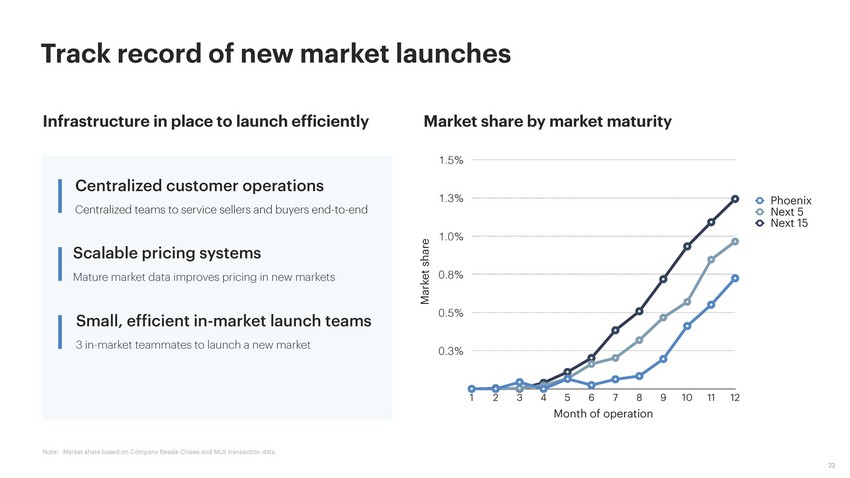

22 Track record of new market launches Market share Market share by market maturity Month of operation 0.0% 0.3% 0.5% 0.8% 1.0% 1.3% 1.5% 1 2 3 4 5 6 7 8 9 10 11 12 Phoenix Next 5 Next 15 Infrastructure in place to launch efficiently Centralized customer operations Centralized teams to service sellers and buyers end - to - end Scalable pricing systems Mature market data improves pricing in new markets Small, efficient in - market launch teams 3 in - market teammates to launch a new market Market share based on Company Resale Closes and MLS transaction data Note:

23 Our current playbook takes us to $50B in revenue $50B Run - rate revenue 4% Market share 100 Markets Phoenix Atlanta Orlando Las Vegas Sacramento Tampa Raleigh - Durham Portland Denver Nashville Jacksonville Minneapolis - St.Paul Washington, DC Seattle Philadelphia Baltimore Chicago Riverside Boston Detroit St. Louis San Diego Ft. Lauderdale Kansas City Orange County Indianapolis Miami Long Island Cleveland Columbus Cincinnati Stockton Pittsburgh Milwaukee Oklahoma City Ft. Myers Tucson Tacoma Birmingham Louisville Charleston Providence Omaha New Orleans Hudson Valley Memphis Grand Rapids Tulsa Buffalo Knoxville Baton Rouge Albuquerque Dover El Centro Hanford Hanford Reno Kennewick Salem Spokane Salt Lake City Ogden Provo - Orem Lexington Yuma Santa Fe Trenton Visalia Vero Beach Los Angeles Ventura Oakland Modesto Bakersfield Boulder Canton Hampton Roads Richmond Charlottesville Colorado Springs Fort Collins Greeley Dallas - Fort Worth San Antonio Austin Houston Ocala Redding Savannah Charlotte Wilmington Newark Boise Killeen

Phoenix Dallas - Fort Worth Atlanta Orlando Las Vegas Sacramento Tampa Raleigh - Durham Portland Charlotte Nashville Jacksonville San Antonio Austin Minneapolis - St.Paul Washington, DC Seattle Philadelphia Baltimore Chicago Riverside Los Angeles Boston Detroit St. Louis San Diego Ft. Lauderdale Kansas City Orange County Indianapolis Miami Long Island Cleveland Columbus Cincinnati Pittsburgh Hampton Roads Milwaukee Oklahoma City Ft. Myers Richmond Tucson Tacoma Birmingham Louisville Charleston Providence Omaha New Orleans Hudson Valley Memphis Grand Rapids Tulsa Buffalo Knoxville Baton Rouge Albuquerque 24 With a U.S. market potential of $1.3T 5M Annual homes sold Annual homes sold and sales distribution per National Association of Realtors (NAR) Gross Merchandise Value = annual homes sold x $310k average sales price x 87%. Individual metrics per NAR 87% Homes in buy box of $100K to $750K $1.3T Total annual GMV Houston Note: Dover El Centro Hanford Reno Kennewick Salem Spokane Salt Lake City Ogden Provo - Orem Lexington Yuma Santa Fe Trenton Visalia Vero Beach Ventura Stockton Oakland Modesto Bakersfield Canton Charlottesville Denver Boulder Colorado Springs Fort Collins Greeley Killeen Ocala Redding Savannah Wilmington Newark Boise

25 And this is just the beginning

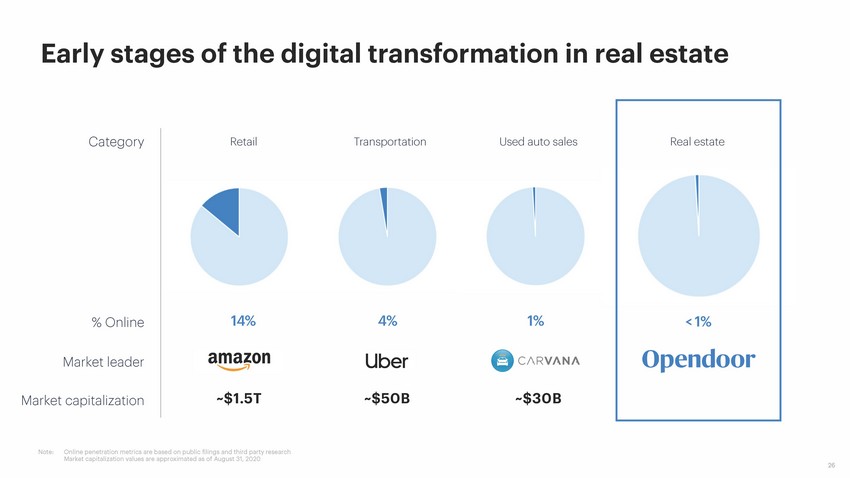

26 Category % Online Market leader Market capitalization Retail Transportation Used auto sales Real estate 14% 4% 1% < 1% ~$1.5T ~$50B ~$30B Online penetration metrics are based on public filings and third party research Market capitalization values are approximated as of August 31, 2020 Early stages of the digital transformation in real estate Note:

27 Customers are prioritizing safety Opendoor provides a digital, contact - less way to buy and sell a home Customers are demanding digital first experiences De - urbanization is occurring as buyers avoid dense areas Demand for housing in our markets is strengthening COVID - 19 has accelerated shifts in consumer behavior

Home maintenance Title and Escrow Financing Upgrades Warranty Insurance Moving services 28 Consumers demand digital experiences for the services that revolve around the home

29 We’ve transformed how people sell a home Today Sold in a few taps The picture can't be displayed. As the market leader, we are just getting started Tomorrow We will transform how people move Digital one - stop shop to move

Financial overview 30

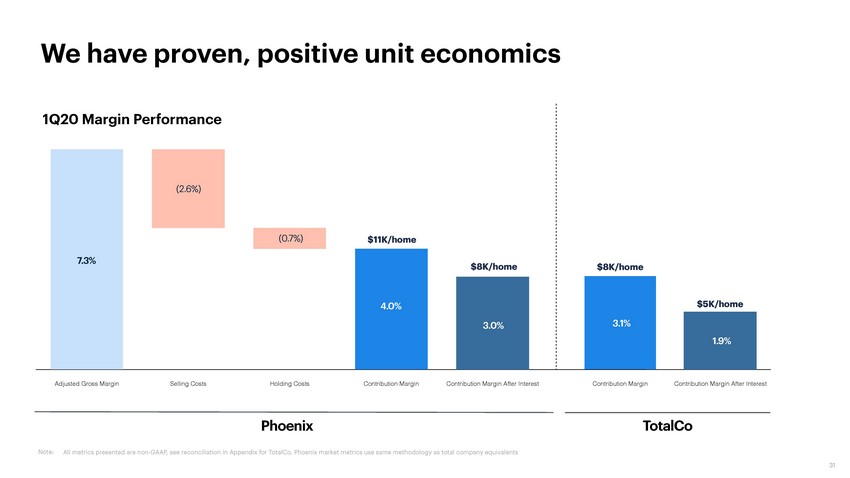

31 We have proven, positive unit economics Contribution Margin 3.1% 1Q20 Margin Performance Phoenix TotalCo All metrics presented are non - GAAP, see reconciliation in Appendix for TotalCo. Phoenix market metrics use same methodology as t otal company equivalents $8K/home Contribution Margin After Interest $5K/home Note: Adjusted Gross Margin Selling Costs Holding Costs Contribution Margin Contribution Margin After Interest 7.3% (2.6%) (0.7%) 4.0% $11K/home $8K/home 3.0% 1.9%

Phoenix Contribution Margin per home by market (1Q20) 32 $8K / home TotalCo Contribution Margin $11K / home 4.0% All metrics presented are non - GAAP, see reconciliation in Appendix. Based on 1Q20 performance for 19 markets. Excludes ramping m arkets with fewer than 50 Resale Closes in 1Q20 The vast majority of our markets are CM positive 90% of markets are CM positive Note:

33 Adjacent services roadmap First proof point with title & escrow Quarter since launch 7,031 103 510 1,134 2,381 3,951 4,720 5,394 20% 40% 60% 80% 8,157 82.9% 75.9% 78.4% 75.8% 74.5% 57.8% 36.1% 21.6% 5.7% Title & escrow transactions (#) Attach rate (%) Attach rate based on total acquisition and Resale Closes in markets where Company title product is active, beginning 3Q17 Active adjacent services Contribution Margin / home based on Company forecasts assuming $250K home. To be launched category r efl ects Company estimates Established Target CM / home Title & Escrow $1,750 Recently launched Home Loans $5,000 Buy with Opendoor $5,000 List with Opendoor $3,750 To be launched Home warranty, upgrade & remodel, home insurance, moving services $7,500 Demonstrated success in adding high margin services Note:

Ancillary Gross Margin Ancillary Gross Margin Vehicle Gross Margin Vehicle Gross Margin Expect ~50 / 50 long - term unit margin composition, similar to other “trade - in” business models 34 1Q20 Contribution Margin Cost optimization Additional services Long - term target Contribution Margin $11K/home Phoenix (at scale) Contribution Margin presented is non - GAAP, see reconciliation in Appendix Carvana and AutoNation business mix based on public filings; AutoNation mix excludes parts and warranty services Cost optimization includes selling cost and holding cost improvements $6.6K/home $19K/home 0.6% 4.0% 2.4% $1.5K/home 7.0% Significant margin upside from additional services and cost optimization Note:

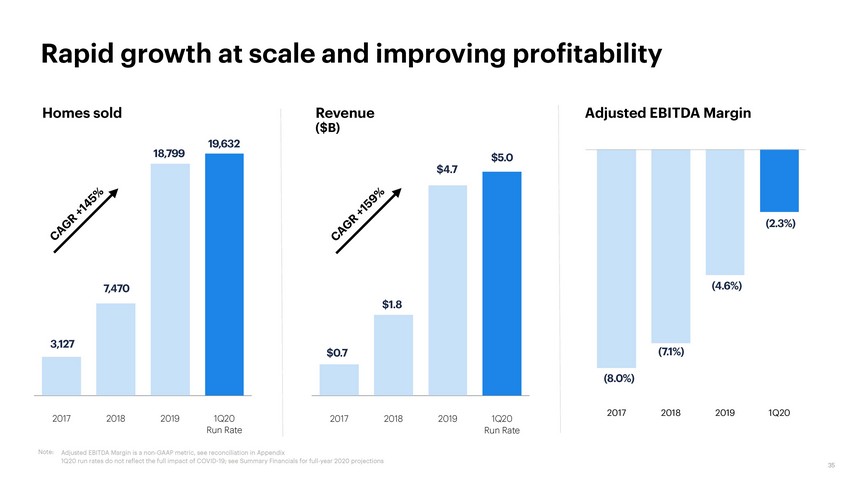

35 Adjusted EBITDA Margin 1Q20 (8.0%) (7.1%) (4.6%) (2.3%) Homes sold 2017 2018 2019 1Q20 Run Rate 3,127 7,470 18,799 19,632 2017 2018 2019 1Q20 Run Rate Revenue ($B) $0.7 $1.8 $4.7 $5.0 Rapid growth at scale and improving profitability Note: Adjusted EBITDA Margin is a non - GAAP metric, see reconciliation in Appendix 1Q20 run rates do not reflect the full impact of COVID - 19; see Summary Financials for full - year 2020 projections

2016 2018 2020 36 Scalable, efficient financing in place (1) As of June 30, 2020. Debt facilities restricted use for the purchase of homes (2) Advance rate and Senior debt cost as representative. Advance rate represents the combined senior and mezzanine advance on the pu rchase price of homes at time of acquisition (3) Interest rates presented are an approximate average, weighted by senior bank committed capacity (4) Adjusted Equity is a non - GAAP metric. As of June 30 2020, Adjusted Equity was equal to $539M in GAAP equity plus $191M in Conver tible Notes and Derivative Liabilities on an as converted basis (5) Cash includes Unrestricted Cash and Marketable Securities as of June 30, 2020 95% 97% 100% Pro forma equity capital ($M) $979 $1,709 $730 Opendoor Adjusted Equity (4) Expected net transaction proceeds Pro Forma Adjusted Equity $560 Cash Committed, non - recourse asset - backed facilities of $2.4B Proven ability to scale capacity and reduce costs Diversified and high quality lender base with staggered maturities • Increased advance rate from ~80% to ~100% • Decreased interest spread from ~650 to ~250 (1) ~80% L + ~250 L + ~350 ~90% ~100% L + ~650 Senior debt cost Advance rate (2) Attractive debt financing (3) Metrics as of June 30, 2020 are preliminary and subject to change (5) Note:

37 COVID - 19: Systems built to react quickly to changing market conditions 15,192 First offers sent (#) 7,362 Paused offers Feb - 20 Jul - 20 $1,019 $172 Inventory ($M) De - risked balance sheet Adjusted Gross Margin (%) 7.1% >6.8% 5.6% Adjusted Gross Margin is a non - GAAP metric, see reconciliation in Appendix 2Q20 is preliminary and subject to change Maintained margins Note:

38 Projecting continued strong growth and path to profitability 2022P $2.5 $3.5 $6.2 $9.8 Revenue ($B) 2020P 2021P 2022P 2023P (5.7%) (5.4%) (2.0%) 0.1% Adjusted EBITDA Margin 2022P 3.0% 4.1% 4.7% 5.5% Contribution Margin ($M) $72 $142 $290 $539 Note: Contribution Margin and Adjusted EBITDA Margin are non - GAAP metrics, see reconciliation in Appendix

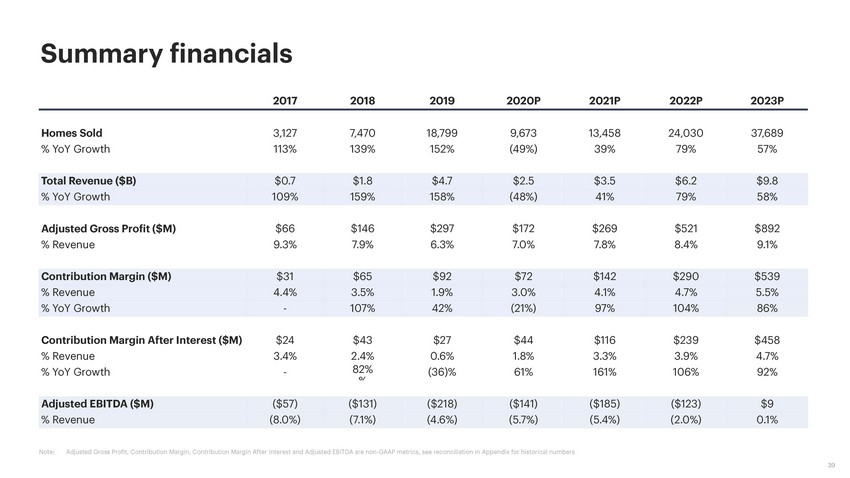

2017 2018 2019 2020P 2021P 2022P 2023P Homes Sold 3,127 7,470 18,799 9,673 13,458 24,030 37,689 % YoY Growth 113% 139% 152% (49%) 39% 79% 57% Total Revenue ($B) $0.7 $1.8 $4.7 $2.5 $3.5 $6.2 $9.8 % YoY Growth 109% 159% 158% (48%) 41% 79% 58% Adjusted Gross Profit ($M) $66 $146 $297 $172 $269 $521 $892 % Revenue 9.3% 7.9% 6.3% 7.0% 7.8% 8.4% 9.1% Contribution Margin ($M) $31 $65 $92 $72 $142 $290 $539 % Revenue 4.4% 3.5% 1.9% 3.0% 4.1% 4.7% 5.5% % YoY Growth - 107% 42% (21%) 97% 104% 86% Contribution Margin After Interest ($M) $24 $43 $27 $44 $116 $239 $458 % Revenue 3.4% 2.4% 0.6% 1.8% 3.3% 3.9% 4.7% % YoY Growth - 82% % (36)% 61% 161% 106% 92% Adjusted EBITDA ($M) ($57) ($131) ($218) ($141) ($185) ($123) $9 % Revenue (8.0%) (7.1%) (4.6%) (5.7%) (5.4%) (2.0%) 0.1% Adjusted Gross Profit, Contribution Margin, Contribution Margin After Interest and Adjusted EBITDA are non - GAAP metrics, see rec onciliation in Appendix for historical numbers 39 Summary financials Note:

(1) Assumes home sale price of $250K All metrics presented are non - GAAP, see reconciliation in Appendix 40 Metric 2018 2019 1Q20 Long - Term Target Key Drivers Total Contribution Margin 3.5% 1.9% 3.1% 7 - 9% ($20K/home) • Maturation of existing, launched markets • Continuing optimization of cost structure • Penetration of high margin services Contribution Margin After Interest 2.4% 0.6% 1.9% 6 - 8% ($17.5K/home) • Assumes 100bps of steady - state interest expense Adjusted EBITDA Margin (7.1%) (4.6%) (2.3%) 4 - 6% • Flow - through from improving contribution • Leverage on operations, marketing and fixed operating costs Long - term margin targets (1) (1) Note:

41 Investment summary Massive, fragmented market $1.6T Existing home sales <1% Online penetration Superior consumer experience T 70 Customer NPS 34% Real seller conversion Market leader with low cost platform 12x More efficient 40%+ Scale cost savings Rapid growth and scale $4.7B 2019 revenue 150%+ CAGR (2017 - 19) Strong unit economics 3.1% 1Q20 Contribution Margin 90% % of markets with +CM Significant upside via market and services expansion 100+ Market opportunity +3% Additional service margin

Transaction overview 43

44 Pro forma valuation Sources and uses IPOB illustrative share price $10.00 Pro forma shares outstanding (M) 630.7 Total equity value $6,307 Cash on balance sheet $1,539 Total enterprise value $4,768 Total Enterprise Value / Revenue 1.0x (based on 2019 Revenue of $4.7B) 0.5x (based on 2023 Revenue of $9.8B) ($M except per share values) Sources Cash from PIPE (including co - investment) $600 Cash from IPOB $414 Total sources $1,014 Uses Cash to balance sheet $979 Estimated transaction fees and expenses $35 Total uses $1,014 ($M) (1) Note: Transaction overview (2) (1) Total shares includes 500.0 million rollover equity shares (inclusive of existing management options and RSUs rolling over), 41. 4 million IPOB public shares, 60.0 million shares from PIPE, 10.4 million IPOB founder shares and 18.9 million bonus shares t o m anagement. Assumes no redemptions (2) Cash on balance sheet includes unrestricted cash and marketable securities of $560M as of June 30, 2020 plus $979M of pro cee ds from the transaction

45 Pro forma enterprise value of $4.8B $200M from affiliated entities, led by $100M from Chamath Palihapitiya, Founder and CEO of SCH, and $58M from Hedosophia, with the remainder invested by existing Opendoor shareholders, Access Industries and Lennar, along with Opendoor management Over $1.5B of pro forma cash held on balance sheet Completion of transaction is expected by 4Q20 Pro forma ownership (1) Total shares includes 500.0 million rollover equity shares (inclusive of existing management options and RSUs rolling over), 41. 4 million IPOB public shares, 60.0 million shares from PIPE, 10.4 million IPOB founder shares and 18.9 million bonus shares t o m anagement. Assumes no redemptions (2) 1.0% of the management bonus award will be allocated to the CEO, while the remainder will be allocated by the compensation co mm ittee of the combined company within normal planning cycle (i.e., within the next year). One - quarter of these awards will vest 1 - year after completion and the remainder of which will vest ratably over the following three years. (3) Excludes investment in PIPE 9.5% 6.6% 3.0% 1.6% PIPE IPOB shareholders IPOB sponsors Management awards (1) (2) (3) Note: Transaction overview (continued) 79.3% Existing Opendoor shareholders 100% rollover by existing Opendoor shareholders Top - tier institutional investors are investing an additional $400M including funds and accounts managed by BlackRock and Healthcare of Ontario Pension Plan (HOOPP) $600M PIPE raised at $10 / share consisting of:

Appendix 46

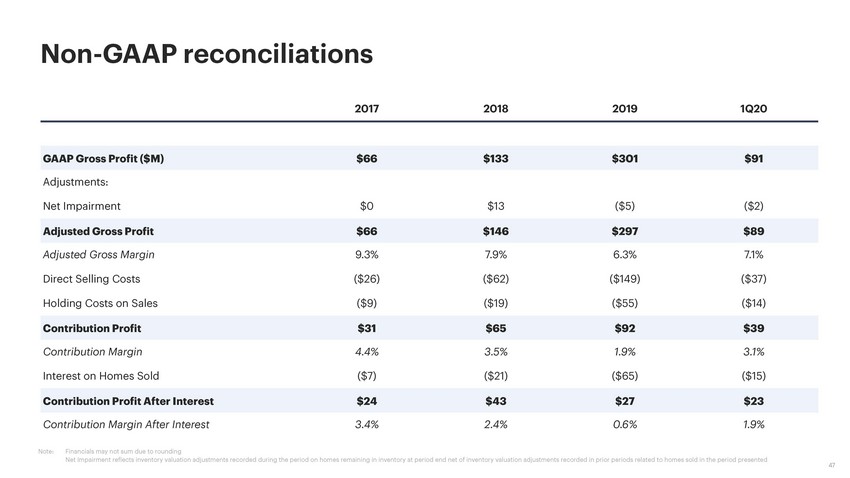

47 2017 2018 2019 1Q20 GAAP Gross Profit ($M) $66 $133 $301 $91 Adjustments: Net Impairment $0 $13 ($5) ($2) Adjusted Gross Profit $66 $146 $297 $89 Adjusted Gross Margin 9.3% 7.9% 6.3% 7.1% Direct Selling Costs ($26) ($62) ($149) ($37) Holding Costs on Sales ($9) ($19) ($55) ($14) Contribution Profit $31 $65 $92 $39 Contribution Margin 4.4% 3.5% 1.9% 3.1% Interest on Homes Sold ($7) ($21) ($65) ($15) Contribution Profit After Interest $24 $43 $27 $23 Contribution Margin After Interest 3.4% 2.4% 0.6% 1.9% Non - GAAP reconciliations Financials may not sum due to rounding Net Impairment reflects inventory valuation adjustments recorded during the period on homes remaining in inventory at period end net of inventory valuation adjustments recorded in prior periods related to homes sold in the period presented Note:

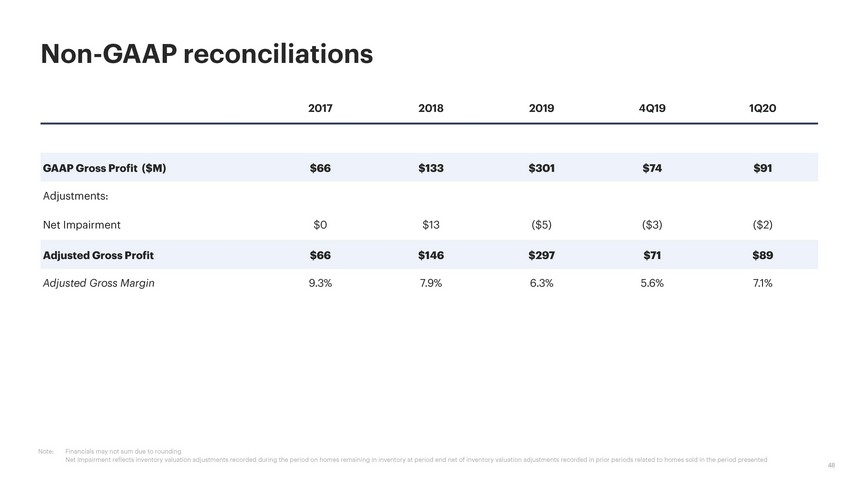

48 2017 2018 2019 4Q19 1Q20 GAAP Gross Profit ($M) $66 $133 $301 $74 $91 Adjustments: Net Impairment $0 $13 ($5) ($3) ($2) Adjusted Gross Profit $66 $146 $297 $71 $89 Adjusted Gross Margin 9.3% 7.9% 6.3% 5.6% 7.1% Non - GAAP reconciliations Financials may not sum due to rounding Net Impairment reflects inventory valuation adjustments recorded during the period on homes remaining in inventory at period end net of inventory valuation adjustments recorded in prior periods related to homes sold in the period presented Note:

49 2017 2018 2019 1Q20 GAAP Net Income ($M) ($85) ($240) ($339) ($62) Adjustments: Stock Based Compensation $4 $15 $13 $3 Warrant Expense $0 $18 ($6) $1 Net Impairment $0 $13 ($5) ($2) Intangibles Amortization Expense $0 $1 $3 $1 Restructuring $0 $0 $3 $1 Convertible Note Interest & Discount Amortization $0 $0 $4 $3 Other $0 $1 $0 $0 Adjusted Net Income ($81) ($192) ($327) ($56) Adjustments: Depreciation & Amortization $1 $5 $15 $5 Property Financing $16 $48 $84 $18 Other Interest and Amortization of Loan Costs $7 $12 $21 $7 Interest Income ($1) ($4) ($12) ($3) Taxes – $0 $0 $0 Adjusted EBITDA ($57) ($131) ($218) ($28) Adjusted EBITDA Margin (8.0%) (7.1%) (4.6%) (2.3%) Non - GAAP reconciliations Financials may not sum due to rounding Other reflects Other Income, Other Expense, and Gain/(Loss) on Mortgage Rate Lock Commitment Note: