Exhibit 99.3

SOCIAL CAPITAL HEDOSOPHIA II SEPTEMBER 2020 IPOB

2 GOALS

3 PARTNER WITH AN ICONIC TECHNOLOGY COMPANY

4 HELP THEM TRANSITION TO THE PUBLIC MARKETS

5 ENABLE THEM TO FUND LONG - TERM GROWTH

6 BUILD A LEGACY COMPANY

7 CONSUMPTION

8 OFFLINE CONSUMPTION HAS BECOME TOO CUMBERSOME FOR MOST PEOPLE

9 PEOPLE VALUE TIME, CONVENIENCE AND CONSISTENCY

10 THIS IS WHAT MODERN SOFTWARE EXCELS AT DELIVERING

11 THE RESULT IS THAT EVERYTHING IS MOVING ONLINE

12 BUYING CLOTHES BUYING GROCERIES BUYING CARS BUYING ANYTHING BUYING EVERYTHING

13 13

14 LEADERS IN THESE CATEGORIES HAVE TAILWINDS

15 LONG TERM GROWTH AND ADVANTAGES OF SCALE

16 ONE CATEGORY OF CONSUMPTION HAS STAYED THE SAME

17 REAL ESTATE

18 68% OF AMERICANS ARE HOMEOWNERS Note: Data sourced from U.S. Census Bureau.

19 5M HOMES ARE SOLD EVERY YEAR IN THE US Note: Data sourced from National Association of Realtors.

20 THE LARGEST , UNDISRUPTED MARKET IN THE US WORTH $1.6T ANNUALLY Note: Data sourced from U.S. Census Bureau and National Association of Realtors.

21 HIGHLY FRAGMENTED INCUMBENTS , LOW NPS AND 28% DO IT AS A PART - TIME JOB Note: Data sourced from U.S. Bureau of Labor Statistics, U.S. Census Bureau and National Association of Realtors.

22

23 IPOB +

24 TAILWINDS

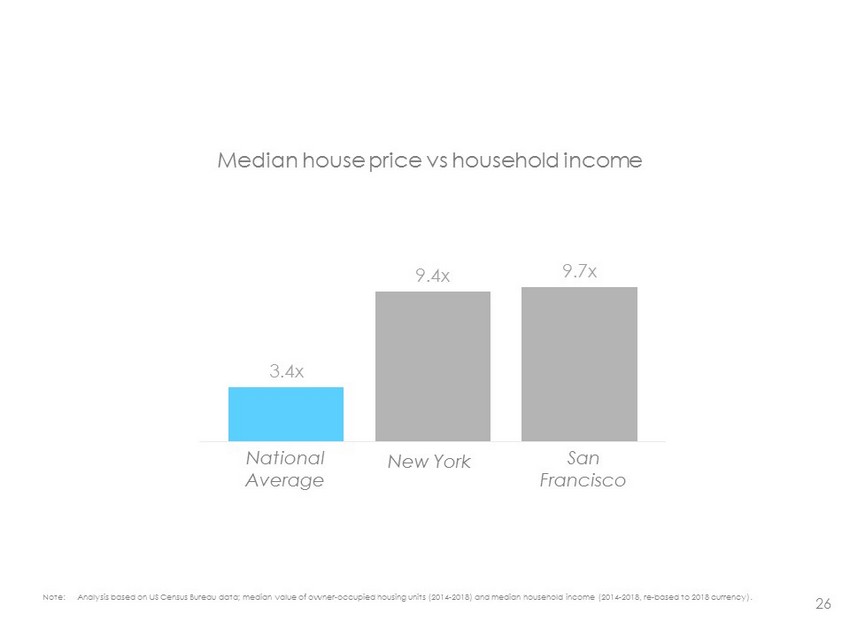

25 LACK OF RESALE INVENTORY AND NEW HOME EXPANSION HAS CONSTRAINED SUPPLY

26 3.4x 9.4x 9.7x Median house price vs household income National Average New York San Francisco Note: Analysis based on US Census Bureau data; median value of owner - occupied housing units (2014 - 2018) and median household income ( 2014 - 2018, re - based to 2018 currency).

27 INCREASING STATE TAXES AND ELIMINATION OF SALT DEDUCTIONS ARE CREATING RELOCATION DECISIONS

CENTERS OF GRAVITY IN US ARE SHIFTING 28 Phoenix Dallas - Fort Worth Atlanta Raleigh - Durham Orlando San Jose San Francisco $1,050 0.6x $1,380 0.1x Los Angeles $582 (0.3x) Median Sales Price ($k) Population Growth (vs. National Average: 0.5%) New York Newark $440 (0.4x) $435 0.2x $313 4.0x $251 2.4x $296 3.7x $281 3.2x $315 3.5x Note: Population growth shown as a 3 - yr CAGR from 2016 - 2019. Analysis based on National Association of Realtors (NAR) data as of 2Q20 and US Census Bureau data from 2016 - 2019.

29 WORKING FROM HOME IS ACCELERATING RELOCATION DECISIONS

30 URBAN RESIDENTS NOW SEARCH MORE FOR SUBURBAN PROPERTIES, AN ALL TIME RECORD

31 75M MILLENIALS ARE STARTING TO ENTER THE HOUSING MARKET Source: Pew Research Center.

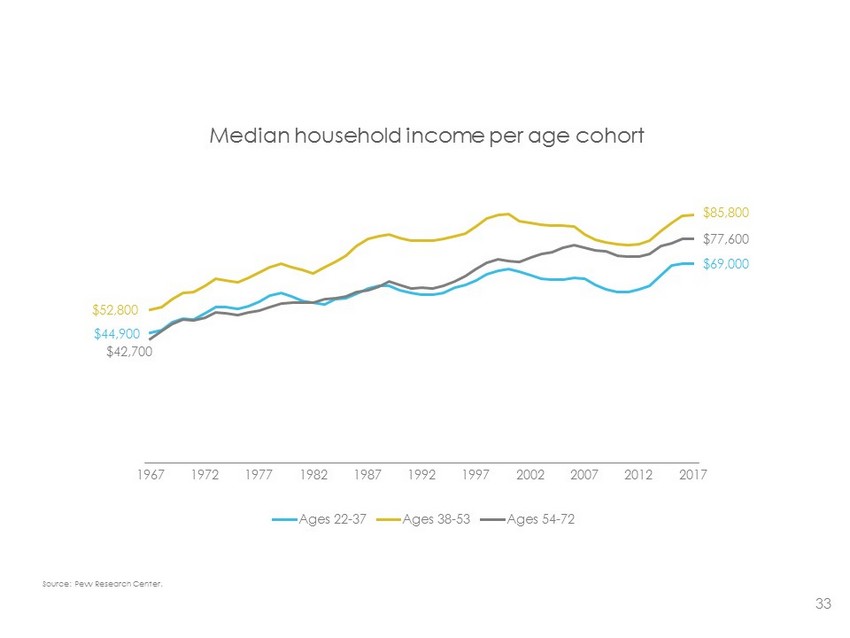

32 AND THEY HAVE BUYING POWER

33 $44,900 $69,000 $42,700 $77,600 1967 1972 1977 1982 1987 1992 1997 2002 2007 2012 2017 Ages 22-37 Ages 38-53 Ages 54-72 $85,800 $52,800 Median household income per age cohort Source: Pew Research Center.

34 AMERICANS ARE ON THE MOVE

35 OPENDOOR

36 PRODUCT BRINGS MACHINE LEARNING, USER EXPERIENCE AND OPERATIONS TOGETHER TO CREATE A SEAMLESS EXPERIENCE

37 OPENDOOR HAS ACHIEVED SIGNIFICANT SCALE IN JUST A FEW YEARS

38 2019 REVENUE OF $4.7B Note: Company data.

39 BUILDING A VIRTUOUS CYCLE WITH COMPOUNDING ADVANTAGES OF SCALE

40 COMPOUNDING ADVANTAGES MORE SALES & MORE PURCHASES MORE OFFERS BROADER GEOGRAPHICAL COVERAGE MORE DEMAND CHEAPER CAPITAL SCALED VALUE ADDED SERVICES

41 EXISTING PLAYBOOK AT 4% MARKETSHARE CREATES A COMPANY WITH $50B IN REVENUES

42 FIN

43 DISCLAIMER Confidentiality and Disclosures This presentation has been prepared for use by Social Capital Hedosophia Holdings Corp. II (“Social Capital”) and Opendoor Labs Inc. (“ Opendoor ”) in connection with their proposed business combination. This presentation is for information purposes only and is being provided to you solely in your capacity as a pot ent ial investor in considering an investment in Social Capital and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Social Capital and Opendoor . Neither Social Capital nor Opendoor makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation. This presentation is not intended to be all - incl usive or to contain all the information that a person may desire in considering an investment in Social Capital and is not intended to form the basis of any investment decision in Social Capita l. You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and must make your own investment decision and perform your own indepen den t investigation and analysis of an investment in Social Capital and the transactions contemplated in this presentation. This presentation shall neither constitute an o ff er to sell or the solicitation of an o ff er to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the o ff er, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. Forward - Looking Statements Certain statements in this presentation may constitute “forward - looking statements” within the meaning of the federal securities laws. Forward - looking statements include, but are not limited to, statements regarding Social Capital’s or Opendoor’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projec ti ons, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward - looking statements. The w ords “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and si mil ar expressions may identify forward - looking statements, but the absence of these words does not mean that a statement is not forward - looking. Forward - looking statements are predictions, projections and o ther statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. You should carefully consider the risk s a nd uncertainties described in the “Risk Factors” section of Social Capital’s registration statement on Form S - 1, the proxy statement/prospectus on Form S - 4 relating to the business combination, which is ex pected to be filed by Social Capital with the Securities and Exchange Commission (the “SEC”) and other documents filed by Social Capital from time to time with the SEC. These filings identify and ad dress other important risks and uncertainties that could cause actual events and results to di ff er materially from those contained in the forward - looking statements. Forward - looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward - looking statements, and Social Capital and Opendoor assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise. Neither Social Capital nor Opendoor gives any assurance that either Social Capital or Opendoor will achieve its expectations. Use of Projections The financial projections, estimates and targets in this presentation are forward - looking statements that are based on assumptio ns that are inherently subject to significant uncertainties and contingencies, many of which are beyond Social Capital’s and Opendoor’s control. While all financial projections, estimates and targets are necessarily speculative, Social Capital and Opendoor believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the furt her out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to di ff er materially from those contained in the financial projections, estimates and targets. The inclusion of financial projection s, estimates and targets in this presentation should not be regarded as an indication that Social Capital and Opendoor , or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. Use of Data The data contained herein is derived from various internal and external sources. No representation is made as to the reasonab len ess of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Social Capital and Opendoor assume no obligation to update the information in this presentation. Further, these financials were prepared by the Company i n accordance with private Company AICPA standards. The Company is currently in the process of uplifting its financials to comply with public company and SEC requirements. Participants in Solicitation Social Capital and Opendoor and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of Social Capital’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regard ing the names and interests in the proposed business combination of Social Capital’s directors and officers in Social Capital’s filings with the Securities and Exchange Commission (the “SEC”), inc luding Social Capital’s registration statement on Form S - 1, which was originally filed with the SEC on February 28, 2020. To the extent that holdings of Social Capital’s securities have changed f rom the amounts reported in Social Capital’s registration statement on Form S - 1, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Social Capital’s shareholders in connection with the proposed business combina tio n is set forth in the proxy statement/prospectus on Form S - 4 for the proposed business combination, which is expected to be filed by Social Capital with the SEC. Investors and security holders of Social Capital and Opendoor are urged to read the proxy statement/prospectus and other relevant documents that will be filed with the SEC carefully and i n their entirety when they become available because they will contain important information about the proposed business combination. Inv estors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about Social Capital and Opendoor through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Social Capital can be obtained free of charge by directing a written request to Social Capita l Hedosophia Holdings Corp. II, 317 University Ave, Suite 200, Palo Alto, California 94301. 43