UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Name of Fund:

| BlackRock ETF Trust II |

| BlackRock AAA CLO ETF |

| Blackrock Flexible Income ETF |

| BlackRock Floating Rate Loan ETF |

| BlackRock High Yield Muni Income Bond ETF |

| BlackRock Intermediate Muni Income Bond ETF |

| BlackRock Short-Term California Muni Bond ETF |

| BlackRock Total Return ETF |

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock ETF Trust II, 50 Hudson Yards, New York, NY 10001

Registrant's telephone number, including area code:

Date of reporting period:

Item 1 — Report to Stockholders

(a) The Report to Shareholders is attached herewith

BlackRock AAA CLO ETF

CLOA | NASDAQ

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock AAA CLO ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (1‑800‑474‑2737).

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| BlackRock AAA CLO ETF | $21 | 0.20% |

How did the Fund perform last year?

The U.S. Federal Reserve (“Fed”) held the federal funds rate steady throughout the 12-month period at a target range of 5.25% to 5.50%, citing the improving inflation outlook, supporting attractive all-in CLO yields.

CLO demand outpaced CLO supply given a muted supply of new bank loans. As a result, prices were driven above par for the majority of secondary market CLOs, even for deals with a high probability of getting called and leaving investors to be paid back at par.

Credit spread tightening in the first quarter of 2024 contributed to CLO market returns as well.

What contributed to performance?

The Fund actively purchased bonds from top-tier managers with established track records of managing credit through multiple economic cycles as such deals are generally higher quality and more liquid. This focus contributed to performance as there was meaningful dispersion in returns between cleaner, higher quality bonds from top-tier managers versus bonds from less established, lower-tier managers. Allocations to AAA CLO bonds from preferred managers led contributions to performance from a carry perspective. In addition, allocations to AA and single A CLO bonds held prior to the spread tightening seen in early 2024 contributed to performance based on a combination of higher income and price strength.

What detracted from performance?

There were no material detractors from performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

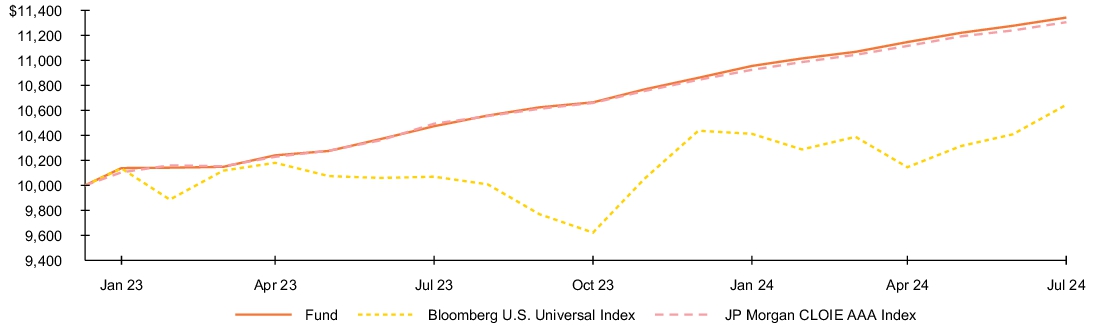

Fund performance

Cumulative performance: January 10, 2023 through July 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | |

| 1 Year | | Since Fund

Inception | |

| Fund NAV | 8.29 | % | 8.43 | % |

| Fund Market | 8.06 | | 8.54 | |

| Bloomberg U.S. Universal Index | 5.72 | | 4.09 | |

| JP Morgan CLOIE AAA Index | 7.74 | | 8.21 | |

| Key Fund statistics | |

| Net Assets | $399,571,057% |

| Number of Portfolio Holdings | $177% |

| Net Investment Advisory Fees | $261,676% |

| Portfolio Turnover Rate | $33% |

The Fund has added the Bloomberg U.S. Universal Index in response to new regulatory requirements.

The inception date of the Fund was January 10, 2023. The first day of secondary market trading was January 12, 2023.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of July 31, 2024)

| Maturity | Percent of

Total Investments (a) | |

| 5-10 Years | 28.8 | % |

| 10-15 Years | 71.2 | % |

| Security | Percent of

Total Investments(a) | |

| RR 8 Ltd., 6.67%, 07/15/37 | 1.3 | % |

| Flatiron CLO 21 Ltd., Series 2021 1A, Class A1, 6.65%, 07/19/34 | 1.3 | % |

| Apidos CLO XXXIII, Series 2020 33A, Class AR, 6.70%, 10/24/34 | 1.3 | % |

| OHA Loan Funding Ltd., 6.69%, 01/19/37 | 1.3 | % |

| Golub Capital Partners CLO 58B Ltd., 6.73%, 01/25/35 | 1.3 | % |

| OHA Credit Funding 2 Ltd., 6.69%, 04/21/34 | 1.3 | % |

| Golub Capital Partners CLO 41B-R Ltd., 6.86%, 01/20/34 | 1.3 | % |

| Whitebox CLO III Ltd., 6.78%, 10/15/34 | 1.3 | % |

| Apidos CLO XXXVII, 6.67%, 10/22/34 | 1.2 | % |

| Whitebox CLO I Ltd., 6.66%, 07/24/36 | 1.2 | % |

(a) | Excludes money market funds. |

Material Fund changes

This is a summary of certain changes to the Fund since July 31, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2024 at blackrock.com/fundreports or upon request by contacting us at (1-800-474-2737).

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock AAA CLO ETF to iShares AAA CLO Active ETF. This change is expected to become effective on or about October 10, 2024.

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (1-800-474-2737).

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited or JPMorgan Chase & Co., nor do these companies make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the companies listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock AAA CLO ETF

Annual Shareholder Report — July 31, 2024

CLOA-07/24-AR

BlackRock Flexible Income ETF

BINC | NYSE Arca

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock Flexible Income ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (1‑800‑474‑2737).

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| BlackRock Flexible Income ETF | $40 | 0.38% |

How did the Fund perform last year?

The U.S. Federal Reserve (“Fed”) held the federal funds rate steady throughout the 12-month period at a target range of 5.25% to 5.50%, citing the improving inflation outlook.

Short-term interest rates generally finished the period lower as the market anticipated that the Fed would soon begin to lower its benchmark overnight lending rate, while longer-term rates ended the period moderately higher.

Within the benchmark, credit-sensitive sectors outperformed as risk sentiment was bolstered by the anticipation of a soft landing for the economy.

What contributed to performance?

Over the period, economic growth generally surprised to the upside and spread sectors across fixed income continued to perform well despite elevated interest rate volatility. Given those dynamics, the most notable contributions to performance included the Fund’s allocation to securitized assets where holdings favored select top-of-the-capital structure segments within commercial mortgage-backed securities, higher-quality collateralized loan obligations. Allocations to non-U.S. corporate bonds and U.S. high yield corporate bonds also contributed as non-US credit remains appealing due to the diversified yield pickup.

What detracted from performance?

The Fund’s emerging markets debt position detracted from performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

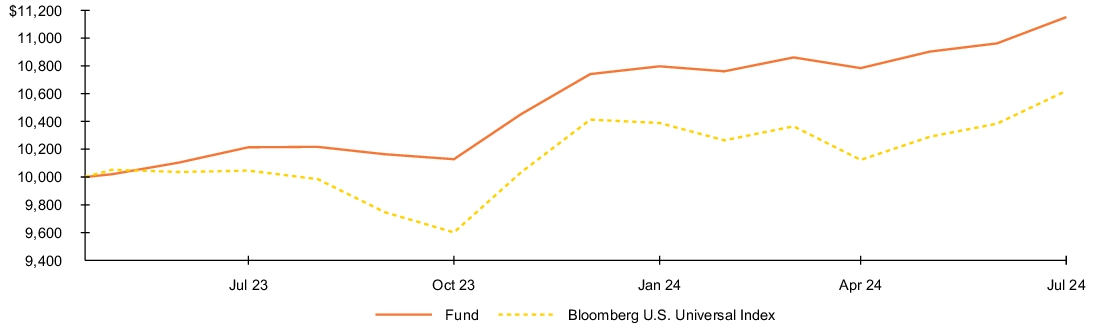

Fund performance

Cumulative performance: May 19, 2023 through July 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | |

| 1 Year | | Since Fund

Inception | |

| Fund NAV | 9.17 | % | 9.48 | % |

| Fund Market | 9.00 | | 9.75 | |

| Bloomberg U.S. Universal Index | 5.72 | | 5.15 | |

| Key Fund statistics | |

| Net Assets | $3,623,012,344% |

| Number of Portfolio Holdings | $2,537% |

| Net Investment Advisory Fees | $5,663,858% |

| Portfolio Turnover Rate | $200% |

The inception date of the Fund was May 19, 2023. The first day of secondary market trading was May 23, 2023.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of July 31, 2024)

| Investment Type | Percent of

Total Investments(a) | |

| Corporate Bonds & Notes | 45.0 | % |

| Asset-Backed Securities | 16.9 | % |

| Collaterized Mortgage Obligations | 13.9 | % |

| U.S. Government & Agency Obligations | 10.4 | % |

| Foreign Government Obligations | 5.7 | % |

| Investment Companies | 4.3 | % |

| Floating Rate Loan Interests | 3.2 | % |

| Convertible Bonds | 0.5 | % |

| Municipal Debt Obligations | 0.1 | % |

Credit quality allocation

| Credit Rating* | Percent of

Total Investments(a) | |

| AAA/Aaa(d) | 27.7 | % |

| AA/Aa | 3.8 | % |

| A | 6.2 | % |

| BBB/Baa | 10.6 | % |

| BB/Ba | 22.9 | % |

| B | 12.8 | % |

| CCC/Caa | 0.7 | % |

| D | — | % (b) |

| N/R(c) | 15.3 | % |

(a) | Excludes money market funds. |

(b) | Rounds to less than 0.1%. |

(c) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of July 31, 2024, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of total investments. |

(d) | Includes U.S. Government Sponsored Agency Securities which are deemed AAA/Aaa by the investment adviser. |

* | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Material Fund changes

This is a summary of certain changes to the Fund since July 31, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2024 at blackrock.com/fundreports or upon request by contacting us at (1-800-474-2737).

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Flexible Income ETF to iShares Flexible Income Active ETF. This change is expected to become effective on or about October 10, 2024.

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (1-800-474-2737).

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Flexible Income ETF

Annual Shareholder Report — July 31, 2024

BINC-07/24-AR

BlackRock Floating Rate Loan ETF

BRLN | Cboe BZX

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock Floating Rate Loan ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (1‑800‑474‑2737).

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| BlackRock Floating Rate Loan ETF | $56 | 0.53% |

How did the Fund perform last year?

Loans and high yield bonds gained ground in the annual period. Both categories benefited from the combination of declining spreads and their above-average income.

Bank loans have demonstrated resilience in an environment of interest-rate volatility and speculation around central bank policy. Additionally, total measurable demand for loans reached record levels in the first half of 2024.

The Fund produced a strong absolute return but underperformed its benchmark, the Morningstar LSTA Leveraged Loan Index.

What contributed to performance?

The Fund’s tactical allocation to high yield bonds, which was achieved in part through the use of liquid products, contributed positively. From a sector perspective, overweights in the brokerage/asset managers/exchanges, diversified manufacturing, and insurance sectors were the largest contributors.

What detracted from performance?

Ratings positioning detracted, with underweights and selection in B2/B3 issues having the largest adverse effect. At the sector level, underweights in healthcare, technology, and chemicals detracted.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

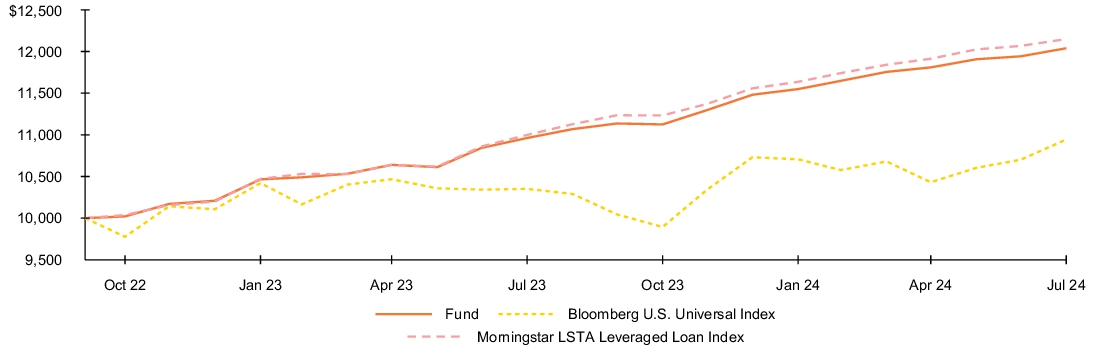

Fund performance

Cumulative performance: October 4, 2022 through July 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | |

| 1 Year | | Since Fund

Inception | |

| Fund NAV | 9.82 | % | 10.70 | % |

| Fund Market | 8.99 | | 10.79 | |

| Bloomberg U.S. Universal Index | 5.72 | | 5.08 | |

| Morningstar LSTA Leveraged Loan Index | 10.45 | | 11.27 | |

| Key Fund statistics | |

| Net Assets | $49,811,298% |

| Number of Portfolio Holdings | $431% |

| Net Investment Advisory Fees | $158,934% |

| Portfolio Turnover Rate | $33% |

The Fund has added the Bloomberg U.S. Universal Index in response to new regulatory requirements.

The inception date of the Fund was October 4, 2022. The first day of secondary market trading was October 6, 2022.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of July 31, 2024)

Credit quality allocation

| Credit Rating* | Percent of

Total Investments(a) | |

| A | — | % (b) |

| BBB/Baa | 4.4 | % |

| BB/Ba | 25.3 | % |

| B | 59.2 | % |

| CCC/Caa | 4.2 | % |

| N/R | 6.9 | % |

| Maturity | Percent of

Total Investments (a) | |

| 0-1 Year | 1.2 | % |

| 1-5 Years | 53.0 | % |

| 5-10 Years | 45.8 | % |

(a) | Excludes money market funds. |

(b) | Rounds to less than 0.1%. |

* | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Material Fund changes

This is a summary of certain changes to the Fund since July 31, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2024 at blackrock.com/fundreports or upon request by contacting us at (1-800-474-2737).

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Floating Rate Loan ETF to iShares Floating Rate Loan Active ETF. This change is expected to become effective on or about October 10, 2024.

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (1-800-474-2737).

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited or Morningstar, Inc., nor do these companies make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the companies listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Floating Rate Loan ETF

Annual Shareholder Report — July 31, 2024

BRLN-07/24-AR

BlackRock High Yield Muni Income Bond ETF

HYMU | Cboe BZX

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock High Yield Muni Income Bond ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (1‑800‑474‑2737).

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| BlackRock High Yield Muni Income Bond ETF | $36 | 0.34% |

How did the Fund perform last year?

High-yield municipal bonds delivered strong returns in the annual period, with rising prices augmenting the benefit of income.

Declining inflation fueled expectations that the U.S. Federal Reserve was set to begin cutting interest rates later in 2024, benefiting the broader fixed-income market.

Municipal bonds were well supported by positive economic growth, strong issuer fundamentals, and favorable supply-and-demand trends.

What contributed to performance?

An overweight in below investment-grade bonds contributed to the Fund’s outperformance, as did a long duration and long yield curve positioning. (Duration is a measure of interest rate sensitivity.) At the sector level, the largest contributions came from the corporate-backed sector, which includes metals, prepaid gas, and airline issues. The other industries that contributed to performance include development district issues, and tax-backed states primarily being Puerto Rico debt.

What detracted from performance?

At a time of strong returns for the broader asset class, there were no meaningful detractors from Fund performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

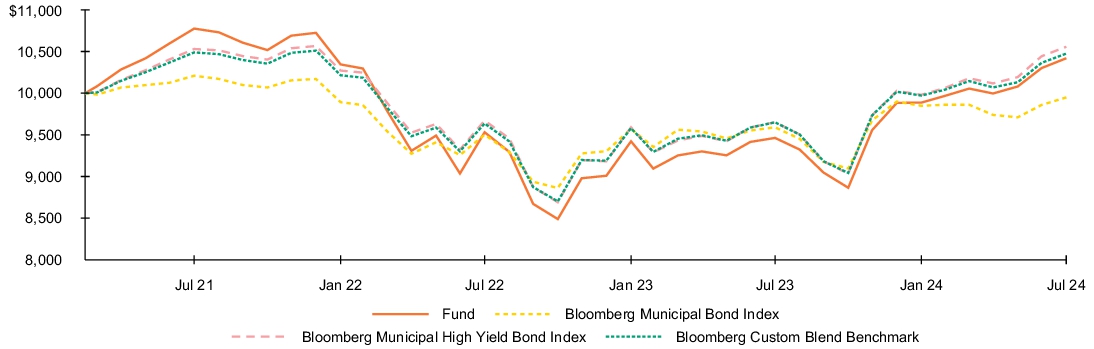

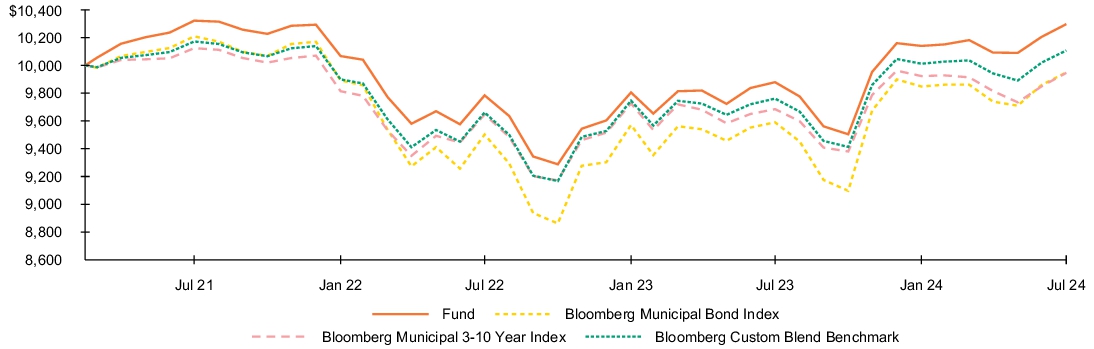

Fund performance

Cumulative performance: March 16, 2021 through July 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | |

| 1 Year | | Since Fund

Inception | |

| Fund NAV | 10.10 | % | 1.22 | % |

| Fund Market | 10.89 | | 1.53 | |

| Bloomberg Municipal Bond Index | 3.74 | | (0.15 | ) |

| Bloomberg Municipal High Yield Bond Index | 9.38 | | 1.62 | |

| Bloomberg Custom Blend Benchmark | 8.55 | | 1.39 | |

| Key Fund statistics | |

| Net Assets | $147,876,692% |

| Number of Portfolio Holdings | $271% |

| Net Investment Advisory Fees | $270,038% |

| Portfolio Turnover Rate | $46% |

The Fund has added the Bloomberg Municipal Bond Index in response to new regulatory requirements.

The inception date of the Fund was March 16, 2021. The first day of secondary market trading was March 18, 2021.

The Bloomberg Custom Blend Benchmark is comprised of the Bloomberg Municipal High Yield Index (80%), the Bloomberg BBB Index (10%) and the Bloomberg Single A Index (10%).

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of July 31, 2024)

Credit quality allocation

| Credit Rating* | Percent of

Total Investments(a) | |

| AAA/Aaa | 1.5 | % |

| AA/Aa | 3.9 | % |

| A | 6.3 | % |

| BBB/Baa | 15.8 | % |

| BB/Ba | 13.1 | % |

| B | 2.1 | % |

| N/R(b) | 57.3 | % |

| Security | Percent of

Total Investments(a) | |

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue RB, 5.00%, 07/01/58 | 3.5 | % |

| New York Transportation Development Corp RB AMT, 5.38%, 06/30/60 | 2.8 | % |

| Hoover Industrial Development Board RB AMT, 5.75%, 10/01/49 | 2.3 | % |

| Tobacco Settlement Financing Corp. RB, 5.00%, 06/01/46 | 2.0 | % |

| Commonwealth of Puerto Rico GO, 4.00%, 07/01/37 | 1.9 | % |

(a) | Excludes money market funds. |

(b) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of July 31, 2024, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of total investments. |

* | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Material Fund changes

This is a summary of certain changes to the Fund since July 31, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2024 at blackrock.com/fundreports or upon request by contacting us at (1-800-474-2737).

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock High Yield Muni Income ETF to iShares High Yield Muni Income Active ETF. This change is expected to become effective on or about October 10, 2024.

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (1-800-474-2737).

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock High Yield Muni Income Bond ETF

Annual Shareholder Report — July 31, 2024

HYMU-07/24-AR

BlackRock Intermediate Muni Income Bond ETF

INMU | NYSE Arca

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock Intermediate Muni Income Bond ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (1‑800‑474‑2737).

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| BlackRock Intermediate Muni Income Bond ETF | $32 | 0.31% |

How did the Fund perform last year?

The municipal bond market gained ground in the reporting period, with income playing the largest role in total returns.

Declining inflation fueled expectations that the U.S. Federal Reserve was set to begin cutting interest rates later in 2024, benefiting the broader fixed-income market.

Municipal bonds were well supported by positive economic growth, strong issuer fundamentals, and favorable supply-and-demand trends.

What contributed to performance?

The Fund benefited from both sector allocations and security selection in high yield (below investment-grade) bonds. The Fund’s positioning on the investment-grade side, which tilted in favor of A and BBB rated securities, also made a positive contribution. Most of the outperformance was driven by an overweight in the corporate-backed sector in general and prepaid gas issues in particular. Underweights in the tax-backed and utilities sectors contributed, as well. An overweight on the steepest parts of the yield curve further contributed.

What detracted from performance?

The Fund’s positioning with respect to duration (interest rate sensitivity) detracted. While the Fund’s positioning shifted over the course of the period, it began with its duration shorter than the benchmark and subsequently moved to a longer duration by the end of July 2024.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Fund performance

Cumulative performance: March 16, 2021 through July 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | |

| 1 Year | | Since Fund

Inception | |

| Fund NAV | 4.23 | % | 0.87 | % |

| Fund Market | 5.19 | | 1.04 | |

| Bloomberg Municipal Bond Index | 3.74 | | (0.15 | ) |

| Bloomberg Municipal 3-10 Year Index | 2.70 | | (0.16 | ) |

| Bloomberg Custom Blend Benchmark | 3.54 | | 0.32 | |

| Key Fund statistics | |

| Net Assets | $21,325,335% |

| Number of Portfolio Holdings | $73% |

| Net Investment Advisory Fees | $66,024% |

| Portfolio Turnover Rate | $58% |

The Fund has added the Bloomberg Municipal Bond Index in response to new regulatory requirements.

The inception date of the Fund was March 16, 2021. The first day of secondary market trading was March 18, 2021.

The Bloomberg Custom Blend Benchmark is comprised of the Bloomberg 1-15 Year Municipal Bond Index (90%) and the Bloomberg Municipal High Yield 1-15 Year Index (10%).

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of July 31, 2024)

Credit quality allocation

| Credit Rating* | Percent of

Total Investments(a) | |

| AAA/Aaa | 1.9 | % |

| AA/Aa | 23.6 | % |

| A | 42.8 | % |

| BBB/Baa | 19.2 | % |

| BB/Ba | 1.1 | % |

| B | 1.3 | % |

| N/R | 10.1 | % |

| Security | Percent of

Total Investments(a) | |

| County of Jefferson Alabama Sewer Revenue RB, 5.25%, 10/01/44 | 5.3 | % |

| Tennergy Corp./Tennessee RB, 5.50%, 10/01/53 | 3.9 | % |

| Kansas City Industrial Development Authority RB AMT, 5.00%, 03/01/34 | 3.8 | % |

| California Community Choice Financing Authority RB, 5.54%, 12/01/53 | 3.7 | % |

| New Hope Cultural Education Facilities Finance Corp. RB, 4.00%, 08/15/34 | 3.7 | % |

(a) | Excludes money market funds. |

* | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Material Fund changes

This is a summary of certain changes to the Fund since July 31, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2024 at blackrock.com/fundreports or upon request by contacting us at (1-800-474-2737).

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Intermediate Muni Income Bond ETF to iShares Intermediate Muni Income Active ETF. This change is expected to become effective on or about October 10, 2024.

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (1-800-474-2737).

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Intermediate Muni Income Bond ETF

Annual Shareholder Report — July 31, 2024

INMU-07/24-AR

BlackRock Short-Term California Muni Bond ETF

CALY | NASDAQ

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock Short-Term California Muni Bond ETF (the “Fund”) for the period of August 1, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (1‑800‑474‑2737).

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| BlackRock Short-Term California Muni Bond ETF | $21 | 0.21% |

How did the Fund perform last year?

The municipal bond market gained ground in the reporting period, with income playing the largest role in total returns.

Declining inflation fueled expectations that the U.S. Federal Reserve was set to begin cutting interest rates in 2024, benefiting the broader fixed-income market.

Municipal bonds were well supported by positive economic growth, strong issuer fundamentals, and favorable supply-and-demand trends.

What contributed to performance?

The Fund maintained a longer duration (interest rate sensitivity) than its benchmark while also focusing on variable rate demand notes (VRDNs) and tender option bond floaters (TOBs) as core holdings which offered both attractive yields and price stability. Given the inverted yield curve, this approach contributed to performance. (An inverted yield curve occurs when yields on longer-term debt are below those on shorter-term issues). The Fund was underweight in AAA and AA rated bonds and overweight in those rated A, which further contributed to the Fund’s performance. At the sector level, overweights in tax-backed local, corporate-backed, and transportation issues were additive.

What detracted from performance?

The Fund was hurt by being underweight in pre-refunded/escrow bonds, as well as underweight in the tax-backed states and utilities sectors.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

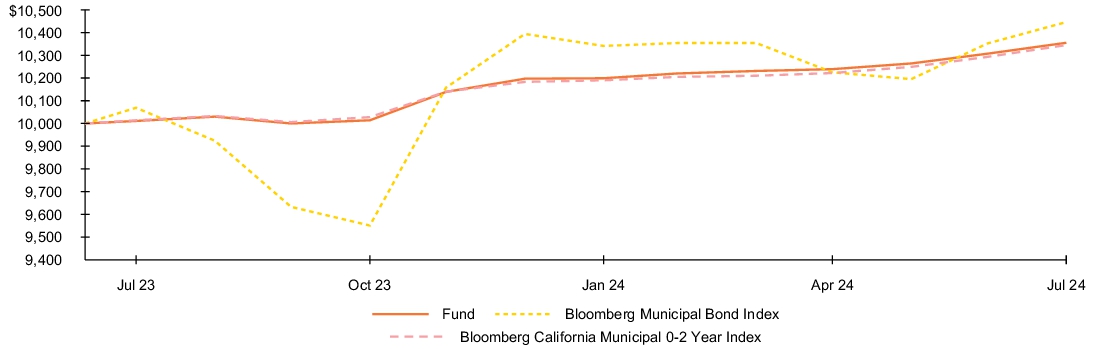

Fund performance

Cumulative performance: July 11, 2023 through July 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

| Average annual total returns | | | | |

| 1 Year | | Since Fund

Inception | |

| Fund NAV | 3.43 | % | 3.35 | % |

| Fund Market | 3.61 | | 3.51 | |

| Bloomberg Municipal Bond Index | 3.74 | | 4.23 | |

| Bloomberg California Municipal 0-2 Year Index | 3.31 | | 3.28 | |

| Key Fund statistics | |

| Net Assets | $32,667,565% |

| Number of Portfolio Holdings | $78% |

| Net Investment Advisory Fees | $43,061% |

| Portfolio Turnover Rate | $175% |

The Fund has added the Bloomberg Municipal Bond Index in response to new regulatory requirements.

The inception date of the Fund was July 11, 2023. The first day of secondary market trading was July 13, 2023.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of July 31, 2024)

Credit quality allocation

| Credit Rating* | Percent of

Total Investments(a) | |

| AAA/Aaa | 6.2 | % |

| AA/Aa | 65.7 | % |

| A | 23.2 | % |

| BBB/Baa | 3.0 | % |

| N/R | 1.9 | % |

| Security | Percent of

Total Investments(a) | |

| City of Modesto California Water Revenue COP, 3.20%, 08/07/24 | 3.9 | % |

| City of Los Angeles California Revenue Notes, 5.00%, 06/26/25 | 2.4 | % |

| California Community Choice Financing Authority RB, 5.00%, 10/01/28 | 2.4 | % |

| California State Public Works Board RB, Series A, 5.00%, 09/01/27 | 2.4 | % |

| Long Beach Unified School District GO, 3.64%, 08/07/24 | 2.4 | % |

(a) | Excludes money market funds. |

* | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Material Fund changes

This is a summary of certain changes to the Fund since July 31, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2024 at blackrock.com/fundreports or upon request by contacting us at (1-800-474-2737).

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Short-Term California Muni Bond ETF to iShares Short-Term California Muni Active ETF . The Fund's ticker will also be changed from CALY to CALI. These changes are expected to become effective on or about October 10, 2024.

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (1-800-474-2737).

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Short-Term California Muni Bond ETF

Annual Shareholder Report — July 31, 2024

CALY-07/24-AR

BlackRock Total Return ETF

BRTR | NASDAQ

Annual Shareholder Report — July 31, 2024

This annual shareholder report contains important information about BlackRock Total Return ETF (the “Fund”) for the period of December 12, 2023 to July 31, 2024. You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (1‑800‑474‑2737).

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund name | Costs of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| BlackRock Total Return ETF | $24(a) | 0.37%(b) |

(a) | The Fund commenced operations during the reporting period. Expenses for a full reporting period would be higher than the amount shown. |

(b) | Annualized. |

How did the Fund perform during the period?

The U.S. Federal Reserve (“Fed”) held the federal funds rate steady throughout the 12-month period at a target range of 5.25% to 5.50%, citing the improving inflation outlook.

Short-term interest rates generally finished the period lower as the market anticipated that the Fed would soon begin to lower its benchmark overnight lending rate, while longer-term rates ended the period moderately higher.

Within the benchmark, credit-sensitive sectors outperformed as risk sentiment was bolstered by the anticipation of a soft landing for the economy.

What contributed to performance?

Over the period, economic growth generally surprised to the upside and spread sectors across fixed income continued to perform well despite elevated interest rate volatility. Given those dynamics, the most notable contributions to performance came from within the Fund’s allocation to securitized assets where holdings favored select top-of-the-capital structure segments within commercial mortgage-backed securities, higher-quality collateralized loan obligations with structural protections, and shorter-maturity senior issues within asset-backed securities, while limiting exposure to non-agency residential mortgage-backed securities. Positioning with respect to U.S. interest rates and credit selection within investment grade corporate bonds also contributed to performance.

What detracted from performance?

An overweight to emerging market debt detracted from performance as local rate holdings, mainly in select Latin American countries, sold-off in April as markets priced in the possibility of higher-for-longer U.S. interest rates.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

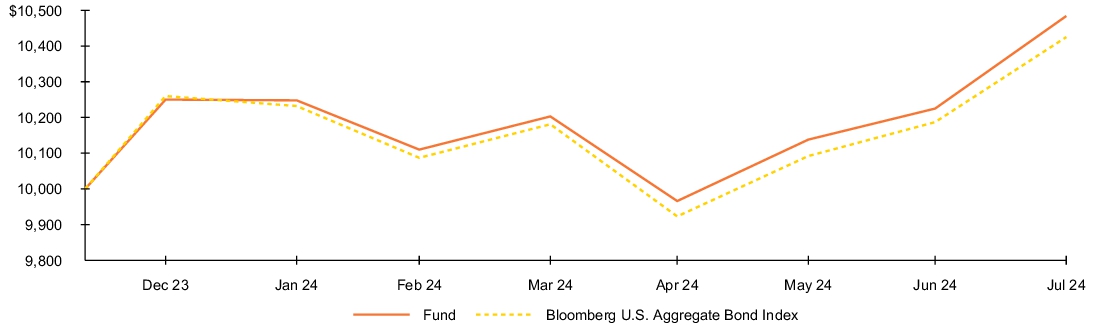

Fund performance

Cumulative performance: December 12, 2023 through July 31, 2024

Initial investment of $10,000

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

As of the date of this report, the Fund does not have a full fiscal year of performance information to report.

| Key Fund statistics | |

| Net Assets | $91,909,615% |

| Number of Portfolio Holdings | $1,000% |

| Net Investment Advisory Fees | $193,222% |

| Portfolio Turnover Rate | $379% |

The inception date of the Fund was December 12, 2023. The first day of secondary market trading was December 14, 2023.

Past performance is not an indication of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. Visit blackrock.com for more recent performance information.

What did the Fund invest in?

(as of July 31, 2024)

Credit quality allocation

| Credit Rating* | Percent of

Total Investments(a) | |

| AAA/Aaa(b) | 62.0 | % |

| AA/Aa | 3.8 | % |

| A | 8.0 | % |

| BBB/Baa | 14.4 | % |

| BB/Ba | 1.9 | % |

| B | 0.7 | % |

| CCC/Caa | 0.2 | % |

| C | 1.8 | % |

| D | 0.1 | % |

| N/R(c) | 7.1 | % |

| Maturity | Percent of

Total Investments (a) | |

| 0-1 Year | 2.4 | % |

| 1-5 Years | 20.9 | % |

| 5-10 Years | 20.7 | % |

| 10-15 Years | 12.0 | % |

| 15-20 Years | 10.0 | % |

| More than 20 Years | 34.0 | % |

(a) | Excludes money market funds, short investments and options, if any. |

(b) | Includes U.S. Government Sponsored Agency Securities which are deemed AAA/Aaa by the investment adviser. |

(c) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of July 31, 2024, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of total investments. |

* | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Material Fund changes

This is a summary of certain changes to the Fund since December 12, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2024 at blackrock.com/fundreports or upon request by contacting us at (1-800-474-2737).

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Total Return ETF to iShares Total Return Active ETF. This change is expected to become effective on or about October 10, 2024.

Additional information

If you wish to view additional information about the Fund, including but not limited to financial statements, the Fund’s prospectus, and proxy voting policies and procedures, please visit blackrock.com/fundreports. For proxy voting records, visit blackrock.com/proxyrecords.

Householding

The Fund will mail only one copy of shareholder documents, including prospectuses, annual and semi-annual reports and proxy statements, to shareholders with multiple accounts at the same address. This practice is commonly called “householding” and is intended to reduce expenses and eliminate duplicate mailings of shareholder documents. Mailings of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please call the Fund at (1-800-474-2737).

The Fund is not sponsored, endorsed, issued, sold, or promoted by Bloomberg Index Services Limited and its affiliates, nor does this company make any representation regarding the advisability of investing in the Fund. BlackRock is not affiliated with the company listed above.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock Total Return ETF

Annual Shareholder Report — July 31, 2024

BRTR-07/24-AR

(b) Not Applicable

| Item 2 – | Code of Ethics – The registrant (or the “Fund”) has adopted a code of ethics, as of the end of the period covered by this report, applicable to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. During the period covered by this report, the code of ethics was amended to update certain information and to make other non-material changes. During the period covered by this report, there have been no waivers granted under the code of ethics. The registrant undertakes to provide a copy of the code of ethics to any person upon request, without charge, who calls 1-800-441-7762. |

| Item 3 – | Audit Committee Financial Expert – The registrant’s board of trustees (the “board of trustees”), has determined that (i) the registrant has the following audit committee financial experts serving on its audit committee and (ii) each audit committee financial expert is independent: |

Lorenzo A. Flores

Catherine A. Lynch

Arthur P. Steinmetz

Under applicable securities laws, a person determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for the purposes of Section 11 of the Securities Act of 1933, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and board of trustees in the absence of such designation or identification. The designation or identification of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the audit committee or board of trustees.

| Item 4 – | Principal Accountant Fees and Services |

The following table presents fees billed by Pricewaterhouse Coopers LLP (“PwC”) in each of the last two fiscal years for the services rendered to the Fund:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (a) Audit Fees | | | (b) Audit-Related Fees1 | | | (c) Tax Fees2 | | | (d) All Other Fees | |

| Entity Name | | Current

Fiscal Year End | | | Previous Fiscal Year End | | | Current Fiscal Year End | | | Previous Fiscal Year End | | | Current Fiscal Year End | | | Previous Fiscal Year End | | | Current Fiscal Year End | | | Previous Fiscal Year End | |

BlackRock AAA CLO ETF | | | $13,989 | | | | $12,423 | | | | $0 | | | | $0 | | | | $9,700 | | | | $7,760 | | | | $0 | | | | $0 | |

BlackRock Flexible Income ETF | | | $16,564 | | | | $13,850 | | | | $0 | | | | $0 | | | | $9,700 | | | | $9,700 | | | | $0 | | | | $0 | |

BlackRock Floating Rate Loan ETF | | | $16,564 | | | | $14,746 | | | | $0 | | | | $0 | | | | $9,700 | | | | $9,700 | | | | $0 | | | | $0 | |

BlackRock High Yield Muni Income Bond ETF | | | $13,989 | | | | $13,736 | | | | $0 | | | | $0 | | | | $9,700 | | | | $9,700 | | | | $0 | | | | $0 | |

BlackRock Intermediate Muni Income Bond ETF | | | $13,989 | | | | $13,736 | | | | $0 | | | | $0 | | | | $9,700 | | | | $9,700 | | | | $0 | | | | $0 | |

BlackRock Short-Term California Muni Bond ETF | | | $13,989 | | | | $13,600 | | | | $0 | | | | $0 | | | | $9,700 | | | | $9,700 | | | | $0 | | | | $0 | |

BlackRock Total Return ETF | | | $12,500 | | | | $0 | | | | $0 | | | | $0 | | | | $9,700 | | | | $4,850 | | | | $0 | | | | $0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The following table presents fees billed by PwC that were required to be approved by the registrant’s audit committee (the “Committee”) for services that relate directly to the operations or financial reporting of the Fund and that are rendered on behalf of BlackRock Advisors, LLC (the “Investment Adviser” or “BlackRock”) and entities controlling, controlled by, or under common control with BlackRock (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund (“Affiliated Service Providers”):

| | | | | | | | |

| | | | Current Fiscal Year End | | | | Previous Fiscal Year End | |

(b) Audit-Related Fees1 | | | $0 | | | | $0 | |

(c) Tax Fees2 | | | $0 | | | | $0 | |

(d) All Other Fees3 | | | $0 | | | | $0 | |

1 The nature of the services includes assurance and related services reasonably related to the performance of the audit or review of financial statements not included in Audit Fees, including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters, out-of-pocket expenses and internal control reviews not required by regulators.

2 The nature of the services includes tax compliance and/or tax preparation, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews, taxable income and tax distribution calculations.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The Committee has adopted policies and procedures with regard to the pre-approval of services. Audit, audit-related and tax compliance services provided to the registrant on an annual basis require specific pre-approval by the Committee. The Committee also must approve other non-audit services provided to the registrant and those non-audit services provided to the Investment Adviser and Affiliated Service Providers that relate directly to the operations and the financial reporting of the registrant. Certain of these non-audit services that the Committee believes are (a) consistent with the SEC’s auditor independence rules and (b) routine and recurring services that will not impair the independence of the independent accountants may be approved by the Committee without consideration on a specific case-by-case basis (“general pre-approval”). The term of any general pre-approval is 12 months from the date of the pre-approval, unless the Committee provides for a different period. Tax or other non-audit services provided to the registrant which have a direct impact on the operations or financial reporting of the registrant will only be deemed pre-approved provided that any individual project does not exceed $10,000 attributable to the registrant or $50,000 per project. For this purpose, multiple projects will be aggregated to determine if they exceed the previously mentioned cost levels.

Any proposed services exceeding the pre-approved cost levels will require specific pre-approval by the Committee, as will any other services not subject to general pre-approval (e.g., unanticipated but permissible services). The Committee is informed of each service approved subject to general pre-approval at the next regularly scheduled in-person board meeting. At this meeting, an analysis of such services is presented to the Committee for ratification. The Committee may delegate to the Committee Chairman the authority to approve the provision of and fees for any specific engagement of permitted non-audit services, including services exceeding pre-approved cost levels.

(e)(2) None of the services described in each of Items 4(b) through (d) were approved by the Committee pursuant to the de minimis exception in paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not Applicable

(g) The aggregate non-audit fees, defined as the sum of the fees shown under “Audit-Related Fees,” “Tax Fees” and “All Other Fees,” paid to the accountant for services rendered by the accountant to the registrant, the Investment Adviser and the Affiliated Service Providers were:

| | | | |

| Entity Name | | Current Fiscal Year End | | Previous Fiscal Year End |

BlackRock AAA CLO ETF | | $9,700 | | $7,760 |

BlackRock Flexible Income ETF | | $9,700 | | $9,700 |

BlackRock Floating Rate Loan ETF | | $9,700 | | $9,700 |

BlackRock High Yield Muni Income Bond ETF | | $9,700 | | $9,700 |

BlackRock Intermediate Muni Income Bond ETF | | $9,700 | | $9,700 |

BlackRock Short-Term California Muni Bond ETF | | $9,700 | | $9,700 |

BlackRock Total Return ETF | | $9,700 | | $4,850 |

(h) The Committee has considered and determined that the provision of non-audit services that were rendered to the Investment Adviser and the Affiliated Service Providers that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not Applicable

(j) Not Applicable

| Item 5 – | Audit Committee of Listed Registrant |

(a) The following individuals are members of the registrant’s separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (15 U.S.C. 78c(a)(58)(A)):

Lorenzo A. Flores

J. Phillip Holloman

Catherine A. Lynch

Arthur P. Steinmetz

(b) Not Applicable

(a) The registrant’s Schedule of Investments is included as part of the Financial Statements and Financial Highlights for Open-End Management Investment Companies filed under Item 7 of this Form.

(b) Not Applicable due to no such divestments during the semi-annual period covered since the previous Form N-CSR filing.

| Item 7 – | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a) The registrant’s Financial Statements are attached herewith.

(b) The registrant’s Financial Highlights are attached herewith.

2024 Annual Financial Statements |

|

• BlackRock AAA CLO ETF | CLOA | NASDAQ |

• BlackRock Flexible Income ETF | BINC | NYSE Arca |

• BlackRock Floating Rate Loan ETF | BRLN | Cboe BZX |

• BlackRock High Yield Muni Income Bond ETF | HYMU | Cboe BZX |

• BlackRock Intermediate Muni Income Bond ETF | INMU | NYSE Arca |

• BlackRock Short-Term California Muni Bond ETF | CALY | NASDAQ |

• BlackRock Total Return ETF | BRTR | NASDAQ |

|

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Schedule of InvestmentsJuly 31, 2024

BlackRock AAA CLO ETF(Percentages shown are based on Net Assets)

| | |

|

1988 CLO 5 Ltd., 6.87%, 07/15/37, (3-mo. SOFR + 1.540%)(a)(b) | | |

37 Capital CLO 1 Ltd., 6.76%, 10/15/34, (3-mo. SOFR + 1.462%)(a)(b) | | |

37 Capital CLO II, 7.30%, 07/15/34, (3-mo. SOFR + 2.000%)(a)(b) | | |

522 Funding CLO Ltd., 6.63%, 04/15/35, (3-mo. SOFR + 1.330%)(a)(b) | | |

720 East CLO IV Ltd., 6.89%, 04/15/37, (3-mo. SOFR + 1.600%)(a)(b) | | |

720 East CLO Ltd., 7.40%, 04/15/36, (3-mo. SOFR + 2.100%)(a)(b) | | |

AB BSL CLO 3 Ltd., 6.73%, 10/20/34, (3-mo. SOFR + 1.452%)(a)(b) | | |

| | |

7.78%, 04/20/36, (3-mo. SOFR + 2.500%)(a)(b) | | |

7.28%, 04/20/36, (3-mo. SOFR + 2.000%)(a)(b) | | |

AGL CLO 12 Ltd., 6.70%, 07/20/34, (3-mo. SOFR + 1.422%)(a)(b) | | |

AGL CLO 29 Ltd., 6.85%, 04/21/37, (3-mo. SOFR + 1.570%)(a)(b) | | |

AGL CLO 3 Ltd., 6.86%, 01/15/33, (3-mo. SOFR + 1.562%)(a)(b) | | |

AGL CLO 5 Ltd. Series 2020 5A, Class A1R, 6.70%, 07/20/34, (3-mo. SOFR + 1.422%)(a)(b) | | |

AGL CLO 7 Ltd., 6.76%, 07/15/34, (3-mo. SOFR + 1.461%)(a)(b) | | |

AGL Core CLO 15 Ltd., 6.69%, 01/20/35, (3-mo. SOFR + 1.412%)(a)(b) | | |

AGL Core CLO 2 Ltd., 6.79%, 07/20/37, (3-mo. SOFR + 1.460%)(a)(b) | | |

Aimco CLO 11 Ltd., 6.68%, 10/17/34, (3-mo. SOFR + 1.392%)(a)(b) | | |

Aimco CLO 14 Ltd., 6.89%, 04/20/34, (3-mo. SOFR + 1.612%)(a)(b) | | |

Aimco CLO 20 Ltd., 7.49%, 10/16/36, (3-mo. SOFR + 2.200%)(a)(b) | | |

Apidos CLO XXXIII Series 2020 33A, Class AR, 6.70%, 10/24/34, (3-mo. SOFR +1.411%)(a)(b) | | |

Apidos CLO XXXIV, 6.69%, 01/20/35, (3-mo. SOFR + 1.412%)(a)(b) | | |

Apidos CLO XXXVII, 6.67%, 10/22/34, (3-mo. SOFR + 1.392%)(a)(b) | | |

Ares Loan Funding IV Ltd., 7.05%, 10/15/36, (3-mo. SOFR + 1.750%)(a)(b) | | |

Ares LV CLO Ltd., 6.69%, 07/15/34, (3-mo. SOFR + 1.392%)(a)(b) | | |

Ares LVI CLO Ltd., 6.71%, 10/25/34, (3-mo. SOFR + 1.422%)(a)(b) | | |

Bain Capital Credit CLO Ltd., 7.08%, 07/24/36, (3-mo. SOFR + 1.800%)(a)(b) | | |

Ballyrock CLO 14 Ltd., 7.00%, 07/20/37, (3-mo. SOFR + 1.700%)(a)(b) | | |

Ballyrock CLO 15 Ltd., 6.62%, 04/15/34, (3-mo. SOFR + 1.322%)(a)(b) | | |

Ballyrock CLO 16 Ltd., 6.67%, 07/20/34, (3-mo. SOFR +1.391%)(a)(b) | | |

Ballyrock CLO 19 Ltd., 6.61%, 04/20/35, (3-mo. SOFR + 1.330%)(a)(b) | | |

| | |

Ballyrock CLO 2 Ltd., 6.72%, 02/20/36, (3-mo. SOFR + 1.400%)(a)(b) | | |

| | |

7.26%, 04/25/36, (3-mo. SOFR + 1.980%)(a)(b) | | |

8.48%, 04/25/36, (3-mo. SOFR + 3.200%)(a)(b) | | |

Ballyrock CLO Ltd., 7.09%, 10/20/31, (3-mo. SOFR + 1.812%)(a)(b) | | |

Battery Park CLO II Ltd., 7.49%, 10/20/35, (3-mo. SOFR + 2.210%)(a)(b) | | |

Beechwood Park CLO Ltd., 6.59%, 01/17/35, (3-mo. SOFR + 1.300%)(a)(b) | | |

Benefit Street Partners CLO Ltd., 6.73%, 07/20/34, (3-mo. SOFR + 1.452%)(a)(b) | | |

Benefit Street Partners CLO XVII Ltd. Series 2019 17A, Class AR, 6.64%, 07/15/32, (3-mo. SOFR + 1.322%)(a)(b) | | |

Benefit Street Partners CLO XXI Ltd. Series 2020 21A, Class A1R, 6.73%, 10/15/34, (3-mo. SOFR +1.431%)(a)(b) | | |

Benefit Street Partners CLO XXII Ltd., 6.63%, 04/20/35, (3-mo. SOFR + 1.350%)(a)(b) | | |

Benefit Street Partners CLO XXIV Ltd., 6.71%, 10/20/34, (3-mo. SOFR + 1.432%)(a)(b) | | |

Benefit Street Partners CLO XXVII Ltd., 7.08%, 07/20/35, (3-mo. SOFR + 1.800%)(a)(b) | | |

Birch Grove CLO 5 Ltd., 7.48%, 04/20/35, (3-mo. SOFR + 2.200%)(a)(b) | | |

Birch Grove CLO 8 Ltd., 6.93%, 04/20/37, (3-mo. SOFR + 1.630%)(a)(b) | | |

| | |

6.93%, 04/15/37, (3-mo. SOFR + 1.620%)(a)(b) | | |

7.33%, 10/18/36, (3-mo. SOFR + 2.050%)(a)(b) | | |

6.90%, 05/15/37, (3-mo. SOFR + 1.570%)(a)(b) | | |

Canyon Capital CLO Ltd., 6.74%, 07/15/34, (3-mo. SOFR + 1.442%)(a)(b) | | |

Canyon CLO Ltd., 6.73%, 10/15/34, (3-mo. SOFR + 1.431%)(a)(b) | | |

| | |

6.70%, 04/15/34, (3-mo. SOFR + 1.402%)(a)(b) | | |

Series 2021 5A, Class A1, 6.66%, 07/20/34, (3-mo. SOFR + 1.382%)(a)(b) | | |

| | |

6.96%, 04/20/37, (3-mo. SOFR + 1.680%)(a)(b) | | |

7.38%, 04/20/37, (3-mo. SOFR + 2.100%)(a)(b) | | |

CarVal CLO VC Ltd., 6.76%, 10/15/34, (3-mo. SOFR + 1.461%)(a)(b) | | |

Carval CLO VIII-C Ltd., 7.58%, 10/22/35, (3-mo. SOFR + 2.300%)(a)(b) | | |

Cedar Funding VIII CLO Ltd., 6.70%, 10/17/34, (3-mo. SOFR + 1.412%)(a)(b) | | |

Cedar Funding XV CLO Ltd., 6.60%, 04/20/35, (3-mo. SOFR + 1.320%)(a)(b) | | |

CIFC Funding 2019-I Ltd., 7.09%, 04/20/32, (3-mo. SOFR + 1.811%)(a)(b) | | |

CIFC Funding 2020-IV Ltd., 6.88%, 01/15/34, (3-mo. SOFR + 1.581%)(a)(b) | | |

| | |

6.61%, 07/15/33, (3-mo. SOFR + 1.312%)(a)(b) | | |

6.71%, 10/20/34, (3-mo. SOFR + 1.432%)(a)(b) | | |

6.61%, 04/20/34, (3-mo. SOFR + 1.331%)(a)(b) | | |

6.70%, 07/15/34, (3-mo. SOFR + 1.402%)(a)(b) | | |

6.71%, 07/15/36, (3-mo. SOFR + 1.412%)(a)(b) | | |

32024 BlackRock Annual Financial Statements

Schedule of Investments (continued)July 31, 2024

BlackRock AAA CLO ETF(Percentages shown are based on Net Assets)

| | |

Series 2021 6A, Class A, 6.70%, 10/15/34, (3-mo. SOFR + 1.402%)(a)(b) | | |

| | |

6.64%, 04/22/34, (3-mo. SOFR + 1.362%)(a)(b) | | |

Series 2021 3A, Class A, 6.71%, 01/25/35, (3-mo. SOFR +1.421%)(a)(b) | | |

Crown Point CLO 9 Ltd., 6.75%, 07/14/34, (3-mo. SOFR + 1.452%)(a)(b) | | |

Diameter Capital CLO 1 Ltd., 6.80%, 07/15/36, (3-mo. SOFR + 1502%)(a)(b) | | |

Diameter Capital CLO 7 Ltd., 6.81%, 07/20/37, (3-mo. SOFR + 1.480%)(a)(b) | | |

Eaton Vance CLO Ltd., 6.71%, 01/15/35, (3-mo. SOFR + 1.412%)(a)(b) | | |

Elmwood CLO 15 Ltd., 6.62%, 04/22/35, (3-mo. SOFR + 1.340%)(a)(b) | | |

Elmwood CLO 18 Ltd., 8.04%, 07/17/33, (3-mo. SOFR + 2.750%)(a)(b) | | |

Elmwood CLO 19 Ltd., 7.69%, 10/17/36, (3-mo. SOFR + 2.400%)(a)(b) | | |

Elmwood CLO 21 Ltd., 6.93%, 10/20/36, (3-mo. SOFR + 1.65%)(a)(b) | | |

Elmwood CLO 22 Ltd., 7.09%, 04/17/36, (3-mo. SOFR + 1.800%)(a)(b) | | |

Elmwood CLO 23 Ltd., 7.09%, 04/16/36, (3-mo. SOFR + 1.800%)(a)(b) | | |

Elmwood CLO IX Ltd., 6.67%, 07/20/34, (3-mo. SOFR + 1.392%)(a)(b) | | |

Elmwood CLO VIII Ltd., 6.83%, 04/20/37, (3-mo. SOFR + 1.550%)(a)(b) | | |

Flatiron CLO 19 Ltd., 6.67%, 11/16/34, (3-mo. SOFR + 1.342%)(a)(b) | | |

Flatiron CLO 21 Ltd. Series 2021 1A, Class A1, 6.65%, 07/19/34, (3-mo. SOFR +1.371%)(a)(b) | | |

Flatiron CLO 23 LLC, 7.09%, 04/17/36, (3-mo. SOFR + 1.800%)(a)(b) | | |

Fort Washington CLO Ltd., 6.76%, 10/20/34, (3-mo. SOFR + 1.482%)(a)(b) | | |

Generate CLO 15 Ltd., 6.87%, 07/20/37, (3-mo. SOFR + 1.570%)(a)(b) | | |

Generate CLO 6 Ltd., 6.74%, 01/22/35, (3-mo. SOFR + 1.462%)(a)(b) | | |

Generate CLO 9 Ltd., 7.29%, 10/20/34, (3-mo. SOFR + 2.012%)(a)(b) | | |

GoldenTree Loan Management U.S. CLO 1 Ltd., 6.67%, 10/20/34, (3-mo. SOFR + 1.392%)(a)(b) | | |

GoldenTree Loan Management U.S. CLO 16 Ltd., 6.95%, 01/20/34, (3-mo. SOFR + 1.670%)(a)(b) | | |

GoldenTree Loan Management U.S. CLO 8 Ltd., 6.69%, 10/20/34, (3-mo. SOFR + 1.412%)(a)(b) | | |

GoldentTree Loan Management U.S. CLO 1 Ltd., 6.78%, 04/20/37, (3-mo. SOFR + 1.500%)(a)(b) | | |

Golub Capital Partners 48 LP, 6.86%, 04/17/33, (3-mo. SOFR + 1.572%)(a)(b) | | |

Golub Capital Partners CLO 41B-R Ltd., 6.86%, 01/20/34, (3-mo. SOFR +1.581%)(a)(b) | | |

Golub Capital Partners CLO 55B Ltd., 6.74%, 07/20/34, (3-mo. SOFR +1.461%)(a)(b) | | |

Golub Capital Partners CLO 58B Ltd., 6.73%, 01/25/35, (3-mo. SOFR + 1.441%)(a)(b) | | |

HalseyPoint CLO 4 Ltd., 6.76%, 04/20/34, (3-mo. SOFR + 1.482%)(a)(b) | | |

| | |

HalseyPoint CLO 6 Ltd., 7.73%, 10/20/34, (3-mo. SOFR + 2.450%)(a)(b) | | |

Halseypoint CLO 7 Ltd., 7.53%, 07/20/36, (3-mo. SOFR + 2.250%)(a)(b) | | |

Invesco CLO Ltd. Series 2021 3A, Class A, 6.67%, 10/22/34, (3-mo. SOFR + 1.392%)(a)(b) | | |

Kings Park CLO Ltd., 6.67%, 01/21/35, (3-mo. SOFR + 1.392%)(a)(b) | | |

Madison Park Funding LIV Ltd., 8.13%, 10/21/34, (3-mo. SOFR + 2.850%)(a)(b) | | |

Madison Park Funding LIX Ltd., 6.78%, 04/18/37, (3-mo. SOFR + 1.500%)(a)(b) | | |

Madison Park Funding LXI Ltd., 7.01%, 01/20/37, (3-mo. SOFR + 1.730%)(a)(b) | | |

Madison Park Funding LXII Ltd., 7.14%, 07/17/36, (3-mo. SOFR + 1.850%)(a)(b) | | |

Madison Park Funding LXVII Ltd., 6.80%, 04/25/37, (3-mo. SOFR + 1.510%)(a)(b) | | |

Madison Park Funding XLV Ltd., 6.68%, 07/15/34, (3-mo. SOFR + 1.382%)(a)(b) | | |

Madison Park Funding XXII Ltd., 6.82%, 01/15/33, (3-mo. SOFR + 1.522%)(a)(b) | | |

Madison Park Funding XXXIV Ltd., 7.70%, 04/25/32, (3-mo. SOFR + 2.411%)(a)(b) | | |

Neuberger Berman Loan Advisers CLO 33 Ltd. Series 2019 33A, Class AR, 6.63%, 10/16/33, (3-mo. SOFR + 1.342%)(a)(b) | | |

New Mountain CLO 1 Ltd., 6.76%, 10/15/34, (3-mo. SOFR + 1.462%)(a)(b) | | |

New Mountain CLO 3 Ltd., 7.24%, 10/20/34, (3-mo. SOFR + 1.962%)(a)(b) | | |

| | |

6.85%, 04/20/37, (3-mo. SOFR + 1.550%)(a)(b) | | |

6.71%, 07/15/34, (3-mo. SOFR + 1.412%)(a)(b) | | |

7.31%, 01/15/35, (3-mo. SOFR + 2.012%)(a)(b) | | |

7.29%, 10/20/34, (3-mo. SOFR + 2.012%)(a)(b) | | |

6.72%, 07/15/34, (3-mo. SOFR + 1.422%)(a)(b) | | |

| | |

6.63%, 07/20/32, (3-mo. SOFR + 1.352%)(a)(b) | | |

7.84%, 04/17/36, (3-mo. SOFR + 2.550%)(a)(b) | | |

6.81%, 04/18/37, (3-mo. SOFR + 1.530%)(a)(b) | | |

6.77%, 01/17/32, (3-mo. SOFR + 1.482%)(a)(b) | | |

6.92%, 04/20/37, (3-mo. SOFR + 1.630%)(a)(b) | | |

6.70%, 04/26/36, (3-mo. SOFR + 1.420%)(a)(b) | | |

Octagon 66 Ltd., 7.08%, 11/16/36, (3-mo. SOFR + 1.750%)(a)(b) | | |

OHA Credit Funding 17 Ltd., 6.79%, 04/20/37, (3-mo. SOFR + 1.480%)(a)(b) | | |

OHA Credit Funding 2 Ltd., 6.69%, 04/21/34, (3-mo. SOFR + 1.412%)(a)(b) | | |

OHA Credit Funding 3 Ltd. Series 2019 3A, Class AR, 6.68%, 07/02/35, (3-mo. SOFR +1.401%)(a)(b) | | |

OHA Credit Funding 4 Ltd., 6.69%, 10/22/36, (3-mo. SOFR + 1.412%)(a)(b) | | |

OHA Credit Funding 6 Ltd., 6.68%, 07/20/34, (3-mo. SOFR + 1.402%)(a)(b) | | |

OHA Credit Partners XVI, 6.69%, 10/18/34, (3-mo. SOFR + 1.412%)(a)(b) | | |

| | |

6.69%, 01/19/37, (3-mo. SOFR + 1.412%)(a)(b) | | |

7.04%, 07/20/37, (3-mo. SOFR + 1.700%)(a)(b) | | |

Schedule of Investments (continued)July 31, 2024

BlackRock AAA CLO ETF(Percentages shown are based on Net Assets)

| | |

| | |

6.73%, 11/14/34, (3-mo. SOFR + 1.412%)(a)(b) | | |

6.97%, 11/15/36, (3-mo. SOFR + 1.65%)(a)(b) | | |

7.28%, 11/14/34, (3-mo. SOFR + 1.962%)(a)(b) | | |

7.97%, 11/15/36, (3-mo. SOFR + 2.650%)(a)(b) | | |

Series 2015 1A, Class A4, 6.72%, 05/21/34, (3-mo. SOFR +1.391%)(a)(b) | | |

Series 2021 4A, Class A, 6.73%, 10/15/34, (3-mo. SOFR + 1.432%)(a)(b) | | |

Pikes Peak CLO 6, 6.76%, 05/18/34, (3-mo. SOFR +1.431%)(a)(b) | | |

Pikes Peak CLO 8, 7.29%, 07/20/34, (3-mo. SOFR + 2.012%)(a)(b) | | |

Post CLO Ltd., 6.87%, 04/20/37, (3-mo. SOFR + 1.600%)(a)(b) | | |

Rad CLO 18 Ltd., 7.25%, 04/15/36, (3-mo. SOFR + 1.950%)(a)(b) | | |

Rad CLO 22 Ltd., 7.11%, 01/20/37, (3-mo. SOFR +1.830%)(a)(b) | | |

Reese Park CLO Ltd., 6.69%, 10/15/34, (3-mo. SOFR + 1.392%)(a)(b) | | |

Regatta VI Funding Ltd., 7.24%, 04/20/34, (3-mo. SOFR + 1.961%)(a)(b) | | |

Regatta XVIII Funding Ltd. | | |

7.01%, 01/15/34, (3-mo. SOFR + 1.712%)(a)(b) | | |

6.66%, 01/15/34, (3-mo. SOFR + 1.392%)(a)(b) | | |

Regatta XXII Funding Ltd., 6.82%, 07/20/35, (3-mo. SOFR + 1.540%)(a)(b) | | |

Regatta XXIII Funding Ltd., 6.69%, 01/20/35, (3-mo. SOFR + 1.412%)(a)(b) | | |

Regatta XXIV Funding Ltd., 6.69%, 01/20/35, (3-mo. SOFR +1.411%)(a)(b) | | |

Regatta XXVII Funding Ltd., 6.83%, 04/26/37, (3-mo. SOFR + 1.530%)(a)(b) | | |

Regatta XXVIII Funding Ltd., 6.83%, 04/25/37, (3-mo. SOFR + 1.550%)(a)(b) | | |

Rockland Park CLO Ltd. Series 2021 1A, Class A, 6.66%, 04/20/34, (3-mo. SOFR + 1.382%)(a)(b) | | |

| | |

6.67%, 07/15/37, (3-mo. SOFR + 1.50%)(a)(b) | | |

7.02%, 07/15/37, (3-mo. SOFR + 1.700%)(a)(b) | | |

RRX 4 Ltd. Series 2021 4A, Class A1, 6.76%, 07/15/34, (3-mo. SOFR +1.461%)(a)(b) | | |

RRX 7 Ltd., 6.66%, 07/15/35, (3-mo. SOFR + 1.360%)(a)(b) | | |

Sixth Street CLO XIX Ltd., 7.24%, 07/20/34, (3-mo. SOFR + 1.961%)(a)(b) | | |

Sixth Street CLO XVII Ltd., 6.78%, 01/20/34, (3-mo. SOFR + 1502%)(a)(b) | | |

Sixth Street CLO XX Ltd. Series 2021 20A, Class A1, 6.70%, 10/20/34, (3-mo. SOFR + 1.422%)(a)(b) | | |

Sycamore Tree CLO Ltd., 6.93%, 04/20/37, (3-mo. SOFR + 1.650%)(a)(b) | | |

Symphony CLO 35 Ltd., 6.98%, 10/24/36, (3-mo. SOFR + 1.700%)(a)(b) | | |

Symphony CLO XXVIII Ltd., 6.68%, 10/23/34, (3-mo. SOFR + 1.402%)(a)(b) | | |

| | |

TCW CLO Ltd., 6.70%, 04/20/34, (3-mo. SOFR + 1.422%)(a)(b) | | |

Texas Debt Capital CLO Ltd., 8.28%, 04/20/36, (3-mo. SOFR + 3.000%)(a)(b) | | |

Trestles CLO IV Ltd., 6.71%, 07/21/34, (3-mo. SOFR + 1.432%)(a)(b) | | |

Trinitas CLO XXIII Ltd., 7.08%, 10/20/36, (3-mo. SOFR + 1.800%)(a)(b) | | |

Trinitas CLO XXV Ltd., 7.13%, 01/23/37, (3-mo. SOFR + 1.850%)(a)(b) | | |

Trinitas CLO XXVI Ltd., 6.97%, 01/20/35, (3-mo. SOFR + 1.690%)(a)(b) | | |

Valley Stream Park CLO Ltd., 6.91%, 10/20/34, (3-mo. SOFR + 1.630%)(a)(b) | | |

Voya CLO Ltd., 6.70%, 07/16/34, (3-mo. SOFR + 1.412%)(a)(b) | | |

Warwick Capital CLO 1 Ltd., 8.08%, 10/20/36, (3-mo. SOFR + 2.800%)(a)(b) | | |

Wellington Management CLO 1 Ltd., 7.08%, 10/20/36, (3-mo. SOFR + 1.800%)(a)(b) | | |

Wellman Park CLO Ltd., 7.16%, 07/15/34, (3-mo. SOFR +1.861%)(a)(b) | | |

| | |

6.66%, 07/24/36, (3-mo. SOFR + 1.320%)(a)(b) | | |

7.09%, 07/24/36, (3-mo. SOFR + 1.750%)(a)(b) | | |

Whitebox CLO III Ltd., 6.78%, 10/15/34, (3-mo. SOFR + 1.482%)(a)(b) | | |

Whitebox CLO IV Ltd., 7.88%, 04/20/36, (3-mo. SOFR + 2.600%)(a)(b) | | |

Total Long-Term Investments — 98.0%

(Cost: $390,926,715) | |

| | |

|

Money Market Funds — 2.6% |

BlackRock Cash Funds: Treasury, SL Agency Shares, 5.29%(c)(d) | | |

Total Short-Term Securities — 2.6%

(Cost: $10,430,000) | |

Total Investments — 100.6%

(Cost: $401,356,715) | |

Liabilities in Excess of Other Assets — (0.6)% | |

| |

| Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of period end. Security description also includes the reference rate and spread if published and available. |

| |

| Annualized 7-day yield as of period end. |

52024 BlackRock Annual Financial Statements

Schedule of Investments (continued)July 31, 2024

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended July 31, 2024 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

| | | | | Change in

Unrealized

Appreciation

(Depreciation) | | | | Capital

Gain

Distributions

from

Underlying

Funds |

BlackRock Cash Funds: Treasury, SL Agency Shares | | | | | | | | | |

| Represents net amount purchased (sold). |

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.