PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all the information you should consider before investing in our Class A Common Stock. You should read this entire prospectus carefully, especially the sections entitled “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” and the historical consolidated financial statements and the related notes thereto, before you decide to invest in our Class A Common Stock.

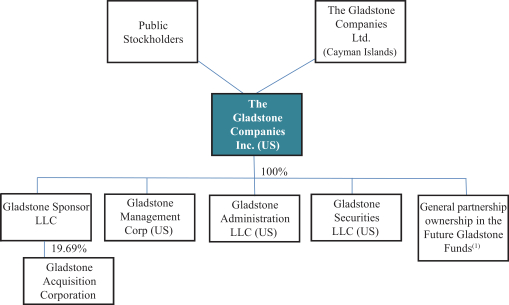

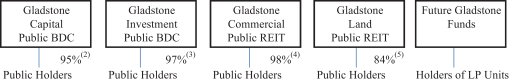

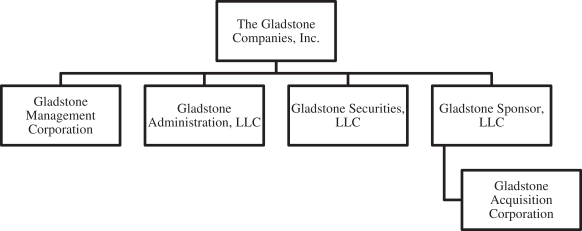

Except where the context suggests otherwise, the terms “we,” “us,” “our,” the “Company” and “The Gladstone Companies” refer to The Gladstone Companies, Inc.; “Adviser Subsidiary” refers to Gladstone Management Corporation; “Administrator Subsidiary” refers to Gladstone Administration, LLC; “GAIN” refers to Gladstone Investment Corporation; “GLAD” refers to Gladstone Capital Corporation; “GOOD” refers to Gladstone Commercial Corporation; “LAND” refers to Gladstone Land Corporation; “Broker-Dealer Subsidiary” refers to Gladstone Securities, LLC; and “Existing Gladstone Funds” refers collectively to GAIN, GLAD, GOOD and LAND.

The Gladstone Companies, Inc.

We were formed on December 7, 2009 as a Delaware corporation to continue the asset management business conducted through predecessor entities since 2001. Our sole stockholder is The Gladstone Companies, Ltd., a Cayman Islands exempted company (“TGC LTD”), which is wholly owned by David Gladstone, our Chairman, President and Chief Executive Officer.

We are an independent United States alternative asset manager with assets under management of approximately $4.0 billion as of December 31, 2021. Our alternative asset management businesses include the management, through our Adviser Subsidiary, of (1) GAIN, a business development company (“BDC”) that primarily invests in debt and equity securities of private businesses operating in the United States, generally with annual earnings before interest, taxes, depreciation and amortization (“EBITDA”) of $3 million to $20 million (“lower middle market”) (including in connection with management buyouts, recapitalization or, to a lesser extent, refinancing of existing debt facilities); (2) GLAD, a BDC that primarily invests in debt securities of established private lower middle market companies in the United States; (3) GOOD, a real estate investment trust (“REIT”) under Section 856 of the Internal Revenue Code of 1986, as amended (the “Code”), which focuses on acquiring, owning and managing primarily office and industrial properties in the United States; and (4) Gladstone Land Corporation (“LAND”), a REIT and natural resources company that focuses on acquiring, owning and leasing farmland in the United States. We also provide various administrative and financial services, including investment banking, due diligence, dealer manager, mortgage placement, and other financial services through our Broker-Dealer Subsidiary.

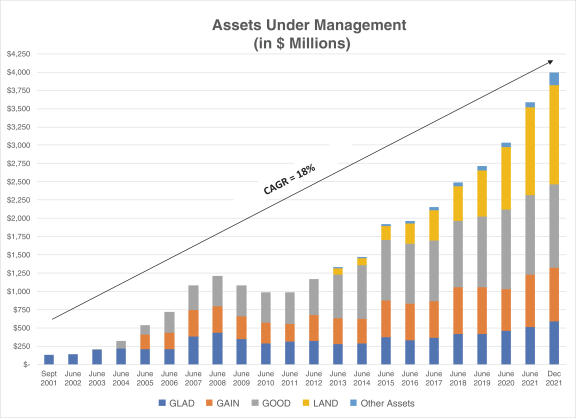

We have grown our assets under management significantly, from approximately $132.2 million as of September 30, 2001, to approximately $4.0 billion as of December 31, 2021, representing a compound annual growth rate (“CAGR”) of approximately 18%. Our Adviser Subsidiary oversees the investments of the four Existing Gladstone Funds which have collectively invested approximately $7.1 billion in 668 businesses or properties through December 31, 2021. As of December 31, 2021, we had 29 executive officers, managing directors and directors and also employed 48 other investment and administrative professionals. Our headquarters is in McLean, Virginia (a suburb of Washington, D.C.) and we have offices in New York, New York; Seattle, Washington; Dallas, Texas; Palm Beach Gardens, Florida; Brandon, Florida; Camarillo, California; Salinas, California; and Tulsa, Oklahoma.

The Existing Gladstone Funds invest in a diverse range of alternative strategies, including private debt, private equity, real estate and natural resource real assets. We seek to deliver superior returns to investors in our