securities. Following subsequent amendments, the S-1 was declared effective on August 4, 2021. On August 9, 2021, Gladstone Acquisition consummated its initial public offering (the “SPAC IPO”) of 10,000,000 units (the “Units”). Each Unit consists of one share of Class A Common Stock, $0.0001 par value per share of Gladstone Acquisition (the “SPAC Common Stock”), and one-half of one redeemable warrant (the “Public Warrants”), each whole Public Warrant entitling the holder thereof to purchase one share of SPAC Common Stock at an exercise price of $11.50 per share, subject to adjustment. The Units were sold at an offering price of $10.00 per Unit, generating gross proceeds of $100,000,000.

Simultaneous with the consummation of the SPAC IPO and the issuance and sale of the Units, (i) Gladstone Acquisition consummated the private placement of 4,200,000 private placement warrants (the “Private Placement Warrants”) to Sponsor, each exercisable to purchase one share of SPAC Common Stock at $11.50 per share, subject to adjustment, at a price of $1.00 per Private Placement Warrant, generating total proceeds of $4,200,000 and (ii) Gladstone Acquisition consummated the private placement to EF Hutton, division of Benchmark Investments, LLC (the “Representative”), of 200,000 shares of SPAC Common Stock (the “Representative Shares”) for nominal consideration.

Of the proceeds Gladstone Acquisition received from the SPAC IPO, the sale of the Private Placement Warrants and the sale of the Representative Shares, $102.0 million, or $10.20 per Unit issued in the SPAC IPO, was deposited into a trust account with Continental Stock Transfer & Trust Company acting as trustee (the “Trust Account”).

Subsequently, on August 10, 2021, the Representative exercised the over-allotment option in part, and the closing of the issuance and sale of the additional Units (the “Over-Allotment Units”), additional Private Placement Warrants (the “Over-Allotment Private Placement Warrants”) and additional Representative Shares (the “Over-Allotment Representative Shares”) occurred on August 18, 2021. The total aggregate issuance by Gladstone Acquisition of 492,480 Over-Allotment Units, 98,496 Over-Allotment Private Placement Warrants at a purchase price of $1.00 per Private Placement Warrant and 9,850 Over-Allotment Representative Shares for nominal consideration resulted in total gross proceeds of $5,023,296 (the “Over-Allotment Proceeds”).

The Over-Allotment Proceeds were deposited to the Trust Account and added to the net proceeds from the SPAC IPO and certain of the proceeds from the sale of the Private Placement Warrants and Representative Shares at the SPAC IPO; upon closing of the over-allotment in part, there was an aggregate of approximately $107,023,296, or $10.20 per issued and outstanding Unit, in the Trust Account.

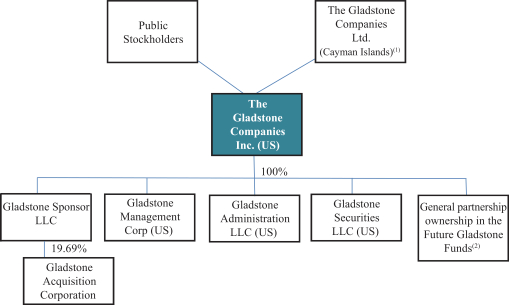

On September 18, 2021, Sponsor automatically surrendered to Gladstone Acquisition 251,880 shares of Class B Common Stock, par value $0.0001 per share, of Gladstone Acquisition for no consideration, pursuant to contractual arrangements with Gladstone Acquisition that were triggered by the expiration of the option of the Representative to purchase additional units. Following this forfeiture, Sponsor owns 2,623,120 shares of Class B Common Stock of Gladstone Acquisition, equal to approximately 19.69% of the issued and outstanding shares of Common Stock of Gladstone Acquisition.

Gladstone Acquisition will not generate any operating revenues until after the completion of its Initial Business Combination, at the earliest. Gladstone Acquisition will generate non-operating income in the form of interest income on cash and cash equivalents from the proceeds derived from the SPAC IPO.

In determining the accounting treatment of our equity interest in Gladstone Acquisition, management concluded that Gladstone Acquisition is a variable interest entity (“VIE”) as defined by Accounting Standards Codification (“ASC”) Topic 810, “Consolidation.” A VIE is an entity in which equity investors at risk lack the characteristics of a controlling financial interest. VIEs are consolidated by the primary beneficiary, the party who has both the power to direct the activities of a VIE that most significantly impact the entity’s economic performance, as well as the obligation to absorb losses of the entity or the right to receive benefits from the entity