UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23556

Datum One Series Trust

(Exact name of registrant as specified in charter)

50 S. LaSalle Street

Chicago, Illinois 60603

(Address of principal executive offices) (Zip code)

The Northern Trust Company

50 S. LaSalle Street

Chicago, Illinois 60603

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866) 494-4270

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The following are copies of reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Polar Capital Funds

ANNUAL REPORT

MARCH 31, 2024

The Securities and Exchange Commission (“SEC”) recently adopted a rule requiring mutual funds to produce “concise and visually engaging” annual and semi-annual reports to shareholders. The streamlined format is intended to highlight key information for retail shareholders to permit them to assess and monitor their fund investments. More detailed information that has historically been part of shareholder reports, such as the shareholder letter, financial statements and financial highlights, will not appear in the new streamlined shareholder reports, but will be available free of charge upon request to the Funds or via the Funds’ Form N-CSR filed with the SEC on its EDGAR database. The compliance date for funds to implement streamlined shareholder reports is July 24, 2024; therefore, the Funds will issue their first streamlined shareholder reports beginning with their September 30, 2024 semi-annual report. The new rule requires that each series of a mutual fund issue a separate streamlined shareholder report. For example, if you are a shareholder of both funds you will receive two (2) separate streamlined shareholder reports, one for each fund, upon implementation of the new rule. In addition, the new rule requires that a hard copy of a fund’s streamlined shareholder report be mailed to each shareholder, unless the shareholder elects to receive such reports electronically. If you wish to ‘opt-in’ for electronic delivery of the Funds’ annual and semi-annual shareholder reports, please contact your financial advisor (or for direct shareholders, please contact the Funds at (800) 806-1112 (toll free) or (312) 557-3164 for assistance in enrolling your account in paperless (i.e., electronic) delivery of shareholder materials.

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

POLAR CAPITAL FUNDS

TABLE OF CONTENTS

March 31, 2024

POLAR CAPITAL FUNDS

LETTER TO SHAREHOLDERS

Dear Shareholder:

We are pleased to present to shareholders the March 31, 2024 Annual Report for the Polar Capital Emerging Market Stars Fund and the Polar Capital Emerging Market ex-China Stars Fund (together the “Funds” each a “Fund”), each a series of the Datum One Series Trust. This report contains the results of the Funds’ operations for the period ended March 31, 2024.

We appreciate the trust and confidence you have placed in us by choosing the Funds and their Investment Adviser, Polar Capital LLP, and we look forward to continuing to serve your investing needs.

Sincerely,

Alastair Barrie

Managing Director - North America

Polar Capital

1

POLAR CAPITAL EMERGING MARKET STARS FUND

PERFORMANCE COMMENTARY

(Unaudited)

Fund performance

The Polar Capital Emerging Market Stars Fund (the “Fund”) returned 9.63% for the year ending March 31, 2024, compared to 8.15% for its benchmark, the MSCI Emerging Markets Net Total Return Index (the “Index”), for the same period.

Macro background

The past 12 months has continued to be a challenging macroeconomic environment for emerging markets, however many have demonstrated great resilience given the difficult global backdrop of high US inflation and tight Federal Reserve (Fed) monetary policy as well as high geopolitical tensions. Despite these headwinds, we have seen what we believe are green shoots of a recovery that could be the beginning of a stronger structural growth period for many emerging market economies. The Fund, focusing on stock selection, has benefited from these positive trends to deliver good returns during this period.

There is no question that inflation in the US, on the back of extreme expansionary monetary policy, continued reckless – in our view – fiscal policy, the tight US monetary cycle and related strong dollar have created a strong headwind for the majority of emerging markets. It has led to central banks reacting conservatively even though there are few inflation issues in emerging markets (with the exception of small relatively irrelevant countries, from an investment point of view, such as Turkey). They have hiked rates and created an economic environment where most emerging markets are faced with relatively high interest rates hurting both the investment cycle and the credit/consumer cycle. In addition, we believe the whole ‘higher for longer’ narrative around inflation in the US, on top of direct monetary conditions, is creating a higher discount rate as risk aversion is higher.

On the positive side, we are very impressed with how well most emerging market economies have been able to cope with this backdrop, and we strongly believe this is testament to their significantly improved underlying fundamentals over the past 5-6 years.

Looking at countries like India and Indonesia, it is hard to believe it was not that long ago that they were part of the so-called ‘Fragile Five’. We believe this general level of improvement in macro (and corporate) fundamentals over the past five years or so is setting up emerging markets as an asset class very well for the next upcycle, which we feel we are not far away from.

Another negative over the past 12 months has been geopolitical tensions and we see returns from China being the hardest hit, given its weakness is externally related to geopolitics as well as domestic politics and economics. The trade and technology war between China and the US has been edging up over the past 12 months and it is very clear the world will never return to the old US/China relationship. Alongside this is Taiwan, plus China supporting Russia over Ukraine – or at least turning a blind eye to many Chinese companies selling sanctioned products to Russia. We believe this has all resulted in a significant expansion of the equity risk premium in Chinese equities expressed in those listed in Hong Kong where we have seen extreme selling pressure and now have a market on very cheap multiples.

The Fund has a significant underweight in Chinese equities and we are very selective when it comes to stock selection.

2

POLAR CAPITAL EMERGING MARKET STARS FUND

PERFORMANCE COMMENTARY

(Unaudited)

We also believe China’s domestic economic issues have played a significant role in its underperformance over the past 12 months (and before). In our view, much of this comes down to President Xi setting the wrong agendas for an economic recovery, micro-managing regulation of industries and encouraging government-linked companies to kill off private companies. Xi has clearly communicated that national security is the top priority and, in our view, there seems to be an element of paranoia that is discouraging willingness and encouraging risk aversion for businesses to invest. In our view, China is at a crossroads where it has to deal with huge levels of debt, over-capacity in many industries and a property market/asset class at a real risk of deflation. This is all at a time when China needs to export to drive growth but its export engine is at risk due to geopolitics. Therefore, the last thing China needs is an environment where local entrepreneurs are risk averse and are just as eager as foreign investors to take capital out of China. Given the domestic political situation, we see a real risk that large parts of the Chinese economy will face the risk of some form of debt/deflation trap which will be hard to reverse. From an investment point of view, we look for growth pockets within China or in those areas where we believe a risk to exports will be low.

While there has been a great deal of negative noise surrounding emerging markets over the past year, there have also been positive developments, many of which the Fund has participated very well in.

We have been very positive on technology, particularly semiconductors and hardware, which has given us strong exposure to Taiwan and South Korea. This has played out very well for the Fund over this period and the sector and stock selection have been important drivers behind the Fund’s outperformance over the past 12 months. Artificial intelligence (AI) has been one of the key developments for a renewed strong capex (capital expenditure) cycle for semiconductors. Many of the headlines have been written in the US, but the AI evolution and related buildout of data centers is very semiconductor and technology hardware-heavy, which is where Taiwan and South Korea come into the equation. We have seen strong performance here over the past 12 months, but believe we are early in a new technology upcycle and still see many attractive opportunities in both countries as there are plenty of companies with exposure to these growth areas. At the same time, we think valuation levels are still attractive. Given our current forecasts, we expect to keep a large exposure to these areas for now.

Another very positive development for the Fund has been India – even though we are fully aware that many have been saying for a long time that it is popular among investors and expensive – and our stock selection has helped deliver strong absolute and relative returns. We acknowledge the high market valuations in India, but still see a strong, growing economy and believe India will be one of the best emerging markets over the coming decade. Furthermore, India fits well into our so-called ‘Multipolar World’ narrative. Geopolitics and global supply chains are fast changing and we believe India is one country that stands to benefit structurally. We will continue to be selective in our stock-picking in India but strongly believe we can keep deploying capital with a good level of expected returns.

Elsewhere, we remain positive on Latin America (LatAm), where we have increased our exposure to Mexico over the past 12 months, again helped by our multipolar world view, thanks to the country’s ‘nearshoring’ trend. We see upside in Brazil, though do need a rate-cutting cycle to start before it can realize its full potential – Brazil is still faced with very high interest rates.

3

POLAR CAPITAL EMERGING MARKET STARS FUND

PERFORMANCE COMMENTARY

(Unaudited)

We see strong long-term potential for the CE-MENA (Central Europe, Middle East and North Africa) region, especially in Saudi Arabia and the United Arab Emirates (UAE), given a strong focus on driving domestic economic growth. However, there is a pause in the market at the moment due to the Hamas (and now Iran)/Israel conflict. We are increasingly positive on the economic developments in Central Asia as, in the years to come, we see the evolution of a larger, more integrated economic area between India, Central Asia and the Middle East. Here you will have labor and a large number of consumers which, combined with energy and commodities, provides the ingredients for a powerhouse region over the coming decade.

In the ASEAN (Association of Southeast Asian Nations) region, we continue to favor Vietnam (off benchmark for the Fund) and Indonesia, and are increasingly positive on the Philippines. The ASEAN region is well positioned to benefit from lower rates globally as well as taking lower-end manufacturing jobs from China.

Fund activity

The key activity in the Fund has, at the country level, been a further reduction in both our absolute and relative weighting towards China. As described above, structurally we see a risk of the Chinese economy finding itself in some form of debt/deflation trap that will be hard to work itself out of, so we are very careful on our overall allocation of capital towards China. We still see opportunities in attractive growth areas, and are very selective when it comes to stock selection.

Over the past 12 months, we have also allocated more capital to Mexico via selective stocks and, for the first time in many years, are overweight the country. We have also increased the Fund’s exposure to the Middle East and Central Asia.

The significantly reduced weighting in China, combined with the more attractive relative opportunities in LatAm and the Middle East, means the Fund is, for the first time ever, underweight Asia (though the Fund does still have strong exposure to the region).

At a sector level, we have retained a high overweight to technology though we have made changes within the sector. The most significant has been to increase exposure to the memory cycle within semiconductors, particularly via Samsung Electronics and SK Hynix, for exposure to the high bandwidth memory (HBM) segment, needed to train AI models.

We have kept our weighting to other sectors relatively stable, with smaller changes driven mainly by stock-specific issues as well as smaller variations in relative performance.

Key new stocks to mention over the past 12 months would be MakeMyTrip (Indian online travel agent), SK Hynix (South Korean technology), Faraday Technology (Taiwanese technology), Kaspi.kz (Kazakh internet and FinTech), Aldar Properties (UAE property), Nu Holdings (Brazilian online bank), Pinduoduo (Chinese e-commerce), Corp Inmobiliaria Vesta (Mexican industrial real estate) and Grupo Traxion (Mexican transportation and logistics).

Key exits over the past 12 months include Alibaba Group Holding, JD.com (both Chinese e-commerce), Venus MedTech Hangzhou (Chinese MedTech), JD Health International (Chinese online healthcare), Naver (South Korean internet/e-commerce) and Samsung SDI (South Korean electric vehicle battery maker).

4

POLAR CAPITAL EMERGING MARKET STARS FUND

PERFORMANCE COMMENTARY

(Unaudited)

Outlook

We believe we are close to the inflection point of the equity market moving more towards a growth style, which could provide a tailwind for the Fund, having been fighting a strong value environment for the past three years (since November 9, 2020, when the Covid vaccine was announced and the market style fully swung from growth to value).

We expect the Fed will soon start to pivot and we will see an easing cycle in late 2H24. The specific timing is difficult to predict but our best forecast is around December (i.e. after the US election). We cannot rule out rate cuts starting in 2025, though in such a scenario we would expect cuts to be more aggressive. We see key emerging markets starting to cut rates before the Fed, which is not normal practice but we have already seen a few start. We are clearly seeing a difference in underlying inflation trends that can fundamentally justify such a move and believe we are increasingly getting to a stage where the market will like these moves.

The recovery playing out in China will be gradual and will likely be a ‘muddle through’ scenario for the domestic side of the economy. We think the risk of China ‘turning Japanese’ in terms of being in a debt/deflation trap is high, however we also believe there will be opportunities in niche areas in the domestic economy and strong exporters to the rest of the emerging markets. For this reason, we also believe there will still be good EPS (earnings per share) growth stories in China so it is too early to call China, as some have, uninvestable.

Most emerging markets, excluding China, look good given the global backdrop and many economies in India as well as the ASEAN, LatAm and CE-MENA regions could be well positioned for a strong cyclical growth period when inflation eases and monetary conditions can become loose once again. Key companies in these areas are attractively priced now, in our view.

We believe we are entering a new structural technology upcycle for the next 12-24 months, in which North Asia is well positioned, on the back of the combination of an inventory cleanup, further supply-side consolidation (within semiconductors in particular) and AI – the Polar Capital Technology team talk excitedly about the whole redesign of compute architecture needed for the AI age. We believe the leading South Korean and Taiwanese technology companies give us attractive exposure to it at what we believe are attractive valuation levels.

Finally, we see the evolution of a new multipolar world underpinning a structural trend for many emerging market countries. This will sit in a world that will de-dollarize for trade to further boost spending power in many emerging economies and create an investment and consumption uptrend. These structural trends will likely create a very different emerging market universe to the one we saw in the past decade – and it makes us bullish from both an absolute and relative return perspective.

Polar Capital Emerging Markets & Asia Team

March 31, 2024

5

POLAR CAPITAL EMERGING MARKET STARS FUND

HISTORICAL PERFORMANCE

March 31, 2024 (Unaudited)

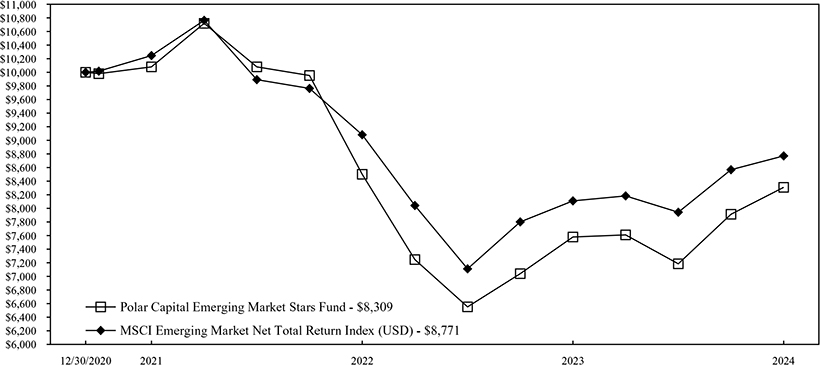

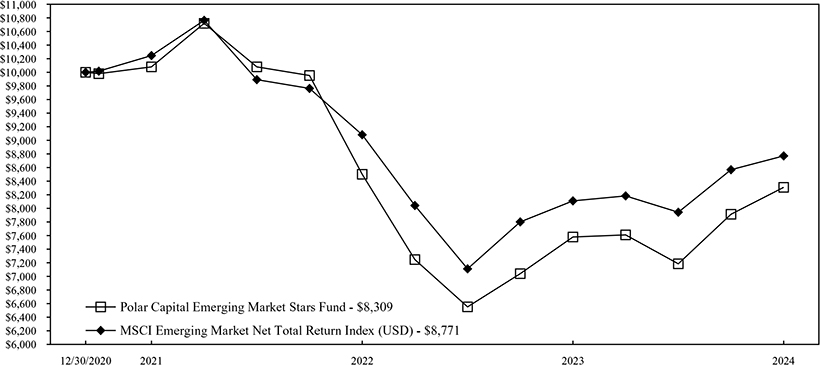

Change in Value of a $10,000 Investment in Polar Capital Emerging Market Stars Fund vs. MSCI Emerging Market Net Total Return Index for the Period December 30, 2020 to March 31, 2024

| | | | | | |

| | | | | Annualized Total Return |

| | | | 1 Year | | Commencement of Operations 12/30/2020 to 03/31/2024 |

| | Polar Capital Emerging Market Stars Fund | | 9.63%* | | -5.54% |

| | MSCI Emerging Market Net Total Return Index | | 8.15% | | -3.96% |

| | | | | | |

| * | Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. |

Based on a hypothetical $10,000 initial investment, the graph and table above illustrate the total return of the Fund against the MSCI Emerging Market Net Total Return Index. The Index is a float-adjusted market capitalization index that is designed to measure the combined equity market performance of developed and emerging market countries excluding the United States. This index does not reflect any commissions or fees which would be incurred by an investor purchasing the stocks it represents. An investor cannot invest directly in an index. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares. The performance of the Fund and of the Index is computed on a total return basis which includes reinvestment of all distributions, if any.

6

POLAR CAPITAL EMERGING MARKET STARS FUND

HISTORICAL PERFORMANCE

March 31, 2024 (Unaudited)

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Month-end performance data can be obtained by visiting the website at www.polarcapitalfunds.com or by calling (800) 806-1112 (toll free) or (312) 557-3164. The gross expense ratio is 2.45%; the net expense ratio is 1.00%. The latter reflects contractual fee waivers through July 31, 2024. Information regarding the Fund’s current expense ratio and redemption fees can be found on page 29. The Prospectus details the Fund’s objective and policies, sales charges, and other matters of interest to prospective investors. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.polarcapitalfunds.com, by email at PolarCapital@ntrs.com, by calling (800) 806-1112 (toll free) or (312) 557-3164 or by contacting the Fund in writing.

7

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND PERFORMANCE COMMENTARY

(Unaudited)

Fund performance

The Polar Capital Emerging Market ex-China Stars Fund (the “Fund”) was launched on June 30, 2023, since then it has returned 13.30%, compared to 13.64% for its benchmark, the MSCI Emerging Markets ex-China Net Total Return Index (the “Index”), for the same period.

Macro background

The past nine month period has continued to be a challenging macroeconomic environment for emerging markets, however many have demonstrated great resilience given the difficult global backdrop of high US inflation and tight Federal Reserve (Fed) monetary policy as well as high geopolitical tensions. Despite these headwinds, we have seen what we believe are green shoots of a recovery that could be the beginning of a stronger structural growth period for many emerging market economies outside China. The Fund, focusing on stock selection, has benefited from these positive trends to deliver good returns during this period.

There is no question that inflation in the US, on the back of extreme expansionary monetary policy, continued reckless – in our view – fiscal policy, the tight US monetary cycle and related strong dollar have created a strong headwind for the majority of emerging markets. It has led to central banks reacting conservatively even though there are few inflation issues in emerging markets (with the exception of small relatively irrelevant countries, from an investment point of view, such as Turkey). They have hiked rates and created an economic environment where most emerging markets are faced with relatively high interest rates hurting both the investment cycle and the credit/consumer cycle. In addition, we believe the whole ‘higher for longer’ narrative around inflation in the US, on top of direct monetary conditions, is creating a higher discount rate as risk aversion is higher.

On the positive side, we are very impressed with how well most emerging market economies have been able to cope with this backdrop, and we strongly believe this is testament to their significantly improved underlying fundamentals over the past 5-6 years.

Looking at countries like India and Indonesia, it is hard to believe it was not that long ago that they were part of the so-called ‘Fragile Five’. We believe this general level of improvement in macro (and corporate) fundamentals over the past five years or so is setting up emerging markets as an asset class very well for the next upcycle, which we feel we are not far away from.

Another negative over the past 12 months has been geopolitical tensions and we see returns from China being the hardest hit, given its weakness is externally related to geopolitics as well as domestic politics and economics. The trade and technology war between China and the US has been edging up over the past 12 months and it is very clear the world will never return to the old US/China relationship. Alongside this is Taiwan, plus China supporting Russia over Ukraine – or at least turning a blind eye to many Chinese companies selling sanctioned products to Russia.

The Fund, obviously, does not invest directly in Chinese equities though the size of its economy, number of consumers, geopolitical tensions and its position as a global manufacturing powerhouse combine to result in a significant expansion of the risk premiums into the broader emerging market universe.

8

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

PERFORMANCE COMMENTARY

(Unaudited)

We believe China’s domestic economic issues come down to President Xi setting the wrong agendas for an economic recovery, micro-managing the regulation of industries and encouraging government-linked companies to kill off private companies. Xi has clearly communicated that national security is the top priority and, in our view, there seems to be an element of paranoia that is discouraging willingness and encouraging risk aversion for businesses to invest. In our view, China is at a crossroads where it has to deal with huge levels of debt, over-capacity in many industries and a property market/asset class at a real risk of deflation. This is all at a time when China needs to export to drive growth but its export engine is at risk due to geopolitics. Therefore, the last thing China needs is an environment where local entrepreneurs are risk averse and are just as eager as foreign investors to take capital out of China. Given the domestic political situation, we see a real risk that large parts of the Chinese economy will face the risk of some form of debt/deflation trap which will be hard to reverse.

While there has been negative noise surrounding emerging markets, there have also been positive developments, many of which the Fund has participated very well in.

We have been very positive on technology, particularly semiconductors and hardware, which has given us strong exposure to Taiwan and South Korea. This has played out very well for the Fund over this period and the sector and stock selection have been important drivers behind our outperformance over the past 12 months. Artificial intelligence (AI) has been one of the key developments for a renewed strong capex (capital expenditure) cycle for semiconductors. Many of the headlines have been written in the US, but the AI evolution and related buildout of data centers is very semiconductor and technology hardware-heavy, which is where Taiwan and South Korea come into the equation. We have seen strong performance here over the past 12 months, but believe we are early in a new technology upcycle and still see many attractive opportunities in both countries as there are plenty of companies with exposure to these growth areas. At the same time, we think valuation levels are still attractive. Given our current forecasts, we expect to keep a large exposure to these areas for now.

Another very positive development for the Fund has been India – even though we are fully aware that many have been saying for a long time that it is well owned and expensive – and our stock selection has helped deliver strong absolute and relative returns. We acknowledge the high market valuations in India, but still see a strong, growing economy and believe India will be one of the best emerging markets over the coming decade. Furthermore, India fits well into our so-called ‘Multipolar World’ narrative. Geopolitics and global supply chains are fast changing and we believe India is one country that stands to benefit structurally. We will continue to be selective in our stock-picking in India but strongly believe we can keep deploying capital with a good level of expected returns.

Elsewhere, we remain positive on Latin America (LatAm), where we have increased our exposure to Mexico over the past 12 months, again helped by our multipolar world view, thanks to the country’s ‘nearshoring’ trend. We see upside in Brazil, though do need a rate-cutting cycle to start before it can realize its full potential – Brazil is still faced with very high interest rates.

We see strong long-term potential for the CE-MENA (Central Europe, Middle East and North Africa) region, especially in Saudi Arabia and the United Arab Emirates (UAE), given a strong focus on driving domestic economic growth. However, there is a pause in the market at the moment due to the Hamas (and now Iran)/Israel conflict. We are increasingly positive on the economic developments in Central Asia as, in the years to come, we

9

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

PERFORMANCE COMMENTARY

(Unaudited)

see the evolution of a larger, more integrated economic area between India, Central Asia and the Middle East. Here you will have labor and a large number of consumers which, combined with energy and commodities, provides the ingredients for another powerhouse region over the coming decade.

In the ASEAN (Association of Southeast Asian Nations) region, we continue to favor Vietnam (off benchmark for the Fund) and Indonesia, and are increasingly positive on the Philippines. The ASEAN region is well positioned to benefit from lower rates globally as well as taking lower-end manufacturing jobs from China.

Fund activity

Given our longer-term focus as investors, we have not made significant structural changes since we launched the strategy and any changes have been more driven by stock-specific changes during the period under review.

At a sector level, we have retained a high overweight to technology though we have made changes within the sector. The most significant has been to increase exposure to the memory cycle within semiconductors, particularly via Samsung Electronics and SK Hynix, for exposure to the high bandwidth memory (HBM) segment, needed to train AI models.

We have kept the Fund’s weighting to other sectors relatively stable, with smaller changes driven mainly by stock-specific issues as well as smaller variations in relative performance.

Key new stocks to mention over the past nine months would be SK Hynix (South Korean technology), Kaspi.kz (Kazakhstan internet and FinTech), Aldar Properties (UAE property), Nu Holdings (Brazilian online bank) and Grupo Traxion (Mexican transportation and logistics).

Key exits to mention include Ethos (Indian watch retailer), Prestige Estates Projects (Indian property developer), Allkem (Brazilian lithium producer) and Samsung SDI (South Korean electric vehicle battery maker).

Outlook

We believe we are close to the inflection point of the equity market moving more towards a growth style, which could provide a tailwind for the Fund, having been fighting a strong value environment since before the Fund was launched.

We expect the Fed will soon start to pivot and we will see an easing cycle in late 2H24. The specific timing is difficult to predict but our best forecast is around December (i.e. after the US election). We cannot rule out rate cuts starting in 2025, though in such a scenario we would expect cuts to be more aggressive. We see key emerging markets starting to cut rates before the Fed, which is not normal practice but we have already seen a few start. We are clearly seeing a difference in underlying inflation trends that can fundamentally justify such a move and believe we are increasingly getting to a stage where the market will like these moves.

Most emerging markets, excluding China, look good given the global backdrop and many economies in India as well as the ASEAN, LatAm and CE-MENA regions could be well positioned for a strong cyclical growth period when inflation eases and monetary conditions can become loose once again. Key companies in these areas are attractively priced now, in our view.

10

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

PERFORMANCE COMMENTARY

(Unaudited)

We are entering a new structural technology upcycle for the next 12-24 months, in which North Asia is well positioned, on the back of the combination of an inventory cleanup, further supply-side consolidation (within semiconductors in particular) and AI – the Polar Capital Technology team talk excitedly about the whole redesign of compute architecture needed for the AI age. We believe the leading South Korean and Taiwanese technology companies give us attractive exposure to it at what we believe are attractive valuation levels.

Finally, we see the evolution of a new multipolar world underpinning a structural trend for many emerging market countries. This will sit in a world that will de-dollarize for trade to further boost spending power in many emerging economies and create an investment and consumption uptrend. These structural trends will likely create a very different emerging market universe to the one we saw in the past decade – and it makes us bullish from both an absolute and relative return perspective.

Polar Capital Emerging Markets & Asia Team

March 31, 2024

11

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

HISTORICAL PERFORMANCE

March 31, 2024 (Unaudited)

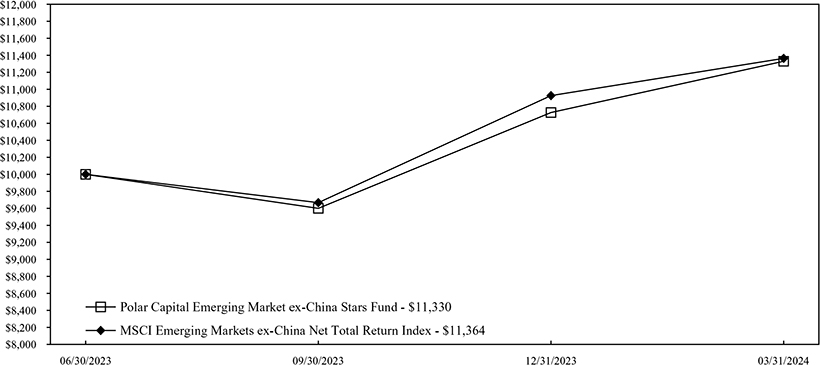

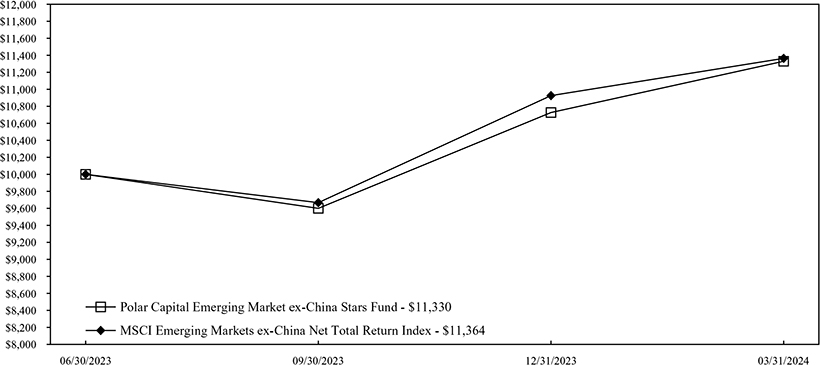

Change in Value of a $10,000 Investment in Polar Capital Emerging Market ex-China Stars Fund vs. MSCI Emerging Markets ex-China Net Total Return Index for the Period June 30, 2023 to March 31, 2024

| | | | |

| | | | Commencement of Operations 06/30/2023 to 03/31/2024 |

| | Polar Capital Emerging Market ex-China Stars Fund | | 13.30%* |

| | MSCI Emerging Markets ex-China Net Total Return Index | | 13.64% |

| | | | |

| * | Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from the amount reported in the Financial Highlights. |

Based on a hypothetical $10,000 initial investment, the graph and table above illustrate the total return of the Fund against the MSCI Emerging Markets ex-China Net Total Return Index. The Index is a float-adjusted market capitalization index that is designed to measure the combined equity market performance of developed and emerging market countries excluding the United States. This index does not reflect any commissions or fees which would be incurred by an investor purchasing the stocks it represents. An investor cannot invest directly in an index. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares. The performance of the Fund and of the Index is computed on a total return basis which includes reinvestment of all distributions, if any.

12

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

HISTORICAL PERFORMANCE

March 31, 2024 (Unaudited)

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Month-end performance data can be obtained by visiting the website at www.polarcapitalfunds.com or by calling (800) 806-1112 (toll free) or (312) 557-3164. The gross expense ratio is 17.88%; the net expense ratio is 1.00%. The latter reflects contractual fee waivers through November 8, 2024. Information regarding the Fund’s current expense ratio and redemption fees can be found on page 30. The Prospectus details the Fund’s objective and policies, sales charges, and other matters of interest to prospective investors. Please read the Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.polarcapitalfunds.com, by email at PolarCapital@ntrs.com, by calling (800) 806-1112 (toll free) or (312) 557-3164 or by contacting the Fund in writing.

13

POLAR CAPITAL FUNDS

IMPORTANT DISCLOSURES, INDEX DEFINITIONS AND TERM DEFINITIONS

(Unaudited)

Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale with respect to any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be made pursuant to the Fund’s Prospectus which supersedes the information contained herein in its entirety.

The views expressed herein and any forward-looking statements are as of the date of this publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

Please refer to the Portfolio of Investments in this report for a complete list of the portfolio holdings. Portfolio composition will change due to ongoing management of the Fund. References to individual securities are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio manager, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.polarcapitalfunds.com. The Fund’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

Index Definitions

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The MSCI Emerging Markets Index consists of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. Net dividends reinvested.

The MSCI Emerging Markets ex-China Index captures large and mid-cap representation across 23 of the 24 Emerging Markets countries excluding China. The 23 Emerging Markets countries include: Brazil, Chile, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. With 672 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

14

POLAR CAPITAL FUNDS

IMPORTANT DISCLOSURES, INDEX DEFINITIONS AND TERM DEFINITIONS

(Unaudited)

Term Definitions

Basis points (bps or “bips”): A unit of measure used in finance to describe the percentage change in the value of financial instruments or the rate change in an index or other benchmark. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form.

Capex (capital expenditure): Money a company uses to purchase, maintain or expand fixed assets.

Duration: How long a stock investor needs to receive dividends to be repaid the purchase price of the stock.

EPS (earnings per share): A measure of a company’s value by assessing how much money a company makes for each of its shares.

Nearshoring: To hire or outsource to workers in locales closer to a company’s home market.

15

POLAR CAPITAL EMERGING MARKET STARS FUND

PORTFOLIO OF INVESTMENTS

March 31, 2024

| | | | | |

| Industry Allocation | | Percent of

Net Assets |

Semiconductors & Semiconductor Equipment | | | | 19.1 | % |

Banks | | | | 12.6 | |

Real Estate Management & Development | | | | 7.9 | |

Technology Hardware, Storage & Peripherals | | | | 7.0 | |

Broadline Retail | | | | 5.2 | |

Hotels, Restaurants & Leisure | | | | 5.1 | |

Interactive Media & Services | | | | 5.1 | |

Oil, Gas & Consumable Fuels | | | | 4.9 | |

Electronic Equipment, Instruments & Components | | | | 4.8 | |

Metals & Mining | | | | 4.0 | |

IT Services | | | | 2.6 | |

Chemicals | | | | 1.9 | |

Capital Markets | | | | 1.9 | |

Machinery | | | | 1.8 | |

Insurance | | | | 1.5 | |

Electrical Equipment | | | | 1.5 | |

Industrial Conglomerates | | | | 1.4 | |

Consumer Finance | | | | 1.3 | |

Textiles, Apparel & Luxury Goods | | | | 1.2 | |

Construction & Engineering | | | | 1.2 | |

Consumer Staples Distribution & Retail | | | | 1.2 | |

Health Care Providers & Services | | | | 1.1 | |

Entertainment | | | | 1.0 | |

Software | | | | 1.0 | |

Ground Transportation | | | | 0.6 | |

Health Care Equipment & Supplies | | | | 0.5 | |

Financial Services | | | | 0.5 | |

Other Assets And Liabilities, Net | | | | 2.1 | % |

| | | | | |

| |

Net Assets | | | | 100.0 | % |

| | | | | |

| | | | | |

| Country Allocation | | Percent of

Net Assets |

India | | | | 18.3 | % |

Taiwan | | | | 16.4 | |

South Korea | | | | 15.3 | |

China | | | | 15.1 | |

Brazil | | | | 8.4 | |

Vietnam | | | | 4.4 | |

Mexico | | | | 4.3 | |

South Africa | | | | 3.5 | |

Argentina | | | | 2.5 | |

Indonesia | | | | 1.7 | |

Hong Kong | | | | 1.5 | |

United Arab Emirates | | | | 1.4 | |

Kazakhstan | | | | 1.3 | |

United States | | | | 1.2 | |

Singapore | | | | 1.0 | |

Saudi Arabia | | | | 1.0 | |

Jersey, Cayman Islands | | | | 0.6 | |

Other Assets And Liabilities, Net | | | | 2.1 | % |

| | | | | |

| |

Net Assets | | | | 100.0 | % |

| | | | | |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Fund holdings are subject to change daily.

See accompanying Notes to Financial Statements.

16

POLAR CAPITAL EMERGING MARKET STARS FUND

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2024

| | | | | | | | |

COMMON STOCKS – 95.7% | | Shares | | Fair Value | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT – 19.1% | | | | | | | | |

Andes Technology Corp. (Taiwan) | | | 31,926 | | | $ | 427,955 | |

eMemory Technology Inc. (Taiwan) | | | 50,087 | | | | 3,896,968 | |

Faraday Technology Corp. (Taiwan) | | | 211,335 | | | | 2,271,603 | |

HPSP Co. Ltd. (South Korea) | | | 57,500 | | | | 2,267,967 | |

SK Hynix Inc. (South Korea) | | | 30,994 | | | | 4,213,112 | |

StarPower Semiconductor Ltd. (China) | | | 61,198 | | | | 1,206,466 | |

Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | | | 603,108 | | | | 14,680,305 | |

| | | | | | | | |

| | | | | | $ | 28,964,376 | |

| | | | | | | | |

BANKS – 10.4% | | | | | | | | |

Alinma Bank (Saudi Arabia) | | | 133,985 | | | $ | 1,520,082 | |

Grupo Financiero Banorte S.A.B. de C.V. (Mexico) | | | 413,912 | | | | 4,396,324 | |

HDFC Bank Ltd. (India) | | | 122,151 | | | | 2,130,023 | |

ICICI Bank Ltd. (India) | | | 310,623 | | | | 4,095,149 | |

NU Holdings Ltd. (Brazil) (a) | | | 106,643 | | | | 1,272,251 | |

Vietnam Technological & Commercial Joint Stock Bank (Vietnam) (a) | | | 1,228,889 | | | | 2,356,671 | |

| | | | | | | | |

| | | | | | $ | 15,770,500 | |

| | | | | | | | |

REAL ESTATE MANAGEMENT & DEVELOPMENT – 7.9% | | | | | | | | |

Aldar Properties PJSC (United Arab Emirates) | | | 1,421,986 | | | $ | 2,160,714 | |

Corp. Inmobiliaria Vesta S.A.B. de C.V. (Mexico) | | | 296,499 | | | | 1,160,963 | |

Phoenix Mills (The) Ltd. (India) | | | 168,884 | | | | 5,634,968 | |

Vincom Retail JSC (Vietnam) (a) | | | 1,460,378 | | | | 1,522,515 | |

Vinhomes JSC (Vietnam) (a),(b) | | | 902,267 | | | | 1,559,272 | |

| | | | | | | | |

| | | | | | $ | 12,038,432 | |

| | | | | | | | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS – 7.0% | | | | | | | | |

Samsung Electronics Co. Ltd. (South Korea) | | | 174,294 | | | $ | 10,668,023 | |

| | | | | | | | |

| | |

BROADLINE RETAIL – 5.2% | | | | | | | | |

MercadoLibre Inc. (Brazil) (a) | | | 2,440 | | | $ | 3,689,182 | |

Mitra Adiperkasa Tbk PT (Indonesia) | | | 14,303,487 | | | | 1,642,533 | |

PDD Holdings Inc. (China) (a),(c) | | | 22,383 | | | | 2,602,024 | |

| | | | | | | | |

| | | | | | $ | 7,933,739 | |

| | | | | | | | |

HOTELS, RESTAURANTS & LEISURE – 5.1% | | | | | | | | |

H World Group Ltd. (China) | | | 465,552 | | | $ | 1,803,016 | |

MakeMyTrip Ltd. (India) (a) | | | 50,311 | | | | 3,574,597 | |

Meituan (China) (a),(b) | | | 193,310 | | | | 2,386,237 | |

| | | | | | | | |

| | | | | | $ | 7,763,850 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

17

POLAR CAPITAL EMERGING MARKET STARS FUND

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2024

| | | | | | | | |

COMMON STOCKS — Continued | | Shares | | Fair Value | |

INTERACTIVE MEDIA & SERVICES – 5.1% | | | | | | | | |

Tencent Holdings Ltd. (China) | | | 197,211 | | | $ | 7,681,358 | |

| | | | | | | | |

| | |

OIL, GAS & CONSUMABLE FUELS – 4.9% | | | | | | | | |

Reliance Industries Ltd. (India) | | | 205,598 | | | $ | 7,351,812 | |

| | | | | | | | |

| | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS – 4.8% | | | | | | | | |

Chroma ATE Inc. (Taiwan) | | | 442,836 | | | $ | 3,528,463 | |

Daejoo Electronic Materials Co. Ltd. (South Korea) (a) | | | 21,035 | | | | 1,448,427 | |

OPT Machine Vision Tech Co. Ltd. (China) | | | 81,182 | | | | 1,022,278 | |

Zhejiang Supcon Technology Co. Ltd. (China) | | | 195,783 | | | | 1,254,394 | |

| | | | | | | | |

| | | | | | $ | 7,253,562 | |

| | | | | | | | |

METALS & MINING – 4.0% | | | | | | | | |

Ivanhoe Mines Ltd. (South Africa) (a) | | | 439,653 | | | $ | 5,245,131 | |

Merdeka Copper Gold Tbk PT (Indonesia) (a) | | | 6,178,545 | | | | 889,618 | |

| | | | | | | | |

| | | | | | $ | 6,134,749 | |

| | | | | | | | |

IT SERVICES – 2.6% | | | | | | | | |

FPT Corp. (Vietnam) | | | 278,042 | | | $ | 1,306,388 | |

Globant S.A. (Argentina) (a) | | | 13,261 | | | | 2,677,396 | |

| | | | | | | | |

| | | | | | $ | 3,983,784 | |

| | | | | | | | |

CHEMICALS – 1.9% | | | | | | | | |

Arcadium Lithium PLC (Jersey, Cayman Islands) (a) | | | 190,108 | | | $ | 838,718 | |

Bioceres Crop Solutions Corp. (Argentina) (a) | | | 93,503 | | | | 1,183,748 | |

Ganfeng Lithium Group Co. Ltd. (China) (b) | | | 293,583 | | | | 899,926 | |

| | | | | | | | |

| | | | | | $ | 2,922,392 | |

| | | | | | | | |

CAPITAL MARKETS – 1.9% | | | | | | | | |

360 ONE WAM Ltd. (India) | | | 204,213 | | | $ | 1,659,372 | |

B3 S.A. - Brasil Bolsa Balcao (Brazil) | | | 520,984 | | | | 1,245,484 | |

| | | | | | | | |

| | | | | | $ | 2,904,856 | |

| | | | | | | | |

MACHINERY – 1.8% | | | | | | | | |

MTAR Technologies Ltd. (India) (a) | | | 47,116 | | | $ | 953,404 | |

Shenzhen Inovance Technology Co. Ltd. (China) | | | 217,822 | | | | 1,836,204 | |

| | | | | | | | |

| | | | | | $ | 2,789,608 | |

| | | | | | | | |

INSURANCE – 1.5% | | | | | | | | |

AIA Group Ltd. (Hong Kong) | | | 334,512 | | | $ | 2,250,120 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

18

POLAR CAPITAL EMERGING MARKET STARS FUND

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2024

| | | | | | | | |

COMMON STOCKS — Continued | | Shares | | Fair Value | |

ELECTRICAL EQUIPMENT – 1.5% | | | | | | | | |

Sungrow Power Supply Co. Ltd. (China) | | | 155,686 | | | $ | 2,225,219 | |

| | | | | | | | |

| | |

INDUSTRIAL CONGLOMERATES – 1.4% | | | | | | | | |

SK Square Co. Ltd. (South Korea) (a) | | | 35,353 | | | $ | 2,074,568 | |

| | | | | | | | |

| | |

CONSUMER FINANCE – 1.3% | | | | | | | | |

Kaspi.kz JSC (Kazakhstan) (c) | | | 15,213 | | | $ | 1,957,000 | |

| | | | | | | | |

| | |

TEXTILES, APPAREL & LUXURY GOODS – 1.2% | | | | | | | | |

Samsonite International S.A. (United States) (a),(b) | | | 484,295 | | | $ | 1,834,931 | |

| | | | | | | | |

| | |

CONSTRUCTION & ENGINEERING – 1.2% | | | | | | | | |

Samsung Engineering Co. Ltd. (South Korea) (a) | | | 96,254 | | | $ | 1,787,447 | |

| | | | | | | | |

| | |

CONSUMER STAPLES DISTRIBUTION & RETAIL – 1.2% | | | | | | | | |

Raia Drogasil S.A. (Brazil) | | | 318,922 | | | $ | 1,740,418 | |

| | | | | | | | |

| | |

HEALTH CARE PROVIDERS & SERVICES – 1.1% | | | | | | | | |

Apollo Hospitals Enterprise Ltd. (India) | | | 22,211 | | | $ | 1,695,533 | |

| | | | | | | | |

| | |

ENTERTAINMENT – 1.0% | | | | | | | | |

Sea Ltd. (Singapore) (a),(c) | | | 28,354 | | | $ | 1,522,893 | |

| | | | | | | | |

| | |

SOFTWARE – 1.0% | | | | | | | | |

TOTVS S.A. (Brazil) (a) | | | 266,158 | | | $ | 1,506,074 | |

| | | | | | | | |

| | |

GROUND TRANSPORTATION – 0.6% | | | | | | | | |

Grupo Traxion S.A.B. de C.V. (Mexico) (a),(b) | | | 525,694 | | | $ | 979,670 | |

| | | | | | | | |

| | |

HEALTH CARE EQUIPMENT & SUPPLIES – 0.5% | | | | | | | | |

Ray Co. Ltd. (South Korea) (a) | | | 65,477 | | | $ | 775,267 | |

| | | | | | | | |

| | |

FINANCIAL SERVICES – 0.5% | | | | | | | | |

Jio Financial Services Ltd. (India) (a) | | | 159,653 | | | $ | 678,748 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS–95.7% (Cost $124,768,627) | | | | | | $ | 145,188,929 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

19

POLAR CAPITAL EMERGING MARKET STARS FUND

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2024

| | | | | | | | |

PREFERRED STOCKS – 2.2% | | | | | |

BANKS – 2.2% | | | | | | | | |

Itau Unibanco Holding S.A. (Brazil), 3.25% (d) | | | 474,276 | | | $ | 3,275,695 | |

| | | | | | | | |

TOTAL INVESTMENTS–97.9% (Cost $127,284,793) | | | | | | $ | 148,464,624 | |

Other Assets and Liabilities, net – 2.1% | | | $ | 3,199,243 | |

| | | | | | | | |

NET ASSETS–100.0% | | | | | | $ | 151,663,867 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. |

| (c) | This security represents the common stock of a foreign company which trades directly or through an American Depositary Receipt (“ADR”) on the over-the-counter market or on a U.S. national securities exchange. |

| (d) | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

See accompanying Notes to Financial Statements.

20

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

PORTFOLIO OF INVESTMENTS

March 31, 2024

| | | | | |

| Industry Allocation | | Percent of

Net Assets |

Semiconductors & Semiconductor Equipment | | | | 19.7 | % |

Banks | | | | 12.2 | |

Technology Hardware, Storage & Peripherals | | | | 8.4 | |

Real Estate Management & Development | | | | 8.3 | |

Oil, Gas & Consumable Fuels | | | | 5.1 | |

Metals & Mining | | | | 4.8 | |

Consumer Staples Distribution & Retail | | | | 4.6 | |

Broadline Retail | | | | 4.0 | |

Electronic Equipment, Instruments & Components | | | | 3.9 | |

Electrical Equipment | | | | 3.7 | |

Hotels, Restaurants & Leisure | | | | 3.6 | |

Capital Markets | | | | 2.5 | |

Health Care Providers & Services | | | | 2.5 | |

Industrial Conglomerates | | | | 2.2 | |

IT Services | | | | 1.9 | |

Chemicals | | | | 1.7 | |

Consumer Finance | | | | 1.7 | |

Construction & Engineering | | | | 1.5 | |

Software | | | | 1.1 | |

Entertainment | | | | 1.1 | |

Specialty Retail | | | | 1.0 | |

Ground Transportation | | | | 0.9 | |

Transportation Infrastructure | | | | 0.8 | |

Machinery | | | | 0.7 | |

Health Care Equipment & Supplies | | | | 0.6 | |

Financial Services | | | | 0.5 | |

Other Assets And Liabilities, Net | | | | 1.0 | % |

| | | | | |

| |

Net Assets | | | | 100.0 | % |

| | | | | |

| | | | | |

| Country Allocation | | Percent of

Net Assets |

India | | | | 23.1 | % |

South Korea | | | | 18.6 | |

Taiwan | | | | 18.5 | |

Brazil | | | | 11.3 | |

Mexico | | | | 8.6 | |

South Africa | | | | 4.0 | |

Argentina | | | | 2.9 | |

Vietnam | | | | 2.9 | |

Indonesia | | | | 2.6 | |

Saudi Arabia | | | | 2.2 | |

Kazakhstan | | | | 1.6 | |

United Arab Emirates | | | | 1.4 | |

Jersey, Cayman Islands | | | | 0.7 | |

Singapore | | | | 0.6 | |

Other Assets And Liabilities, Net | | | | 1.0 | % |

| | | | | |

| |

Net Assets | | | | 100.0 | % |

| | | | | |

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Fund holdings are subject to change daily.

See accompanying Notes to Financial Statements.

21

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2024

| | | | | | | | | | | | |

| COMMON STOCKS – 96.9% | | | | Shares | | | | Fair Value | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT – 19.7% | | | | | | | | | | | | |

Andes Technology Corp. (Taiwan) | | | | | 656 | | | | | $ | 8,794 | |

eMemory Technology Inc. (Taiwan) | | | | | 420 | | | | | | 32,678 | |

Faraday Technology Corp. (Taiwan) | | | | | 2,073 | | | | | | 22,282 | |

HPSP Co. Ltd. (South Korea) | | | | | 462 | | | | | | 18,223 | |

SK Hynix Inc. (South Korea) | | | | | 233 | | | | | | 31,672 | |

Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | | | | | 4,545 | | | | | | 110,630 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 224,279 | |

| | | | | | | | | | | | |

BANKS – 10.1% | | | | | | | | | | | | |

Alinma Bank (Saudi Arabia) | | | | | 1,211 | | | | | $ | 13,739 | |

Grupo Financiero Banorte S.A.B. de C.V. (Mexico) | | | | | 3,222 | | | | | | 34,222 | |

HDFC Bank Ltd. (India) | | | | | 1,076 | | | | | | 18,763 | |

ICICI Bank Ltd. (India) | | | | | 2,816 | | | | | | 37,125 | |

NU Holdings Ltd. (Brazil) (a) | | | | | 915 | | | | | | 10,916 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 114,765 | |

| | | | | | | | | | | | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS – 8.4% | | | | | | | | | | | | |

Samsung Electronics Co. Ltd. (South Korea) | | | | | 1,556 | | | | | $ | 95,238 | |

| | | | | | | | | | | | |

| | | | |

REAL ESTATE MANAGEMENT & DEVELOPMENT – 8.3% | | | | | | | | | | | | |

Aldar Properties PJSC (United Arab Emirates) | | | | | 10,839 | | | | | $ | 16,470 | |

Corp. Inmobiliaria Vesta S.A.B. de C.V. (Mexico) | | | | | 3,857 | | | | | | 15,102 | |

Phoenix Mills (The) Ltd. (India) | | | | | 1,245 | | | | | | 41,541 | |

Vincom Retail JSC (Vietnam) (a) | | | | | 10,924 | | | | | | 11,389 | |

Vinhomes JSC (Vietnam) (a),(b) | | | | | 5,661 | | | | | | 9,783 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 94,285 | |

| | | | | | | | | | | | |

OIL, GAS & CONSUMABLE FUELS – 5.1% | | | | | | | | | | | | |

Reliance Industries Ltd. (India) | | | | | 1,636 | | | | | $ | 58,500 | |

| | | | | | | | | | | | |

| | | | |

METALS & MINING – 4.8% | | | | | | | | | | | | |

Ivanhoe Mines Ltd. (South Africa) (a) | | | | | 3,817 | | | | | $ | 45,537 | |

Merdeka Copper Gold Tbk PT (Indonesia) (a) | | | | | 58,810 | | | | | | 8,468 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 54,005 | |

| | | | | | | | | | | | |

CONSUMER STAPLES DISTRIBUTION & RETAIL – 4.6% | | | | | | | | | | | | |

BBB Foods Inc. (Mexico) (a) | | | | | 1,238 | | | | | $ | 29,440 | |

Nahdi Medical Co. (Saudi Arabia) | | | | | 290 | | | | | | 11,366 | |

Raia Drogasil S.A. (Brazil) | | | | | 2,201 | | | | | | 12,011 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 52,817 | |

| | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

22

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2024

| | | | | | | | | | | | |

| COMMON STOCKS — Continued | | | | Shares | | | | Fair Value | |

BROADLINE RETAIL – 4.0% | | | | | | | | | | | | |

MercadoLibre Inc. (Brazil) (a) | | | | | 19 | | | | | $ | 28,727 | |

Mitra Adiperkasa Tbk PT (Indonesia) | | | | | 147,559 | | | | | | 16,945 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 45,672 | |

| | | | | | | | | | | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS – 3.9% | | | | | | | | | | | | |

Chroma ATE Inc. (Taiwan) | | | | | 3,482 | | | | | $ | 27,744 | |

Daejoo Electronic Materials Co. Ltd. (South Korea) (a) | | | | | 246 | | | | | | 16,939 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 44,683 | |

| | | | | | | | | | | | |

ELECTRICAL EQUIPMENT – 3.7% | | | | | | | | | | | | |

KEI Industries Ltd. (India) | | | | | 417 | | | | | $ | 17,377 | |

Voltronic Power Technology Corp. (Taiwan) | | | | | 160 | | | | | | 8,199 | |

WEG S.A. (Brazil) | | | | | 2,221 | | | | | | 16,916 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 42,492 | |

| | | | | | | | | | | | |

HOTELS, RESTAURANTS & LEISURE – 3.6% | | | | | | | | | | | | |

MakeMyTrip Ltd. (India) (a) | | | | | 570 | | | | | $ | 40,499 | |

| | | | | | | | | | | | |

| | | | |

CAPITAL MARKETS – 2.5% | | | | | | | | | | | | |

360 ONE WAM Ltd. (India) | | | | | 2,397 | | | | | $ | 19,477 | |

B3 S.A. - Brasil Bolsa Balcao (Brazil) | | | | | 3,934 | | | | | | 9,405 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 28,882 | |

| | | | | | | | | | | | |

HEALTH CARE PROVIDERS & SERVICES – 2.5% | | | | | | | | | | | | |

Apollo Hospitals Enterprise Ltd. (India) | | | | | 200 | | | | | $ | 15,268 | |

Oncoclinicas do Brasil Servicos Medicos S.A. (Brazil) (a) | | | | | 7,682 | | | | | | 13,555 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 28,823 | |

| | | | | | | | | | | | |

INDUSTRIAL CONGLOMERATES – 2.2% | | | | | | | | | | | | |

SK Square Co. Ltd. (South Korea) (a) | | | | | 418 | | | | | $ | 24,529 | |

| | | | | | | | | | | | |

| | | | |

IT SERVICES – 1.9% | | | | | | | | | | | | |

Globant S.A. (Argentina) (a) | | | | | 107 | | | | | $ | 21,603 | |

| | | | | | | | | | | | |

| | | | |

CHEMICALS – 1.7% | | | | | | | | | | | | |

Arcadium Lithium PLC (Jersey, Cayman Islands) (a) | | | | | 1,888 | | | | | $ | 8,329 | |

Bioceres Crop Solutions Corp. (Argentina) (a) | | | | | 883 | | | | | | 11,179 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 19,508 | |

| | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

23

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2024

| | | | | | | | | | | | |

| COMMON STOCKS — Continued | | | | Shares | | | | Fair Value | |

CONSUMER FINANCE – 1.7% | | | | | | | | | | | | |

Kaspi.kz JSC (Kazakhstan) (c) | | | | | 146 | | | | | $ | 18,782 | |

| | | | | | | | | | | | |

| | | | |

CONSTRUCTION & ENGINEERING – 1.5% | | | | | | | | | | | | |

Samsung Engineering Co. Ltd. (South Korea) (a) | | | | | 938 | | | | | $ | 17,419 | |

| | | | | | | | | | | | |

| | | | |

SOFTWARE – 1.1% | | | | | | | | | | | | |

TOTVS S.A. (Brazil) (a) | | | | | 2,213 | | | | | $ | 12,523 | |

| | | | | | | | | | | | |

| | | | |

ENTERTAINMENT – 1.1% | | | | | | | | | | | | |

Nusantara Sejahtera Raya Tbk PT (Indonesia) (a),(b) | | | | | 325,338 | | | | | $ | 4,719 | |

Sea Ltd. (Singapore) (a),(c) | | | | | 135 | | | | | | 7,251 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 11,970 | |

| | | | | | | | | | | | |

SPECIALTY RETAIL – 1.0% | | | | | | | | | | | | |

Mobile World Investment Corp. (Vietnam) | | | | | 5,500 | | | | | $ | 11,335 | |

| | | | | | | | | | | | |

| | | | |

GROUND TRANSPORTATION – 0.9% | | | | | | | | | | | | |

Grupo Traxion S.A.B. de C.V. (Mexico) (a),(b) | | | | | 5,290 | | | | | $ | 9,858 | |

| | | | | | | | | | | | |

| | | | |

TRANSPORTATION INFRASTRUCTURE – 0.8% | | | | | | | | | | | | |

Grupo Aeroportuario del Centro Norte S.A.B. de C.V. (Mexico) | | | | | 903 | | | | | $ | 8,918 | |

| | | | | | | | | | | | |

| | | | |

MACHINERY – 0.7% | | | | | | | | | | | | |

MTAR Technologies Ltd. (India) (a) | | | | | 369 | | | | | $ | 7,467 | |

| | | | | | | | | | | | |

| | | | |

HEALTH CARE EQUIPMENT & SUPPLIES – 0.6% | | | | | | | | | | | | |

Ray Co. Ltd. (South Korea) (a) | | | | | 598 | | | | | $ | 7,081 | |

| | | | | | | | | | | | |

| | | | |

FINANCIAL SERVICES – 0.5% | | | | | | | | | | | | |

Jio Financial Services Ltd. (India) (a) | | | | | 1,460 | | | | | $ | 6,207 | |

| | | | | | | | | | | | |

| | | | |

TOTAL COMMON STOCKS–96.9% (Cost $973,810) | | | | | | | | | | $ | 1,102,140 | |

| | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

24

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

PORTFOLIO OF INVESTMENTS (Continued)

March 31, 2024

| | | | | | | | | | | | |

PREFERRED STOCKS – 2.1% | | | | | | | | | |

BANKS – 2.1% | | | | | | | | | | | | |

Itau Unibanco Holding S.A. (Brazil), 3.25% (d) | | | | | 3,484 | | | | | $ | 24,063 | |

| | | | | | | | | | | | |

TOTAL INVESTMENTS–99.0% (Cost $994,765) | | | | | | | | | | $ | 1,126,203 | |

Other Assets and Liabilities, net – 1.0% | | | | | $ | 11,076 | |

| | | | | | | | | | | | |

NET ASSETS–100.0% | | | | | | | | | | $ | 1,137,279 | |

| | | | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. |

| (c) | This security represents the common stock of a foreign company which trades directly or through an American Depositary Receipt (“ADR”) on the over-the-counter market or on a U.S. national securities exchange. |

| (d) | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

See accompanying Notes to Financial Statements.

25

POLAR CAPITAL FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

March 31, 2024

| | | | | | | | |

| | Polar

Capital

Emerging

Market

Stars Fund | | | Polar

Capital

Emerging

Market

ex-China

Stars Fund | |

ASSETS | | | | | | | | |

Investment securities— at fair value (identified cost $127,284,793 and $994,765, respectively) | | $ | 148,464,624 | | | $ | 1,126,203 | |

Cash | | | 3,886,599 | | | | 9,672 | |

Foreign currencies at value (identified cost $68,714 and $17,746, respectively) | | | 68,497 | | | | 16,894 | |

Receivable for: | | | | | | | | |

Dividends and interest | | | 299,638 | | | | 2,314 | |

Dividend reclaims | | | 971 | | | | — | |

Capital stock sold | | | 295,300 | | | | — | |

Investments sold | | | 133,413 | | | | — | |

Reimbursement from Administrator (Note 6) | | | — | | | | 50,000 | |

Reimbursement from Adviser (Note 6) | | | 78,459 | | | | — | |

Prepaid expenses | | | 47,790 | | | | 16,712 | |

| | | | | | | | |

Total assets | | | 153,275,291 | | | | 1,221,795 | |

| | | | | | | | |

| | |

LIABILITIES | | | | | | | | |

Payable for: | | | | | | | | |

Investments purchased | | | 9,002 | | | | — | |

Capital stock repurchased | | | 583,548 | | | | — | |

Advisory fees | | | 126,248 | | | | 949 | |

Accrued expenses and other liabilities | | | 191,835 | | | | 76,720 | |

Foreign capital gains taxes payable | | | 700,791 | | | | 6,847 | |

| | | | | | | | |

Total liabilities | | | 1,611,424 | | | | 84,516 | |

| | | | | | | | |

| | |

NET ASSETS | | $ | 151,663,867 | | | $ | 1,137,279 | |

| | | | | | | | |

| | |

SUMMARY OF SHAREHOLDERS’ EQUITY | | | | | | | | |

Capital stock—no par value; unlimited authorized shares; 18,943,787 and 100,452, respectively outstanding shares | | | 136,634,962 | | | | 1,004,641 | |

Distributable earnings | | | 15,028,905 | | | | 132,638 | |

| | | | | | | | |

| | |

NET ASSETS | | $ | 151,663,867 | | | $ | 1,137,279 | |

| | | | | | | | |

| | |

NET ASSET VALUE | | | | | | | | |

Offering and redemption price per share | | $ | 8.01 | | | $ | 11.32 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

26

POLAR CAPITAL FUNDS

STATEMENTS OF OPERATIONS

For the Year Ended March 31, 2024

| | | | | | | | | | | | | | |

| | | | | Polar Capital Emerging Market Stars Fund | | | | Polar Capital Emerging Market ex-China Stars Fund(a) |

INVESTMENT INCOME | | | | | | | | | | | | | | |

Dividends (net of foreign taxes withheld of $220,505 and $1,263, respectively) | | | | | $ | 1,677,909 | | | | | | $ | 8,686 | |

Interest | | | | | | 114,801 | | | | | | | 401 | |

| | | | | | | | | | | | | | |

Total investment income | | | | | | 1,792,710 | | | | | | | 9,087 | |

| | | | | | | | | | | | | | |

| | | | |

EXPENSES | | | | | | | | | | | | | | |

Advisory fees (Note 6) | | | | | | 1,231,946 | | | | | | | 7,717 | |

Trustee fees and expenses (Note 6) | | | | | | 150,340 | | | | | | | 926 | |

Fund accounting and administrative services fees (Note 6) | | | | | | 130,000 | | | | | | | 98,222 | |

Legal fees | | | | | | 124,205 | | | | | | | 731 | |

Custodian fees (Note 6) | | | | | | 90,827 | | | | | | | 8,977 | |

Compliance fees (Note 6) | | | | | | 73,583 | | | | | | | 26,341 | |

Audit and tax services fees | | | | | | 38,793 | | | | | | | 37,114 | |

Transfer agent fees and expenses (Note 6) | | | | | | 37,832 | | | | | | | 22,717 | |

Reports to shareholders | | | | | | 26,228 | | | | | | | 4,661 | |

State filing fees | | | | | | 25,433 | | | | | | | 1,937 | |

Other | | | | | | 82,134 | | | | | | | 2,977 | |

| | | | | | | | | | | | | | |

Total expenses | | | | | | 2,011,321 | | | | | | | 212,320 | |

| | | | | | | | | | | | | | |

Waiver from Administrator (Note 6) | | | | | | — | | | | | | | (113,333 | ) |

Waiver/Reimbursement from Adviser (Note 6) | | | | | | (779,376 | ) | | | | | | (91,270 | ) |

| | | | | | | | | | | | | | |

Net expenses | | | | | | 1,231,945 | | | | | | | 7,717 | |

| | | | | | | | | | | | | | |

Net Investment Income | | | | | | 560,765 | | | | | | | 1,370 | |

| | | | | | | | | | | | | | |

| | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | | | |

Investments | | | | | | (3,182,257 | ) | | | | | | 13,401 | |

Foreign currency transactions | | | | | | (77,001 | ) | | | | | | (380 | ) |

Net change in unrealized appreciation (depreciation) of: | | | | | | | | | | | | | | |

Investments (net change in deferred capital gains taxes of ($700,791) and ($6,847), respectively) | | | | | | 16,760,639 | | | | | | | 124,591 | |

Translation of foreign currency denominated amounts | | | | | | (4,821 | ) | | | | | | (875 | ) |

| | | | | | | | | | | | | | |

Net realized and unrealized gain | | | | | | 13,496,560 | | | | | | | 136,737 | |

| | | | | | | | | | | | | | |

| | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | $ | 14,057,325 | | | | | | $ | 138,107 | |

| | | | | | | | | | | | | | |

| (a) | For the period from June 30, 2023 (Commencement of Operations) to March 31, 2024. |

See accompanying Notes to Financial Statements.

27

POLAR CAPITAL FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | Polar Capital Emerging Market Stars Fund |

| | | Year Ended

March 31, 2024 | | Year Ended

March 31, 2023 |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | | | |

Operations: | | | | | | | | | | |

Net investment income (loss) | | | $ | 560,765 | | | | $ | (162,933 | ) |

Net realized loss | | | | (3,259,258 | ) | | | | (1,441,714 | ) |

Net change in unrealized appreciation (depreciation) | | | | 16,755,818 | | | | | 4,960,647 | |

| | | | | | | | | | |

Net increase in net assets resulting from operations | | | | 14,057,325 | | | | | 3,356,000 | |

| | | | | | | | | | |

| | |

Distributions to shareholders | | | | (581,602 | ) | | | | — | |

| | | | | | | | | | |

Capital stock transactions: | | | | | | | | | | |

Proceeds from capital stock sold | | | | 49,309,876 | | | | | 88,690,524 | |

Proceeds from shares issued to shareholders upon reinvestment of dividends and distributions | | | | 176,107 | | | | | — | |

Cost of capital stock repurchased | | | | (9,975,917 | ) | | | | (1,996,990 | ) |

| | | | | | | | | | |

Net increase from capital stock transactions | | | | 39,510,066 | | | | | 86,693,534 | |

| | | | | | | | | | |

Total change in net assets | | | | 52,985,789 | | | | | 90,049,534 | |

| | | | | | | | | | |

| | |

NET ASSETS | | | | | | | | | | |

Beginning of period | | | | 98,678,078 | | | | | 8,628,544 | |

| | | | | | | | | | |

End of period | | | $ | 151,663,867 | | | | $ | 98,678,078 | |

| | | | | | | | | | |

| | |

CHANGE IN CAPITAL STOCK OUTSTANDING | | | | | | | | | | |

Shares of capital stock sold | | | | 6,780,535 | | | | | 12,722,603 | |

Shares issued to shareholders upon reinvestment of dividends and distributions | | | | 23,607 | | | | | — | |

Shares of capital stock repurchased | | | | (1,352,254 | ) | | | | (283,453 | ) |

| | | | | | | | | | |

Change in capital stock outstanding | | | | 5,451,888 | | | | | 12,439,150 | |

| | | | | | | | | | |

See accompanying Notes to Financial Statements.

28

POLAR CAPITAL FUNDS

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | |

| | | Polar Capital Emerging Market ex-China Stars Fund |

| | | Period Ended

March 31, 2024* |

INCREASE (DECREASE) IN NET ASSETS | | | | | |

Operations: | | | | | |

Net investment income (loss) | | | $ | 1,370 | |

Net realized gain | | | | 13,021 | |

Net change in unrealized appreciation (depreciation) | | | | 123,716 | |

| | | | | |

Net increase in net assets resulting from operations | | | | 138,107 | |

| | | | | |

| |

Distributions to shareholders | | | | (5,521 | ) |

| | | | | |

| |

Capital stock transactions: | | | | | |

Proceeds from capital stock sold | | | | 1,000,010 | |

Proceeds from shares issued to shareholders upon reinvestment of dividends and distributions | | | | 4,693 | |

Cost of capital stock repurchased | | | | (10 | ) |

| | | | | |

Net increase from capital stock transactions | | | | 1,004,693 | |

| | | | | |

Total change in net assets | | | | 1,137,279 | |

| | | | | |

| |

NET ASSETS | | | | | |

Beginning of period | | | | — | |

| | | | | |

End of period | | | $ | 1,137,279 | |

| | | | | |

| |

CHANGE IN CAPITAL STOCK OUTSTANDING | | | | | |

Shares of capital stock sold | | | | 100,000 | |

Shares issued to shareholders upon reinvestment of dividends and distributions | | | | 453 | |

Shares of capital stock repurchased | | | | (1 | ) |

| | | | | |

Change in capital stock outstanding | | | | 100,452 | |

| | | | | |

| * | For the period from June 30, 2023 (Commencement of Operations) to March 31, 2024. |

See accompanying Notes to Financial Statements.

29

POLAR CAPITAL EMERGING MARKET STARS FUND

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Year

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year

Ended

March 31, | | | Period Ended

March 31, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021* | |

Per share operating performance: | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value at beginning of period | | $ | 7.31 | | | $ | 8.20 | | | $ | 10.08 | | | | | | | $ | 10.00 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(a) | | $ | 0.03 | | | $ | (0.02 | ) | | $ | (0.01 | ) | | | | | | $ | (0.02 | ) | | | | |

Net realized and unrealized gain (loss) on investment securities | | | 0.70 | | | | (0.87 | ) | | | (1.52 | ) | | | | | | | 0.10 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Investment from operations | | $ | 0.73 | | | $ | (0.89 | ) | | $ | (1.53 | ) | | | | | | $ | 0.08 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | $ | (0.03 | ) | | $ | — | | | $ | (0.09 | ) | | | | | | $ | — | | | | | |

Distributions from net realized capital gains | | | — | | | | — | | | | (0.26 | ) | | | | | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | $ | (0.03 | ) | | $ | — | | | $ | (0.35 | ) | | | | | | $ | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 8.01 | | | $ | 7.31 | | | $ | 8.20 | | | | | | | $ | 10.08 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total investment return(b), (c) | | | 10.05% | | | | (10.85 | )% | | | (15.66 | )% | | | | | | | 0.80% | | | | | |

| | | | | | |

Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in $000’s) | | $ | 151,664 | | | $ | 98,678 | | | $ | 8,629 | | | | | | | $ | 10,079 | | | | | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Before waiver/reimbursement (d) | | | 1.63% | | | | 2.45% | | | | 4.70% | | | | | | | | 5.34% | | | | | |

After waiver/reimbursement(d) | | | 1.00% | | | | 1.00% | | | | 1.00% | | | | | | | | 1.00% | | | | | |

Ratio of net investment income to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Before waiver/reimbursement(d) | | | (0.17 | )% | | | (1.80 | )% | | | (3.84 | )% | | | | | | | (5.14 | )% | | | | |

After waiver/reimbursement(d) | | | 0.46% | | | | (0.35 | )% | | | (0.14 | )% | | | | | | | (0.80 | )% | | | | |

| | | | | | |

Portfolio turnover rate(b) | | | 38% | | | | 29% | | | | 38% | | | | | | | | 15% | | | | | |

| * | For the period from December 30, 2020 (Commencement of Operations) to March 31, 2021. |

| (a) | Per share amount is based on average shares outstanding. |

| (b) | Not annualized for periods less than a year. |

| (c) | Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect deduction of the sales charge. |

| (d) | Annualized for periods less than one year. |

See accompanying Notes to Financial Statements.

30

POLAR CAPITAL EMERGING MARKET EX-CHINA STARS FUND

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout The Period

| | | | | |

| | | Period Ended

March 31, |

| | | 2024* |

Per share operating performance: | | | | | |

Net asset value, beginning of period | | | $ | 10.00 | |

| | | | | |

| |

Income from investment operations: | | | | | |

Net investment income (loss)(a) | | | $ | 0.01 | |

Net realized and unrealized gain (loss) on investment securities | | | | 1.37 | |

| | | | | |

Total from investment operations | | | $ | 1.38 | |

| | | | | |

Distributions from net realized capital gains | | | | (0.06 | ) |

Total distributions | | | $ | (0.06 | ) |

| | | | | |

Net asset value, end of period | | | $ | 11.32 | |

| | | | | |

Total investment return(b), (c) | | | | 13.82% | |

| |

Ratios/supplemental data: | | | | | |

Net assets, end of period (in $000’s) | | | $ | 1,137 | |

Ratio of expenses to average net assets | | | | | |