Issuer Free Writing Prospectus dated January 24, 2023

Filed Pursuant To Rule 433

Registration No. 333-255424

[Transcript of National Investment Services Group Monthly Call Webinar from January __, 2023]

Benjamin Tapper: Today we have a great guest speaker, a long-time friend of mine, Benjamin Hatz. I am going to let Ben do an introduction, but I have known Ben through now three evolutions of his real estate career. Starting in the medical space, moving more into the multifamily and now with the publicly-traded company that has an incredibly interesting opportunity within Opportunity Zones, no pun intended. And instead of underselling it, I am going to let the smarter Ben take the microphone.

Benjamin Hatz: Thanks, Ben. I am going to share my screen. Hello everyone, I am Ben Hatz from Belpointe Capital. We are based up in Greenwich, Connecticut. And as Ben just mentioned, we are investors in Multifamily Opportunity Zones. Before I present, I have to give a disclaimer. As a publicly-traded company, we have to read this disclaimer to you.

Today’s presentation may include statements that are forward-looking statements within the meaning of the federal securities laws. Any forward-looking statements expressed in this webinar are made in good faith, and we believe there is a reasonable basis for them. However, there are a number of risks, uncertainties, and other important factors, many of which are difficult or impossible to predict, that could cause actual results to vary materially from the forward-looking statements expressed in this webinar. Except as otherwise required by law, we will not be updating or revising any forward-looking statements to reflect subsequent events.

Belpointe PREP has filed a registration statement with the SEC for the offer and sale of up to $750,000,000.00 of its Class A units, or our stock, which is now publicly-traded on the New York Stock Exchange. Investing in Belpointe PREP’s Class A units involves a high degree of risk, including a complete loss of your investment. Again, if you want to invest in Belpointe, you should read Belpointe PREP’s most recent prospectus and the other documents that it has filed with the SEC for more complete information about Belpointe PREP.

Prior to making an investment decision, you should carefully consider Belpointe PREP’s investment objectives and strategy, risk factors, fees and expenses, and any tax consequences that may results from an investment in Belpointe PREP’s Class A units.

You can obtain a copy of Belpointe PREP’s prospectus and other filings on the SEC’s website, on our website at investors.belpointeoz.com, or by contacting me at the phone number above.

On this call, we will focus on three main areas. First, we will talk about Opportunity Zones. What are the benefits of investing in Opportunity Zones? Second, I will present a small summary of Belpointe and talk about some of our current investments and why an investor might want to invest with Belpointe. Finally, how could Lee and Associates and Belpointe OZ work together in the future?

As Ben mentioned, we have a unique structure for the developers of Opportunity Zones to have a capital event without paying capital gain taxes. In most cases, Opportunity Zone developers need to hold their investments for 10 years, but we have found a way for them to be able to get out of their investments earlier without having to have a taxable capital event for IRS purposes. This could be a great source of new leads for both Lee and Associates’ equity, as well as their debt brokers.

Opportunity Zones were created through Trump’s Tax Cuts and Jobs Act of 2017. Approximately 35,000 low-income census tracts were nominated by the U.S. state governors, and of that 35,000, approximately 8,800 have been certified by the U.S. Department of the Treasury. These Opportunity Zones are in all 50 states, as well as in Puerto Rico. And the goal was really to incentivize real estate investors to develop in these lower income areas. The way that they did that was to provide capital gains tax advantages. Opportunity Zones work in the following way: First, if an investor has a capital gain—it could be both a short-term or a long-term capital gain—they could invest in into a Qualified Opportunity Fund, or a QOF. For that investment, there are a couple of tax benefits that they will be able to participate in, many of which I will be talking about later in this presentation.

But, for the most part, all appreciation in those funds is completely excluded from capital gains going forward.

For example, if you invested in $100,000,000.00 transaction in 2018, and within ten years or by 2028, the property has increased in value by $100,000,000.00, that $100,000,000.00 of capital gain, if and when the asset is sold, does not pay any federal capital gains taxes. This presents an incredible opportunity.

Opportunity Zones are included in every single one of the states in the United States. The Zones were determined based on the 2010 census, so there has been a lot of changes that have occurred over the last 13 years.

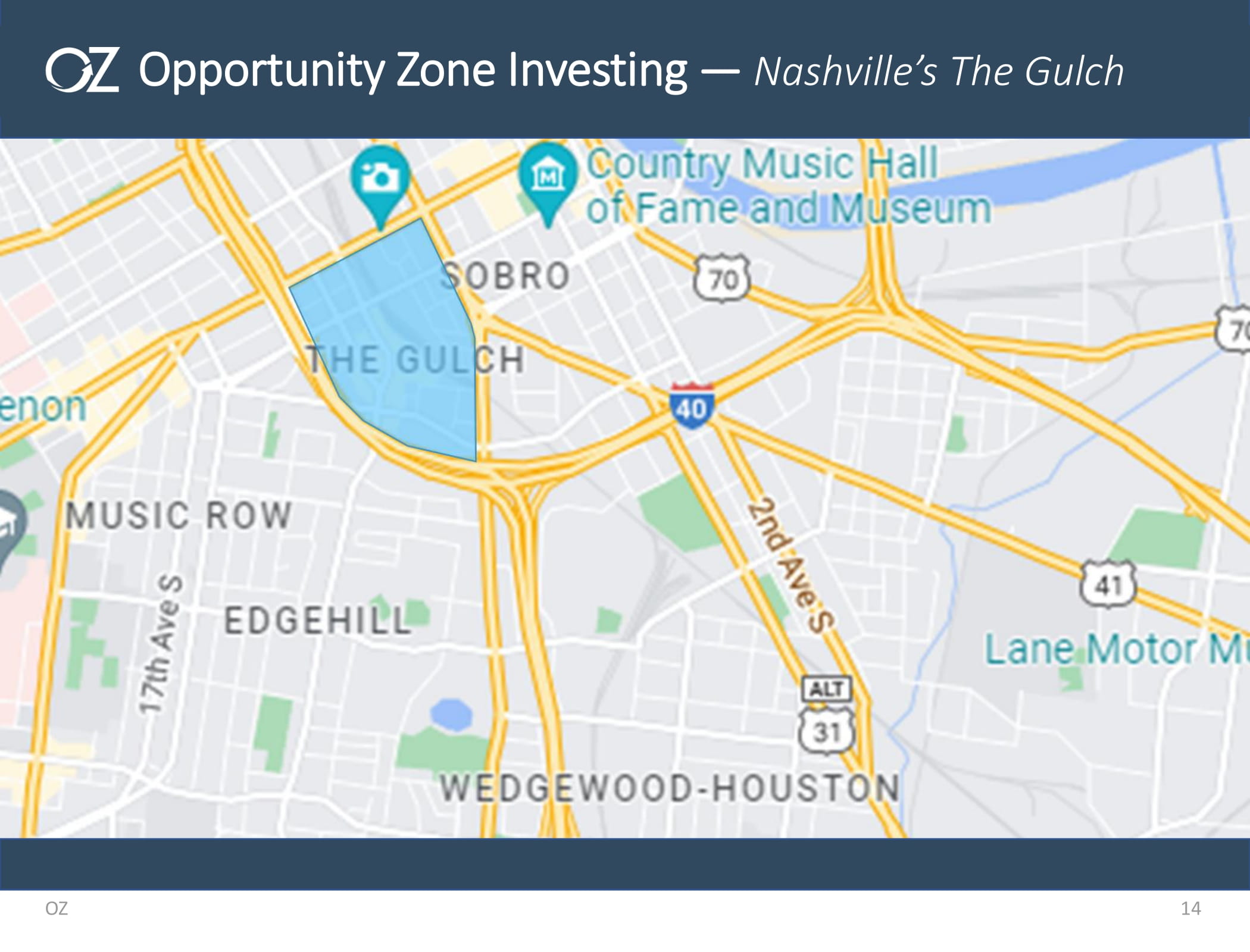

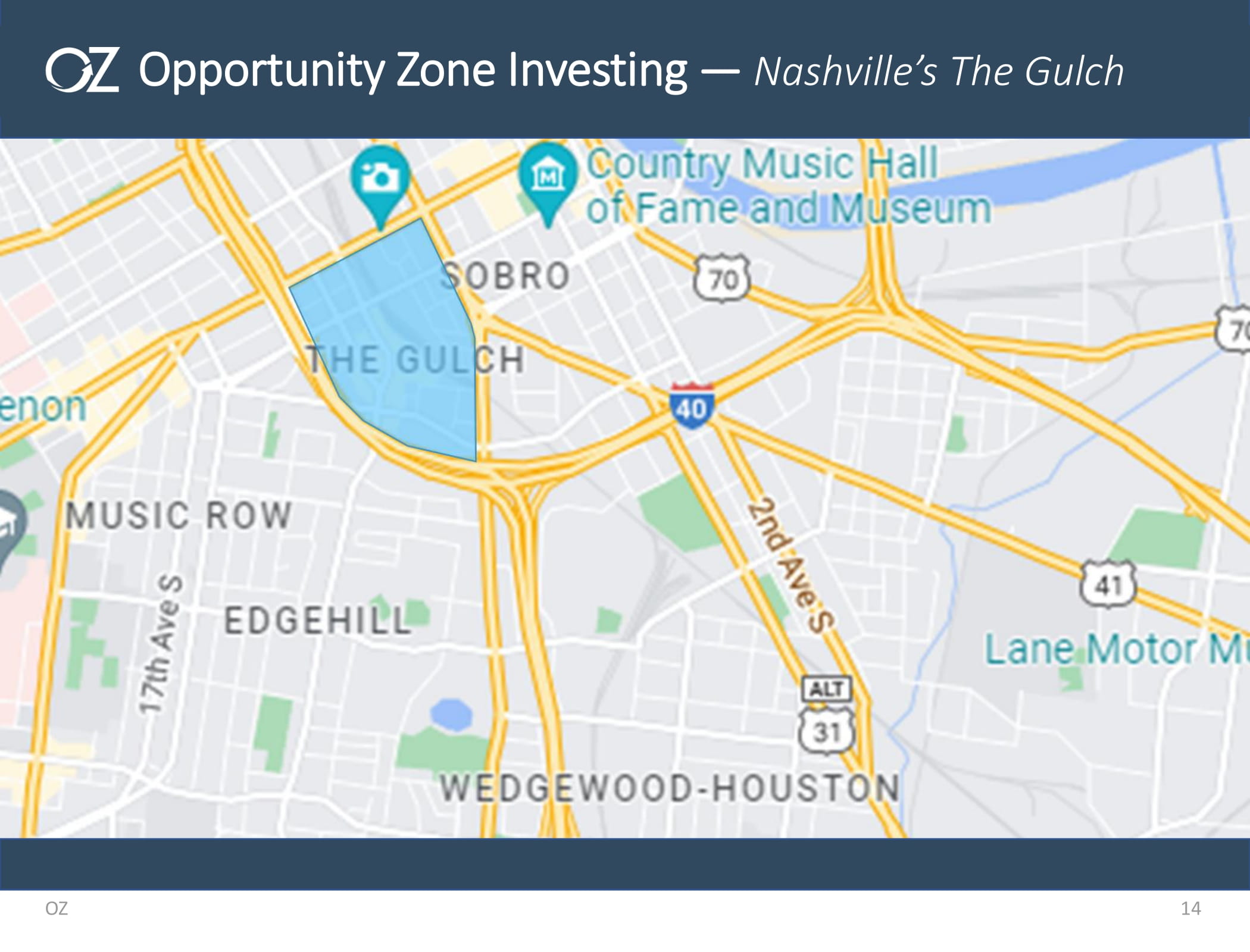

Let’s talk about Nashville. Nashville right now is the number one market for investment based on ULI for 2022, as well as 2023. There has been a tremendous amount of development in this area. There are four main pockets of development in Nashville right now. Right here is the Gulch, which has a lot of high-end restaurants, high-end hotels and there is approximately 10,000 or so jobs that are all within walking distance. There is Vanderbilt University and Oracle campus, which is going to house 8,000 jobs, as well as the $2.1 billion Tennessee Titan Stadium. Finally, Uptown has a lot of new 25- to 30-story multifamily developments going up right now. There is not a dearth of new development going on in Nashville.

There is the Thompson Hotel located in the Gulch, right across the street from Nashville Yards, which is Amazon’s second largest location in the entire United States. Since the definition of what is allowed to be included in these low-income census tracts was based on 2010 information, a lot of things have changed. The area right outside the Gulch, is within a walking distance from probably one of the hottest neighborhoods in all of Nashville, where Belpointe’s 900 8th Ave Development is located. It is going to be 266 units, and we are building this with CA South, a local developer based in Nashville.

As I mentioned before, Opportunity Zones have a couple of tax advantages. The first one is that if an investor invests in an Opportunity Zone Fund, there is a deferral of that initial capital gain up until the earlier of a sale of the asset or December 31st of 2026.

The second main benefit is the elimination of future capital gains: All of the capital gains derived from the appreciation of their investments in Opportunity Zones, if the asset is held for the next 10 years, are exempt from federal, and in some cases, state capital gains taxes.

Belpointe PREP is set up as a PREP, a public real estate partnership. As such, and similarly to REITs, 90% of our income has to be distributed on a yearly basis.

Belpointe has all of the same benefits as the other Qualified Opportunity Zone Funds. However, one of the main differences of Belpointe from other Qualified Opportunity Zone Funds is that we are the only one that is listed on the New York Stock Exchange, which allows us to provide liquidity for our unit holders.

Finally, we have some other advantages, including a reduced annual management fee. We are only 75 basis points versus the standard 200 basis points, only a 5% minimum carried interest. And, for many investors, we do not ever ask for additional capital calls.

Finally, we are the only group that is able to acquire other Qualified Opportunity Zone Funds and their stabilized assets, eliminating any construction, development, or lease up risk.

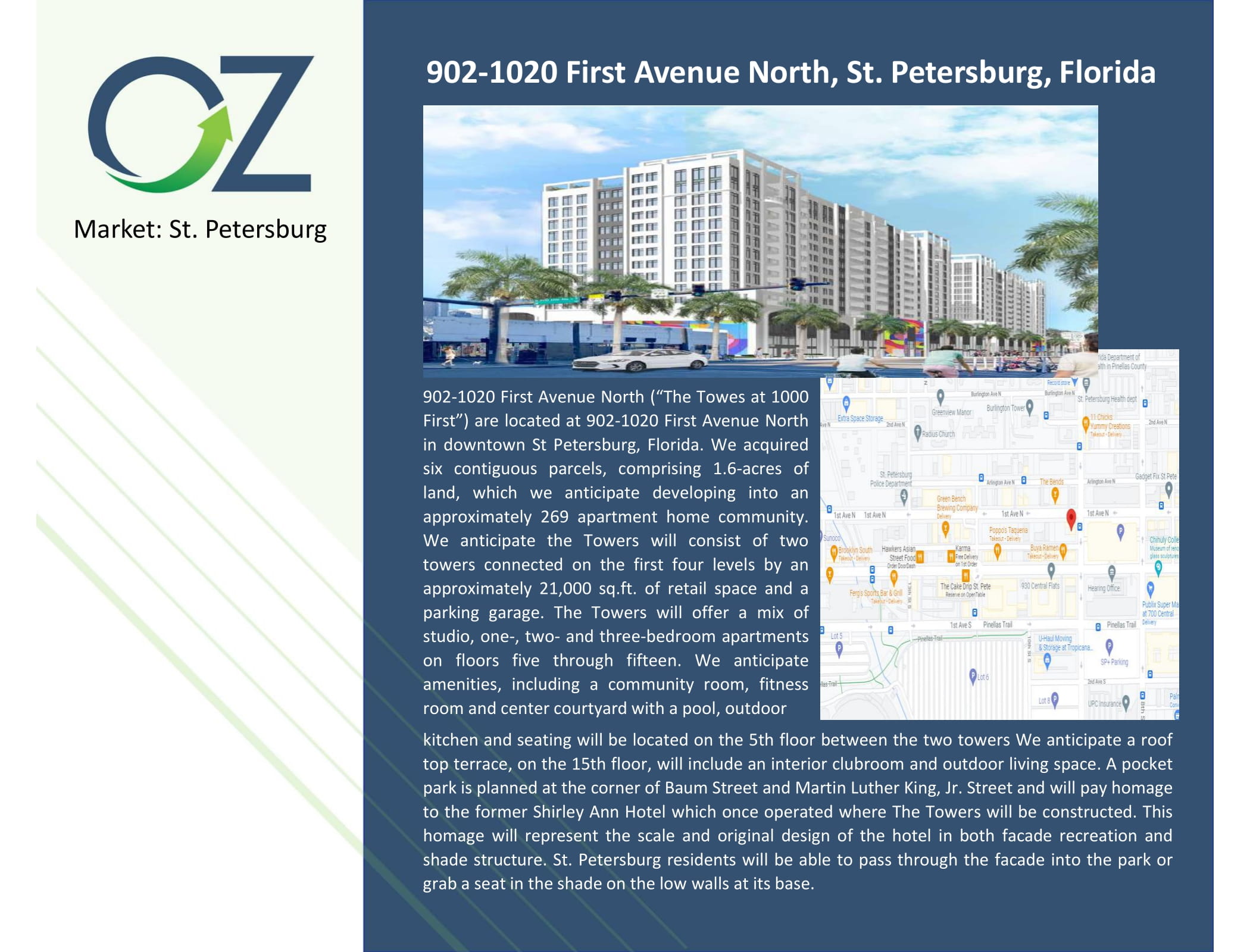

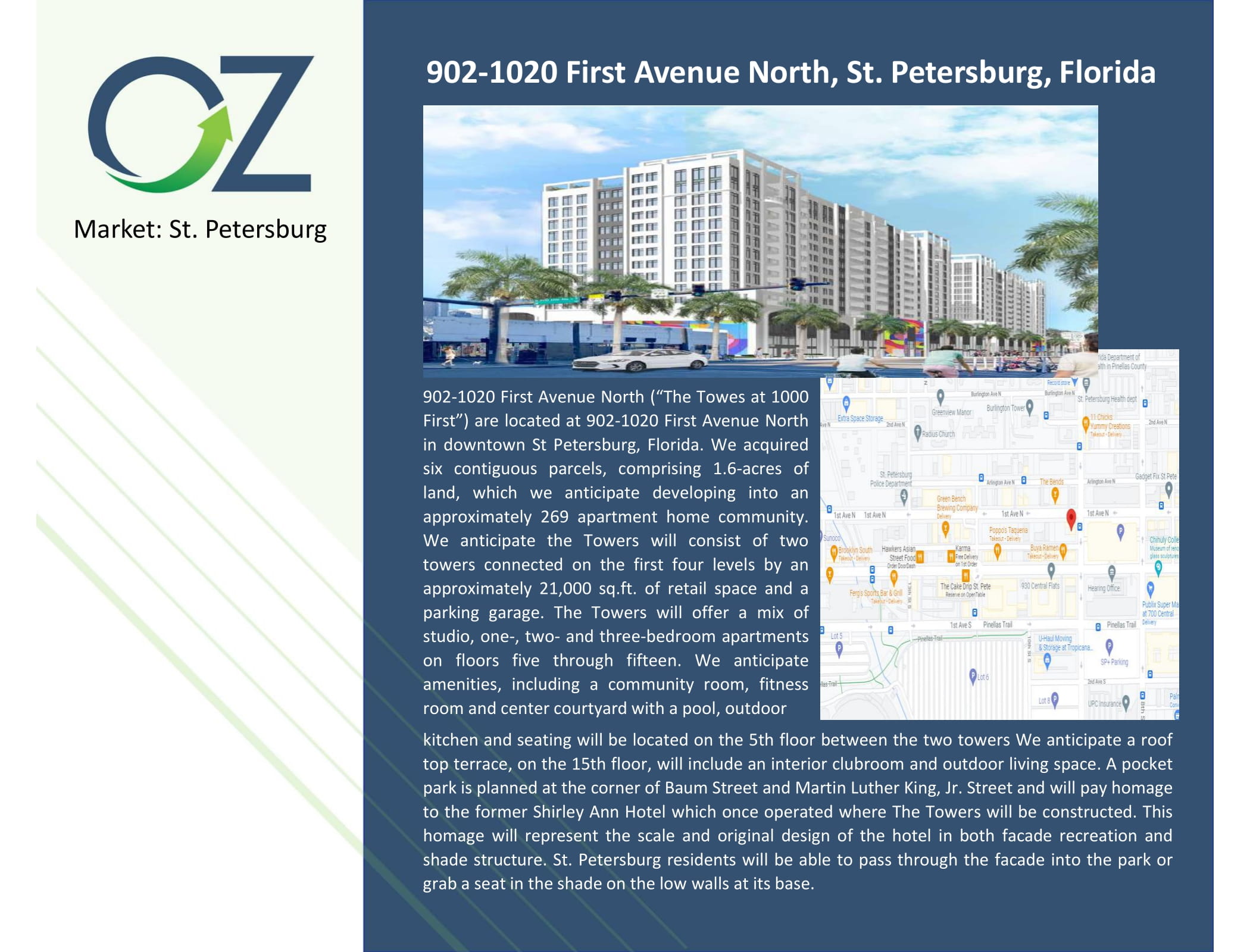

Our investments are located up and down the Eastern Coast. We have a student housing development in Storrs, Connecticut right off UConn’s main campus. In Nashville, we have the 266-unit property I mentioned before, as well as a master development, which is going to be somewhere between 400 and 1000 units on the Cumberland River. In Saint Petersburg, Florida, we have a two-acre site which just has been approved for 15 stories and 269 units. This is directly North of the Tampa Bay Rays Stadium. And in Sarasota, we are building a Class-A mixed-use development with 218 market rate units and 51,000 square feet of retail in an absolutely Class-A location.

Let’s talk about that unique QOF sale opportunity. How is this possible? As I said before, if an investor invests in a QOF, they have to hold that investment for 10 years, without selling, so that they can get those tax benefits. Investors are taking capital market risk because even if you came out of the ground in 2018, you still have to wait until 2028 before you are able to realize your investment.

As a PREP, we are able to acquire these private QOFs and their assets without causing an inclusion event. An inclusion event is a capital event, taxable by the IRS, which includes a recapitalization and a sale of the assets.

It is a win-win for everyone, as it allows the sponsors to get out of their deals early and realize their promote earlier than that 10 years. They can get out 2-3 years after the development. Also, the limited partners in those QOFs are also happy. They have taken away all of the capital market risk that I mentioned earlier. In addition, they are able to keep all of the tax benefits that come with investing in an Opportunity Zone deal.

Benjamin Tapper: Before Ben continues on, does anybody have any questions at this point for Ben? About what he has talked about so far. Anybody want clarity on anything? Alright, all yours.

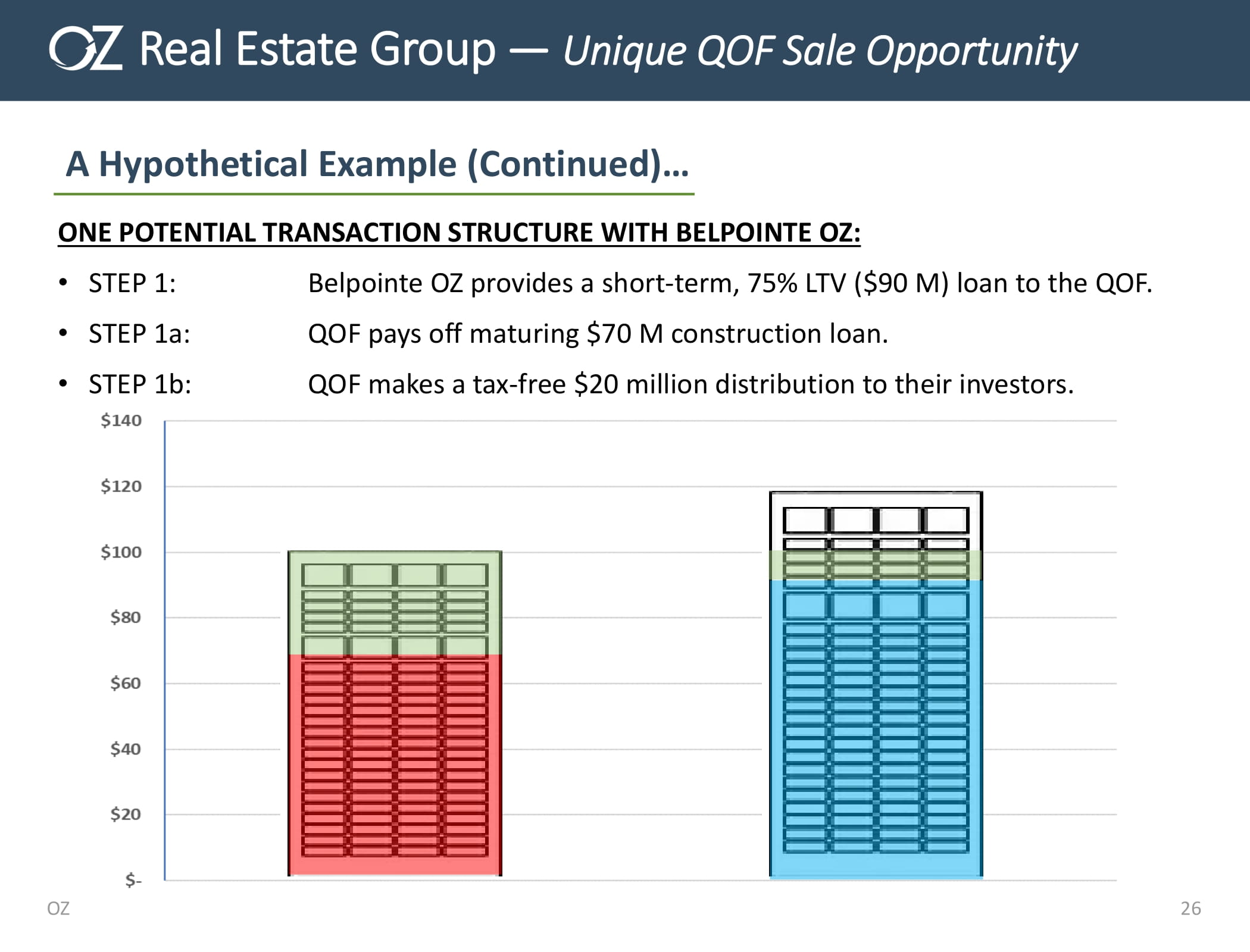

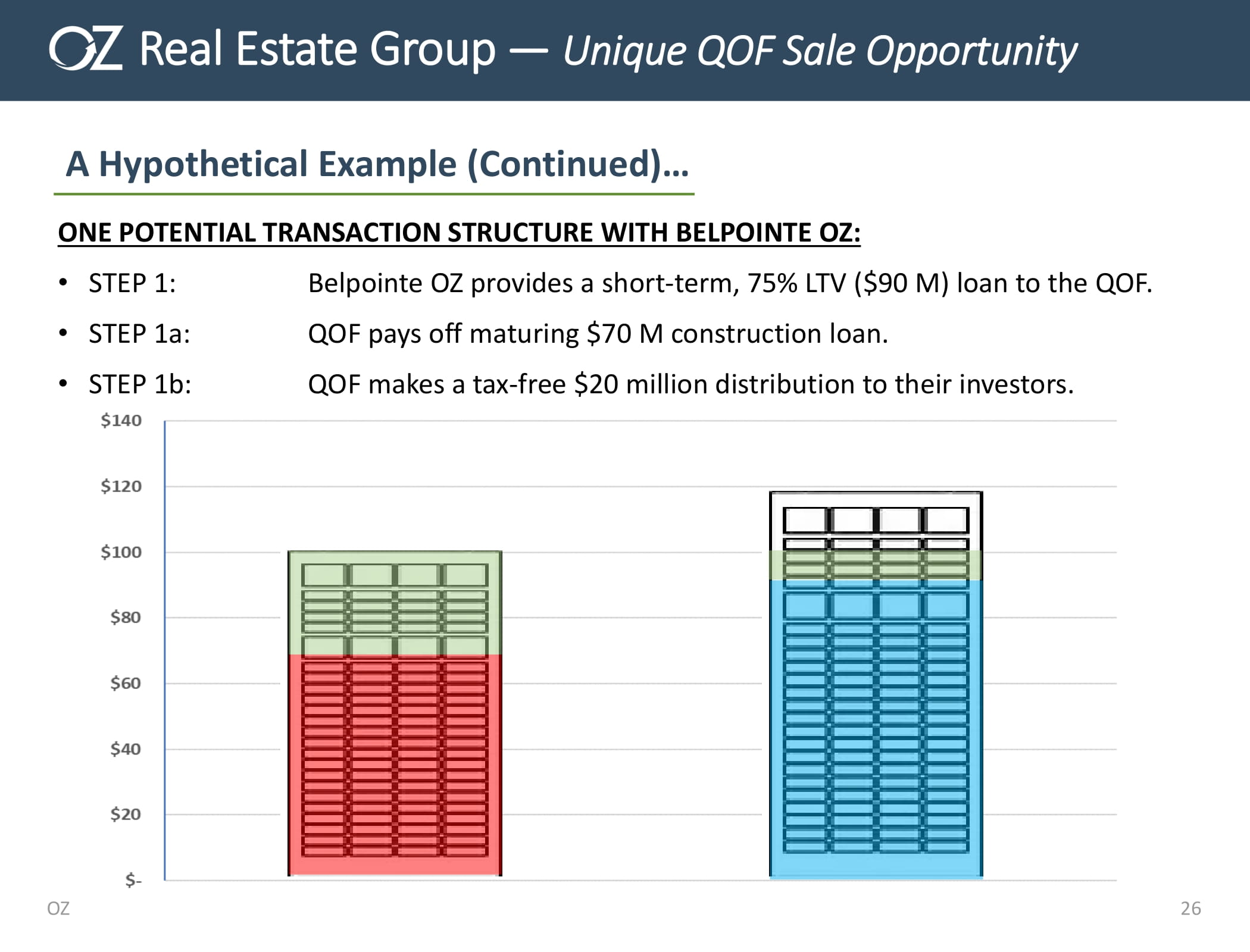

Benjamin Hatz: I guess, I have been extremely clear, Ben. Let’s walk through an example of how this works. In 2019, a developer finds a plot of land, which is included in an Opportunity Zone and they decide to build a luxury multifamily asset over the next two-year period. The project is going to cost $100,000,000.00 and the way that they are going to capitalize it is with a 3-year construction loan and $30,000,000.00 of equity. That equity is going to be coming from limited partners, and it is going to be a syndication. Those limited partners are going to be investing capital gains so that they can accrue all those Opportunity Zone benefits that we talked about. The developer guarantees to his limited partners that there will be no inclusion events before the 10-year period is up, which would effectively delete the tax benefits of investing in a QOF.

Now, it is the December of 2022. Property has received its certificate of occupancy and begun leasing. The construction loan has matured and, great news, because of increasing rents in the market, the property has appreciated to $120,000,000.00.

However, as I’m sure everyone on this phone call knows, the 10-year has increased significantly since 2019 and because of higher debt service amounts, a 65% or 70% LTV loan is not really able to be sourced today. Probably, most multifamily investors are only able to get approximately 50%, maybe 55% LTV or in this case, $60,000,000.00, which is going to lead to a $10,000,000.00 equity shortfall.

Where is the QOF going to possibly find this $10,000,000.00? The LP’s do not want to invest any more money. They may not have any new capital gains to be invested into this deal. Secondly, the QOF cannot sell, because if they do sell, the LP investors lose those tax benefits we have been talking about. What could be done? And that is where Belpointe comes in.

What we are able to do is to do a merger of the Qualified Opportunity Zone Fund from the private investor and merge it into Belpointe PREP. This gets done in two steps.

The first step is Belpointe being a lender to that original QOF and providing a short term 6-, 9-, or 12-month loan to the property for approximately 75% LTV financing. Again, because of that, the private QOF is able to pay off its maturing construction loan and make a tax-free $20,000,000.00 distribution to their LP investors. However, right now Belpointe is only acting as a lender and ownership is still with the private QOF.

The second step is Belpointe merging the original QOF into Belpointe PREP at that $120,000,000.00 basis. We are going to assume the short-term $90,000,000.00 loan, and concurrently, we are going to provide $30,000,000.00 in Belpointe OZ units in a tax-free exchange.

This is very important: Although a sale has effectively taken place, since it is done as a merger, an inclusion event has not occurred. The IRS does not deem that a sale has actually taken place. And as such, all those tax benefits that the LPs were promised still stay intact.

Since Belpointe PREP is publicly-traded on the New York Stock Exchange, anytime over the next, 5-, 10-, 15-, 20-year term, the original investors can sell those shares. They could wait for the full 10-year period when all the Opportunity Zone tax benefits accrue, or if they need capital, a liquidity event, they can just go into the into the market, sell their shares and yes, they are going to have to pay capital gains on that appreciation. But again, it is not like this is going to be tied up in shares that cannot be traded for the next couple year term.

As I was saying earlier, at any time those shares could be sold. If they sell prior to the 10-year investment period, it will trigger capital gains taxes. If they sell after the 10-year period, those capital gains taxes are excluded. It is a win-win for all parties: Belpointe is able to get great assets to be held in its structure, and the developer of the deal is able to get out without having to do a capital call to the LP investors and they are also able to realize their promote earlier than they had forecasted. Additionally, the LP investors get exactly what they were promised without taking any more market rate risk. Hence, every party is made whole.

I wanted to kind of throw this back to Ben to see if there are any questions, we can go over at any of the assets or any of the specifics to our deals. I will show you some of the pictures of our assets. This is a deal in Sarasota that is getting built right now. This is St Petersburg. This is that deal in Tennessee. And then this is a picture of a property that we own in Storrs right off of UCONN’s campus. But I’d love to take questions if there are any.

Benjamin Tapper: Thank you, Ben. Group, if you have got a question, please unmute yourself and fire away.

Josh Harkavy: I have a question. I’m Josh Harkavy with Lee & Associates in Cincinnati. The reasoning for the developer wanting to sell one of their properties because it is struggling, or is there a reason, a motivation, for them to sell if their properties are doing fine?

Benjamin Hatz: There is definitely a lot of uncertainty right now in the market. Who is to say what the 10-year is going to be a year from now or two years from now? My guess is that there is some correlation between the cost of debt and the overall residual cap rate. So, right now they could say, “I have built this property for $100,000,000.00, I am able to get out, take my money off the table and make $20,000,000.00 appreciation.” Why not?

The one thing that really has to be done though, that I want to make sure is that that original loan has to still be in place. If they have already refinanced the asset, Belpointe is not able to provide that take-out financing, and thus, cannot get cash into the investor’s hands. The thing that really is important is that the property is currently owned by a QOF and that the construction loan needs to be repaid.

But of course, Josh, if you have any clients that want to just talk about getting out from a development that they were not expecting to sell for the next 8 years? I would be more than glad to discuss further.

Benjamin Tapper: Ben, one of the questions I had is what are your acquisition criteria? I know, we have talked about many Opportunity Zones across the country, but do you want 4 units, do you want 400? Is it a $2,000,000 check? Is it a $20,000,000.00 check? What are your criteria?

Benjamin Hatz: We are willing to be in any Opportunity Zone around the country. However, the assets we are really looking for are multifamily assets of 75 to 100 units or more. And our minimum deal size is probably $25,000,000.00. The larger for us is the better. We would much rather do a $400,000,000.00 transaction than eight $50,000,000.00 transactions.

Benjamin Tapper: I have got a question here from one of the other brokers. When do the QOF funds sunset for contribution? And is there any provision to extend? I understand that the completion of work has to occur within 30 months. Is there any provision to extend for entitlement delays? But the first question was when do the QOF funds sunset for contribution?

Benjamin Hatz: Contribution is still ongoing. They are talking about extending it, I believe, until around 2027. Right now, I think it is set for 2025 or 2026. The rules regarding getting the money out 30 months after a development has started. Everyone who is in the space has to follow those same rules and it is something that we do track closely.

For us as for a PREP, we have somewhat different roles. We are not a QOF that has only one asset. Our expectations are that right now we have 14 developments going on. We expect that every year going forward we are going to continue to accumulate assets. We are going to be constantly not only raising capital, and distributing capital to are investors, but also just continuing trying to find new developments, as well as new acquisition opportunities.

Benjamin Tapper: Next question: What is the size of your portfolio today and what is the goal for end of 2023? Where do you want to be at the end of the year?

Benjamin Hatz: As I mentioned earlier, we began our public offering at $750,000,000.00. We have raised to date approximately half of that amount, and are in the process of filing to be able to raise even more. Right now, our main investments are in those four markets - Sarasota, Tampa, Nashville and in Storrs. We have approximately 2,000 or something units that are going to be in those deals.

Our hope is that in 2023 that we do five or six of these acquisitions and in addition to that, we are also constantly looking at new developments. We are talking to a fair number of developers that may have got a little bit ahead of themselves and are now having problems finding capital, so we are always interested in having those discussions and seeing if we could provide them with a solution.

Benjamin Tapper: Thank you. Does anybody else have any more questions?

Seth Denison: Ben, this is Seth Denison in the Miami office. I just want to be clear that your organization is a publicly traded company. If one were to take shares in it, you are going to be at the whims of the public markets as well, right? And if the capital markets are in disarray, that is a market risk that one would have in the same regard that they would have if they were to sell their property to an end user.

Benjamin Hatz: That is true. Except for the fact that when the sale actually does take place, the amount of stock is going to be predicated on the share price at that particular time. So yes, the investor will be at the whims of the market, but if they wanted to do so, they could sell out of their position on day one.

Benjamin Tapper: Let me ask on behalf of some of our new members of the NISG who are in Nashville. When can they walk your project?

Benjamin Hatz: We are expecting to break ground probably in 2023. And our development on the Cumberland River is really going to be something that is going to be something to behold. We are very, very excited about it.

Benjamin Tapper: Sounds good. If nobody has anything else for Ben, I am going to thank him for his time. If anybody wants to connect with him, please let me know. I am happy to put that all together. Any questions before we say goodbye to Ben?

Benjamin Hatz: Well, it was a pleasure, Ben, and thank you for the for the time and, hopefully, I speak to some of you guys in the future.