Issuer Free Writing Prospectus dated December 27, 2022

Filed Pursuant to Rule 433

Registration Nos. 333-255424 and 333-271262

Volume 2, Edition 169 May 31, 2023

Subject line – Multi-Family REITs Potentially Poised to Outperform on Fed Pause

Headline: Belpointe OZ Announces a New Offering Designed Specifically for Broker-Dealers

Headwinds that have been impeding the market for the past several months seem to be dissipating, creating, in my view, a growing base case for why certain classes of real estate investment trusts (“REITs”) could realize some tailwinds in the second half of 2023. U.S. consumer inflation peaked in June 2022 at 9.1% and has been steadily on the decline ever since, coming in at 4.9% year-over-year for April. The preliminary University of Michigan Consumer Sentiment Index for May checked in at 57.7, down from the final reading of 63.5 for April.

Source: U.S. Bureau of Labor Statistics (last accessed May 17, 2023).

Commodities have been in a steady downtrend since mid-April according to the Thomson Reuters/CoreCommodity CRB Index which is calculated using arithmetic average of commodity futures prices with monthly rebalancing. The index consists of 19 commodities, which are sorted into 4 groups, with different weightings: Energy: 39%, Agriculture: 41%, Precious Metals: 7%, Base/Industrial Metals: 13%. Here too, commodity inflation is on the decline.

Source: Trading Economics, CRB Commodity Index (last accessed May 17, 2023).

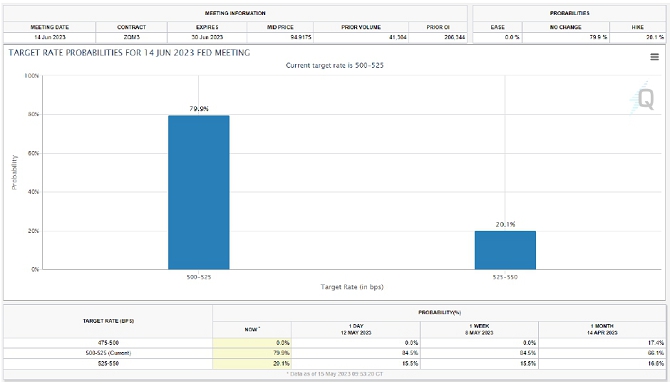

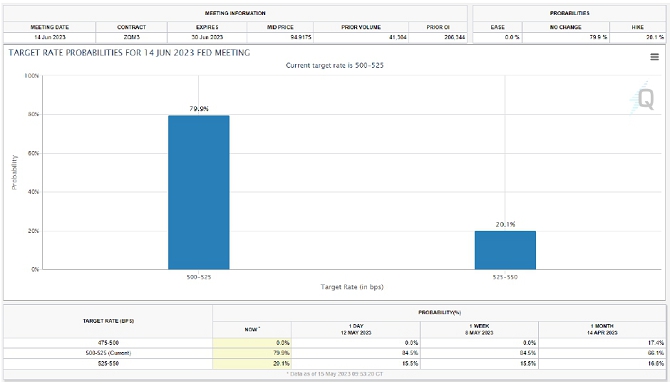

The lag effect of ten consecutive rate hikes appears to have produced the results the Federal Reserve desired—to slow economic activity, dampen spending and reverse the tide of wage inflation in what had been a tight job market. I think that these data points, among others, collectively suggest that there will be changes in monetary policy as well. The next Federal Open Market Committee meeting is slated for June 14th with the CME FedWatch Tool showing a near 80% probability the Fed will pause on a further hike.

Source: CME Fed Watch Tool (last accessed May 17, 2023).

This is where I think the REIT sector, as well as other market sectors could pivot higher after being mired in a trading range for most of 2023. Because REITs are capital intensive by nature, any rate relief later this year could have a meaningful impact on the heavy debt loads that REITs typically have. So, if the Federal Reserve hits the breaks on rates, it could potentially help restore investor confidence, and mark “a cyclical low,” as Brent Dilts, a real estate analyst at Columbia Threadneedle Investments recently told Barron’s. Further, Dilts points out that “REITs tend to outperform the broader stock market 18 months after the Fed ceases hiking interest rates.” In that same article Michael Knott, head of U.S. REIT research Green Street, told Barron’s “that publicly traded real estate is less expensive than property in the private market … [and] can offer ‘a cheaper way to buy real estate today.”

To sum up, I believe that professional real estate owners and developers may be entering a new phase—a change in trend—which could be a green light for key real estate subsectors, such as qualified opportunity zones, the focus of Belpointe PREP, LLC (“Belpointe OZ”) (NYSE: American “OZ”). Belpointe OZ is the only publicly traded qualified opportunity fund (“QOF”) that is building and acquiring full-featured Class A apartment complexes in cities that, according to our research, are continuing to grow, like Sarasota, Florida and Nashville, Tennessee.

What’s more Belpointe OZ (NYSE American: “OZ”) has just announced the commencement of an offering to raise up to $750 million in capital. This latest offering also affords broker-dealers the opportunity to participate in the selling group, and Belpointe OZ has retained Emerson Equity LLC as dealer manager for the offering. Interested broker-dealers may contact Cody Laidlaw at IR@BelpointeOZ.com or call 203-883-1944 for further information.

QOFs offer investors looking to shelter capital gains have a viable opportunity. As part of the program structure, any taxable gain invested in a QOF is not recognized (on the federal level and in many states) until December 31, 2026 (due with the filing of the 2026 return in 2027), or until the interest in the QOF is sold or exchanged, whichever occurs first. The potential to compound growth and income thereafter within QOFs expires December 31, 2047.

Out of the many opportunity zones that we’ve reviewed at Belpointe OZ (and there are more than 8,700 of them), we believe that there are less than 100 worth investing in. In addition to Sarasota, Belpointe OZ owns three properties just up the road in St. Petersburg, the coastal part of the greater Tampa, Florida area. Our development team is comprised of executives with combined decades of experience in bringing projects online in the Class-A multi-family apartment sector.

Moreover, Belpointe OZ represents an attractive alternative to Internal Revenue Code Section 1031 like-kind exchanges. Investors that have sold real estate within the past 180 days and that may be under pressure to comply with Section 1031 regulations in order to complete a tax-free exchange, may want to avoid the inconvenience of having to identify a replacement property (and one or more alternative replacement properties, just in case a replacement property falls through) within 45 days of selling the original property, escrowing the sale proceeds with a 1031 qualified intermediary, and closing on a replacement property within 180 days of the sale of the original property. Instead, investors may want to consider investing capital gains from the sale of the original property into a QOF like Belpointe OZ.

Further, in its effort to disrupt the U.S. real estate industry, Belpointe OZ is charging among the lowest fees in the market, including:

● No investors servicing fees;

● No disposition fees;

● 0.75% annual management fee; and

● 5% carried interest.

The 180-day look-back window for 2022 that allows capital gains realized from late November through December 31, 2022 to be offset and not recognized until December 31, 2026, is closing soon. Those investors sitting on capital gains that were realized in the fourth quarter of 2022 and that have filed an extension with the IRS for 2022 returns may still be able to take full advantage of deferring payment of taxes on those capital gains by investing in a QOF, like Belpointe OZ (NYSE American: “OZ”). In the meantime, the potential growth and income from those capital gains invested into a QOF can be compounding free of federal and in some cases state taxation as long as an investor holds their interest in the QOF for at least 10 years, through December 31, 2047. Again, there is no limit on how much in realized capital gains one can contribute to a QOF.

Have questions? You can contact Cody Laidlaw at (203) 883-1944. I can answer as many of your questions as possible and direct you to resources that will provide you with information about the nuts and bolts of QOFs and opportunity zone investing, so you can start planning today.

Cody H. Laidlaw

Editor-in-Chief

255 Glenville Road

Greenwich, CT 06831

T: (203) 883-1944

E: IR@belpointeoz.com

Disclosure: Cody H. Laidlaw is the Chief Business Development Officer and Head of Investor Relations. Cody is also an investment advisor representative with Seaside Advisory Services, Inc. (d/b/a Seaside Financial & Insurance Services), a SEC registered investment adviser offering advisory accounts and services, and holds a long position in Belpointe PREP, LLC’s Class A units.

The information in this communication is for illustrative, educational and informational purposes only and is subject to change. Nothing in this communication is or should be construed as an offer to sell or the solicitation of an offer to buy any securities. Offers may only be made by means of a prospectus.

Belpointe PREP, LLC (“Belpointe OZ”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Prior to making an investment decision, you should read Belpointe OZ’s prospectus and the other documents that it has filed with the SEC in their entirety, and carefully consider its investment objectives and strategy, risk factors, fees and expenses and any tax consequences that may results from an investment in the offering. Copies of these documents can be obtained free of charge from www.sec.gov or www.investors.belpointeoz.com or from any broker-dealer participating in the offering.

The information in this communication should not be relied upon as investment or tax advice. You should consult with your own investment and tax advisers concerning the federal, state and local income tax consequences of purchasing, owning or disposing of securities in the offering, and of Belpointe OZ’s election to qualify as a partnership and qualified opportunity fund for federal income tax purposes. There is no guarantee that Belpointe OZ will continue to qualify as a partnership or qualified opportunity fund.

Past performance is not an indicator or a guarantee of future performance. An investment in the offering to which this communication relates involves a high degree of risk, including a complete loss of your investment, and may not be suitable for all investors. The price of Belpointe OZ’s securities will fluctuate in market value and may trade above or below net asset value. Brokerage commissions and expenses will reduce returns.

The offering to which this communication relates is being made on a best-efforts basis on behalf of Belpointe OZ through Emerson Equity, LLC, Member FINRA, SIPC, as managing broker-dealer.

©2023 Belpointe PREP, LLC. All rights reserved.