UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------------------------------------------------

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23566

----------------------------------------------------------------

Bow River Capital Evergreen Fund

(Exact name of registrant as specified in charter)

----------------------------------------------------------------

205 Detroit Street, Suite 800

Denver, Colorado 80206

(Address of principal executive offices) (Zip code)

Jeremy Held

Bow River Advisers, LLC

205 Detroit Street, Suite 800

Denver, Colorado 80206

(Name and address of agent for service)

COPIES TO:

Joshua B. Deringer, Esq.

Faegre Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, PA 19103-6996

215-988-2700

----------------------------------------------------------------

Registrant’s telephone number, including area code: (303) 861-8466

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1)

Bow River Capital Evergreen Fund |

Annual Report

March 31, 2023

bowriverevergreen.com • 1-888-330-3350

• DISTRIBUTED BY FORESIDE FINANCIAL SERVICES, LLC (MEMBER OF FINRA)

Bow River Capital Evergreen Fund |

TABLE OF CONTENTS

MARCH 31, 2023 |

Bow River Capital Evergreen Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE

MARCH 31, 2023 (Unaudited) |

Dear Bow River Capital Evergreen Fund Investor:

We are pleased to present our annual report for the Bow River Capital Evergreen Fund.

The Bow River Capital Evergreen Fund (the “Fund”) was launched in May of 2020 to provide investors with access to institutional quality private equity investments with broader investment exposure and greater flexibility than traditional private investment funds. By providing access to private equity in an investor-friendly registered fund we believe the Fund will transform the way investors approach the asset class and provide them with an important tool to build better portfolios.

The Fund seeks to capture the best practices of private equity investing by combining the access, scale and pricing power of a large institution with the specialization and agility of a middle-market boutique. The Fund’s investment objective is to generate long-term capital appreciation by investing in a broad portfolio of private equity investments that provide attractive risk-adjusted return potential.

Since its launch in 2020 the Fund has been well received by investors as both a private markets access vehicle and as a portfolio customization tool. As of March 31, 2023, the Fund has a diverse investor base including individuals, wealth management firms, family offices and institutional investors.

Highlights for the fiscal year-ended March 31, 2023, include the following:

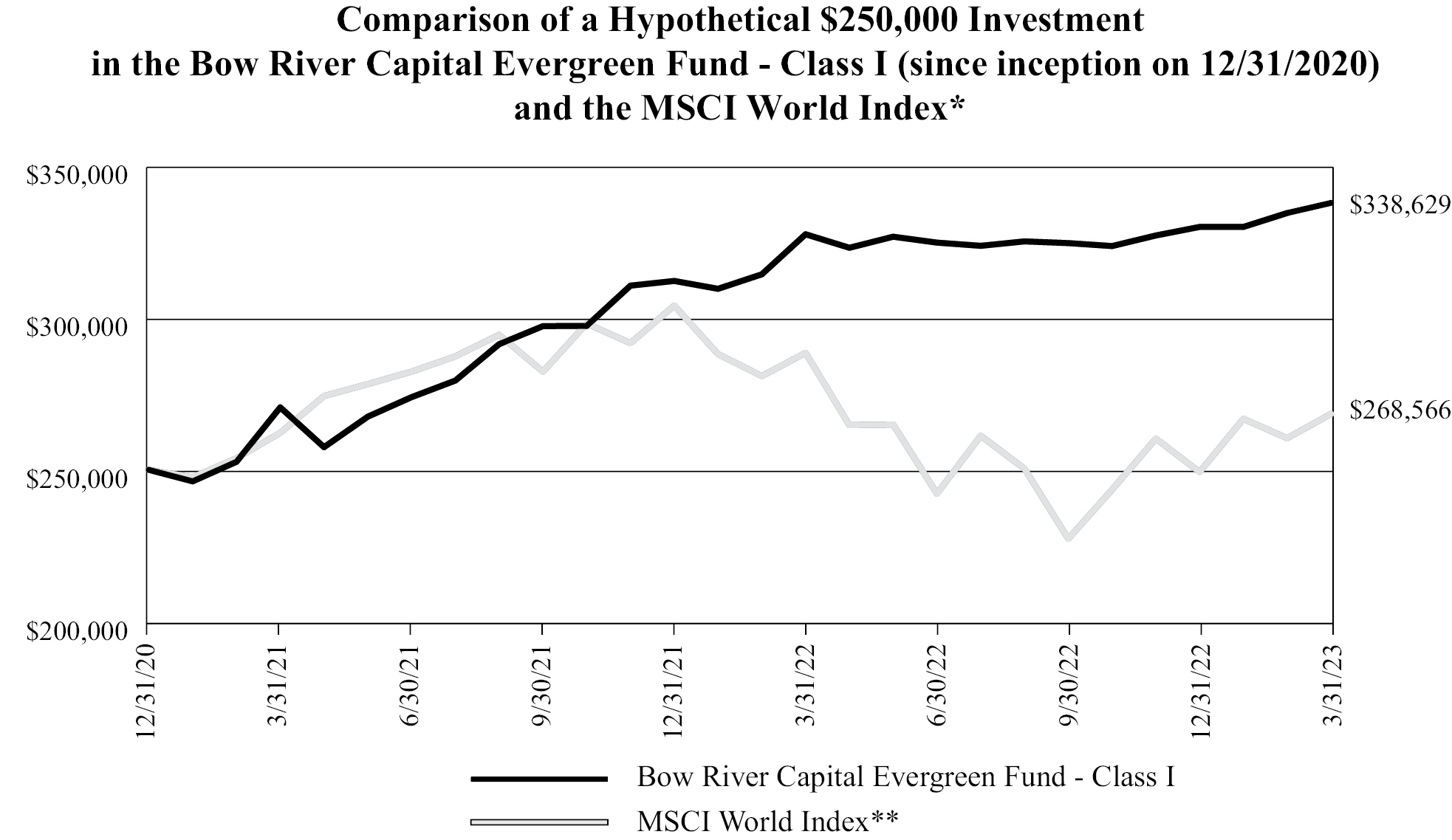

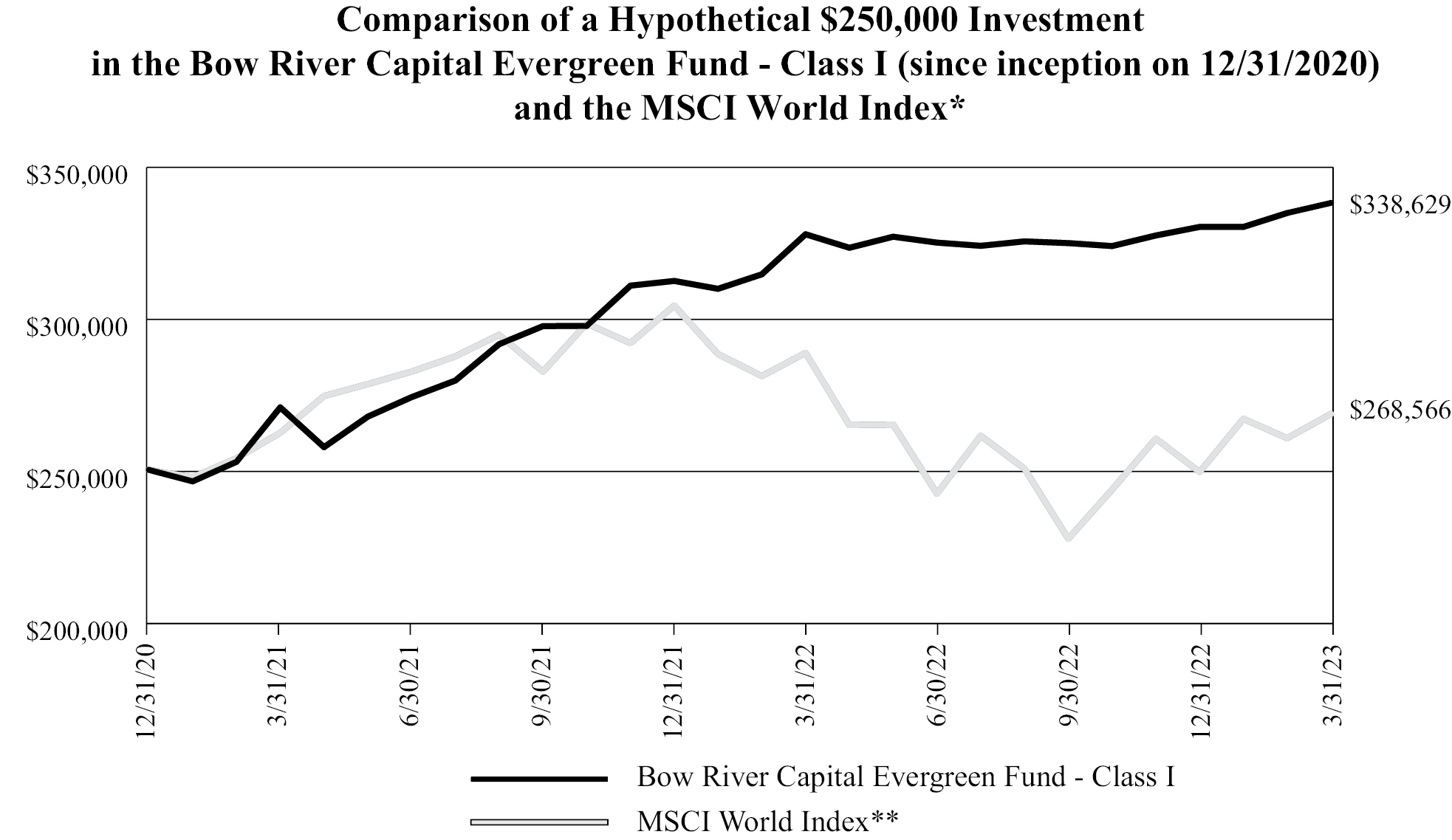

• Class I of the Fund returned 3.17% for the 1-year ended March 31, 2023.

• The Fund deployed a total of $77 million into 18 transactions during the fiscal year across the co-investment, secondary and primary fund market, bringing total private market investments in the Fund to 75.

• The Fund’s net assets increased from $217 million in March 2022 to $340 million at the end of March 2023.

Market Update

The 12-month period ended March 31, 2023, represented one of the most challenging periods for global markets since the great financial crisis. While it appears that inflation has finally started to moderate, it is still too early to tell what the long-term effects of a step change in interest rates will ultimately have on the broader economy. Expensive assets, both public and private, suffered mightily in this environment as calendar year 2022 was the worst year for a 60/40 stock/bond portfolio in nearly a century. For venture capital (“VC”), the most expensive segment of the private markets, the situation is likely to go from bad to worse. With the spectacular collapse of Silicon Valley Bank, startup firms that were already strapped for cash and feeling the weight of lofty valuations in previous funding rounds are now losing one of the most significant providers of capital and liquidity in their ecosystem. This lack of liquidity comes at a time when many VC-backed companies are likely running out of cash runway from capital raises executed around the 2021 peak. This could force firms to raise money sooner than expected in the teeth of a brutal funding market. Venture startup funding dropped more than 55% in the first quarter of 2023 year-over-year while late-stage valuations dropped approximately 17% in the same period. By contrast, privately held cash-flowing buyout businesses have remained quite resilient, benefiting in many cases from more moderate valuations and lower debt burdens, particularly in the middle and lower middle market.

Rising debt costs are not just a headwind, however; they also have the potential to create opportunities in previously expensive sectors of the market. The secondary market, in our view, was highly unattractive for several quarters due to high prices and an imbalance of supply and demand. Low interest rates created an artificial bid for secondary assets, allowing large sponsors to submit overpriced bids for mediocre assets by using significant amounts of deal or fund-level leverage to achieve their return targets. Now that the cost of these credit lines has increased, secondary pricing has rapidly reset to more rational levels. This dynamic, combined with a significant increase in volume of LP interest sales (and limited secondary-dedicated dry powder) has made secondary purchases much more attractive on a relative value basis in late 2022 and into 2023. Pricing in certain segments of the secondary market has already started to approach COVID-crisis levels, however we expect the buying window to be longer this time given the sustained sale volume coming from institutional investors.

1

Bow River Capital Evergreen Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (CONTINUED)

MARCH 31, 2023 (Unaudited) |

We also believe that the banking crisis has exacerbated trends in lending that were already shifting the balance of power from banks to private lenders. This will likely result in an overall reduction in deal flow, longer hold periods and more muted valuation multiples. However, we believe the impact will not be felt in a uniform fashion across the market. Highly levered, larger companies that have relied upon financial engineering and debt-funded inorganic growth, in our view, should be most acutely impacted. By contrast, companies with multiple organic growth levers alongside barriers to entry and pricing power, in our view, should not only do well, they may actually trade at higher multiples given scarcity value in the market based on a similar number of buyers and fewer high quality companies for sale.

As a result, we believe this environment has strengthened our conviction of investing in cash-flow generative middle market businesses while also creating interesting opportunities in both the private credit and secondary markets, two of the Fund’s most significant current overweights. As we approach our 3-year track record in May 2023, we continue to be comforted by the strong fundamentals in our current portfolio as well as the Fund’s current level of diversification, with no single company representing more than 3% of Fund assets and no single investment representing more than 5% as of March 31, 2023.

Asset Allocation

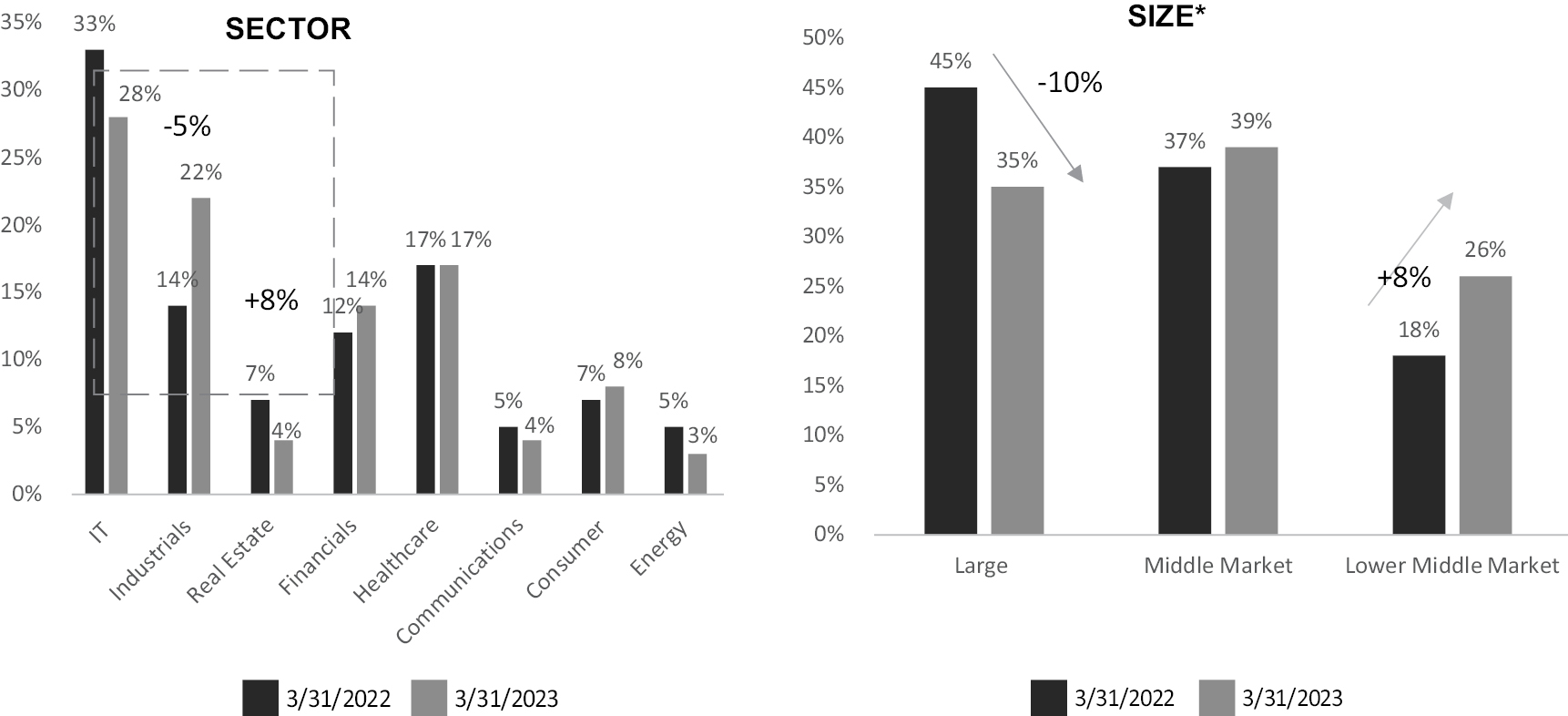

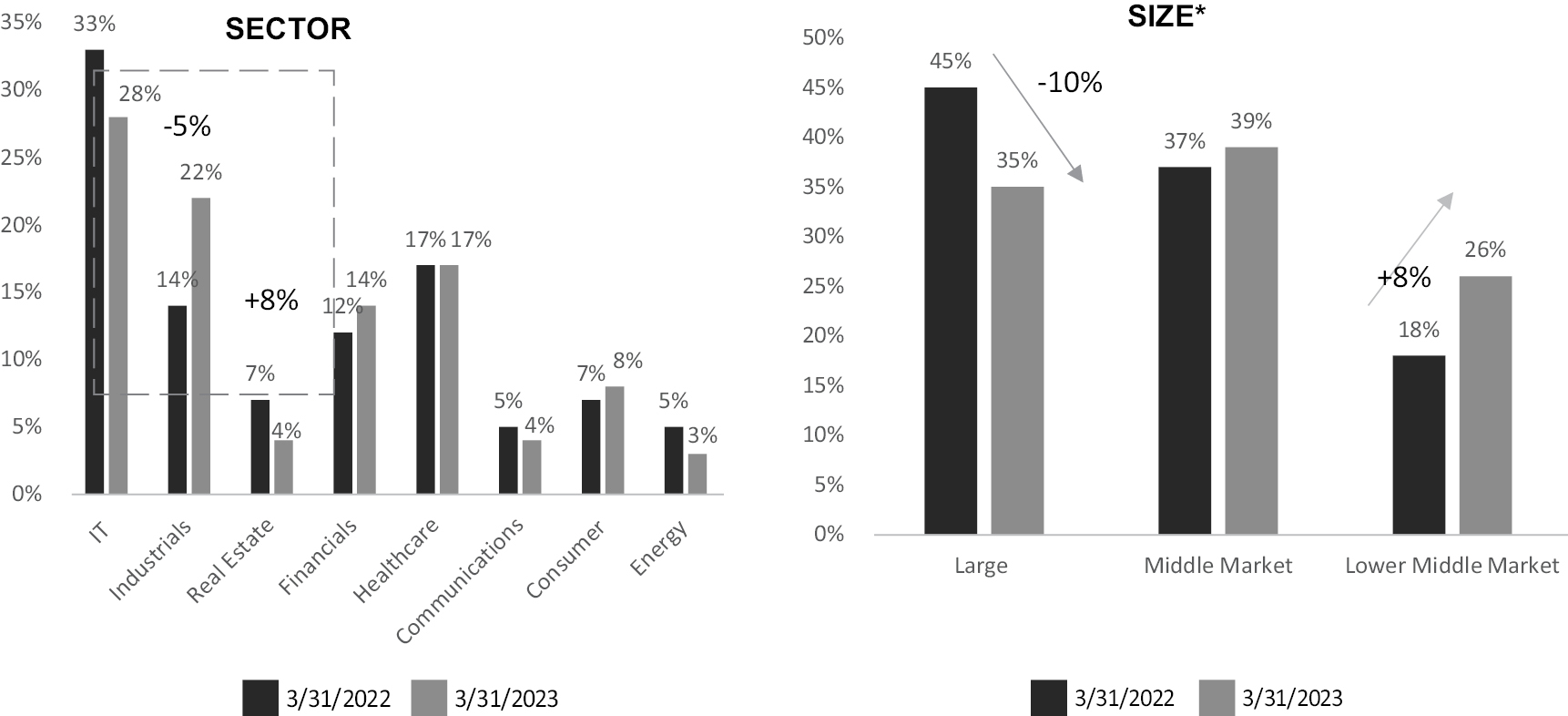

During the fiscal year ended March 31, 2023, the portfolio management team made a concerted effort to increase Fund exposure to Industrial Services and Financials, while reducing the Fund’s overall exposure to Technology. In addition, we meaningfully increased Fund exposure to lower middle market companies from 18% to 26% while large-cap exposure was reduced from 45% to 35%. The middle market continues to be the Fund’s largest overweight, with exposure increasing modestly from 37% to 39% in the most recent fiscal year ended March 31, 2023. The positive performance from our co-investment portfolio was partially offset by modest reductions in our secondaries portfolio, which was negatively impacted by multiple compression in older vintage exposures.

2

Bow River Capital Evergreen Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (CONTINUED)

MARCH 31, 2023 (Unaudited) |

Performance

Class I of the Fund returned 3.17% for the 1-year ending March 31, 2023. Fund performance during the year was driven largely by valuation uplift in several of the Fund’s early direct co-investments, particularly in middle and lower middle market companies.

3

Bow River Capital Evergreen Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (CONTINUED)

MARCH 31, 2023 (Unaudited) |

Average Annual Total Return Information |

| |

Share Class | 1-Year | 2-Year | Since

Inception | Inception

Date | |

Class I | 3.17% | 11.84% | 14.46% | 12/31/2020 | |

Class II | 2.92% | —% | 6.37% | 1/3/2022 | |

Fund Benchmark | | | | | |

MSCI World Index(1) | (7.02)% | 1.19% | 3.24%(2) | | |

Outlook

Despite the resiliency in the Fund’s portfolio, on a go-forward basis we remain cautious with respect to the looming impact of higher borrowing costs, thinning margins and the potential for slower growth in a recession. While we believe labor costs will ultimately moderate in a slowing economy, easing margin pressure on many businesses, the short-term impact will be very difficult for companies that cannot pass through higher costs as the impact of higher rates will be felt before margins expand. A weak exit environment should also result in longer hold periods and an increased reliance on bolt-on or tuck-in acquisitions to bolster growth, further highlighting the importance of free cash flow and a manageable debt load. As a result of these changing market dynamics, the Fund has recently shifted from an underweight to an overweight in private credit. Private equity remains the Fund’s dominant asset class, and we firmly believe that high quality businesses, as they have done in the past, can thrive in a higher interest rate environment. Consequently, we are continuing to deploy capital in the private equity sector, maintaining our underweight to growth and venture, and doubling down on our overweight to middle market cash flowing businesses. We are particularly focused on businesses that can support higher borrowing costs, have high barriers to entry and can pass through higher inflation costs. Recent equity co-investments in the consumer staples and healthcare space are indicative of this approach. Lastly, the middle market will continue to be our dominant area of emphasis, as we believe these businesses have more levers for value creation alongside more reasonable entry prices.

In light of the market’s current challenges, we are comforted by the number of risk mitigants in the Fund’s portfolio that should allow it to continue to weather a difficult investing environment. In addition to the Fund’s underweight to growth equity and venture capital, we have increased our liquidity sleeve slightly above target. This enhanced liquidity serves two purposes — first, it provides an extra cash flow cushion given that we expect a decrease in the value of distributions in the coming quarters alongside an increase in capital calls as sponsors wind down expensive lines of credit. Secondly, it allows us ample dry powder to deploy in an environment that we believe will be increasingly attractive in coming quarters. The general trend in our portfolio has been one of positive revenue and EBITDA growth partially offset by a reduction in multiples. Preserving a larger amount of dry powder will allow us to be opportunistic as high-quality assets become available at attractive entry points across all asset types. We remain overweight in secondaries and while bid/ask spreads remain wide, we expect continual decay in prices in the coming quarters.

4

Bow River Capital Evergreen Fund |

MANAGER’S DISCUSSION OF FUND PERFORMANCE (CONTINUED)

MARCH 31, 2023 (Unaudited) |

As always, the investment team is available to answer any questions about the Fund and we look forward to speaking with you in the future.

Sincerely,

The Bow River Capital Evergreen Fund Team

| |

| |

| |

|

Jeremy Held | | Michael Trihy | | Richard Wham | | Joe Stork |

An offer can only be made by the prospectus and only in jurisdictions in which such an offer would be lawful. The prospectus contains important information concerning risk factors and other material aspects of the Fund to carefully consider and must be read carefully before a decision to invest is made. Please visit www.bowriverevergreen.com or contact your Financial Advisor to obtain a copy of the prospectus.

The Fund commenced investment operations on December 31, 2020, after the conversion of a limited partnership Account, Bow River Capital Evergreen Private Equity Fund LP, which commenced operations on May 22, 2020, (the “Predecessor Account”), into shares of the Fund’s Class I Shares. Information portrayed prior to December 31, 2020 is for the Predecessor Account. The Fund’s objectives, policies, guidelines and restrictions are in all material respects equivalent to those of the Predecessor Account. The Predecessor Account was not registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and therefore was not subject to certain restrictions imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986, as amended, on regulated investment companies. If the Predecessor Account had been registered under the 1940 Act, the Predecessor Account’s performance may have been adversely affected.

Performance data quoted represents past performance and is no guarantee of future results. Total return figures include the reinvestment of dividends and capital gains. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month end performance, please call (888)-330-3350.

Any person subscribing for an investment must be able to bear the risks involved and must meet the suitability requirements of the Fund. Investors could lose all or a substantial amount of their investment. No assurance can be given that the Fund’s investment objectives will be achieved. The Fund is speculative and involves a substantial degree of risk. The Fund is a closed-end, non-diversified management investment company that will make periodic repurchase offers for its securities and is highly illiquid. There is no secondary market for investors’ interests, and none is expected to develop. There are certain restrictions on transferring interests. Fees and expenses will offset the Fund’s trading profits. The Fund is subject to conflicts of interest. Other risks include those related to equity securities, fixed income securities, high-yield/high risk bonds, listed private equity, listed infrastructure securities, foreign securities, derivative instruments, leverage, capital calls, investment manager risk, as well as those related to general economic and market conditions, all of which may present significant risks. Please see the prospectus for more information on these and other risks.

Bow River Advisers, LLC (“Bow River Capital”) is the management company for the Bow River Capital Evergreen Fund.

All statements made herein are opinions of Bow River Capital and should not be construed as investment advice and recommendations.

Fund Distributor: Foreside Financial Services, LLC

5

Bow River Capital Evergreen Fund |

SCHEDULE OF INVESTMENTS

MARCH 31, 2023 |

| | Value |

Private Investments — 78.1% | | | |

Credit Co-Investments — 7.5% | | | |

Ashgrove Specialty Lending Investments I, 12.07% (SONIA + CSA + 7.75%, 0.50% Floor), 4/9/2026, principal GBP 718,1471,2 | | $ | 861,613 |

Ashgrove Specialty Lending Investments I, DAC, 12.80% (SONIA + CSA + 8.50%, 0.25% Floor), 6/1/2026, principal GBP 2,500,0001,2 | | | 2,210,576 |

Digital Alpha Solutions Fund, LP, 14.27% (SOFR3M + CSA + 9.50% PIK)1,3 | | | 3,829,410 |

Ecoville Investments Limited, 9.50%, 1/11/24, principal $2,000,0001,2 | | | 1,980,000 |

Palmer Square Loan Funding 2021-3, Ltd.1 | | | 1,320,900 |

PARIOUS LP, 8.00% PIK, 10/31/2030, principal EUR 5,208,7201,3 | | | 5,842,948 |

Planet US Buyer, LLC, 11.26% (SOFR3M + 6.75%), 1/31/2030, principal $3,000,0001,2 | | | 2,711,806 |

Polaris Newco, 12.84% (LIBOR + 8.00%, 1.00% Floor), 6/3/2029, principal $2,000,0001,2 | | | 1,705,000 |

Sand Trust Series 21-1A – Class SUB, 10/15/20341 | | | 651,415 |

US Hospitality Publishers, Inc., 11.84% (LIBOR + 7.00%, 1.00% Floor), 12/18/2025, principal $2,000,0001,2 | | | 1,823,562 |

VCPF III Co-Invest 1-A, LP1,3 | | | 2,623,806 |

Total Credit Co-Investments

(Cost $24,692,171) | | | 25,561,036 |

| | | | |

Equity Co-Investments — 31.4% | | | |

ACP Hyperdrive Co-Invest, LLC1,3,4 | | | 2,620,000 |

AP DSB Co-Invest II, LP1,3,4 | | | 3,561,985 |

Ashgrove Specialty Lending Investments I, DAC1,2,4 | | | 722,592 |

Biloxi Co-Investment Partners, LP1,3,4 | | | 1,681,794 |

Butterfly Nourish Co-Invest, LP1,2,4 | | | 4,999,848 |

BW Colson Co-Invest Feeder (Cayman),

LP1,3,4 | | | 3,822,242 |

Carlyle Riser Co-Investment, LP1,3,4 | | | 4,635,058 |

Constellation 2022, LP1,3,4 | | | 4,998,967 |

Corsair Amore Investors, LP1,3,4 | | | 4,994,829 |

Coyote 2021, LP1,3,4 | | | 7,652,220 |

DSG Group Holdings, LP1,2,4 | | | 6,715,991 |

Enak Aggregator, LP1,3,4 | | | 3,185,673 |

Falcon Co-Investment Partners, LP1,3,4 | | | 2,895,574 |

ISH Co-Investment Aggregator, LP1,3,4 | | | 2,573,735 |

OceanSound Partners Co-Invest II, LP – Series B1,3,4,5 | | | 5,464,518 |

OceanSound Partners Co-Invest II, LP – Series E1,3,4 | | | 7,569,913 |

| | Value |

Private Investments — 78.1% (continued) | | | |

Equity Co-Investments — 31.4% (continued) | | | |

Onex OD Co-Invest, LP1,3,4 | | $ | 5,292,788 |

Palms Co-Investment Partners, LP1,3,4 | | | 3,807,958 |

Project Stream Co-Invest Fund, LP1,3,4 | | | 1,666,765 |

SANCY SLP1,3,4 | | | 1,624,496 |

SEP Hamilton III Aggregator, LP1,3,4 | | | 6,585,374 |

SEP Skyhawk Fund III Aggregator, LP1,3,4 | | | 545,487 |

The Global Atlantic Financial Group, LLC1,2,4 | | | 4,380,373 |

Veregy Parent, LLC1,2,4 | | | 3,182,840 |

Vistage Equity Investors, LP1,3,4 | | | 4,999,608 |

WestCap Cerebral Co-Invest 2021, LLC1,3,4 | | | 139,525 |

WestCap LoanPal Co-Invest 2020, LLC1,2,4 | | | 3,799,773 |

Wildcat 21 Co-Invest Fund, LP1,3,4 | | | 2,592,890 |

Total Equity Co-Investments (Cost $84,792,444) | | | 106,712,816 |

| | | | |

Primary Funds — 16.3% | | | |

Ashgrove Specialty Lending Fund I SCSp RAIF1,3,4 | | | 1,289,558 |

Avista Capital Partners V, LP1,3,4 | | | 4,690,650 |

Coller Credit Opportunities I – B, LP1,3 | | | 2,074,985 |

EnCap Energy Transition Fund 1-A, LP1,3,4 | | | 3,043,313 |

FFL Capital Partners V, LP1,3,4 | | | 5,651,328 |

Grain Spectrum Holdings III (Cayman), LP1,3,4 | | | 3,310,155 |

Lynx EBO Fund I (A), LLC1,3,4 | | | 447,112 |

OceanSound Partners Fund, LP1,3,4 | | | 4,583,838 |

Onex Structured Credit Opportunities International Fund I, LLC1,3 | | | 1,629,394 |

Overbay Fund XIV Offshore, LP1,3,4 | | | 2,411,632 |

Sheridan Capital Partners Fund III, LP1,2,4 | | | 984,347 |

Sumeru Equity Partners Fund III, LP1,3,4 | | | 2,460,102 |

Sumeru Equity Partners Fund IV, LP1,3,4 | | | 398,869 |

TKO Fund1,3,4 | | | 3,411,419 |

WestCap Strategic Operator Fund II, LP1,3,4 | | | 3,480,643 |

WestCap Strategic Operator U.S. Feeder Fund, LP1,2,4 | | | 8,652,438 |

Whitehorse Liquidity Partners IV, LP1,3,4 | | | 3,647,076 |

Whitehorse Liquidity Partners V, LP1,3,4 | | | 3,159,709 |

Total Primary Funds

(Cost $38,064,575) | | | 55,326,568 |

| | | | |

Private Investment Funds — 7.9% | | | |

PIMCO DSCO Fund II Offshore

Feeder, LP1,3,4 | | | 4,799,094 |

Post Limited Term High Yield Fund, LP1,3,4 | | | 6,042,865 |

Ruffer Absolute Institutional, Ltd.1,3,4 | | | 5,091,501 |

Saba Capital Carry Neutral Tail Hedge Offshore Fund, Ltd.1,3,4 | | | 5,475,615 |

Voloridge Fund, LP1,3,4 | | | 5,293,489 |

Total Private Investment Funds (Cost $25,883,485) | | | 26,702,564 |

See accompanying Notes to Financial Statements.

6

Bow River Capital Evergreen Fund |

SCHEDULE OF INVESTMENTS (CONTINUED)

MARCH 31, 2023 |

| | Value |

Private Investments — 78.1% (continued) | | | |

Secondary Funds — 15.0% | | | |

Adams Street 2009 Direct Fund, LP1,3,4 | | $ | 24,107 |

Adams Street 2010 Direct Fund, LP1,3,4 | | | 29,343 |

Adams Street 2011 Direct Fund, LP1,3,4 | | | 41,638 |

Adams Street 2011 Non-U.S. Developed Markets Fund, LP1,3,4 | | | 140,953 |

Adams Street 2011 U.S. Fund, LP1,3,4 | | | 318,549 |

Adams Street 2013 Global Fund, LP1,3,4 | | | 1,907,607 |

Adams Street 2014 Global Fund, LP1,3,4 | | | 1,055,592 |

Adams Street Partnership Fund 2009 Non-U.S. Developed Markets Fund, LP1,3,4 | | | 115,939 |

Adams Street Partnership Fund 2009 U.S. Fund, LP1,3,4 | | | 260,310 |

Adams Street Partnership Fund 2010 Non-U.S. Developed Markets Fund, LP1,3,4 | | | 111,342 |

Adams Street Partnership Fund 2010 U.S. Fund, LP1,3,4 | | | 291,712 |

Altor Fund IV (No. 1) AB1,3,4 | | | 6,208,258 |

ASP (Feeder) 2017 Global Fund, LP1,3,4 | | | 1,160,633 |

BRCE SPV I, LLC1,2 | | | 254,491 |

Coller Credit Opportunities I – Annex I,

SLP1,3 | | | 3,136,179 |

Coller International Partners VI Feeder Fund, LP – Class A1,3,4 | | | 990,109 |

Coller International Partners VII Feeder Fund, LP – Series B1,3,4 | | | 1,805,561 |

CRG Partners III – Parallel Fund (A), LP1,3,4 | | | 3,615,488 |

Forrest Holdings I, LP – Class A1,2,4 | | | 13,634 |

Forrest Holdings I, LP – Class B1,2,4 | | | 190,808 |

Global Infrastructure Partners II-C, LP1,3,4 | | | 1,215,146 |

Graphite Capital Partners VIII D, LP1,2,4 | | | 4,841,715 |

KH Aggregator, LP1,3,4 | | | 4,824,252 |

Onex Fund V, LP1,3,4 | | | 6,516,342 |

Overbay Fund XIV (AIV III), LP1,3,4 | | | 2,443,436 |

Overbay Fund XIV Offshore (AIV), LP1,3,4,5 | | | 4,121,372 |

Porcupine Holdings, LP – Class A1,3,4 | | | 2,895,534 |

Porcupine Holdings, LP – Class B1,3,4 | | | 2,543,439 |

Total Secondary Funds

(Cost $30,385,723) | | | 51,073,489 |

| | | | |

Total Private Investments

(Cost $203,818,398) | | | 265,376,473 |

| | | | |

Exchange Traded Funds — 0.9% | | | |

Equity Funds — 0.9% | | | |

Core Alternative ETF, shares 100,000 | | | 2,983,000 |

Total Exchange Traded Funds

(Cost $3,047,500) | | | 2,983,000 |

| | | | |

| | Value |

U.S. Treasury Bills — 8.8% | | | | |

United States Treasury Bill, 0.00%, 04/13/2023, principal $20,227,000 | | $ | 19,999,321 | |

United States Treasury Bill, 4.57% OID, 05/09/2023, principal $10,149,000 | | | 9,954,208 | |

Total U.S. Treasury Bills

(Cost $29,999,108) | | | 29,953,529 | |

| | | | | |

Short-Term Investments — 16.2% | | | | |

UMB Money Market Fiduciary, 0.01%, shares 9,556,0676,7 | | | 9,556,067 | |

UMB Money Market Special, 4.68%, shares 20,000,0006,7 | | | 20,000,000 | |

Goldman Sachs Financial Square Government Fund – Institutional Class, 4.73%, shares 25,462,6296 | | | 25,462,629 | |

Total Short-Term Investments

(Cost $55,018,696) | | | 55,018,696 | |

| | | | | |

Total Investments

(Cost $291,883,702) — 104.0% | | $ | 353,331,698 | |

Liabilities in excess of other assets — (4.0%) | | | (13,711,766 | ) |

Net Assets — 100% | | $ | 339,619,932 | |

CSA — Credit Spread Adjustment

DAC — Designated Activity Company

LLC — Limited Liability Company

LP — Limited Partnership

LIBOR — London Interbank Offered Rate

OID — Original Issue Discount

PIK — Payment In Kind

RAIF — Reserved Alternative Investment Fund

SCSp — Special Limited Partnership

SLP — Special Limited Partnership

SONIA — Sterling Overnight Index Average

SOFR3M — Three month average Secured Overnight Financing Rate

See accompanying Notes to Financial Statements.

7

Bow River Capital Evergreen Fund |

SCHEDULE OF INVESTMENTS (CONTINUED)

MARCH 31, 2023 |

1 Restricted security. The total value of these securities is $265,376,473, which represents 78.1% of total net assets of the Fund. Please refer to Note 7 in the Notes to the Financial Statements.

2 Level 3 securities fair valued using significant unobservable inputs. The total value of these securities is $50,031,407, which represents 14.7% of total net assets of the Fund.

3 Investment is valued using the Fund’s pro rata net asset value (or its equivalent) as a practical expedient. Please see Note 3 in the Notes to the Financial Statements for respective investment strategies, unfunded commitments, and redemptive restrictions.

4 Non-income producing.

5 Affiliated investment for which ownership exceeds 5% of the investment’s capital. Please refer to Note 6 in the Notes to the Financial Statements.

6 Rate disclosed represents the seven day yield as of the Fund’s period end.

7 The account is an interest-bearing money market deposit account maintained by UMB Bank, n.a. in its capacity as a custodian for various participating custody accounts. The Fund may redeem its investments in whole, or in part, on each business day.

On March 31, 2023, the Bow River Capital Evergreen Fund had outstanding forward foreign currency contracts with terms as set forth below:

Settlement Date | | Counterparty | | Currency Purchased | | Currency Sold | | Contract Amount | | Value | | Unrealized

Appreciation |

Buy | | Sell | |

June 30, 2023 | | Bannockburn Global

Forex, LLC | | USD | | EUR | | $ | 2,185,000 | | EUR 2,000,000 | | $ | 2,178,249 | | $ | 6,751 |

June 30, 2023 | | Bannockburn Global

Forex, LLC | | USD | | GBP | | $ | 1,858,500 | | GBP 1,500,000 | | $ | 1,852,731 | | $ | 5,769 |

| | | | | | | | | | | | | | | | | $ | 12,520 |

See accompanying Notes to Financial Statements.

8

Bow River Capital Evergreen Fund |

SUMMARY OF INVESTMENTS

MARCH 31, 2023 |

Security Type/Geographic Region | | Percent of

Total

Net Assets |

Private Investments | | | |

North America | | 58.1 | % |

Global | | 10.5 | % |

Europe | | 8.9 | % |

Asia | | 0.6 | % |

Total Private Investments | | 78.1 | % |

Exchange Traded-Funds | | | |

North America | | 0.9 | % |

Total Exchange Traded-Funds | | 0.9 | % |

U.S. Treasury Bills | | 8.8 | % |

Short-Term Investments | | 16.2 | % |

Total Investments | | 104.0 | % |

Liabilities in excess of other assets | | -4.0 | % |

Net Assets | | 100.0 | % |

See accompanying Notes to Financial Statements.

9

Bow River Capital Evergreen Fund |

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2023 |

Assets: | | | |

Unaffiliated investments, at fair value (cost $202,911,293) | | $ | 258,773,583 |

Affiliated investments, at fair value (cost $3,954,605) | | | 9,585,890 |

Short-term investments, at fair value (cost $85,017,804) | | | 84,972,225 |

Cash | | | 35,589 |

Interest receivable | | | 315,084 |

Prepaid expenses | | | 114,339 |

Unrealized appreciation on forward foreign currency contracts | | | 12,520 |

Total Assets | | | 353,809,230 |

| | | | |

Liabilities: | | | |

Payables | | | |

Shareholder subscriptions received in advance | | | 9,556,067 |

Shareholder redemptions | | | 3,819,112 |

Net Investment management fee and expense recoupment | | | 526,712 |

Distribution and service fees | | | 5,161 |

Professional fees | | | 248,728 |

Accounting and administration fees | | | 33,518 |

Total Liabilities | | | 14,189,298 |

Commitments and contingencies (Note 9) | | | |

| | | | |

Net Assets | | $ | 339,619,932 |

| | | | |

Composition of Net Assets: | | | |

Paid-in capital | | $ | 292,584,976 |

Total distributable earnings | | | 47,034,956 |

Net Assets | | $ | 339,619,932 |

| | | | |

Net Assets Attributable to: | | | |

Class I Shares | | $ | 315,332,694 |

Class II Shares | | | 24,287,238 |

| | | $ | 339,619,932 |

Shares of Beneficial Interest Outstanding (Unlimited Number of Shares

Authorized, 100,000 shares registered; par value of $0.001): | | | |

Class I Shares | | | 7,817,381 |

Class II Shares | | | 603,960 |

| | | | 8,421,341 |

Net Asset Value per Share1: | | | |

Class I Shares | | $ | 40.34 |

Class II Shares | | | 40.21 |

See accompanying Notes to Financial Statements.

10

Bow River Capital Evergreen Fund |

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED MARCH 31, 2023 |

Investment Income: | | | | |

Interest income from unaffiliated investments | | $ | 2,626,044 | |

Other Income | | | 34,367 | |

Dividend income from unaffiliated investments | | | 33,433 | |

Total Investment Income | | | 2,693,844 | |

| | | | | |

Expenses: | | | | |

Investment management fee (Note 5) | | | 4,916,262 | |

Audit and tax fees | | | 244,536 | |

Accounting and administration fees | | | 302,654 | |

Legal fees | | | 161,000 | |

Trustee fees (Note 5) | | | 102,500 | |

Interest Expense | | | 60,000 | |

Pricing Fees | | | 57,206 | |

Distribution and service fees (Class II) | | | 48,649 | |

Transfer agent fees | | | 92,000 | |

Chief Compliance Officer and Chief Financial Officer fees (Note 5) | | | 90,533 | |

Other fees | | | 137,975 | |

Custody fees | | | 32,200 | |

Total Expenses Before Recoupment | | | 6,245,515 | |

Fund expenses recouped by the Adviser (Note 5) | | | 192,185 | |

Net Expenses | | | 6,437,700 | |

Net Investment Loss | | | (3,743,856 | ) |

| | | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) on: | | | | |

Unaffiliated investments | | | 2,565,408 | |

Foreign currency transactions | | | 9,214 | |

Forward foreign currency contracts | | | 10,126 | |

Total net realized gain | | | 2,584,748 | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Unaffiliated investments | | | 11,365,193 | |

Affiliated investments | | | 1,367,299 | |

Investments paid in advance | | | (841,033 | ) |

Forward foreign currency contracts | | | 12,520 | |

Total net change in unrealized appreciation | | | 11,903,979 | |

Net Realized and Unrealized Gain | | | 14,488,727 | |

| | | | | |

Net Increase in Net Assets from Operations | | $ | 10,744,871 | |

See accompanying Notes to Financial Statements.

11

Bow River Capital Evergreen Fund |

STATEMENT OF CHANGES IN NET ASSETS

|

| | For the

year ended

March 31, 2023 | | For the

year ended

March 31, 2022 |

Net Increase in Net Assets from: | | | | | | | | |

Operations: | | | | | | | | |

Net investment loss | | $ | (3,743,856 | ) | | $ | (2,712,270 | ) |

Net realized gain | | | 2,584,748 | | | | 595,511 | |

Net change in unrealized appreciation | | | 11,903,979 | | | | 35,286,186 | |

Net Increase in Net Assets Resulting from Operations | | | 10,744,871 | | | | 33,169,427 | |

| | | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

Distributions: | | | | | | | | |

Class I | | | (7,818,326 | ) | | | (1,278,522 | ) |

Class II | | | (647,048 | ) | | | —3 | |

Decrease in Net Assets from Distributions to Shareholders | | | (8,465,374 | ) | | | (1,278,522 | ) |

| | | | | | | | | |

Capital Transactions: | | | | | | | | |

Proceeds from shares sold: | | | | | | | | |

Class I | | | 101,446,819 | | | | 88,816,420 | |

Class II | | | 18,222,387 | | | | 6,091,3283 | |

Reinvestment of distributions: | | | | | | | | |

Class I | | | 6,076,353 | | | | 1,077,120 | |

Class II | | | 207,174 | | | | — | |

Cost of shares repurchased: | | | | | | | | |

Class I | | | (9,170,783 | )1 | | | (2,492,250 | ) |

Class II | | | (728,873 | )2 | | | —3 | |

Net Increase in Net Assets from Capital Transactions | | | 116,053,077 | | | | 93,492,618 | |

| | | | | | | | | |

Total Net Increase in Net Assets | | | 118,332,574 | | | | 125,383,523 | |

| | | | | | | | | |

Net Assets | | | | | | | | |

Beginning of period | | | 221,287,358 | | | | 95,903,835 | |

End of period | | $ | 339,619,932 | | | $ | 221,287,358 | |

| | | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Shares sold: | | | | | | | | |

Class I | | | 2,551,057 | | | | 2,512,347 | |

Class II | | | 457,545 | | | | 159,4193 | |

Shares issued in reinvestment of distributions: | | | | | | | | |

Class I | | | 154,273 | | | | 28,100 | |

Class II | | | 5,273 | | | | — | |

Shares redeemed: | | | | | | | | |

Class I | | | (229,544 | ) | | | (68,170 | ) |

Class II | | | (18,277 | ) | | | —3 | |

Net Increase in Capital Shares Outstanding | | | 2,920,327 | | | | 2,631,696 | |

See accompanying Notes to Financial Statements.

12

Bow River Capital Evergreen Fund |

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED MARCH 31, 2023 |

Cash Flows from Operating Activities | | | | |

Net increase in net assets from operations | | $ | 10,744,871 | |

Adjustments to reconcile net increase in net assets

from operations to net cash used in operating activities: | | | | |

Net realized gain from investments | | | (2,565,408 | ) |

Net realized gain from foreign currency transactions | | | (9,214 | ) |

Net realized gain from foreign currency contracts | | | (10,126 | ) |

Net change in unrealized appreciation from investments | | | (12,732,492 | ) |

Net change in unrealized depreciation from investments paid in advance | | | 841,033 | |

Net change in unrealized appreciation from foreign currency contracts | | | (12,520 | ) |

Purchases of investments | | | (106,136,929 | ) |

Sales of investments | | | 28,973,488 | |

Purchases of short term investments, net | | | (42,854,798 | ) |

(Increase)/Decrease in Assets: | | | | |

Due from Adviser | | | 50,545 | |

Interest receivable | | | (243,168 | ) |

Prepaid expenses | | | (25,275 | ) |

Unrealized appreciation on forward foreign currency contracts | | | (12,520 | ) |

Investments paid in advance, at cost | | | 9,945,832 | |

Increase/(Decrease) in Liabilities: | | | | |

Unrealized depreciation on forward foreign currency contracts | | | (4,829 | ) |

Net Investment management fee and expense recoupment | | | 209,111 | |

Interest fees | | | (6,250 | ) |

Distribution and service fees | | | 3,860 | |

Professional fees | | | 2,287 | |

Transfer agent fees | | | (11,377 | ) |

Accounting and administration fees | | | 12,269 | |

Other accrued liabilities | | | (10,311 | ) |

Net Cash Used in Operating Activities | | | (113,851,921 | ) |

| | | | | |

Cash Flows from Financing Activities | | | | |

Proceeds from shares sold | | | 121,112,273 | |

Distributions paid to shareholders, net of reinvestments | | | (2,181,847 | ) |

Payments for shares repurchased, net of repurchase fees | | | (6,080,544 | ) |

Net Cash Provided by Financing Activities | | | 112,849,882 | |

| | | | | |

Effects of foreign currency exchange rate changes in cash | | | 31,860 | |

| | | | | |

Net decrease in cash | | | (970,179 | ) |

| | | | | |

Cash at beginning of period | | | 1,005,768 | |

Cash denominated in foreign currencies at beginning of period | | | — | |

Total cash and cash equivalents at beginning of period | | | 1,005,768 | |

| | | | | |

Cash at end of period | | | 35,589 | |

Cash denominated in foreign currencies at end of period | | | — | |

Total cash at end of period | | $ | 35,589 | |

| | | | | |

Supplemental disclosure of non-cash activity: | | | | |

Reinvestment of distributions | | $ | 6,283,527 | |

See accompanying Notes to Financial Statements.

13

Bow River Capital Evergreen Fund |

FINANCIAL HIGHLIGHTS

CLASS I SHARES |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the

year ended

March 31,

20231 | | For the

year ended

March 31,

20221 | | For the

period ended

March 31,

20211,2 |

Net Asset Value, beginning of period | | $ | 40.23 | | | $ | 33.42 | | | $ | 30.86 | |

Income from Investment Operations: | | | | | | | | | | | | |

Net investment loss3 | | | (0.52 | ) | | | (0.63 | ) | | | (0.13 | ) |

Net realized and unrealized gain on investments | | | 1.76 | | | | 7.71 | | | | 2.69 | |

Total from investment operations | | | 1.24 | | | | 7.08 | | | | 2.56 | |

| | | | | | | | | | | | | |

Distributions to investors: | | | | | | | | | | | | |

From net realized gain | | | (1.14 | ) | | | (0.27 | ) | | | — | |

Total distributions to investors | | | (1.14 | ) | | | (0.27 | ) | | | — | |

Redemption Fees3: | | | 0.01 | | | | — | | | | — | |

Net Asset Value, end of period | | $ | 40.34 | | | $ | 40.23 | | | $ | 33.42 | |

| | | | | | | | | | | | | |

Total Return4 | | | 3.17 | % | | | 21.23 | % | | | 8.30 | %5 |

| | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | |

Net Assets, end of period (in thousands) | | $ | 315,333 | | | $ | 214,878 | | | $ | 95,904 | |

| | | | | | | | | | | | | |

Net investment loss6 | | | (1.31 | )% | | | (1.73 | )% | | | (1.71 | )%7 |

| | | | | | | | | | | | | |

Gross expenses inclusive of interest expense6,8 | | | 2.20 | % | | | 2.42 | % | | | 3.06 | %9 |

Net expenses inclusive of interest expense6,10 | | | 2.27 | % | | | 2.26 | % | | | 2.25 | %7 |

| | | | | | | | | | | | | |

Gross expenses exclusive of interest expense6,8 | | | 2.18 | % | | | 2.41 | % | | | 3.06 | %9 |

Net expenses exclusive of interest expense6,10 | | | 2.25 | % | | | 2.25 | % | | | 2.25 | %7 |

| | | | | | | | | | | | | |

Portfolio Turnover Rate | | | 13 | % | | | 19 | % | | | 21 | %5 |

Borrowings – Revolving Credit Facility | | $ | — | | | $ | — | | | $ | — | |

Assets Coverage per $1,000 of Borrowings11 | | | — | | | | — | | | | — | |

Revolving Credit Facility | | | Not Applicable | | | | Not Applicable | | | | Not Applicable | |

See accompanying Notes to Financial Statements.

14

Bow River Capital Evergreen Fund |

FINANCIAL HIGHLIGHTS

CLASS II SHARES |

Per share operating performance.

For a capital share outstanding throughout each period.

| | For the

year ended

March 31,

20231 | | For the

period ended

March 31,

20221,2 |

Net Asset Value, beginning of period | | $ | 40.20 | | | $ | 38.33 | |

Income from Investment Operations: | | | | | | | | |

Net investment loss3 | | | (0.62 | ) | | | (0.14 | ) |

Net realized and unrealized gain on investments | | | 1.76 | | | | 2.01 | |

Total from investment operations | | | 1.14 | | | | 1.87 | |

| | | | | | | | | |

Distributions to investors: | | | | | | | | |

From net realized gain | | | (1.14 | ) | | | — | |

Total distributions to investors | | | (1.14 | ) | | | — | |

Redemption Fees3: | | | 0.01 | | | | — | |

Net Asset Value, end of period | | $ | 40.21 | | | $ | 40.20 | |

| | | | | | | | | |

Total Return4 | | | 2.92 | % | | | 4.88 | %5 |

| | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | |

Net Assets, end of period (in thousands) | | $ | 24,287 | | | $ | 6,409 | |

| | | | | | | | | |

Net investment loss6,7 | | | (1.56 | )% | | | (1.71 | )% |

| | | | | | | | | |

Gross expenses inclusive of interest expense6,8 | | | 2.45 | % | | | 2.67 | %7 |

Net expenses inclusive of interest expense6,9 | | | 2.52 | % | | | 2.51 | %7 |

| | | | | | | | | |

Gross expenses exclusive of interest expense6,8 | | | 2.43 | % | | | 2.66 | %7 |

Net expenses exclusive of interest expense6,9 | | | 2.50 | % | | | 2.50 | %7 |

| | | | | | | | | |

Portfolio Turnover Rate | | | 13 | % | | | 19 | %10 |

Borrowings – Revolving Credit Facility | | $ | — | | | $ | — | |

Assets Coverage per $1,000 of Borrowings11 | | | — | | | | — | |

Revolving Credit Facility | | | Not Applicable | | | | Not Applicable | |

See accompanying Notes to Financial Statements.

15

Bow River Capital Evergreen Fund |

NOTES TO THE FINANCIAL STATEMENTS

MARCH 31, 2023 |

1. Organization

Bow River Capital Evergreen Fund (the “Fund”) was organized as a Delaware statutory trust on April 21, 2020 and commenced operations on January 1, 2021 following the reorganization of the Bow River Capital Evergreen Private Equity Fund, LP (the “Predecessor Fund”) with and into Class I shares of the Fund, which was effective as of the close of business on December 31, 2020. The Fund currently offers two classes of shares: Class I Shares and Class II Shares (“Shares”). Class II Shares commenced operations on January 3, 2022. The Fund is a non-diversified, closed-end management investment company that operates as an interval fund pursuant to Rule 23c-3 of the Investment Company Act of 1940 (the “1940 Act”), as amended. The Fund is available to “accredited investors” within the meaning of Rule 501 under the Security Act of 1933, as amended.

The Fund’s investment objective is to generate long-term capital appreciation by investing in a broad portfolio of private equity investments that provide attractive risk-adjusted return potential. The Fund will seek to achieve its investment objective through broad exposure to private equity, private credit, and semi-liquid or listed investments, that may include: (i) direct investments; (ii) secondary investments; (iii) private credit instruments; (iv) primary fund commitments; (v) direct or secondary purchases of liquid credit instruments; (vi) other liquid investments; and (vii) short-term investments.

Effective at the close of business on March 31, 2023, Bow River Asset Management LLC transferred its rights and obligations under the investment management agreement with the Fund to Bow River Advisers, LLC, (the “Adviser”) a majority-owned subsidiary that is registered as an investment adviser under the Investment Advisers Act of 1940 (the “Advisers Act”), as amended. Aksia CA LLC, an investment adviser registered under the Advisers Act, serves as a non-discretionary investment consultant to the Adviser with respect to the Fund. The Fund’s Board of Trustees (the “Board”) has the overall responsibility for the management and supervision of the business operations of the Fund. The Board may delegate any of its rights, powers, and authority to, among others, the officers of the Fund, any committee of the Board, or the Adviser.

2. Significant Accounting Policies

Basis of Presentation and Use of Estimates — The Fund is an investment company and as a result, maintains its accounting records and has presented these financial statements in accordance with the reporting requirements under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies (“ASC 946”). The presentation of the financial statements are in conformity with generally accepted accounting principles in the United States of America (“GAAP”), which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statement, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Income Recognition and Expenses — Interest income is recognized on an accrual basis as earned. Dividend income is recorded on the ex-dividend date. Distributions received from investments in securities and private funds that represent a return of capital or capital gains are recorded as a reduction of cost of investment or as a realized gain, respectively. Expenses are recognized on an accrual basis as incurred. The Fund bears all expenses incurred in the course of its operations, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Fund’s account; professional fees; costs of insurance; registration expenses; and expenses of meetings of the Board. Expenses are subject to the Fund’s Expense Limitation Agreement (see Note 5).

Investment Transactions — Investment transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the identified cost basis for publicly traded investments and average cost for the Fund’s private investments for both financial statement and federal income tax purposes.

Distributions to Shareholders — Distributions to shareholders arising from net investment income and net realized capital gains, if any, are declared and paid annually. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. Distributions to shareholders are recorded on the ex-dividend date.

Valuation — The Fund will calculate its net asset value (“NAV”) as of the close of regular trading on the New York Stock Exchange on the last business day of each calendar week, each business day for the five business days preceding a repurchase request deadline (at such specific time set by the Board), each date that a Share is offered or repurchased, as of the date of any distribution and at such other times as the Board shall determine (each, a “Determination Date”). In determining its NAV, the Fund will value its investments as of the relevant Determination Date. The NAV of the Fund will equal, unless otherwise noted, the value of the total assets of the Fund, less all liabilities, including accrued fees and expenses, each determined as of the relevant Determination Date.

16

Bow River Capital Evergreen Fund |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

MARCH 31, 2023 |

In December 2020, the Securities and Exchange Commission (“SEC”) adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good faith for purposes of the 1940 Act. The Fund was required to comply with Rule 2a-5 by September 8, 2022 and as a result, the Board has approved valuation procedures for the Fund (the “Valuation Procedures”) which will be used for determining the fair value of any Fund investments for which a market quotation is not readily available. The valuation of the Fund’s investments is performed in accordance with the principles found in Rule 2a-5 and in conjunction with FASB’s ASC Topic 820, Fair Value Measurements and Disclosures (“ASC 820-10). The Board has designated the Adviser as the valuation designee of the Fund. As valuation designee, the Adviser performs the fair value determination relating to any and all Fund investments, subject to the conditions and oversight requirements described in the Valuation Procedures. In furtherance of its duties as valuation designee, the Adviser has formed a valuation committee (the “Valuation Committee”), to perform fair value determinations and oversee the day-to-day functions related to the fair valuation of the Fund’s investments. The Valuation Committee may consult with representatives from the Fund’s outside legal counsel or other third-party consultants in their discussions and deliberations.

Securities traded on one or more of the U.S. national securities exchanges, the Nasdaq Stock Market or any foreign stock exchange will be valued based on their respective market price. The money market demand accounts are priced at cost. Shares of mutual funds, including money market funds, are valued at their reported NAV. U.S. Treasury Bills with a maturity date of 91 days or less from the date of purchase are valued at amortized cost. U.S. Treasury Bills with a maturity date more than 91 days from the date of purchase are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

Debt instruments for which market quotations are readily available are typically valued based on such market quotations. In validating market quotations, the Valuation Committee considers different factors such as the source and the nature of the quotation in order to determine whether the quotation represents fair value. The Valuation Committee makes use of reputable financial information providers in order to obtain the relevant quotations.

For debt and equity securities which are not publicly traded or for which market prices are not readily available (unquoted investments) the fair value is determined in good faith. In determining the fair values of these investments, the Valuation Committee will typically apply widely recognized market and income valuation methodologies including, but not limited to, earnings and multiple analysis, discounted cash flow method and third-party valuations. In order to determine a fair value, these methods, in the discretion of the Valuation Committee, are applied to the latest information provided by the underlying portfolio companies or other business counterparties.

Due to the inherent uncertainty in determining the fair value of investments for which market values are not readily available the fair values of these investments may fluctuate from period to period. In addition, such fair value may differ materially from the values that may have been used had a ready market existed for such investments and may significantly differ from the value ultimately realized by the Fund.

Assets and liabilities initially expressed in foreign currencies will be converted into U.S. Dollars using foreign exchange rates provided by a recognized pricing service.

Primary and Secondary Fund Investments

Primary investments are commitments to new private equity, private credit, or other private funds. Secondary investments are purchases of existing interests that are acquired on the secondary market. Primary or secondary investments in private funds are generally valued based on the latest NAV reported by the third-party fund manager or General Partner. This is commonly referred to as using NAV as a practical expedient which allows for estimation of the fair value of an investment in a private fund based on NAV or its equivalent if the NAV of the private fund is calculated in a manner consistent with ASC 946. Because of the inherent uncertainty of valuations of the investments in private funds, their estimated values may differ significantly from the values that would have been used had a ready market for the private funds existed, and the differences could be material. New purchases of primary or secondary investments in private funds will be valued at acquisition cost initially until a NAV is provided by the third-party fund manager or General Partner. The Fund will review any cash flows since the reference date of the last NAV for a private fund received by the Fund from a third-party manager (“Portfolio Fund Manager”) until the Determination Date are recognized by (i) adding the nominal amount of the investment related capital calls and (ii) deducting the nominal amount of investment related distributions from the NAV as reported by the Portfolio Fund Manager.

In addition to tracking the NAV plus related cash flows of such secondary purchases of interests in closed-end private funds (“Portfolio Funds”), the Valuation Committee may also track relevant broad-based and issuer (or fund) specific valuation information relating to the assets held by each private fund which is reasonably available at the time the Fund values its investments. Portfolio Funds’ Managers

17

Bow River Capital Evergreen Fund |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

MARCH 31, 2023 |

only provide determinations of the net asset values of the Portfolio Funds on a monthly or quarterly basis, in which event it will not be possible to determine the net asset value of the Fund more frequently. The Valuation Committee will consider such information and may conclude in certain circumstances that the information provided by the Portfolio Fund Manager does not represent the fair value of a particular asset held by a Portfolio Fund. If the Valuation Committee concludes in good faith that the latest NAV reported by a Portfolio Fund Manager does not represent fair value (e.g., there is more current information regarding a portfolio asset which significantly changes its fair value) the Valuation Committee will make a corresponding adjustment to reflect the current fair value of such asset within such Portfolio Fund. In determining the fair value of assets held by Portfolio Funds, the Valuation Committee applies valuation methodologies as outlined above.

Co-Investments

Co-investments are minority investments in a company made by investors alongside a private equity fund manager or venture capital firm. Co-investments in private equity funds may be valued based on the latest NAV reported by the third-party fund manager or General Partner. In assessing the fair value of the Fund’s Co-Investments in accordance with the Valuation Procedures, the Adviser uses a variety of methods such as earnings and multiple analysis, discounted cash flow and market data from third party pricing services and makes assumptions that are based on market conditions existing at the end of each reporting period. Because of the inherent uncertainty of estimates, fair value determinations based on estimates may differ from the values that would have been used had a ready market for the securities existed, and the differences could be material.

Foreign Currency Exchange Contracts — The Fund may enter into foreign currency exchange contracts. The Fund may enter into these contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date to hedge various investments, for risk management (i.e., hedging purposes). All foreign currency exchange contracts are market-to-market at the applicable translation rates resulting in unrealized gains or losses. Realized gains or losses are recorded at the time the foreign currency exchange contract is offset by entering into a closing transaction, or by the delivery, or receipt, of the currency. Risk may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar.

Federal Income Taxes — The Fund intends to continue to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. The Fund utilizes a tax-year end of September 30 and the Fund’s income and federal excise tax returns and all financial records supporting the prior year returns are subject to examination by the federal and Delaware revenue authorities. If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required. Management of the Fund is required to determine whether a tax position taken by the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. Based on its analysis, there were no tax positions identified by management of the Fund which did not meet the “more likely than not” standard as of March 31, 2023. The Fund’s policy is to classify any interest or penalties associated with underpayment of federal and state income taxes as an income tax expense on the Statement of Operations.

Shareholder Subscriptions — Shareholder subscriptions received in advance are comprised of cash received on or prior to March 31, 2023 for which shares are issued on April 1, 2023. Shareholder subscriptions received in advance do not participate in the earnings of the Fund until shares are issued.

3. Fair Value Disclosures

GAAP defines fair value, establishes a three-tier framework for measuring fair value based on a hierarchy of inputs, and expands disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly and how that information must be incorporated into a fair value measurement. The hierarchy distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the fair value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

• Level 1 — unadjusted quoted prices in active markets for identical securities. An active market for the security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value.

18

Bow River Capital Evergreen Fund |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

MARCH 31, 2023 |

• Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc. and quoted prices for identical or similar assets in markets that are not active.) Inputs that are derived principally from or corroborated by observable market data. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement.

• Level 3 — significant unobservable inputs, including inputs that are not derived from market data or cannot be corroborated by market data and when the investment is not redeemable in the near term.

Private investments that are reported on the Fund’s schedule of investments as being measured at fair value using the Fund’s pro rata NAV (or its equivalent) without further adjustment, as a practical expedient of fair value and therefore these investments are excluded from the fair value hierarchy. Generally, the fair value of the Fund’s investment in a private investment represents the amount that the Fund could reasonably expect to receive from the investment fund if the Fund’s investment is withdrawn at the measurement date based on NAV.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the valuation inputs used to value the Fund’s assets and liabilities as of March 31, 2023:

| | | | Fair Value Measurements at the

End of the Reporting Period Using | | |

Investments | | Practical

Expedient* | | Level 1

Quoted Prices | | Level 2

Other Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Total |

Security Type | | | | | | | | | | | | | | | |

Private Investments** | | $ | 213,372,751 | | $ | — | | $ | 1,972,315 | | $ | 50,031,407 | | $ | 265,376,473 |

Exchange Traded Funds | | | — | | | 2,983,000 | | | — | | | — | | | 2,983,000 |

U.S. Treasury Bills | | | — | | | — | | | 29,953,529 | | | — | | | 29,953,529 |

Short-Term Investments | | | — | | | 55,018,696 | | | — | | | — | | | 55,018,696 |

Total | | $ | 213,372,751 | | $ | 58,001,696 | | $ | 31,925,844 | | $ | 50,031,407 | | $ | 353,331,698 |

| |

The following is a summary of valuation inputs used to measure the Fund’s other financial instruments that are derivative instruments not reflected in the Schedule of Investments as of March 31, 2023:

Type | | Level 1 | | Level 2 | | Level 3 | | Total |

Forward foreign currency contracts | | $ | — | | $ | 12,520 | | $ | — | | $ | 12,520 |

| | | $ | — | | $ | 12,520 | | $ | — | | $ | 12,520 |

| |

19

Bow River Capital Evergreen Fund |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

MARCH 31, 2023 |

The following is a roll-forward of the activity in investments in which significant unobservable inputs (Level 3) were used in determining fair value on a recurring basis:

| | Beginning

balance

April 1, 2022 | | Transfers

into Level 3

during the

period | | Transfers

out of

Level 3

during the

period | | Purchases or

Contributions | | Sales or

Distributions | | Net realized

gain | | Change in net

unrealized

appreciation | | Ending

balance

March 31,

2023 |

Private Investments | | $ | 57,564,880 | | $ | 22,144,933 | | $ | (23,263,214) | | $ | 4,303,315 | | $ | (12,817,182) | | $ | 3,022,035 | | $ | (923,360) | | $ | 50,031,407 |

The change in net unrealized appreciation (depreciation) included in the Statement of Operations attributable to Level 3 investments that were held as of March 31, 2023 is $(1,589,537).

Transfers into Level 3 during the period represent investments being valued by management using unobservable inputs as an adjustment to reported fair values. Transfers out of Level 3 during the period represent investments that are being measured at fair value using the Fund’s pro rata NAV (or its equivalent) as a practical expedient and/or being valued using observable market data.

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of March 31, 2023:

Level 3 Investments | | Fair Value as of

March 31, 2023 | | Valuation Technique | | Unobservable

Inputs | | Range of

Inputs/Discount

Rate/Price | | Impact to

Valuation from

an Increase in

Input |

Credit Co-Investments | | | | | | | | | | | |

Ashgrove Specialty Lending Investments I | | $ | 861,613 | | Market Approach | | General Partner Net Asset Value | | Not Applicable | | Increase |

Ashgrove Specialty Lending Investments I, DAC | | $ | 2,210,576 | | Market Approach | | Transaction Price | | Not Applicable | | Increase |

Ecoville Investments Limited | | $ | 1,980,000 | | Income Approach | | Discount Rate | | 11.16% - 12.16% | | Decrease |

Polaris Newco | | $ | 1,705,000 | | Income Approach | | Discount Rate | | 13.97% - 14.97% | | Decrease |

US Hospitality Publishers, Inc. | | $ | 1,823,562 | | Income Approach | | Discount Rate | | 11.46% - 12.46% | | Decrease |

Planet US Buyer, LLC | | $ | 2,711,806 | | Income Approach | | Discount Rate | | 9.95% - 10.95% | | Decrease |

Equity Co-Investments | | | | | | | | | | | |

The Global Atlantic Financial Group, LLC | | $ | 4,380,373 | | Market Approach | | Net Book Value | | Not Applicable | | Increase |

Veregy Parent, LLC | | $ | 3,182,840 | | Market Approach | | Adjusted EBITDA Multiple | | 9.1x - 14.3x | | Increase |

Ashgrove Specialty Lending Investments I, DAC | | $ | 722,592 | | Market Approach | | Transaction Price | | Not Applicable | | Increase |

Westcap Loanpal Co-invest 2020 LLC* | | $ | 3,799,773 | | Income Approach | | Discount Rate | | 31.00% | | Decrease |

| | | | | | Market Approach | | Adjusted EBITDA Multiple | | 16.2x - 28.7x | | Increase |

| | | | | | Market Approach | | General Partner Net Asset Value | | Not Applicable | | Increase |

DSG Group Holdings, LP | | $ | 6,715,991 | | Market Approach | | Adjusted EBITDA Multiple | | 10.5x | | Increase |

Butterfly Nourish Co-Invest, LP | | $ | 4,999,848 | | Market Approach | | Recent Transaction Price | | Not Applicable | | Increase |

20

Bow River Capital Evergreen Fund |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

MARCH 31, 2023 |

Level 3 Investments | | Fair Value as of

March 31, 2023 | | Valuation Technique | | Unobservable

Inputs | | Range of

Inputs/Discount

Rate/Price | | Impact to

Valuation from

an Increase in

Input |

Primary Funds | | | | | | | | | | | |

Sheridan Capital Partners Fund III, LP | | $ | 984,347 | | Market Approach | | Recent Transaction Price | | Not Applicable | | Increase |

Westcap Strategic Operator U.S. Feeder Fund, LP | | $ | 8,652,438 | | Market Approach | | General Partner Net Asset Value | | Not Applicable | | Increase |

| | | | | | | | Discount Rate | | 1.77% | | Decrease |

Secondary Funds | | | | | | | | | | | |

BRCE SPV I, LLC | | $ | 254,491 | | Market Approach | | General Partner Net Asset Value | | Not Applicable | | Increase |

Forrest Holdings I, LP – Class A | | $ | 13,634 | | Market Approach | | Transaction Price | | Not Applicable | | Increase |

Forrest Holdings I, LP – Class B | | $ | 190,808 | | Market Approach | | Transaction Price | | Not Applicable | | Increase |

Graphite Capital Partners VIII D, LP | | $ | 4,841,715 | | Market Approach | | General Partner Net Asset Value | | Not Applicable | | Increase |

Total Level 3 Investments | | $ | 50,031,407 | | | | | | | | |

The following is the fair value measurement of investments that are measured at the Fund’s pro rata NAV (or its equivalent) as a practical expedient:

Private Investments* | | Investment Strategy | | Fair Value | | Unfunded

Commitments | | Redemption

Frequency | | Redemption

Notice Period | | Lock Up Period |

ACP Hyperdrive Co-Invest, LLC | | Private Equity Co-Investment | | $ | 2,620,000 | | $ | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street 2009 Direct Fund, LP | | Private Equity Secondary | | | 24,107 | | | 1,762 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street 2010 Direct Fund, LP | | Private Equity Secondary | | | 29,343 | | | 3,471 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street 2011 Direct Fund, LP | | Private Equity Secondary | | | 41,638 | | | 6,666 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street 2011 Non-U.S. Developed Markets Fund, LP | | Private Equity Secondary | | | 140,953 | | | 42,587 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street 2011 U.S. Fund, LP | | Private Equity Secondary | | | 318,549 | | | 58,073 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street 2013 Global Fund, LP | | Private Equity Secondary | | | 1,907,607 | | | 134,811 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street 2014 Global Fund, LP | | Private Equity Secondary | | | 1,055,592 | | | 69,822 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street Partnership Fund 2009 Non-U.S. Developed Markets Fund, LP | | Private Equity Secondary | | | 115,939 | | | 29,504 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street Partnership Fund 2009 U.S. Fund, LP | | Private Equity Secondary | | | 260,310 | | | 36,490 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street Partnership Fund 2010 Non-U.S. Developed Markets Fund, LP | | Private Equity Secondary | | | 111,342 | | | 26,567 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Adams Street Partnership Fund 2010 U.S. Fund, LP | | Private Equity Secondary | | | 291,712 | | | 52,955 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Altor Fund IV (No. 1) AB | | Private Equity Secondary | | | 6,208,258 | | | 1,986,344 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

21

Bow River Capital Evergreen Fund |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

MARCH 31, 2023 |

Private Investments* | | Investment Strategy | | Fair Value | | Unfunded

Commitments | | Redemption

Frequency | | Redemption

Notice Period | | Lock Up Period |

AP DSB Co-Invest II, LP | | Private Equity Co-Investment | | $ | 3,561,985 | | $ | 39,424 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Ashgrove Specialty Lending Fund I SCSp RAIF | | Private Credit Primary | | | 1,289,558 | | | 976,033 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

ASP (Feeder) 2017 Global Fund, LP | | Private Equity Secondary | | | 1,160,633 | | | 179,185 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Avista Capital Partners V, LP | | Private Equity Primary | | | 4,690,650 | | | 112,052 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Biloxi Co-Investment Partners, LP | | Private Equity Co-Investment | | | 1,681,794 | | | 544,679 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

BW Colson Co-Invest Feeder (Cayman), LP | | Private Equity Co-Investment | | | 3,822,242 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Carlyle Riser Co-Investment, LP | | Private Equity Co-Investment | | | 4,635,058 | | | 1,000,000 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Coller Credit Opportunities I – Annex I, SLP | | Private Credit Secondary | | | 3,136,179 | | | 1,126,133 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Coller Credit Opportunities I – B, LP | | Private Credit Primary | | | 2,074,985 | | | 3,111,281 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Coller International Partners VI Feeder Fund, LP – Class A | | Private Equity Secondary | | | 990,109 | | | 327,000 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Coller International Partners VII Feeder Fund, LP – Series B | | Private Equity Secondary | | | 1,805,561 | | | 1,244,188 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Constellation 2022, LP | | Private Equity Co-Investment | | | 4,998,967 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Corsair Amore Investors, LP | | Private Equity Co-Investment | | | 4,994,829 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Coyote 2021, LP | | Private Equity Co-Investment | | | 7,652,220 | | | 393,776 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

CRG Partners III – Parallel Fund (A), LP | | Private Credit Secondary | | | 3,615,488 | | | 2,895,395 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Digital Alpha Solutions Fund, LP | | Private Credit Co-Investment | | | 3,829,410 | | | 560,154 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Enak Aggregator, LP | | Private Equity Co-Investment | | | 3,185,673 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

EnCap Energy Transition Fund 1-A, LP | | Private Equity Primary | | | 3,043,313 | | | 1,607,436 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Falcon Co-Investment Partners, LP | | Private Equity Co-Investment | | | 2,895,574 | | | 1,101,449 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

FFL Capital Partners V, LP | | Private Equity Primary | | | 5,651,328 | | | 3,382,145 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Global Infrastructure Partners II-C, LP | | Private Equity Secondary | | | 1,215,146 | | | 229,867 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Grain Spectrum Holdings III (Cayman), LP | | Private Equity Primary | | | 3,310,155 | | | 553,296 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

ISH Co-Investment Aggregator, LP | | Private Equity Co-Investment | | | 2,573,735 | | | 692,308 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

KH Aggregator, LP | | Private Equity Secondary | | | 4,824,252 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Lynx EBO Fund I (A), LLC | | Private Credit Primary | | | 447,112 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

OceanSound Partners Co-Invest II, LP – Series B | | Private Equity Co-Investment | | | 5,464,518 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

OceanSound Partners Co-Invest II, LP – Series E | | Private Equity Co-Investment | | | 7,569,913 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

OceanSound Partners Fund, LP | | Private Equity Primary | | | 4,583,838 | | | 934,679 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Onex Fund V, LP | | Private Equity Secondary | | | 6,516,342 | | | 1,554,275 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

22

Bow River Capital Evergreen Fund |

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

MARCH 31, 2023 |

Private Investments* | | Investment Strategy | | Fair Value | | Unfunded

Commitments | | Redemption

Frequency | | Redemption

Notice Period | | Lock Up Period |

Onex OD Co-Invest, LP | | Private Equity Co-Investment | | $ | 5,292,788 | | $ | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Onex Structured Credit Opportunities International Fund I, LLC | | Private Equity Primary | | | 1,629,394 | | | 284,515 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Overbay Fund XIV (AIV III), LP | | Private Equity Secondary | | | 2,443,436 | | | 170,407 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Overbay Fund XIV Offshore (AIV), LP | | Private Equity Secondary | | | 4,121,372 | | | 579,387 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Overbay Fund XIV Offshore, LP | | Private Equity Secondary | | | 2,411,632 | | | 16,715 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Palms Co-Investment Partners, LP | | Private Equity Co-Investment | | | 3,807,958 | | | 190,476 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

PARIOU S.L.P. | | Private Credit Co-Investment | | | 5,842,948 | | | 33,576 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

PIMCO DSCO Fund II Offshore Feeder, LP | | Private Credit Primary | | | 4,799,094 | | | — | | Quarterly | | 60 days | | Not Applicable |

Porcupine Holdings, LP – Class A | | Private Equity Secondary | | | 2,895,534 | | | 2,075,472 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Porcupine Holdings, LP – Class B | | Private Equity Secondary | | | 2,543,439 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Post Limited Term High Yield Fund, LP | | Short Duration High Yield | | | 6,042,865 | | | — | | Monthly | | 30 days | | Not Applicable |

Project Stream Co-Invest Fund, LP | | Private Equity Co-Investment | | | 1,666,765 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Ruffer Absolute Institutional, Ltd. | | Global Macro | | | 5,091,501 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Saba Capital Carry Neutral Tail Hedge Offshore Fund, Ltd. | | Long/Short Carry Neutral | | | 5,475,615 | | | — | | Monthly | | 35 days | | 6 months |

SANCY S.L.P. | | Private Equity Co-Investment | | | 1,624,496 | | | 11,192 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

SEP Hamilton III Aggregator, LP | | Private Equity Co-Investment | | | 6,585,374 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

SEP Skyhawk Fund III Aggregator, LP | | Private Equity Co-Investment | | | 545,487 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Sumeru Equity Partners Fund III, LP | | Private Equity Primary | | | 2,460,102 | | | 509,451 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Sumeru Equity Partners Fund IV, LP | | Private Equity Primary | | | 398,869 | | | 3,513,298 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

TKO Fund | | Private Credit Primary | | | 3,411,419 | | | 2,150,460 | | Subject to GP Consent | | Not Applicable | | Not Applicable |

VCPF III Co-Invest 1-A, LP | | Private Credit Co-Investment | | | 2,623,806 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Vistage Equity Investors, LP | | Private Equity Co-Investment | | | 4,999,608 | | | — | | Subject to GP Consent | | Not Applicable | | Not Applicable |

Voloridge Fund, LP | | Absolute Return | | | 5,293,489 | | | — | | Monthly | | 90 days | | Not Applicable |