UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23570

Simplify Exchange Traded Funds

(Exact name of registrant as specified in charter)

54 West 40th Street

New York, NY 10018

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (646) 741-2438

Date of fiscal year end: June 30

Date of reporting period: June 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

June 30, 2021

Annual Report

Simplify Exchange Traded Funds

Simplify Interest Rate Hedge ETF (PFIX)

Simplify Nasdaq 100 PLUS Convexity ETF (formerly Simplify Growth Equity PLUS Convexity ETF) (QQC)

Simplify Nasdaq 100 PLUS Downside Convexity ETF (formerly Simplify Growth Equity PLUS Downside Convexity ETF) (QQD)

Simplify US Equity PLUS Convexity ETF (SPYC)

Simplify US Equity PLUS Downside Convexity ETF (SPD)

Simplify US Equity PLUS GBTC ETF (SPBC)

Simplify US Equity PLUS Upside Convexity ETF (SPUC)

Simplify Volt Cloud and Cybersecurity Disruption ETF (VCLO)

Simplify Volt Fintech Disruption ETF (VFIN)

Simplify Volt Pop Culture Disruption ETF (VPOP)

Simplify Volt RoboCar Disruption and Tech ETF (VCAR)

Simplify Volatility Premium ETF (SVOL)

Simplify Exchange Traded Funds

Table of Contents

Simplify Exchange Traded Funds

Letter to Shareholders (Unaudited)

Dear Shareholder,

I am honored to write to you this inaugural shareholder letter on behalf of all of us at Simplify Asset Management (“Simplify”). Founded in 2020, Simplify is a fintech startup founded by veterans of leading asset management firms. We are particularly focused on “long volatility” strategies that make use of options and other derivatives to help improve risk-adjusted returns, portfolio efficiency, and investment outcomes. Our clients are mostly advisors and institutional asset managers using exchange-traded funds (“ETFs”). We believe in a first principles approach to asset allocation and portfolio construction, the importance of education and accessibility to support our advisor clients, and the power and efficiency of technology to augment human capital.

The past 12 months as of June 30, 2021 has been a study of contrasts. On one hand, it has been a very difficult period defined by a once-in-a-generation pandemic and associated stay-at-home policies, social distancing and hardships. On the other hand, we have seen remarkable innovations in medicine and science and a demonstration of human resilience, sacrifice and will to carry on and protect those most vulnerable. While no one knows the duration of this war on covid-19, I am confident we will emerge stronger than ever.

In terms of financial markets, the 12-month period has been nothing but spectacular. Coordinated global monetary and fiscal policies increased liquidity and risk appetite, pushing most risk assets towards all-time highs. US equity returns led the way with the S&P 500 index up over 40%, Nasdaq 100 index up over 44%, and Russell 2000 up 62%. International markets also rebounded strongly with the MSCI EAFE up almost 33% and MSCI EM up over 41% over the 12-month period.

Both realized and implied volatility dropped over this period with the spot VIX index falling in half over this period. But underneath the relative calm of the market, the demand for safety and diversification remains high with yields clinging near lows and the demand for portfolio hedges including equity puts elevated.

While inflation has increased over this period, it is for the most part viewed to be “transitory” in nature as priced in breakeven inflation rates. We believe the market for the most part has priced in a Goldilocks scenario of easing financial conditions, transitory inflationary pressures, continued liquidity, a perpetual bid for risk assets and improving fundamentals as we eventually exit from the pandemic. It very much feels like the calm before the (next) storm but for now “There Is No Alternative” (TINA) and “Fear of Missing Out” (FOMO) are the two momentum factors feeding the strong domestic appetite for equity and contributing to the resilience of the U.S. equity market.

We are committed to continue to bring to you innovative strategies to help meet the asset allocation needs of your portfolio. We encourage you to reach out to your financial advisor and/or visit our website at www.simplify.us. to learn more about Simplify’s strategies, team and thoughts.

Thank you and best regards,

Paul Kim

President, Simplify Exchange Traded Funds

CEO and co-founder, Simplify Asset Management Inc.

1

Simplify Interest Rate Hedge ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

Simplify Interest Rate Hedge ETF [Ticker: PFIX]

For the period ended June 30, 2021, PFIX returned -18.89% since its inception on May 10, 2021 vs. the ICE U.S. Treasury 20+ Year Bond Index benchmark return of 4.83% for the same period. The Fund’s underperformance is due to the payer swaption position which decreased in value as the 20-year U.S. Treasury yield declined 20 bps during this period. The 5-year U.S. Treasury position also decreased in value as 5-year yields rose 7 bps from May 10th to June 30th. A variety of factors including central bank policy, economic growth, and investor expectations will likely drive movement in longer dated yields.

At June 30, 2021, the Fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify Interest Rate Hedge NAV | -18.89 | % | ||

| Simplify Interest Rate Hedge Market Price | -17.21 | % | ||

| ICE U.S. Treasury 20+ Year Bond Index | 4.83 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.50% and the net expense ratio is 0.50%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception May 10, 2021.

The ICE U.S. Treasury 20+ Year Bond Index is part of a series of indices intended to the assess U.S. Treasury market. The Index is market value weighted and is designed to measure the performance of U.S. dollar denominated, fixed rate securities with minimum term to maturity greater than twenty years. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

2

Simplify Nasdaq 100 PLUS Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

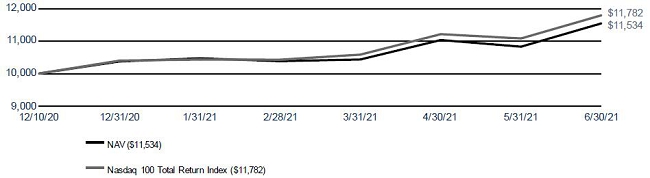

Simplify Nasdaq 100 PLUS Convexity ETF [Ticker: QQC]

For the period ended June 30, 2021, QQC returned 15.33% since its inception on December 10, 2020 vs. the Nasdaq 100 Total Return Index benchmark return of 17.82% for the same period. The Fund’s underperformance is due to the options overlay, a budgeted allocation which seeks to provide or aims to provide downside protection and upside capture when the Nasdaq 100 Total Return index drops and/ or rises significantly. In a steadily rising market such as the one we experienced in the past year, the options budget added cost to the portfolio.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 10, 2020* to June 30, 2021

* Inception date.

3

Simplify Nasdaq 100 PLUS Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify Nasdaq 100 PLUS Convexity ETF NAV | 15.33 | % | ||

| Simplify Nasdaq 100 PLUS Convexity ETF Market Price | 15.98 | % | ||

| Nasdaq 100 Total Return Index | 17.82 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.70% and the net expense ratio is 0.45%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception December 10, 2020.

The Nasdaq 100 Total Return Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market based on market capitalization. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

4

Simplify Nasdaq 100 PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

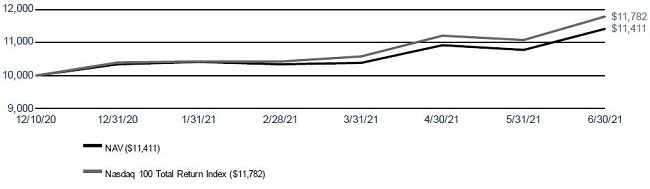

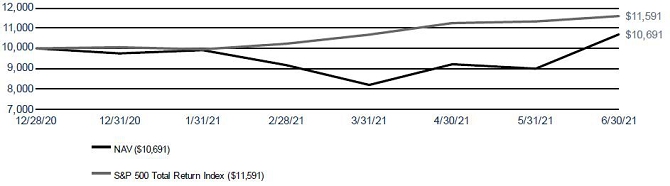

Simplify Nasdaq 100 PLUS Downside Convexity ETF [Ticker: QQD]

For the period ended June 30, 2021, QQD returned 14.11% since its inception on December 10, 2020 vs. the Nasdaq 100 Total Return Index benchmark return of 17.82% for the same period. The Fund’s underperformance is due to the options overlay, a budgeted allocation which seeks or aims to provide downside protection to the Fund when the Nasdaq 100 Total Return index drops significantly. In a steadily rising market such as the one we experienced in the past year, the options budget added cost to the portfolio.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 10, 2020* to June 30, 2021

* Inception date.

5

Simplify Nasdaq 100 PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify Nasdaq 100 PLUS Downside Convexity NAV | 14.11 | % | ||

| Simplify Nasdaq 100 PLUS Downside Convexity Market Price | 14.41 | % | ||

| Nasdaq 100 Total Return Index | 17.82 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.70% and the net expense ratio is 0.45%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception December 10, 2020.

The Nasdaq 100 Total Return Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market based on market capitalization. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

6

Simplify US Equity PLUS Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

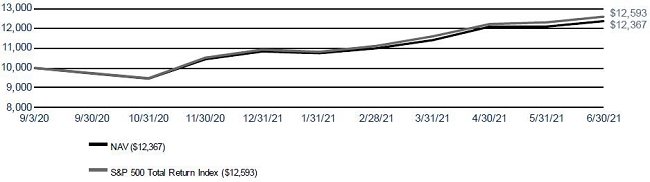

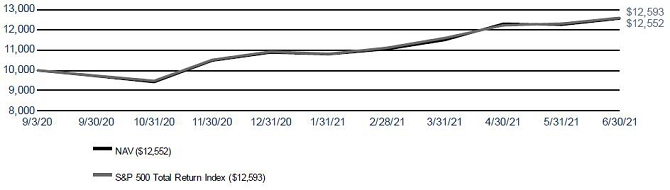

Simplify US Equity PLUS Convexity ETF [Ticker: SPYC]

For the period ended June 30, 2021, SPYC returned 23.68% since its inception on September 3, 2020 vs. the S&P 500 Total Return Index benchmark return of 25.77% for the same period. The Fund’s underperformance is due to the options overlay, a budgeted allocation which seeks or aims to provide downside protection and upside capture when the broad U.S. equity market index drops and/or rises significantly. In a steadily rising market such as the one we experienced in the past year, the options budget added cost to the portfolio.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 3, 2020* to June 30, 2021

* Inception date.

7

Simplify US Equity PLUS Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify US Equity PLUS Convexity ETF NAV | 23.68 | % | ||

| Simplify US Equity PLUS Convexity ETF Market Price | 24.46 | % | ||

| S&P 500 Total Return Index | 25.77 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.53% and the net expense ratio is 0.28%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception September 3, 2020.

The S&P 500 Total Return Index is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

8

Simplify US Equity PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

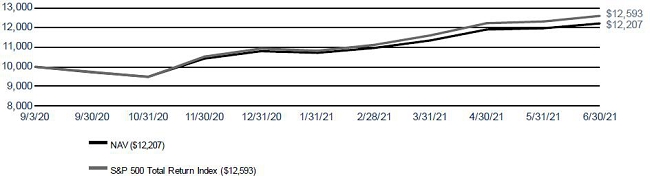

Simplify US Equity PLUS Downside Convexity ETF [Ticker: SPD]

For the period ended June 30, 2021, SPD returned 22.07% since its inception on September 3, 2020 vs. the S&P 500 Total Return Index benchmark return of 25.77% for the same period. The Fund’s underperformance is due to the options overlay, a budgeted allocation which helps or seeks to provide downside protection to the Fund when the broad U.S. equity market index drops significantly. In a steadily rising market such as the one we experienced in the past year, the options budget added cost to the portfolio.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 3, 2020* to June 30, 2021

* Inception date.

9

Simplify US Equity PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify US Equity PLUS Downside Convexity ETF NAV | 22.07 | % | ||

| Simplify US Equity PLUS Downside Convexity ETF Market Price | 23.06 | % | ||

| S&P 500 Total Return Index | 25.77 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.53% and the net expense ratio is 0.28%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception September 3, 2020.

The S&P 500 Total Return Index is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

10

Simplify US Equity PLUS GBTC ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

Simplify US Equity PLUS GBTC ETF [Ticker: SPBC]

For the period ended June 30, 2021, SPBC returned 1.46% since its inception on May 24, 2021 vs. the S&P 500 Total Return Index benchmark return of 2.55% for the same period. The Fund’s underperformance is due to its allocation to the Grayscale Bitcoin Trust (GBTC), which lagged the broader U.S. equity markets during this period.

At June 30, 2021, the Fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify U.S. Equity PLUS GBTC ETF NAV | 1.46 | % | ||

| Simplify U.S. Equity PLUS GBTC ETF Market Price | 2.31 | % | ||

| S&P 500 Total Return Index | 2.55 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.50% and the net expense ratio is 0.50%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception May 24, 2021.

The S&P 500 Total Return Index is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

11

Simplify US Equity PLUS Upside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

Simplify US Equity PLUS Upside Convexity ETF [Ticker: SPUC]

For the period ended June 30, 2021, SPUC returned 25.52% since its inception on September 3, 2020 vs. the S&P 500 Total Return Index benchmark return of 25.77% for the same period. The Fund’s underperformance is due to the options overlay, a budgeted allocation which seeks or aims to provide upside capture when the broad U.S. equity market index rises significantly. In a steadily rising market such as the one we experienced in the past year, the options budget added cost to the portfolio.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 3, 2020* to June 30, 2021

* Inception date.

12

Simplify US Equity PLUS Upside Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify US Equity PLUS Upside Convexity ETF NAV | 25.52 | % | ||

| Simplify US Equity PLUS Upside Convexity ETF Market Price | 26.41 | % | ||

| S&P 500 Total Return Index | 25.77 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.53% and the net expense ratio is 0.28%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception September 3, 2020.

The S&P 500 Total Return Index is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

13

Simplify Volt Cloud and Cybersecurity Disruption ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

Simplify Volt Cloud and Cybersecurity Disruption ETF [Ticker: VCLO]

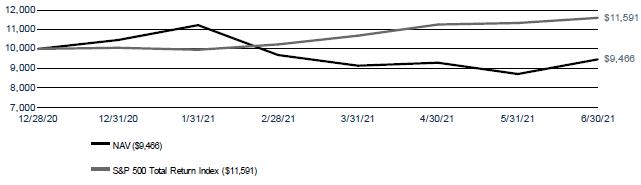

For the period ended June 30, 2021, VCLO returned 6.91% since its inception on December 28, 2020 vs. the S&P 500 Total Return Index benchmark return of 16.10% for the same period. The Fund’s underperformance is due to its high cash position (13.3% as of June 30, 2021) which limited the portfolio exposure to the rising U.S. equity market. During the reporting period, the fund provided exposure to the cloud and cyberspace subsector. As such, if this were to continue, we could expect performance to deviate from its benchmark which represents the broader U.S. equity market.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 28, 2020* to June 30, 2021

* Inception date.

14

Simplify Volt Cloud and Cybersecurity Disruption ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify Volt Cloud and Cybersecurity Disruption ETF NAV | 6.91 | % | ||

| Simplify Volt Cloud and Cybersecurity Disruption ETF Market Price | 11.27 | % | ||

| S&P 500 Total Return Index | 16.10 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.02% and the net expense ratio is 1.02%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception December 28, 2020.

The S&P 500 Total Return Index is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

15

Simplify Volt Fintech Disruption ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

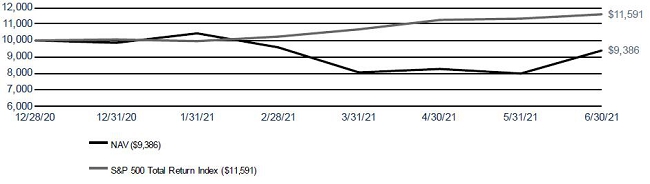

Simplify Volt Fintech Disruption ETF [Ticker: VFIN]

For the period ended June 30, 2021, VFIN returned -6.14% since its inception on December 28, 2020 vs. the S&P 500 Total Return Index benchmark return of 16.10% for the same period. The Fund’s underperformance is due to its sizable holdings (more than 39% by market value) in Lemonade Inc. (LMND) and Square Inc. (SQ), both of which lagged the broader U.S. equity market. During the reporting period, the fund provided exposure to the financial technology subsector. As such, if this were to continue, we could expect performance to deviate from its benchmark which represents the broader U.S. equity market.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 28, 2020* to June 30, 2021

* Inception date.

16

Simplify Volt Fintech Disruption ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify Volt Fintech Disruption ETF NAV | -6.14 | % | ||

| Simplify Volt Fintech Disruption ETF Market Price | -5.29 | % | ||

| S&P 500 Total Return Index | 16.10 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.03% and the net expense ratio is 1.03%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception December 28, 2020.

The S&P 500 Total Return Index is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

17

Simplify Volt Pop Culture Disruption ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

Simplify Volt Pop Culture Disruption ETF [Ticker: VPOP]

For the period ended June 30, 2021, VPOP returned -1.19% since its inception on December 28, 2020 vs. the S&P 500 Total Return Index benchmark return of 16.10% for the same period. Overall, the fund underperformed versus its index. Despite the strong performance from the fund’s holdings in SNAP and FB, the fund’s sizable allocation to SPOT, PTON, and NFLX (over 25% of market value combined) which decreased in value in a rising equity market detracted from performance. During the reporting period, the fund provided exposure to the media and technology subsectors. As such, if this were to continue, we could expect performance to deviate from its benchmark which represents the broader U.S. equity market.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 28, 2020* to June 30, 2021

* Inception date.

18

Simplify Volt Pop Culture Disruption ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify Volt Pop Culture Disruption ETF NAV | -1.19 | % | ||

| Simplify Volt Pop Culture Disruption ETF Market Price | 0.90 | % | ||

| S&P 500 Total Return Index | 16.10 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.03% and the net expense ratio is 1.03%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception December 28, 2020.

The S&P 500 Total Return Index is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

19

Simplify Volt RoboCar Disruption and Tech ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

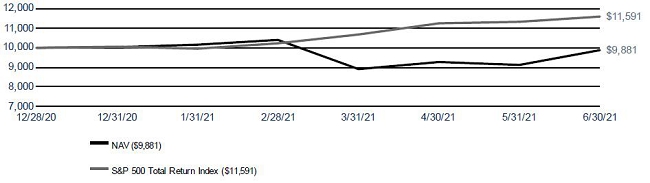

Simplify Volt Robocar Disruption and Tech ETF [Ticker: VCAR]

For the period ended June 30, 2021, VCAR returned -5.34% since its inception on December 28, 2020 vs. the S&P 500 Total Return Index benchmark return of 16.10% for the same period. The Fund’s underperformance is due to its sizable allocation (with over 24% of portfolio’s market value) to Tesla (TSLA), which underperformed relative to the broader U.S. equity market. Tesla was the only single stock holding in the Fund as of June 30, 2021. During the reporting period, the fund provided exposure to the autonomous vehicle & tech subsector. As such, if this were to continue, we could expect performance to deviate from its benchmark which represents the broader U.S. equity market.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 28, 2020* to June 30, 2021

* Inception date.

20

Simplify Volt RoboCar Disruption and Tech ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2021 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify Volt RoboCar Disruption and Tech ETF NAV | -5.34 | % | ||

| Simplify Volt RoboCar Disruption and Tech ETF Market Price | -4.81 | % | ||

| S&P 500 Total Return Index | 16.10 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.09% and the net expense ratio is 1.09%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception December 28, 2020.

The S&P 500 Total Return Index is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

21

Simplify Volatility Premium ETF

Management’s Discussion of Fund Performance

June 30, 2021 (Unaudited)

Simplify Volatility Premium ETF [Ticker: SVOL]

For the period ended June 30, 2021, SVOL returned 8.05% since its inception on May 12, 2021 vs. the S&P 500 VIX Short-Term Futures Index benchmark return of -39.11% for the same period. The Fund’s outperformance is due to the monetization of premiums in short term VIX futures, which declined during this period.

At June 30, 2021, the Fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2021

| Cumulative Total Return* | ||||

| Simplify Volatility Premium ETF NAV | 8.05 | % | ||

| Simplify Volatility Premium ETF Market Price | 7.56 | % | ||

| S&P 500 VIX Short-Term Futures Index | -39.11 | % | ||

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.50% and the net expense ratio is 0.50%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

* Since Inception May 12, 2021.

The S&P 500® VIX Short-Term Futures Index utilizes prices of the next two near-term VIX® futures contracts to replicate a position that rolls the nearest month VIX futures to the next month on a daily basis in equal fractional amounts. This results in a constant one-month rolling long position in first and second month VIX futures contracts. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

22

Simplify Exchange Traded Funds

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of fund shares, and (2) ongoing costs, including unitary advisory fees and other Fund expenses. In the most recent six-month period the Funds, except for Simplify Interest Rate Hedge ETF, Simplify US Equity PLUS GBTC ETF, Simplify Volt Cloud and Cybersecurity Disruption ETF, Simplify Volt Fintech Disruption ETF, Simplify Volt Pop Culture Disruption ETF, Simplify Volt RoboCar Disruption and Tech ETF and Simplify Volatility Premium ETF, limited these expenses; had they not done so, expenses would have been higher. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The examples in the tables are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2021 except otherwise noted below, to June 30, 2021).

Actual expenses

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses (which is not the Fund’s actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value January 1, 2021 | Ending Account Value June 30, 2021 | Annualized Expense Ratio | Expenses Paid During the Period Per $1,000 (1) | |||||||||||||

| Simplify Interest Rate Hedge ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 811.10 | 0.50 | % | $ | 0.63 | (2) | |||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.32 | 0.50 | % | $ | 2.51 | ||||||||

| Simplify Nasdaq 100 PLUS Convexity ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,112.50 | 0.25 | % | $ | 1.31 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.55 | 0.25 | % | $ | 1.25 | ||||||||

| Simplify Nasdaq 100 PLUS Downside Convexity ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,103.50 | 0.25 | % | $ | 1.30 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.55 | 0.25 | % | $ | 1.25 | ||||||||

| Simplify US Equity PLUS Convexity ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,141.50 | 0.25 | % | $ | 1.33 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.55 | 0.25 | % | $ | 1.25 | ||||||||

| Simplify US Equity PLUS Downside Convexity ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,130.50 | 0.25 | % | $ | 1.32 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.55 | 0.25 | % | $ | 1.25 | ||||||||

| Simplify US Equity PLUS GBTC ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,014.60 | 0.51 | % | $ | 0.52 | (3) | |||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.27 | 0.51 | % | $ | 2.56 | ||||||||

| Simplify US Equity PLUS Upside Convexity ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,154.00 | 0.25 | % | $ | 1.34 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,023.55 | 0.25 | % | $ | 1.25 | ||||||||

| Simplify Volt Cloud and Cybersecurity Disruption ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,096.20 | 0.95 | % | $ | 4.94 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,020.08 | 0.95 | % | $ | 4.76 | ||||||||

| Simplify Volt Fintech Disruption ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 952.40 | 0.96 | % | $ | 4.65 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,020.03 | 0.96 | % | $ | 4.81 | ||||||||

| Simplify Volt Pop Culture Disruption ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 985.00 | 0.95 | % | $ | 4.68 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,020.08 | 0.95 | % | $ | 4.76 | ||||||||

23

Simplify Exchange Traded Funds

Fees and Expenses (Unaudited) (Continued)

| Beginning Account Value January 1, 2021 | Ending Account Value June 30, 2021 | Annualized Expense Ratio | Expenses Paid During the Period Per $1,000 (1) | |||||||||||||

| Simplify Volt RoboCar Disruption and Tech ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 905.30 | 0.95 | % | $ | 4.49 | ||||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,020.08 | 0.95 | % | $ | 4.76 | ||||||||

| Simplify Volatility Premium ETF | ||||||||||||||||

| Actual | $ | 1,000.00 | $ | 1,080.50 | 0.51 | % | $ | 0.71 | (4) | |||||||

| Hypothetical (5% return before expenses) | $ | 1,000.00 | $ | 1,022.27 | 0.51 | % | $ | 2.56 | ||||||||

| (1) | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 181 (the number of days in the most recent six-month period), then divided by 365. |

| (2) | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 51 (the number of days in the period May 11, 2021 (commencement of operations) to June 30, 2021), then divided by 365. |

| (3) | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 37 (the number of days in the period May 25, 2021 (commencement of operations) to June 30, 2021), then divided by 365. |

| (4) | Expenses are equal to each Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 49 (the number of days in the period May 13, 2021 (commencement of operations) to June 30, 2021), then divided by 365. |

24

Simplify Interest Rate Hedge ETF

Schedule of Investments

June 30, 2021

| Principal | Value | |||||||

| U.S. Government Obligations – 61.4% | ||||||||

| U.S. Treasury Note, 0.75%, 4/30/2026(a) | ||||||||

| (Cost $38,631,530) | $ | 38,750,000 | $ | 38,577,441 | ||||

| Notional Amount | ||||||||

| Purchased Swaptions – (18.8)% | ||||||||

| Puts – Over the Counter – (18.8)% | ||||||||

| Interest Rate Swaption, pay semi annually a fixed rate of 4.25% and received quarterly a floating rate of 3-month LIBOR, Expires 5/11/28 (counterparty: Bank of America NA) | 280,000,000 | (1,205,217 | ) | |||||

| Interest Rate Swaption, pay semi annually a fixed rate of 3.50% and received quarterly a floating rate of 3-month LIBOR, Expires 5/12/28 (counterparty: Goldman Sachs International) | 74,000,000 | (1,209,670 | ) | |||||

| Interest Rate Swaption, pay semi annually a fixed rate of 4.25% and received quarterly a floating rate of 3-month LIBOR, Expires 5/12/28 (counterparty: Goldman Sachs International) | 250,000,000 | (2,859,215 | ) | |||||

| Interest Rate Swaption, pay semi annually a fixed rate of 3.50% and received quarterly a floating rate of 3-month LIBOR, Expires 5/11/28 (counterparty: Morgan Stanley Capital Services LLC) | 166,000,000 | (3,209,207 | ) | |||||

| Interest Rate Swaption, pay semi annually a fixed rate of 4.25% and received quarterly a floating rate of 3-month LIBOR, Expires 5/11/28 (counterparty: Morgan Stanley Capital Services LLC) | 310,000,000 | (3,304,947 | ) | |||||

| (11,788,256 | ) | |||||||

| Total Purchased Swaptions (Cost $0) | (11,788,256 | ) | ||||||

| Total Investments – 42.6% | ||||||||

| (Cost $38,631,530) | $ | 26,789,185 | ||||||

| Other Assets in Excess of Liabilities – 57.4% | 36,070,936 | |||||||

| Net Assets – 100.0% | $ | 62,860,121 | ||||||

| (a) | Security with an aggregate market value of $6,084,783 and cash of $7,390,000 have been pledged as collateral for purchased swaptions as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| U.S. Government Obligations | 61.4 | % | ||

| Purchased Swaptions | (18.8 | )% | ||

| Total Investments | 42.6 | % | ||

| Other Assets in Excess of Liabilities | 57.4 | % | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

25

Simplify Nasdaq 100 PLUS Convexity ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Exchange-Traded Funds – 98.1% | ||||||||

| Invesco QQQ Trust Series 1(a) | ||||||||

| (Cost $2,471,286) | 8,169 | $ | 2,895,339 | |||||

| Number of Contracts | Notional Amount | |||||||||

| Purchased Options – 1.9% | ||||||||||

| Calls – Exchange-Traded – 1.4% | ||||||||||

| NASDAQ 100 Index, September Strike Price $17,000, Expires 9/17/21 | 1 | $ | 1,700,000 | 1,195 | ||||||

| NASDAQ 100 Index, December Strike Price $16,000, Expires 12/17/21 | 1 | 1,600,000 | 21,930 | |||||||

| NASDAQ 100 Index, March Strike Price $17,000, Expires 3/18/22 | 1 | 1,700,000 | 17,445 | |||||||

| 40,570 | ||||||||||

| Puts – Exchange-Traded – 0.5% | ||||||||||

| Invesco QQQ Trust, June Strike Price $100, Expires 6/17/22 | 119 | 1,190,000 | 3,689 | |||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/17/21 | 1 | 700,000 | 475 | |||||||

| NASDAQ 100 Index, December Strike Price $4,000, Expires 12/17/21 | 3 | 1,200,000 | 945 | |||||||

| NASDAQ 100 Index, March Strike Price $7,000, Expires 3/18/22 | 1 | 700,000 | 3,205 | |||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/16/22 | 1 | 700,000 | 6,100 | |||||||

| 14,414 | ||||||||||

| Total Purchased Options (Cost $82,343) | 54,984 | |||||||||

| Shares | ||||||||

| Money Market Funds – 0.0%† | ||||||||

| Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, 0.01%(b) | ||||||||

| (Cost $1,037) | 1,037 | 1,037 | ||||||

| Total Investments – 100.0% | ||||

| (Cost $2,554,666) | $ | 2,951,360 | ||

| Other Assets in Excess of Liabilities – 0.0%† | 1,281 | |||

| Net Assets – 100.0% | $ | 2,952,641 |

| † | Less than 0.05% |

| (a) | A copy of the security’s annual report to shareholders may be obtained without charge at www.invesco.com. |

| (b) | Rate shown reflects the 7-day yield as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Exchange-Traded Funds | 98.1 | % | ||

| Purchased Options | 1.9 | % | ||

| Money Market Funds | 0.0 | %† | ||

| Total Investments | 100.0 | % | ||

| Other Assets in Excess of Liabilities | 0.0 | %† | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

26

Simplify Nasdaq 100 PLUS Downside Convexity ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Exchange-Traded Funds – 99.1% | ||||||||

| Invesco QQQ Trust Series 1(a) | ||||||||

| (Cost $2,600,794) | 8,109 | $ | 2,874,073 | |||||

| Number of Contracts | Notional Amount | |||||||||||

| Purchased Options – 0.9% | ||||||||||||

| Puts – Exchange-Traded – 0.9% | ||||||||||||

| Invesco QQQ Trust, June Strike Price $100, Expires 6/17/22 | 236 | $ | 2,360,000 | 7,316 | ||||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/17/21 | 1 | 700,000 | 475 | |||||||||

| NASDAQ 100 Index, December Strike Price $4,000, Expires 12/17/21 | 5 | 2,000,000 | 1,575 | |||||||||

| NASDAQ 100 Index, March Strike Price $7,000, Expires 3/18/22 | 1 | 700,000 | 3,205 | |||||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/16/22 | 2 | 1,400,000 | 12,200 | |||||||||

| 24,771 | ||||||||||||

| Total Purchased Options (Cost $57,486) | 24,771 | |||||||||||

| Shares | ||||||||

| Money Market Funds – 0.0%† | ||||||||

| Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, 0.01%(b) | ||||||||

| (Cost $736) | 736 | 736 | ||||||

| Total Investments – 100.0% | ||||

| (Cost $2,659,016) | $ | 2,899,580 | ||

| Other Assets in Excess of Liabilities – 0.0%† | 976 | |||

| Net Assets – 100.0% | $ | 2,900,556 |

| † | Less than 0.05% |

| (a) | A copy of the security’s annual report to shareholders may be obtained without charge at www.invesco.com. |

| (b) | Rate shown reflects the 7-day yield as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Exchange-Traded Funds | 99.1 | % | ||

| Purchased Options | 0.9 | % | ||

| Money Market Funds | 0.0 | %† | ||

| Total Investments | 100.0 | % | ||

| Other Assets in Excess of Liabilities | 0.0 | %† | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements

27

Simplify US Equity PLUS Convexity ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Exchange-Traded Funds – 98.1% | ||||||||

| iShares Core S&P 500 ETF(a) | ||||||||

| (Cost $79,311,057) | 202,908 | $ | 87,234,207 | |||||

| Number of Contracts | Notional Amount | |||||||||||

| Purchased Options – 1.9% | ||||||||||||

| Calls – Exchange-Traded – 1.4% | ||||||||||||

| S&P 500 Index, September Strike Price $4,400, Expires 9/17/21 | 126 | $ | 55,440,000 | 634,410 | ||||||||

| S&P 500 Index, March Strike Price $5,000, Expires 3/18/22 | 172 | 86,000,000 | 257,140 | |||||||||

| SPDR S&P 500, September Strike Price $510, Expires 9/16/22 | 507 | 25,857,000 | 197,730 | |||||||||

| SPDR S&P 500, March Strike Price $510, Expires 3/17/23 | 285 | 14,535,000 | 202,778 | |||||||||

| 1,292,058 | ||||||||||||

| Puts – Exchange-Traded – 0.5% | ||||||||||||

| S&P 500 Index, September Strike Price $1,800, Expires 9/17/21 | 86 | 15,480,000 | 4,730 | |||||||||

| S&P 500 Index, December Strike Price $1,800, Expires 12/17/21 | 100 | 18,000,000 | 34,500 | |||||||||

| S&P 500 Index, March Strike Price $2,000, Expires 3/18/22 | 65 | 13,000,000 | 56,550 | |||||||||

| S&P 500 Index, June Strike Price $2,000, Expires 6/17/22 | 71 | 14,200,000 | 92,655 | |||||||||

| SPDR S&P 500, September Strike Price $210, Expires 9/16/22 | 1,025 | 21,525,000 | 221,913 | |||||||||

| 410,348 | ||||||||||||

| Total Purchased Options (Cost $1,768,209) | 1,702,406 | |||||||||||

| Shares | ||||||||

| Money Market Funds – 0.6% | ||||||||

| Dreyfus Government Cash Management Fund, Institutional Shares, 0.03%(b) | ||||||||

| (Cost $507,523) | 507,523 | 507,523 | ||||||

| Total Investments – 100.6% | ||||

| (Cost $81,586,789) | $ | 89,444,136 | ||

| Liabilities in Excess of Other Assets – (0.6)% | (497,666 | ) | ||

| Net Assets – 100.0% | $ | 88,946,470 |

| (a) | A copy of the security’s annual report to shareholders may be obtained without charge at www.ishares.com. |

| (b) | Rate shown reflects the 7-day yield as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Exchange-Traded Funds | 98.1 | % | ||

| Purchased Options | 1.9 | % | ||

| Money Market Funds | 0.6 | % | ||

| Total Investments | 100.6 | % | ||

| Liabilities in Excess of Other Assets | (0.6 | )% | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

28

Simplify US Equity PLUS Downside Convexity ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Exchange-Traded Funds – 99.1% | ||||||||

| iShares Core S&P 500 ETF(a) | ||||||||

| (Cost $205,455,276) | 517,822 | $ | 222,622,034 | |||||

| Number of Contracts | Notional Amount | |||||||||||

| Purchased Options – 0.9% | ||||||||||||

| Puts – Exchange-Traded – 0.9% | ||||||||||||

| S&P 500 Index, September Strike Price $1,800, Expires 9/17/21 | 369 | $ | 66,420,000 | 20,295 | ||||||||

| S&P 500 Index, December Strike Price $1,800, Expires 12/17/21 | 507 | 91,260,000 | 174,915 | |||||||||

| S&P 500 Index, March Strike Price $2,000, Expires 3/18/22 | 328 | 65,600,000 | 285,360 | |||||||||

| S&P 500 Index, June Strike Price $2,000, Expires 6/17/22 | 356 | 71,200,000 | 464,580 | |||||||||

| SPDR S&P 500, September Strike Price $210, Expires 9/16/22 | 5,182 | 108,822,000 | 1,121,903 | |||||||||

| 2,067,053 | ||||||||||||

| Total Purchased Options (Cost $3,779,665) | 2,067,053 | |||||||||||

| Shares | ||||||||

| Money Market Funds – 0.4% | ||||||||

| Dreyfus Government Cash Management Fund, Institutional Shares, 0.03%(b) | ||||||||

| (Cost $926,163) | 926,163 | 926,163 | ||||||

| Total Investments – 100.4% | ||||||||

| (Cost $210,161,104) | $ | 225,615,250 | ||||||

| Liabilities in Excess of Other Assets – (0.4)% | (919,617 | ) | ||||||

| Net Assets – 100.0% | $ | 224,695,633 | ||||||

| (a) | A copy of the security’s annual report to shareholders may be obtained without charge at www.ishares.com. |

| (b) | Rate shown reflects the 7-day yield as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Exchange-Traded Funds | 99.1 | % | ||

| Purchased Options | 0.9 | % | ||

| Money Market Funds | 0.4 | % | ||

| Total Investments | 100.4 | % | ||

| Liabilities in Excess of Other Assets | (0.4 | )% | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

29

Simplify US Equity PLUS GBTC ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Exchange-Traded Funds – 86.0% | ||||||||

| iShares Core S&P 500 ETF(a) | ||||||||

| (Cost $86,615,501) | 205,078 | $ | 88,167,134 | |||||

| Grantor Trusts – 8.9% | ||||||||

| Grayscale Bitcoin Trust BTC* | ||||||||

| (Cost $9,553,505) | 306,127 | 9,125,646 | ||||||

| Total Investments – 94.9% | ||||

| (Cost $96,169,006) | $ | 97,292,780 | ||

| Other Assets in Excess of Liabilities – 5.1% | 5,261,088 | |||

| Net Assets – 100.0% | $ | 102,553,868 |

| * | Non Income Producing |

| (a) | A copy of the security’s annual report to shareholders may be obtained without charge at www.ishares.com. |

| At June 30, 2021 open futures contracts purchased were as follows: |

| Number of Contracts | Notional Value | Expiration Date | Value/ Unrealized Appreciation (Depreciation) | ||||||||||

| S&P 500 E-Mini Future | 70 | $ | 15,010,100 | 9/17/21 | $ | 177,736 | |||||||

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Exchange-Traded Funds | 86.0 | % | ||

| Grantor Trusts | 8.9 | % | ||

| Total Investments | 94.9 | % | ||

| Other Assets in Excess of Liabilities | 5.1 | % | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

30

Simplify US Equity PLUS Upside Convexity ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Exchange-Traded Funds – 97.1% | ||||||||

| iShares Core S&P 500 ETF(a) | ||||||||

| (Cost $7,876,697) | 20,993 | $ | 9,025,311 | |||||

| Number of Contracts | Notional Amount | |||||||||||

| Purchased Options – 2.9% | ||||||||||||

| Calls – Exchange-Traded – 2.9% | ||||||||||||

| S&P 500 Index, September Strike Price $4,400, Expires 9/17/21 | 26 | $ | 11,440,000 | 130,910 | ||||||||

| S&P 500 Index, March Strike Price $5,000, Expires 3/18/22 | 36 | 18,000,000 | 53,820 | |||||||||

| SPDR S&P 500, September Strike Price $510, Expires 9/16/22 | 109 | 5,559,000 | 42,510 | |||||||||

| SPDR S&P 500, March Strike Price $510, Expires 3/17/23 | 61 | 3,111,000 | 43,401 | |||||||||

| 270,641 | ||||||||||||

| Total Purchased Options (Cost $261,166) | 270,641 | |||||||||||

| Shares | ||||||||

| Money Market Funds – 0.5% | ||||||||

| Dreyfus Government Cash Management Fund, Institutional Shares, 0.03%(b) | ||||||||

| (Cost $47,205) | 47,205 | 47,205 | ||||||

| Total Investments – 100.5% | ||||||||

| (Cost $8,185,068) | $ | 9,343,157 | ||||||

| Liabilities in Excess of Other Assets – (0.5)% | (46,104 | ) | ||||||

| Net Assets – 100.0% | $ | 9,297,053 | ||||||

| (a) | A copy of the security’s annual report to shareholders may be obtained without charge at www.ishares.com. |

| (b) | Rate shown reflects the 7-day yield as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Exchange-Traded Funds | 97.1 | % | ||

| Purchased Options | 2.9 | % | ||

| Money Market Funds | 0.5 | % | ||

| Total Investments | 100.5 | % | ||

| Liabilities in Excess of Other Assets | (0.5 | )% | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

31

Simplify Volt Cloud and Cybersecurity Disruption ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Common Stocks – 58.9% | ||||||||

| Communications – 1.8% | ||||||||

| Okta, Inc.* | 383 | $ | 93,712 | |||||

| Technology – 57.1% | ||||||||

| Cloudflare, Inc., Class A* | 9,000 | 952,560 | ||||||

| Crowdstrike Holdings, Inc., Class A* | 4,860 | 1,221,367 | ||||||

| Datadog, Inc., Class A* | 2,176 | 226,478 | ||||||

| Dropbox, Inc., Class A* | 6,736 | 204,168 | ||||||

| Fastly, Inc., Class A* | 2,352 | 140,179 | ||||||

| Snowflake, Inc., Class A* | 862 | 208,432 | ||||||

| Zscaler, Inc.* | 466 | 100,684 | ||||||

| 3,053,868 | ||||||||

| Total Common Stocks (Cost $2,709,558) | 3,147,580 | |||||||

| Exchange-Traded Funds – 20.8% | ||||||||

| Invesco QQQ Trust Series 1 | ||||||||

| (Cost $1,046,090) | 3,136 | 1,111,493 | ||||||

| Number of Contracts | Notional Amount | |||||||||||

| Purchased Options – 7.1% | ||||||||||||

| Calls – Exchange-Traded – 6.3% | ||||||||||||

| Cloudflare, Inc., July Strike Price $135, Expires 7/16/21 | 583 | $ | 7,870,500 | 8,162 | ||||||||

| Cloudflare, Inc., January Strike Price $135, Expires 1/21/22 | 178 | 2,403,000 | 112,585 | |||||||||

| Cloudflare, Inc., January Strike Price $135, Expires 1/20/23 | 74 | 999,000 | 121,360 | |||||||||

| Crowdstrike Holdings, Inc., January Strike Price $310, Expires 1/21/22 | 14 | 434,000 | 20,895 | |||||||||

| Crowdstrike Holdings, Inc., January Strike Price $350, Expires 1/21/22 | 10 | 350,000 | 8,050 | |||||||||

| Crowdstrike Holdings, Inc., January Strike Price $310, Expires 1/20/23 | 16 | 496,000 | 65,400 | |||||||||

| 336,452 | ||||||||||||

| Puts – Exchange-Traded – 0.8% | ||||||||||||

| Invesco QQQ Trust, June Strike Price $100, Expires 6/17/22 | 366 | 3,660,000 | 11,346 | |||||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/17/21 | 3 | 2,100,000 | 1,425 | |||||||||

| NASDAQ 100 Index, December Strike Price $4,000, Expires 12/17/21 | 14 | 5,600,000 | 4,410 | |||||||||

| NASDAQ 100 Index, March Strike Price $7,000, Expires 3/18/22 | 3 | 2,100,000 | 9,615 | |||||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/16/22 | 3 | 2,100,000 | 18,300 | |||||||||

| 45,096 | ||||||||||||

| Total Purchased Options (Cost $306,592) | 381,548 | |||||||||||

| Shares | ||||||||

| Money Market Funds – 3.2% | ||||||||

| Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, 0.01%(a) | ||||||||

| (Cost $173,678) | 173,678 | 173,678 | ||||||

| Total Investments – 90.0% | ||||||||

| (Cost $4,235,918) | $ | 4,814,299 | ||||||

| Other Assets in Excess of Liabilities – 10.0% | 535,203 | |||||||

| Net Assets – 100.0% | $ | 5,349,502 | ||||||

See Notes to Financial Statements.

32

Simplify Volt Cloud and Cybersecurity Disruption ETF

Schedule of Investments (Continued)

June 30, 2021

| * | Non Income Producing |

| (a) | Rate shown reflects the 7-day yield as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Common Stocks | 58.9 | % | ||

| Exchange-Traded Funds | 20.8 | % | ||

| Purchased Options | 7.1 | % | ||

| Money Market Funds | 3.2 | % | ||

| Total Investments | 90.0 | % | ||

| Other Assets in Excess of Liabilities | 10.0 | % | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

33

Simplify Volt Fintech Disruption ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Common Stocks – 52.9% | ||||||||

| Communications – 10.7% | ||||||||

| MercadoLibre, Inc.* | 63 | $ | 98,141 | |||||

| Pinduoduo, Inc., ADR* | 450 | 57,159 | ||||||

| Shopify, Inc., Class A* | 87 | 127,105 | ||||||

| 282,405 | ||||||||

| Consumer, Non-cyclical – 19.8% | ||||||||

| PayPal Holdings, Inc.* | 443 | 129,126 | ||||||

| Square, Inc., Class A* | 1,624 | 395,931 | ||||||

| 525,057 | ||||||||

| Financial – 22.4% | ||||||||

| Coinbase Global, Inc., Class A* | 563 | 142,608 | ||||||

| Lemonade, Inc.* | 4,102 | 448,800 | ||||||

| 591,408 | ||||||||

| Total Common Stocks (Cost $1,453,537) | 1,398,870 | |||||||

| Exchange-Traded Funds – 31.2% | ||||||||

| Invesco QQQ Trust Series 1(a) | ||||||||

| (Cost $731,546) | 2,329 | 825,467 | ||||||

| Number of Contracts | Notional Amount | |||||||||||

| Purchased Options – 8.6% | ||||||||||||

| Calls – Exchange-Traded – 7.5% | ||||||||||||

| Lemonade, Inc., September Strike Price $260, Expires 9/17/21 | 29 | $ | 754,000 | 797 | ||||||||

| Lemonade, Inc., January Strike Price $190, Expires 1/21/22 | 147 | 2,793,000 | 69,825 | |||||||||

| Lemonade, Inc., January Strike Price $190, Expires 1/20/23 | 41 | 779,000 | 68,675 | |||||||||

| Square, Inc., September Strike Price $390, Expires 9/17/21 | 27 | 1,053,000 | 1,242 | |||||||||

| Square, Inc., January Strike Price $350, Expires 1/21/22 | 18 | 630,000 | 11,205 | |||||||||

| Square, Inc., January Strike Price $350, Expires 1/20/23 | 20 | 700,000 | 45,900 | |||||||||

| 197,644 | ||||||||||||

| Puts – Exchange-Traded – 1.1% | ||||||||||||

| Invesco QQQ Trust, June Strike Price $100, Expires 6/17/22 | 201 | 2,010,000 | 6,231 | |||||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/17/21 | 2 | 1,400,000 | 950 | |||||||||

| NASDAQ 100 Index, December Strike Price $4,000, Expires 12/17/21 | 7 | 2,800,000 | 2,205 | |||||||||

| NASDAQ 100 Index, March Strike Price $7,000, Expires 3/18/22 | 2 | 1,400,000 | 6,410 | |||||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/16/22 | 2 | 1,400,000 | 12,200 | |||||||||

| 27,996 | ||||||||||||

| Total Purchased Options (Cost $443,942) | 225,640 | |||||||||||

| Shares | ||||||||

| Money Market Funds – 12.5% | ||||||||

| Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, 0.01%(b) | ||||||||

| (Cost $330,957) | 330,957 | 330,957 | ||||||

See Notes to Financial Statements.

34

Simplify Volt Fintech Disruption ETF

Schedule of Investments (Continued)

June 30, 2021

| Value | ||||

| Total Investments – 105.2% | ||||

| (Cost $2,959,982) | $ | 2,780,934 | ||

| Liabilities in Excess of Other Assets – (5.2)% | (137,282 | ) | ||

| Net Assets – 100.0% | $ | 2,643,652 | ||

| * | Non Income Producing |

| (a) | A copy of the security’s annual report to shareholders may be obtained without charge at www.invesco.com. |

| (b) | Rate shown reflects the 7-day yield as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Common Stocks | 52.9 | % | ||

| Exchange-Traded Funds | 31.2 | % | ||

| Purchased Options | 8.6 | % | ||

| Money Market Funds | 12.5 | % | ||

| Total Investments | 105.2 | % | ||

| Liabilities in Excess of Other Assets | (5.2 | )% | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

35

Simplify Volt Pop Culture Disruption ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Common Stocks – 58.4% | ||||||||

| Communications – 50.6% | ||||||||

| Facebook, Inc., Class A* | 140 | $ | 48,679 | |||||

| Netflix, Inc.* | 72 | 38,031 | ||||||

| Snap, Inc., Class A* | 3,700 | 252,118 | ||||||

| Spotify Technology SA* | 840 | 231,496 | ||||||

| Walt Disney Co. (The)* | 324 | 56,950 | ||||||

| 627,274 | ||||||||

| Consumer, Cyclical – 3.6% | ||||||||

| Peloton Interactive, Inc., Class A* | 356 | 44,151 | ||||||

| Technology – 4.2% | ||||||||

| Activision Blizzard, Inc. | 548 | 52,301 | ||||||

| Total Common Stocks (Cost $683,472) | 723,726 | |||||||

| Exchange-Traded Funds – 33.1% | ||||||||

| Invesco QQQ Trust Series 1(a) | ||||||||

| (Cost $361,771) | 1,157 | 410,075 | ||||||

| Number of Contracts | Notional Amount | |||||||||||

| Purchased Options – 4.8% | ||||||||||||

| Calls – Exchange-Traded – 3.7% | ||||||||||||

| Snap, Inc., July Strike Price $75, Expires 7/16/21 | 20 | $ | 150,000 | 1,560 | ||||||||

| Snap, Inc., January Strike Price $75, Expires 1/21/22 | 6 | 45,000 | 4,605 | |||||||||

| Snap, Inc., January Strike Price $105, Expires 1/21/22 | 41 | 430,500 | 8,405 | |||||||||

| Snap, Inc., January Strike Price $75, Expires 1/20/23 | 8 | 60,000 | 11,160 | |||||||||

| Snap, Inc., January Strike Price $105, Expires 1/20/23 | 24 | 252,000 | 16,500 | |||||||||

| Spotify Technology SA, July Strike Price $500, Expires 7/16/21 | 6 | 300,000 | 60 | |||||||||

| Spotify Technology SA, January Strike Price $500, Expires 1/21/22 | 3 | 150,000 | 443 | |||||||||

| Spotify Technology SA, January Strike Price $500, Expires 1/20/23 | 3 | 150,000 | 3,840 | |||||||||

| 46,573 | ||||||||||||

| Puts – Exchange-Traded – 1.1% | ||||||||||||

| Invesco QQQ Trust, June Strike Price $100, Expires 6/17/22 | 99 | 990,000 | 3,069 | |||||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/17/21 | 1 | 700,000 | 475 | |||||||||

| NASDAQ 100 Index, December Strike Price $4,000, Expires 12/17/21 | 3 | 1,200,000 | 945 | |||||||||

| NASDAQ 100 Index, March Strike Price $7,000, Expires 3/18/22 | 1 | 700,000 | 3,205 | |||||||||

| NASDAQ 100 Index, September Strike Price $7,000, Expires 9/16/22 | 1 | 700,000 | 6,100 | |||||||||

| 13,794 | ||||||||||||

| Total Purchased Options (Cost $122,694) | 60,367 | |||||||||||

| Shares | ||||||||

| Money Market Funds – 0.5% | ||||||||

| Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, 0.01%(b) | ||||||||

| (Cost $5,607) | 5,607 | 5,607 | ||||||

See Notes to Financial Statements.

36

Simplify Volt Pop Culture Disruption ETF

Schedule of Investments (Continued)

June 30, 2021

| Value | ||||

| Total Investments – 96.8% | ||||

| (Cost $1,173,544) | $ | 1,199,775 | ||

| Other Assets in Excess of Liabilities – 3.2% | 39,276 | |||

| Net Assets – 100.0% | $ | 1,239,051 | ||

| * | Non Income Producing |

| (a) | A copy of the security’s annual report to shareholders may be obtained without charge at www.invesco.com. |

| (b) | Rate shown reflects the 7-day yield as of June 30, 2021. |

Summary of Schedule of Investments

| Industry | % of Net Assets | |||

| Common Stocks | 58.4 | % | ||

| Exchange-Traded Funds | 33.1 | % | ||

| Purchased Options | 4.8 | % | ||

| Money Market Funds | 0.5 | % | ||

| Total Investments | 96.8 | % | ||

| Other Assets in Excess of Liabilities | 3.2 | % | ||

| Net Assets | 100.0 | % | ||

See Notes to Financial Statements.

37

Simplify Volt RoboCar Disruption and Tech ETF

Schedule of Investments

June 30, 2021

| Shares | Value | |||||||

| Exchange-Traded Funds – 70.4% | ||||||||

| Invesco Nasdaq Next Gen 100 ETF(a) | 20,854 | $ | 717,586 | |||||

| Invesco QQQ Trust Series 1(a) | 2,099 | 743,949 | ||||||

| Total Exchange-Traded Funds (Cost $1,390,472) | 1,461,535 | |||||||

| Common Stocks – 15.6% | ||||||||

| Consumer, Cyclical – 15.6% | ||||||||

| Tesla, Inc.* | ||||||||

| (Cost $371,772) | 478 | 324,896 | ||||||

| Number of Contracts | Notional Amount | |||||||||||

| Purchased Options – 9.7% | ||||||||||||

| Calls – Exchange-Traded – 8.8% | ||||||||||||