UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23570

Simplify Exchange Traded Funds

(Exact name of registrant as specified in charter)

54 West 40th Street

New York, NY 10018

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (646) 741-2438

Date of fiscal year end: June 30

Date of reporting period: June 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

June 30, 2022

Annual Report

Simplify Exchange Traded Funds

Simplify Aggregate Bond PLUS Credit Hedge ETF (AGGH)

Simplify Developed Ex-US PLUS Downside Convexity ETF (EAFD)

Simplify Emerging Markets Equity PLUS Downside Convexity ETF (EMGD)

Simplify Health Care ETF (PINK)

Simplify Hedged Equity ETF (HEQT)

Simplify High Yield PLUS Credit Hedge ETF (CDX)

Simplify Interest Rate Hedge ETF (PFIX)

Simplify Nasdaq 100 PLUS Convexity ETF (QQC)

Simplify Nasdaq 100 PLUS Downside Convexity ETF (QQD)

Simplify Risk Parity Treasury ETF (TYA)

Simplify Tail Risk Strategy ETF (CYA)

Simplify US Equity PLUS Convexity ETF (SPYC)

Simplify US Equity PLUS Downside Convexity ETF (SPD)

Simplify US Equity PLUS GBTC ETF (SPBC)

Simplify US Equity PLUS Upside Convexity ETF (SPUC)

Simplify US Small Cap PLUS Downside Convexity ETF (RTYD)

Simplify Volt Cloud and Cybersecurity Disruption ETF (VCLO)

Simplify Volt RoboCar Disruption and Tech ETF (VCAR)

Simplify Macro Strategy ETF (FIG)

Simplify Managed Futures Strategy ETF (CTA)

Simplify Volatility Premium ETF (SVOL)

Simplify Exchange Traded Funds

Table of Contents

This report is provided for the general information of shareholders and is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

Simplify Exchange Traded Funds

Table of Contents

This report is provided for the general information of shareholders and is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

Simplify Exchange Traded Funds

Letter to Shareholders (Unaudited)

Dear Shareholder,

I am honored to write on behalf of all of us at Simplify Exchange Traded Funds (“Simplify ETFs”) and Simplify Asset Management (“Simplify”). First, thank you for your trust and investment in our strategies. This past year has been one of the most challenging years to invest. It’s been a rare year when both bonds and equities have struggled. It’s also been a reminder that alternative exposures and portfolio diversification are crucial.

Our mission at Simplify is to help advisors and asset managers with their greatest investment needs: diversifying and de-risking portfolios, generating attractive income, and improving risk-adjusted returns. We are here to help our advisors and their clients remain invested and focused on the long term – staying the course on financial plans and retirement goals. We believe that transparency, education, and accessibility are more important than ever.

The past 12 months, as of June 30, 2022, US equities are down over 10% in this period, nearly 20% from the November highs. International equities have fared even worse in US dollar terms partly due to the strengthening USD. US bonds are down over 10% in the same period on the back of higher interest rates and wider credit spreads.

The steep increase in inflation globally have led to higher policy rates and financial conditions. In the US, the 10-year Treasury yield nearly doubled to 3% and June 2022 CPI year-over-year was a stunning 8.5%. Among alternatives, commodities were significantly higher, driven by energy and food prices. Volatility remains elevated, with the VIX Index1 almost doubling over the year.

Looking ahead, the threat of stagflation and recession, geopolitical pressures, disruption in food and energy markets, threats from pandemics, and political uncertainty suggest more volatility investment environment that requires steadfast focus on long-term investment goals and nimbleness in taking advantage of present opportunities.

As always, we are here to help and look forward to sharing our perspectives and strategies. We encourage you to reach out to your financial advisor and/or visit our website at www.simplify.us to learn more about Simplify’s strategies, team and perspectives.

Thank you for your trust in us.

Best regards,

Paul Kim

President, Simplify Exchange Traded Funds

CEO and co-founder, Simplify Asset Management Inc.

| 1 | The Cboe Volatility Index of often referred to as “the VIX” is a real-time market index representing the market’s expectations for volatility over the coming 30 days. It is often used as a way to gauge market sentiment, and in particular the degree of fear among market participants. |

Simplify Aggregate Bond PLUS Credit Hedge ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

Simplify Aggregate Bond PLUS Credit Hedge ETF [Ticker: AGGH]

Since its inception on February 14, 2022, performance for AGGH has been -4.89% vs. Bloomberg Capital U.S. Aggregate Bond Index return of -6.68%. The fund’s outperformance was driven by its position in two hedges; a credit hedge in the form of two equity total rate of return swaps and equity puts and its ownership of the Simplify Interest Rate Hedge ETF (PFIX). The equity hedges contributed roughly one third of the outperformance while the interest rate hedge contributed the other two thirds.

Equity markets experienced a drawdown and credit spreads widened since the fund’s inception. During the period rates and implied volatilities also increased. Both hedges performed in the manner expected. There were a variety of factors driving the changes in the equity valuation, credit spread and rate environment including central bank policy, changes in realized and expected inflation as well changes in expectation relating to future economic growth.

In the next 12 months, we expect that credit risk may remain elevated and as such believe our credit hedge to remain viable. Additionally, we expect to continue focusing on shorter-dated equity puts as hedges given the high equity volatility environment. Finally, we continue to see value in an asymmetric duration hedge like PFIX.

At June 30, 2022, the fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Aggregate Bond PLUS Credit Hedge ETF NAV | | | -4.89 | % |

| Simplify Aggregate Bond PLUS Credit Hedge ETF Market Price | | | -4.74 | % |

| Bloomberg Capital U.S. Aggregate Bond Index | | | -6.68 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.54% and the net expense ratio is 0.29%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception February 14, 2022. |

The Bloomberg Capital U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Developed Ex-US PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

Simplify Developed Ex-US PLUS Downside Convexity ETF [Ticker: EAFD]

Since its inception on January 10, 2022, EAFD returned -21.47% vs. the MSCI EAFE IMI Index benchmark return of -20.53% for the same period.

The fund’s underperformance is due to the 300bps option budget on downside protection. The option value decayed away during this period resulting in net losses on option premium.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated puts.

At June 30, 2022, the fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Developed Ex-US PLUS Downside Convexity ETF NAV | | | -21.47 | % |

| Simplify Developed Ex-US PLUS Downside Convexity ETF Market Price | | | -22.48 | % |

| MSCI EAFE IMI Index | | | -20.53 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.57% and the net expense ratio is 0.32%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception January 10, 2022. |

The MSCI EAFE Investable Market Index (IMI), is an equity index which captures large, mid and small cap representation across Developed Markets countries around the world, excluding the US and Canada. With 3,153 constituents, the index is comprehensive, covering approximately 99% of the free float-adjusted market capitalization in each country. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Emerging Markets Equity PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

Simplify Emerging Markets PLUS Downside Convexity ETF [Ticker: EMGD]

Since its inception on January 10, 2022, EMGD returned -19.50% vs. the MSCI Emerging Markets Index benchmark return of -18.75% for the same period.

The fund’s underperformance is due to the 300bps option budget on downside protection. The option value decayed away during this period resulting in net losses on option premium.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated puts.

At June 30, 2022, the fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Emerging Markets PLUS Downside Convexity ETF NAV | | | -19.50 | % |

| Simplify Emerging Markets PLUS Downside Convexity ETF Market Price | | | -21.26 | % |

| MSCI Emerging Markets Index | | | -18.75 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.61% and the net expense ratio is 0.36%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception January 10, 2022. |

The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,382 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Health Care ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

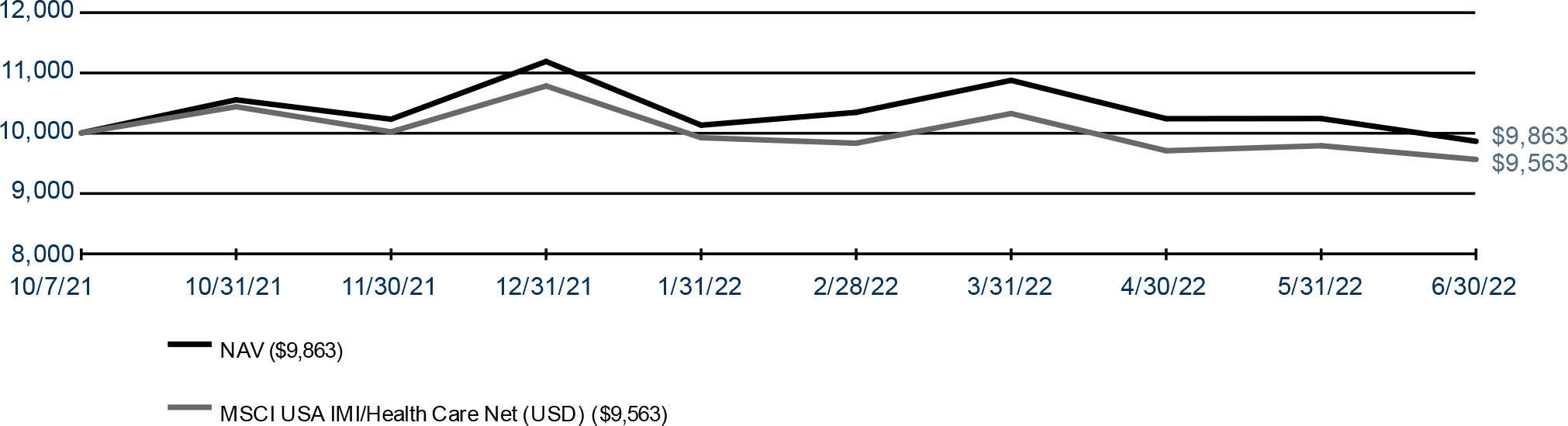

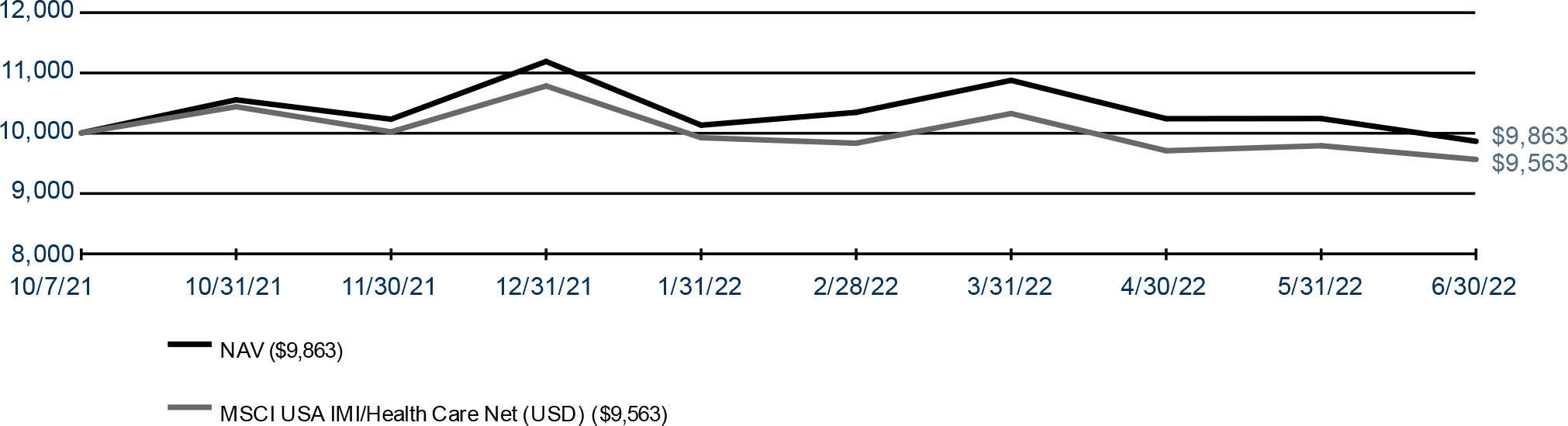

Simplify Health Care ETF [Ticker: PINK]

Since its inception on October 7, 2021, PINK has returned -1.38% vs the MSCI USA IMI Health Care Index benchmark of -4.37%.

Relative outperformance has been marked by idiosyncratic overweights in several Drug, HMO and Medtech names. A material underweighting in Covid-Vaccine related names also assisted outperformance.

For 2022 PINK has slightly underperformed the benchmark to date due to an extreme dichotomy of stock factors. A handful of large cap pharma names have driven the entire group performance vs extreme underperformance of Medtech.

In the next 12 months, PINK anticipates a material reversal in the performance of Medtech vs Pharma with a return to idiosyncratic stock-picking to drive outperformance.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period October 7, 2021* to June 30, 2022

Simplify Health Care ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Health Care ETF NAV | | | -1.38 | % |

| Simplify Health Care ETF Market Price | | | -0.96 | % |

| MSCI USA IMI Health Care (NET (USD) Index | | | -4.37 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.50% and the net expense ratio is 0.50%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception October 7, 2021. |

The MSCI USA Investable Market Index (IMI) Health Care is designed to capture the large, mid and small cap segments of the US equity universe. All securities in the index are classified in the Health Care sector as per the Global Industry Classification Standard (GICS®). Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Hedged Equity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

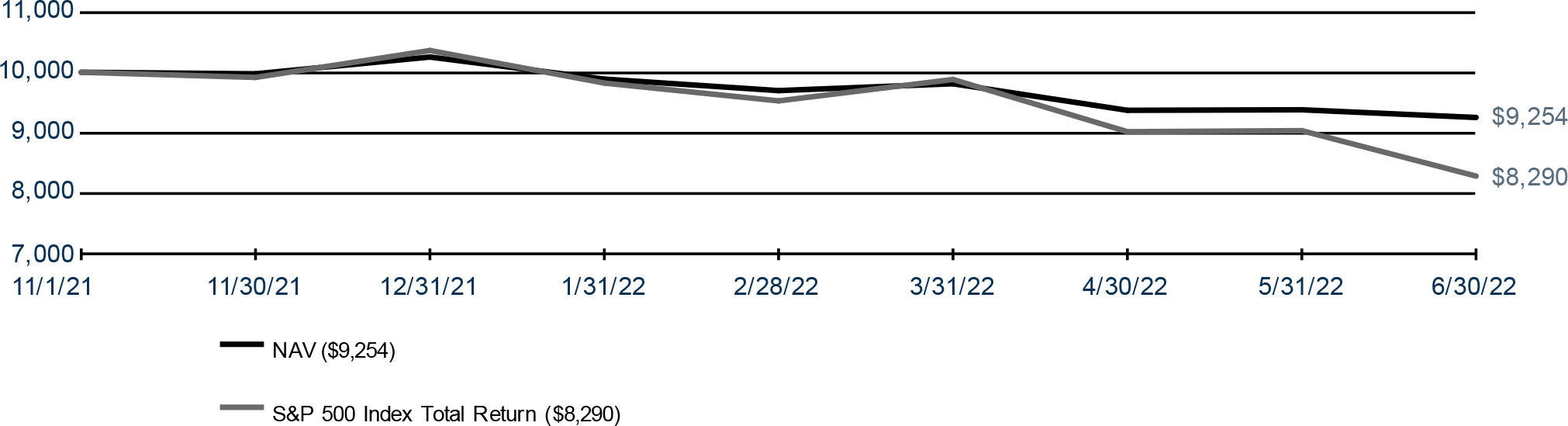

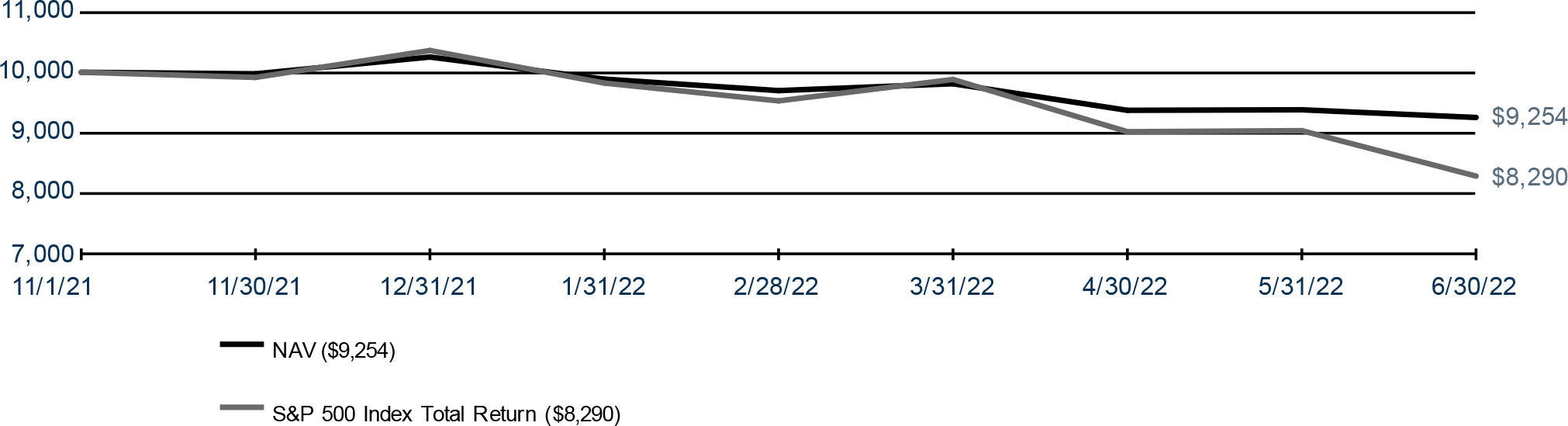

Simplify Hedged Equity ETF [Ticker: HEQT]

HEQT posted a -7.46% total return since inception, outperforming the S&P 500 Index Total Return by 9.6% over that time. Put spread collars functioned well to limit drawdowns, and our regular monthly expiry 5% out of the money puts were frequently monetized with gains. Upside call strikes were tested but did not detract from performance during the general weakness in the market. As equity implied volatility has risen and call strikes have richened relative to puts, this has enabled better upside economics/return potential for collar strategies.

In the next 12 months, we expect comparable elevated levels of implied volatility (especially in calls relative to puts) and collar strategies should continue to enhance returns.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period November 1, 2021* to June 30, 2022

Simplify Hedged Equity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Hedged Equity ETF NAV | | | -7.46 | % |

| Simplify Hedged Equity ETF Market Price | | | -7.79 | % |

| S&P 500 Index Total Return | | | -17.10 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.53% and the net expense ratio is 0.53%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception November 1, 2021. |

The S&P 500 Index Total Return is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify High Yield PLUS Credit Hedge ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

Simplify High Yield PLUS Credit Hedge ETF [Ticker: CDX]

Since its inception on February 14, 2022, performance for CDX has been -9.74% vs. ICE BofA US High Yield Index -10.02%. The fund’s outperformance was driven by its credit hedge in the form of two equity total rate of return swaps and equity puts. During the period since the fund’s inception equity markets experienced a drawdown and credit spreads widened. There were a variety of factors driving the changes in the equity valuations and credit spreads including central bank policy, changes in realized and expected inflation as well changes in expectation relating to future economic growth.

In the next 12 months, we expect that credit risk may remain elevated and as such believe our credit hedge to remain viable. Additionally, we expect to continue focusing on shorter-dated equity puts as hedges given the high equity volatility environment.

At June 30, 2022, the fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify High Yield PLUS Credit Hedge ETF NAV | | | -9.74 | % |

| Simplify High Yield PLUS Credit Hedge ETF Market Price | | | -9.64 | % |

| ICE BofA US High Yield Index | | | -10.02 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.75% and the net expense ratio is 0.50%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception February 14, 2022. |

The ICE BofA US High Yield Index is market capitalization weighted and is designed to measure the performance of U.S. dollar denominated below investment grade (commonly referred to as “junk”) corporate debt publicly issued in the U.S. domestic market. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Interest Rate Hedge ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

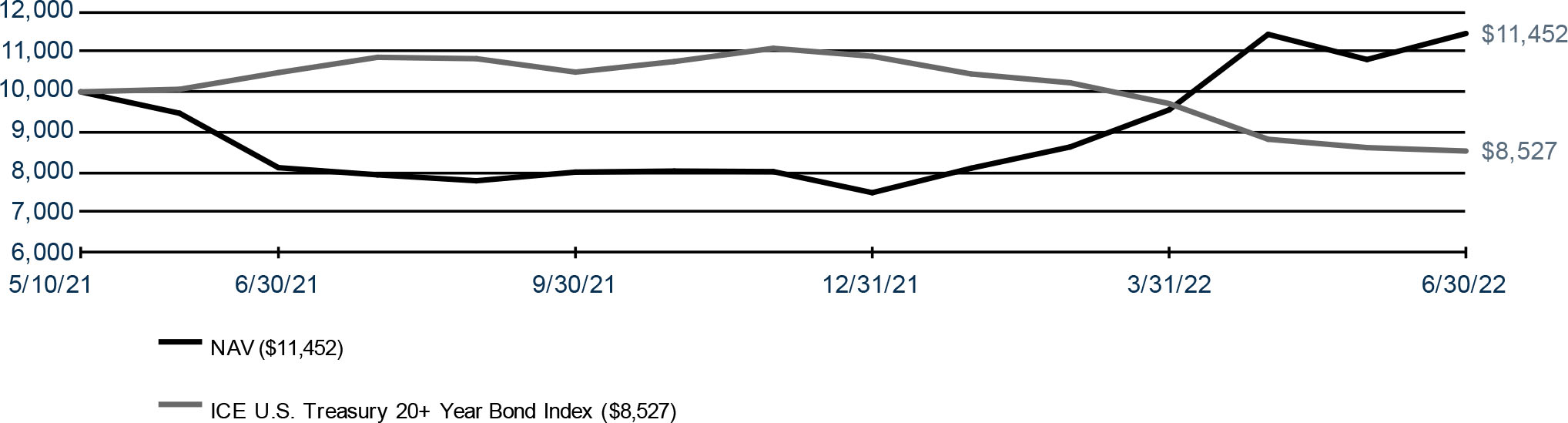

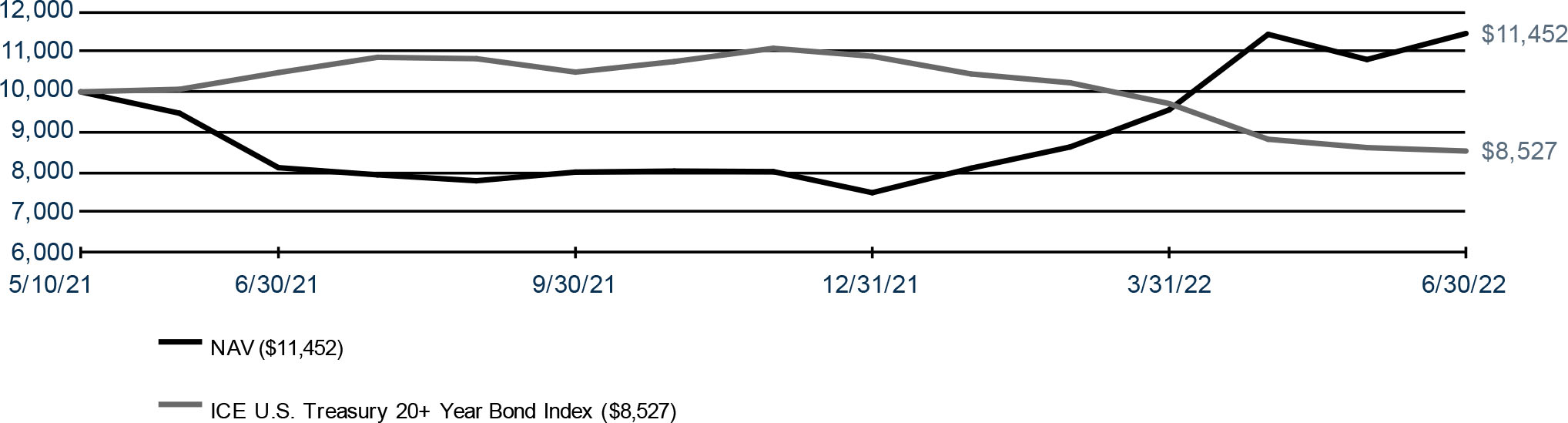

Simplify Interest Rate Hedge ETF [Ticker: PFIX]

For the year ended June 30, 2022, performance for PFIX was 41.18%, while the ICE U.S. Treasury 20+ Year Bond Index return was -18.82%. The fund’s outperformance was driven by its position in payer swaptions which increased significantly in value as long-dated USD rates increased. Additionally, an increase in implied volatilities also contributed to the increase in value of the swaption position. These changes more than offset the modest time decay that the payer swaptions experienced over the course of the year.

In the next 12 months, we expect fixed income volatility to remain elevated and expect Fed decisions to be the primary driver of Treasury curve moves.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period ended May 10, 2021 to June 30, 2022

Simplify Interest Rate Hedge ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | One Year | | | Since Inception* | |

| Simplify Interest Rate Hedge ETF NAV | | | 41.18 | % | | | 12.63 | % |

| Simplify Interest Rate Hedge ETF Market Price | | | 36.69 | % | | | 11.28 | % |

| ICE U.S. Treasury 20+ Year Bond Index | | | -18.62 | % | | | -13.05 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.50% and the net expense ratio is 0.50%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception May 10, 2021. |

The ICE U.S. Treasury 20+ Year Bond Index is part of a series of indices intended to the assess U.S. Treasury market. The Index is market value weighted and is designed to measure the performance of U.S. dollar denominated, fixed rate securities with minimum term to maturity greater than twenty years. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Nasdaq 100 PLUS Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

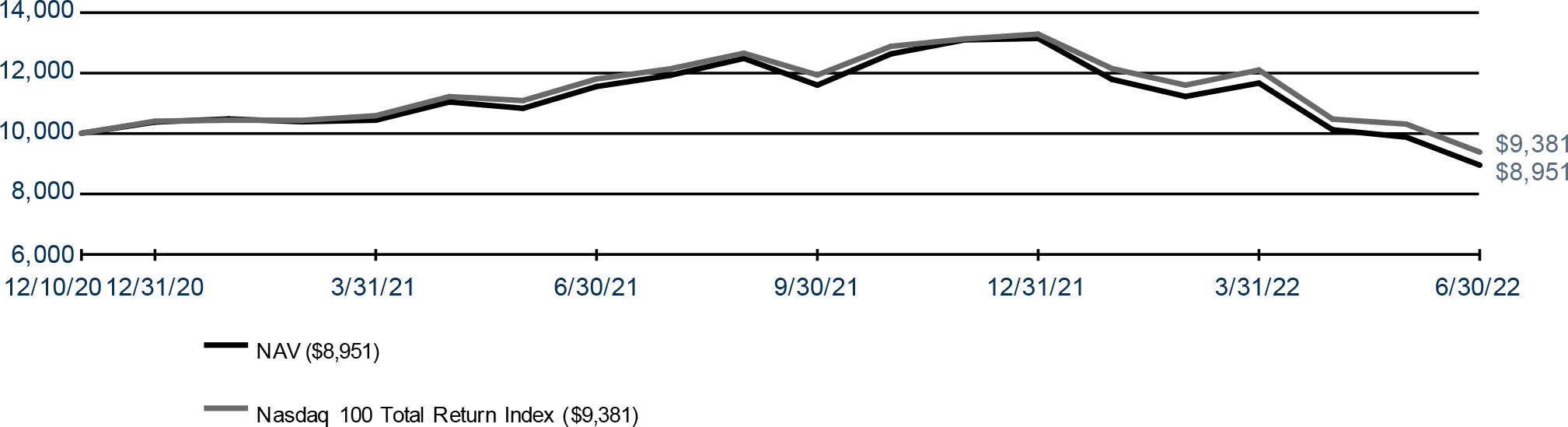

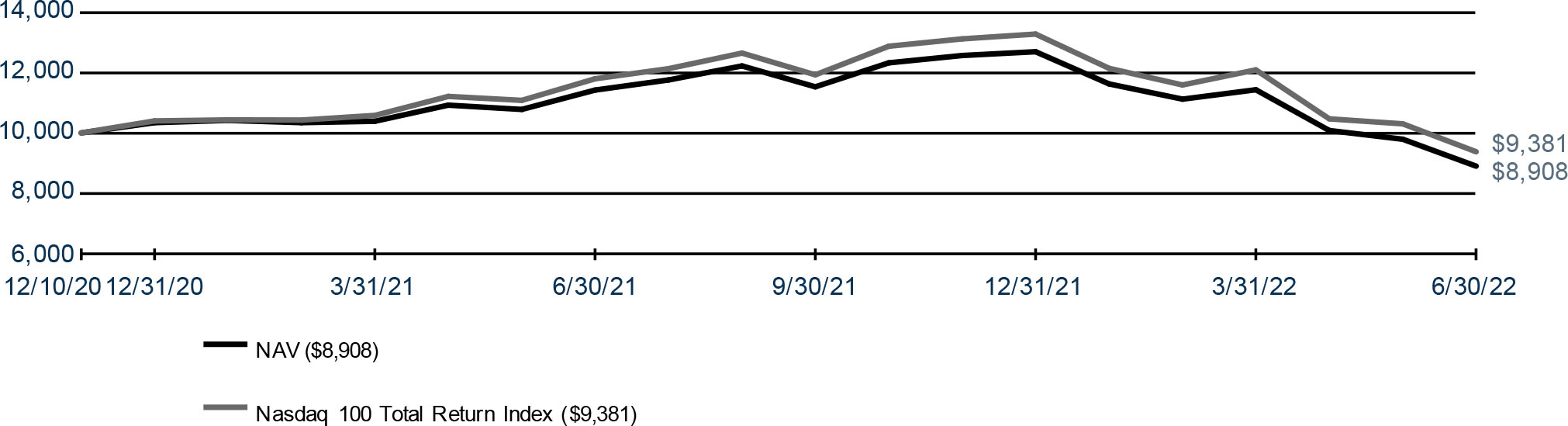

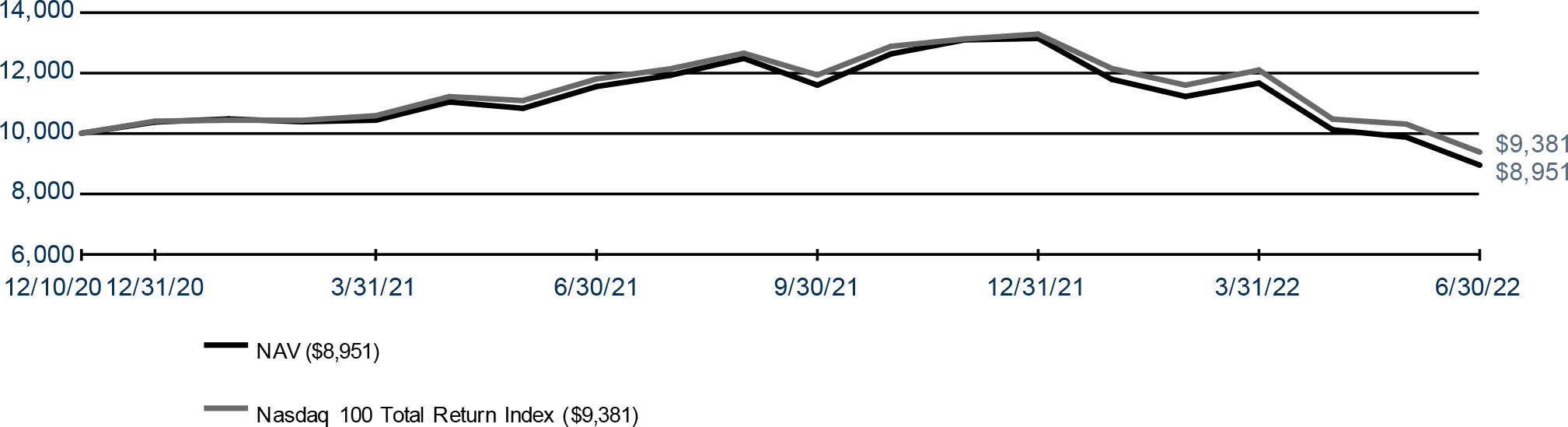

Simplify Nasdaq 100 PLUS Convexity ETF [Ticker: QQC]

For the year ended June 30, 2022, QQC returned -22.39% vs. the Nasdaq 100 Total Return benchmark return of -20.38% for the same period.

The fund’s underperformance is due to net losses on option premium, where neither call nor put ladders could add value relative to their annualized spending budget during this middle of the road drawdown.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated puts and calls.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 10, 2020* to June 30, 2022

Simplify Nasdaq 100 PLUS Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | One Year | | | Since Inception* | |

| Simplify Nasdaq 100 PLUS Convexity ETF NAV | | | -22.39 | % | | | -6.89 | % |

| Simplify Nasdaq 100 PLUS Convexity ETF Market Price | | | -22.80 | % | | | -6.88 | % |

| Nasdaq 100 Total Return Index | | | -20.38 | % | | | -4.03 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.70% and the net expense ratio is 0.45%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception December 10, 2020. |

The Nasdaq 100 Total Return Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market based on market capitalization. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Nasdaq 100 PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

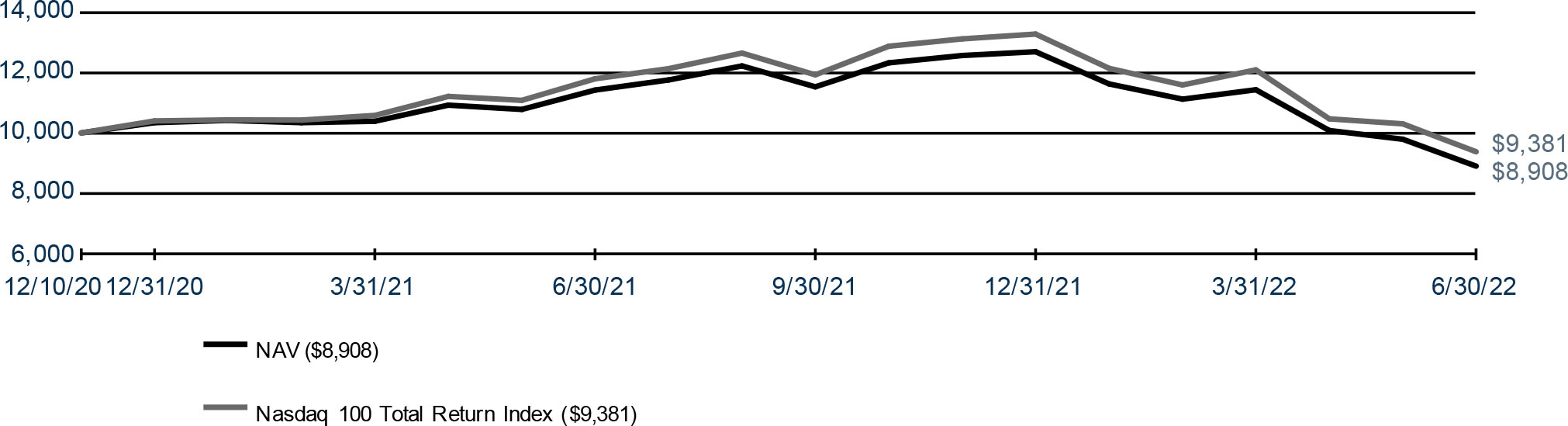

Simplify Nasdaq 100 PLUS Downside Convexity ETF [Ticker: QQD]

For the year ended June 30, 2022, QQD returned -21.94% vs. the Nasdaq 100 Total Return benchmark return of -20.38% for the same period.

The fund’s underperformance is due to net losses on option premium. However, the fund targets a 300bps option budget on a rolling annual basis, so the fiscal year performance reflects some unrealized option gains over the period.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated puts.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 10, 2020* to June 30, 2022

Simplify Nasdaq 100 PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | One Year | | | Since Inception* | |

| Simplify Nasdaq 100 PLUS Downside Convexity ETF NAV | | | -21.94 | % | | | -7.17 | % |

| Simplify Nasdaq 100 PLUS Downside Convexity ETF Market Price | | | -22.12 | % | | | -7.17 | % |

| Nasdaq 100 Total Return Index | | | -20.38 | % | | | -4.03 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.70% and the net expense ratio is 0.45%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception December 10, 2020. |

The Nasdaq 100 Total Return Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market based on market capitalization. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Risk Parity Treasury ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

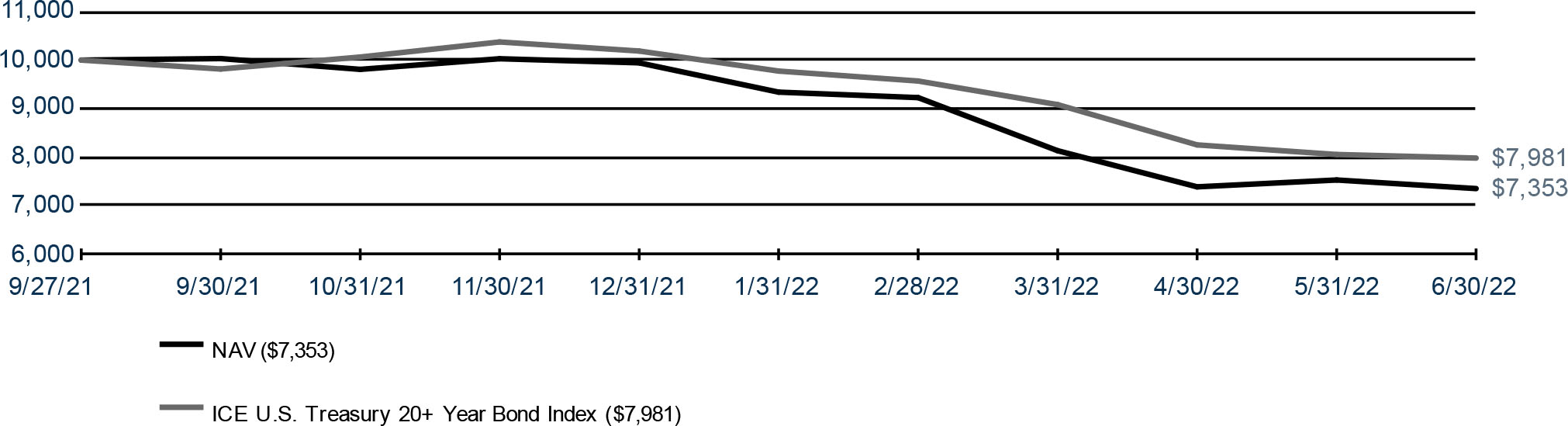

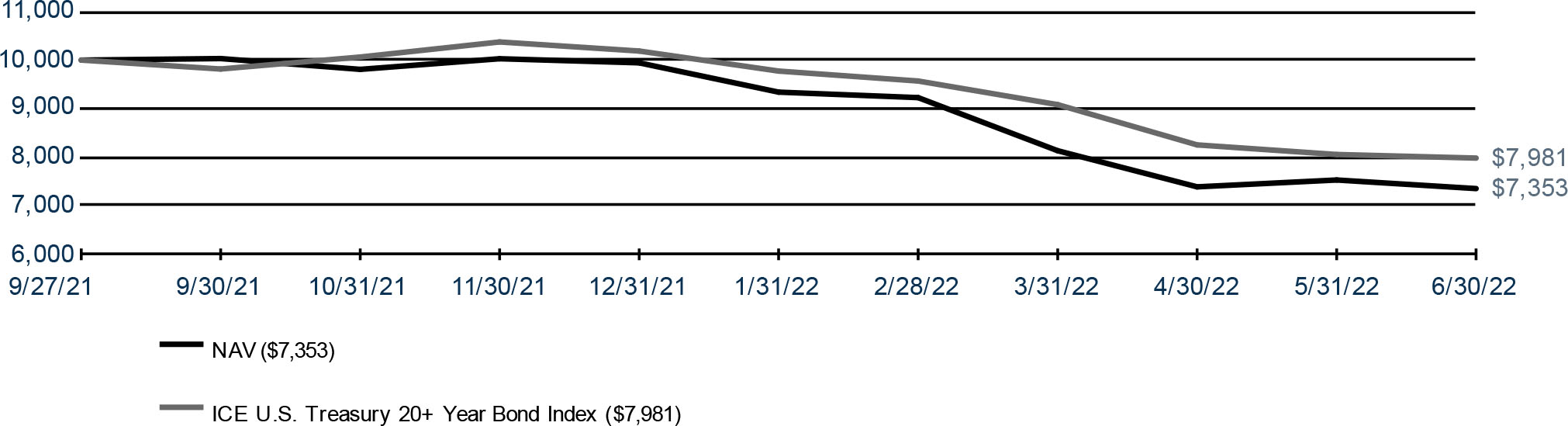

Simplify Risk Parity Treasury ETF [Ticker: TYA]

Since its inception on September 27, 2021, TYA returned -26.47% vs. the ICE US Treasury 20+ Year Bond Index benchmark return of -20.19% for the same period. The negative returns were due to uptick in yields. During this period the yield curve flattened as 30yr US Treasury increased by 1.10%, while yield on the 7yr increased by 1.74%. TYA achieves to take similar duration exposure to the benchmark via US Treasury Note Future Contract which typically references 7yr US Treasury Note and this larger increase in yield of the 7yr vs. 30yr resulted in underperformance of TYA.

In the next 12 months, we expect the yield curve to steepen as the flattening has been extreme as compared to historical standards, which could potentially contribute to TYA performance vs. its benchmark.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 27, 2021* to June 30, 2022

Simplify Risk Parity Treasury ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Risk Parity Treasury ETF NAV | | | -26.47 | % |

| Simplify Risk Parity Treasury ETF Market Price | | | -26.75 | % |

| ICE U.S. Treasury 20+ Year Bond Index | | | -20.19 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.25% and the net expense ratio is 0.15%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.15%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception September 27, 2021. |

The ICE U.S. Treasury 20+ Year Bond Index is part of a series of indices intended to the assess U.S. Treasury market. The Index is market value weighted and is designed to measure the performance of U.S. dollar denominated, fixed rate securities with minimum term to maturity greater than twenty years. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Tail Risk Strategy ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

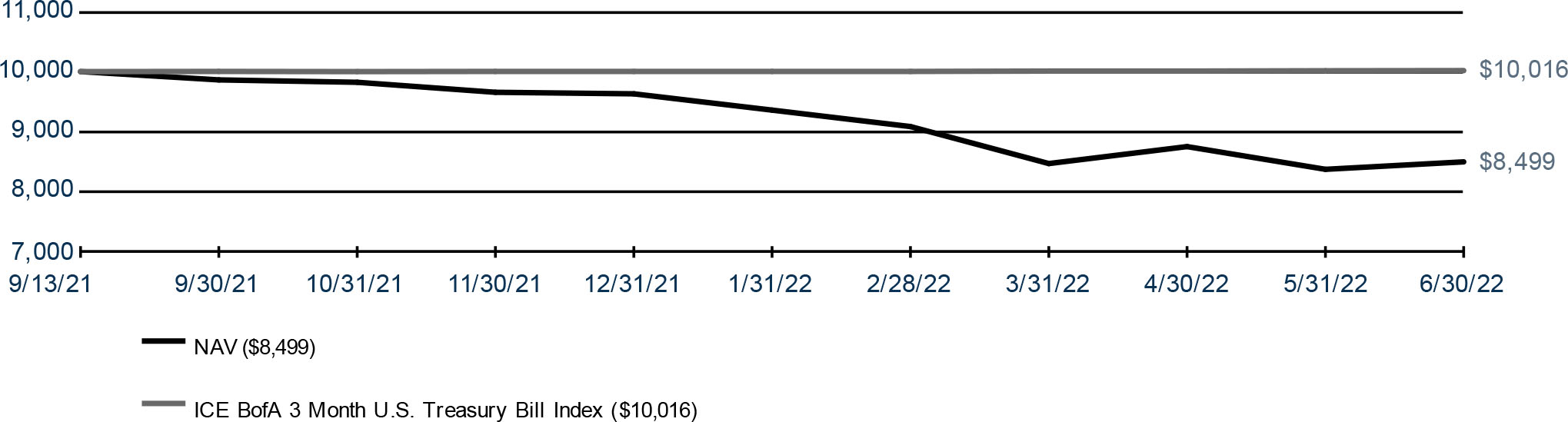

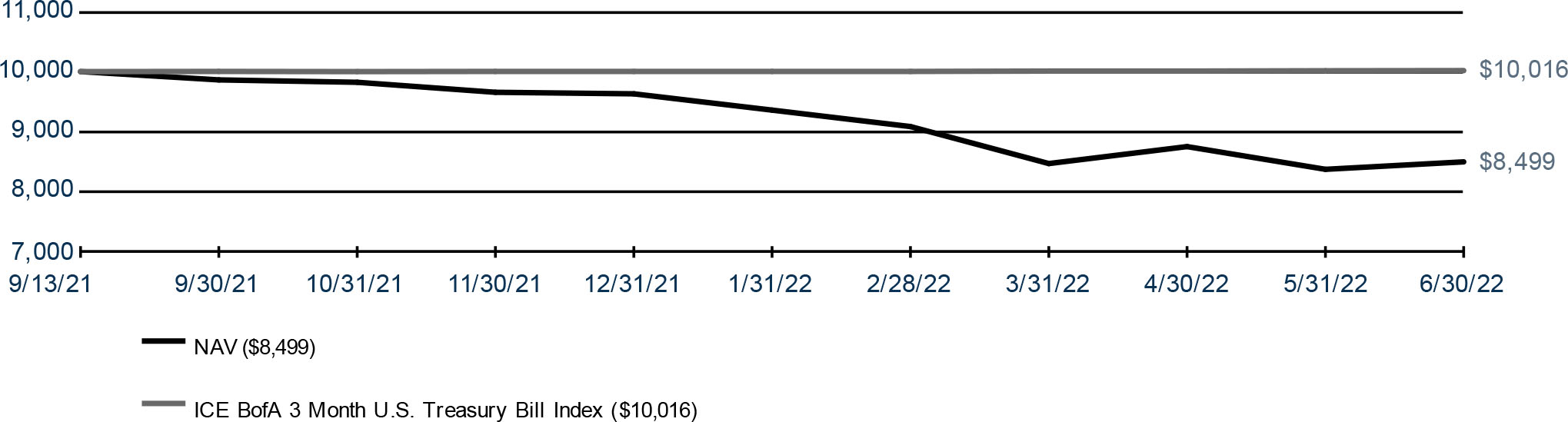

Simplify Tail Risk Strategy ETF [Ticker: CYA]

Since its inception on September 13, 2021, CYA returned -15.01% vs. the ICE BofA 3 Month Treasury Bill Index benchmark return of 0.16% for the same period.

The fund’s underperformance is due to losses in both the income generating strategy and the tail hedge option overlay. About one third of the losses stemmed from the income investments and the remaining two-thirds of losses came from option overlay declines. The decline in option overlay is in line with our expected 12% annual option budget.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated puts.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 13, 2021* to June 30, 2022

Simplify Tail Risk Strategy ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Tail Risk Strategy ETF NAV | | | -15.01 | % |

| Simplify Tail Risk Strategy ETF Market Price | | | -14.97 | % |

| ICE BofA 3 Month U.S. Treasury Bill Index | | | 0.16 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.75% and the net expense ratio is 0.50%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.50%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception September 13, 2021. |

The ICE BofA 3 Month U.S. Treasury Bill Index measures the performance of a single issue of outstanding treasury bill which matures closest to, but not beyond, three months from the rebalancing date. The issue is purchased at the beginning of the month and held for a full month; at the end of the month that issue is sold and rolled into a newly selected issue. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify US Equity PLUS Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

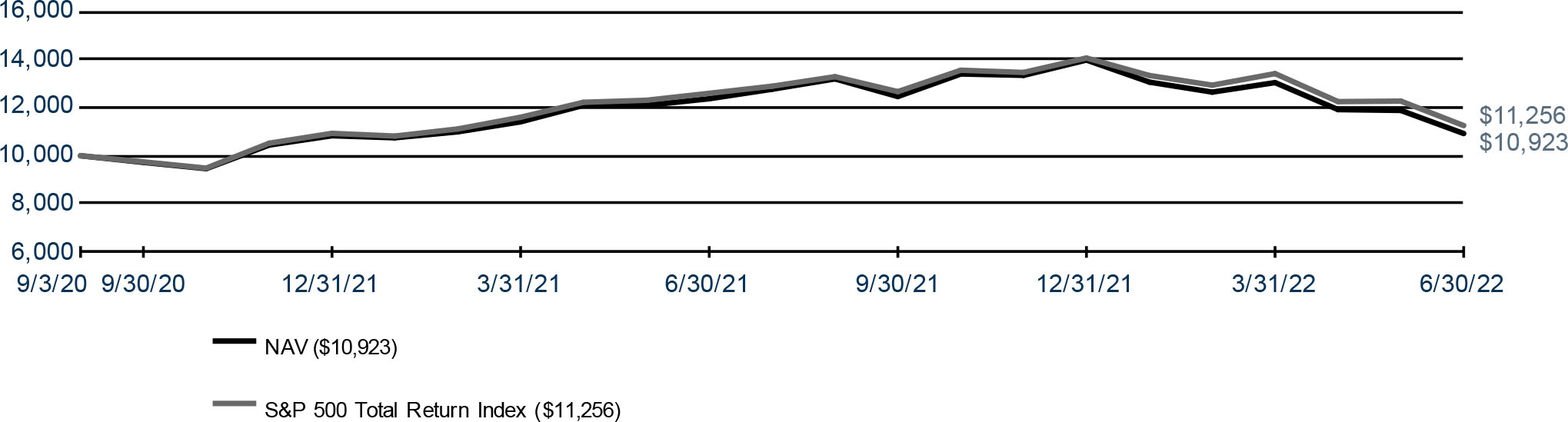

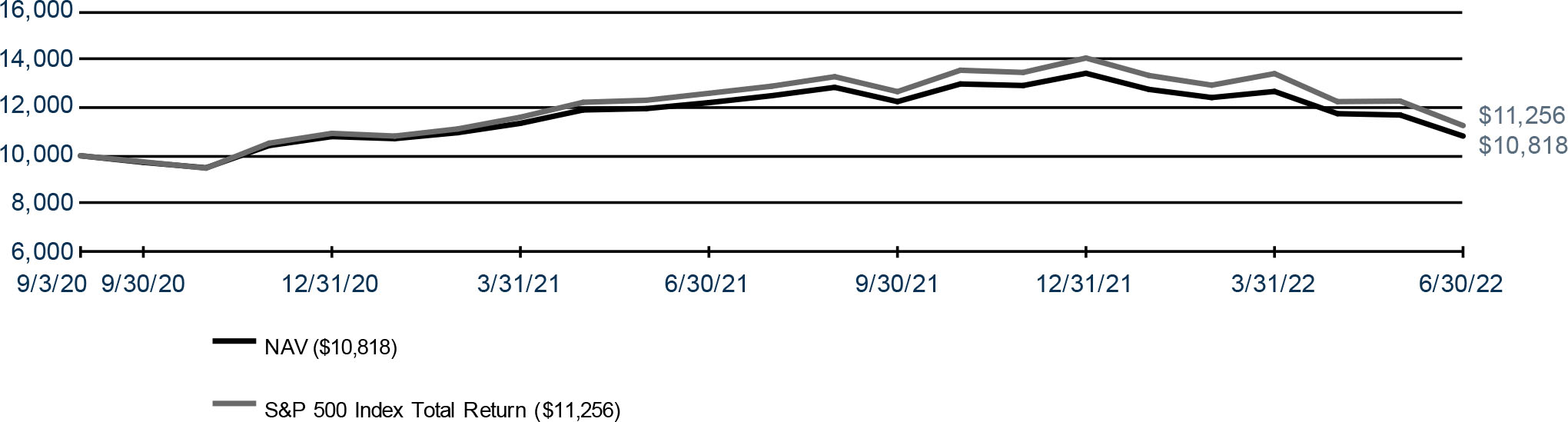

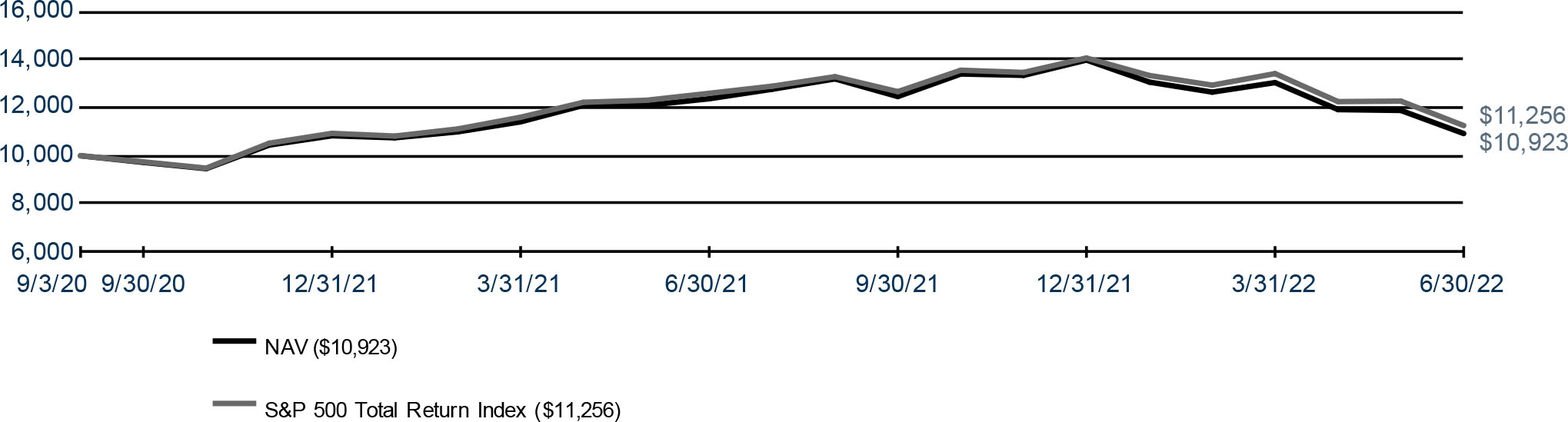

Simplify US Equity PLUS Convexity ETF [Ticker: SPYC]

For the year ended June 30, 2022, SPYC returned -11.68% vs. the S&P 500 Total Return Index benchmark return of -10.62% for the same period.

The fund’s underperformance is due to net losses on option premium, where neither call nor put ladders could add value relative to their annualized spending budget during this middle of the road drawdown.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated puts and calls.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 3, 2020* to June 30, 2022

Simplify US Equity PLUS Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | One Year | | | Since Inception* | |

| Simplify US Equity PLUS Convexity ETF NAV | | | -11.68 | % | | | 4.97 | % |

| Simplify US Equity PLUS Convexity ETF Market Price | | | -11.94 | % | | | 5.17 | % |

| S&P 500 Index Total Return | | | -10.62 | % | | | 6.71 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.53% and the net expense ratio is 0.28%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception September 3, 2020. |

The S&P 500 Index Total Return is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify US Equity PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

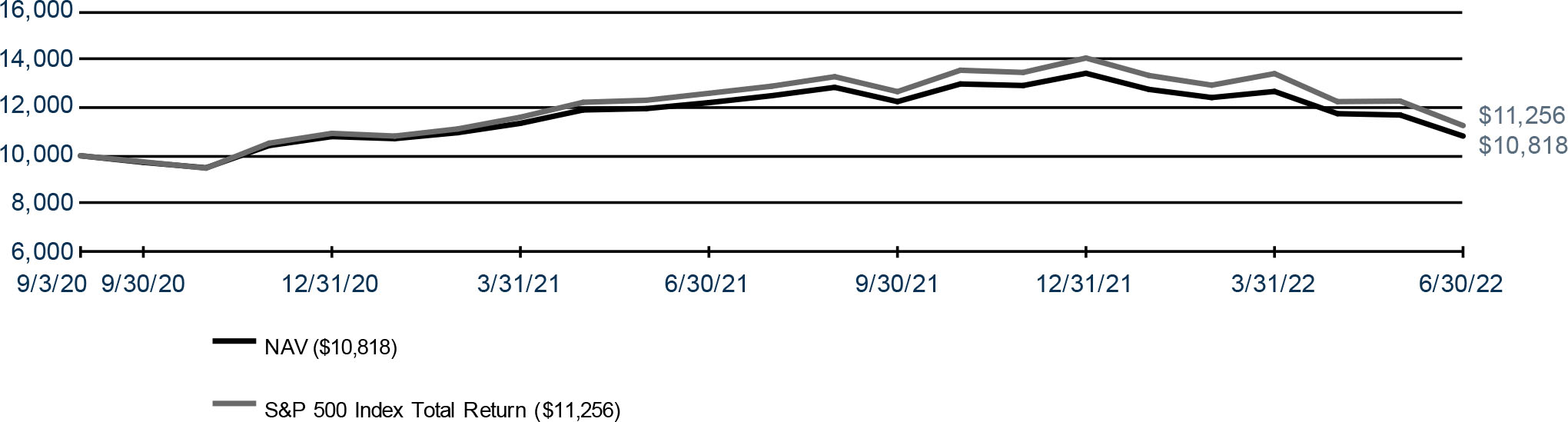

Simplify US Equity PLUS Downside Convexity ETF [Ticker: SPD]

For the year ended June 30, 2022, SPD returned -11.38% vs. the S&P 500 Index Total Return benchmark return of -10.62% for the same period.

The fund’s underperformance is due to net losses on option premium. However, the fund targets a 300bps option budget on a rolling annual basis, so the fiscal year performance reflects some unrealized option gains over the period.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated puts.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 3, 2020* to June 30, 2022

Simplify US Equity PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | | | | Since | |

| | | One Year | | | Inception* | |

| Simplify US Equity PLUS Downside Convexity ETF NAV | | | -11.38 | % | | | 4.41 | % |

| Simplify US Equity PLUS Downside Convexity ETF Market Price | | | -11.57 | % | | | 4.76 | % |

| S&P 500 Index Total Return | | | -10.62 | % | | | 6.71 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.53% and the net expense ratio is 0.28%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception September 3, 2020. |

The S&P 500 Index Total Return is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify US Equity PLUS GBTC ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

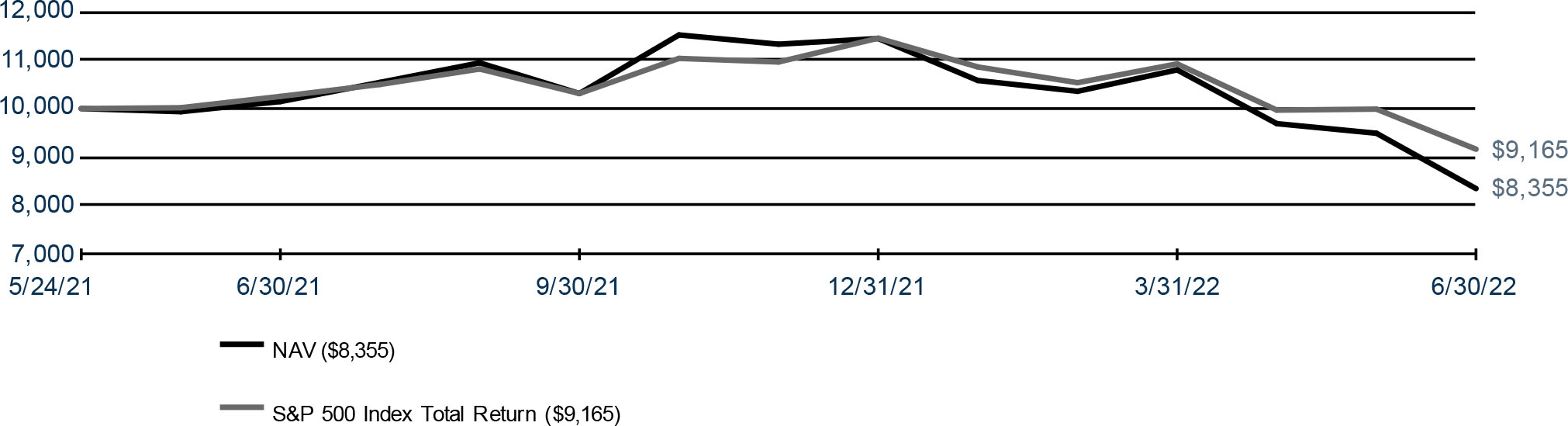

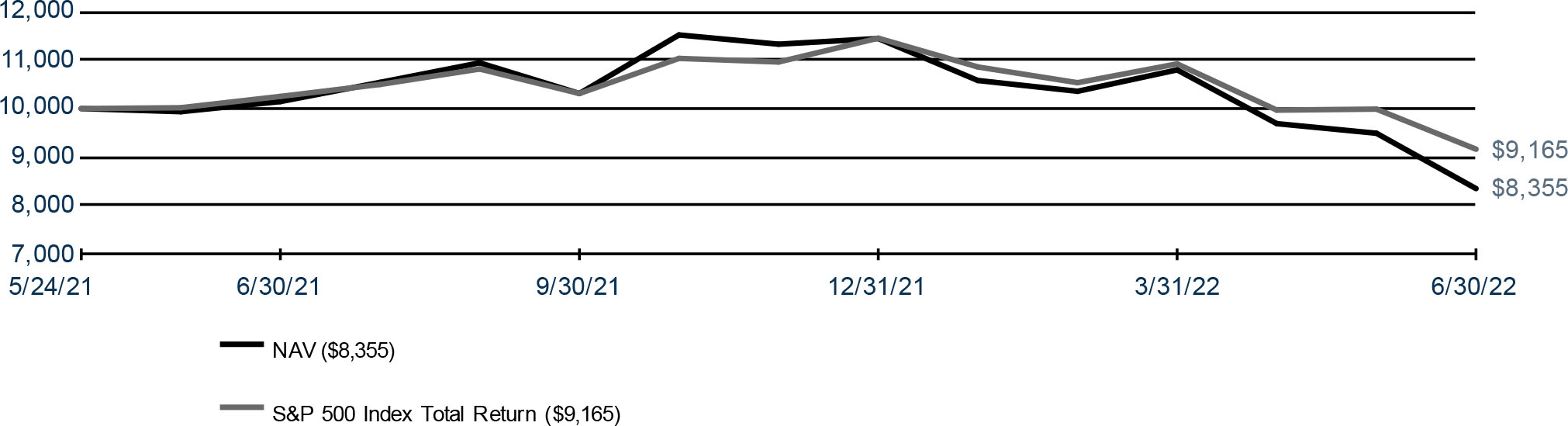

Simplify US Equity PLUS GBTC ETF [Ticker: SPBC]

For the year ended June 30, 2022, performance for SPBC was -17.66%, while the S&P 500 Index Total Return return was -10.62% for the same period as bitcoin retreated from its highs of Nov 2021 more aggressively than the equity markets. The growing market concern about cryptocurrencies as an inflation hedge led to the deepening of the GBTC discount to Net Asset Value which ended -31% on June 30, 2022.

In the next 12 months, we expect SPBC to continue to track the broader equity and cryptocurrency markets. We expect risk markets to continue to reflect a challenging environment.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period May 24, 2021* to June 30, 2022

Simplify US Equity PLUS GBTC ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | | | | Since | |

| | | One Year | | | Inception* | |

| Simplify US Equity PLUS GBTC ETF NAV | | | -17.66 | % | | | -15.06 | % |

| Simplify US Equity PLUS GBTC ETF Market Price | | | -17.86 | % | | | -14.64 | % |

| S&P 500 Index Total Return | | | -10.62 | % | | | -7.61 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.74% and the net expense ratio is 0.74%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception May 24, 2021. |

The S&P 500 Index Total Return is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify US Equity PLUS Upside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

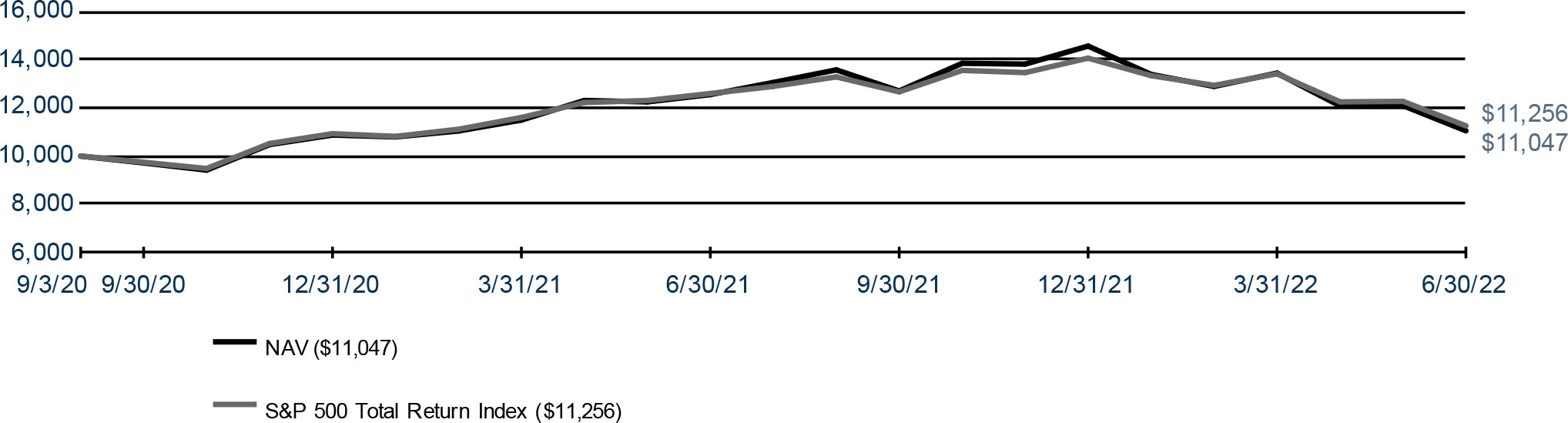

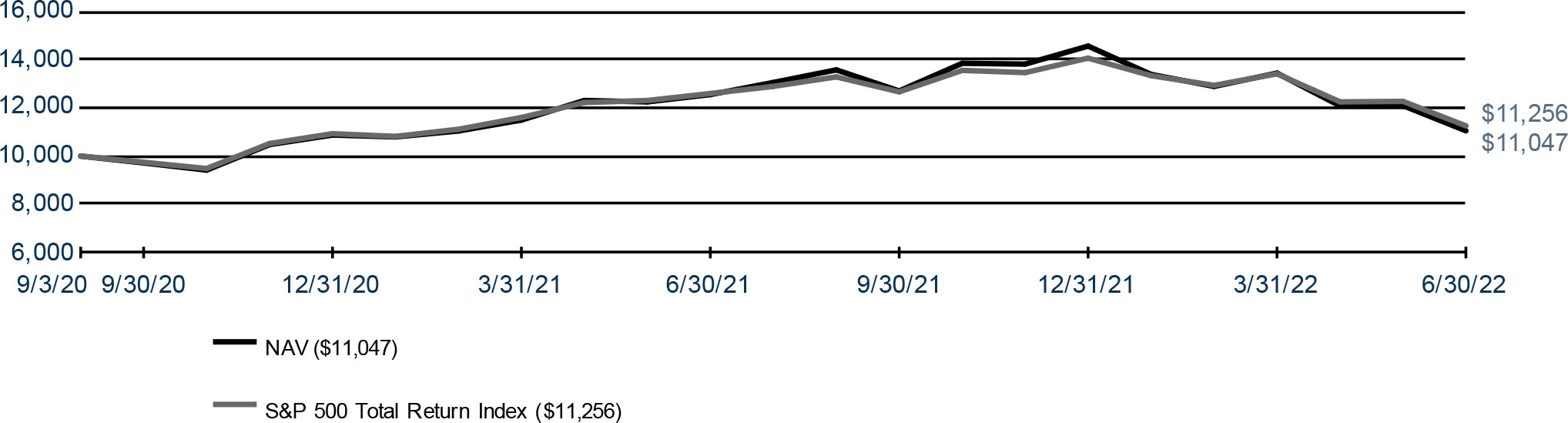

Simplify US Equity PLUS Upside Convexity ETF [Ticker: SPUC]

During the fiscal year ended June 30, 2022, SPUC returned -11.99% vs. the S&P 500 Index TR benchmark return of -10.62% for the same period.

The fund’s underperformance is due to net losses on option premium, as we saw a drawdown over the period of just over 10%, whereby the call premium were greatly eroded.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated calls.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 3, 2020* to June 30, 2022

Simplify US Equity PLUS Upside Convexity ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | | | | Since | |

| | | One Year | | | Inception* | |

| Simplify US Equity PLUS Upside Convexity ETF NAV | | | -11.99 | % | | | 5.62 | % |

| Simplify US Equity PLUS Upside Convexity ETF Market Price | | | -12.26 | % | | | 5.86 | % |

| S&P 500 Index Total Return | | | -10.62 | % | | | 6.71 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.53% and the net expense ratio is 0.28%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception September 3, 2020. |

The S&P 500 Index Total Return is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify US Small Cap PLUS Downside Convexity ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

Simplify US Small Cap PLUS Downside Convexity ETF [Ticker: RTYD]

Since its inception on January 10, 2022, RTYD returned -18.50% vs. the Russell 2000 Index benchmark return of -21.47% for the same period.

The fund’s outperformance is due to the S&P 600 Small Cap Index outperforming Russell 2000 Index and unrealized gain on option premium.

In the next 12 months, we expect equity markets to remain in a high volatility environment, where the fund will continue focusing on rolling shorter-dated puts.

At June 30, 2022, the fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify US Small Cap PLUS Downside Convexity ETF NAV | | | -18.50 | % |

| Simplify US Small Cap PLUS Downside Convexity ETF Market Price | | | -19.25 | % |

| Russell 2000 Index | | | -21.47 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.56% and the net expense ratio is 0.31%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception January 10, 2022. |

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Volt Cloud and Cybersecurity Disruption ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

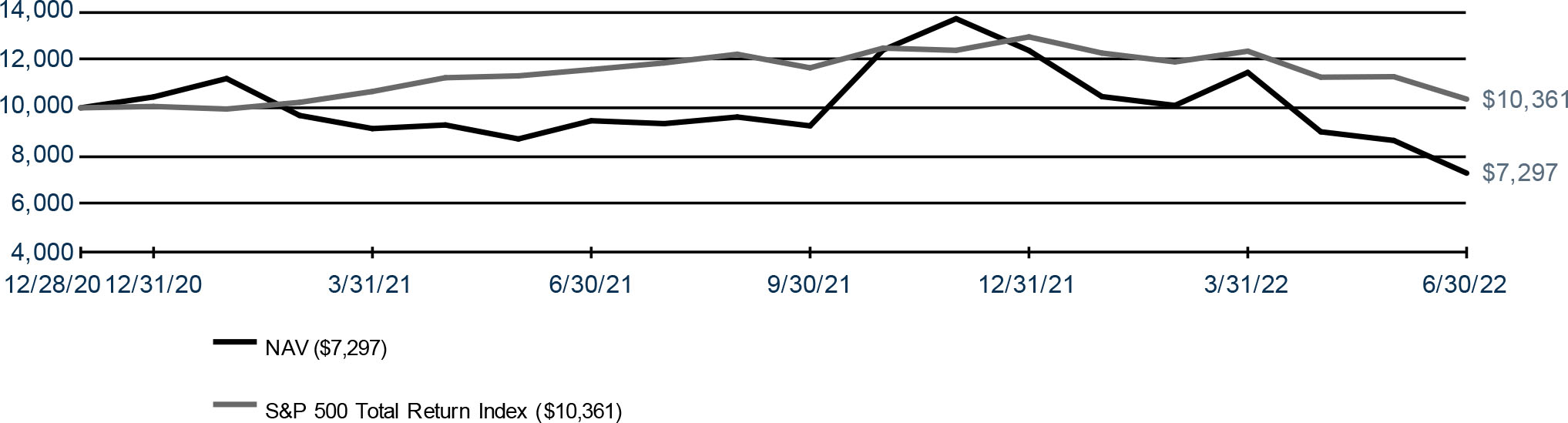

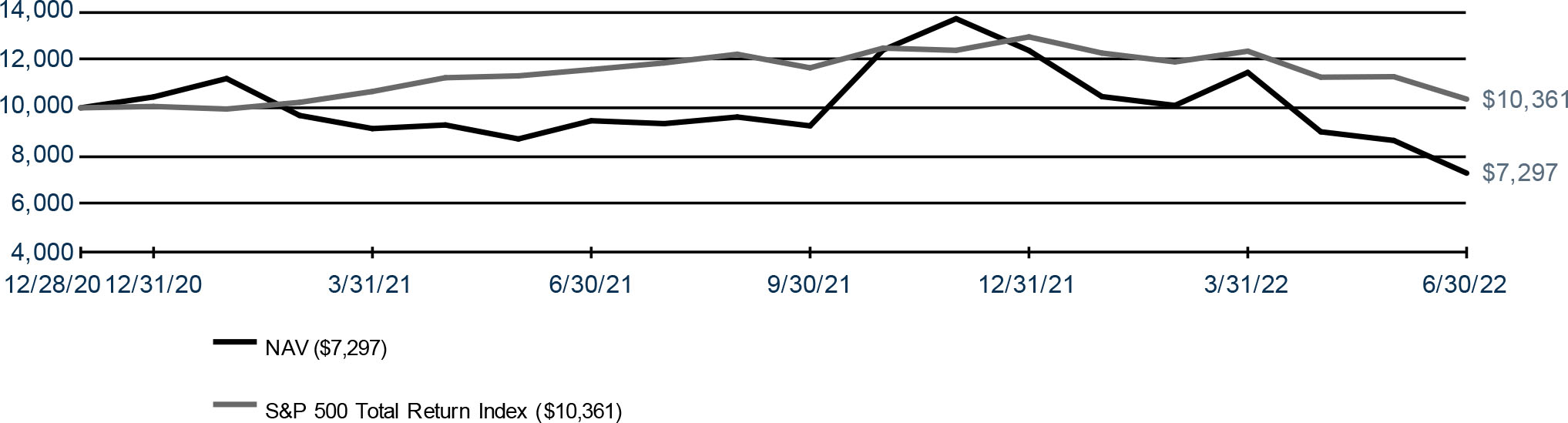

Simplify Volt Cloud and Cybersecurity Disruption ETF [Ticker: VCLO]

For the fiscal year ended June 30, 2022, VCLO returned -40.74% vs. the S&P 500 Index Total Return benchmark return of -10.62% for the same period.

The fund’s underperformance is due to high exposure to multiple cloud companies, which have seen their multiples compress in the midst of the Federal Reserve’s interest rate hikes in response to rising inflation.

In the next 12 months, the fund’s performance with concentrated exposure to cloud and cybersecurity names could continue to deviate from the broader U.S. market.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 28, 2020* to June 30, 2022

Simplify Volt Cloud and Cybersecurity Disruption ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | | | | | |

| | | | | | Since | |

| | | One Year | | | Inception* | |

| Simplify Volt Cloud and Cybersecurity Disruption ETF NAV | | | -40.74 | % | | | -26.18 | % |

| Simplify Volt Cloud and Cybersecurity Disruption ETF Market Price | | | -41.99 | % | | | -25.29 | % |

| S&P 500 Index Total Return | | | -10.62 | % | | | 2.38 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.95% and the net expense ratio is 0.95%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception December 28, 2020. |

The S&P 500 Index Total Return is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Volt RoboCar Disruption and Tech ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

Simplify Volt Robocar Disruption and Tech ETF [Ticker: VCAR]

For the fiscal year ended June 30, 2022, VCAR returned -22.91% vs. the S&P 500 Index Total Return benchmark return of -10.62% for the same period.

The fund’s underperformance is due to high exposure to multiple tech companies, which have seen their multiples compress in the midst of the Federal Reserve’s interest rate hikes in response to rising inflation.

In the next 12 months, the fund’s performance with concentrated exposure to robocar and technology names could continue to deviate from the broader U.S. market.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 28, 2020* to June 30, 2022

Simplify Volt RoboCar Disruption and Tech ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | | | | Since | |

| | | One Year | | | Inception* | |

| Simplify Volt RoboCar Disruption and Tech ETF NAV | | | -22.91 | % | | | -18.90 | % |

| Simplify Volt RoboCar Disruption and Tech ETF Market Price | | | -23.31 | % | | | -18.91 | % |

| S&P 500 Index Total Return | | | -10.62 | % | | | 2.38 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.95% and the net expense ratio is 0.95%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception December 28, 2020. |

The S&P 500 Index Total Return is a stock market index that tracks 500 large companies listed on stock exchanges in the United States. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Macro Strategy ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

Simplify Macro Strategy ETF [Ticker: FIG]

Since its inception on May 16, 2022, FIG returned -5.61%, while the Bloomberg US EQ:FI 60:40 Index benchmark returned -4.37% for the same period.

The fund’s underperformance is due to a combination of factors including the fund’s use of bond aggregate which underperformed the Bloomberg Bond Aggregate. Additionally, the higher equity weight relative to the benchmark contributed negatively to performance as large cap equities fell. However, the underperformance was offset by outperformance in the fund’s investment in managed futures, and a timely investment in US Treasuries.

In the next 12 months, we expect risk markets to continue to reflect a challenging environment, particularly for equities due to a reduction in monetary accommodation combined with a broadly slowing global economy. Positions in bond substitutes offer relatively attractive risk reward in a slowing economy and we anticipate that our rate positions will benefit as inflation retreats and the economy cools. We see significant opportunities in our relative outperformance positioning for higher quality assets vs lower quality assets under these conditions.

At June 30, 2022, the fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Macro Strategy ETF NAV | | | -5.61 | % |

| Simplify Macro Strategy ETF Market Price | | | -5.66 | % |

| Bloomberg US EQ:FI 60:40 Index | | | -4.37 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.75% and the net expense ratio is 0.75%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception May 16, 2022. |

The Bloomberg US EQ:FI 60:40 Index is designed to measure cross-asset market performance in the US. The index rebalances monthly to 60% equities and 40% fixed. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Managed Futures Strategy ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

Simplify Managed Futures Strategy ETF [Ticker: CTA]

Since its inception on March 7, 2022, CTA gained 9.07% as commodity and fixed income markets trended very consistently amid rising inflation due to geopolitical stresses and the resumption central bank hike cycles. Long positions in commodities with positive spot price performance due to supply shortages combined with heavily backwardated curves contributed the bulk of Q1 performance. Separately, rising interest rates and broad equity market weakness drove positive price return from precious metal (Gold, Silver) and Copper shorts, and short duration positions in money market futures in the US and Canada curves outperformed. As physical commodity prices eased further in May and June, a quick shift into flat to slightly short positions (especially the energy complex) added to returns.

In the next 12 months, we expect the prevailing market consensus for persistent inflation and accompanying economic/equity and bond market volatility to bode favorably for uncorrelated and trend-based strategies.

At June 30, 2022, the fund’s financial statements covered a period of less than 6 months, therefore a line graph is not presented.

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Cumulative | |

| | | Total Return* | |

| Simplify Managed Futures Strategy ETF NAV | | | 9.07 | % |

| Simplify Managed Futures Strategy ETF Market Price | | | 8.57 | % |

| Societe Generale CTA Index | | | 7.94 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.75% and the net expense ratio is 0.75%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception March 7, 2022. |

The Societe Generale CTA Index is designed to track the largest 20 (by AUM) CTAs and be representative of the managed futures space. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.

Simplify Volatility Premium ETF

Management’s Discussion of Fund Performance

June 30, 2022 (Unaudited)

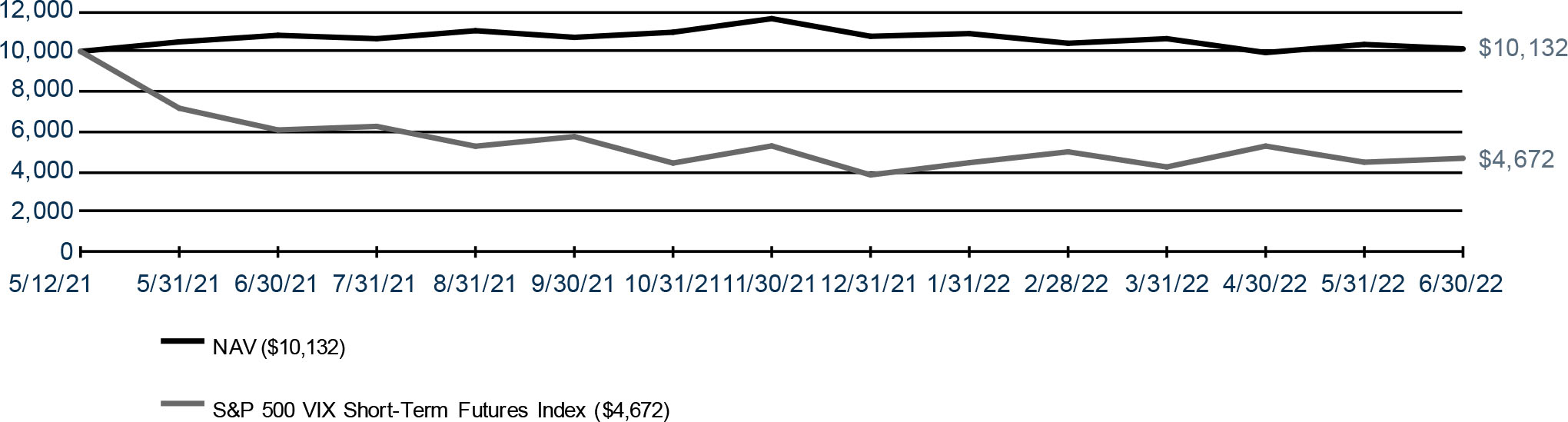

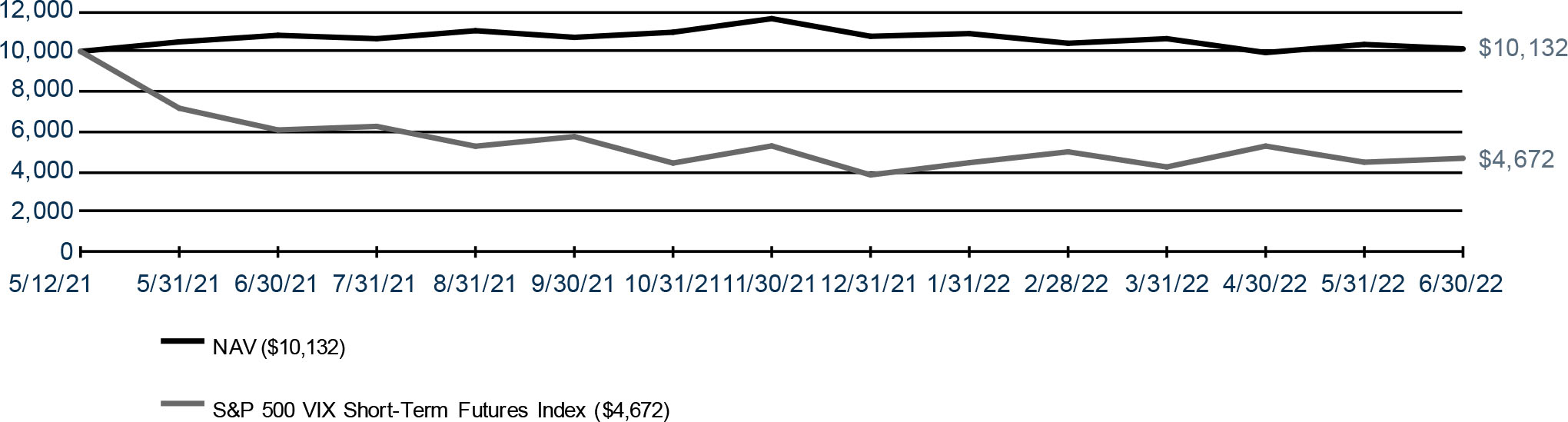

Simplify Volatility Premium ETF [Ticker: SVOL]

For the year ended June 30, 2022, SVOL returned -6.23% vs. the S&P 500 VIX Short-Term Futures Index benchmark return of -23.28% for the same period. The fund’s performance is due to challenging equity market conditions where S&P500 Index returned -10.62% causing VIX to go up by 81%. The impact of rising VIX was lower on SVOL due to moderate exposure of short 25% VIX futures, which further benefitted from lower volatility than VIX. Short positions in VIX futures also continued to gain from roll down in upward sloping VIX curve aka Contango.

In the next 12 months, we expect SVOL to continue to be correlated with S&P500 Index with potentially higher return and lower risk due to persistence of Contango in VIX curve.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period May 12, 2021* to June 30, 2022

Simplify Volatility Premium ETF

Management’s Discussion of Fund Performance (Continued)

June 30, 2022 (Unaudited)

HISTORICAL PERFORMANCE

Average Annual Total Return as of June 30, 2022

| | | | | | Since | |

| | | One Year | | | Inception* | |

| Simplify Volatility Premium ETF NAV | | | -6.23 | % | | | 1.16 | % |

| Simplify Volatility Premium ETF Market Price | | | -6.36 | % | | | 0.63 | % |

| S&P 500 VIX Short-Term Futures Index | | | -23.28 | % | | | -48.88 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.54% and the net expense ratio is 0.54%. (Actual expenses excluding acquired fund fees and expenses can be referenced in the Financial Highlights section later in this report.) Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1 (855) 772-8488.

| * | Since Inception May 12, 2021. |

The S&P 500® VIX Short-Term Futures Index utilizes prices of the next two near-term VIX® futures contracts to replicate a position that rolls the nearest month VIX futures to the next month on a daily basis in equal fractional amounts. This results in a constant one-month rolling long position in first and second month VIX futures contracts. Investors cannot invest directly in an index.

Investments involve risk. Principal loss is possible. Redemptions are limited and often commissions are charged on each trade. The ETF may be non-diversified, which may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s Shares and greater risk of loss. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The fund is new and has limited operating history to judge.