united states

securities and exchange commission

Washington, d.c. 20549

form n-csr

certified shareholder report of registered

management investment companies

Investment Company Act file number: 811-23570

Simplify Exchange Traded Funds

(Exact name of registrant as specified in charter)

10845 Griffith Peak Drive 2/F

Las Vegas, NV 89135 |

| (Address of principal executive offices) (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (646) 585-0476

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

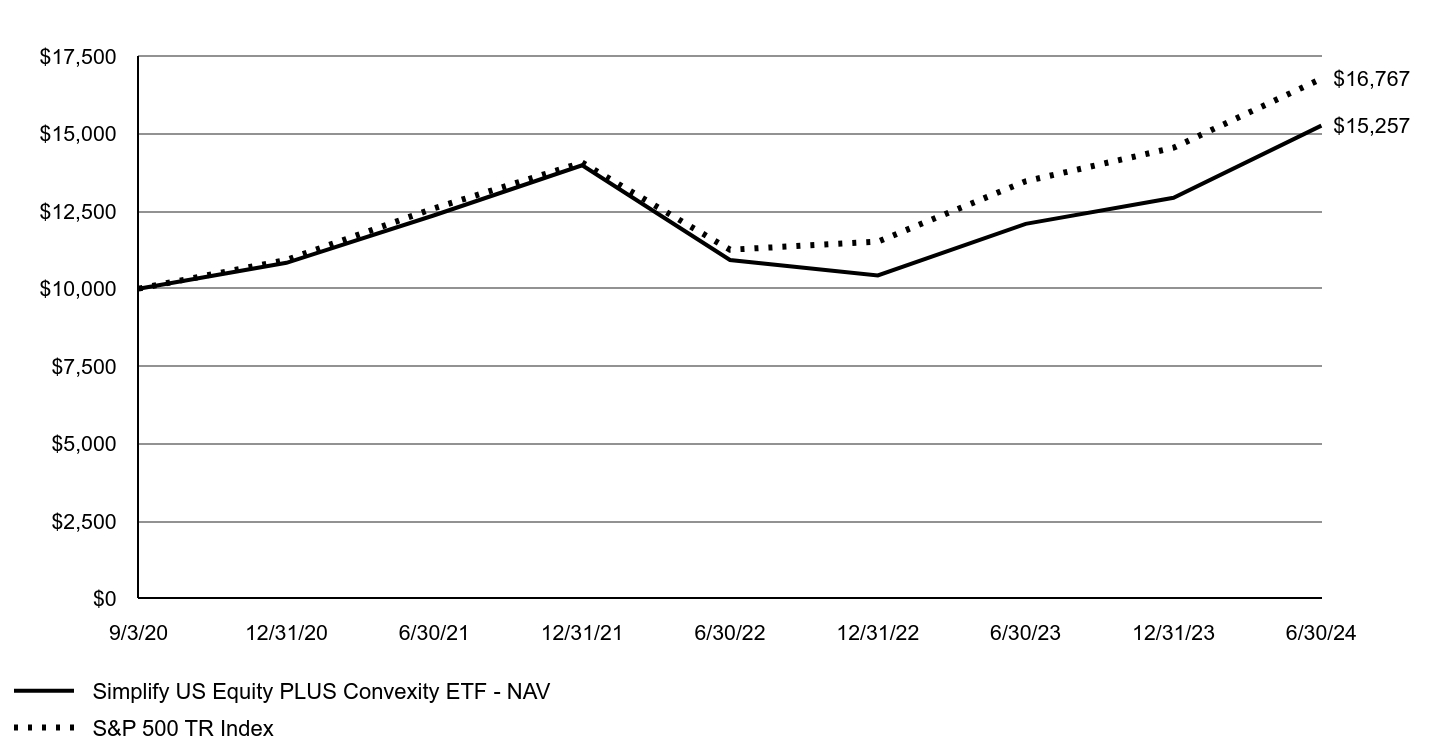

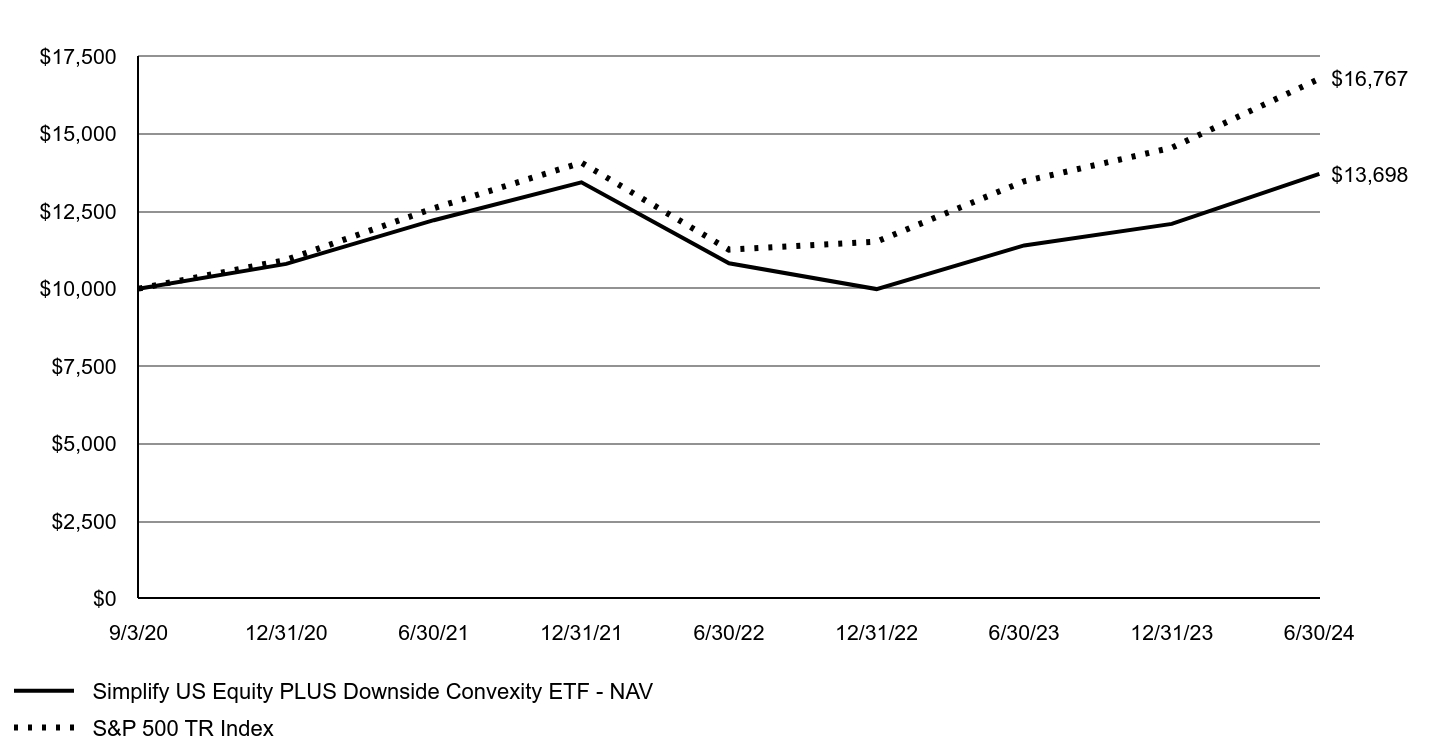

0001810747 simplify:SimplifyUSEquityPLUSDownsideConvexityETFMinusMarket34375AdditionalIndexMember 2020-09-03 2024-06-30

Simplify Aggregate Bond ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Aggregate Bond ETF ("AGGH" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Aggregate Bond ETF | $27 | 0.26% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, AGGH returned 2.48% vs its referenced benchmark, Bloomberg Capital U.S. Aggregate Bond Index, return of 2.63%, underperforming the benchmark by 0.15%.

Rising interest rates were a headwind for the Fund and the bond market in general. The Fund underperformed the benchmark due to the challenges in hedging structural volatility selling strategies in rapidly changing long-term treasury rates. The Fund used long and short positions in options across equities, fixed income, volatility indices, commodities, and currencies asset classes to hedge against relevant interest rate and credit risks as well as generate potential income.

In the next 12 months, we believe the Fed will likely start a rate-cutting cycle, which will potentially stall last year’s trend of rising rates. We believe AGGH is well-positioned to deliver high returns and outperform the Bloomberg Capital U.S. Aggregate Bond Index due to structural volatility selling strategies as long-term treasury rates stabilize.

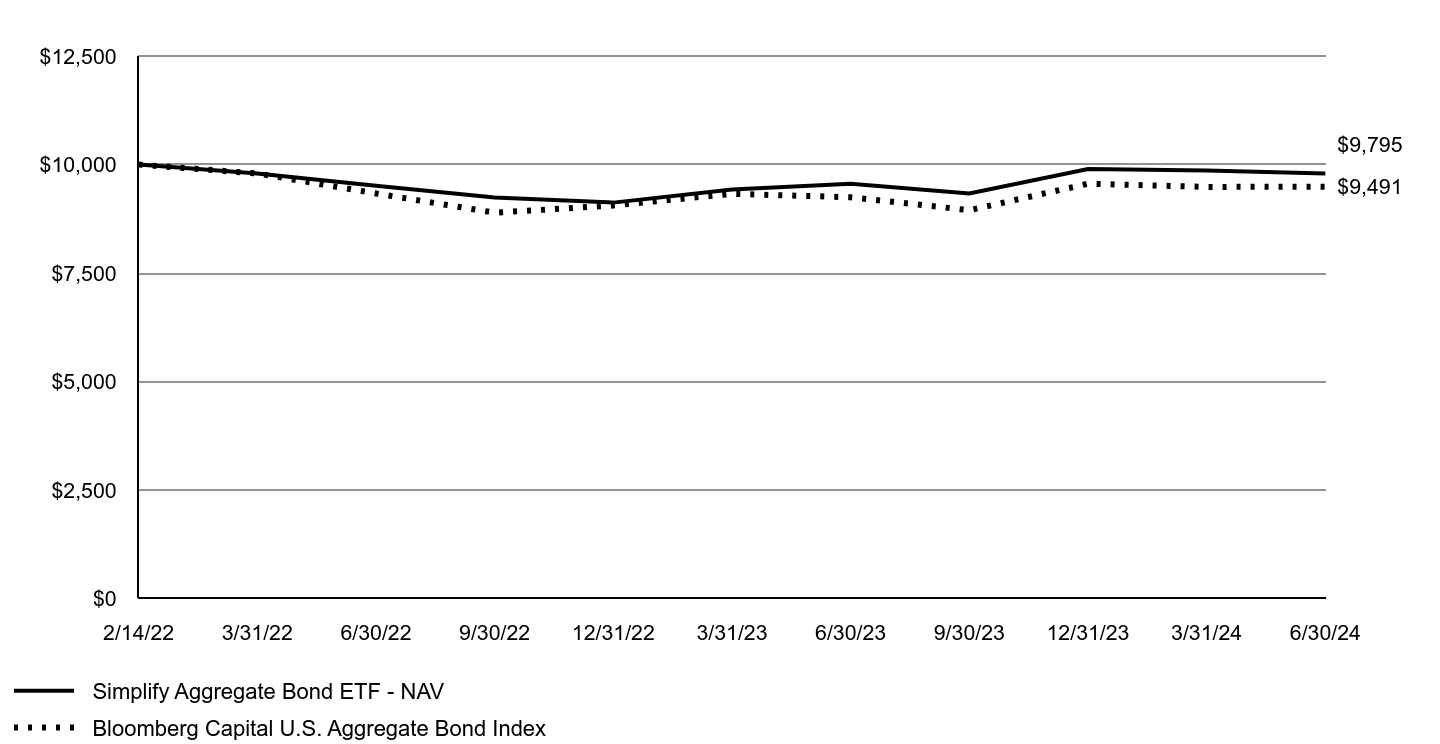

Growth of an Assumed $10,000 Investment

| Simplify Aggregate Bond ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index |

|---|

| 2/14/22 | $10,000 | $10,000 |

| 3/31/22 | $9,797 | $9,795 |

| 6/30/22 | $9,511 | $9,335 |

| 9/30/22 | $9,243 | $8,892 |

| 12/31/22 | $9,124 | $9,058 |

| 3/31/23 | $9,424 | $9,326 |

| 6/30/23 | $9,558 | $9,248 |

| 9/30/23 | $9,336 | $8,949 |

| 12/31/23 | $9,897 | $9,559 |

| 3/31/24 | $9,861 | $9,485 |

| 6/30/24 | $9,795 | $9,491 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 2/14/2022 |

|---|

| Simplify Aggregate Bond ETF - NAV | 2.48% | |

| Simplify Aggregate Bond ETF - Market | 2.57% | |

| Bloomberg Capital U.S. Aggregate Bond Index | 2.63% | |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The Fund had a return of capital of $8,368,404.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $207,337,384 |

| Total number of portfolio holdings | 4 |

| Total advisory fee paid, net of waiver | $319,366 |

| Period portfolio turnover rate | 385% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Exchange-Traded Funds | 94.4% |

| U.S. Treasury Bills | 5.0% |

| U.S. Government Agency Mortgage Backed Securities | 4.9% |

| Liabilities in Excess of Other Assets | (4.3)% |

| Total | 100.0% |

This is a summary of certain changes to the Fund since July 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 1, 2024 at www.simplify.us/resources or upon request at (855) 772-8488.

- The Fund's name changed from Simplify Aggregate Bond PLUS Credit Hedge ETF to Simplify Aggregate Bond ETF.

- The Fund's investment objective changed from seeking to maximize total return by investing primarily in investment grade bonds while mitigating credit risk to seeking to maximize total return.

- "Other expenses" in the Fund's fee table were restated.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Health Care ETF ("PINK" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Health Care ETF | $55 | 0.50% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, PINK returned 18.83% vs its referenced benchmark, MSCI USA IMI/Health Care Net Index, return of 9.76% for the same period, outperforming the benchmark by 9.07%.

PINK's outperformance is attributed to bottoms-up analysis, tactical trading, and strategic weightings in subsectors. In FY2024, stock selection played the most significant role, avoiding major drawdowns and identifying alpha-generating stocks across subsectors.

Looking ahead, we believe PINK is positioned defensively, anticipating a cyclical economic slowdown. We expect a rotation from economically sensitive areas to defensives. The Fund currently is overweight in select drug stocks versus Medtech and HMOs, anticipating economic headwinds for the latter. We focus on drug stocks with asymmetric earnings potential and will selectively add Medtech and HMOs. PINK adapts its strategy to optimize alpha, recognizing the diminishing global tailwind from government spending. We will monitor and adjust as needed.

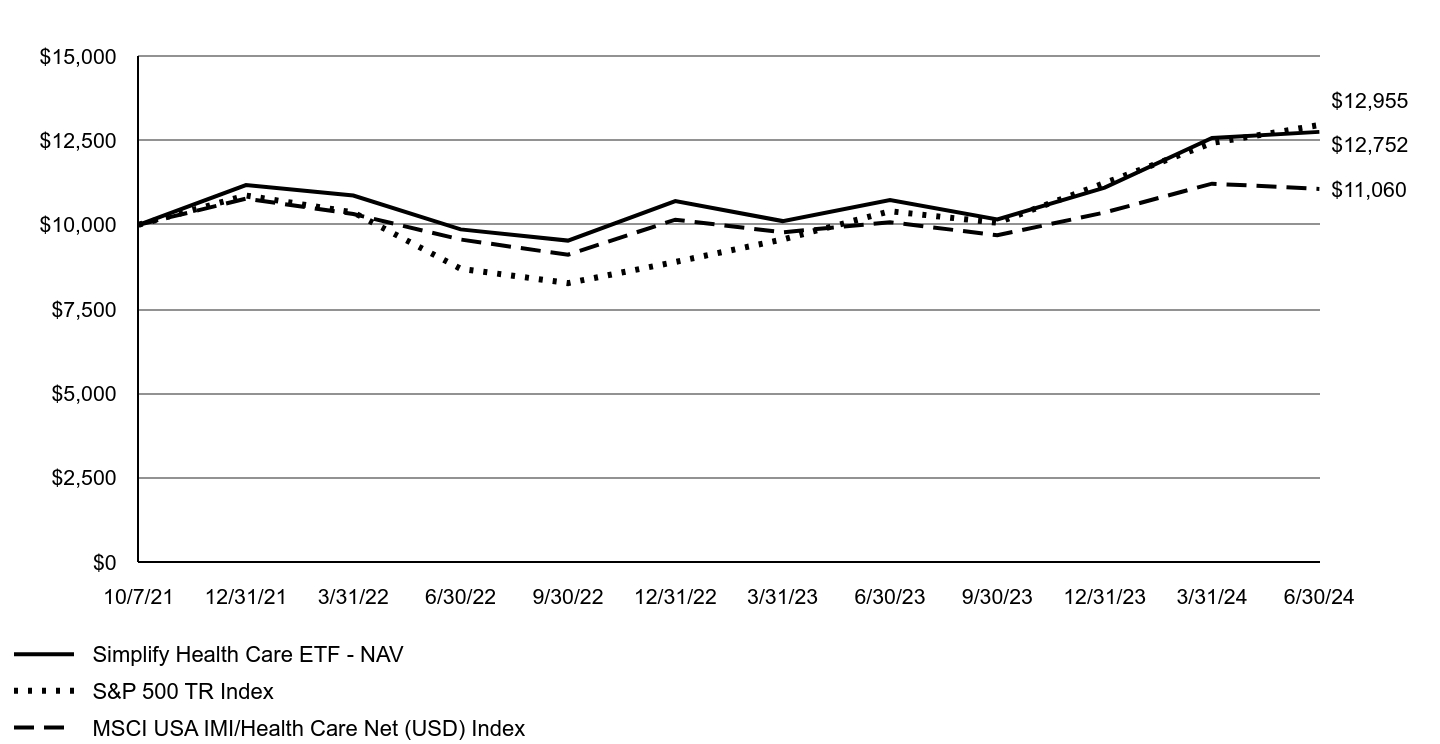

Growth of an Assumed $10,000 Investment

| Simplify Health Care ETF - NAV | S&P 500 TR Index | MSCI USA IMI/Health Care Net (USD) Index |

|---|

| 10/7/21 | $10,000 | $10,000 | $10,000 |

| 12/31/21 | $11,178 | $10,866 | $10,774 |

| 3/31/22 | $10,865 | $10,366 | $10,318 |

| 6/30/22 | $9,863 | $8,697 | $9,563 |

| 9/30/22 | $9,531 | $8,272 | $9,112 |

| 12/31/22 | $10,701 | $8,898 | $10,151 |

| 3/31/23 | $10,109 | $9,565 | $9,778 |

| 6/30/23 | $10,731 | $10,401 | $10,076 |

| 9/30/23 | $10,159 | $10,060 | $9,689 |

| 12/31/23 | $11,102 | $11,237 | $10,364 |

| 3/31/24 | $12,570 | $12,423 | $11,218 |

| 6/30/24 | $12,752 | $12,955 | $11,060 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 10/7/2021 |

|---|

| Simplify Health Care ETF - NAV | 18.83% | 9.32% |

| Simplify Health Care ETF - Market | 19.08% | 9.52% |

| S&P 500 TR Index | 24.56% | 9.95% |

| MSCI USA IMI/Health Care Net (USD) Index | 9.76% | 3.76% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $137,169,249 |

| Total number of portfolio holdings | 53 |

| Total advisory fee paid, net of waiver | $426,070 |

| Period portfolio turnover rate | 210% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Common Stocks | 90.0% |

| Money Market Funds | 5.8% |

| Other Assets in Excess of Liabilities | 4.2% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

Simplify Hedged Equity ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Hedged Equity ETF ("HEQT" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Hedged Equity ETF | $55 | 0.51% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, HEQT returned 16.08% vs its referenced benchmark, Bloomberg US EQ:FI 60:40 Index, return of 15.69% for the same period, outperforming the benchmark by 0.39%.

Stock market weakness in Q3 2023 drove HEQT to an early 3% gain versus the large cap index but relinquished this alpha as stocks rose steadily rose until the end of Q1 2024. Subsequent periods of choppy price action in the broader market enabled HEQT to post a similar relative outperformance. More frequent strike resets in the HEQT were a benefit versus its competitors during the cycle of brief drawdowns with ensuing market rebounds.

Due to continued investor demand for market upside, call strike moneyness on regular monthly option rolls has consistently been above 5%. The relative cheapness of puts to calls in the 1-3 month maturity make costless collars an attractive defensive positioning alternative for a sustained correction in stocks, and with the potential for heightened volatility in the upcoming election cycle we believe HEQT is well-positioned to perform favorably.

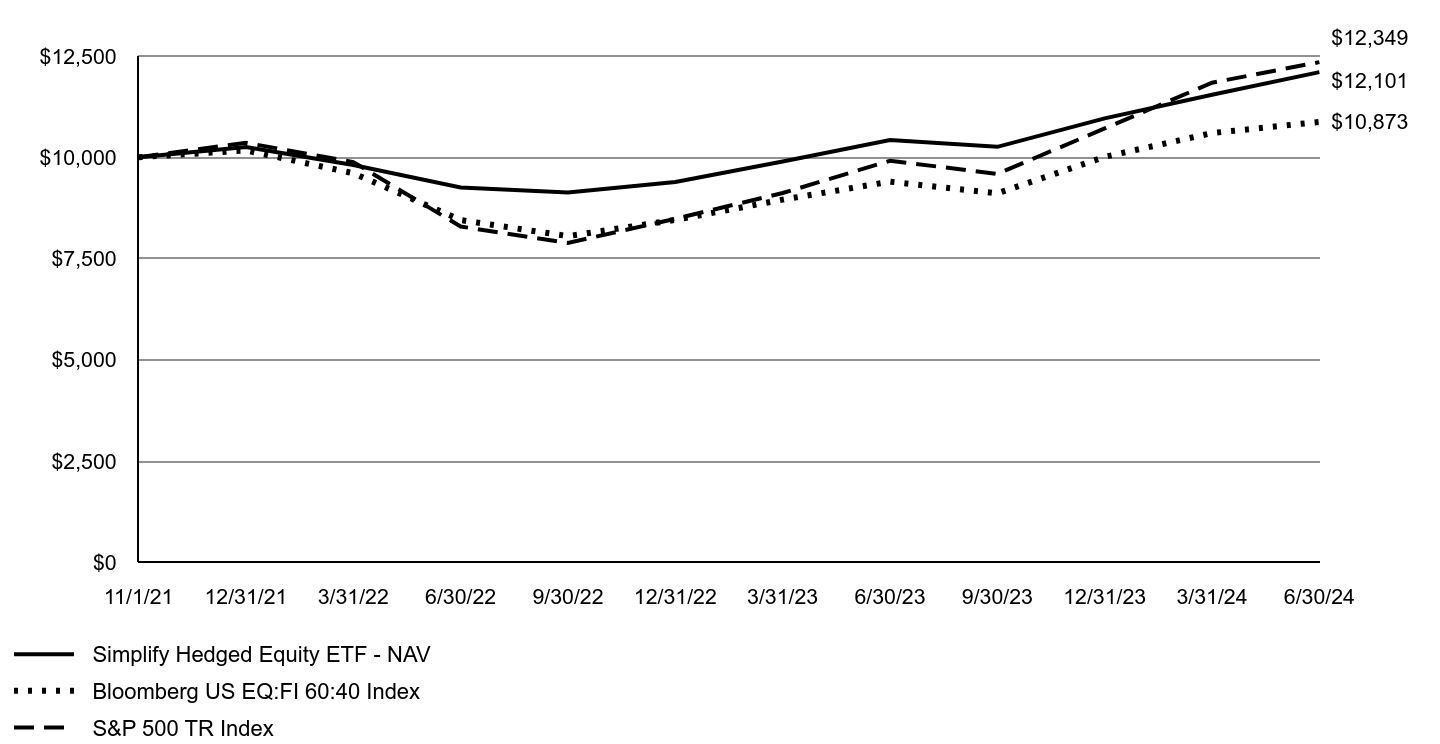

Growth of an Assumed $10,000 Investment

| Simplify Hedged Equity ETF - NAV | Bloomberg US EQ:FI 60:40 Index | S&P 500 TR Index |

|---|

| 11/1/21 | $10,000 | $10,000 | $10,000 |

| 12/31/21 | $10,251 | $10,168 | $10,357 |

| 3/31/22 | $9,810 | $9,606 | $9,881 |

| 6/30/22 | $9,254 | $8,449 | $8,290 |

| 9/30/22 | $9,128 | $8,053 | $7,885 |

| 12/31/22 | $9,389 | $8,454 | $8,481 |

| 3/31/23 | $9,895 | $8,953 | $9,117 |

| 6/30/23 | $10,425 | $9,398 | $9,914 |

| 9/30/23 | $10,258 | $9,108 | $9,590 |

| 12/31/23 | $10,961 | $10,010 | $10,711 |

| 3/31/24 | $11,545 | $10,597 | $11,841 |

| 6/30/24 | $12,101 | $10,873 | $12,349 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 11/1/2021 |

|---|

| Simplify Hedged Equity ETF - NAV | 16.08% | 7.43% |

| Simplify Hedged Equity ETF - Market | 16.28% | 7.31% |

| S&P 500 TR Index | 24.56% | 8.25% |

| Bloomberg US EQ:FI 60:40 Index | 15.69% | 3.20% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $168,665,904 |

| Total number of portfolio holdings | 5 |

| Total advisory fee paid, net of waiver | $754,254 |

| Period portfolio turnover rate | 1% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Exchange-Traded Funds | 101.3% |

| Purchased Options | 0.3% |

| Money Market Funds | 0.0%Footnote Reference† |

| Liabilities in Excess of Other Assets | (1.6)% |

| Total | 100.0% |

| Footnote | Description |

Footnote† | Less than 0.05% |

This is a summary of certain changes to the Fund since July 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 1, 2024 at www.simplify.us/resources or upon request at (855) 772-8488.

- "Other expenses" in the Fund's fee table were restated.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

Simplify High Yield PLUS Credit Hedge ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify High Yield PLUS Credit Hedge ETF ("CDX" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify High Yield PLUS Credit Hedge ETF | $27 | 0.25% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, CDX returned 11.82% vs its referenced benchmark, ICE BofA U.S. High Yield Index, return of 10.45%. The Fund outperformed the benchmark by 3.27% during spread widening and underperformed the benchmark by 2.26% during tightening.

Outperformance was driven by:

1. Credit hedges, including the “Quality-Junk” overlay, High Yield CDS, and equity puts, added 1.88%, mainly from the Quality-Junk overlay.

2. Total return swaps via the iShares iBoxx $ High Yield Corporate Bond ETF ("HYG ETF") added 9.91%, despite HYG ETF underperforming the benchmark by 1.07%.

3. Tightening of High Yield credit spreads from 3.90% to 3.09% added 2.75% to absolute return but subtracted a 0.80% from relative performance.

Looking forward, CDX is modestly over-hedged due to tight credit spreads and deteriorating US growth. Tight conditions and high bankruptcy filings suggest outperformance if spreads widen. Current positioning could generate a 0.02% outperformance for every 0.01% of spread widening, potentially leading to a 10% outperformance if spreads reach recession averages. If spreads do not widen, performance should remain favorable.

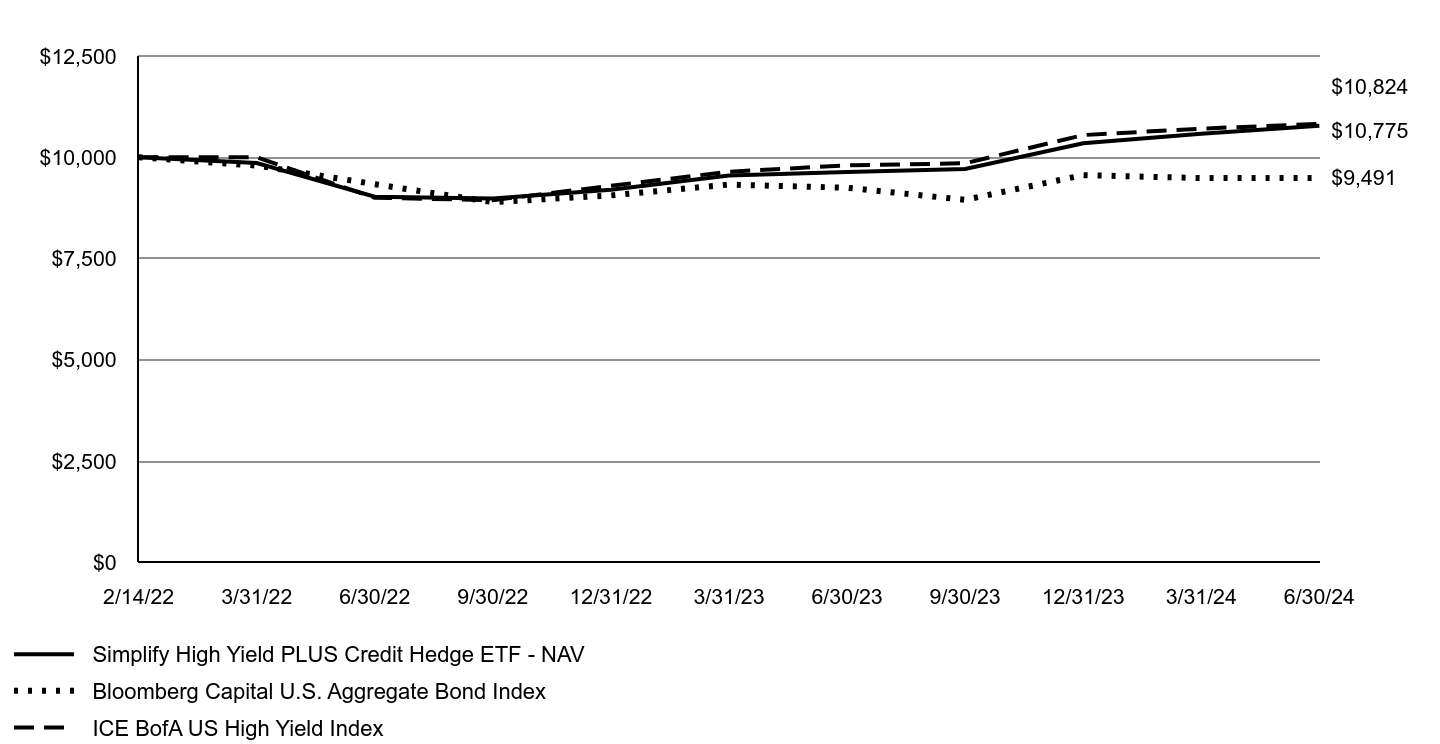

Growth of an Assumed $10,000 Investment

| Simplify High Yield PLUS Credit Hedge ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | ICE BofA US High Yield Index |

|---|

| 2/14/22 | $10,000 | $10,000 | $10,000 |

| 3/31/22 | $9,859 | $9,795 | $9,999 |

| 6/30/22 | $9,027 | $9,335 | $9,002 |

| 9/30/22 | $8,983 | $8,892 | $8,941 |

| 12/31/22 | $9,200 | $9,058 | $9,297 |

| 3/31/23 | $9,551 | $9,326 | $9,643 |

| 6/30/23 | $9,636 | $9,248 | $9,800 |

| 9/30/23 | $9,709 | $8,949 | $9,852 |

| 12/31/23 | $10,347 | $9,559 | $10,548 |

| 3/31/24 | $10,583 | $9,485 | $10,707 |

| 6/30/24 | $10,775 | $9,491 | $10,824 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 2/14/2022 |

|---|

| Simplify High Yield PLUS Credit Hedge ETF - NAV | 11.82% | 3.20% |

| Simplify High Yield PLUS Credit Hedge ETF - Market | 11.66% | 3.20% |

| Bloomberg Capital U.S. Aggregate Bond Index | 2.63% | |

| ICE BofA US High Yield Index | 10.45% | 3.39% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $156,167,780 |

| Total number of portfolio holdings | 5 |

| Total advisory fee paid, net of waiver | $181,060 |

| Period portfolio turnover rate | 0% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 98.9% |

| Purchased Options | 0.0%Footnote Reference† |

| Other Assets in Excess of Liabilities | 1.1% |

| Total | 100.0% |

| Footnote | Description |

Footnote† | Less than 0.05% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

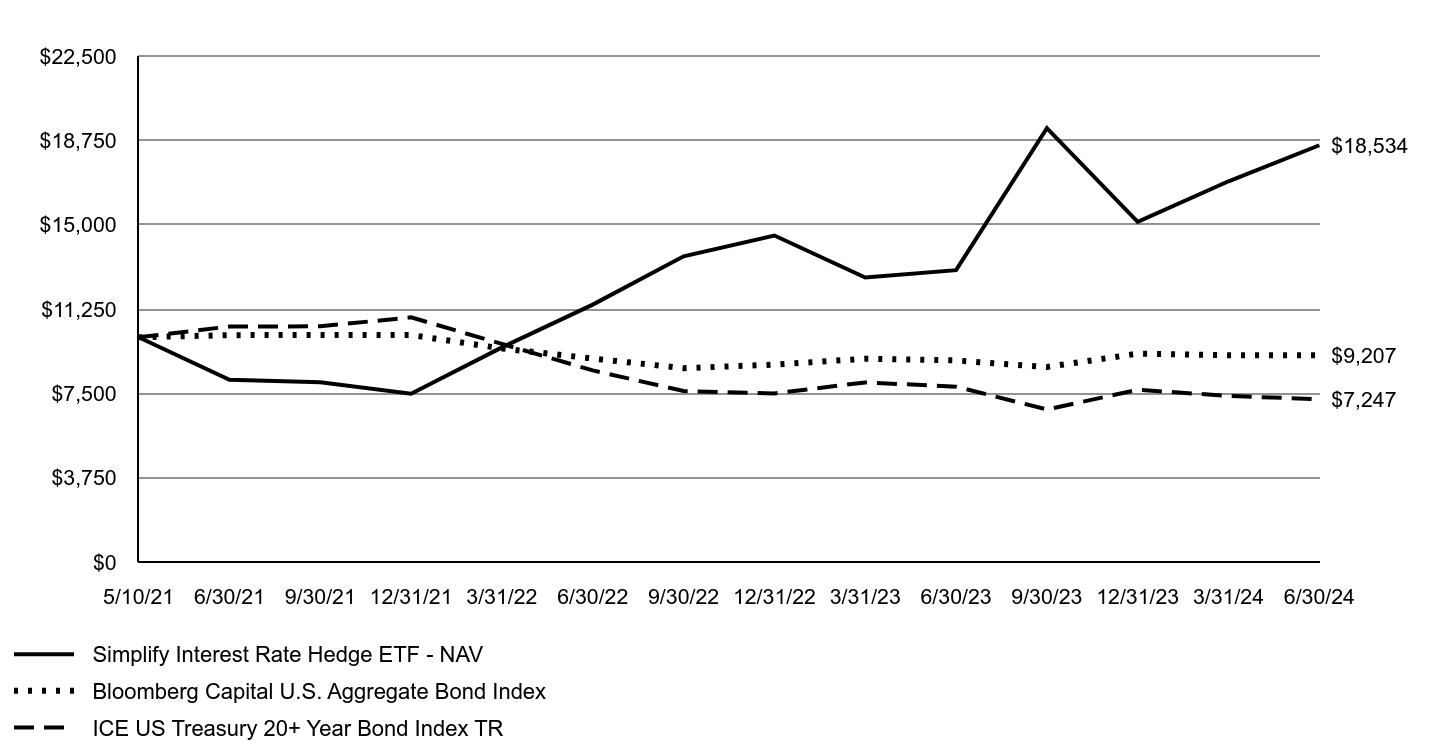

Simplify Interest Rate Hedge ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Interest Rate Hedge ETF ("PFIX" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Interest Rate Hedge ETF | $61 | 0.50% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, PFIX returned 42.78% vs. its referenced benchmark, ICE U.S. Treasury 20+ Year Bond Index, return of -7.15% for the same period, outperforming the benchmark by 49.93%.

The main reason for the difference is that PFIX holds a long position in a set of out-of-the-money pay-fixed options with 5 to 7 years to expiry into a 20-year swap. These swaptions performed well as the forward interest rates that underly them increased. These increases were offset somewhat by time decay on the options and increases in the rates used to discount the option payoff.

Looking forward, increases in rates that drive increases in the forward rates along with increases in implied volatilities would be beneficial to the Fund’s performance while decreases in forward rates and declines in implied volatilities would be harmful. The path of future interest rates and implied volatilities is notoriously difficult to predict.

Growth of an Assumed $10,000 Investment

| Simplify Interest Rate Hedge ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | ICE US Treasury 20+ Year Bond Index TR |

|---|

| 5/10/21 | $10,000 | $10,000 | $10,000 |

| 6/30/21 | $8,111 | $10,095 | $10,478 |

| 9/30/21 | $8,000 | $10,100 | $10,488 |

| 12/31/21 | $7,489 | $10,101 | $10,885 |

| 3/31/22 | $9,551 | $9,502 | $9,705 |

| 6/30/22 | $11,452 | $9,056 | $8,527 |

| 9/30/22 | $13,597 | $8,626 | $7,610 |

| 12/31/22 | $14,523 | $8,787 | $7,506 |

| 3/31/23 | $12,654 | $9,047 | $7,995 |

| 6/30/23 | $12,981 | $8,971 | $7,805 |

| 9/30/23 | $19,295 | $8,681 | $6,791 |

| 12/31/23 | $15,133 | $9,273 | $7,669 |

| 3/31/24 | $16,932 | $9,201 | $7,393 |

| 6/30/24 | $18,534 | $9,207 | $7,247 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 5/10/2021 |

|---|

| Simplify Interest Rate Hedge ETF - NAV | 42.78% | 21.72% |

| Simplify Interest Rate Hedge ETF - Market | 45.24% | 21.60% |

| Bloomberg Capital U.S. Aggregate Bond Index | 2.63% | |

| ICE US Treasury 20+ Year Bond Index TR | | |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $145,441,147 |

| Total number of portfolio holdings | 9 |

| Total advisory fee paid, net of waiver | $873,405 |

| Period portfolio turnover rate | 164% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 52.1% |

| U.S. Government Obligations | 33.2% |

| Purchased Swaptions | 14.5% |

| Other Assets in Excess of Liabilities | 0.2% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

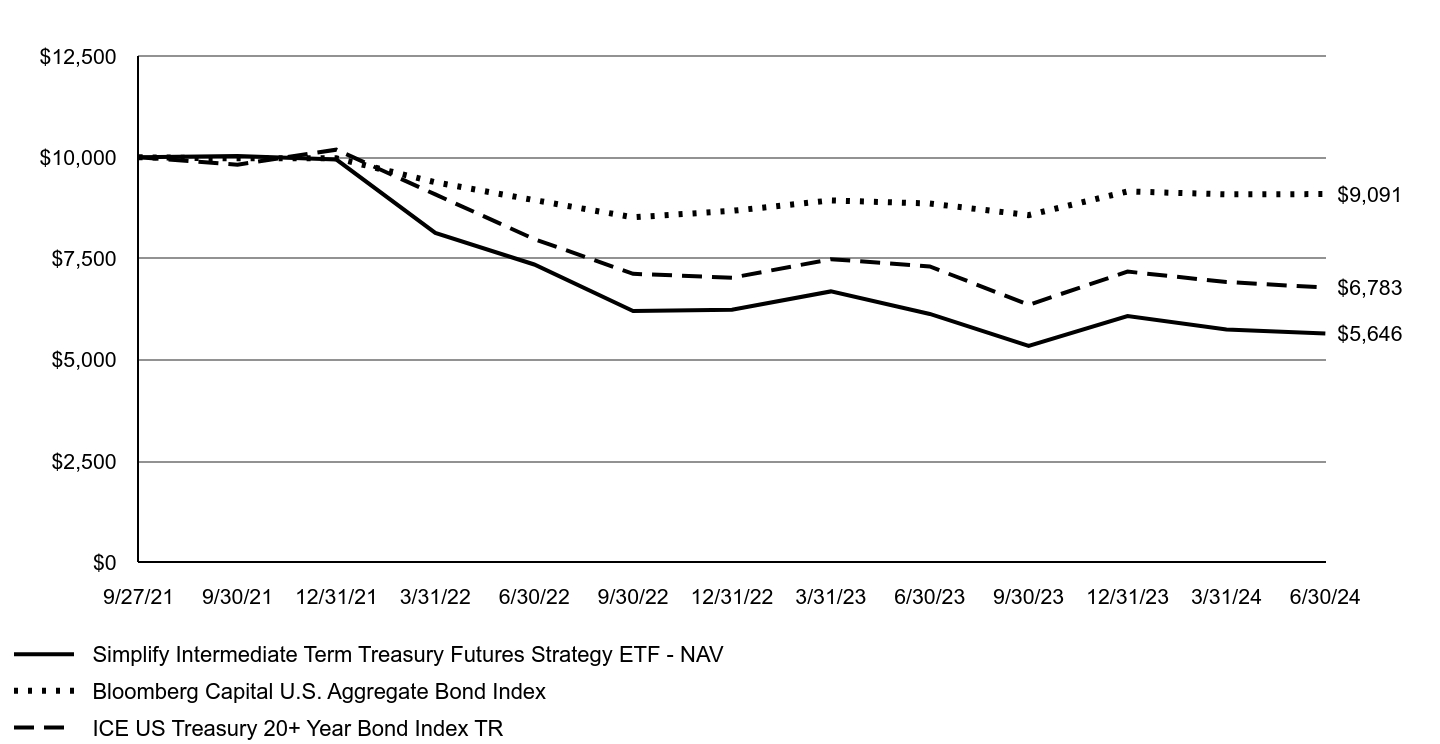

Simplify Intermediate Term Treasury Futures Strategy ETF

| Cboe BZX Exchange, Inc.

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Intermediate Term Treasury Futures Strategy ETF ("TYA" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Intermediate Term Treasury Futures Strategy ETF | $14 | 0.15% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, TYA returned -7.93% vs its referenced benchmark, ICE U.S. Treasury 20+ Year Bond Index, return of -7.15% for the same period, under performing the benchmark by 0.78%.

The Fund’s performance was driven by its long exposure to Intermediate-Term Treasury Futures and short-term treasuries. A long position in Treasury futures earns returns on the cheapest to deliver bond in exchange for paying a short-term financing rate. With an inverted yield curve (long-term rates below short-term rates), this exposure has a negative carry. Leveraged up to 3 times, increases in yields on intermediate-term treasuries led to negative returns, outweighing positive returns on short-term treasuries.

Looking forward, TYA's performance will depend on rate movements. Increases in rates or further inversions will be harmful, while decreases and steepening would be beneficial. Predicting future rates and their term structure is challenging.

Growth of an Assumed $10,000 Investment

| Simplify Intermediate Term Treasury Futures Strategy ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | ICE US Treasury 20+ Year Bond Index TR |

|---|

| 9/27/21 | $10,000 | $10,000 | $10,000 |

| 9/30/21 | $10,031 | $9,973 | $9,816 |

| 12/31/21 | $9,944 | $9,974 | $10,187 |

| 3/31/22 | $8,132 | $9,382 | $9,083 |

| 6/30/22 | $7,353 | $8,942 | $7,981 |

| 9/30/22 | $6,204 | $8,517 | $7,123 |

| 12/31/22 | $6,238 | $8,677 | $7,026 |

| 3/31/23 | $6,688 | $8,934 | $7,483 |

| 6/30/23 | $6,132 | $8,858 | $7,305 |

| 9/30/23 | $5,345 | $8,572 | $6,356 |

| 12/31/23 | $6,078 | $9,156 | $7,177 |

| 3/31/24 | $5,747 | $9,085 | $6,920 |

| 6/30/24 | $5,646 | $9,091 | $6,783 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 9/27/2021 |

|---|

| Simplify Intermediate Term Treasury Futures Strategy ETF - NAV | | |

| Simplify Intermediate Term Treasury Futures Strategy ETF - Market | | |

| Bloomberg Capital U.S. Aggregate Bond Index | 2.63% | |

| ICE US Treasury 20+ Year Bond Index TR | | |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $48,678,096 |

| Total number of portfolio holdings | 5 |

| Total advisory fee paid, net of waiver | $70,871 |

| Period portfolio turnover rate | 0% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 98.7% |

| Money Market Funds | 0.2% |

| Other Assets in Excess of Liabilities | 1.1% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

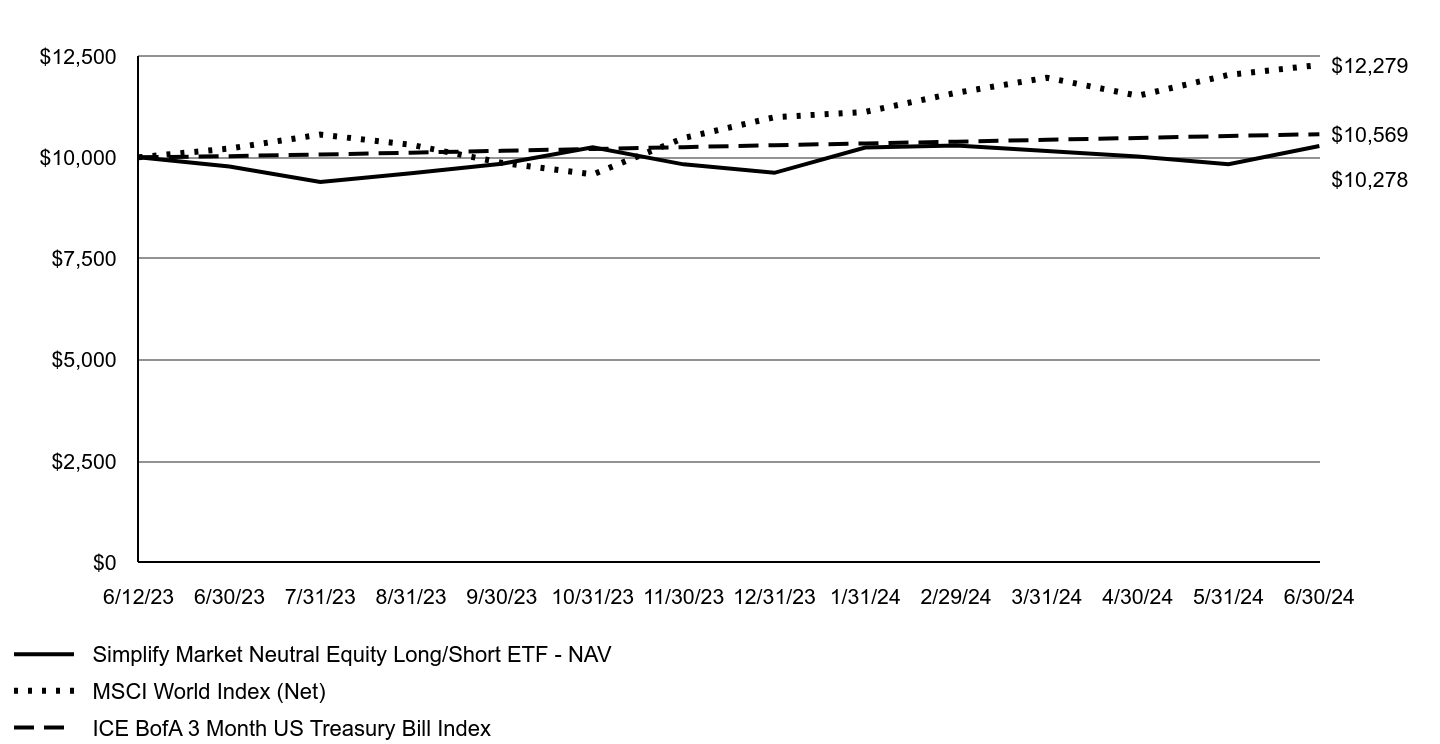

Simplify Market Neutral Equity Long/Short ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Market Neutral Equity Long/Short ETF ("EQLS" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Market Neutral Equity Long/Short ETF | $103 | 1.00% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, EQLS returned 5.19% vs its referenced benchmark, ICE BofA US 3-Month Treasury Bill Index, return of 5.40% for the same period, underperforming the benchmark by 0.21%.

Performance derived from systematic exposure was positive and in-line with expectations. Significant contributors included negative exposures to Short Interest Utilization and positive exposures to Profitability, Momentum, and Size. Detractors included negative exposure to Volatility and positive exposures to Revision and Earnings Yield, which underperformed. Non-systematic/idiosyncratic performance was positive but below expectations. Historically, residual performance improves as the model adapts.

Looking ahead, a rate-cutting regime is anticipated, which should boost economic growth and firm investment. We believe EQLS is well-positioned with positive exposures to Profitability and Earnings Yield, and negative exposure to Book-to-Market, to benefit from this transition.

Growth of an Assumed $10,000 Investment

| Simplify Market Neutral Equity Long/Short ETF - NAV | MSCI World Index (Net) | ICE BofA 3 Month US Treasury Bill Index |

|---|

| 6/12/23 | $10,000 | $10,000 | $10,000 |

| 6/30/23 | $9,771 | $10,216 | $10,028 |

| 7/31/23 | $9,389 | $10,559 | $10,068 |

| 8/31/23 | $9,603 | $10,307 | $10,113 |

| 9/30/23 | $9,838 | $9,862 | $10,159 |

| 10/31/23 | $10,246 | $9,576 | $10,205 |

| 11/30/23 | $9,825 | $10,474 | $10,250 |

| 12/31/23 | $9,616 | $10,988 | $10,298 |

| 1/31/24 | $10,242 | $11,120 | $10,342 |

| 2/29/24 | $10,291 | $11,591 | $10,385 |

| 3/31/24 | $10,155 | $11,964 | $10,431 |

| 4/30/24 | $10,016 | $11,519 | $10,476 |

| 5/31/24 | $9,829 | $12,034 | $10,526 |

| 6/30/24 | $10,278 | $12,279 | $10,569 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 6/12/2023 |

|---|

| Simplify Market Neutral Equity Long/Short ETF - NAV | 5.19% | 2.65% |

| Simplify Market Neutral Equity Long/Short ETF - Market | 4.42% | 2.51% |

| MSCI World Index (Net) | 20.19% | 21.61% |

| ICE BofA 3 Month US Treasury Bill Index | 5.40% | 5.42% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The Fund had a return of capital of $687,184.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $156,231,187 |

| Total number of portfolio holdings | 3 |

| Total advisory fee paid, net of waiver | $1,196,259 |

| Period portfolio turnover rate | 0% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 98.1% |

| Other Assets in Excess of Liabilities | 1.9% |

| Total | 100.0% |

This is a summary of certain changes to the Fund since July 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by November 1, 2024 at www.simplify.us/resources or upon request at (855) 772-8488.

- Effective May 24, 2024, Simplify EQLS LLC became the investment advisor of the Fund.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

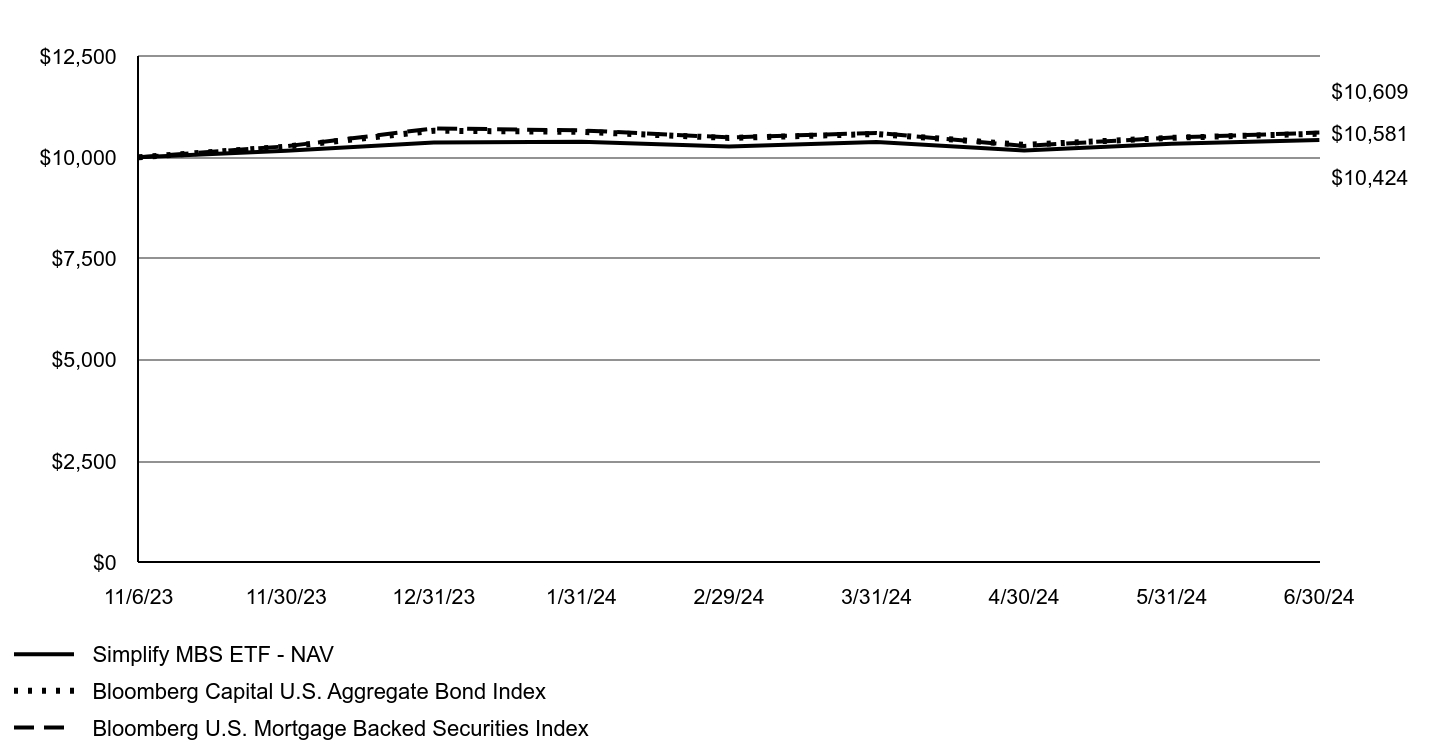

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify MBS ETF ("MTBA" or the "Fund") for the period of November 6, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify MBS ETF | $12Footnote Reference(1) | 0.17% |

| Footnote | Description |

Footnote(1) | Based on the period November 6, 2023 (commencement of operations) through June 30, 2024. Expenses would have been higher if based on the full reporting period. |

Management's Discussion of Fund Performance

For the period November 7, 2023, to June 30, 2024, MTBA returned 4.24% vs. the Bloomberg US MBS Index Total Return of 6.09%, underperforming the benchmark by 1.85%.

MTBA invests in the mortgage market by taking long positions in current coupon TBA mortgage futures in the over-the-counter market. These positions accrue mortgage interest, incur financing charges, and experience mark-to-market gains and losses from interest rate changes. From inception, mortgage rates were volatile but decreased slightly. TBA positions are notional, leaving NAV to be invested in short-term treasuries.

Looking ahead, the Fund's performance is sensitive to changes in fixed-rate mortgage rates and short-term financing rates. Mortgage rates depend on multiple points on the term structure, volatilities, and supply-demand dynamics, all of which are challenging to predict.

Growth of an Assumed $10,000 Investment

| Simplify MBS ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | Bloomberg U.S. Mortgage Backed Securities Index |

|---|

| 11/6/23 | $10,000 | $10,000 | $10,000 |

| 11/30/23 | $10,158 | $10,263 | $10,271 |

| 12/31/23 | $10,367 | $10,656 | $10,713 |

| 1/31/24 | $10,384 | $10,627 | $10,664 |

| 2/29/24 | $10,268 | $10,477 | $10,490 |

| 3/31/24 | $10,377 | $10,574 | $10,601 |

| 4/30/24 | $10,168 | $10,307 | $10,281 |

| 5/31/24 | $10,333 | $10,481 | $10,486 |

| 6/30/24 | $10,424 | $10,581 | $10,609 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | Since Inception 11/6/2023 |

|---|

| Simplify MBS ETF - NAV | 4.24% |

| Simplify MBS ETF - Market | 4.01% |

| Bloomberg Capital U.S. Aggregate Bond Index | 5.81% |

| Bloomberg U.S. Mortgage Backed Securities Index | 6.09% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The Fund had a return of capital of $2,807,611.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $750,306,937 |

| Total number of portfolio holdings | 5 |

| Total advisory fee paid, net of waiver | $387,878 |

| Period portfolio turnover rate | 769% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 99.7% |

| U.S. Government Agency Mortgage Backed Securities | 98.3% |

| Liabilities in Excess of Other Assets | (98.0)% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

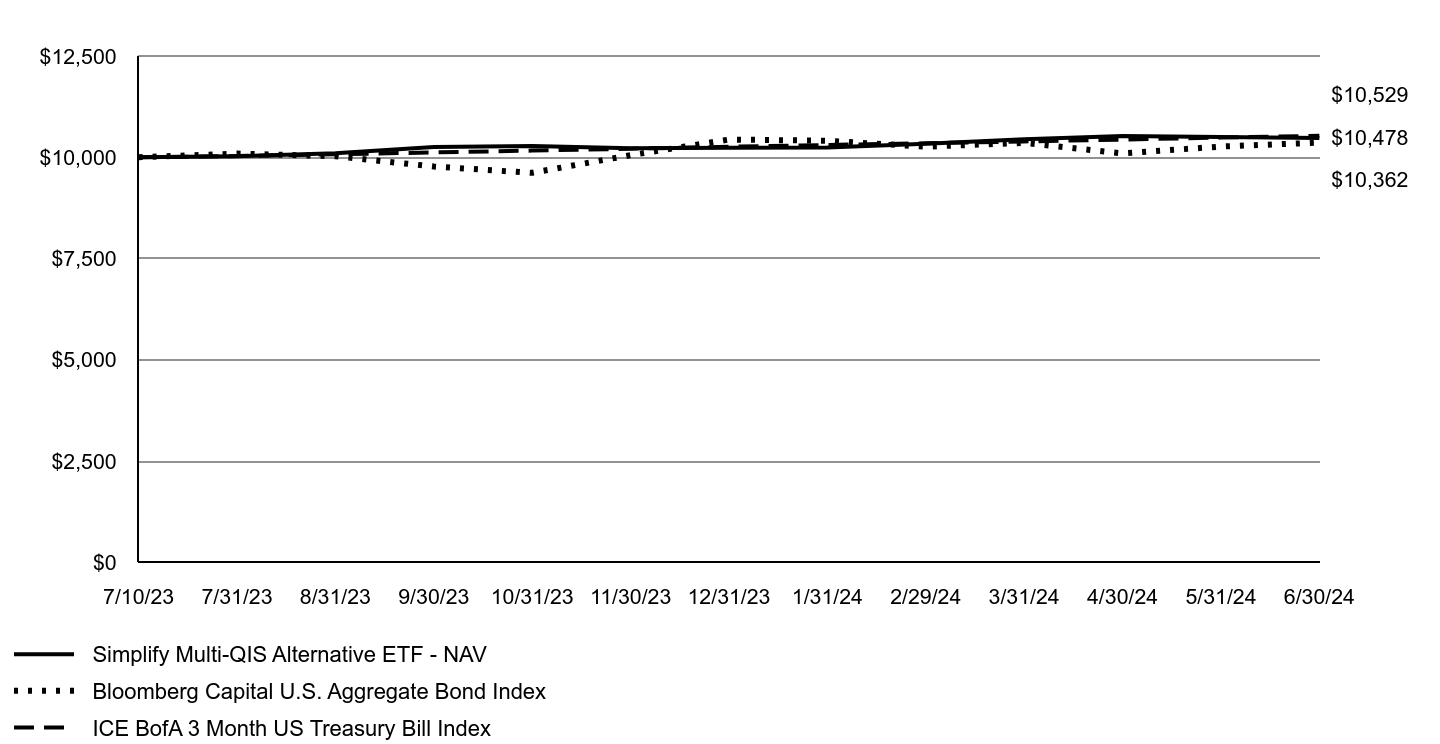

Simplify Multi-QIS Alternative ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Multi-QIS Alternative ETF ("QIS" or the "Fund") for the period of July 10, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Multi-QIS Alternative ETF | $99.6Footnote Reference(1) | 1.00% |

| Footnote | Description |

Footnote(1) | Based on the period July 10, 2023 (commencement of operations) through June 30, 2024. Expenses would have been higher if based on the full reporting period. |

Management's Discussion of Fund Performance

For the period July 10, 2023, to June 30, 2024, QIS returned 4.78% vs. the ICE BofA US 3-Month Treasury Bill Index benchmark return of 5.29%, underperforming by 0.51%.

Quantitative strategies across the board have had one of their most challenging periods in the last decade, and we have seen above average correlations between strategies further reduce normal diversification benefits. Equity volatility strategies have also been a headwind, as implied volatilities have been low and realized volatilities have been high. We did also see some more idiosyncratic headwinds out of the commodity complex. Bouts of higher correlations and challenging realized volatility are expected to happen occasionally, and as such the performance thus far is well within our expected bounds.

Looking ahead, we expect normalization of these features, which should become tailwinds and improve performance.

Growth of an Assumed $10,000 Investment

| Simplify Multi-QIS Alternative ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | ICE BofA 3 Month US Treasury Bill Index |

|---|

| 7/10/23 | $10,000 | $10,000 | $10,000 |

| 7/31/23 | $10,026 | $10,090 | $10,029 |

| 8/31/23 | $10,101 | $10,025 | $10,074 |

| 9/30/23 | $10,256 | $9,771 | $10,120 |

| 10/31/23 | $10,276 | $9,616 | $10,165 |

| 11/30/23 | $10,221 | $10,052 | $10,211 |

| 12/31/23 | $10,237 | $10,437 | $10,259 |

| 1/31/24 | $10,243 | $10,408 | $10,303 |

| 2/29/24 | $10,335 | $10,261 | $10,345 |

| 3/31/24 | $10,445 | $10,356 | $10,391 |

| 4/30/24 | $10,527 | $10,094 | $10,436 |

| 5/31/24 | $10,500 | $10,265 | $10,486 |

| 6/30/24 | $10,478 | $10,362 | $10,529 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | Since Inception 7/10/2023 |

|---|

| Simplify Multi-QIS Alternative ETF - NAV | 4.78% |

| Simplify Multi-QIS Alternative ETF - Market | 4.80% |

| Bloomberg Capital U.S. Aggregate Bond Index | 3.62% |

| ICE BofA 3 Month US Treasury Bill Index | 5.29% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $114,939,300 |

| Total number of portfolio holdings | 4 |

| Total advisory fee paid, net of waiver | $1,095,980 |

| Period portfolio turnover rate | 0% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 99.6% |

| Purchased Options | 0.0%Footnote Reference† |

| Other Assets in Excess of Liabilities | 0.4% |

| Total | 100.0% |

| Footnote | Description |

Footnote† | Less than 0.05% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

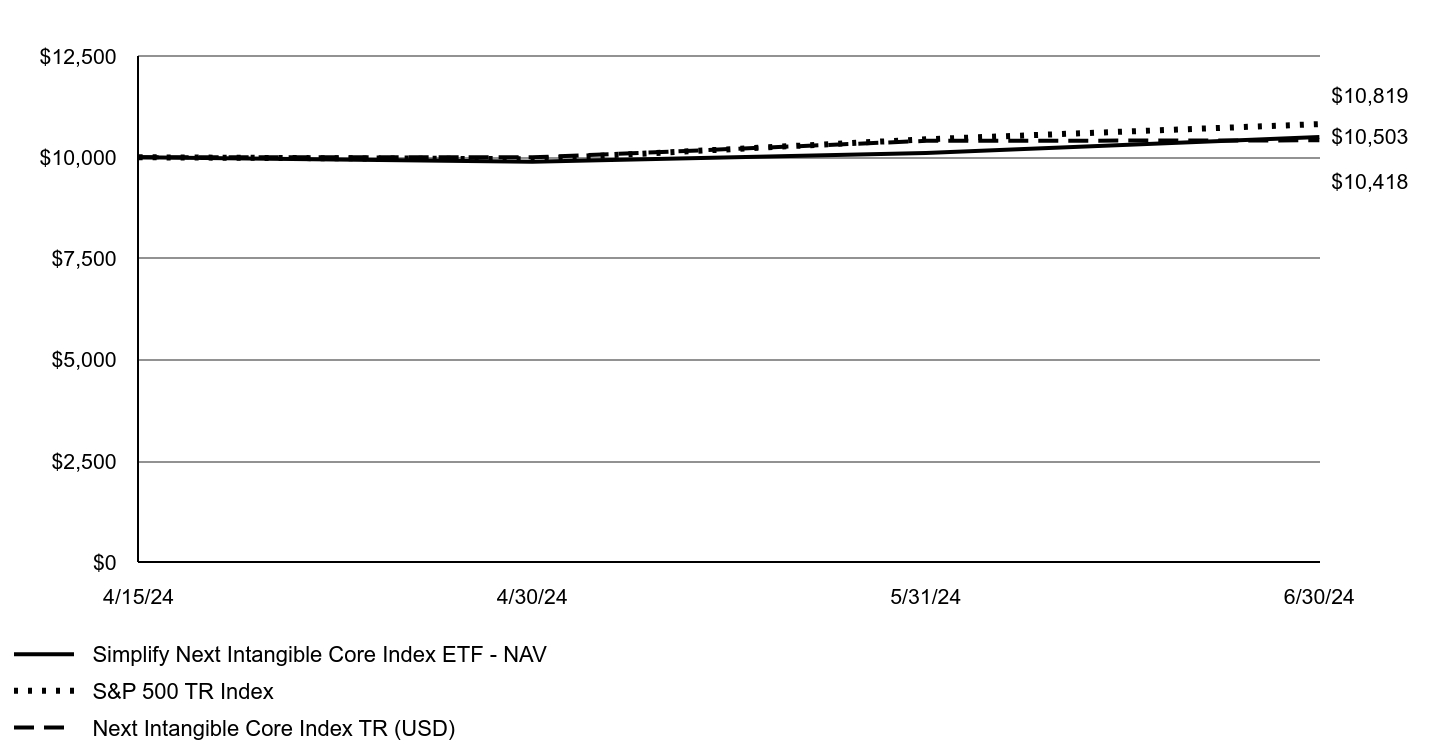

Simplify Next Intangible Core Index ETF

| Cboe BZX Exchange, Inc.

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Next Intangible Core Index ETF ("NXTI" or the "Fund") for the period of April 15, 2024 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Next Intangible Core Index ETF | $5Footnote Reference(1) | 0.25% |

| Footnote | Description |

Footnote(1) | Based on the period April 15, 2024 (commencement of operations) through June 30, 2024. Expenses would have been higher if based on the full reporting period. |

Management's Discussion of Fund Performance

For the period April 15, 2024, to June 30, 2024, NXTI returned 5.03% vs. the NEXT Intangible Core Index benchmark return of 4.18%, underperforming by 0.85%.

NXTI had positive returns in Healthcare, Utilities, Consumer Staples, Information Technology, Communication Services, Consumer Discretionary, Real Estate, Financials, and Industrials. NXTI had negative returns in Energy and Materials. Eli Lilly, Qualcomm, and Walmart were key contributors to positive returns while Cisco Systems, Mastercard, and Accenture were distractors to performance.

Looking ahead, NXTI will continue to select companies with high intangible capital-to-book asset ratios within their respective sectors.

Growth of an Assumed $10,000 Investment

| Simplify Next Intangible Core Index ETF - NAV | S&P 500 TR Index | Next Intangible Core Index TR (USD) |

|---|

| 4/15/24 | $10,000 | $10,000 | $10,000 |

| 4/30/24 | $9,891 | $9,951 | $9,998 |

| 5/31/24 | $10,106 | $10,444 | $10,405 |

| 6/30/24 | $10,503 | $10,819 | $10,418 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | Since Inception 4/15/2024 |

|---|

| Simplify Next Intangible Core Index ETF - NAV | 5.03% |

| Simplify Next Intangible Core Index ETF- Market | 4.92% |

| S&P 500 TR Index | 8.19% |

| Next Intangible Core Index TR (USD) | 4.18% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $2,620,804 |

| Total number of portfolio holdings | 202 |

| Total advisory fee paid, net of waiver | $1,303 |

| Period portfolio turnover rate | 28% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Common Stocks | 100.0% |

| Money Market Funds | 0.0%Footnote Reference† |

| Other Assets in Excess of Liabilities | 0.0%Footnote Reference† |

| Total | 100.0% |

| Footnote | Description |

Footnote† | Less than 0.05% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

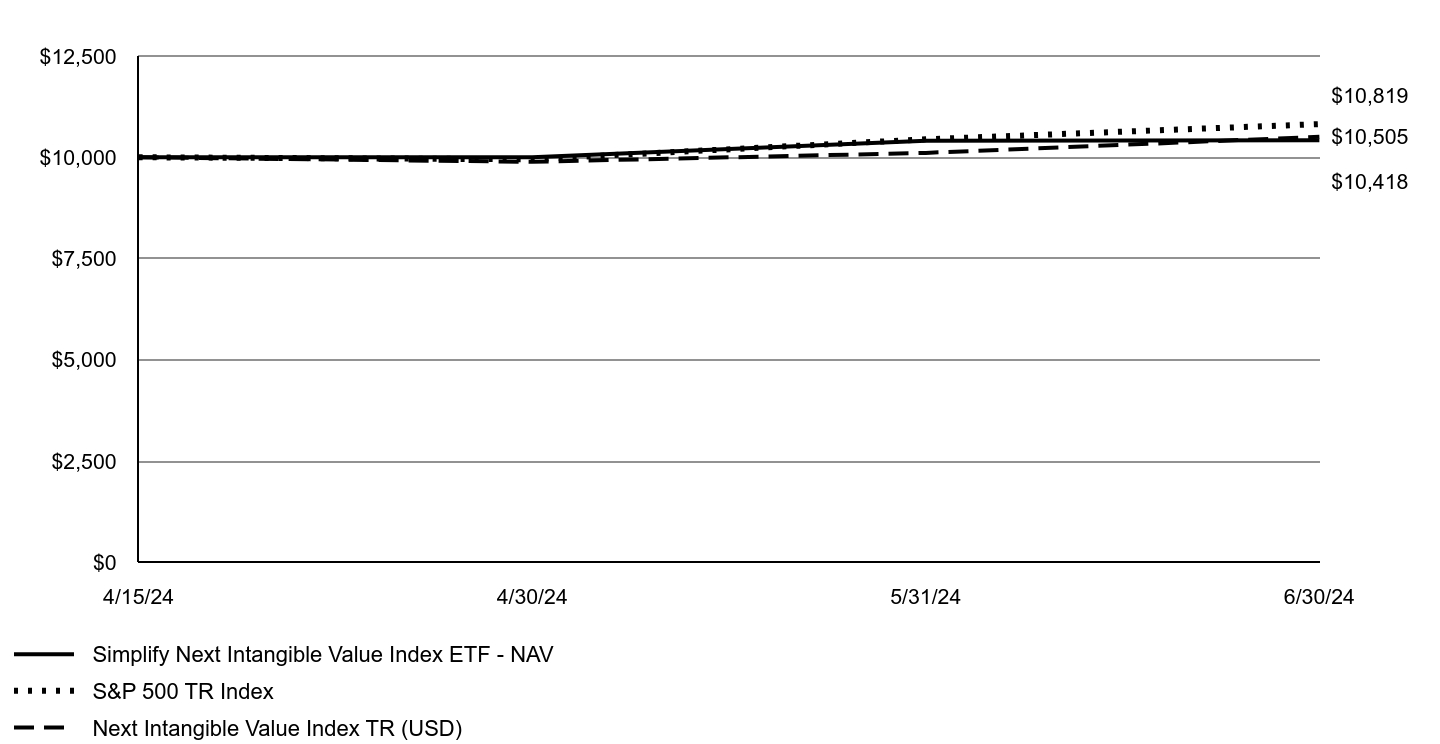

Simplify Next Intangible Value Index ETF

| Cboe BZX Exchange, Inc.

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Next Intangible Value Index ETF ("NXTV" or the "Fund") for the period of April 15, 2024 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Next Intangible Value Index ETF | $5Footnote Reference(1) | 0.25% |

| Footnote | Description |

Footnote(1) | Based on the period April 15, 2024 (commencement of operations) through June 30, 2024. Expenses would have been higher if based on the full reporting period. |

Management's Discussion of Fund Performance

For the period April 15, 2024, to June 30, 2024, NXTV returned 4.18% vs. the NEXT Intangible Value Total Return Index benchmark return of 5.05%, underperforming by 0.87%.

NXTV had positive returns in Communication Services, Utilities, Financials, Industrials, Consumer Discretionary, Real Estate, Consumer Staples, Information Technology and Healthcare. NXTV had negative returns in Energy and Materials. Walmart, AT&T, and Micron Technology were key contributors to positive returns while Intel, Cisco Systems, and International Business Machines were distractors to performance.

Looking ahead, NXTV will continue to select companies with attractive equity value to intangible-adjusted book value within their respective sectors.

Growth of an Assumed $10,000 Investment

| Simplify Next Intangible Value Index ETF - NAV | S&P 500 TR Index | Next Intangible Value Index TR (USD) |

|---|

| 4/15/24 | $10,000 | $10,000 | $10,000 |

| 4/30/24 | $10,000 | $9,951 | $9,887 |

| 5/31/24 | $10,405 | $10,444 | $10,108 |

| 6/30/24 | $10,418 | $10,819 | $10,505 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | Since Inception 4/15/2024 |

|---|

| Simplify Next Intangible Value Index ETF - NAV | 4.18% |

| Simplify Next Intangible Value Index ETF - Market | 4.38% |

| S&P 500 TR Index | 8.19% |

| Next Intangible Value Index TR (USD) | 5.05% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $2,599,486 |

| Total number of portfolio holdings | 202 |

| Total advisory fee paid, net of waiver | $1,313 |

| Period portfolio turnover rate | 65% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Common Stocks | 99.8% |

| Money Market Funds | 0.1% |

| Other Assets in Excess of Liabilities | 0.1% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

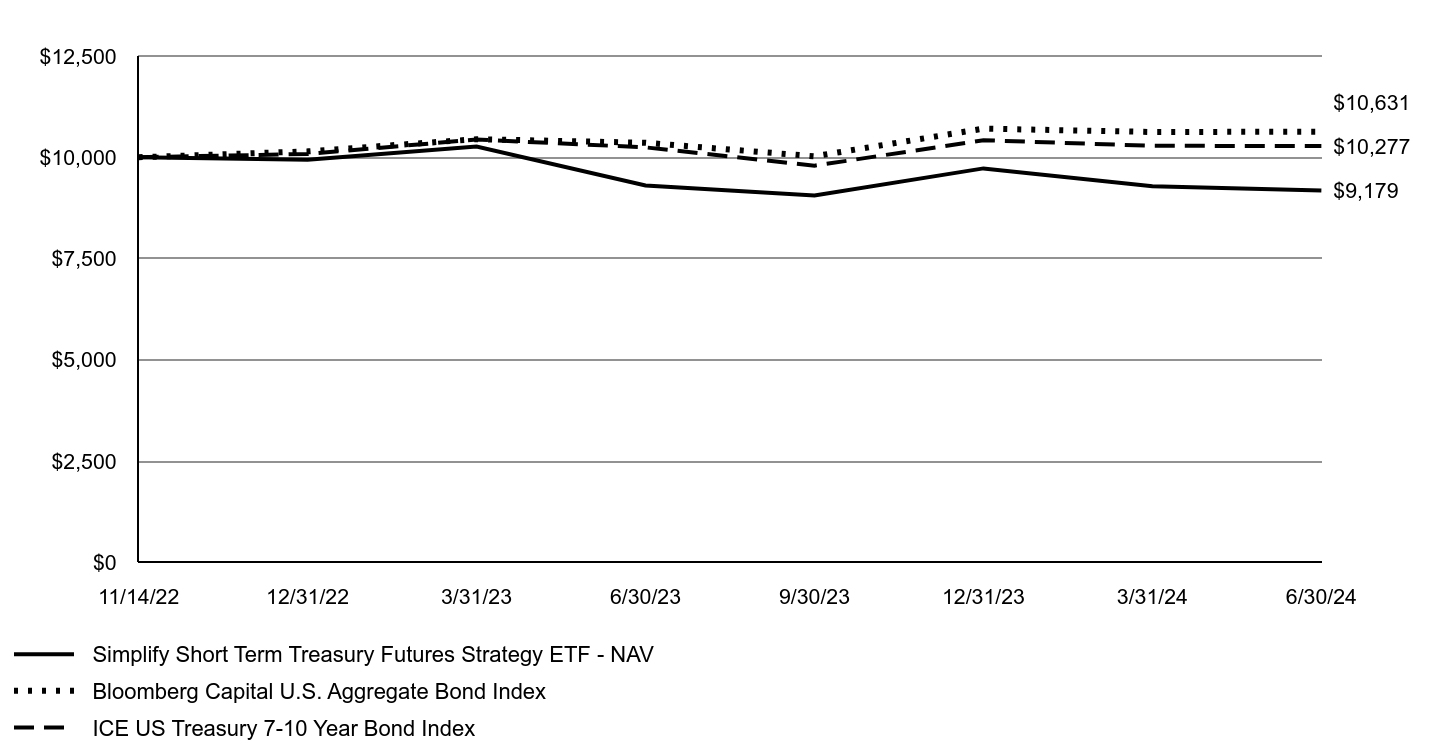

Simplify Short Term Treasury Futures Strategy ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Short Term Treasury Futures Strategy ETF ("TUA" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Short Term Treasury Futures Strategy ETF | $15 | 0.15% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, TUA returned -1.33% vs. the ICE U.S. Treasury 7-10 Year Bond Index benchmark return of 0.32% for the same period, underperforming the benchmark by 1.65%.

TUA's performance was driven by its long exposure to Two Year Treasury Futures and holdings of short-term treasuries. A long position in Treasury futures earns returns on the cheapest to deliver bond in exchange for paying a short-term financing rate. With an inverted yield curve (2-year rates below short-term rates), this exposure has a structurally negative carry. Leveraged up 5 times, minimal yield changes in the focus treasuries led to negative returns, offsetting positive returns on short-term treasuries.

Looking forward, performance for TUA will be driven by movements in rates. Increases in rates and/or further inversions will generally be harmful and decreases accompanied by steepening would be beneficial. The path of future interest rates and their term structure is notoriously difficult to predict.

Growth of an Assumed $10,000 Investment

| Simplify Short Term Treasury Futures Strategy ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | ICE US Treasury 7-10 Year Bond Index |

|---|

| 11/14/22 | $10,000 | $10,000 | $10,000 |

| 12/31/22 | $9,940 | $10,146 | $10,081 |

| 3/31/23 | $10,267 | $10,446 | $10,438 |

| 6/30/23 | $9,303 | $10,358 | $10,244 |

| 9/30/23 | $9,055 | $10,024 | $9,792 |

| 12/31/23 | $9,725 | $10,707 | $10,422 |

| 3/31/24 | $9,286 | $10,624 | $10,283 |

| 6/30/24 | $9,179 | $10,631 | $10,277 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 11/14/2022 |

|---|

| Simplify Short Term Treasury Futures Strategy ETF - NAV | | |

| Simplify Short Term Treasury Futures Strategy ETF - Market | | |

| Bloomberg Capital U.S. Aggregate Bond Index | 2.63% | 3.84% |

| ICE US Treasury 7-10 Year Bond Index | 0.32% | 1.69% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $539,079,601 |

| Total number of portfolio holdings | 4 |

| Total advisory fee paid, net of waiver | $882,008 |

| Period portfolio turnover rate | 0% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 99.5% |

| Other Assets in Excess of Liabilities | 0.5% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

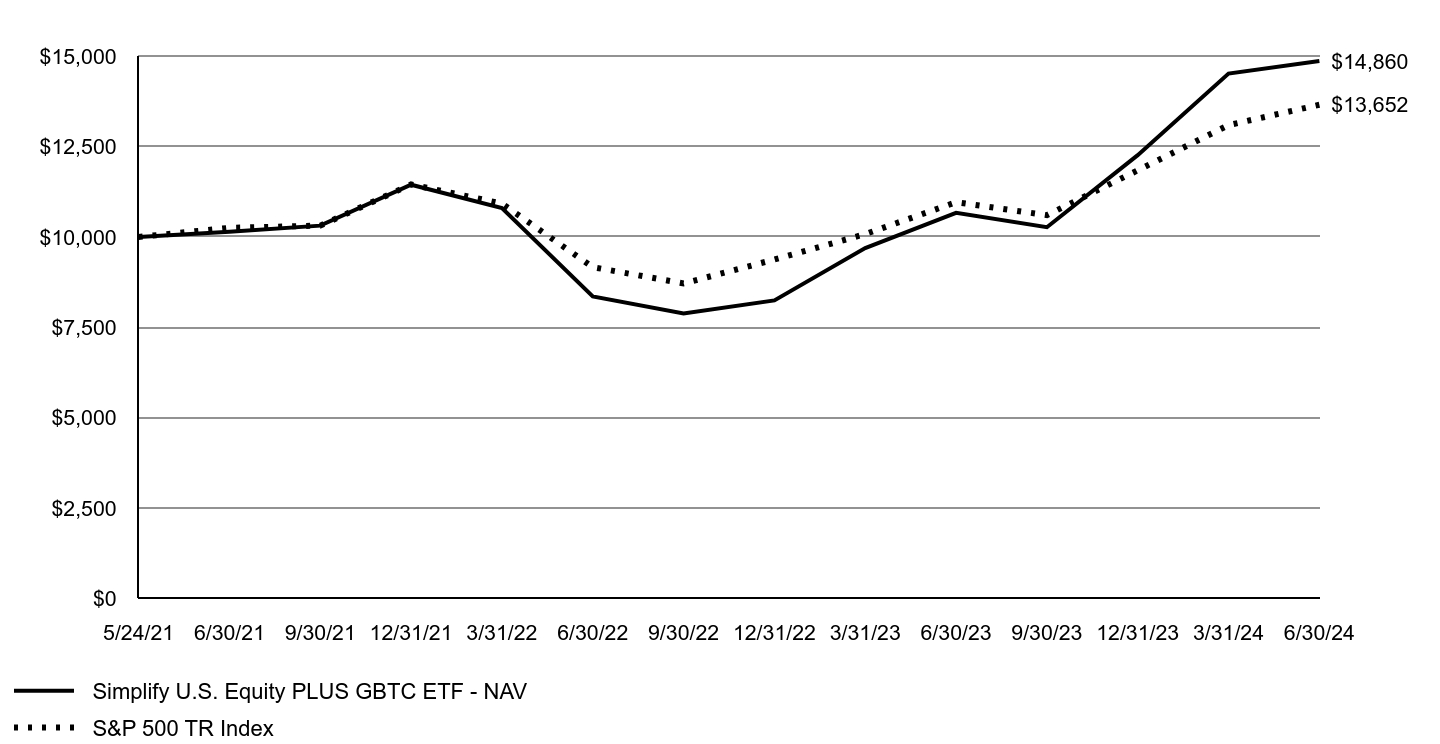

Simplify US Equity PLUS GBTC ETF

| Nasdaq Stock Market LLC

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify US Equity PLUS GBTC ETF ("SPBC" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify U.S. Equity PLUS GBTC ETF | $61 | 0.51% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, SPBC returned 39.29% vs its referenced benchmark, S&P 500 Index, return of 24.56%, outperforming the benchmark by 14.73%.

SPBC targets a 10% exposure to GBTC, which returned 93.79% over the same period, driving the outperformance of 14.73% vs. the benchmark. The Fund’s holding in GBTC also benefitted from a shrinking in the premium between the market price of GBTC to its NAV, which shrunk from -30.15% to -0.01%, over the same period.

Looking forward, SPBC remains uniquely positioned to provide investors with exposure to U.S. Large Cap Equity combined with Bitcoin exposure. With the advent of Bitcoin exchange traded products in early 2024, GBTC should act as a good proxy for exposure to the price of spot Bitcoin moving forward, as the Fund pursues its stated investment objective.

Growth of an Assumed $10,000 Investment

| Simplify U.S. Equity PLUS GBTC ETF - NAV | S&P 500 TR Index |

|---|

| 5/24/21 | $10,000 | $10,000 |

| 6/30/21 | $10,146 | $10,253 |

| 9/30/21 | $10,313 | $10,313 |

| 12/31/21 | $11,444 | $11,450 |

| 3/31/22 | $10,798 | $10,923 |

| 6/30/22 | $8,355 | $9,165 |

| 9/30/22 | $7,883 | $8,717 |

| 12/31/22 | $8,247 | $9,376 |

| 3/31/23 | $9,693 | $10,079 |

| 6/30/23 | $10,668 | $10,960 |

| 9/30/23 | $10,269 | $10,602 |

| 12/31/23 | $12,260 | $11,841 |

| 3/31/24 | $14,513 | $13,091 |

| 6/30/24 | $14,860 | $13,652 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 5/24/2021 |

|---|

| Simplify US Equity PLUS GBTC ETF - NAV | 39.29% | 13.62% |

| Simplify U.S. Equity PLUS GBTC ETF - Market | 39.50% | 13.97% |

| S&P 500 TR Index | 24.56% | 10.56% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The Fund had a return of capital of $93,611.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $21,526,455 |

| Total number of portfolio holdings | 4 |

| Total advisory fee paid, net of waiver | $53,810 |

| Period portfolio turnover rate | 21% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Exchange-Traded Funds | 85.2% |

| Grantor Trusts | 9.9% |

| U.S. Treasury Bills | 4.6% |

| Money Market Funds | 0.0%Footnote Reference† |

| Other Assets in Excess of Liabilities | 0.3% |

| Total | 100.0% |

| Footnote | Description |

Footnote† | Less than 0.05% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

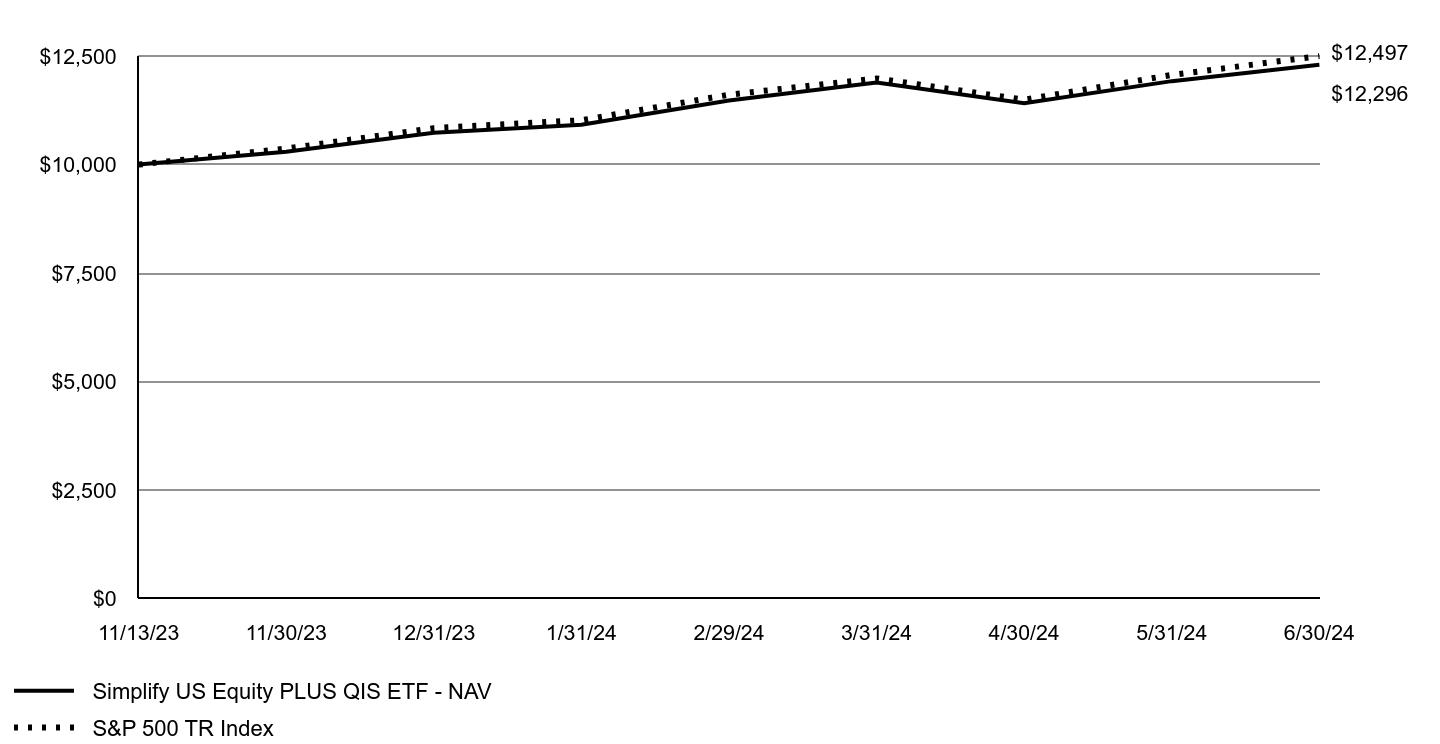

Simplify US Equity PLUS QIS ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify US Equity PLUS QIS ETF ("SPQ" or the "Fund") for the period of November 13, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify US Equity PLUS QIS ETF | $39Footnote Reference(1) | 0.56% |

| Footnote | Description |

Footnote(1) | Based on the period November 13, 2023 (commencement of operations) through June 30, 2024. Expenses would have been higher if based on the full reporting period. |

Management's Discussion of Fund Performance

For the period November 13 2023, to June 30, 2024, SPQ returned 22.97% vs. its referenced benchmark, S&P 500 Index, return of 24.97%, underperforming by 2.00%.

Quant strategies across the board have had one of their most challenging periods in the last decade, and we have seen above average correlations between strategies further reduce normal diversification benefits. Equity volatility strategies have also been a headwind, as implied volatilities have been low and realized volatilities have been high. We did also see some more idiosyncratic headwinds out of the commodity complex. Bouts of higher correlations and challenging realized volatilities are expected to happen occasionally, and as such the performance thus far is well within our expected bounds.

Looking ahead, we expect normalization of these features, which should become tailwinds and improve performance.

Growth of an Assumed $10,000 Investment

| Simplify US Equity PLUS QIS ETF - NAV | S&P 500 TR Index |

|---|

| 11/13/23 | $10,000 | $10,000 |

| 11/30/23 | $10,295 | $10,368 |

| 12/31/23 | $10,732 | $10,839 |

| 1/31/24 | $10,915 | $11,021 |

| 2/29/24 | $11,475 | $11,610 |

| 3/31/24 | $11,887 | $11,983 |

| 4/30/24 | $11,413 | $11,494 |

| 5/31/24 | $11,921 | $12,064 |

| 6/30/24 | $12,296 | $12,497 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | Since Inception 11/13/2023 |

|---|

| Simplify US Equity PLUS QIS ETF - NAV | 22.97% |

| Simplify US Equity PLUS QIS ETF - Market | 20.88% |

| S&P 500 TR Index | 24.97% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $3,002,992 |

| Total number of portfolio holdings | 3 |

| Total advisory fee paid, net of waiver | $10,319 |

| Period portfolio turnover rate | 88% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Exchange-Traded Funds | 94.7% |

| U.S. Treasury Bills | 3.3% |

| Other Assets in Excess of Liabilities | 2.0% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

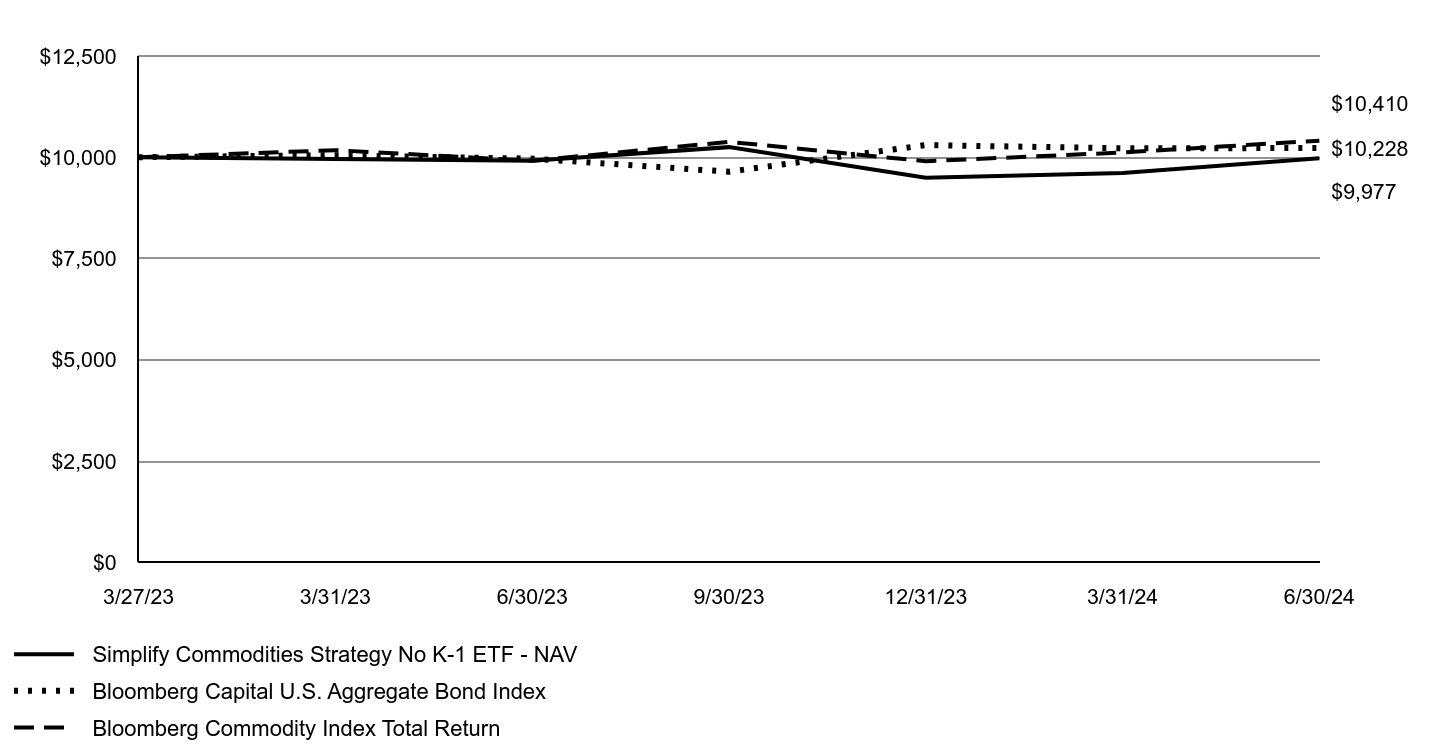

Simplify Commodities Strategy No K-1 ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Commodities Strategy No K-1 ETF ("HARD" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Commodities Strategy No K-1 ETF | $75 | 0.75% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, HARD returned 0.63% vs its referenced benchmark, Bloomberg Commodity Index Total Return, return of 2.63% for the same period, underperforming the benchmark by 2.00%.

Positive returns from positions in selected energy and base metals were helpful to the Fund performance, while giving back performance in its precious metals posture. Average overall weight of aggregate commodity positioning was about +30%, which is a result of the strategy’s long commodity bias. Additionally, the Fund minimized negative carry positioning in individual commodities with curves having excess steepness or inversion.

Going forward, our view is that HARD’s asset selection and positioning should enable it to outperform during a cyclical bull market in commodities, especially in energy and metals.

Growth of an Assumed $10,000 Investment

| Simplify Commodities Strategy No K-1 ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | Bloomberg Commodity Index Total Return |

|---|

| 3/27/23 | $10,000 | $10,000 | $10,000 |

| 3/31/23 | $9,956 | $10,050 | $10,175 |

| 6/30/23 | $9,914 | $9,966 | $9,914 |

| 9/30/23 | $10,250 | $9,644 | $10,381 |

| 12/31/23 | $9,497 | $10,301 | $9,901 |

| 3/31/24 | $9,611 | $10,221 | $10,118 |

| 6/30/24 | $9,977 | $10,228 | $10,410 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 3/27/2023 |

|---|

| Simplify Commodities Strategy No K-1 ETF - NAV | 0.63% | |

| Simplify Commodities Strategy No K-1 ETF - Market | 0.44% | |

| Bloomberg Capital U.S. Aggregate Bond Index | 2.63% | 1.80% |

| Bloomberg Commodity Index Total Return | 5.00% | 3.24% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $10,273,122 |

| Total number of portfolio holdings | 3 |

| Total advisory fee paid, net of waiver | $65,614 |

| Period portfolio turnover rate | 0% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 98.8% |

| Other Assets in Excess of Liabilities | 1.2% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

Simplify Macro Strategy ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Macro Strategy ETF ("FIG" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Macro Strategy ETF | $59 | 0.61% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, FIG returned -7.19% vs its referenced benchmark, Bloomberg US EQ:FI 60:40 Index, return of 15.69% for the same period, underperforming the benchmark by -22.88%.

The Fund’s net short US equity position drove underperformance. From June 30, 2023 to October 26, 2023, equity shorts and investment in the Simplify Managed Futures ETF boosted performance by 2.56% over the benchmark. A strong equity rally from October 26, 2023 led to a 1.25% underperformance in Q1-2024 and a 2.5% underperformance in Q2-2024 due to underinvestment. An aggressive short on Carvana (CVNA) resulted in a 7.8% NAV loss on May 2, 2024, and a -10.24% impact overall.

Looking forward, FIG remains underinvested in US equities due to high valuations and aggressive earnings expectations. Despite disappointing earnings, valuations have risen sharply. Implied volatility and equity correlations are low, and equity allocations are at historic highs. US government bonds offer attractive real yields of 2-2.5%. We anticipate that slowing economic growth and rising unemployment will highlight the divergence between bonds and equities, impacting performance.

Growth of an Assumed $10,000 Investment

| Simplify Macro Strategy ETF - NAV | Bloomberg US EQ:FI 60:40 Index | ICE BofA 3 Month US Treasury Bill Index |

|---|

| 5/16/22 | $10,000 | $10,000 | $10,000 |

| 6/30/22 | $9,439 | $9,654 | $10,006 |

| 9/30/22 | $9,504 | $9,202 | $10,052 |

| 12/31/22 | $9,668 | $9,660 | $10,137 |

| 3/31/23 | $9,770 | $10,231 | $10,246 |

| 6/30/23 | $9,811 | $10,739 | $10,366 |

| 9/30/23 | $9,520 | $10,408 | $10,502 |

| 12/31/23 | $9,913 | $11,438 | $10,645 |

| 3/31/24 | $9,915 | $12,109 | $10,783 |

| 6/30/24 | $9,106 | $12,424 | $10,926 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 5/16/2022 |

|---|

| Simplify Macro Strategy ETF - NAV | | |

| Simplify Macro Strategy ETF - Market | | |

| Bloomberg US EQ:FI 60:40 Index | 15.69% | 10.76% |

| ICE BofA 3 Month US Treasury Bill Index | 5.40% | 4.26% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $17,785,413 |

| Total number of portfolio holdings | 21 |

| Total advisory fee paid, net of waiver | $162,934 |

| Period portfolio turnover rate | 68% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Exchange-Traded Funds | 79.8% |

| U.S. Treasury Inflation Indexed Bonds | 18.5% |

| Purchased Options | 1.8% |

| Money Market Funds | 0.3% |

| Liabilities in Excess of Other Assets | (0.4)% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

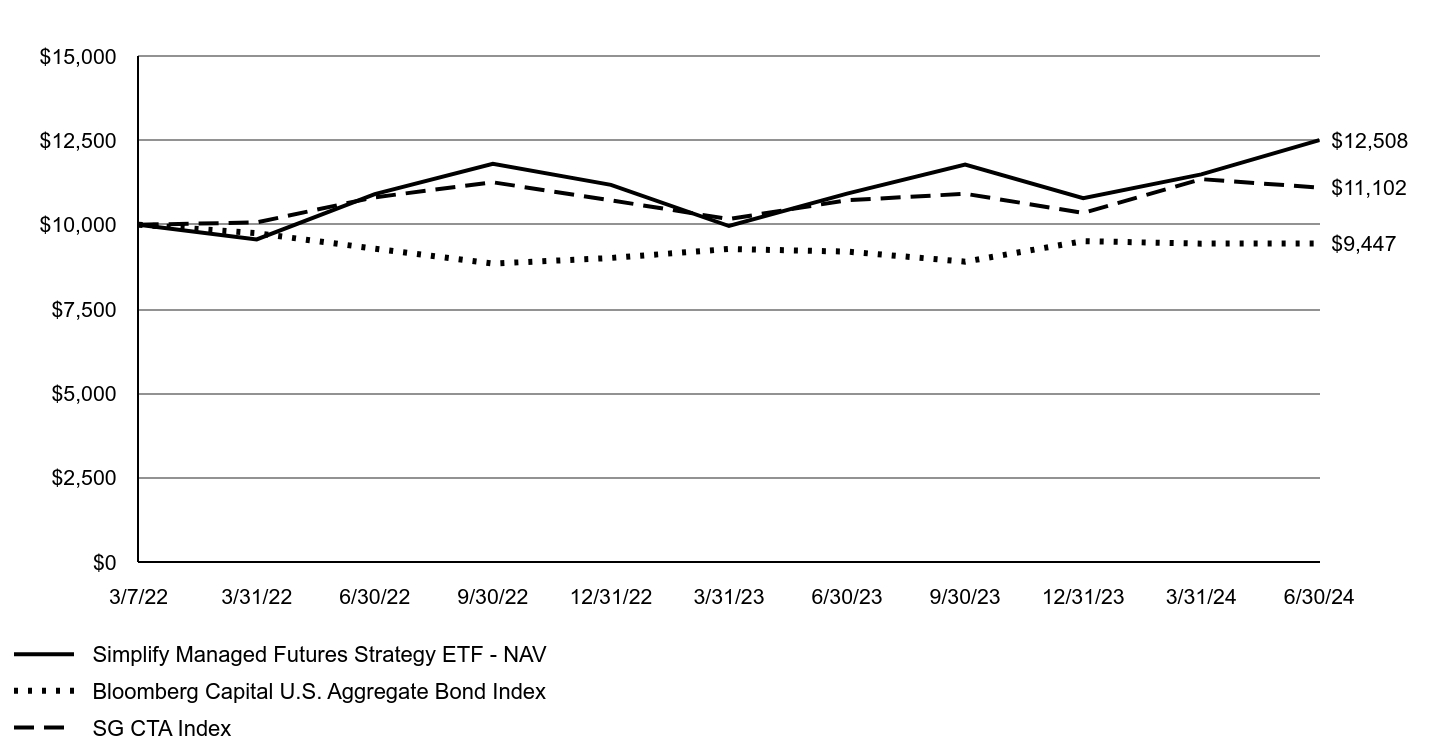

Simplify Managed Futures Strategy ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Managed Futures Strategy ETF ("CTA" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Managed Futures Strategy ETF | $81 | 0.76% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, CTA returned 14.52% vs its referenced benchmark, SG CTA Index, return of 3.50% for the same period, outperforming the benchmark by 11.02%.

Short interest rate and related positions were the predominant risks and primary contributors to CTA. Higher rates across the curve, along with timely energy, metals, and agricultural positioning, resulted in a nearly 15% total return, outperforming competitors and the benchmark. The Fund's positioning benefited from asset curves' shapes, providing positive carry. Additionally, the Fund’s realized volatility was around 14%, slightly below the typical target for trend-following funds.

Looking ahead, we believe the Fund is well-positioned to capitalize on a near-term bull market in energy and metals and softer agricultural prices, coinciding with higher global yields. The inclusion of additional liquid energy, metal, and agricultural positions should enhance diversification and provide broader sources of potential alpha.

Growth of an Assumed $10,000 Investment

| Simplify Managed Futures Strategy ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | SG CTA Index |

|---|

| 3/7/22 | $10,000 | $10,000 | $10,000 |

| 3/31/22 | $9,566 | $9,749 | $10,070 |

| 6/30/22 | $10,907 | $9,292 | $10,814 |

| 9/30/22 | $11,809 | $8,850 | $11,258 |

| 12/31/22 | $11,182 | $9,016 | $10,725 |

| 3/31/23 | $9,963 | $9,283 | $10,169 |

| 6/30/23 | $10,922 | $9,205 | $10,727 |

| 9/30/23 | $11,783 | $8,907 | $10,918 |

| 12/31/23 | $10,789 | $9,515 | $10,351 |

| 3/31/24 | $11,492 | $9,441 | $11,351 |

| 6/30/24 | $12,508 | $9,447 | $11,102 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 3/7/2022 |

|---|

| Simplify Managed Futures Strategy ETF - NAV | 14.52% | 10.15% |

| Simplify Managed Futures Strategy ETF - Market | 14.61% | 9.58% |

| Bloomberg Capital U.S. Aggregate Bond Index | 2.63% | |

| SG CTA Index | 3.50% | 4.62% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $204,869,602 |

| Total number of portfolio holdings | 3 |

| Total advisory fee paid, net of waiver | $1,155,079 |

| Period portfolio turnover rate | 0% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 93.1% |

| Other Assets in Excess of Liabilities | 6.9% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

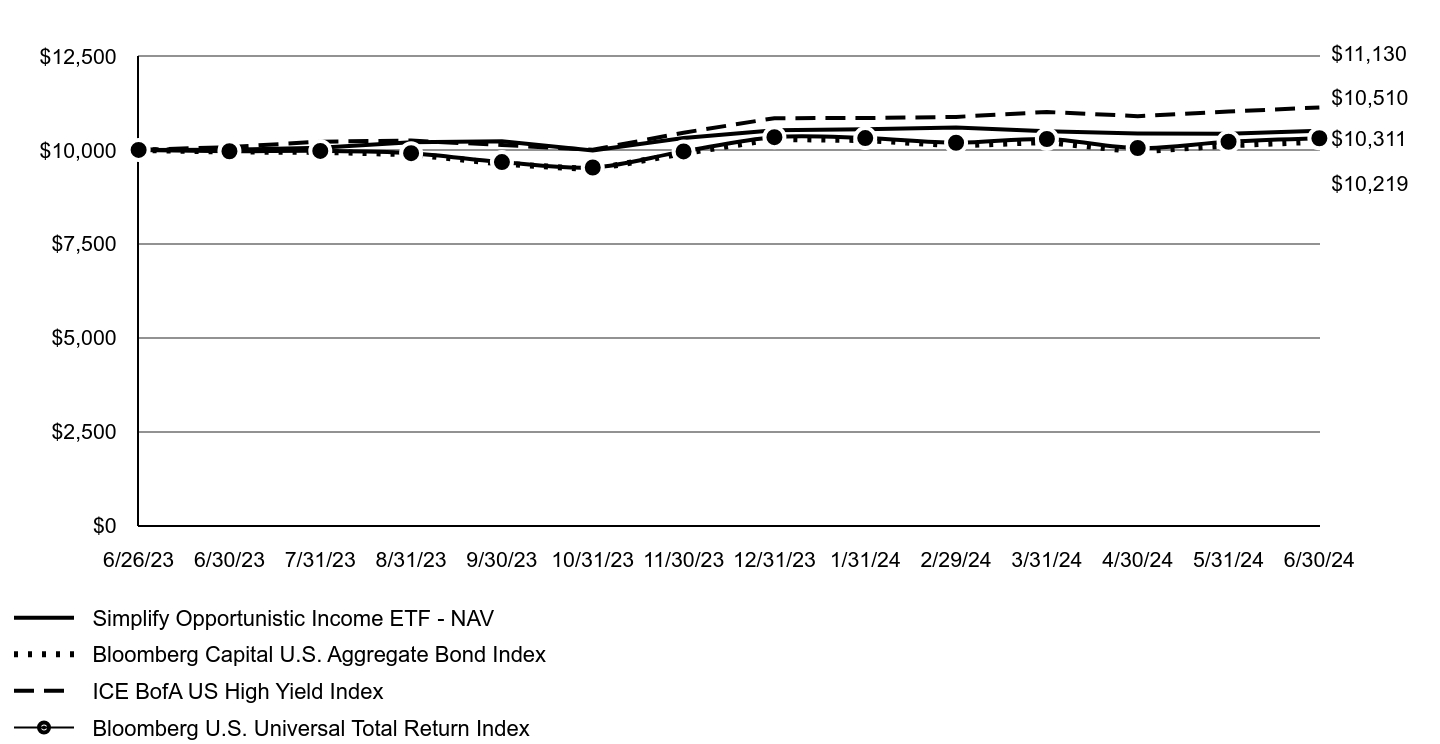

Simplify Opportunistic Income ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Opportunistic Income ETF ("CRDT" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Opportunistic Income ETF | $53 | 0.51% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, CRDT returned 5.05% vs. the Bloomberg U.S. Universal Total Return Index benchmark return of 3.47% for the same period, outperforming the benchmark by 1.58%.

Tactical positioning during the year focused on dislocations in single name distressed and high dividend preferred corporate bonds, which provided a steady source of coupon income, but were somewhat offset by price return losses. Other major positions generated modest positive return and included securitized bonds (mortgage-related and ABS), foreign positions including sovereign CDS buy protection, and futures and TRS overlays (e.g., long Quality vs Junk equities).

Looking ahead, the Fund continues to focus on undervalued sectors like ABS and corporates where management is addressing fundamentals and will identify cheap high yield and distressed credits versus underweighting the index, where our view is that the spreads are too tight.

Growth of an Assumed $10,000 Investment

| Simplify Opportunistic Income ETF - NAV | Bloomberg Capital U.S. Aggregate Bond Index | ICE BofA US High Yield Index | Bloomberg U.S. Universal Total Return Index |

|---|

| 6/26/23 | $10,000 | $10,000 | $10,000 | $10,000 |

| 6/30/23 | $10,004 | $9,958 | $10,077 | $9,965 |

| 7/31/23 | $10,060 | $9,951 | $10,221 | $9,975 |

| 8/31/23 | $10,204 | $9,887 | $10,250 | $9,915 |

| 9/30/23 | $10,232 | $9,636 | $10,131 | $9,678 |

| 10/31/23 | $9,986 | $9,484 | $10,005 | $9,533 |

| 11/30/23 | $10,319 | $9,913 | $10,460 | $9,962 |

| 12/31/23 | $10,526 | $10,293 | $10,846 | $10,340 |

| 1/31/24 | $10,550 | $10,264 | $10,848 | $10,315 |

| 2/29/24 | $10,596 | $10,119 | $10,880 | $10,192 |

| 3/31/24 | $10,497 | $10,213 | $11,010 | $10,292 |

| 4/30/24 | $10,441 | $9,955 | $10,900 | $10,051 |

| 5/31/24 | $10,428 | $10,124 | $11,023 | $10,218 |

| 6/30/24 | $10,510 | $10,219 | $11,130 | $10,311 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 6/26/2023 |

|---|

| Simplify Opportunistic Income ETF - NAV | 5.05% | 5.04% |

| Simplify Opportunistic Income ETF - Market | 5.12% | 4.99% |

| Bloomberg Capital U.S. Aggregate Bond Index | 2.63% | 2.17% |

| ICE BofA US High Yield Index | 10.45% | 11.17% |

| Bloomberg U.S. Universal Total Return Index | 3.47% | 3.09% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $74,700,650 |

| Total number of portfolio holdings | 79 |

| Total advisory fee paid, net of waiver | $329,974 |

| Period portfolio turnover rate | 322% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| U.S. Treasury Bills | 27.5% |

| Corporate Bonds | 25.9% |

| U.S. Government Agency Mortgage Backed Securities | 18.1% |

| Asset Backed Securities | 14.2% |

| Foreign Bonds | 13.9% |

| Preferred Stocks | 7.5% |

| Common Stocks | 7.2% |

| Closed-End Funds | 0.6% |

| Term Loans | 0.3% |

| Liabilities in Excess of Other Assets | (15.2)% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

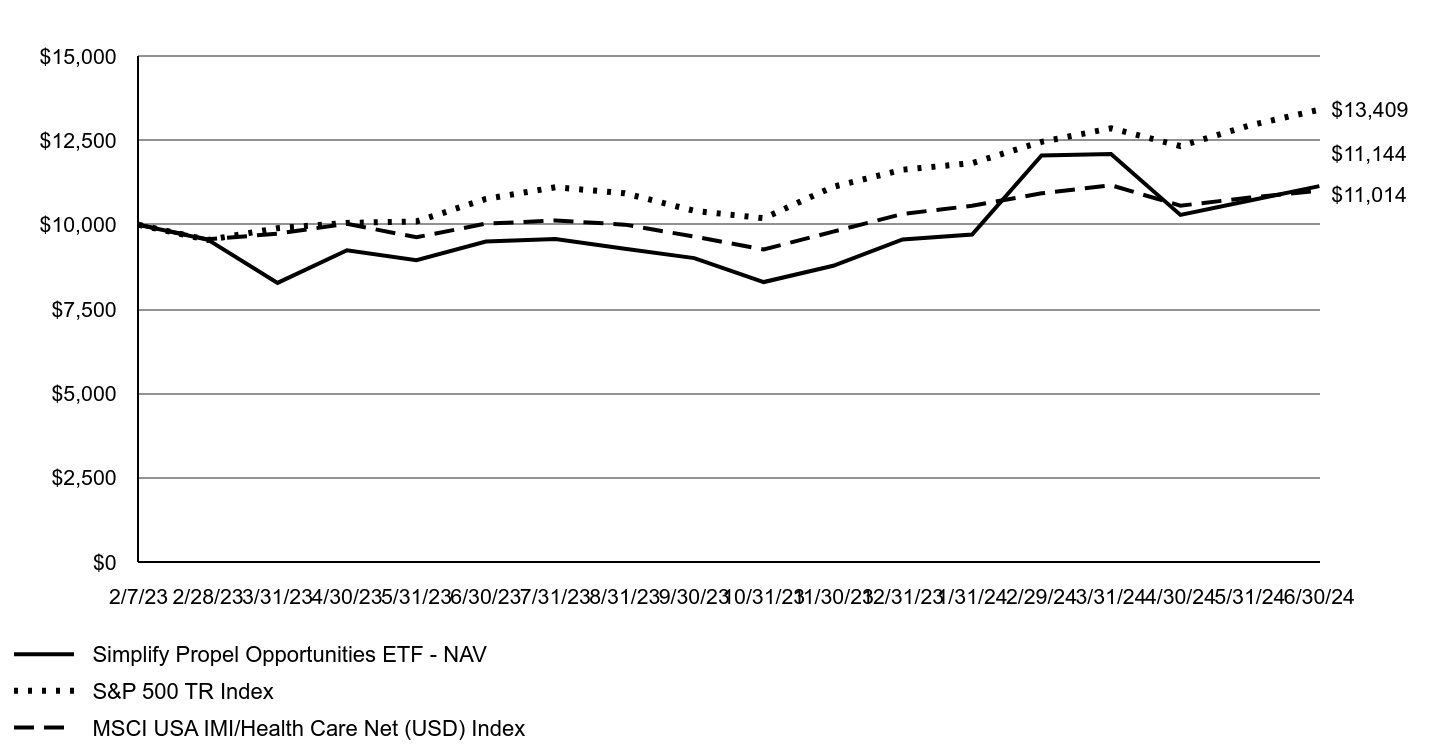

Simplify Propel Opportunities ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Propel Opportunities ETF ("SURI" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Simplify Propel Opportunities ETF | $272 | 2.50% |

Management's Discussion of Fund Performance

For the year ended June 30, 2024, SURI returned 17.27% vs. the MSCI USA IMI Health Care Net Total Return USD Index benchmark return of 9.76% for the same period, outperforming the benchmark by 7.51%.

SURI has a heavier weighting of early-stage and small/mid-cap (SMID) companies in SURI versus MSCI USA IMI Health Care Net Total Return USD Index. While, in general SMID companies have underperformed versus large cap healthcare companies during this period, we have still been able to outperform versus the benchmark due to our high touch, active management of the portfolio.

In the next 12 months, while we anticipate continued volatility in SMID healthcare companies versus the overall market, we expect specific catalysts within the SURI portfolio along with increased M&A and strategic activities targeting SMID healthcare companies to drive outperformance.

Growth of an Assumed $10,000 Investment

| Simplify Propel Opportunities ETF - NAV | S&P 500 TR Index | MSCI USA IMI/Health Care Net (USD) Index |

|---|

| 2/7/23 | $10,000 | $10,000 | $10,000 |

| 2/28/23 | $9,552 | $9,549 | $9,568 |

| 3/31/23 | $8,279 | $9,900 | $9,737 |

| 4/30/23 | $9,245 | $10,055 | $10,029 |

| 5/31/23 | $8,948 | $10,098 | $9,629 |

| 6/30/23 | $9,503 | $10,766 | $10,034 |

| 7/31/23 | $9,581 | $11,111 | $10,126 |

| 8/31/23 | $9,290 | $10,934 | $10,004 |

| 9/30/23 | $9,012 | $10,413 | $9,649 |

| 10/31/23 | $8,303 | $10,194 | $9,269 |

| 11/30/23 | $8,785 | $11,125 | $9,796 |

| 12/31/23 | $9,566 | $11,631 | $10,321 |

| 1/31/24 | $9,709 | $11,826 | $10,563 |

| 2/29/24 | $12,053 | $12,457 | $10,931 |

| 3/31/24 | $12,099 | $12,858 | $11,172 |

| 4/30/24 | $10,293 | $12,333 | $10,566 |

| 5/31/24 | $10,720 | $12,945 | $10,806 |

| 6/30/24 | $11,144 | $13,409 | $11,014 |

| AVERAGE ANNUAL TOTAL RETURN Fund/Index | 1 Year | Since Inception 2/7/2023 |

|---|

| Simplify Propel Opportunities ETF - NAV | 17.27% | 8.09% |

| Simplify Propel Opportunities ETF - Market | 16.83% | 8.96% |

| S&P 500 TR Index | 24.56% | 23.46% |

| MSCI USA IMI/Health Care Net (USD) Index | 9.76% | 7.18% |

The Fund's past performance is not a good predictor of future performance. The graph and table do not reflect deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The Fund had a return of capital of $13,554,166.

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $96,943,570 |

| Total number of portfolio holdings | 26 |

| Total advisory fee paid, net of waiver | $2,421,546 |

| Period portfolio turnover rate | 42% |

Graphical Representation of Holdings

The table below shows the types of investments that make up the Fund as of the end of the reporting period.

| Investment Categories | % of Net Assets |

| Common Stocks | 68.2% |

| Limited Partnership | 26.7% |

| Corporate Bonds | 3.3% |

| Closed-End Funds | 1.6% |

| Money Market Funds | 0.3% |

| Liabilities in Excess of Other Assets | (0.1)% |

| Total | 100.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting at the website address or contact number included at the beginning of this shareholder report.

Distributed by Foreside Financial Services, LLC.

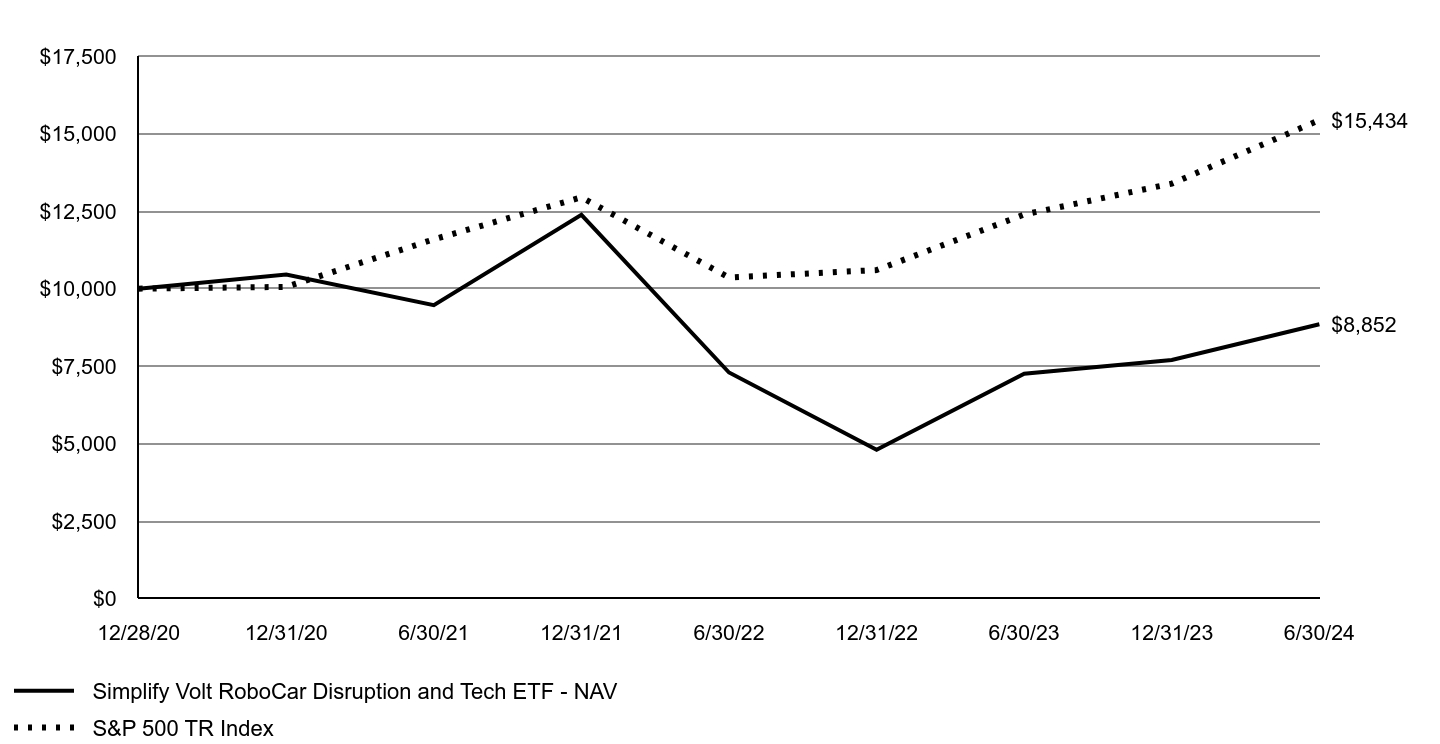

Simplify Volt RoboCar Disruption and Tech ETF

Annual Shareholder Report | June 30, 2024

This annual shareholder report contains important information about Simplify Volt RoboCar Disruption and Tech ETF ("VCAR" or the "Fund") for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.simplify.us/resources. You can also request this information by contacting us at (855) 772-8488.

What were the Fund’s costs for the period?

(based on a hypothetical $10,000 investment)