Our mission is to deliver on the therapeutic potential of psychedelics and other novel candidates to address the significant unmet need in brain health disorders. We have overseen tremendous progress toward this goal, and your current Board and management team are creating a foundation for the Company that will generate sustainable value for all shareholders. Your support of the Company’s highly qualified director candidates is essential to ensure this progress continues.

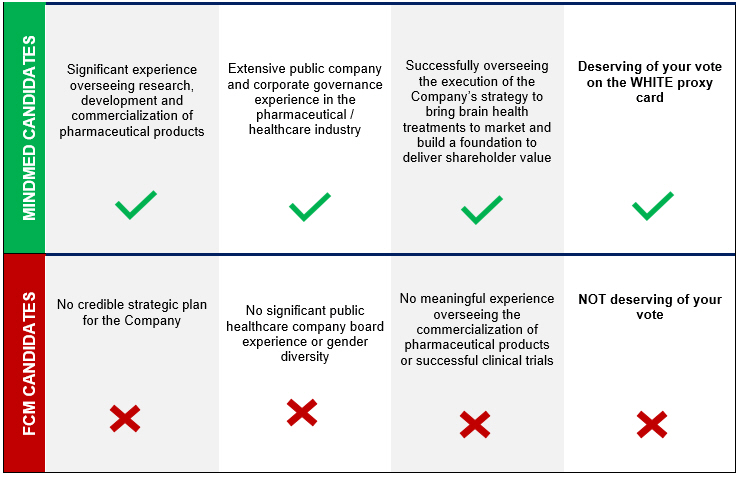

FCM MM Holdings, LLC (“FCM”), an entity affiliated with Jake Freeman, Scott Freeman and Chad Boulanger, has nominated four director candidates who we believe are unqualified to serve on your Board. FCM is waging a proxy contest to take control of the Company despite only owning a small percentage of our outstanding shares and failing to provide any realistic strategic plan for MindMed.

We believe that allowing FCM to harm the Company’s current strategy and management team – who have been successfully executing our plan under your Board’s oversight – would put your investment at risk.

We strongly urge you to protect your investment by voting today on the WHITE proxy card FOR the election of the Board’s highly qualified nominees – Chief Executive Officer Robert Barrow, Dr. Suzanne Bruhn, Dr. Roger Crystal, Andreas Krebs, Chair Carol A. Vallone, and new candidate David W. Gryska, a 35-year industry veteran who has served as Chief Financial Officer of two S&P 500 pharmaceutical companies – and WITHHOLD on FCM’s inferior nominees.

YOUR BOARD IS OVERSEEING A WELL-DEFINED PLAN TO CREATE VALUE BY BRINGING IMPORTANT NEW TREATMENTS TO PATIENTS – WE URGE YOU TO STAY THE COURSE AT THIS CRITICAL MOMENT

Since Robert Barrow took on the role of CEO in mid-2021, we have made decisive and comprehensive changes that are essential to the long-term success of our organization. We have recruited an efficient and execution-oriented team with deep experience in the successful research, development and commercialization of brain health treatments.

We have also built an internal organizational infrastructure – which incorporates high standards of compliance and financial controls – to support our operations as a publicly traded pharmaceutical company. These changes have transformed MindMed from a nascent public company with a single product candidate to a high-functioning organization in a position of strength as we enter a critical period for our R&D pipeline.

By progressing this strategy to develop our diversified pipeline of clinical programs, we are on track to build a world-class fully integrated pharmaceutical organization to create long-term value for our shareholders. We are also well capitalized, with cash on hand of $142.1 million as of the end of 2022 – sufficient to fund the Company’s operations beyond our key development milestones in 2023 and into the first half of 2025.

MindMed is at a pivotal inflection point – with clinical readouts on our two lead product candidates expected this year:

| | 1. | Our Phase 2b study of MM-120 for the treatment of Generalized Anxiety Disorder (“GAD”), and |

| | 2. | Our Phase 2a proof-of-concept trial of repeated low-dose MM-120 in ADHD. |

We also plan to share preclinical results demonstrating the potential of MM-402 in autism spectrum disorder and to initiate our first sponsored clinical trial of MM-402.

Our research with patients and healthcare practitioners in the U.S. and Europe indicates that there is significant demand for a new class of drugs that can offer faster, more effective and longer lasting benefits for patients with GAD. This represents a tremendous potential addressable market for our therapies.

We have also pursued a robust strategy to maximize and protect the value of our intellectual property: our patent portfolio includes 26 pending U.S. applications and 12 pending Patent Cooperation Treaty applications. These include applications covering compositions, dosing, dosage formulations and methods of treatment, among others, with projected expiration dates beginning in 2041.