Table of Contents

mll

| | |

| | Filed Pursuant to Rule (424)(b)(3) |

PROSPECTUS SUPPLEMENT NO. 12 | | Registration No. 333-267113 |

(to Prospectus dated September 13, 2022) | | |

ASTRA SPACE, INC.

34,000,000 SHARES OF CLASS A COMMON STOCK

This prospectus supplement amends and supplements the prospectus dated September 13, 2022 (as supplemented or amended from time to time, the “Prospectus”), which forms a part of our Registration Statement on Form S‑1 (No. 333-267113). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on November 9, 2022 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and resale of up to 34,000,000 shares of Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”), of Astra Space, Inc. by B. Riley Principal Capital II, LLC (the “Selling Stockholder”). The shares included in the Prospectus and this Prospectus supplement consist of shares of Class A Common Stock that we may, in our discretion, elect to issue and sell to the Selling Stockholder pursuant to a common stock purchase agreement we entered into with the Selling Stockholder on August 2, 2022 (the “Purchase Agreement”). Such shares of Class A Common Stock include (i) up to 33,281,805 shares of our Class A Common Stock that we may, in our sole discretion, elect to sell to the Selling Stockholder from time to time after the date of this prospectus, pursuant to the Purchase Agreement and (ii) 718,195 shares of our Class A Common Stock we issued, or may issue if certain conditions are met, in each case, to the Selling Stockholder as consideration for its commitment to purchase shares of our Class A Common Stock in one or more purchases that we may, in our sole discretion, direct them to make, from time to time after the date of this prospectus, pursuant to the Purchase Agreement. See “The Committed Equity Financing” for a description of the Purchase Agreement and “Selling Stockholder” for additional information regarding the Selling Stockholder.

Our Class A common stock is listed on Nasdaq under the symbol “ASTR”. On November 8, 2022, the closing price of our Class A common stock was $0.5850 per share.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

_________________________

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 17 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 10, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Table of Contents

FORM 10-Q

(Mark One)

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2022

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________

Commission File Number: 001-39426

ASTRA SPACE, INC.

(Exact Name of Registrant as Specified in its Charter)

| |

Delaware | 85-1270303 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1900 Skyhawk Street Alameda, CA | 94501 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (866) 278-7217

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, par value $0.0001 per share | | ASTR | | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 7, 2022, the registrant had 211,926,952 shares of Class A common stock, $0.0001 par value per share, outstanding and 55,539,188 shares of Class B common stock, $0.0001 par value per share, outstanding.

Table of Contents

Table of Contents

Table of Contents

PART I—FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements (unaudited)

ASTRA SPACE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

| | | | | | | | |

| | As of | |

| | September 30, 2022 | | | December 31, 2021 | |

ASSETS | | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 67,608 | | | $ | 325,007 | |

Marketable securities | | | 82,936 | | | | — | |

Trade accounts receivable | | | 4,923 | | | | 1,816 | |

Inventories | | | 5,174 | | | | 7,675 | |

Prepaid and other current assets | | | 7,609 | | | | 12,238 | |

Total current assets | | | 168,250 | | | | 346,736 | |

Non-current assets: | | | | | | |

Property, plant and equipment, net | | | 20,048 | | | | 66,316 | |

Right-of-use asset | | | 14,909 | | | | 9,079 | |

Goodwill | | | — | | | | 58,251 | |

Intangible assets, net | | | 10,699 | | | | 17,921 | |

Other non-current assets | | | 1,999 | | | | 721 | |

Total assets | | $ | 215,905 | | | $ | 499,024 | |

| | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | |

Current liabilities: | | | | | | |

Accounts payable | | $ | 9,347 | | | $ | 9,122 | |

Operating lease obligation, current portion | | | 3,903 | | | | 1,704 | |

Contingent consideration, current portion | | | 32,420 | | | | — | |

Accrued expenses and other current liabilities | | | 27,382 | | | | 29,899 | |

Total current liabilities | | | 73,052 | | | | 40,725 | |

Non-current liabilities: | | | | | | |

Operating lease obligation, net of current portion | | | 10,974 | | | | 7,180 | |

Contingent consideration, net of current portion | | | 10,530 | | | | 13,700 | |

Other non-current liabilities | | | 7,277 | | | | 899 | |

Total liabilities | | | 101,833 | | | | 62,504 | |

| | | | | | |

Commitments and Contingencies (Note 11) | | | | | | |

| | | | | | |

STOCKHOLDERS’ EQUITY | | | | | | |

Founders convertible preferred stock, $0.0001 par value; 1,000,000 shares authorized; none issued

and outstanding as of September 30, 2022 and December 31, 2021 | | | — | | | | — | |

Class A common stock, $0.0001 par value; 400,000,000 shares authorized; 211,824,567 and 207,451,107

shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | | | 22 | | | | 22 | |

Class B common stock, $0.0001 par value; 65,000,000 shares authorized; 55,539,188 and 55,539,189

shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | | | 6 | | | | 6 | |

Additional paid in capital | | | 1,889,759 | | | | 1,844,875 | |

Accumulated other comprehensive loss | | | (202 | ) | | | — | |

Accumulated deficit | | | (1,775,513 | ) | | | (1,408,383 | ) |

Total stockholders’ equity | | | 114,072 | | | | 436,520 | |

Total liabilities and stockholders’ equity | | $ | 215,905 | | | $ | 499,024 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

1

Table of Contents

ASTRA SPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Revenues | | | | | | | | | | | | |

Launch services | | $ | — | | | $ | — | | | $ | 5,899 | | | $ | — | |

Space products | | | 2,777 | | | | — | | | | 3,471 | | | | — | |

Total revenues | | | 2,777 | | | | — | | | | 9,370 | | | | — | |

Cost of revenues | | | | | | | | | | | | |

Launch services | | | — | | | | — | | | | 28,193 | | | | — | |

Space products | | | 1,071 | | | | — | | | | 1,337 | | | | — | |

Total cost of revenues | | | 1,071 | | | | — | | | | 29,530 | | | | — | |

Gross income (loss) | | | 1,706 | | | | — | | | | (20,160 | ) | | | — | |

Operating expenses: | | | | | | | | | | | | |

Research and development | | | 32,821 | | | | 21,724 | | | | 111,546 | | | | 44,159 | |

Sales and marketing | | | 4,052 | | | | 1,090 | | | | 13,452 | | | | 2,229 | |

General and administrative | | | 19,222 | | | | 19,730 | | | | 60,816 | | | | 50,712 | |

Impairment expense | | | 75,116 | | | | — | | | | 75,116 | | | | — | |

Goodwill impairment | | | 58,251 | | | | — | | | | 58,251 | | | | — | |

Loss on change in fair value of contingent consideration | | | 11,949 | | | | — | | | | 29,249 | | | | — | |

Total operating expenses | | | 201,411 | | | | 42,544 | | | | 348,430 | | | | 97,100 | |

Operating loss | | | (199,705 | ) | | | (42,544 | ) | | | (368,590 | ) | | | (97,100 | ) |

Interest income (expense), net | | | 616 | | | | 18 | | | | 1,146 | | | | (1,194 | ) |

Other (expense) income, net | | | (25 | ) | | | 25,895 | | | | 314 | | | | 25,177 | |

Loss on extinguishment of convertible notes | | | — | | | | — | | | | — | | | | (131,908 | ) |

Loss on extinguishment of convertible notes attributable

to related parties | | | — | | | | — | | | | — | | | | (1,875 | ) |

Loss before taxes | | | (199,114 | ) | | | (16,631 | ) | | | (367,130 | ) | | | (206,900 | ) |

Income tax (benefit) provision | | | — | | | | (383 | ) | | | — | | | | (383 | ) |

Net loss | | $ | (199,114 | ) | | $ | (16,248 | ) | | $ | (367,130 | ) | | $ | (206,517 | ) |

Adjustment to redemption value on Convertible Preferred

Stock | | | — | | | | — | | | | — | | | | (1,011,726 | ) |

Net loss attributable to common stockholders | | $ | (199,114 | ) | | $ | (16,248 | ) | | $ | (367,130 | ) | | $ | (1,218,243 | ) |

| | | | | | | | | | | | |

Net loss per share: | | | | | | | | | | | | |

Weighted average number of shares of Class A

common stock outstanding – basic and diluted | | | 210,788,116 | | | | 201,080,003 | | | | 209,317,361 | | | | 79,784,524 | |

Net loss per share of Class A common

stock – basic and diluted | | $ | (0.75 | ) | | $ | (0.06 | ) | | $ | (1.39 | ) | | $ | (9.39 | ) |

Weighted average number of shares of Class B

common stock outstanding – basic and diluted | | | 55,539,188 | | | | 56,239,188 | | | | 55,539,188 | | | | 49,970,071 | |

Net loss per share of Class B common

stock – basic and diluted | | $ | (0.75 | ) | | $ | (0.06 | ) | | $ | (1.39 | ) | | $ | (9.39 | ) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

Table of Contents

ASTRA SPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | |

| | For The Three Months Ended September 30, | | | For The Nine Months Ended September 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Net loss | | $ | (199,114 | ) | | $ | (16,248 | ) | | $ | (367,130 | ) | | $ | (206,517 | ) |

Other comprehensive loss: | | | | | | | | | | | | |

Unrealized gain (loss) on available-for-sale marketable securities | | | 31 | | | | — | | | | (202 | ) | | | — | |

Total comprehensive loss | | $ | (199,083 | ) | | $ | (16,248 | ) | | $ | (367,332 | ) | | $ | (206,517 | ) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

Table of Contents

ASTRA SPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

Nine Months Ended September 30, 2022

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Class A Common Stock | | | Class B Common Stock | | | Additional

Paid in | | | Accumulated

Other

Comprehensive | | | Accumulated | | | Total Stockholders' | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Loss | | | Deficit | | | Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance as of December 31, 2021 | | | 207,451,107 | | | $ | 22 | | | | 55,539,189 | | | $ | 6 | | | $ | 1,844,875 | | | $ | — | | | $ | (1,408,383 | ) | | $ | 436,520 | |

Stock-based compensation | | | — | | | | — | | | | (1 | ) | | | — | | | | 17,041 | | | | — | | | | — | | | | 17,041 | |

Issuance of common stock under equity plans | | | 1,159,383 | | | | — | | | | — | | | | — | | | | 793 | | | | — | | | | — | | | | 793 | |

Unrealized gain (loss) on available-for-sale marketable securities | | | — | | | | — | | | | — | | | | — | | | | — | | | | (155 | ) | | | — | | | | (155 | ) |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (85,713 | ) | | | (85,713 | ) |

Balance as of March 31, 2022 | | | 208,610,490 | | | $ | 22 | | | | 55,539,188 | | | $ | 6 | | | $ | 1,862,709 | | | $ | (155 | ) | | $ | (1,494,096 | ) | | $ | 368,486 | |

Stock-based compensation | | | — | | | | — | | | | — | | | | — | | | | 12,791 | | | | — | | | | — | | | | 12,791 | |

Issuance of common stock under equity plans | | | 797,935 | | | | — | | | | — | | | | — | | | | 27 | | | | — | | | | — | | | | 27 | |

Unrealized loss on available-for-sale marketable securities | | | — | | | | — | | | | — | | | | — | | | | — | | | | (78 | ) | | | — | | | | (78 | ) |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (82,303 | ) | | | (82,303 | ) |

Balance as of June 30, 2022 | | | 209,408,425 | | | $ | 22 | | | | 55,539,188 | | | $ | 6 | | | $ | 1,875,527 | | | $ | (233 | ) | | $ | (1,576,399 | ) | | $ | 298,923 | |

Stock-based compensation | | | — | | | | — | | | | — | | | | — | | | | 13,748 | | | | — | | | | — | | | | 13,748 | |

Issuance of common stock under equity plans | | | 2,057,044 | | | | — | | | | — | | | | — | | | | 484 | | | | — | | | | — | | | | 484 | |

Issuance of common stock as consideration for the commitment under

the Common Stock Purchase agreement (Note 13) | | | 359,098 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Unrealized gain on available-for-sale marketable securities | | | — | | | | — | | | | — | | | | — | | | | — | | | | 31 | | | | — | | | | 31 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (199,114 | ) | | | (199,114 | ) |

Balance as of September 30, 2022 | | | 211,824,567 | | | $ | 22 | | | | 55,539,188 | | | $ | 6 | | | $ | 1,889,759 | | | $ | (202 | ) | | $ | (1,775,513 | ) | | $ | 114,072 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

Table of Contents

ASTRA SPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF TEMPORARY EQUITY AND STOCKHOLDERS’ EQUITY (DEFICIT)

Nine Months Ended September 30, 2021

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Temporary Equity | | | | Permanent Equity | |

| | Convertible Preferred Stock | | | | Common Stock

(Pre-combination Astra) | | | Class A Common Stock

( New Astra) | | | Class B Common Stock

(New Astra) | | | Founders Preferred Stock | | | Additional

Paid in | | | Accumulated | | | Total Stockholders' | |

| | Shares | | | Amount | | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity (Deficit) | |

Balance as of

December 31, 2020 | | | 90,768,286 | | | $ | 108,829 | | | | | 62,961,258 | | | $ | 6 | | | | — | | | $ | — | | | | — | | | $ | — | | | | 12,302,500 | | | $ | 1 | | | $ | 50,282 | | | $ | (190,697 | ) | | $ | (140,408 | ) |

Cumulative effect adjustment

due to adoption of

ASU 2020-06 | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (9,719 | ) | | | 691 | | | | (9,028 | ) |

Stock-based compensation | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,177 | | | | — | | | | 2,177 | |

Exercise of options | | | — | | | | — | | | | | 498,807 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 228 | | | | — | | | | 228 | |

Issuance of Series C

Convertible Preferred Stock,

net of issuance costs | | | 28,498,141 | | | | 221,943 | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Conversion of Founders

Convertible Preferred Stock

to Series C Convertible

Preferred Stock | | | 5,073,576 | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (5,073,576 | ) | | | — | | | | 8,156 | | | | — | | | | 8,156 | |

Adjustment to redemption value

on Convertible Preferred

Stock | | | — | | | | 1,011,726 | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (51,131 | ) | | | (960,595 | ) | | | (1,011,726 | ) |

Net loss | | | — | | | | — | | | | | — | | | | — | | | | �� | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (158,972 | ) | | | (158,972 | ) |

Balance as of March 31, 2021 | | | 124,340,003 | | | $ | 1,342,498 | | | | | 63,460,065 | | | $ | 6 | | | | — | | | $ | — | | | | — | | | $ | — | | | $ | 7,228,924 | | | $ | 1 | | | $ | (7 | ) | | $ | (1,309,573 | ) | | $ | (1,309,573 | ) |

Stock-based compensation | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 7,444 | | | | — | | | | 7,444 | |

Exercise of options | | | — | | | | — | | | | | 1,812,081 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,081 | | | | — | | | | 1,081 | |

Adjustment to redemption value

on Convertible Preferred

Stock | | | — | | | | (1,011,726 | ) | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,011,726 | | | | — | | | | 1,011,726 | |

Merger recapitalization-

Class A | | | (124,340,003 | ) | | | (330,772 | ) | | | | (16,261,881 | ) | | | (2 | ) | | | 140,601,884 | | | | 14 | | | | — | | | | — | | | | — | | | | | | | 330,751 | | | | — | | | | 330,763 | |

Merger recapitalization-

Class B | | | — | | | | — | | | | | (49,010,265 | ) | | | (4 | ) | | | — | | | | — | | | | 56,239,189 | | | | 6 | | | | (7,228,924 | ) | | | (1 | ) | | | — | | | | — | | | | 1 | |

Private offering and merger

financing, net of

redemptions and equity

issuance costs of $23,337 | | | — | | | | — | | | | | — | | | | — | | | | 57,489,019 | | | | 6 | | | | — | | | | — | | | | — | | | | — | | | | 406,863 | | | | — | | | | 406,869 | |

Net loss | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (31,297 | ) | | | (31,297 | ) |

Balance as of June 30, 2021 | | | — | | | $ | — | | | | | — | | | $ | — | | | | 198,090,903 | | | $ | 20 | | | | 56,239,189 | | | $ | 6 | | | | — | | | $ | — | | | $ | 1,757,858 | | | $ | (1,340,870 | ) | | $ | 417,014 | |

Stock-based compensation | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,688 | | | | — | | | | 2,688 | |

Exercise of options | | | — | | | | — | | | | | — | | | | — | | | | 912,760 | | | | 1 | | | | — | | | | — | | | | — | | | | — | | | | 469 | | | | — | | | | 470 | |

Exercise of warrants | | | — | | | | — | | | | | — | | | | — | | | | 472,113 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Issuance of common stock upon acquisition of Apollo Fusion, Inc. | | | — | | | | — | | | | | — | | | | — | | | | 2,558,744 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 33,008 | | | | — | | | | 33,008 | |

Net loss | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (16,248 | ) | | | (16,248 | ) |

Balance as of September 30, 2021 | | | — | | | $ | — | | | | | — | | | $ | — | | | | 202,034,520 | | | $ | 21 | | | | 56,239,189 | | | $ | 6 | | | | — | | | $ | — | | | $ | 1,794,023 | | | $ | (1,357,118 | ) | | $ | 436,932 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

Table of Contents

ASTRA SPACE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | |

| | Nine Months Ended September 30, | |

| | 2022 | | | 2021 | |

Cash flows from operating activities: | | | | | | |

Net loss | | $ | (367,130 | ) | | $ | (206,517 | ) |

Adjustments to reconcile net loss to cash flows used in operating activities | | | | | | |

Stock-based compensation | | | 43,580 | | | | 20,465 | |

Impairment expense | | | 75,116 | | | | — | |

Goodwill impairment | | | 58,251 | | | | — | |

Depreciation | | | 9,664 | | | | 2,958 | |

Amortization of intangible assets | | | 2,394 | | | | 938 | |

Inventory write-downs | | | 18,828 | | | | — | |

Non-cash lease expense | | | 1,370 | | | | 767 | |

Deferred income taxes | | | — | | | | (383 | ) |

Change in fair value of warrant liabilities | | | — | | | | (20,447 | ) |

Gain on forgiveness of PPP note | | | — | | | | (4,850 | ) |

Accretion (amortization) of marketable securities purchased at a premium (discount) | | | 33 | | | | — | |

Loss on change in fair value of contingent consideration | | | 29,249 | | | | — | |

Loss on extinguishment of convertible notes | | | — | | | | 131,908 | |

Loss on extinguishment of convertible notes attributable to related parties | | | — | | | | 1,875 | |

Amortization of convertible note discounts | | | — | | | | 315 | |

Amortization of convertible note discounts attributable to related parties | | | — | | | | 55 | |

Loss on marketable securities | | | 24 | | | | — | |

Changes in operating assets and liabilities: | | | | | | |

Trade accounts receivable | | | (3,107 | ) | | | — | |

Inventories | | | (15,466 | ) | | | (4,246 | ) |

Prepaid and other current assets | | | 3,768 | | | | (13,935 | ) |

Other non-current assets | | | (1,278 | ) | | | (101 | ) |

Accounts payable | | | 2,990 | | | | 1,333 | |

Lease liabilities | | | (1,207 | ) | | | (861 | ) |

Accrued expenses and other current liabilities | | | (2,125 | ) | | | 11,355 | |

Other non-current liabilities | | | 10,431 | | | | (205 | ) |

Net cash used in operating activities | | $ | (134,615 | ) | | $ | (79,576 | ) |

Cash flows from investing activities: | | | | | | |

Acquisition of Apollo, net of cash acquired | | | — | | | | (19,360 | ) |

Acquisition of trademark | | | (850 | ) | | | (3,200 | ) |

Purchases of marketable securities | | | (136,445 | ) | | | — | |

Proceeds from sales of marketable securities | | | 6,000 | | | | — | |

Proceeds from maturities of marketable securities | | | 47,250 | | | | — | |

Purchases of property, plant and equipment | | | (40,043 | ) | | | (18,720 | ) |

Net cash used in investing activities | | $ | (124,088 | ) | | $ | (41,280 | ) |

Cash flows from financing activities: | | | | | | |

Proceeds from business combination and private offering, net of transaction costs of $23,337 | | | — | | | | 463,648 | |

Borrowings on Pendrell bridge loan | | | — | | | | 10,000 | |

Repayment on Pendrell bridge loan | | | — | | | | (10,000 | ) |

Proceeds from issuance of Series C preferred stock | | | — | | | | 30,000 | |

Issuance cost of Series C preferred stock | | | — | | | | (94 | ) |

Repayments on term loans | | | — | | | | (2,800 | ) |

Repayments on equipment advances | | | — | | | | (3,636 | ) |

Proceeds from stock issued under equity plans | | | 1,304 | | | | 1,779 | |

Net cash provided by financing activities | | $ | 1,304 | | | $ | 488,897 | |

| | | | | | |

Net increase (decrease) in cash and cash equivalents | | $ | (257,399 | ) | | $ | 368,041 | |

Cash and cash equivalents at beginning of period | | | 325,007 | | | | 10,611 | |

Cash and cash equivalents at end of period | | $ | 67,608 | | | $ | 378,652 | |

| | | | | | |

Non-cash investing and financing activities: | | | | | | |

Conversion of Series A, Series B, Series C, and Founders' convertible preferred into

common stock | | $ | — | | | $ | 330,764 | |

6

Table of Contents

| | | | | | | | |

Assets acquired included in accounts payable, accrued expenses and other

current liabilities | | | 2,777 | | | | 4,903 | |

Public and private placement of warrants acquired as part of business combination | | | — | | | | 56,786 | |

Change in redemption value of Convertible Preferred Stock | | | — | | | | 1,011,726 | |

Issuance of Class A common stock upon acquisition of Apollo Fusion, Inc. | | | — | | | | 33,008 | |

Fair value of contingent consideration provided upon acquisition of Apollo Fusion, Inc. | | | — | | | | 23,000 | |

Supplemental disclosures of cash flow information: | | | | | | |

Cash paid for interest | | $ | 15 | | | $ | 691 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

7

Table of Contents

ASTRA SPACE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Description of Business, Basis of Presentation and Significant Accounting Policies

Description of Business

Astra Space, Inc. designs, tests, manufactures and operates the next generation of launch services and space products and services that it expects to enable a new generation of global communications, earth observation, precision weather monitoring, navigation, and surveillance capabilities. Astra Space, Inc.'s mission is to Improve Life on Earth from Space® through greater connectivity and more regular observation and to enable a wave of innovation in low Earth orbit by expanding its space platform offerings.

Holicity Inc. (“Holicity”) was originally incorporated in Delaware and was established as a special purpose acquisition company, which completed its initial public offering in August 2020. On June 30, 2021 (the “Closing Date”), Holicity consummated a business combination (the “Business Combination”) pursuant to the Business Combination Agreement dated as of February 2, 2021 (the “BCA”), by and among Holicity, Holicity Merger Sub Inc., a wholly owned subsidiary of Holicity (“Merger Sub”), and Astra Space Operations, Inc. (“pre-combination Astra”). Immediately upon the consummation of the Business Combination, Merger Sub merged with and into pre-combination Astra with pre-combination Astra surviving the merger as a wholly owned subsidiary of Holicity. Holicity changed its name to “Astra Space, Inc.” and pre-combination Astra changed its name to “Astra Space Operations, Inc.”

Unless the context otherwise requires, “we”, “us”, “our”, “Astra” and the “Company” refers to Astra Space, Inc., the combined company and its subsidiaries following the Business Combination and Astra Space Operations, Inc. prior to the Business Combination. See Note 3 — Acquisitions for further discussion of the Business Combination. The Company’s Class A common stock is listed on the Nasdaq under the symbol “ASTR”.

Basis of Presentation and Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of Astra and its subsidiaries, and have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) as determined by the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) and pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) for financial reporting. The condensed consolidated financial statements included herein are unaudited, and reflect all adjustments which are, in the opinion of management, of a normal recurring nature and necessary for a fair statement of the results for the periods presented. The December 31, 2021 condensed consolidated balance sheet data were derived from Astra’s audited consolidated financial statements included in its Annual Report on Form 10-K for year ended December 31, 2021 as filed with the SEC. All intercompany transactions and balances have been eliminated in consolidation. The operating results for the three and nine months ended September 30, 2022 are not necessarily indicative of the results that may be expected for the year ending December 31, 2022, or for any other future period.

Business Combination

On June 30, 2021, the Business Combination pursuant to the BCA, by and among Holicity, Merger Sub, and pre-combination Astra, was accounted for as a reverse recapitalization as pre-combination Astra was determined to be the accounting acquirer under ASC 805. The determination is primarily based on the evaluation of the following facts and circumstances:

•the equity holders of pre-combination Astra hold the majority of voting rights in the Company;

•the board of directors of pre-combination Astra represent a majority of the members of the board of directors of the Company;

•the senior management of pre-combination Astra became the senior management of the Company; and

•the operations of pre-combination Astra comprise the ongoing operations of the Company.

In connection with the Business Combination, outstanding common stock and preferred convertible stock of the pre-combination Astra was converted into common stock of the Company, par value of $0.0001 per share, representing a recapitalization, and the net assets of the Company were acquired and recorded at historical cost, with no goodwill or intangible assets recorded. Pre-combination Astra was deemed to be the predecessor and the condensed consolidated assets and liabilities and results of operations prior to the Closing Date are those of pre-combination Astra. Reported shares and earnings per share available to common stockholders, prior to the Business Combination, have been retroactively restated as shares reflecting the exchange ratio established in the BCA. The number of shares of preferred stock was also retroactively restated based on the exchange ratio. See Note 3 — Acquisitions for additional information.

8

Table of Contents

Liquidity

The accompanying unaudited condensed consolidated interim financial statements have been prepared assuming the Company will continue as a going concern. The going concern basis of presentation assumes that the Company will continue in operation one year after the date these unaudited condensed consolidated interim financial statements are issued and will be able to realize its assets and discharge its liabilities and commitments in the normal course of business.

Pursuant to the requirements of the Financial Accounting Standards Board’s Accounting Standards Codification (“ASC”) Topic 205-40, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern, management must evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year from the date these unaudited condensed consolidated interim financial statements are issued. This evaluation does not take into consideration the potential mitigating effect of management’s plans that have not been fully implemented or are not within control of the Company as of the date the unaudited condensed consolidated interim financial statements are issued. When substantial doubt exists, management evaluates whether the mitigating effect of its plans sufficiently alleviates substantial doubt about the Company’s ability to continue as a going concern. The mitigating effect of management’s plans, however, is only considered if both (1) it is probable that the plans will be effectively implemented within one year after the date that the unaudited condensed consolidated interim financial statements are issued, and (2) it is probable that the plans, when implemented, will mitigate the relevant conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the date that the unaudited condensed consolidated interim financial statements are issued.

The Company evaluated whether there are any conditions and events, considered in the aggregate, that raise substantial doubt about its ability to continue as a going concern over the next twelve months through November 2023. Since inception, the Company has incurred significant operating losses and has an accumulated deficit of approximately $1,775.5 million. As of September 30, 2022, the Company’s existing sources of liquidity included cash and cash equivalents of $67.6 million and marketable securities of $82.9 million. The Company believes that its current level of cash and cash equivalents and marketable securities are not sufficient to fund commercial scale production and sale of its services and products. These conditions raise substantial doubt regarding its ability to continue as a going concern for a period of at least one year from the date of issuance of these unaudited condensed consolidated financial statements.

In order to proceed with the Company’s business plan, the Company will need to raise substantial additional funds through the issuance of additional debt, equity or both. Until such time, if ever, the Company can generate revenue sufficient to achieve profitability, the Company expects to finance its operations through equity or debt financings, which may not be available to the Company on the timing needed or on terms that the Company deems to be favorable. To the extent that the Company raises additional capital through the sale of equity or convertible debt securities, the ownership interest of its stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of common stockholders. Debt financing and equity financing, if available, may involve agreements that include covenants limiting or restricting the Company’s ability to take specific actions, such as incurring additional debt, making acquisitions or capital expenditures or declaring dividends. If the Company is unable to obtain sufficient financial resources, its business, financial condition and results of operations will be materially and adversely affected. The Company may be required to delay, limit, reduce or terminate its product development activities or future commercialization efforts. There can be no assurance that the Company will be able to obtain the needed financing on acceptable terms or at all.

In an effort to alleviate these conditions, management continues to seek and evaluate opportunities to raise additional capital through the issuance of equity or debt securities. As an example, on August 2, 2022, the Company entered into a Common Stock Purchase Agreement with B. Riley Principal Capital II LLC ("B. Riley"), which would allow the Company to sell newly issued shares of its Class A Common Stock to B. Riley in aggregate amount not to exceed $100.0 million or 19.99% of the aggregate outstanding Class A and Class B Common Stock of the Company as of August 2, 2022. See Note 13 – Stockholders’ Equity for additional information about this financing arrangement. However, actual sales of shares under the Purchase Agreement will depend on a variety of factors including, among other things, market conditions and the trading price of the Class A Common Stock, and the full amount of capital may not be fully realized. As we seek additional sources of financing, there can be no assurance that such financing would be available to us on favorable terms or at all. Our ability to obtain additional financing in the debt and equity capital markets is subject to several factors, including market and economic conditions, our performance and investor sentiment with respect to us and our industry.

As a result of these uncertainties, and notwithstanding management’s plans and efforts to date, there is substantial doubt about the Company’s ability to continue as a going concern. If we are unable to raise substantial additional capital in the near term, our operations and production plans will be scaled back or curtailed. If the funds raised are insufficient to provide a bridge to full commercial production at a profit, our operations could be severely curtailed or cease entirely and we may not realize any significant value from our assets.

We have, however, prepared these condensed consolidated financial statements on a going concern basis, assuming that our financial resources will be sufficient to meet our capital needs over the next twelve months. Accordingly, our financial statements do not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be necessary should we be unable to continue in operation.

9

Table of Contents

Impairment of long-lived assets, indefinite-lived intangibles and goodwill

The Company performs an annual impairment review of goodwill and indefinite-lived intangible assets during the fourth fiscal quarter of each year, and more frequently if the Company believes that indicators of impairment exist. Long-lived assets are tested for recoverability when events or changes in circumstances indicate that their carrying amounts may not be recoverable. As of the third quarter of fiscal year 2022, the Company determined that impairment indicators were present based on the existence of substantial doubt about the Company’s ability to continue as a going concern, a sustained decrease in the Company’s share price and macroeconomic factors. Accordingly, the Company proceeded with the quantitative impairment tests.

For indefinite-lived intangible assets, the Company compared the carrying amount of the asset to its fair value, resulting in a non-cash impairment charge, as described further in Note 5 – Goodwill and Intangible Assets.

For the long-lived assets, the Company compared the sum of the undiscounted future cash flows attributable to the Launch Services and Space Products asset groups (the lowest level for which identifiable cash flows are available) to their respective carrying amounts and concluded that the Space Products asset group was recoverable. The Launch Services asset group was not recoverable, and the Company proceeded with the comparison of the asset group’s carrying amount to its fair value, resulting in a non-cash impairment charge, as described further in Note 4 – Supplemental Financial Information.

For goodwill, the Company compared the carrying amount of the reporting unit to its fair value. During the third quarter of fiscal year 2022, the Company took steps to realign management and internal reporting, resulting in two operating and reportable segments, as described further in Note 16 – Segment Information. In accordance with the accounting guidance under ASC 350, the reorganization triggered a goodwill impairment test based on the reporting structure immediately before the reorganization, as a single reporting unit, resulting in a non-cash impairment charge writing off the entire goodwill balance, as described further in Note 5 – Goodwill and Intangible Assets.

Fair values of the Company’s reporting units were determined using the discounted cash flow model and fair value of the tradename was determined using the relief-from-royalty method. Significant inputs include discount rates, growth rates, and cash flow projections, and for the tradename, the royalty rate. These valuation inputs are considered Level 3 inputs as defined by ASC 820 Fair Value Measurement.

Impact of the COVID-19 Pandemic

The Company has been actively monitoring the ongoing COVID-19 pandemic situation and its impact on the Company’s business while keeping abreast of the latest developments, particularly the variants of the virus, to ensure preparedness for Astra’s employees and its business. The COVID-19 pandemic had disrupted everyday life and markets worldwide, leading to significant business and supply-chain disruption, as well as broad-based changes in supply and demand. The Company has been diligent in testing and monitoring its employees, and there have been disruptions in productivity, although these disruptions have not resulted in suspension of its manufacturing facilities. However, there has been a trend in many parts of the world of increasing availability and administration of vaccines against COVID-19, as well as an easing of restrictions on social, business, travel and government activities and functions. On the other hand, infection rates and regulations continue to fluctuate in various regions and there are ongoing global impacts resulting from the pandemic, including challenges and increases in costs for logistics and supply chains, such as increased intermittent supplier delays and a shortfall of semiconductor supply. Ultimately, the Company cannot predict the duration of the COVID-19 pandemic. The Company will continue to monitor macroeconomic conditions to remain flexible and to optimize and evolve its business as appropriate and deploy its production, workforce and other resources accordingly.

Use of Estimates and Judgements

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the condensed consolidated financial statements and accompanying notes. The Company bases these estimates on historical experience and on various other assumptions that it believes are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying amounts of assets and liabilities that are not readily apparent from other sources. Actual results could differ significantly from those estimates. Significant items subject to such estimates and assumptions include the valuation of goodwill and long-lived assets, inventory valuation and reserves, stock-based compensation, pre-combination Astra common stock, useful lives of intangible assets and property, plant and equipment, deferred tax assets, income tax uncertainties, contingent consideration, and other contingencies.

10

Table of Contents

Significant Accounting Policies

Other than those described below, there have been no changes to the Company’s significant accounting policies described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, that have had a material impact on its unaudited condensed consolidated financial statements and related notes.

Segment reporting. Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision-maker (“CODM”) in making decisions regarding resource allocation and assessing performance. Prior to the third quarter of fiscal year 2022, the Company operated as one operating and reportable segment, as the CODM reviewed financial information presented on a consolidated basis for purposes of making operating decisions, allocating resources and evaluating financial performance.

During the third quarter of fiscal year 2022, the Company took steps to realign management and internal reporting, resulting in two operating and reportable segments: Launch Services and Space Products. The segment reporting for prior periods has been reclassified to conform to the current period presentation. Refer to Note 16 – Segment Information for more information.

Marketable securities. Marketable securities consist of U.S. Treasury securities, corporate debt securities, commercial paper, and asset backed securities. The Company classifies marketable securities as available-for-sale at the time of purchase and reevaluates such classification as of each balance sheet date. Interest receivable on these securities is presented in other current assets on the condensed consolidated balance sheets. All marketable securities are recorded at their estimated fair values. When the fair value of a marketable security declines below its amortized cost basis, the carrying value of the security will be reduced to its fair value if it is more likely than not that management is required to sell the impaired security before recovery of its amortized basis, or management has the intention to sell the security. If neither of these conditions are met, the Company determines whether any portion of the decline is due to credit losses. Any portion of that decline attributable to credit losses, to the extent expected to be nonrecoverable before the sale of the security, is recognized in the Company’s condensed consolidated statement of operations. When the fair value of the security declines below its amortized cost basis due to changes in interest rates, such amounts are recorded in accumulated other comprehensive income (loss) and are recognized in the Company’s condensed consolidated statement of operations only if the Company sells or intends to sell the security before recovery of its cost basis. Realized gains and losses are determined based on the specific identification method and are reported in other income (expense), net in the Company’s condensed consolidated statements of operations.

Note 2 — Revenues

The Company recognizes revenue to reflect the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. Through its current offerings, the Company expects to generate revenue by providing the following goods or services:

Launch Services — To provide rapid, global, and affordable launch services to satellite operators and governments in partnership with third-party spaceport providers globally. The launch services include services tied directly to launch along with complementary services that are not part of the Company's fixed pricing for which we charge a separate fee. The Company operated its launches from Pacific Spaceport Complex in Kodiak, Alaska and Cape Canaveral Space Force Station in Cape Canaveral, Florida. The Company is in discussions with SaxaVord UK Spaceport regarding an opportunity to launch from the United Kingdom.

Space Products — To design and provide space products based on the customers' needs for a successful satellite launch and other products that the Company may sell in the future. Currently the Company offers two in-space electric propulsion systems.

As of September 30, 2022, the Company has entered into contracts for launch services and space products. The Company’s contracts may provide customers with termination for convenience clauses, which may or may not include termination penalties. In some contracts, the size of the contractual termination penalty increases closer to the scheduled launch date. At each balance sheet date, the Company evaluates each contract’s termination provisions and the impact on the accounting contract term, i.e., the period in which the Company has enforceable rights and obligations. This includes evaluating whether there are termination penalties and if so, whether they are considered substantive. The Company applies judgment in determining whether the termination penalties are substantive. In July 2022, the Company decided to focus on the development and production of the next version of its launch system. As a result, the Company has discontinued the production of launch vehicles supported by its current launch system and does not plan to conduct any further commercial launches in 2022. The Company has begun discussions with customers for whom it agreed to launch payloads on launch vehicles supported by its old launch system and the shift of those flights to launch vehicles supported by our new launch vehicle. If a customer terminates its contract with the Company due to the shifting of the flights, the customer may not be obligated to pay the termination for convenience penalties. As of September 30, 2022, the Company has not incurred any termination penalties in launch services as a result of the shifting of flights.

11

Table of Contents

Recognition of Revenue

The work performed by the Company in fulfilling launch services and space products performance obligations is not expected to create an asset to the customer since the launch vehicle that is built to deliver the customer’s payload into orbit will not be owned by the customer or the propulsion systems that are built to thrust the customers' satellite into orbit will not be owned by the customer until they are delivered to the customer. The Company recognizes revenue at a point in time upon satisfaction of the performance obligations under its launch services and space products agreements. The following table presents revenue disaggregated by type of revenue for the periods presented:

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Launch services | | $ | — | | | $ | — | | | $ | 5,899 | | | $ | — | |

Space products | | | 2,777 | | | | — | | | | 3,471 | | | | — | |

Total revenues | | $ | 2,777 | | | $ | — | | | $ | 9,370 | | | $ | — | |

Contracts with governmental entities involving research and development milestone activities do not represent contracts with customers under ASC 606 and as such, amounts received are recorded in other income (expense), net in the condensed consolidated statements of operations. No such income was recorded for the three months ended September 30, 2022. The Company recorded $0.4 million in other income for the nine months ended September 30, 2022. No such income was recorded for the three and nine months ended September 30, 2021.

Contract Balances and Remaining Performance Obligations

Contract balances. Contract assets and liabilities represent the differences in the timing of revenue recognition from the receipt of cash from the Company’s customers and billings. Contract assets reflect revenue recognized and performance obligations satisfied in advance of customer billing. Contract liabilities relate to payments received in advance of the satisfaction of performance under the contract. Receivables represent rights to consideration that are unconditional. Such rights are considered unconditional if only the passage of time is required before payment of that consideration is due. The Company had no contract assets as of September 30, 2022 and December 31, 2021. The Company had contract liabilities of $18.0 million and $10.4 million as of September 30, 2022 and December 31, 2021, respectively. The Company recognized revenue of $0.3 million and $5.2 million during the three and nine months ended September 30, 2022, respectively, that was included in the contract liabilities balance at the beginning of the period. No revenue was recognized for the three and nine months ended September 30, 2021.

Remaining performance obligations. Revenue allocated to remaining performance obligations represents the transaction price allocated to the performance obligations that are unsatisfied, or partially unsatisfied. It includes unearned revenue and amounts that will be invoiced and recognized as revenue in future periods and does not include contracts where the customer is not committed. Customers are not considered committed when they are able to terminate their contractual obligations to us without payment of a substantive penalty under the contract. Many of the Company’s contracts allow the customer to terminate the contract prior to launch or delivery without a substantive penalty, and therefore the enforceable contract is for a period less than the stated contractual term. Further, the Company has elected not to disclose the value of unsatisfied performance obligations for contracts with an original expected length of one year or less. The Company had unsatisfied performance obligations of $40.6 million as of September 30, 2022.

Note 3 — Acquisitions

Acquisition of Apollo Fusion, Inc.

On July 1, 2021, or the Apollo Acquisition Date, the Company, through its wholly owned indirect subsidiary, merged with Apollo Fusion, Inc. ("Apollo"). The results of Apollo’s operations have been included in the unaudited condensed consolidated financial statements since that date. Apollo designs, tests, manufactures and operates propulsion modules to enable satellites to orbit in space.

The fair value of the consideration paid as of July 1, 2021, was $70.8 million, net of cash acquired (the "Apollo Merger"), which consisted of the following:

12

Table of Contents

| | | | |

Purchase Consideration (in thousands) | | | |

Cash paid for outstanding Apollo common stock and options | | $ | 19,926 | |

Fair value of Astra Class A common stock issued | | | 33,008 | |

Fair value of contingent consideration | | | 18,400 | |

Total purchase consideration | | | 71,334 | |

Less: cash acquired | | | 566 | |

Total purchase consideration, net of cash acquired | | $ | 70,768 | |

The fair value of the shares of Class A common stock issued in the Apollo Merger was determined based on the closing market price of the Company’s Class A common stock on the Apollo Acquisition Date.

The vesting of all unvested stock options of Apollo granted prior to the Apollo Acquisition Date were accelerated prior to the acquisition and were then cancelled in exchange for a right of each option-holder to cash, equity and contingent consideration based on their pro-rata percentage, assuming all stock options of Apollo had been exercised.

The contingent consideration requires the Company to pay up to $75.0 million of additional consideration to Apollo’s former shareholders and option-holders, if Apollo meets certain customer revenue related milestones over a two and half year period ending on December 31, 2023. The contingent consideration is earned, which is a combination of total contract value and relevant payout ratio, if the contract with the customer is entered into after the acquisition date and 25% of revenue under the contract is recognized by December 31, 2023 under ASC 606. Contingent consideration is payable on a quarterly basis based on the milestones achieved. The fair value of the contingent consideration arrangement at the acquisition date was $18.4 million. The Company estimated the fair value of the contingent consideration using a Monte Carlo simulation model. This fair value measurement is based on significant inputs not observable in the market and thus represents a Level 3 measurement as defined in ASC 820. As of September 30, 2022, the contingent consideration recognized increased to $43.0 million as a result of changes in forecasted revenues subject to milestone payments and the passage of time. The Company has recognized $24.6 million in cumulative net losses on changes in fair value of contingent consideration from the Apollo Acquisition Date, of which $12.0 million and $29.2 million in loss was recognized in the condensed consolidated statement of operations for the three and nine months ended September 30, 2022, respectively.

An additional $10.0 million of cash ("Cash Earnout") will be paid to employees of Apollo that joined Astra, subject to certain vesting conditions, as amended. The Cash Earnout is accounted for as compensation expense over the requisite service period in the post-acquisition period as the payment is subject to the employee's continued employment with the Company. The Company has recognized $8.4 million in compensation cost from the Apollo Acquisition Date, of which $2.6 million in compensation cost was recognized in research and development expense in the condensed consolidated statement of operations for the nine months ended September 30, 2022. During the third quarter of 2022, the agreement was amended to remove the performance conditions and the Company paid $1.7 million to fulfill the Company’s remaining obligation under the Cash Earnout as of September 30, 2022. The remaining accrued liability of $1.9 million was written off as of September 30, 2022, since the total eligible compensation under the Cash Earnout was fully paid.

In addition, the Company awarded 1,047,115 Performance Stock Units ("PSUs") to employees of Apollo that joined Astra, subject to certain performance-based milestones, as amended, and other vesting provisions. The PSUs are accounted for as compensation expense over the requisite service period in the post-acquisition period as the vesting of PSUs is subject to time-based and performance-based vesting conditions. During the third quarter of 2022, the performance stock award agreements were amended to remove the performance-based milestone as a vesting condition. The PSUs now are only subject to vesting based on the applicable employees’ years of service. See Note 14 — Stock-Based Compensation for additional information.

The Company allocated the fair value of the purchase consideration to the tangible assets, liabilities and intangible assets acquired, based on the fair values as of the acquisition date. We have completed the valuation as of March 31, 2022. The excess purchase price over those fair values is recorded as goodwill. The valuation assumptions of acquired assets and assumed liabilities require significant estimates, especially with respect to intangible assets. The final purchase consideration allocation is presented in the following table.

13

Table of Contents

| | | | |

(in thousands) | | Fair Value | |

Inventory | | $ | 131 | |

Prepaid and other current assets | | | 796 | |

Property, plant and equipment | | | 996 | |

Right of use assets | | | 163 | |

Goodwill | | | 58,251 | |

Intangible assets | | | 15,350 | |

Other non-current assets | | | 75 | |

Total assets acquired | | | 75,762 | |

Accounts payable | | | (950 | ) |

Accrued expenses and other current liabilities | | | (1,939 | ) |

Operating lease obligation | | | (163 | ) |

Other non-current liabilities | | | (1,942 | ) |

Total liabilities assumed | | | (4,994 | ) |

Fair value of net assets acquired | | $ | 70,768 | |

Goodwill is primarily attributable to the assembled workforce and anticipated synergies expected from the integration of the Apollo business. The synergies include operating efficiencies, and other strategic benefits projected to be achieved as a result of the Apollo Merger. Goodwill is not deductible for tax purposes.

There were $2.8 million and $3.5 million of revenues recorded during the three and nine months ended September 30, 2022, respectively, related to Apollo. It was impracticable to determine the effect on net income attributable to Apollo as the Company had integrated a substantial portion of Apollo into its ongoing operations during the year.

| | | | | | |

Intangible Assets | | | | | |

| | Fair Value | | | Weighted-Average Amortization Periods |

| | (in thousands) | | | (in years) |

Developed technology | | $ | 12,100 | | | 6 |

Customer contracts and related relationships | | | 2,900 | | | 3 |

Order backlog | | | 200 | | | 1 |

Tradename | | | 150 | | | 2 |

Total identified intangible assets | | $ | 15,350 | | | |

Developed technology relates to propulsion modules. The Company valued the developed technology using the relief-from-royalty method under the income approach. This method is based on the application of a royalty rate to forecasted revenue that are expected to be generated by developed technology. The economic useful life was determined based on the technology cycle related to the developed technology, as well as the cash flows over the forecast period.

Customer contracts and related relationships represent the fair value of future projected revenue that will be derived from sales of products to existing customers of Apollo. Customer contracts and related relationships were valued using the multi-period excess earnings method under the income approach. This method reflects the present value of the projected cash flows that are expected to be generated by the customer contracts and related relationships less charges representing the contribution of other assets to those cash flows. The economic useful life was determined based on historical customer turnover rates.

Order backlog represents business under existing contractual obligations. The fair value of backlog was determined using the multi-period excess earnings method under the income approach based on expected operating cash flows from future contractual revenue. The economic useful life was determined based on the expected life of the backlog and the cash flows over the forecast period.

Trade name relates to the “Apollo” trade name. The fair value was determined by applying the relief-from-royalty method under the income approach. This method is based on the application of a royalty rate to forecasted revenue under the trade name. The economic useful life was determined based on the expected life of the trade name and the cash flows anticipated over the forecast period.

The Company believes the amounts of purchased intangible assets recorded above represent the fair values of, and approximate the amounts a market participant would pay for, these intangible assets as of the Apollo Acquisition Date.

Unaudited Pro Forma Information

14

Table of Contents

The following unaudited pro forma financial information presents combined results of operations for each of the periods presented, as if Apollo had been acquired as of the beginning of fiscal year 2020. The unaudited pro forma results include certain pro forma adjustments to revenue and net loss that were directly attributable to the acquisition including transaction costs and amortization of intangible assets. Transactions costs of approximately $4.4 million are assumed to have occurred on January 1, 2020 and are recognized as if incurred in the first quarter of 2020. Of these transaction costs, $0.4 million are incurred by Apollo and $4.0 million are incurred by the Company. Intangible assets are assumed to be recognized at their assigned fair values as of the pro forma close date of January 1, 2020 and are amortized over their estimated useful lives. The amortization expenses were $0.8 million and $2.5 million for the three and nine months ended September 30, 2021, respectively. The unaudited pro forma information presented below is for informational purposes only and is not necessarily indicative of our consolidated results of operations of the combined business had the acquisition actually occurred at the beginning of fiscal year 2020 or of the results of our future operations of the combined business.

| | | | | | | | |

in thousands | | For the Three Months Ended September 30, 2021 | | | For The Nine Months Ended September 30, 2021 | |

Pro forma net revenues | | $ | — | | | $ | 400 | |

Pro forma net loss and net loss attributable to common stockholders | | $ | (13,038 | ) | | $ | (207,789 | ) |

Reverse Recapitalization

On June 30, 2021, pre-combination Astra Space, Inc. and Holicity Inc. consummated the Business Combination contemplated by the BCA, with pre-combination Astra surviving the merger as a wholly owned subsidiary of Holicity. Upon consummation of the Business Combination, Holicity changed its name to Astra Space, Inc., and pre-combination Astra changed its name to Astra Space Operations, Inc.

Immediately following the Business Combination, there were 198,090,903 shares of Class A common stock and 56,239,189 shares of Class B common stock issued and outstanding with a par value of $0.0001. Additionally, there were outstanding options to purchase an aggregate of 5,993,412 shares of Class A common stock and outstanding warrants to purchase 15,813,829 shares of Class A common stock.

The Business Combination was accounted for as a reverse recapitalization in accordance with GAAP as pre-combination Astra has been determined to be the accounting acquirer. Under this method of accounting, while Holicity was the legal acquirer, it has been treated as the “acquired” company for financial reporting purposes. Accordingly, the Business Combination was treated as the equivalent of pre-combination Astra issuing stock for the net assets of Holicity, accompanied by a recapitalization. The net assets of Holicity were stated at historical cost, with no goodwill or other intangible assets recorded. Operations prior to the Business Combination are those of pre-combination Astra. Reported shares and earnings per share available to holders of the Company’s common stock, prior to the Business Combination, have been retroactively restated as shares reflecting the exchange ratio established in the BCA (approximately one pre-combination Astra share to 0.665 of the Company's shares).

The most significant change in the post-combination Company’s reported financial position and results was an increase in cash, net of transactions costs, of $463.6 million, including $200.0 million in gross proceeds from the private placements (the “PIPE”). In connection with the Business Combination, $25.2 million of transaction costs were paid on the Closing Date. Additionally, on the Closing Date, the Company repaid the short-term promissory notes with Pendrell (the “Bridge Loan”) of $10.4 million, which included principal of $10.0 million and end of term fee of $0.4 million as of June 30, 2021. The Company also repaid the outstanding principal and interest of $4.6 million for the term loan and equipment advances with Silicon Valley Bank. Refer to Note 6 – Long-term Debt.

The Company incurred $25.5 million in transaction costs relating to the merger with Holicity, of which $23.3 million has been recorded against additional paid-in capital in the Condensed Consolidated Balance Sheets and the remaining amount of $2.2 million was recognized as general and administrative expenses on the Condensed Consolidated Statements of Operations for the three and nine months ended September 30, 2021. On the date of the Business Combination, the Company recorded a liability related to the Public and Private Placement Warrants of $56.8 million, with an offsetting entry to additional paid-in capital. In relation to the Public and Private Placement Warrants, the Company recognized a portion of pre-combination Astra’s capitalizable transaction costs relating to the merger with Holicity, using the relative fair value method, as general and administrative expenses in the Condensed Consolidated Statements of Operations for the three and nine months ended September 30, 2021.

Upon closing of the Business Combination, the shareholders of Holicity, including Holicity founders, were issued 37,489,019 shares of Class A common stock. In connection with the Closing, holders of 10,981 shares of common stock of Holicity were redeemed at a price per share of $10.00. In connection with the Closing 20,000,000 shares were issued to PIPE investors at a price per share of $10.00.

15

Table of Contents

The number of shares of Class A common stock issued immediately following the consummation of the Business Combination were:

| | | | |

Common stock of Holicity | | | 29,989,019 | |

Holicity founder shares | | | 7,500,000 | |

Shares issued in PIPE | | | 20,000,000 | |

Business Combination and PIPE shares | | | 57,489,019 | |

Pre-combination Astra shares | | | 140,601,884 | |

Total shares of Class A common stock immediately after Business Combination | | | 198,090,903 | |

In addition, in connection with the consummation of the Business Combination, 56,239,189 shares of Class B common stock were issued to two executive officers and founders of the Company: Chris Kemp and Adam London in exchange for an aggregate 73,699,647 shares of common stock and an aggregate 10,870,562 shares of Founders Preferred Stock of pre-combination Astra.

Note 4 — Supplemental Financial Information

Inventories

| | | | | | | | |

in thousands | | As of September 30, 2022 | | | As of December 31, 2021 | |

Raw materials | | $ | 1,015 | | | $ | 5,775 | |

Work in progress | | | 4,159 | | | | 941 | |

Finished goods | | | — | | | | 959 | |

Inventories | | $ | 5,174 | | | $ | 7,675 | |

There were no inventory write-downs recorded during the three months ended September 30, 2022. There were $18.8 million of inventory write-downs recorded within cost of revenues during the nine months ended September 30, 2022, of which $10.2 million related to the discontinuance of production of the current version of its launch vehicle as the Company focuses on developing the new version of its launch system. There were no inventory write-downs recorded during the three and nine months ended September 30, 2021.

Property, Plant and Equipment, net

Presented in the table below are the major classes of property, plant and equipment:

| | | | | | | | |

in thousands | | As of September 30, 2022 | | | As of December 31, 2021 | |

Construction in progress | | $ | 6,381 | | | $ | 39,246 | |

Computer and software | | | 6,501 | | | | 3,092 | |

Leasehold improvements | | | 58,255 | | | | 14,177 | |

Research equipment | | | 14,478 | | | | 8,935 | |

Production equipment | | | 23,439 | | | | 10,442 | |

Furniture and fixtures | | | 1,523 | | | | 1,001 | |

Total property, plant and equipment | | | 110,577 | | | | 76,893 | |

Less: accumulated depreciation | | | (20,241 | ) | | | (10,577 | ) |

Less: accumulated impairment charges | | | (70,288 | ) | | | — | |

Property, plant and equipment, net | | $ | 20,048 | | | $ | 66,316 | |

Depreciation expense amounted to $3.7 million and $0.8 million for the three months ended September 30, 2022 and 2021, respectively. Depreciation expense amounted to $9.7 million and $3.0 million for the nine months ended September 30, 2022 and 2021, respectively.

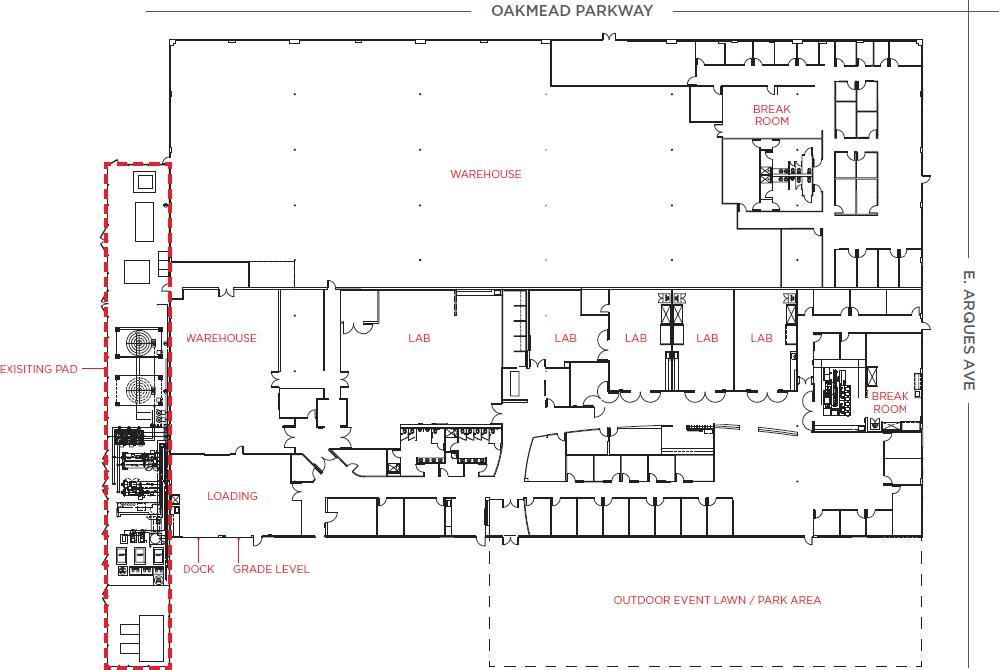

The Company recorded a non-cash impairment charge of $70.3 million primarily related to leasehold improvements, production equipment and research equipment of Launch Services in the condensed consolidated statements of operations for the three and nine months ended September 30, 2022. No impairment charges were recorded for the three and nine months ended September 30, 2021. See Note 1 – Description of Business, Basis of Presentation and Significant Accounting Policies, for discussion of triggers for impairment as of September 30, 2022.

16

Table of Contents

Accrued Expenses and Other Current Liabilities

| | | | | | | | |

in thousands | | As of September 30, 2022 | | | As of December 31, 2021 | |

Employee compensation and benefits | | $ | 5,882 | | | $ | 9,927 | |

Contract liabilities, current portion | | | 12,028 | | | | 10,162 | |

Construction in progress related accruals | | | 1,072 | | | | 3,726 | |

Accrued expenses | | | 5,280 | | | | 3,464 | |

Other (miscellaneous) | | | 3,120 | | | | 2,620 | |

Accrued expenses and other current liabilities | | $ | 27,382 | | | $ | 29,899 | |

Other Non-Current Liabilities

| | | | | | | | |

in thousands | | As of September 30, 2022 | | | As of December 31, 2021 | |

Contract liabilities, net of current portion | | | 6,013 | | | | 149 | |

Other (miscellaneous) | | | 1,264 | | | | 750 | |

Other non-current liabilities | | $ | 7,277 | | | $ | 899 | |

Other (Expense) Income, Net

| | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

in thousands | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Change in fair value of warrant liabilities | | $ | — | | | $ | 20,447 | | | $ | — | | | $ | 20,447 | |

Gain on forgiveness of PPP note | | | — | | | | 4,850 | | | | — | | | | 4,850 | |

Other (miscellaneous) | | | (25 | ) | | | 598 | | | | 314 | | | | (120 | ) |

Other (expense) income, net | | $ | (25 | ) | | $ | 25,895 | | | $ | 314 | | | $ | 25,177 | |

Note 5 — Goodwill and Intangible Assets

Goodwill

The following table summarizes the changes in the carrying amount of goodwill:

| | | | | | | | | | | | |

(in thousands) | | Carrying Amount | | | Accumulated Impairment Charge | | | Net Book Value | |

Goodwill | | $ | 58,251 | | | $ | (58,251 | ) | | $ | — | |

The Company recorded a pre-tax impairment charge of $58.3 million for the three and nine months ended September 30, 2022, respectively, fully impairing its goodwill balance. There was no impairment charge for the three and nine months ended September 30, 2021. See Note 1 – Description of Business, Basis of Presentation and Significant Accounting Policies for discussion of events triggering the goodwill impairment test.

17

Table of Contents

Intangible Assets

| | | | | | | | | | | | | | | | |

in thousands | | Gross Carrying Amount | | | Accumulated Impairment Charge | | | Accumulated Amortization | | | Net Book Value | |

As of September 30, 2022: | | | | | | | | | | | | |

Definite-lived intangible assets | | | | | | | | | | | | |

Developed technology | | $ | 12,100 | | | $ | (2,191 | ) | | $ | (2,521 | ) | | $ | 7,388 | |

Customer contracts and related relationship | | | 2,900 | | | | (517 | ) | | | (1,208 | ) | | | 1,175 | |

Order backlog | | | 200 | | | | — | | | | (200 | ) | | | — | |

Trade names | | | 150 | | | | (27 | ) | | | (94 | ) | | | 29 | |

Intangible assets subject to amortization | | | 15,350 | | | | (2,734 | ) | | | (4,023 | ) | | | 8,593 | |

Indefinite-lived intangible assets | | | | | | | | | | | | |

Trademarks | | | 4,200 | | | | (2,094 | ) | | | — | | | | 2,106 | |

Total | | $ | 19,550 | | | $ | (4,828 | ) | | $ | (4,023 | ) | | $ | 10,699 | |

The Company recorded a pre-tax impairment charge of $4.8 million for the three and nine months ended September 30, 2022, respectively. There was no impairment charge for the three and nine months ended September 30, 2021. See Note 1 – Description of Business, Basis of Presentation and Significant Accounting Policies for discussion of events triggering the impairment assessment of definite-lived and indefinite-lived intangible assets.

| | | | | | | | | | | | |

in thousands | | Gross Carrying Amount | | | Accumulated Amortization | | | Net Book Value | |

As of December 31, 2021: | | | | | | | | | |

Definite-lived intangible assets | | | | | | | | | |

Developed technology | | $ | 12,100 | | | $ | (1,008 | ) | | $ | 11,092 | |

Customer contracts and related relationship | | | 2,900 | | | | (483 | ) | | | 2,417 | |

Order backlog | | | 200 | | | | (100 | ) | | | 100 | |

Trade names | | | 150 | | | | (38 | ) | | | 112 | |

Intangible assets subject to amortization | | | 15,350 | | | | (1,629 | ) | | | 13,721 | |

Indefinite-lived intangible assets | | | | | | | | | |

Trademarks | | | 4,200 | | | | — | | | | 4,200 | |

Total | | $ | 19,550 | | | $ | (1,629 | ) | | $ | 17,921 | |

Based on the amount of intangible assets as of September 30, 2022, the expected amortization expense for each of the next five years and thereafter is as follows:

| | | | |

in thousands | | Expected Amortization Expense | |

2022 (remainder) | | $ | 567 | |

2023 | | | 2,247 | |

2024 | | | 1,891 | |

2025 | | | 1,555 | |

2026 | | | 1,555 | |

Thereafter | | | 778 | |

Total Intangible assets subject to amortization | | $ | 8,593 | |