Filed Pursuant to Rule (424)(b)(3)

Registration No. 333-267113

PROSPECTUS SUPPLEMENT NO. 11

(to Prospectus dated September 13, 2022)

ASTRA SPACE, INC.

34,000,000 SHARES OF CLASS A COMMON STOCK

This prospectus supplement amends and supplements the prospectus dated September 13, 2022 (as supplemented or amended from time to time, the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (No. 333-267113). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on November 8, 2022 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and resale of up to 34,000,000 shares of Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”), of Astra Space, Inc. by B. Riley Principal Capital II, LLC (the “Selling Stockholder”). The shares included in the Prospectus and this Prospectus supplement consist of shares of Class A Common Stock that we may, in our discretion, elect to issue and sell to the Selling Stockholder pursuant to a common stock purchase agreement we entered into with the Selling Stockholder on August 2, 2022 (the “Purchase Agreement”). Such shares of Class A Common Stock include (i) up to 33,281,805 shares of our Class A Common Stock that we may, in our sole discretion, elect to sell to the Selling Stockholder from time to time after the date of this prospectus, pursuant to the Purchase Agreement and (ii) 718,195 shares of our Class A Common Stock we issued, or may issue if certain conditions are met, in each case, to the Selling Stockholder as consideration for its commitment to purchase shares of our Class A Common Stock in one or more purchases that we may, in our sole discretion, direct them to make, from time to time after the date of this prospectus, pursuant to the Purchase Agreement. See “The Committed Equity Financing” for a description of the Purchase Agreement and “Selling Stockholder” for additional information regarding the Selling Stockholder.

Our Class A common stock is listed on Nasdaq under the symbol “ASTR”. On November 7, 2022, the closing price of our Class A common stock was $0.585 per share.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 17 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 8, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2022

Astra Space, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | |

| Delaware | | 001-39426 | | 85-1270303 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | |

1900 Skyhawk Street

Alameda, California | | | | 94501 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (866) 278-7217

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | ASTR | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 | Results of Operations and Financial Condition. |

On November 8, 2022, Astra Space, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2022.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02 of this Current Report, including the accompanying Exhibit 99.1, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 7.01 | Regulation FD Disclosure. |

Also, on November 8, 2022, the Company made a presentation available on its website: astra.com. This presentation is intended to accompany the earnings call to be held on November 8, 2022, at 4:30 p.m. eastern time, and to assist in understanding information that the Company will discuss on this call. A copy of this presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information in this Item 7.01 of this Current Report, including the accompanying Exhibit 99.2, shall be deemed “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of such section, nor shall it be incorporated by reference in any filing made by the Company pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except to the extent that such filing incorporates by reference any or all of such information by express reference thereto.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | |

Exhibit

No. | | Description |

| |

| 99.1 | | Press release issued by Astra Space, Inc. dated November 8, 2022 |

| |

| 99.2 | | Earnings presentation dated November 8, 2022 |

| |

| 104 | | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | |

| Date: November 8, 2022 | | | | Astra Space, Inc. |

| | | |

| | | | By: | | /s/ Chris Kemp |

| | | | Name: | | Chris Kemp |

| | | | Title: | | Chief Executive Officer |

Exhibit 99.1

ASTRA ANNOUNCES THIRD QUARTER 2022 FINANCIAL RESULTS

ALAMEDA, California — November 8, 2022 — Astra Space, Inc. (“Astra”) (Nasdaq: ASTR) today announced financial results for its third quarter ended September 30, 2022.

Astra also announced 2371 cumulative committed orders of the Astra Spacecraft Engine™, an increase of 130% since June 30, 2022, and that it has completed delivery of two full programs.

In addition, Astra continues to make progress on development for Rocket 4 in anticipation of test flights expected to commence in the later part of 2023.

“We continue to focus on executing our long-term strategic plan. Specifically, a successful test flight of Rocket 4 and scaling delivery of our Astra Spacecraft Engines™ are our primary near-term objectives. We have completed the build-out of our rocket production facility in Alameda, CA, including the provisioning of test infrastructure for the development of Launch System 2. We are also excited to welcome Airbus OneWeb Satellites, Maxar Technologies, and Astroscale as Astra Spacecraft Engine™ customers, among others,” said Chris Kemp, Astra Co-Founder, Chairman, and CEO.

“Given the challenging macroeconomic environment, we made the difficult but prudent decision to reduce our operating expenses to support our primary near-term objectives,” continued Kemp.

“We have prioritized the careful execution of our strategic plan as we enter a new stage of growth for our business,” said incoming CFO, Axel Martinez. “The refinement of this plan includes a reduction of our existing headcount by approximately 16%. Savings from headcount reductions are expected to be realized beginning in Q1 2023. We are also reducing our near-term investments in developing Space Services to direct our resources to support the growth of our core Launch Services and Space Products businesses. We continue to explore opportunities to develop or partner in the development of our Space Services offerings as it remains a significant part of our long-term business strategy.”

Q3 2022 represented the first quarter in which Astra reported a positive GAAP gross profit, driven by deliveries of Astra Spacecraft Engines™.

Recent Business Highlights:

| | • | | Completed the first design loop for Launch System 2, including Rocket 4, ground system, and software and published an update on our progress |

| | • | | Provisioned core rocket test infrastructure, including upgrades to the first stage engine test stand and commissioning of new launch system valve test stands |

| | • | | Designed and released tooling required to manufacture Rocket 4 propellant tanks |

| | • | | Successfully delivered two full programs of the Astra Spacecraft Engine™ |

| | • | | Finalizing the build-out of Astra’s 60,000 square foot Astra Spacecraft Engine™ manufacturing facility in Sunnyvale, CA, targeted to be completed in Q1 2023 |

Third Quarter 2022 Financial Highlights:

For the three months ended September 30, 2022:

| | • | | GAAP Gross Profit was $1.7 million |

| 1 | Measured from July 1, 2021, through November 8, 2022, and includes committed orders for 14 units acquired as part of the Apollo Fusion acquisition on July 1, 2021. |

| | • | | GAAP Net Loss was $199.1 million |

| | • | | Adjusted Net Loss* was $45.2 million |

| | • | | Adjusted EBITDA Loss* was $41.4 million |

| | • | | Additions for capital expenditures during the quarter totaled $5.5 million |

| | • | | Cash and cash equivalents and marketable securities totaled $150.5 million |

| * | Denotes Non-GAAP financial measure. Refer to “Explanation of Adjusted (or Non-GAAP) Financial Measures” later in this press release for reconciliation of GAAP to Non-GAAP financial measures. |

Fourth Quarter 2022 Outlook

As of November 8, 2022, we are providing guidance for the fourth quarter 2022 based on current market conditions, our focus on the development of Launch System 2, and our ongoing investments to scale our Space Products business in Q1 2023. We emphasize that the guidance is subject to various important cautionary factors referenced in the section entitled “Forward-Looking Statements” below and our annual report on Form 10-K for the year ended December 31, 2021, and quarterly reports on Form 10-Q for the periods June 30, 2022, and September 30, 2022, including risks and uncertainties associated with geopolitical conditions and their potential impact on our business as well as our ability to continue operating as a going concern.

For the fourth quarter ending December 31, 2022, we currently expect:

| | • | | adjusted EBITDA loss* to be between $42.0 million and $45.0 million, |

| | • | | basic shares outstanding to be between 268 million and 270 million shares, and |

| | • | | capital additions to be between $5.0 million and $7.0 million |

| * | Denotes Non-GAAP financial measure. Refer to “Explanation of Adjusted (or Non-GAAP) Financial Measures” later in this press release for reconciliation of GAAP to Non-GAAP financial measures. |

Conference Call Information

In conjunction with this announcement, Astra will host a conference call for investors at 1:30 p.m. PT (4:30 p.m. ET) today to discuss third quarter results and our outlook for the fourth quarter ending December 31, 2022. The live webcast and a replay of the webcast will be available on the Investor Relations section of Astra’s website: https://investor.astra.com/news-and-events/events-and-presentations.

About Astra Space, Inc.

Astra’s mission is to improve life on Earth from space® by creating a healthier and more connected planet. Today, Astra offers one of the lowest cost-per-launch dedicated orbital launch services of any operational launch provider in the world, and one of the industry’s first flight-proven electric propulsion systems for satellites, Astra Spacecraft Engine™. Astra delivered its first commercial launch to low Earth orbit in 2021, making it the fastest company in history to reach this milestone, just five years after it was founded in 2016. Astra (NASDAQ: ASTR) was the first space launch company to be publicly traded on Nasdaq. Visit astra.com to learn more about Astra.

Forward Looking Statements

Certain statements made in this press release are “forward-looking statements”. Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements reflect the current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, actual results may differ materially from Astra’s expectations or projections, including the following factors, among others: (i) the failure to meet projected development, delivery and launch targets, including as a result of the decisions of governmental authorities or other third parties not within our control; (ii) changes in applicable laws or regulations; (iii) the ability of Astra to meet its financial and strategic goals, due to, among other things, competition and the dedication of our launch resources to the development of Launch System 2 and its ability to continue operating as a going concern; (iv) the ability of Astra to pursue a growth strategy and manage growth profitability without additional funding; (v) the possibility that Astra may be adversely affected by other economic, business, and/or competitive factors; (vi) the ability to manage its cash outflows related to its business operations, (vii) the ability of Astra to develop its space services offering as part of its long-term business and growth strategy and (viii) other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in other reports and other public filings with the Securities and Exchange Commission by Astra.

Explanation of Non-GAAP (or Adjusted) Financial Measures

This press release includes information about Adjusted Gross Profit (Loss), Adjusted Net Loss and Adjusted EBITDA (collectively the “non-GAAP financial measures”), all of which are non-GAAP financial measures. These non-GAAP financial measures are measurements of financial performance that are not prepared in accordance with U.S. generally accepted accounting principles and computational methods may differ from those used by other companies. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with Astra’s condensed consolidated financial statements prepared in accordance with GAAP. Non-GAAP financial measures are reconciled to their most comparable GAAP measures in the table set forth in this release.

We believe that both management and our investors benefit from referring to these non-GAAP financial measures in planning, forecasting and analyzing future periods. Specifically, our management uses these non-GAAP financial measures in planning, monitoring and evaluating our financial and operational decision making and as a means to evaluate period-to-period comparisons. Our management recognizes that the non-GAAP financial measures have inherent limitations because of the excluded items described below.

We believe that providing the non-GAAP financial measures, together with the reconciliation to GAAP measures, helps investors make comparisons between Astra and other companies in our industry. In making any comparisons to other companies in our industry, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each company under applicable SEC rules.

Adjusted Gross Profit (Loss) differs from GAAP Gross Profit (Loss) in that it excludes inventory adjustments related to Rocket 3.

Adjusted Net Loss differs from GAAP Net Loss in that it excludes the following items: (a) stock-based compensation, (b) loss on change in fair value of contingent consideration, (c) cash earnout compensation cost related to the acquisition of Apollo Fusion, (d) inventory write-downs related to discontinuance of production of Launch System 1, (e) capitalized launch costs write-downs related to discontinuance of production of Launch System 1 (f) impairment charge, (g) employee retention credit, (h) PPP loan forgiveness, and (i) other special items, including related to employee safety and licensed technology.

We define Adjusted EBITDA as Adjusted Net Loss, excluding the following items: (a) interest expense and interest income, (b) income tax expense, (c) loss on marketable securities, and (d) depreciation and amortization. We are unable to predict with reasonable certainty the ultimate outcome of these exclusions without unreasonable effort.

Astra Space, Inc.

Condensed Consolidated Statements of Operations

(Unaudited, in thousands except per share data)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Revenues | | | | | | | | | | | | | | | | |

Launch services | | $ | — | | | $ | — | | | $ | 5,899 | | | $ | — | |

Space products | | | 2,777 | | | | — | | | | 3,471 | | | | — | |

| | | | | | | | | | | | | | | | |

Total revenues | | | 2,777 | | | | | | | | 9,370 | | | | — | |

| | | | | | | | | | | | | | | | |

Cost of revenues | | | | | | | | | | | | | | | | |

Launch services | | | — | | | | — | | | | 28,193 | | | | — | |

Space products | | | 1,071 | | | | — | | | | 1,337 | | | | | |

| | | | | | | | | | | | | | | | |

Total cost of revenues | | | 1,071 | | | | | | | | 29,530 | | | | | |

| | | | | | | | | | | | | | | | |

Gross profit (loss) | | | 1,706 | | | | — | | | | (20,160 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | | | | |

Research and development | | | 32,821 | | | | 21,724 | | | | 111,546 | | | | 44,159 | |

Sales and marketing | | | 4,052 | | | | 1,090 | | | | 13,452 | | | | 2,229 | |

General and administrative | | | 19,222 | | | | 19,730 | | | | 60,816 | | | | 50,712 | |

Impairment expense | | | 75,116 | | | | — | | | | 75,116 | | | | — | |

Goodwill impairment | | | 58,251 | | | | — | | | | 58,251 | | | | — | |

Loss on change in fair value of contingent consideration | | | 11,949 | | | | — | | | | 29,249 | | | | — | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 201,411 | | | | 42,544 | | | | 348,430 | | | | 97,100 | |

| | | | | | | | | | | | | | | | |

Operating loss | | | (199,705 | ) | | | (42,544 | ) | | | (368,590 | ) | | | (97,100 | ) |

Interest income (expense), net | | | 616 | | | | 18 | | | | 1,146 | | | | (1,194 | ) |

Other income (expense), net | | | (25 | ) | | | 25,895 | | | | 314 | | | | 25,177 | |

Loss on extinguishment of convertible notes | | | — | | | | — | | | | — | | | | (131,908 | ) |

Loss on extinguishment of convertible notes attributable to related parties | | | — | | | | — | | | | — | | | | (1,875 | ) |

Loss before taxes | | | (199,114 | ) | | | (16,631 | ) | | | (367,130 | ) | | | (206,900 | ) |

Income tax (benefit) provision | | | — | | | | (383 | ) | | | — | | | | (383 | ) |

Net loss | | $ | (199,114 | ) | | $ | (16,248 | ) | | $ | (367,130 | ) | | $ | (206,517 | ) |

| | | | | | | | | | | | | | | | |

Adjustment to redemption value on Convertible Preferred Stock | | | — | | | | — | | | | — | | | | (1,011,726 | ) |

Net loss attributable to common stockholders | | $ | (199,114 | ) | | $ | (16,248 | ) | | $ | (367,130 | ) | | $ | (1,218,243 | ) |

Basic and diluted loss per share | | | | | | | | | | | | | | | | |

Weighted average basic and diluted shares - Class A | | | 210,788 | | | | 201,080 | | | | 209,317 | | | | 79,785 | |

Loss per share | | $ | (0.75 | ) | | $ | (0.06 | ) | | $ | (1.39 | ) | | $ | (9.39 | ) |

Weighted average basic and diluted shares - Class B | | | 55,539 | | | | 56,239 | | | | 55,539 | | | | 49,970 | |

Loss per share | | $ | (0.75 | ) | | $ | (0.06 | ) | | $ | (1.39 | ) | | $ | (9.39 | ) |

Astra Space, Inc.

Condensed Consolidated Balance Sheets

(Unaudited, in thousands)

| | | | | | | | |

| | | September 30, 2022 | | | December 31, 2021 | |

| | | | | | | |

Assets: | | | | |

Cash and cash equivalents | | $ | 67,608 | | | $ | 325,007 | |

Marketable securities | | | 82,936 | | | | — | |

Trade accounts receivable | | | 4,923 | | | | 1,816 | |

Inventories | | | 5,174 | | | | 7,675 | |

Prepaid and other current assets | | | 7,609 | | | | 12,238 | |

| | | | | | | | |

Total current assets | | | 168,250 | | | | 346,736 | |

| | | | | | | | |

| | | | | | | | |

Property, plant and equipment, net | | | 20,048 | | | | 66,316 | |

Right-of-use asset | | | 14,909 | | | | 9,079 | |

Goodwill | | | — | | | | 58,251 | |

Intangible assets, net | | | 10,699 | | | | 17,921 | |

Other non-current assets | | | 1,999 | | | | 721 | |

| | | | | | | | |

Total assets | | $ | 215,905 | | | $ | 499,024 | |

| | | | | | | | |

Liabilities and Stockholders’ Equity: | | | | | | | | |

Accounts payable | | $ | 9,347 | | | $ | 9,122 | |

Operating lease obligation, current portion | | | 3,903 | | | | 1,704 | |

Contingent consideration, current portion | | | 32,420 | | | | — | |

Accrued expenses and other current liabilities | | | 27,382 | | | | 29,899 | |

| | | | | | | | |

Total current liabilities | | | 73,052 | | | | 40,725 | |

| | | | | | | | |

Operating lease obligation, net of current portion | | | 10,974 | | | | 7,180 | |

Contingent consideration, net of current portion | | | 10,530 | | | | 13,700 | |

Other non-current liabilities | | | 7,277 | | | | 899 | |

| | | | | | | | |

Total liabilities | | | 101,833 | | | | 62,504 | |

| | | | | | | | |

Total stockholders’ equity | | | 114,072 | | | | 436,520 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 215,905 | | | $ | 499,024 | |

| | | | | | | | |

Astra Space, Inc.

Summary Cash Flow Data:

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Summary Cash Flow Data: | | | | | | | | | | | | | | | | |

Cash used in operating activities | | $ | (42,753 | ) | | $ | (44,921 | ) | | $ | (134,615 | ) | | $ | (79,576 | ) |

Capital expenditures | | | (7,979 | ) | | | (9,924 | ) | | | (40,043 | ) | | | (18,720 | ) |

Free cash flow (non-GAAP) | | | (50,732 | ) | | | (54,845 | ) | | | (174,658 | ) | | | (98,296 | ) |

Cash used in investing activities | | | 5,559 | | | | (29,284 | ) | | | (124,088 | ) | | | (41,280 | ) |

Cash provided by financing activities | | | 487 | | | | 470 | | | | 1,304 | | | | 488,897 | |

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures

(in thousands)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Nine Months Ended | |

| | | September 30, | | | September 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Revenues | | | | | | | | | | | | | | | | |

Launch services | | $ | — | | | $ | — | | | $ | 5,899 | | | $ | — | |

Space products | | | 2,777 | | | | — | | | | 3,471 | | | | — | |

| | | | | | | | | | | | | | | | |

Total revenues | | | 2,777 | | | | — | | | | 9,370 | | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Cost of revenues | | | | | | | | | | | | | | | | |

Launch services | | $ | — | | | $ | — | | | $ | 28,193 | | | $ | — | |

Space products | | | 1,071 | | | | — | | | | 1,337 | | | | — | |

| | | | | | | | | | | | | | | | |

Total cost of revenues | |

| 1,071

|

| | | — | | | | 29,530 | | | | — | |

| | | | | | | | | | | | | | | | |

GAAP gross profit (loss) | | $ | 1,706 | | | $ | — | | | $ | (20,160 | ) | | $ | — | |

GAAP gross margin | | | 61 | % | | | — | | | | (215 | )% | | | — | |

Inventory adjustments | | | — | | | | — | | | | 10,200 | | | | — | |

Capitalize launch costs write downs | | | — | | | | — | | | | 2,213 | | | | — | |

Adjusted gross profit (loss) | | $ | 1,706 | | | $ | — | | | $ | (7,747 | ) | | $ | — | |

Adjusted gross margin | | | 61 | % | | | — | | | | (83 | )% | | | — | |

GAAP net loss | | $ | (199,114 | ) | | $ | (16,248 | ) | | $ | (367,130 | ) | | $ | (206,517 | ) |

Stock-based compensation | | | 13,748 | | | | 2,688 | | | | 43,580 | | | | 20,465 | |

Fair value of warrant liabilities | | | — | | | | (20,447 | ) | | | — | | | | (20,447 | ) |

Loss on change in fair value of contingent consideration | | | 11,949 | | | | — | | | | 29,249 | | | | — | |

Apollo cash earnout compensation | | | (1,900 | ) | | | 1,362 | | | | 675 | | | | 1,362 | |

Inventory write downs | | | 1,012 | | | | — | | | | 11,212 | | | | — | |

| | | | | | | | | | | | | | | | |

Capitalized launch cost write downs | | | — | | | | — | | | | 2,213 | | | | — | |

Loss on extinguishment of convertible notes | | | — | | | | — | | | | — | | | | 133,783 | |

Impairment expense | | | 75,116 | | | | — | | | | 75,116 | | | | — | |

Goodwill impairment | | | 58,251 | | | | — | | | | 58,251 | | | | — | |

Employee retention credit | | | (4,283 | ) | | | — | | | | (4,283 | ) | | | — | |

PPP loan forgiveness | | | — | | | | (4,850 | ) | | | — | | | | (4,850 | ) |

Other special items | | | 18 | | | | 3,030 | | | | 2,796 | | | | 3,780 | |

Adjusted net loss | | $ | (45,203 | ) | | $ | (34,465 | ) | | $ | (148,321 | ) | | $ | (72,424 | ) |

Interest (income) expense, net | | | (616 | ) | | | (18 | ) | | | (1,146 | ) | | | 1,194 | |

Income tax (benefit) expense | | | — | | | | (383 | ) | | | — | | | | — | |

Realized Gain/Loss on Investment | | | (9 | ) | | | — | | | | 123 | | | | — | |

Depreciation and amortization | | | 4,425 | | | | 1,978 | | | | 12,058 | | | | 3,896 | |

Adjusted EBITDA | | $ | (41,403 | ) | | $ | (32,888 | ) | | $ | (137,286 | ) | | $ | (67,334 | ) |

Investor Contact:

investors@astra.com

Media Contact:

press@astra.com

Exhibit 99.2 ASTRA INVESTOR UPDATE Q3 2022 Astra’s headquarters in Alameda, California

DISCLAIMER AND FORWARD-LOOKING STATEMENTS Certain statements made in this press release are “forward-looking statements”. Forward-looking Accordingly, none of Astra nor its respective affiliates and advisors makes any representations statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, as to the accuracy or completeness of these data. Certain amounts related to the “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or transaction described herein have been expressed in U.S. dollars for convenience and, when trends or that are not statements of historical matters. These forward-looking statements reflect the expressed in U.S. dollars in the future, such amounts may be different from those set forth current analysis of existing information and are subject to various risks and uncertainties. As a result, herein. caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, actual results may differ materially from Astra’s expectations or projections, including the Non-GAAP Financial Measures. This Presentation includes non-GAAP financial measures. following factors, among others: (i) the failure to meet projected development, delivery and launch Astra believes that these non-GAAP measures of financial results provide useful information targets, including as a result of the decisions of governmental authorities or other third parties not to management and investors regarding certain financial and business trends relating to within our control; (ii) changes in applicable laws or regulations; (iii) the ability of Astra to meet its Astra’s financial condition and results of operations. Astra’s management uses certain of these financial and strategic goals, due to, among other things, competition and the dedication of our non-GAAP measures to compare Astra’s performance to that of prior periods for trend analyses launch resources to the development of Launch System 2 and its ability to continue operating as a and for budgeting and planning purposes. going concern; (iv) the ability of Astra to pursue a growth strategy and manage growth profitability without additional funding; (v) the possibility that Astra may be adversely affected by other economic, business, and/or competitive factors; (vi) the ability to manage its cash outflows related to its All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong business operations, (vii) the ability of Astra to develop its space services offering as part of its long- to their respective owners and Astra’s use thereof does not imply an affiliation with, or term business and growth strategy and (viii) other risks and uncertainties described herein, as well as endorsement by the owners of such trademarks, copyrights, logos and other intellectual property. those risks and uncertainties discussed from time to time in other reports and other public filings Solely for convenience, trademarks and trade names referred to in this Presentation may appear with the Securities and Exchange Commission by Astra. with the ® or ™ symbols, but such references are not intended to indicate, in any way, that such names and logos are trademarks or registered trademarks of Astra. This Presentation contains statistical data, estimates and forecasts that have been provided by Astra and/or are based on independent industry publications or other publicly available This Presentation accompanies Astra’s earnings call for the third quarter 2022, which was held on information, as well as other information based on Astra’s internal sources. This information November 8, 2022, and is intended to assist in understanding information Astra’s management discussed in that call. This Presentation should be viewed in conjunction with the November 8, involves many assumptions and limitations, and you are cautioned not to give undue weight to 2022, earnings call, a replay of which is available on Astra’s website at www.astra.com, under these estimates. We have not independently verified the accuracy or completeness of the data Investors. that has been provided by Astra and/or contained in these industry publications and other publicly available information.

EXPLANATION OF NON-GAAP (OR ADJUSTED) FINANCIAL MEASURES This press release includes information about Adjusted Gross Profit (Loss), Adjusted Net Loss and Adjusted Gross Profit (Loss) differs from GAAP Gross Profit (Loss) in that it excludes inventory Adjusted EBITDA (collectively the “non-GAAP financial measures”), all of which are non-GAAP financial adjustments related to Rocket 3. measures. These non-GAAP financial measures are measurements of financial performance that are not prepared in accordance with U.S. generally accepted accounting principles and computational Adjusted Gross margin is calculated by dividing Adjusted Gross Profit (Loss) by revenue. methods may differ from those used by other companies. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be Adjusted Net Loss differs from GAAP Net Loss in that it excludes the following items: (a) stock-based read only in conjunction with Astra’s condensed consolidated financial statements prepared in compensation, (b) loss on change in fair value of contingent consideration, (c) cash earnout accordance with GAAP. Non-GAAP financial measures are reconciled to their most comparable GAAP compensation cost related to the acquisition of Apollo Fusion, (d) inventory write-downs related to measures in the table set forth in this release. discontinuance of production of Launch System 1, (e) capitalized launch costs write-downs related to discontinuance of production of Launch System 1 (f) impairment charge, (g) employee retention We believe that both management and our investors benefit from referring to these non-GAAP credit, (h) PPP loan forgiveness, and (i) other special items, including related to employee safety and financial measures in planning, forecasting and analyzing future periods. Specifically, our licensed technology. management uses these non-GAAP financial measures in planning, monitoring and evaluating our financial and operational decision making and as a means to evaluate period-to-period comparisons. We define Adjusted EBITDA as Adjusted Net Loss, excluding the following items: (a) interest expense Our management recognizes that the non-GAAP financial measures have inherent limitations because and interest income, (b) income tax expense, (c) loss on marketable securities, and (d) depreciation of the excluded items described below. and amortization. We are unable to predict with reasonable certainty the ultimate outcome of these exclusions without unreasonable effort. We believe that providing the non-GAAP financial measures, together with the reconciliation to GAAP measures, helps investors make comparisons between Astra and other companies in our industry. In For a reconciliation of our Non-GAAP financial measures to their GAAP, please see our earnings making any comparisons to other companies in our industry, investors need to be aware that release furnished with the SEC on November 8, 2022. companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each company under applicable SEC rules.

OUR MISSION Improve Life On Earth From Space®

ASTRA SPACE PLATFORM LAUNCH SERVICES SPACE PRODUCTS

LAUNCH SYSTEM 2 UPDATE 600 KG 500 km — 50° OVER THE COURSE OF THE PRODUCT LIFECYCLE

Astra’s headquarters in Alameda, California — 1900 Skyhawk Street

TM ASTRA SPACECRAFT ENGINE 237 COMMITTED ORDERS* CURRENTLY AT WORK ON ORBIT 600+ ON-ORBIT BURNS *From July 1, 2021 through November 8, 2022, including 14 units sold, but not delivered, before Astra acquired Apollo Fusion.

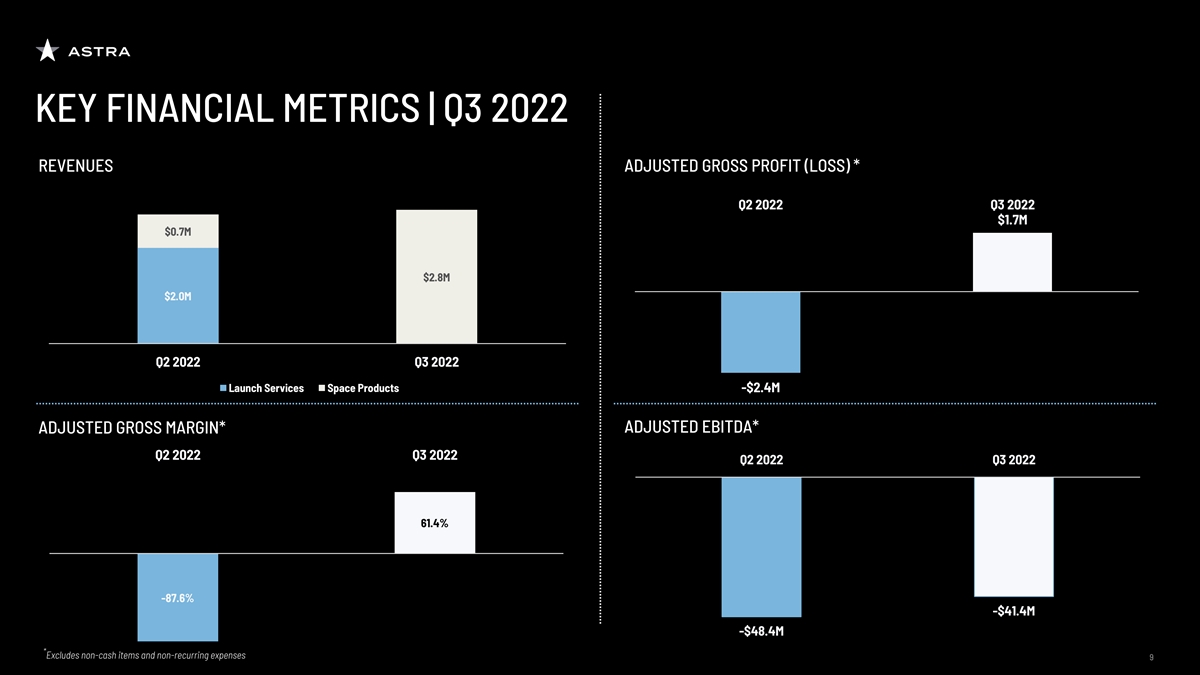

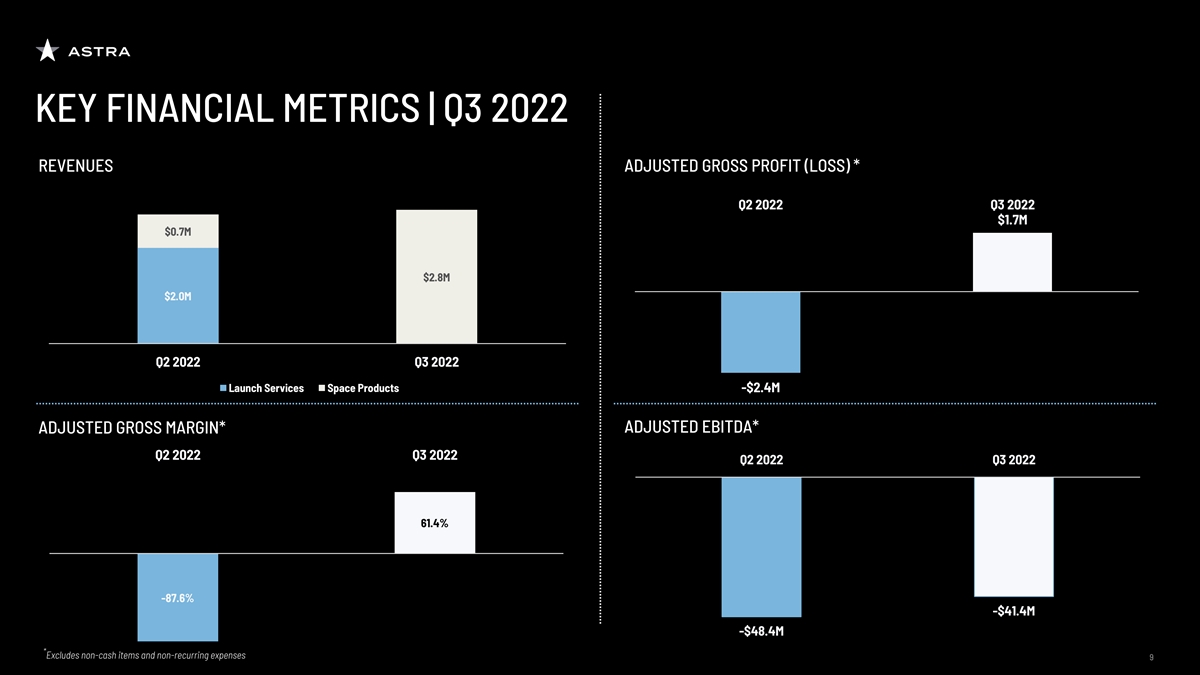

KEY FINANCIAL METRICS | Q3 2022 REVENUES ADJUSTED GROSS PROFIT (LOSS) * Q2 2022 Q3 2022 $1.7M $0.7M $2.8M $2.0M Q2 2022 Q3 2022 Launch Services Space Products -$2.4M ADJUSTED EBITDA* ADJUSTED GROSS MARGIN* Q2 2022 Q3 2022 Q2 2022 Q3 2022 61.4% -87.6% -$41.4M -$48.4M * Excludes non-cash items and non-recurring expenses 9 9 November 1, 2022

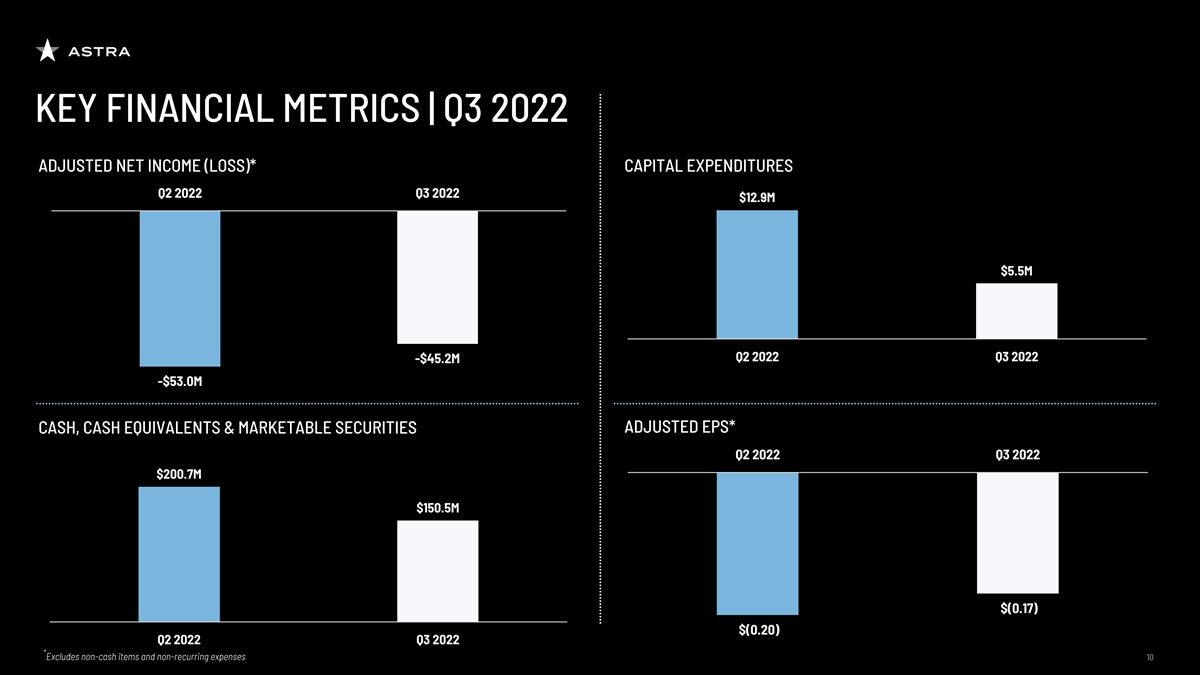

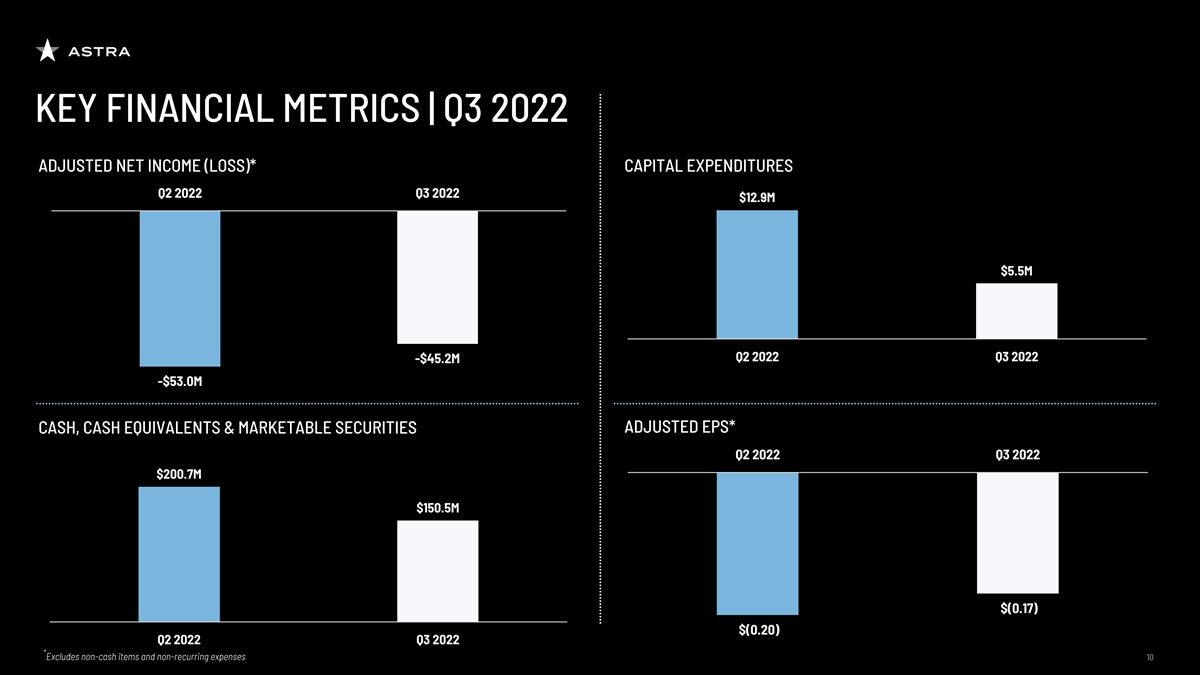

KEY FINANCIAL METRICS | Q3 2022 ADJUSTED NET INCOME (LOSS)* CAPITAL EXPENDITURES Q2 2022 Q3 2022 $12.9M $5.5M Q2 2022 Q3 2022 -$45.2M -$53.0M ADJUSTED EPS* CASH, CASH EQUIVALENTS & MARKETABLE SECURITIES Q2 2022 Q3 2022 $200.7M $150.5M $(0.17) $(0.20) Q2 2022 Q3 2022 * Excludes non-cash items and non-recurring expenses 10 10

ASTRA.COM/LAUNCHUPDATE1 For more details on our Launch System 2 update