united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered

management investment companies

Investment Company Act file number: 811-23579

Flat Rock Core Income Fund

(Exact name of registrant as specified in charter)

Robert K. Grunewald,

Chief Executive Officer

680 S. Cache Street, Suite 100,

P.O. Box 7403,

Jackson, WY 83001

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Copy to:

Owen J. Pinkerton, Esq.

Krisztina Nadasdy, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, NW, Suite 700

Washington, DC 20001

(202) 383-0262

Registrant’s telephone number, including area code: (307) 500-5200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders.

(a)

Flat Rock Core Income Fund | Shareholder Letter |

| | December 31, 2024 (Unaudited) |

Fellow CORFX Shareholders:

The Flat Rock Core Income Fund (“CORFX” or the “Fund”) finished fiscal year 2024 up 10.70%. Since inception in July of 2017, the Fund generated average annual returns of 7.99% with a standard deviation of 2.90%. We have outperformed the Bloomberg US Aggregate Bond Index and the Bloomberg US Corporate High Yield Bond Index by wide margins, while also delivering a fraction of the volatility. The Fund has experienced only eight down months in its history.

We believe our commitment to first lien investments while maintaining a highly selective investment approach creates the foundation for outperformance. We often describe the Fund as our best ideas in private credit, with an intense focus on downside risk.

Fund Performance (Net)

Fund Performance | | 1-Year

Return | | 3-Year

Return | | 5-Year

Return | | Return

Since

Inception | | Standard

Deviation

Since

Inception |

Flat Rock Core Income Fund | | 10.70% | | 8.60% | | 8.96% | | 7.99% | | 2.90% |

Bloomberg US Aggregate Bond Index | | 1.25% | | (2.41)% | | (0.33)% | | 1.07% | | 5.14% |

Bloomberg US Corporate High Yield Bond Index | | 8.19% | | 2.92% | | 4.21% | | 4.69% | | 5.74% |

Morningstar LSTA US Leveraged Loan Index | | 8.93% | | 7.00% | | 5.85% | | 5.53% | | 3.42% |

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance quoted above. Investment return and principal value will fluctuate, so that shares, when repurchased by the Fund, may be worth more or less than their original cost. Past performance is no guarantee of future results. The Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. All historical performance related to Flat Rock Core Income Fund prior to 11/23/2020 is of the Predecessor Fund, Flat Rock Capital Corp.

Today, middle market loans offer yields in the high single digits. Primary deals in the loan market experienced tighter pricing as the year progressed and we saw some of our existing direct loans refinance at lower rates. However, in 2024, we committed capital to eight new direct loans with average pricing greater than the Secured Overnight Financing Rate (“SOFR”) + 5.75%. The loans we purchased were underwritten using our private equity-style due diligence process. We remained highly selective and focused on recession-resistant industry sectors. At year end, the average loan to value of the direct loan portfolio was 52% and interest coverage was 2.3x.2

At year-end, the Fund had 75 positions in middle market issuers as well as in equity and junior debt tranches of CLOs, which collectively provide exposure to over 1,400 first lien secured loans. At the beginning of 2025, we have seen a pickup in new middle market loan investment opportunities.

|

Annual Report | December 31, 2024 | 1 |

Flat Rock Core Income Fund | Shareholder Letter |

| | December 31, 2024 (Unaudited) |

The Fund had $379 million of assets under management at 12/31/24. The Fund’s leverage ratio was a modest 0.24x at year-end.

Our target investments pay floating rate spreads over SOFR, which declined from 5.3% to 4.3% during the year. In November 2024, our Board of Trustees declared a decrease in the monthly distribution from $0.175 to $0.170 per share, which became effective with the January 2025 distribution. At year-end, the distribution rate was 9.92%, using the updated distribution rate.

We continue to view CORFX as a potential core position in client portfolios, delivering a consistent monthly dividend, with low volatility and low-interest rate risk given the floating rate nature of our investments. Our Fund offers investors a published daily net asset value, Securities and Exchange Commission regulation and reporting, minimum 5% quarterly liquidity, and the ability to invest directly into the Fund using the ticker, CORFX

As always, if you have any questions, please feel free to reach out.

Sincerely,

Robert Grunewald

Chief Executive Officer and Founder

Glossary: The Bloomberg US Aggregate Bond Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. The index excludes bonds from emerging markets. The Morningstar LSTA Leveraged Loan Index is a market value weighted index designed to capture the performance of the U.S. leveraged loan market. Indexes are unmanaged, do not incur fees, expenses or taxes, and cannot be invested in directly.

Consider the investment risks, charges, and expenses of the Fund carefully before investing. Other information about the Fund may be obtained at https://flatrockglobal.com/core-income-fund/. Please read it carefully.

The Fund is suitable for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment. Our shares have no history of public trading, nor is it intended that our shares will be listed on a national securities exchange at this time, if ever. No secondary market is expected to develop for our shares; liquidity for our shares will be provided only through quarterly repurchase offers for no less than 5% of and no more than 25% of our shares at net asset value, and

Flat Rock Core Income Fund | Shareholder Letter |

| | December 31, 2024 (Unaudited) |

there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. Due to these limited restrictions, an investor should consider an investment in the Fund to be of limited liquidity. Investing in our shares may be speculative and involves a high degree of risk, including the risks associated with leverage. Investing in the Fund involves risks, including the risk that shareholder may lose part or all their investment. We may pay distributions in significant part from sources that may not be available in the future and that are unrelated to our performance, such as a return of capital or borrowing. The amount of distributions that we may pay, if any, is uncertain. Ultimus Fund Distributors, LLC serves as our principal underwriter, within the meaning of the 1940 Act, and will act as the distributor of our shares on a best efforts basis, subject to various conditions. You can contact Ultimus Fund Distributors at (833) 415-1088.

|

Annual Report | December 31, 2024 | 3 |

Flat Rock Core Income Fund | Portfolio Update |

| | December 31, 2024 (Unaudited) |

INVESTMENT OBJECTIVE

Flat Rock Core Income Fund’s (the “Fund”) investment objective is the preservation of capital while generating current income from its debt investments and seeking to maximize the portfolio’s total return.

PERFORMANCE as of December 31, 2024

| | 1 Year | | 3 Year(1) | | 5 Year(1) | | Since

Inception(1) |

Flat Rock Core Income Fund(2)(6) | | 10.70% | | 8.60% | | 8.96% | | 7.99% |

Bloomberg US Aggregate Bond Index(3) | | 1.25% | | -2.41% | | -0.33% | | 1.07% |

Bloomberg U.S. Corporate High Yield Bond Index(4) | | 8.19% | | 2.92% | | 4.21% | | 4.69% |

Morningstar LSTA U.S. Leveraged Loan Index(5) | | 8.93% | | 7.00% | | 5.85% | | 5.53% |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, if repurchased, may be worth more or less than their original cost. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

The Fund is a continuously offered, non-diversified, closed-end management investment company that is operated as an interval fund. The Fund is suitable only for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment. The Fund’s shares have no history of public trading, nor is it intended that its shares will be listed on a national securities exchange at this time, if ever. Investing in the Fund’s shares may be speculative and involves a high degree of risk, including the risks associated with leverage. Investing in the Fund involves risk, including the risk that shareholders may receive little or no return on their investment or that shareholders may lose part or all of their investment. The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to its performance, such as a return of capital or borrowings. The amount of distributions that the Fund may pay, if any, is uncertain.

Flat Rock Core Income Fund | Portfolio Update |

| | December 31, 2024 (Unaudited) |

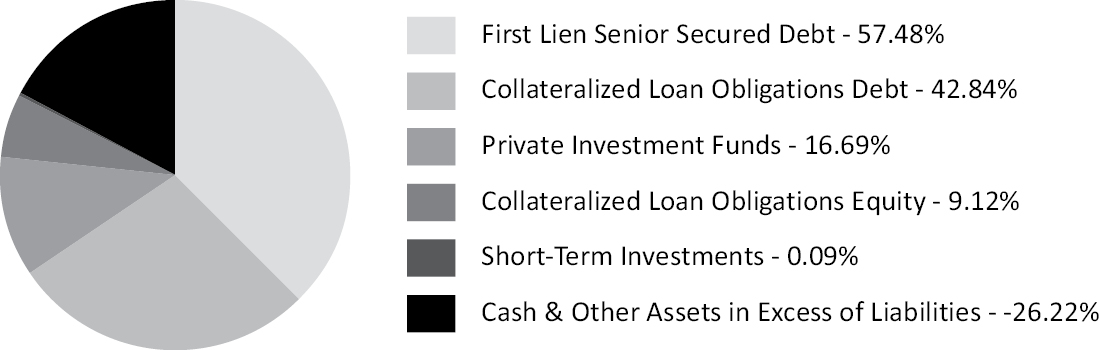

ASSET ALLOCATION as of December 31, 2024*

TOP TEN HOLDINGS* as of December 31, 2024

| | % of Net Assets |

Hercules Private Global Venture Growth Fund I LP | | 5.12% |

TriplePoint Private Venture Credit, Inc. | | 5.05% |

BCP Great Lakes II - Series A | | 4.23% |

Fortress Credit Opportunities XXI CLO LLC, Series 2023-21A | | 3.35% |

Fortress Credit Opportunities XXI CLO LLC, Series 2021-1A | | 3.33% |

Vehicle Management Services TL | | 2.81% |

Brightwood Capital MM CLO Ltd., Series 2023-1A | | 2.71% |

George Intermediate Holdings, Inc. | | 2.61% |

Oil Changer Holding Corporation | | 2.31% |

Diversified Risk Holdings TL | | 2.29% |

|

Annual Report | December 31, 2024 | 5 |

Flat Rock Core Income Fund | Portfolio Update |

| | December 31, 2024 (Unaudited) |

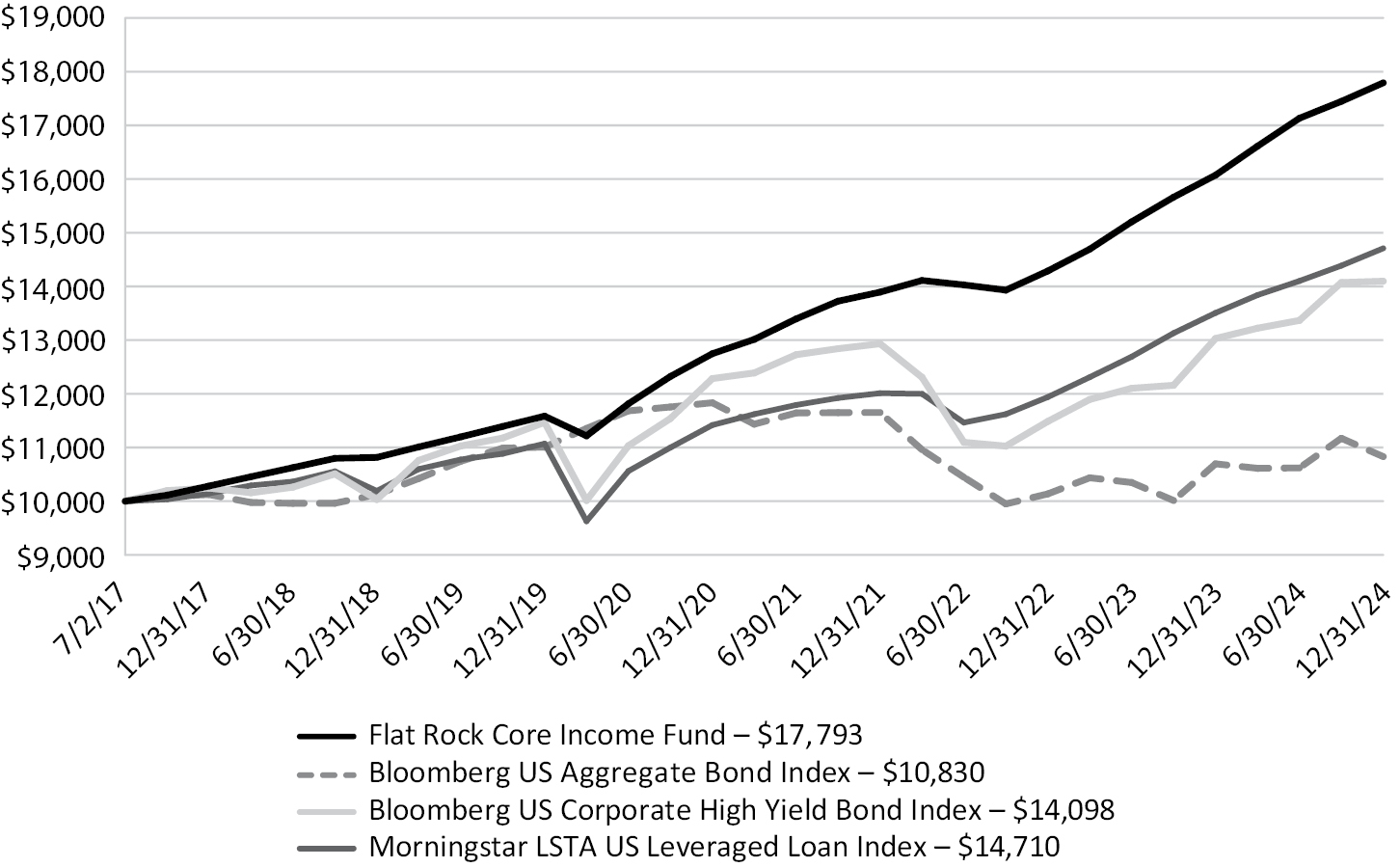

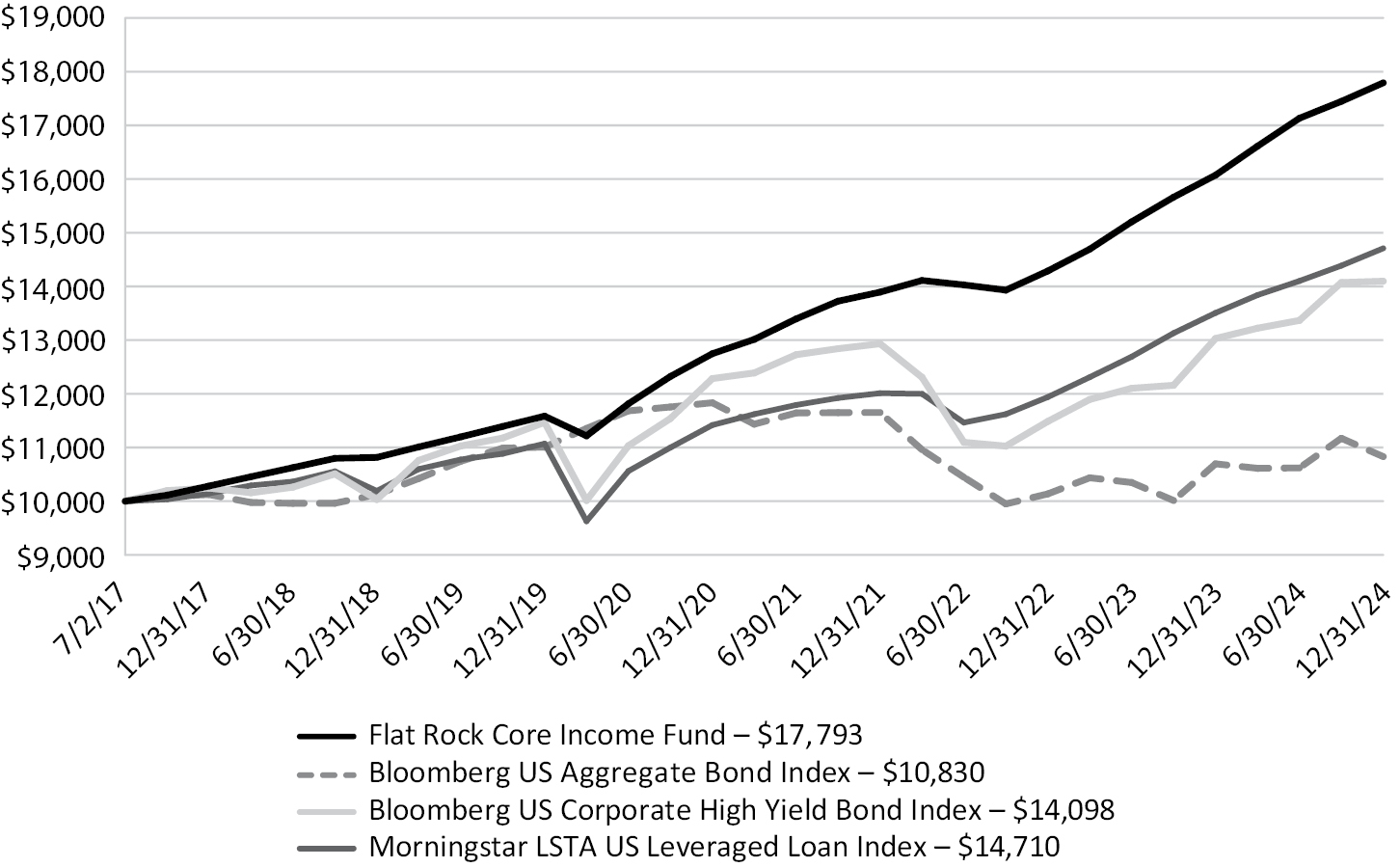

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares at the NAV of $20.00 on July 2, 2017 (commencement of operations) and tracking its progress through December 31, 2024.

The hypothetical $10,000 investment at inception includes changes due to share price and reinvestment of dividends and capital gains. The chart does not imply future performance. Indexes are unmanaged, do not incur fees, expenses or taxes, and cannot be invested in directly. Performance quoted does not include a deduction for taxes that a shareholder would pay on the repurchase of its shares by the Fund.

Flat Rock Core Income Fund | Consolidated Schedule of Investments |

| | December 31, 2024 |

| | Principal

Amount | | Fair Value |

COLLATERALIZED LOAN OBLIGATIONS EQUITY(a)(b) - 9.12% | | | | | | |

Barings Middle Market CLO Ltd., Series 2021-1,

Subordinated Notes, 18.37%, 7/20/2033(c) | | $ | 6,300,000 | | $ | 5,492,169 |

BlackRock Elbert CLO V, LLC, Series 5I,

Subordinated Notes, 6.04%, 6/15/2034 | | | 2,000,000 | | | 1,349,727 |

BlackRock Maroon Bells CLO XI, LLC, Series 1A,

Subordinated Notes, 6.72%, 10/15/2034(c) | | | 10,191,083 | | | 6,678,652 |

Blackrock Mt. Hood CLO X, LLC, Series 1A,

Class VDN, 26.39%, 4/20/2035(c) | | | 5,000,000 | | | 2,317,873 |

Churchill Middle Market CLO III Ltd., Series 2021-1A,

Subordinated Notes, 12.46%, 10/24/2033(c) | | | 5,000,000 | | | 3,495,774 |

Jefferies Credit Partners DL CLO 2024-II Ltd,

Series 2A, Subordinated Notes, 0.00%, 1/20/2037(c)(l) | | | 5,671,692 | | | 4,965,379 |

TCP Whitney CLO Ltd., Series 1A,

Subordinated Notes, 5.17%, 8/20/2033(c) | | | 5,000,000 | | | 3,047,528 |

| | | | | | | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS EQUITY

(Cost $27,887,085) | | | | | | 27,347,102 |

| | | | | | | |

COLLATERALIZED LOAN OBLIGATIONS DEBT(a) - 42.84% | | | | | | |

ABPCI Direct Lending Fund ABS II, LLC, Series 2A,

Class B, 4.99%, 3/1/2032(c) | | | 7,158,374 | | | 6,591,751 |

ABPCI Direct Lending Fund ABS IV LP, Series 2024-1A,

Class C, 12.40%, 5/1/2034 (3M US SOFR + 783 bps)(c)(d) | | | 2,000,000 | | | 1,995,533 |

ABPCI Direct Lending Fund CLO, Series 2019-5A,

Class D, 12.75%, 1/20/2036 (3M US SOFR + 813 bps)(c)(d) | | | 5,250,000 | | | 5,275,067 |

ABPCI Direct Lending Fund CLO I, LLC, Series 2016-1A,

Class E3, 13.61%, 7/20/2033 (3M US SOFR + 899 bps)(c)(d) | | | 5,000,000 | | | 5,019,595 |

Barings Middle Market CLO Ltd., Series 2023-IIA,

Class D, 13.95%, 1/20/2032 (3M US SOFR + 867 bps)(c)(d) | | | 5,000,000 | | | 5,024,877 |

Brightwood Capital MM CLO Ltd., Series 2023-1X,

Class D, 11.12%, 10/15/2035 (3M US SOFR + 646 bps)(c)(d) | | | 1,500,000 | | | 1,541,912 |

Brightwood Capital MM CLO Ltd., Series 2023-1A,

11.79%, 10/15/2035 (3M US SOFR + 646 bps)(c)(d) | | | 7,900,000 | | | 8,120,734 |

Brightwood Capital MM CLO Ltd., Series 2024-2A,

Class D, 10.41%, 4/15/2036 (3M US SOFR + 575 bps)(c)(d) | | | 5,000,000 | | | 5,125,757 |

Deerpath Capital CLO Ltd., Series 2020-1A,

Class DR, 11.68%, 4/17/2034 (3M US SOFR + 639 bps)(c)(d) | | | 4,125,000 | | | 4,238,911 |

Fortress Credit Opportunities XIX CLO, LLC, Series 2022-19A,

Class ER, 13.23%, 10/15/2036 (3M US SOFR + 800 bps)(c)(d) | | | 5,000,000 | | | 5,015,023 |

Fortress Credit Opportunities XXI CLO LLC, Series 2023-21A,

Class ER, 11.54%, 1/21/2037 (3M US SOFR + 725 bps)(c)(d)(l) | | | 10,000,000 | | | 10,000,000 |

See Notes to Consolidated Financial Statements. |

Annual Report | December 31, 2024 | 7 |

Flat Rock Core Income Fund | | Consolidated Schedule of Investments |

| | | December 31, 2024 |

| | Principal

Amount | | Fair Value |

COLLATERALIZED LOAN OBLIGATIONS DEBT(a) - 42.84% | | | | | | |

Fortress Credit Opportunities XXI CLO, LLC, Series 2023-21A,

Class E, 12.74%, 1/21/2035 (3M US SOFR + 812 bps)(c)(d) | | $ | 10,000,000 | | $ | 10,035,766 |

Great Lakes CLO Ltd., Series 2014-1A,

Class FR, 14.92%, 10/15/2029 (3M US SOFR + 1026 bps)(c)(d) | | | 3,000,000 | | | 2,861,740 |

Great Lakes CLO Ltd., Series 2019-1A,

Class E, 12.92%, 7/15/2031 (3M US SOFR + 800 bps)(c)(d) | | | 6,000,000 | | | 6,039,659 |

Maranon Loan Funding Ltd., Series 2021-3A,

Class DR, 10.04%, 10/15/2036 (3M US SOFR + 481 bps)(c)(d) | | | 5,000,000 | | | 5,120,155 |

MCF CLO IV, LLC,

Class ERR, 13.53%, 10/20/2033 (3M US SOFR + 891 bps)(c)(d) | | | 5,000,000 | | | 5,019,987 |

MCF CLO VII, LLC, Class ER, Series 2017-3A,

Class ER, 14.03%, 7/20/2033 (3M US SOFR + 915 bps)(c)(d) | | | 5,000,000 | | | 5,017,969 |

Monroe Capital MML CLO VIII Ltd., Series 2019-1A,

Class ER, 13.14%, 11/22/2033 (3M US SOFR + 862 bps)(c)(d) | | | 6,250,000 | | | 6,271,477 |

Monroe Capital MML CLO XIV, LLC, Series 2022-2A,

Class E, 14.66%, 10/24/2034 (3M US SOFR + 1002 bps)(c)(d) | | | 3,000,000 | | | 3,000,150 |

Monroe Capital MML Ltd., Series 2019-2A,

Class E, 13.59%, 10/22/2031 (3M US SOFR + 896 bps)(c)(d) | | | 1,625,000 | | | 1,629,147 |

Monroe Capital MML Ltd., Series 2021-1A,

Class E, 13.32%, 5/20/2033 (3M US SOFR + 880 bps)(c)(d) | | | 5,000,000 | | | 5,022,575 |

Mount Logan Funding LP, Series 2018-1A,

Class ER, 14.00%, 1/22/2033 (3M US SOFR + 872 bps)(c)(d) | | | 6,500,000 | | | 6,523,542 |

PennantPark CLO V Ltd., Series 2022-5A,

Class ER, 12.61%, 10/15/2033 (3M US SOFR + 795 bps)(c)(d) | | | 4,000,000 | | | 4,012,582 |

PennantPark CLO VII, LLC, Series 2023-7A,

Class D, 11.62%, 7/20/2035 (3M US SOFR + 700 bps)(c)(d) | | | 3,000,000 | | | 3,083,664 |

TCP Whitney CLO, LLC, Series 2017-1A,

Class DR, 8.63%, 8/20/2033 (3M US SOFR + 411 bps)(c)(d) | | | 1,897,000 | | | 1,915,123 |

THL Credit Lake Shore MM CLO I LTD, Series 2019-1A,

Class ER, 13.89%, 4/15/2033 (3M US SOFR + 923 bps)(c)(d) | | | 5,000,000 | | | 5,012,068 |

| | | | | | | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS DEBT

(Cost $126,161,255) | | | | | | 128,514,764 |

| | | | | | | |

FIRST LIEN SENIOR SECURED DEBT(a) - 57.48% | | | | | | |

24 Seven Holdco – Term Loan, 11/16/2027

(1M US SOFR + 600 bps)(d) | | | 4,269,529 | | | 4,244,765 |

Accordion Partners – Term Loan, 11/15/2031

(3M US SOFR + 600 bps)(d)(e) | | | 5,478,261 | | | 5,478,261 |

See Notes to Consolidated Financial Statements. |

8 | www.flatrockglobal.com |

Flat Rock Core Income Fund | Consolidated Schedule of Investments |

| | December 31, 2024 |

| | Principal

Amount | | Fair Value |

FIRST LIEN SENIOR SECURED DEBT(a) - 57.48% | | | | | | |

Accordion Partners – DDTL, 11/15/2031 (1.00%)(f) | | $ | 913,043 | | $ | 913,044 |

Accordion Partners – Revolver, 11/15/2031 (.50%)(f) | | | 608,696 | | | 608,696 |

ALM Media, LLC – Term Loan, 02/21/2029

(3M US SOFR + 550 bps)(d)(e) | | | 6,947,500 | | | 6,822,445 |

Bounteous Inc. – Term Loan, 08/02/2027

(1M US SOFR + 475 bps)(d)(e) | | | 4,269,744 | | | 4,207,406 |

Congruex Group, LLC – Term Loan, 05/03/2029

(3M US SOFR + 650 bps)(d) | | | 6,969,280 | | | 6,335,075 |

Consor Intermediate II, LLC – Term Loan, 07/18/2028

(1M US SOFR + 475 bps)(d) | | | 2,788,732 | | | 2,760,845 |

Consor Intermediate II, LLC – DDTL, 07/18/2028 (1.00%)(f) | | | 2,535,211 | | | 2,509,859 |

Consor Intermediate II, LLC – Revolver, 07/18/2028 (.50%)(f) | | | 676,056 | | | 669,296 |

Crane Engineering Sales – Term Loan, 8/25/2029

(3M US SOFR + 525 bps)(d)(e) | | | 5,925,000 | | | 5,901,893 |

Cyber Advisors – DDTL, 07/18/2028

(1M US SOFR + 525 bps)(d)(e) | | | 4,937,500 | | | 4,883,681 |

Cyber Advisors – DDTL, 7/18/2028 (1.00%)(f) | | | 62,500 | | | 61,819 |

Diversified Risk Holdings – Term Loan, 04/30/2026

(3M US SOFR + 625 bps)(d)(e) | | | 7,002,814 | | | 6,862,758 |

Diversified Risk Holdings – Revolver, 04/30/2026

(3M US SOFR + 625 bps)(d)(e) | | | 118,519 | | | 116,148 |

Diversified Risk Holdings – Revolver, 04/30/2026 (.50%)(f) | | | 177,778 | | | 174,222 |

Drive Automotive Services – Term Loan, 08/02/2026

(3M US SOFR + 600 bps)(d)(e) | | | 4,185,415 | | | 3,956,891 |

ETC Group – Term Loan, 10/08/2029

(3M US SOFR + 600 bps)(d)(e) | | | 1,977,395 | | | 1,457,340 |

Flagship Oral Surgery Partners, LLC – Term Loan, 11/20/2025

(3M US SOFR + 600 bps)(d) | | | 624,817 | | | 621,622 |

Flagship Oral Surgery Partners, LLC – DDTL, 11/20/2025 (1.00%)(f) | | | 4,375,183 | | | 4,352,807 |

Galactic Litigation Partners – Term Loan,

06/21/2024 (0.00%)(g)(h)(j) | | | 7,274,854 | | | 4,772,304 |

George Intermediate Holdings, Inc. – Term Loan, 08/15/2027

(3M US SOFR + 650 bps)(d)(e) | | | 7,860,000 | | | 7,817,556 |

Inmar Inc. – Term Loan, 05/01/2026

(1M US SOFR + 550 bps)(d)(e) | | | 3,950,000 | | | 3,956,162 |

Isagenix International, LLC – Term Loan, 04/14/2028

(3M US SOFR + 660 bps)(d)(i) | | | 1,336,838 | | | 802,103 |

See Notes to Consolidated Financial Statements. |

Annual Report | December 31, 2024 | 9 |

Flat Rock Core Income Fund | | Consolidated Schedule of Investments |

| | | December 31, 2024 |

| | Principal

Amount | | Fair Value |

FIRST LIEN SENIOR SECURED DEBT(a) - 57.48% | | | | | | |

Mag Aerospace – Term Loan, 04/01/2027

(3M US SOFR + 550 bps)(d)(e) | | $ | 3,617,009 | | $ | 3,481,371 |

Magnate Worldwide, LLC – Term Loan, 12/30/2028

(3M US SOFR + 550 bps)(d)(e) | | | 3,805,366 | | | 3,700,719 |

Magnate Worldwide, LLC – Incremental Term Loan, 12/30/2028

(3M US SOFR + 550 bps)(d)(e) | | | 3,000,000 | | | 2,917,500 |

NorthPole US, LLC – Term Loan, 03/03/2025

(3M US SOFR + 700 bps)(d) | | | 1,837,500 | | | 91,875 |

Oak Point Partners – Term Loan, 12/01/2027

(1M US SOFR + 525 bps)(d)(e) | | | 3,917,797 | | | 3,875,876 |

Oil Changer Holding Corporation – Term Loan, 02/01/2027

(3M US SOFR + 675 bps)(d) | | | 7,000,000 | | | 6,940,360 |

Perennial Services Group – Term Loan, 09/08/2029

(3M US SOFR + 550 bps)(d)(e) | | | 4,955,130 | | | 4,824,314 |

Perennial Services Group – DDTL, 09/07/2029

(3M US SOFR + 475 bps)(d)(e) | | | 2,150,421 | | | 2,093,650 |

Perennial Services Group – DDTL, 09/07/2029 (1.00%)(f) | | | 548,146 | | | 533,675 |

Profile Products – Term Loan, 11/12/2027

(1M US SOFR + 575 bps)(d)(e) | | | 2,942,733 | | | 2,852,096 |

S&P Engineering Solutions – Term Loan, 05/02/2030

(3M US SOFR + 500 bps)(d)(e)(g) | | | 4,950,000 | | | 4,939,110 |

SGA Dental Partners – DDTL, 07/17/2029 (1.00%)(f) | | | 641,111 | | | 628,289 |

SGA Dental Partners – Term Loan, 07/17/2029

(1M US SOFR + 550 bps)(d)(e) | | | 6,358,036 | | | 6,230,875 |

Solaray, LLC – Term Loan, 12/15/2025

(3M US SOFR + 650 bps)(d)(e) | | | 1,660,255 | | | 1,514,153 |

Solaray, LLC – Term Loan, 12/15/2025

(3M US SOFR + 650 bps)(d)(e) | | | 1,570,727 | | | 1,432,503 |

Solaray, LLC – Term Loan, 12/15/2025

(3M US SOFR + 650 bps)(d)(e) | | | 1,377,815 | | | 1,256,567 |

Spencer Spirit, LLC – Term Loan, 07/15/2031

(1M US SOFR + 550 bps)(d)(e) | | | 5,000,000 | | | 5,018,750 |

Thryv, Inc. – Term Loan, 05/01/2029

(1M US SOFR + 675 bps)(d)(e) | | | 2,325,000 | | | 2,359,875 |

Trulite Holding Corp. – Term Loan, 03/01/2030

(1M US SOFR + 600 bps)(d)(e) | | | 4,937,500 | | | 4,912,813 |

See Notes to Consolidated Financial Statements. |

10 | www.flatrockglobal.com |

Flat Rock Core Income Fund | | Consolidated Schedule of Investments |

| | | December 31, 2024 |

| | Principal

Amount | | Fair Value |

FIRST LIEN SENIOR SECURED DEBT(a) - 57.48% | | | | | | |

Vehicle Management Services, LLC – Term Loan, 07/26/2027

(1M US SOFR + 625 bps)(d)(e) | | $ | 8,429,530 | | $ | 8,429,530 |

Viapath Technologies – Term Loan, 08/06/2029

(1M US SOFR + 750 bps)(d) | | | 5,000,000 | | | 4,875,000 |

Watchguard Technologies, Inc. – Term Loan, 06/30/2029

(1M US SOFR + 525 bps)(d)(e) | | | 4,914,811 | | | 4,857,996 |

Watterson – Term Loan, 12/17/2026

(3M US SOFR + 1200 bps)(g)(i) | | | 4,182,779 | | | 3,918,846 |

Xanitos, Inc. – Term Loan, 06/25/2026

(3M US SOFR + 650 bps)(d)(e)(g) | | | 3,478,165 | | | 3,475,035 |

Zavation Medical Products, LLC – Term Loan, 06/30/2028

(3M US SOFR + 650 bps)(d)(e) | | | 6,517,306 | | | 6,517,306 |

Zavation Medical Products, LLC – Revolver, 06/30/2028

(3M US SOFR + 650 bps)(d)(e) | | | 245,720 | | | 245,720 |

Zavation Medical Products, LLC – Revolver, 06/30/2028 (.50%)(f) | | | 222,318 | | | 222,318 |

| | | | | | | |

TOTAL FIRST LIEN SENIOR SECURED DEBT

(Cost $178,183,378) | | | | | | 172,433,120 |

| | Shares | | Fair Value |

COMMON STOCKS(a) - 0.00% | | | | | |

Isagenix International, LLC(j) | | 85,665 | | $ | — |

| | | | | | |

TOTAL COMMON STOCKS

(Cost $–) | | | | | — |

| | | | | | |

PRIVATE INVESTMENT FUNDS - 16.69% | | | | | |

BCP Great Lakes II - Series A Holdings LP(m) | | N/A | | | 12,703,990 |

Hercules Private Global Venture Growth Fund I L.P.(m) | | N/A | | | 15,360,073 |

New Mountain Guardian IV Rated Feeder III, Ltd.(m) | | 6,960,610 | | | 6,856,201 |

TriplePoint Private Venture Credit, Inc. | | 1,324,394 | | | 15,137,829 |

| | | | | | |

TOTAL PRIVATE INVESTMENT FUNDS

(Cost $53,852,712) | | | | | 50,058,093 |

See Notes to Consolidated Financial Statements. |

Annual Report | December 31, 2024 | 11 |

Flat Rock Core Income Fund | Consolidated Schedule of Investments |

| | December 31, 2024 |

| | Shares | | Fair Value |

SHORT-TERM INVESTMENTS - 0.09% | | | | | |

| | | | | | |

MONEY MARKET FUNDS - 0.09% | | | | | |

First American Government Obligations Fund,

Class X, 4.41%(k) | | 256,050 | | $ | 256,050 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $256,050) | | | | | 256,050 |

TOTAL INVESTMENTS - 126.22%

(Cost $386,340,480) | | | | | 378,609,129 |

Liabilities in Excess of Other Assets - (26.22)% | | | | | (78,624,327) |

NET ASSETS - 100.00% | | | | $ | 299,984,802 |

SOFR - Secured Overnight Financing Rate

Reference Rates:

1M US SOFR - 1 Month SOFR as of December 31, 2024 was 4.53%.

3M US SOFR - 3 Month SOFR as of December 31, 2024 was 4.69%.

See Notes to Consolidated Financial Statements. |

12 | www.flatrockglobal.com |

Flat Rock Core Income Fund | | Consolidated Statement of Assets and Liabilities |

| | | December 31, 2024 |

Assets | |

Investments at fair value (cost $386,340,480) | $ 378,609,129 |

Interest receivable | 9,996,459 |

Cash and cash equivalents | 321,051 |

Receivable for fund shares sold | 310,701 |

Fee Rebate | 187,455 |

Prepaid loan commitment fees | 172,546 |

Dividends receivable | 7,043 |

Prepaid expenses and other assets | 194,100 |

Total assets | 389,798,484 |

Liabilities | |

Credit Facility, net (see Note 9) | $ 41,583,286 |

Unfunded loan commitments | 10,591,310 |

Securities purchased payable | 15,000,000 |

Mandatorily redeemable preferred stock (net of deferred financing costs of $92,136(a) (see Note 10)) | 19,907,864 |

Incentive fee payable | 1,180,455 |

Management fee payable | 370,904 |

Payable for excise tax | 347,906 |

Accrued interest expense | 250,032 |

Payable to transfer agent | 133,932 |

Payable for audit and tax service fees | 125,000 |

Dividends payable on redeemable preferred stock | 40,139 |

Payable for fund accounting and administration fees | 29,414 |

Payable for custodian fees | 8,125 |

Other accrued expenses | 245,315 |

Total liabilities | 89,813,682 |

Net Assets | $ 299,984,802 |

Commitments and Contingencies (see Note 12) | |

Net Assets Consist Of | |

Paid-in capital | $ 297,133,786 |

Accumulated earnings | 2,851,016 |

Fund Shares: | |

Net Assets | 299,984,802 |

Shares of beneficial interest outstanding

(Unlimited number of shares, at $0.001 par value per share) | 14,612,491 |

Net asset value and offering price per share | $ 20.53 |

See Notes to Consolidated Financial Statements. |

Annual Report | December 31, 2024 | 13 |

Flat Rock Core Income Fund | Consolidated Statement of Operations |

| | For the Year Ended December 31, 2024 |

Investment Income | |

Interest income | $ 35,656,195 |

Dividend income | 6,308,601 |

Total Investment Income | 41,964,796 |

Expenses | |

Incentive fees | 4,567,297 |

Management fees | 4,501,685 |

Interest on credit facility | 3,987,520 |

Dividends on redeemable preferred stock | 850,000 |

Transfer agent fees and expenses | 591,385 |

Excise tax expense | 347,906 |

Accounting and administration fees | 344,748 |

Audit and tax service fees | 319,051 |

Printing expenses | 135,039 |

Legal fees | 75,777 |

Registration expenses | 67,215 |

Trustee expenses | 45,000 |

Custodian expenses | 33,819 |

Compliance expenses | 30,000 |

Insurance expenses | 29,242 |

Loan issuance costs | 2,228 |

Amortization of deferred financing costs | 111,692 |

Miscellaneous expenses | 562,921 |

Total expenses | 16,602,525 |

Fees waived by Adviser | (189,344) |

Net expenses | 16,413,181 |

Net investment income | 25,551,615 |

Realized and Change in Unrealized Gain/(Loss) from Investments | |

Net realized gain on sale of investments | 690,975 |

Net change in unrealized appreciation/(depreciation) from investments | (885,094) |

Net realized and change in unrealized loss from investments | (194,119) |

Net increase in net assets resulting from operations | $ 25,357,496 |

See Notes to Consolidated Financial Statements. |

14 | www.flatrockglobal.com |

Flat Rock Core Income Fund | | Consolidated Statements of Changes in Net Assets |

| | | |

| For The Year

Ended

December 31,

2024 | For The Year

Ended

December 31,

2023 |

Increase/(Decrease) In Net Assets Resulting From Operations | | |

Net investment income | $ 25,551,615 | $ 21,753,372 |

Net realized gain/(loss) on sale of investments | 690,975 | (704,124) |

Net change in unrealized appreciation/(depreciation) from investments | (885,094) | 1,870,472 |

Net increase in net assets resulting from operations | 25,357,496 | 22,919,720 |

Distributions To Shareholders | | |

Distributions paid from earnings | (25,678,219) | (16,904,113) |

Decrease in net assets from distributions to shareholders | (25,678,219) | (16,904,113) |

Capital Share Transactions | | |

Proceeds from shares sold | 100,063,833 | 63,788,862 |

Reinvestment of distributions | 5,026,776 | 5,330,172 |

Cost of shares repurchased | (22,999,621) | (41,302,630) |

Net increase in net assets resulting from capital share transactions | 82,090,988 | 27,816,404 |

Net increase in net assets | 81,770,265 | 33,832,011 |

Net Assets | | |

Beginning of year | 218,214,537 | 184,382,526 |

End of year | $ 299,984,802 | $ 218,214,537 |

Share Transactions | | |

Shares sold | 4,845,922 | 3,149,706 |

Shares issued in reinvestment of distributions | 244,428 | 264,003 |

Shares repurchased | (1,111,626) | (2,046,890) |

Net increase in share transactions | 3,978,724 | 1,366,819 |

See Notes to Consolidated Financial Statements. |

Annual Report | December 31, 2024 | 15 |

Flat Rock Core Income Fund | | Consolidated Statement of Cash Flows |

| | | For the Year Ended December 31, 2024 |

CASH FLOWS RESULTING FROM OPERATING ACTIVITIES: | | | |

Net increase in net assets resulting from operations | | $ | 25,357,496 |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | |

Purchase of investment securities | | | (149,659,261) |

Proceeds from sales of investment securities | | | 87,960,626 |

Net purchases of short-term investments securities | | | (256,050) |

Amortization of premium and accretion of discount on investments, net | | | (1,133,220) |

Net realized (gain) on: | | | |

Investments | | | (690,975) |

Net change in unrealized (appreciation)/depreciation on: | | | |

Investments | | | 885,094 |

(Increase)/Decrease in assets: | | | |

Fee rebate | | | 18,228 |

Prepaid loan commitment fees | | | 2,228 |

Interest receivable | | | (3,149,124) |

Dividends receivable | | | 779,062 |

Prepaid expenses and other assets | | | 11,286 |

Increase/(Decrease) in liabilities: | | | |

Accrued interest expense | | | (141,926) |

Management fee payable | | | 28,508 |

Payable for excise tax | | | 347,906 |

Payable for fund accounting and administration fees | | | (43,611) |

Payable to transfer agent | | | 107,264 |

Incentive fee payable | | | 71,061 |

Payable for custodian fees | | | (5,648) |

Payable to trustees | | | (15,000) |

Other accrued expenses | | | 204,826 |

Net cash used in operating activities | | | (39,321,230) |

See Notes to Consolidated Financial Statements. |

16 | www.flatrockglobal.com |

Flat Rock Core Income Fund | Consolidated Statement of Cash Flows |

| | For the Year Ended December 31, 2024 |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

Proceeds from shares sold | | $ | 100,156,540 |

Cost of shares repurchased | | | (22,999,621) |

Borrowings on credit facility | | | 124,955,382 |

Mandatorily redeemable preferred stock | | | 111,692 |

Dividends payable on redeemable preferred stock | | | 234 |

Payments on credit facility | | | (142,281,177) |

Distributions paid (net of reinvestments) | | | (20,651,443) |

Net cash provided by financing activities | | | 39,291,607 |

Net increase/(decrease) in cash | | | (29,623) |

Cash, beginning of year | | $ | 350,674 |

Cash, end of year | | $ | 321,051 |

Non-cash financing activities not included herein consist of: | | | |

Reinvestment of dividends and distributions: | | $ | 5,026,776 |

Supplemental Disclosure of Cash Flow Information | | | |

Cash paid for interest on credit facility: | | $ | 4,129,455 |

Cash paid for dividends on mandatory redeemable preferred stock: | | $ | 850,000 |

See Notes to Consolidated Financial Statements. |

Annual Report | December 31, 2024 | 17 |

Flat Rock Core Income Fund | | Consolidated Financial Highlights |

| | | |

| | For the Year

Ended

December 31,

2024* | | For the Year

Ended

December 31,

2023 | | For the Year

Ended

December 31,

2022 | | For the Year

Ended

December 31,

2021 | | For the Year

Ended

December 31,

2020(a) |

Per Share Operating Performance | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 20.52 | | | $ | 19.90 | | $ | 20.64 | | $ | 20.29 | | $ | 19.76 |

Income/(loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income(b) | | | 2.05 | | | | 2.27 | | | 1.76 | | | 1.54 | | | 1.41 |

Net realized and unrealized gains/(losses) from investments | | | 0.03 | (c) | | | 0.11 | | | (1.13) | | | 0.17 | | | 0.48 |

Total income/(loss) from investment operations | | | 2.08 | | | | 2.38 | | | 0.63 | | | 1.71 | | | 1.89 |

Less distributions: | | | | | | | | | | | | | | | | |

Net investment income | | | (2.07) | | | | (1.76) | | | (1.35) | | | (1.36) | | | (0.81) |

Net realized gains | | | — | | | | — | | | (0.02) | | | — | | | (0.55) |

Total distributions | | | (2.07) | | | | (1.76) | | | (1.37) | | | (1.36) | | | (1.36) |

Net increase/(decrease) in net asset value | | | 0.01 | | | | 0.62 | | | (0.74) | | | 0.35 | | | 0.53 |

Net asset value, end of year | | $ | 20.53 | | | $ | 20.52 | | $ | 19.90 | | $ | 20.64 | | $ | 20.29 |

Total return(d) | | | 10.60% | | | | 12.43% | | | 3.14% | | | 8.73% | | | 10.03% |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of year (in thousands) | | $ | 299,985 | | | $ | 218,215 | | $ | 184,382 | | $ | 116,384 | | $ | 60,436 |

Ratios To Average Net Assets (including interest on credit facility and dividends on redeemable preferred stock)(e) | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets including fee waivers and reimbursements | | | 6.36%(h) | | | | 7.17% | | | 6.16% | | | 5.51% | | | 7.69% |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 6.43% | | | | 7.17% | | | 6.16% | | | 5.51% | | | 8.07% |

Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 9.90% | | | | 11.19% | | | 8.74% | | | 7.50% | | | 7.15% |

Ratio of net investment income to average net assets excluding fee waivers and reimbursements | | | 9.83% | | | | 11.19% | | | 8.74% | | | 7.50% | | | 6.77% |

See Notes to Consolidated Financial Statements. |

18 | www.flatrockglobal.com |

Flat Rock Core Income Fund | Consolidated Financial Highlights |

| | |

| | For the Year

Ended

December 31,

2024* | | For the Year

Ended

December 31,

2023 | | For the Year

Ended

December 31,

2022 | | For the Year

Ended

December 31,

2021 | | For the Year

Ended

December 31,

2020(a) |

Ratios To Average Net Assets (excluding interest on credit facility and dividends on redeemable preferred stock)(e) | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets including fee waivers and reimbursements | | | 4.49%(h) | | | 4.66% | | | 4.41% | | | 4.41% | | | 5.69% |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 4.56% | | | 4.66% | | | 4.41% | | | 4.41% | | | 6.07% |

Ratio of net investment income to average net assets including fee waivers and reimbursements | | | 11.77% | | | 13.70% | | | 10.49% | | | 8.60% | | | 9.15% |

Ratio of net investment income to average net assets excluding fee waivers and reimbursements | | | 11.70% | | | 13.70% | | | 10.49% | | | 8.60% | | | 8.77% |

Portfolio turnover rate | | | 68% | | | 25% | | | 17% | | | 67% | | | 32% |

Credit Facility: | | | | | | | | | | | | | | | |

Aggregate principal amount, end of year (000s): | | $ | 41,583 | | $ | 54,998 | | $ | 48,548 | | $ | 41,703 | | $ | 25,676 |

Assets Coverage, end of year per $1,000:(f) | | | 8,220 | | | 4,975 | | | 4,804 | | | 3,780 | | | 3,354 |

Redeemable Preferred Stock: | | | | | | | | | | | | | | | |

Liquidation value, end of year (000s): | | $ | 20,000 | | $ | 20,000 | | $ | 20,000 | | $ | 10,000 | | | N/A |

Asset coverage, end of year per share:(g) | | | 32,002 | | | 23,825 | | | 20,442 | | | 12,640 | | | N/A |

See Notes to Consolidated Financial Statements. |

Annual Report | December 31, 2024 | 19 |

Flat Rock Core Income Fund | | Consolidated Financial Highlights |

| | | |

See Notes to Consolidated Financial Statements. |

20 | www.flatrockglobal.com |

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

Flat Rock Core Income Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”) as a non-diversified, closed-end management investment company. The shares of beneficial interest of the Fund (the “Shares”) are continuously offered under Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”). The Fund operates as an interval fund pursuant to Rule 23c-3 under the 1940 Act, and has adopted a fundamental policy to conduct quarterly repurchase offers at net asset value (“NAV”).

The Fund’s investment objective is the preservation of capital while generating current income from its debt investments and seeking to maximize the portfolio’s total return.

The Fund was formed as a Delaware statutory trust on June 11, 2020 and operates pursuant to a Second Amended and Restated Agreement and Declaration of Trust governed by and interpreted in accordance with the laws of the State of Delaware. The Fund had no operations from that date to November 23, 2020, other than those related to organizational matters and the registration of its shares under applicable securities laws.

The operations reported in the accompanying consolidated financial statements and financial highlights for the periods from January 1, 2020 to November 22, 2020 are for Flat Rock Capital Corp., a Maryland corporation formed on March 20, 2017 that commenced operations on May 3, 2017. Flat Rock Capital Corp. was an externally managed, non-diversified, closed-end management investment company that elected to be regulated as a business development company (“BDC”) under the 1940 Act and that elected to be treated as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). On November 20, 2020, Flat Rock Capital Corp. transferred all of its assets to the Fund as part of a reorganization as described in Note 14.

FRC Funding I, LLC, the Fund’s wholly owned financing subsidiary, is consolidated in the Fund’s financial statements.

Regulatory Update — The Fund is deemed to be an individual reporting segment. The objective and strategy of the Fund is used by the Adviser to make investment decisions, and the results of the operations, as shown in the Consolidated Statement of Operations and the Consolidated Financial Highlights is the information utilized for the day-to-day management of the Fund. The Fund is party to the expense agreements as disclosed in the notes to the financial statements and resources are not allocated to the Fund based on performance measurements. Due to the significance of oversight and their role, the Adviser is deemed to be the Chief Operating Decision Maker.

2. SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund is an investment company under U.S. GAAP and follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946.

|

Annual Report | December 31, 2024 | 21 |

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

Use of Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of increases and decreases in net assets from operations during the period. Actual results could differ from these estimates.

Preferred Shares: In accordance with ASC 480-10-25, the Fund’s mandatorily redeemable preferred stock has been classified as debt on the Statement of Assets and Liabilities. Refer to “Note 10. Mandatorily Redeemable Preferred Stock” for further details.

Security Valuation: The Fund determines the NAV of its shares daily as of the close of regular trading (normally, 4:00 p.m., Eastern time) on each day that the New York Stock Exchange (“NYSE”) is open for business.

The 1940 Act requires the Fund to determine the value of its portfolio securities using market quotations when “readily available,” and when market quotations are not readily available, portfolio securities must be valued at fair value, as determined in good faith by the Fund’s Board. As stated in Rule 2a-5 under the 1940 Act, determining fair value in good faith requires (i) assessment and management of risks, (ii) establishment of fair value methodologies, (iii) testing of fair value methodologies, and (iv) evaluation of pricing services. Under Rule 2a-5, a fund’s board may designate the fund’s adviser as “valuation designee” to perform fair value determinations. The Board, including a majority of the Trustees who are not “interested persons” of the Fund, as such term is defined in the 1940 Act, has designated the Adviser to perform fair value determinations and act as “valuation designee” for each Fund’s investments.

The Fund records its investments at fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used to determine fair value are further discussed below.

It is the policy of the Fund to value its portfolio securities using market quotations when readily available. For purposes of this policy, a market quotation is readily available only when that quotation is a quoted price (unadjusted) in active markets for identical investments that the Fund can access at the measurement date, provided that a quotation will not be readily available if it is not reliable. If market quotations are not readily available, securities or other assets will be valued at their fair market value as determined using the valuation methodologies approved by the Board.

Equity securities for which market quotations are available are generally valued at the last sale price or official closing price on the primary market or exchange on which they trade.

Short-term debt securities having a remaining maturity of 60 days or less when purchased are valued at cost adjusted for amortization of premiums and accretion of discounts, which approximates fair value.

The Fund primarily invests directly in senior secured loans of U.S. middle-market companies (“Senior Loans”) (either in the primary or secondary markets). The Fund’s Senior Loans are valued without accrued interest, and accrued interest is reported as income in the Fund’s Consolidated Statement of operations.

Certain of the Senior Loans held by the Fund will be broadly syndicated loans. Broadly syndicated loans will be valued by using readily available market quotations or indicative market quotations provided by an independent, third-party pricing service.

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

For each Senior Loan held by the Fund, that is either: 1) not a broadly syndicated loan; or 2) is a broadly-syndicated loan but has limited liquidity such that the Adviser determines that readily available or indicative market quotations do not reflect fair value, the Adviser will employ the methodology it deems most appropriate to fair value the Senior Loan. For the period before such a Senior Loan begins providing quarterly financial updates, the Senior Loan’s fair value will usually be listed as the cost at which the Fund purchased the Senior Loan. For all other such Senior Loans, the Adviser will fair value each of these on a quarterly basis after the underlying portfolio company has reported its most recent quarterly financial update. These fair value calculations involve significant professional judgment by the Adviser in the application of both observable and unobservable attributes, and it is possible that the fair value determined for a Senior Loan may differ materially from the value that could be realized upon the sale of the Senior Loan. There is no single standard for determining the fair value of an investment. Accordingly, the methodologies the Adviser may use to fair value the Senior Loan may include: 1) fair values provided by an independent third-party valuation firm; 2) mark-to-model valuation techniques; and 3) matrix pricing.

For each Senior Loan that is either: 1) not a broadly syndicated loan; or 2) is a broadly-syndicated loan but has limited liquidity such that the Adviser determines that readily available or indicative market quotations do not reflect fair value, the Adviser may adjust the value of the Senior Loan between quarterly valuations based on changes in the capital markets. To do this, as a proxy for discount rates and market comparable, the Adviser may look to the Morningstar LSTA U.S. Leveraged Loan 100 Index (the “LSTA Index”). The LSTA Index is an equal value-weighted index designed to track the performance of the largest U.S. leveraged loan facilities. The LSTA Index is comprised of senior secured loans denominated in U.S. dollars that meet certain selection criteria. If there are significant moves in the LSTA Index, the Adviser may adjust the value of the Senior Loan using its discretion.

In addition, the values of the Fund’s Senior Loans may be adjusted daily based on changes to the estimated total return that the asset will generate. The Adviser will monitor these estimates and update them as necessary if macro or individual changes warrant any adjustments.

The Fund may invest in junior debt or equity tranches of collateralized loan obligations (“CLOs”). In valuing such investments, the Adviser considers a number of factors, including: 1) the indicative prices provided by a recognized, independent third-party industry pricing service, and the implied yield of such prices; 2) recent trading prices for specific investments; 3) recent purchases and sales known to the Adviser in similar securities; 4) the indicative prices for specific investments and similar securities provided by the broker who arranges transactions in such CLOs; and 5) the Adviser’s own models, which will incorporate key inputs including, but not limited to, assumptions for future loan default rates, recovery rates, prepayment rates, and discount rates — all of which are determined by considering both observable and third-party market data and prevailing general market assumptions and conventions, as well as those of the Adviser. While the use of an independent third-party industry pricing service can be a source for valuing its CLO investments, the Adviser will not use the price provided by a third-party service if it believes that the price does not accurately reflect fair value, and will instead utilize another methodology outlined above to make its own assessment of fair value.

The Fund may invest in business development companies (“BDCs”) or senior loan facilities that provide the Fund with exposure to Senior Loans (“Loan Facilities”). When valuing BDCs that are publicly-traded, the Adviser will use the daily closing price quoted by the BDC’s respective exchange. When valuing BDCs that are not publicly-traded, as well as Loan Facilities, the Adviser will use the most recently reported net asset value provided by the manager of the respective investment.

|

Annual Report | December 31, 2024 | 23 |

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

The Fund may invest in interests or shares in private investment companies and/or funds (“Private Investment Funds”) where the net asset value is calculated and reported by respective unaffiliated investment managers on a monthly or quarterly basis. Unless the Adviser is aware of information that a value reported to the Fund by a portfolio, underlying manager, or administrator does not accurately reflect the value of the Fund’s interest in that Private Investment Fund, the Adviser will use the net asset value provided by the Private Investment Funds as a practical expedient to estimate the fair value of such interests.

All available information, including non-binding indicative bids which may not be considered reliable, typically will be considered by us in making fair value determinations. In some instances, there may be limited trading activity in a security even though the market for the security is considered not active. In such cases we will consider the number of trades, the size and timing of each trade, and other circumstances around such trades, to the extent such information is available. We will engage third-party valuation firms to provide assistance to the Adviser in valuing a substantial portion of our investments. We expect to evaluate the impact of such additional information and factor it into its consideration of fair value.

Federal Income Taxes: The Fund has elected to be treated for U.S. federal income tax purposes as a RIC under Subchapter M of the Code. Accordingly, the Fund will generally not pay corporate-level U.S. federal income taxes on any net ordinary income or capital gains that are timely distributed to shareholders. To qualify as a RIC, the Fund must, among other things, meet certain source-of-income and asset diversification requirements and timely distribute at least 90% of its investment company taxable income each year to its shareholders.

Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for the open tax years ended December 31, 2021 to December 31, 2023, or expected to be taken in the Fund’s December 31, 2024 year-end tax returns. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expenses on the Consolidated Statement of Operations. During the year ended December 31, 2024, the Fund paid $347,906 in excise tax.

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex-dividend date. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the identified cost basis method for financial reporting purposes. Interest income from investments in the “equity” tranche of CLO funds is recorded based upon an estimate of an effective yield to expected maturity utilizing assumed cash flows in accordance with FASB ASC 325-40, Beneficial Interests in Securitized Financials Assets.

Debt Issuance Costs: The Fund records origination and other expenses related to its debt obligations as debt issuance costs. These expenses are deferred and amortized over the life of the related debt instrument. Debt issuance costs are presented on the Consolidated Statement of Assets and Liabilities as a direct deduction from the debt liability.

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

Distributions to Shareholders: The Fund normally pays dividends, if any, monthly, and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and interest income the Fund receives from its investments, including short term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than one year.

Cash and Cash Equivalents: Cash and cash equivalents (e.g., U.S. Treasury bills) may include demand deposits and highly liquid investments with original maturities of three months or less. Cash and cash equivalents are carried at cost, which approximates fair value. The Fund deposits its cash and cash equivalents with highly-rated banking corporations and, at times, may exceed the insured limits under applicable law.

Participation Agreements and Assignments: The Fund enters into participation agreements in which one or more participants purchase an interest in a loan, but a lead lender is the sole lender of record and is responsible for originating the loan, retains control over the loan, manages the relationship and handles communication with the borrower and services the loan for both itself and the participants. The other participants have a contract with the lead lender rather than the borrower unless otherwise specified in the participation agreement, and accordingly cannot make claims against the borrower but instead must request reimbursement for their participation from the lead lender.

3. FAIR VALUE MEASUREMENTS |

The Fund utilizes various inputs to measure the fair value of its investments. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | Level 1 | | - | | Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access at the measurement date. |

| | | Level 2 | | - | | Significant observable inputs (including quoted prices for the identical instrument on an inactive market, quoted prices for similar instruments, interest rates, prepayment spreads, credit risk, yield curves, default rates and similar data). |

| | | Level 3 | | - | | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of the investments) to the extent relevant observable inputs are not available, for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

|

Annual Report | December 31, 2024 | 25 |

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used to value the Fund’s investments under the fair value hierarchy levels as of December 31, 2024:

| | Valuation Inputs | | |

Investments in Securities at Value | | Level 1 | | Level 2 | | Level 3 | | Total |

Collateralized Loan Obligations Equity | | $ | — | | $ | — | | $ | 27,347,102 | | $ | 27,347,102 |

Collateralized Loan Obligations Debt | | | — | | | — | | | 128,514,764 | | | 128,514,764 |

First Lien Senior Secured Debt | | | — | | | — | | | 172,433,120 | | | 172,433,120 |

Common Stock | | | — | | | — | | | — | | | — |

Private Investment Funds* | | | — | | | — | | | — | | | 50,058,093 |

Short-Term Investments | | | 256,050 | | | — | | | — | | | 256,050 |

Total | | $ | 256,050 | | $ | — | | $ | 328,294,986 | | $ | 378,609,129 |

The following table presents changes in the fair value of investments for which Level 3 inputs were used to determine the fair value as of and for the year ended December 31, 2024:

| | Balance

as of

December 31,

2023 | | Realized

gain

(loss) | | Amortization/

Accretion | | Change in

unrealized

appreciation

(depreciation) | | Purchases | | Sales/

Paydown | | Transfer

in

Level 3 | | Transfer

out

Level 3 | | Balance

as of

December 31,

2024 |

Collateralized Loan Obligations Equity | | $ | 19,398,591 | | $ | — | | $ | (549,775) | | $ | 1,420,407 | | $ | 7,077,879 | | $ | — | | $ | — | | $ | — | | $ | 27,347,102 |

Collateralized Loan Obligations Debt | | | 78,541,178 | | | 475,471 | | | 1,180,830 | | $ | 1,889,976 | | | 73,589,475 | | | (27,162,166) | | | — | | | — | | $ | 128,514,764 |

Common Stocks | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | $ | — |

First Lien Senior Secured Debt | | | 150,276,867 | | | 192,665 | | | 389,623 | | | (3,498,057) | | | 74,122,254 | | | (49,050,232) | | | — | | | — | | $ | 172,433,120 |

Total | | $ | 248,216,636 | | $ | 668,136 | | $ | 1,020,678 | | $ | (187,674) | | $ | 154,789,608 | | $ | (76,212,398) | | $ | — | | $ | — | | $ | 328,294,986 |

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

| | Net Change in

Unrealized Appreciation/

(Depreciation) included

in Statements of

Operations attributable

to Level 3 investments

held at December 31,

2024 |

Collateralized Loan Obligations Equity | | $ | 1,313,416 |

Collateralized Loan Obligations Debt | | | 2,086,448 |

Common Stocks | | | — |

First Lien Senior Secured Debt | | | (3,615,663) |

Total | | $ | (215,799) |

The following table summarizes the valuation techniques and significant unobservable inputs used for the Fund’s investments that are categorized in Level 3 of the fair value hierarchy as of December 31, 2024:

Assets | | Fair Value at

December 31,

2024 | | Valuation

Techniques/

Methodlogies | | Unobservable

Input | | Range/Weighted

Average(2) | | Valuation

from an

Increase in

Input(3) |

First Lien Senior Secured Debt | | $ | 121,848,822 | | Market and income approach (through third-party

vendor pricing service) | | EV/LTM EBITDA Multiple | | 2.90x – 20.10x/10.57x | | Increase |

DCF Discount Margins | | 5.37% – 21.50%/7.51% | | Decrease |

First Lien Senior Secured Debt | | | 26,072,470 | | Market Quotes | | NBIB(1) | | 5.00 – 101.50/99.12 | | Increase |

First Lien Senior Secured Debt | | | 19,739,524 | | Recent Transaction | | Acquisition Cost | | 98.00 – 99.15/98.70 | | Increase |

First Lien Senior Secured Debt | | | 4,772,304 | | Probability-Weighted Expected Return Method | | Probability Weighted Alternative Outcomes | | 0 – 102.5/65.60 | | Increase |

CLO Debt | | | 118,514,764 | | Market Quotes | | NBIB(1) | | 92.08 – 102.79/100.32 | | Increase |

CLO Debt | | | 10,000,000 | | Recent Transaction | | Acquisition Cost | | 100.00 – 100.00/100.00 | | Increase |

CLO Equity | | | 15,703,071 | | Market Quotes | | NBIB(1) | | 48.69 – 90.46/72.57 | | Increase |

|

Annual Report | December 31, 2024 | 27 |

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

Assets | | Fair Value at

December 31,

2024 | | Valuation

Techniques/

Methodlogies | | Unobservable

Input | | Range/Weighted

Average(2) | | Valuation

from an

Increase in

Input(3) |

CLO Equity | | 6,678,652 | | Yield Analysis | | Internal Rate of Return | | 17% – 17%/17% | | Decrease |

CLO Equity | | 4,965,379 | | Recent Transaction | | Acquisition Cost | | 87.55 – 87.55/87.55 | | Increase |

4. INVESTMENT ADVISORY SERVICES AND OTHER AGREEMENTS |

Flat Rock Global, LLC serves as the investment adviser to the Fund pursuant to the terms of an investment advisory agreement (the “Advisory Agreement”). Under the terms of the Advisory Agreement, the Adviser provides the Fund such investment advice as it deems advisable and furnishes a continuous investment program for the Fund consistent with the Fund’s investment objective and strategies. As compensation for its management services, the Fund pays the Adviser a management fee of 1.375% (as a percentage of the average daily value of total assets), paid monthly in arrears, calculated based on the average daily value of total assets during such period.

In addition to the management fee, the Adviser is entitled to an incentive fee. The incentive fee is calculated and payable quarterly in arrears in an amount equal to 15.0% of the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s “adjusted capital,” equal to 1.50% per quarter (or an annualized hurdle rate of 6.00%), subject to a “catch-up” feature, which allows the Adviser to recover foregone incentive fees that were previously limited by the hurdle rate. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income (including any other fees such as commitment, origination, structuring, diligence and consulting fees or other fees that the Fund receives from portfolio companies) accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser for any administrative services provided by the Adviser and any interest expense and distributions paid on any issued and outstanding debt and preferred shares, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with payment-in-kind interest and zero coupon securities), accrued income that the Fund has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. “Adjusted

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

capital” means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund’s distribution reinvestment plan), reduced by amounts paid in connection with purchases of the Fund’s shares pursuant to the Fund’s repurchase program.

The calculation of the incentive fee on pre-incentive fee net investment income for each quarter is as follows:

• No incentive fee is payable in any calendar quarter in which the Fund’s pre-incentive fee net investment income does not exceed the hurdle rate of 1.50% per quarter (or an annualized rate of 6.00%);

• 100% of the Fund’s pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than or equal to 1.764%. This portion of the Fund’s pre-incentive fee net investment income (which exceeds the hurdle rate but is less than or equal to 1.764%) is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 15.0% on all of the Fund’s pre-incentive fee net investment income when the Fund’s pre-incentive fee net investment income reaches 1.764% in any calendar quarter; and

• 15.0% of the amount of the Fund’s pre-incentive fee net investment income, if any, that exceeds 1.764% in any calendar quarter is payable to the Adviser once the hurdle rate is reached and the catch-up is achieved (15.0% of all pre-incentive fee net investment income thereafter will be allocated to the Adviser).

For the year ended December 31, 2024, the Adviser earned $4,501,685 in management fees and $4,567,297 in incentive fees, and voluntarily waived $189,344 in fees. The fees waived by the Adviser are not subject to recoupment.

Ultimus Fund Solutions, LLC serves as the administrator, fund accountant, transfer agent and shareholder servicing agent for the Fund and receives customary fees from the Fund for such services.

U.S. Bank N.A. serves as the Fund’s custodian.

The Fund entered into a Distribution Agreement with Ultimus Fund Distributors, LLC (the “Distributor”). Distributor served as principal underwriter/distributor of shares of the Fund.

U.S. Bank N.A., and the Distributor are not considered affiliates, as defined under the 1940 Act, of the Fund.

The Fund conducts quarterly repurchase offers of 5% of the Fund’s outstanding shares. Repurchase offers in excess of 5% are made solely at the discretion of the Board and investors should not rely on any expectation of repurchase offers in excess of 5%. In the event that a repurchase offer is oversubscribed, shareholders may only be able to have a portion of their shares repurchased.

|

Annual Report | December 31, 2024 | 29 |

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

Quarterly repurchases occur in the months of January, April, July, and October. A repurchase offer notice will be sent to shareholders at least 21 calendar days before the repurchase request deadline. The repurchase price will be the Fund’s NAV determined on the repurchase pricing date, which is ordinarily expected to be the repurchase request deadline. Payment for all shares repurchased pursuant to these offers will be made not later than seven calendar days after the repurchase pricing date.

During the year ended December 31, 2024, the Fund completed four repurchase offers. In these offers, the Fund offered to repurchase no less than 5% of the number of its outstanding shares as of the repurchase pricing dates. The results of the repurchase offers were as follows:

| | Repurchase Offer

#1 | | Repurchase Offer

#2 |

Commencement Date | | December 20, 2023 | | March 21, 2024 |

Repurchase Request Deadline | | January 24, 2024 | | April 25, 2024 |

Repurchase Pricing Date | | January 24, 2024 | | April 25, 2024 |

Amount Repurchased | | $4,567,778 | | $6,791,466 |

Shares Repurchased | | 221,885 | | 328,050 |

| | Repurchase Offer

#3 | | Repurchase Offer

#4 |

Commencement Date | | June 20, 2024 | | September 19, 2024 |

Repurchase Request Deadline | | July 25, 2024 | | October 24, 2024 |

Repurchase Pricing Date | | July 25, 2024 | | October 24, 2024 |

Amount Repurchased | | $6,972,844 | | $4,667,533 |

Shares Repurchased | | 335,879 | | 225,812 |

Purchases and sales of securities for the year ended December 31, 2024, excluding short-term securities, were as follows:

| | Purchases of Securities | | Proceeds from Sales of Securities |

| | | $165,364,441 | | $83,466,991 |

Classification of Distributions

Distributions are determined in accordance with U.S. federal income tax regulations, which differ from U.S. GAAP, and therefore, may differ significantly in amount or character from net investment income and realized gains for financial statement purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

The tax character of distributions paid by the Fund for the years ended December 31, 2024 and December 31, 2023, were as follows:

| | 2024 | | 2023 |

Distributions paid from: | | | | | | |

Ordinary Income | | $ | 25,678,219 | | $ | 16,904,113 |

Long-Term Capital Gain | | | — | | | — |

Total | | $ | 25,678,219 | | $ | 16,904,113 |

Components of Distributable Earnings on a Tax Basis

Permanent book and tax differences, primarily attributable to the tax treatment of non-deductible expenses resulted in reclassifications for the year ended December 31, 2024, as follows:

| | Paid-in Capital | | Accumulated

Earnings |

| | | $ | (347,927) | | $ | 347,927 |

As of December 31, 2024, the components of accumulated earnings/(deficit) on a tax basis for the Fund were as follows:

Undistributed Ordinary Income | | $ | 17,013,732 |

Undistributed Long-Term Capital Gains | | | — |

Capital Loss Carry Forwards | | | (1,743,866) |

Unrealized Appreciation (Depreciation) | | | (12,418,850) |

Total | | $ | 2,851,016 |

Tax Basis of Investments

Net unrealized appreciation/(depreciation) of investments based on federal tax cost as of December 31, 2024, with differences related to partnership investments and wash sales, was as follows:

Gross Unrealized Appreciation | | $ | 5,651,261 |

Gross Unrealized Depreciation | | | (18,070,111) |

Net Unrealized Depreciation on Investments | | $ | (12,418,850) |

Tax Cost | | $ | 391,027,979 |

|

Annual Report | December 31, 2024 | 31 |

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

Capital losses

As of December 31, 2024, the Fund had capital loss carryforwards which may reduce the Fund’s taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code and thus may reduce the amount of the distributions to shareholders which would otherwise be necessary to relieve the fund of any liability for federal tax pursuant to the Code. The capital loss carryforwards may be carried forward indefinitely. At December 31, 2024, the Fund had capital loss carry forwards for federal income tax purposes available to offset future capital gains, along with capital loss carryforwards utilized as follows:

| | Non-Expiring

Short-Term | | Non-Expiring

Long-Term | | Total | | Capital Loss Carry Forwards Utilized |

| | | $ | 567,754 | | $ | 1,176,112 | | $ | 1,743,866 | | $ | 661,782 |

In the normal course of business, the Fund invests in financial instruments and enters into financial transactions where risk of potential loss exists due to such things as changes in the market (market risk) or failure or inability of the other party to a transaction to perform (credit and counterparty risk). See below for a detailed description of select principal risks. The following is not intended to be a comprehensive description of all of the potential risks associated with the Fund. The Fund’s prospectus provides a detailed discussion of the Fund’s risks.

Credit Risk. The Fund is subject to the risk that the issuer or guarantor of an obligation, or the counterparty to a transaction, may fail, or become less able, to make timely payment of interest or principal or otherwise honor its obligations or default completely. The strategies utilized by the Adviser require accurate and detailed credit analysis of issuers, and there can be no assurance that its analysis will be accurate or complete. The Fund may be subject to substantial losses in the event of credit deterioration or bankruptcy of one or more issuers in its portfolio.

Financial strength and solvency of an issuer are the primary factors influencing credit risk. The Fund could lose money if the issuer or guarantor of a debt security is unable or unwilling, or is perceived (whether by market participants, rating agencies, pricing services or otherwise) as unable or unwilling, to make timely principal and/or interest payments, or to otherwise honor its obligations. Companies in which the Fund invests could deteriorate as a result of, among other factors, an adverse development in their business, a change in the competitive environment or an economic downturn. As a result, companies that the Adviser may have expected to be stable may operate, or expect to operate, at a loss or have significant variations in operating results, may require substantial additional capital to support their operations or maintain their competitive position, or may otherwise have a weak financial condition or be experiencing financial distress. In addition, inadequacy of collateral or credit enhancement for a debt obligation may affect its credit risk. Although the Fund may invest in investments that the Adviser believes are secured by specific collateral, the value of which may exceed the principal amount of the investments at the time of initial investment, there can be no assurance that the liquidation of any such collateral would satisfy the borrower’s obligation in the event of non-payment of scheduled interest or principal payments with

Flat Rock Core Income Fund | Notes to Consolidated Financial Statements |

| | December 31, 2024 |

respect to such investment, or that such collateral could be readily liquidated. In addition, in the event of bankruptcy of a borrower, the Fund could experience delays or limitations with respect to its ability to realize the benefits of the collateral securing an investment. Under certain circumstances, collateral securing an investment may be released without the consent of the Fund.

Credit risk is typically greater for securities with ratings that are below investment grade (commonly referred to as “junk bonds”). Since the Fund can invest significantly in high-yield investments considered speculative in nature and unsecured investments, this risk may be substantial. The Fund’s right to payment and its security interest, if any, may be subordinated to the payment rights and security interests of more senior creditors. This risk may also be greater to the extent the Fund uses leverage or derivatives in connection with the management of the Fund. Changes in the actual or perceived creditworthiness of an issuer, or a downgrade or default affecting any of the Fund’s securities, could affect the Fund’s performance.