UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: 811-23585 |

VELA FUNDS

(Exact name of registrant as specified in charter)

220 Market Street, Suite 208

New Albany, OH 43054

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

New Castle County

Wilmington, DE 19801

(Name and address of agent for service)

With copy to: Peter Schwartz, Esq.

Davis Graham & Stubbs LLP

1550 17th Street, Suite 500

Denver, CO 80202

and

Jesse D. Hallee

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

| Registrant’s telephone number, including area code: | 614-653-8352 |

| Date of fiscal year end: | September 30 |

| Date of reporting period: | September 30, 2022 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth

Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

Annual Report

September 30, 2022 |

| |

| |

| |

| |

| |

VELA Small Cap Fund

Class A (VESAX)

Class I (VESMX) |

| |

VELA Large Cap Plus Fund

Class A (VELAX)

Class I (VELIX) |

| |

VELA International Fund

Class A (VEILX)

Class I (VEITX) |

| |

| VELA Income Opportunities Fund |

| Class A (VIOAX) |

| Class I (VIOIX) |

Management’s Discussion of Fund Performance (Unaudited)

Market Review

For the fiscal year ended September 30, 2022, volatility has been a key descriptor of financial markets, led by investors’ uncertainty and recessionary concerns. In the U.S., the S&P 500 Index (a proxy for U.S. equity markets) provided a -15 % total return. The Russell 3000 Total Return Index, a similar broad-market index composed of 3,000 companies, returned -18% over the same period. Small Cap and International Companies, broadly, delivered relatively poorer performance (as is often the case in market contractions), with the Russell 2000 Index returning -24% and the MSCI World ex USA -24% for the year. Contrastingly, the Russell 1000 Index (representing the largest 1,000 stocks in the Russell 3000 Total Return Index) provided a -17 % total return.

Globally, inflationary pressures have been a primary concern throughout the fiscal year, augmented in the latter half by the war in Ukraine, which continues to pressure energy prices, and movements by central banks around the world to increase short term interest rates, resulting in slowing economic growth. This combination of factors pressured financial asset valuations over the past year, bringing the average Price-to-Earnings (P/E) Ratio1 for the S&P 500 Index from above 20x at the start of calendar year 2022 to a current level of 17x, showing a decline in the perceived value of U.S. equities2. While declines in equity valuations can be stressful over the short term, we believe asset valuations are far more favorable than at the outset of the year, providing ample opportunity for long-term investors.

With regard to economic sector, stocks of energy companies, which benefitted considerably from elevated energy prices over the six month period ended September 30, 2022, led the market. As was the case for 2021, our investment approach, centered on valuing businesses, served us well this past year, and we expect that to be the case over the long term.

VELA Small Cap Fund

Annual Returns Discussion

The VELA Small Cap Fund Class I Shares returned -7.20% for the fiscal year ended September 30, 2022, compared to -23.50% for the Russell 2000 Index, the Fund’s primary benchmark, and -18.83% for the S&P SmallCap 600 Index.

Favorable stock selection and an overweight position in the Energy sector were key drivers of returns for the fiscal year, with Companies in the energy sector representing three of the top five contributors to performance within the Fund. These included Texas Pacific Land Corporation (TPL), Devon Energy Corporation (DVN), and Civitas Resources, Inc. (CIVI). In line with 2021, Kirby Corporation (KEX), a dominant player in the inland tank barge industry, was the single highest contributor to returns for FY2022, with MGPI Ingredients, Inc. (MGPI), rounding out the top five. Bottom contributors during the fiscal year included Live Oak Bancshares (LOB), Greenbriar Companies, Inc. (GBX), Scotts Miracle-Gro Class A (SMG), Hanesbrands (HBI), and Verint Systems (VRNT).

Portfolio Changes

We took advantage of the market’s volatility and lower asset valuations over the year, reducing the Fund’s cash balance from over 10% at the end of fiscal year 2021 to 7% as of the fiscal year ended September 30, 2022. Over the period, we added to higher conviction holdings

Management’s Discussion of Fund Performance (Unaudited) (continued)

and added several new positions. We were pleased with our ability to source new ideas across many sectors in a challenging market environment. Turnover remains elevated relative to our long-term expectations for the Fund, as we worked to act on opportunities presented by the market conditions, as well as harvest tax losses to offset capital gains.

Operationally, we made two changes over the course of the fiscal year. The first related to the Fund’s primary benchmark. Prior to 3/1/22, the Small Cap Fund compared its performance only against the S&P Small Cap 600 Index. VELA and the Board of Trustees of the Trust (the “Board”) believe the Russell 2000 Index is a more appropriate and accurate index against which to compare the Small Cap Fund’s investment strategy and, therefore, the Russell 2000 Index replaces the S&P 600 Index as the Small Cap Fund’s primary benchmark as of 3/1/22. Second, we reviewed and made the decision to reduce the administrative fee for each of our mutual funds and associated share classes from an annual rate of 0.45% to 0.42%, effective as of 10/01/2022. For the Small Cap Class I Shares, this brings the total expense ratio from the previous 1.22% down to 1.19% for all investors.

VELA Large Cap Plus Fund

Annual Returns Discussion

The VELA Large Cap Plus Fund Class I Shares returned -6.80% for the fiscal year ended September 30, 2022, vs. -17.22% for the Russell 1000 Index, the Fund’s primary benchmark, and -15.47% for the S&P 500 Index.

Overweight positions in the Healthcare and Energy sectors were primary drivers of performance during the fiscal year, led by Vertex Pharmaceuticals, Inc. (VRTX) and AbbVie, Inc. (ABBV) in Healthcare. Energy holdings EQT Corporation (EQT), Pioneer Natural Resources Company (PXD), and Suncor Energy (SU) each benefitted from tight global energy supply, exacerbated over the past six months by the war in Ukraine. Upside was partially limited by call options written at our estimate of intrinsic value3. Put options on the ARK Innovation ETF (AARK) rounded out the top five contributors to returns as the underlying ETF declined sharply over the fiscal year period.

Within the Fund, technology companies made up the top five detractors to returns, including NVIDIA Corporation (NVDA), Meta Platforms Inc. Class A (META), PayPal Holdings, Inc. (PYPL), Adobe Inc. (ADBE), and, finally, Alphabet Inc. Class A (GOOGL). Difficult year over year comparisons following COVID impacted many technology companies. META and ADBE’s questionable strategic decisions also weighed on the stocks. At various times the Fund held written call options on several of the top underperforming positions, which helped mitigate the net impact to the Fund.

Portfolio Changes

Operationally, we made two changes over the course of the fiscal year. The first related to the Fund’s primary benchmark: prior to 5/1/2022, the Large Cap Plus Fund compared its performance only against the S&P 500 Index. VELA and the Board believe the Russell 1000 Index is a more appropriate and accurate index against which to compare the Large Cap Plus Fund’s investment strategies and, therefore, the Russell 1000 Index replaced the S&P 500 Index as the Large Cap Plus Fund’s primary benchmark as of 5/1/2022. Second,

Management’s Discussion of Fund Performance (Unaudited) (continued)

we reviewed and made the decision to reduce the administrative fee for each of our mutual funds and associated share classes from an annual rate of 0.45% to 0.42%, effective as of 10/01/2022. For the Large Cap Plus Class I Shares, this brings the total expense ratio from the previous 1.87% down to 1.84% for all investors.

VELA International Fund

Annual Returns Discussion

The VELA International Fund Class I Shares returned -20.84% for the fiscal year ended September 30, 2022, compared to -23.91% for the MSCI World ex USA Index, the Fund’s primary benchmark.

Energy and Materials sector names were well represented among the top contributors the Fund’s better relative performance during the period, led by Canadian oil producer Suncor Energy Inc. (SU), French energy super major Total Energies SE (B15C55), and United Tractors (623084), which is both the largest holding in the Fund and a repeat outperformer from FY21 on the continued strength of coal prices. Swiss luxury consumer brand Compagnie Financiere Richemont SA (BCRWZ1) and Dutch dredging and heavylift company Koninklijke Boskalis Westminster N.V. (B1XF88) were also among the top contributors to returns. Top detractors to performance over the fiscal year included German healthcare provider Fresenius SE & Co. (435209), whose management lost credibility following the disclosure of its new strategic plan during its capital markets day presentation, Hong-Kong based auto-parts manufacturing company Johnson Electric Holdings, Ltd. (BP4JH1), Dutch medical equipment company Koninklijke Philips N.V. (598662), and Belgian multi-channel bank-insurer KBC Group N.V. (449774). Lastly, Associated British Foods (067312) rounded out the bottom five, declining on recessionary fears regarding potential impact to the company’s value-oriented fashion retail operations.

Portfolio Changes

Through the year, we added several new names to the Fund as we’ve seen the opportunity to buy at what we believe to be favorable prices. These include German companies Henkel AC (507670) and Infineon Technologies AG (588950) in the most recent quarter, the first of which has two major businesses, a global position in industrial adhesives and a significant presence in consumer beauty and home laundry care, and the second of which is the largest player in the power semiconductor market. Sales over the fiscal year ended September 30, 2022 included Dutch healthcare conglomerate Philips NV (598662), German healthcare company Fresenius SE (435209), Dutch dredging and heavy-lifting company Royal Boskalis (B1XF88), Swedish asset-manager Industrivarden AB, Class A (INDU.A-SE), Belgian technology company Barco NV (BAR-BE), and Swiss human resources and staffing firm Adecco Group AG (ADEN-CH) as we worked to seek to mitigate the impact of taxable investment gains and to reinforce positions in our highest-conviction ideas. The Fund ended the fiscal year with 47 holdings and a turnover for the period of 23%. Average cash position fluctuated between 7-9% for most of the fiscal year, finishing higher at 10% on the buyout of Royal Boskalis Westminster during the most recent quarter. Exiting the fiscal year, we remain comfortable with this elevated level of cash; however, further market declines with evidence the market is discounting lower

Management’s Discussion of Fund Performance (Unaudited) (continued)

earnings could be a signal which allows a reduction in this level. We continue to evaluate the Fund’s holdings given the changing investment landscape and remain disciplined in seeking the best ideas, regardless of how this environment evolves.

Operationally, we reviewed and made the decision to reduce the administrative fee for each of our mutual funds and associated share classes from an annual rate of 0.45% to 0.42%, effective as of 10/01/2022. For the International Fund Class I Shares, this brings the total expense ratio from the previous 1.22% down to 1.19% for all investors.

VELA Income Opportunities Fund

Annual Returns Discussion

The VELA Income Opportunities Fund Class I Shares returned -17.91% for the six months ended September 30, 2022 (based on the Fund’s inception date of March 31, 2022) compared to a return of -20.42% for the Fund’s primary benchmark, the Russell 3000 Total Return Index, and a -14.84% return for the Fund’s secondary benchmark, 50% Russell 3000 Total Return Index /50% Bloomberg U.S. Aggregate Bond Index, a 50%/50% blend of the Russell 3000 Total Return Index and the Bloomberg U.S. Aggregate Index (an index of U.S. – based fixed income securities).

Despite widespread volatility, we believe the Fund performed well on a relative basis due to the strategy’s focus on well-capitalized, cash flow generative businesses selling at discounts to our estimates of intrinsic value and with an ongoing ability to make dividend and interest payments. Top contributors to performance within the Fund came from a mix of sectors, led by auto-parts retailer Genuine Parts Company (GPC), which continues to benefit from tailwinds in the professional Do-it-For-Me channel as well as an aging car fleet in the U.S., and Colorado-based energy producer Civitas Resources (CIVI). Aerospace and defense technology producer Northrop Grumman Corp. (NOC), off-price department store TJX Companies, Inc. (TJX), and building materials and specialty coating manufacturer RPM International, Inc. (RPM) rounded out the top five contributors to return. Bottom performers for the period included consumer lawn and garden manufacturer Scotts Miracle-Gro Company Class A (SMG), transportation manufacturing company Greenbrier Companies, Inc. (GBX), apparel company Hanesbrands Inc. (HBI), auto insurance organization Mercury General Corporation (MCY), and apparel and footwear company V.F. Corporation (VFC).

Portfolio Changes

Over the past two quarters, we have utilized market volatility to improve the quality of the businesses in the Fund’s portfolio and are pleased with the combination of business quality and attractive valuations of the collection of businesses the Fund owns. We have also modestly added to the Fund’s preferred equity securities and initiated two corporate bond positions as these areas have become more attractive in recent months. We continue to evaluate the opportunity set with regard to both equity and fixed income securities, and seek to opportunistically add to or initiate new positions as they meet our investment criteria.

Management’s Discussion of Fund Performance (Unaudited) (continued)

Operationally, we reviewed and made the decision to reduce the administrative fee for each of our mutual funds and associated share classes from an annual rate of 0.45% to 0.42%, effective as of 10/01/2022. For the Income Opportunities Class I Shares, this brings the total expense ratio from the previous 0.95% down to 0.92% for all investors.

Important Information:

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Investors may obtain performance data current to the most recent month-end by calling 833-399-1001.

A complete list of portfolio holdings can be found at www.velafunds.com.

You cannot invest directly in an index.

The S&P 500 Index is a composite of 500 of the largest companies in the United States. The S&P 500 Index is unmanaged and does not represent the performance of any particular investment.

The Russell 3000 Index is a market-capitalization-weighted equity index maintained by FTSE Russell that tracks the performance of the 3,000 largest U.S. traded stocks across all market sectors, inclusive of dividends, capital gains, distributions, and interest.

The Russell 2000 Index is a small-cap stock market index of the smallest 2,000 stocks in the Russell 3000 Index.

The MSCI World ex USA Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries excluding the United States.

The Russell 1000 Index is an unmanaged market capitalization-weighted index comprised of the largest 1,000 companies by market capitalization in the Russell 3000 Index, which is comprised of the 3,000 largest U.S. companies by total market capitalization.

The S&P SmallCap 600 Index is a stock market index established by Standard & Poor’s. It covers roughly the small-cap range of American stocks, using a capitalization-weighted index.

The secondary index for the Income Opportunities Fund is a blend of the Russell 3000 Total Return Index (50%) and The Bloomberg Aggregate Bond Index (50%). The Bloomberg Aggregate Bond Index broadly tracks the performance of the U.S. investment-grade bond market. The index is composed of investment-grade government and corporate bonds.

| 1 | Price to Earnings (P/E) Ratio: The price to earnings ratio is a ratio for estimating the value of a company by measuring the market price for a security relative to its’ earnings per share. A high P/E ratio could mean that a company’s stock is overvalued, or that investors are expecting high growth rates in the future. |

| 3 | Intrinsic Value: the estimated underlying value of a company or stock, arrived at by a financial model, rather than the current trading price. |

VELA Small Cap Fund

Investment Results (Unaudited)

Average Annual Total Returns as of September 30, 2022(a)

| | | Since Inception |

| VELA Small Cap Fund | One Year | (9/30/20) |

| Class A Shares | | |

| Without Load | -7.41% | 19.78% |

| With Load | -12.07% | 16.72% |

| Class I Shares | -7.20% | 20.09% |

| Russell 2000 Index(b) | -23.50% | 6.29% |

| S&P SmallCap 600 Index(c) | -18.83% | 13.12% |

| | | |

| | Expense Ratios(d) |

| | Class A | Class I |

| | Shares | Shares |

| | 1.44% | 1.19% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the VELA Small Cap Fund’s (the “Fund”) distributions or the redemption of shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (833) 399-1001.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (b) | The Russell 2000 Index is an unmanaged market capitalization weighted index measuring performance of the smallest 2,000 companies by market capitalization in the Russell 3000 Index. The Russell 3000 Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. |

| (c) | The S&P SmallCap 600 Index is an unmanaged capitalization weighted index that measures the performance of selected U.S. stocks with small market capitalization. Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an index, however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (d) | The expense ratios shown, which include acquired fund fees and other expenses of 0.02%, reflect information from the Fund’s prospectus dated January 12, 2022, as supplemented September 30, 2022. Additional information pertaining to the expense ratios as of September 30, 2022 can be found in the financial highlights. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 833-399-1001.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

VELA Small Cap Fund

Investment Results (Unaudited) (continued)

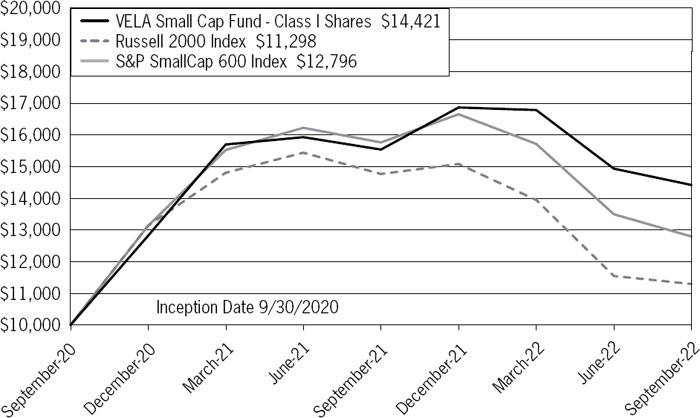

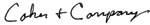

Comparison of the Growth of a $10,000 Investment in the

VELA Small Cap Fund - Class I Shares, the Russell 2000 Index and

the S&P SmallCap 600 Index.

The chart above assumes an initial investment of $10,000 made on September 30, 2020 (commencement of operations) and held through September 30, 2022. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Investment returns and principal values will fluctuate so that your shares, when redeemed may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 833-399-1001. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

VELA Large Cap Plus Fund

Investment Results (Unaudited) (continued)

Average Annual Total Returns as of September 30, 2022(a)

| | | Since Inception |

| VELA Large Cap Plus Fund | One Year | (9/30/20) |

| Class A Shares | | |

| Without Load | -6.97% | 12.95% |

| With Load | -11.61% | 10.07% |

| Class I Shares | -6.80% | 13.19% |

| Russell 1000 Index(b) | -17.22% | 4.12% |

| S&P 500 Index(c) | -15.47% | 4.83% |

| | | |

| | Expense Ratios(d) |

| | Class A | Class I |

| | Shares | Shares |

| | 2.09% | 1.84% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the VELA Large Cap Plus Fund’s (the “Fund”) distributions or the redemption of shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (833) 399-1001.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (b) | The Russell 1000 Index is an unmanaged market capitalization weighted index measuring the performance of the largest 1,000 companies by market capitalization in the Russell 3000 Index. The Russell 3000 Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. |

| (c) | The S&P 500 Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than are found in the Fund’s portfolio. Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an index, however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (d) | The expense ratios shown, which include acquired fund fees and expenses of 0.01%, reflect information from the Fund’s prospectus dated January 12, 2022, as supplemented September 30, 2022. Additional information pertaining to the expense ratios as of September 30, 2022 can be found in the financial highlights. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The Fund’s prospectus contains this and other important information about the Fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 833-399-1001.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

VELA Large Cap Plus Fund

Investment Results (Unaudited) (continued)

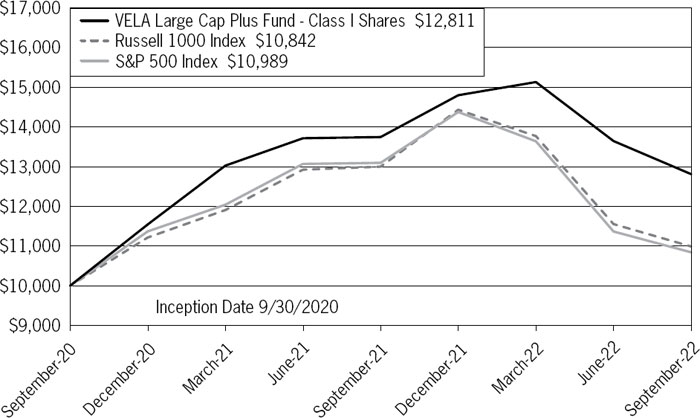

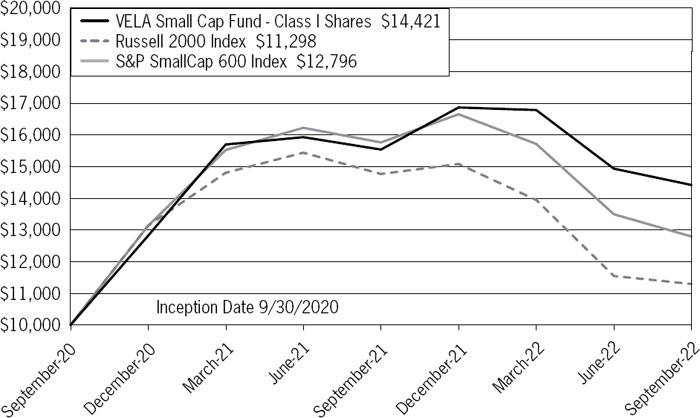

Comparison of the Growth of a $10,000 Investment in the

VELA Large Cap Plus Fund - Class I Shares, the Russell 1000 Index, and

the S&P 500 Index

The chart above assumes an initial investment of $10,000 made on September 30, 2020 (commencement of operations) and held through September 30, 2022. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Investment returns and principal values will fluctuate so that your shares, when redeemed may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 833-399-1001. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

VELA International Fund

Investment Results (Unaudited) (continued)

Average Annual Total Returns as of September 30, 2022(a)

| | | Since Inception |

| VELA International Fund | One Year | (9/30/20) |

| Class A Shares | | |

| Without Load | -21.10% | -1.45% |

| With Load | -25.05% | -3.96% |

| Class I Shares | -20.84% | -1.08% |

| MSCI World ex USA Index(b) | -23.91% | -1.89% |

| | | |

| | Expense Ratios(c) |

| | Class A | Class I |

| | Shares | Shares |

| | 1.44% | 1.19% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the VELA International Fund’s (the “Fund”) distributions or the redemption of shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (833) 399-1001.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (b) | The MSCI World ex USA Index is an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an index, however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios shown, which include acquired fund fees and other expenses of 0.02%,reflect information from the Fund’s prospectus dated January 12, 2022, as supplemented September 30, 2022. Additional information pertaining to the expense ratios as of September 30, 2022 can be found in the financial highlights. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 833-399-1001.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

VELA International Fund

Investment Results (Unaudited) (continued)

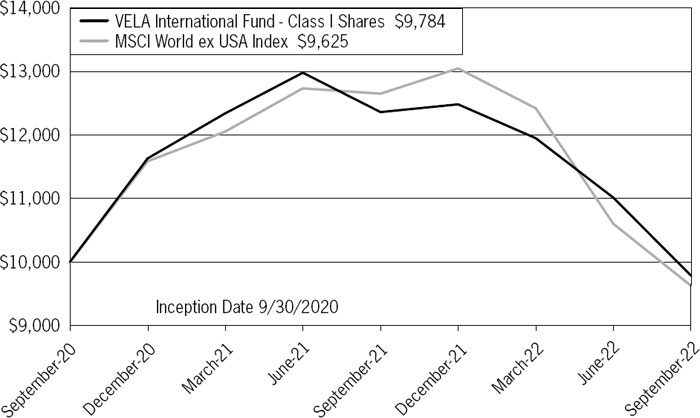

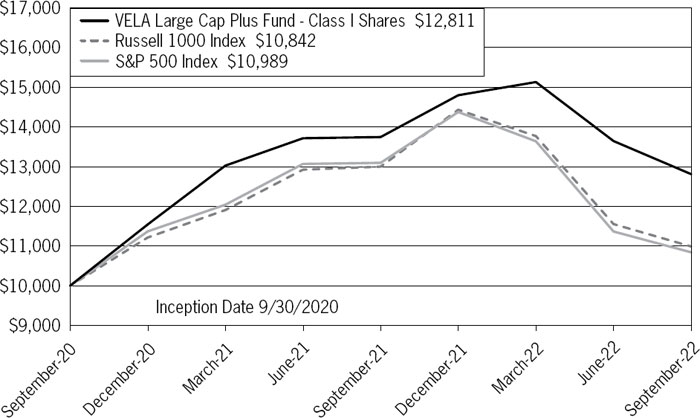

Comparison of the Growth of a $10,000 Investment in the

VELA International Fund - Class I Shares and the MSCI World ex USA Index.

The chart above assumes an initial investment of $10,000 made on September 30, 2020 (commencement of operations) and held through September 30, 2022. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Investment returns and principal values will fluctuate so that your shares, when redeemed may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 833-399-1001. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

VELA Income Opportunities Fund

Investment Results (Unaudited) (continued)

Total Returns as of September 30, 2022(a)

| | | Since Inception |

| VELA Income Opportunities Fund | | (3/31/22) |

| Class A Shares | | |

| Without Load | | -18.15% |

| With Load | | -22.27% |

| Class I Shares | | -17.91% |

| Russell 3000 Total Return Index(b) | | -20.42% |

| 50% Russell 3000 Total Return Index(b) / | | |

| 50% Bloomberg U.S. Aggregate Bond Index(c) | | -14.84% |

| | | |

| | Expense Ratios(d) |

| | Class A | Class I |

| | Shares | Shares |

| | 1.17% | 0.92% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the VELA Income Opportunities Fund’s (the “Fund”) distributions or the redemption of shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (833) 399-1001.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for less than one year are not annualized. |

| (b) | The Russell 3000 Total Return Index is a capitalization-weighted stock market index, maintained by FTSE Russell, that seeks to be a benchmark of the entire U.S stock market. It measures the performance of the 3,000 largest publicly held companies incorporated in America as measured by total market capitalization, and represents approximately 98% of the American public equity market. |

| (c) | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and collateralized mortgage-backed securities. |

| (d) | The expense ratios shown reflect information from the Fund’s prospectus dated March 30, 2022, as supplemented September 30, 2022. Additional information pertaining to the expense ratios as of September 30, 2022 can be found in the financial highlights. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 833-399-1001.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

VELA Income Opportunities Fund

Investment Results (Unaudited) (continued)

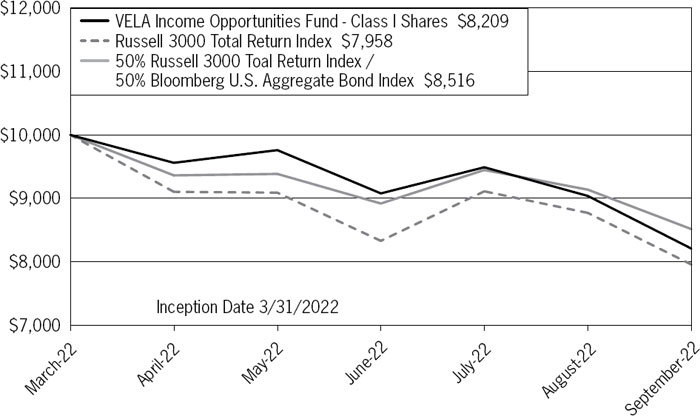

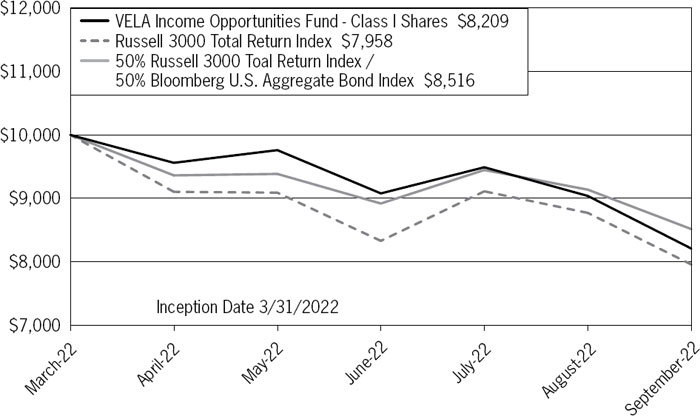

Comparison of the Growth of a $10,000 Investment in the

VELA Income Opportunities Fund - Class I Shares, the Russell 3000

Total Return Index and the 50% Russell 3000 Total Return Index /

50% Bloomberg U.S. Aggregate Bond Index

The chart above assumes an initial investment of $10,000 made on March 31, 2022 (commencement of operations) and held through September 30, 2022. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund Shares. Investment returns and principal values will fluctuate so that your shares, when redeemed may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 833-399-1001. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

VELA Funds

Sector Holdings (Unaudited)

VELA Small Cap Fund

| Sector Allocation(a) | |

| Consumer Discretionary | 11.44% |

| Consumer Staples | 6.42% |

| Energy | 14.13% |

| Financials | 20.16% |

| Health Care | 8.47% |

| Industrials | 21.41% |

| Materials | 4.37% |

| Technology | 3.95% |

| Utilities | 2.56% |

| Put Options | 0.12% |

| Money Market Funds | 7.17% |

| Written Options | -0.11% |

| Liabilities in Excess of Other Assets | -0.09% |

| | 100.00% |

| (a) | As a percentage of net assets. |

The investment objective of the VELA Small Cap Fund is to provide long-term capital appreciation.

VELA Large Cap Plus Fund

| Sector Allocation(a) | | Long | | | Short | | | Gross | | | Net | |

| Communications | | | 5.63 | % | | | -0.28 | % | | | 5.91 | % | | | 5.35 | % |

| Consumer Discretionary | | | 11.01 | % | | | -1.93 | % | | | 12.94 | % | | | 9.08 | % |

| Consumer Staples | | | 5.66 | % | | | -0.54 | % | | | 6.20 | % | | | 5.12 | % |

| Energy | | | 7.83 | % | | | -0.49 | % | | | 8.32 | % | | | 7.34 | % |

| Financials | | | 13.56 | % | | | -0.88 | % | | | 14.44 | % | | | 12.68 | % |

| Health Care | | | 19.09 | % | | | -0.83 | % | | | 19.92 | % | | | 18.26 | % |

| Industrials | | | 7.50 | % | | | -1.41 | % | | | 8.91 | % | | | 6.09 | % |

| Materials | | | 2.61 | % | | | -0.97 | % | | | 3.58 | % | | | 1.64 | % |

| Technology | | | 21.26 | % | | | -1.18 | % | | | 22.44 | % | | | 20.08 | % |

| Utilities | | | 3.05 | % | | | 0.00 | % | | | 3.05 | % | | | 3.05 | % |

| Purchased Options | | | 1.96 | % | | | 0.00 | % | | | 1.96 | % | | | 1.96 | % |

| Money Market Funds | | | 11.85 | % | | | 0.00 | % | | | 11.85 | % | | | 11.85 | % |

| Written Options | | | 0.00 | % | | | -1.00 | % | | | 1.00 | % | | | -1.00 | % |

| Liabilities in Excess of Other Assets | | | 0.00 | % | | | -1.50 | % | | | 1.50 | % | | | -1.50 | % |

| | | | 111.01 | % | | | -11.01 | % | | | 122.18 | % | | | 100.00 | % |

| (a) | As a percentage of net assets. |

The investment objective of the VELA Large Cap Plus Fund is to provide long-term capital appreciation.

VELA Funds

Sector Holdings (Unaudited) (continued)

VELA International Fund

| Sector Allocation(a) | |

| Communications | 7.32% |

| Consumer Discretionary | 9.20% |

| Consumer Staples | 17.92% |

| Energy | 5.18% |

| Financials | 7.45% |

| Health Care | 4.51% |

| Industrials | 14.50% |

| Materials | 15.89% |

| Technology | 7.83% |

| Money Market Funds | 13.86% |

| Liabilities in Excess of Other Assets | -3.66% |

| | 100.00% |

| (a) | As a percentage of net assets. |

The investment objective of the VELA International Fund is to provide long-term capital appreciation.

VELA Income Opportunities Fund

| Sector Allocation(a) | |

| Communications | 4.84% |

| Consumer Discretionary | 17.47% |

| Consumer Staples | 12.36% |

| Energy | 5.65% |

| Financials | 16.35% |

| Health Care | 9.91% |

| Industrials | 12.85% |

| Materials | 3.53% |

| Real Estate | 3.58% |

| Technology | 5.80% |

| Utilities | 4.02% |

| Money Market Funds | 10.29% |

| Written Options | -0.12% |

| Liabilities in Excess of Other Assets | -6.53% |

| | 100.00% |

| (a) | As a percentage of net assets. |

The investment objective of the VELA Income Opportunities Fund is to provide current income and the secondary investment objective is to provide long-term capital appreciation.

VELA Funds

Sector Holdings (Unaudited) (continued)

Availability of Portfolio Schedule (Unaudited)

The Funds file a complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at http://www.sec.gov or on the Funds’ website at www.velafunds.com.

VELA SMALL CAP FUND

Schedule of Investments

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — 92.91% | | | | | | | | |

| Consumer Discretionary — 11.44% | | | | | | | | |

| Gildan Activewear, Inc. | | | 20,026 | | | $ | 566,135 | |

| Graham Holdings Co., Class B | | | 2,173 | | | | 1,169,031 | |

| Green Brick Partners, Inc.(a) | | | 13,217 | | | | 282,579 | |

| Liberty Media Corp. - Liberty Braves - Series C(a) | | | 44,051 | | | | 1,211,402 | |

| Papa John’s International, Inc. | | | 9,466 | | | | 662,715 | |

| Polaris Industries, Inc. | | | 7,955 | | | | 760,896 | |

| Vail Resorts, Inc. | | | 5,441 | | | | 1,173,297 | |

| Wendy’s Co. (The) | | | 38,178 | | | | 713,547 | |

| | | | | | | | 6,539,602 | |

| Consumer Staples — 6.42% | | | | | | | | |

| Flowers Foods, Inc. | | | 27,204 | | | | 671,667 | |

| MGP Ingredients, Inc.(b) | | | 9,469 | | | | 1,005,229 | |

| Ollie’s Bargain Outlet Holdings, Inc.(a) | | | 20,438 | | | | 1,054,600 | |

| Performance Food Group Co.(a)(b) | | | 21,868 | | | | 939,231 | |

| | | | | | | | 3,670,727 | |

| Energy — 14.13% | | | | | | | | |

| Civitas Resources, Inc.(b) | | | 27,035 | | | | 1,551,539 | |

| Coterra Energy, Inc.(b) | | | 21,875 | | | | 571,375 | |

| Devon Energy Corp.(b) | | | 9,545 | | | | 573,941 | |

| PDC Energy, Inc. | | | 30,613 | | | | 1,769,125 | |

| Range Resources Corp. | | | 73,224 | | | | 1,849,638 | |

| Texas Pacific Land Corp. | | | 992 | | | | 1,763,012 | |

| | | | | | | | 8,078,630 | |

| Financials — 20.16% | | | | | | | | |

| 1st Source Corp. | | | 20,904 | | | | 967,855 | |

| Assured Guaranty Ltd. | | | 20,789 | | | | 1,007,227 | |

| Axis Capital Holdings Ltd. | | | 32,507 | | | | 1,597,720 | |

| Bank OZK | | | 37,931 | | | | 1,500,550 | |

| BOK Financial Corp. | | | 15,535 | | | | 1,380,440 | |

| Community Trust Bancorp, Inc. | | | 12,372 | | | | 501,685 | |

| Hingham Institution for Savings | | | 1,031 | | | | 258,894 | |

| Houlihan Lokey, Inc. | | | 7,815 | | | | 589,095 | |

| Live Oak Bancshares, Inc. | | | 41,589 | | | | 1,272,623 | |

| MBIA, Inc.(a) | | | 46,822 | | | | 430,762 | |

| UMB Financial Corp. | | | 14,123 | | | | 1,190,428 | |

| Washington Trust Bancorp, Inc. | | | 17,705 | | | | 822,928 | |

| | | | | | | | 11,520,207 | |

See accompanying notes which are an integral part of these financial statements.

VELA SMALL CAP FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| Health Care — 8.47% | | | | | | | | |

| Denali Therapeutics, Inc.(a) | | | 5,472 | | | $ | 167,936 | |

| Encompass Health Corp. | | | 15,125 | | | | 684,104 | |

| Envista Holdings Corp.(a) | | | 41,392 | | | | 1,358,072 | |

| LivaNova PLC(a) | | | 10,944 | | | | 555,627 | |

| National Healthcare Corp. | | | 17,801 | | | | 1,127,515 | |

| SI-BONE, Inc.(a) | | | 36,008 | | | | 628,700 | |

| Syneos Health, Inc.(a) | | | 6,800 | | | | 320,620 | |

| | | | | | | | 4,842,574 | |

| Industrials — 21.41% | | | | | | | | |

| Applied Industrial Technologies, Inc. | | | 17,942 | | | | 1,844,079 | |

| BWX Technologies, Inc. | | | 34,563 | | | | 1,740,938 | |

| Copa Holdings, S.A., Class A(a) | | | 10,589 | | | | 709,569 | |

| Greenbrier Companies, Inc. (The) | | | 65,334 | | | | 1,585,656 | |

| Hub Group, Inc., Class A(a) | | | 26,660 | | | | 1,839,007 | |

| Huntington Ingalls Industries, Inc.(b) | | | 3,556 | | | | 787,654 | |

| Kirby Corp.(a) | | | 48,456 | | | | 2,944,672 | |

| XPO Logistics, Inc.(a) | | | 17,637 | | | | 785,199 | |

| | | | | | | | 12,236,774 | |

| Materials — 4.37% | | | | | | | | |

| Ashland Global Holdings, Inc.(b) | | | 19,292 | | | | 1,832,161 | |

| RPM International, Inc.(b) | | | 7,994 | | | | 665,980 | |

| | | | | | | | 2,498,141 | |

| Technology — 3.95% | | | | | | | | |

| JFrog Ltd.(a) | | | 38,710 | | | | 855,878 | |

| Nutanix, Inc., Class A(a)(b) | | | 19,421 | | | | 404,539 | |

| Verint Systems, Inc.(a) | | | 29,751 | | | | 999,039 | |

| | | | | | | | 2,259,456 | |

| Utilities — 2.56% | | | | | | | | |

| NorthWestern Corp. | | | 14,169 | | | | 698,248 | |

| Southwest Gas Holdings, Inc. | | | 10,984 | | | | 766,134 | |

| | | | | | | | 1,464,382 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $51,731,237) | | | | | | | 53,110,493 | |

See accompanying notes which are an integral part of these financial statements.

VELA SMALL CAP FUND

Schedule of Investments (continued)

September 30, 2022

| | | Number of | | | Notional | | | Exercise | | | Expiration | | | Fair | |

| Description | | Contracts | | | Amount | | | Price | | | Date | | | Value | |

| Put Options Purchased — 0.12% | | | | | | | | | | | | | | | | | | | |

| Energy Select Sector SPDR Fund | | | 325 | | | $ | 2,340,650 | | | $ | 62.00 | | | December 2022 | | | $ | 64,187 | |

| TOTAL PUT OPTIONS PURCHASED | | | | | | | | | | | | | | | | | | | |

| (Cost $124,404) | | | | | | | | | | | | | | | | | | 64,187 | |

| | | | | | | | | | | | | | | | | | | | |

| Money Market Funds — 7.17% | | | | | | | | | | | | | | | | | | | |

| Federated Hermes Treasury Obligations Fund, Institutional Shares, 2.84%(c) | | | | | | | 4,095,572 | | | | 4,095,572 | |

| | | | | | | | | | | | | | | | | | | | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | | | | | | | | | | | | |

| (Cost $4,095,572) | | | | | | | | | | | | | | | | | | 4,095,572 | |

| | | | | | | | | | | | | | | | | | | | |

| Total Investments — 100.20% | | | | | | | | | | | | | | | | | | | |

| (Cost $55,951,213) | | | | | | | | | | | | | | | | | | 57,270,252 | |

| Liabilities in Excess of Other Assets — (0.20)% | | | | | | | | | | | (114,069 | ) |

| Net Assets — 100.00% | | | | | | | | | | | | | | | | | $ | 57,156,183 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is held as collateral for written options. |

| (c) | Rate disclosed is the seven day effective yield as of September 30, 2022. |

See accompanying notes which are an integral part of these financial statements.

VELA SMALL CAP FUND

Schedule of Open Written Option Contracts

September 30, 2022

| | | Number of | | | Notional | | | Exercise | | | Expiration | | Fair | |

| Description | | Contracts | | | Amount | | | Price | | | Date | | Value | |

| Written Call Options — (0.11)% | | | | | | | | | | | | | | | | | | |

| Ashland Global Holdings, Inc. | | | (65 | ) | | $ | (617,305 | ) | | $ | 115.00 | | | January 2023 | | $ | (8,125 | ) |

| Civitas Resources, Inc. | | | (55 | ) | | | (315,645 | ) | | | 80.00 | | | January 2023 | | | (7,700 | ) |

| Coterra Energy, Inc. | | | (55 | ) | | | (143,660 | ) | | | 34.50 | | | January 2023 | | | (3,575 | ) |

| Devon Energy Corp. | | | (25 | ) | | | (150,325 | ) | | | 80.00 | | | January 2023 | | | (4,537 | ) |

| Huntington Ingalls Industries, Inc. | | | (20 | ) | | | (443,000 | ) | | | 250.00 | | | November 2022 | | | (4,000 | ) |

| MGP Ingredients, Inc. | | | (32 | ) | | | (339,712 | ) | | | 120.00 | | | December 2022 | | | (12,960 | ) |

| Nutanix, Inc. | | | (145 | ) | | | (302,035 | ) | | | 27.50 | | | January 2023 | | | (12,325 | ) |

| Performance Food Group Co. | | | (155 | ) | | | (665,725 | ) | | | 60.00 | | | December 2022 | | | (4,805 | ) |

| RPM International, Inc. | | | (50 | ) | | | (416,550 | ) | | | 100.00 | | | November 2022 | | | (2,300 | ) |

| Total Written Options | | | | | | | | | | | | | | | | | | |

| (Premiums Received $163,566) | | | | | | | | | | | | | | | | $ | (60,327 | ) |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Investments

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — 97.20% | | | | | | | | |

| Communications — 5.63% | | | | | | | | |

| Alphabet, Inc., Class A(a)(b) | | | 7,600 | | | $ | 726,940 | |

| Meta Platforms, Inc., Class A(a)(b)(c) | | | 3,066 | | | | 415,995 | |

| T-Mobile US, Inc.(a)(b)(c) | | | 4,267 | | | | 572,503 | |

| | | | | | | | 1,715,438 | |

| Consumer Discretionary — 11.01% | | | | | | | | |

| Aptiv PLC(a)(b)(c) | | | 4,797 | | | | 375,173 | |

| Home Depot, Inc. (The) | | | 1,941 | | | | 535,600 | |

| Live Nation Entertainment, Inc.(a) | | | 3,813 | | | | 289,941 | |

| NVR, Inc.(a) | | | 131 | | | | 522,307 | |

| O’Reilly Automotive, Inc.(a) | | | 680 | | | | 478,278 | |

| Polaris Industries, Inc. | | | 1,911 | | | | 182,787 | |

| Starbucks Corp. | | | 4,543 | | | | 382,793 | |

| TJX Cos., Inc. (The) | | | 9,479 | | | | 588,836 | |

| | | | | | | | 3,355,715 | |

| Consumer Staples — 5.66% | | | | | | | | |

| Dollar General Corp. | | | 2,121 | | | | 508,743 | |

| Kraft Heinz Co. (The) | | | 13,433 | | | | 447,991 | |

| PepsiCo, Inc. | | | 3,331 | | | | 543,819 | |

| Tyson Foods, Inc., Class A(b) | | | 3,402 | | | | 224,294 | |

| | | | | | | | 1,724,847 | |

| Energy — 7.83% | | | | | | | | |

| Baker Hughes Co.(b)(c) | | | 29,556 | | | | 619,494 | |

| EQT Corp.(b)(c) | | | 16,105 | | | | 656,278 | |

| Pioneer Natural Resources Co.(b)(c) | | | 2,403 | | | | 520,322 | |

| Suncor Energy, Inc.(b)(c) | | | 21,006 | | | | 591,319 | |

| | | | | | | | 2,387,413 | |

| Financials — 13.56% | | | | | | | | |

| Arch Capital Group Ltd.(a) | | | 12,759 | | | | 581,045 | |

| Bank of America Corp.(b)(c) | | | 19,396 | | | | 585,759 | |

| Berkshire Hathaway, Inc., Class B(a) | | | 3,773 | | | | 1,007,466 | |

| Goldman Sachs Group, Inc. (The)(b)(c) | | | 1,720 | | | | 504,046 | |

| MetLife, Inc. | | | 9,260 | | | | 562,823 | |

| SVB Financial Group(a)(b)(c) | | | 1,092 | | | | 366,672 | |

| Wells Fargo & Co. | | | 13,070 | | | | 525,675 | |

| | | | | | | | 4,133,486 | |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| Health Care — 19.09% | | | | | | | | |

| AbbVie, Inc.(b)(c) | | | 4,907 | | | $ | 658,568 | |

| Alnylam Pharmaceuticals, Inc.(a)(b)(c) | | | 3,325 | | | | 665,533 | |

| AstraZeneca PLC - ADR | | | 7,970 | | | | 437,075 | |

| BioMarin Pharmaceutical, Inc.(a) | | | 3,492 | | | | 296,017 | |

| Boston Scientific Corp.(a) | | | 15,604 | | | | 604,342 | |

| Denali Therapeutics, Inc.(a) | | | 3,005 | | | | 92,223 | |

| Encompass Health Corp. | | | 8,009 | | | | 362,247 | |

| Humana, Inc. | | | 1,518 | | | | 736,518 | |

| Jazz Pharmaceuticals PLC(a) | | | 1,567 | | | | 208,865 | |

| Johnson & Johnson | | | 3,132 | | | | 511,644 | |

| Lantheus Holdings, Inc.(a)(b)(c) | | | 2,342 | | | | 164,713 | |

| Medtronic PLC | | | 2,654 | | | | 214,311 | |

| Sarepta Therapeutics, Inc.(a) | | | 926 | | | | 102,360 | |

| Syneos Health, Inc.(a) | | | 3,445 | | | | 162,432 | |

| Vertex Pharmaceuticals, Inc.(a)(b)(c) | | | 2,083 | | | | 603,112 | |

| | | | | | | | 5,819,960 | |

| Industrials — 7.50% | | | | | | | | |

| CSX Corp. | | | 10,455 | | | | 278,521 | |

| Deere & Co. | | | 748 | | | | 249,750 | |

| FedEx Corp.(b)(c) | | | 2,684 | | | | 398,493 | |

| JB Hunt Transport Services, Inc. | | | 2,676 | | | | 418,580 | |

| Johnson Controls International PLC | | | 8,485 | | | | 417,632 | |

| Northrop Grumman Corp. | | | 1,110 | | | | 522,055 | |

| | | | | | | | 2,285,031 | |

| Materials — 2.61% | | | | | | | | |

| Avery Dennison Corp. | | | 1,544 | | | | 251,209 | |

| Linde PLC | | | 1,356 | | | | 365,563 | |

| Teck Resources Ltd., Class B(b) | | | 5,933 | | | | 180,423 | |

| | | | | | | | 797,195 | |

| Technology — 21.26% | | | | | | | | |

| Accenture PLC, Class A | | | 2,541 | | | | 653,800 | |

| Adobe, Inc.(a)(b)(c) | | | 1,405 | | | | 386,656 | |

| Apple, Inc.(b) | | | 7,900 | | | | 1,091,780 | |

| EPAM Systems, Inc.(a) | | | 423 | | | | 153,206 | |

| Microchip Technology, Inc.(b)(c) | | | 6,683 | | | | 407,863 | |

| Microsoft Corp. | | | 4,609 | | | | 1,073,437 | |

| Nutanix, Inc., Class A(a)(b) | | | 17,816 | | | | 371,107 | |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| Technology — (continued) | | | | | | | | |

| PayPal Holdings, Inc.(a) | | | 1,421 | | | $ | 122,305 | |

| S&P Global, Inc. | | | 967 | | | | 295,273 | |

| Salesforce.com, Inc.(a)(b)(c) | | | 4,251 | | | | 611,464 | |

| Teradyne, Inc.(b)(c) | | | 4,037 | | | | 303,381 | |

| Visa, Inc., Class A | | | 3,420 | | | | 607,563 | |

| VMware, Inc., Class A(b)(c) | | | 3,791 | | | | 403,590 | |

| | | | | | | | 6,481,425 | |

| Utilities — 3.05% | | | | | | | | |

| CenterPoint Energy, Inc. | | | 17,820 | | | | 502,167 | |

| Exelon Corp. | | | 11,425 | | | | 427,981 | |

| | | | | | | | 930,148 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $27,901,621) | | | | | | | 29,630,658 | |

| | | Number of | | | Notional | | | Exercise | | | Expiration | | Fair | |

| Description | | Contracts | | | Amount | | | Price | | | Date | | Value | |

| Call Options Purchased — 0.53% | | | | | | | | | | | | | | | | | | |

| Amazon.com, Inc. | | | 230 | | | $ | 2,599,000 | | | $ | 135.00 | | | January 2023 | | $ | 84,525 | |

| PayPal Holdings, Inc. | | | 70 | | | | 602,490 | | | | 110.00 | | | January 2023 | | | 19,985 | |

| Tesla, Inc. | | | 74 | | | | 1,962,850 | | | | 366.67 | | | January 2023 | | | 56,795 | |

| TOTAL CALL OPTIONS PURCHASED | | | | | | | | | | | | | | | | | | |

| (Cost $299,723) | | | | | | | | | | | | | | | | | 161,305 | |

| | | | | | | | | | | | | | | | | | | |

| Put Options Purchased — 1.43% | | | | | | | | | | | | | | | | | | |

| Apple, Inc. | | | 50 | | | | 691,000 | | | | 140.00 | | | January 2023 | | | 59,000 | |

| Chevron Corp. | | | 100 | | | | 1,436,700 | | | | 145.00 | | | December 2022 | | | 108,000 | |

| Microsoft Corp. | | | 25 | | | | 582,250 | | | | 225.00 | | | January 2023 | | | 33,625 | |

| Vertex Pharmaceuticals, Inc. | | | 25 | | | | 723,850 | | | | 250.00 | | | October 2022 | | | 2,313 | |

| Invesco DB Commodity Index Tracking Fund | | | 500 | | | | 1,195,500 | | | | 23.00 | | | October 2022 | | | 17,500 | |

| SPDR S&P 500 ETF Trust | | | 200 | | | | 7,143,600 | | | | 330.00 | | | January 2023 | | | 215,300 | |

| TOTAL PUT OPTIONS PURCHASED | | | | | | | | | | | | | | | | | | |

| (Cost $273,118) | | | | | | | | | | | | | | | | | 435,738 | |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Money Market Funds — 11.85% | | | | | | | | |

| Federated Hermes Treasury Obligations Fund, Institutional Shares, 2.84%(d) | | | 3,612,041 | | | $ | 3,612,041 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $3,612,041) | | | | | | | 3,612,041 | |

| | | | | | | | | |

| Total Investments — 111.01% | | | | | | | | |

| (Cost $32,086,503) | | | | | | | 33,839,742 | |

| Liabilities in Excess of Other Assets — (11.01)% | | | | | | | (3,354,659 | ) |

| Net Assets — 100.00% | | | | | | $ | 30,485,083 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is held as collateral for securities sold short. The fair value of this collateral on September 30, 2022, was $11,708,295. |

| (c) | All or a portion of the security is held as collateral for written options. |

| (d) | Rate disclosed is the seven day effective yield as of September 30, 2022. |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Open Written Options Contracts

September 30, 2022

| | | Number of | | | Notional | | | Exercise | | | Expiration | | Fair | |

| Description | | Contracts | | | Amount | | | Price | | | Date | | Value | |

| Written Call Options — (1.00)% | | | | | | | | | | | | | | | | | | |

| AbbVie, Inc. | | | (40 | ) | | $ | (536,840 | ) | | $ | 160.00 | | | January 2023 | | $ | (5,100 | ) |

| Adobe, Inc. | | | (10 | ) | | | (275,200 | ) | | | 360.00 | | | March 2023 | | | (7,300 | ) |

| Alnylam Pharmaceuticals, Inc. | | | (25 | ) | | | (500,400 | ) | | | 175.00 | | | January 2023 | | | (94,375 | ) |

| Aptiv PLC | | | (40 | ) | | | (312,840 | ) | | | 105.00 | | | January 2023 | | | (7,700 | ) |

| Baker Hughes Co. | | | (200 | ) | | | (419,200 | ) | | | 30.00 | | | January 2023 | | | (6,000 | ) |

| Bank of America Corp. | | | (100 | ) | | | (302,000 | ) | | | 37.00 | | | March 2023 | | | (7,600 | ) |

| EQT Corp. | | | (150 | ) | | | (611,250 | ) | | | 40.00 | | | January 2023 | | | (94,500 | ) |

| FedEx Corp. | | | (20 | ) | | | (296,940 | ) | | | 185.00 | | | January 2023 | | | (5,650 | ) |

| Goldman Sachs Group, Inc. (The) | | | (10 | ) | | | (293,050 | ) | | | 390.00 | | | January 2023 | | | (1,365 | ) |

| Lantheus Holdings, Inc. | | | (20 | ) | | | (140,660 | ) | | | 100.00 | | | January 2023 | | | (3,900 | ) |

| Meta Platforms, Inc. | | | (25 | ) | | | (339,200 | ) | | | 205.00 | | | December 2022 | | | (1,575 | ) |

| Microchip Technology, Inc. | | | (30 | ) | | | (183,090 | ) | | | 75.00 | | | January 2023 | | | (4,725 | ) |

| Nutanix, Inc. | | | (150 | ) | | | (312,450 | ) | | | 27.50 | | | January 2023 | | | (12,750 | ) |

| Pioneer Natural Resources Co. | | | (15 | ) | | | (324,795 | ) | | | 250.00 | | | January 2023 | | | (13,500 | ) |

| Salesforce.com, Inc. | | | (30 | ) | | | (431,520 | ) | | | 200.00 | | | January 2023 | | | (3,660 | ) |

| Suncor Energy, Inc. | | | (100 | ) | | | (281,500 | ) | | | 40.00 | | | June 2023 | | | (12,250 | ) |

| SVB Financial Group | | | (10 | ) | | | (335,780 | ) | | | 450.00 | | | December 2022 | | | (6,800 | ) |

| Teradyne, Inc. | | | (30 | ) | | | (225,450 | ) | | | 100.00 | | | January 2023 | | | (3,825 | ) |

| T-Mobile US, Inc. | | | (30 | ) | | | (402,510 | ) | | | 150.00 | | | November 2022 | | | (4,410 | ) |

| Vertex Pharmaceuticals, Inc. | | | (5 | ) | | | (144,770 | ) | | | 320.00 | | | January 2023 | | | (5,525 | ) |

| VMware, Inc. | | | (35 | ) | | | (372,610 | ) | | | 142.60 | | | January 2023 | | | (2,205 | ) |

| Total Written Options | | | | | | | | | | | | | | | | | | |

| (Premiums Received $405,864) | | | | | | | | | | | | | | | | $ | (304,715 | ) |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Securities Sold Short

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks - Short — (8.51%) | | | | | | | | |

| Communications — (0.28%) | | | | | | | | |

| Roblox Corp., Class A(a) | | | (2,394 | ) | | $ | (85,801 | ) |

| | | | | | | | | |

| Consumer Discretionary — (1.93%) | | | | | | | | |

| Advance Auto Parts, Inc. | | | (505 | ) | | | (78,952 | ) |

| BorgWarner, Inc. | | | (2,319 | ) | | | (72,817 | ) |

| Burlington Stores, Inc.(a) | | | (594 | ) | | | (66,463 | ) |

| Etsy, Inc.(a) | | | (966 | ) | | | (96,726 | ) |

| Ross Stores, Inc. | | | (990 | ) | | | (83,427 | ) |

| Tesla, Inc.(a) | | | (317 | ) | | | (84,084 | ) |

| Texas Roadhouse, Inc. | | | (1,191 | ) | | | (103,927 | ) |

| | | | | | | | (586,396 | ) |

| Consumer Staples — (0.54%) | | | | | | | | |

| Clorox Co. (The) | | | (610 | ) | | | (78,318 | ) |

| Hormel Foods Corp. | | | (1,924 | ) | | | (87,427 | ) |

| | | | | | | | (165,745 | ) |

| Energy — (0.49%) | | | | | | | | |

| Schlumberger Ltd. | | | (4,124 | ) | | | (148,052 | ) |

| | | | | | | | | |

| Financials — (0.88%) | | | | | | | | |

| Capital One Financial Corp. | | | (1,067 | ) | | | (98,345 | ) |

| Franklin Resources, Inc. | | | (3,129 | ) | | | (67,336 | ) |

| Jefferies Financial Group, Inc. | | | (3,500 | ) | | | (103,250 | ) |

| | | | | | | | (268,931 | ) |

| Health Care — (0.83%) | | | | | | | | |

| Avantor, Inc.(a) | | | (5,309 | ) | | | (104,056 | ) |

| Insulet Corp.(a) | | | (430 | ) | | | (98,642 | ) |

| Integra LifeSciences Holdings Corp.(a) | | | (1,197 | ) | | | (50,705 | ) |

| | | | | | | | (253,403 | ) |

| Industrials — (1.41%) | | | | | | | | |

| GFL Environmental, Inc. | | | (4,884 | ) | | | (123,516 | ) |

| Illinois Tool Works, Inc. | | | (711 | ) | | | (128,442 | ) |

| Rockwell Automation, Inc. | | | (400 | ) | | | (86,044 | ) |

| Watsco, Inc. | | | (354 | ) | | | (91,141 | ) |

| | | | | | | | (429,143 | ) |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Securities Sold Short (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks - Short — (continued) | | | | | | | | |

| Materials — (0.97%) | | | | | | | | |

| Albemarle Corp. | | | (400 | ) | | $ | (105,776 | ) |

| Nucor Corp. | | | (989 | ) | | | (105,813 | ) |

| Steel Dynamics, Inc. | | | (1,178 | ) | | | (83,579 | ) |

| | | | | | | | (295,168 | ) |

| Technology — (1.18%) | | | | | | | | |

| Applied Materials, Inc. | | | (881 | ) | | | (72,180 | ) |

| Equifax, Inc. | | | (566 | ) | | | (97,029 | ) |

| Logitech International S.A. | | | (2,449 | ) | | | (112,654 | ) |

| Moody’s Corp. | | | (322 | ) | | | (78,281 | ) |

| | | | | | | | (360,144 | ) |

| TOTAL COMMON STOCKS — SHORT | | | | | | | | |

| (Proceeds Received $3,106,173) | | | | | | | (2,592,783 | ) |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT — (8.51)% | | | | | | | | |

| (Proceeds Received $3,106,173) | | | | | | $ | (2,592,783 | ) |

| (a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

VELA INTERNATIONAL FUND

Schedule of Investments

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — 89.80% | | | | | | | | |

| Australia — 3.67% | | | | | | | | |

| Consumer Staples — 1.44% | | | | | | | | |

| Treasury Wine Estates Ltd. | | | 48,300 | | | $ | 388,603 | |

| | | | | | | | | |

| Health Care — 2.23% | | | | | | | | |

| Ansell Ltd. | | | 37,400 | | | | 601,723 | |

| Total Australia | | | | | | | 990,326 | |

| | | | | | | | | |

| Austria — 3.48% | | | | | | | | |

| Communications — 2.29% | | | | | | | | |

| Telekom Austria AG(a) | | | 107,000 | | | | 617,711 | |

| | | | | | | | | |

| Materials — 1.19% | | | | | | | | |

| Wienerberger AG | | | 16,000 | | | | 321,104 | |

| Total Austria | | | | | | | 938,815 | |

| | | | | | | | | |

| Belgium — 2.24% | | | | | | | | |

| Financials — 2.24% | | | | | | | | |

| KBC Group NV | | | 12,700 | | | | 602,581 | |

| Total Belgium | | | | | | | 602,581 | |

| | | | | | | | | |

| Canada — 9.84% | | | | | | | | |

| Consumer Staples — 2.12% | | | | | | | | |

| Empire Co., Ltd., Class A | | | 23,000 | | | | 572,186 | |

| | | | | | | | | |

| Energy — 2.77% | | | | | | | | |

| Suncor Energy, Inc. | | | 26,500 | | | | 745,975 | |

| | | | | | | | | |

| Industrials — 1.96% | | | | | | | | |

| Finning International, Inc. | | | 30,000 | | | | 527,383 | |

| | | | | | | | | |

| Materials — 2.99% | | | | | | | | |

| OceanaGold Corp.(a) | | | 495,000 | | | | 806,387 | |

| Total Canada | | | | | | | 2,651,931 | |

See accompanying notes which are an integral part of these financial statements.

VELA INTERNATIONAL FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| Denmark — 2.49% | | | | | | | | |

| Industrials — 2.49% | | | | | | | | |

| FLSmidth & Co. A/S | | | 31,000 | | | $ | 671,368 | |

| Total Denmark | | | | | | | 671,368 | |

| | | | | | | | | |

| France — 5.64% | | | | | | | | |

| Consumer Discretionary — 2.24% | | | | | | | | |

| Cia Generale de Establissements Michelin SCA | | | 27,000 | | | | 604,869 | |

| | | | | | | | | |

| Energy — 2.41% | | | | | | | | |

| TotalEnergies SE | | | 13,800 | | | | 647,329 | |

| | | | | | | | | |

| Industrials — 0.99% | | | | | | | | |

| Rexel SA | | | 17,800 | | | | 266,727 | |

| Total France | | | | | | | 1,518,925 | |

| | | | | | | | | |

| Germany — 9.22% | | | | | | | | |

| Consumer Discretionary — 1.79% | | | | | | | | |

| Fielmann AG | | | 15,000 | | | | 481,328 | |

| | | | | | | | | |

| Consumer Staples — 1.54% | | | | | | | | |

| Henkel AG & Co. KGaA | | | 7,000 | | | | 415,651 | |

| | | | | | | | | |

| Industrials — 1.12% | | | | | | | | |

| Duerr AG | | | 14,500 | | | | 301,468 | |

| | | | | | | | | |

| Materials — 3.23% | | | | | | | | |

| Covestro AG | | | 12,300 | | | | 351,628 | |

| Fuchs Petrolub SE | | | 23,600 | | | | 519,980 | |

| | | | | | | | 871,608 | |

| Technology — 1.54% | | | | | | | | |

| Infineon Technologies AG | | | 19,000 | | | | 415,738 | |

| Total Germany | | | | | | | 2,485,793 | |

| | | | | | | | | |

| Hong Kong — 7.04% | | | | | | | | |

| Consumer Staples — 2.77% | | | | | | | | |

| WH Group Ltd. | | | 1,190,000 | | | | 748,436 | |

See accompanying notes which are an integral part of these financial statements.

VELA INTERNATIONAL FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| Hong Kong — (continued) | | | | | | | | |

| Industrials — 2.03% | | | | | | | | |

| Johnson Electric Holdings Ltd. | | | 547,025 | | | $ | 546,070 | |

| | | | | | | | | |

| Technology — 2.24% | | | | | | | | |

| VTech Holdings Ltd. | | | 105,200 | | | | 603,162 | |

| Total Hong Kong | | | | | | | 1,897,668 | |

| | | | | | | | | |

| Iceland — 1.27% | | | | | | | | |

| Industrials — 1.27% | | | | | | | | |

| Marel HF | | | 113,285 | | | | 343,247 | |

| Total Iceland | | | | | | | 343,247 | |

| | | | | | | | | |

| Indonesia — 3.27% | | | | | | | | |

| Materials — 3.27% | | | | | | | | |

| United Tractors Tbk PT | | | 410,000 | | | | 880,301 | |

| Total Indonesia | | | | | | | 880,301 | |

| | | | | | | | | |

| Japan — 11.97% | | | | | | | | |

| Consumer Discretionary — 2.08% | | | | | | | | |

| Honda Motor Co. Ltd. | | | 25,800 | | | | 560,009 | |

| | | | | | | | | |

| Consumer Staples — 1.80% | | | | | | | | |

| Suntory Beverage & Food Ltd. | | | 13,600 | | | | 484,013 | |

| | | | | | | | | |

| Industrials — 2.39% | | | | | | | | |

| Okuma Corp. | | | 9,100 | | | | 312,498 | |

| OSG Corp. | | | 26,900 | | | | 332,738 | |

| | | | | | | | 645,236 | |

| Materials — 3.46% | | | | | | | | |

| Fuji Seal International, Inc. | | | 33,500 | | | | 354,762 | |

| Toray Industries, Inc. | | | 117,000 | | | | 575,854 | |

| | | | | | | | 930,616 | |

| Technology — 2.24% | | | | | | | | |

| Nintendo Co. Ltd. | | | 15,000 | | | | 605,015 | |

| Total Japan | | | | | | | 3,224,889 | |

See accompanying notes which are an integral part of these financial statements.

VELA INTERNATIONAL FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| Mexico — 4.18% | | | | | | | | |

| Consumer Staples — 4.18% | | | | | | | | |

| Gruma SAB de CV | | | 52,000 | | | $ | 495,199 | |

| Kimberly-Clark de Mexico SAB de CV | | | 475,000 | | | | 631,179 | |

| | | | | | | | 1,126,378 | |

| Total Mexico | | | | | | | 1,126,378 | |

| | | | | | | | | |

| Netherlands — 4.36% | | | | | | | | |

| Communications — 1.64% | | | | | | | | |

| Koninklijke KPN NV | | | 163,000 | | | | 441,075 | |

| | | | | | | | | |

| Financials — 2.72% | | | | | | | | |

| ING Groep NV | | | 85,800 | | | | 735,068 | |

| Total Netherlands | | | | | | | 1,176,143 | |

| | | | | | | | | |

| Sweden — 4.74% | | | | | | | | |

| Financials — 2.49% | | | | | | | | |

| Svenska Handelsbanken AB, Class A | | | 81,800 | | | | 671,407 | |

| | | | | | | | | |

| Industrials — 2.25% | | | | | | | | |

| Loomis AB | | | 24,600 | | | | 606,234 | |

| Total Sweden | | | | | | | 1,277,641 | |

| | | | | | | | | |

| Switzerland — 5.38% | | | | | | | | |

| Consumer Discretionary — 3.09% | | | | | | | | |

| Cie Financiere Richemont SA | | | 3,800 | | | | 358,706 | |

| Swatch Group AG (The) | | | 2,100 | | | | 471,661 | |

| | | | | | | | 830,367 | |

| Health Care — 2.29% | | | | | | | | |

| Roche Holding AG | | | 1,900 | | | | 618,519 | |

| Total Switzerland | | | | | | | 1,448,886 | |

| | | | | | | | | |

| United Kingdom — 11.01% | | | | | | | | |

| Communications — 3.39% | | | | | | | | |

| Informa PLC | | | 78,000 | | | | 445,903 | |

| WPP PLC | | | 56,900 | | | | 469,787 | |

| | | | | | | | 915,690 | |

See accompanying notes which are an integral part of these financial statements.

VELA INTERNATIONAL FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| United Kingdom — (continued) | | | | | | | | |

| Consumer Staples — 4.07% | | | | | | | | |

| Associated British Foods PLC | | | 39,000 | | | $ | 545,009 | |

| British American Tobacco PLC | | | 15,300 | | | | 548,697 | |

| | | | | | | | 1,093,706 | |

| Materials — 1.75% | | | | | | | | |

| DS Smith PLC | | | 167,200 | | | | 472,916 | |

| | | | | | | | | |

| Technology — 1.80% | | | | | | | | |

| Serco Group PLC | | | 280,000 | | | | 485,734 | |

| Total United Kingdom | | | | | | | 2,968,046 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $27,983,041) | | | | | | | 24,202,938 | |

| | | | | | | | | |

| Money Market Funds - 13.86% | | | | | | | | |

| Federated Hermes Treasury Obligations Fund, Institutional Shares, 2.84%(b) | | | 3,735,067 | | | | 3,735,067 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $3,735,067) | | | | | | | 3,735,067 | |

| | | | | | | | | |

| Total Investments — 103.66% | | | | | | | | |

| (Cost $31,718,108) | | | | | | | 27,938,005 | |

| Liabilities in Excess of Other Assets — (3.66)% | | | | | | | (987,109 | ) |

| Net Assets — 100.00% | | | | | | $ | 26,950,896 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of September 30, 2022. |

See accompanying notes which are an integral part of these financial statements.

VELA INCOME OPPORTUNITIES FUND

Schedule of Investments

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — 91.05% | | | | | | | | |

| Communications — 4.84% | | | | | | | | |

| Comcast Corp., Class A | | | 11,176 | | | $ | 327,792 | |

| Omnicom Group, Inc. | | | 6,477 | | | | 408,634 | |

| Verizon Communications, Inc. | | | 8,822 | | | | 334,971 | |

| | | | | | | | 1,071,397 | |

| Consumer Discretionary — 16.98% | | | | | | | | |

| Genuine Parts Co. | | | 3,059 | | | | 456,771 | |

| Hanesbrands, Inc. | | | 24,873 | | | | 173,116 | |

| Home Depot, Inc. (The) | | | 1,619 | | | | 446,747 | |

| Polaris Industries, Inc.(a) | | | 4,635 | | | | 443,338 | |

| Scotts Miracle-Gro Co. (The) | | | 10,394 | | | | 444,344 | |

| Starbucks Corp.(a) | | | 5,383 | | | | 453,571 | |

| TJX Cos., Inc. (The)(a) | | | 5,492 | | | | 341,163 | |

| Vail Resorts, Inc. | | | 1,547 | | | | 333,595 | |

| VF Corp. | | | 11,232 | | | | 335,949 | |

| Wendy’s Co. (The) | | | 17,788 | | | | 332,458 | |

| | | | | | | | 3,761,052 | |

| Consumer Staples — 11.43% | | | | | | | | |

| Coca-Cola Co. (The)(a) | | | 4,546 | | | | 254,667 | |

| Flowers Foods, Inc. | | | 22,586 | | | | 557,648 | |

| Kraft Heinz Co. (The)(a) | | | 16,850 | | | | 561,948 | |

| Mondelez International, Inc., Class A | | | 8,027 | | | | 440,120 | |

| PepsiCo, Inc.(a) | | | 1,673 | | | | 273,134 | |

| Sysco Corp. | | | 6,260 | | | | 442,645 | |

| | | | | | | | 2,530,162 | |

| Energy — 5.65% | | | | | | | | |

| Baker Hughes Co. | | | 16,040 | | | | 336,198 | |

| Civitas Resources, Inc.(a) | | | 8,124 | | | | 466,237 | |

| Suncor Energy, Inc.(a) | | | 15,926 | | | | 448,317 | |

| | | | | | | | 1,250,752 | |

| Financials — 12.46% | | | | | | | | |

| Ally Financial, Inc. | | | 7,945 | | | | 221,109 | |

| Axis Capital Holdings Ltd. | | | 4,624 | | | | 227,270 | |

| Bank OZK | | | 11,442 | | | | 452,646 | |

| Community Trust Bancorp, Inc. | | | 8,238 | | | | 334,051 | |

| JPMorgan Chase & Co. | | | 3,174 | | | | 331,683 | |

| Mercury General Corp. | | | 10,724 | | | | 304,776 | |

| Prudential Financial, Inc. | | | 3,889 | | | | 333,598 | |

See accompanying notes which are an integral part of these financial statements.

VELA INCOME OPPORTUNITIES FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| Communications — (continued) | | | | | | | | |

| Financials — (continued) | | | | | | | | |

| Washington Trust Bancorp, Inc. | | | 11,909 | | | $ | 553,530 | |

| | | | | | | | 2,758,663 | |

| Health Care — 9.91% | | | | | | | | |

| Abbott Laboratories | | | 4,586 | | | | 443,741 | |

| AbbVie, Inc.(a) | | | 3,312 | | | | 444,504 | |

| Johnson & Johnson | | | 2,802 | | | | 457,734 | |

| Medtronic PLC | | | 6,452 | | | | 520,999 | |

| National Healthcare Corp. | | | 5,158 | | | | 326,708 | |

| | | | | | | | 2,193,686 | |

| Industrials — 12.85% | | | | | | | | |

| BWX Technologies, Inc. | | | 6,622 | | | | 333,550 | |

| FedEx Corp. | | | 1,479 | | | | 219,587 | |

| Greenbrier Companies, Inc. (The) | | | 22,142 | | | | 537,386 | |

| Johnson Controls International PLC(a) | | | 9,074 | | | | 446,623 | |

| Norfolk Southern Corp.(a) | | | 2,108 | | | | 441,943 | |

| Northrop Grumman Corp.(a) | | | 751 | | | | 353,210 | |

| Stanley Black & Decker, Inc. | | | 2,434 | | | | 183,061 | |

| United Parcel Service, Inc., Class B | | | 2,048 | | | | 330,834 | |

| | | | | | | | 2,846,194 | |

| Materials — 3.53% | | | | | | | | |

| Linde PLC(a) | | | 1,243 | | | | 335,100 | |

| RPM International, Inc.(a) | | | 5,352 | | | | 445,875 | |

| | | | | | | | 780,975 | |

| Real Estate — 3.58% | | | | | | | | |

| Realty Income Corp. | | | 5,832 | | | | 339,422 | |

| Simon Property Group, Inc. | | | 5,056 | | | | 453,776 | |

| | | | | | | | 793,198 | |

| Technology — 5.80% | | | | | | | | |

| Cisco Systems, Inc.(a) | | | 5,521 | | | | 220,840 | |

| Fidelity National Information Services, Inc. | | | 5,868 | | | | 443,445 | |

| Intel Corp. | | | 6,821 | | | | 175,777 | |

| Texas Instruments, Inc.(a) | | | 2,866 | | | | 443,599 | |

| | | | | | | | 1,283,661 | |

See accompanying notes which are an integral part of these financial statements.

VELA INCOME OPPORTUNITIES FUND

Schedule of Investments (continued)

September 30, 2022

| | | | | | Fair | |

| | | Shares | | | Value | |

| Common Stocks — (continued) | | | | | | | | |

| Communications — (continued) | | | | | | | | |

| Utilities — 4.02% | | | | | | | | |

| Exelon Corp. | | | 11,877 | | | $ | 444,912 | |

| NorthWestern Corp. | | | 9,036 | | | | 445,295 | |

| | | | | | | | 890,207 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $23,440,866) | | | | | | | 20,159,947 | |

| | | | | | | | | |

| Preferred Stocks — 3.89% | | | | | | | | |

| Financials — 3.89% | | | | | | | | |

| Arch Capital Group Ltd., Series G, 4.55% | | | 15,451 | | | | 289,861 | |

| First Republic Bank, Series J, 4.70%, | | | 14,815 | | | | 285,781 | |

| SVB Financial Group, Series A, 5.25% | | | 13,685 | | | | 286,153 | |

| | | | | | | | 861,795 | |

| | | | | | | | | |

| TOTAL PREFERRED STOCKS | | | | | | | | |

| (Cost $880,399) | | | | | | | 861,795 | |

| | | | | | | | | |

| | | | Principal | | | | Fair | |

| | | | Amount | | | | Value | |

| Corporate Bonds — 1.42% | | | | | | | | |

| Consumer Discretionary — 0.49% | | | | | | | | |