UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23585

VELA Funds

(Exact name of registrant as specified in charter)

220 Market Street, Suite 208

New Albany, OH 43054

(Address of principal executive offices)

(Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

New Castle County

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Peter Schwartz, Esq.

Davis Graham & Stubbs LLP

1550 17th Street, Suite 500

Denver, CO 80202

and

Jesse D. Hallee

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

Registrant’s telephone number, including area code: 614-653-8352

Date of fiscal year end: September 30

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders.

VELA Income Opportunities Fund

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about VELA Income Opportunities Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $123 | 1.14% |

How did the Fund perform during the reporting period?

For the past twelve months, the Income Opportunities Fund - Class A (the “Fund”) returned 16.47% compared to 35.19% for the Russell 3000 Index and 22.96% for the Fund’s additional benchmark, a 50/50 blend between the Russell 3000 Index and the Bloomberg US Aggregate Index.

During the fiscal year, equity markets continued to benefit from strength in growth and technology stocks. Long-term interest rates remain elevated, but cooling inflation over the past two quarters culminated in the U.S. Federal Reserve's Chairman Jay Powell announcing a 50-basis point cut to the Fed Funds rate following the Fed’s September meeting, signaling a change in monetary policy1.

While we cannot predict what will happen to inflation or interest rates over the next five years, exiting the period we continue to believe the opportunity set in fixed income is more robust than it has been in some time and seek to continue to add opportunistically to our corporate bond holdings during the period.

We believe the Fund's mix of securities at period end sets the Fund up well to provide investors a competitive current yield and long-term price appreciation for an overall attractive risk-adjusted return.

The Fund ended the fiscal year with 100 holdings, including 38 common stocks, 51 corporate bonds, 3 US Treasuries, 7 preferred stocks, and 1 money market fund. Furthermore, the Fund had 28 outstanding call options written against certain of its underlying equity holdings. Based on the dollar value of our holdings, this equates to approximately 54% in common equities, 39.5% in fixed income, 4.5% in preferred equity and a little more than 2% in cash.

1 Source: Federal Reserve

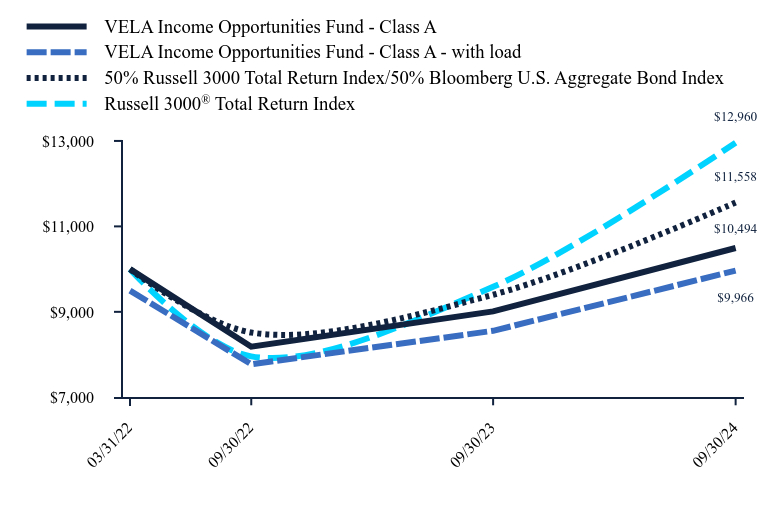

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA Income Opportunities Fund - Class A | VELA Income Opportunities Fund - Class A - with load | 50% Russell 3000 Total Return Index/50% Bloomberg U.S. Aggregate Bond Index | Russell 3000® Total Return Index |

|---|

| 03/31/22 | $10,000 | $9,497 | $10,000 | $10,000 |

| 09/30/22 | $8,185 | $7,773 | $8,516 | $7,958 |

| 09/30/23 | $9,010 | $8,556 | $9,400 | $9,586 |

| 09/30/24 | $10,494 | $9,966 | $11,558 | $12,960 |

Average Annual Total Returns

| 1 Year | Since Inception (March 31, 2022) |

|---|

| VELA Income Opportunities Fund - Class A | 16.47% | 1.95% |

| With Load | 10.62% | -0.14% |

| 50% Russell 3000 Total Return Index/50% Bloomberg U.S. Aggregate Bond Index | 22.96% | 5.65% |

Russell 3000® Total Return Index | 35.19% | 10.92% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$29,483,772

- Number of Portfolio Holdings128

- Advisory Fee $141,444

- Portfolio Turnover35%

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Greenbrier Companies, Inc. (The) | 3.6% |

| Medtronic PLC | 2.8% |

| Sysco Corp. | 2.6% |

| Suncor Energy, Inc. | 2.1% |

| Johnson & Johnson | 2.1% |

| Flowers Foods, Inc. | 2.1% |

| Starbucks Corp. | 1.9% |

| Fidelity National Information Services, Inc. | 1.9% |

| Kraft Heinz Co. (The) | 1.8% |

| Huntington Ingalls Industries, Inc. | 1.8% |

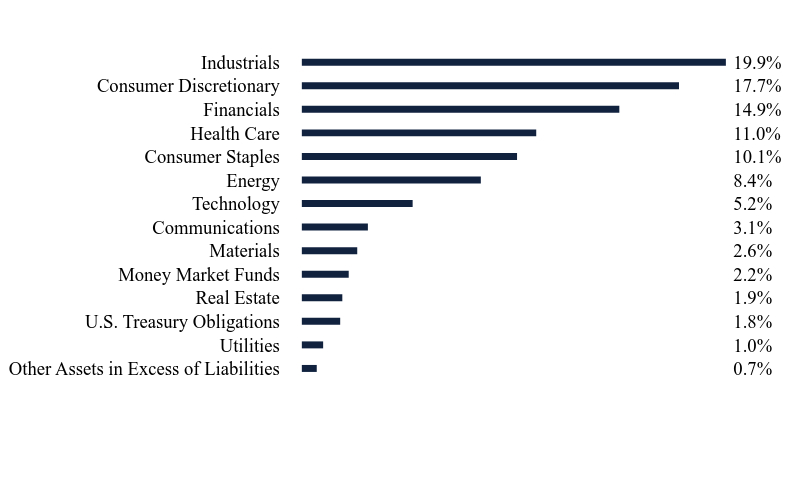

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| Utilities | 1.0% |

| U.S. Treasury Obligations | 1.8% |

| Real Estate | 1.9% |

| Money Market Funds | 2.2% |

| Materials | 2.6% |

| Communications | 3.1% |

| Technology | 5.2% |

| Energy | 8.4% |

| Consumer Staples | 10.1% |

| Health Care | 11.0% |

| Financials | 14.9% |

| Consumer Discretionary | 17.7% |

| Industrials | 19.9% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA Income Opportunities Fund - Class A (VIOAX)

Annual Shareholder Report - September 30, 2024

VELA Income Opportunities Fund

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about VELA Income Opportunities Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $96 | 0.89% |

How did the Fund perform during the reporting period?

For the past twelve months, the Income Opportunities Fund - Class I (the “Fund”) returned 16.76% compared to 35.19% for the Russell 3000 Index and 22.96% for the Fund’s additional benchmark, a 50/50 blend between the Russell 3000 Index and the Bloomberg US Aggregate Index.

During the fiscal year, equity markets continued to benefit from strength in growth and technology stocks. Long-term interest rates remain elevated, but cooling inflation over the past two quarters culminated in the U.S. Federal Reserve's Chairman Jay Powell announcing a 50-basis point cut to the Fed Funds rate following the Fed’s September meeting, signaling a change in monetary policy1.

While we cannot predict what will happen to inflation or interest rates over the next five years, exiting the period we continue to believe the opportunity set in fixed income is more robust than it has been in some time and seek to continue to add opportunistically to our corporate bond holdings during the period.

We believe the Fund's mix of securities at period end sets the Fund up well to provide investors a competitive current yield and long-term price appreciation for an overall attractive risk-adjusted return.

The Fund ended the fiscal year with 100 holdings, including 38 common stocks, 51 corporate bonds, 3 US Treasuries, 7 preferred stocks, and 1 money market fund. Furthermore, the Fund had 28 outstanding call options written against certain of its underlying equity holdings. Based on the dollar value of our holdings, this equates to approximately 54% in common equities, 39.5% in fixed income, 4.5% in preferred equity and a little more than 2% in cash.

1 Source: Federal Reserve

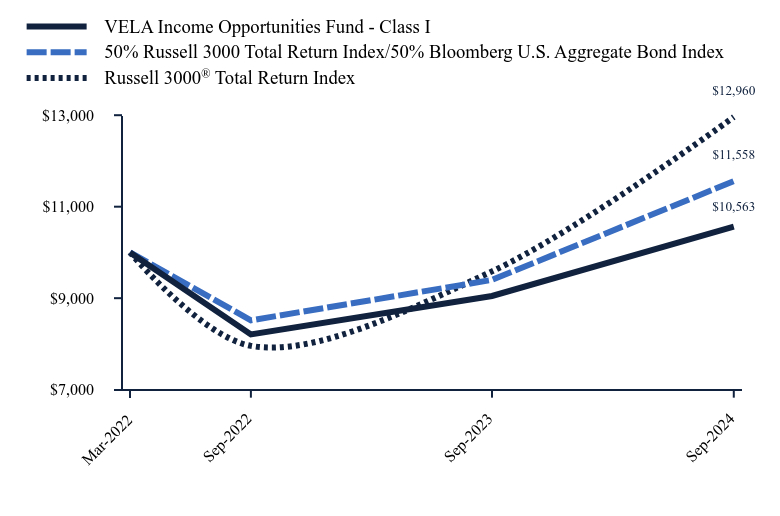

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA Income Opportunities Fund - Class I | 50% Russell 3000 Total Return Index/50% Bloomberg U.S. Aggregate Bond Index | Russell 3000® Total Return Index |

|---|

| Mar-2022 | $10,000 | $10,000 | $10,000 |

| Sep-2022 | $8,209 | $8,516 | $7,958 |

| Sep-2023 | $9,048 | $9,400 | $9,586 |

| Sep-2024 | $10,563 | $11,558 | $12,960 |

Average Annual Total Returns

| 1 Year | Since Inception (March 31, 2022) |

|---|

| VELA Income Opportunities Fund - Class I | 16.76% | 2.22% |

| 50% Russell 3000 Total Return Index/50% Bloomberg U.S. Aggregate Bond Index | 22.96% | 5.65% |

Russell 3000® Total Return Index | 35.19% | 10.92% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$29,483,772

- Number of Portfolio Holdings128

- Advisory Fee $141,444

- Portfolio Turnover35%

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Greenbrier Companies, Inc. (The) | 3.6% |

| Medtronic PLC | 2.8% |

| Sysco Corp. | 2.6% |

| Suncor Energy, Inc. | 2.1% |

| Johnson & Johnson | 2.1% |

| Flowers Foods, Inc. | 2.1% |

| Starbucks Corp. | 1.9% |

| Fidelity National Information Services, Inc. | 1.9% |

| Kraft Heinz Co. (The) | 1.8% |

| Huntington Ingalls Industries, Inc. | 1.8% |

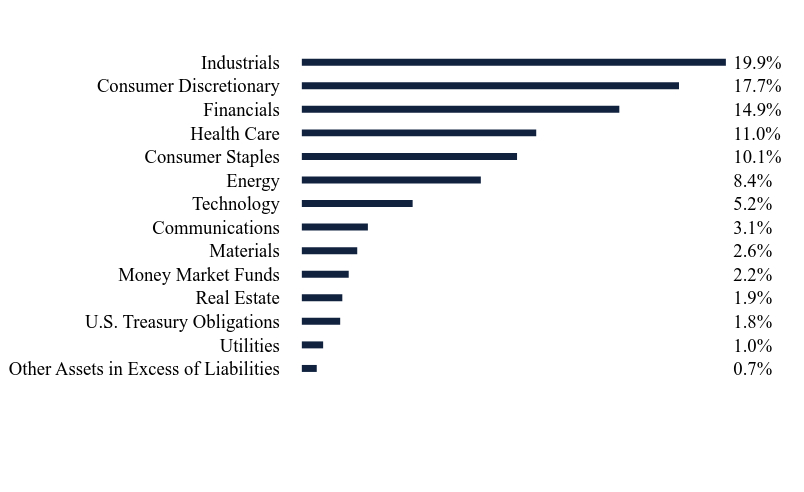

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| Utilities | 1.0% |

| U.S. Treasury Obligations | 1.8% |

| Real Estate | 1.9% |

| Money Market Funds | 2.2% |

| Materials | 2.6% |

| Communications | 3.1% |

| Technology | 5.2% |

| Energy | 8.4% |

| Consumer Staples | 10.1% |

| Health Care | 11.0% |

| Financials | 14.9% |

| Consumer Discretionary | 17.7% |

| Industrials | 19.9% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA Income Opportunities Fund - Class I (VIOIX)

Annual Shareholder Report - September 30, 2024

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about VELA International Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $152 | 1.39% |

How did the Fund perform during the reporting period?

The VELA International Fund - Class A (the “Fund”) returned 19.33%, compared to 24.98% for the Fund’s benchmark, the MSCI World ex USA Index. The recently completed fiscal year saw rising geopolitical tensions, uncertain Chinese economic policy shifts, euro-zone malaise, and was shadowed by the pending outcome of the US presidential elections. While this background noise can sometimes be quite deafening, we always find it easier to focus on the prospects of individual companies and how the market values those prospects. When we identify an investment opportunity which we feel is mispriced, our experience shows that the key attributes to weigh are company-specific ones and not macro factors. We continue to evaluate the Fund's portfolio given this background of macro noise and remain disciplined in seeking the best ideas, regardless of how the crosscurrents develop.

Selecting from an opportunity set which is three times larger than the US market, the Fund’s focus is active security selection of companies which meet our valuation requirements, those trading below our estimate of intrinsic value plus the incorporation of an adequate margin of safety. The Fund's portfolio is built from the bottom-up, seeking opportunities across the market capitalization spectrum: we go where we see value. As part of the selection process, we seek companies with balance sheet strength and prefer those which pay a current dividend. We also like to find management teams who we believe have demonstrated the ability to properly allocate capital, usually identified by high or improving returns on invested capital.

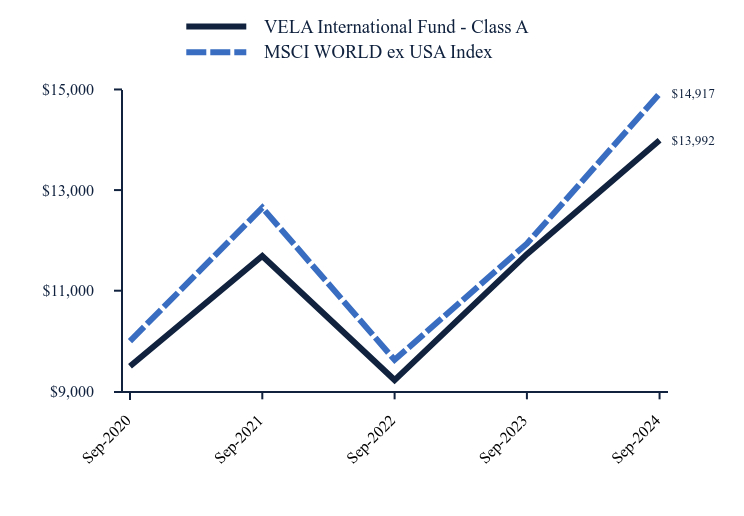

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA International Fund - Class A | MSCI WORLD ex USA Index |

|---|

| Sep-2020 | $9,497 | $10,000 |

| Sep-2021 | $11,690 | $12,650 |

| Sep-2022 | $9,224 | $9,625 |

| Sep-2023 | $11,726 | $11,935 |

| Sep-2024 | $13,992 | $14,917 |

Average Annual Total Returns

| 1 Year | Since Inception (September 30, 2020) |

|---|

| VELA International Fund - Class A | | |

| Without Load | 19.33% | 10.17% |

| With Load | 13.35% | 8.76% |

| MSCI WORLD ex USA Index | 24.98% | 10.51% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

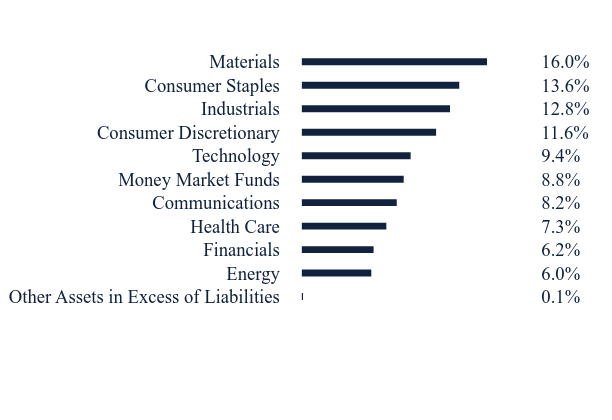

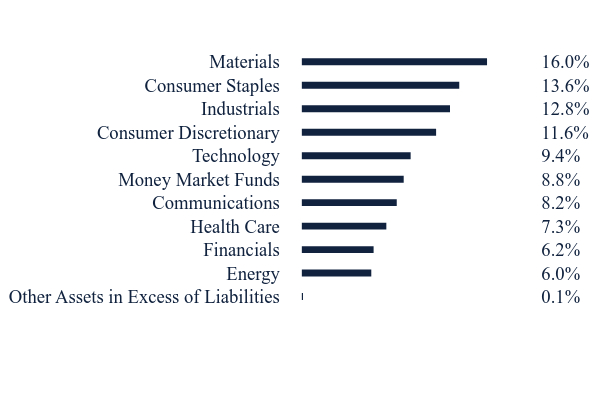

What did the Fund invest in?

- Net Assets$51,633,954

- Number of Portfolio Holdings54

- Advisory Fee $341,553

- Portfolio Turnover21%

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Energy | 6.0% |

| Financials | 6.2% |

| Health Care | 7.3% |

| Communications | 8.2% |

| Money Market Funds | 8.8% |

| Technology | 9.4% |

| Consumer Discretionary | 11.6% |

| Industrials | 12.8% |

| Consumer Staples | 13.6% |

| Materials | 16.0% |

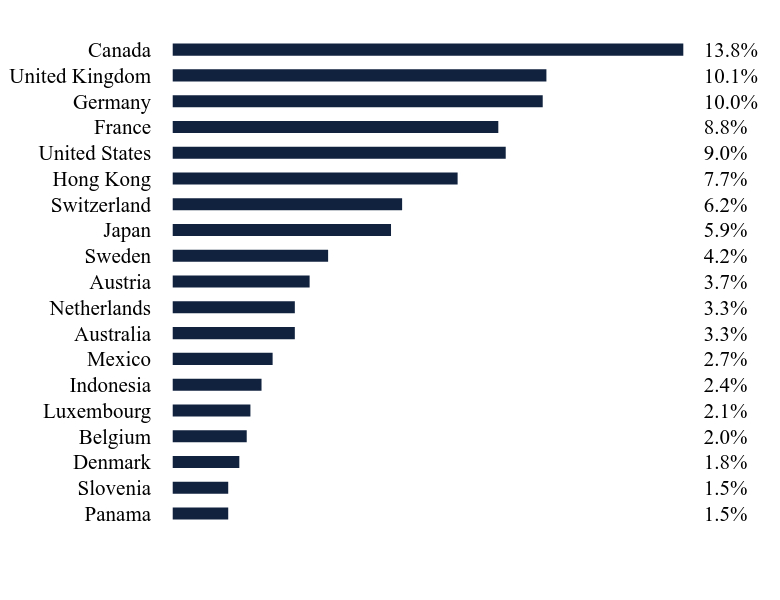

Country Weighting (% of net assets)

| Value | Value |

|---|

| Panama | 1.5% |

| Slovenia | 1.5% |

| Denmark | 1.8% |

| Belgium | 2.0% |

| Luxembourg | 2.1% |

| Indonesia | 2.4% |

| Mexico | 2.7% |

| Australia | 3.3% |

| Netherlands | 3.3% |

| Austria | 3.7% |

| Sweden | 4.2% |

| Japan | 5.9% |

| Switzerland | 6.2% |

| Hong Kong | 7.7% |

| United States | 9.0% |

| France | 8.8% |

| Germany | 10.0% |

| United Kingdom | 10.1% |

| Canada | 13.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| WH Group Ltd. 144A | 3.0% |

| Alamos Gold, Inc. - Class A | 2.7% |

| Roche Holding AG | 2.5% |

| Infineon Technologies AG | 2.5% |

| Empire Co., Ltd. - Class A | 2.5% |

| Serco Group PLC | 2.5% |

| United Tractors Tbk PT | 2.4% |

| Johnson Electric Holdings Ltd. | 2.4% |

| Criteo S.A. - ADR | 2.4% |

| Svenska Handelsbanken AB - Class A | 2.3% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA International Fund - Class A (VEILX)

Annual Shareholder Report - September 30, 2024

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about VELA International Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $125 | 1.14% |

How did the Fund perform during the reporting period?

The VELA International Fund - Class I (the “Fund”) returned 19.69%, compared to 24.98% for the Fund’s benchmark, the MSCI World ex USA Index. The recently completed fiscal year saw rising geopolitical tensions, uncertain Chinese economic policy shifts, euro-zone malaise, and was shadowed by the pending outcome of the US presidential elections. While this background noise can sometimes be quite deafening, we always find it easier to focus on the prospects of individual companies and how the market values those prospects. When we identify an investment opportunity which we feel is mispriced, our experience shows that the key attributes to weigh are company-specific ones and not macro factors. We continue to evaluate the Fund's portfolio given this background of macro noise and remain disciplined in seeking the best ideas, regardless of how the crosscurrents develop.

Selecting from an opportunity set which is three times larger than the US market, the Fund’s focus is active security selection of companies which meet our valuation requirements, those trading below our estimate of intrinsic value plus the incorporation of an adequate margin of safety. The Fund's portfolio is built from the bottom-up, seeking opportunities across the market capitalization spectrum: we go where we see value. As part of the selection process, we seek companies with balance sheet strength and prefer those which pay a current dividend. We also like to find management teams who we believe have demonstrated the ability to properly allocate capital, usually identified by high or improving returns on invested capital.

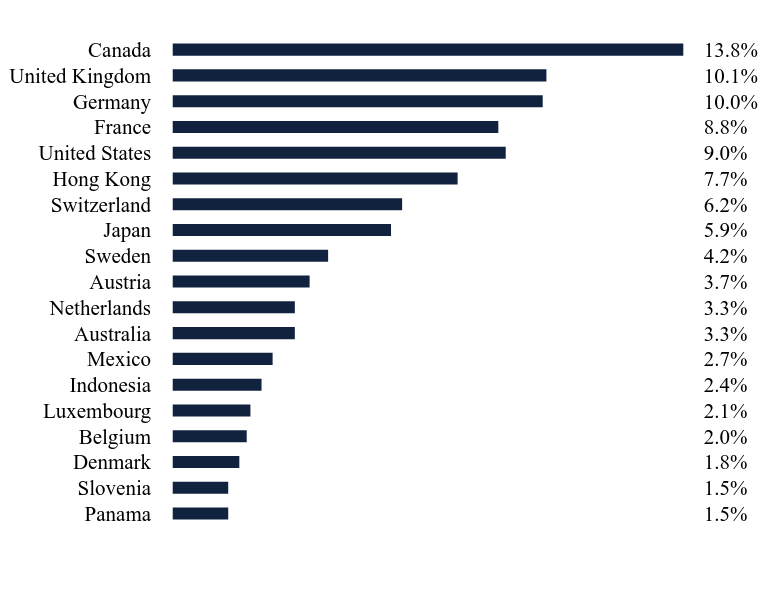

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA International Fund - Class I | MSCI WORLD ex USA Index |

|---|

| Sep-2020 | $10,000 | $10,000 |

| Sep-2021 | $12,360 | $12,650 |

| Sep-2022 | $9,784 | $9,625 |

| Sep-2023 | $12,453 | $11,935 |

| Sep-2024 | $14,905 | $14,917 |

Average Annual Total Returns

| 1 Year | Since Inception (September 30, 2020) |

|---|

| VELA International Fund - Class I | 19.69% | 10.49% |

| MSCI WORLD ex USA Index | 24.98% | 10.51% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

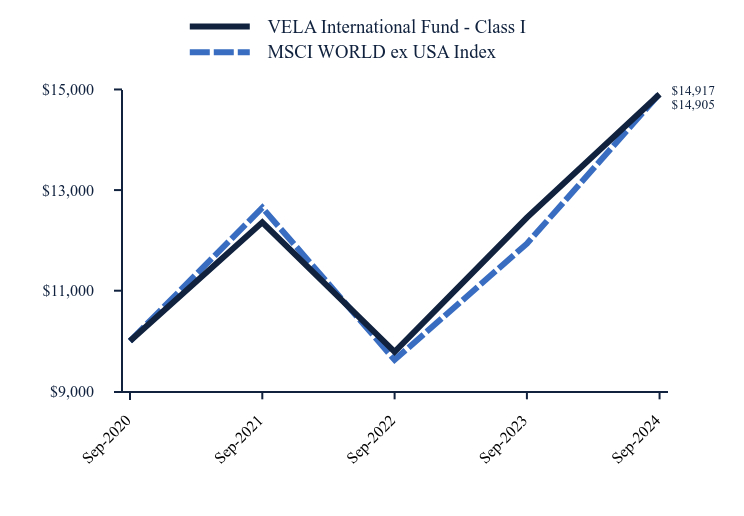

What did the Fund invest in?

- Net Assets$51,633,954

- Number of Portfolio Holdings54

- Advisory Fee $341,553

- Portfolio Turnover21%

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Energy | 6.0% |

| Financials | 6.2% |

| Health Care | 7.3% |

| Communications | 8.2% |

| Money Market Funds | 8.8% |

| Technology | 9.4% |

| Consumer Discretionary | 11.6% |

| Industrials | 12.8% |

| Consumer Staples | 13.6% |

| Materials | 16.0% |

Country Weighting (% of net assets)

| Value | Value |

|---|

| Panama | 1.5% |

| Slovenia | 1.5% |

| Denmark | 1.8% |

| Belgium | 2.0% |

| Luxembourg | 2.1% |

| Indonesia | 2.4% |

| Mexico | 2.7% |

| Australia | 3.3% |

| Netherlands | 3.3% |

| Austria | 3.7% |

| Sweden | 4.2% |

| Japan | 5.9% |

| Switzerland | 6.2% |

| Hong Kong | 7.7% |

| United States | 9.0% |

| France | 8.8% |

| Germany | 10.0% |

| United Kingdom | 10.1% |

| Canada | 13.8% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| WH Group Ltd. 144A | 3.0% |

| Alamos Gold, Inc. - Class A | 2.7% |

| Roche Holding AG | 2.5% |

| Infineon Technologies AG | 2.5% |

| Empire Co., Ltd. - Class A | 2.5% |

| Serco Group PLC | 2.5% |

| United Tractors Tbk PT | 2.4% |

| Johnson Electric Holdings Ltd. | 2.4% |

| Criteo S.A. - ADR | 2.4% |

| Svenska Handelsbanken AB - Class A | 2.3% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA International Fund - Class I (VEITX)

Annual Shareholder Report - September 30, 2024

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about VELA Large Cap Plus Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $150 | 1.34% |

How did the Fund perform during the reporting period?

For the fiscal year ended September 30, 2024, the VELA Large Cap Plus Fund - Class A returned 23.74% compared to 35.68% for the Russell 1000® Total Return Index and 35.19% for the Russell 3000® Index. Although value stocks staged a comeback in the final quarter, mega cap tech stocks drove a narrowly concentrated rally driven by enthusiasm about artificial intelligence.

We’ve remarked in the past that while there is little doubt that artificial intelligence is more substance than hype in aggregate, consumer facing applications are still in their infancy. History teaches us that capitalism drives competition, and we suspect that artificial intelligence could represent more of a long-term threat than opportunity for many of the current market leaders.

In our view, large cap valuations also reflect considerable optimism around the prospects of a “no landing” scenario for the global economy. Our focus remains on investing in companies with what we believe to be strong competitive moats and conservative balance sheets. However, at period end, the prospects for below average returns and the potential for unfavorable surprises has led us to bolster our defensive hedges such as option collars.

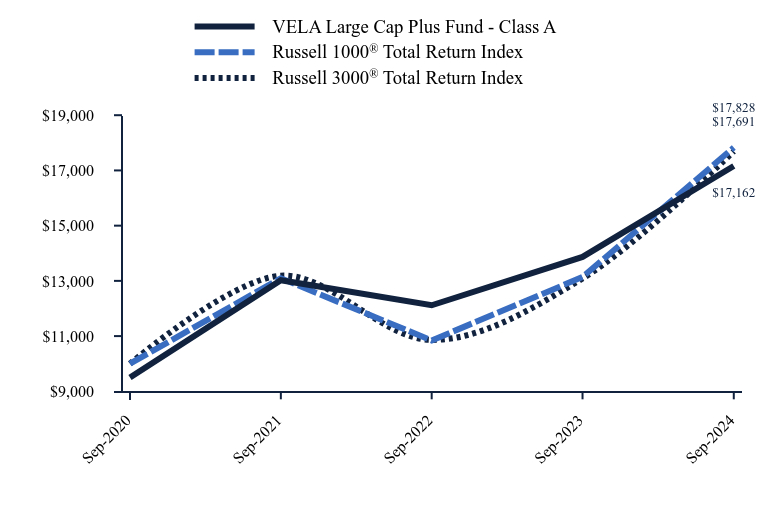

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA Large Cap Plus Fund - Class A | Russell 1000® Total Return Index | Russell 3000® Total Return Index |

|---|

| Sep-2020 | $9,497 | $10,000 | $10,000 |

| Sep-2021 | $13,023 | $13,096 | $13,188 |

| Sep-2022 | $12,116 | $10,842 | $10,863 |

| Sep-2023 | $13,869 | $13,140 | $13,086 |

| Sep-2024 | $17,162 | $17,828 | $17,691 |

Average Annual Total Returns

| 1 Year | Since Inception (September 30, 2020) |

|---|

| VELA Large Cap Plus Fund - Class A | | |

| Without Load | 23.74% | 15.94% |

| With Load | 17.56% | 14.46% |

Russell 1000® Total Return Index | 35.68% | 15.55% |

Russell 3000® Total Return Index | 35.19% | 15.33% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$72,000,604

- Number of Portfolio Holdings136

- Advisory Fee $479,426

- Portfolio Turnover62%

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Microsoft Corp. | 4.7% |

| Alphabet, Inc. - Class A | 4.0% |

| Amazon.com, Inc. | 3.4% |

| Meta Platforms, Inc. - Class A | 3.0% |

| Berkshire Hathaway, Inc. - Class B | 2.9% |

| Johnson & Johnson | 2.8% |

| 3M Co. | 2.5% |

| Microchip Technology, Inc. | 2.3% |

| JB Hunt Transport Services, Inc. | 2.3% |

| Salesforce, Inc. | 2.3% |

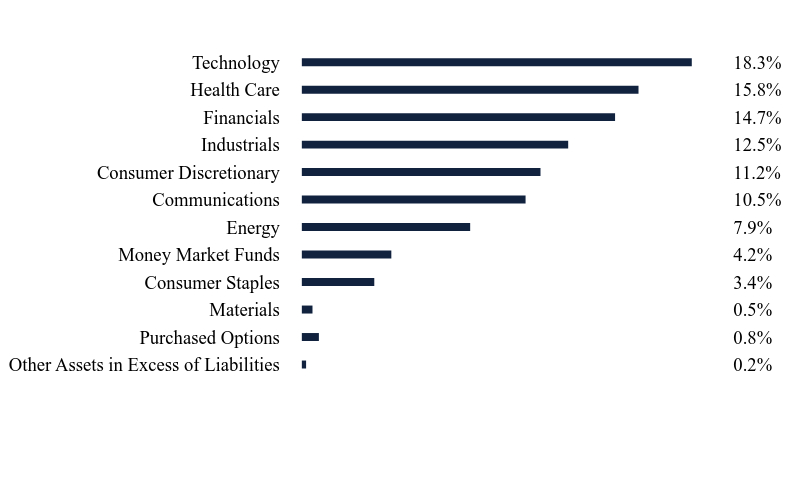

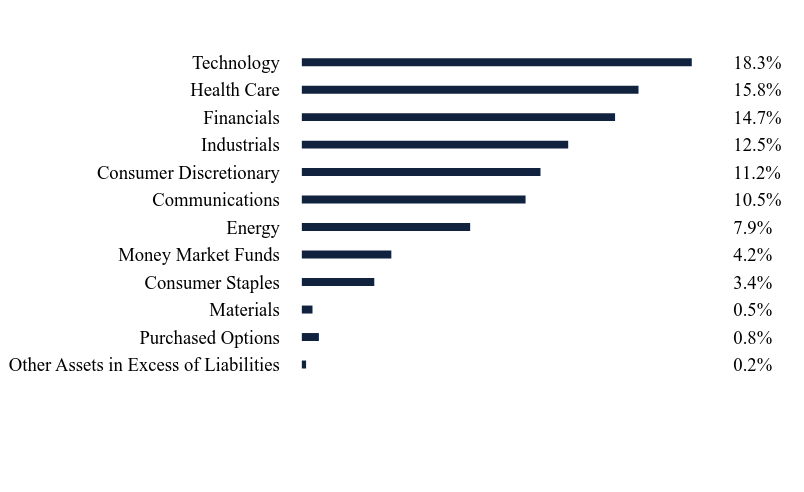

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.2% |

| Purchased Options | 0.8% |

| Materials | 0.5% |

| Consumer Staples | 3.4% |

| Money Market Funds | 4.2% |

| Energy | 7.9% |

| Communications | 10.5% |

| Consumer Discretionary | 11.2% |

| Industrials | 12.5% |

| Financials | 14.7% |

| Health Care | 15.8% |

| Technology | 18.3% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual management fee of the Fund from an annual rate of 0.75% to 0.60% and reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA Large Cap Plus Fund - Class A (VELAX)

Annual Shareholder Report - September 30, 2024

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about VELA Large Cap Plus Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $122 | 1.09% |

How did the Fund perform during the reporting period?

For the fiscal year ended September 30, 2024, the VELA Large Cap Plus Fund - Class I returned 24.04% compared to 35.68% for the Russell 1000® Total Return Index and 35.19% for the Russell 3000® Index. Although value stocks staged a comeback in the final quarter, mega cap tech stocks drove a narrowly concentrated rally driven by enthusiasm about artificial intelligence.

We’ve remarked in the past that while there is little doubt that artificial intelligence is more substance than hype in aggregate, consumer facing applications are still in their infancy. History teaches us that capitalism drives competition, and we suspect that artificial intelligence could represent more of a long-term threat than opportunity for many of the current market leaders.

In our view, large cap valuations also reflect considerable optimism around the prospects of a “no landing” scenario for the global economy. Our focus remains on investing in companies with what we believe to be strong competitive moats and conservative balance sheets. However, at period end, the prospects for below average returns and the potential for unfavorable surprises has led us to bolster our defensive hedges such as option collars.

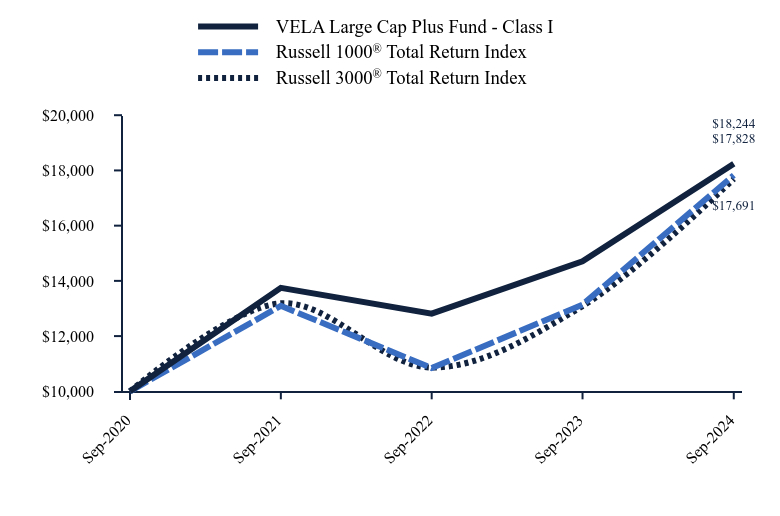

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA Large Cap Plus Fund - Class I | Russell 1000® Total Return Index | Russell 3000® Total Return Index |

|---|

| Sep-2020 | $10,000 | $10,000 | $10,000 |

| Sep-2021 | $13,746 | $13,096 | $13,188 |

| Sep-2022 | $12,811 | $10,842 | $10,863 |

| Sep-2023 | $14,709 | $13,140 | $13,086 |

| Sep-2024 | $18,244 | $17,828 | $17,691 |

Average Annual Total Returns

| 1 Year | Since Inception (September 30, 2020) |

|---|

| VELA Large Cap Plus Fund - Class I | 24.04% | 16.22% |

Russell 1000® Total Return Index | 35.68% | 15.55% |

Russell 3000® Total Return Index | 35.19% | 15.33% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$72,000,604

- Number of Portfolio Holdings136

- Advisory Fee $479,426

- Portfolio Turnover62%

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Microsoft Corp. | 4.7% |

| Alphabet, Inc. - Class A | 4.0% |

| Amazon.com, Inc. | 3.4% |

| Meta Platforms, Inc. - Class A | 3.0% |

| Berkshire Hathaway, Inc. - Class B | 2.9% |

| Johnson & Johnson | 2.8% |

| 3M Co. | 2.5% |

| Microchip Technology, Inc. | 2.3% |

| JB Hunt Transport Services, Inc. | 2.3% |

| Salesforce, Inc. | 2.3% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.2% |

| Purchased Options | 0.8% |

| Materials | 0.5% |

| Consumer Staples | 3.4% |

| Money Market Funds | 4.2% |

| Energy | 7.9% |

| Communications | 10.5% |

| Consumer Discretionary | 11.2% |

| Industrials | 12.5% |

| Financials | 14.7% |

| Health Care | 15.8% |

| Technology | 18.3% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual management fee of the Fund from an annual rate of 0.75% to 0.60% and reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA Large Cap Plus Fund - Class I (VELIX)

Annual Shareholder Report - September 30, 2024

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about VELA Short Duration Fund (the "Fund") for the period of December 15, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $96 | 0.94% |

How did the Fund perform during the reporting period?

Inception-to-date, the Short Duration Fund - Class A (the “Fund”) generated a total return of 4.05% versus the benchmark return of 4.86% (unannualized) and 5.10% for the Bloomberg U.S. Aggregate Bond Index.

We have constructed the portfolio with a mixture of high-grade US government treasuries and agencies, cash, and corporate bonds – mostly with fixed rate coupons with a smaller allocation to floating rate securities, with a mix of investment grade and below investment grade rated issues.

Throughout the summer, we saw indications from the Federal Reserve of a potential lower-interest rate environment, culminating with a rate cut of 50 basis points at the end of September1,2. Over the period, we focused on positioning the portfolio accordingly.

Since inception, we have continued to upgrade the Fund’s overall credit profile with the goal of generating attractive risk-adjusted returns via a mix of higher-coupon bonds, which provide a steady stream of current income, and lower-coupon, longer-dated bonds which provide price appreciation potential in a declining-rate environment.

1,2 Source: Trading Economics

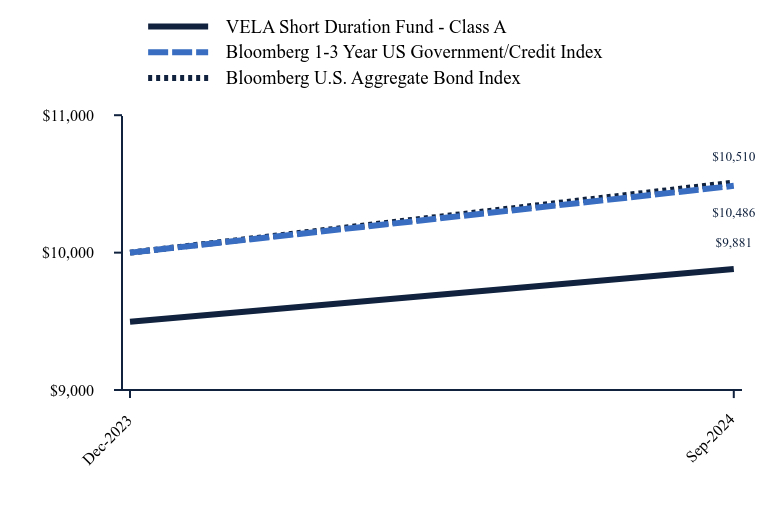

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA Short Duration Fund - Class A | Bloomberg 1-3 Year US Government/Credit Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| Dec-2023 | $9,497 | $10,000 | $10,000 |

| Sep-2024 | $9,881 | $10,486 | $10,510 |

Average Annual Total Returns

| Since Inception (December 15, 2023) |

|---|

| VELA Short Duration Fund - Class A | |

| Without Load | 4.05% |

| With Load | -1.19% |

| Bloomberg 1-3 Year US Government/Credit Index | 4.86% |

| Bloomberg U.S. Aggregate Bond Index | 5.10% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$18,442,660

- Number of Portfolio Holdings102

- Advisory Fee $26,770

- Portfolio Turnover66%

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Note | 1.9% |

| United States Treasury Note | 1.6% |

| Radian Group Inc. | 1.4% |

| Essent Group, Ltd. | 1.4% |

| United Rentals North America, Inc. 144A | 1.4% |

| Harley-Davidson Financial Services, Inc. 144A | 1.4% |

| Berry Global, Inc. 144A | 1.4% |

| Performance Food Group Inc. 144A | 1.4% |

| United States Treasury Bill | 1.4% |

| Installed Building Products, Inc. 144A | 1.4% |

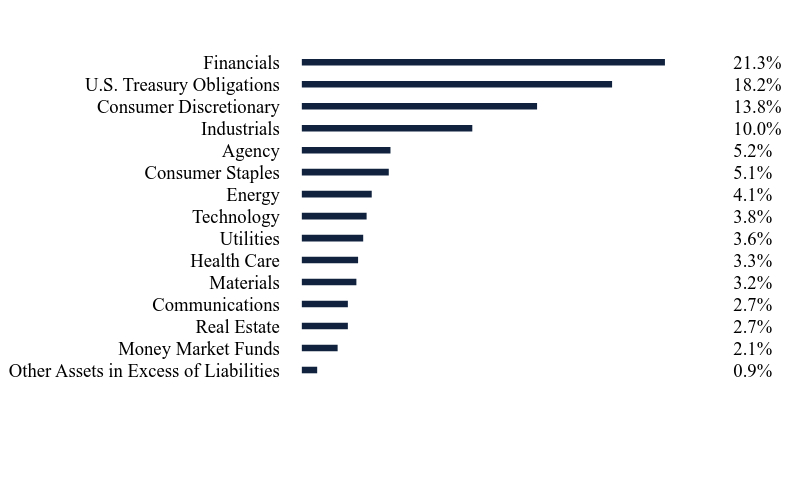

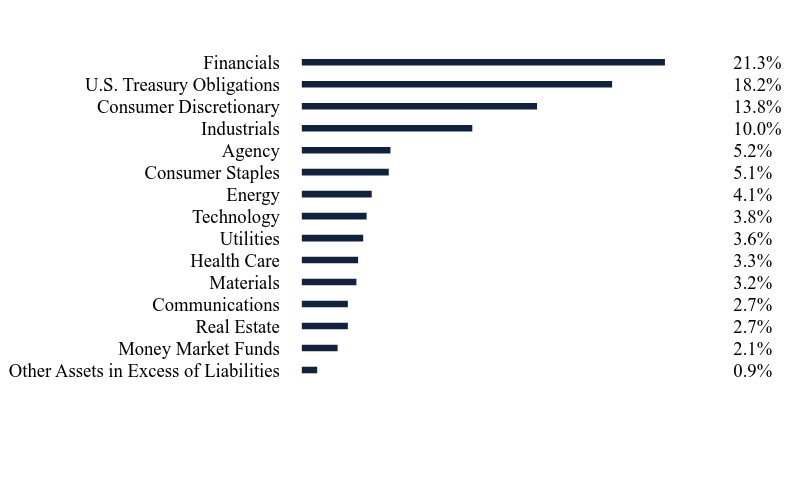

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Money Market Funds | 2.1% |

| Real Estate | 2.7% |

| Communications | 2.7% |

| Materials | 3.2% |

| Health Care | 3.3% |

| Utilities | 3.6% |

| Technology | 3.8% |

| Energy | 4.1% |

| Consumer Staples | 5.1% |

| Agency | 5.2% |

| Industrials | 10.0% |

| Consumer Discretionary | 13.8% |

| U.S. Treasury Obligations | 18.2% |

| Financials | 21.3% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA Short Duration Fund - Class A (VASDX)

Annual Shareholder Report - September 30, 2024

Annual Shareholder Report - September 30, 2024

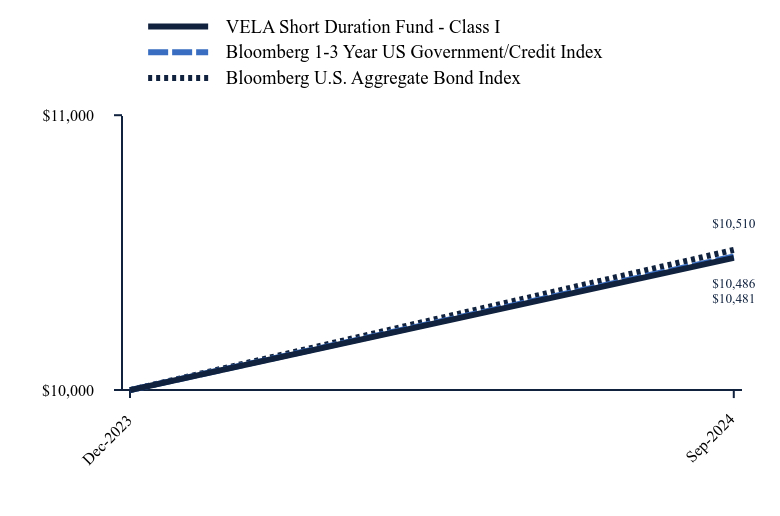

This annual shareholder report contains important information about VELA Short Duration Fund (the "Fund") for the period of December 15, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $71 | 0.69% |

How did the Fund perform during the reporting period?

Inception-to-date, the Short Duration Fund - Class I (the “Fund”) generated a total return of 4.81% versus the benchmark return of 4.86% (unannualized) and 5.10% for the Bloomberg U.S. Aggregate Bond Index.

We have constructed the portfolio with a mixture of high-grade US government treasuries and agencies, cash, and corporate bonds – mostly with fixed rate coupons with a smaller allocation to floating rate securities, with a mix of investment grade and below investment grade rated issues.

Throughout the summer, we saw indications from the Federal Reserve of a potential lower-interest rate environment, culminating with a rate cut of 50 basis points at the end of September1,2. Over the period, we focused on positioning the portfolio accordingly.

Since inception, we have continued to upgrade the Fund’s overall credit profile with the goal of generating attractive risk-adjusted returns via a mix of higher-coupon bonds, which provide a steady stream of current income, and lower-coupon, longer-dated bonds which provide price appreciation potential in a declining-rate environment.

1,2 Source: Trading Economics

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA Short Duration Fund - Class I | Bloomberg 1-3 Year US Government/Credit Index | Bloomberg U.S. Aggregate Bond Index |

|---|

| Dec-2023 | $10,000 | $10,000 | $10,000 |

| Sep-2024 | $10,481 | $10,486 | $10,510 |

Average Annual Total Returns

| Since Inception (December 15, 2023) |

|---|

| VELA Short Duration Fund - Class I | 4.81% |

| Bloomberg 1-3 Year US Government/Credit Index | 4.86% |

| Bloomberg U.S. Aggregate Bond Index | 5.10% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$18,442,660

- Number of Portfolio Holdings102

- Advisory Fee $26,770

- Portfolio Turnover66%

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Note | 1.9% |

| United States Treasury Note | 1.6% |

| Radian Group Inc. | 1.4% |

| Essent Group, Ltd. | 1.4% |

| United Rentals North America, Inc. 144A | 1.4% |

| Harley-Davidson Financial Services, Inc. 144A | 1.4% |

| Berry Global, Inc. 144A | 1.4% |

| Performance Food Group Inc. 144A | 1.4% |

| United States Treasury Bill | 1.4% |

| Installed Building Products, Inc. 144A | 1.4% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Money Market Funds | 2.1% |

| Real Estate | 2.7% |

| Communications | 2.7% |

| Materials | 3.2% |

| Health Care | 3.3% |

| Utilities | 3.6% |

| Technology | 3.8% |

| Energy | 4.1% |

| Consumer Staples | 5.1% |

| Agency | 5.2% |

| Industrials | 10.0% |

| Consumer Discretionary | 13.8% |

| U.S. Treasury Obligations | 18.2% |

| Financials | 21.3% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA Short Duration Fund - Class I (VESDX)

Annual Shareholder Report - September 30, 2024

Annual Shareholder Report - September 30, 2024

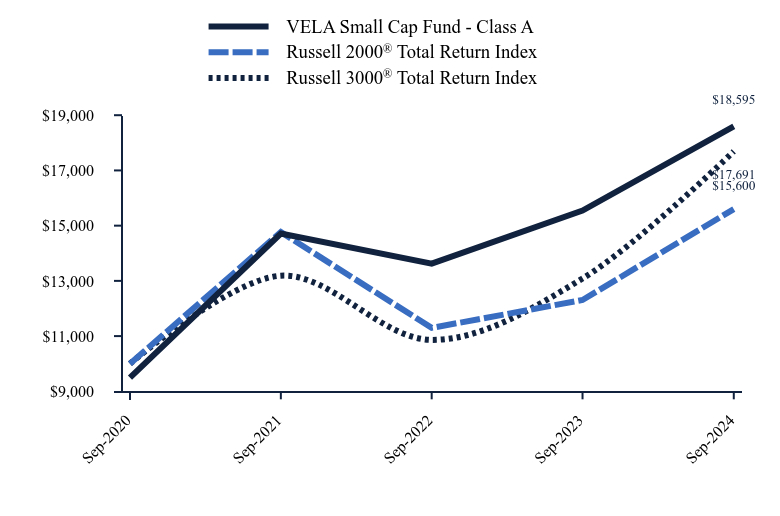

This annual shareholder report contains important information about VELA Small Cap Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $153 | 1.39% |

How did the Fund perform during the reporting period?

For the fiscal year ended September 30, 2024, the VELA Small Cap Fund - Class A (the “Fund”) performed well on an absolute basis, returning 19.61%, but trailed on a relative basis, with the Russell 2000® Index returning 26.76% and the Russell 3000® Index returning 35.19%. Trailing the benchmark in a period of strong equity market performance driven by macroeconomic factors is consistent with our expectations. Over the long-term, we expect our stock picking to drive our performance, and periods of macroeconomic euphoria or depression often provide opportunities to enhance the Fund’s total return potential.

Small cap valuations continued to remain attractive to us during the period despite strong market performance, and we took advantage of opportunities to seek to add to several new positions over the period by exiting existing positions and reducing the Fund's exposure to companies approaching our estimates of intrinsic value. As the end of the year approached, turnover was elevated as we took opportunities to seek to offset realized long-term capital gains with losses and our investment team continued to turn out new ideas.

The core of our strategy focuses on businesses with what we believe to be strong balance sheets that are generally less reliant on the capital markets for growth. While there is no free lunch, we believe maintaining this discipline has proven essential to running a concentrated small cap strategy that can outperform over the long-term. As of the period end, the Fund was invested in 54 businesses, a total that reflects the attractiveness of the small cap investment universe and the realities of investing the Fund in a tax efficient manner. We are pleased with the Fund’s positioning (well concentrated in our highest conviction ideas with our top ten holdings representing greater than 35% of Fund assets) and remain focused on providing favorable risk and tax adjusted returns.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA Small Cap Fund - Class A | Russell 2000® Total Return Index | Russell 3000® Total Return Index |

|---|

| Sep-2020 | $9,497 | $10,000 | $10,000 |

| Sep-2021 | $14,715 | $14,768 | $13,188 |

| Sep-2022 | $13,624 | $11,298 | $10,863 |

| Sep-2023 | $15,547 | $12,307 | $13,086 |

| Sep-2024 | $18,595 | $15,600 | $17,691 |

Average Annual Total Returns

| 1 Year | Since Inception (September 30, 2020) |

|---|

| VELA Small Cap Fund - Class A | | |

| Without Load | 19.61% | 18.29% |

| With Load | 13.62% | 16.77% |

Russell 2000® Total Return Index | 26.76% | 11.76% |

Russell 3000® Total Return Index | 35.19% | 15.33% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$107,224,433

- Number of Portfolio Holdings85

- Advisory Fee $670,989

- Portfolio Turnover47%

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Kirby Corp. | 5.5% |

| Hub Group, Inc. - Class A | 4.5% |

| Graham Holdings Co. - Class B | 3.8% |

| Applied Industrial Technologies, Inc. | 3.7% |

| Range Resources Corp. | 3.4% |

| Coca-Cola Consolidated, Inc. | 3.2% |

| Greenbrier Companies, Inc. (The) | 3.2% |

| Axis Capital Holdings Ltd. | 3.1% |

| Performance Food Group Co. | 3.0% |

| Seaboard Corp. | 2.7% |

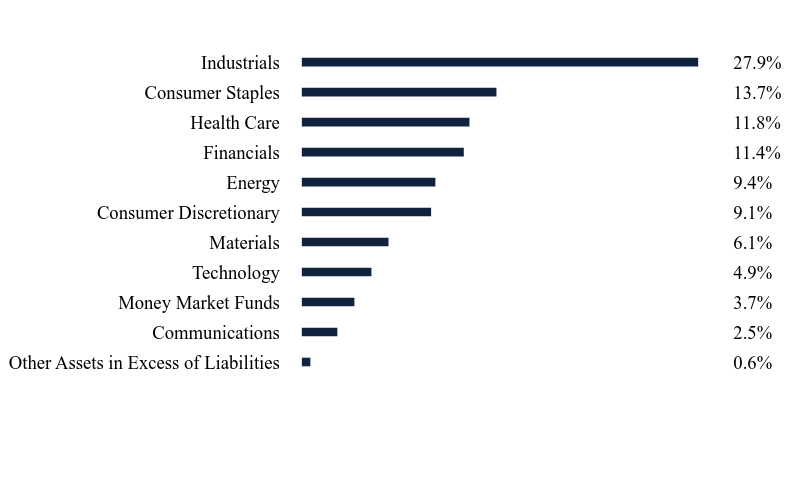

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Communications | 2.5% |

| Money Market Funds | 3.7% |

| Technology | 4.9% |

| Materials | 6.1% |

| Consumer Discretionary | 9.1% |

| Energy | 9.4% |

| Financials | 11.4% |

| Health Care | 11.8% |

| Consumer Staples | 13.7% |

| Industrials | 27.9% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA Small Cap Fund - Class A (VESAX)

Annual Shareholder Report - September 30, 2024

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about VELA Small Cap Fund (the "Fund") for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.velafunds.com/strategies.html?stab=doc. You can also request this information by contacting us at 1-833-399-1001. This report describes changes to the Fund that occurred after the reporting period as described below in Material Fund Changes.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $125 | 1.14% |

How did the Fund perform during the reporting period?

For the fiscal year ended September 30, 2024, the VELA Small Cap Fund - Class I (the “Fund”) performed well on an absolute basis, returning 19.92%, but trailed on a relative basis, with the Russell 2000® Index returning 26.76% and the Russell 3000® Index returning 35.19%. Trailing the benchmark in a period of strong equity market performance driven by macroeconomic factors is consistent with our expectations. Over the long-term, we expect our stock picking to drive our performance, and periods of macroeconomic euphoria or depression often provide opportunities to enhance the Fund’s total return potential.

Small cap valuations continued to remain attractive to us during the period despite strong market performance, and we took advantage of opportunities to seek to add to several new positions over the period by exiting existing positions and reducing the Fund's exposure to companies approaching our estimates of intrinsic value. As the end of the year approached, turnover was elevated as we took opportunities to seek to offset realized long-term capital gains with losses and our investment team continued to turn out new ideas.

The core of our strategy focuses on businesses with what we believe to be strong balance sheets that are generally less reliant on the capital markets for growth. While there is no free lunch, we believe maintaining this discipline has proven essential to running a concentrated small cap strategy that can outperform over the long-term. As of the period end, the Fund was invested in 54 businesses, a total that reflects the attractiveness of the small cap investment universe and the realities of investing the Fund in a tax efficient manner. We are pleased with the Fund’s positioning (well concentrated in our highest conviction ideas with our top ten holdings representing greater than 35% of Fund assets) and remain focused on providing favorable risk and tax adjusted returns.

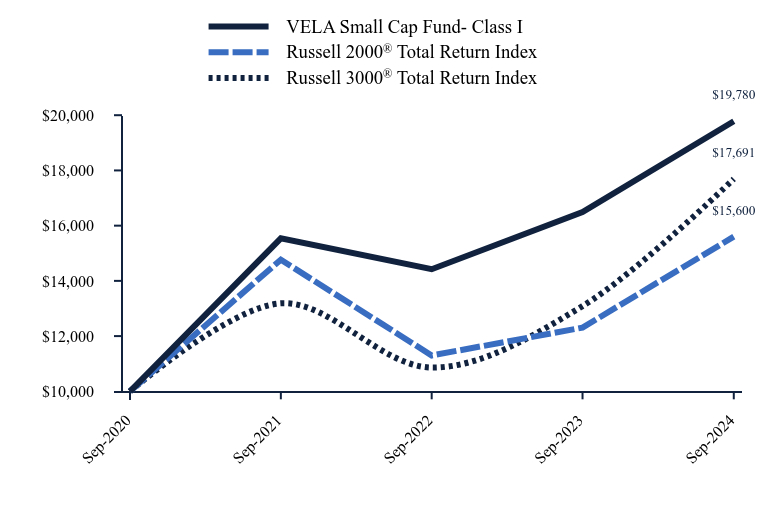

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| VELA Small Cap Fund- Class I | Russell 2000® Total Return Index | Russell 3000® Total Return Index |

|---|

| Sep-2020 | $10,000 | $10,000 | $10,000 |

| Sep-2021 | $15,539 | $14,768 | $13,188 |

| Sep-2022 | $14,421 | $11,298 | $10,863 |

| Sep-2023 | $16,495 | $12,307 | $13,086 |

| Sep-2024 | $19,780 | $15,600 | $17,691 |

Average Annual Total Returns

| 1 Year | Since Inception (September 30, 2020) |

|---|

| VELA Small Cap Fund- Class I | 19.92% | 18.59% |

Russell 2000® Total Return Index | 26.76% | 11.76% |

Russell 3000® Total Return Index | 35.19% | 15.33% |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$107,224,433

- Number of Portfolio Holdings85

- Advisory Fee $670,989

- Portfolio Turnover47%

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Kirby Corp. | 5.5% |

| Hub Group, Inc. - Class A | 4.5% |

| Graham Holdings Co. - Class B | 3.8% |

| Applied Industrial Technologies, Inc. | 3.7% |

| Range Resources Corp. | 3.4% |

| Coca-Cola Consolidated, Inc. | 3.2% |

| Greenbrier Companies, Inc. (The) | 3.2% |

| Axis Capital Holdings Ltd. | 3.1% |

| Performance Food Group Co. | 3.0% |

| Seaboard Corp. | 2.7% |

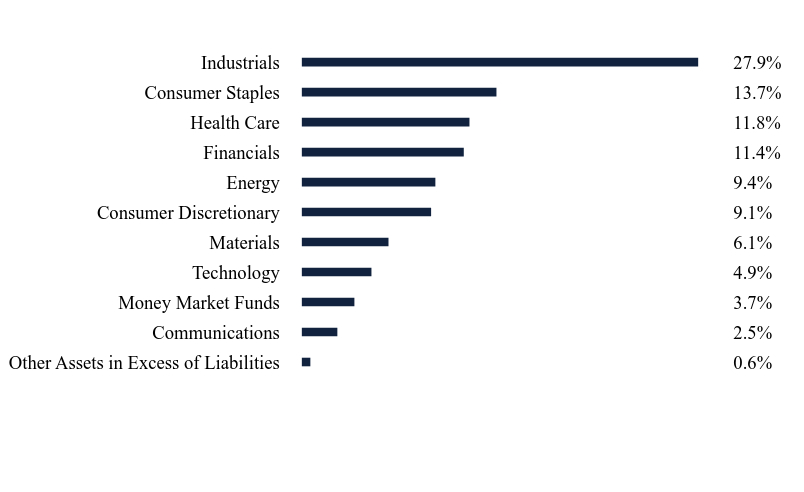

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.6% |

| Communications | 2.5% |

| Money Market Funds | 3.7% |

| Technology | 4.9% |

| Materials | 6.1% |

| Consumer Discretionary | 9.1% |

| Energy | 9.4% |

| Financials | 11.4% |

| Health Care | 11.8% |

| Consumer Staples | 13.7% |

| Industrials | 27.9% |

This is a summary of certain changes to the Fund since January 30, 2024. For more complete information, you may review the sticker to Fund’s prospectus, which is available upon request at 1-833-399-1011 or on the Fund's website at https://www.velafunds.com/strategies.html?stab=doc.

Effective October 1, 2024, the Adviser will reduce the contractual administrative fee for the Fund from an annual rate of 0.39% to 0.36% of the Fund’s average daily net assets for each share class.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://www.velafunds.com/strategies.html?stab=doc), including its:

Prospectus

Financial information

Holdings

Proxy voting information

VELA Small Cap Fund - Class I (VESMX)

Annual Shareholder Report - September 30, 2024

Item 2. Code of Ethics.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | |

| (b) | Not applicable. |

| | |

| (c) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (d) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (e) | Not applicable. |

| | |

| (f) | See Item 19 (a)(1) |

Item 3. Audit Committee Financial Expert.

| (a)(1) | The Registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. |

| | |

| (a)(2) | Jim Haring is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR. |

| | |

| (a)(3) | Not applicable. |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

| | September 30, 2024 | $71,150 |

| | September 30, 2023 | $56,000 |

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| (c) | Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

| | September 30, 2024 | $15,250 |

| | September 30, 2023 | $12,000 |

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees. The aggregate fees billed for the fiscal years ended September 30, 2024 and September 30, 2023 for products and services provided by the principal accountant, other than the services reported above in Items 4(a) through (c) were $0 and $0, respectively. |

| | |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| | |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. |

| | |

| (g) | All non-audit fees billed by the registrant’s accountant for services rendered to the registrant for the fiscal years ended September 30, 2024 and September 30, 2023, respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

| | |

| (h) | Not applicable. |

| | |

| (i) | Not applicable. |

| | |

| (j) | Not applicable. |

Item 5. Audit Committee of Listed Registrants.

Not applicable to Registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Financial Statements |

| |

| September 30, 2024 |

| |

| |

| |

| |

| |

| VELA Small Cap Fund |

| |

| Class A (VESAX) |

| Class I (VESMX) |

| |

| VELA Large Cap Plus Fund |

| |

| Class A (VELAX) |

| Class I (VELIX) |

| |

| VELA International Fund |

| |

| Class A (VEILX) |

| Class I (VEITX) |

| |

| VELA Income Opportunities Fund |

| |

| Class A (VIOAX) |

| Class I (VIOIX) |

| |

| VELA Short Duration Fund |

| |

| Class A (VASDX) |

| Class I (VESDX) |

VELA SMALL CAP FUND

Schedule of Investments

September 30, 2024

| | | Shares | | | Fair Value | |

| Common Stocks — 96.81% | | | | | | | | |

| Communications — 2.48% | | | | | | | | |

| Criteo S.A. - ADR(a) | | | 66,159 | | | $ | 2,662,238 | |

| | | | | | | | | |

| Consumer Discretionary — 9.06% | | | | | | | | |

| Atlanta Braves Holdings, Inc., Class C(a)(b) | | | 61,504 | | | | 2,447,859 | |

| Graham Holdings Co., Class B | | | 4,953 | | | | 4,069,979 | |

| Movado Group, Inc. | | | 42,058 | | | | 782,279 | |

| Valvoline, Inc.(a)(b) | | | 57,673 | | | | 2,413,615 | |

| | | | | | | | 9,713,732 | |

| Consumer Staples — 13.73% | | | | | | | | |

| Casey’s General Stores, Inc.(b) | | | 3,700 | | | | 1,390,127 | |

| Coca-Cola Consolidated, Inc. | | | 2,584 | | | | 3,401,578 | |

| Mama’s Creations, Inc.(a)(b) | | | 391,025 | | | | 2,854,482 | |

| Ollie’s Bargain Outlet Holdings, Inc.(a)(b) | | | 9,528 | | | | 926,122 | |

| Performance Food Group Co.(a) | | | 41,020 | | | | 3,214,737 | |

| Seaboard Corp. | | | 935 | | | | 2,933,095 | |

| | | | | | | | 14,720,141 | |

| Energy — 9.45% | | | | | | | | |

| Antero Resources Corp.(a)(b) | | | 70,664 | | | | 2,024,524 | |

| Civitas Resources, Inc. | | | 55,769 | | | | 2,825,815 | |

| Range Resources Corp. | | | 118,019 | | | | 3,630,264 | |

| Tidewater, Inc.(a)(b) | | | 22,921 | | | | 1,645,499 | |

| | | | | | | | 10,126,102 | |

| Financials — 11.37% | | | | | | | | |

| 1st Source Corp.(b) | | | 28,790 | | | | 1,723,945 | |

| Assured Guaranty Ltd.(b) | | | 28,980 | | | | 2,304,489 | |

| Axis Capital Holdings Ltd.(b) | | | 41,706 | | | | 3,320,215 | |

| BOK Financial Corp.(b) | | | 17,685 | | | | 1,850,205 | |

| Cullen/Frost Bankers, Inc.(b) | | | 13,926 | | | | 1,557,762 | |

| Houlihan Lokey, Inc. | | | 4,487 | | | | 709,036 | |

| Trustmark Corp.(b) | | | 22,819 | | | | 726,101 | |

| | | | | | | | 12,191,753 | |

| Health Care — 11.82% | | | | | | | | |

| AMN Healthcare Services, Inc.(a) | | | 28,301 | | | | 1,199,680 | |

| Biohaven Ltd.(a) | | | 11,455 | | | | 572,406 | |

| Denali Therapeutics, Inc.(a) | | | 9,357 | | | | 272,570 | |

| Dentsply Sirona, Inc. | | | 39,485 | | | | 1,068,464 | |

| Encompass Health Corp.(b) | | | 27,488 | | | | 2,656,440 | |

See accompanying notes which are an integral part of these financial statements.

VELA SMALL CAP FUND

Schedule of Investments (continued)

September 30, 2024

| | | Shares | | | Fair Value | |

| Common Stocks — (continued) | | | | | | | | |

| Health Care — (continued) | | | | | | | | |

| Halozyme Therapeutics, Inc.(a)(b) | | | 7,435 | | | $ | 425,579 | |

| Indivior PLC(a) | | | 57,452 | | | | 560,157 | |

| Lantheus Holdings, Inc.(a)(b) | | | 11,993 | | | | 1,316,232 | |

| Maravai LifeSciences Holdings, Inc.(a)(b) | | | 91,569 | | | | 760,938 | |

| PROCEPT BioRobotics Corp.(a)(b) | | | 19,551 | | | | 1,566,426 | |

| Rocket Pharmaceuticals, Inc.(a) | | | 29,631 | | | | 547,285 | |

| Roivant Sciences Ltd.(a) | | | 35,139 | | | | 405,504 | |

| SI-BONE, Inc.(a) | | | 94,242 | | | | 1,317,503 | |

| | | | | | | | 12,669,184 | |

| Industrials — 27.86% | | | | | | | | |

| Applied Industrial Technologies, Inc.(b) | | | 17,783 | | | | 3,967,921 | |

| BWX Technologies, Inc.(b) | | | 26,105 | | | | 2,837,613 | |

| Copa Holdings, S.A., Class A | | | 16,395 | | | | 1,538,507 | |

| Core & Main, Inc.(a) | | | 32,144 | | | | 1,427,193 | |

| Greenbrier Companies, Inc. (The)(b) | | | 66,537 | | | | 3,386,068 | |

| Hub Group, Inc., Class A(b) | | | 107,134 | | | | 4,869,240 | |

| Huntington Ingalls Industries, Inc.(b) | | | 5,675 | | | | 1,500,357 | |

| Kirby Corp.(a)(b) | | | 47,906 | | | | 5,865,132 | |

| Lincoln Electric Holdings, Inc. | | | 7,652 | | | | 1,469,337 | |

| Sun Country Airlines Holdings, Inc.(a) | | | 32,901 | | | | 368,820 | |

| Tetra Tech, Inc.(b) | | | 56,010 | | | | 2,641,432 | |

| | | | | | | | 29,871,620 | |

| Materials — 6.10% | | | | | | | | |

| Alamos Gold, Inc., Class A(b) | | | 111,956 | | | | 2,232,402 | |

| Ashland, Inc.(b) | | | 19,481 | | | | 1,694,263 | |

| Foraco International SA | | | 663,994 | | | | 1,060,576 | |

| Major Drilling Group International, Inc.(a) | | | 251,362 | | | | 1,555,782 | |

| | | | | | | | 6,543,023 | |

| Technology — 4.94% | | | | | | | | |

| JFrog Ltd.(a)(b) | | | 78,392 | | | | 2,276,504 | |

| Onto Innovation, Inc.(a) | | | 2,994 | | | | 621,435 | |

| SEMrush Holdings, Inc.(a) | | | 42,767 | | | | 671,869 | |

| Wix.com Ltd.(a)(b) | | | 10,333 | | | | 1,727,368 | |

| | | | | | | | 5,297,176 | |

TOTAL COMMON STOCKS

(Cost $79,119,458) | | | | | | | 103,794,969 | |

See accompanying notes which are an integral part of these financial statements.

VELA SMALL CAP FUND

Schedule of Investments (continued)

September 30, 2024

| | | Shares | | | Fair Value | |

| Money Market Funds — 3.74% | | | | | | | | |

| Federated Hermes Treasury Obligations Fund, Institutional Shares, 4.80%(c) | | | 4,013,883 | | | $ | 4,013,883 | |

| | | | | | | | | |

TOTAL MONEY MARKET FUNDS

(Cost $4,013,883) | | | | | | | 4,013,883 | |

| | | | | | | | |

Total Investments — 100.55%

(Cost $83,133,341) | | | | | | | 107,808,852 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.55)% | | | | | | | (584,419 | ) |

| | | | | | | | | |

| Net Assets — 100.00% | | | | | | $ | 107,224,433 | |

| (a) | Non-income producing security. |

| (b) | Securities, or a portion thereof, have been pledged as collateral on written options. The total collateral pledged is $28,032,388. |

| (c) | Rate disclosed is the seven day effective yield as of September 30, 2024. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

VELA SMALL CAP FUND

Schedule of Open Written Option Contracts

September 30, 2024

| Description | | Number of

Contracts | | | Notional

Amount | | | Exercise

Price | | | Expiration

Date | | Fair Value | |

| Written Call Options (1.06)% | | | | | | | | | | | | | | | | | | |

| 1st Source Corp. | | | (173 | ) | | $ | (1,035,924 | ) | | $ | 70.00 | | | February 2025 | | $ | (21,452 | ) |

| Alamos Gold, Inc. | | | (336 | ) | | | (669,984 | ) | | | 24.00 | | | February 2025 | | | (20,160 | ) |

| Antero Resources Corp. | | | (106 | ) | | | (303,690 | ) | | | 35.00 | | | February 2025 | | | (11,130 | ) |

| Applied Industrial Technologies, Inc. | | | (90 | ) | | | (2,008,170 | ) | | | 230.00 | | | February 2025 | | | (129,599 | ) |

| Ashland, Inc. | | | (68 | ) | | | (591,396 | ) | | | 100.00 | | | April 2025 | | | (13,940 | ) |

| Assured Guaranty Ltd. | | | (116 | ) | | | (922,432 | ) | | | 95.00 | | | April 2025 | | | (13,920 | ) |

| Axis Capital Holdings Ltd. | | | (202 | ) | | | (1,608,122 | ) | | | 85.00 | | | March 2025 | | | (71,710 | ) |

| BOK Financial Corp. | | | (70 | ) | | | (732,340 | ) | | | 115.00 | | | December 2024 | | | (17,850 | ) |

| BWX Technologies, Inc. | | | (150 | ) | | | (1,630,500 | ) | | | 130.00 | | | May 2025 | | | (57,000 | ) |

| Casey’s General Stores, Inc. | | | (35 | ) | | | (1,314,985 | ) | | | 400.00 | | | February 2025 | | | (51,100 | ) |

| Cullen/Frost Bankers, Inc. | | | (70 | ) | | | (783,020 | ) | | | 125.00 | | | January 2025 | | | (17,150 | ) |

| Encompass Health Corp. | | | (254 | ) | | | (2,454,656 | ) | | | 100.00 | | | April 2025 | | | (144,779 | ) |

| Greenbrier Companies, Inc. (The) | | | (200 | ) | | | (1,017,800 | ) | | | 65.00 | | | March 2025 | | | (27,500 | ) |

| Halozyme Therapeutics, Inc. | | | (60 | ) | | | (343,440 | ) | | | 70.00 | | | March 2025 | | | (10,500 | ) |

| Hub Group, Inc. | | | (107 | ) | | | (486,315 | ) | | | 55.00 | | | January 2025 | | | (5,618 | ) |

| Huntington Ingalls Industries, Inc. | | | (17 | ) | | | (449,446 | ) | | | 300.00 | | | December 2024 | | | (3,358 | ) |

| JFrog Ltd. | | | (210 | ) | | | (609,840 | ) | | | 35.00 | | | December 2024 | | | (16,800 | ) |

| Kirby Corp. | | | (144 | ) | | | (1,762,992 | ) | | | 135.00 | | | March 2025 | | | (74,160 | ) |

| Lantheus Holdings, Inc. | | | (60 | ) | | | (658,500 | ) | | | 110.00 | | | January 2025 | | | (80,100 | ) |

| Lantheus Holdings, Inc. | | | (36 | ) | | | (395,100 | ) | | | 140.00 | | | June 2025 | | | (39,240 | ) |

| Liberty Media Corp. - Liberty Braves | | | (307 | ) | | | (1,221,860 | ) | | | 50.00 | | | February 2025 | | | (14,583 | ) |

| Mama’s Creations, Inc. | | | (1,955 | ) | | | (1,427,150 | ) | | | 10.00 | | | January 2025 | | | (34,213 | ) |

| Maravai LifeSciences Holdings, Inc. | | | (212 | ) | | | (176,172 | ) | | | 17.50 | | | January 2025 | | | (5,088 | ) |

| Ollie’s Bargain Outlet Holdings, Inc. | | | (50 | ) | | | (486,000 | ) | | | 115.00 | | | April 2025 | | | (22,500 | ) |

| PROCEPT BioRobotics Corp. | | | (191 | ) | | | (1,530,292 | ) | | | 82.50 | | | November 2024 | | | (125,105 | ) |

| Tetra Tech, Inc. | | | (155 | ) | | | (730,980 | ) | | | 50.00 | | | March 2025 | | | (28,675 | ) |

| Tidewater, Inc. | | | (34 | ) | | | (244,086 | ) | | | 100.00 | | | January 2025 | | | (3,910 | ) |

| Trustmark Corp. | | | (217 | ) | | | (690,494 | ) | | | 40.00 | | | November 2024 | | | (217 | ) |

| Valvoline, Inc. | | | (202 | ) | | | (845,370 | ) | | | 45.00 | | | April 2025 | | | (55,550 | ) |

| Wix.com Ltd. | | | (52 | ) | | | (869,284 | ) | | | 200.00 | | | January 2025 | | | (24,960 | ) |

TOTAL WRITTEN CALL OPTIONS

(Premiums Received $1,300,709) | | | | | | | | | | | | | | | | $ | (1,141,867 | ) |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Investments

September 30, 2024

| | | Shares | | | Fair Value | |

| Common Stocks — 98.98% | | | | | | | | |

| Communications — 10.90% | | | | | | | | |

| Alphabet, Inc., Class A(a) | | | 17,385 | | | $ | 2,883,302 | |

| Electronic Arts, Inc. | | | 2,358 | | | | 338,232 | |

| Meta Platforms, Inc., Class A(a) | | | 3,755 | | | | 2,149,512 | |

| T-Mobile US, Inc. | | | 6,101 | | | | 1,259,002 | |

| Uber Technologies, Inc.(a)(b) | | | 8,702 | | | | 654,043 | |

| Walt Disney Co. (The) | | | 5,849 | | | | 562,615 | |

| | | | | | | | 7,846,706 | |

| Consumer Discretionary — 12.19% | | | | | | | | |

| Amazon.com, Inc.(a)(b) | | | 13,024 | | | | 2,426,762 | |

| Booking Holdings, Inc.(a) | | | 330 | | | | 1,390,000 | |

| Home Depot, Inc. (The)(a) | | | 3,079 | | | | 1,247,611 | |

| NIKE, Inc., Class B(a) | | | 10,036 | | | | 887,182 | |

| Starbucks Corp.(a) | | | 13,672 | | | | 1,332,883 | |

| TJX Companies, Inc. (The) | | | 10,033 | | | | 1,179,279 | |

| Ulta Beauty, Inc.(b) | | | 806 | | | | 313,631 | |

| | | | | | | | 8,777,348 | |

| Consumer Staples — 3.80% | | | | | | | | |

| Kraft Heinz Co. (The)(a) | | | 28,341 | | | | 995,053 | |

| PepsiCo, Inc. | | | 6,941 | | | | 1,180,317 | |

| Tyson Foods, Inc., Class A | | | 9,350 | | | | 556,886 | |

| | | | | | | | 2,732,256 | |

| Energy — 7.89% | | | | | | | | |

| Baker Hughes Co., Class A(a) | | | 33,717 | | | | 1,218,869 | |

| Energy Transfer LP(a) | | | 90,407 | | | | 1,451,032 | |

| Enterprise Products Partners LP(a) | | | 46,541 | | | | 1,354,809 | |

| MPLX LP | | | 20,503 | | | | 911,563 | |

| Suncor Energy, Inc. | | | 20,180 | | | | 745,046 | |

| | | | | | | | 5,681,319 | |

| Financials — 14.98% | | | | | | | | |

| Arch Capital Group Ltd.(b) | | | 6,907 | | | | 772,755 | |

| Bank of America Corp.(a) | | | 32,742 | | | | 1,299,202 | |

| Berkshire Hathaway, Inc., Class B(b) | | | 4,537 | | | | 2,088,200 | |

| Citigroup, Inc.(a) | | | 23,675 | | | | 1,482,055 | |

| Goldman Sachs Group, Inc. (The)(a) | | | 2,515 | | | | 1,245,202 | |

| MetLife, Inc.(a) | | | 19,194 | | | | 1,583,121 | |

| PayPal Holdings, Inc.(a)(b) | | | 13,322 | | | | 1,039,516 | |

| Visa, Inc., Class A(a) | | | 4,651 | | | | 1,278,792 | |

| | | | | | | | 10,788,843 | |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Investments (continued)

September 30, 2024

| | | Shares | | | Fair Value | |

| Common Stocks — (continued) | | | | | | | | |

| Health Care — 16.06% | | | | | | | | |

| Abbott Laboratories | | | 9,455 | | | $ | 1,077,964 | |

| AbbVie, Inc.(a) | | | 6,670 | | | | 1,317,192 | |

| AstraZeneca PLC - ADR(a) | | | 14,539 | | | | 1,132,734 | |

| Biohaven Ltd.(a)(b) | | | 5,589 | | | | 279,282 | |

| Boston Scientific Corp.(b) | | | 4,416 | | | | 370,061 | |

| Denali Therapeutics, Inc.(b) | | | 5,859 | | | | 170,673 | |

| Dentsply Sirona, Inc. | | | 27,320 | | | | 739,279 | |

| Elevance Health, Inc.(a) | | | 1,018 | | | | 529,360 | |

| Encompass Health Corp.(a) | | | 7,830 | | | | 756,691 | |

| Halozyme Therapeutics, Inc.(b) | | | 4,960 | | | | 283,910 | |

| Johnson & Johnson | | | 12,525 | | | | 2,029,801 | |

| Lantheus Holdings, Inc.(a)(b) | | | 8,822 | | | | 968,215 | |

| Roivant Sciences Ltd.(a)(b) | | | 32,386 | | | | 373,734 | |

| Sarepta Therapeutics, Inc.(b) | | | 1,214 | | | | 151,617 | |

| Zoetis, Inc., Class A(a) | | | 7,069 | | | | 1,381,141 | |

| | | | | | | | 11,561,654 | |

| Industrials — 13.59% | | | | | | | | |

| 3M Co.(a) | | | 12,953 | | | | 1,770,675 | |

| Copa Holdings, S.A., Class A | | | 2,414 | | | | 226,530 | |

| Core & Main, Inc.(a)(b) | | | 14,313 | | | | 635,497 | |

| CSX Corp.(a) | | | 32,514 | | | | 1,122,708 | |

| Deere & Co.(a) | | | 2,451 | | | | 1,022,876 | |

| FedEx Corp.(a) | | | 4,097 | | | | 1,121,267 | |

| JB Hunt Transport Services, Inc.(a) | | | 9,565 | | | | 1,648,337 | |

| Kirby Corp.(b) | | | 5,945 | | | | 727,846 | |

| Lincoln Electric Holdings, Inc. | | | 5,423 | | | | 1,041,325 | |

| Northrop Grumman Corp. | | | 885 | | | | 467,342 | |

| | | | | | | | 9,784,403 | |

| Materials — 0.64% | | | | | | | | |

| LyondellBasell Industries N.V., Class A(a) | | | 4,839 | | | | 464,060 | |

| | | | | | | | | |

| Technology — 18.93% | | | | | | | | |

| Accenture PLC, Class A(a) | | | 4,560 | | | | 1,611,869 | |

| Autodesk, Inc.(a)(b) | | | 5,615 | | | | 1,546,820 | |

| EPAM Systems, Inc.(b) | | | 3,397 | | | | 676,105 | |

| JFrog Ltd.(b) | | | 10,298 | | | | 299,054 | |

| Microchip Technology, Inc.(a) | | | 20,684 | | | | 1,660,718 | |

| Microsoft Corp.(a) | | | 7,804 | | | | 3,358,061 | |

See accompanying notes which are an integral part of these financial statements.

VELA LARGE CAP PLUS FUND

Schedule of Investments (continued)

September 30, 2024

| | | Shares | | | Fair Value | |

| Common Stocks — (continued) | | | | | | | | |

| Technology — (continued) | | | | | | | | |

| Salesforce, Inc.(a) | | | 6,009 | | | $ | 1,644,723 | |

| ServiceNow, Inc.(a)(b) | | | 1,797 | | | | 1,607,219 | |

| Smartsheet, Inc., Class A(a)(b) | | | 12,291 | | | | 680,430 | |

| Workday, Inc., Class A(a)(b) | | | 2,227 | | | | 544,301 | |

| | | | | | | | 13,629,300 | |

TOTAL COMMON STOCKS

(Cost $53,328,462) | | | | | | $ | 71,265,889 | |

| Description | | Number of

Contracts | | | Notional

Amount | | | Exercise

Price | | | Expiration

Date | | Fair Value | |

| Purchased Call Options — 0.20% | | | | | | | | | | | | | | | | | | |

| NVIDIA Corp. | | | 150 | | | $ | 1,821,600 | | | $ | 140.00 | | | February 2025 | | $ | 142,125 | |

TOTAL PURCHASED CALL OPTIONS

(Cost $217,454) | | | | | | | | | | | | | | | | | 142,125 | |

| | | | | | | | | | | | | | | | | | | |

| Purchased Put Options — 0.57% | | | | | | | | | | | | | | | | | | |

| 3M Co. | | | 120 | | | | 1,640,400 | | | | 110.00 | | | March 2025 | | | 24,120 | |

| Accenture PLC, Class A | | | 34 | | | | 1,201,832 | | | | 280.00 | | | June 2025 | | | 18,700 | |

| Alphabet, Inc., Class A | | | 60 | | | | 995,100 | | | | 145.00 | | | March 2025 | | | 25,050 | |

| Amazon.com, Inc. | | | 50 | | | | 931,650 | | | | 140.00 | | | February 2025 | | | 8,675 | |

| Baker Hughes Co., Class A | | | 250 | | | | 903,750 | | | | 30.00 | | | January 2025 | | | 7,500 | |

| Bank of America Corp. | | | 525 | | | | 2,083,200 | | | | 28.00 | | | January 2025 | | | 7,875 | |

| Citigroup, Inc. | | | 180 | | | | 1,126,800 | | | | 52.50 | | | March 2025 | | | 24,120 | |

| Deere & Co. | | | 16 | | | | 667,728 | | | | 290.00 | | | June 2025 | | | 5,760 | |

| Enterprise Products Partners LP | | | 400 | | | | 1,164,400 | | | | 25.00 | | | June 2025 | | | 17,000 | |

| Goldman Sachs Group, Inc. (The) | | | 32 | | | | 1,584,352 | | | | 400.00 | | | January 2025 | | | 12,560 | |

| Meta Platforms, Inc., Class A | | | 20 | | | | 1,144,880 | | | | 420.00 | | | June 2025 | | | 27,500 | |

| Microchip Technology, Inc. | | | 65 | | | | 521,885 | | | | 70.00 | | | January 2025 | | | 16,900 | |

| Microsoft Corp. | | | 70 | | | | 3,012,100 | | | | 300.00 | | | June 2025 | | | 18,830 | |

| NIKE, Inc., Class B | | | 80 | | | | 707,200 | | | | 75.00 | | | March 2025 | | | 17,400 | |

| NVIDIA Corp. | | | 150 | | | | 1,821,600 | | | | 75.00 | | | February 2025 | | | 25,200 | |