UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811- 23582

Modern Capital Funds Trust

1701 Meeting Street

Charleson, SC 29464

(Address of Principal Executive Offices)

Paracorp Inc.

2140 South Dupont Hwy.

Camden DE 19934

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 711-9164

Date of fiscal year end: 3/31/2024

Date of reporting period: 9/30/2023

Item 1. Reports to Stockholders.

Semi-Annual Report 2023

As of September 30, 2023

Modern Capital Tactical Opportunities Fund

Class A Shares: MCTOX

Class ADV Shares: MCTDX

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Modern Capital Tactical Opportunities Fund (the “Fund”). The Fund’s shares are not deposits or obligations of, or guaranteed by, any depository institution. The Fund’s shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Fund nor the Fund’s distributor is a bank.

The Modern Capital Tactical Opportunities Fund is distributed by Vigilant Distributors, LLC., Member FINRA/SIPC, 223 Wilmington West Chester Pike, Suite 216, Chadds Ford, PA, 19317. There is no affiliation between the Fund, including its principals, and Vigilant Distributors, LLC.

Statements in this Semi-Annual Report that reflect projections or expectations of future financial or economic performance of the Modern Capital Tactical Opportunities Fund (“Fund”) and of the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include, without limitation, general economic conditions such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. A copy of the prospectus is available at https://gryphonfundinfo.com/assets/pdfs/MCTOX_Prospectus.pdf or by calling Shareholder Services at 800-711-9164. The prospectus should be read carefully before investing.

For More Information on the Modern Capital Tactical Opportunities Fund:

See Our Website @ moderncap.com

or

Call Our Shareholder Services Group at 800-711-9164.

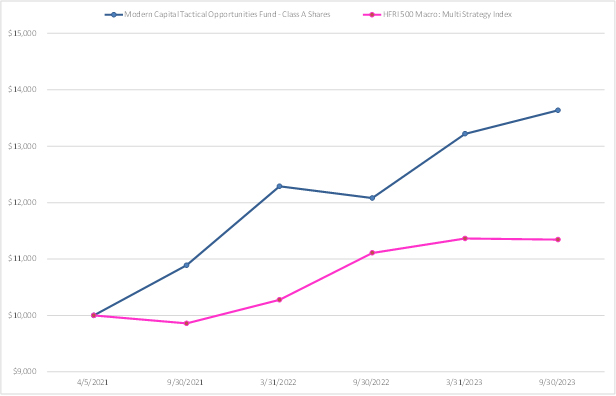

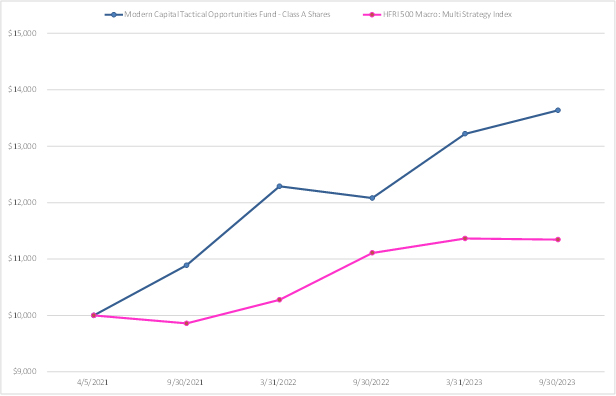

Modern Capital Tactical Opportunities Fund - Class A Shares

Investment Highlights (Unaudited)

For the period from April 5, 2021 (Commencement of Operations) through September 30, 2023

Comparison of the Change in Value of a $10,000 Investment

This graph assumes an initial investment of $10,000 ($9,500 after maximum sales load of 5.00%) at April 5, 2021 (Commencement of Operations). Assume all dividends and distributions are reinvested. This graph depicts the performance of the Modern Capital Tactical Opportunities Fund - Class A Shares versus the Fund’s benchmark index, the HFRI 500 Macro: Multi-Strategy Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. The Fund’s total net annual operating expense ratio as provided in the Prospectus dated August 1, 2023 was 1.92% for Class A shares. The Advisor and Modern Capital Funds Trust (the “Trust”) have entered into an expense limitation agreement whereby the Advisor has contractually agreed to waive a portion of its fees and/or reimburse certain Fund expenses, including the Advisor’s management fee, any organizational expenses (exclusive of (i) brokerage fees and commissions, (ii) These estimated acquired fund fees and expenses; (iii) borrowing costs (such as interest and dividend expense on securities sold short); (iv) taxes; (v) specialized pricing services and (vi) extraordinary expenses, such as litigation expenses (which may include indemnification of Trust officers and Trustees, contractual indemnification of Fund service providers (other than the advisor)) in order to limit annual Fund operating expenses to 0.90%, and 0.90% for Class A shares, and Class ADV shares, respectively. These expense limitations will remain in effect until at least July 31, 2024. This agreement may be terminated by the Trust’s Board of Trustees (the “Board”) upon written notice to the Advisor. The agreement may not be terminated by the Advisor without consent of the Board. The Advisor will be permitted to recover fees and expenses it has borne, within three years after the fees were waived or expenses reimbursed, only to the extent that the Fund’s expenses do not exceed the lesser of (1) the expense limit in effect at the time the Advisor waives or limits the fees and (2) the expense limit in effect at the time the Advisor recovers fees. The Fund’s total gross annual operating expense ratio as provided in the Prospectus dated August 1, 2023 was 2.72% for Class A shares.

| Average Total Returns |

For the Fiscal Period Ended September 30, 2023 | | 6 Months | | | 1 Year | | | Since Inception* | |

| Modern Capital Tactical Opportunities Fund - Class A Shares | | | 3.20 | % | | | 12.77 | % | | | 35.06 | % |

| Modern Capital Tactical Opportunities Fund - Class A Shares - with 5.00% sales load | | | (1.74 | )% | | | 7.64 | % | | | 29.34 | % |

| HFRI 500 Macro: Multi-Strategy Index ** | | | (0.18 | )% | | | 2.12 | % | | | 13.43 | % |

*Inception date of Class A Shares is April 5, 2021.

** The HFRI 500 Macro Index is a global, equal-weighted index of the largest hedge funds that report to the HFR Database which are open to new investments and offer quarterly liquidity or better. The Macro funds that comprise the index are a subset of the HFRI 500 Fund Weighted Composite Index. The index is rebalanced on a quarterly basis.

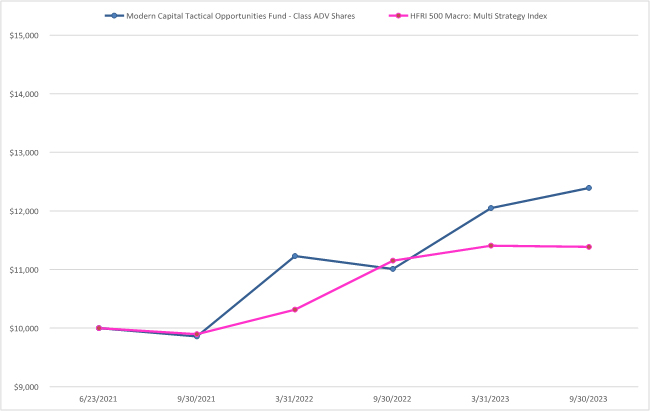

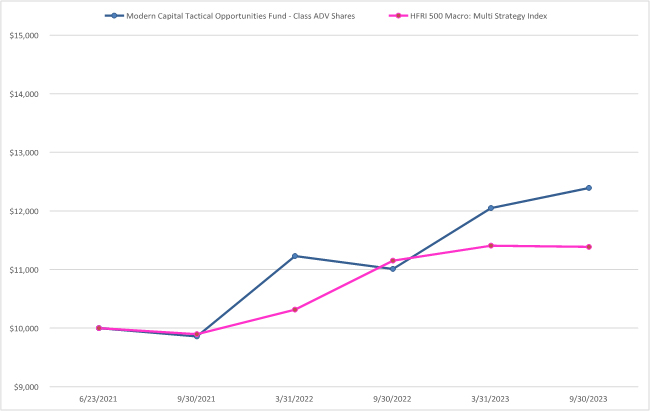

Modern Capital Tactical Opportunities Fund - Class ADV Shares

Investment Highlights (Unaudited)

For the period from June 23, 2021 (Commencement of Operations) through September 30, 2023

Comparison of the Change in Value of a $10,000 Investment

This graph assumes an initial investment of $10,000 at June 23, 2021 (Commencement of Operations). Assume all dividends and distributions are reinvested. This graph depicts the performance of the Modern Capital Tactical Opportunities Fund - Class ADV Shares versus the Fund’s benchmark index, the HFRI 500 Macro: Multi-Strategy Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. The Fund’s total net annual operating expense ratio as provided in the Prospectus dated August 1, 2023 was 1.92% for Class ADV shares. The Advisor and Modern Capital Funds Trust (the “Trust”) have entered into an expense limitation agreement whereby the adviser has contractually agreed to waive a portion of its fees and/or reimburse certain Fund expenses, including the adviser’s management fee, any organizational expenses (exclusive of (i) brokerage fees and commissions, (ii) These estimated acquired fund fees and expenses; (iii) borrowing costs (such as interest and dividend expense on securities sold short); (iv) taxes; (v) specialized pricing services and (vi) extraordinary expenses, such as litigation expenses (which may include indemnification of Trust officers and Trustees, contractual indemnification of Fund service providers (other than the advisor)) in order to limit annual Fund operating expenses to 0.90%, and 0.90% for Class A shares, and Class ADV shares, respectively. These expense limitations will remain in effect until at least July 31, 2024. This agreement may be terminated by the Trust’s Board of Trustees (the “Board”) upon written notice to the Advisor. The agreement may not be terminated by the Advisor without consent of the Board. The Advisor will be permitted to recover fees and expenses it has borne, within three years after the fees were waived or expenses reimbursed, only to the extent that the Fund’s expenses do not exceed the lesser of (1) the expense limit in effect at the time the Advisor waives or limits the fees and (2) the expense limit in effect at the time the Advisor recovers fees. The Fund’s total gross annual operating expense ratio as provided in the Prospectus dated August 1, 2023 was 2.72% for Class ADV shares.

| Average Total Returns |

For the Fiscal Period Ended September 30, 2023 | | 6 Months | | | 1 Year | | | Since Inception* | |

| Modern Capital Tactical Opportunities Fund - Class ADV Shares | | | 2.88 | % | | | 12.50 | % | | | 22.66 | % |

| HFRI 500 Macro: Multi-Strategy Index ** | | | (0.18 | )% | | | 2.12 | % | | | 13.86 | % |

*Inception date of Class A Shares is June 23, 2021.

** The HFRI 500 Macro Index is a global, equal-weighted index of the largest hedge funds that report to the HFR Database which are open to new investments and offer quarterly liquidity or better. The Macro funds that comprise the index are a subset of the HFRI 500 Fund Weighted Composite Index. The index is rebalanced on a quarterly basis.

Modern Capital Tactical Opportunities Fund

Schedule of Investments (Unaudited)

As of September 30, 2023

| | | Shares | | | Fair Value | |

| CLOSED-END FUNDS - 53.68% | | | | | | | | |

| Adams Natural Resources Fund, Inc. | | | 13,600 | | | $ | 314,432 | |

| Allspring Income Opportunities Fund | | | 15,203 | | | | 92,738 | |

| BlackRock MuniYield Quality Fund III, Inc. | | | 14,138 | | | | 135,018 | |

| BlackRock MuniYield Quality Fund, Inc | | | 50,466 | | | | 516,267 | |

| Blackstone Strategic Credit Fund | | | 123,798 | | | | 1,360,541 | |

| BrandywineGLOBAL - Global Income Opportunities Fund, Inc. | | | 158,078 | | | | 1,187,056 | |

| Brookfield Real Assets Income Fund, Inc. | | | 81,949 | | | | 1,003,875 | |

| Clough Global Dividend and Income Fund | | | 61,526 | | | | 305,784 | |

| Clough Global Equity Fund | | | 68,703 | | | | 376,498 | |

| Clough Global Opportunities Fund | | | 18,336 | | | | 81,139 | |

| First Trust/Aberdeen Global Opportunity Income Fund | | | 97,439 | | | | 555,402 | |

| Flaherty & Crumrine Total Return Fund | | | 4,728 | | | | 64,726 | |

| FS Credit Opportunities Corp. | | | 30,053 | | | | 162,887 | |

| Highland Global Allocation Fund | | | 37,282 | | | | 298,256 | |

| Highland Income Fund | | | 77,870 | | | | 626,075 | |

| Invesco Municipal Trust | | | 29,205 | | | | 243,570 | |

| John Hancock Premium Dividend Fund | | | 5,100 | | | | 49,062 | |

| John Hancock Tax-Advantaged Global Shareholder Yield Fund | | | 113,620 | | | | 500,133 | |

| Kayne Anderson MLP/Midstream Investment Company | | | 116,875 | | | | 982,919 | |

| Kayne Anderson NextGen Energy & Infrastructure, Inc. | | | 93,683 | | | | 667,023 | |

| Mexico Equity & Income Fund, Inc. (a) | | | 130,965 | | | | 1,231,071 | |

| Morgan Stanley Emerging Markets Debt Fund, Inc. | | | 47,408 | | | | 313,387 | |

| Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | | | 146,386 | | | | 623,605 | |

| Neuberger Berman MLP and Energy Income Fund, Inc. | | | 104,879 | | | | 721,568 | |

| New America High Income Fund, Inc. | | | 89,587 | | | | 580,524 | |

| Nuveen Quality Municipal Income Fund | | | 70,000 | | | | 709,800 | |

| NXG NextGen Infrastructure Income Fund | | | 1,612 | | | | 60,450 | |

| PGIM Global High Yield Fund, Inc. | | | 71,740 | | | | 773,262 | |

| Templeton Emerging Markets Income Fund, Inc. | | | 259,560 | | | | 1,196,572 | |

| Voya Global Equity Dividend and Premium Opportunity Fund | | | 26,766 | | | | 131,496 | |

| Western Asset Emerging Markets Debt Fund, Inc. | | | 137,695 | | | | 1,142,869 | |

| Western Asset High Income Opportunity Fund, Inc. | | | 154,091 | | | | 560,891 | |

| | | | | | | | | |

| CLOSED-END FUNDS - (Cost $18,209,211) | | | | | | | 17,568,896 | |

| | | | | | | | | |

COMMON STOCK - 12.11% | | | | | | | | |

| Consumer Discretionary - 1.17% | | | | | | | | |

| Cresud SACIF y A (b) | | | 13,231 | | | | 88,515 | |

| Despegar.com, Inc. (a) (b) | | | 40,445 | | | | 293,226 | |

| | | | | | | | 381,741 | |

Energy - 3.97% | | | | | | | | |

| Ecopetrol S.A. (b) | | | 22,500 | | | | 260,550 | |

| Petróleo Brasileiro, S.A. (b) | | | 35,935 | | | | 538,666 | |

| Transportadora de Gas del Sur (a) (b) | | | 15,239 | | | | 155,133 | |

| Vista Oil & Gas S.A. de C.V. (a) (b) | | | 11,340 | | | | 344,623 | |

| | | | | | | | 1,298,972 | |

Modern Capital Tactical Opportunities Fund

Schedule of Investments (Unaudited) - Continued

As of September 30, 2023

| | | Shares | | | Fair Value | |

| COMMON STOCK - 12.11% - Continued | | | | | | | | |

| Financials - 3.72% | | | | | | | | |

| Arcos Dorados Holdings, Inc. (b) | | | 15,000 | | | $ | 141,900 | |

| Banco BBVA Argentina S.A. (b) | | | 11,908 | | | | 49,418 | |

| Banco Bradesco S.A. (b) | | | 125,000 | | | | 357,250 | |

| Grupo Financiero Galicia (b) | | | 32,500 | | | | 424,125 | |

| Grupo Supervielle S.A. (a) (b) | | | 33,000 | | | | 73,260 | |

| UBS Group AG | | | 7,000 | | | | 172,550 | |

| | | | | | | | 1,218,503 | |

| Industrials - 1.69% | | | | | | | | |

| Uber Technologies, Inc. (a) | | | 12,000 | | | | 551,880 | |

| | | | | | | | | |

| Materials - 0.28% | | | | | | | | |

| Loma Negra Compania Industrial Argentina S.A. (b) | | | 15,000 | | | | 90,450 | |

| | | | | | | | | |

| Real Estate - 0.21% | | | | | | | | |

| Irsa Inversiones Y Representaciones S.A. (b) | | | 11,720 | | | | 68,679 | |

| | | | | | | | | |

| Telecommunications - 0.27% | | | | | | | | |

| Telecom Argentina S.A. (b) | | | 18,732 | | | | 89,726 | |

| | | | | | | | | |

| Utilities - 0.80% | | | | | | | | |

| Central Puerto S.A. (b) | | | 22,500 | | | | 130,950 | |

| Empresa Distribuidora Y Comercializadora Norte S.A. (a) (b) | | | 10,906 | | | | 130,872 | |

| | | | | | | | 261,822 | |

| | | | | | | | | |

| TOTAL COMMON STOCK - (Cost $3,480,029) | | | | | | | 3,961,773 | |

| | | | | | | | | |

| Real Estate Investment Trust - 4.00% | | | | | | | | |

| NexPoint Diversified Real Estate Trust | | | 42,456 | | | | 369,366 | |

| Seven Hills Realty Trust | | | 85,849 | | | | 937,471 | |

| | | | | | | | | |

| TOTAL REAL ESTATE INVESTMENT TRUST - (Cost $1,212,381) | | | | | | | 1,306,837 | |

| | | Principal Amount ($) | | | Coupon Rate (%) | | | Fair Value | |

| SHORT-TERM INVESTMENTS - 31.86% | | | | | | | | | | | | |

| Money Market Funds - 31.86% | | | | | | | | | | | | |

| First American Government Obligations Fund, Class X (c) | | | 10,422,927 | | | | 5.265 | | | | 10,422,927 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS - (Cost $10,422,927) | | | | | | | | | | | 10,422,927 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS - 101.65% - (Cost $33,324,548) | | | | | | | | | | | 33,260,433 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (1.65%) | | | | | | | | | | | (542,068 | ) |

| | | | | | | | | | | | | |

| NET ASSETS - 100.0% | | | | | | | | | | $ | 32,718,365 | |

(a) Non-income producing investment

(b) American Depositary Receipt

(c) Rate disclosed is the seven day effective yield as of September 30, 2023.

Modern Capital Tactical Opportunities Fund

Schedule of Investments (Unaudited) - Continued

As of September 30, 2023

| Summary of Investments by Type and Sector | | % of Net Assets | | | Fair Value | |

| Closed-End Funds | | | 53.68 | % | | $ | 17,568,896 | |

| Common Stocks: | | | | | | | | |

| Consumer Discretionary | | | 1.17 | % | | | 381,741 | |

| Energy | | | 3.97 | % | | | 1,298,972 | |

| Financials | | | 3.72 | % | | | 1,218,503 | |

| Industrials | | | 1.69 | % | | | 551,880 | |

| Materials | | | 0.28 | % | | | 90,450 | |

| Real Estate | | | 0.21 | % | | | 68,679 | |

| Telecommunications | | | 0.27 | % | | | 89,726 | |

| Utilities | | | 0.80 | % | | | 261,822 | |

| Real Estate Investment Trust | | | 4.00 | % | | | 1,306,837 | |

| Short-Term Investments | | | 31.86 | % | | | 10,422,927 | |

| Liabilities in Excess of Other Assets | | | (1.65 | )% | | | (542,068 | ) |

| Total Net Assets | | | 100.00 | % | | | 32,718,365 | |

See accompanying notes to financial statements.

Modern Capital Tactical Opportunities Fund

Statement of Assets and Liabilities (Unaudited)

As of September 30, 2023

| Assets: | | | |

| Investments, at value (Cost $33,324,548) | | $ | 33,260,433 | |

| Receivable for securities sold | | | 1,467,693 | |

| Dividends and interest receivable | | | 205,186 | |

| Due from advisor | | | 41,927 | |

| Prepaid expenses and other assets | | | 128,825 | |

| | | | | |

| Total Assets | | | 35,104,064 | |

| | | | | |

| Liabilities: | | | | |

| Payable for securities purchased | | | 2,343,623 | |

| Accrued fund administration, fund accounting, and transfer agency fees | | | 2,250 | |

| Accrued trustee fees and expenses | | | 6,623 | |

| Accrued audit fees and expenses | | | 11,286 | |

| Accrued distribution and service fees - Class A and ADV Class Shares | | | 10,983 | |

| Accrued expenses and other liabilities | | | 10,934 | |

| | | | | |

| Total Liabilities | | | 2,385,699 | |

| | | | | |

| Net Assets | | $ | 32,718,365 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 33,222,214 | |

| Distributable earnings | | | (503,849 | ) |

| | | | | |

| Net Assets | | $ | 32,718,365 | |

| | | | | |

| Net Asset Value Per Share: | | | | |

| Class A Shares: (1) | | | | |

| Net Assets | | $ | 3,642,083 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | 318,487 | |

| | | | | |

| Net asset value (Net Assets ÷ Shares Outstanding), and redemption price per share | | $ | 11.44 | |

| | | | | |

| Offering price per share (net asset value plus maximum sales charge of 5.00%) | | $ | 12.04 | |

| Class ADV Shares: | | | | |

| Net Assets | | $ | 29,076,282 | |

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | | | 2,865,765 | |

| | | | | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | | $ | 10.15 | |

(1) The Class A Shares charge a 5.00% maximum sales load on all initial purchases.

See accompanying notes to financial statements.

Modern Capital Tactical Opportunities Fund

Statement of Operations (Unaudited)

For the Period Ended September 30, 2023

| Investment Income: | | | |

| Dividend income, net of witholding tax expense | | $ | 1,858,816 | |

| Interest income | | | 67,495 | |

| | | | | |

| Total Investment Income | | | 1,926,311 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees | | | 99,355 | |

| Distribution (12b-1) fees: | | | | |

| Class A | | | 5,034 | |

| Class ADV | | | 36,370 | |

| Shareholder fulfillment expenses | | | 14,823 | |

| Professional fees | | | 31,858 | |

| Registration fees | | | 18,192 | |

| Trustees’ fees and expenses | | | 16,893 | |

| Fund accounting fees | | | 22,838 | |

| Administration fees | | | 8,995 | |

| Transfer agency fees | | | 11,232 | |

| Compliance officer fees | | | 23,803 | |

| Insurance expense | | | 1,830 | |

| Pricing expense | | | 3,557 | |

| Printing and postage expenses | | | 2,165 | |

| Custodian fees | | | 15,407 | |

| Miscellaneous expense | | | 18,848 | |

| | | | | |

| Total Expenses | | | 331,200 | |

| | | | | |

| Advisory fees waived (note 3) | | | (99,355 | ) |

| Expenses reimbursed by advisor (note 3) | | | (51,295 | ) |

| | | | | |

| Net Expenses | | | 180,550 | |

| | | | | |

| Net Investment Income | | | 1,745,761 | |

| | | | | |

| Realized and Unrealized Loss on Investments | | | | |

| Net realized loss on Investments | | | (612,841 | ) |

| Net change in unrealized depreciation on investments | | | (271,394 | ) |

| | | | | |

| Net Realized and Unrealized Loss on Investments | | | (884,235 | ) |

| | | | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 861,526 | |

See accompanying notes to financial statements.

Modern Capital Tactical Opportunities Fund

Statement of Changes in Net Assets

For the fiscal period or year ended

| | | Period Ended September 30,

2023(1) | | | Year Ended March 31,

2023 | |

| From Operations: | | | | | | | | |

| Net investment income | | $ | 1,745,761 | | | $ | 1,128,575 | |

| Net realized gain/(loss) from investments | | | (612,841 | ) | | | 1,268,631 | |

| Long-term capital gain distributions from underlying funds | | | — | | | | 278,349 | |

| Net change in unrealized depreciation on investments | | | (271,394 | ) | | | (710,406 | ) |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | 861,526 | | | | 1,965,149 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Total distributions paid from earnings: | | | | | | | | |

| Class A | | | (166,289 | ) | | | (308,912 | ) |

| Class ADV | | | (1,530,772 | ) | | | (2,348,608 | ) |

| | | | | | | | | |

| Net decrease in net assets from distributions to shareholders | | | (1,697,061 | ) | | | (2,657,520 | ) |

| | | | | | | | | |

| Shares of Beneficial Interest: | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Class A | | | 452,986 | | | | 2,204,902 | |

| Class ADV | | | 4,464,799 | | | | 12,093,025 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders: | | | | | | | | |

| Class A | | | 158,309 | | | | 298,918 | |

| Class ADV | | | 1,530,772 | | | | 2,350,649 | |

| Payments for shares redeemed: | | | | | | | | |

| Class A | | | (1,126,036 | ) | | | (608,976 | ) |

| Class ADV | | | (2,733,351 | ) | | | (3,378,170 | ) |

| Net increase in net assets from shares of beneficial interest | | | 2,747,479 | | | | 12,960,348 | |

| | | | | | | | | |

| Total Increase in Net Assets | | | 1,911,944 | | | | 12,267,977 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year/period | | | 30,806,421 | | | | 18,538,444 | |

| | | | | | | | | |

| End of year/period | | $ | 32,718,365 | | | $ | 30,806,421 | |

(1) Unaudited.

See accompanying notes to financial statements.

Modern Capital Tactical Opportunities Fund

Statement of Changes in Net Assets - Continued

For the fiscal period or year ended

| | | Period Ended September 30, 2023 (1) | | | Year Ended March 31, 2023 | |

| Share Activity: | | | | | | |

| Class A: | | | | | | |

| Shares sold | | 38,003 | | | 184,487 | |

| Shares reinvested | | 13,411 | | | 26,142 | |

| Shares repurchased | | (92,688 | ) | | (50,728 | ) |

| Net increase / (decrease) in shares of beneficial interest | | (41,274 | ) | | 159,901 | |

| | | | | | | |

| | | | | | | |

| Class ADV: | | | | | | |

| Shares sold | | 413,193 | | | 1,156,216 | |

| Shares reinvested | | 146,125 | | | 228,049 | |

| Shares repurchased | | (256,060 | ) | | (331,790 | ) |

| | | | | | | |

| Net increase in shares of beneficial interest | | 303,258 | | | 1,052,475 | |

| | | | | | | |

| SHARES OUTSTANDING | | | | | | |

| Class A: | | | | | | |

| Beginning of year/period | | 359,761 | | | 199,860 | |

| | | | | | | |

| End of year/period | | 318,487 | | | 359,761 | |

| | | | | | | |

| Class ADV: | | | | | | |

| Beginning of year/period | | 2,562,507 | | | 1,510,032 | |

| | | | | | | |

| End of year/period | | 2,865,765 | | | 2,562,507 | |

(1) Unaudited.

See accompanying notes to financial statements.

Modern Capital Tactical Opportunities Fund

Financial Highlights

| |

| For a share outstanding during the fiscal period or year ended | | Class A Shares | |

| | | Period Ended September 30, 2023(1) | | | Year Ended March 31, 2023 | | | Year Ended March 31, 2022(2) | |

| Net Asset Value, beginning of year/period | | $ | 11.58 | | | $ | 11.79 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| From Investment operations: | | | | | | | | | | | | |

| Net investment income (3) | | | 0.58 | | | | 0.59 | | | | (0.13 | ) |

| Net realized and unrealized gain / (loss) on investments | | | (0.21 | ) | | | 0.26 | | | | 2.42 | |

| | | | | | | | | | | | | |

| Total from investment operations | | | 0.37 | | | | 0.85 | | | | 2.29 | |

| | | | | | | | | | | | | |

| Distributions from: | | | | | | | | | | | | |

| Net investment income | | | (0.51 | ) | | | (0.83 | ) | | | (0.50 | ) |

| Capital gains | | | — | | | | (0.23 | ) | | | — | |

| | | | | | | | | | | | | |

| Total distributions | | | (0.51 | ) | | | (1.06 | ) | | | (0.50 | ) |

| | | | | | | | | | | | | |

| Net Asset Value, end of year/period | | $ | 11.44 | | | $ | 11.58 | | | $ | 11.79 | |

| | | | | | | | | | | | | |

| Total Return (6) | | | 3.20 | %(5) | | | 7.62 | % | | | 23.12 | %(5) |

| | | | | | | | | | | | | |

| Net Asset Value, end of year/period (000s) | | $ | 3,642 | | | $ | 4,167 | | | $ | 2,356 | |

| | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | |

| Gross expenses to average net assets (7) (8) | | | 2.08 | %(4) | | | 5.74 | % | | | 13.12 | %(4) |

| Net expenses to average net assets (7) (8) | | | 1.18 | %(4) | | | 4.55 | %(9) | | | 7.81 | %(4)(9) |

| Net investment income / (loss) to average net assets (8) | | | 9.62 | %(4) | | | 4.89 | % | | | (1.16) | %(4) |

| | | | | | | | | | | | | |

| Portfolio Turnover Rate | | | 374.99 | %(5) | | | 1228.52 | % | | | 1496.05 | %(5) |

| (2) | For a share outstanding during the initial period from April 5, 2021 (Commencement of Operations) through March 31, 2022. |

| (3) | Per shares amounts calculated using the average share method, which appropriately presents the per share data for the year/period. |

| (6) | Total return does not relect sales charge, if any. |

| (7) | The expense ratios listed reflect total expenses prior to any waivers and reimbursements (gross expense ratio) and after any waivers and reimbursements (net expense ratio). |

| (8) | Recognition of the Fund’s net investment income is affected by the timing of dividend declarations of underlying funds. The expenses of the underlying funds are excluded from the Fund’s expense ratio. |

| (9) | Net expenses include tax expenses as a result of grantor trust income (Note 1). |

See accompanying notes to financial statements.

Modern Capital Tactical Opportunities Fund

Financial Highlights

| |

| For a share outstanding during the fiscal period or year ended | | Class ADV | |

| | | Period Ended September 30, 2023(1) | | | Year Ended March 31, 2023 | | | Year Ended March 31, 2022(2) | |

| Net Asset Value, beginning of year/period | | $ | 10.40 | | | $ | 10.72 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| From Investment operations: | | | | | | | | | | | | |

| Net investment income (3) | | | 0.53 | | | | 0.47 | | | | (0.09 | ) |

| Net realized and unrealized gain / (loss) on investments | | | (0.23 | ) | | | 0.27 | | | | 1.32 | |

| | | | | | | | | | | | | |

| Total from investment operations | | | 0.30 | | | | 0.74 | | | | 1.23 | |

| | | | | | | | | | | | | |

| Distributions from: | | | | | | | | | | | | |

| Net investment income | | | (0.55 | ) | | | (0.83 | ) | | | (0.51 | ) |

| Capital gains | | | — | | | | (0.23 | ) | | | — | |

| | | | | | | | | | | | | |

| Total distributions | | | (0.55 | ) | | | (1.06 | ) | | | (0.51 | ) |

| | | | | | | | | | | | | |

| Net Asset Value, end of year/period | | $ | 10.15 | | | $ | 10.40 | | | $ | 10.72 | |

| | | | | | | | | | | | | |

| Total Return (6) | | | 2.88 | %(5) | | | 7.40 | % | | | 12.54 | %(5) |

| | | | | | | | | | | | | |

| Net Asset Value, end of year/period (000s) | | $ | 29,076 | | | $ | 26,639 | | | $ | 16,182 | |

| | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | |

| Gross expenses to average net assets (7) (8) | | | 1.98 | %(4) | | | 5.71 | % | | | 13.04 | %(4) |

| Net expenses to average net assets (7) (8) | | | 1.07 | %(4) | | | 4.52 | %(9) | | | 7.95 | %(4) (9) |

| Net investment income / (loss) to average net assets (8) | | | 9.74 | %(4) | | | 4.37 | % | | | (1.17) | %(4) |

| | | | | | | | | | | | | |

| Portfolio Turnover Rate | | | 374.99 | %(5) | | | 1228.52 | % | | | 1496.05 | %(5) |

| (2) | For a share outstanding during the initial period from June 23, 2021 (Commencement of Operations) through March 31, 2022. |

| (3) | Per shares amounts calculated using the average share method, which appropriately presents the per share data for the year/period. |

| (6) | Total return does not relect sales charge, if any. |

| (7) | The expense ratios listed reflect total expenses prior to any waivers and reimbursements (gross expense ratio) and after any waivers and reimbursements (net expense ratio). |

| (8) | Recognition of the Fund’s net investment income is affected by the timing of dividend declarations of underlying funds. The expenses of the underlying funds are excluded from the Fund’s expense ratio. |

| (9) | Net expenses include tax expenses as a result of grantor trust income (Note 1). |

See accompanying notes to financial statements.

Modern Capital Tactical Opportunities Fund

Notes to the Financial Statements (Unaudited)

As of September 30, 2023

The Modern Capital Tactical Opportunities Fund (the “Fund”) is a series of the Modern Capital Funds Trust (the “Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-end management investment company. The Fund is a separate, non-diversified series of the Trust.

The investment objective of the Fund is to seek to provide income and capital gains. The Fund seeks to achieve its investment objective by tactically investing long or short primarily in publicly traded closed-end funds, domestic or foreign common stocks, exchange-traded funds (“ETFs”), sponsored American Depositary Receipts (“ADRs”) and debt instruments. The Fund seeks income from interest payments and dividends; and seeks capital gains through short-term trading strategies. The Fund may invest without restriction as to issuer capitalization, currency, or country. However, it focuses primarily on issuers in the $100 million to $10 billion capitalization range and generally limits emerging market exposure to 20% of portfolio assets.

The Fund currently has an unlimited number of authorized shares, which are divided into two classes – Class A Shares and Class ADV Shares. Each class of shares has equal rights to assets of the Fund, and the classes are identical except for differences in sales loads.

The Class A Shares and Class ADV Shares are subject to distribution plan fees as described in Note 5. The Fund’s Class A Shares are sold with an initial sales charge of 5.00%. Income, expenses (other than distribution and service fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based upon its relative net assets. Both classes have equal voting privileges, except where otherwise required by law or when the Trustees determine that the matter to be voted on affects only the interests of the shareholders of a particular class.

| (2) | Significant Accounting Policies |

The Fund follows the accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946 “Financial Services – Investment Companies,” and Financial Accounting Standards Update (“ASU”) 2013-08. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Investment Valuation

The Fund’s investments in securities are carried at market or fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value. Securities and assets for which representative market quotations are not readily available (e.g., (i) an exchange-traded portfolio security is so thinly traded that there have been no transactions for that security over an extended period of time or the validity of a market quotation received is questionable; (ii) the exchange on which the portfolio security is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s NAV calculation) or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by Modern Capital Management Co. (the “Advisor”), the Fund’s investment Advisor. The Board of Trustees (the Board) has designated the Advisor as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment Advisor has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices or quotations are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund’s fair valuation policies and procedures. The Advisor reports to the Board information regarding the fair valuation process and related material matters.

Fair Value Measurement

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1: quoted prices in active markets for identical securities

Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

Modern Capital Tactical Opportunities Fund

Notes to the Financial Statements (Unaudited) (Continued)

As of September 30, 2023

| (2) | Significant Accounting Policies (Continued) |

Fair Value Measurement (Continued)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of September 30, 2023, for the Fund’s assets measured at fair value:

| | | | | | | | | | | | | |

Investments in Securities (a) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | | | | | |

| Closed-End Funds | | $ | 17,568,896 | | | $ | — | | | $ | — | | | $ | 17,568,896 | |

| Common Stock* | | | 3,961,773 | | | | — | | | | — | | | | 3,961,773 | |

| Real Estate Investment Trusts | | | 1,306,837 | | | | — | | | | — | | | | 1,306,837 | |

| Short-Term Investments | | | 10,422,927 | | | | — | | | | — | | | | 10,422,927 | |

| Total | | $ | 33,260,433 | | | $ | — | | | $ | — | | | $ | 33,260,433 | |

(a) The Fund had no Level 2 or Level 3 holdings during the fiscal period ended September 30, 2023.

* Refer to the Schedule of Investments for breakdown by industry.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Interest income is recorded on an accrual basis and includes accretion of discounts and amortization of premiums using the effective interest method. Gains and losses are determined on the identified cost basis, which is the same basis used for federal tax income purposes.

Expenses

The Fund is responsible for all expenses incurred specifically on its behalf by the Trustees. Distribution fees are charged to that class of shares. All other expenses are allocated based upon the daily net assets of each class of shares.

Distributions

The Fund may declare and distribute dividends from net investment income (if any) quarterly. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reported period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

The Fund’s tax year end of February 28th differs from the book fiscal year end of March 31st.

Modern Capital Tactical Opportunities Fund

Notes to the Financial Statements (Unaudited) (Continued)

As of September 30, 2023

| (2) | Significant Accounting Policies (Continued) |

Federal Income Taxes (Continued)

For the fiscal tax year ended February 28, 2023, the Fund did not meet the gross income test for qualification as a regulated investment company (“RIC”). In order to continue to qualify as a RIC, the Fund elected to pay an excise tax in the amount of $922,456. The Fund did not meet the gross income test due to their investment in certain Grantor Trusts that generated income that was not considered qualifying under the gross income test.

Reclassification of capital accounts: Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

For the year ended March 31, 2023, the Fund made the following permanent tax adjustments on the Statement of Assets and Liabilities:

Distributable Earnings | Paid-in Capital |

| ($53,692) | $53,692 |

| (3) | Transactions with Related Parties and Service Providers |

Advisor

The Fund pays a monthly fee to Modern Capital Management Co. (the “Advisor”) calculated at the annual rate of 0.60% of the Fund’s average daily net assets.

The Advisor has entered into a contractual agreement (the “Expense Limitation Agreement”) with the Trust in which the Advisor has contractually agreed to waive a portion of its fees and/or reimburse certain Fund expenses, including the Advisor’s management fee, any organizational and offering expenses (exclusive of (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iv) borrowing costs (such as interest and dividend expense on securities sold short); (v) taxes; (vi) specialized pricing services and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Trust officers and Trustees, contractual indemnification of Fund service providers (other than the Advisor)) in order to limit annual Fund operating expenses to 0.90%, and 0.90% for Class A shares, and Class ADV shares, respectively. These expense limitations will remain in effect until at least July 31, 2024. This agreement may be terminated by the Trust’s Board of Trustees upon written notice to the Advisor. The agreement may not be terminated by the Advisor without consent of the Board. The Advisor will be permitted to recover fees and expenses it has borne, within three years after the fees were waived or expenses reimbursed, only to the extent that the Fund’s expenses do not exceed the lesser of (1) the expense limit in effect at the time the Advisor waives or limits the fees and (2) the expense limit in effect at the time the Advisor recovers fees.

For the fiscal period ended September 30, 2023, $99,355 in advisory fees were incurred by the Fund, all of which were waived by the Advisor, and $51,295 of expenses were reimbursed to the Fund by the Advisor. The Advisor may recapture a portion of the amount noted above no later than the years as stated below:

March 31, 2025 | March 31, 2026 | March 31, 2027 | Total |

| $378,355 | $303,620 | $150,650 | $832,625 |

Administrator, Fund Accounting and Custody

Gryphon Fund Group, LLC (“Gryphon”) provides accounting, administrative, and transfer agent services to the Fund. The Fund has entered into a Master Services Agreement (“Services Agreement”) with Gryphon. Under the Services Agreement, Gryphon is responsible for a wide variety of’ functions, including but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund’s portfolio investments; (d) pricing the Fund’s shares; (e) assistance in preparing tax returns; and (f) preparation and filing of required regulatory reports and are paid fees, computed and payable monthly at an annual rate based on the average daily net assets of the Fund.

U.S. Bank National Association (“USB N.A.”) serves as the custodian to the Fund. Under a custody services agreement, USB N.A. is paid a custody fee monthly based on the average daily market value of any securities and cash held in the portfolio.

Modern Capital Tactical Opportunities Fund

Notes to the Financial Statements (Unaudited) (Continued)

As of September 30, 2023

| (3) | Transactions with Related Parties and Service Providers (Continued) |

Administrator, Fund Accounting and Custody (Continued)

| Fund Accounting and Administration Fee | |

| Fund Accounting and Administration Fees | | |

| Base Fee: $57,000 | | |

| Net-Assets Annual Fee: | | |

| On the first $250 million | | 0.10% |

| On assets above $250 million but below $500 million | 0.08% |

| On assets above $500 million but below $1 billion | 0.06% |

| On all assets over $1 billion | | 0.04% |

The Fund incurred $8,995 in administration fees, $22,839 in fund accounting fees, and $15,407 in custody fees for the fiscal period ended September 30, 2023.

Compliance Services

Vigilant Compliance, LLC provides services as the Trust’s Chief Compliance Officer. Vigilant Compliance, LLC is entitled to receive customary fees from the Fund for their services pursuant to the Compliance Services agreement with the Fund.

Transfer Agency

As of October 9, 2023, The Gryphon Fund Group, LLC, located at 3000 Auburn Drive, Suite 410, Beachwood, OH 44122, also serves as dividend disbursing agent and transfer agent (the “Transfer Agent”) pursuant to the Master Fund Services Agreement with the Trust. Nottingham Shareholder Services, LLC, located at 116 South Franklin Street, Rocky Mount, NC 27804, served as dividend disbursing agent and transfer agent prior to that date with the Trust. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent’s fee arrangements with the Fund. The Fund incurred $11,232 in transfer agent fees for the fiscal period ended September 30, 2023.

Distributor

Vigilant Distributors, LLC. (the “Distributor”) serves as the Fund’s principal underwriter and distributor.

Related Broker

The Fund utilizes brokerage services through an affiliate of the Advisor. Modern Capital Securities, Inc. (“Mountain Capital Securities”), a registered broker-dealer which is wholly owned by the Advisor, acted as the Fund’s fully disclosed clearing broker for the fiscal period ended June 30, 2023. Effective July 3, 2023 White Mountain Capital, LLC (“White Mountain”), a registered broker-dealer which is wholly owned by the Advisor, acted as the Fund’s fully disclosed clearing broker. During the period ended September 30, 2023, Modern Capital Securities and White Mountain received commissions from trading activities in the amounts of $138,625 and $313,053, respectively.

The Trust is governed by the Board of Trustees, which is responsible for the management and oversight of the Fund. The Trustees meet periodically throughout the year to review contractual agreements with companies that furnish services to the Fund; review performance of the Advisor and the Fund; and oversee activities of the Fund. Officers of the Trust and Trustees who are interested persons of the Trust or the Advisor will receive no salary or fees from the Trust. Each Trustee who is not an “interested person” of the Trust or the Advisor within the meaning of the 1940 Act, as amended (the “Independent Trustees”) receives $2,500 per quarter from the Fund. The Trust reimburses each Trustee and officer of the Trust for his or her travel and other expenses related to attendance of Board meetings.

Modern Capital Tactical Opportunities Fund

Notes to the Financial Statements (Unaudited) (Continued)

As of September 30, 2023

| (5) | Distributions and Service Fees |

The Board of Trustees, including a majority of the Independent Trustees, adopted a distribution and service plan pursuant to Rule 12b-1 of the 1940 Act (the “Prior Plan”) for the Class A Shares and Class ADV Shares. The 1940 Act regulates the manner in which a registered investment company may assume costs of distributing and promoting the sales of its shares and servicing of its shareholder accounts. The Prior Plan provides that the Fund may incur certain costs, which may not exceed 0.25% per annum of the average daily net assets of the Class A Shares and Class ADV Shares for each year elapsed subsequent to adoption of the Prior Plan, for payment to the Distributor and others for items such as advertising expenses, selling expenses, commissions, travel, or other expenses reasonably intended to result in sales of Class A Shares or Class ADV Shares or servicing of Class A and Class ADV shareholder accounts.

The Distribution and Service Fees of the Class A Shares and Class ADV Shares for the Fund for the fiscal period ended September 30, 2023 were $5,034 and $36,370, respectively.

In August, 2023, the Board of Trustees, including a majority of the Independent Trustees, voted to discontinue the Prior Plan.

| (6) | Purchases and Sales of Investment Securities |

For the fiscal period ended September 30, 2023, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchase of Securities | Proceeds from Sales of Securities |

| $113,992,471 | $120,822,004 |

There were no long-term purchases or sales of the U.S. Government Obligations for the fiscal period ended September 30, 2023.

Active Trading Risk. Active trading of portfolio securities (commonly known as day-trading strategies) may result in added expenses, a lower return and increased tax liability. Because the Advisor engages in high turnover trading strategies that seek to leverage short term price dislocations through the duration of a trade, the Fund will have high portfolio turnover rates, which at times may be significantly in excess of 1,000% of capital over the course of a year. Increased portfolio turnover causes the Fund to incur higher brokerage costs, which may adversely affect the Fund’s performance and may produce increased taxable distributions.

Closed-End Fund Risk. Closed-end funds are subject to investment advisory and other expenses, which will be indirectly paid by the Fund resulting in duplicative fees and expenses. As such, your cost of investing will be higher than the cost of investing directly in a closed-end fund and may be higher than other mutual funds that invest directly in stocks and bonds. Closed-end funds are also subject to management risk because the Advisor to the underlying closed-end fund may be unsuccessful in meeting the fund’s investment objective. These funds may also trade at a discount or premium to their net asset value and may trade at a larger discount or smaller premium subsequent to purchase by the Fund. Since closed-end funds trade on exchanges, the Fund will also incur brokerage expenses and commissions when it buys or sells closed-end fund shares.

Equity Securities Risk. The Fund may invest in equity securities including common stocks, which include the common stock of any class or series of domestic or foreign corporations or any similar equity interest, such as a trust or partnership interest. The value of the equity securities held by the Fund may fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, or facts relating to specific companies in which the Fund invests. These investments may or may not pay dividends and may or may not carry voting rights. Common stock occupies the most junior position in a company’s capital structure.

Modern Capital Tactical Opportunities Fund

Notes to the Financial Statements (Unaudited) (Continued)

As of September 30, 2023

ADR Risk. ADRs are receipts, issued by depository banks in the United States, for shares of a foreign-based company that entitle the holder to dividends and capital gains on the underlying security. ADRs may be sponsored or unsponsored. In a sponsored ADR arrangement, the foreign issuer assumes the obligation to pay some or all of the depositary’s transaction fees. Under an unsponsored ADR arrangement, the foreign issuer assumes no obligations and the depositary’s transaction fees are paid directly by the ADR holders. In addition to the risks of investing in foreign securities, there is no guarantee that an ADR issuer will continue to offer a particular ADR. As a result, the Fund may have difficulty selling the ADR or selling them quickly and efficiently at the prices at which they have been valued. The issuers of unsponsored ADRs are not obligated to disclose information that is considered material in the U.S. and voting rights with respect to the deposited securities are not passed through. ADRs may not track the prices of the underlying foreign securities on which they are based, and their values may change materially at times when U.S. markets are not open for trading.

Call Risk. During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or repay the security before its stated maturity, and the Fund may have to reinvest the proceeds at lower interest rates, resulting in a decline in the Fund’s income.

Cybersecurity Risk. The computer systems, networks and devices used by the Fund and its service providers to carry out routine business operations employ a variety of protections designed to prevent damage or interruption from computer viruses, network failures, computer and telecommunication failures, infiltration by unauthorized persons and security breaches. Despite the various protections utilized by the Fund and its service providers, systems, networks, or devices potentially can be breached. The Fund and its shareholders could be negatively impacted as a result of a cybersecurity breach.

Emerging Market Risk. Emerging market countries may have relatively unstable governments, weaker economies, and less developed legal systems with fewer security holder rights. Emerging market economies may be based on only a few industries and security issuers may be more susceptible to economic weakness and more likely to default. Emerging market securities also tend to be less liquid.

ETF Risk. When the Fund invests in an ETF, it will indirectly bear its proportionate share of any fees and expenses payable directly by the ETF. Therefore, the Fund will incur higher expenses, many of which may be duplicative. In addition, the Fund may be affected by losses of the ETFs and the level of risk arising from the investment practices of the ETFs (such as the use of leverage by the funds). The Fund has no control over the investments and related risks taken by the ETFs in which it invests. Additionally, investments in ETFs are also subject to the following risks: (i) the market price of an ETF’s shares may trade above or below their net asset value; (ii) an active trading market for an ETF’s shares may not develop or be maintained; or (iii) trading of an ETF’s shares may be halted for a number of reasons.

Foreign and Currency Exposure Risk. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market, or economic developments and can perform differently from the U.S. market. The value of foreign securities is also affected by the value of the local currency relative to the U.S. dollar.

High-Yield Risk. High-yield, high-risk securities, commonly called “junk bonds,” are considered speculative. While generally providing greater income than investments in higher-quality securities, these lower-quality securities will involve greater risk of principal and income that higher-quality securities.

Interest Rate Risk. Interest rate risk is the risk that debt prices overall, including the prices of securities held by the Fund, will decline over short or even long periods of time due to rising interest rates. Debt instruments with longer maturities tend to be more sensitive to interest rates than bonds with shorter maturities. Recently, interest rates have been historically low. Current conditions may result in a rise in interest rates. As a result, for the present, interest rate risk may be heightened.

Leverage Risk. The use of leverage by the Fund, by borrowing money to purchase securities, will cause the Fund to incur additional expenses and magnify the Fund’s gains or losses.

Management Risk. The Advisor’s tactical strategy may not produce the desired results. The portfolio manager’s judgments about the attractiveness, value and potential appreciation of particular asset classes, sectors or other securities in which the Fund invests may prove to be incorrect and there is no guarantee that the portfolio manager’s judgment will produce the desired results.

Non-Diversification Risk. Because a relatively high percentage of a non-diversified Fund’s assets may be invested in the securities of a limited number of companies that could be in the same or related economic sectors, the Fund’s portfolio may be more susceptible to any single economic, technological or regulatory occurrence than the portfolio of a diversified fund.

Modern Capital Tactical Opportunities Fund

Notes to the Financial Statements (Unaudited) (Continued)

As of September 30, 2023

Security Market Risk. The value of the Fund may decrease in response to the activities and financial prospects of the securities markets generally, or an individual security in the Fund’s portfolio. Unexpected local, regional or global events, such as war; acts of terrorism; financial, political or social disruptions; natural, environmental or man-made disasters; the spread of infectious illnesses or other public health issues, climate change and climate related events; and recessions and depressions could have a significant impact on the Fund and its investments and may impair market liquidity. Such events can cause investor fear, which can adversely affect the economies of nations, regions and the market in general, in ways that cannot necessarily be foreseen.

Inflation pressures have been fueled by elevated energy prices. One of the main near-term sources of elevated energy prices is the geopolitical tensions between Russia and Ukraine These tensions could either escalate into military conflict or could dissipate based on various factors facing Russia and Ukraine. Due to Europe’s reliance on Russian oil and gas, Russia’s bargaining position may decline as the demand for oil and gas declines. This could lead to near term energy price volatility and may contribute to inflation pressures.

China remains a risk factor to both the global supply and demand. The 2021 Chinese property market correction appears broader and deeper than China’s prior housing cycles. Weak market sentiment in China, combined with a high volume of property developer bonds maturing in the offshore USD denominated markets in the first half of 2022, increase the risk of a lack of liquidity in the Chinese property market. The Chinese property market slowdown and resulting potential weakness in China’s economic growth could have broader repercussions. China currently accounts for around half the annual copper and steal used globally while being expected to comprise more than 20% of global GDP growth between 2021 and 2026. Additionally, the Chinese market remains important to both U.S. and globally listed companies as a growing consumer market and an important part of supply chains. Chinese policy action may help mitigate this risk from the property sector and restore confidence and stability.

It is impossible to predict the effects of these or similar events in the future on the Fund, although it is possible that these or similar events could have a significant adverse impact on the NAV and/or risk profile of the Fund.

Short Selling Risk. If a security sold short increases in price, the Fund may have to cover its short position at a higher price than the short sale price, resulting in a loss. The Fund may not be able to successfully implement its short sale strategy due to limited availability of desired securities or for other reasons.

Small and Medium (Mid) Capitalization Stock Risk. The earnings and prospects of small and mid-capitalization companies are more volatile than larger companies, they may experience higher failure rates than larger companies and normally have a lower trading volume than larger companies, which may tend to make their market price fall more disproportionately than larger companies in response to selling pressures.

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

Management reviewed the Fund’s tax positions taken or to be taken on federal income tax returns for the years ended February 28, 2023 and 2022 and determined that the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties.

The Fund paid $2,321,497 in income and $105,378 long-term capital gain distributions for the tax year ended February 28, 2023.

As of September 30, 2023, the tax-basis cost of investments and components of distributable earnings were as follows:

| | | | |

| Tax Cost | Gross Unrealized

Appreciation | Gross Unrealized

Depreciation | Net Unrealized

Depreciation |

| $33,324,548 | $814,681 | ($878,796) | ($64,115) |

Modern Capital Tactical Opportunities Fund

Notes to the Financial Statements (Unaudited) (Continued)

As of September 30, 2023

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of September 30, 2023, RBC Capital Markets, LLC held 85% of the Fund. The Fund has no knowledge as to whether all or any portion of the shares of record owned by RBC Capital Markets, LLC are also owned beneficially, or the identity of customers of RBC Capital Markets, LLC who may beneficially own Fund shares.

| (10) | Commitments and Contingencies |

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects risk of loss to be remote.

| (11) | New Regulatory Pronouncements |

In October 2022, the SEC adopted a rule and form amendments relating to tailored shareholder reports for mutual funds and ETFs; and fee information in investment company advertisements. The rule and form amendments will require mutual funds and ETFs to transmit streamlined shareholder reports that highlight key information to investors. The rule amendments will require that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective in January 2023 and there is an 18-month transition period after the effective date of the amendment with a compliance date of July 2024.

As of October 9, 2023, The Gryphon Fund Group, LLC, located at 3000 Auburn Drive, Suite 410, Beachwood, OH 44122, also serves as dividend disbursing agent and transfer agent (the “Transfer Agent”) pursuant to the Master Fund Services Agreement with the Trust. Nottingham Shareholder Services, LLC, located at 116 South Franklin Street, Rocky Mount, NC 27804, served as dividend disbursing agent and transfer agent prior to that date with the Trust.

In August, 2023, the Board of Trustees, including a majority of the Independent Trustees, voted to eliminate plans pursuant to Rule 12b-1 under the 1940 Act. The plan was terminated effective October 19, 2023.

In accordance with GAAP, management has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. Management has concluded there are no additional matters, other than those noted above, requiring recognition or disclosure.

Modern Capital Tactical Opportunities Fund

Additional Information (Unaudited)

As of September 30, 2023

| 1. | Proxy Voting Policies and Voting Records |

A copy of the Advisor’s Proxy and Corporate Action Voting Policies and Procedures is included as Appendix A to the Fund’s Statement of Additional Information and is available, without charge, upon request, by calling 800-711-9164, and on the website of the Securities and Exchange Commission (“SEC”) at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (1) without charge, upon request, by calling the Fund at the number above and (2) on the SEC’s website at http://www.sec.gov.

| 2. | Quarterly Portfolio Holdings |

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT is available on the SEC’s website at http://www.sec.gov. You may also obtain copies without charge, upon request, by calling the Fund at 800-711-9164.

We are required to advise you within 60-days of the Fund’s fiscal year-end regarding the federal tax status of certain distributions received by shareholders during each fiscal year. The following information is provided for the Fund’s fiscal year ended March 31, 2023.

During the fiscal year ended March 31, 2023, the Fund paid $2,552,142 in income distributions and $105,378 long-term capital gains distributions.

Dividend and distributions received by retirement plans such as IRAs, Keogh-type plans, and 403(b) plans need not be reported as taxable income. However, many retirement plans may need this information for their annual information meeting.

| 4. | Shareholder Expense Example |

As a shareholder of the Fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the period from April 1, 2023, through September 30, 2023.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Modern Capital Tactical Opportunities Fund

Additional Information (Unaudited) (Continued)

As of September 30, 2023

| 4. | Shareholder Expense Example (Continued) |

| Class A Shares | |

Beginning Account

Value

April 1, 2023 | | | Ending Account

Value

September 30, 2023 | | | Expenses Paid

During Period* | |

| Actual | | $ | 1,000 | | | $ | 1,031.87 | | | $ | 10.76 | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000 | | | $ | 1,014.64 | | | $ | 10.50 | |

*Expenses paid during period are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183 days and divided by 365 (to reflect the number of days in the (to reflect the number of days in the six month period ending September 30, 2023).

| Class A Shares | |

Beginning Account

Value

April 1, 2023 | | | Ending Account

Value

September 30, 2023 | | | Expenses Paid

During Period* | |

| Actual | | $ | 1,000 | | | $ | 1,028.77 | | | $ | 10.21 | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000 | | | $ | 1,015.14 | | | $ | 10.00 | |

*Expenses paid during period are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183 days and divided by 365 (to reflect the number of days in the (to reflect the number of days in the six month period ending September 30, 2023).

| 5. | Approval of Investment Advisory Agreement |

The Board of Trustees (the “Board”) of Modern Capital Funds Trust (the “Trust”) met virtually at the Trust’s organizational meeting on October 16, 2023, for purposes of, among other things, considering whether it would be in the best interests of Modern Capital Tactical Opportunities Fund (the “Fund”) and its shareholders for the Board to approve a new Management Agreement (the “Agreement”) by and between the Fund and Modern Capital Management Co. (the “Advisor”).

In connection with the Board’s review of the Agreement, the Trustees of the Trust who were not “interested persons” of the Fund within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”) (collectively, the “Independent Trustees”) requested, and the Advisor provided the Board with information about a variety of matters, including, without limitation, the following information:

| ● | nature, extent and quality of services to be provided by the Advisor, including background information on the qualifications and experience of key professional of the Advisor personnel that provide services to the Fund; |

| ● | fees charged to and expenses of the Fund, including comparative fee and expense information for registered investment companies similar to the Fund; |

| ● | costs of the services provided, and profits, if any, expected to be realized by the Advisor; |

At the October 16, 2023 meeting, the Board and the Independent Trustees determined that the Agreement was in the best interests of the Fund in light of the proposed services, personnel, expenses and such other matters as the Board considered to be relevant in the exercise of its reasonable business judgment and approved them.

To reach this determination, the Board considered its duties under the 1940 Act as well as under the general principles of state law in reviewing and approving advisory contracts; the fiduciary duty of investment advisor with respect to an advisory agreement and the receipt of investment advisory compensation; the standards used by courts in determining whether investment company boards have fulfilled their duties; and the factors to be considered by the Board in voting on such agreements. To assist the Board in its evaluation of the Agreement, the Independent Trustees received materials in advance of the Board meeting from the Advisor. The Board applied its business judgment to determine whether the arrangement by the Fund and Advisor is a reasonable business arrangement from the Fund’s perspective as well as from the perspective of its proposed shareholders.

Nature, Extent and Quality of Services Provided by the Advisor

The Board considered the following factors to be of fundamental importance to its consideration of the nature, extent and quality of services to be provided by the Advisor: (i) background information on the qualifications and experience of the Advisor’s management and the key professional personnel that will provide services to the Fund; (ii) the proposed portfolio managers’ experience in managing quantitative strategies; and (iii) the Advisor’s marketing plan designed to grow the assets of the Fund.

Modern Capital Tactical Opportunities Fund

Additional Information (Unaudited) (Continued)

As of September 30, 2023

Nature, Extent and Quality of Services Provided by the Advisor (Continued)

The Board noted that the Advisor will provide research, trade execution, operations, risk monitoring, settlement, and service provider monitoring for the Fund. The Board discussed the particular risks associated with the Advisor’s strategy, including turnover risk, and considered the Advisor’s compliance policies and procedures in place to mitigate such risks. The Board concluded that the Advisor had sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures essential to perform its duties under the Agreement and that the nature, overall quality and extent of the management services to be provided by the Advisor to the Fund were expected to be satisfactory.

Investment Performance

The Board recognized the Fund’s strong performance over the review period, noting that Class A and ADV shares had a total return over the prior one-year of 7.62% and 7.40% respectively.

Fees and Expenses

The Board considered that the Advisor proposed a management fee equal to 0.60% of the average daily net assets of the Fund and that the fee was less than the average management fee in the Fund’s peer group, which was 1.20%, and in the lower range of management fees in the Fund’s peer group, which ranged from 0.60% to 2.00%. The Board noted that the Fund’s average expense ratio would be 0.90%, which was lower than the peer group average of 1.54%. The Board concluded that the fee to be collected by the Advisor for managing the Fund was not unreasonable.

Profitability

The Board reviewed the profitability analysis provided by the Advisor with respect to its management of the Fund. With respect to profitability, the Board noted that the Advisor expected to operate with a loss for the first year of the Fund’s operations.

Economies of Scale

The Board considered the possibility of any economies of scale in the provision of services by the Advisor if the Fund grows and whether those economies would be shared with the Fund. Such economies could be shared through breakpoints in the Advisor’s management fee or other means, such as expense caps or fee waivers. The Board noted that the assets of the Fund at its outset would be too small to meaningfully consider economies of scale and the necessity of breakpoints.

The Board concluded that the current fee structure as proposed for the Fund was reasonable and that no changes were currently necessary.

Fall Out Benefits

The Board reviewed the “fallout” benefits or ancillary revenue to be received by the Advisor or an affiliated person of the Advisor in connection with the services provided to the Fund by the Advisor. The Board noted that portfolio transactions on behalf of the Fund would be placed through an affiliated person of the Advisor would be reported to the Board pursuant to Rule 17e-1 under the 1940 Act. The Board concluded that any such ancillary benefits would not be disadvantageous to the Fund’s shareholders and thus would not alter the Board’s conclusion with respect to the appropriateness of approving the Agreement.

Conclusion

It was noted that no single factor was cited as determinative to the decision of the Trustees. Rather, after weighing all of the considerations and conclusions discussed above, the entire Board, including all of the Independent Trustees, approved the Management Agreement, concluding that having the Fund receive services from the Advisor under the Agreement was in the best interest of the shareholders of the Fund and that the investment advisory fee rate was reasonable in relation to the services provided.

| 6. | Information about Trustees and Officers |