Investor Presentation December 2020 Exhibit 99.2

Disclaimers About this Presentation This investor presentation (this “Presentation”) does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination between Ouster, Inc. (“Ouster”) and Colonnade Acquisition Corp. (“Colonnade”) or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Colonnade, Ouster, or any of their respective affiliates. No such offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. Forward Looking Statements This Presentation contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed business combination between Ouster and Colonnade, including statements regarding the benefits of the business combination and the anticipated timing of the business combination and projected future results of Ouster’s business. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “forecast,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Presentation, including but not limited to: (i) the risk that the business combination may not be completed in a timely manner or at all, which may adversely affect the price of Colonnade’s securities, (ii) the risk that the business combination may not be completed by Colonnade’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Colonnade, (iii) the failure to satisfy the conditions to the consummation of the business combination, including the adoption of the merger agreement relating to the business combination (the “Merger Agreement”) by the shareholders of Colonnade and Ouster, the satisfaction of the minimum cash condition under the Merger Agreement and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third-party valuation in determining whether or not to pursue the proposed business combination, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vi) the effect of the announcement or pendency of the business combination on Ouster’s business relationships, performance and business generally, (vii) risks that the proposed business combination disrupts current plans of Ouster and potential difficulties in Ouster employee retention as a result of the proposed business combination, (viii) the outcome of any legal proceedings that may be instituted against Ouster or against Colonnade related to the Merger Agreement or the proposed business combination, (ix) the ability to maintain the listing of Colonnade’s securities on the New York Stock Exchange, (x) the price of Colonnade’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Ouster plans to operate, variations in performance across competitors, changes in laws and regulations affecting Ouster’s business and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities, and (xii) the risk of downturns in the highly competitive lidar technology and related industries. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Colonnade’s prospectus dated August 20, 2020 relating to its initial public offering, the registration statement on Form S-4 and proxy statement/prospectus discussed below and other documents filed by Colonnade from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Ouster and Colonnade assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Ouster nor Colonnade gives any assurance that either Ouster or Colonnade will achieve its expectations. Use of Projections This Presentation contains financial forecasts for Ouster with respect to certain financial results for Ouster’s fiscal years 2020 through 2025. Neither Colonnade’s nor Ouster’s independent auditors have audited, studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections are forward-looking statements and should not be relied upon as being necessarily indicative of future results. In this Presentation, certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Ouster or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved.

Non-GAAP Financial Measures This Presentation also includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) including, but not limited to, EBITDA and certain ratios and other metrics derived therefrom. Ouster defines EBITDA is defined as operating income plus depreciation and amortization expenses. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing Ouster’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Ouster’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. Colonnade and Ouster believe these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Ouster’s financial condition and results of operations. Colonnade and Ouster believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing Ouster’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. This Presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Colonnade and Ouster are unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward-looking non-GAAP financial measures is included. Industry and Market Data In this Presentation, Colonnade and Ouster rely on and refer to certain information and statistics obtained from third-party sources which they believe to be reliable. Neither Colonnade nor Ouster has independently verified the accuracy or completeness of any such third-party information. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but Colonnade and Ouster will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Additional Information and Where to Find It Colonnade intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement/prospectus, that will be both the proxy statement to be distributed to holders of Colonnade’s ordinary shares in connection with its solicitation of proxies for the vote by Colonnade’s shareholders with respect to the proposed business combination and other matters as may be described in the registration statement, as well as the prospectus relating to the offer and sale of the securities to be issued in the business combination. After the registration statement is declared effective, Colonnade will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders. This document does not contain all the information that should be considered concerning the proposed business combination and is not intended to form the basis of any investment decision or any other decision in respect of the business combination. Colonnade’s shareholders, Ouster’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the registration statement and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed business combination, as these materials will contain important information about Ouster, Colonnade and the business combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed business combination will be mailed to shareholders of Colonnade as of a record date to be established for voting on the proposed business combination. Colonnade shareholders and Company stockholders will also be able to obtain copies of the preliminary proxy statement, the definitive proxy statement and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to Colonnade’s secretary at 1400 Centrepark Blvd, Suite 810, West Palm Beach, FL 33401, (561) 712-7860. Participants in the Solicitation Colonnade and its directors and executive officers may be deemed participants in the solicitation of proxies from Colonnade’s shareholders with respect to the proposed business combination. A list of the names of those directors and executive officers and a description of their interests in Colonnade is contained in Colonnade’s prospectus dated August 20, 2020 relating to its initial public offering, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov. To the extent such holdings of Colonnade’s securities may have changed since that time, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the proposed business combination when available. Ouster and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of Colonnade in connection with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed business combination will be included in the proxy statement/prospectus for the proposed business combination when available. Disclaimers

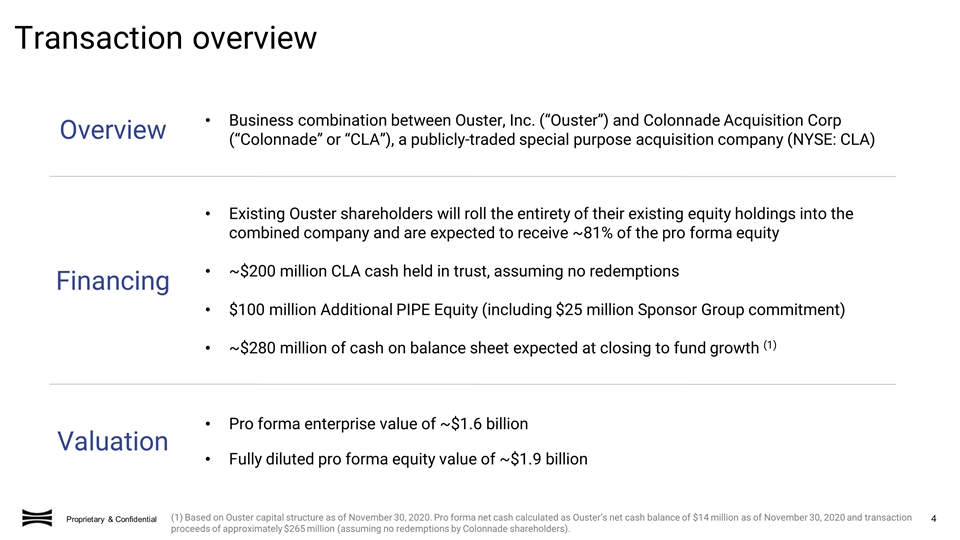

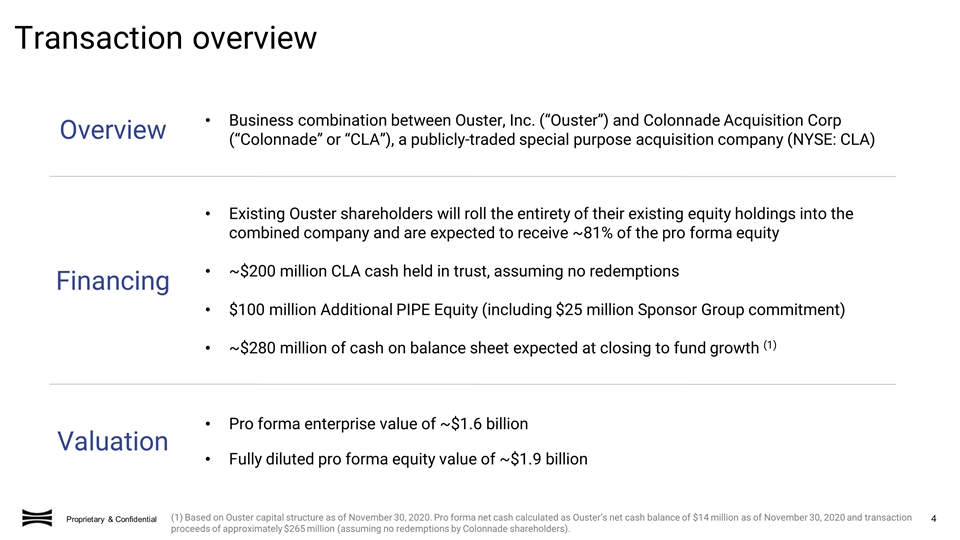

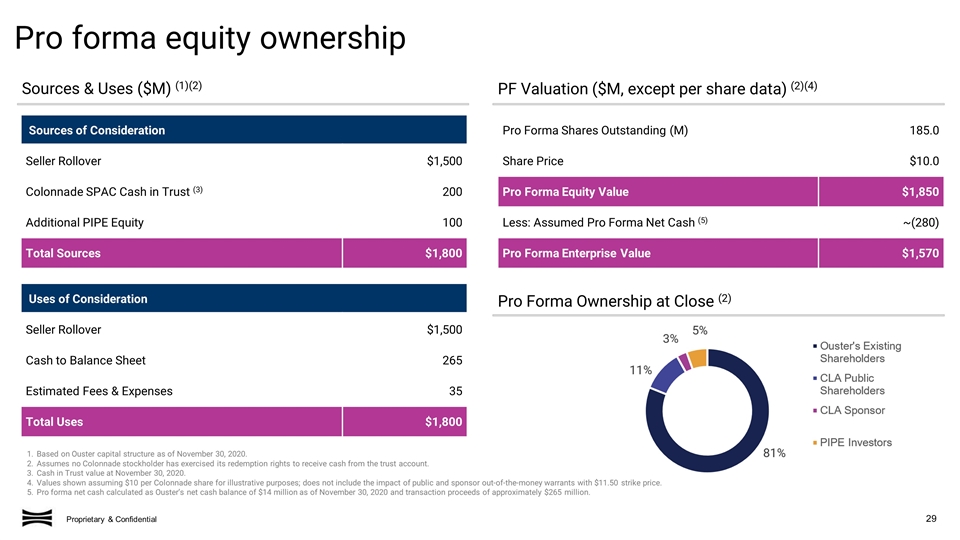

(1) Based on Ouster capital structure as of November 30, 2020. Pro forma net cash calculated as Ouster’s net cash balance of $14 million as of November 30, 2020 and transaction proceeds of approximately $265 million (assuming no redemptions by Colonnade shareholders). Transaction overview Overview Financing Valuation Business combination between Ouster, Inc. (“Ouster”) and Colonnade Acquisition Corp (“Colonnade” or “CLA”), a publicly-traded special purpose acquisition company (NYSE: CLA) Pro forma enterprise value of ~$1.6 billion Fully diluted pro forma equity value of ~$1.9 billion Existing Ouster shareholders will roll the entirety of their existing equity holdings into the combined company and are expected to receive ~81% of the pro forma equity ~$200 million CLA cash held in trust, assuming no redemptions $100 million Additional PIPE Equity (including $25 million Sponsor Group commitment) ~$280 million of cash on balance sheet expected at closing to fund growth (1)

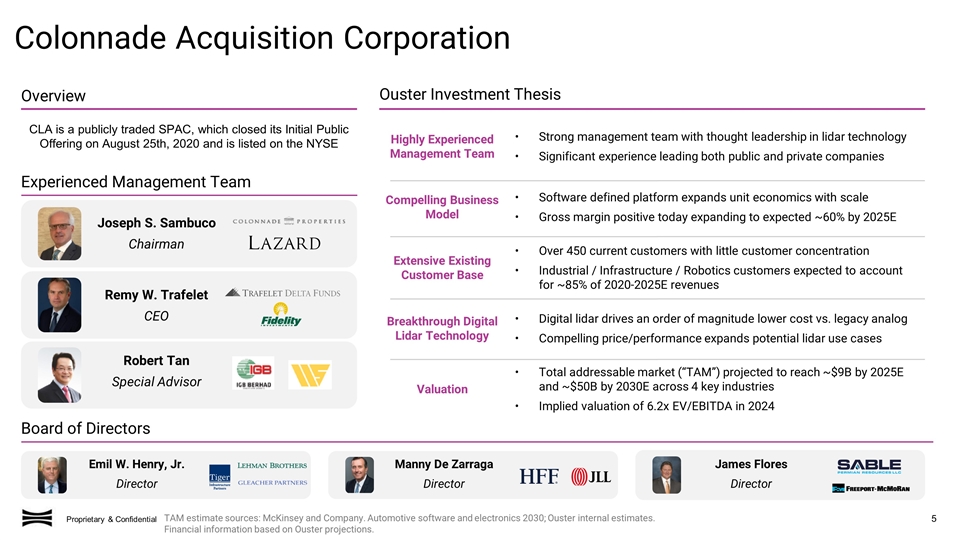

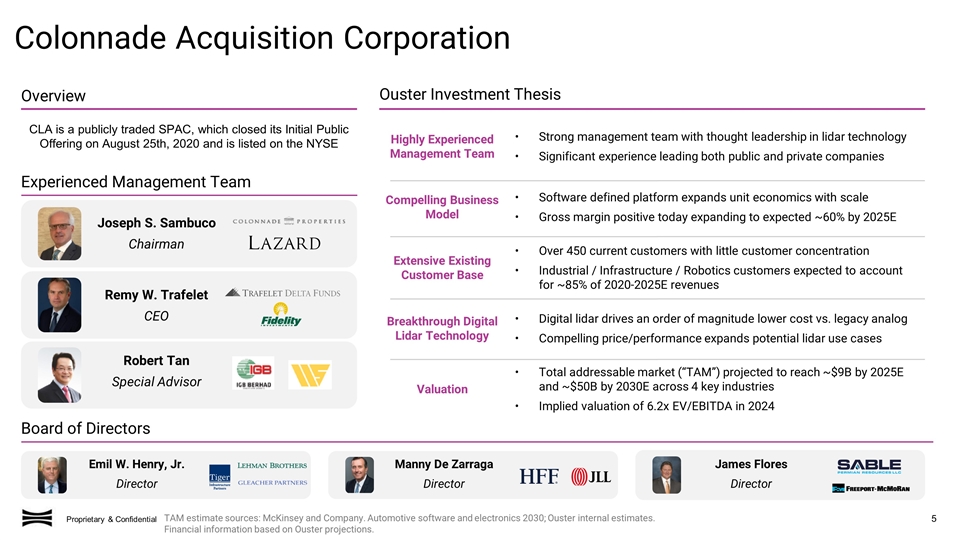

TAM estimate sources: McKinsey and Company. Automotive software and electronics 2030; Ouster internal estimates. Financial information based on Ouster projections. Colonnade Acquisition Corporation Overview Ouster Investment Thesis Experienced Management Team CLA is a publicly traded SPAC, which closed its Initial Public Offering on August 25th, 2020 and is listed on the NYSE Extensive Existing Customer Base Over 450 current customers with little customer concentration Industrial / Infrastructure / Robotics customers expected to account for ~85% of 2020-2025E revenues Compelling Business Model Breakthrough Digital Lidar Technology Digital lidar drives an order of magnitude lower cost vs. legacy analog Compelling price/performance expands potential lidar use cases Highly Experienced Management Team Valuation Total addressable market (“TAM”) projected to reach ~$9B by 2025E and ~$50B by 2030E across 4 key industries Implied valuation of 6.2x EV/EBITDA in 2024 Emil W. Henry, Jr. Director Manny De Zarraga Director James Flores Director Board of Directors Strong management team with thought leadership in lidar technology Significant experience leading both public and private companies Software defined platform expands unit economics with scale Gross margin positive today expanding to expected ~60% by 2025E Joseph S. Sambuco Chairman Remy W. Trafelet CEO Robert Tan Special Advisor

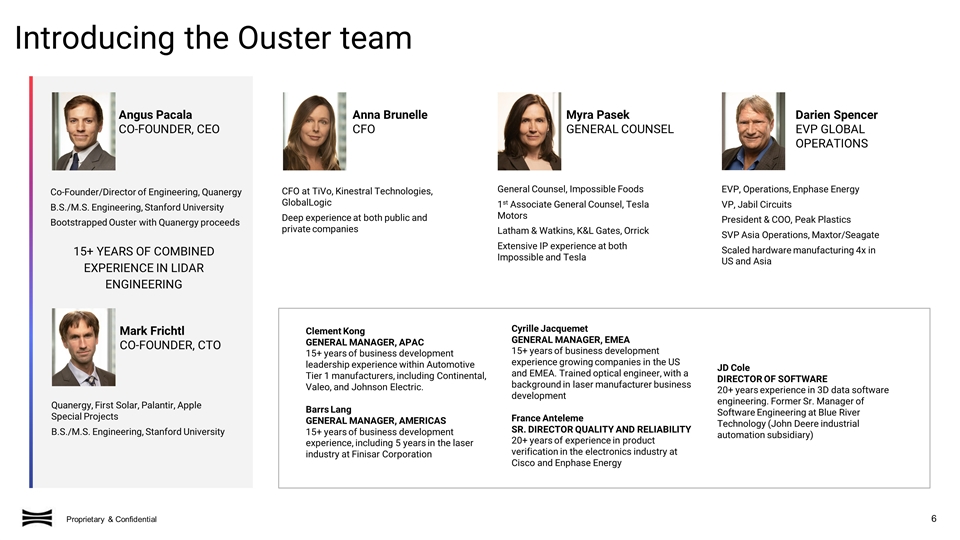

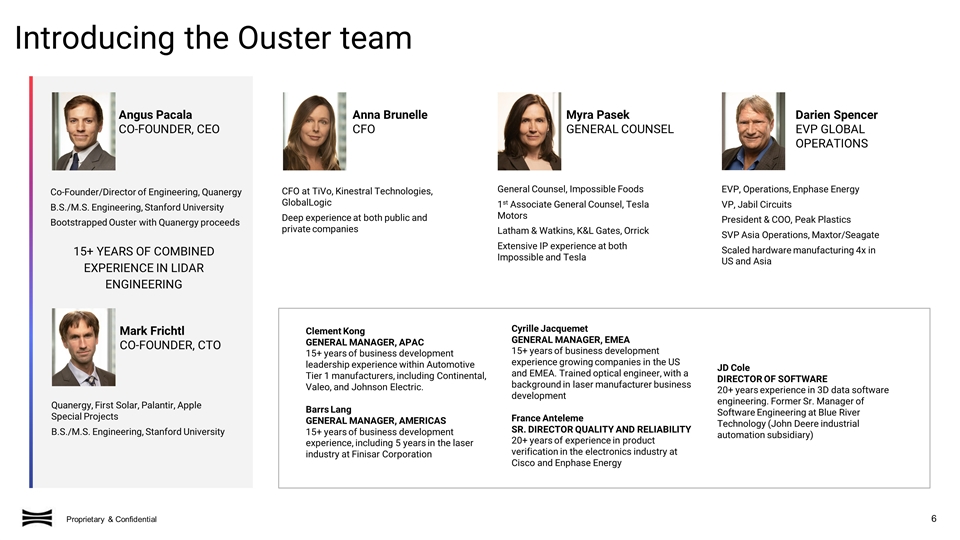

Cyrille Jacquemet GENERAL MANAGER, EMEA 15+ years of business development experience growing companies in the US and EMEA. Trained optical engineer, with a background in laser manufacturer business development France Anteleme SR. DIRECTOR QUALITY AND RELIABILITY 20+ years of experience in product verification in the electronics industry at Cisco and Enphase Energy Clement Kong GENERAL MANAGER, APAC 15+ years of business development leadership experience within Automotive Tier 1 manufacturers, including Continental, Valeo, and Johnson Electric. Barrs Lang GENERAL MANAGER, AMERICAS 15+ years of business development experience, including 5 years in the laser industry at Finisar Corporation Angus Pacala CO-FOUNDER, CEO Mark Frichtl CO-FOUNDER, CTO EVP, Operations, Enphase Energy VP, Jabil Circuits President & COO, Peak Plastics SVP Asia Operations, Maxtor/Seagate Scaled hardware manufacturing 4x in US and Asia General Counsel, Impossible Foods 1st Associate General Counsel, Tesla Motors Latham & Watkins, K&L Gates, Orrick Extensive IP experience at both Impossible and Tesla CFO at TiVo, Kinestral Technologies, GlobalLogic Deep experience at both public and private companies Introducing the Ouster team 15+ YEARS OF COMBINED EXPERIENCE IN LIDAR ENGINEERING Darien Spencer EVP GLOBAL OPERATIONS Myra Pasek GENERAL COUNSEL Anna Brunelle CFO Quanergy, First Solar, Palantir, Apple Special Projects B.S./M.S. Engineering, Stanford University Co-Founder/Director of Engineering, Quanergy B.S./M.S. Engineering, Stanford University Bootstrapped Ouster with Quanergy proceeds JD Cole DIRECTOR OF SOFTWARE 20+ years experience in 3D data software engineering. Former Sr. Manager of Software Engineering at Blue River Technology (John Deere industrial automation subsidiary)

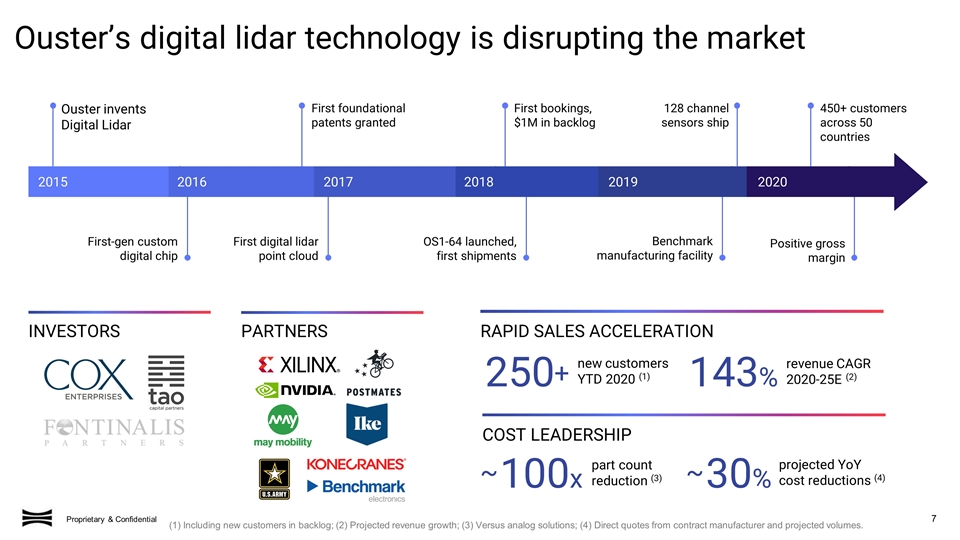

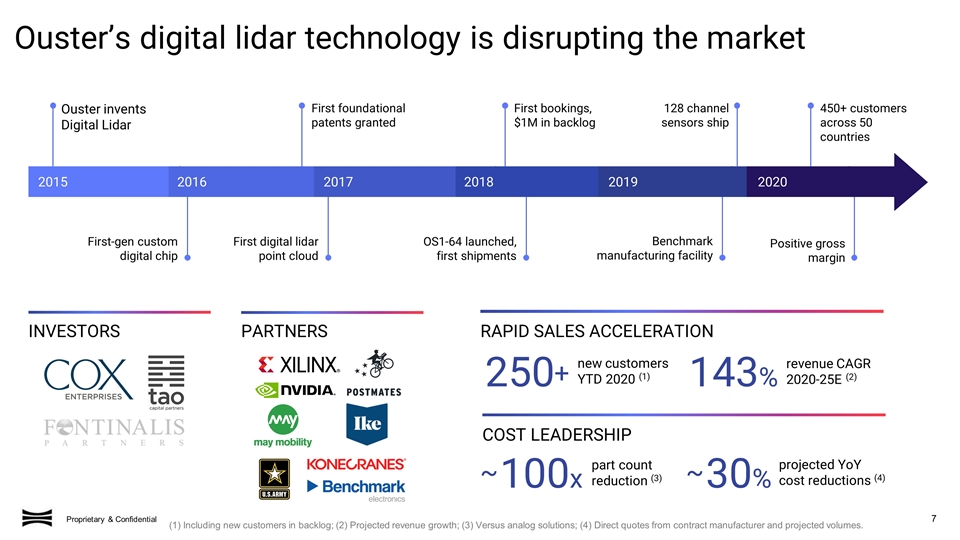

Ouster invents Digital Lidar First digital lidar point cloud First-gen custom digital chip OS1-64 launched, first shipments PARTNERS INVESTORS 128 channel sensors ship First foundational patents granted First bookings, $1M in backlog 450+ customers across 50 countries Positive gross margin 2015 2016 2017 2018 2020 Ouster’s digital lidar technology is disrupting the market Benchmark manufacturing facility 2019 RAPID SALES ACCELERATION 143% revenue CAGR 2020-25E (2) 250 new customers YTD 2020 (1) + (1) Including new customers in backlog; (2) Projected revenue growth; (3) Versus analog solutions; (4) Direct quotes from contract manufacturer and projected volumes. part count reduction (3) 30% ~ projected YoY cost reductions (4) COST LEADERSHIP 100x ~

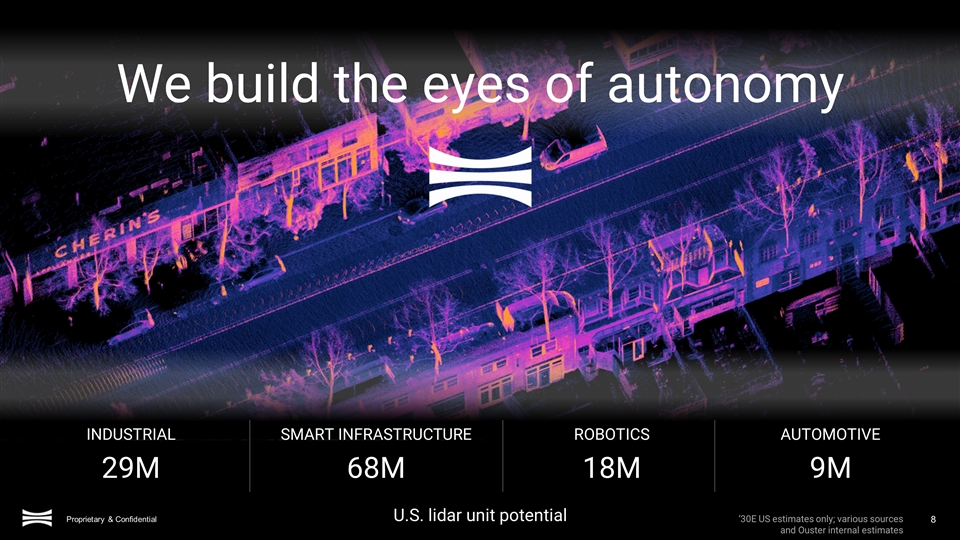

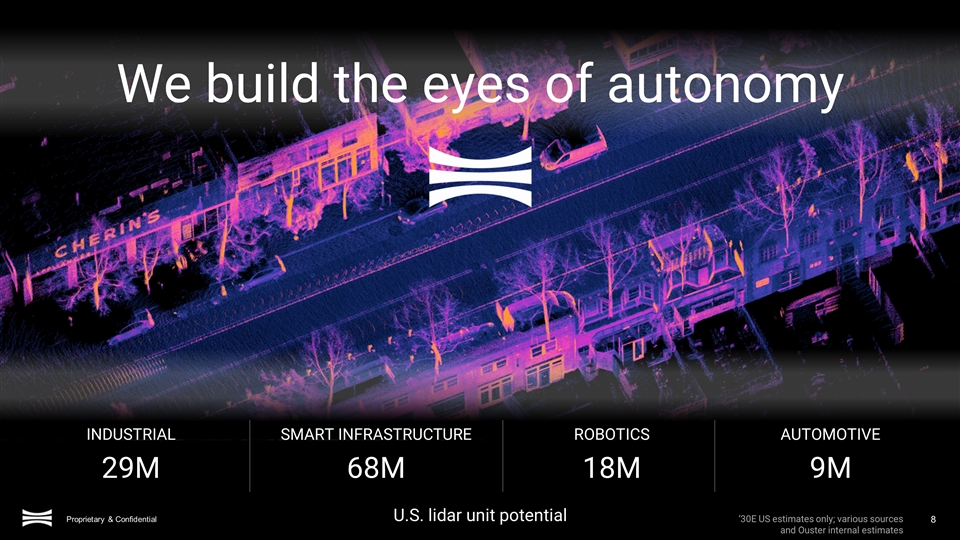

AUTOMOTIVE INDUSTRIAL SMART INFRASTRUCTURE ROBOTICS 29M 68M 18M 9M U.S. lidar unit potential We build the eyes of autonomy ‘30E US estimates only; various sources and Ouster internal estimates

‘30E US estimates only; various sources and Ouster internal estimates We build digital lidar U.S. lidar unit potential 29M 68M 18M 9M AUTOMOTIVE INDUSTRIAL SMART INFRASTRUCTURE ROBOTICS

10

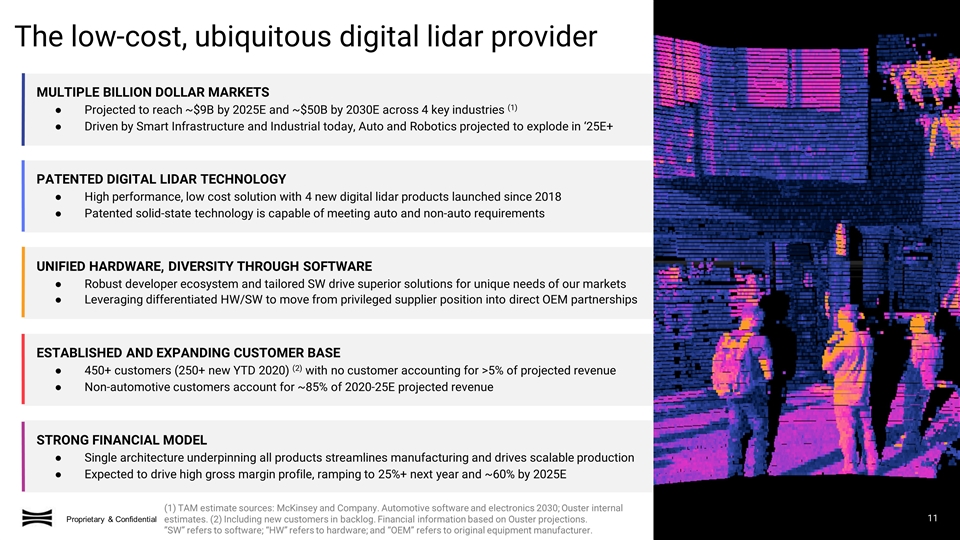

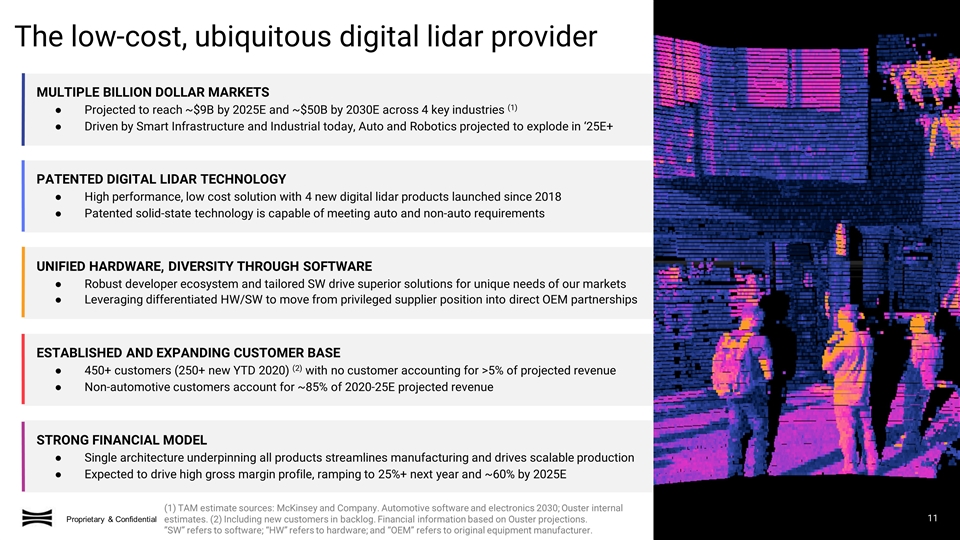

UNIFIED HARDWARE, DIVERSITY THROUGH SOFTWARE Robust developer ecosystem and tailored SW drive superior solutions for unique needs of our markets Leveraging differentiated HW/SW to move from privileged supplier position into direct OEM partnerships The low-cost, ubiquitous digital lidar provider MULTIPLE BILLION DOLLAR MARKETS Projected to reach ~$9B by 2025E and ~$50B by 2030E across 4 key industries (1) Driven by Smart Infrastructure and Industrial today, Auto and Robotics projected to explode in ‘25E+ PATENTED DIGITAL LIDAR TECHNOLOGY High performance, low cost solution with 4 new digital lidar products launched since 2018 Patented solid-state technology is capable of meeting auto and non-auto requirements ESTABLISHED AND EXPANDING CUSTOMER BASE 450+ customers (250+ new YTD 2020) (2) with no customer accounting for >5% of projected revenue Non-automotive customers account for ~85% of 2020-25E projected revenue STRONG FINANCIAL MODEL Single architecture underpinning all products streamlines manufacturing and drives scalable production Expected to drive high gross margin profile, ramping to 25%+ next year and ~60% by 2025E (1) TAM estimate sources: McKinsey and Company. Automotive software and electronics 2030; Ouster internal estimates. (2) Including new customers in backlog. Financial information based on Ouster projections. ”SW” refers to software; “HW” refers to hardware; and “OEM” refers to original equipment manufacturer. 11

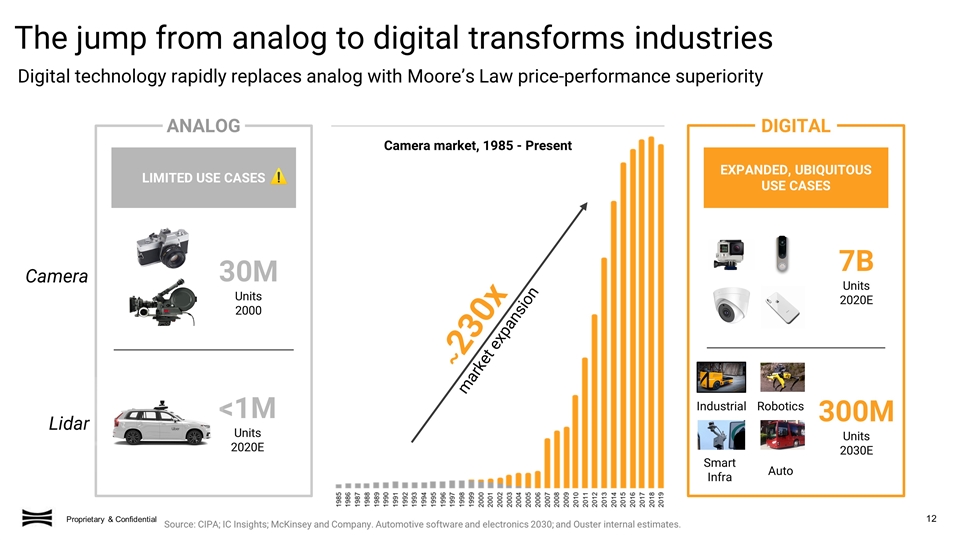

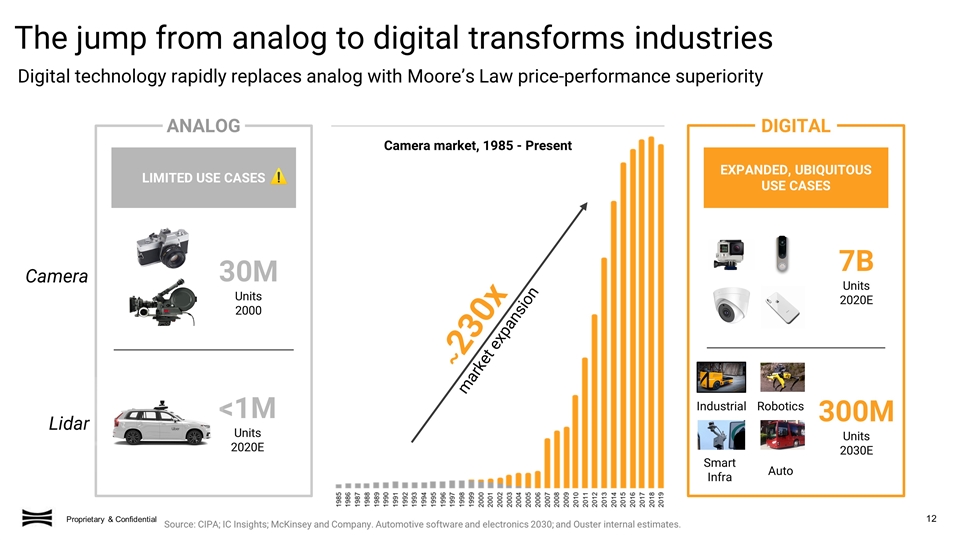

Digital technology rapidly replaces analog with Moore’s Law price-performance superiority ANALOG DIGITAL The jump from analog to digital transforms industries LIMITED USE CASES EXPANDED, UBIQUITOUS USE CASES Camera Lidar Industrial Robotics Smart Infra Auto 7B Units 2020E 300M Units 2030E 30M Units 2000 <1M Units 2020E Camera market, 1985 - Present ~230x market expansion Source: CIPA; IC Insights; McKinsey and Company. Automotive software and electronics 2030; and Ouster internal estimates.

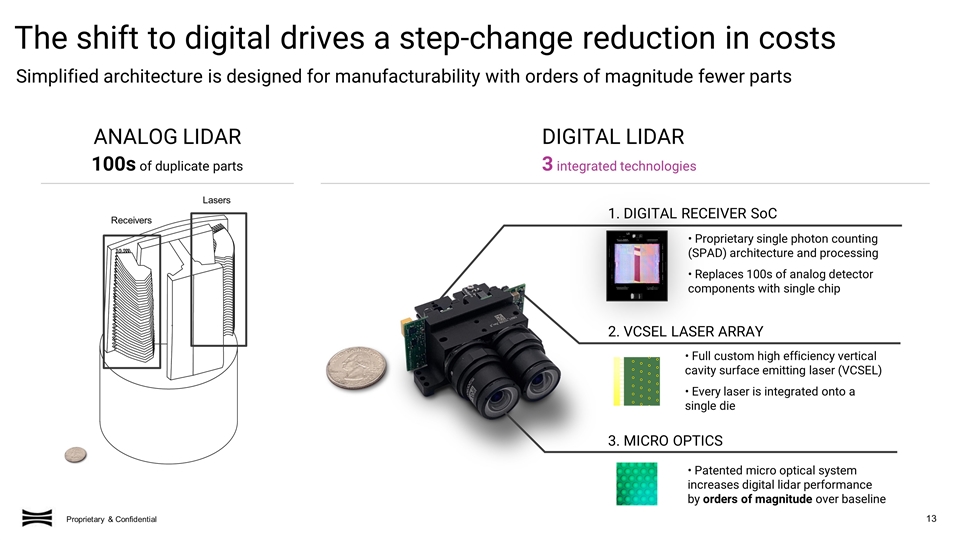

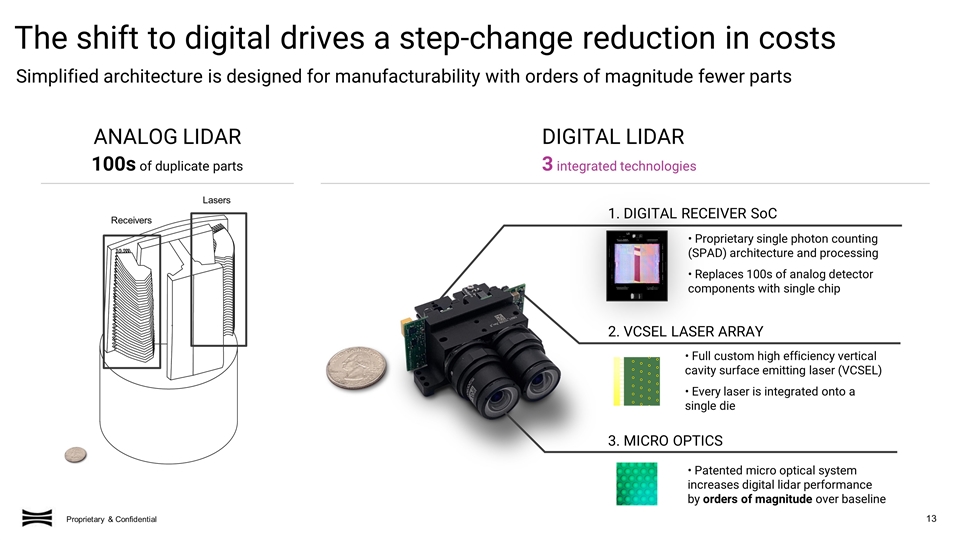

The shift to digital drives a step-change reduction in costs ANALOG LIDAR DIGITAL LIDAR 2. VCSEL LASER ARRAY 1. DIGITAL RECEIVER SoC • Proprietary single photon counting (SPAD) architecture and processing • Replaces 100s of analog detector components with single chip • Full custom high efficiency vertical cavity surface emitting laser (VCSEL) • Every laser is integrated onto a single die • Patented micro optical system increases digital lidar performance by orders of magnitude over baseline 3. MICRO OPTICS Simplified architecture is designed for manufacturability with orders of magnitude fewer parts 100s of duplicate parts 3 integrated technologies Receivers Lasers

COGS today are materially lower than competitors and expected to drop ~30% annually with projected volume ...driving visible cost leadership today and in the future. COGS based on real quotes for products in mass production today… …and $100 lidar by 2030E Analog 128-channel lidar Digital 128-channel lidar Direct COGS visibility confirms cost leadership over analog solutions Order of magnitude lower today... Ouster Production Facility Active Since 2018 Note: COGS refers to cost of goods sold.

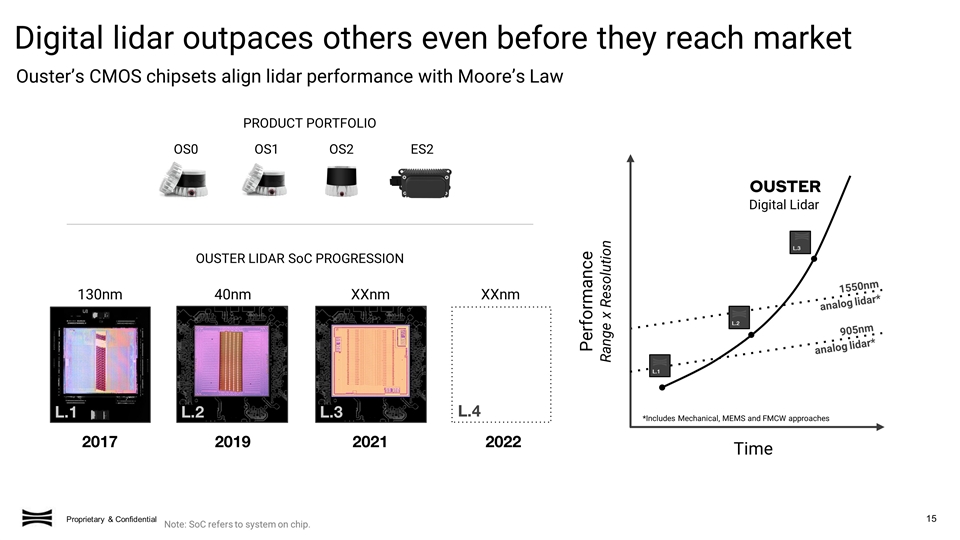

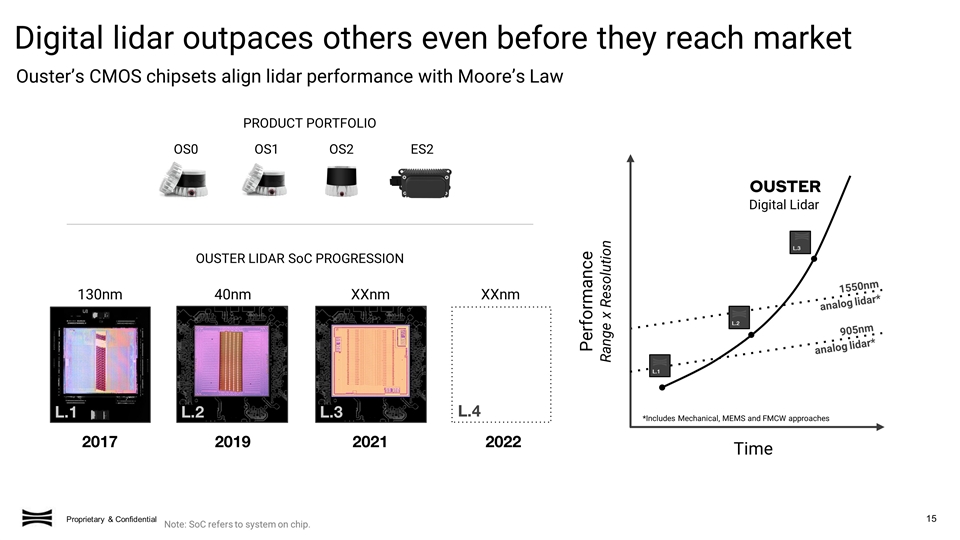

Ouster’s CMOS chipsets align lidar performance with Moore’s Law Digital lidar outpaces others even before they reach market OS0 OS1 OS2 ES2 PRODUCT PORTFOLIO Performance Range x Resolution Time 905nm analog lidar* Digital Lidar *Includes Mechanical, MEMS and FMCW approaches 130nm L.1 L.2 L.3 40nm XXnm OUSTER LIDAR SoC PROGRESSION L.1 L.2 L.3 1550nm analog lidar* 2017 2019 2021 2022 L.4 XXnm Note: SoC refers to system on chip.

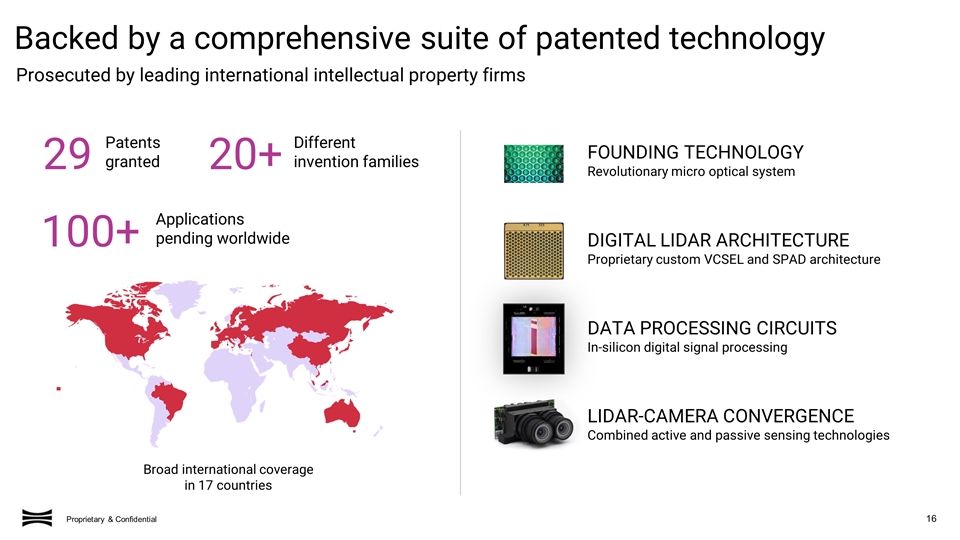

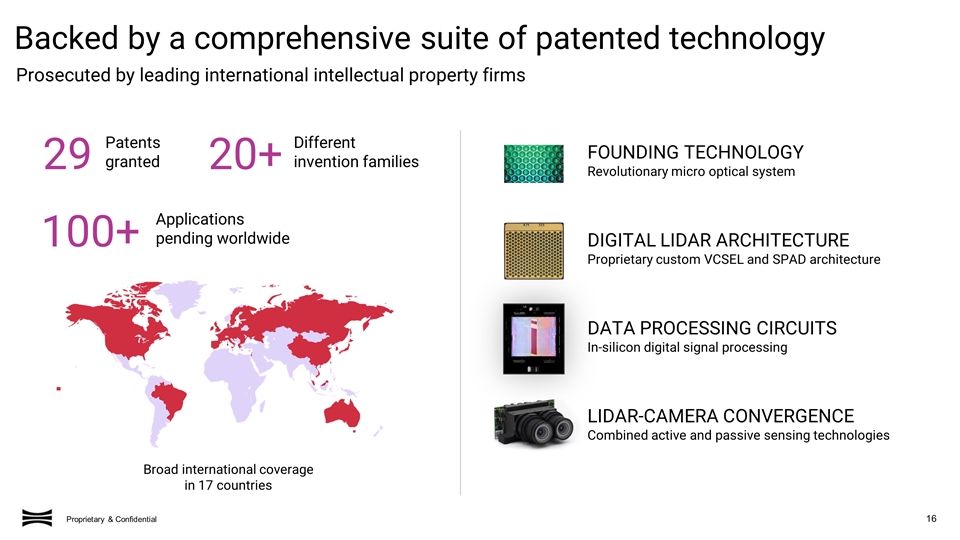

LIDAR-CAMERA CONVERGENCE Combined active and passive sensing technologies DATA PROCESSING CIRCUITS In-silicon digital signal processing Backed by a comprehensive suite of patented technology Broad international coverage in 17 countries 29 Patents granted 100+ Applications pending worldwide 20+ Different invention families Prosecuted by leading international intellectual property firms FOUNDING TECHNOLOGY Revolutionary micro optical system DIGITAL LIDAR ARCHITECTURE Proprietary custom VCSEL and SPAD architecture

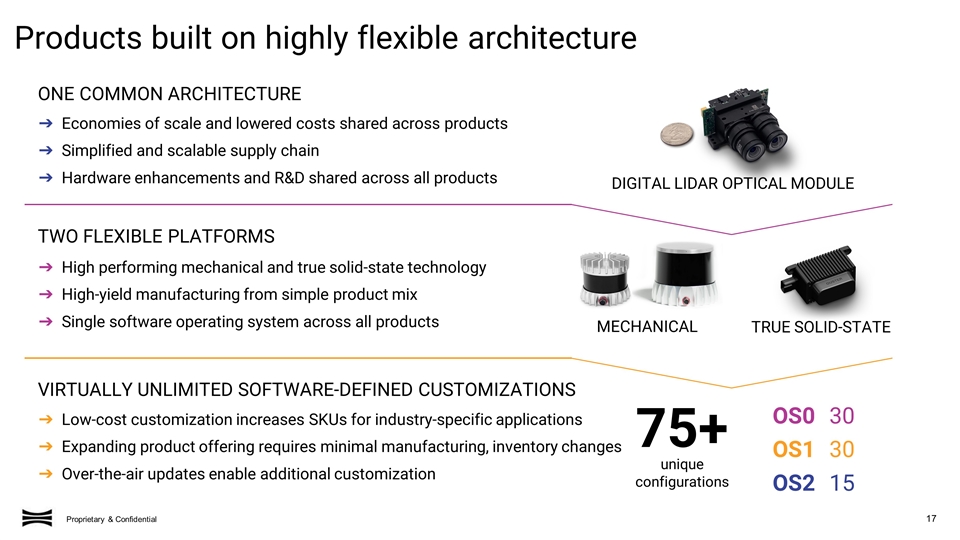

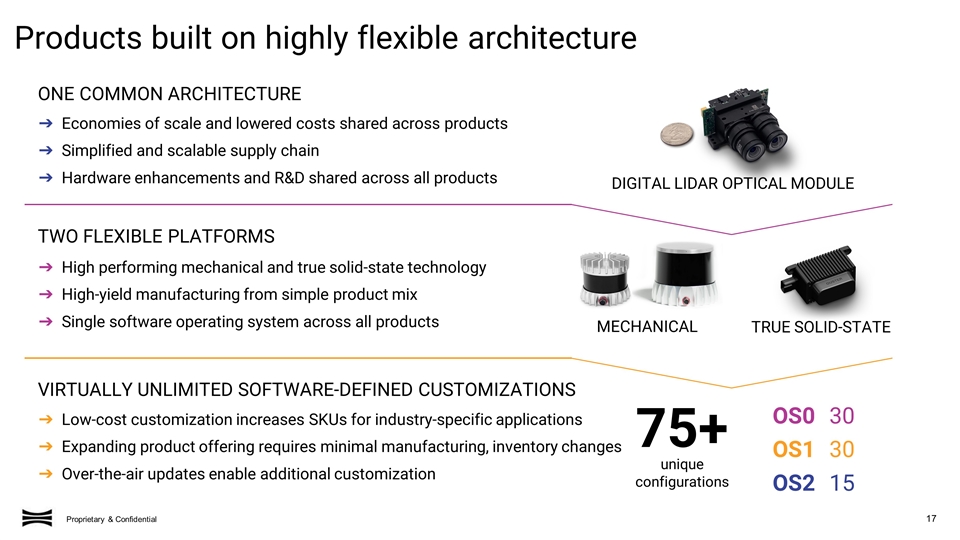

ONE COMMON ARCHITECTURE MECHANICAL TRUE SOLID-STATE OS0 OS1 OS2 30 30 15 75+ unique configurations ➔ Economies of scale and lowered costs shared across products ➔ Simplified and scalable supply chain ➔ Hardware enhancements and R&D shared across all products TWO FLEXIBLE PLATFORMS ➔ High performing mechanical and true solid-state technology ➔ High-yield manufacturing from simple product mix ➔ Single software operating system across all products ➔ Low-cost customization increases SKUs for industry-specific applications ➔ Expanding product offering requires minimal manufacturing, inventory changes ➔ Over-the-air updates enable additional customization DIGITAL LIDAR OPTICAL MODULE Products built on highly flexible architecture VIRTUALLY UNLIMITED SOFTWARE-DEFINED CUSTOMIZATIONS

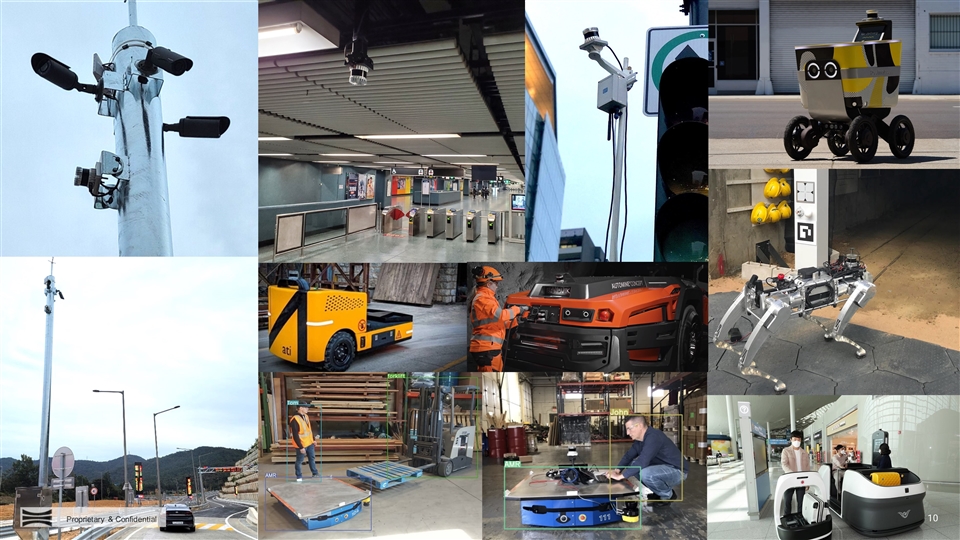

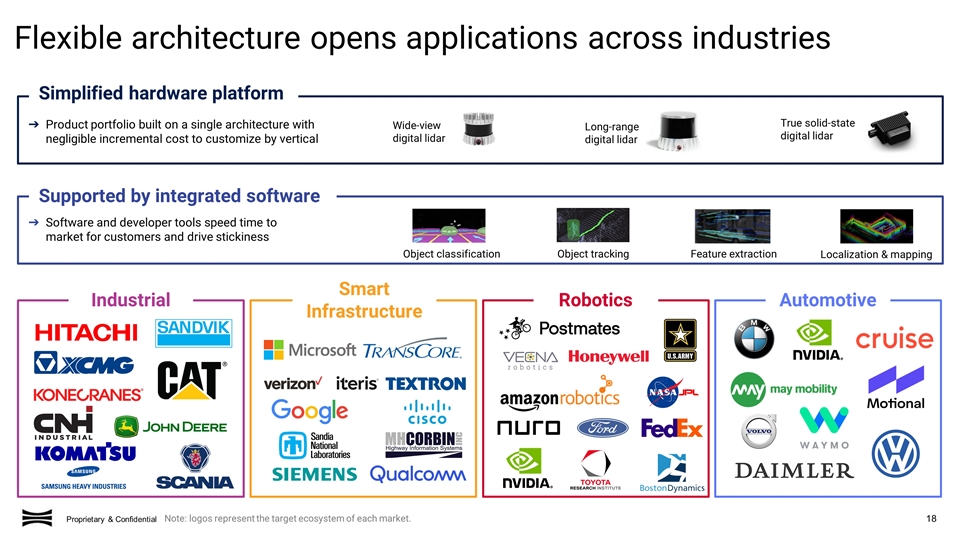

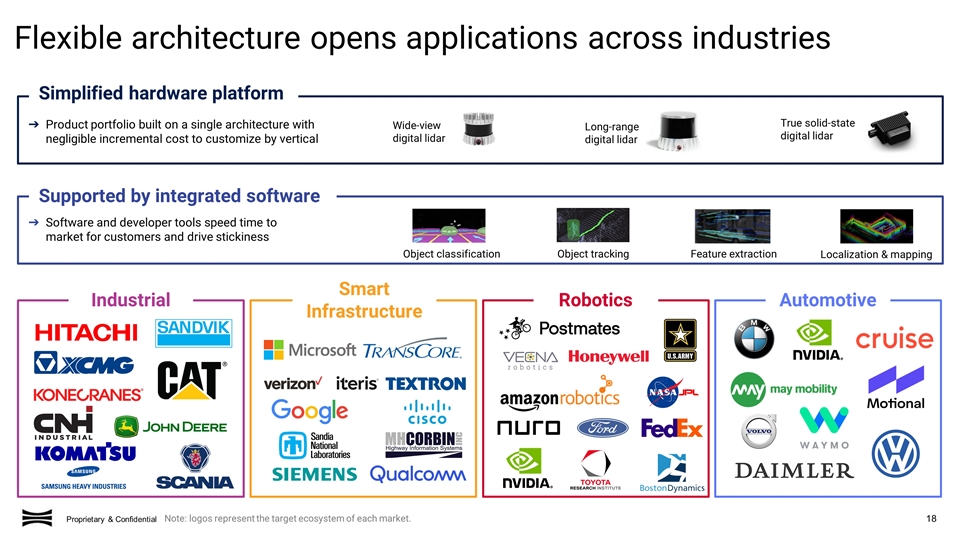

Wide-view digital lidar Long-range digital lidar *Logos shown represent target customer ecosystem. True solid-state digital lidar Supported by integrated software Object classification Object tracking Localization & mapping Feature extraction Industrial Smart Infrastructure Robotics Automotive Flexible architecture opens applications across industries ➔ Product portfolio built on a single architecture with negligible incremental cost to customize by vertical ➔ Software and developer tools speed time to market for customers and drive stickiness Simplified hardware platform Note: logos represent the target ecosystem of each market.

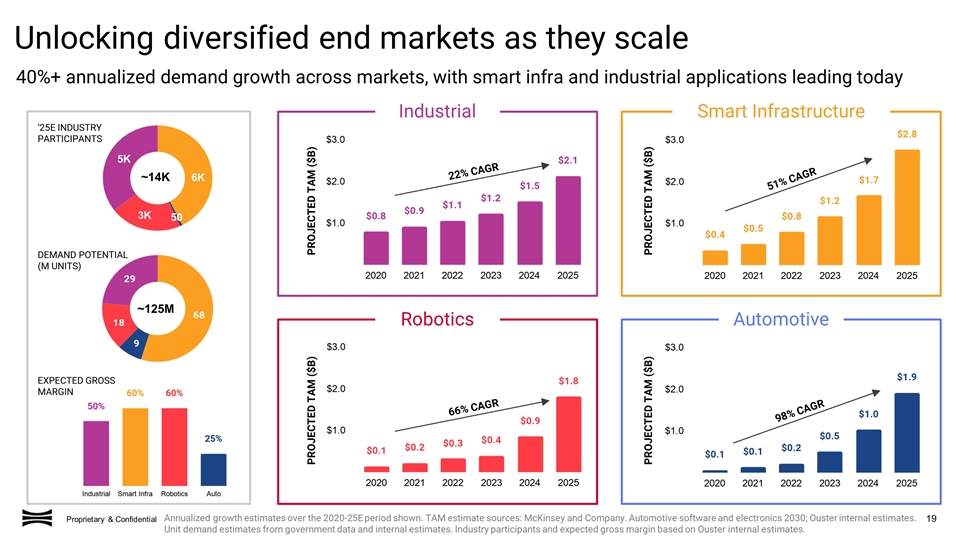

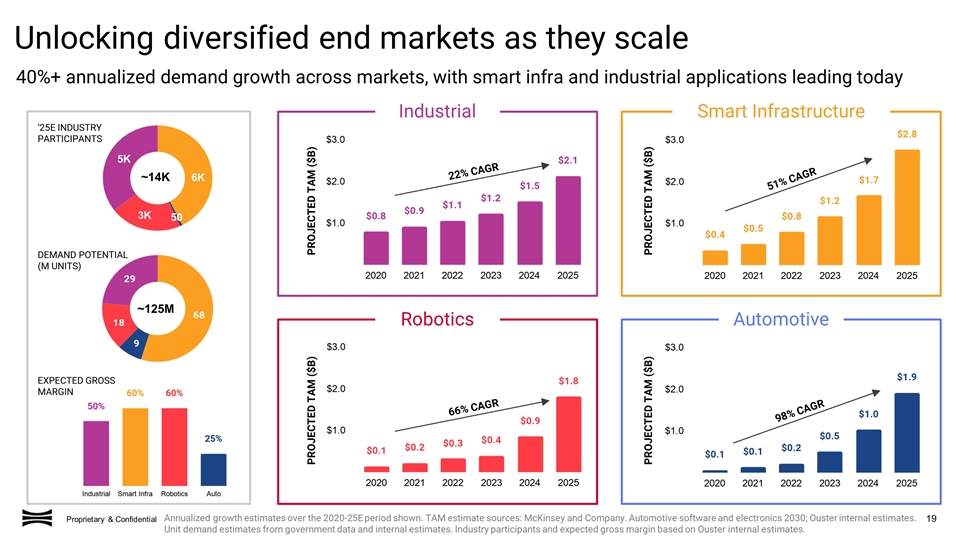

Annualized growth estimates over the 2020-25E period shown. TAM estimate sources: McKinsey and Company. Automotive software and electronics 2030; Ouster internal estimates. Unit demand estimates from government data and internal estimates. Industry participants and expected gross margin based on Ouster internal estimates. Industrial Smart Infrastructure Robotics Automotive Unlocking diversified end markets as they scale 40%+ annualized demand growth across markets, with smart infra and industrial applications leading today PROJECTED TAM ($B) 22% CAGR 66% CAGR PROJECTED TAM ($B) PROJECTED TAM ($B) PROJECTED TAM ($B) ‘25E INDUSTRY PARTICIPANTS 50 DEMAND POTENTIAL (M UNITS) EXPECTED GROSS MARGIN 6K 5K 3K 51% CAGR 98% CAGR ~14K ~125M

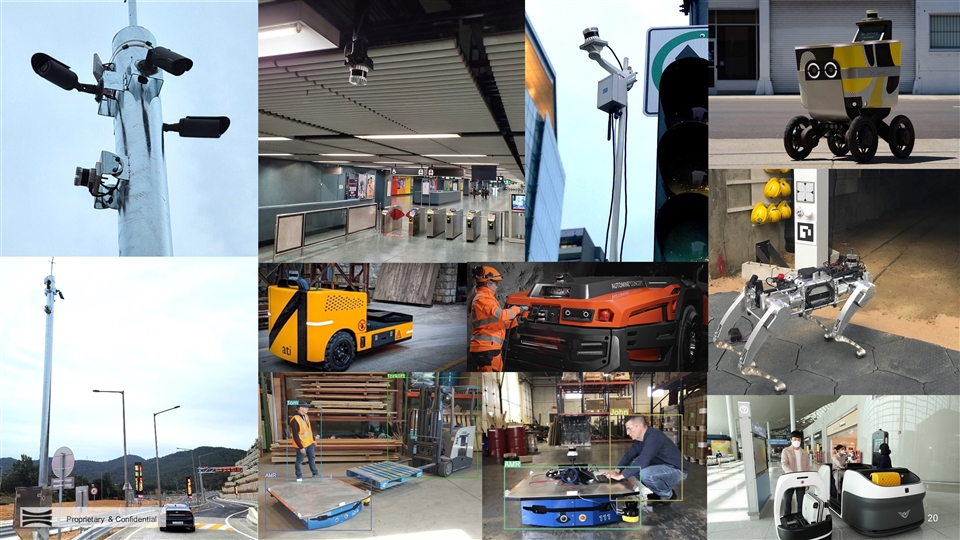

20

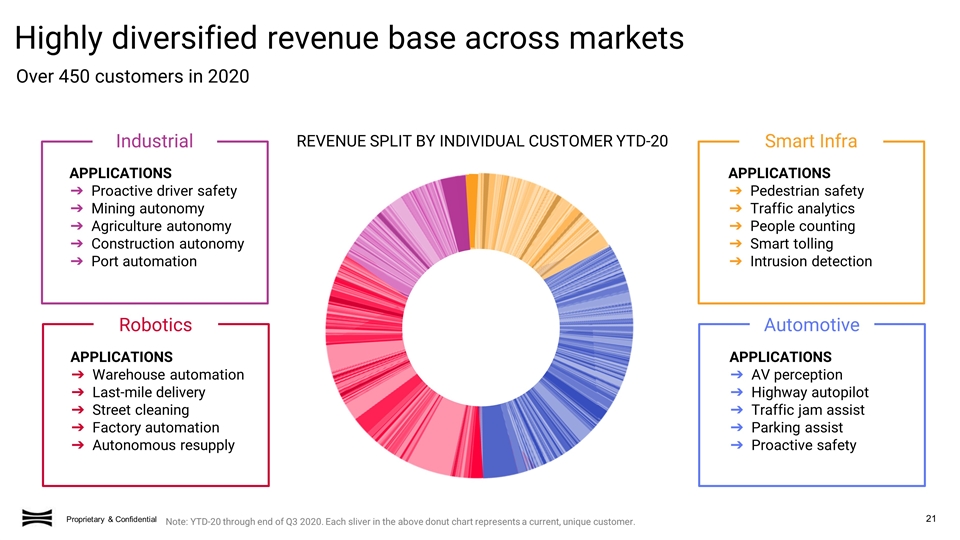

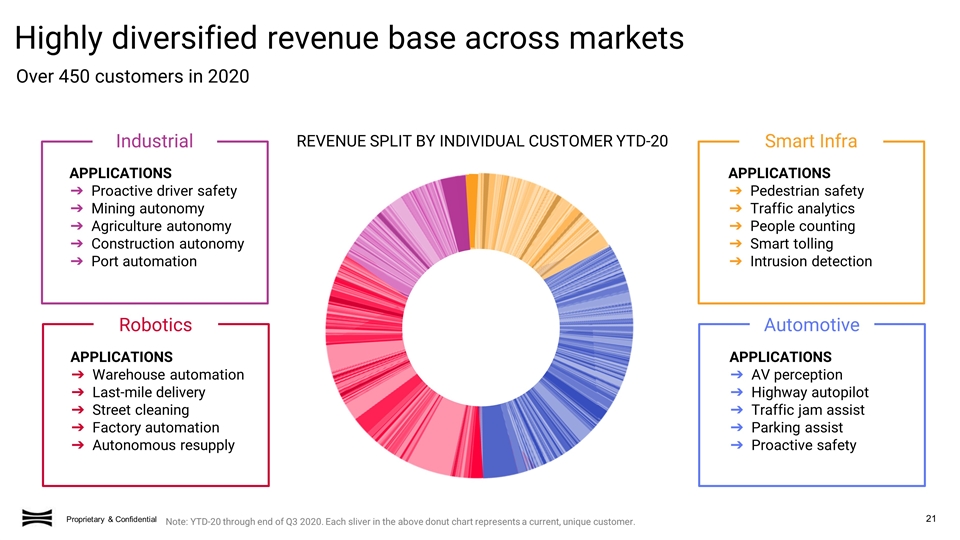

Highly diversified revenue base across markets Industrial Smart Infra Robotics APPLICATIONS ➔ Proactive driver safety ➔ Mining autonomy ➔ Agriculture autonomy ➔ Construction autonomy ➔ Port automation APPLICATIONS ➔ Pedestrian safety ➔ Traffic analytics ➔ People counting ➔ Smart tolling ➔ Intrusion detection APPLICATIONS ➔ Warehouse automation ➔ Last-mile delivery ➔ Street cleaning ➔ Factory automation ➔ Autonomous resupply Automotive APPLICATIONS ➔ AV perception ➔ Highway autopilot ➔ Traffic jam assist ➔ Parking assist ➔ Proactive safety Note: YTD-20 through end of Q3 2020. Each sliver in the above donut chart represents a current, unique customer. REVENUE SPLIT BY INDIVIDUAL CUSTOMER YTD-20 Over 450 customers in 2020

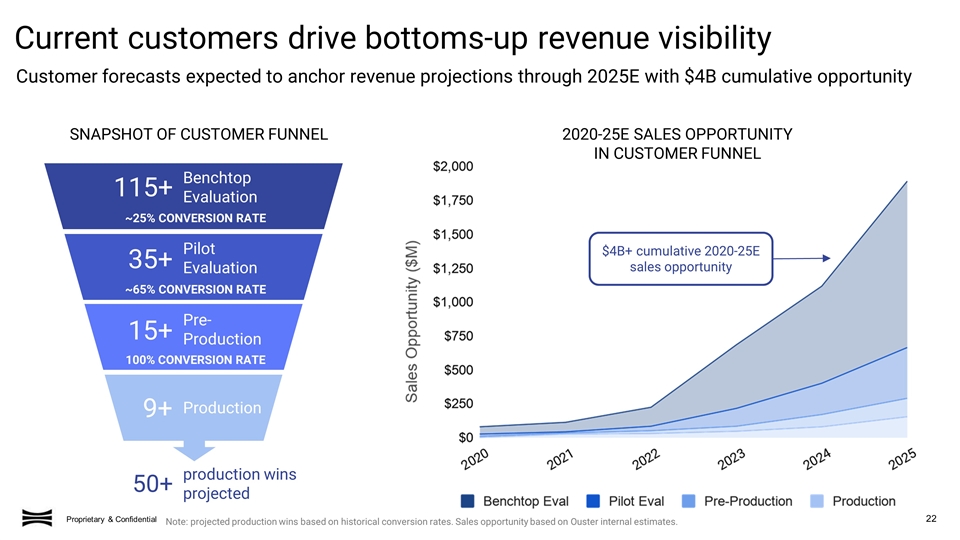

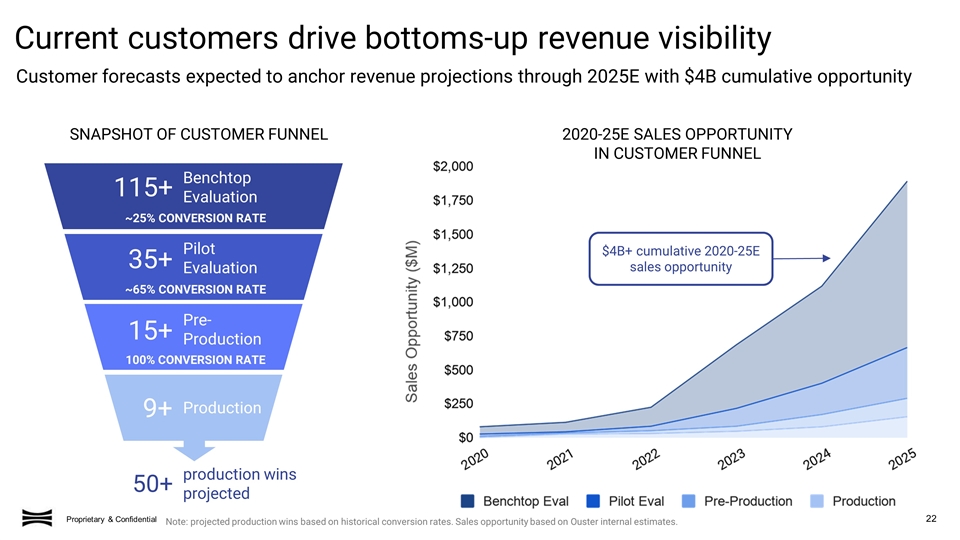

210 existing 35+ Pilot Evaluation Production 115+ Benchtop Evaluation 9+ ~25% CONVERSION RATE ~65% CONVERSION RATE 15+ 100% CONVERSION RATE Pre- Production 50+ production wins projected 2020-25E SALES OPPORTUNITY IN CUSTOMER FUNNEL Customer forecasts expected to anchor revenue projections through 2025E with $4B cumulative opportunity Current customers drive bottoms-up revenue visibility $4B+ cumulative 2020-25E sales opportunity SNAPSHOT OF CUSTOMER FUNNEL Note: projected production wins based on historical conversion rates. Sales opportunity based on Ouster internal estimates.

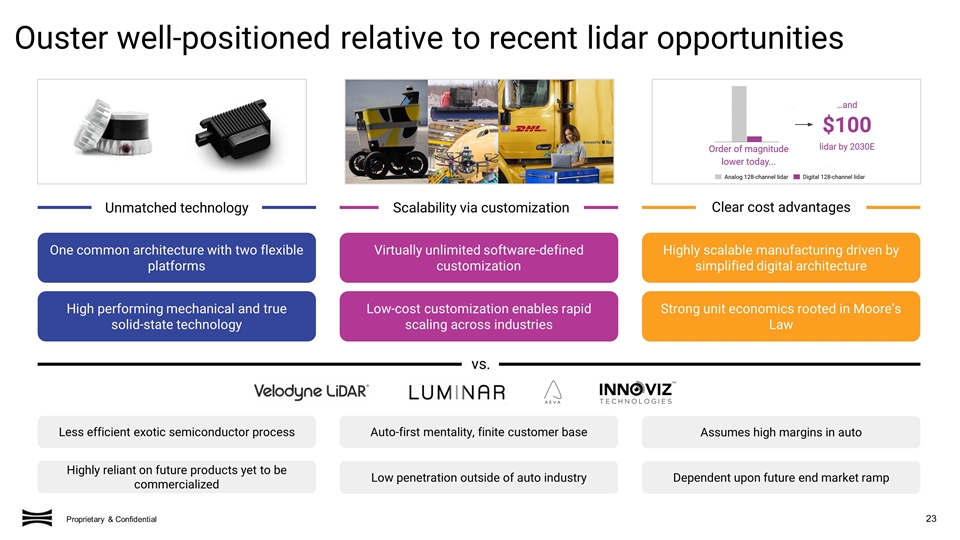

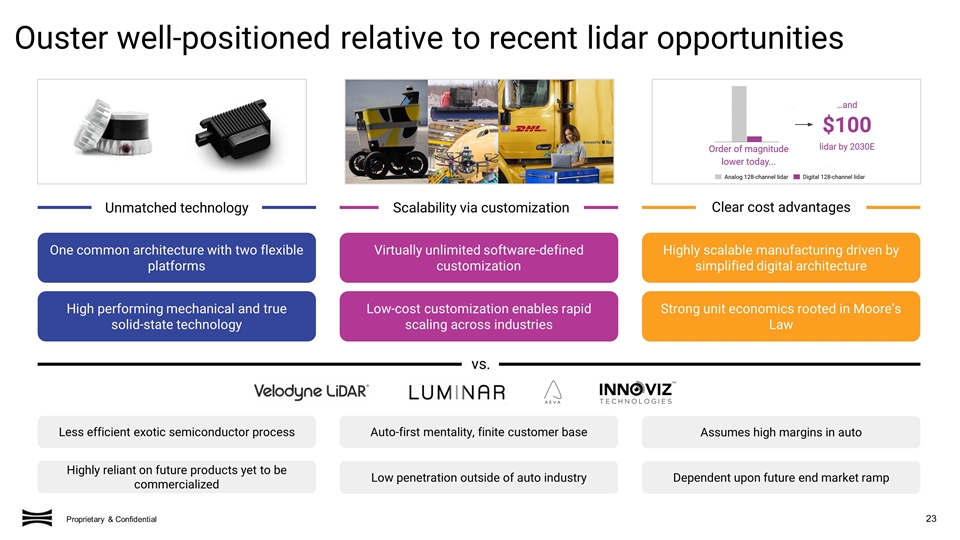

Virtually unlimited software-defined customization Unmatched technology Scalability via customization Clear cost advantages vs. Less efficient exotic semiconductor process Dependent upon future end market ramp One common architecture with two flexible platforms High performing mechanical and true solid-state technology Low-cost customization enables rapid scaling across industries Highly scalable manufacturing driven by simplified digital architecture Strong unit economics rooted in Moore’s Law Auto-first mentality, finite customer base Low penetration outside of auto industry Assumes high margins in auto Ouster well-positioned relative to recent lidar opportunities Highly reliant on future products yet to be commercialized

Financial Overview

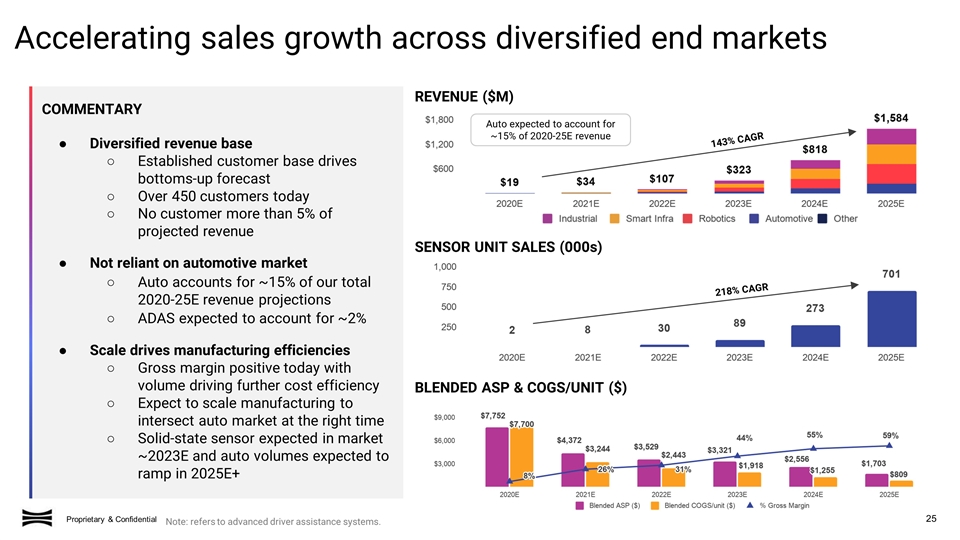

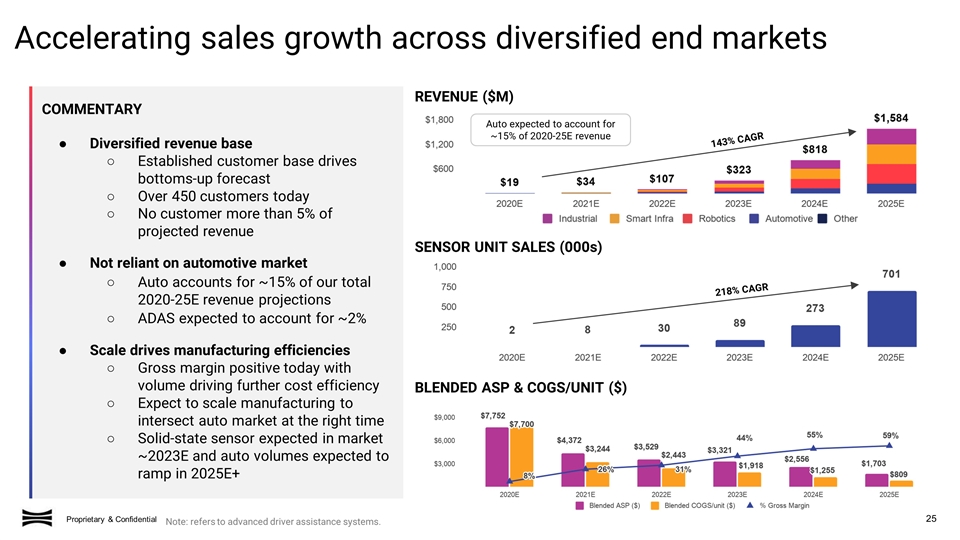

REVENUE ($M) SENSOR UNIT SALES (000s) Accelerating sales growth across diversified end markets 143% CAGR Auto expected to account for ~15% of 2020-25E revenue BLENDED ASP & COGS/UNIT ($) 218% CAGR Note: refers to advanced driver assistance systems. COMMENTARY Diversified revenue base Established customer base drives bottoms-up forecast Over 450 customers today No customer more than 5% of projected revenue Not reliant on automotive market Auto accounts for ~15% of our total 2020-25E revenue projections ADAS expected to account for ~2% Scale drives manufacturing efficiencies Gross margin positive today with volume driving further cost efficiency Expect to scale manufacturing to intersect auto market at the right time Solid-state sensor expected in market ~2023E and auto volumes expected to ramp in 2025E+

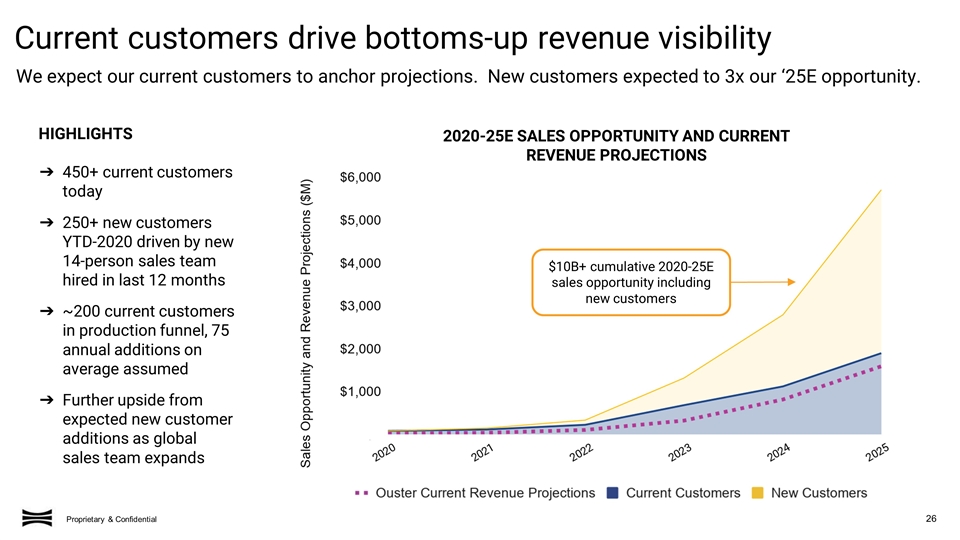

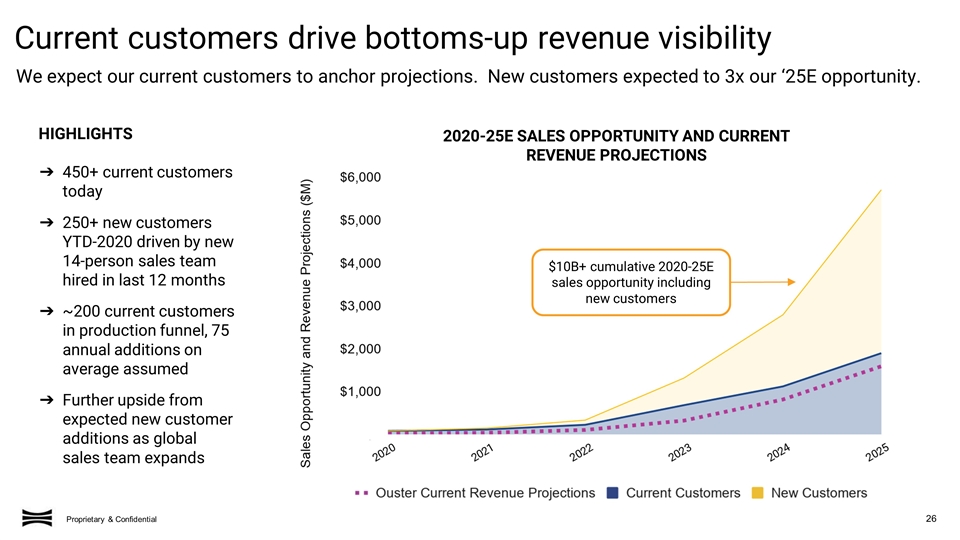

$10B+ cumulative 2020-25E sales opportunity including new customers We expect our current customers to anchor projections. New customers expected to 3x our ‘25E opportunity. 2020-25E SALES OPPORTUNITY AND CURRENT REVENUE PROJECTIONS Current customers drive bottoms-up revenue visibility HIGHLIGHTS ➔450+ current customers today ➔250+ new customers YTD-2020 driven by new 14-person sales team hired in last 12 months ➔~200 current customers in production funnel, 75 annual additions on average assumed ➔ Further upside from expected new customer additions as global sales team expands

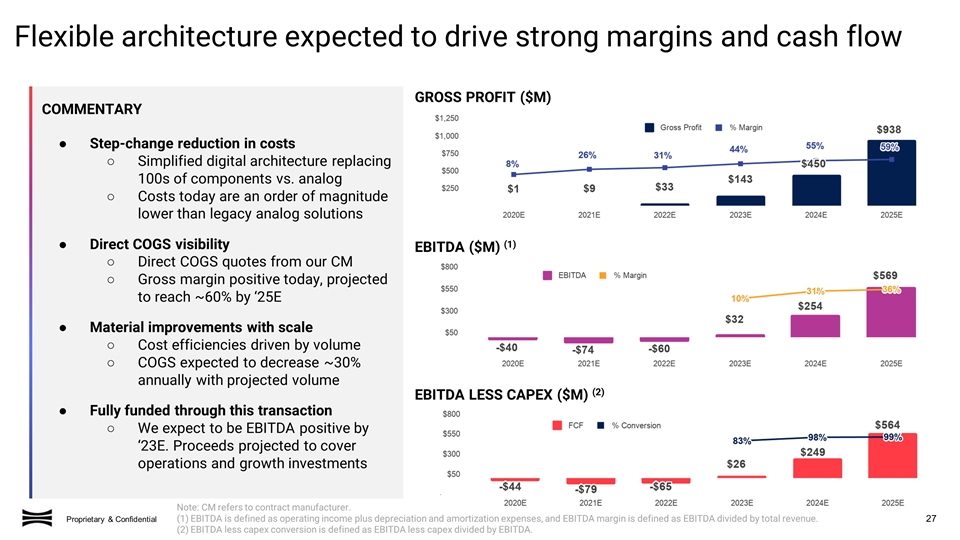

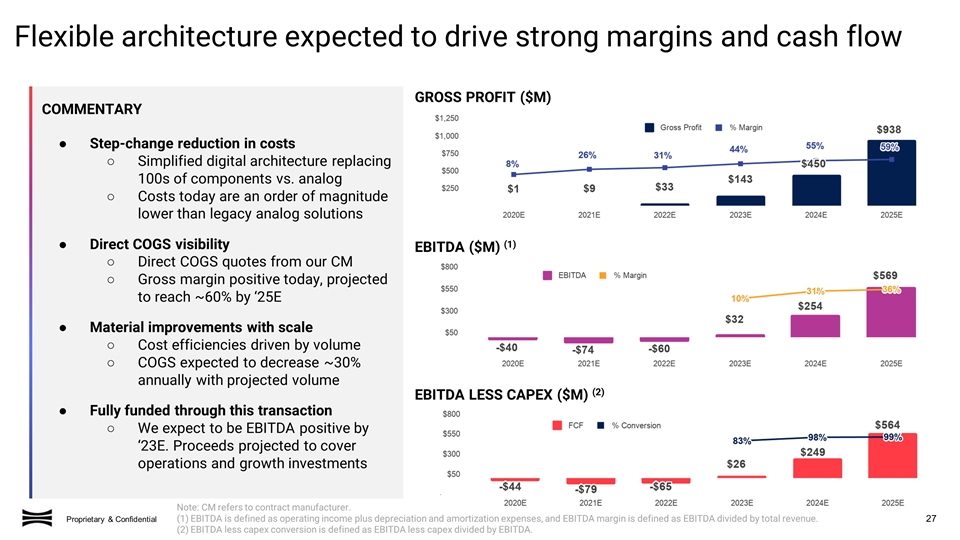

Note: CM refers to contract manufacturer. (1) EBITDA is defined as operating income plus depreciation and amortization expenses, and EBITDA margin is defined as EBITDA divided by total revenue. (2) EBITDA less capex conversion is defined as EBITDA less capex divided by EBITDA. EBITDA ($M) (1) GROSS PROFIT ($M) Flexible architecture expected to drive strong margins and cash flow EBITDA LESS CAPEX ($M) (2) COMMENTARY Step-change reduction in costs Simplified digital architecture replacing 100s of components vs. analog Costs today are an order of magnitude lower than legacy analog solutions Direct COGS visibility Direct COGS quotes from our CM Gross margin positive today, projected to reach ~60% by ‘25E Material improvements with scale Cost efficiencies driven by volume COGS expected to decrease ~30% annually with projected volume Fully funded through this transaction We expect to be EBITDA positive by ‘23E. Proceeds projected to cover operations and growth investments

Transaction Overview

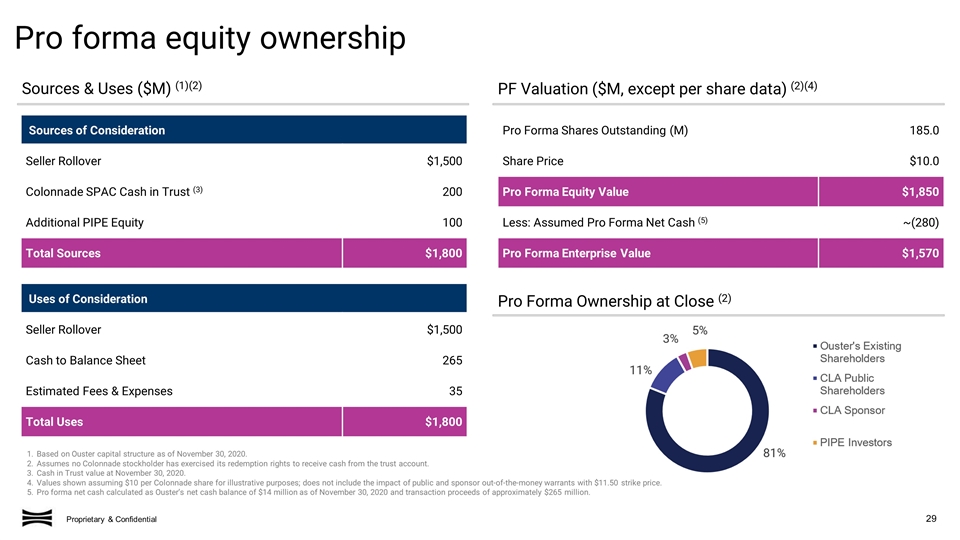

Pro Forma Ownership at Close (2) PF Valuation ($M, except per share data) (2)(4) Sources & Uses ($M) (1)(2) Pro forma equity ownership Uses of Consideration Seller Rollover $1,500 Cash to Balance Sheet 265 Estimated Fees & Expenses 35 Total Uses $1,800 Pro Forma Shares Outstanding (M) 185.0 Share Price $10.0 Pro Forma Equity Value $1,850 Less: Assumed Pro Forma Net Cash (5) ~(280) Pro Forma Enterprise Value $1,570 Sources of Consideration Seller Rollover $1,500 Colonnade SPAC Cash in Trust (3) 200 Additional PIPE Equity 100 Total Sources $1,800 Based on Ouster capital structure as of November 30, 2020. Assumes no Colonnade stockholder has exercised its redemption rights to receive cash from the trust account. Cash in Trust value at November 30, 2020. Values shown assuming $10 per Colonnade share for illustrative purposes; does not include the impact of public and sponsor out-of-the-money warrants with $11.50 strike price. Pro forma net cash calculated as Ouster’s net cash balance of $14 million as of November 30, 2020 and transaction proceeds of approximately $265 million.

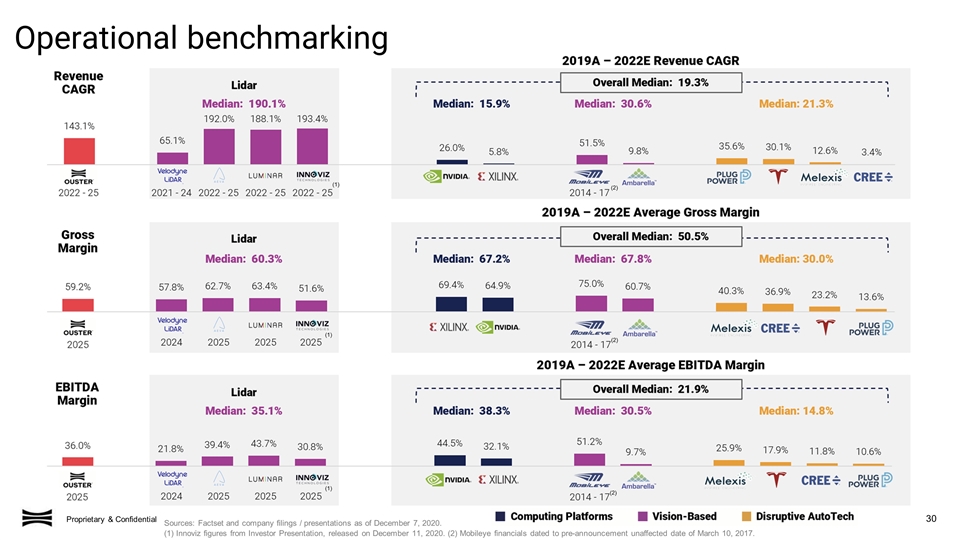

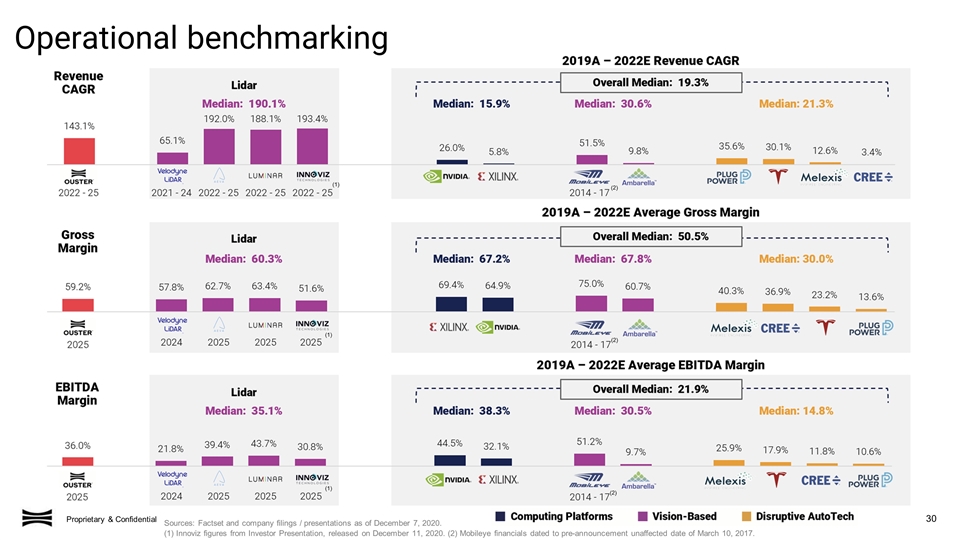

Operational benchmarking Sources: Factset and company filings / presentations as of December 7, 2020. (1) Innoviz figures from Investor Presentation, released on December 11, 2020. (2) Mobileye financials dated to pre-announcement unaffected date of March 10, 2017.

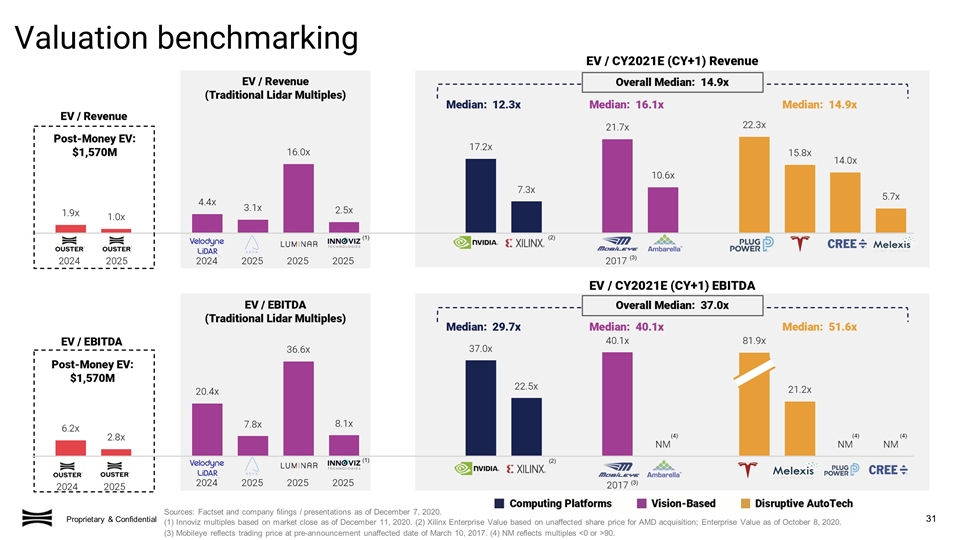

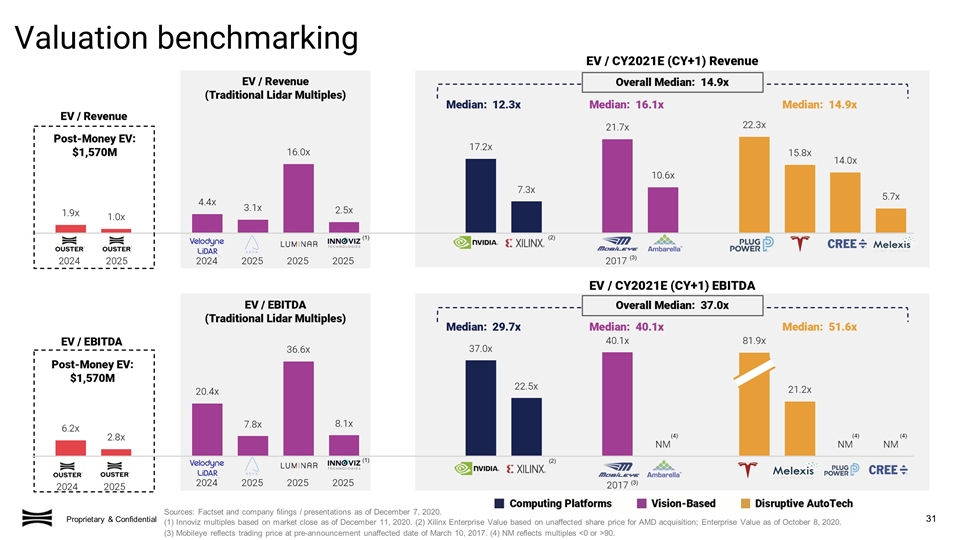

Sources: Factset and company filings / presentations as of December 7, 2020. (1) Innoviz multiples based on market close as of December 11, 2020. (2) Xilinx Enterprise Value based on unaffected share price for AMD acquisition; Enterprise Value as of October 8, 2020. (3) Mobileye reflects trading price at pre-announcement unaffected date of March 10, 2017. (4) NM reflects multiples <0 or >90. Valuation benchmarking

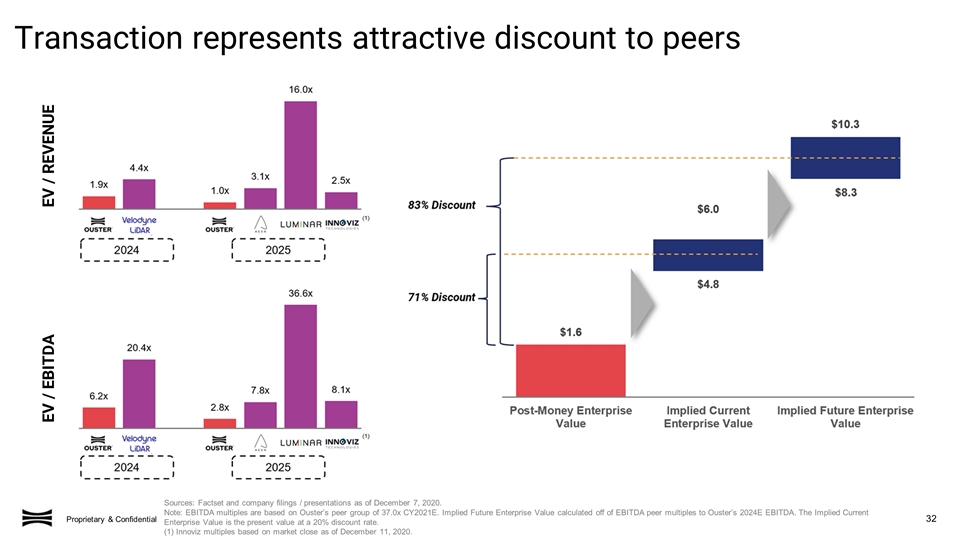

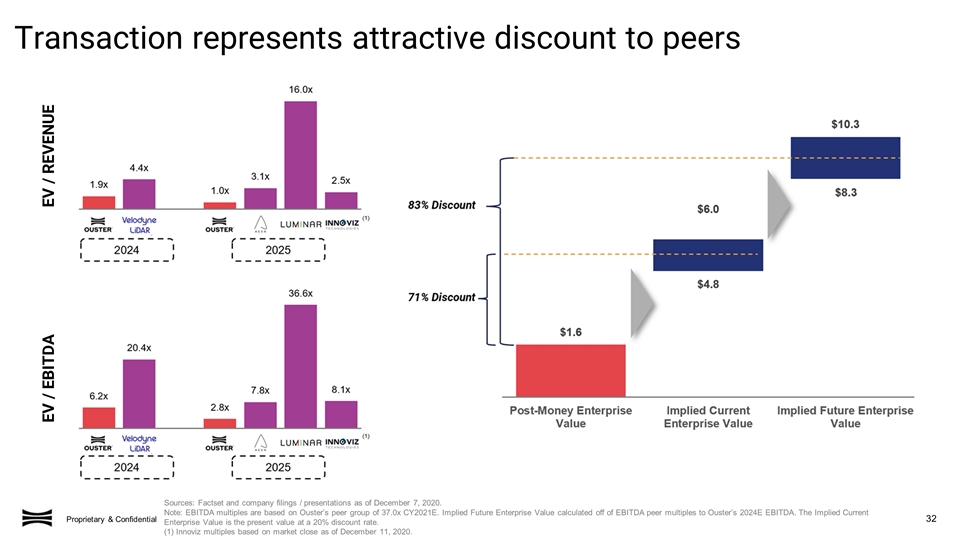

Transaction represents attractive discount to peers EV / REVENUE EV / EBITDA Sources: Factset and company filings / presentations as of December 7, 2020. Note: EBITDA multiples are based on Ouster’s peer group of 37.0x CY2021E. Implied Future Enterprise Value calculated off of EBITDA peer multiples to Ouster’s 2024E EBITDA. The Implied Current Enterprise Value is the present value at a 20% discount rate. (1) Innoviz multiples based on market close as of December 11, 2020.

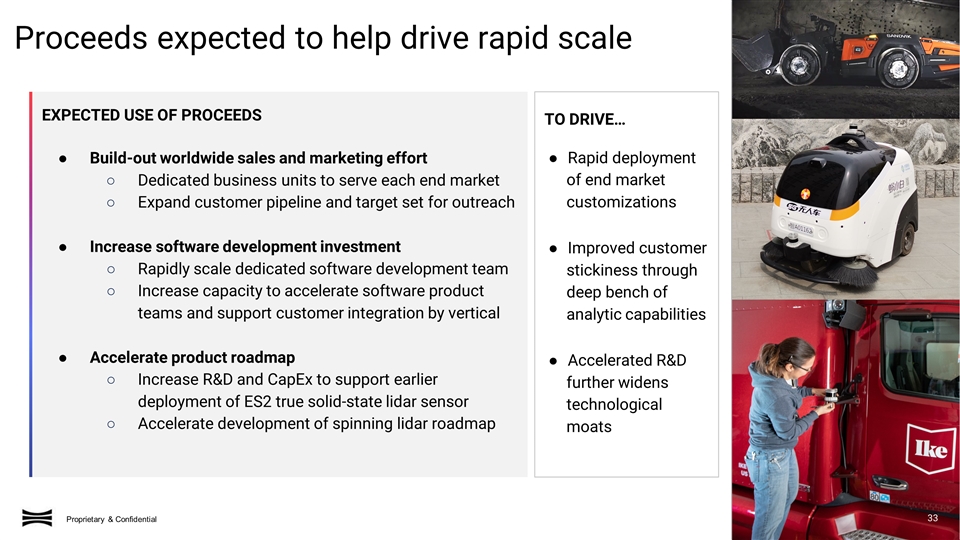

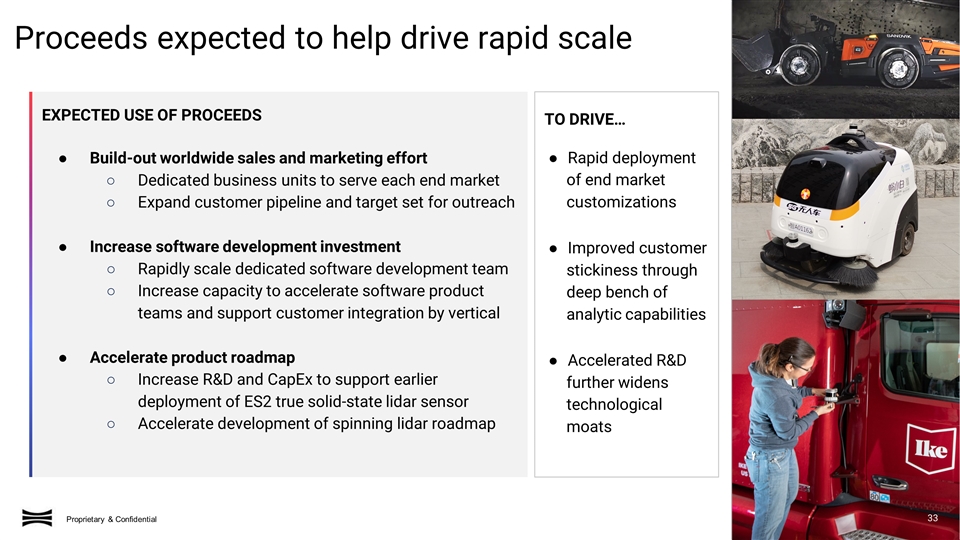

TO DRIVE… Proceeds expected to help drive rapid scale Rapid deployment of end market customizations Improved customer stickiness through deep bench of analytic capabilities Accelerated R&D further widens technological moats EXPECTED USE OF PROCEEDS Build-out worldwide sales and marketing effort Dedicated business units to serve each end market Expand customer pipeline and target set for outreach Increase software development investment Rapidly scale dedicated software development team Increase capacity to accelerate software product teams and support customer integration by vertical Accelerate product roadmap Increase R&D and CapEx to support earlier deployment of ES2 true solid-state lidar sensor Accelerate development of spinning lidar roadmap 33

Appendix

Technology that powers a cleaner, safer world Enabling ESG solutions for customers across industries ➔Enabling safe, energy efficient vehicles, machinery and robotics across end markets ➔Reduction in global carbon emissions through automation helps curb climate change (1) ➔Safer cities and improved human rights through privacy protection (2) ➔Active involvement in our local communities, leveraging supply chain to donate PPE during COVID (1) Assumes emissions reductions given potential to reduce fleet sizes – per Rocky Mountain Institute report “How the U.S. Transportation System Can Save $1 Trillion, 2 Billion Barrels of Oil and 1 Gigaton of Carbon Emissions Annually” (2015). (2) Per McKinsey Global Institute – “Smart Cities: Digital Solutions for a More Livable Future” (2018); Applications can help cities fight crime and improve other aspects of public safety. 35

And delivers on privacy protection ➔“Privacy by design” ➔AkiraKan deploying digital lidar sensors for vehicle and pedestrian traffic flow monitoring in APAC cities ➔Ouster selected due to customizable software enabling “privacy safe” sensor, producing no PII and protecting from facial recognition technology Smart Infrastructure case study 36

Thank you.