UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23592

First Eagle Credit Opportunities Fund

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas

New York, NY 10105-4300

(Address of principal executive offices) (Zip code)

David O'Connor

First Eagle Investment Management, LLC

1345 Avenue of the Americas

New York, NY 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-698-3300

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Semiannual Report

June 30, 2023

First Eagle Credit Opportunities Fund

Advised by First Eagle Investment Management, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seek", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

2

Table of Contents

Letter from the President | | | 4 | | |

Management's Discussion of Fund Performance | | | 6 | | |

Fund Overview | | | 10 | | |

Consolidated Schedule of Investments | | | 12 | | |

Consolidated Statement of Assets and Liabilities | | | 40 | | |

Consolidated Statement of Operations | | | 41 | | |

Consolidated Statements of Changes in Net Assets | | | 42 | | |

Consolidated Statement of Cash Flows | | | 44 | | |

Financial Highlights | | | 46 | | |

Notes to Financial Statements | | | 50 | | |

Fund Expenses | | | 77 | | |

General Information | | | 81 | | |

Dividend Reinvestment Plan | | | 82 | | |

Board Considerations for Continuation of Advisory Agreement | | | 83 | | |

Board Considerations for Continuation of Subadvisory Agreement | | | 86 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

3

Letter from the President (unaudited)

Dear Fellow Shareholders,

Over the last six months, financial markets broadly have staged an impressive rebound off the painful lows of 2022, when there appeared to be nowhere to hide as nearly every asset class, sector and geography declined.1 While the pullback across equity markets in 2022 largely represented a rational and mathematical response to higher interest rates, the renewed risk appetite in 2023 seems to be rooted in expectations that rates are near their peak in certain economies, including the US.

It increasingly has been a tale of two markets in the US, as signals coming from the equity and fixed income markets appear to have fallen further out of sync. Given strong year-to-date returns and volatility at pre-Covid levels, equities appear to be pricing in a soft landing for the economy as the Federal Reserve continues to wage war against inflation. Fixed income markets, however, are flashing warning signs. The yield on two-year Treasuries backed up during the quarter to the 5% level that preceded March's bank failures, further inverting the yield curve, while measures of interest rate volatility remained elevated.1

While the systemic fragility laid bare in the mid-March bank failures called into question the Fed's willingness to follow through on its "higher for longer" strategy, policy rhetoric from the central bank in the months that followed suggested there was still work to be done in the fight against inflation. And with good reason—though headline inflation has improved markedly on the back of falling energy and food costs, core inflation remains sticky, reflecting the still-strong labor market. As a result of these shifting narratives, rates for both two-year and ten-year US Treasuries have retraced their pre-bank failure levels. Higher debt servicing and refinancing costs across the loan complex are likely to be a headwind to free cash flow, interest coverage and other issuer fundamentals.2

While fundamentals may be softening, a dearth of new-loan supply continued to be supportive of leveraged loan prices. Merger and acquisition (M&A) activity is a key source of capital demand from lenders, and a rebound in equity prices and the uncertain trajectory of the economy has weighed on transaction volumes in recent quarters. Loan demand, meanwhile, has been held back by the lack of new collateralized loan obligations (CLO), a structure whose economics are less compelling in an environment of high loan prices and expensive financing.

1 Source: FactSet; data as of June 30, 2023

2 Source: PitchBook | LCD; data as of June 30, 2023.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

4

Transaction volume is unlikely to pick up until market participants have greater clarity into a whole host of risks—risks that spread levels do not adequately reward, in our view. In this environment, our Alternative Credit team has been trying to de-risk the portfolio in various ways over recent quarters and continues to do so such that we can maintain the optionality to take advantage of potential opportunities as they emerge. Within broadly syndicated loans, we have been focused on more-liquid, higher-quality paper. We continue to be thoughtful about the structure of our directly originated loans, which we believe provides an added measure of downside mitigation. We believe defensive positioning is warranted until we have greater clarity on the challenges facing the debt market, including the direction of monetary policy.

As always, I want to thank you for entrusting your assets to our stewardship.

Sincerely,

Mehdi Mahmud,

President

August 2023

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

5

Management's Discussion of Fund

Performance (unaudited)

The net asset value ("NAV") of the Fund's Class I shares increased 5.08% for the six months ended June 30, 2023, while the Credit Suisse Leveraged Loan Index increased 6.33% during the same period. The Fund's short-term investments*, comprised 3.0% of the portfolio as of June 30, 2023.

The five largest contributors to the performance of First Eagle Credit Opportunities Fund during the period were RSA Security LLC (Redstone) Initial Loan—Second Lien (systems software); Limetree Bay Terminals, LLC (Limetree Bay Financing, LLC) 2022 Term Facility—First Lien (marine ports & services); LifeScan Global Corp., Term 1st Lien—First Lien (health care supplies); LaserShip, Inc., Initial Loan—Second Lien (air freight & logistics); and Creation Technologies Inc., Initial Term Loan—First Lien (electronic manufacturing services). Their combined contribution to the Fund's return was 0.91%.3

The five largest detractors were International Textile Group Inc. (Elevate Textiles, Inc.) Initial Term Loan—First Lien (textiles); BCP Qualtek Merger Sub LLC (Qualtek) Tranche B Term Loan—First Lien (specialized finance); Anthology / Blackboard (Astra AquisitionCorp.; BruinMergerCoInc.) Term B Loan—First Lien (commercial printing); HDT Holdco, Inc., Initial Term Loan—First Lien (aerospace & defense); and Civitas Solutions Inc. (National Mentor Holding), Initial Term Loan—Second Lien (health care services). Combined, they subtracted 0.88% from fund performance.3

| |

| |

| |

Christopher J. Flynn

President of First Eagle Alternative Credit | | James Fellows

Chief Investment Officer and Head of the Tradable Credit platform of First Eagle Alternative Credit | | Michelle Handy

Senior Managing Director, Deputy Chief Investment Officer for the Direct Lending Credit platform of First Eagle Alternative Credit | |

* Includes short-term commercial paper that settles in 90 days or less, long-term commercial paper that settles in 91 days or greater and other short-term investments, such as U.S. treasury bills or money market funds.

3 Exact net returns for individual investments cannot be calculated due to the lack of a mechanism to precisely allocate fees and other expenses to individual investments.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

6

Management's Discussion of Fund Performance (unaudited)

| |

| |

| |

Robert Hickey

Senior Managing Director, Deputy Chief Investment Officer for the Tradable Credit platform of First Eagle Alternative Credit | | Brian Murphy

Senior Portfolio Manager for the Tradable Credit platform and Head of Capital Markets of First Eagle Alternative Credit | | Steve Krull

Portfolio Manager and Head of Trading for the Tradable Credit platform of First Eagle Alternative Credit | |

August 2023

The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact a fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when repurchased by the Fund, may be worth more or less than their original cost. Past performance data through the most recent month- end is available at www.firsteagle.com or by calling 800.334.2143.

The commentary represents the opinion of Mehdi Mahmud and the Portfolio Management team as of August 2023, and is subject to change based on market and other conditions. These materials are provided for informational purposes only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

7

Management's Discussion of Fund Performance (unaudited)

Collateralized loan obligations (CLOs) are financial instruments collateralized by a pool of corporate loans.

Two-year treasury rate is the yield received for investing in a US government issued treasury security that has a maturity of two years. The two-year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy.

10-year treasury rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 years. The 10-year treasury yield is included on the longer end of the yield curve and is important when looking at the overall US economy.

Credit Suisse Leveraged Loan Index measures the performance of the investable universe of the USD-denominated leveraged loan market. The index inception is January 1992. The index frequency is daily, weekly and monthly.

Indexes are unmanaged and one cannot invest directly in an index.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

8

This page was intentionally left blank.

First Eagle Credit Opportunities Fund

Fund Overview

Data as of June 30, 2023 (unaudited)

Investment Objective

The First Eagle Credit Opportunities Fund's primary investment objective is to provide current income, with a secondary objective of providing long-term risk-adjusted returns. The Fund seeks to achieve its investment objective by investing in a portfolio of a variety of credit asset classes.

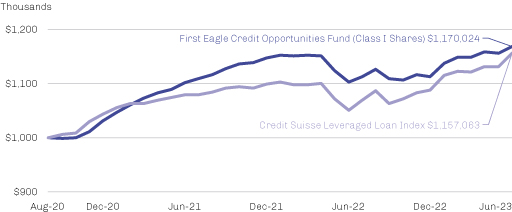

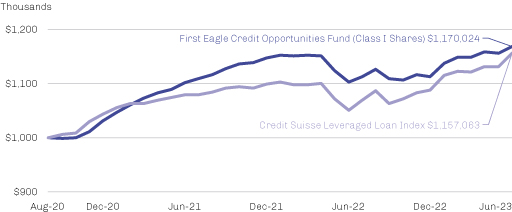

Average Annual Returns^ (%) | |

One Year | | Since

Inception

(9/15/2020) | |

First Eagle Credit Opportunities Fund Class I | | | 6.06 | | | | 5.78 | | |

Credit Suisse Leverage Loan Index | | | 10.10 | | | | 5.28 | | |

Top 5 Industries* (%)

Health Care Services | | | 8.8 | | |

Application Software | | | 5.5 | | |

Research & Consulting Services | | | 4.5 | | |

Specialized Finance | | | 3.6 | | |

Trucking | | | 3.0 | | |

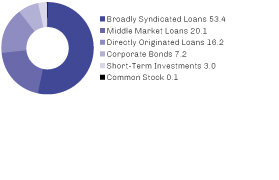

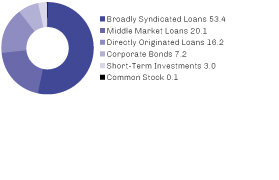

Debt Breakdown** (%)

Secured vs. Unsecured | |

First Lien Secured Loans | | | 86.04 | | |

Unsecured Debt | | | 7.39 | | |

Second Lien Secured Loans | | | 6.57 | | |

Floating vs Fixed | | | |

Floating Rate | | | 92.61 | | |

Fixed Rate | | | 7.39 | | |

Portfolio Characteristics**

Weighted Average Loan Spread | | | 5.38 | % | |

% of Portfolio at Floor | | | 0.00 | % | |

Weighted Average Maturity (Years) | | | 4.21 | | |

Weighted Average Duration (Years) | | | 0.44 | | |

Weighted Average Days to Reset | | | 53.91 | *** | |

Weighted Average Purchase Price | | $ | 97.40 | | |

Weighted Average Market Price | | $ | 92.11 | | |

Number of Positions | | | 317 | | |

^ Performance figures reflect certain fee waivers and/or expense limitations, without which returns would have been lower. For information regarding these fee waivers and/or expense limitations, see Note 6.

^^ Broadly Syndicated Loans, Middle Market Loans and Directly Originated Loans are presented under the Senior Loans category on the Consolidated Schedule of Investments.

* Asset Allocation and Industries percentages are based on total investments in the portfolio.

** Excludes short-term investments and common stocks.

*** Includes Senior Loans only.

The Fund's portfolio composition is subject to change at any time.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

10

First Eagle Credit Opportunities Fund | Fund Overview

Growth of a $1,000,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses.

Class I Shares require $1 million minimum investment and are offered without a sales charge. If a sales charge was included values would be lower.

The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the US denominated leveraged loan market. It consists of issues rated "5B" or lower, i.e. the highest Moody's/S&P ratings are Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries.

Top 10 Holdings* (%)

Eisner Advisory Group LLC, Term B Loan — First Lien (Research & Consulting Services, United States) | | | 1.7 | | |

Apex Group Treasury LLC, 2022 Incremental Term Loan — First Lien (Specialized Finance,

United States) | | | 1.7 | | |

Endo1 Partners, Seventh Amendment DDTL — First Lien (Health Care Services, United States) | | | 1.5 | | |

Uber Technologies, Inc., 2023 Refinancing Term Loan — First Lien (Trucking, United States) | | | 1.4 | | |

SPX Flow, Inc., Term Loan — First Lien (Industrial Machinery, United States) | | | 1.3 | | |

Outerstuff LLC, Closing Date Loan — First Lien (Apparel, Accessories & Luxury Goods,

United States) | | | 1.2 | | |

Archer Systems, LLC, Initial Term Loan — First Lien (Diversified Support Services, United States) | | | 1.1 | | |

Park Place Technologies, LLC, Closing Date Term Loan — First Lien (IT Consulting & Other Services,

United States) | | | 1.1 | | |

VeriFone Systems, Inc., Initial Term Loan — First Lien (Electronic Equipment & Instruments,

United States) | | | 1.1 | | |

Mauser Packaging Solutions Holding Co. (Containers & Packaging, United States) | | | 1.1 | | |

Total | | | 13.2 | | |

* Holdings in cash, short-term commercial paper, long-term commercial paper and other short-term cash equivalents have been excluded.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

11

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Senior Loans (a) — 100.7% | |

Advertising — 2.2% | |

MH Sub I / Indigo / WebMD Health

(fka Micro holdings / Internet Brands),

2023 May Incremental Term Loan — First Lien

(SOFR 1 month + 4.25%), 9.35%, 5/3/2028 | | | 2,984,655 | | | | 2,867,507 | | |

New Insight Holdings Inc. (Research Now),

Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.50%, 1.00% Floor),

10.80%, 12/20/2024 | | | 4,918,286 | | | | 3,525,796 | | |

WH Borrower, LLC (aka WHP Global),

2023-1 Term Loan — First Lien

(SOFR 3 month + 5.50%, 0.50% Floor),

10.49%, 2/15/2027‡ | | | 1,995,000 | | | | 1,970,063 | | |

WH Borrower, LLC (aka WHP Global),

Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 0.50% Floor),

10.49%, 2/15/2027‡ | | | 2,970,000 | | | | 2,929,162 | | |

| | | | 11,292,528 | | |

Aerospace & Defense — 1.1% | |

HDT Holdco, Inc., Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.75%, 0.75% Floor),

11.29%, 7/8/2027 | | | 2,734,177 | | | | 1,620,000 | | |

MAG DS Corp., Initial Term Loan — First Lien

(SOFR 3 month + 5.50%), 10.84%,4/1/2027‡ (c)(d)(b) | | | 1,994,585 | | | | 1,882,390 | | |

New Constellis Borrower LLC, Extended

Term B Loan — First Lien

(SOFR 1 month + 7.75%), 12.96%, 9/27/2025 | | | 2,949,748 | | | | 2,482,700 | | |

| | | | 5,985,090 | | |

Agricultural & Farm Machinery — 0.2% | |

Hydrofarm Holdings Group, Inc., Term Loan — First Lien

(SOFR 1 month + 5.50%), 10.66%, 10/25/2028‡ (c)(d) | | | 1,203,670 | | | | 1,011,083 | | |

Air Freight & Logistics — 1.2% | |

LaserShip, Inc., Initial Loan — Second Lien

(ICE LIBOR USD 1 month + 7.50%, 0.75% Floor),

12.69%, 5/7/2029‡ | | | 4,000,000 | | | | 3,000,000 | | |

Omni Intermediate Holdings, LLC (Omni Logistics),

Initial Term Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.07%, 12/30/2026‡ (c)(d) | | | 3,450,640 | | | | 3,312,615 | | |

| | | | 6,312,615 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

12

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Airlines — 1.0% | |

AAdvantage Loyalty IP Ltd., Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 4.75%, 0.75% Floor),

10.00%, 4/20/2028 | | | 5,000,000 | | | | 5,113,400 | | |

Alternative Carriers — 0.8% | |

Zayo Group Holdings, Inc., 2022 Incremental

Term Loan — First Lien

(SOFR 1 month + 4.25%, 0.50% Floor), 9.35%, 3/9/2027 | | | 4,974,811 | | | | 3,964,303 | | |

Apparel, Accessories & Luxury Goods — 1.2% | |

Outerstuff LLC, Closing Date Loan — First Lien

(ICE LIBOR USD 3 month + 5.00%, 1.00% Floor),

10.54%, 12/31/2023‡ | | | 6,860,609 | | | | 6,054,487 | | |

Application Software — 6.2% | |

Apex Analytix, Inc. (Montana Buyer, Inc.),

Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 0.75% Floor),

10.98%, 7/22/2029‡ (c)(e) | | | 2,688,913 | | | | 2,621,690 | | |

AppHub LLC, Delayed Draw Tem Loan — First Lien

(SOFR 3 month + 6.25%, 1.00% Floor),

11.81%, 9/29/2028‡ (c)(e) | | | 166,285 | | | | 164,621 | | |

AppHub LLC, Term Loan — First Lien

(SOFR 6 month + 6.25%, 1.00% Floor),

11.36%, 9/29/2028‡ (c)(d)(e) | | | 2,675,011 | | | | 2,648,250 | | |

Apryse Software Corp. (PDFTron Systems Inc.),

2022-1 Incremental Term Loan — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.60%, 7/15/2027‡ (c)(d)(e) | | | 3,456,250 | | | | 3,404,430 | | |

Apryse Software Corp. (PDFTron Systems Inc.),

Delayed Draw Term Loan — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.60%, 7/15/2027‡ (c)(d)(e) | | | 357,991 | | | | 352,624 | | |

Apryse Software Corp. (PDFTron Systems Inc.),

Initial Term Loan — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.60%, 7/15/2027‡ (c)(d)(e) | | | 1,102,612 | | | | 1,086,080 | | |

CDK Global, Inc. (Central Parent Inc.),

Initial Term Loan — First Lien

(SOFR 3 month + 4.25%, 0.50% Floor),

9.49%,7/6/2029 (b) | | | 997,494 | | | | 995,868 | | |

Certify, Inc., 2022 Incremental Delayed Draw

Term Loan — First Lien

(SOFR 1 month + 5.50%),

10.65%, 2/28/2024‡ (c)(e) | | | 1,000,000 | | | | 1,000,010 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

13

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Application Software — 6.2% (continued) | |

Certify, Inc., 2022 Incremental Term Loan — First Lien

(SOFR 1 month + 5.50%), 10.65%, 2/28/2024‡ (c)(d)(e) | | | 1,000,000 | | | | 1,000,010 | | |

Cloud Software Group, Inc. (TIBCO Software),

Dollar Term B Loan — First Lien

(SOFR 3 month + 4.50%, 0.50% Floor),

9.84%, 3/30/2029 | | | 2,992,500 | | | | 2,806,097 | | |

Greeneden U.S. Holdings II, LLC

(Genesys Telecommunications Laboratories),

Initial Dollar Term Loan (2020) — First Lien

(ICE LIBOR USD 1 month + 4.00%, 0.75% Floor),

9.18%, 12/1/2027 | | | 2,992,347 | | | | 2,988,337 | | |

Help/Systems Holdings, Inc., Term Loan — First Lien

(SOFR 3 month + 4.00%), 9.15%, 11/19/2026 | | | 2,992,288 | | | | 2,737,944 | | |

Precisely (Pearl Debt Merger Sub 1 Inc.),

Third Amendment Term Loan — First Lien

(ICE LIBOR USD 3 month + 4.00%, 0.75% Floor),

9.51%, 4/24/2028 | | | 1,979,849 | | | | 1,886,014 | | |

Quartz Acquireo LLC (Qualtrics),

Term Loan B — First Lien

6/28/2030‡ (b) | | | 1,000,000 | | | | 1,001,250 | | |

Sapio Sciences, LLC (Jarvis Bidco),

Initial Term Loan — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.45%, 11/17/2028‡ (c)(d)(e) | | | 3,295,938 | | | | 3,246,390 | | |

TMA Buyer, LLC, Delayed Draw Term Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

8.35%, 9/30/2027‡ (c)(e) | | | 147,087 | | | | 136,786 | | |

TMA Buyer, LLC, Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

8.40%, 9/30/2027‡ (c)(d)(e) | | | 1,235,849 | | | | 1,149,295 | | |

Veracode (Mitnick Corporate Purchaser Inc.),

Initial Term Loan — First Lien

(SOFR 3 month + 4.75%, 0.50% Floor),

9.90%, 5/2/2029 | | | 2,977,500 | | | | 2,891,897 | | |

| | | | 32,117,593 | | |

Asset Management & Custody Banks — 2.1% | |

ABC Financials (Project Accelerate Parent LLC),

Term Loan — First Lien

(SOFR 1 month + 4.25%), 9.47%, 1/2/2025‡ | | | 992,147 | | | | 979,745 | | |

Advisor Group Holdings Inc., Term B-1 Loan — First Lien

(ICE LIBOR USD 1 month + 4.50%), 9.65%, 7/31/2026 (b) | | | 1,200,512 | | | | 1,202,967 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

14

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Asset Management & Custody Banks — 2.1% (continued) | |

Doxa Insurance Holdings LLC, Term Loan — First Lien

(SOFR 1 month + 5.75%), 10.95%, 12/4/2026‡ (c)(d)(e) | | | 2,863,722 | | | | 2,835,085 | | |

Oak Point Partners, LLC, Term Loan — First Lien

(SOFR 1 month + 5.25%), 10.45%, 12/1/2027‡ (c)(d)(e) | | | 2,772,647 | | | | 2,744,976 | | |

Orion Group Holdco, LLC, First Amendment Incremental

Delayed Draw Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.50%, 3/19/2027‡ (c)(d)(e) | | | 893,697 | | | | 878,025 | | |

Orion Group Holdco, LLC, First Amendment

Incremental Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.50%, 3/19/2027‡ (c)(d)(e) | | | 2,170,203 | | | | 2,132,149 | | |

| | | | 10,772,947 | | |

Auto Parts & Equipment — 1.1% | |

Enthusiast Auto Holdings, LLC (EAH-Intermediate

Holdco LLC), Third Amendment Term Loan — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.45%, 12/19/2025‡ (c)(d)(e) | | | 1,419,336 | | | | 1,419,269 | | |

Panther BF Aggregator 2 LP (Power Solutions/Clarios

Global LP), 2023 Term Loan — First Lien

(SOFR 1 month + 3.75%), 8.85%, 5/6/2030 (b) | | | 1,500,000 | | | | 1,498,358 | | |

Power Stop, LLC, Initial Term Loan — First Lien

(ICE LIBOR USD 1 month + 4.75%, 0.50% Floor),

9.94%, 1/26/2029 | | | 3,950,000 | | | | 2,952,625 | | |

| | | | 5,870,252 | | |

Automotive Retail — 1.0% | |

Rising Tide Holdings, Inc., FILO Loan — First Lien

(SOFR 3 month + 9.00%, 3.00% Floor),

13.82%, 6/1/2026‡ (e) | | | 5,500,000 | | | | 5,376,250 | | |

Brewers — 0.4% | |

City Brewing Company, LLC, Closing Date

Term Loan — First Lien

(ICE LIBOR USD 3 month + 3.50%, 0.75% Floor),

8.76%, 4/5/2028 | | | 2,877,365 | | | | 1,899,061 | | |

Broadcasting — 1.1% | |

A-L Parent LLC (Learfield), Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 3.25%, 1.00% Floor),

8.77%, 12/1/2023 | | | 1,963,255 | | | | 1,537,120 | | |

Allen Media, LLC, Initial Term Loan (2021) — First Lien

(SOFR 3 month + 5.50%), 10.89%, 2/10/2027 | | | 1,974,486 | | | | 1,710,754 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

15

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Broadcasting — 1.1% (continued) | |

Terrier Media Buyer Inc. (Cox Media Group), 2021

Term B Loan — First Lien

(SOFR 3 month + 3.50%), 8.66%, 12/17/2026 | | | 2,992,327 | | | | 2,687,484 | | |

| | | | 5,935,358 | | |

Casinos & Gaming — 2.2% | |

888 Acquisitions Limited, Facility B (USD) — First Lien

(SOFR 6 month + 5.25%, 0.50% Floor),

10.21%, 7/3/2028 (b) | | | 1,495,652 | | | | 1,392,452 | | |

Caesars Entertainment Inc., 2023 Incremental

Term B Loan — First Lien

(SOFR 1 month + 3.25%), 8.45%, 2/6/2030 | | | 2,992,500 | | | | 2,996,405 | | |

Golden Nugget, Inc., Initial B Term Loan — First Lien

(SOFR 1 month + 4.00%, 0.50% Floor), 9.10%, 1/27/2029 | | | 248,116 | | | | 245,350 | | |

J&J Ventures Gaming, LLC, Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 4.00%, 0.75% Floor),

9.54%, 4/26/2028 | | | 3,015,849 | | | | 2,996,051 | | |

Jack Ohio Finance (Jack Entertainment), Initial

Term Loan — First Lien

(SOFR 1 month + 4.75%), 9.97%, 10/4/2028 | | | 991,957 | | | | 958,791 | | |

Penn National Gaming, Inc.,

Term B Facility Loan — First Lien

(SOFR 1 month + 2.75%, 0.50% Floor),

7.95%, 5/3/2029 | | | 2,992,443 | | | | 2,986,518 | | |

| | | | 11,575,567 | | |

Commercial Printing — 0.7% | |

Anthology / Blackboard (Astra AcquisitionCorp.;

BruinMergerCoInc.), Term B Loan — First Lien

(ICE LIBOR USD 1 month + 5.25%, 0.50% Floor),

10.44%, 10/25/2028 (d) | | | 5,000,000 | | | | 3,523,450 | | |

| | | | 3,523,450 | | |

Commodity Chemicals — 0.8% | |

A&A Global Imports, LLC, Revolving Loan — First Lien

(SOFR 1 month + 8.50%, 1.00% Floor),

11.65%, 6/1/2026‡ (c)(e) | | | 21,133 | | | | 16,484 | | |

A&A Global Imports, LLC, Term Loan — First Lien

(ICE LIBOR USD 1 month + 6.50%, 1.00% Floor),

11.52%, 6/1/2026‡ (c)(d)(e) | | | 1,753,057 | | | | 1,367,385 | | |

USALCO, LLC, Term Loan A — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.22%, 10/19/2027‡ (c)(d)(e) | | | 2,955,000 | | | | 2,895,873 | | |

| | | | 4,279,742 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

16

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Communications Equipment — 0.9% | |

SonicWALL Inc., Term Loan — Second Lien

(ICE LIBOR USD 1 month + 7.50%), 12.66%, 5/18/2026 | | | 5,140,000 | | | | 4,808,316 | | |

Construction Machinery & Heavy Trucks — 1.0% | |

AI Mistral Luxembourg Subco Sarl (V. Group), 2022

Extended Term B Loan — First Lien

(SOFR 1 month + 6.00%), 11.10%, 9/30/2025 (b) | | | 5,396,531 | | | | 5,396,531 | | |

Construction Materials — 0.9% | |

Foley Products Co., LLC, Initial Term Loan — First Lien

(SOFR 3 month + 4.75%, 0.50% Floor),

10.14%, 12/29/2028 | | | 4,794,231 | | | | 4,757,076 | | |

Construction & Engineering — 1.0% | |

Amentum Government Services Holdings LLC

(AECOM Technology Corp.), Tranche 2

Term Loan — Second Lien

(SOFR 1 month + 7.50%, 0.75% Floor),

12.75%, 2/15/2030 | | | 2,000,000 | | | | 1,795,000 | | |

Amentum Government Services Holdings LLC

(AECOM Technology Corp.), Tranche 3

Term Loan — First Lien

(SOFR 1 month + 4.00%, 0.50% Floor),

9.15%, 2/15/2029‡ | | | 1,980,000 | | | | 1,940,400 | | |

TriStrux, LLC, Delayed Draw Term Loan — First Lien

(ICE LIBOR USD 3 month + 6.00%, 1.00% Floor),

11.54%, 12/23/2026‡ (c)(e) | | | 319,335 | | | | 311,352 | | |

TriStrux, LLC, Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 6.00%, 1.00% Floor),

11.16%, 12/23/2026‡ (c)(d)(e) | | | 912,651 | | | | 889,834 | | |

TriStrux, LLC, Revolving Loan — First Lien

(ICE LIBOR USD 3 month + 6.00%, 1.00% Floor),

11.17%, 12/23/2026‡ (c)(e) | | | 187,686 | | | | 182,994 | | |

| | | | 5,119,580 | | |

Consumer Finance — 0.2% | |

Riveron Acquisition Holdings, Inc., Fifth Amendment

Term Loan Retired — First Lien

(ICE LIBOR USD 1 month + 5.75%, 1.00% Floor),

10.83%, 5/22/2025‡ (c)(d)(e) | | | 396,087 | | | | 396,086 | | |

Riveron Acquisition Holdings, Inc., Initial

Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.75%, 1.00% Floor),

10.83%, 5/22/2025‡ (c)(d)(e) | | | 498,861 | | | | 498,858 | | |

| | | | 894,944 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

17

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Distributors — 0.7% | |

Highline Aftermarket Acquisition, LLC,

Initial Term Loan — First Lien

(SOFR 1 month + 4.50%), 9.70%, 11/9/2027 | | | 937,781 | | | | 907,303 | | |

Project Castle, Inc. (Material Handling Systems Inc./

MHS/Deliver Buyer) , Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 0.50% Floor),

10.42%, 6/1/2029 (d) | | | 2,977,500 | | | | 2,530,875 | | |

| | | | 3,438,178 | | |

Diversified Capital Markets — 0.5% | |

Reich & Tang Deposits Network, Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.41%, 12/31/2027‡ (c)(e) | | | 860,691 | | | | 860,691 | | |

Reich & Tang Deposits Network, First Amendment

Term Loan — First Lien

(SOFR 6 month + 5.00%),

10.11%, 12/31/2027‡ (c)(d)(e) | | | 645,652 | | | | 645,652 | | |

Reich & Tang Deposits Network,

Term A Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.39%, 12/31/2027‡ (c)(d)(e) | | | 919,333 | | | | 919,334 | | |

| | | | 2,425,677 | | |

Diversified Chemicals — 0.5% | |

Project Cloud Holdings, LLC (AgroFresh Inc.),

Initial USD Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.86%, 3/31/2029‡ (c) | | | 2,510,593 | | | | 2,491,764 | | |

Project Cloud Holdings, LLC (AgroFresh Inc.),

Revolver — First Lien

(SOFR 1 month + 6.50%), 11.74%, 3/30/2029‡ (c) | | | 167,797 | | | | 165,162 | | |

| | | | 2,656,926 | | |

Diversified Metals & Mining — 0.1% | |

Form Technologies (Dynacast), Last Out

Term Loan — First Lien

(SOFR 3 month + 9.00%, 1.00% Floor),

14.33%, 10/22/2025 (d) | | | 285,662 | | | | 217,103 | | |

Form Technologies (Dynacast), Term B Loan — First Lien

(SOFR 3 month + 4.50%, 1.00% Floor),

9.83%, 7/22/2025 (d) | | | 325,123 | | | | 303,177 | | |

| | | | 520,280 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

18

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Diversified Support Services — 1.1% | |

Archer Systems, LLC, Initial Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

10.96%, 8/11/2027‡ (c)(d)(e) | | | 5,984,167 | | | | 5,924,469 | | |

Education Services — 0.3% | |

American Public Education, Term Loan B — First Lien

(SOFR 1 month + 5.50%), 10.71%, 3/29/2027‡ | | | 1,719,711 | | | | 1,668,119 | | |

Electronic Equipment & Instruments — 1.1% | |

VeriFone Systems, Inc., Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 4.00%), 9.48%, 8/20/2025 | | | 5,990,689 | | | | 5,673,062 | | |

Electronic Manufacturing Services — 1.6% | |

Creation Technologies Inc., Initial Term Loan — First Lien

(SOFR 3 month + 5.50%), 10.72%, 10/5/2028 | | | 4,992,443 | | | | 4,792,746 | | |

Natel Engineering Co., Inc., Initial Term Loan — First Lien

(SOFR 1 month + 6.25%), 11.47%, 4/30/2026‡ (d) | | | 3,921,707 | | | | 3,375,923 | | |

| | | | 8,168,669 | | |

Environmental & Facilities Services — 0.2% | |

EnergySolutions (Energy Capital Partners),

Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 3.75%, 1.00% Floor),

9.29%, 5/9/2025 | | | 1,014,980 | | | | 999,278 | | |

Food Distributors — 0.8% | |

United Air Lines, Inc. (fka: Continental Airlines, Inc.),

Class B Term Loan — First Lien

(ICE LIBOR USD 3 month + 3.75%, 0.75% Floor),

9.29%, 4/21/2028 | | | 3,979,592 | | | | 3,984,029 | | |

Health Care Equipment — 0.0% (f) | |

Carestream Dental Equipment Inc., Tranche B

Term Loan — First Lien

(ICE LIBOR USD 3 month + 4.50%, 0.50% Floor),

10.23%, 9/1/2024‡ | | | 150,403 | | | | 135,363 | | |

Health Care Facilities — 0.9% | |

ConvenientMD (CMD Intermediate Holdings, Inc.),

Delayed Draw Term Loan — First Lien

(SOFR 1 month + 5.50%), 10.66%, 6/9/2027‡ (c)(e) | | | 326,484 | | | | 267,717 | | |

ConvenientMD (CMD Intermediate Holdings, Inc.),

Initial Term Loan — First Lien

(SOFR 1 month + 5.50%), 10.70%, 6/9/2027‡ (c)(d)(e) | | | 1,715,000 | | | | 1,406,300 | | |

Quorum Health Resources (QHR), 2023 Incremental

Term Loan — First Lien

(SOFR 6 month + 6.25%), 11.37%, 5/28/2027‡ (c)(d)(e) | | | 2,000,000 | | | | 1,970,000 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

19

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Facilities — 0.9% (continued) | |

Quorum Health Resources (QHR), Term Loan — First Lien

(SOFR 6 month + 5.25%, 1.00% Floor),

10.63%, 5/28/2027‡ (c)(d)(e) | | | 1,059,775 | | | | 1,033,287 | | |

| | | | 4,677,304 | | |

Health Care Services — 9.9% | |

Anne Arundel Dermatology Management, LLC,

DDTL A — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.89%, 10/16/2025‡ (c)(d)(e) | | | 114,632 | | | | 108,902 | | |

Anne Arundel Dermatology Management, LLC,

DDTL B — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.89%, 10/16/2025‡ (c)(d)(e) | | | 194,172 | | | | 184,466 | | |

Anne Arundel Dermatology Management, LLC,

DDTL C — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.70%, 10/16/2025‡ (c)(e) | | | 488,544 | | | | 464,122 | | |

Anne Arundel Dermatology Management, LLC,

Restatement Date Term Loan — First Lien

(SOFR 3 month + 5.50%), 10.55%, 10/16/2025‡ (c)(d)(e) | | | 1,891,666 | | | | 1,797,101 | | |

BCDI BHI Intermediate 2, LP (Basic Home Infusion),

Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.75%, 1.00% Floor),

6.75%, 9/29/2028‡ (c)(d)(e) | | | 2,928,943 | | | | 2,885,011 | | |

Boston Clincial Trials LLC (Alcanza Clinical Research),

Incremental Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.25%),

10.44%, 12/15/2027‡ (c)(d)(e) | | | 3,655,234 | | | | 3,586,691 | | |

Boston Clincial Trials LLC (Alcanza Clinical Research),

Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.25%, 1.00% Floor),

10.98%, 12/20/2027‡ (c)(d)(e) | | | 741,563 | | | | 727,657 | | |

CC Amulet Management, LLC (Children's Choice),

Revolving Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.59%, 8/31/2026‡ (c)(e) | | | 45,948 | | | | 44,800 | | |

CC Amulet Management, LLC (Children's Choice),

Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.59%, 8/31/2027‡ (c)(d)(e) | | | 1,683,962 | | | | 1,641,886 | | |

Civitas Solutions Inc. (National Mentor Holding),

Initial Term C Loan — First Lien

(SOFR 3 month + 3.75%), 9.09%, 3/2/2028 | | | 81,404 | | | | 61,944 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

20

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Services — 9.9% (continued) | |

Civitas Solutions Inc. (National Mentor Holding),

Initial Term Loan — First Lien

(SOFR 1 month + 3.75%, 0.75% Floor),

8.91%, 3/2/2028 | | | 2,853,471 | | | | 2,171,320 | | |

Civitas Solutions Inc. (National Mentor Holding),

Initial Term Loan — Second Lien

(SOFR 3 month + 7.25%), 12.15%, 3/2/2029‡ | | | 5,000,000 | | | | 2,550,000 | | |

Community Based Care Acquisition, Inc.,

Delayed Draw Tranche A Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.59%, 9/16/2027‡ (c)(d)(e) | | | 903,456 | | | | 894,428 | | |

Community Based Care Acquisition, Inc.,

Delayed Draw Tranche B Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.92%, 9/30/2027‡ (c)(e) | | | 70,758 | | | | 70,404 | | |

Community Based Care Acquisition, Inc., Initial

Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.59%, 9/16/2027‡ (c)(d)(e) | | | 2,228,598 | | | | 2,206,327 | | |

Endo1 Partners, Seventh Amendment DDTL — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.60%, 3/24/2026‡ (c)(d)(e) | | | 7,942,857 | | | | 7,704,659 | | |

Endo1 Partners, Third Amendment DDTL — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.60%, 3/24/2026‡ (c)(d)(e) | | | 1,920,391 | | | | 1,862,800 | | |

Epic Staffing Group (Cirrus/Tempus/Explorer Investor),

Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 0.50% Floor),

10.90%, 6/28/2029‡ (c) | | | 4,090,426 | | | | 3,865,453 | | |

IPM MSO Management, LLC, Closing Date

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.90%, 6/17/2026‡ (c)(d)(e) | | | 822,061 | | | | 815,860 | | |

IPM MSO Management, LLC, Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.90%, 6/17/2026‡ (c)(d)(e) | | | 98,609 | | | | 97,866 | | |

IPM MSO Management, LLC, Second Amendment

Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.54%, 6/17/2026‡ (c)(d)(e) | | | 225,826 | | | | 224,123 | | |

Life Northwestern Pennsylvania, LLC

(FFL Pace Buyer, Inc.),

Delayed Draw Term Loan — First Lien

(SOFR 1 month + 5.25%), 10.46%, 12/6/2027‡ (c)(e) | | | 582,614 | | | | 579,673 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

21

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Services — 9.9% (continued) | |

Life Northwestern Pennsylvania, LLC

(FFL Pace Buyer, Inc.), Initial Term Loan — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.49%, 12/6/2027‡ (c)(d)(e) | | | 1,738,859 | | | | 1,730,079 | | |

Lighthouse Lab Services (LMSI Buyer, LLC),

Initial Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.00%, 1.00% Floor),

10.54%, 10/25/2027‡ (c)(d)(e) | | | 1,931,882 | | | | 1,796,697 | | |

Lighthouse Lab Services (LMSI Buyer, LLC),

Revolving Credit Loan — First Lien

(ICE LIBOR USD 3 month + 5.00%, 1.00% Floor),

10.27%, 10/25/2027‡ (c)(e) | | | 55,788 | | | | 51,884 | | |

NAPA Management Services Corp.,

Initial Term Loan — First Lien

(SOFR 1 month + 5.25%, 0.75% Floor),

10.45%, 2/23/2029 (d) | | | 4,722,292 | | | | 3,307,966 | | |

NSM Top Holdings Corp. (National Seating &

Mobility Inc.), Initial Term Loan — First Lien

(SOFR 1 month + 5.25%), 10.45%, 11/16/2026 | | | 3,953,912 | | | | 3,706,792 | | |

Point Quest Acquisition LLC,

Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

10.98%, 8/14/2028‡ (c)(d)(e) | | | 3,338,707 | | | | 3,338,707 | | |

Point Quest Acquisition LLC, Revolving

Credit Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.47%, 8/14/2028‡ (c)(e) | | | 261,905 | | | | 261,905 | | |

Weight Watchers International, Inc.,

Initial Term Loan — First Lien

(SOFR 1 month + 3.50%, 0.50% Floor),

8.72%, 4/13/2028 (b) | | | 1,000,000 | | | | 653,330 | | |

Women's Care Holdings, Inc.,

Initial Term Loan — Second Lien

(SOFR 3 month + 8.25%, 0.75% Floor),

13.40%, 1/12/2029‡ (d) | | | 2,179,247 | | | | 1,874,152 | | |

| | | | 51,267,005 | | |

Health Care Supplies — 1.0% | |

LifeScan Global Corp., Term 1st Lien — First Lien

(SOFR 6 month + 6.50%, 1.00% Floor),

11.75%, 12/30/2026 (d) | | | 6,575,975 | | | | 5,370,402 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

22

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Technology — 2.1% | |

AG Parent Holdings LLC (ArisGlobal),

Initial Term Loan — First Lien

(ICE LIBOR USD 1 month + 5.00%),

10.22%, 7/31/2026 (d) | | | 4,936,061 | | | | 4,808,045 | | |

CT Technologies Intermediate Holdings, Inc.

(HealthPort), 2021 Term Loan — First Lien

(SOFR 1 month + 4.25%), 9.47%, 12/16/2025 | | | 2,984,733 | | | | 2,792,814 | | |

Greenway Health, LLC (fka Vitera Healthcare

Solutions, LLC), Term Loan — First Lien

(ICE LIBOR USD 3 month + 3.75%, 1.00% Floor),

8.96%, 2/16/2024 | | | 3,101,515 | | | | 2,312,179 | | |

nThrive, Inc. (fka Precyse Acquisition Corp.),

Initial Loan — Second Lien

(ICE LIBOR USD 1 month + 6.75%, 0.50% Floor),

11.94%, 12/17/2029 | | | 2,000,000 | | | | 1,201,250 | | |

| | | | 11,114,288 | | |

Heavy Electrical Equipment — 0.5% | |

Arcline FM Holding, LLC (Fairbanks),

Initial Term Loan — First Lien

(SOFR 1 month + 4.75%), 9.91%, 6/23/2028‡ | | | 2,450,032 | | | | 2,394,906 | | |

Hotels, Resorts & Cruise Lines — 1.3% | |

Alpine X, 2nd Amendment Revovler — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.15%, 12/27/2027‡ (c)(e) | | | 28,571 | | | | 28,286 | | |

Alpine X, Delayed Draw Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.15%, 12/27/2027‡ (c)(d)(e) | | | 606,646 | | | | 600,581 | | |

Alpine X, Revolving Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.15%, 12/27/2027‡ (c)(e) | | | 60,876 | | | | 60,267 | | |

Alpine X, Second Amendment Incremental

Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.15%, 12/27/2027‡ (c)(d)(e) | | | 992,500 | | | | 982,577 | | |

Alpine X, Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.15%, 12/27/2027‡ (c)(d)(e) | | | 938,614 | | | | 929,230 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

23

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Hotels, Resorts & Cruise Lines — 1.3% (continued) | |

Stats, LLC (Peak Jersey Holdco Ltd.),

Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.25%),

10.58%, 7/10/2026 (d) | | | 4,936,061 | | | | 4,318,017 | | |

| | | | 6,918,958 | | |

Household Products — 0.3% | |

Lash Opco LLC, Initial Term Loan — First Lien

(SOFR 6 month + 7.00%), 12.13%, 3/18/2026‡ (c)(d)(e) | | | 1,898,980 | | | | 1,841,988 | | |

Human Resource & Employment Services — 0.8% | |

Danforth Buyer, Inc., First Amendment Additional

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.93%, 12/9/2027‡ (c)(d)(e) | | | 1,183,483 | | | | 1,183,503 | | |

Danforth Buyer, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.32%, 12/9/2027‡ (c)(d)(e) | | | 1,504,861 | | | | 1,486,022 | | |

Triple Crown Consulting, Senior Secured

Term Loan — First Lien

(SOFR 6 month + 6.50%), 12.12%, 6/2/2028‡ (c)(d)(e) | | | 1,630,435 | | | | 1,599,864 | | |

| | | | 4,269,389 | | |

Industrial Machinery — 2.1% | |

Engineered Machinery Holdings, Inc. (WP Deluxe

Merger Sub Inc (Duravant)), Incremental

Amendment No. 2 Term Loan — Second Lien

(ICE LIBOR USD 3 month + 6.50%, 0.75% Floor),

12.04%, 5/21/2029‡ | | | 500,000 | | | | 468,750 | | |

Filtration Group Corp., Term Loan — First Lien

(SOFR 1 month + 4.25%), 9.46%, 10/30/2028 | | | 2,600,000 | | | | 2,602,925 | | |

Restaurant Technologies, Inc. (Eagle Parent Corp.),

Initial Term Loan — First Lien

(SOFR 3 month + 4.25%, 0.50% Floor),

9.49%, 4/2/2029 | | | 248,116 | | | | 242,636 | | |

SPX Flow, Inc., Term Loan — First Lien

(SOFR 1 month + 4.50%, 0.50% Floor),

9.70%, 4/5/2029 (b) | | | 6,770,186 | | | | 6,699,674 | | |

WasteQuip, Inc. (Patriot Container),

Closing Date Term Loan — First Lien

(SOFR 3 month + 3.75%, 1.00% Floor),

8.95%, 3/20/2025 | | | 997,368 | | | | 924,705 | | |

| | | | 10,938,690 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

24

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Insurance Brokers — 2.4% | |

Alliant Holdings Intermediate LLC (Alliant Holdings I LLC),

TLB-5 New Term Loan — First Lien

(SOFR 1 month + 3.50%), 8.65%, 11/5/2027 | | | 488,434 | | | | 486,060 | | |

Hub International Limited, Term Loan B — First Lien

6/8/2030 (b) | | | 1,500,000 | | | | 1,505,108 | | |

Newcleus, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.39%, 8/2/2026‡ (c)(d)(e) | | | 1,194,271 | | | | 1,098,730 | | |

Portfolio Holding, Inc. (Turbo Buyer / PGM),

Amendment No. 3 Incremental Term Loan — First Lien

(SOFR 6 month + 6.00%), 11.15%, 12/2/2025‡ (c)(d)(e) | | | 1,965,000 | | | | 1,925,676 | | |

Portfolio Holding, Inc. (Turbo Buyer / PGM),

Amendment No. 4 Incremental Delayed Draw

Term Loan — First Lien

(SOFR 6 month + 6.00%), 11.59%, 12/2/2025‡ (c)(d)(e) | | | 770,393 | | | | 754,976 | | |

Portfolio Holding, Inc. (Turbo Buyer / PGM),

Amendment No. 4 Incremental Term Loan — First Lien

(SOFR 6 month + 6.00%), 11.59%, 12/2/2025‡ (c)(d)(e) | | | 1,152,898 | | | | 1,129,826 | | |

RXB Holdings, Inc. (RxBenefits), Term Loan B — First Lien

(SOFR 1 month + 5.25%, 0.75% Floor),

10.33%, 12/18/2027‡ | | | 2,000,000 | | | | 1,955,000 | | |

Socius Insurance Services, Inc., Closing Date

Term Loan Retired — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.39%, 6/30/2027‡ (c)(d)(e) | | | 1,203,509 | | | | 1,203,509 | | |

Tricor, LLC, Delayed Draw Term Loan — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.44%, 10/22/2026‡ (c)(e) | | | 447,519 | | | | 438,566 | | |

Tricor, LLC, Term Loan — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.45%, 10/22/2026‡ (c)(d)(e) | | | 1,909,753 | | | | 1,871,546 | | |

| | | | 12,368,997 | | |

Integrated Telecommunication Services — 0.5% | |

Altice France SA (Numericable), USD TLB-[14]

Loan — First Lien

(SOFR 3 month + 5.50%), 10.49%, 8/15/2028 | | | 2,992,063 | | | | 2,672,915 | | |

Interactive Media & Services — 1.0% | |

Ingenio LLC, First Amendment Term Loan — First Lien

(SOFR 1 month + 7.00%), 12.43%, 8/3/2026‡ (c)(d)(e) | | | 3,977,273 | | | | 3,897,886 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

25

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Interactive Media & Services — 1.0% (continued) | |

Ingenio LLC, Term Loan — First Lien

(SOFR 1 month + 7.15%), 12.43%, 8/3/2026‡ (c)(d)(e) | | | 1,283,879 | | | | 1,258,253 | | |

| | | | 5,156,139 | | |

Internet & Direct Marketing Retail — 2.9% | |

Delivery Hero SE, Initial Dollar Term Loan — First Lien

(SOFR 3 month + 5.75%, 0.50% Floor),

10.85%, 8/12/2027 (c) | | | 3,960,000 | | | | 3,938,557 | | |

Everlane, Inc., Term Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

11.66%, 3/31/2025‡ (c)(e) | | | 3,750,000 | | | | 3,750,000 | | |

Kobra International, Ltd. (d/b/a Nicole Miller),

Term Loan — First Lien

(SOFR 1 month + 7.00%),

12.17%, 5/17/2025‡ (c)(e) | | | 4,829,603 | | | | 4,829,603 | | |

Sweetwater Borrower LLC, Initial

Term Loan — First Lien

(SOFR 1 month + 4.25%, 0.75% Floor),

9.47%, 8/7/2028‡ | | | 2,698,843 | | | | 2,563,901 | | |

| | | | 15,082,061 | | |

Internet Services & Infrastructure — 1.0% | |

Go Daddy Operating Company LLC (GD Finance Co., Inc.),

Amendment No. 6 Term Loan — First Lien

(SOFR 1 month + 3.00%), 8.10%, 11/9/2029 | | | 2,985,000 | | | | 2,994,194 | | |

Technology Partners, LLC (Imagine Software),

Initial Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.42%, 11/16/2027‡ (c)(d)(e) | | | 2,298,776 | | | | 2,252,800 | | |

| | | | 5,246,994 | | |

Investment Banking & Brokerage — 0.2% | |

Aretec Group Inc. (Cetera Financial Group),

Incremental Term Loan — First Lien

3/7/2030 (b) | | | 1,000,000 | | | | 999,065 | | |

IT Consulting & Other Services — 3.3% | |

Alpine SG, LLC (ASG), February 2023

Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.41%, 11/5/2027‡ (c)(d)(e) | | | 809,139 | | | | 794,943 | | |

Alpine SG, LLC (ASG), Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.41%, 11/5/2027‡ (c)(d)(e) | | | 1,351,194 | | | | 1,327,488 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

26

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

IT Consulting & Other Services — 3.3% (continued) | |

Alpine SG, LLC (ASG), May 2022 Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.30%, 11/5/2027‡ (c)(d)(e) | | | 708,496 | | | | 696,066 | | |

Alpine SG, LLC (ASG), November 2021

Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.30%, 11/5/2027‡ (c)(d)(e) | | | 2,101,990 | | | | 2,065,113 | | |

Automated Control Concepts, Inc.,

Revolving Credit Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.72%, 10/22/2026‡ (c)(e) | | | 104,167 | | | | 100,000 | | |

Automated Control Concepts, Inc.,

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.72%, 10/22/2026‡ (c)(d)(e) | | | 2,264,974 | | | | 2,174,375 | | |

Eliassen Group, LLC, 2022 Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 5.50%, 0.75% Floor),

10.80%, 4/14/2028‡ (c)(e) | | | 82,708 | | | | 81,878 | | |

Eliassen Group, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 0.75% Floor),

10.41%, 4/14/2028‡ (c)(d)(e) | | | 2,426,111 | | | | 2,401,763 | | |

Marlin DTC — LS Midco 2, LLC (Clarus

Commerce, LLC), 2A Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.86%, 7/1/2025‡ (c)(d)(e) | | | 1,514,425 | | | | 1,499,304 | | |

Park Place Technologies, LLC, Closing Date

Term Loan — First Lien

(SOFR 1 month + 5.00%, 1.00% Floor),

10.20%, 11/10/2027 (d) | | | 5,969,466 | | | | 5,820,229 | | |

| | | | 16,961,159 | | |

Leisure Facilities — 0.7% | |

Bandon Fitness Texas, Inc., Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.37%, 7/27/2028‡ (c)(e) | | | 432,544 | | | | 424,981 | | |

Bandon Fitness Texas, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.20%, 7/27/2028‡ (c)(d)(e) | | | 2,920,877 | | | | 2,869,805 | | |

Bandon Fitness Texas, Inc., Revolving Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.39%, 7/27/2028‡ (c)(e) | | | 147,297 | | | | 144,722 | | |

| | | | 3,439,508 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

27

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Leisure Products — 1.0% | |

Abe Investment Holdings, Inc. (Getty Images, Inc.),

Initial Dollar Term Loan — First Lien

(SOFR 1 month + 4.50%), 9.84%, 2/19/2026 | | | 4,980,445 | | | | 4,986,671 | | |

Life Sciences Tools & Services — 1.8% | |

Sequoia Consulting Group, LLC, Term Loan — First Lien

(SOFR 3 month + 6.75%, 1.00% Floor),

11.98%, 12/17/2026‡ (c)(d)(e) | | | 4,326,181 | | | | 4,228,694 | | |

VCR Buyer, Inc. (Velocity Clinical Research),

Facility B1 — First Lien

(SOFR 3 month + 6.50%, 0.75% Floor),

11.75%, 4/28/2028‡ (c)(d)(e) | | | 4,953,307 | | | | 4,841,828 | | |

VCR Buyer, Inc. (Velocity Clinical Research),

Revolver — First Lien

(SOFR 3 month + 6.50%, 0.75% Floor),

11.75%, 12/4/2028‡ (c)(e) | | | 124,263 | | | | 121,466 | | |

| | | | 9,191,988 | | |

Managed Health Care — 0.4% | |

Lighthouse Behavioral Health Solutions, Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.06%, 3/28/2028‡ (c)(e) | | | 314,389 | | | | 273,518 | | |

Lighthouse Behavioral Health Solutions,

Revolving Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

9.44%, 3/28/2028‡ (c)(e) | | | 763,359 | | | | 664,120 | | |

Lighthouse Behavioral Health Solutions,

Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.25%, 3/28/2028‡ (c)(d)(e) | | | 1,507,634 | | | | 1,311,637 | | |

| | | | 2,249,275 | | |

Marine Ports & Services — 0.7% | |

Limetree Bay Terminals, LLC (Limetree Bay

Financing, LLC), 2022 Term Facility — First Lien

(SOFR 3 month + 4.00%, 1.00% Floor, 1.00% PIK),

10.50%, 2/15/2024 | | | 4,208,679 | | | | 3,620,327 | | |

Metal & Glass Containers — 1.0% | |

Pretium Packaging Holdings Inc., Initial

Term Loan — First Lien

(SOFR 3 month + 4.00%, 0.50% Floor),

9.29%, 10/2/2028 | | | 2,984,848 | | | | 2,250,173 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

28

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Metal & Glass Containers — 1.0% (continued) | |

Pretium Packaging Holdings Inc.,

Initial Term Loan — Second Lien

(SOFR 3 month + 6.75%, 0.50% Floor),

12.12%, 10/1/2029 | | | 2,868,534 | | | | 1,552,608 | | |

Valcour Packaging (Mold-Rite Plastics),

Initial Term Loan — First Lien

(ICE LIBOR USD 6 month + 3.75%, 0.50% Floor),

9.40%, 10/4/2028 | | | 1,929,474 | | | | 1,637,159 | | |

| | | | 5,439,940 | | |

Movies & Entertainment — 1.5% | |

Creative Artists Agency, LLC, Term B Loan — First Lien

(SOFR 1 month + 3.50%), 8.60%, 11/27/2028 | | | 2,992,500 | | | | 2,989,881 | | |

WildBrain Ltd. (DHX Media), Term Loan — B — First Lien

(SOFR 1 month + 4.25%, 0.75% Floor),

9.47%, 3/24/2028 (d) | | | 4,924,433 | | | | 4,825,945 | | |

| | | | 7,815,826 | | |

Multi-Sector Holdings — 0.8% | |

Auxey Bidco Ltd. (Alexander Mann Solutions),

Facility B (USD) — First Lien

(ICE LIBOR USD 3 month + 5.00%),

10.27%, 6/16/2025 (c) | | | 4,562,500 | | | | 4,372,381 | | |

Office Services & Supplies — 0.6% | |

Equiniti Group PLC (AST/Armor Holdco),

Initial Dollar Term Loan — First Lien

(SOFR 6 month + 4.50%), 10.09%, 12/11/2028 | | | 2,977,330 | | | | 2,986,634 | | |

Packaged Foods & Meats — 1.1% | |

Alpine US Bidco LLC (Aryzta North America)

(Aspire Bakeries), Initial Term Loan — First Lien

(ICE LIBOR USD 1 month + 5.25%, 0.75% Floor),

10.40%, 5/3/2028 | | | 1,704,588 | | | | 1,642,797 | | |

Bengal Debt Sub Merger LLC (Tropicana, Naked Juice),

Initial Loan — Second Lien

(SOFR 3 month + 6.00%, 0.50% Floor),

11.34%, 1/24/2030 | | | 4,915,863 | | | | 3,948,667 | | |

| | | | 5,591,464 | | |

Paper Packaging — 1.0% | |

Advanced Web Technologies (AWT),

Delayed Draw Term Loan — First Lien

(ICE LIBOR USD 3 month + 6.00%, 1.00% Floor),

11.01%, 12/17/2026‡ (c)(d)(e) | | | 310,958 | | | | 304,741 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

29

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Paper Packaging — 1.0% (continued) | |

Advanced Web Technologies (AWT), First Amendment

Delayed Draw Term Loan 1 — First Lien

(ICE LIBOR USD 3 month + 6.00%, 1.00% Floor),

11.01%, 12/17/2026‡ (c)(d)(e) | | | 330,000 | | | | 323,403 | | |

Advanced Web Technologies (AWT), First Amendment

Delayed Draw Term Loan 2 — First Lien

(ICE LIBOR USD 3 month + 6.50%),

11.92%, 12/17/2026‡ (c)(e) | | | 476,190 | | | | 469,051 | | |

Advanced Web Technologies (AWT), First Requested

Incremental Term Loan — First Lien

(ICE LIBOR USD 3 month + 6.50%, 1.00% Floor),

11.51%, 12/17/2026‡ (c)(d)(e) | | | 992,500 | | | | 977,620 | | |

Advanced Web Technologies (AWT), Second Amendment

Delayed Draw Term Loan — First Lien

(ICE LIBOR USD 3 month + 6.50%, 1.00% Floor),

12.15%, 12/17/2026‡ (c)(e) | | | 471,956 | | | | 464,881 | | |

Advanced Web Technologies (AWT),

Term Loan — First Lien

(ICE LIBOR USD 3 month + 6.00%, 1.00% Floor),

11.01%, 12/17/2026‡ (c)(d)(e) | | | 790,571 | | | | 774,766 | | |

Golden West Packaging Group LLC,

Initial Term Loan — First Lien

(SOFR 1 month + 5.25%), 10.40%, 12/1/2027‡ (c) | | | 1,915,517 | | | | 1,872,418 | | |

| | | | 5,186,880 | | |

Paper Products — 0.9% | |

R-Pac International Corp. (Project Radio),

Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 0.75% Floor),

11.31%, 12/29/2027‡ (c)(e) | | | 4,937,500 | | | | 4,740,232 | | |

Pharmaceuticals — 1.8% | |

Alvogen Pharma US, Inc., June 2022 Loan — First Lien

(SOFR 3 month + 7.50%, 1.00% Floor),

12.89%, 6/30/2025‡ (b) | | | 4,446,970 | | | | 3,690,985 | | |

ANI Pharmaceuticals, Inc., Initial Term Loan — First Lien

(ICE LIBOR USD 1 month + 6.00%, 0.75% Floor),

11.19%, 11/19/2027 | | | 5,140,318 | | | | 5,114,616 | | |

Carestream Health, Inc. (aka Onex),

Term Loan — First Lien

(SOFR 3 month + 7.50%, 1.00% Floor),

12.50%, 9/30/2027 (d) | | | 895,642 | | | | 655,609 | | |

| | | | 9,461,210 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

30

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Real Estate Services — 1.7% | |

Auction.com LLC (fka Ten-X LLC), Term Loan — First Lien

(SOFR 1 month + 6.00%), 11.09%, 5/26/2028‡ | | | 997,361 | | | | 949,987 | | |

Avison Young (Canada) Inc., Fifth Amendment

Incremental Term Loan — First Lien

(SOFR 3 month + 7.00%), 12.38%, 1/31/2026‡ | | | 1,985,000 | | | | 1,240,625 | | |

Avison Young (Canada) Inc., Term Loan B — First Lien

(SOFR 3 month + 6.50%), 12.00%, 1/31/2026 (d) | | | 2,933,451 | | | | 1,804,996 | | |

Hudson's Bay Company ULC, Last Out

Term Loan — Second Lien

(ICE LIBOR USD 1 month + 7.33%, 1.00% Floor),

12.83%, 9/30/2026‡ (c)(d)(e) | | | 5,000,000 | | | | 5,000,000 | | |

| | | | 8,995,608 | | |

Research & Consulting Services — 5.1% | |

Axiom Global Inc., Initial Term Loan — First Lien

(SOFR 1 month + 4.75%, 0.75% Floor),

9.94%, 10/1/2026‡ (c)(d) | | | 2,954,198 | | | | 2,854,494 | | |

Camin Cargo Control, Inc., Term Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

11.65%, 6/4/2026‡ (c)(e) | | | 709,576 | | | | 709,576 | | |

Eisner Advisory Group LLC, September 2022

Incremental Term Loan — First Lien

(SOFR 1 month + 5.25%), 10.47%, 7/28/2028‡ | | | 2,984,962 | | | | 2,984,962 | | |

Eisner Advisory Group LLC, Term B Loan — First Lien

(SOFR 1 month + 5.25%, 0.75% Floor),

10.47%, 7/28/2028‡ | | | 8,959,511 | | | | 8,959,511 | | |

Evergreen Services Group II LLC (Cedar/Pine),

Delayed Draw Term A Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

11.80%, 6/11/2027‡ (c)(d)(e) | | | 1,421,429 | | | | 1,382,351 | | |

Evergreen Services Group II LLC (Cedar/Pine),

Delayed Draw Term Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

11.48%, 6/11/2027‡ (c)(d)(e) | | | 325,583 | | | | 316,632 | | |

Evergreen Services Group II LLC (Cedar/Pine),

First Amendment Incremental Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.89%, 6/11/2027‡ (c)(d)(e) | | | 1,975,000 | | | | 1,920,703 | | |

Evergreen Services Group II LLC (Cedar/Pine),

Initial Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.89%, 6/11/2027‡ (c)(d)(e) | | | 667,315 | | | | 648,969 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

31

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Research & Consulting Services — 5.1% (continued) | |

Teneo Holdings LLC, Initial Term Loan — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.45%, 7/11/2025 (d) | | | 2,976,804 | | | | 2,980,525 | | |

Vaco Holdings LLC, Initial Term Loan — First Lien

(SOFR 6 month + 5.00%, 0.75% Floor),

10.59%, 1/21/2029 | | | 2,977,330 | | | | 2,722,411 | | |

Zenith American Holding, Inc.

(Harbour Benefit Holding Inc. / HPH-TH Holdings, LLC),

Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.00%, 1.00% Floor),

9.48%, 12/13/2024‡ (c)(d)(e) | | | 893,324 | | | | 893,325 | | |

| | | | 26,373,459 | | |

Security & Alarm Services — 0.6% | |

SuperHero Fire Protection, LLC, Closing Date

Term Loan — First Lien

(ICE LIBOR USD 3 month + 6.25%, 1.00% Floor),

11.79%, 9/1/2026‡ (c)(d)(e) | | | 1,127,739 | | | | 1,122,110 | | |

SuperHero Fire Protection, LLC,

Delayed Draw Term Loan — First Lien

(ICE LIBOR USD 1 month + 6.25%, 1.00% Floor),

11.44%, 9/1/2026‡ (c)(d)(e) | | | 343,478 | | | | 341,764 | | |

SuperHero Fire Protection, LLC, Fourth Amendment

Incremental Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.89%, 9/1/2026‡ (c)(d)(e) | | | 1,000,000 | | | | 1,000,009 | | |

SuperHero Fire Protection, LLC,

Revolving Loan — First Lien

(ICE LIBOR USD 3 month + 6.25%, 1.00% Floor),

11.79%, 9/1/2026‡ (c)(e) | | | 27,180 | | | | 27,045 | | |

SuperHero Fire Protection, LLC, Second Amendment

Incremental Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.72%, 9/1/2026‡ (c)(d)(e) | | | 166,829 | | | | 166,830 | | |

SuperHero Fire Protection, LLC, Third Amendment

Incremental Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.90%, 9/1/2026‡ (c)(d)(e) | | | 367,552 | | | | 367,555 | | |

| | | | 3,025,313 | | |

Soft Drinks — 0.6% | |

Pegasus BidCo BV (Refresco), Initial Dollar

Term Loan — First Lien

(SOFR 3 month + 4.25%, 0.50% Floor),

9.34%, 7/12/2029 | | | 2,985,000 | | | | 2,981,269 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

32

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Specialized Consumer Services — 0.5% | |

LaserAway, Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 0.75% Floor),

11.08%, 10/14/2027‡ (c)(d)(e) | | | 2,659,500 | | | | 2,659,500 | | |

Specialized Finance — 4.0% | |

Apex Group Treasury Limited, USD

Term Loan — First Lien

(ICE LIBOR USD 3 month + 3.75%, 0.50% Floor),

9.07%, 7/27/2028 | | | 3,982,272 | | | | 3,937,472 | | |

Apex Group Treasury LLC, 2022 Incremental

Term Loan — First Lien

(SOFR 1 month + 5.00%), 9.89%, 7/27/2028‡ | | | 8,955,000 | | | | 8,921,419 | | |

BCP Qualtek Merger Sub LLC (Qualtek),

Amendment No. 3 Rollover Loan — First Lien

(SOFR 3 month + 6.25%, 1.00% Floor),

7/18/2025‡ (c)(e)(g) | | | 2,009,855 | | | | 1,547,588 | | |

BCP Qualtek Merger Sub LLC (Qualtek),

New Money DIP First Funding Loan — First Lien

(SOFR 3 month + 1.00%, 4.10% PIK),

17.15%, 8/22/2023‡ (c)(e) | | | 3,012,957 | | | | 2,922,569 | | |

BCP Qualtek Merger Sub LLC (Qualtek),

Tranche B Term Loan — First Lien

(SOFR 3 month + 6.25%), 7/18/2025 (c)(g) | | | 2,898,121 | | | | 941,889 | | |

ECL Entertainment, Term B Loan — First Lien

(SOFR 1 month + 7.50%, 0.75% Floor),

12.72%, 5/1/2028‡ (d) | | | 1,390,375 | | | | 1,402,540 | | |

iLending LLC, Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.20%, 6/21/2026‡ (c)(d)(e) | | | 1,158,974 | | | | 1,048,875 | | |

| | | | 20,722,352 | | |

Specialty Chemicals — 1.0% | |

Iris Holding, Inc. (Intertape Polymer Group Inc.),

Initial Term Loan — First Lien

(SOFR 3 month + 4.75%, 0.50% Floor),

9.90%, 6/28/2028 (d) | | | 2,977,500 | | | | 2,535,520 | | |

RLG Holdings, LLC, 2022 Incremental

Term Loan — First Lien

(SOFR 1 month + 5.00%), 10.10%, 7/7/2028‡ | | | 2,992,462 | | | | 2,906,429 | | |

| | | | 5,441,949 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

33

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Systems Software — 2.3% | |

Condor Merger Sub, Inc. (McAfee), Tranche B-1

Term Loan — First Lien

(SOFR 1 month + 3.75%, 0.50% Floor),

9.01%, 3/1/2029 | | | 2,970,000 | | | | 2,849,136 | | |

Idera Inc., 2021 Refinancing Loan — Second Lien

(SOFR 1 month + 6.75%), 12.01%, 3/2/2029‡ | | | 1,981,375 | | | | 1,751,664 | | |

McAfee Enterprise (Magenta Buyer LLC),

Initial Term Loan — First Lien

(SOFR 3 month + 4.75%), 10.03%, 7/27/2028 (d)(b) | | | 3,719,064 | | | | 2,812,542 | | |

McAfee Enterprise (Magenta Buyer LLC),

Initial Term Loan — Second Lien

(ICE LIBOR USD 3 month + 8.25%, 0.75% Floor),

13.53%, 7/27/2029 (d) | | | 2,000,000 | | | | 1,320,000 | | |

RSA Security LLC (Redstone), Initial Loan — Second Lien

(ICE LIBOR USD 3 month + 7.75%, 0.75% Floor),

13.04%, 4/27/2029 | | | 5,000,000 | | | | 3,158,325 | | |

| | | | 11,891,667 | | |

Technology Hardware, Storage & Peripherals — 0.8% | |

TouchTunes (TA TT Buyer), Initial Term Loan — First Lien

(SOFR 3 month + 5.00%, 0.50% Floor), 9.90%, 4/2/2029 | | | 3,980,000 | | | | 3,970,050 | | |

Textiles — 0.8% | |

International Textile Group Inc. (Elevate Textiles, Inc.),

First Out Term Loan — First Lien

6/30/2027‡ (b) | | | 2,111,647 | | | | 2,101,089 | | |

International Textile Group Inc. (Elevate Textiles, Inc.),

Last Out Term Loan — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.58%, 9/30/2027‡ (c) | | | 2,378,891 | | | | 1,962,585 | | |

| | | | 4,063,674 | | |

Tires & Rubber — 0.7% | |

Carlstar Group LLC, The, Initial Term Loan — First Lien

(SOFR 1 month + 6.50%, 0.75% Floor),

11.69%, 7/8/2027‡ (c)(d)(e) | | | 3,888,889 | | | | 3,888,889 | | |

Trading Companies & Distributors — 1.3% | |

Apex Service Partners, LLC, Ninth Amendment

Incremental DDTL — First Lien

(ICE LIBOR USD 3 month + 5.25%, 1.00% Floor),

10.52%, 7/31/2025‡ (c)(d)(e) | | | 788,652 | | | | 788,652 | | |

Apex Service Partners, LLC, Ninth Amendment

Incremental Term Loan — First Lien

(ICE LIBOR USD 3 month + 5.25%, 1.00% Floor),

10.46%, 7/31/2025‡ (c)(d)(e) | | | 525,333 | | | | 525,333 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

34

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Trading Companies & Distributors — 1.3% (continued) | |

Apex Service Partners, LLC, Revolver — First Lien

(ICE LIBOR USD 3 month + 5.25%, 1.00% Floor),

5.25%, 7/31/2025‡ (c)(e) | | | 496 | | | | 496 | | |

Parts Town (PT Intermediate Holdings III LLC),

2022 Incremental Term Loan — First Lien

(SOFR 3 month + 5.98%, 1.00% Floor),

11.23%, 11/1/2028‡ (c) | | | 1,481,250 | | | | 1,436,813 | | |

Parts Town (PT Intermediate Holdings III LLC),

2023 Incremental Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.74%, 11/1/2028‡ (c) | | | 1,329,668 | | | | 1,313,047 | | |

Parts Town (PT Intermediate Holdings III LLC),

Term B Loan — First Lien

(SOFR 3 month + 5.98%, 1.00% Floor),

11.37%, 11/1/2028‡ (c) | | | 2,955,000 | | | | 2,866,350 | | |

| | | | 6,930,691 | | |

Trucking — 3.4% | |

A&R Logistics Holdings, Inc., Tranche 7 Incremental

Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.15%, 5/3/2025‡ (c)(d)(e) | | | 3,263,487 | | | | 3,263,488 | | |

(PRIME 3 month + 5.00%), 13.00%, 5/3/2025‡ (c)(d)(e) | | | 8,325 | | | | 8,325 | | |

A&R Logistics Holdings, Inc., Tranche 9 Incremental

Term Loan — First Lien

(SOFR 3 month + 6.26%, 1.00% Floor),

11.30%, 5/3/2025‡ (c)(d)(e) | | | 619,088 | | | | 619,087 | | |

Avis Budget Car Rental, LLC, Term Loan C — First Lien

(SOFR 1 month + 3.50%, 0.50% Floor),

8.70%, 3/16/2029 (b) | | | 1,979,912 | | | | 1,986,921 | | |

Stonepeak Taurus Lower Holdings LLC (TRAC),

Initial Term Loan (Second Lien

Term Loan) — Second Lien

(SOFR 3 month + 7.00%, 0.50% Floor),

12.34%, 1/28/2030‡ | | | 5,000,000 | | | | 4,725,000 | | |

Uber Technologies, Inc., 2023 Refinancing

Term Loan — First Lien

(SOFR 3 month + 2.75%), 8.02%, 3/3/2030 (b) | | | 6,974,975 | | | | 6,983,275 | | |

| | | | 17,586,096 | | |

Wireless Telecommunication Services — 0.2% | |

NWN Parent Holdings LLC, Term Loan — First Lien

(SOFR 3 month + 8.00%, 1.00% Floor),

13.19%, 5/7/2026‡ (c)(d)(e) | | | 956,152 | | | | 927,442 | | |

Total Senior Loans

(Cost $552,617,079) | | | 523,474,778 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

35

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Corporate Bonds — 8.0% | |

Aerospace & Defense — 0.9% | |

TransDigm, Inc.

6.25%, 3/15/2026 (h) | | | 5,000,000 | | | | 4,975,564 | | |

Commercial Services & Supplies — 0.8% | |

Aramark Services, Inc.

5.00%, 2/1/2028 (h) | | | 2,000,000 | | | | 1,885,080 | | |

Madison IAQ LLC

5.88%, 6/30/2029 (h) | | | 3,000,000 | | | | 2,429,726 | | |

| | | | 4,314,806 | | |

Consumer Staples Distribution & Retail — 0.6% | |

Albertsons Cos., Inc.

6.50%, 2/15/2028 (h) | | | 3,000,000 | | | | 3,004,980 | | |

Containers & Packaging — 1.2% | |

LABL, Inc.

9.50%, 11/1/2028 (h) | | | 500,000 | | | | 508,693 | | |

Mauser Packaging Solutions Holding Co.

9.25%, 4/15/2027 (h) | | | 6,000,000 | | | | 5,538,012 | | |

| | | | 6,046,705 | | |

Entertainment — 0.3% | |

Allen Media LLC

10.50%, 2/15/2028 (h) | | | 3,000,000 | | | | 1,545,000 | | |

Financial Services — 0.2% | |

Armor Holdco, Inc.

8.50%, 11/15/2029 (h) | | | 1,000,000 | | | | 829,961 | | |

Ground Transportation — 0.1% | |

PECF USS Intermediate Holding III Corp.

8.00%, 11/15/2029 (h) | | | 1,000,000 | | | | 562,500 | | |

Insurance — 0.0% (f) | |

Alliant Holdings Intermediate LLC

6.75%, 4/15/2028 (h) | | | 30,000 | | | | 29,752 | | |

Media — 0.5% | |

Univision Communications, Inc.

7.38%, 6/30/2030 (h) | | | 3,000,000 | | | | 2,856,352 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023

36

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2023 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Passenger Airlines — 1.8% | |

American Airlines, Inc.

5.50%, 4/20/2026 (h) | | | 1,000,000 | | | | 990,690 | | |

5.75%, 4/20/2029 (h) | | | 2,000,000 | | | | 1,941,957 | | |

United Airlines, Inc.

4.38%, 4/15/2026 (h) | | | 5,000,000 | | | | 4,750,528 | | |

4.63%, 4/15/2029 (h) | | | 2,000,000 | | | | 1,822,336 | | |

| | | | 9,505,511 | | |

Software — 1.0% | |

AthenaHealth Group, Inc.

6.50%, 2/15/2030 (h) | | | 1,000,000 | | | | 841,640 | | |

McAfee Corp.

7.38%, 2/15/2030 (h) | | | 2,000,000 | | | | 1,739,045 | | |

Rocket Software, Inc.

6.50%, 2/15/2029 (h) | | | 3,000,000 | | | | 2,526,596 | | |

| | | | 5,107,281 | | |

Trading Companies & Distributors — 0.6% | |

United Rentals North America, Inc.

6.00%, 12/15/2029 (h) | | | 3,000,000 | | | | 2,992,622 | | |

Total Corporate Bonds

(Cost $45,113,821) | | | 41,771,034 | | |

| | | Shares | | | |

Common Stocks — 0.1% | |

Electric Utilities — 0.0% (f) | |

Frontera Generation Holdings LLC*‡ | | | 62,500 | | | | 938 | | |

Textiles, Apparel & Luxury Goods — 0.1% | |

International Textile Group, Inc.‡ | | | 100,072 | | | | 400,288 | | |

Transportation Infrastructure — 0.0% (f) | |

Limetree Bay Cayman Ltd.*‡ (e) | | | 1,430 | | | | 14 | | |

Total Common Stocks

(Cost $—) | | | 401,240 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2023