| | OMB APPROVAL |

| | OMB Number: 3235-0570 |

| | Expires: September 30, 2026 Estimated average burden |

| | hours per response 7.78 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23592

First Eagle Credit Opportunities Fund

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas

New York, NY 10105-4300

(Address of principal executive offices)(Zip code)

Sheelyn Michael

First Eagle Funds

1345 Avenue of the Americas

New York, NY 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-632-2700

Date of fiscal year end: December 31

Date of reporting period: June 30,2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N- CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549- 1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Semiannual Report

June 30, 2024

First Eagle Credit Opportunities Fund

Advised by First Eagle Investment Management, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seek", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

2

Table of Contents

Fund Overview | | | 4 | | |

Consolidated Schedule of Investments | | | 5 | | |

Consolidated Statement of Assets and Liabilities | | | 50 | | |

Consolidated Statement of Operations | | | 51 | | |

Consolidated Statements of Changes in Net Assets | | | 52 | | |

Consolidated Statement of Cash Flows | | | 54 | | |

Financial Highlights | | | 56 | | |

Notes to Financial Statements | | | 60 | | |

Fund Expenses | | | 88 | | |

General Information | | | 92 | | |

Dividend Reinvestment Plan | | | 93 | | |

Board Considerations for Continuation of Advisory Agreement | | | 94 | | |

Board Considerations for Continuation of Subadvisory Agreement | | | 97 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

3

First Eagle Credit Opportunities Fund

Fund Overview

Data as of June 30, 2024 (unaudited)

Top 5 Industries* (%)

Health Care Services | | | 14.5 | | |

Application Software | | | 6.0 | | |

Research & Consulting Services | | | 3.1 | | |

Pharmaceuticals | | | 3.0 | | |

IT Consulting & Other Services | | | 2.9 | | |

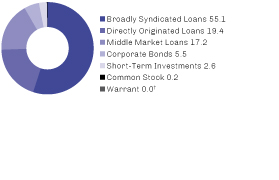

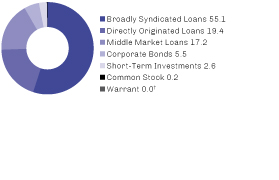

Debt Breakdown** (%)

Secured vs. Unsecured | |

First Lien Secured Loans | | | 89.42 | | |

Second Lien Secured Loans | | | 4.96 | | |

Unsecured Debt | | | 5.62 | | |

Floating vs Fixed | |

Floating Rate | | | 94.38 | | |

Fixed Rate | | | 5.62 | | |

Portfolio Characteristics**

Weighted Average Loan Spread | | | 5.11 | % | |

% of Portfolio at Floor | | | 0.00 | % | |

Weighted Average Maturity (Years) | | | 3.96 | | |

Weighted Average Duration (Years) | | | 0.32 | | |

Weighted Average Days to Reset | | | 37.79 | *** | |

Weighted Average Purchase Price | | $ | 96.79 | | |

Weighted Average Market Price | | $ | 93.70 | | |

Number of Positions | | | 405 | | |

^ Broadly Syndicated Loans, Middle Market Loans and Directly Originated Loans are presented under the Senior Loans category on the Schedule of Investments.

~ The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

* Asset Allocation and Industries percentages are based on total investments in the portfolio.

** Excludes short-term investments, common stocks and warrants.

*** Includes Senior Loans only.

† Less than 0.05%.

The Fund's portfolio composition is subject to change at any time.

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

4

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Senior Loans (a) — 101.8% | |

Advertising — 2.0% | |

MH Sub I / Indigo / WebMD Health

(fka Micro holdings / Internet Brands),

2023 May Incremental Term Loan — First Lien

(SOFR 1 month + 4.25%), 9.59%, 5/3/2028 | | | 6,943,909 | | | | 6,945,332 | | |

New Insight Holdings Inc. (Research Now/

Dynata/Survey Sampling), DIP Term Loan — First Lien

(SOFR 1 month + 8.75%), 14.21%, 8/6/2024‡ | | | 374,482 | | | | 378,227 | | |

New Insight Holdings Inc. (Research Now/Dynata/

Survey Sampling), Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

0.00%, 12/20/2024^ | | | 4,921,656 | | | | 3,733,618 | | |

WH Borrower, LLC (aka WHP Global),

2024-2 Term Loan — First Lien

(SOFR 3 month + 5.50%, 0.50% Floor),

10.82%, 2/15/2027‡ | | | 1,980,000 | | | | 1,955,250 | | |

WH Borrower, LLC (aka WHP Global),

Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 0.50% Floor),

10.82%, 2/15/2027 | | | 2,947,500 | | | | 2,911,585 | | |

| | | | 15,924,012 | | |

Aerospace & Defense — 1.2% | |

Chromalloy, Term Loan — First Lien

(SOFR 3 month + 3.75%), 9.06%, 3/27/2031 | | | 3,000,000 | | | | 3,012,750 | | |

HDT Holdco, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 1.00%, 0.75% Floor),

11.44%, 7/8/2027 | | | 2,677,215 | | | | 1,669,913 | | |

MAG DS Corp., Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.93%, 4/1/2027‡ (b)(c) | | | 1,972,926 | | | | 1,913,739 | | |

New Constellis Borrower LLC, Extended

Term B Loan — First Lien

(SOFR 3 month + 7.75%, 1.00% Floor),

13.33%, 9/27/2025 | | | 2,971,871 | | | | 2,879,000 | | |

| | | | 9,475,402 | | |

Agricultural & Farm Machinery — 0.1% | |

Hydrofarm Holdings Group, Inc., Term Loan — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.96%, 10/25/2028‡ (b)(c) | | | 1,175,252 | | | | 969,583 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

5

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Air Freight & Logistics — 0.2% | |

LaserShip, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 4.50%, 0.75% Floor),

10.10%, 5/7/2028 (d) | | | 1,903,745 | | | | 1,627,445 | | |

Airlines — 0.5% | |

AAdvantage Loyalty IP Ltd., Initial Term

Loan — First Lien

(SOFR 3 month + 4.75%,

0.75% Floor), 10.34%, 4/20/2028 | | | 4,000,000 | | | | 4,137,500 | | |

Alternative Carriers — 0.3% | |

Zayo Group Holdings, Inc., 2022 Incremental

Term Loan — First Lien (SOFR 1 month + 4.33%,

0.50% Floor), 9.67%, 3/9/2027 | | | 2,977,157 | | | | 2,633,861 | | |

Apparel Retail — 0.3% | |

Lids Holdings, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.99%, 12/14/2026‡ (b) | | | 2,108,952 | | | | 2,108,952 | | |

Apparel, Accessories & Luxury Goods — 1.5% | |

Outerstuff LLC, 2023 Extended Closing Date

Loan — First Lien

(SOFR 3 month + 8.50%,

2.50% Floor), 14.07%, 12/31/2027‡ | | | 7,823,337 | | | | 7,497,378 | | |

Rachel Zoe, Inc., Tranche A Loan — First Lien

(SOFR 3 month + 7.66%, 3.00% Floor),

12.97%, 10/9/2026‡ (b)(c)(e) | | | 1,150,815 | | | | 1,150,815 | | |

TR Apparel, LLC, Term Loan — First Lien

(SOFR 1 month + 9.00%, 2.00% Floor),

14.33%, 6/21/2027‡ (b)(c)(e) | | | 3,230,299 | | | | 3,230,299 | | |

| | | | 11,878,492 | | |

Application Software — 6.6% | |

Apex Analytix, Inc. (Montana Buyer, Inc.),

Initial Term Loan — First Lien

(SOFR 1 month + 5.75%, 0.75% Floor),

11.09%, 7/22/2029‡ (b)(e) | | | 2,661,957 | | | | 2,615,372 | | |

Apex Analytix, Inc. (Montana Buyer, Inc.),

Revolving Credit Loan — First Lien

(PRIME 3 month + 4.75%), 13.25%, 7/22/2028‡ (b)(e) | | | 17,391 | | | | 17,087 | | |

AppHub LLC, Delayed Draw Tem Loan — First Lien

(SOFR 6 month + 5.50%, 1.00% Floor),

10.97%, 9/29/2028‡ (b)(e) | | | 365,863 | | | | 365,863 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

6

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Application Software — 6.6% (continued) | |

AppHub LLC, Term Loan — First Lien

(SOFR 6 month + 5.50%, 1.00% Floor),

10.98%, 9/29/2028‡ (b)(c)(e) | | | 2,655,580 | | | | 2,655,580 | | |

AppLovin Corp., Initial Term Loan 2024 — First Lien

(SOFR 1 month + 2.50%, 0.50% Floor),

7.84%, 8/16/2030 | | | 4,985,000 | | | | 4,996,141 | | |

Apryse Software Corp. (PDFTron Systems Inc.),

2022-1 Incremental Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.83%, 7/15/2027‡ (b)(c)(e) | | | 3,421,250 | | | | 3,421,250 | | |

Apryse Software Corp. (PDFTron Systems Inc.),

2024-1 Incremental Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.83%, 7/15/2027‡ (b)(c)(e) | | | 1,820,948 | | | | 1,820,948 | | |

Apryse Software Corp. (PDFTron Systems Inc.),

Delayed Draw Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.83%, 7/15/2027‡ (b)(c)(e) | | | 353,516 | | | | 353,516 | | |

Apryse Software Corp. (PDFTron Systems Inc.),

Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.83%, 7/15/2027‡ (b)(c)(e) | | | 1,091,361 | | | | 1,091,361 | | |

Boxer Parent Co., Inc. (BMC Software) (Banff Merger

Sub), 2028 Extended Dollar Term Loan — First Lien

(SOFR 1 month + 4.00%), 9.34%, 12/29/2028 | | | 2,983,595 | | | | 2,993,441 | | |

CMI Marketing, Inc. (AdThrive), Initial Term

Loan 2021 — First Lien

(SOFR 1 month + 4.25%), 9.71%, 3/23/2028 | | | 997,429 | | | | 980,598 | | |

EagleView Technology Corp., Term Loan — First Lien

(SOFR 3 month + 3.50%), 9.10%, 8/14/2025 (d) | | | 3,476,502 | | | | 3,357,710 | | |

Enverus Holdings, Inc., Initial Term Loan — First Lien

(SOFR 1 month + 5.50%, 0.75% Floor),

10.84%, 12/24/2029‡ (b) | | | 3,838,514 | | | | 3,848,110 | | |

Flexera Software LLC (fka Flexera Software, Inc.),

Term Loan — First Lien

(SOFR 3 month + 3.50%, 0.75% Floor), 8.83%, 3/3/2028 | | | 992,332 | | | | 997,293 | | |

Greeneden U.S. Holdings II, LLC (Genesys

Telecommunications Laboratories),

2024 Incremental No. 2 Dollar Term Loan — First Lien

(SOFR 1 month + 3.50%, 0.75% Floor), 8.84%, 12/1/2027 | | | 994,859 | | | | 1,000,723 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

7

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Application Software — 6.6% (continued) | |

Help/Systems Holdings, Inc. (Fortra),

Term Loan — First Lien

(SOFR 3 month + 4.00%, 0.75% Floor),

9.43%, 11/19/2026 | | | 992,228 | | | | 896,106 | | |

Instructure Holdings, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 2.75%, 0.50% Floor),

8.35%, 10/30/2028 | | | 1,989,822 | | | | 1,991,066 | | |

Mitchell International, Inc., Initial Term Loan — First Lien

(SOFR 1 month + 3.25%), 8.58%, 6/17/2031 (d) | | | 4,100,000 | | | | 4,070,234 | | |

QuickBase Inc. (Quartz Holding Co.),

Term Loan — First Lien

(SOFR 3 month + 3.75%), 9.30%, 10/2/2028‡ (b) | | | 3,979,058 | | | | 3,981,604 | | |

Sapio Sciences, LLC (Jarvis Bidco),

Initial Term Loan — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.69%, 11/17/2028‡ (b)(c)(e) | | | 3,262,813 | | | | 3,262,812 | | |

Sunshine Software Merger Sub Inc.

(Cornerstone OnDemand), Initial Term Loan — First Lien

(SOFR 1 month + 3.75%, 0.50% Floor),

9.21%, 10/16/2028 | | | 992,386 | | | | 939,457 | | |

TMA Buyer, LLC, Delayed Draw Term Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

11.94%, 9/30/2027‡ (b)(e) | | | 145,609 | | | | 136,144 | | |

TMA Buyer, LLC, Revolving Credit Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

11.93%, 9/30/2027‡ (b)(e) | | | 46,196 | | | | 43,193 | | |

TMA Buyer, LLC, Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.98%, 9/30/2027‡ (b)(c)(e) | | | 1,223,270 | | | | 1,143,758 | | |

Upland Software, Inc., Initial Term Loan — First Lien

(SOFR 1 month + 3.75%), 9.19%, 8/6/2026 | | | 4,021,006 | | | | 3,842,554 | | |

Veracode (Mitnick Corp., Purchaser Inc.),

Initial Term Loan — First Lien

(SOFR 3 month + 4.50%, 0.50% Floor), 9.93%, 5/2/2029 | | | 2,955,000 | | | | 2,757,015 | | |

| | | | 53,578,936 | | |

Asset Management & Custody Banks — 1.8% | |

Advisor Group Holdings Inc. (Osaic Holdings),

Term B-3 Loan — First Lien

(SOFR 1 month + 4.00%), 9.34%, 8/17/2028 | | | 2,992,500 | | | | 3,005,413 | | |

Apella Capital LLC, Initial Term Loan — First Lien

(PRIME 3 month + 5.50%, 1.00% Floor),

14.00%, 3/1/2029‡ (b)(c)(e) | | | 1,266,825 | | | | 1,243,072 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

8

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Asset Management & Custody Banks — 1.8% (continued) | |

Apella Capital LLC, Revolving Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.85%, 3/1/2029‡ (b)(e) | | | 250,000 | | | | 245,312 | | |

Modena Buyer LLC (End User Computing),

Term — First Lien 4/17/2031 (d) | | | 5,000,000 | | | | 4,886,725 | | |

Oak Point Partners, LLC, Term Loan — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.69%, 12/1/2027‡ (b)(c)(e) | | | 2,501,281 | | | | 2,476,268 | | |

Orion Group Holdco, LLC, First Amendment

Incremental Delayed Draw Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.56%, 3/19/2027‡ (b)(c)(e) | | | 886,958 | | | | 886,958 | | |

Orion Group Holdco, LLC, First Amendment

Incremental Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.60%, 3/19/2027‡ (b)(c)(e) | | | 2,148,227 | | | | 2,148,227 | | |

| | | | 14,891,975 | | |

Auto Parts & Equipment — 2.2% | |

Enthusiast Auto Holdings, LLC (EAH-Intermediate

Holdco LLC), Third Amendment Term Loan — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.68%, 12/19/2025‡ (b)(c)(e) | | | 1,408,664 | | | | 1,408,664 | | |

First Brands Group, LLC, Term Loan B — First Lien

(SOFR 3 month + 5.00%), 10.59%, 3/30/2027 | | | 1,262,960 | | | | 1,257,435 | | |

Hertz Corp., The, 2023 Incremental

Term Loan — First Lien

(SOFR 3 month + 3.75%), 9.10%, 6/30/2028 | | | 3,628,194 | | | | 3,299,716 | | |

Hertz Corp., The, Initial Term B Loan — First Lien

(SOFR 3 month + 3.25%), 8.86%, 6/30/2028 | | | 1,133,581 | | | | 1,028,469 | | |

Hertz Corp., The, Initial Term C Loan — First Lien

(SOFR 3 month + 3.25%), 8.86%, 6/30/2028 | | | 219,677 | | | | 199,308 | | |

Power Stop, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 4.75%, 0.50% Floor),

10.20%, 1/26/2029 (d) | | | 11,163,122 | | | | 10,935,227 | | |

| | | | 18,128,819 | | |

Automotive Retail — 0.4% | |

BW Gas & Convenience Holdings, LLC (Yesway),

Initial Term Loan — First Lien

(SOFR 1 month + 3.50%), 8.96%, 3/31/2028‡ | | | 2,992,288 | | | | 2,996,028 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

9

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Brewers — 2.2% | |

City Brewing Co., LLC, First Lien Second Out

Term Loan — First Lien

(SOFR 3 month + 3.50%), 9.09%, 4/14/2028‡ | | | 8,516,856 | | | | 6,813,485 | | |

City Brewing Co., LLC, First-Out Closing Date

Exchanging Term Loan — First Lien

(SOFR 3 month + 3.50%, 0.75% Floor), 9.09%, 4/5/2028‡ | | | 8,258,040 | | | | 7,576,751 | | |

City Brewing Co., LLC, Term Loan — New

Money — First Lien

(SOFR 3 month + 6.25%), 11.58%, 4/5/2028‡ | | | 3,522,235 | | | | 3,575,069 | | |

| | | | 17,965,305 | | |

Broadcasting — 1.3% | |

A-L Parent LLC (Learfield), 2023

Term Loan — First Lien

(SOFR 1 month + 5.50%, 2.00% Floor),

10.84%, 6/30/2028 | | | 787,497 | | | | 793,647 | | |

Allen Media, LLC, Initial Term Loan 2021 — First Lien

(SOFR 3 month + 5.50%), 10.98%, 2/10/2027 | | | 1,954,074 | | | | 1,474,105 | | |

Terrier Media Buyer Inc. (Cox Media Group),

2021 Term B Loan — First Lien

(SOFR 3 month + 3.50%), 8.93%, 12/17/2026 | | | 9,948,454 | | | | 7,931,803 | | |

| | | | 10,199,555 | | |

Casinos & Gaming — 2.0% | |

Caesars Entertainment Inc., Incremental

Term B-1 Loan — First Lien

(SOFR 3 month + 2.75%), 8.10%, 2/6/2031 | | | 15,000,000 | | | | 15,030,448 | | |

Jack Ohio Finance (Jack Entertainment),

Initial Term Loan — First Lien

(SOFR 1 month + 4.75%, 0.75% Floor),

10.21%, 10/4/2028 | | | 981,233 | | | | 984,304 | | |

| | | | 16,014,752 | | |

Commercial Printing — 0.5% | |

Anthology / Blackboard (Astra AcquisitionCorp.;

BruinMergerCoInc.), Initial Purchased

Tranche A Term Loan — First Lien

(SOFR 1 month + 6.75%, 2.00% Floor),

12.06%, 2/25/2028 (c) | | | 906,888 | | | | 832,070 | | |

Anthology / Blackboard (Astra AcquisitionCorp.;

BruinMergerCoInc.), Initial Tranche B

Term Loan — First Lien

(SOFR 3 month + 5.25%, 2.00% Floor),

10.56%, 10/25/2028‡ (c) | | | 3,995,900 | | | | 1,478,483 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

10

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Commercial Printing — 0.5% (continued) | |

Anthology / Blackboard (Astra AcquisitionCorp.;

BruinMergerCoInc.), New Money Tranche A

Term Loan — First Lien

(SOFR 1 month + 6.75%, 2.00% Floor),

12.07%, 2/25/2028 (c) | | | 1,619,443 | | | | 1,485,839 | | |

| | | | 3,796,392 | | |

Commodity Chemicals — 0.6% | |

A&A Global Imports, LLC, First Out

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor,

11.97% PIK), 11.97%, 6/1/2026‡ (b)(c)(e) | | | 896,104 | | | | 896,104 | | |

A&A Global Imports, LLC, Last Out

Term Loan — First Lien

(SOFR 3 month + 8.50%, 1.00% Floor, 13.97% PIK),

13.97%, 6/1/2026‡ (b)(c)(e) | | | 1,002,126 | | | | 100,213 | | |

A&A Global Imports, LLC, New

Revolving Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

11.94%, 6/1/2026‡ (b)(e) | | | 3,256 | | | | 3,256 | | |

(PRIME 1 month + 5.50%, 1.00% Floor),

14.00%, 6/1/2026‡ (b)(e) | | | 12,663 | | | | 12,663 | | |

Ineos US Finance LLC, 2031 Dollar

Term Loan — First Lien

(SOFR 1 month + 3.75%), 9.09%, 2/7/2031 | | | 1,000,000 | | | | 1,003,750 | | |

USALCO, LLC, Second Amendment

Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.60%, 10/19/2027‡ (b)(c)(e) | | | 201,718 | | | | 201,718 | | |

USALCO, LLC, Term Loan A — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.57%, 10/19/2027‡ (b)(c)(e) | | | 2,925,000 | | | | 2,925,000 | | |

| | | | 5,142,704 | | |

Communications Equipment — 0.4% | |

SonicWALL Inc., Initial Term Loan — Second Lien

(SOFR 3 month + 7.50%), 12.98%, 5/18/2026 | | | 3,855,000 | | | | 3,580,331 | | |

Construction & Engineering — 0.8% | |

Amentum Government Services Holdings LLC

(AECOM Technology Corp.), Tranche 2

Term Loan — Second Lien

(SOFR 1 month + 7.50%, 0.75% Floor),

12.94%, 2/15/2030‡ | | | 1,867,696 | | | | 1,872,365 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

11

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Construction & Engineering — 0.8% (continued) | |

Amentum Government Services Holdings LLC

(AECOM Technology Corp.), Tranche 3

Term Loan — First Lien

(SOFR 1 month + 4.00%, 0.50% Floor),

9.34%, 2/15/2029 | | | 1,965,000 | | | | 1,976,053 | | |

RL James, Inc. (HH Restore Acquisition, Inc.),

Closing Date Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.44%, 12/15/2028‡ (b)(c)(e) | | | 954,110 | | | | 936,220 | | |

TriStrux, LLC, Delayed Draw Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.48%, 12/23/2026‡ (b)(c)(e) | | | 316,118 | | | | 271,861 | | |

TriStrux, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.46%, 12/23/2026‡ (b)(c)(e) | | | 903,409 | | | | 776,932 | | |

TriStrux, LLC, Revolving Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.45%, 12/23/2026‡ (b)(e) | | | 316,385 | | | | 272,091 | | |

| | | | 6,105,522 | | |

Construction Machinery & Heavy Trucks — 0.2% | |

AI Mistral Luxembourg Subco Sarl (V. Group), 2022

Extended Term B Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.34%, 9/30/2025‡ | | | 1,743,202 | | | | 1,817,288 | | |

Distributors — 1.0% | |

Highline Aftermarket Acquisition, LLC, Initial

Term Loan — First Lien

(SOFR 1 month + 4.50%, 0.75% Floor),

9.94%, 11/9/2027 | | | 928,187 | | | | 933,988 | | |

Project Castle, Inc. (Material Handling Systems Inc./

MHS/Deliver Buyer) , Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 0.50% Floor), 10.80%, 6/1/2029 | | | 7,979,695 | | | | 7,148,491 | | |

| | | | 8,082,479 | | |

Diversified Chemicals — 1.1% | |

Project Cloud Holdings, LLC (AgroFresh Inc.),

2024-1 Incremental Term Loan (USD) — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.68%, 3/31/2029‡ (b)(e) | | | 2,928,667 | | | | 2,870,093 | | |

Project Cloud Holdings, LLC (AgroFresh Inc.),

Initial USD Term Loan Retired — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.68%, 3/31/2029‡ (b)(c)(e) | | | 5,166,843 | | | | 5,063,507 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

12

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Diversified Chemicals — 1.1% (continued) | |

Project Cloud Holdings, LLC (AgroFresh Inc.),

Replacement Revolver — First Lien

(SOFR 1 month + 6.25%), 11.68%, 3/31/2029‡ (b)(e) | | | 568,869 | | | | 557,492 | | |

| | | | 8,491,092 | | |

Diversified Metals & Mining — 1.1% | |

Form Technologies (Dynacast), Last Out

Term Loan — First Lien

(SOFR 3 month + 9.25%, 1.00% Floor),

14.70%, 10/22/2025‡ (c) | | | 282,739 | | | | 208,991 | | |

Form Technologies (Dynacast),

Term B Loan — First Lien

(SOFR 3 month + 4.75%, 1.00% Floor),

10.20%, 7/22/2025 (c) | | | 321,797 | | | | 308,925 | | |

Mid-State Machine and Fabricating Corp.,

Revolver — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.84%, 6/21/2029‡ (b)(e) | | | 333,333 | | | | 328,333 | | |

Mid-State Machine and Fabricating Corp.,

Term Loan — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.84%, 6/21/2029‡ (b)(c)(e) | | | 8,333,333 | | | | 8,208,333 | | |

| | | | 9,054,582 | | |

Diversified Support Services — 0.5% | |

AMCP Clean Acquisition Co., LLC (PureStar),

Term Loan — First Lien

(SOFR 3 month + 5.00%, 0.50% Floor),

10.35%, 6/10/2028‡ (b)(c) | | | 4,433,333 | | | | 4,427,791 | | |

Education Services — 1.4% | |

Cengage Learning Acquisitions, Inc.,

Term Loan B — First Lien

(SOFR 6 month + 4.25%, 1.00% Floor),

9.54%, 3/15/2031 | | | 3,000,000 | | | | 3,012,195 | | |

Point Quest Acquisition, LLC, Initial

Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.99%, 8/14/2028‡ (b)(c)(e) | | | 7,565,489 | | | | 7,565,489 | | |

Point Quest Acquisition, LLC, Revolving

Credit Loan — First Lien

(SOFR 1 month + 5.50%, 1.00% Floor),

10.95%, 8/14/2028‡ (b)(e) | | | 576,669 | | | | 576,669 | | |

| | | | 11,154,353 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

13

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Electric Utilities — 0.2% | |

Granite Acquisition Inc. (Wheelabrator) (WIN Waste

Innovations Holdings), Initial Term Loan — First Lien

3/24/2028 (d) | | | 1,518,971 | | | | 1,418,248 | | |

Electrical Components & Equipment — 0.8% | |

Electrical Components International, Inc. (ECI),

Closing Date Term Loan — First Lien

(SOFR 1 month + 6.50%, 2.00% Floor),

11.83%, 5/10/2029‡ (b)(c)(e) | | | 6,033,333 | | | | 5,912,667 | | |

Electrical Components International, Inc. (ECI),

Delayed Draw Term Loan — First Lien

(SOFR 1 month + 6.50%, 2.00% Floor),

11.84%, 5/10/2029‡ (b)(e) | | | 286,667 | | | | 280,933 | | |

| | | | 6,193,600 | | |

Electronic Equipment & Instruments — 0.1% | |

VeriFone Systems, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 4.00%), 9.60%, 8/20/2025 | | | 992,126 | | | | 816,167 | | |

Electronic Manufacturing Services — 1.3% | |

Creation Technologies Inc., Initial

Term Loan — First Lien

(SOFR 3 month + 5.75%, 0.50% Floor),

11.32%, 10/5/2028 | | | 4,974,619 | | | | 4,638,833 | | |

Natel Engineering Co., Inc., Initial

Term Loan — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.71%, 4/30/2026 (c) | | | 6,839,851 | | | | 6,032,748 | | |

| | | | 10,671,581 | | |

Environmental & Facilities Services — 0.8% | |

EnergySolutions (Energy Capital Partners),

Initial Term Loan — First Lien

(SOFR 1 month + 3.75%), 9.09%, 9/20/2030 | | | 2,930,663 | | | | 2,957,229 | | |

SR Landscaping, LLC, Closing Date

Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.43%, 10/30/2029‡ (b)(c)(e) | | | 2,688,477 | | | | 2,661,592 | | |

SR Landscaping, LLC, Delayed Draw

Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.44%, 10/30/2029‡ (b)(e) | | | 477,125 | | | | 472,353 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

14

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Environmental & Facilities Services — 0.8% (continued) | |

SR Landscaping, LLC, Revolving Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.43%, 10/30/2029‡ (b)(e) | | | 44,511 | | | | 44,066 | | |

| | | | 6,135,240 | | |

Financial Exchanges & Data — 0.6% | |

Priority Holdings LLC, PRTH

Term Loan B USD — First Lien

(SOFR 1 month + 4.75%), 10.08%, 4/24/2029 | | | 4,814,563 | | | | 4,822,098 | | |

Footwear — 0.1% | |

SHO Holding I Corp., New Money

Delayed Draw DIP — First Lien

(SOFR 1 month + 8.00%, 1.00% Floor),

13.44%, 1/12/2031‡ (b) | | | 542,943 | | | | 518,511 | | |

Health Care Equipment — 0.7% | |

Carestream Dental Equipment Inc.,

Initial Term Loan — First Lien

(ICE LIBOR USD 1 month + 3.25%, 1.00% Floor),

8.71%, 9/1/2024 | | | 5,956,572 | | | | 5,182,218 | | |

Carestream Dental Equipment Inc., Tranche B

Term Loan — First Lien

(SOFR 3 month + 4.50%, 0.50% Floor),

10.07%, 9/1/2024 | | | 965,823 | | | | 804,048 | | |

| | | | 5,986,266 | | |

Health Care Facilities — 2.1% | |

ConvenientMD (CMD Intermediate Holdings, Inc.),

2024 Extended Term Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.49%, 6/8/2029‡ (b)(c)(e) | | | 1,802,631 | | | | 1,748,552 | | |

Crisis Prevention Institute Inc.,

Initial Term Loan — First Lien

(SOFR 3 month + 4.75%, 0.50% Floor),

10.08%, 4/9/2031 | | | 2,000,000 | | | | 2,008,330 | | |

Quorum Health Resources (QHR), 2023

Incremental Term Loan — First Lien

(SOFR 1 month + 5.25%),

10.69%, 5/28/2027‡ (b)(c)(e) | | | 1,980,000 | | | | 1,930,500 | | |

Quorum Health Resources (QHR), Specified

Delayed Draw Term Loan — First Lien

(SOFR 6 month + 5.25%), 10.68%, 5/28/2027‡ (b)(c)(e) | | | 1,980,000 | | | | 1,930,500 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

15

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Facilities — 2.1% (continued) | |

Quorum Health Resources (QHR),

Term Loan — First Lien

(SOFR 6 month + 5.25%, 1.00% Floor),

10.79%, 5/28/2027‡ (b)(c)(e) | | | 1,046,292 | | | | 1,020,135 | | |

RegionalCare Hospital Partners Holdings Inc.

(Lifepoint Health), Term Loan B — First Lien

(SOFR 3 month + 4.00%), 9.33%, 5/9/2031 | | | 3,362,530 | | | | 3,371,474 | | |

RegionalCare Hospital Partners Holdings Inc.

(Lifepoint Health), 2024 Refinancing

Term Loan — First Lien

(SOFR 3 month + 4.75%), 10.06%, 11/16/2028 | | | 4,987,500 | | | | 5,020,866 | | |

| | | | 17,030,357 | | |

Health Care Services — 16.1% | |

Anne Arundel Dermatology Management, LLC,

DDTL A — First Lien

(SOFR 3 month + 2.75%, 1.00% Floor,

4.25% PIK), 12.48%, 10/16/2025‡ (b)(c)(e) | | | 116,824 | | | | 105,142 | | |

Anne Arundel Dermatology Management, LLC,

DDTL B — First Lien

(SOFR 3 month + 2.75%, 1.00% Floor,

4.25% PIK), 12.48%, 10/16/2025‡ (b)(c)(e) | | | 197,886 | | | | 178,097 | | |

Anne Arundel Dermatology Management, LLC,

DDTL C — First Lien

(SOFR 3 month + 2.75%, 1.00% Floor,

4.25% PIK), 12.48%, 10/16/2025‡ (b)(e) | | | 557,254 | | | | 501,331 | | |

Anne Arundel Dermatology Management, LLC,

Restatement Date Term Loan — First Lien

(SOFR 3 month + 2.75%, 1.00% Floor,

4.25% PIK), 12.48%, 10/16/2025‡ (b)(c)(e) | | | 1,927,840 | | | | 1,735,056 | | |

Aspen Dental Management Inc. (aka: ADMI Corp.),

Amendment No.10 Extended Term Loan — First Lien

(SOFR 1 month + 5.75%), 11.09%, 12/23/2027 | | | 2,985,000 | | | | 3,009,865 | | |

BCDI BHI Intermediate 2, LP (Basic Home Infusion),

Delayed Draw Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.25%, 9/29/2028‡ (b)(c)(e) | | | 1,222,271 | | | | 1,216,160 | | |

BCDI BHI Intermediate 2, LP (Basic Home Infusion),

Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.23%, 9/29/2028‡ (b)(c)(e) | | | 2,899,432 | | | | 2,884,935 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

16

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Services — 16.1% (continued) | |

BCDI BHI Intermediate 2, LP (Basic Home Infusion),

Revolving Credit Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.23%, 9/29/2028‡ (b)(e) | | | 331,251 | | | | 329,594 | | |

Boston Clinical Trials LLC (Alcanza Clinical Research),

Fourth Amendment Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

11.00%, 12/20/2027‡ (b)(e) | | | 906,977 | | | | 897,907 | | |

Boston Clinical Trials LLC (Alcanza Clinical Research),

Fourth Amendment Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.98%, 12/20/2027‡ (b)(c)(e) | | | 2,093,023 | | | | 2,072,093 | | |

Boston Clinical Trials LLC (Alcanza Clinical Research),

Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.48%, 12/20/2027‡ (b)(c)(e) | | | 4,718,153 | | | | 4,694,562 | | |

Boston Clinical Trials LLC (Alcanza Clinical Research),

Revolving Credit Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.49%, 12/20/2027‡ (b)(e) | | | 187,500 | | | | 186,562 | | |

CC Amulet Management, LLC (Children's Choice),

Delayed Draw Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

12.09%, 8/31/2027‡ (b)(e) | | | 96,856 | | | | 96,856 | | |

CC Amulet Management, LLC (Children's Choice),

Revolving Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.84%, 8/31/2026‡ (b)(e) | | | 44,099 | | | | 43,879 | | |

CC Amulet Management, LLC (Children's Choice),

Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.84%, 8/31/2027‡ (b)(c)(e) | | | 1,666,822 | | | | 1,658,488 | | |

Civitas Solutions Inc. (National Mentor Holding),

Initial Term C Loan — First Lien 3/2/2028 (d) | | | 134,248 | | | | 127,049 | | |

Civitas Solutions Inc. (National Mentor Holding),

Initial Term Loan — First Lien 3/2/2028 (d) | | | 4,657,661 | | | | 4,407,894 | | |

Civitas Solutions Inc. (National Mentor Holding),

Initial Term Loan — Second Lien

(SOFR 3 month + 7.25%, 0.75% Floor),

12.68%, 3/2/2029 | | | 9,386,585 | | | | 8,457,313 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

17

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Services — 16.1% (continued) | |

Community Based Care Acquisition, Inc.,

Delayed Draw Tranche A Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.68%, 9/16/2027‡ (b)(c)(e) | | | 894,309 | | | | 894,309 | | |

Community Based Care Acquisition, Inc.,

Delayed Draw Tranche B Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.93%, 9/30/2027‡ (b)(e) | | | 939,394 | | | | 939,394 | | |

Community Based Care Acquisition, Inc.,

Initial Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.68%, 9/16/2027‡ (b)(c)(e) | | | 2,205,915 | | | | 2,205,915 | | |

Community Based Care Acquisition, Inc.,

Revolving Credit Loan — First Lien

(PRIME 3 month + 4.25%, 1.00% Floor),

12.75%, 9/16/2027‡ (b)(e) | | | 43,903 | | | | 43,902 | | |

Dermatology Intermediate Holdings III, Inc.

(Forefront), Term B-1 Loan — First Lien

(SOFR 3 month + 5.50%, 0.50% Floor),

10.83%, 3/30/2029 (d) | | | 5,486,250 | | | | 5,422,225 | | |

Elevate HD Parent, Inc., Delayed Draw

Term Loan A — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.44%, 8/20/2029‡ (b)(e) | | | 74,750 | | | | 74,003 | | |

Elevate HD Parent, Inc., Initial Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.44%, 8/20/2029‡ (b)(c)(e) | | | 3,225,625 | | | | 3,193,369 | | |

Elevate HD Parent, Inc., Revolving Loan — First Lien

(SOFR 1 month + 6.10%, 1.00% Floor),

11.44%, 8/20/2029‡ (b)(e) | | | 65,000 | | | | 64,350 | | |

Endo1 Partners, LLC, Seventh

Amendment DDTL — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.84%, 3/24/2026‡ (b)(c)(e) | | | 7,942,857 | | | | 7,883,286 | | |

Endo1 Partners, LLC, Third

Amendment DDTL — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.84%, 3/24/2026‡ (b)(c)(e) | | | 1,820,631 | | | | 1,806,976 | | |

Epic Staffing Group (Cirrus/Tempus/Explorer

Investor), Initial Term Loan — First Lien

(SOFR 1 month + 6.00%, 0.50% Floor),

11.34%, 6/28/2029‡ (b) | | | 4,914,531 | | | | 4,791,668 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

18

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Services — 16.1% (continued) | |

First Steps Recovery Acquisition, LLC (True North

Detox), Term Loan — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.59%, 3/29/2030‡ (b)(c)(e) | | | 3,113,818 | | | | 3,067,110 | | |

Gen4 Dental Partners Opco, LLC,

Initial Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

10.82%, 5/13/2030‡ (b)(c)(e) | | | 5,500,000 | | | | 5,390,000 | | |

Grifols Worldwide Operations USA, Inc., Dollar

Tranche B Term Loan — First Lien

(SOFR 1 month + 2.00%), 7.44%, 11/15/2027 | | | 1,796,197 | | | | 1,769,254 | | |

Houseworks Holdings, Fourth Amendment

Term Loan — First Lien

(SOFR 6 month + 5.25%, 1.00% Floor),

10.55%, 12/15/2028‡ (b)(c)(e) | | | 2,649,964 | | | | 2,596,965 | | |

Houseworks Holdings, Revolving Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

6.50%, 12/15/2028‡ (b)(e) | | | 18,800 | | | | 18,800 | | |

Houseworks Holdings, Third Amendment

Term Loan — First Lien

(SOFR 3 month + 6.50%), 12.00%, 12/15/2028‡ (b)(c)(e) | | | 1,679,041 | | | | 1,679,041 | | |

In Vitro Sciences, LLC (New IVS Holdings, LLC),

Closing Date Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.46%, 2/28/2029‡ (b)(c)(e) | | | 4,393,352 | | | | 4,327,451 | | |

In Vitro Sciences, LLC (New IVS Holdings, LLC),

Delayed Draw Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.46%, 2/28/2029‡ (b)(e) | | | 1,122,400 | | | | 1,105,564 | | |

IPM MSO Management, LLC, Closing Date

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.95%, 6/17/2026‡ (b)(c)(e) | | | 800,569 | | | | 788,560 | | |

IPM MSO Management, LLC, Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.95%, 6/17/2026‡ (b)(c)(e) | | | 96,081 | | | | 94,640 | | |

IPM MSO Management, LLC, Second Amendment

Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.95%, 6/17/2026‡ (b)(c)(e) | | | 220,073 | | | | 216,772 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

19

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Services — 16.1% (continued) | |

Life Northwestern Pennsylvania, LLC (FFL Pace

Buyer, Inc.), Delayed Draw Term Loan — First Lien

(SOFR 1 month + 5.75%, 1.00% Floor),

11.18%, 12/6/2027‡ (b)(c)(e) | | | 576,759 | | | | 563,782 | | |

Life Northwestern Pennsylvania, LLC (FFL Pace

Buyer, Inc.), Initial Term Loan — First Lien

(SOFR 1 month + 5.75%, 1.00% Floor),

11.18%, 12/6/2027‡ (b)(c)(e) | | | 1,721,250 | | | | 1,682,522 | | |

Life Northwestern Pennsylvania, LLC (FFL Pace

Buyer, Inc.), Revolving Loan — First Lien

(SOFR 1 month + 5.75%, 1.00% Floor),

11.18%, 12/6/2027‡ (b)(e) | | | 219,578 | | | | 214,638 | | |

LMSI Buyer, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.23%, 10/25/2027‡ (b)(c)(e) | | | 2,150,159 | | | | 1,935,143 | | |

LMSI Buyer, LLC, Revolving Credit Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.23%, 10/25/2027‡ (b)(e) | | | 334,728 | | | | 301,255 | | |

Medrina, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 6.25%, 1.00% Floor),

11.55%, 10/20/2029‡ (b)(c)(e) | | | 5,479,417 | | | | 5,424,623 | | |

Midwest Physician Administrative Services, LLC

(ACOF V DP Acquiror LLC aka Dupage Medical Group),

Initial Term Loan — First Lien

(SOFR 3 month + 3.25%), 8.85%, 3/12/2028 (d) | | | 4,987,113 | | | | 4,382,426 | | |

Monarch Behavioral Therapy, LLC,

Term Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.33%, 6/6/2030‡ (b)(c)(e) | | | 9,668,583 | | | | 9,523,554 | | |

NAPA Management Services Corp., Initial

Term Loan — First Lien

(SOFR 1 month + 5.25%, 0.75% Floor),

10.69%, 2/23/2029 (c)(d) | | | 1,775,026 | | | | 1,703,102 | | |

NSM Top Holdings Corp. (National Seating &

Mobility Inc.), Initial Term Loan — First Lien

(SOFR 3 month + 5.25%), 10.66%, 11/16/2026 | | | 3,923,182 | | | | 3,933,009 | | |

Phoenix Guarantor (BrightSpring Health),

Tranche B-4 Term Loan — First Lien

(SOFR 1 month + 3.25%), 8.59%, 2/21/2031 | | | 4,987,500 | | | | 4,980,667 | | |

Physician Partners, LLC, Second Amendment

Incremental Term Loan — First Lien

(SOFR 6 month + 5.50%), 10.81%, 12/22/2028‡ | | | 1,990,000 | | | | 1,502,450 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

20

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Health Care Services — 16.1% (continued) | |

Visante Acquisition, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.08%, 1/31/2030‡ (b)(c)(e) | | | 4,964,587 | | | | 4,890,118 | | |

Women's Care Holdings, Inc.,

Initial Term Loan — First Lien

(SOFR 3 month + 4.50%, 0.75% Floor), 9.93%, 1/15/2028 | | | 2,646,002 | | | | 2,466,074 | | |

Women's Care Holdings, Inc., Initial

Term Loan — Second Lien

(SOFR 3 month + 8.25%, 0.75% Floor),

13.68%, 1/12/2029‡ (c) | | | 5,701,232 | | | | 4,879,314 | | |

| | | | 129,359,014 | | |

Health Care Supplies — 1.0% | |

Journey Personal Care (Domtar Corp.), Initial

Term Loan — First Lien

(SOFR 1 month + 4.25%, 0.75% Floor),

9.69%, 3/1/2028 | | | 5,000,000 | | | | 4,992,500 | | |

LifeScan Global Corp., Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.93%, 12/30/2026 (c) | | | 5,877,278 | | | | 2,825,972 | | |

| | | | 7,818,472 | | |

Health Care Technology — 2.6% | |

AG Parent Holdings LLC (ArisGlobal), Initial

Term Loan — First Lien

(SOFR 3 month + 5.00%), 10.60%, 7/31/2026 (c) | | | 5,855,198 | | | | 5,381,923 | | |

Athenahealth Group Inc., Initial Term Loan — First Lien

(SOFR 1 month + 3.25%, 0.50% Floor), 8.59%, 2/15/2029 | | | 992,405 | | | | 990,390 | | |

CT Technologies Intermediate Holdings, Inc.

(HealthPort), 2021 Term Loan — First Lien

(SOFR 1 month + 4.25%, 0.75% Floor),

9.71%, 12/16/2025 | | | 3,437,949 | | | | 3,446,544 | | |

Greenway Health, LLC (fka Vitera Healthcare

Solutions, LLC), Term Loan — First Lien

(SOFR 6 month + 6.75%), 12.01%, 4/1/2029‡ (b)(c)(e) | | | 7,079,032 | | | | 7,025,939 | | |

nThrive, Inc. (fka Precyse Acquisition Corp.),

Initial Loan — Second Lien

(SOFR 1 month + 6.75%, 0.50% Floor),

12.21%, 12/17/2029 | | | 2,000,000 | | | | 1,383,340 | | |

RMBUS Holdco Inc. (Eclat Health Solutions Inc.),

Initial Term Loan — First Lien

(SOFR 6 month + 6.50%, 1.00% Floor),

11.68%, 1/8/2029‡ (b)(c)(e) | | | 2,815,524 | | | | 2,768,012 | | |

| | | | 20,996,148 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

21

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Heavy Electrical Equipment — 0.1% | |

Arcline FM Holding, LLC (Fairbanks), Initial

Term Loan — First Lien

(SOFR 3 month + 4.75%), 10.35%, 6/23/2028 | | | 994,885 | | | | 999,004 | | |

Highways & Railtracks — 0.4% | |

Patriot Rail Co., LLC (NA Rail), Tranche B-2

Term Loan — First Lien

(SOFR 3 month + 4.00%, 0.25% Floor),

9.60%, 10/19/2026‡ (b)(c) | | | 2,976,681 | | | | 2,978,542 | | |

Home Furnishings — 0.4% | |

Dorel Industries Inc., First Out Term Loan — First Lien

(SOFR 1 month + 8.30%, 2.00% Floor),

13.63%, 12/8/2026‡ (b)(e) | | | 2,961,107 | | | | 2,961,107 | | |

Home Improvement Retail — 0.4% | |

Air Conditioning Specialist, Inc.,

Revolving Loan — First Lien

(SOFR 3 month + 7.25%, 1.00% Floor),

12.81%, 11/9/2026‡ (b)(e) | | | 84,926 | | | | 84,289 | | |

Air Conditioning Specialist, Inc., Term Loan — First Lien

(SOFR 3 month + 7.25%, 1.00% Floor),

12.82%, 11/9/2026‡ (b)(c)(e) | | | 3,133,574 | | | | 3,110,072 | | |

| | | | 3,194,361 | | |

Hotels, Resorts & Cruise Lines — 0.9% | |

Stats, LLC (Peak Jersey Holdco Ltd.),

Term Loan — First Lien

(SOFR 3 month + 5.25%), 10.84%, 7/10/2026 (c) | | | 7,148,295 | | | | 7,005,329 | | |

| | | | 7,005,329 | | |

Household Products — 0.2% | |

Lash Opco LLC, Initial Term Loan — First Lien

(SOFR 3 month + 2.65%, 1.00% Floor,

5.10% PIK), 13.18%, 3/18/2026‡ (b)(c)(e) | | | 1,933,312 | | | | 1,822,496 | | |

Human Resource & Employment Services — 1.3% | |

Danforth Global, Inc., First Amendment

Additional Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.60%, 12/9/2027‡ (b)(c)(e) | | | 971,797 | | | | 957,220 | | |

Danforth Global, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.71%, 12/9/2027‡ (b)(c)(e) | | | 1,232,437 | | | | 1,213,950 | | |

Danforth Global, Inc., Revolving Credit Loan — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.58%, 12/9/2027‡ (b)(e) | | | 83,333 | | | | 82,083 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

22

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Human Resource & Employment Services — 1.3% (continued) | |

Danforth Global, Inc., Second Amendment Incremental

Term Loan — First Lien

(SOFR 3 month + 5.25%, 1.00% Floor),

10.58%, 12/9/2027‡ (b)(c)(e) | | | 7,282,649 | | | | 7,173,410 | | |

Triple Crown Consulting, Term A Loan — First Lien

(SOFR 1 month + 6.75%, 1.50% Floor),

12.19%, 6/2/2028‡ (b)(c)(e) | | | 1,469,203 | | | | 1,333,302 | | |

| | | | 10,759,965 | | |

Industrial Machinery — 2.9% | |

Filtration Group Corp., 2021 Incremental

Term Loan — First Lien

(SOFR 1 month + 3.50%, 0.50% Floor),

8.96%, 10/21/2028 (b) | | | 2,574,000 | | | | 2,588,479 | | |

Kenan Advantage Group, Inc., The, U.S.

Term B-3 Loan — First Lien

(SOFR 1 month + 3.75%), 9.09%, 1/25/2029 (c) | | | 4,987,500 | | | | 5,018,672 | | |

SPX Flow Inc., Term Loan — First Lien

(SOFR 1 month + 3.50%), 8.84%, 4/5/2029 | | | 8,004,241 | | | | 8,059,630 | | |

WasteQuip, Inc. (Patriot Container), Closing Date

Term Loan — First Lien

(SOFR 1 month + 3.75%, 1.00% Floor),

9.19%, 3/20/2025 | | | 7,915,567 | | | | 7,730,422 | | |

| | | | 23,397,203 | | |

Insurance Brokers — 3.0% | |

Acrisure, LLC, Term Loan B6 USD — First Lien

11/6/2030 (d) | | | 5,000,000 | | | | 5,000,025 | | |

Amynta Agency Borrower Inc. (Amynta Warranty

Borrower Inc.), MAYAGE Term Loan B USD — First Lien

2/28/2028 (d) | | | 2,000,000 | | | | 2,007,320 | | |

Newcleus, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor,

2.00% PIK), 13.48%, 8/2/2026‡ (b)(c)(e) | | | 1,212,797 | | | | 1,115,571 | | |

Portfolio Holding, Inc. (Turbo Buyer / PGM),

Amendment No. 3 Incremental Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.48%, 12/2/2025‡ (b)(c)(e) | | | 1,940,000 | | | | 1,862,400 | | |

Portfolio Holding, Inc. (Turbo Buyer / PGM),

Amendment No. 4 Incremental Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.48%, 12/2/2025‡ (b)(c)(e) | | | 762,590 | | | | 732,087 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

23

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Insurance Brokers — 3.0% (continued) | |

Portfolio Holding, Inc. (Turbo Buyer / PGM),

Amendment No. 4 Incremental Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.48%, 12/2/2025‡ (b)(c)(e) | | | 1,141,193 | | | | 1,095,545 | | |

The Mutual Group, LLC, Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

11.08%, 1/31/2030‡ (b)(c)(e) | | | 4,857,955 | | | | 4,785,085 | | |

Tricor, LLC, Amendment No 3 Incremental

Term Loan — First Lien

(SOFR 1 month + 5.00%, 1.00% Floor),

10.44%, 10/22/2026‡ (c)(e) | | | 1,827,000 | | | | 1,799,595 | | |

Tricor, LLC, Delayed Draw Term Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.46%, 10/22/2026‡ (b)(c)(e) | | | 717,519 | | | | 713,931 | | |

Tricor, LLC, Revolving Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.45%, 10/22/2026‡ (b)(e) | | | 128,077 | | | | 127,437 | | |

Tricor, LLC, Term Loan — First Lien

(SOFR 1 month + 5.00%, 1.00% Floor),

10.44%, 10/22/2026‡ (b)(c)(e) | | | 1,909,753 | | | | 1,900,204 | | |

Truist Insurance Holdings, LLC, Initial

Term Loan — First Lien

(SOFR 3 month + 3.25%), 8.59%, 5/6/2031 | | | 3,000,000 | | | | 3,010,170 | | |

| | | | 24,149,370 | | |

Integrated Telecommunication Services — 0.8% | |

Altice France SA (Numericable), USD Term

Loan B-[14] Loan — First Lien

(SOFR 3 month + 5.50%), 10.83%, 8/15/2028 | | | 4,987,406 | | | | 3,678,212 | | |

NEP Group, Inc., Extended Initial Dollar

Term Loan — First Lien 8/19/2026 (d) | | | 2,995,755 | | | | 2,848,453 | | |

| | | | 6,526,665 | | |

Interactive Media & Services — 0.6% | |

Ingenio LLC, First Amendment Term Loan — First Lien

(SOFR 3 month + 7.00%, 1.00% Floor),

12.50%, 8/3/2026‡ (b)(c)(e) | | | 3,893,273 | | | | 3,873,806 | | |

Ingenio LLC, Term Loan — First Lien

(SOFR 3 month + 7.00%, 1.00% Floor),

12.50%, 8/3/2026‡ (b)(c)(e) | | | 1,255,699 | | | | 1,249,421 | | |

| | | | 5,123,227 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

24

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Internet & Direct Marketing Retail — 1.3% | |

Everlane, Inc., Term Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor),

11.83%, 3/31/2025‡ (b)(e) | | | 3,750,000 | | | | 3,750,000 | | |

Kobra International, Ltd. (d/b/a Nicole Miller),

Term Loan — First Lien

(SOFR 1 month + 6.75%, 1.00% Floor),

12.08%, 5/17/2025‡ (b)(e) | | | 4,448,118 | | | | 4,448,118 | | |

Sweetwater Borrower LLC, Initial

Term Loan — First Lien

(SOFR 1 month + 4.25%, 0.75% Floor),

9.71%, 8/7/2028 | | | 2,556,950 | | | | 2,568,303 | | |

| | | | 10,766,421 | | |

Internet Services & Infrastructure — 0.3% | |

Dcert Buyer Inc. (Digicert), Initial

Term Loan — First Lien

(SOFR 1 month + 4.00%), 9.34%, 10/16/2026 | | | 374,403 | | | | 365,744 | | |

Technology Partners, LLC (Imagine Software),

Initial Term Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.43%, 11/16/2027‡ (b)(c)(e) | | | 2,275,438 | | | | 2,269,750 | | |

| | | | 2,635,494 | | |

Investment Banking & Brokerage — 0.6% | |

Aretec Group Inc. (Cetera Financial Group),

RCAP Term Loan USD — First Lien

(SOFR 1 month + 4.00%), 9.34%, 8/9/2030 | | | 4,962,500 | | | | 4,987,834 | | |

IT Consulting & Other Services — 3.3% | |

Acumera, Inc., Initial Term Loan — First Lien

(SOFR 3 month + 7.00%, 1.00% Floor),

12.44%, 6/7/2028‡ (b)(c)(e) | | | 2,391,275 | | | | 2,391,275 | | |

Ahead DB Holdings, LLC, 2024 Incremental

Term Loan — First Lien

(SOFR 3 month + 4.25%, 0.75% Floor), 9.58%, 2/1/2031 | | | 5,000,000 | | | | 5,022,675 | | |

Alpine SG, LLC (ASG), February 2023

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor), 11.98%,

11/5/2027‡ (b)(c)(e) | | | 809,139 | | | | 801,047 | | |

Alpine SG, LLC (ASG), Initial Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.98%, 11/5/2027‡ (b)(c)(e) | | | 1,351,194 | | | | 1,337,682 | | |

Alpine SG, LLC (ASG), May 2022 Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.98%, 11/5/2027‡ (b)(c)(e) | | | 708,496 | | | | 701,411 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

25

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

IT Consulting & Other Services — 3.3% (continued) | |

Alpine SG, LLC (ASG), November 2021

Term Loan — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.98%, 11/5/2027‡ (b)(c)(e) | | | 2,101,990 | | | | 2,080,970 | | |

Alpine X, Delayed Draw Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.56%, 12/27/2027‡ (b)(c)(e) | | | 599,037 | | | | 599,037 | | |

Alpine X, Fourth Amendment Term Loan — First Lien

(SOFR 3 month + 7.25%), 12.81%, 12/27/2027‡ (b)(c)(e) | | | 86,120 | | | | 86,120 | | |

Alpine X, Revolving Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.56%, 12/27/2027‡ (b)(e) | | | 60,876 | | | | 60,876 | | |

Alpine X, Second Amendment Incremental

Revolving Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.56%, 12/27/2027‡ (b)(e) | | | 28,571 | | | | 28,572 | | |

Alpine X, Second Amendment Incremental

Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.56%, 12/27/2027‡ (b)(c)(e) | | | 982,500 | | | | 982,500 | | |

Alpine X, Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.56%, 12/27/2027‡ (b)(c)(e) | | | 929,109 | | | | 929,109 | | |

Asurion, LLC, New B-11 Term Loan — First Lien

(SOFR 1 month + 4.25%), 9.69%, 8/19/2028 | | | 4,962,312 | | | | 4,931,843 | | |

Eliassen Group, LLC, 2022 Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 5.75%, 0.75% Floor),

11.08%, 4/14/2028‡ (b)(e) | | | 172,854 | | | | 171,126 | | |

Eliassen Group, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 0.75% Floor),

11.05%, 4/14/2028‡ (b)(c)(e) | | | 2,401,667 | | | | 2,377,650 | | |

Inflexionpoint LLC (fka Automated Control Concepts),

Revolving Credit Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

11.10%, 10/22/2026‡ (b)(e) | | | 104,167 | | | | 103,646 | | |

Inflexionpoint LLC (fka Automated Control Concepts),

Term Loan — First Lien

(SOFR 3 month + 5.50%, 1.00% Floor),

11.10%, 10/22/2026‡ (b)(c)(e) | | | 2,241,953 | | | | 2,230,743 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

26

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

IT Consulting & Other Services — 3.3% (continued) | |

Marlin DTC — LS Midco 2, LLC (Clarus Commerce, LLC),

2A Term Loan — First Lien

(SOFR 6 month + 6.50%, 1.00% Floor),

11.92%, 7/1/2025‡ (b)(c)(e) | | | 1,501,002 | | | | 1,478,487 | | |

| | | | 26,314,769 | | |

Leisure Facilities — 0.5% | |

Bandon Fitness Texas, Inc., Delayed Draw

Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.00% Floor),

11.47%, 7/27/2028‡ (b)(e) | | | 902,618 | | | | 891,336 | | |

Bandon Fitness Texas, Inc., Initial

Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.48%, 7/27/2028‡ (b)(c)(e) | | | 2,891,447 | | | | 2,855,304 | | |

Bandon Fitness Texas, Inc.,

Revolving Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.48%, 7/27/2028‡ (b)(e) | | | 147,297 | | | | 145,456 | | |

| | | | 3,892,096 | | |

Leisure Products — 0.2% | |

Abe Investment Holdings, Inc., (Getty Images, Inc.),

Initial Dollar Term Loan — First Lien

(SOFR 3 month + 4.50%), 9.93%, 2/19/2026 | | | 1,344,393 | | | | 1,345,670 | | |

Life Sciences Tools & Services — 1.1% | |

Sequoia Consulting Group, LLC, Term Loan — First Lien

(SOFR 3 month + 6.75%, 1.00% Floor),

12.23%, 12/17/2026‡ (b)(c)(e) | | | 4,231,809 | | | | 3,977,901 | | |

VCR Buyer, Inc. (Velocity Clinical Research),

Facility B1 — First Lien

(SOFR 3 month + 7.50%, 1.00% Floor),

12.84%, 4/28/2028‡ (b)(c)(e) | | | 4,903,650 | | | | 4,830,095 | | |

VCR Buyer, Inc. (Velocity Clinical Research),

Revolving Credit Facility — First Lien

(SOFR 3 month + 6.50%, 1.00% Floor),

11.83%, 4/28/2027‡ (b)(e) | | | 248,525 | | | | 244,797 | | |

| | | | 9,052,793 | | |

Managed Health Care — 0.3% | |

LBH Services, LLC, Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor, 0.50% PIK),

11.84%, 3/28/2028‡ (b)(e) | | | 313,940 | | | | 266,579 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

27

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Managed Health Care — 0.3% (continued) | |

LBH Services, LLC, Revolving Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor, 0.50% PIK),

11.83%, 3/28/2028‡ (b)(e) | | | 768,218 | | | | 652,953 | | |

LBH Services, LLC, Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor, 0.00% PIK),

11.35%, 3/28/2028‡ (b)(c)(e) | | | 1,502,057 | | | | 1,276,686 | | |

| | | | 2,196,218 | | |

Metal & Glass Containers — 1.5% | |

Closure Systems International Group Inc.

(Canister International Group Inc.),

Amendment No. 4 Term Loan — First Lien

(SOFR 1 month + 4.00%), 9.34%, 3/22/2029 | | | 5,000,000 | | | | 5,035,950 | | |

Pretium PKG Holdings, Inc., Initial

Term Loan — Second Lien

(SOFR 3 month + 6.75%, 0.50% Floor),

12.33%, 10/1/2029 | | | 2,868,534 | | | | 1,685,665 | | |

Pretium PKG Holdings, Inc., Initial Third

Amendment Tranche A-1 Term Loan — First Lien

(SOFR 3 month + 3.20%), 8.52%, 10/2/2028 | | | 3,688,096 | | | | 3,212,332 | | |

Pretium PKG Holdings, Inc., Third Amendment

Tranche A Term Loan — First Lien

(SOFR 3 month + 2.50%), 7.83%, 10/2/2028 | | | 2,438,312 | | | | 2,503,570 | | |

| | | | 12,437,517 | | |

Movies & Entertainment — 0.7% | |

WildBrain Ltd. (DHX Media), Term Loan — B — First Lien

(SOFR 1 month + 4.25%, 0.75% Floor),

9.71%, 3/24/2028‡ (c) | | | 5,838,749 | | | | 5,702,823 | | |

Multi-Sector Holdings — 0.4% | |

Auxey Bidco Ltd. (Alexander Mann Solutions),

Facility B (USD) — First Lien

(SOFR 1 month + 6.00%), 11.41%, 6/29/2027‡ (b) | | | 2,977,500 | | | | 2,929,116 | | |

Office Services & Supplies — 0.8% | |

Equiniti Group PLC (AST/Armor Holdco),

Initial Dollar Term Loan — First Lien

(SOFR 6 month + 4.50%), 9.93%, 12/11/2028‡ (d) | | | 6,454,660 | | | | 6,490,967 | | |

Oil & Gas Storage & Transportation — 0.6% | |

Essar Oil (UK) Ltd., Receivables Finance

Facility — First Lien

(SOFR 1 month + 6.25%, 3.00% Floor),

11.71%, 10/29/2024‡ (b)(c)(e) | | | 3,804,348 | | | | 3,804,348 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

28

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Oil & Gas Storage & Transportation — 0.6% (continued) | |

Liquid Tech Solutions Holdings, LLC, Sixth

Amendment Incremental Term Loan — First Lien

(SOFR 1 month + 4.75%), 10.19%, 3/20/2028‡ | | | 992,500 | | | | 993,740 | | |

| | | | 4,798,088 | | |

Packaged Foods & Meats — 0.6% | |

Aspire Bakeries Holdings LLC, Initial

Term Loan — First Lien

(SOFR 1 month + 4.25%), 9.59%, 12/23/2030 | | | 997,500 | | | | 1,001,241 | | |

Bengal Debt Sub Merger LLC (Tropicana,

Naked Juice), Initial Loan — Second Lien

(SOFR 3 month + 6.00%, 0.50% Floor),

11.43%, 1/24/2030 | | | 4,915,863 | | | | 3,999,595 | | |

| | | | 5,000,836 | | |

Paper Packaging — 1.3% | |

Advanced Web Technologies (AWT),

Delayed Draw Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.49%, 12/17/2026‡ (b)(c)(e) | | | 307,805 | | | | 302,418 | | |

Advanced Web Technologies (AWT), First Amendment

Delayed Draw Term Loan 1 — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.49%, 12/17/2026‡ (b)(c)(e) | | | 325,833 | | | | 320,132 | | |

Advanced Web Technologies (AWT), First Amendment

Delayed Draw Term Loan 2 — First Lien

(SOFR 3 month + 6.25%), 11.74%, 12/17/2026‡ (b)(c)(e) | | | 469,726 | | | | 461,506 | | |

Advanced Web Technologies (AWT), First Requested

Incremental Term Loan — First Lien

(SOFR 3 month + 6.25%, 1.00% Floor),

11.74%, 12/17/2026‡ (b)(c)(e) | | | 982,500 | | | | 965,306 | | |

Advanced Web Technologies (AWT), Second

Amendment Delayed Draw Term Loan — First Lien

(SOFR 3 month + 6.25%, 1.00% Floor),

11.74%, 12/17/2026‡ (b)(c)(e) | | | 728,600 | | | | 715,849 | | |

Advanced Web Technologies (AWT),

Term Loan — First Lien

(SOFR 3 month + 6.00%, 1.00% Floor),

11.49%, 12/17/2026‡ (b)(c)(e) | | | 782,462 | | | | 768,769 | | |

Golden West Packaging Group LLC,

Initial Term Loan — First Lien

(SOFR 1 month + 5.25%, 0.75% Floor),

10.99%, 12/1/2027‡ (b) | | | 8,212,500 | | | | 6,919,031 | | |

| | | | 10,453,011 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

29

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Paper Products — 0.6% | |

R-Pac International Corp. (Project Radio),

Initial Revolving Loan — First Lien

(SOFR 1 month + 6.00%, 0.75% Floor),

11.44%, 12/29/2027‡ (b)(e) | | | 254,975 | | | | 248,601 | | |

R-Pac International Corp. (Project Radio),

Initial Term Loan — First Lien

(SOFR 3 month + 6.00%, 0.75% Floor),

11.59%, 12/29/2027‡ (b)(e) | | | 4,887,500 | | | | 4,765,312 | | |

| | | | 5,013,913 | | |

Pharmaceuticals — 3.3% | |

Alvogen Pharma US, Inc., June 2022 Loan — First Lien

(SOFR 3 month + 7.50%, 1.00% Floor),

12.98%, 6/30/2025‡ | | | 15,188,699 | | | | 13,897,180 | | |

Amneal Pharmaceuticals LLC, 2023

Term Loan B — First Lien

(SOFR 1 month + 5.50%), 10.84%, 5/4/2028 | | | 3,151,480 | | | | 3,175,762 | | |

ANI Pharmaceuticals, Inc., Initial

Term Loan — First Lien

(SOFR 1 month + 6.00%, 0.75% Floor),

11.46%, 11/19/2027‡ | | | 5,088,132 | | | | 5,107,212 | | |

Carestream Health, Inc. (aka Onex),

Term Loan — First Lien

(SOFR 3 month + 7.50%, 1.00% Floor),

12.91%, 9/30/2027 (c) | | | 4,993,906 | | | | 4,473,716 | | |

| | | | 26,653,870 | | |

Real Estate Services — 1.0% | |

Auction.com LLC (fka Ten-X LLC),

Term Loan — First Lien

(SOFR 1 month + 6.00%, 1.50% Floor),

11.34%, 5/26/2028 | | | 986,807 | | | | 953,749 | | |

(PRIME 1 month + 5.00%), 13.50%, 5/26/2028 | | | 2,639 | | | | 2,550 | | |

Avison Young (Canada) Inc., First Out

Term Loan — First Lien

(SOFR 3 month + 7.50%, 2.00% Floor),

13.10%, 3/12/2028 (c) | | | 1,184,525 | | | | 1,184,158 | | |

Avison Young (Canada) Inc., Second Out

Term Loan — First Lien

(SOFR 1 month + 8.00%, 2.00% Floor),

13.33%, 3/12/2029 (c) | | | 1,596,751 | | | | 1,257,442 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

30

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Real Estate Services — 1.0% (continued) | |

Avison Young (Canada) Inc., Third Out

Term Loan — First Lien

(SOFR 1 month + 8.00%, 2.00% Floor),

13.59%, 3/12/2029‡ (c) | | | 528,434 | | | | 311,116 | | |

Hudson's Bay Co., ULC, First Out Loan

(Term Loan) — First Lien

(SOFR 3 month + 7.00%, 1.00% Floor),

12.33%, 9/30/2026‡ (b)(c)(e) | | | 935,939 | | | | 935,939 | | |

Hudson's Bay Co., ULC, Last Out Loan

(Term Loan) — Second Lien

(SOFR 3 month + 9.73%, 1.00% Floor),

15.16%, 9/30/2026‡ (b)(c)(e) | | | 3,556,101 | | | | 3,556,101 | | |

| | | | 8,201,055 | | |

Research & Consulting Services — 3.5% | |

Axiom Global Inc., Initial Term Loan — First Lien

(SOFR 3 month + 4.75%, 0.75% Floor),

10.17%, 10/1/2026‡ (b)(c) | | | 2,923,664 | | | | 2,837,781 | | |

Eisner Advisory Group LLC, February 2024

Incremental Term Loan — First Lien

(SOFR 1 month + 4.00%, 0.50% Floor),

9.34%, 2/28/2031 | | | 5,000,000 | | | | 5,055,225 | | |

Grant Thornton LLP/Chicago, GRATHO

Term Loan B USD — First Lien

(SOFR 3 month + 3.25%), 8.60%, 5/30/2031 | | | 2,000,000 | | | | 2,008,230 | | |

Nielsen Consumer, Inc. (NielsenIQ),

Term Loan — First Lien

3/6/2028 (d) | | | 3,000,000 | | | | 3,007,500 | | |

Star Merger Sub Inc. (Dun & Bradstreet),

2022 Incremental Term B-2 Loan 2024 — First Lien

(SOFR 1 month + 2.75%), 8.10%, 1/18/2029 | | | 3,000,000 | | | | 3,005,625 | | |

Strategy Corps., LLC, Term Loan — First Lien

(SOFR 1 month + 5.25%, 1.00% Floor),

10.59%, 6/28/2030‡ (b)(c)(e) | | | 6,578,947 | | | | 6,492,105 | | |

Teneo Holdings LLC, Initial Term Loan — First Lien

(SOFR 1 month + 4.75%, 1.00% Floor),

10.09%, 3/13/2031 | | | 2,992,500 | | | | 3,004,350 | | |

Vaco Holdings LLC, Initial Term Loan — First Lien

(SOFR 3 month + 5.00%, 0.75% Floor),

10.43%, 1/21/2029 (d) | | | 1,655,771 | | | | 1,646,797 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

31

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Research & Consulting Services — 3.5% (continued) | |

Zenith American Holding, Inc. (Harbour Benefit Holding

Inc / HPH-TH Holdings, LLC), Term Loan — First Lien

(SOFR 3 month + 5.00%, 1.00% Floor),

10.45%, 12/13/2024‡ (b)(c)(e) | | | 878,735 | | | | 878,735 | | |

| | | | 27,936,348 | | |

Security & Alarm Services — 0.6% | |

SuperHero Fire Protection, LLC, Closing Date

Term Loan — First Lien

(SOFR 3 month + 6.25%, 1.00% Floor),

11.73%, 9/1/2026‡ (b)(c)(e) | | | 1,460,135 | | | | 1,460,135 | | |

SuperHero Fire Protection, LLC,

Revolving Loan — First Lien

(SOFR 1 month + 6.25%, 1.00% Floor),

11.69%, 9/1/2026‡ (b)(e) | | | 464,674 | | | | 464,674 | | |

SuperHero Fire Protection, LLC, Second Amendment

Incremental Term Loan — First Lien

(SOFR 3 month + 6.50%), 11.98%, 9/1/2026‡ (b)(c)(e) | | | 3,066,115 | | | | 3,066,115 | | |

| | | | 4,990,924 | | |

Soft Drinks — 0.4% | |

Pegasus BidCo BV (Refresco), 2024-1

Term Dollar Loan — First Lien

(SOFR 3 month + 3.75%, 0.50% Floor), 9.07%, 7/12/2029 | | | 2,955,150 | | | | 2,976,072 | | |

Specialized Consumer Services — 2.0% | |

LaserAway, Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 0.75% Floor),

11.33%, 10/14/2027‡ (b)(c)(e) | | | 4,117,272 | | | | 4,117,272 | | |

Mammoth Holdings, LLC, Delayed Draw

Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.06%, 11/15/2030‡ (b)(e) | | | 818,182 | | | | 801,818 | | |

Mammoth Holdings, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 5.75%, 1.00% Floor),

11.08%, 11/15/2030‡ (b)(c)(e) | | | 3,618,182 | | | | 3,545,818 | | |

Reedy Industries Inc. (Thermostat Purchaser),

(USD) Term Loan B — First Lien

(SOFR 1 month + 4.00%), 9.34%, 8/31/2028‡ (d) | | | 7,403,828 | | | | 7,440,847 | | |

| | | | 15,905,755 | | |

Specialized Finance — 2.8% | |

Alchemy US Holdco 1 LLC (Kymera),

2023 Incremental Term Loan — First Lien

(SOFR 6 month + 6.00%), 12.78%, 10/10/2025‡ | | | 981,250 | | | | 981,250 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

32

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Specialized Finance — 2.8% (continued) | |

Apex Group Treasury LLC, 2022 Incremental

Term Loan — First Lien

(SOFR 3 month + 5.00%), 10.32%, 7/27/2028 | | | 8,865,000 | | | | 8,920,406 | | |

Apex Group Treasury Ltd., USD Term Loan — First Lien

(SOFR 3 month + 3.75%, 0.50% Floor),

9.33%, 7/27/2028 | | | 8,895,900 | | | | 8,918,139 | | |

BCP Qualtek Merger Sub LLC (Qualtek), Initial

Second Lien Term Loan — Second Lien

(SOFR 3 month + 1.00%, 9.00% PIK),

0.00%, 1/14/2027‡ (b)(e) | | | 2,245,957 | | | | — | | |

BCP Qualtek Merger Sub LLC (Qualtek),

Initial Term Loan — First Lien

(SOFR 3 month + 10.00%, 9.00% PIK),

0.00%, 7/14/2025‡ (b)(e) | | | 4,005,923 | | | | 621,199 | | |

BCP Qualtek Merger Sub LLC (Qualtek),

QUAUSA REV EXIT USD — First Lien

7/14/2024‡ (b)(d)(e) | | | 760,079 | | | | 760,079 | | |

iLending LLC, Term Loan — First Lien

(SOFR 1 month + 6.50%, 1.00% Floor, 2.00% PIK),

13.94%, 6/21/2026‡ (b)(c)(e) | | | 1,162,466 | | | | 871,268 | | |

Univar (Windsor Holdings III LLC), 2024 Dollar

Refinancing Term B Loan — First Lien

(SOFR 1 month + 4.00%), 9.34%, 8/1/2030 | | | 1,883,096 | | | | 1,897,690 | | |

| | | | 22,970,031 | | |

Specialty Chemicals — 0.9% | |

Nouryon USA LLC (StarFruit US Holdco),

2024 B-1 Dollar Term Loan — First Lien

(SOFR 3 month + 3.50%), 8.83%, 4/3/2028 | | | 2,984,962 | | | | 2,996,529 | | |

Plaze (PLZ Aeroscience), 2021-1 Term Loan — First Lien

(SOFR 1 month + 3.75%, 0.75% Floor), 9.21%, 8/3/2026 | | | 994,859 | | | | 962,526 | | |

RLG Holdings, LLC, 2022 Incremental

Term Loan — First Lien

(SOFR 1 month + 5.00%), 10.34%, 7/7/2028 | | | 2,650,113 | | | | 2,635,537 | | |

RLG Holdings, LLC, Closing Date Initial

Term Loan — First Lien

(SOFR 1 month + 4.25%, 0.75% Floor), 9.71%, 7/7/2028 | | | 910,324 | | | | 896,342 | | |

| | | | 7,490,934 | | |

Systems Software — 1.8% | |

Condor Merger Sub, Inc. (McAfee), MCFE

Term Loan B USD — First Lien

(SOFR 1 month + 3.25%), 8.58%, 3/1/2029 | | | 2,947,500 | | | | 2,948,192 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

33

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Systems Software — 1.8% (continued) | |

Idera Inc., 2021 Refinancing Loan — Second Lien

(SOFR 3 month + 6.75%), 12.23%, 3/2/2029‡ | | | 1,341,463 | | | | 1,316,311 | | |

McAfee Enterprise (Magenta Buyer LLC), Initial

Term Loan — First Lien

(SOFR 3 month + 5.00%, 0.75% Floor),

10.59%, 7/27/2028 (c) | | | 3,681,307 | | | | 2,063,833 | | |

McAfee Enterprise (Magenta Buyer LLC),

Initial Term Loan — Second Lien

(SOFR 3 month + 8.25%, 0.75% Floor),

13.84%, 7/27/2029 (c) | | | 12,000,000 | | | | 3,728,340 | | |

RSA Security LLC (Redstone), Initial Loan — Second Lien

(SOFR 1 month + 7.75%, 0.75% Floor),

13.21%, 4/27/2029 | | | 5,000,000 | | | | 4,100,000 | | |

| | | | 14,156,676 | | |

Technology Hardware, Storage & Peripherals — 0.5% | |

TouchTunes (TA TT Buyer), Initial

Term Loan — First Lien

(SOFR 1 month + 5.25%, 0.50% Floor),

10.59%, 4/2/2029 | | | 3,917,817 | | | | 3,926,789 | | |

Textiles — 0.4% | |

International Textile Group Inc. (Elevate Textiles, Inc.),

First Out Term Loan — First Lien

(SOFR 3 month + 8.50%), 13.95%, 9/30/2027‡ | | | 2,095,810 | | | | 2,062,633 | | |

International Textile Group Inc. (Elevate Textiles, Inc.),

Last Out Term Loan — First Lien

(SOFR 3 month + 1.00%, 1.00% Floor, 5.50% PIK),

11.95%, 9/30/2027‡ | | | 2,459,078 | | | | 1,385,930 | | |

| | | | 3,448,563 | | |

Trading Companies & Distributors — 0.9% | |

Johnstone Supply, LLC, JHNSPL

Term Loan B USD — First Lien

(SOFR 1 month + 3.00%), 8.33%, 6/9/2031 | | | 2,000,000 | | | | 2,005,000 | | |

Verde Purchaser, LLC, Initial Term Loan — First Lien

(SOFR 3 month + 4.50%), 9.81%, 11/30/2030 | | | 5,000,000 | | | | 5,001,875 | | |

| | | | 7,006,875 | | |

Trucking — 1.4% | |

A&R Logistics Holdings, Inc., Tranche 7

Incremental Term Loan — First Lien

(SOFR 3 month + 6.75%, 1.00% Floor),

12.20%, 8/3/2026‡ (b)(c)(e) | | | 3,238,512 | | | | 3,189,934 | | |

First Eagle Credit Opportunities Fund | Semiannual Report | June 30, 2024

34

First Eagle Credit Opportunities Fund | Consolidated Schedule of Investments | June 30, 2024 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Trucking — 1.4% (continued) | |

A&R Logistics Holdings, Inc., Tranche 9

Incremental Term Loan — First Lien

(SOFR 3 month + 6.75%, 1.00% Floor),

12.20%, 8/3/2026‡ (b)(c)(e) | | | 612,818 | | | | 603,626 | | |

First Student Bidco Inc. (First Transit Parent Inc.),

Initial Term B Loan — First Lien

(SOFR 3 month + 3.00%), 8.56%, 7/21/2028 | | | 1,433,731 | | | | 1,436,017 | | |

First Student Bidco Inc. (First Transit Parent Inc.),

Initial Term C Loan — First Lien

(SOFR 3 month + 3.00%), 8.56%, 7/21/2028 | | | 436,106 | | | | 436,802 | | |

First Student Bidco Inc. (First Transit Parent Inc.),

Term Loan B-2 — First Lien

(SOFR 3 month + 3.00%, 0.50% Floor), 8.43%, 7/21/2028 | | | 745,976 | | | | 747,491 | | |

Stonepeak Taurus Lower Holdings LLC (TRAC),

Initial Term Loan — Second Lien

(SOFR 3 month + 7.00%, 0.50% Floor),

12.43%, 1/28/2030‡ | | | 5,000,000 | | | | 4,600,000 | | |

| | | | 11,013,870 | | |

Water Utilities — 0.6% | |

Waste Resource Management Inc.,

Delayed Draw Term Loan — First Lien

(SOFR 1 month + 5.75%, 1.00% Floor),

11.09%, 12/28/2029‡ (b)(e) | | | 397,262 | | | | 393,290 | | |

Waste Resource Management Inc.,

Term Loan — First Lien

(SOFR 1 month + 5.75%, 1.00% Floor),

11.09%, 12/28/2029‡ (b)(c)(e) | | | 4,210,361 | | | | 4,168,258 | | |

| | | | 4,561,548 | | |

Total Senior Loans

(Cost $847,729,853) | | | 820,122,998 | | |

Corporate Bonds — 6.0% | |