NEWS RELEASE OppFi Reports Third Quarter 2023 Results, Raises Full-Year Earnings Outlook 11/9/2023 Total revenue increased 7% year over year to $133.2 million for third quarter of 2023 Net income of $15.5 million for third quarter of 2023 Adjusted net income of $13.8 million for third quarter of 2023 Basic and Diluted EPS of $0.13 and $0.13, respectively, for third quarter of 2023 Adjusted EPS of $0.16 for third quarter of 2023 Net charge-o� rate as a percentage of total revenue decreased 23% year over year to 42% for third quarter of 2023 Yield increased 7% year over year to 129% for third quarter of 2023 CHICAGO--(BUSINESS WIRE)-- OppFi Inc. (NYSE: OPFI; OPFI WS) (“OppFi” or the “Company”), a tech-enabled, mission- driven specialty �nance platform that broadens the reach of community banks to extend credit access to everyday Americans, today reported �nancial results for the third quarter ended September 30, 2023. “Throughout this year we have continued to make impactful adjustments to credit models with our bank partners that have resulted in improved credit performance and accelerated earnings growth,” said Todd Schwartz, Chief Executive O�cer and Executive Chairman of OppFi. “These results demonstrate our ability to balance growth and risk, while maintaining expense discipline. These core competencies combined with our strong balance sheet and 1

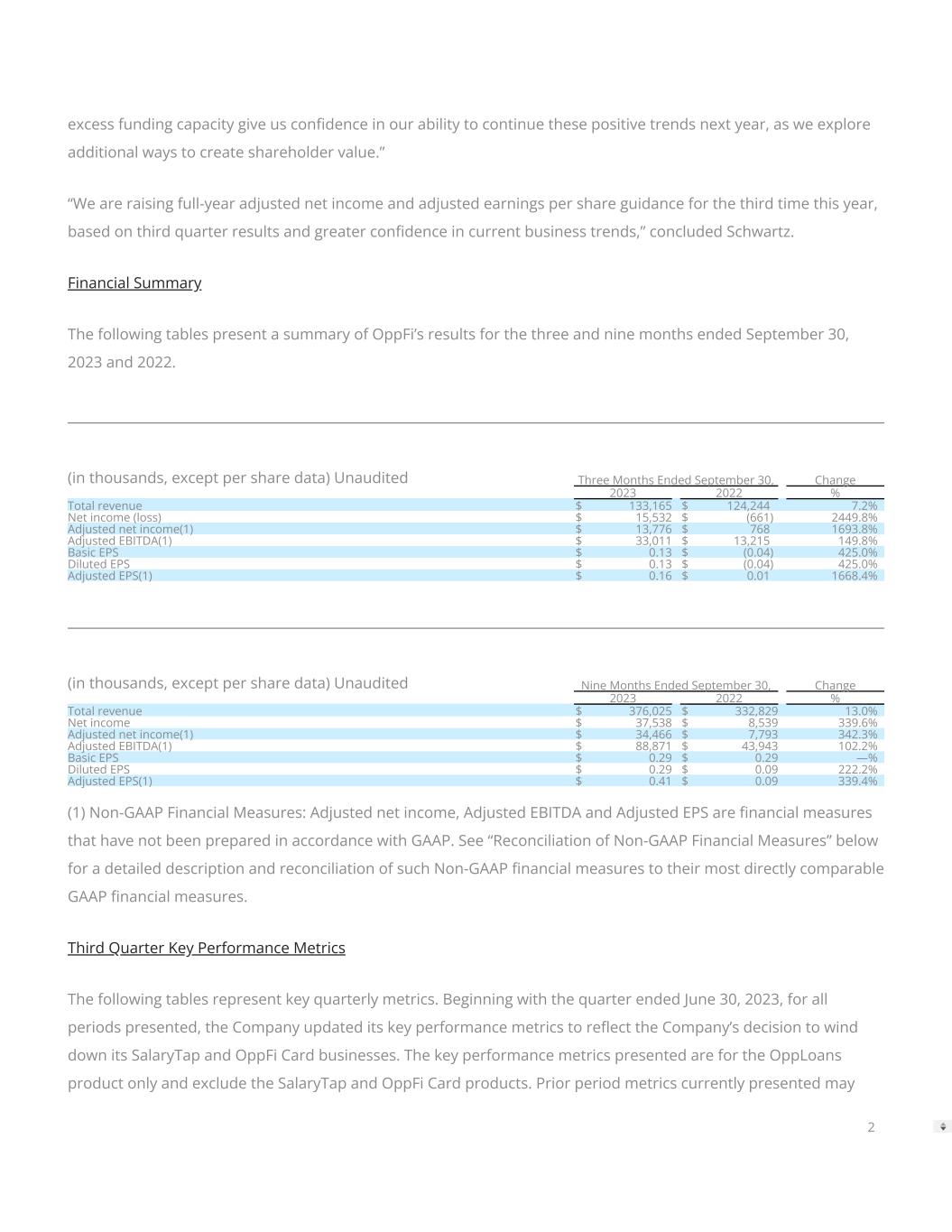

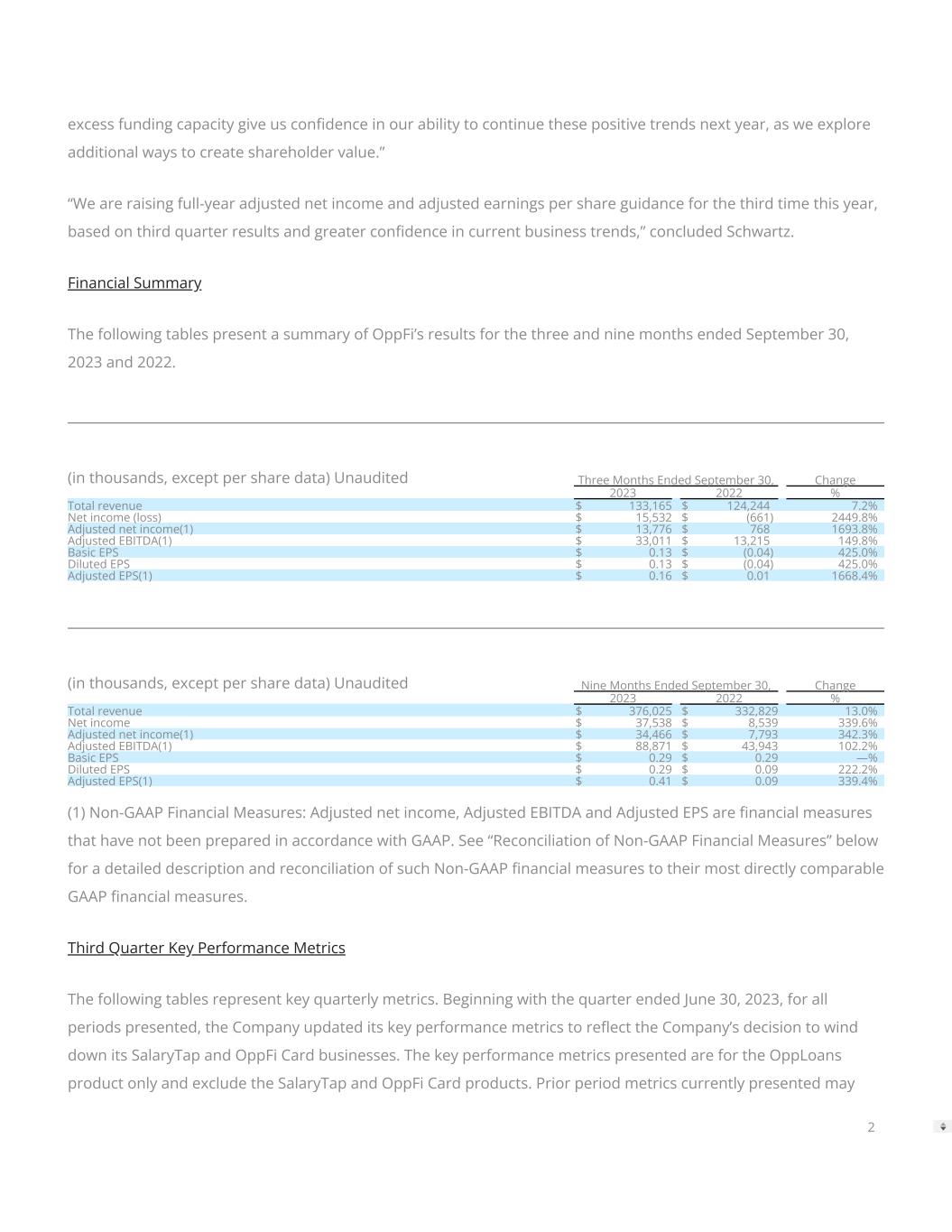

excess funding capacity give us con�dence in our ability to continue these positive trends next year, as we explore additional ways to create shareholder value.” “We are raising full-year adjusted net income and adjusted earnings per share guidance for the third time this year, based on third quarter results and greater con�dence in current business trends,” concluded Schwartz. Financial Summary The following tables present a summary of OppFi’s results for the three and nine months ended September 30, 2023 and 2022. (in thousands, except per share data) Unaudited Three Months Ended September 30, Change 2023 2022 % Total revenue $ 133,165 $ 124,244 7.2% Net income (loss) $ 15,532 $ (661) 2449.8% Adjusted net income(1) $ 13,776 $ 768 1693.8% Adjusted EBITDA(1) $ 33,011 $ 13,215 149.8% Basic EPS $ 0.13 $ (0.04) 425.0% Diluted EPS $ 0.13 $ (0.04) 425.0% Adjusted EPS(1) $ 0.16 $ 0.01 1668.4% (in thousands, except per share data) Unaudited Nine Months Ended September 30, Change 2023 2022 % Total revenue $ 376,025 $ 332,829 13.0% Net income $ 37,538 $ 8,539 339.6% Adjusted net income(1) $ 34,466 $ 7,793 342.3% Adjusted EBITDA(1) $ 88,871 $ 43,943 102.2% Basic EPS $ 0.29 $ 0.29 —% Diluted EPS $ 0.29 $ 0.09 222.2% Adjusted EPS(1) $ 0.41 $ 0.09 339.4% (1) Non-GAAP Financial Measures: Adjusted net income, Adjusted EBITDA and Adjusted EPS are �nancial measures that have not been prepared in accordance with GAAP. See “Reconciliation of Non-GAAP Financial Measures” below for a detailed description and reconciliation of such Non-GAAP �nancial measures to their most directly comparable GAAP �nancial measures. Third Quarter Key Performance Metrics The following tables represent key quarterly metrics. Beginning with the quarter ended June 30, 2023, for all periods presented, the Company updated its key performance metrics to re�ect the Company’s decision to wind down its SalaryTap and OppFi Card businesses. The key performance metrics presented are for the OppLoans product only and exclude the SalaryTap and OppFi Card products. Prior period metrics currently presented may 2

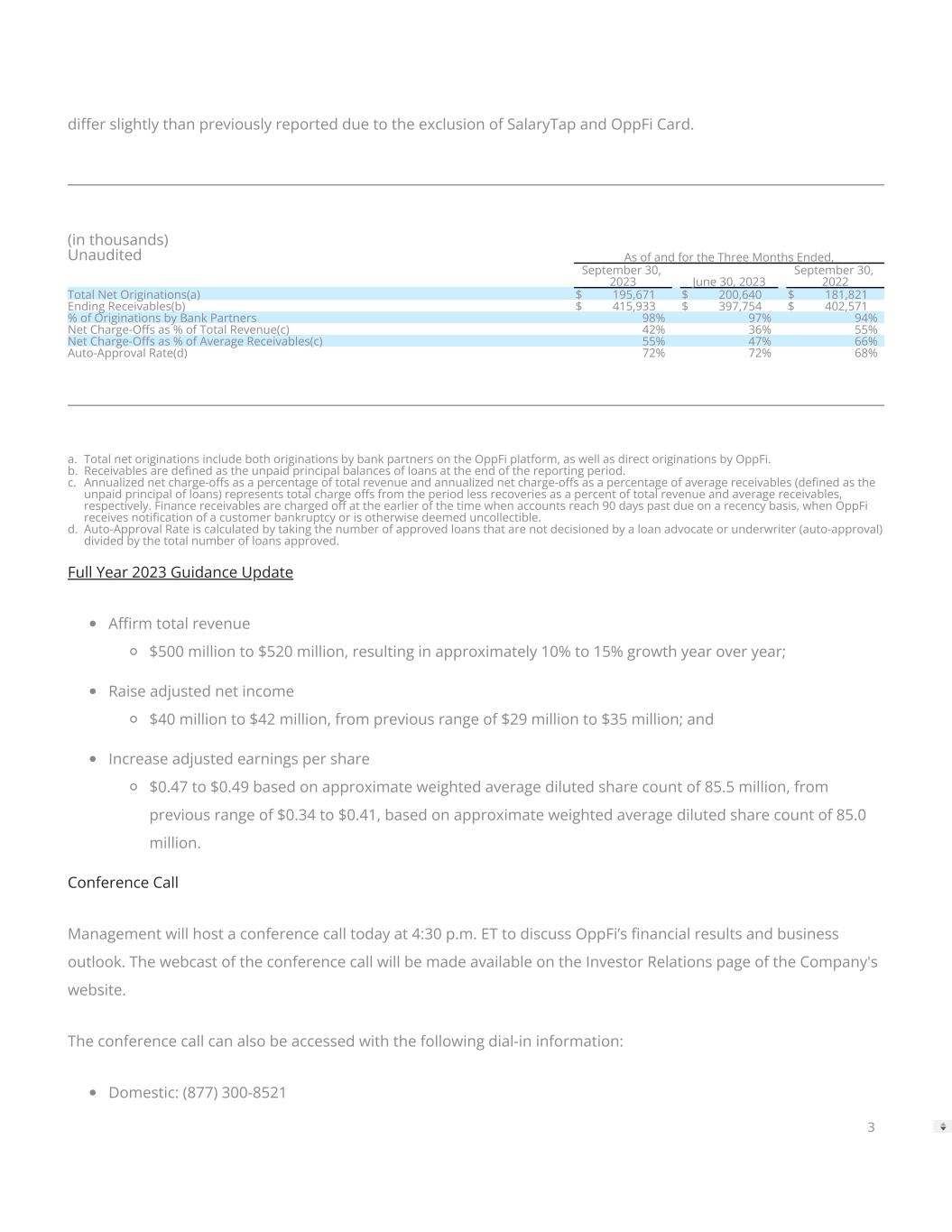

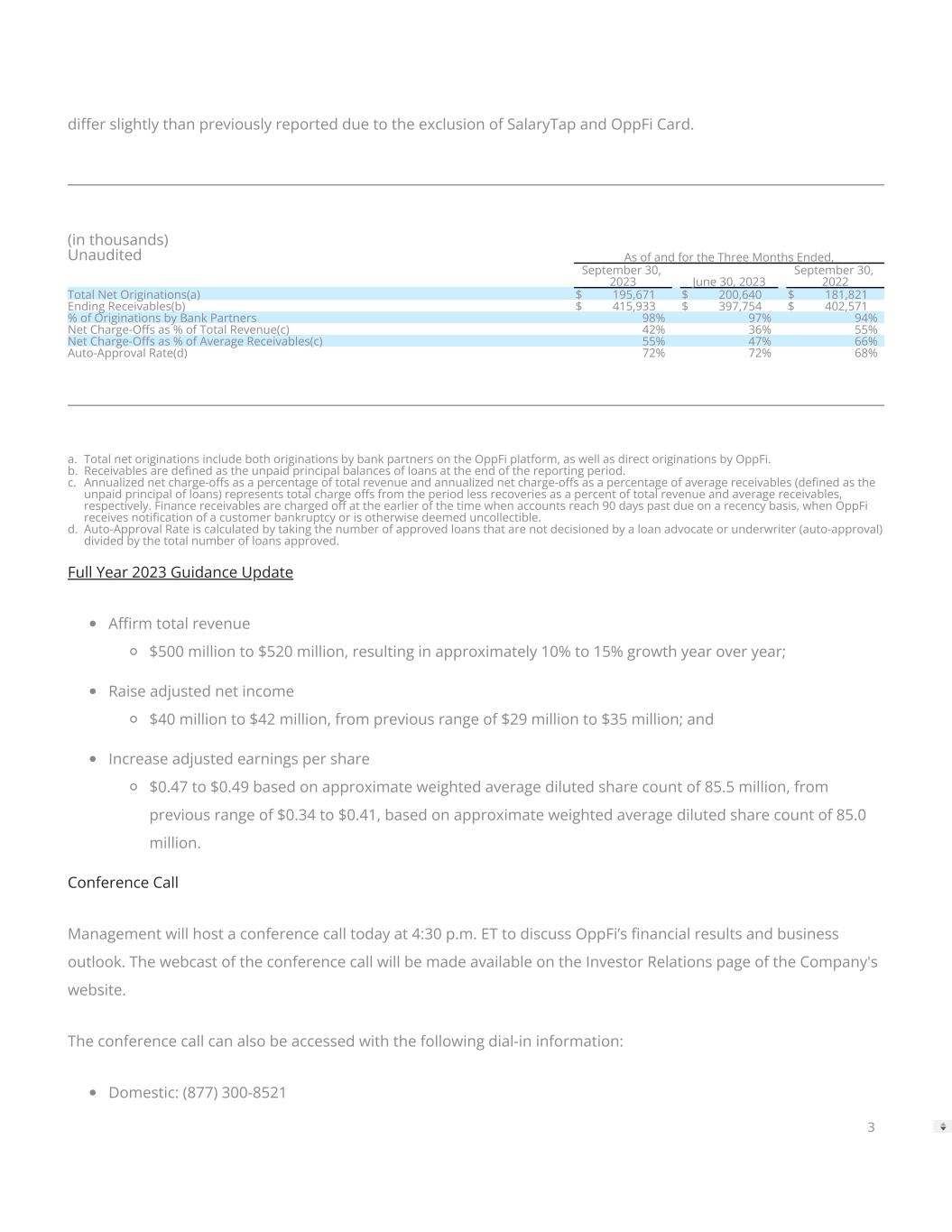

di�er slightly than previously reported due to the exclusion of SalaryTap and OppFi Card. (in thousands) Unaudited As of and for the Three Months Ended, September 30, 2023 June 30, 2023 September 30, 2022 Total Net Originations(a) $ 195,671 $ 200,640 $ 181,821 Ending Receivables(b) $ 415,933 $ 397,754 $ 402,571 % of Originations by Bank Partners 98% 97% 94% Net Charge-O�s as % of Total Revenue(c) 42% 36% 55% Net Charge-O�s as % of Average Receivables(c) 55% 47% 66% Auto-Approval Rate(d) 72% 72% 68% a. Total net originations include both originations by bank partners on the OppFi platform, as well as direct originations by OppFi. b. Receivables are de�ned as the unpaid principal balances of loans at the end of the reporting period. c. Annualized net charge-o�s as a percentage of total revenue and annualized net charge-o�s as a percentage of average receivables (de�ned as the unpaid principal of loans) represents total charge o�s from the period less recoveries as a percent of total revenue and average receivables, respectively. Finance receivables are charged o� at the earlier of the time when accounts reach 90 days past due on a recency basis, when OppFi receives noti�cation of a customer bankruptcy or is otherwise deemed uncollectible. d. Auto-Approval Rate is calculated by taking the number of approved loans that are not decisioned by a loan advocate or underwriter (auto-approval) divided by the total number of loans approved. Full Year 2023 Guidance Update A�rm total revenue $500 million to $520 million, resulting in approximately 10% to 15% growth year over year; Raise adjusted net income $40 million to $42 million, from previous range of $29 million to $35 million; and Increase adjusted earnings per share $0.47 to $0.49 based on approximate weighted average diluted share count of 85.5 million, from previous range of $0.34 to $0.41, based on approximate weighted average diluted share count of 85.0 million. Conference Call Management will host a conference call today at 4:30 p.m. ET to discuss OppFi’s �nancial results and business outlook. The webcast of the conference call will be made available on the Investor Relations page of the Company's website. The conference call can also be accessed with the following dial-in information: Domestic: (877) 300-8521 3

International: (412) 317-6026 An archived version of the webcast will be available on OppFi's website. About OppFi OppFi (NYSE: OPFI; OPFI WS) is a tech-enabled, mission-driven specialty �nance platform that broadens the reach of community banks to extend credit access to everyday Americans. Through transparency, responsible lending, �nancial inclusion, and an excellent customer experience, the Company supports consumers, who are turned away by mainstream options, to build better �nancial health. OppLoans by OppFi maintains a 4.5/5.0 star rating on Trustpilot with more than 4,000 reviews, making the Company one of the top consumer-rated �nancial platforms online. For more information, please visit opp�.com. Forward-Looking Statements This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi’s actual results may di�er from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “possible,” “continue,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, without limitation, OppFi’s expectations with respect to its full year 2023 guidance, the future performance of OppFi’s platform, and expectations for OppFi’s growth and future �nancial performance. These forward-looking statements are based on OppFi’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve signi�cant risks and uncertainties that could cause the actual results to di�er materially from the expected results. Most of these factors are outside OppFi’s control and are di�cult to predict. Factors that may cause such di�erences include, but are not limited to: the impact of general economic conditions, including economic slowdowns, in�ation, interest rate changes, recessions, and tightening of credit markets on OppFi’s business; the impact of challenging macroeconomic and marketplace conditions, including lingering e�ects of COVID-19 on OppFi’s business; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi’s bank partners will continue to lend in California and whether OppFi’s �nancing sources will continue to �nance the purchase of participation rights in loans originated by OppFi’s bank partners in California; the impact that events involving �nancial institutions or the �nancial services 4

industry generally, such as actual concerns or events involving liquidity, defaults, or non-performance, may have on OppFi’s business; risks related to the material weakness in OppFi’s internal controls over �nancial reporting; the risk that the business combination disrupts current plans and operations; the ability to recognize the anticipated bene�ts of the business combination, which may be a�ected by, among other things, competition, the ability of OppFi to grow and manage growth pro�tably and retain its key employees; risks related to new products; concentration risk; costs related to the business combination; changes in applicable laws or regulations; the possibility that OppFi may be adversely a�ected by other economic, business, and/or competitive factors; risks related to management transitions; risks related to the restatement of OppFi’s �nancial statements and any accounting de�ciencies or weaknesses related thereto; and other risks and uncertainties indicated from time to time in OppFi’s �lings with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned “Risk Factors.” OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to re�ect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures This press release includes certain non-GAAP �nancial measures that are unaudited and do not conform to GAAP, such as Adjusted EBT, Adjusted Net Income, Adjusted EBITDA and Adjusted EPS. Adjusted EBT is de�ned as Net Income, plus (1) provision for income taxes; (2) amortization of debt issuance costs; (3) other addbacks and one- time expenses; and (4) sublease income. Adjusted Net Income is de�ned as Adjusted EBT as de�ned above, adjusted for taxes assuming a tax rate of 24.17% for the three months ended September 30, 2023, a tax rate of 24.14% for the three months ended September 30, 2022, a tax rate of 24.17% for the nine months ended September 30, 2023, and a tax rate of 24.09% for the nine months ended September 30, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. Adjusted EBITDA is de�ned as Adjusted Net Income as de�ned above, excluding (1) pro forma and business (non-income) taxes; (2) depreciation and amortization; and (3) interest expense. Adjusted EPS is de�ned as Adjusted Net Income as de�ned above, divided by weighted average diluted shares outstanding, which represent shares of both classes of common stock outstanding, excluding 25,500,000 shares related to earnout obligations and including the impact of unvested restricted stock units, unvested performance stock units, and the employee stock purchase plan. These non-GAAP �nancial measures have not been prepared in accordance with accounting principles generally accepted in the United States and may be di�erent from non-GAAP �nancial measures used by other companies. OppFi believes that the use of these non- GAAP �nancial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non-GAAP measures with comparable names should not be considered in isolation from, or as 5

an alternative to, �nancial measures determined in accordance with GAAP. See “Reconciliation of Non-GAAP Financial Measures” below for reconciliations for OppFi's non-GAAP �nancial measures to the most directly comparable GAAP �nancial measures. A reconciliation of projected full year 2023 Adjusted Net Income and projected full year 2023 Adjusted EPS to the most directly comparable GAAP �nancial measures is not included in this press release because, without unreasonable e�orts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. Third Quarter Results of Operations Consolidated Statements of Operations Comparison of the three months ended September 30, 2023 and 2022 The following table presents consolidated results of operations for the three months ended September 30, 2023 and 2022 (in thousands, except number of shares and per share data, unaudited). Three Months Ended September 30, Change 2023 2022 $ % Interest and loan related income $ 132,090 $ 123,605 $ 8,485 6.9% Other revenue 1,075 639 436 68.2% Total revenue 133,165 124,244 8,921 7.2% Change in fair value of �nance receivables (57,302) (70,601) 13,299 (18.8)% Provision for credit losses on �nance receivables (195) (1,017) 822 (80.8)% Net revenue 75,668 52,626 23,042 43.8% Expenses: Sales and marketing 12,814 11,674 1,140 9.8% Customer operations 10,543 10,591 (48) (0.5)% Technology, products, and analytics 9,732 8,325 1,407 16.9% General, administrative, and other 14,921 13,910 1,011 7.3% Total expenses before interest expense 48,010 44,500 3,510 7.9% Interest expense 12,077 9,095 2,982 32.8% Total expenses 60,087 53,595 6,492 12.1% Income (loss) from operations 15,581 (969) 16,550 1707.9% Change in fair value of warrant liability 334 1,323 (989) (74.8)% Other income 80 — 80 —% Income before income taxes 15,995 354 15,641 4418.4% Income tax expense 463 1,015 (552) (54.4)% Net income (loss) 15,532 (661) 16,193 2449.8% Less: net income (loss) attributable to noncontrolling interest 13,363 (90) 13,453 14947.8% Net income (loss) attributable to OppFi Inc. $ 2,169 $ (571) $ 2,740 479.9% Earnings (loss) per share attributable to OppFi Inc.: Earnings (loss) per common share: Basic $ 0.13 $ (0.04) Diluted $ 0.13 $ (0.04) Weighted average common shares outstanding: Basic 16,772,275 13,972,971 Diluted 17,057,778 13,972,971 Comparison of the nine months ended September 30, 2023 and 2022 The following table presents consolidated results of operations for the nine months ended September 30, 2023 and 6

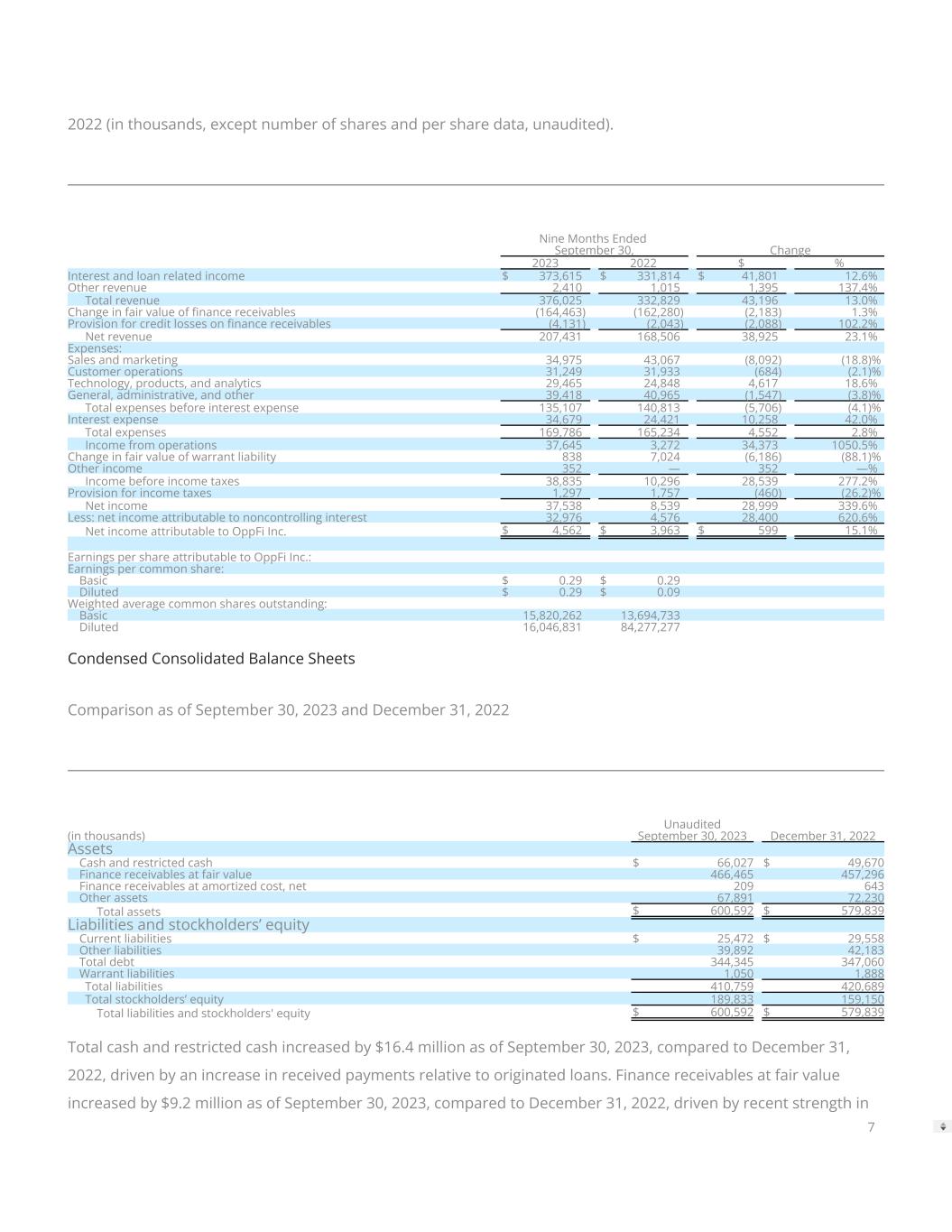

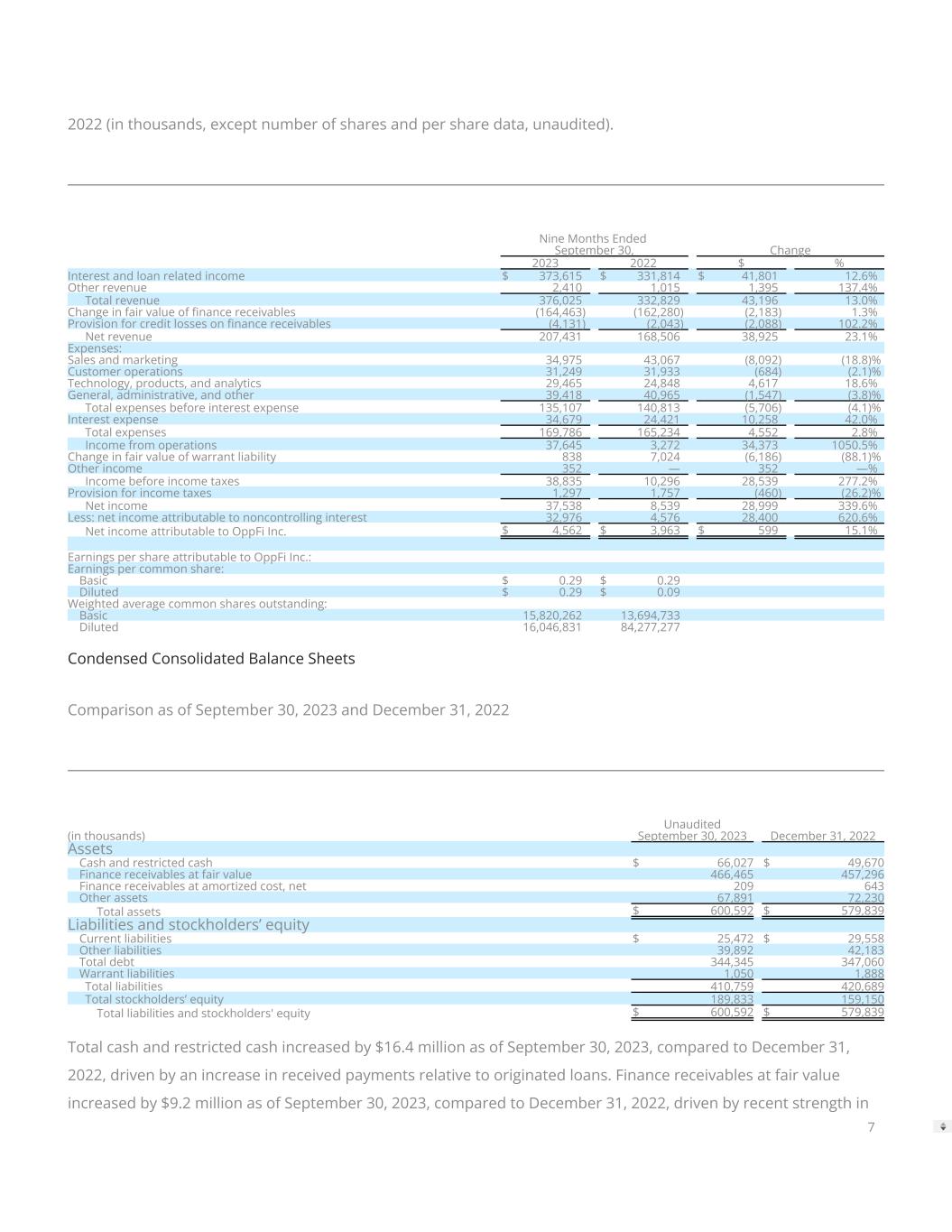

2022 (in thousands, except number of shares and per share data, unaudited). Nine Months Ended September 30, Change 2023 2022 $ % Interest and loan related income $ 373,615 $ 331,814 $ 41,801 12.6% Other revenue 2,410 1,015 1,395 137.4% Total revenue 376,025 332,829 43,196 13.0% Change in fair value of �nance receivables (164,463) (162,280) (2,183) 1.3% Provision for credit losses on �nance receivables (4,131) (2,043) (2,088) 102.2% Net revenue 207,431 168,506 38,925 23.1% Expenses: Sales and marketing 34,975 43,067 (8,092) (18.8)% Customer operations 31,249 31,933 (684) (2.1)% Technology, products, and analytics 29,465 24,848 4,617 18.6% General, administrative, and other 39,418 40,965 (1,547) (3.8)% Total expenses before interest expense 135,107 140,813 (5,706) (4.1)% Interest expense 34,679 24,421 10,258 42.0% Total expenses 169,786 165,234 4,552 2.8% Income from operations 37,645 3,272 34,373 1050.5% Change in fair value of warrant liability 838 7,024 (6,186) (88.1)% Other income 352 — 352 —% Income before income taxes 38,835 10,296 28,539 277.2% Provision for income taxes 1,297 1,757 (460) (26.2)% Net income 37,538 8,539 28,999 339.6% Less: net income attributable to noncontrolling interest 32,976 4,576 28,400 620.6% Net income attributable to OppFi Inc. $ 4,562 $ 3,963 $ 599 15.1% Earnings per share attributable to OppFi Inc.: Earnings per common share: Basic $ 0.29 $ 0.29 Diluted $ 0.29 $ 0.09 Weighted average common shares outstanding: Basic 15,820,262 13,694,733 Diluted 16,046,831 84,277,277 Condensed Consolidated Balance Sheets Comparison as of September 30, 2023 and December 31, 2022 Unaudited (in thousands) September 30, 2023 December 31, 2022 Assets Cash and restricted cash $ 66,027 $ 49,670 Finance receivables at fair value 466,465 457,296 Finance receivables at amortized cost, net 209 643 Other assets 67,891 72,230 Total assets $ 600,592 $ 579,839 Liabilities and stockholders’ equity Current liabilities $ 25,472 $ 29,558 Other liabilities 39,892 42,183 Total debt 344,345 347,060 Warrant liabilities 1,050 1,888 Total liabilities 410,759 420,689 Total stockholders’ equity 189,833 159,150 Total liabilities and stockholders' equity $ 600,592 $ 579,839 Total cash and restricted cash increased by $16.4 million as of September 30, 2023, compared to December 31, 2022, driven by an increase in received payments relative to originated loans. Finance receivables at fair value increased by $9.2 million as of September 30, 2023, compared to December 31, 2022, driven by recent strength in 7

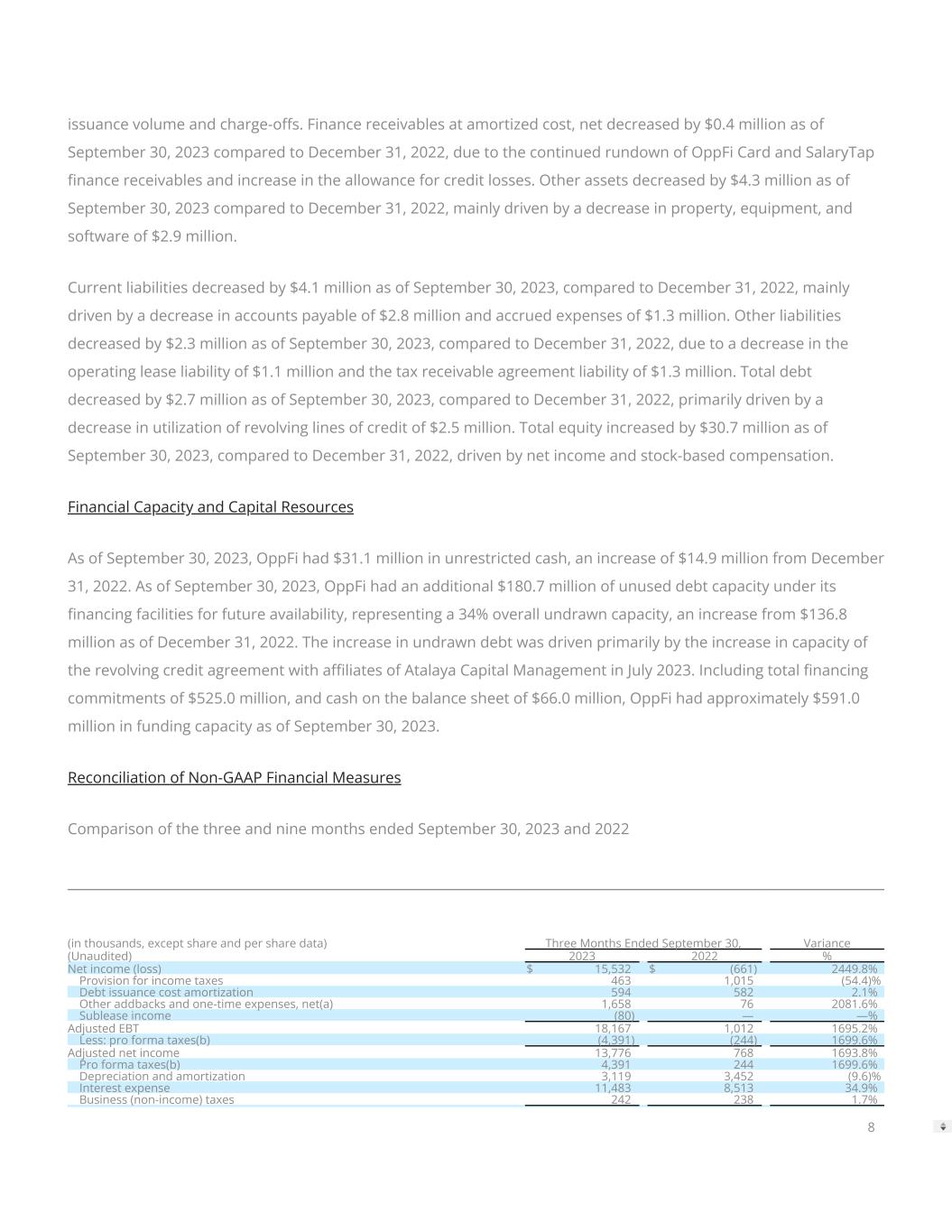

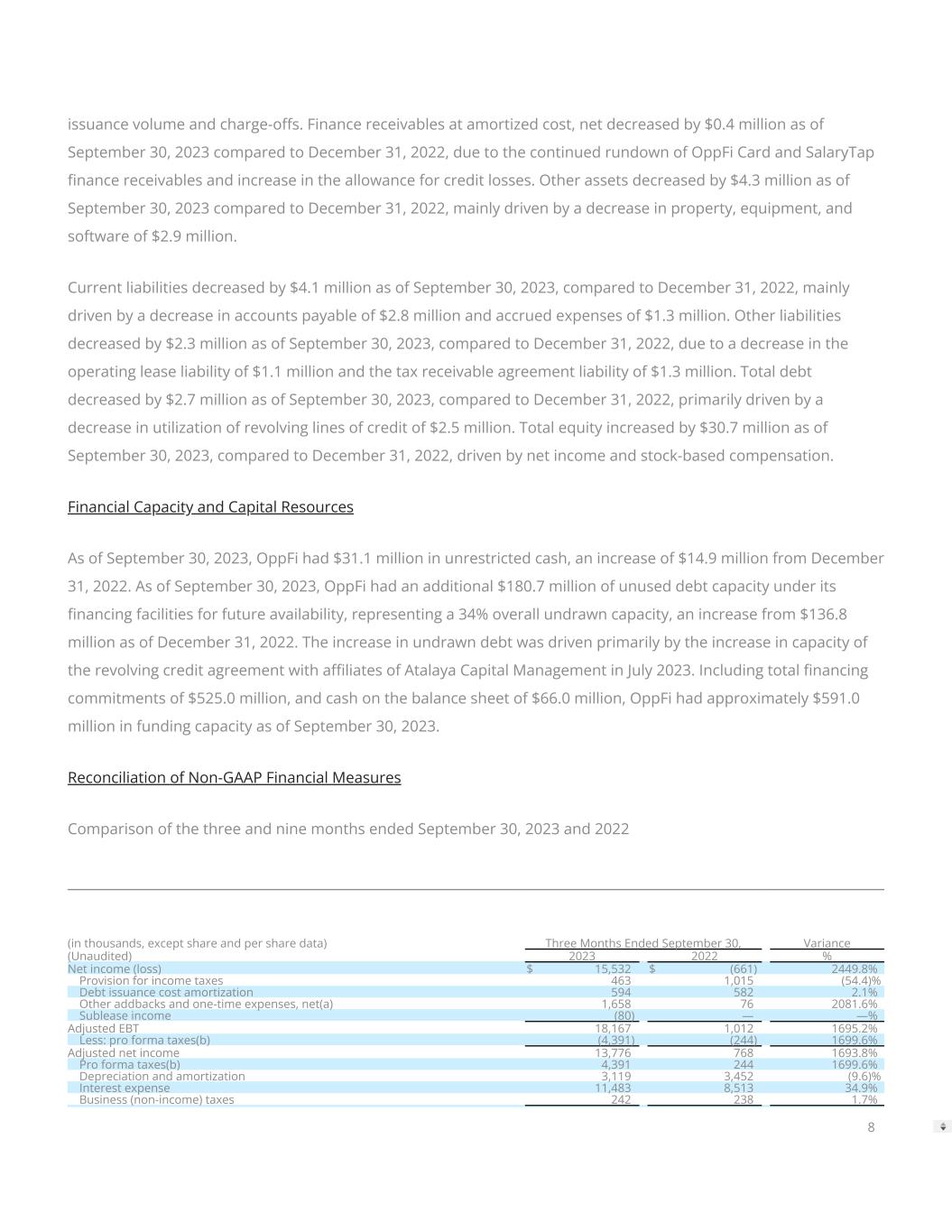

issuance volume and charge-o�s. Finance receivables at amortized cost, net decreased by $0.4 million as of September 30, 2023 compared to December 31, 2022, due to the continued rundown of OppFi Card and SalaryTap �nance receivables and increase in the allowance for credit losses. Other assets decreased by $4.3 million as of September 30, 2023 compared to December 31, 2022, mainly driven by a decrease in property, equipment, and software of $2.9 million. Current liabilities decreased by $4.1 million as of September 30, 2023, compared to December 31, 2022, mainly driven by a decrease in accounts payable of $2.8 million and accrued expenses of $1.3 million. Other liabilities decreased by $2.3 million as of September 30, 2023, compared to December 31, 2022, due to a decrease in the operating lease liability of $1.1 million and the tax receivable agreement liability of $1.3 million. Total debt decreased by $2.7 million as of September 30, 2023, compared to December 31, 2022, primarily driven by a decrease in utilization of revolving lines of credit of $2.5 million. Total equity increased by $30.7 million as of September 30, 2023, compared to December 31, 2022, driven by net income and stock-based compensation. Financial Capacity and Capital Resources As of September 30, 2023, OppFi had $31.1 million in unrestricted cash, an increase of $14.9 million from December 31, 2022. As of September 30, 2023, OppFi had an additional $180.7 million of unused debt capacity under its �nancing facilities for future availability, representing a 34% overall undrawn capacity, an increase from $136.8 million as of December 31, 2022. The increase in undrawn debt was driven primarily by the increase in capacity of the revolving credit agreement with a�liates of Atalaya Capital Management in July 2023. Including total �nancing commitments of $525.0 million, and cash on the balance sheet of $66.0 million, OppFi had approximately $591.0 million in funding capacity as of September 30, 2023. Reconciliation of Non-GAAP Financial Measures Comparison of the three and nine months ended September 30, 2023 and 2022 (in thousands, except share and per share data) Three Months Ended September 30, Variance (Unaudited) 2023 2022 % Net income (loss) $ 15,532 $ (661) 2449.8% Provision for income taxes 463 1,015 (54.4)% Debt issuance cost amortization 594 582 2.1% Other addbacks and one-time expenses, net(a) 1,658 76 2081.6% Sublease income (80) — —% Adjusted EBT 18,167 1,012 1695.2% Less: pro forma taxes(b) (4,391) (244) 1699.6% Adjusted net income 13,776 768 1693.8% Pro forma taxes(b) 4,391 244 1699.6% Depreciation and amortization 3,119 3,452 (9.6)% Interest expense 11,483 8,513 34.9% Business (non-income) taxes 242 238 1.7% 8

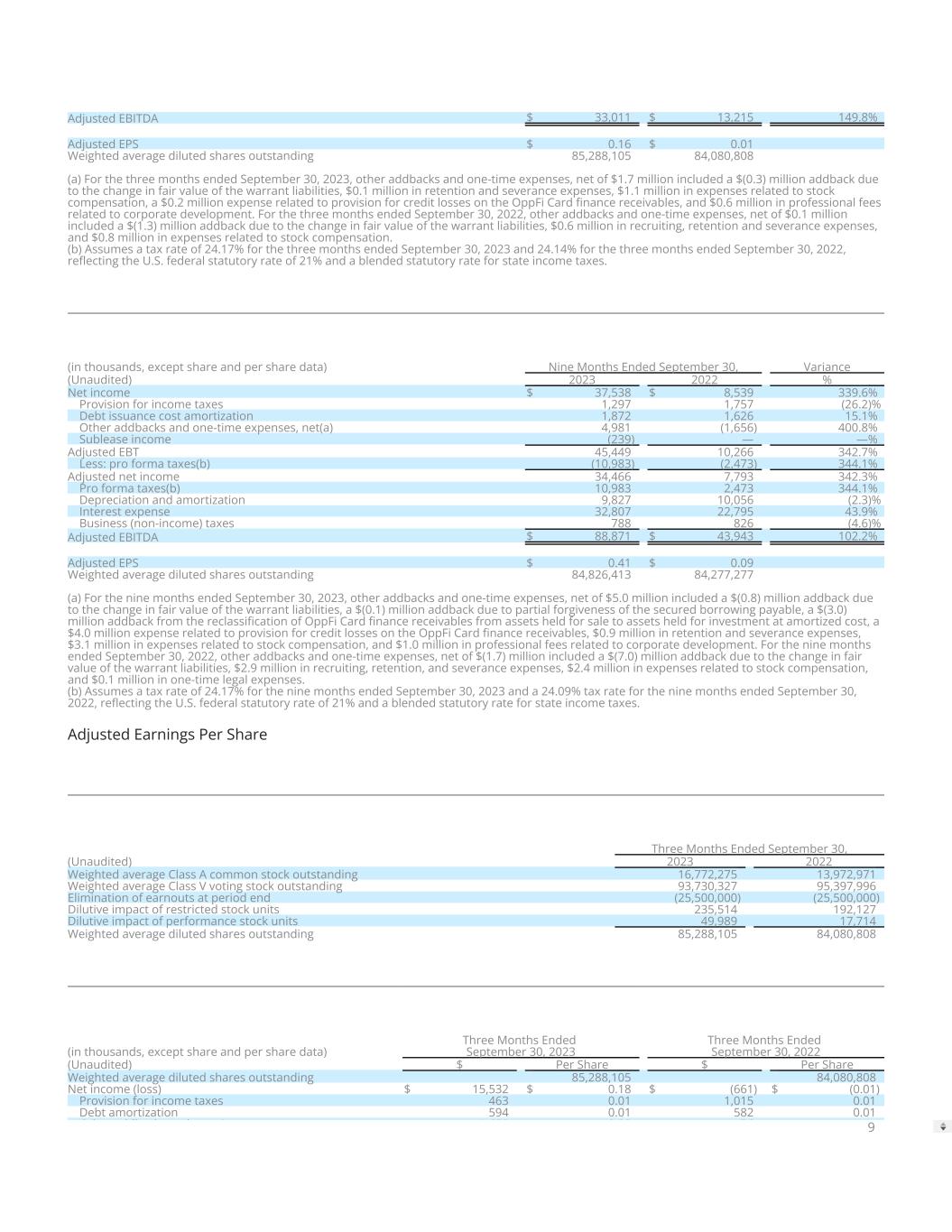

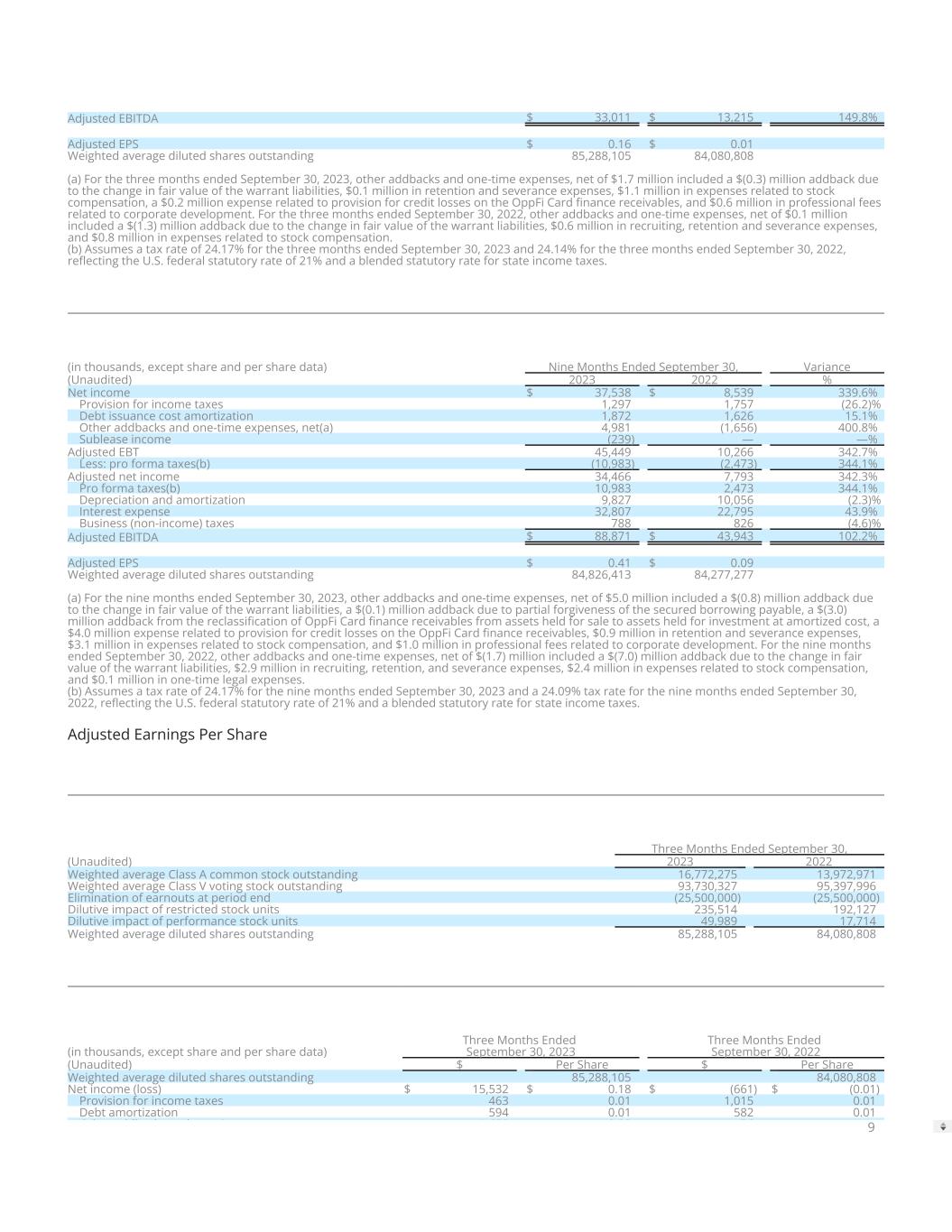

Adjusted EBITDA $ 33,011 $ 13,215 149.8% Adjusted EPS $ 0.16 $ 0.01 Weighted average diluted shares outstanding 85,288,105 84,080,808 (a) For the three months ended September 30, 2023, other addbacks and one-time expenses, net of $1.7 million included a $(0.3) million addback due to the change in fair value of the warrant liabilities, $0.1 million in retention and severance expenses, $1.1 million in expenses related to stock compensation, a $0.2 million expense related to provision for credit losses on the OppFi Card �nance receivables, and $0.6 million in professional fees related to corporate development. For the three months ended September 30, 2022, other addbacks and one-time expenses, net of $0.1 million included a $(1.3) million addback due to the change in fair value of the warrant liabilities, $0.6 million in recruiting, retention and severance expenses, and $0.8 million in expenses related to stock compensation. (b) Assumes a tax rate of 24.17% for the three months ended September 30, 2023 and 24.14% for the three months ended September 30, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. (in thousands, except share and per share data) Nine Months Ended September 30, Variance (Unaudited) 2023 2022 % Net income $ 37,538 $ 8,539 339.6% Provision for income taxes 1,297 1,757 (26.2)% Debt issuance cost amortization 1,872 1,626 15.1% Other addbacks and one-time expenses, net(a) 4,981 (1,656) 400.8% Sublease income (239) — —% Adjusted EBT 45,449 10,266 342.7% Less: pro forma taxes(b) (10,983) (2,473) 344.1% Adjusted net income 34,466 7,793 342.3% Pro forma taxes(b) 10,983 2,473 344.1% Depreciation and amortization 9,827 10,056 (2.3)% Interest expense 32,807 22,795 43.9% Business (non-income) taxes 788 826 (4.6)% Adjusted EBITDA $ 88,871 $ 43,943 102.2% Adjusted EPS $ 0.41 $ 0.09 Weighted average diluted shares outstanding 84,826,413 84,277,277 (a) For the nine months ended September 30, 2023, other addbacks and one-time expenses, net of $5.0 million included a $(0.8) million addback due to the change in fair value of the warrant liabilities, a $(0.1) million addback due to partial forgiveness of the secured borrowing payable, a $(3.0) million addback from the reclassi�cation of OppFi Card �nance receivables from assets held for sale to assets held for investment at amortized cost, a $4.0 million expense related to provision for credit losses on the OppFi Card �nance receivables, $0.9 million in retention and severance expenses, $3.1 million in expenses related to stock compensation, and $1.0 million in professional fees related to corporate development. For the nine months ended September 30, 2022, other addbacks and one-time expenses, net of $(1.7) million included a $(7.0) million addback due to the change in fair value of the warrant liabilities, $2.9 million in recruiting, retention, and severance expenses, $2.4 million in expenses related to stock compensation, and $0.1 million in one-time legal expenses. (b) Assumes a tax rate of 24.17% for the nine months ended September 30, 2023 and a 24.09% tax rate for the nine months ended September 30, 2022, re�ecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. Adjusted Earnings Per Share Three Months Ended September 30, (Unaudited) 2023 2022 Weighted average Class A common stock outstanding 16,772,275 13,972,971 Weighted average Class V voting stock outstanding 93,730,327 95,397,996 Elimination of earnouts at period end (25,500,000) (25,500,000) Dilutive impact of restricted stock units 235,514 192,127 Dilutive impact of performance stock units 49,989 17,714 Weighted average diluted shares outstanding 85,288,105 84,080,808 (in thousands, except share and per share data) Three Months Ended September 30, 2023 Three Months Ended September 30, 2022 (Unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 85,288,105 84,080,808 Net income (loss) $ 15,532 $ 0.18 $ (661) $ (0.01) Provision for income taxes 463 0.01 1,015 0.01 Debt amortization 594 0.01 582 0.01 O h ddb k d i 1 658 0 02 76 9

Other addbacks and one-time expenses 1,658 0.02 76 — Sublease income (80) — — — Adjusted EBT 18,167 0.21 1,012 0.01 Less: pro forma taxes (4,391) (0.05) (244) — Adjusted net income 13,776 0.16 768 0.01 Nine Months Ended September 30, (Unaudited) 2023 2022 Weighted average Class A common stock outstanding 15,820,262 13,694,733 Weighted average Class V voting stock outstanding 94,279,582 95,946,836 Elimination of earnouts at period end (25,500,000) (25,500,000) Dilutive impact of restricted stock units 198,698 123,722 Dilutive impact of performance stock units 27,871 11,986 Weighted average diluted shares outstanding 84,826,413 84,277,277 (in thousands, except share and per share data) Nine Months Ended September 30, 2023 Nine Months Ended September 30, 2022 (Unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 84,826,413 84,277,277 Net income $ 37,538 $ 0.44 $ 8,539 $ 0.10 Provision for income taxes 1,297 0.02 1,757 0.02 Debt amortization 1,872 0.02 1,626 0.02 Other addbacks and one-time expenses 4,981 0.06 (1,656) (0.02) Sublease income (239) — — — Adjusted EBT 45,449 0.54 10,266 0.12 Less: pro forma taxes (10,983) (0.13) (2,473) (0.03) Adjusted net income 34,466 0.41 7,793 0.09 Investor Relations: investors@opp�.com Media Relations: media@opp�.com Source: OppFi 10