Q3 2023 Earnings Presentation November 9, 2023 A Tech-Enabled, Mission-Driven Specialty Finance Platform that Broadens the Reach of Community Banks to Extend Credit Access to Everyday Americans

1 Disclaimer This presentation (the “Presentation”) of OppFi Inc. (“OppFi” or the “Company”) is for information purposes only. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. Trademarks and trade names referred to in this Presentation are the property of their respective owners. The information contained herein does not purport to be all-inclusive. This Presentation does not constitute investment, tax, or legal advice. No representation or warranty, express or implied, is or will be given by the Company or any of its respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this Presentation, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The information contained in this Presentation is preliminary in nature and is subject to change, and any such changes may be material. The Company disclaims any duty to update the information contained in this Presentation, which information is given only as of the date of this Presentation unless otherwise stated herein. Forward-Looking Statements This Presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “possible,” “continue,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, without limitation, OppFi’s expectations with respect to its full year 2023 guidance, the future performance of OppFi’s platform, and expectations for OppFi’s growth, new products and future financial performance. These forward-looking statements are based on OppFi’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside OppFi’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the impact of general economic conditions, including economic slowdowns, inflation, interest rate changes, recessions, and tightening of credit markets on OppFi’s business; the impact of challenging macroeconomic and marketplace conditions, including lingering effects of COVID-19 on OppFi’s business; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi’s bank partners will continue to lend in California and whether OppFi’s financing sources will continue to finance the purchase of participation rights in loans originated by OppFi’s bank partners in California; the impact that events involving financial institutions or the financial services industry generally, such as actual concerns or events involving liquidity, defaults, or non-performance, may have on OppFi’s business; risks related to the material weakness in OppFi’s internal controls over financial reporting; the risk that the business combination disrupts current plans and operations; the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of OppFi to grow and manage growth profitably and retain its key employees; risks related to new products; concentration risk; costs related to the business combination; changes in applicable laws or regulations; the possibility that OppFi may be adversely affected by other economic, business, and/or competitive factors; risks related to management transitions; risks related to the restatement of OppFi’s financial statements and any accounting deficiencies or weaknesses related thereto; and other risks and uncertainties indicated from time to time in OppFi’s filings with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned “Risk Factors.” OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures Certain financial information and data contained in this Presentation are unaudited and do not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any periodic filing, information or proxy statement, or prospectus or registration statement to be filed by OppFi with the SEC. Some of the financial information and data contained in this Presentation, such as Adjusted EBT, Adjusted Net Income, Adjusted EBITDA, and Adjusted EPS have not been prepared in accordance with United States generally acceptable accounting principles ("GAAP"). Adjusted EBT is defined as Net Income, plus (1) provision for income taxes; (2) amortization of debt issuance costs; (3) other addbacks and one-time expenses; and (4) sublease income. Adjusted Net Income is defined as Adjusted EBT as defined above, adjusted for taxes assuming a tax rate of 24.17% for the three months ended September 30, 2023, a tax rate of 24.14% for the three months ended September 30, 2022, a tax rate of 24.17% for the nine months ended September 30, 2023, and a tax rate of 24.09% for the nine months ended September 30, 2022, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. Adjusted EBITDA is defined as Adjusted Net Income as defined above, excluding (1) pro forma and business (non-income) taxes; (2) depreciation and amortization; and (3) interest expense. Adjusted EPS is defined as Adjusted Net Income as defined above, divided by weighted average diluted shares outstanding, which represent shares of both classes of common stock outstanding, excluding 25,500,000 shares related to earnout obligations and including the impact of unvested restricted stock units, unvested performance stock units, and the employee stock purchase plan. These non-GAAP financial measures have not been prepared in accordance with accounting principles generally accepted in the United States and may be different from non-GAAP financial measures used by other companies. OppFi believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non-GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. A reconciliation of OppFi’s non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Appendix. A reconciliation of projected 2023 Adjusted Net Income and projected 2023 Adjusted EPS to the most directly comparable GAAP financial measures is not included in this Presentation because, without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. No Offer or Solicitation This Presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Website This Presentation contains reproductions and references to the Company’s website and mobile content. Website and mobile content are not incorporated into this Presentation. Any references to URLs for the websites are intended to be inactive textual references only.

2 Q3 2023 Highlights 7%, or 8 percentage point, increase year over year in yield to 129% Disciplined expense management, with total expenses (excluding interest expense) as a percentage of total revenue up less than 1% to 36.1% 23%, or 12 percentage point, decrease year over year in net charge-off rate, as a percentage of total revenue2 7% increase year over year in total revenue Net income grew to $15.5 million from net loss of $0.7 million and adjusted net income1 grew to $13.8 million from $0.8 million Raised full-year guidance for adjusted net income and adjusted earnings per share 1. Adjusted net income is a financial measure that has not been prepared in accordance with Generally Accepted Accounting Principles (“GAAP”). See the disclaimer on “Non-GAAP Financial Measures” on slide 1 for a detailed description of such Non-GAAP financial measures and the appendix for a reconciliation of Non-GAAP financial measures to their most directly comparable GAAP financial measures. 2. Beginning with the quarter ended June 30, 2023, for all periods presented, the Company updated its key performance metrics to reflect the Company’s decision to wind down its SalaryTap and OppFi Card businesses. The key performance metrics presented are for the OppLoans product only and exclude the SalaryTap and OppFi Card products. Prior period metrics currently presented may differ slightly than previously reported due to the exclusion of SalaryTap and OppFi Card.

3 Key Company Highlights 1. 2015-2022 2. 2017-2022 Solid Revenue Growth 45% 5-year CAGR2 Significant Scale Facilitated more than $5.3 billion in gross loan issuance covering over 3.1 million loans, since inception3 Leading Proprietary Credit & Technology Platform Real-time AI drove automation for 85% of decisions in 2022 CEO and Executive Chairman as Largest Shareholder Owner / operator dynamic aligns incentives to maximize shareholder value Exceptional Customer Satisfaction Net Promoter Score of 784; 4,000+ Trustpilot customer reviews with 4.5 / 5.0 average rating Profitable Across Business Cycles 8 consecutive years of profitability1 3. As of 9/30/2023 4. For Q3 2023 at the time of loan approval

4 High Percentage of Americans Lack Savings and/or Credit Access 60 million U.S. adults lack access to traditional credit at choice1 62% of U.S. consumers live paycheck to paycheck2 43% of U.S. adults have savings to cover a $1,000 unplanned expense3 1. Hamdani, Kausar, et al. “UNEQUAL ACCESS TO CREDIT The Hidden Impact of Credit Constraints.” NewYorkFed.org, 2019 2. LendingClub Corporation. "New Reality Check: The Paycheck-to-Paycheck Report – The Savings Deep Dive Edition" PYMNTS.com, October 30, 2023 3. Gillespie, Lane. “Bankrate’s 2023 Annual Emergency Savings Report” Bankrate.com, February 23, 2023

5 ▪ Simple interest, amortizing installment loans with no balloon payments ▪ No origination, late, or NSF fees ▪ No prepayment penalties ▪ Report to the 3 major credit bureaus ▪ Work compassionately with customers who require payment plan modification ▪ OppFi TurnUp Program helps eligible applicants find more affordable options by checking market for sub-36% APR products OppFi Customers Can Use Proceeds for any Unexpected Expense Medical Family Auto Repair Education Housing Market Leading Terms A- Rating with BBB 1 78 Net Promoter Score (NPS)2 4.5/5.0 Trustpilot TrustScore1 1. As of 11/1/2023 2. For Q3 2023 at the time of loan approval Exceptional Customer Reviews OppFi Offers Market Leading Terms & Excellent Customer Experience 4.8/5.0 Google Star Rating1

6 OppFi Growth Strategy Accelerate Profitable Growth • Continue to refine and enhance underwriting model, focusing on more favorable credit tiers • Maintain low customer acquisition costs and grow lower cost channels, such as SEO Drive profitable OppLoans volume growth • Acquire platforms or assets providing accessible credit products to new customers • Expand into adjacent service businesses with synergies to core product • Achieve selected vertical integration Diversify into new customer and product types via M&A • Form new strategic channel relationships to reach more non-prime consumers at the point of need • Maintain and grow network of aggregators Serve more customers through new relationships and products

7 Q3 2023 Financial Highlights 1. Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non-GAAP Financial Measures” on slide 1 for a detailed description of such Non-GAAP financial measures and the appendix for a reconciliation of such Non-GAAP financial measures to their most directly comparable GAAP financial measures. 2. Beginning with the quarter ended June 30, 2023, for all periods presented, the Company updated its key performance metrics to reflect the Company’s decision to wind down its SalaryTap and OppFi Card businesses. The key performance metrics presented are for the OppLoans product only and exclude the SalaryTap and OppFi Card products. Prior period metrics currently presented may differ slightly than previously reported due to the exclusion of SalaryTap and OppFi Card. Total Revenue • Total revenue increased 7% year over year to $133M Net Originations2 • Net originations increased 8% year over year to $196M Ending Receivables2 • Ending receivables increased 3% year over year to $416M $15.5M Net Income $13.8M Adj. Net Income1 $0.13 Basic EPS $0.13 Diluted EPS $0.16 Adj. EPS1

8 Year to Date 2023 Financial Highlights Total Revenue • Total revenue increased 13% year over year to $376M Net Originations2 • Net originations decreased 2% year over year to $556M Ending Receivables2 • Ending receivables increased 3% year over year at $416M $37.5M Net Income $34.5M Adj. Net Income1 $0.29 Basic EPS $0.29 Diluted EPS $0.41 Adj. EPS1 1. Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non-GAAP Financial Measures” on slide 1 for a detailed description of such Non-GAAP financial measures and the appendix for a reconciliation of such Non-GAAP financial measures to their most directly comparable GAAP financial measures. 2. Beginning with the quarter ended June 30, 2023, for all periods presented, the Company updated its key performance metrics to reflect the Company’s decision to wind down its SalaryTap and OppFi Card businesses. The key performance metrics presented are for the OppLoans product only and exclude the SalaryTap and OppFi Card products. Prior period metrics currently presented may differ slightly than previously reported due to the exclusion of SalaryTap and OppFi Card.

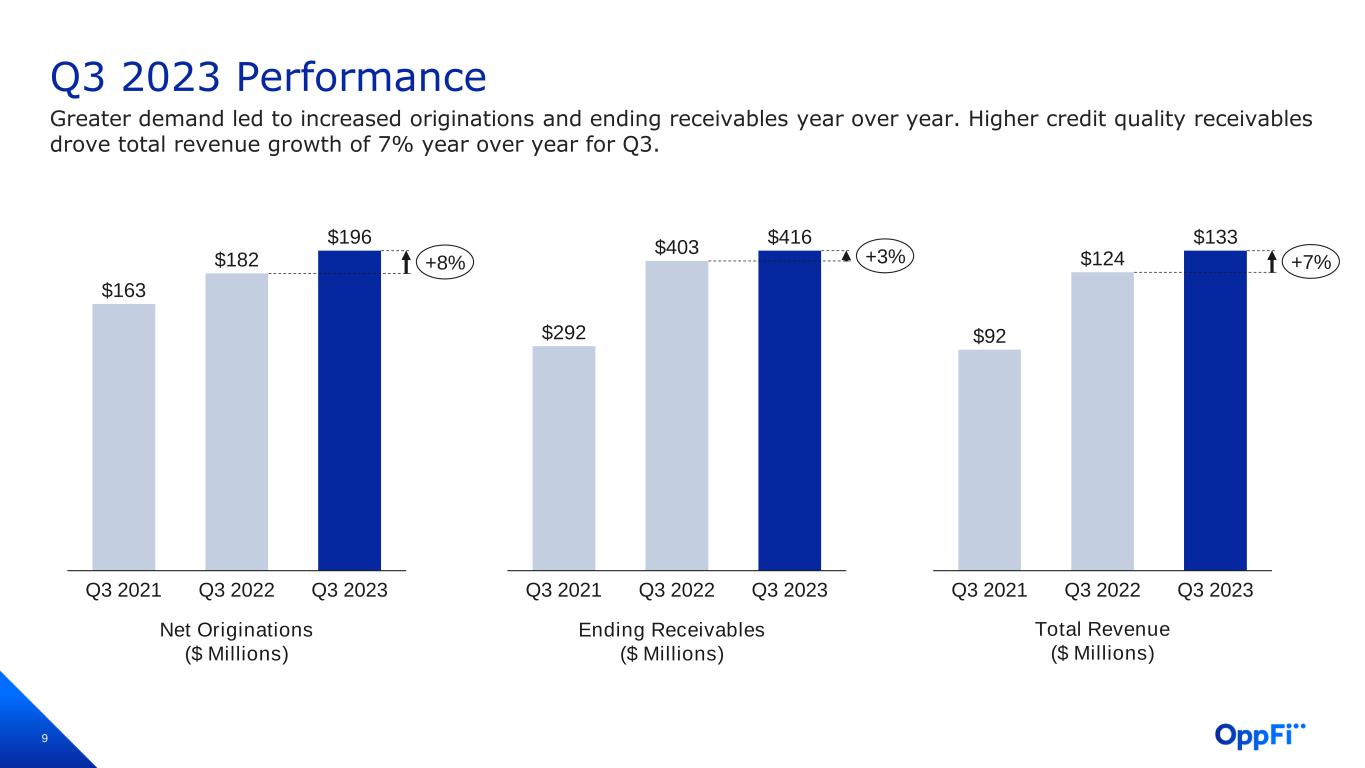

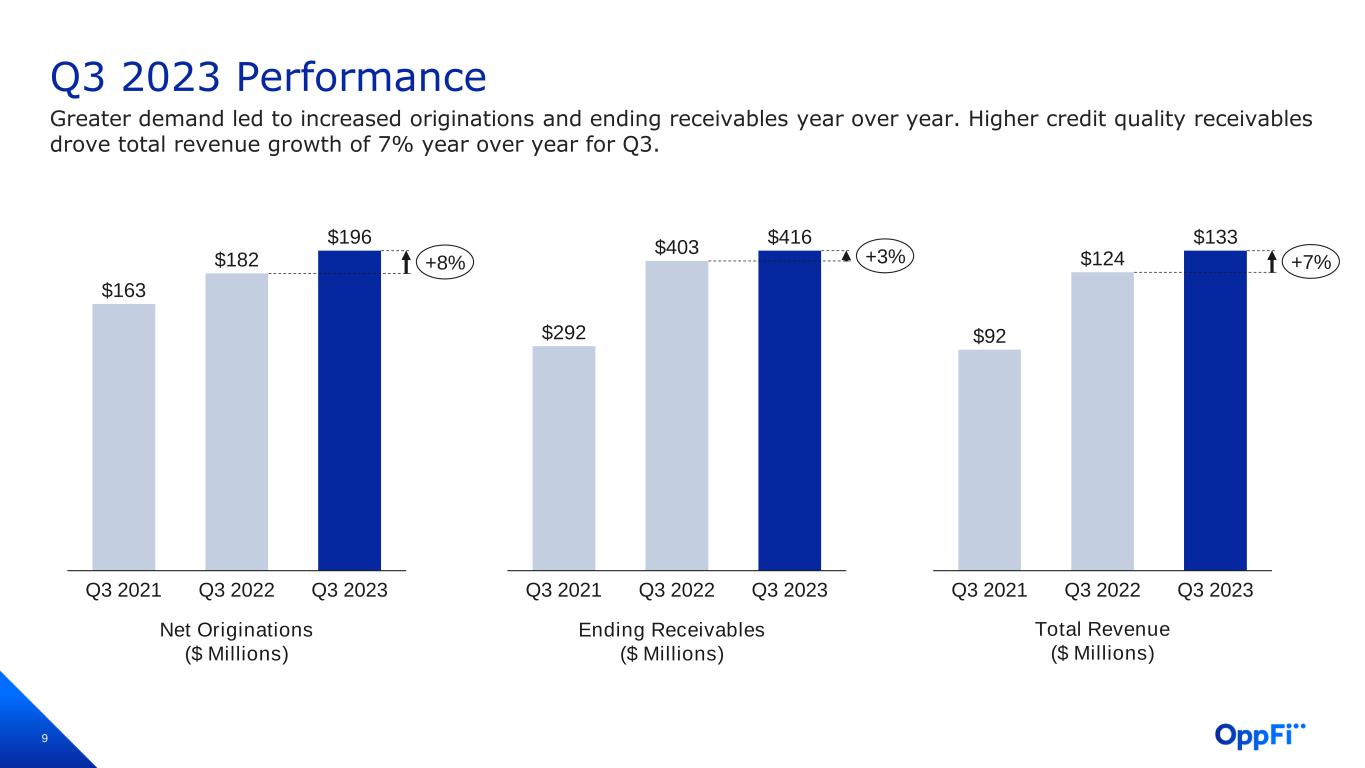

9 Q3 2023 Performance Greater demand led to increased originations and ending receivables year over year. Higher credit quality receivables drove total revenue growth of 7% year over year for Q3. Ending Receivables ($ Millions) Total Revenue ($ Millions) Net Originations ($ Millions) $163 $182 $196 Q3 2021 Q3 2022 Q3 2023 +8% $292 $403 $416 Q3 2021 Q3 2022 Q3 2023 +3% $92 $124 $133 Q3 2021 Q3 2023Q3 2022 +7%

10 Year to Date 2023 Performance Credit adjustments led to lower YTD net originations year over year. Higher credit quality receivables drove total revenue growth of 13% year over year for the first nine months of the year. Ending Receivables ($ Millions) Total Revenue ($ Millions) Net Originations ($ Millions) $407 $567 $556 YTD 2022YTD 2021 YTD 2023 -2% $292 $403 $416 YTD 2021 YTD 2022 YTD 2023 +3% $255 $333 $376 YTD 2021 YTD 2022 YTD 2023 +13%

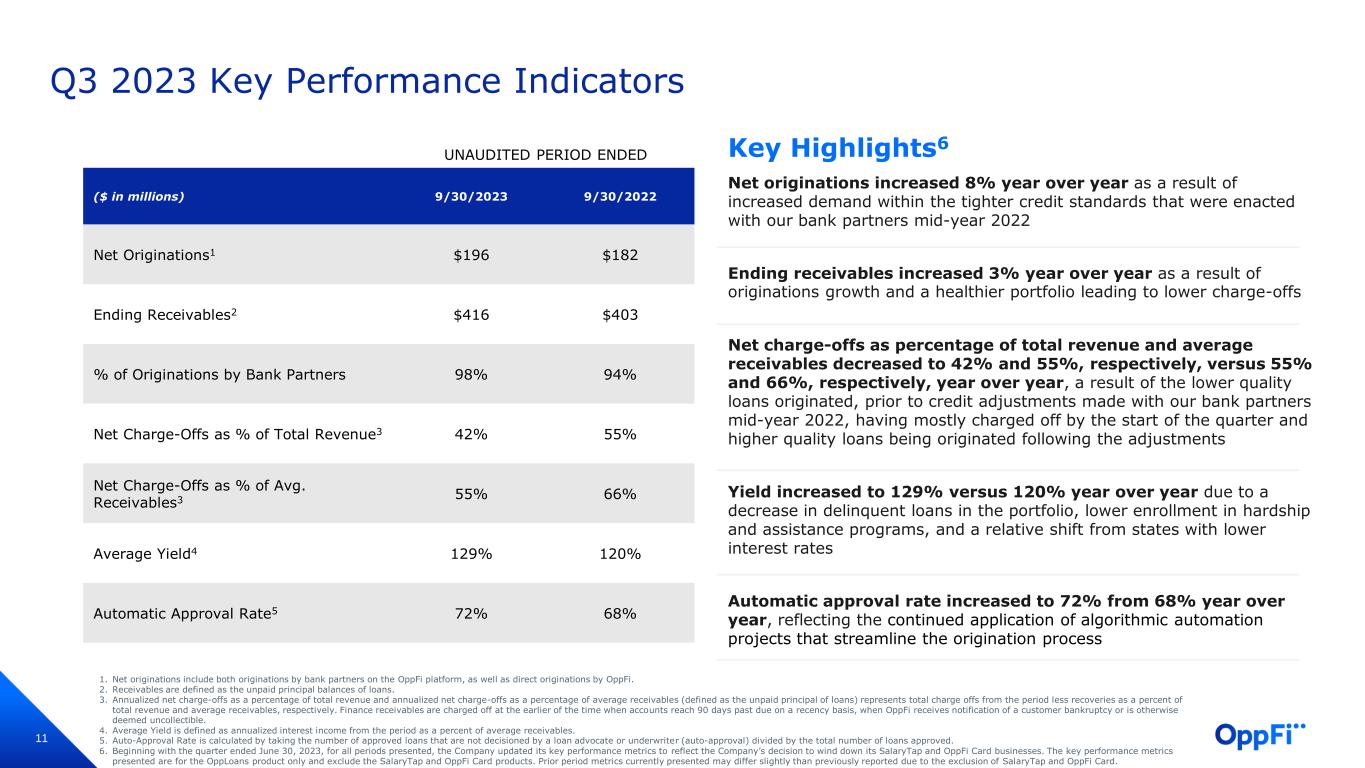

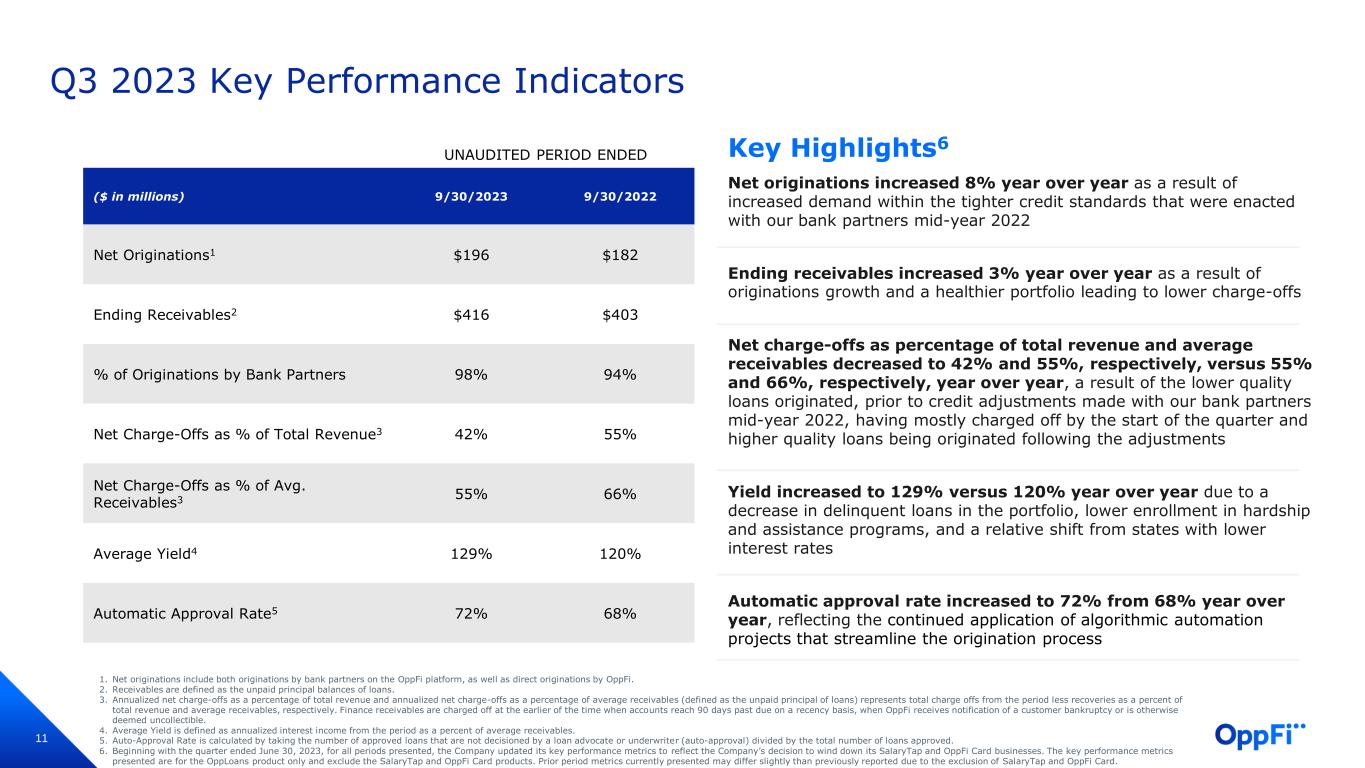

11 Net originations increased 8% year over year as a result of increased demand within the tighter credit standards that were enacted with our bank partners mid-year 2022 Ending receivables increased 3% year over year as a result of originations growth and a healthier portfolio leading to lower charge-offs Net charge-offs as percentage of total revenue and average receivables decreased to 42% and 55%, respectively, versus 55% and 66%, respectively, year over year, a result of the lower quality loans originated, prior to credit adjustments made with our bank partners mid-year 2022, having mostly charged off by the start of the quarter and higher quality loans being originated following the adjustments Yield increased to 129% versus 120% year over year due to a decrease in delinquent loans in the portfolio, lower enrollment in hardship and assistance programs, and a relative shift from states with lower interest rates Automatic approval rate increased to 72% from 68% year over year, reflecting the continued application of algorithmic automation projects that streamline the origination process Q3 2023 Key Performance Indicators UNAUDITED PERIOD ENDED ($ in millions) 9/30/2023 9/30/2022 Net Originations1 $196 $182 Ending Receivables2 $416 $403 % of Originations by Bank Partners 98% 94% Net Charge-Offs as % of Total Revenue3 42% 55% Net Charge-Offs as % of Avg. Receivables3 55% 66% Average Yield4 129% 120% Automatic Approval Rate5 72% 68% 1. Net originations include both originations by bank partners on the OppFi platform, as well as direct originations by OppFi. 2. Receivables are defined as the unpaid principal balances of loans. 3. Annualized net charge-offs as a percentage of total revenue and annualized net charge-offs as a percentage of average receivables (defined as the unpaid principal of loans) represents total charge offs from the period less recoveries as a percent of total revenue and average receivables, respectively. Finance receivables are charged off at the earlier of the time when accounts reach 90 days past due on a recency basis, when OppFi receives notification of a customer bankruptcy or is otherwise deemed uncollectible. 4. Average Yield is defined as annualized interest income from the period as a percent of average receivables. 5. Auto-Approval Rate is calculated by taking the number of approved loans that are not decisioned by a loan advocate or underwriter (auto-approval) divided by the total number of loans approved. 6. Beginning with the quarter ended June 30, 2023, for all periods presented, the Company updated its key performance metrics to reflect the Company’s decision to wind down its SalaryTap and OppFi Card businesses. The key performance metrics presented are for the OppLoans product only and exclude the SalaryTap and OppFi Card products. Prior period metrics currently presented may differ slightly than previously reported due to the exclusion of SalaryTap and OppFi Card. Key Highlights6

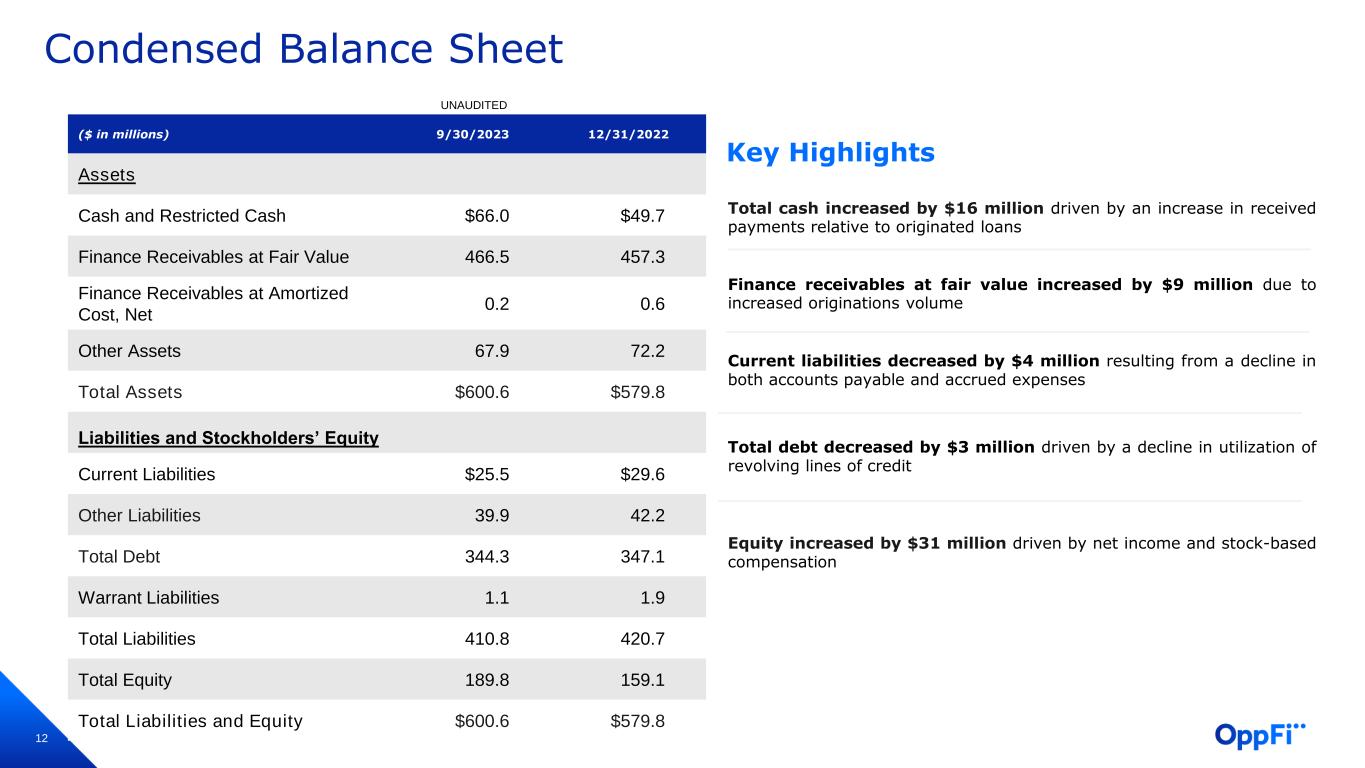

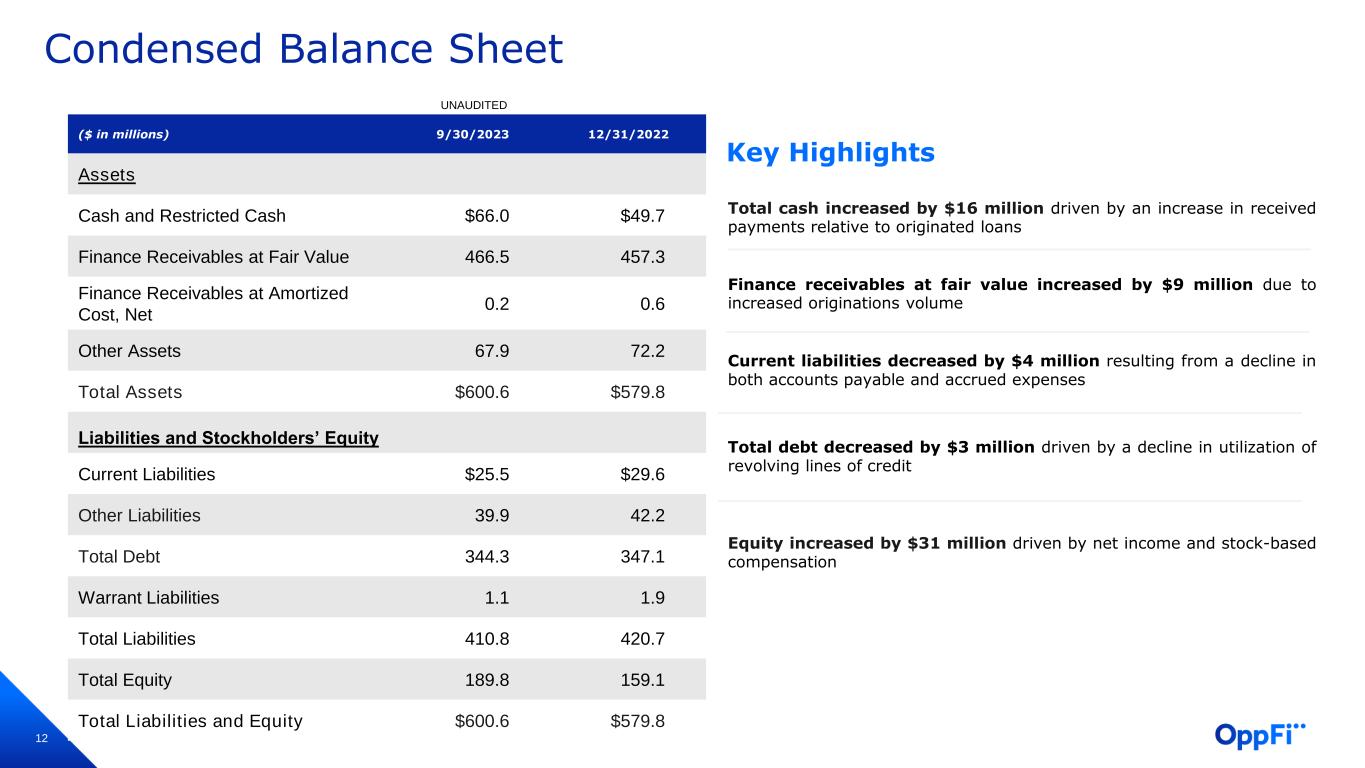

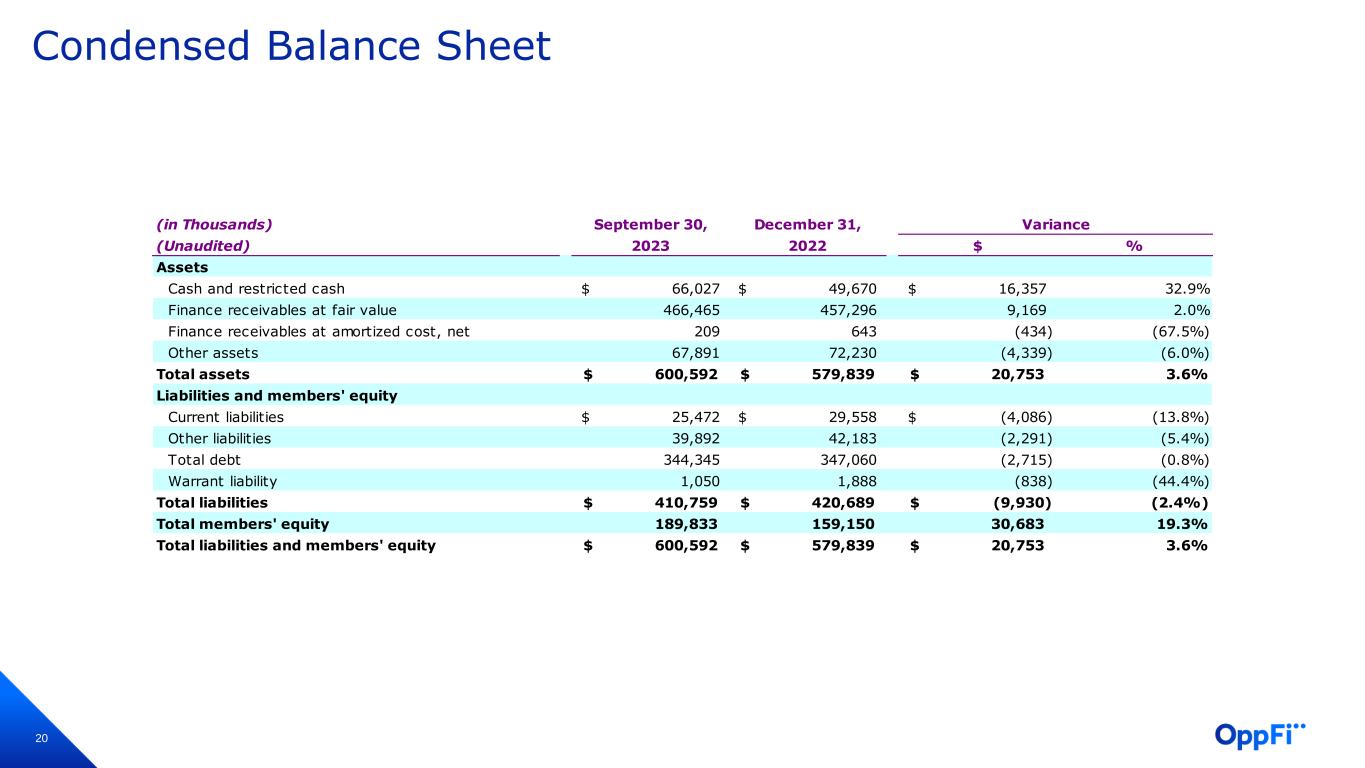

12 Condensed Balance Sheet ($ in millions) 9/30/2023 12/31/2022 Assets Cash and Restricted Cash $66.0 $49.7 Finance Receivables at Fair Value 466.5 457.3 Finance Receivables at Amortized Cost, Net 0.2 0.6 Other Assets 67.9 72.2 Total Assets $600.6 $579.8 Liabilities and Stockholders’ Equity Current Liabilities $25.5 $29.6 Other Liabilities 39.9 42.2 Total Debt 344.3 347.1 Warrant Liabilities 1.1 1.9 Total Liabilities 410.8 420.7 Total Equity 189.8 159.1 Total Liabilities and Equity $600.6 $579.8 Total cash increased by $16 million driven by an increase in received payments relative to originated loans Finance receivables at fair value increased by $9 million due to increased originations volume Current liabilities decreased by $4 million resulting from a decline in both accounts payable and accrued expenses Total debt decreased by $3 million driven by a decline in utilization of revolving lines of credit Equity increased by $31 million driven by net income and stock-based compensation Key Highlights UNAUDITED

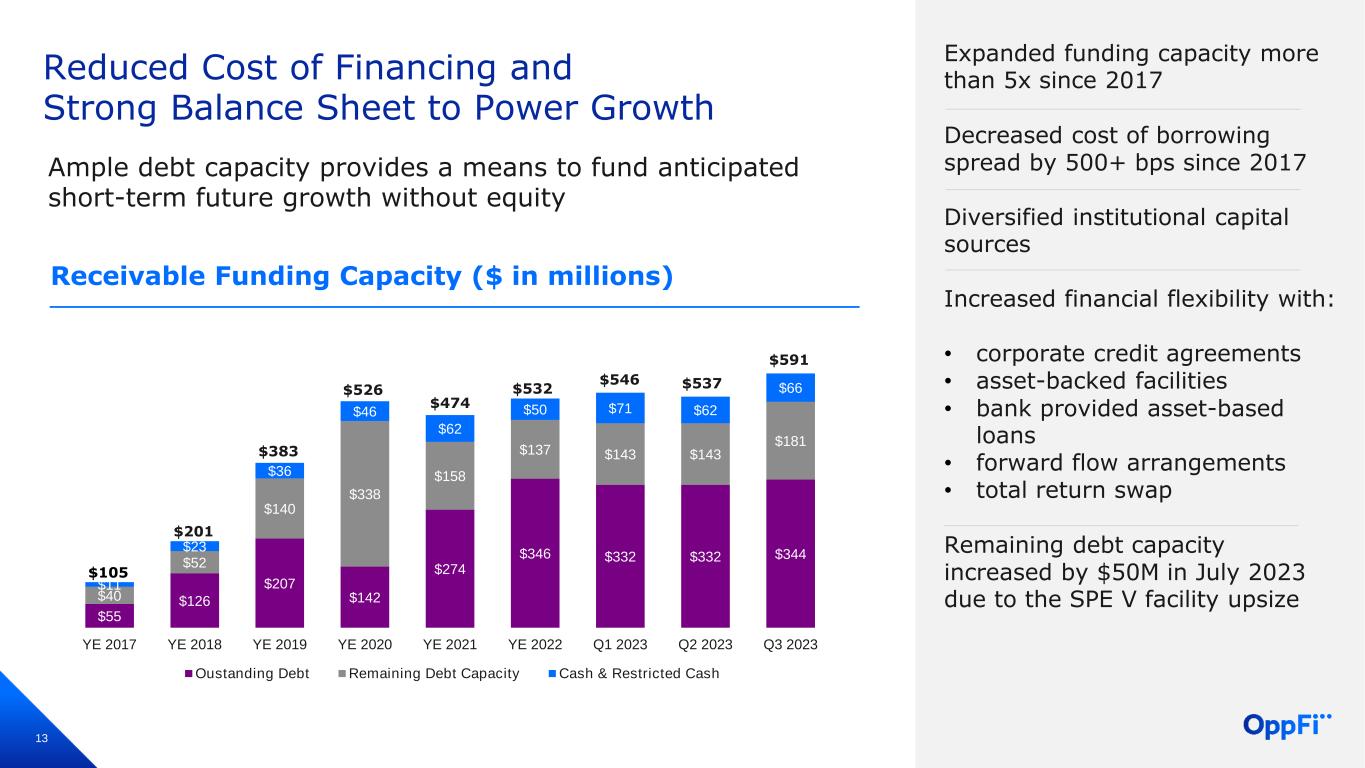

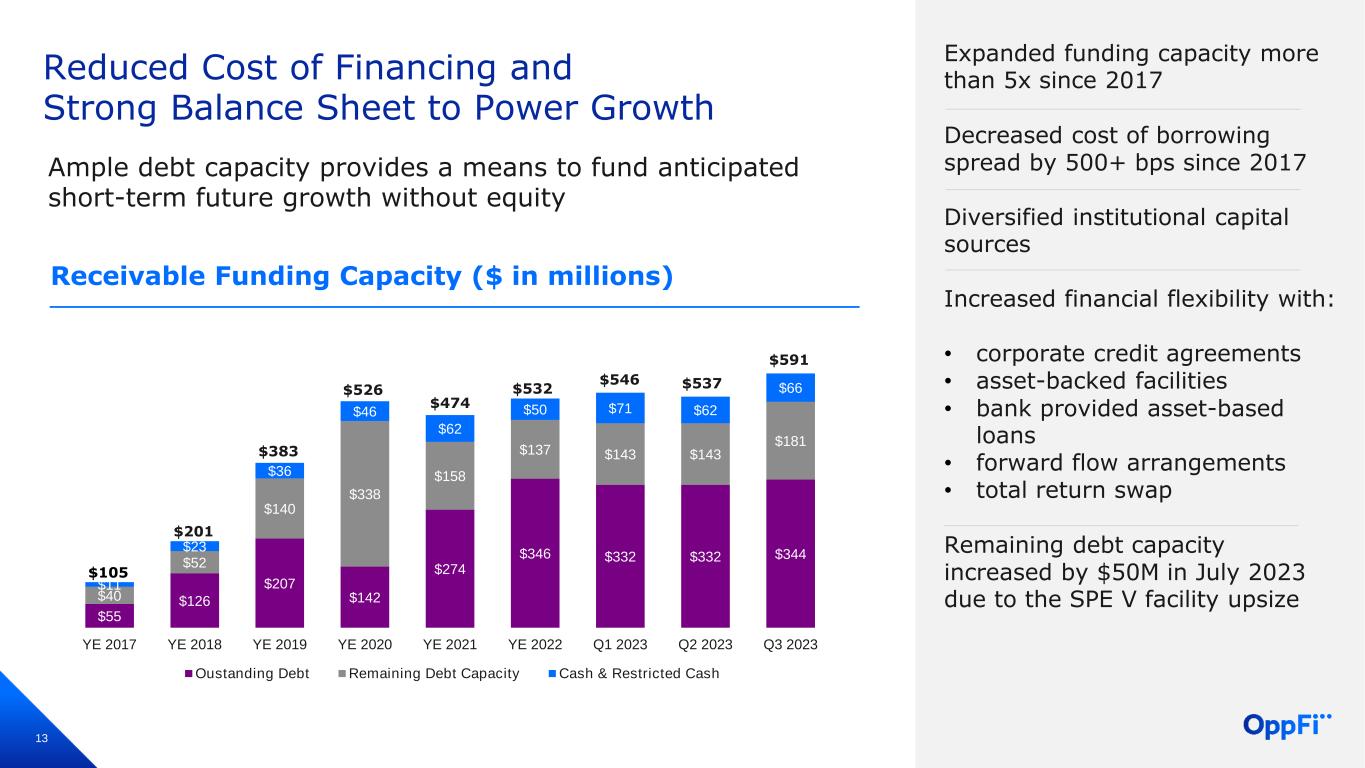

13 Expanded funding capacity more than 5x since 2017 Decreased cost of borrowing spread by 500+ bps since 2017 Diversified institutional capital sources Increased financial flexibility with: • corporate credit agreements • asset-backed facilities • bank provided asset-based loans • forward flow arrangements • total return swap Remaining debt capacity increased by $50M in July 2023 due to the SPE V facility upsize Ample debt capacity provides a means to fund anticipated short-term future growth without equity Receivable Funding Capacity ($ in millions) $55 $126 $207 $142 $274 $346 $332 $332 $344 $40 $52 $140 $338 $158 $137 $143 $143 $181 $11 $23 $36 $46 $62 $50 $71 $62 $66 YE 2017 YE 2018 YE 2019 YE 2020 YE 2021 YE 2022 Q1 2023 Q2 2023 Q3 2023 Oustanding Debt Remaining Debt Capacity Cash & Restricted Cash $105 $537 $591 $201 $383 $526 $474 Reduced Cost of Financing and Strong Balance Sheet to Power Growth $532 $546

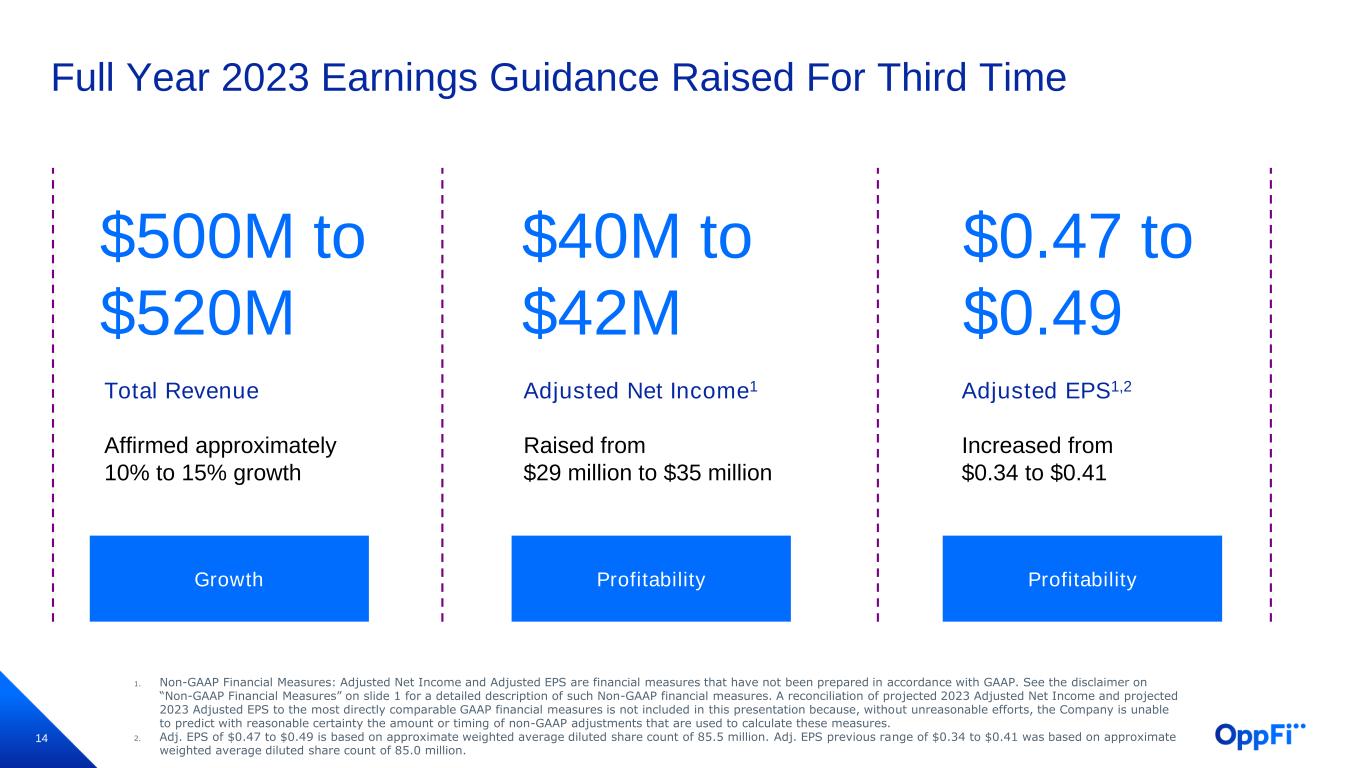

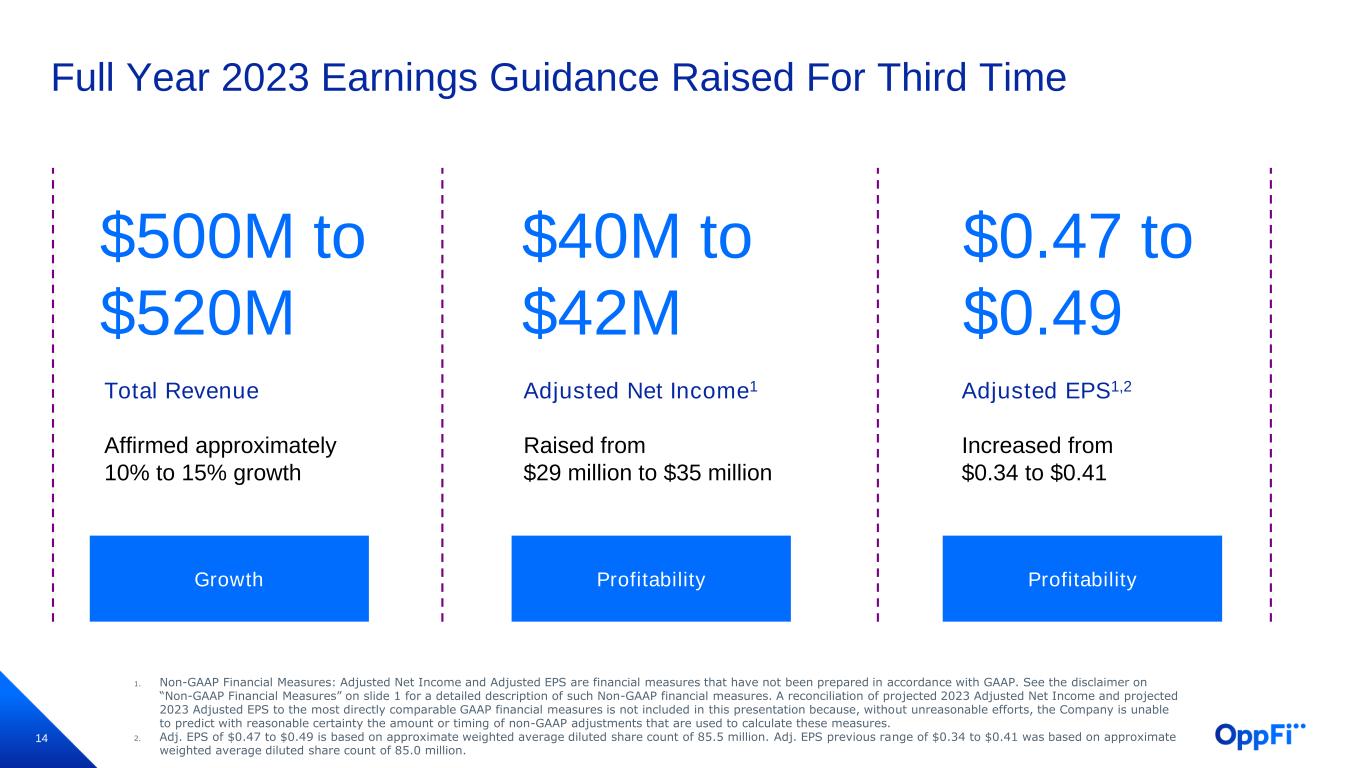

14 $500M to $520M Full Year 2023 Earnings Guidance Raised For Third Time Growth Profitability Profitability $40M to $42M $0.47 to $0.49 Total Revenue Affirmed approximately 10% to 15% growth Adjusted Net Income1 Raised from $29 million to $35 million Adjusted EPS1,2 Increased from $0.34 to $0.41 1. Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non-GAAP Financial Measures” on slide 1 for a detailed description of such Non-GAAP financial measures. A reconciliation of projected 2023 Adjusted Net Income and projected 2023 Adjusted EPS to the most directly comparable GAAP financial measures is not included in this presentation because, without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. 2. Adj. EPS of $0.47 to $0.49 is based on approximate weighted average diluted share count of 85.5 million. Adj. EPS previous range of $0.34 to $0.41 was based on approximate weighted average diluted share count of 85.0 million.

15 Appendix

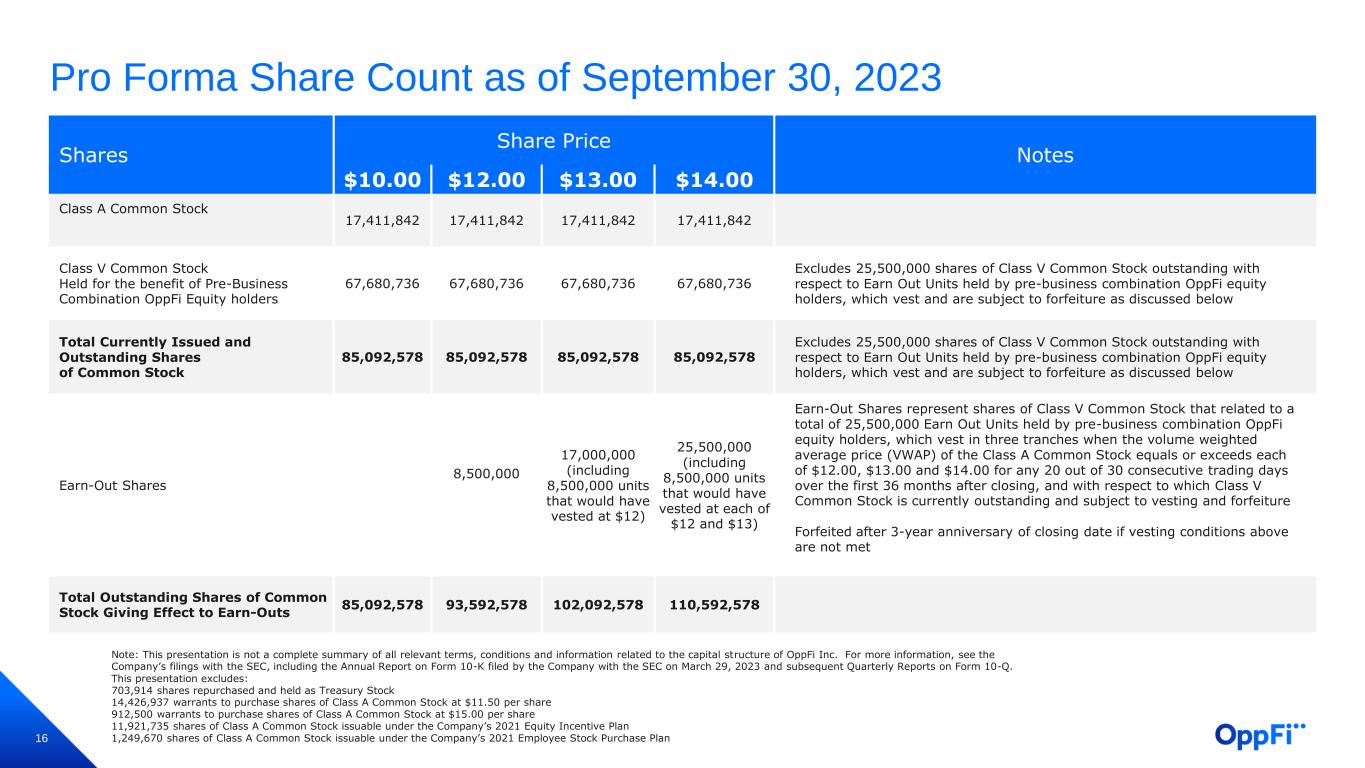

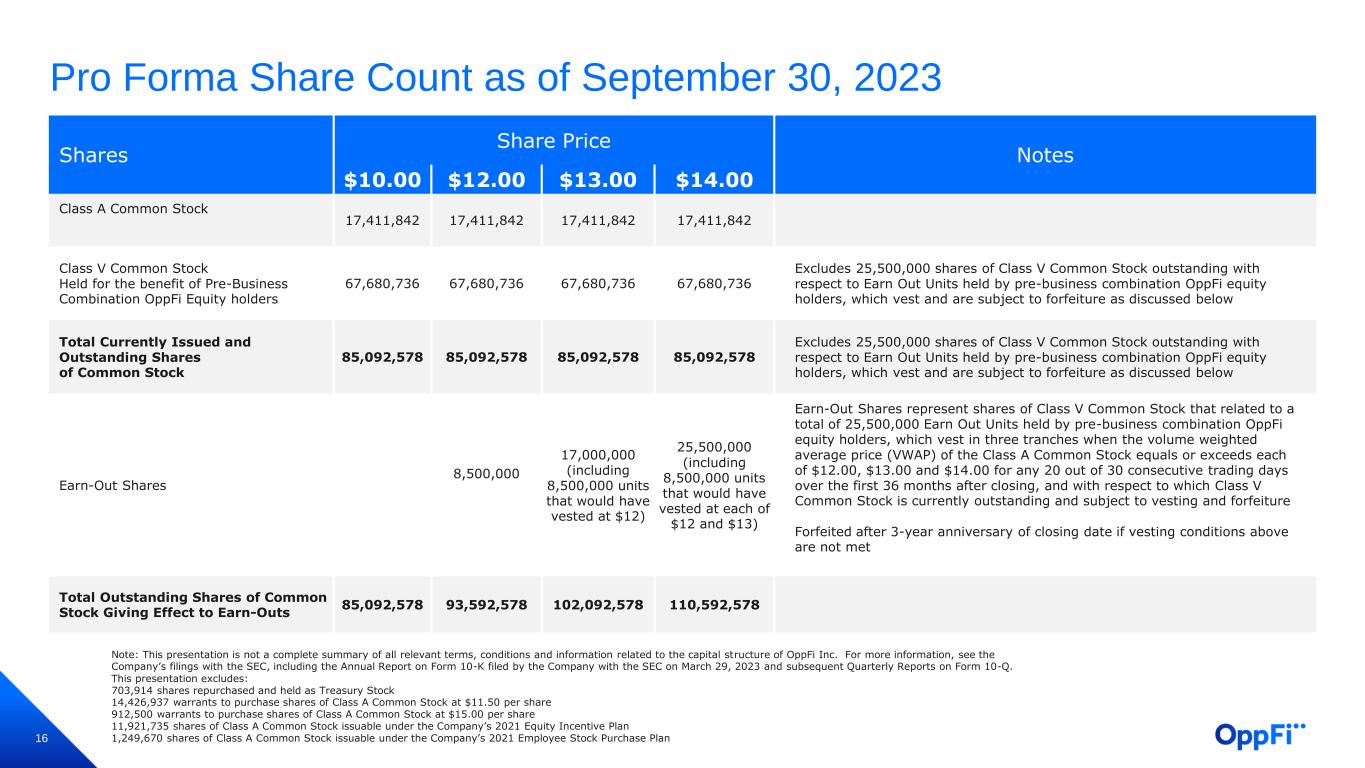

16 Pro Forma Share Count as of September 30, 2023 Shares Share Price Notes $10.00 $12.00 $13.00 $14.00 Class A Common Stock 17,411,842 17,411,842 17,411,842 17,411,842 Class V Common Stock Held for the benefit of Pre-Business Combination OppFi Equity holders 67,680,736 67,680,736 67,680,736 67,680,736 Excludes 25,500,000 shares of Class V Common Stock outstanding with respect to Earn Out Units held by pre-business combination OppFi equity holders, which vest and are subject to forfeiture as discussed below Total Currently Issued and Outstanding Shares of Common Stock 85,092,578 85,092,578 85,092,578 85,092,578 Excludes 25,500,000 shares of Class V Common Stock outstanding with respect to Earn Out Units held by pre-business combination OppFi equity holders, which vest and are subject to forfeiture as discussed below Earn-Out Shares 8,500,000 17,000,000 (including 8,500,000 units that would have vested at $12) 25,500,000 (including 8,500,000 units that would have vested at each of $12 and $13) Earn-Out Shares represent shares of Class V Common Stock that related to a total of 25,500,000 Earn Out Units held by pre-business combination OppFi equity holders, which vest in three tranches when the volume weighted average price (VWAP) of the Class A Common Stock equals or exceeds each of $12.00, $13.00 and $14.00 for any 20 out of 30 consecutive trading days over the first 36 months after closing, and with respect to which Class V Common Stock is currently outstanding and subject to vesting and forfeiture Forfeited after 3-year anniversary of closing date if vesting conditions above are not met Total Outstanding Shares of Common Stock Giving Effect to Earn-Outs 85,092,578 93,592,578 102,092,578 110,592,578 Note: This presentation is not a complete summary of all relevant terms, conditions and information related to the capital structure of OppFi Inc. For more information, see the Company’s filings with the SEC, including the Annual Report on Form 10-K filed by the Company with the SEC on March 29, 2023 and subsequent Quarterly Reports on Form 10-Q. This presentation excludes: 703,914 shares repurchased and held as Treasury Stock 14,426,937 warrants to purchase shares of Class A Common Stock at $11.50 per share 912,500 warrants to purchase shares of Class A Common Stock at $15.00 per share 11,921,735 shares of Class A Common Stock issuable under the Company’s 2021 Equity Incentive Plan 1,249,670 shares of Class A Common Stock issuable under the Company’s 2021 Employee Stock Purchase Plan

17 Fair Value Valuation 1. Stated as a percentage of outstanding principal. Key Highlights • Interest rate increased by 300 bps due to relative increase in base APR loans in the portfolio and a shift away from states with lower statutory rates • Servicing cost decreased by 180 bps to reflect more recent cost trends • Default rate increased by 410 bps due to 2022 vintages with elevated losses ($ in thousands) 9/30/2023 12/31/2022 Outstanding Principal $415,933 $402,180 Interest Rate 155.4% 152.4% Discount Rate 26.3% 25.9% Servicing Cost1 (3.2)% (5.0)% Remaining Life 0.617 years 0.593 years Default Rate1 24.4% 20.3% Accrued Interest1 3.9% 3.9% Prepayment Rate1 21.1% 21.3% Premium to Principal1 8.2% 9.8% UNAUDITED

18 Q3 GAAP Income Statement (in Thousands, except share and per share data) (Unaudited) 2023 2022 $ % Interest and loan related income 132,090$ 123,605$ 8,485$ 6.9% Other revenue 1,075 639 436 68.2% Total revenue 133,165 124,244 8,921 7.2% Change in fair value of finance receivables (57,302) (70,601) 13,299 (18.8%) Provision for credit losses on finance receivables (195) (1,017) 822 (80.8%) Net revenue 75,668 52,626 23,042 43.8% Expenses: Sales and marketing 12,814 11,674 1,140 9.8% Customer operations 10,543 10,591 (48) (0.5%) Technology, products, and analytics 9,732 8,325 1,407 16.9% General, administrative, and other 14,921 13,910 1,011 7.3% Total expenses before interest expense 48,010 44,500 3,510 7.9% Interest expense 12,077 9,095 2,982 32.8% Total expenses 60,087 53,595 6,492 12.1% Income (loss) from operations 15,581 (969) 16,550 1707.9% Change in fair value of warrant liability 334 1,323 (989) (74.8%) Other income 80 - 80 - Income before income taxes 15,995 354 15,641 4418.4% Provision for income taxes 463 1,015 (552) (54.4%) Net income (loss) 15,532 (661) 16,193 2449.8% Less: net income attributable to noncontrolling interest 13,363 (90) 13,453 14947.8% Net income (loss) attributable to OppFi Inc. 2,169$ (571)$ 2,740$ 479.9% Earnings (loss) per share attributable to OppFi Inc. Earnings (loss) per common share: Basic 0.13$ (0.04)$ Diluted 0.13$ (0.04)$ Weighted average common shares outstanding: Basic 16,772,275 13,972,971 Diluted 17,057,778 13,972,971 Three Months Ended September 30, Variance

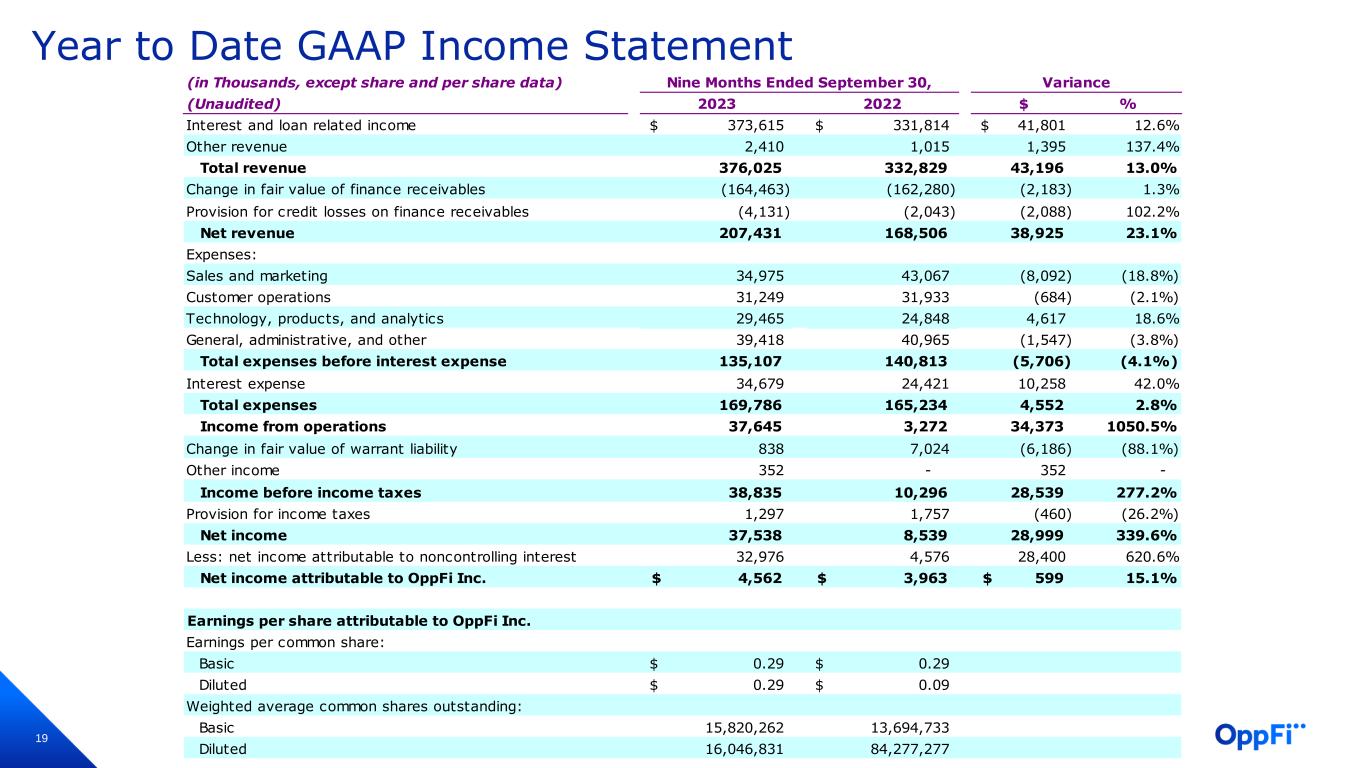

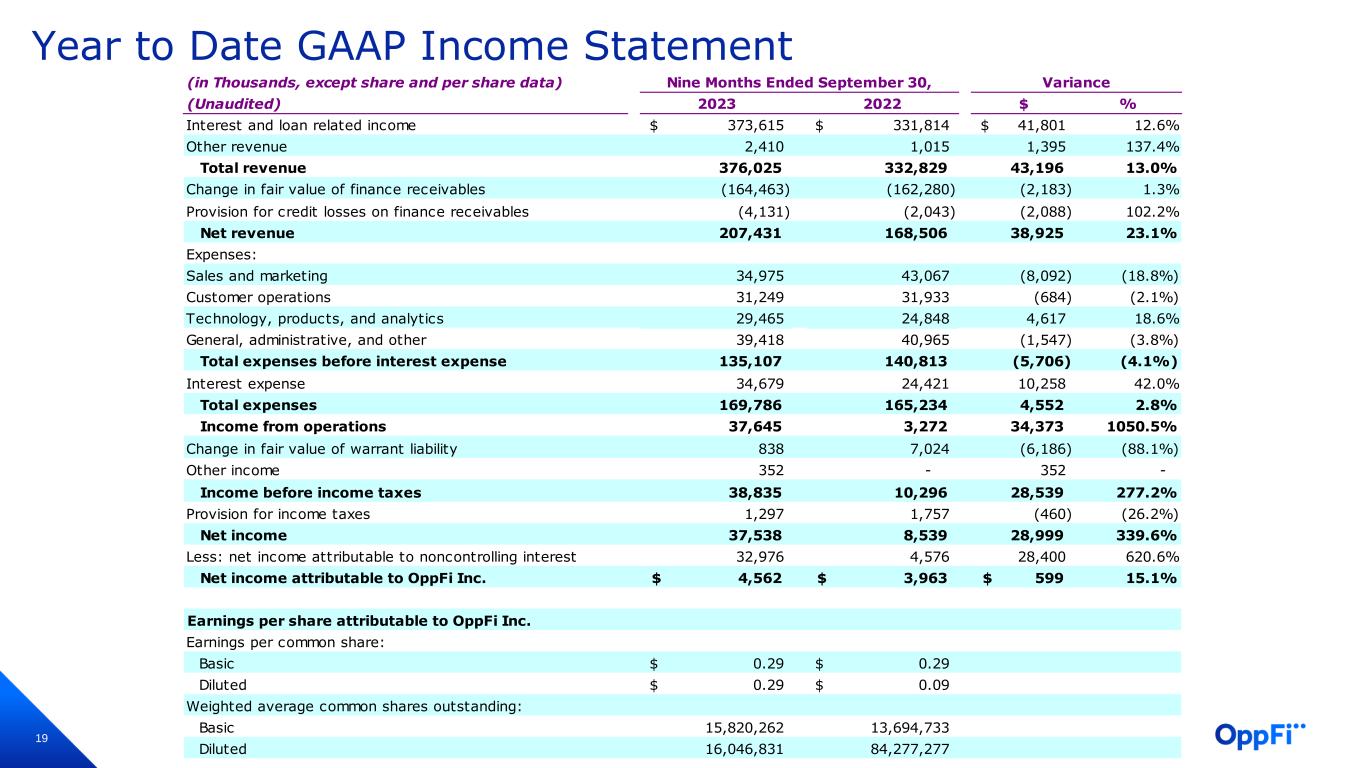

19 Year to Date GAAP Income Statement (in Thousands, except share and per share data) (Unaudited) 2023 2022 $ % Interest and loan related income 373,615$ 331,814$ 41,801$ 12.6% Other revenue 2,410 1,015 1,395 137.4% Total revenue 376,025 332,829 43,196 13.0% Change in fair value of finance receivables (164,463) (162,280) (2,183) 1.3% Provision for credit losses on finance receivables (4,131) (2,043) (2,088) 102.2% Net revenue 207,431 168,506 38,925 23.1% Expenses: Sales and marketing 34,975 43,067 (8,092) (18.8%) Customer operations 31,249 31,933 (684) (2.1%) Technology, products, and analytics 29,465 24,848 4,617 18.6% General, administrative, and other 39,418 40,965 (1,547) (3.8%) Total expenses before interest expense 135,107 140,813 (5,706) (4.1%) Interest expense 34,679 24,421 10,258 42.0% Total expenses 169,786 165,234 4,552 2.8% Income from operations 37,645 3,272 34,373 1050.5% Change in fair value of warrant liability 838 7,024 (6,186) (88.1%) Other income 352 - 352 - Income before income taxes 38,835 10,296 28,539 277.2% Provision for income taxes 1,297 1,757 (460) (26.2%) Net income 37,538 8,539 28,999 339.6% Less: net income attributable to noncontrolling interest 32,976 4,576 28,400 620.6% Net income attributable to OppFi Inc. 4,562$ 3,963$ 599$ 15.1% Earnings per share attributable to OppFi Inc. Earnings per common share: Basic 0.29$ 0.29$ Diluted 0.29$ 0.09$ Weighted average common shares outstanding: Basic 15,820,262 13,694,733 Diluted 16,046,831 84,277,277 Nine Months Ended September 30, Variance

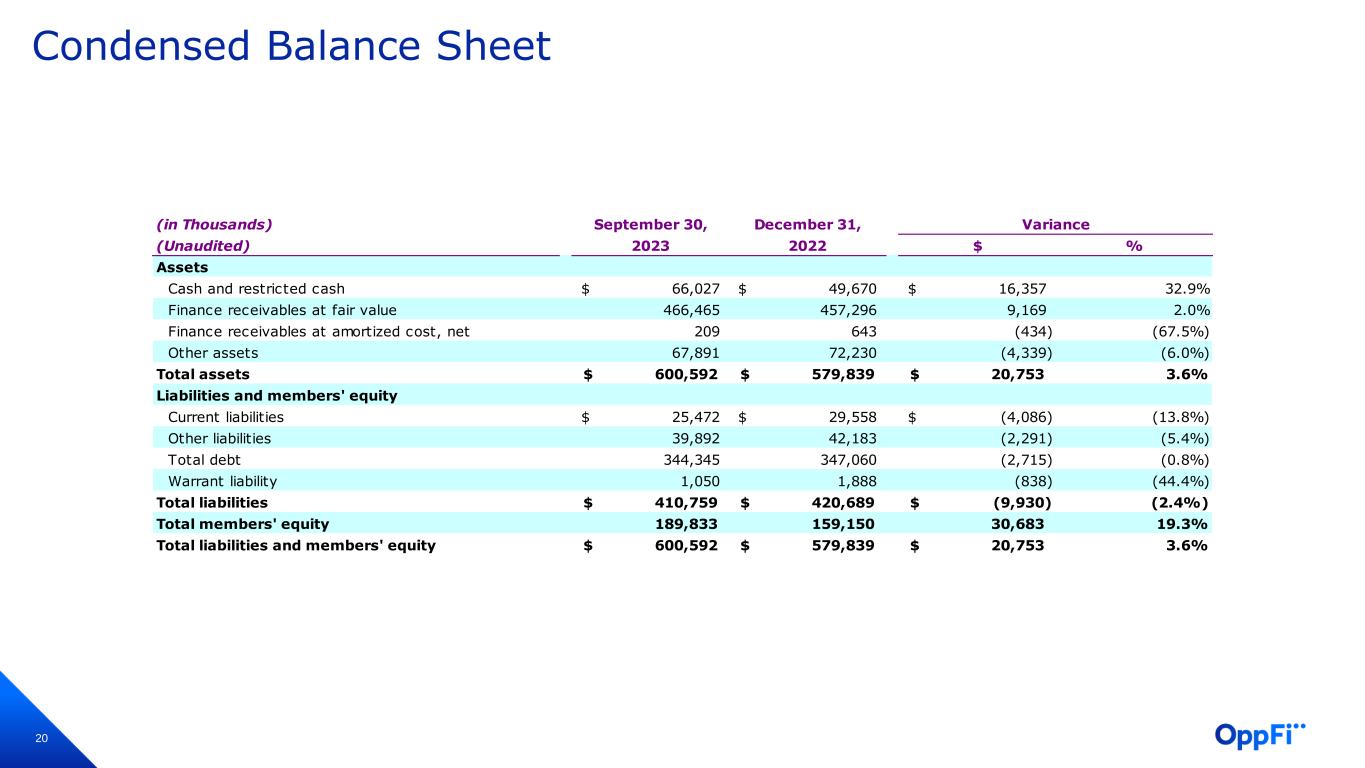

20 Condensed Balance Sheet (in Thousands) September 30, December 31, (Unaudited) 2023 2022 $ % Assets Cash and restricted cash 66,027$ 49,670$ 16,357$ 32.9% Finance receivables at fair value 466,465 457,296 9,169 2.0% Finance receivables at amortized cost, net 209 643 (434) (67.5%) Other assets 67,891 72,230 (4,339) (6.0%) Total assets 600,592$ 579,839$ 20,753$ 3.6% Liabilities and members' equity Current liabilities 25,472$ 29,558$ (4,086)$ (13.8%) Other liabilities 39,892 42,183 (2,291) (5.4%) Total debt 344,345 347,060 (2,715) (0.8%) Warrant liability 1,050 1,888 (838) (44.4%) Total liabilities 410,759$ 420,689$ (9,930)$ (2.4%) Total members' equity 189,833 159,150 30,683 19.3% Total liabilities and members' equity 600,592$ 579,839$ 20,753$ 3.6% Variance

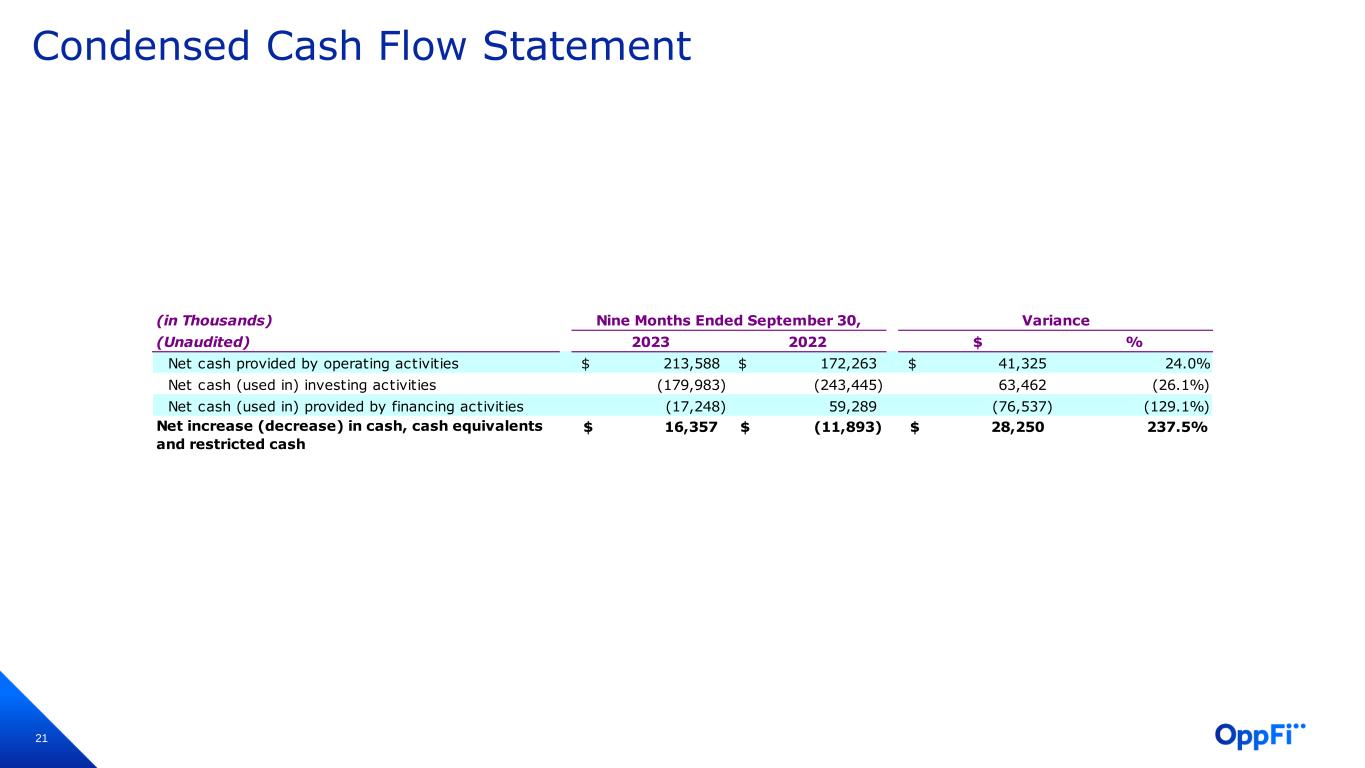

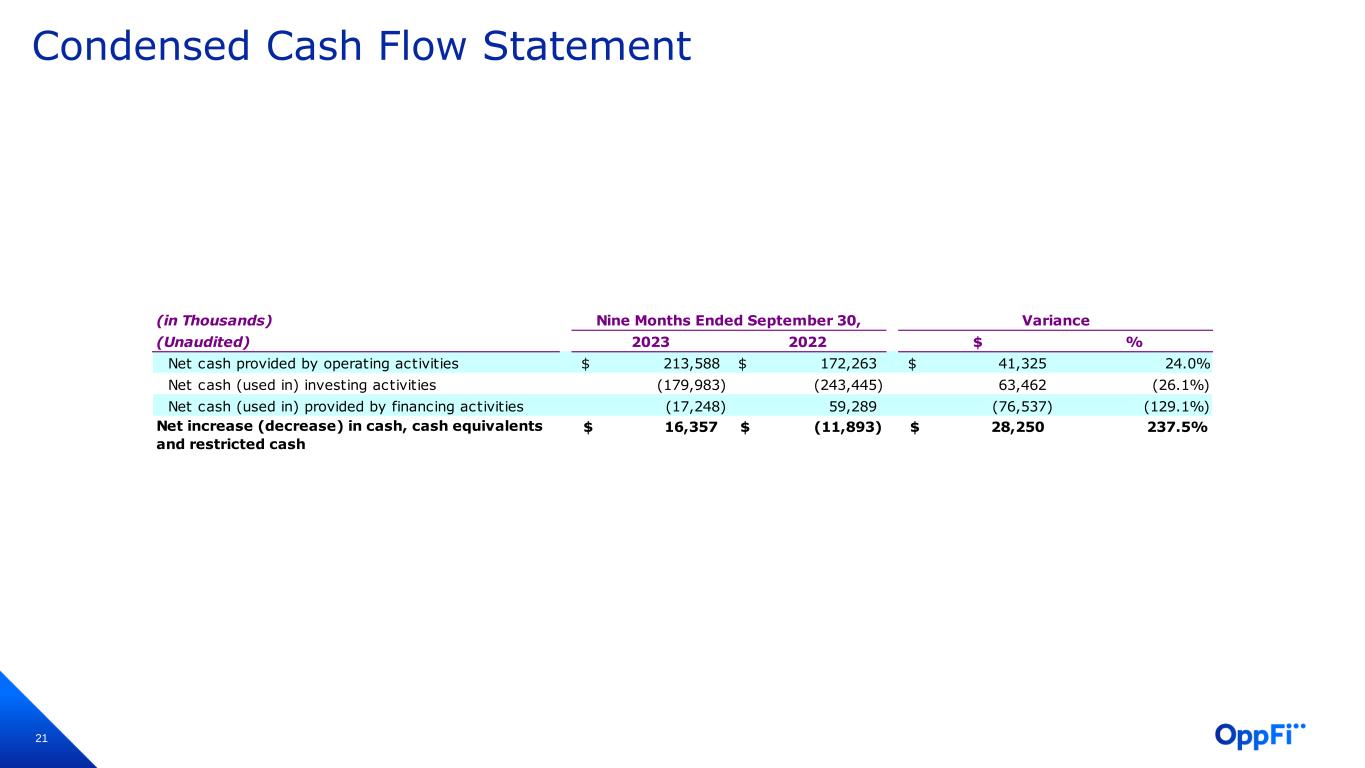

21 Condensed Cash Flow Statement (in Thousands) (Unaudited) 2023 2022 $ % Net cash provided by operating activities 213,588$ 172,263$ 41,325$ 24.0% Net cash (used in) investing activities (179,983) (243,445) 63,462 (26.1%) Net cash (used in) provided by financing activities (17,248) 59,289 (76,537) (129.1%) 16,357$ (11,893)$ 28,250$ 237.5% Variance Net increase (decrease) in cash, cash equivalents and restricted cash Nine Months Ended September 30,

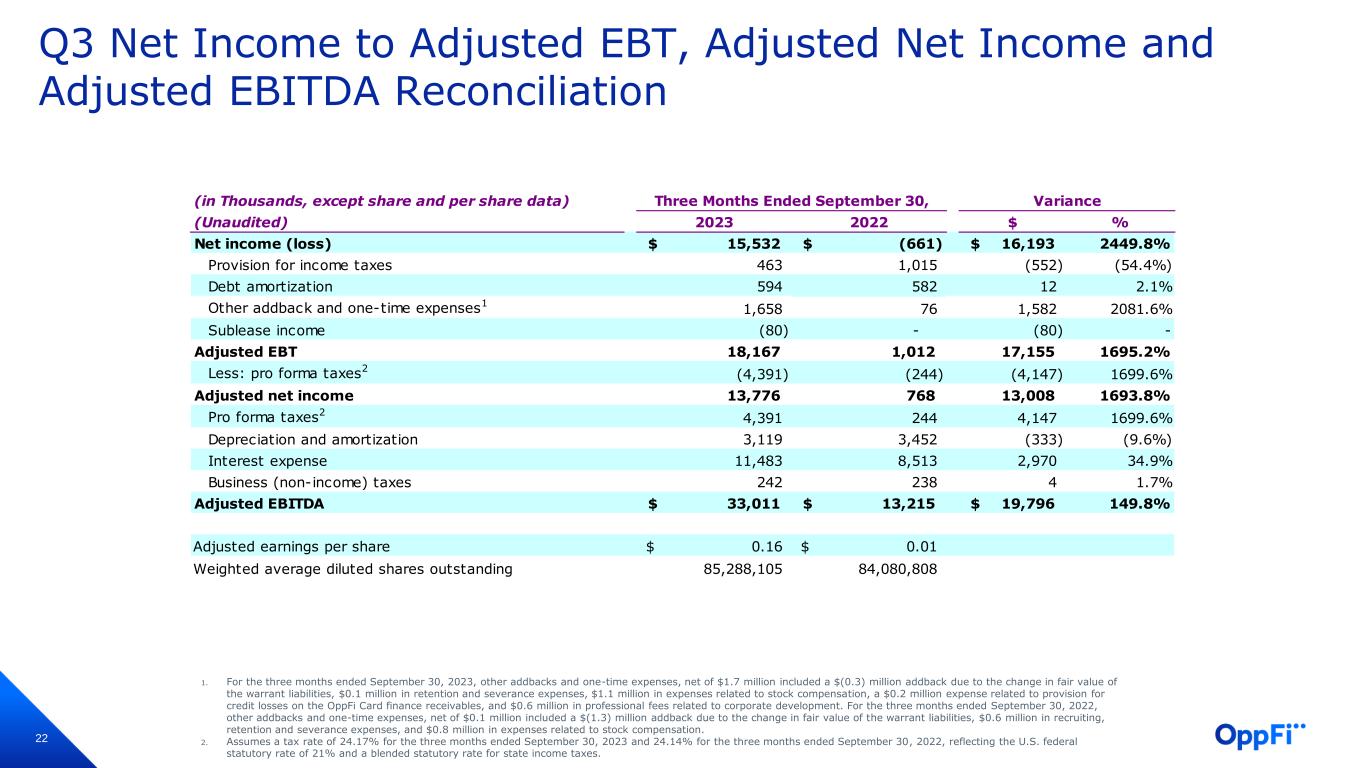

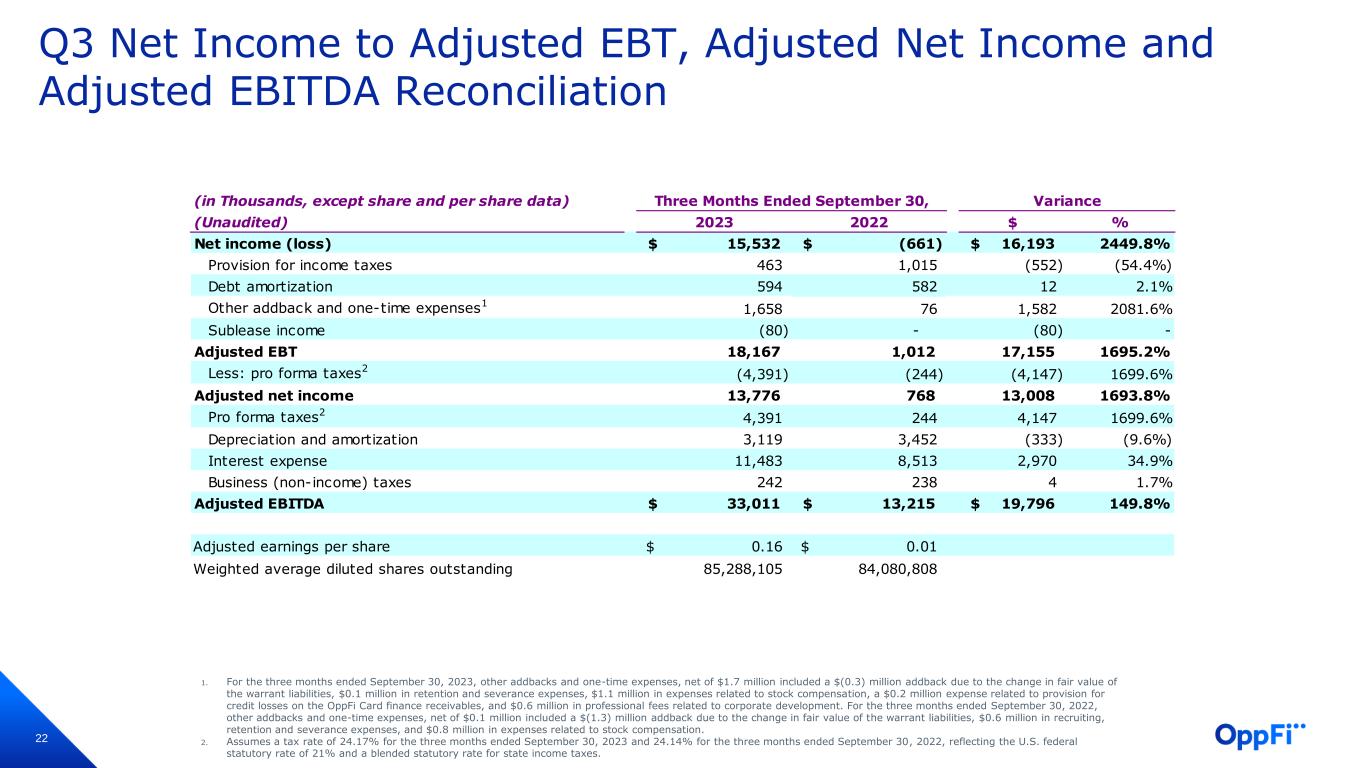

22 Q3 Net Income to Adjusted EBT, Adjusted Net Income and Adjusted EBITDA Reconciliation 1. For the three months ended September 30, 2023, other addbacks and one-time expenses, net of $1.7 million included a $(0.3) million addback due to the change in fair value of the warrant liabilities, $0.1 million in retention and severance expenses, $1.1 million in expenses related to stock compensation, a $0.2 million expense related to provision for credit losses on the OppFi Card finance receivables, and $0.6 million in professional fees related to corporate development. For the three months ended September 30, 2022, other addbacks and one-time expenses, net of $0.1 million included a $(1.3) million addback due to the change in fair value of the warrant liabilities, $0.6 million in recruiting, retention and severance expenses, and $0.8 million in expenses related to stock compensation. 2. Assumes a tax rate of 24.17% for the three months ended September 30, 2023 and 24.14% for the three months ended September 30, 2022, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. (in Thousands, except share and per share data) (Unaudited) 2023 2022 $ % Net income (loss) 15,532$ (661)$ 16,193$ 2449.8% Provision for income taxes 463 1,015 (552) (54.4%) Debt amortization 594 582 12 2.1% Other addback and one-time expenses1 1,658 76 1,582 2081.6% Sublease income (80) - (80) - Adjusted EBT 18,167 1,012 17,155 1695.2% Less: pro forma taxes2 (4,391) (244) (4,147) 1699.6% Adjusted net income 13,776 768 13,008 1693.8% Pro forma taxes2 4,391 244 4,147 1699.6% Depreciation and amortization 3,119 3,452 (333) (9.6%) Interest expense 11,483 8,513 2,970 34.9% Business (non-income) taxes 242 238 4 1.7% Adjusted EBITDA 33,011$ 13,215$ 19,796$ 149.8% Adjusted earnings per share 0.16$ 0.01$ Weighted average diluted shares outstanding 85,288,105 84,080,808 VarianceThree Months Ended September 30,

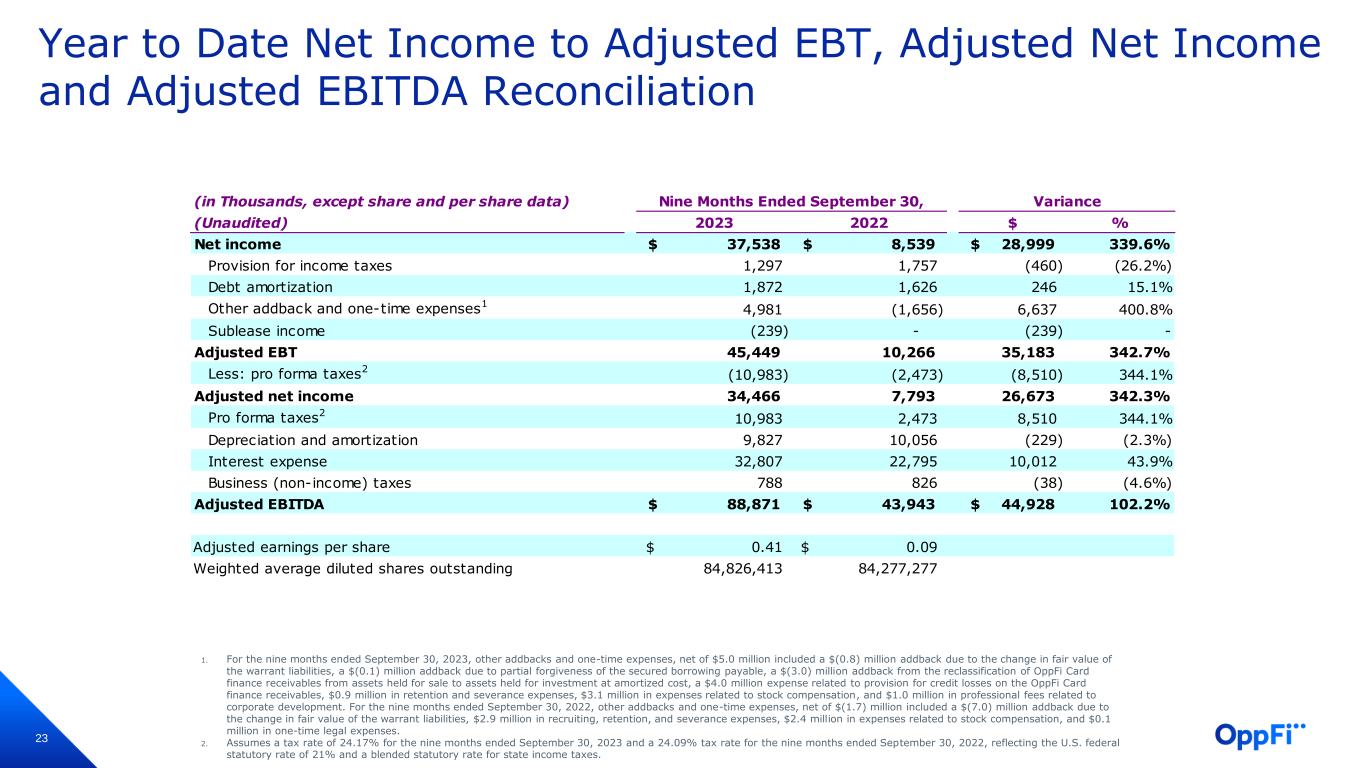

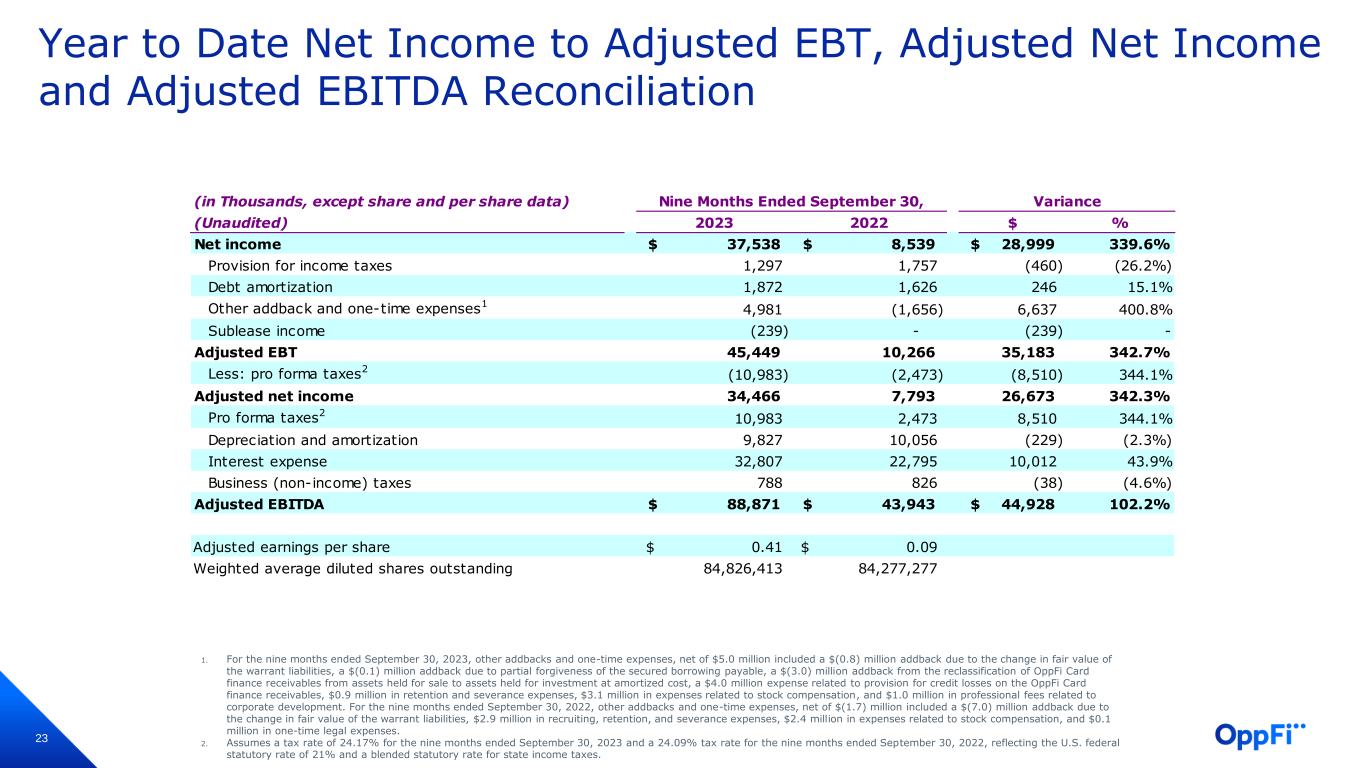

23 Year to Date Net Income to Adjusted EBT, Adjusted Net Income and Adjusted EBITDA Reconciliation 1. For the nine months ended September 30, 2023, other addbacks and one-time expenses, net of $5.0 million included a $(0.8) million addback due to the change in fair value of the warrant liabilities, a $(0.1) million addback due to partial forgiveness of the secured borrowing payable, a $(3.0) million addback from the reclassification of OppFi Card finance receivables from assets held for sale to assets held for investment at amortized cost, a $4.0 million expense related to provision for credit losses on the OppFi Card finance receivables, $0.9 million in retention and severance expenses, $3.1 million in expenses related to stock compensation, and $1.0 million in professional fees related to corporate development. For the nine months ended September 30, 2022, other addbacks and one-time expenses, net of $(1.7) million included a $(7.0) million addback due to the change in fair value of the warrant liabilities, $2.9 million in recruiting, retention, and severance expenses, $2.4 million in expenses related to stock compensation, and $0.1 million in one-time legal expenses. 2. Assumes a tax rate of 24.17% for the nine months ended September 30, 2023 and a 24.09% tax rate for the nine months ended September 30, 2022, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. (in Thousands, except share and per share data) (Unaudited) 2023 2022 $ % Net income 37,538$ 8,539$ 28,999$ 339.6% Provision for income taxes 1,297 1,757 (460) (26.2%) Debt amortization 1,872 1,626 246 15.1% Other addback and one-time expenses1 4,981 (1,656) 6,637 400.8% Sublease income (239) - (239) - Adjusted EBT 45,449 10,266 35,183 342.7% Less: pro forma taxes2 (10,983) (2,473) (8,510) 344.1% Adjusted net income 34,466 7,793 26,673 342.3% Pro forma taxes2 10,983 2,473 8,510 344.1% Depreciation and amortization 9,827 10,056 (229) (2.3%) Interest expense 32,807 22,795 10,012 43.9% Business (non-income) taxes 788 826 (38) (4.6%) Adjusted EBITDA 88,871$ 43,943$ 44,928$ 102.2% Adjusted earnings per share 0.41$ 0.09$ Weighted average diluted shares outstanding 84,826,413 84,277,277 Nine Months Ended September 30, Variance

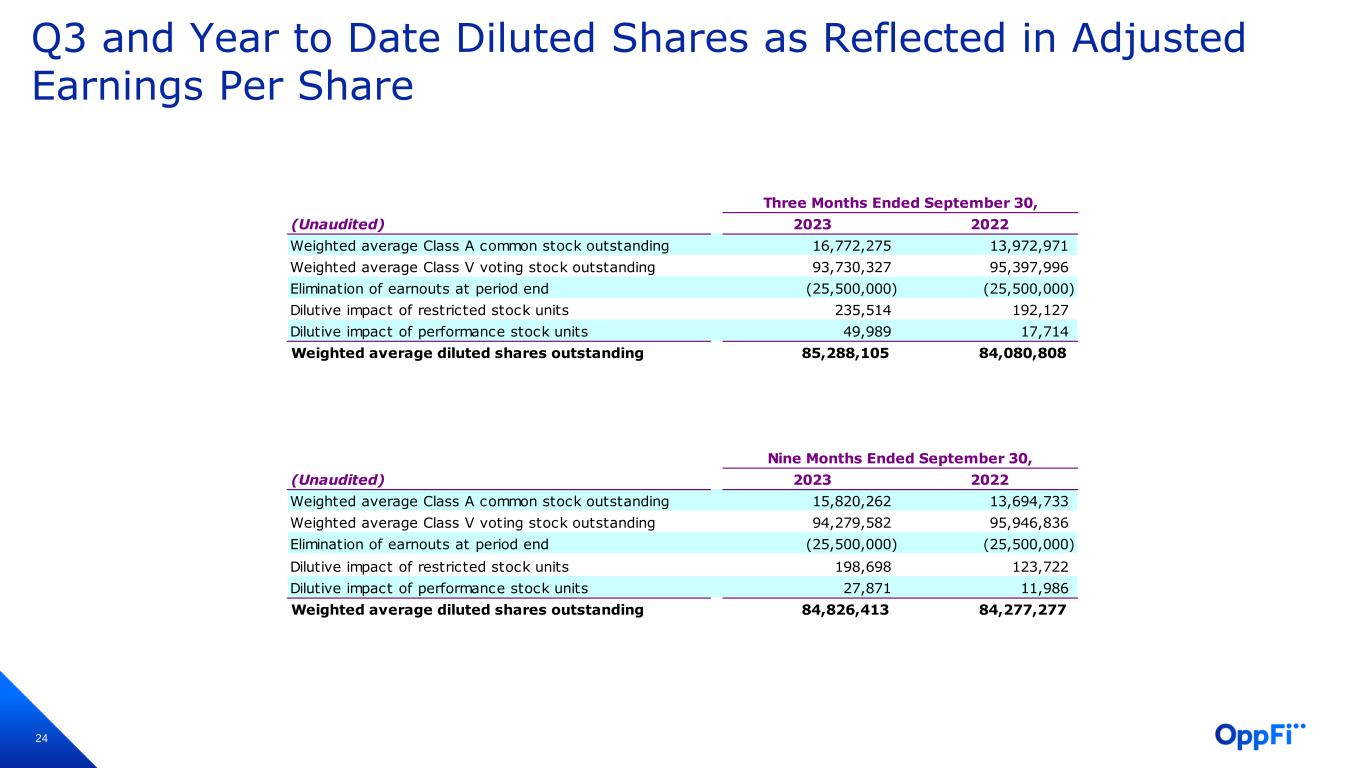

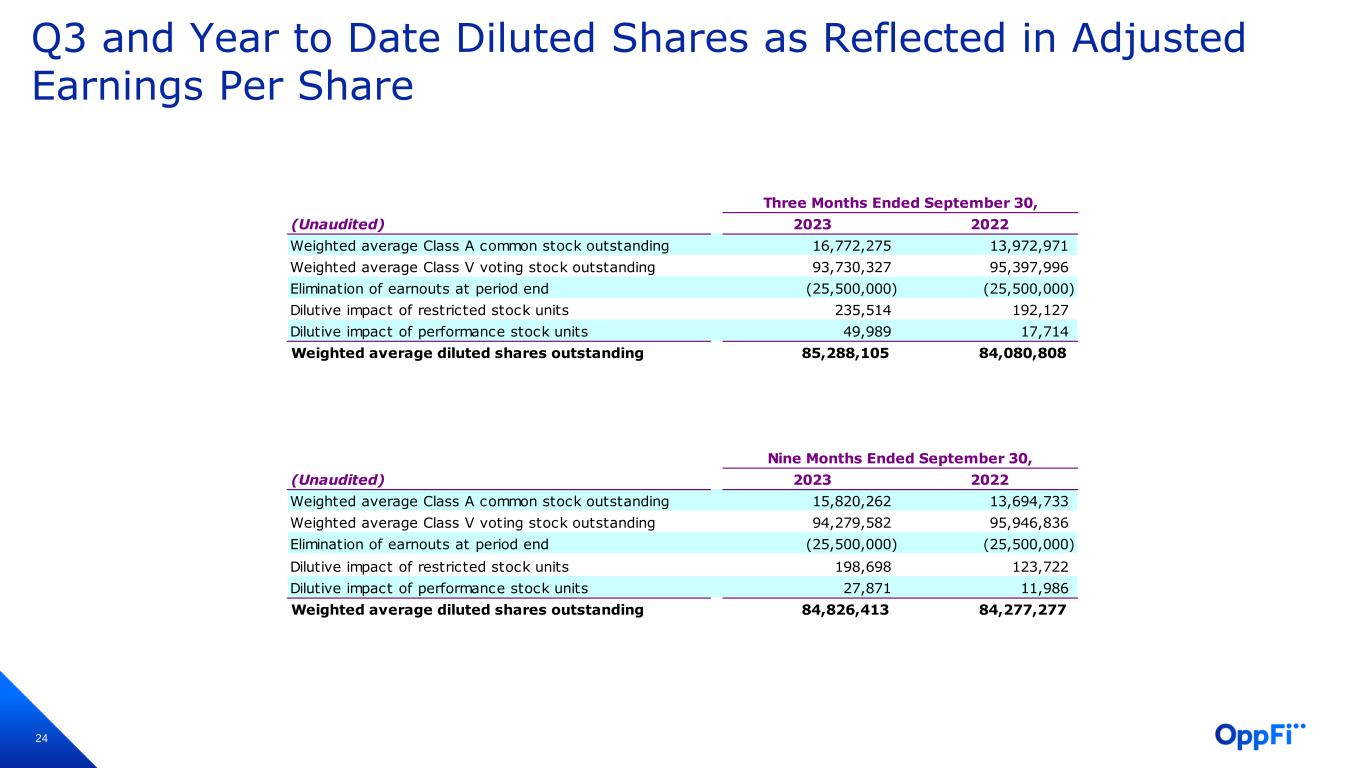

24 Q3 and Year to Date Diluted Shares as Reflected in Adjusted Earnings Per Share (Unaudited) 2023 2022 Weighted average Class A common stock outstanding 16,772,275 13,972,971 Weighted average Class V voting stock outstanding 93,730,327 95,397,996 Elimination of earnouts at period end (25,500,000) (25,500,000) Dilutive impact of restricted stock units 235,514 192,127 Dilutive impact of performance stock units 49,989 17,714 Weighted average diluted shares outstanding 85,288,105 84,080,808 Three Months Ended September 30, (Unaudited) 2023 2022 Weighted average Class A common stock outstanding 15,820,262 13,694,733 Weighted average Class V voting stock outstanding 94,279,582 95,946,836 Elimination of earnouts at period end (25,500,000) (25,500,000) Dilutive impact of restricted stock units 198,698 123,722 Dilutive impact of performance stock units 27,871 11,986 Weighted average diluted shares outstanding 84,826,413 84,277,277 Nine Months Ended September 30,

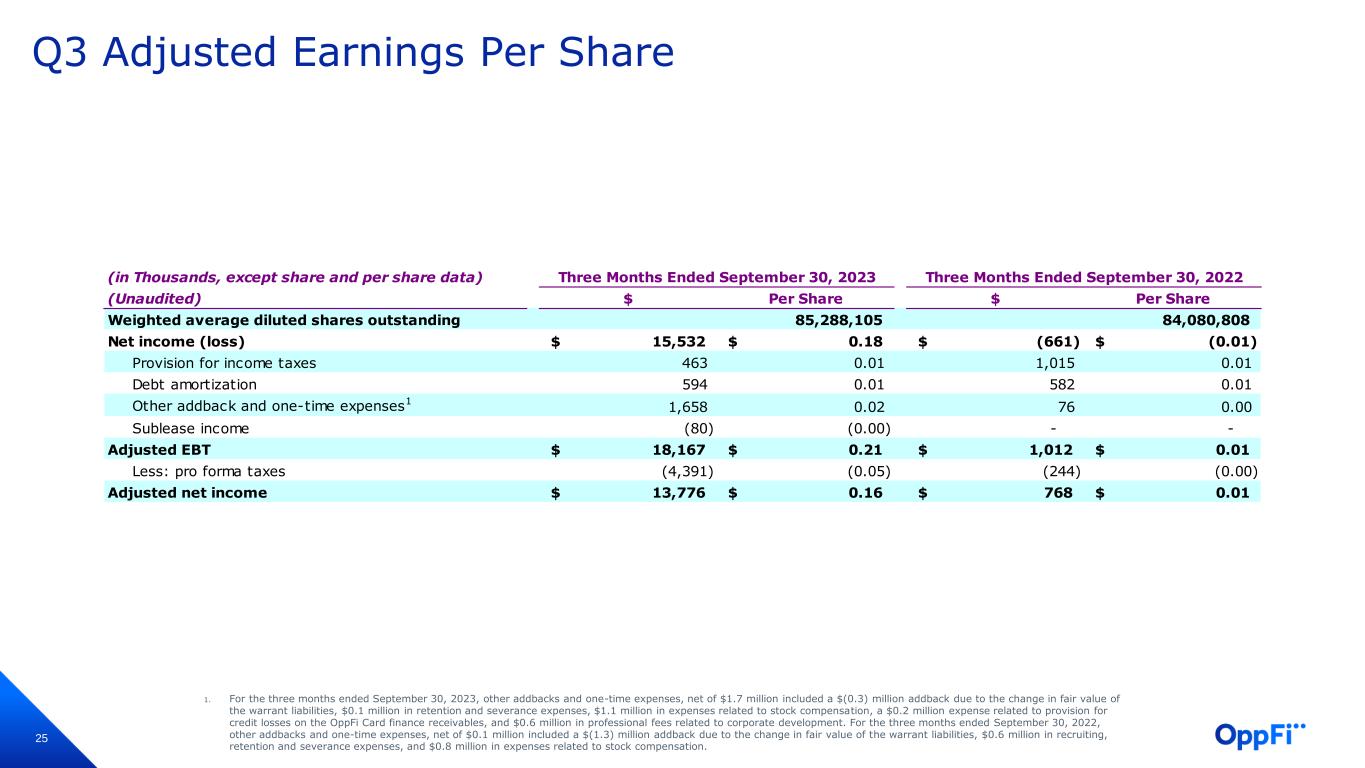

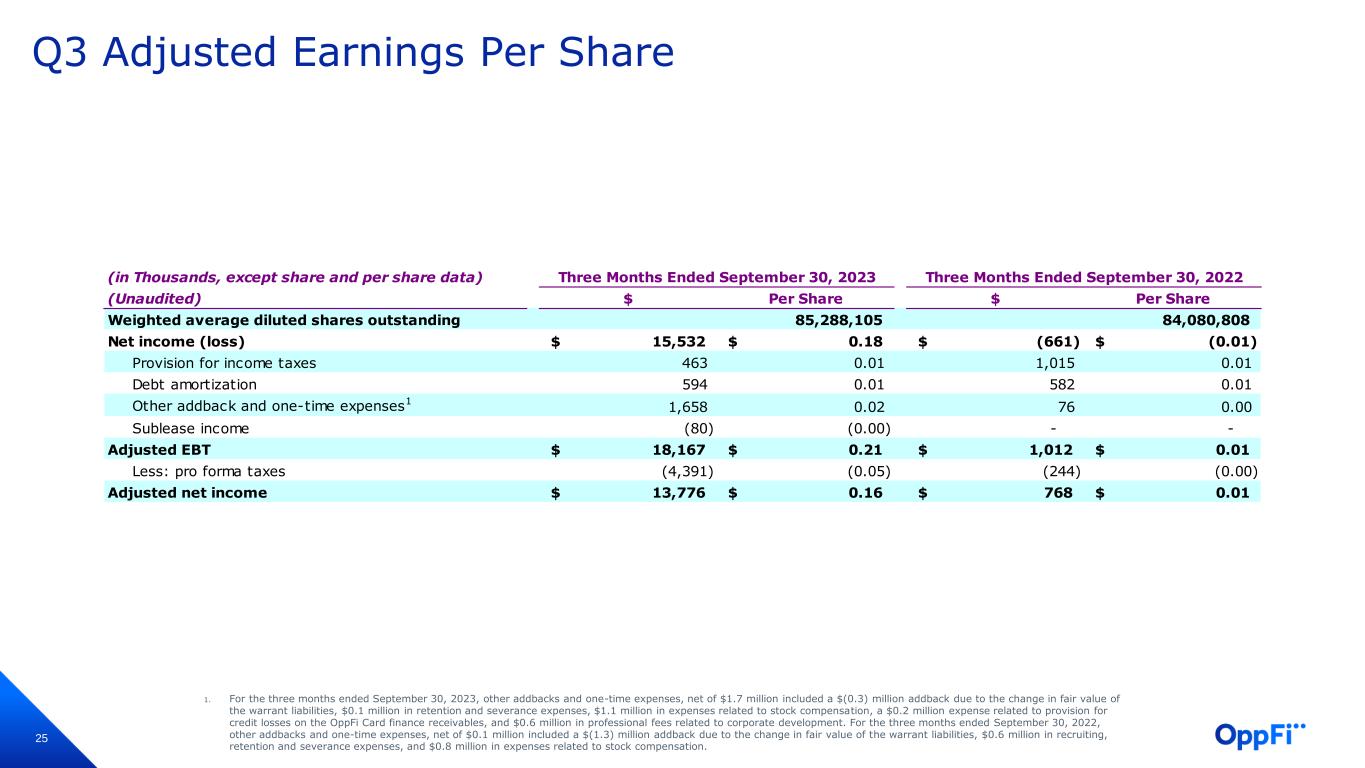

25 Q3 Adjusted Earnings Per Share 1. For the three months ended September 30, 2023, other addbacks and one-time expenses, net of $1.7 million included a $(0.3) million addback due to the change in fair value of the warrant liabilities, $0.1 million in retention and severance expenses, $1.1 million in expenses related to stock compensation, a $0.2 million expense related to provision for credit losses on the OppFi Card finance receivables, and $0.6 million in professional fees related to corporate development. For the three months ended September 30, 2022, other addbacks and one-time expenses, net of $0.1 million included a $(1.3) million addback due to the change in fair value of the warrant liabilities, $0.6 million in recruiting, retention and severance expenses, and $0.8 million in expenses related to stock compensation. (in Thousands, except share and per share data) (Unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 85,288,105 84,080,808 Net income (loss) 15,532$ 0.18$ (661)$ (0.01)$ Provision for income taxes 463 0.01 1,015 0.01 Debt amortization 594 0.01 582 0.01 Other addback and one-time expenses1 1,658 0.02 76 0.00 Sublease income (80) (0.00) - - Adjusted EBT 18,167$ 0.21$ 1,012$ 0.01$ Less: pro forma taxes (4,391) (0.05) (244) (0.00) Adjusted net income 13,776$ 0.16$ 768$ 0.01$ Three Months Ended September 30, 2022Three Months Ended September 30, 2023

26 Year to Date Adjusted Earnings Per Share 1. For the nine months ended September 30, 2023, other addbacks and one-time expenses, net of $5.0 million included a $(0.8) million addback due to the change in fair value of the warrant liabilities, a $(0.1) million addback due to partial forgiveness of the secured borrowing payable, a $(3.0) million addback from the reclassification of OppFi Card finance receivables from assets held for sale to assets held for investment at amortized cost, a $4.0 million expense related to provision for credit losses on the OppFi Card finance receivables, $0.9 million in retention and severance expenses, $3.1 million in expenses related to stock compensation, and $1.0 million in professional fees related to corporate development. For the nine months ended September 30, 2022, other addbacks and one-time expenses, net of $(1.7) million included a $(7.0) million addback due to the change in fair value of the warrant liabilities, $2.9 million in recruiting, retention, and severance expenses, $2.4 million in expenses related to stock compensation, and $0.1 million in one-time legal expenses. (in Thousands, except share and per share data) (Unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 84,826,413 84,277,277 Net income 37,538$ 0.44$ 8,539$ 0.10$ Provision for income taxes 1,297 0.02 1,757 0.02 Debt amortization 1,872 0.02 1,626 0.02 Other addback and one-time expenses1 4,981 0.06 (1,656) (0.02) Sublease income (239) (0.00) - - Adjusted EBT 45,449$ 0.54$ 10,266$ 0.12$ Less: pro forma taxes (10,983) (0.13) (2,473) (0.03) Adjusted net income 34,466$ 0.41$ 7,793$ 0.09$ Nine Months Ended September 30, 2023 Nine Months Ended September 30, 2022