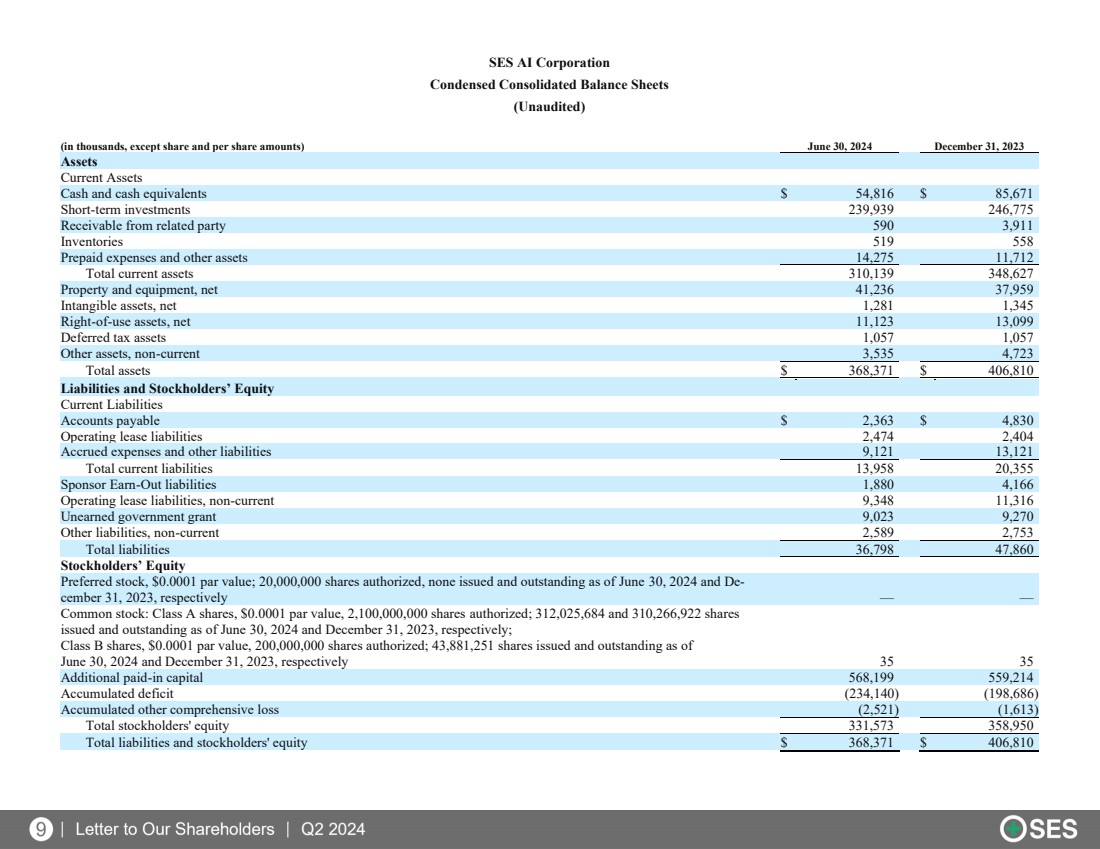

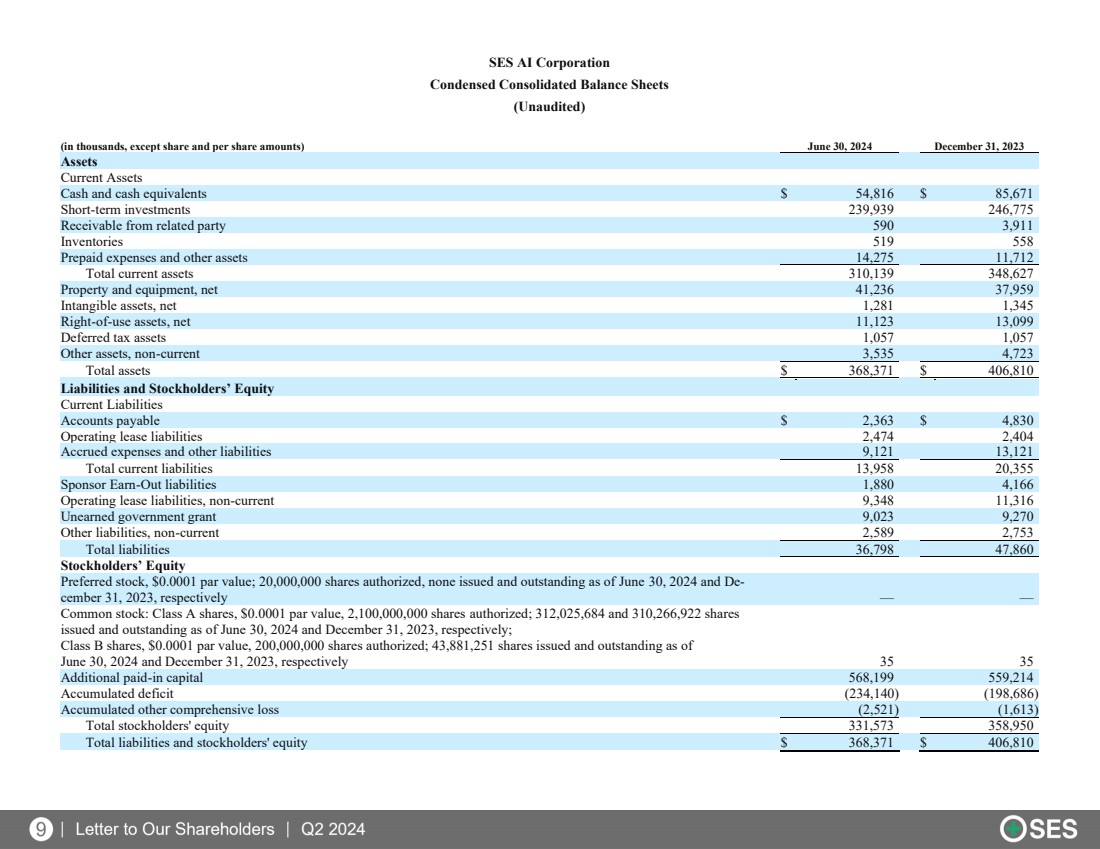

| SES AI Corporation Condensed Consolidated Balance Sheets (Unaudited) (in thousands, except share and per share amounts) June 30, 2024 December 31, 2023 Assets Current Assets Cash and cash equivalents $ 54,816 $ 85,671 Short-term investments 239,939 246,775 Receivable from related party 590 3,911 Inventories 519 558 Prepaid expenses and other assets 14,275 11,712 Total current assets 310,139 348,627 Property and equipment, net 41,236 37,959 Intangible assets, net 1,281 1,345 Right-of-use assets, net 11,123 13,099 Deferred tax assets 1,057 1,057 Other assets, non-current 3,535 4,723 Total assets $ 368,371 $ 406,810 Liabilities and Stockholders’ Equity Current Liabilities Accounts payable $ 2,363 $ 4,830 Operating lease liabilities 2,474 2,404 Accrued expenses and other liabilities 9,121 13,121 Total current liabilities 13,958 20,355 Sponsor Earn-Out liabilities 1,880 4,166 Operating lease liabilities, non-current 9,348 11,316 Unearned government grant 9,023 9,270 Other liabilities, non-current 2,589 2,753 Total liabilities 36,798 47,860 Stockholders’ Equity Preferred stock, $0.0001 par value; 20,000,000 shares authorized, none issued and outstanding as of June 30, 2024 and De-cember 31, 2023, respectively — — Common stock: Class A shares, $0.0001 par value, 2,100,000,000 shares authorized; 312,025,684 and 310,266,922 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively; Class B shares, $0.0001 par value, 200,000,000 shares authorized; 43,881,251 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively 35 35 Additional paid-in capital 568,199 559,214 Accumulated deficit (234,140) (198,686) Accumulated other comprehensive loss (2,521) (1,613) Total stockholders' equity 331,573 358,950 Total liabilities and stockholders' equity $ 368,371 $ 406,810 |