Exhibit 99.1 EVBox Group Investor Presentation January 2021Exhibit 99.1 EVBox Group Investor Presentation January 2021

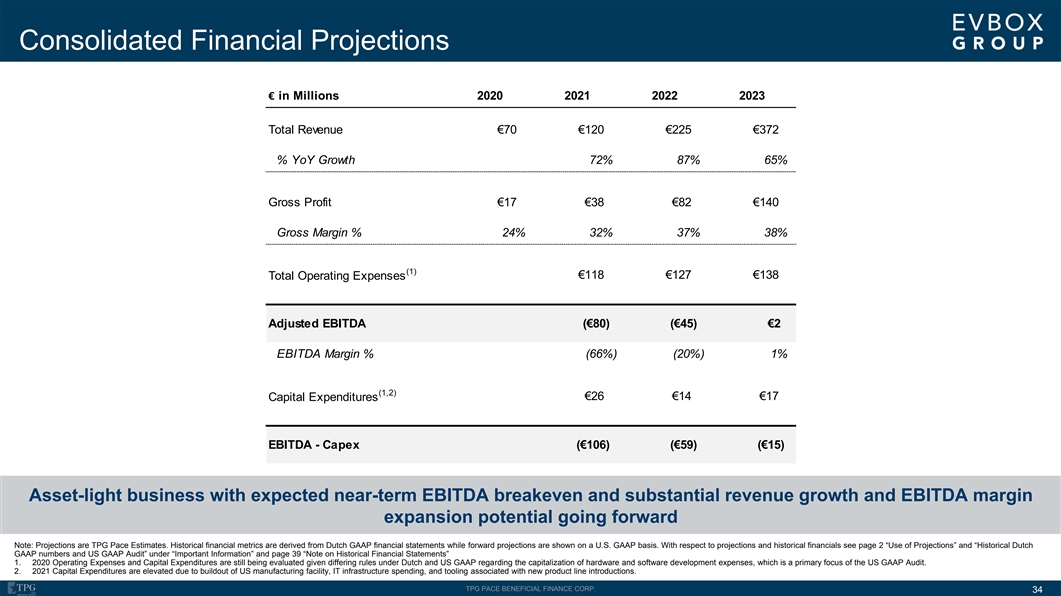

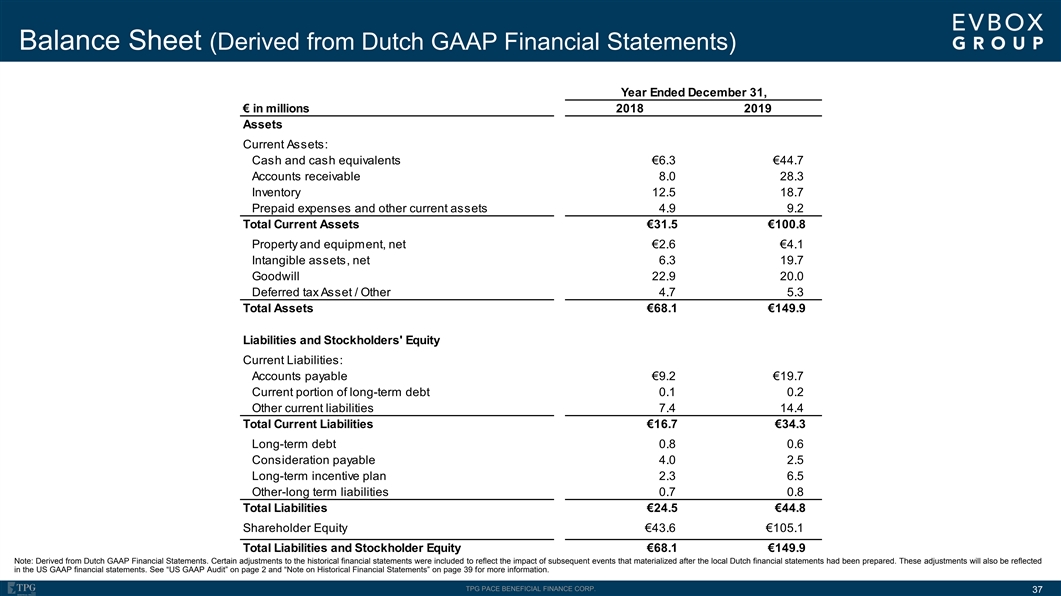

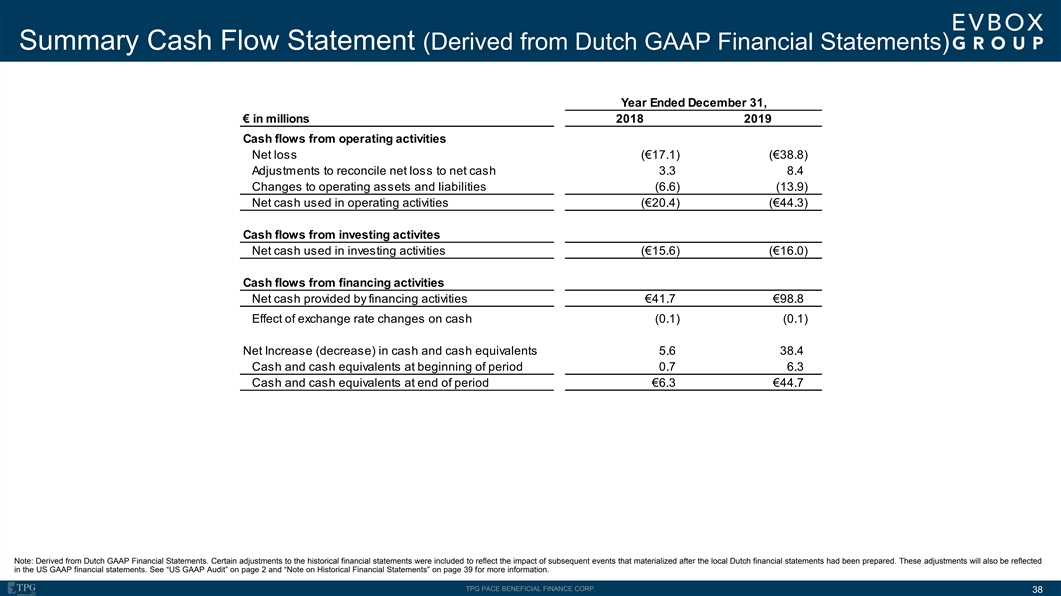

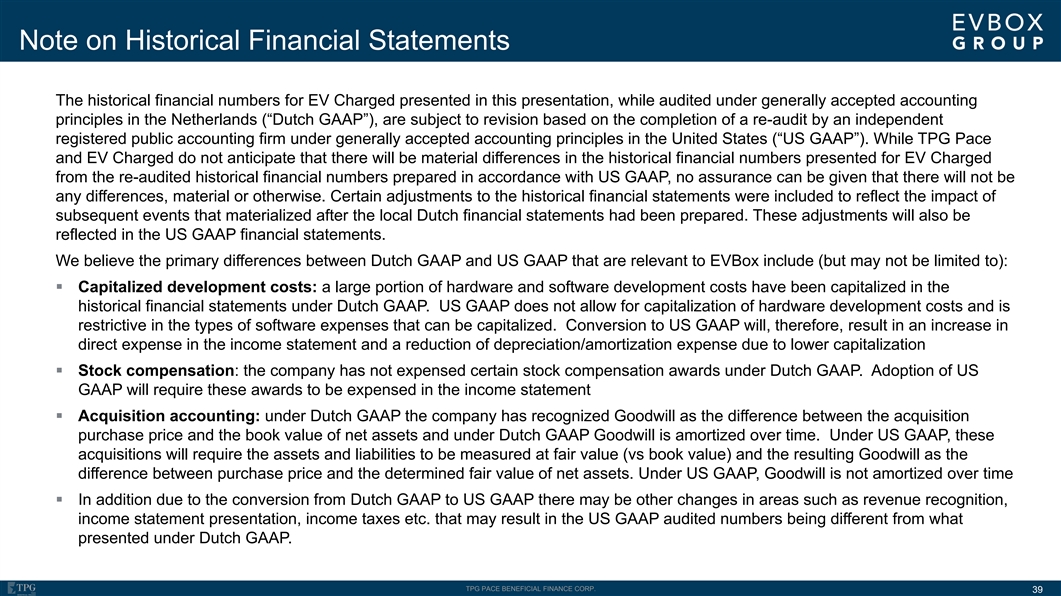

Important Information Use of Projections This presentation contains financial forecasts prepared by TPG Pace Beneficial Finance Corp. (“TPG Pace”) with respect to certain financial metrics of EV Charged B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) (“EV Charged”), including, but not limited to, revenues, gross profit, gross margin, adjusted gross margin, operating expenses, EBITDA, and capital expenditures. Neither TPG Pace’s independent auditors, nor the independent registered public accounting firm of EV Charged, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. The financial forecasts and projections in this presentation were prepared by TPG Pace and not by the management of EV Charged, and these financial forecasts and projections should not be relied upon as being necessarily indicative of future results. Neither TPG Pace nor EV Charged undertakes any commitment to update or revise the projections, whether as a result of new information, future events, or otherwise. Further the financial forecasts have been prepared on a US GAAP basis whereas historical numbers included throughout this presentation are prepared on a Dutch GAAP basis, and are subject to a US GAAP re-audit described below. In this presentation, certain of the above-mentioned projected information has been repeated (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective forecasts are indicative of the future performance of TPG Pace, EV Charged or the combined company after completion of any proposed business combination or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Historical Dutch GAAP numbers and US GAAP Audit The historical financial numbers for EV Charged presented in this presentation, while audited under generally accepted accounting principles in the Netherlands (“Dutch GAAP”), are subject to revision based on the completion of a re- audit by an independent registered public accounting firm under generally accepted accounting principles in the United States (“US GAAP”). Certain adjustments to the historical financial statements were included to reflect the impact of subsequent events that materialized after the local Dutch financial statements had been prepared. These adjustments will also be reflected in the US GAAP financial statements. No assurances can be given that there will not be material differences in the historical financial numbers presented for EV Charged from the re-audited historical financial numbers prepared in accordance with US GAAP, no assurance can be given that there will not be any differences, material or otherwise. See slide 39 “Note on Historical Financial Statements” for a summary of the key differences between Dutch GAAP and US GAAP. Forward-Looking Statements The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included herein, regarding the proposed merger of TPG Pace into New TPG Pace Beneficial Finance Corp., an exempted company incorporated in the Cayman Islands with limited liability under company number 368739 (“New SPAC”) and the proposed acquisition of the common shares of EV Charged by Edison Holdco B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) (“Dutch Holdco”), Dutch Holdco’s and TPG Pace’s ability to consummate the transaction, the benefits of the transaction and Dutch Holdco’s future financial performance following the transaction, as well as Dutch Holdco’s and TPG Pace’s strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used herein, including any oral statements made in connection herewith, the words “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Dutch Holdco and TPG Pace disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Dutch Holdco and TPG Pace caution you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Dutch Holdco and TPG Pace. These risks include, but are not limited to, (1) the inability to complete the transactions contemplated by the proposed business combination; (2) the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, and the ability of the combined business to grow and manage growth profitably; (3) risks related to the rollout of EV Charged’s business and expansion strategy; (4) consumer failure to accept and adopt electric vehicles; (5) overall demand for electric vehicle charging and the potential for reduced demand if governmental rebates, tax credits and other financial incentives are reduced, modified or eliminated; (6) the possibility that EV Charged’s technology and products could have undetected defects or errors; (7) the effects of competition on EV Charged’s future business; (8) the inability to successfully retain or recruit officers, key employees, or directors following the proposed business combination; (9) effects on TPG Pace’s public securities’ liquidity and trading; (10) the market’s reaction to the proposed business combination; (11) the lack of a market for TPG Pace’s securities; (12) TPG Pace’s and EV Charged’s financial performance following the proposed business combination; (13) costs related to the proposed business combination; (14) changes in applicable laws or regulations; (15) the possibility that the novel coronavirus (“COVID-19”) may hinder TPG Pace’s ability to consummate the business combination; (16) the possibility that COVID-19 may adversely affect the results of operations, financial position and cash flows of TPG Pace, Dutch Holdco or EV Charged; (17) the possibility that TPG Pace or EV Charged may be adversely affected by other economic, business, and/or competitive factors; and (18) other risks and uncertainties indicated from time to time in documents filed or to be filed with the SEC by TPG Pace. Should one or more of the risks or uncertainties described herein and in any oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Dutch Holdco’s and TPG Pace’s expectations and projections can be found in TPG Pace’s initial public offering prospectus, which was filed with the SEC on October 8, 2020. In addition, TPG Pace’s periodic reports and other SEC filings are available publicly on the SEC’s website at http://www.sec.gov. TPG PACE BENEFICIAL FINANCE CORP. 2Important Information Use of Projections This presentation contains financial forecasts prepared by TPG Pace Beneficial Finance Corp. (“TPG Pace”) with respect to certain financial metrics of EV Charged B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) (“EV Charged”), including, but not limited to, revenues, gross profit, gross margin, adjusted gross margin, operating expenses, EBITDA, and capital expenditures. Neither TPG Pace’s independent auditors, nor the independent registered public accounting firm of EV Charged, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. The financial forecasts and projections in this presentation were prepared by TPG Pace and not by the management of EV Charged, and these financial forecasts and projections should not be relied upon as being necessarily indicative of future results. Neither TPG Pace nor EV Charged undertakes any commitment to update or revise the projections, whether as a result of new information, future events, or otherwise. Further the financial forecasts have been prepared on a US GAAP basis whereas historical numbers included throughout this presentation are prepared on a Dutch GAAP basis, and are subject to a US GAAP re-audit described below. In this presentation, certain of the above-mentioned projected information has been repeated (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective forecasts are indicative of the future performance of TPG Pace, EV Charged or the combined company after completion of any proposed business combination or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Historical Dutch GAAP numbers and US GAAP Audit The historical financial numbers for EV Charged presented in this presentation, while audited under generally accepted accounting principles in the Netherlands (“Dutch GAAP”), are subject to revision based on the completion of a re- audit by an independent registered public accounting firm under generally accepted accounting principles in the United States (“US GAAP”). Certain adjustments to the historical financial statements were included to reflect the impact of subsequent events that materialized after the local Dutch financial statements had been prepared. These adjustments will also be reflected in the US GAAP financial statements. No assurances can be given that there will not be material differences in the historical financial numbers presented for EV Charged from the re-audited historical financial numbers prepared in accordance with US GAAP, no assurance can be given that there will not be any differences, material or otherwise. See slide 39 “Note on Historical Financial Statements” for a summary of the key differences between Dutch GAAP and US GAAP. Forward-Looking Statements The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included herein, regarding the proposed merger of TPG Pace into New TPG Pace Beneficial Finance Corp., an exempted company incorporated in the Cayman Islands with limited liability under company number 368739 (“New SPAC”) and the proposed acquisition of the common shares of EV Charged by Edison Holdco B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) (“Dutch Holdco”), Dutch Holdco’s and TPG Pace’s ability to consummate the transaction, the benefits of the transaction and Dutch Holdco’s future financial performance following the transaction, as well as Dutch Holdco’s and TPG Pace’s strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used herein, including any oral statements made in connection herewith, the words “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Dutch Holdco and TPG Pace disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Dutch Holdco and TPG Pace caution you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Dutch Holdco and TPG Pace. These risks include, but are not limited to, (1) the inability to complete the transactions contemplated by the proposed business combination; (2) the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, and the ability of the combined business to grow and manage growth profitably; (3) risks related to the rollout of EV Charged’s business and expansion strategy; (4) consumer failure to accept and adopt electric vehicles; (5) overall demand for electric vehicle charging and the potential for reduced demand if governmental rebates, tax credits and other financial incentives are reduced, modified or eliminated; (6) the possibility that EV Charged’s technology and products could have undetected defects or errors; (7) the effects of competition on EV Charged’s future business; (8) the inability to successfully retain or recruit officers, key employees, or directors following the proposed business combination; (9) effects on TPG Pace’s public securities’ liquidity and trading; (10) the market’s reaction to the proposed business combination; (11) the lack of a market for TPG Pace’s securities; (12) TPG Pace’s and EV Charged’s financial performance following the proposed business combination; (13) costs related to the proposed business combination; (14) changes in applicable laws or regulations; (15) the possibility that the novel coronavirus (“COVID-19”) may hinder TPG Pace’s ability to consummate the business combination; (16) the possibility that COVID-19 may adversely affect the results of operations, financial position and cash flows of TPG Pace, Dutch Holdco or EV Charged; (17) the possibility that TPG Pace or EV Charged may be adversely affected by other economic, business, and/or competitive factors; and (18) other risks and uncertainties indicated from time to time in documents filed or to be filed with the SEC by TPG Pace. Should one or more of the risks or uncertainties described herein and in any oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Dutch Holdco’s and TPG Pace’s expectations and projections can be found in TPG Pace’s initial public offering prospectus, which was filed with the SEC on October 8, 2020. In addition, TPG Pace’s periodic reports and other SEC filings are available publicly on the SEC’s website at http://www.sec.gov. TPG PACE BENEFICIAL FINANCE CORP. 2

Important Information (Continued) Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including EBITDA and adjusted gross margin. EBITDA is calculated as Revenue less cost of goods sold, and operating expenses. Adjusted gross margin is calculated as gross profit plus inventory write downs divided by revenue. Management believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to EV Charged’s financial condition and results of operations. TPG Pace believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. Other companies may calculate non-GAAP measures differently, and therefore the non-GAAP measures of EV Charged included in this presentation may not be directly comparable to similarly titled measures of other companies. Industry and Market Data; Trademarks and Trade Names Information and opinions in this presentation rely on and refer to information and statistics regarding the sectors in which EV Charged competes and other industry data. TPG Pace obtained this information and statistics from third-party sources, including reports by market research firms. TPG Pace and EV Charged have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness. TPG Pace and EV Charged have supplemented this information where necessary with information from EV Charged’s own internal estimates, taking into account publicly available information about other industry participants and EV Charged’s management’s best view as to information that is not publicly available. The industry and market data included herein presents information only as of and for the periods indicated, is subject to change at any time, and is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with TPG Pace or EV Charged. TPG Pace and EV Charged also own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with TPG Pace or EV Charged, or an endorsement or sponsorship by or of TPG Pace or EV Charged. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that TPG Pace or EV Charged will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. No Offer or Solicitation This presentation is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed business combination or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Confidentiality All recipients agree that they will keep confidential all information contained herein and not already in the public domain and will use this presentation solely for evaluation purposes. Recipient will maintain all such information in strict confidence, including in strict accordance with any underlying contractual obligations and all applicable laws, including United States federal and state securities laws. This presentation is not intended to constitute and should not be construed as investment advice and does not constitute investment, tax, or legal advice. TPG PACE BENEFICIAL FINANCE CORP. 3Important Information (Continued) Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including EBITDA and adjusted gross margin. EBITDA is calculated as Revenue less cost of goods sold, and operating expenses. Adjusted gross margin is calculated as gross profit plus inventory write downs divided by revenue. Management believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to EV Charged’s financial condition and results of operations. TPG Pace believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. Other companies may calculate non-GAAP measures differently, and therefore the non-GAAP measures of EV Charged included in this presentation may not be directly comparable to similarly titled measures of other companies. Industry and Market Data; Trademarks and Trade Names Information and opinions in this presentation rely on and refer to information and statistics regarding the sectors in which EV Charged competes and other industry data. TPG Pace obtained this information and statistics from third-party sources, including reports by market research firms. TPG Pace and EV Charged have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness. TPG Pace and EV Charged have supplemented this information where necessary with information from EV Charged’s own internal estimates, taking into account publicly available information about other industry participants and EV Charged’s management’s best view as to information that is not publicly available. The industry and market data included herein presents information only as of and for the periods indicated, is subject to change at any time, and is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with TPG Pace or EV Charged. TPG Pace and EV Charged also own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with TPG Pace or EV Charged, or an endorsement or sponsorship by or of TPG Pace or EV Charged. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that TPG Pace or EV Charged will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. No Offer or Solicitation This presentation is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed business combination or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Confidentiality All recipients agree that they will keep confidential all information contained herein and not already in the public domain and will use this presentation solely for evaluation purposes. Recipient will maintain all such information in strict confidence, including in strict accordance with any underlying contractual obligations and all applicable laws, including United States federal and state securities laws. This presentation is not intended to constitute and should not be construed as investment advice and does not constitute investment, tax, or legal advice. TPG PACE BENEFICIAL FINANCE CORP. 3

Important Information (Continued) Important Information For Investors and Stockholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed business combination, Dutch Holdco will file with the SEC a registration statement on Form F-4, which will include a prospectus of Dutch Holdco and a proxy statement of TPG Pace. Dutch Holdco and TPG Pace also plan to file other documents with the SEC regarding the proposed transaction. After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the shareholders of TPG Pace. INVESTORS AND SHAREHOLDERS OF TPG PACE ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. Investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Dutch Holdco and TPG Pace once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Participants in the Solicitation Dutch Holdco, TPG Pace, Engie S.A. (“Engie Parent”) and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of TPG Pace in connection with the proposed transaction. Information about the directors and executive officers of TPG Pace is set forth in TPG Pace’s initial public offering prospectus, which was filed with the SEC on October 8, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Additional Information About the Business Combination and Where to Find It In connection with the proposed business combination, Dutch Holdco will file a registration statement on Form F 4 and the related proxy statement/prospectus with the SEC. Additionally, Dutch Holdco and TPG Pace will file other relevant materials with the SEC in connection with the proposed merger of TPG Pace into New SPAC and the proposed acquisition from Engie Parent of the common shares of EV Charged by Dutch Holdco. The materials to be filed by Dutch Holdco and TPG Pace with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. Investors and security holders of TPG Pace are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed business combination because they will contain important information about the business combination and the parties to the business combination. Dutch Holdco, TPG Pace, Engie Parent and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies of TPG Pace’s stockholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of certain of TPG Pace’s executive officers and directors in the solicitation by reading TPG Pace’s initial public offering prospectus, which was filed with the SEC on October 8, 2020, and the proxy statement and other relevant materials filed with the SEC in connection with the business combination when they become available. Other information concerning the interests of participants in the solicitation, which may, in some cases, be different than those of their stockholders generally, will be set forth in the proxy statement/prospectus relating to the business combination when it becomes available TPG PACE BENEFICIAL FINANCE CORP. 4Important Information (Continued) Important Information For Investors and Stockholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed business combination, Dutch Holdco will file with the SEC a registration statement on Form F-4, which will include a prospectus of Dutch Holdco and a proxy statement of TPG Pace. Dutch Holdco and TPG Pace also plan to file other documents with the SEC regarding the proposed transaction. After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the shareholders of TPG Pace. INVESTORS AND SHAREHOLDERS OF TPG PACE ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. Investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Dutch Holdco and TPG Pace once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Participants in the Solicitation Dutch Holdco, TPG Pace, Engie S.A. (“Engie Parent”) and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of TPG Pace in connection with the proposed transaction. Information about the directors and executive officers of TPG Pace is set forth in TPG Pace’s initial public offering prospectus, which was filed with the SEC on October 8, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Additional Information About the Business Combination and Where to Find It In connection with the proposed business combination, Dutch Holdco will file a registration statement on Form F 4 and the related proxy statement/prospectus with the SEC. Additionally, Dutch Holdco and TPG Pace will file other relevant materials with the SEC in connection with the proposed merger of TPG Pace into New SPAC and the proposed acquisition from Engie Parent of the common shares of EV Charged by Dutch Holdco. The materials to be filed by Dutch Holdco and TPG Pace with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. Investors and security holders of TPG Pace are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed business combination because they will contain important information about the business combination and the parties to the business combination. Dutch Holdco, TPG Pace, Engie Parent and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies of TPG Pace’s stockholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of certain of TPG Pace’s executive officers and directors in the solicitation by reading TPG Pace’s initial public offering prospectus, which was filed with the SEC on October 8, 2020, and the proxy statement and other relevant materials filed with the SEC in connection with the business combination when they become available. Other information concerning the interests of participants in the solicitation, which may, in some cases, be different than those of their stockholders generally, will be set forth in the proxy statement/prospectus relating to the business combination when it becomes available TPG PACE BENEFICIAL FINANCE CORP. 4

Transaction Summary Sponsored Public Listing NYSE: EVB NYSE: TPGY Transaction Overview • TPG Pace Group raised $350 million through the IPO of a special purpose acquisition company (“SPAC”), TPG Pace Beneficial Finance(“Pace Beneficial” or “TPGY”), in October 2020. Concurrent with the IPO, TPGY secured an additional $100 million of Forward Purchase Agreement (“FPA”) commitments, increasing TPGY’s capital base to $450 million • Pace Beneficial has entered into a transaction agreement with Engie New Business S.A.S., a subsidiary of Engie S.A. a multi-national utility based in France, to acquire its subsidiary EVBox Group • EVBox Group will be a Netherlands based company listed on the NYSE with a majority independent board; following the transaction Engie will retain a 1 more than 40% ownership stake in the company and expects to continue as a key partner • In connection with the transaction, TPGY has raised a $225 million PIPE of common equity at $10 / share, in a private placement anchored by funds and accounts managed by BlackRock, Inclusive Capital Partners, Neuberger Berman funds and Wellington Management as well as several other leading institutional investors 1 • Pace Beneficial expects to effect EVBox Group’s public listing with an expected market cap of $1,394 million and target net cash of $425 million • Represents an attractive entry multiple of 6.7x projected 2021 revenue of €120 million and 3.6x projected 2022 Revenue of €225 million • Transaction combines a strong entrepreneurial team and best-in-class hardware and software applications with a fully funded balance sheet in a rapidly growing market EVBox is the leading charging solutions platform for electric vehicles in Europe, with 210,000 charge ports sold to date Note: Projections are TPG Pace estimates. With respect to projections, see page 2 “Use of Projections” under “Important Information”. 1. Market cap assumes $10/share price. Target net cash and Engie ownership assumes no redemptions by SPAC holders in business combination. TPG PACE BENEFICIAL FINANCE CORP. 5Transaction Summary Sponsored Public Listing NYSE: EVB NYSE: TPGY Transaction Overview • TPG Pace Group raised $350 million through the IPO of a special purpose acquisition company (“SPAC”), TPG Pace Beneficial Finance(“Pace Beneficial” or “TPGY”), in October 2020. Concurrent with the IPO, TPGY secured an additional $100 million of Forward Purchase Agreement (“FPA”) commitments, increasing TPGY’s capital base to $450 million • Pace Beneficial has entered into a transaction agreement with Engie New Business S.A.S., a subsidiary of Engie S.A. a multi-national utility based in France, to acquire its subsidiary EVBox Group • EVBox Group will be a Netherlands based company listed on the NYSE with a majority independent board; following the transaction Engie will retain a 1 more than 40% ownership stake in the company and expects to continue as a key partner • In connection with the transaction, TPGY has raised a $225 million PIPE of common equity at $10 / share, in a private placement anchored by funds and accounts managed by BlackRock, Inclusive Capital Partners, Neuberger Berman funds and Wellington Management as well as several other leading institutional investors 1 • Pace Beneficial expects to effect EVBox Group’s public listing with an expected market cap of $1,394 million and target net cash of $425 million • Represents an attractive entry multiple of 6.7x projected 2021 revenue of €120 million and 3.6x projected 2022 Revenue of €225 million • Transaction combines a strong entrepreneurial team and best-in-class hardware and software applications with a fully funded balance sheet in a rapidly growing market EVBox is the leading charging solutions platform for electric vehicles in Europe, with 210,000 charge ports sold to date Note: Projections are TPG Pace estimates. With respect to projections, see page 2 “Use of Projections” under “Important Information”. 1. Market cap assumes $10/share price. Target net cash and Engie ownership assumes no redemptions by SPAC holders in business combination. TPG PACE BENEFICIAL FINANCE CORP. 5

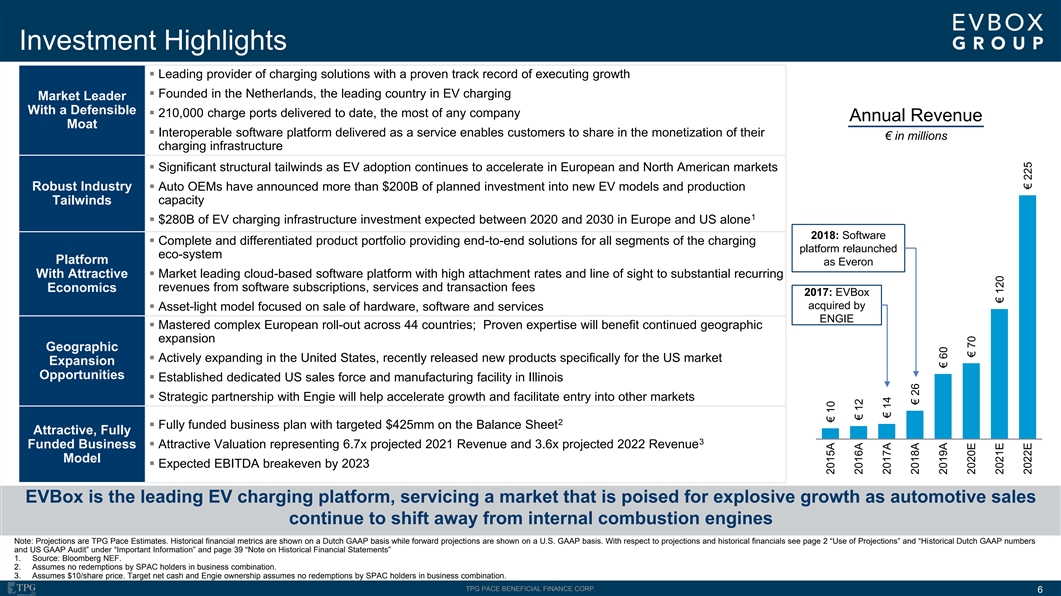

Investment Highlights ▪ Leading provider of charging solutions with a proven track record of executing growth ▪ Founded in the Netherlands, the leading country in EV charging Market Leader With a Defensible ▪ 210,000 charge ports delivered to date, the most of any company Annual Revenue Moat ▪ Interoperable software platform delivered as a service enables customers to share in the monetization of their € in millions charging infrastructure ▪ Significant structural tailwinds as EV adoption continues to accelerate in European and North American markets Robust Industry ▪ Auto OEMs have announced more than $200B of planned investment into new EV models and production Tailwinds capacity 1 ▪ $280B of EV charging infrastructure investment expected between 2020 and 2030 in Europe and US alone 2018: Software ▪ Complete and differentiated product portfolio providing end-to-end solutions for all segments of the charging platform relaunched eco-system Platform as Everon ▪ Market leading cloud-based software platform with high attachment rates and line of sight to substantial recurring With Attractive revenues from software subscriptions, services and transaction fees Economics 2017: EVBox acquired by ▪ Asset-light model focused on sale of hardware, software and services ENGIE ▪ Mastered complex European roll-out across 44 countries; Proven expertise will benefit continued geographic expansion Geographic ▪ Actively expanding in the United States, recently released new products specifically for the US market Expansion Opportunities ▪ Established dedicated US sales force and manufacturing facility in Illinois ▪ Strategic partnership with Engie will help accelerate growth and facilitate entry into other markets 2 ▪ Fully funded business plan with targeted $425mm on the Balance Sheet Attractive, Fully 3 Funded Business ▪ Attractive Valuation representing 6.7x projected 2021 Revenue and 3.6x projected 2022 Revenue Model ▪ Expected EBITDA breakeven by 2023 EVBox is the leading EV charging platform, servicing a market that is poised for explosive growth as automotive sales continue to shift away from internal combustion engines Note: Projections are TPG Pace Estimates. Historical financial metrics are shown on a Dutch GAAP basis while forward projections are shown on a U.S. GAAP basis. With respect to projections and historical financials see page 2 “Use of Projections” and “Historical Dutch GAAP numbers and US GAAP Audit” under “Important Information” and page 39 “Note on Historical Financial Statements” 1. Source: Bloomberg NEF. 2. Assumes no redemptions by SPAC holders in business combination. 3. Assumes $10/share price. Target net cash and Engie ownership assumes no redemptions by SPAC holders in business combination. TPG PACE BENEFICIAL FINANCE CORP. 6 2015A € 10 2016A € 12 2017A € 14 2018A € 26 2019A € 60 2020E € 70 2021E € 120 2022E € 225Investment Highlights ▪ Leading provider of charging solutions with a proven track record of executing growth ▪ Founded in the Netherlands, the leading country in EV charging Market Leader With a Defensible ▪ 210,000 charge ports delivered to date, the most of any company Annual Revenue Moat ▪ Interoperable software platform delivered as a service enables customers to share in the monetization of their € in millions charging infrastructure ▪ Significant structural tailwinds as EV adoption continues to accelerate in European and North American markets Robust Industry ▪ Auto OEMs have announced more than $200B of planned investment into new EV models and production Tailwinds capacity 1 ▪ $280B of EV charging infrastructure investment expected between 2020 and 2030 in Europe and US alone 2018: Software ▪ Complete and differentiated product portfolio providing end-to-end solutions for all segments of the charging platform relaunched eco-system Platform as Everon ▪ Market leading cloud-based software platform with high attachment rates and line of sight to substantial recurring With Attractive revenues from software subscriptions, services and transaction fees Economics 2017: EVBox acquired by ▪ Asset-light model focused on sale of hardware, software and services ENGIE ▪ Mastered complex European roll-out across 44 countries; Proven expertise will benefit continued geographic expansion Geographic ▪ Actively expanding in the United States, recently released new products specifically for the US market Expansion Opportunities ▪ Established dedicated US sales force and manufacturing facility in Illinois ▪ Strategic partnership with Engie will help accelerate growth and facilitate entry into other markets 2 ▪ Fully funded business plan with targeted $425mm on the Balance Sheet Attractive, Fully 3 Funded Business ▪ Attractive Valuation representing 6.7x projected 2021 Revenue and 3.6x projected 2022 Revenue Model ▪ Expected EBITDA breakeven by 2023 EVBox is the leading EV charging platform, servicing a market that is poised for explosive growth as automotive sales continue to shift away from internal combustion engines Note: Projections are TPG Pace Estimates. Historical financial metrics are shown on a Dutch GAAP basis while forward projections are shown on a U.S. GAAP basis. With respect to projections and historical financials see page 2 “Use of Projections” and “Historical Dutch GAAP numbers and US GAAP Audit” under “Important Information” and page 39 “Note on Historical Financial Statements” 1. Source: Bloomberg NEF. 2. Assumes no redemptions by SPAC holders in business combination. 3. Assumes $10/share price. Target net cash and Engie ownership assumes no redemptions by SPAC holders in business combination. TPG PACE BENEFICIAL FINANCE CORP. 6 2015A € 10 2016A € 12 2017A € 14 2018A € 26 2019A € 60 2020E € 70 2021E € 120 2022E € 225

EVBox Group at a Glance Organizational Structure European Market Leader 1 Leading European Market Share AC & DC Hardware Enterprise and Embedded Software Software Platform AC Public DC Public Charging Charging 25% 35% With 210,000 charge ports delivered over the past 10 years, EVBox has established itself as the clear market leader in electric vehicle charging ecosystem 1. EVBox, EAFO. Market share estimates calculated by dividing relevant EVBox product shipments by total number of relevant public connectors as sourced on EAFO website. DC Public Charging estimates excludes AC Connectors and Tesla owned connectors (closed network, only available to Tesla drivers). AC market share estimates assumes 60% of Business Line connectors sold are publicly available. Data calculated as of October 2020. TPG PACE BENEFICIAL FINANCE CORP. 7EVBox Group at a Glance Organizational Structure European Market Leader 1 Leading European Market Share AC & DC Hardware Enterprise and Embedded Software Software Platform AC Public DC Public Charging Charging 25% 35% With 210,000 charge ports delivered over the past 10 years, EVBox has established itself as the clear market leader in electric vehicle charging ecosystem 1. EVBox, EAFO. Market share estimates calculated by dividing relevant EVBox product shipments by total number of relevant public connectors as sourced on EAFO website. DC Public Charging estimates excludes AC Connectors and Tesla owned connectors (closed network, only available to Tesla drivers). AC market share estimates assumes 60% of Business Line connectors sold are publicly available. Data calculated as of October 2020. TPG PACE BENEFICIAL FINANCE CORP. 7

Integrated Charging Platform Platform solutions allows for bundling of Charging Software, Hardware, and Services EVBox AC & DC Smart Everon Enterprise EVBox / Everon Charging Stations Charging Management Software Support & Services With end-to-end solutions, EVBox Group offers a platform-based approach to serve all constituents across the EV charging ecosystem TPG PACE BENEFICIAL FINANCE CORP. 8Integrated Charging Platform Platform solutions allows for bundling of Charging Software, Hardware, and Services EVBox AC & DC Smart Everon Enterprise EVBox / Everon Charging Stations Charging Management Software Support & Services With end-to-end solutions, EVBox Group offers a platform-based approach to serve all constituents across the EV charging ecosystem TPG PACE BENEFICIAL FINANCE CORP. 8

EVBox Group Products and Solutions CUSTOM CORPORATE & Branded Charging management White-label mobile app Professional services for FLEET SOLUTIONS API capabilities to integrate Charging Stations platform for business drivers training, site into parking, fleet, and • Utilities management, and energy applications • Charging Network upgrades • Fleets & Lease • Fuel Retailers • Car Dealerships Regular & Fast Charging management EVBox Care Project Planning, Site INTEGRATED COMMERCIAL Charging Stations software Services Optimization, Energy SOLUTIONS Management • Workplace • Hospitality • Retail RESIDENTIAL & AUTOMOTIVE SOLUTIONS EVBox Elvi home EVBox Elvi for multi- Branded residential charging Mobile app for drivers charging with lifetime family units/apartments for mass production by • Private home subscription & charge with billing capabilities specific charging players • Apartments / card for drivers for tenants (Automotive) Condominiums • Automotive We design and sell market leading hardware, software and services to EV charging station owners and drivers TPG PACE BENEFICIAL FINANCE CORP. 9EVBox Group Products and Solutions CUSTOM CORPORATE & Branded Charging management White-label mobile app Professional services for FLEET SOLUTIONS API capabilities to integrate Charging Stations platform for business drivers training, site into parking, fleet, and • Utilities management, and energy applications • Charging Network upgrades • Fleets & Lease • Fuel Retailers • Car Dealerships Regular & Fast Charging management EVBox Care Project Planning, Site INTEGRATED COMMERCIAL Charging Stations software Services Optimization, Energy SOLUTIONS Management • Workplace • Hospitality • Retail RESIDENTIAL & AUTOMOTIVE SOLUTIONS EVBox Elvi home EVBox Elvi for multi- Branded residential charging Mobile app for drivers charging with lifetime family units/apartments for mass production by • Private home subscription & charge with billing capabilities specific charging players • Apartments / card for drivers for tenants (Automotive) Condominiums • Automotive We design and sell market leading hardware, software and services to EV charging station owners and drivers TPG PACE BENEFICIAL FINANCE CORP. 9

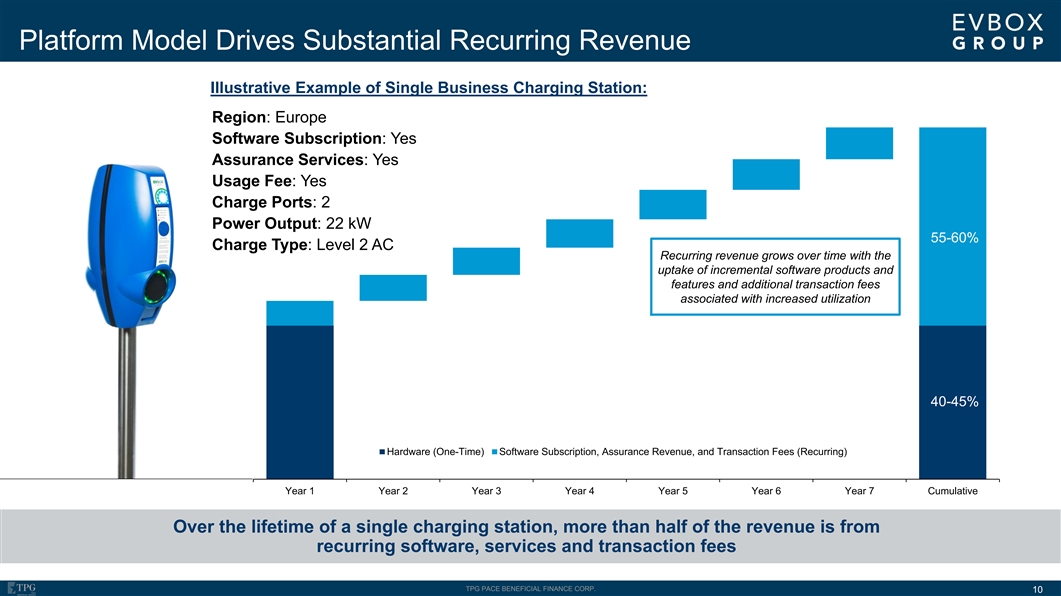

Platform Model Drives Substantial Recurring Revenue Illustrative Example of Single Business Charging Station: Region: Europe Software Subscription: Yes Assurance Services: Yes Usage Fee: Yes Charge Ports: 2 Power Output: 22 kW 55-60% Charge Type: Level 2 AC Recurring revenue grows over time with the uptake of incremental software products and features and additional transaction fees associated with increased utilization 40-45% Hardware (One-Time) Software Subscription, Assurance Revenue, and Transaction Fees (Recurring) Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Cumulative Over the lifetime of a single charging station, more than half of the revenue is from recurring software, services and transaction fees TPG PACE BENEFICIAL FINANCE CORP. 10Platform Model Drives Substantial Recurring Revenue Illustrative Example of Single Business Charging Station: Region: Europe Software Subscription: Yes Assurance Services: Yes Usage Fee: Yes Charge Ports: 2 Power Output: 22 kW 55-60% Charge Type: Level 2 AC Recurring revenue grows over time with the uptake of incremental software products and features and additional transaction fees associated with increased utilization 40-45% Hardware (One-Time) Software Subscription, Assurance Revenue, and Transaction Fees (Recurring) Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Cumulative Over the lifetime of a single charging station, more than half of the revenue is from recurring software, services and transaction fees TPG PACE BENEFICIAL FINANCE CORP. 10

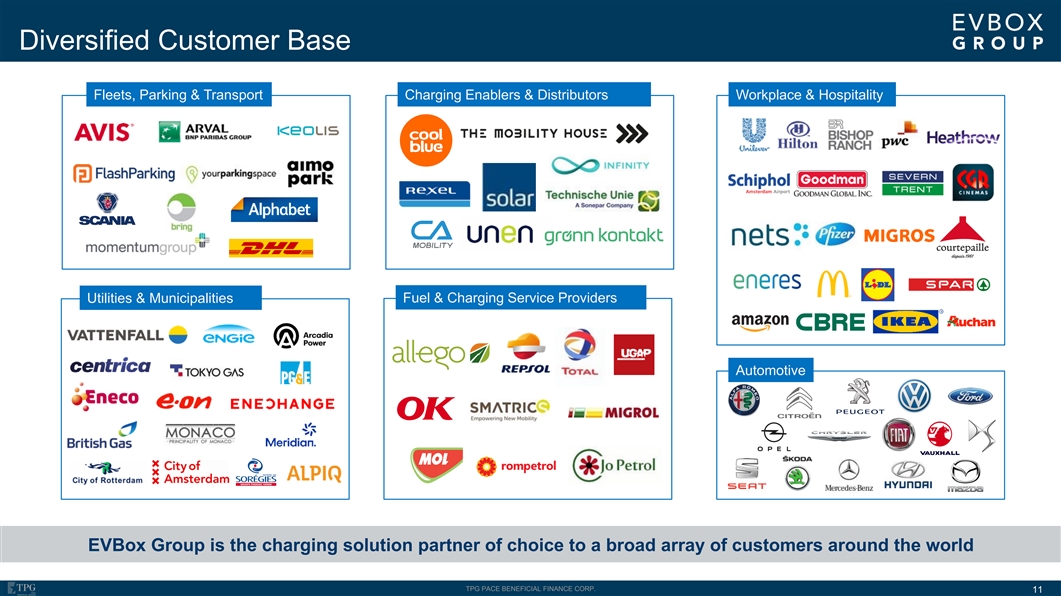

Diversified Customer Base Fleets, Parking & Transport Charging Enablers & Distributors Workplace & Hospitality Fuel & Charging Service Providers Utilities & Municipalities Automotive EVBox Group is the charging solution partner of choice to a broad array of customers around the world TPG PACE BENEFICIAL FINANCE CORP. 11Diversified Customer Base Fleets, Parking & Transport Charging Enablers & Distributors Workplace & Hospitality Fuel & Charging Service Providers Utilities & Municipalities Automotive EVBox Group is the charging solution partner of choice to a broad array of customers around the world TPG PACE BENEFICIAL FINANCE CORP. 11

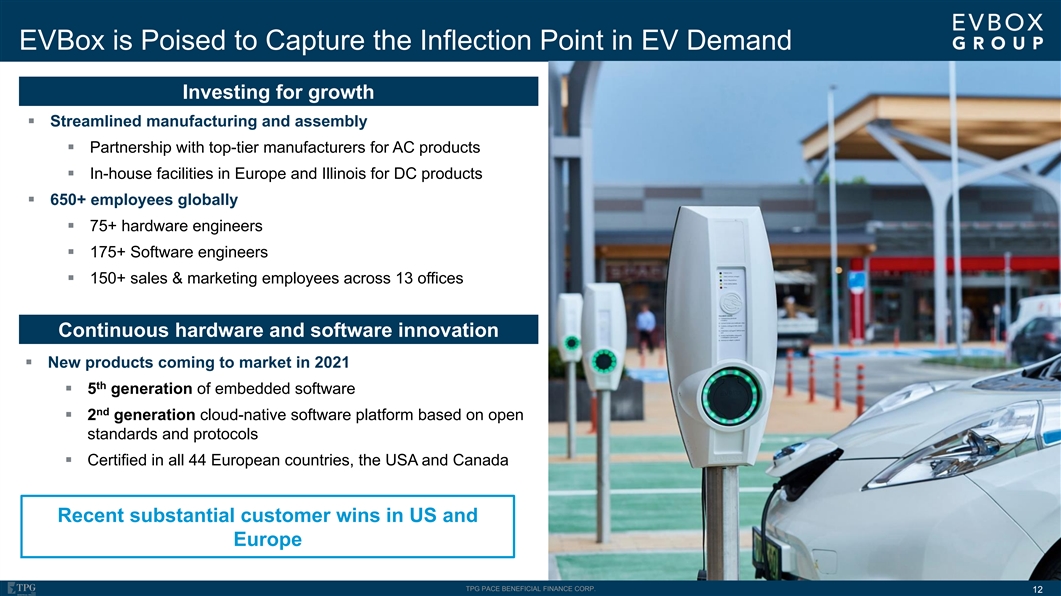

EVBox is Poised to Capture the Inflection Point in EV Demand Investing for growth ▪ Streamlined manufacturing and assembly ▪ Partnership with top-tier manufacturers for AC products ▪ In-house facilities in Europe and Illinois for DC products ▪ 650+ employees globally ▪ 75+ hardware engineers ▪ 175+ Software engineers ▪ 150+ sales & marketing employees across 13 offices Continuous hardware and software innovation ▪ New products coming to market in 2021 th ▪ 5 generation of embedded software nd ▪ 2 generation cloud-native software platform based on open standards and protocols ▪ Certified in all 44 European countries, the USA and Canada Recent substantial customer wins in US and Europe TPG PACE BENEFICIAL FINANCE CORP. 12EVBox is Poised to Capture the Inflection Point in EV Demand Investing for growth ▪ Streamlined manufacturing and assembly ▪ Partnership with top-tier manufacturers for AC products ▪ In-house facilities in Europe and Illinois for DC products ▪ 650+ employees globally ▪ 75+ hardware engineers ▪ 175+ Software engineers ▪ 150+ sales & marketing employees across 13 offices Continuous hardware and software innovation ▪ New products coming to market in 2021 th ▪ 5 generation of embedded software nd ▪ 2 generation cloud-native software platform based on open standards and protocols ▪ Certified in all 44 European countries, the USA and Canada Recent substantial customer wins in US and Europe TPG PACE BENEFICIAL FINANCE CORP. 12

The Shift to Electric Vehicles is Rapidly Accelerating “Volkswagen says last generation of “UK set to ban sale of new petrol and “California to Ban Sales of New Gas- combustion engines to be launched diesel cars from 2030” Powered Cars Starting in 2035” in 2026” - December 2018 - November 2020 - September 2020 “GM will spend $27 billion on all- “EU Approves Biggest Green Stimulus “Germany will require all gas stations electric and autonomous vehicles… in History With $572 Billion Plan” to provide electric car charging” release 30 new EVs globally by 2025” - July 2020 - June 2020 - November 2020 TPG PACE BENEFICIAL FINANCE CORP. 13The Shift to Electric Vehicles is Rapidly Accelerating “Volkswagen says last generation of “UK set to ban sale of new petrol and “California to Ban Sales of New Gas- combustion engines to be launched diesel cars from 2030” Powered Cars Starting in 2035” in 2026” - December 2018 - November 2020 - September 2020 “GM will spend $27 billion on all- “EU Approves Biggest Green Stimulus “Germany will require all gas stations electric and autonomous vehicles… in History With $572 Billion Plan” to provide electric car charging” release 30 new EVs globally by 2025” - July 2020 - June 2020 - November 2020 TPG PACE BENEFICIAL FINANCE CORP. 13

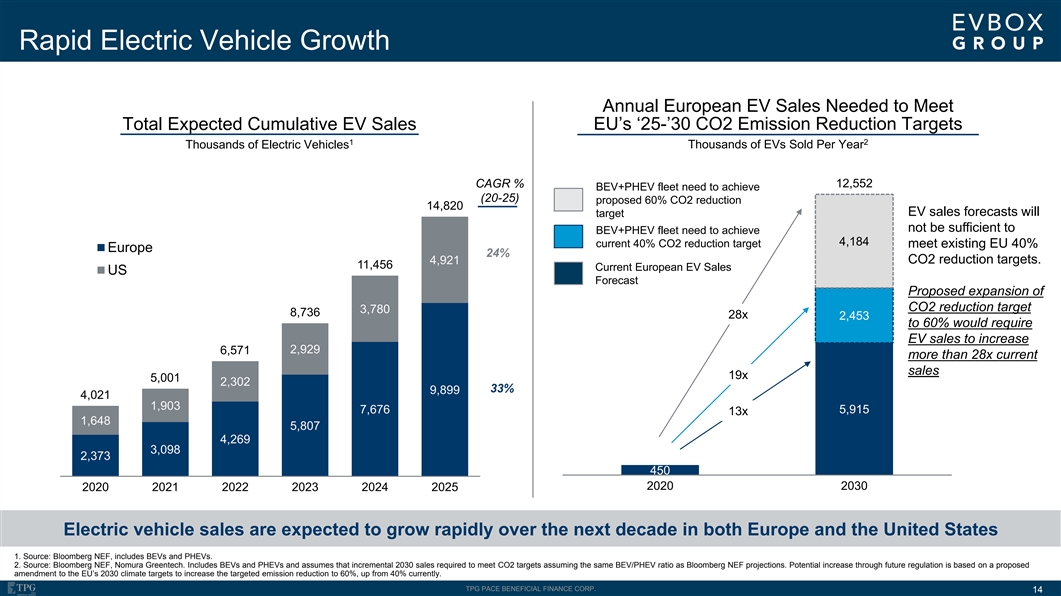

Rapid Electric Vehicle Growth Annual European EV Sales Needed to Meet Total Expected Cumulative EV Sales EU’s ‘25-’30 CO2 Emission Reduction Targets 1 2 Thousands of Electric Vehicles Thousands of EVs Sold Per Year CAGR % 12,552 BEV+PHEV fleet need to achieve (20-25) proposed 60% CO2 reduction 14,820 EV sales forecasts will target not be sufficient to BEV+PHEV fleet need to achieve 4,184 current 40% CO2 reduction target meet existing EU 40% Europe 24% CO2 reduction targets. 4,921 11,456 Current European EV Sales US Forecast Proposed expansion of CO2 reduction target 3,780 8,736 28x 2,453 to 60% would require EV sales to increase 2,929 6,571 more than 28x current sales 19x 5,001 2,302 33% 9,899 4,021 1,903 7,676 5,915 13x 1,648 5,807 4,269 3,098 2,373 450 2020 2030 2020 2021 2022 2023 2024 2025 Source: Forecasts from BNEF’s Long-Term Electric Vehicle Outlook 2020 1) Data shown for both BEV and PHEV sales and assumes that incremental 2030 sales required to meet CO2 targets would consist of the same mix as BNEF projections Electric vehicle sales are expected to grow rapidly over the next decade in both Europe and the United States 1. Source: Bloomberg NEF, includes BEVs and PHEVs. 2. Source: Bloomberg NEF, Nomura Greentech. Includes BEVs and PHEVs and assumes that incremental 2030 sales required to meet CO2 targets assuming the same BEV/PHEV ratio as Bloomberg NEF projections. Potential increase through future regulation is based on a proposed amendment to the EU’s 2030 climate targets to increase the targeted emission reduction to 60%, up from 40% currently. TPG PACE BENEFICIAL FINANCE CORP. 14Rapid Electric Vehicle Growth Annual European EV Sales Needed to Meet Total Expected Cumulative EV Sales EU’s ‘25-’30 CO2 Emission Reduction Targets 1 2 Thousands of Electric Vehicles Thousands of EVs Sold Per Year CAGR % 12,552 BEV+PHEV fleet need to achieve (20-25) proposed 60% CO2 reduction 14,820 EV sales forecasts will target not be sufficient to BEV+PHEV fleet need to achieve 4,184 current 40% CO2 reduction target meet existing EU 40% Europe 24% CO2 reduction targets. 4,921 11,456 Current European EV Sales US Forecast Proposed expansion of CO2 reduction target 3,780 8,736 28x 2,453 to 60% would require EV sales to increase 2,929 6,571 more than 28x current sales 19x 5,001 2,302 33% 9,899 4,021 1,903 7,676 5,915 13x 1,648 5,807 4,269 3,098 2,373 450 2020 2030 2020 2021 2022 2023 2024 2025 Source: Forecasts from BNEF’s Long-Term Electric Vehicle Outlook 2020 1) Data shown for both BEV and PHEV sales and assumes that incremental 2030 sales required to meet CO2 targets would consist of the same mix as BNEF projections Electric vehicle sales are expected to grow rapidly over the next decade in both Europe and the United States 1. Source: Bloomberg NEF, includes BEVs and PHEVs. 2. Source: Bloomberg NEF, Nomura Greentech. Includes BEVs and PHEVs and assumes that incremental 2030 sales required to meet CO2 targets assuming the same BEV/PHEV ratio as Bloomberg NEF projections. Potential increase through future regulation is based on a proposed amendment to the EU’s 2030 climate targets to increase the targeted emission reduction to 60%, up from 40% currently. TPG PACE BENEFICIAL FINANCE CORP. 14

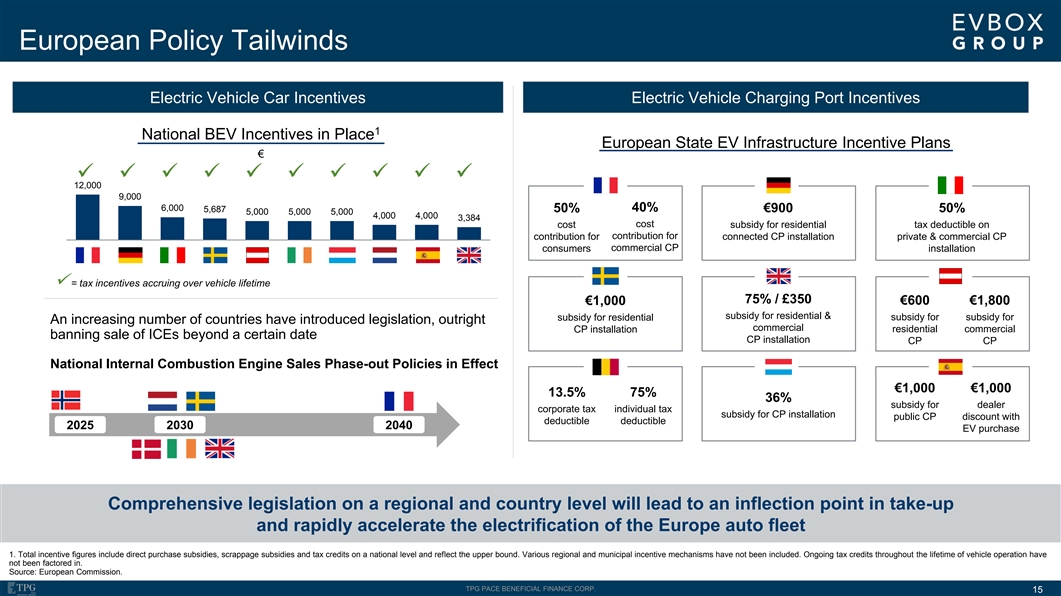

European Policy Tailwinds Electric Vehicle Car Incentives Electric Vehicle Charging Port Incentives 1 National BEV Incentives in Place European State EV Infrastructure Incentive Plans € ✓✓✓✓✓✓✓✓✓✓ 12,000 9,000 6,000 40% 5,687 50% €900 50% 5,000 5,000 5,000 4,000 4,000 3,384 cost cost subsidy for residential tax deductible on contribution for contribution for connected CP installation private & commercial CP consumers commercial CP installation ✓ = tax incentives accruing over vehicle lifetime 75% / £350 €600 €1,800 €1,000 subsidy for residential & subsidy for residential subsidy for subsidy for An increasing number of countries have introduced legislation, outright commercial CP installation residential commercial banning sale of ICEs beyond a certain date CP installation CP CP National Internal Combustion Engine Sales Phase-out Policies in Effect €1,000 €1,000 13.5% 75% 36% subsidy for dealer corporate tax individual tax subsidy for CP installation public CP discount with deductible deductible 2025 2030 2040 EV purchase Comprehensive legislation on a regional and country level will lead to an inflection point in take-up and rapidly accelerate the electrification of the Europe auto fleet 1. Total incentive figures include direct purchase subsidies, scrappage subsidies and tax credits on a national level and reflect the upper bound. Various regional and municipal incentive mechanisms have not been included. Ongoing tax credits throughout the lifetime of vehicle operation have not been factored in. Source: European Commission. TPG PACE BENEFICIAL FINANCE CORP. 15European Policy Tailwinds Electric Vehicle Car Incentives Electric Vehicle Charging Port Incentives 1 National BEV Incentives in Place European State EV Infrastructure Incentive Plans € ✓✓✓✓✓✓✓✓✓✓ 12,000 9,000 6,000 40% 5,687 50% €900 50% 5,000 5,000 5,000 4,000 4,000 3,384 cost cost subsidy for residential tax deductible on contribution for contribution for connected CP installation private & commercial CP consumers commercial CP installation ✓ = tax incentives accruing over vehicle lifetime 75% / £350 €600 €1,800 €1,000 subsidy for residential & subsidy for residential subsidy for subsidy for An increasing number of countries have introduced legislation, outright commercial CP installation residential commercial banning sale of ICEs beyond a certain date CP installation CP CP National Internal Combustion Engine Sales Phase-out Policies in Effect €1,000 €1,000 13.5% 75% 36% subsidy for dealer corporate tax individual tax subsidy for CP installation public CP discount with deductible deductible 2025 2030 2040 EV purchase Comprehensive legislation on a regional and country level will lead to an inflection point in take-up and rapidly accelerate the electrification of the Europe auto fleet 1. Total incentive figures include direct purchase subsidies, scrappage subsidies and tax credits on a national level and reflect the upper bound. Various regional and municipal incentive mechanisms have not been included. Ongoing tax credits throughout the lifetime of vehicle operation have not been factored in. Source: European Commission. TPG PACE BENEFICIAL FINANCE CORP. 15

European EV Charging Ecosystem EVBOX GROUP VALUE PROPOSITION Better access Clearing transactions Enabling businesses to for drivers between stakeholders monetize their sites E V D R I V E R R O A M I N G B U S I N E S S T R A N S A C T I O N C L E A R I N G C H A R G I N G S I T E O W N E R C H A R G I N G S I T E U S E R • Drivers sign up with a • Ensures drivers can charge • Sign up with a Charge Port Mobility Service Provider in all public charging ports Operator • Find publicly accessible • Ensures site owners can • Offer their charging ports to charging ports serve the maximum amount electric vehicle (EV) of EV drivers • Pay for charging sessions • Get paid for charging sessions Key stakeholders in the European mobility industry execute on critical functions within this ecosystem. EVBox Group sells solutions to all of them, ensuring a seamless experience for drivers and site owners TPG PACE BENEFICIAL FINANCE CORP. 16European EV Charging Ecosystem EVBOX GROUP VALUE PROPOSITION Better access Clearing transactions Enabling businesses to for drivers between stakeholders monetize their sites E V D R I V E R R O A M I N G B U S I N E S S T R A N S A C T I O N C L E A R I N G C H A R G I N G S I T E O W N E R C H A R G I N G S I T E U S E R • Drivers sign up with a • Ensures drivers can charge • Sign up with a Charge Port Mobility Service Provider in all public charging ports Operator • Find publicly accessible • Ensures site owners can • Offer their charging ports to charging ports serve the maximum amount electric vehicle (EV) of EV drivers • Pay for charging sessions • Get paid for charging sessions Key stakeholders in the European mobility industry execute on critical functions within this ecosystem. EVBox Group sells solutions to all of them, ensuring a seamless experience for drivers and site owners TPG PACE BENEFICIAL FINANCE CORP. 16

Competitive Positioning Complete CPO & MSP offering ✓✓✓✓ HW-agnostic software ✓ûûû Software White-label & Multi-tenant platform ûûû ✓ Smart Charging Capabilities ✓✓✓✓ Pan-European Billing Solution (Leasing) û✓û ✓ Complete AC lineup ✓✓✓✓ Fast charging (DC) lineup ✓✓û✓ Hardware Ultra-fast charging (HPC) lineup—up to 350 kW û ✓ûû Pan-European / US Product Breadth ûû ✓û SW-agnostic hardware ✓ûûû EVBox Group is the leading full-service provider, offering a complete portfolio of charging stations, an open architecture charging software solution and related services TPG PACE BENEFICIAL FINANCE CORP. 17Competitive Positioning Complete CPO & MSP offering ✓✓✓✓ HW-agnostic software ✓ûûû Software White-label & Multi-tenant platform ûûû ✓ Smart Charging Capabilities ✓✓✓✓ Pan-European Billing Solution (Leasing) û✓û ✓ Complete AC lineup ✓✓✓✓ Fast charging (DC) lineup ✓✓û✓ Hardware Ultra-fast charging (HPC) lineup—up to 350 kW û ✓ûû Pan-European / US Product Breadth ûû ✓û SW-agnostic hardware ✓ûûû EVBox Group is the leading full-service provider, offering a complete portfolio of charging stations, an open architecture charging software solution and related services TPG PACE BENEFICIAL FINANCE CORP. 17

EVBox’s European Leadership Position Enables Global Expansion ▪ Europe is an extremely fragmented and Cumulative Charging Ports Delivered complex market with every European Nordics 10,000 Member State having country specific Primary hardware and software requirements 24 2 Languages Rest of Europe 20,000 – Requires sophisticated products UK & Ireland 7,000 and deep local knowledge and Rest of World 10,000 Currencies 9 1 relationships EVBox Total 210,000 Netherlands 80,000 – EVBox has penetrated Europe 1 with the most advanced products Population 602MM 331MM Germany 50,000 and solutions France 30,000 – Strategic relationship with Engie CPOs 100+ 9 has allowed EVBox to leverage their footprint and quickly scale-up Spain & Portugal 3,000 in new markets Roaming 7 0 Platforms ▪ Our sophisticated solutions are easily translated to less complicated markets, such as North America We are well positioned to defend our competitive position in Europe and rapidly enter North America Note: All statistics refer to Europe as a whole, not limited to EU member nations. 1. Source: UN Department of Economic and Social Affairs, excludes Russia. TPG PACE BENEFICIAL FINANCE CORP. 18EVBox’s European Leadership Position Enables Global Expansion ▪ Europe is an extremely fragmented and Cumulative Charging Ports Delivered complex market with every European Nordics 10,000 Member State having country specific Primary hardware and software requirements 24 2 Languages Rest of Europe 20,000 – Requires sophisticated products UK & Ireland 7,000 and deep local knowledge and Rest of World 10,000 Currencies 9 1 relationships EVBox Total 210,000 Netherlands 80,000 – EVBox has penetrated Europe 1 with the most advanced products Population 602MM 331MM Germany 50,000 and solutions France 30,000 – Strategic relationship with Engie CPOs 100+ 9 has allowed EVBox to leverage their footprint and quickly scale-up Spain & Portugal 3,000 in new markets Roaming 7 0 Platforms ▪ Our sophisticated solutions are easily translated to less complicated markets, such as North America We are well positioned to defend our competitive position in Europe and rapidly enter North America Note: All statistics refer to Europe as a whole, not limited to EU member nations. 1. Source: UN Department of Economic and Social Affairs, excludes Russia. TPG PACE BENEFICIAL FINANCE CORP. 18

North America Represents an Attractive Expansion Market Charging stations Demand for open architecture Dedicated sales & Utility-driven rebates and specificially designed for the charging platform is rising in marketing and dedicated opportunities on state level; American market the US market, EVBox Group manufacturing facility in EVBox Group has key bringing Everon to market Illinois relationship with this segment Top 5 US rebate programs California (approved) 1 S. California (approval pending) Maryland (approved) 1 New York (approval pending) Virginia (approved) Notable North American Customers and Partners EVBox Group is poised to serve the rapidly expanding North American market 1. Approval process pending for all EV Charging Suppliers. TPG PACE BENEFICIAL FINANCE CORP. 19North America Represents an Attractive Expansion Market Charging stations Demand for open architecture Dedicated sales & Utility-driven rebates and specificially designed for the charging platform is rising in marketing and dedicated opportunities on state level; American market the US market, EVBox Group manufacturing facility in EVBox Group has key bringing Everon to market Illinois relationship with this segment Top 5 US rebate programs California (approved) 1 S. California (approval pending) Maryland (approved) 1 New York (approval pending) Virginia (approved) Notable North American Customers and Partners EVBox Group is poised to serve the rapidly expanding North American market 1. Approval process pending for all EV Charging Suppliers. TPG PACE BENEFICIAL FINANCE CORP. 19

EVBox Smart Charging Stations RESIDENTIAL (AC) COMMERCIAL (AC) FLEET / PUBLIC (DC) EVBox EVBox EVBox EVBox EVBox EVBox EVBox Elvi BusinessLine PublicLine Iqon Troniq 50 Troniq 100 Ultroniq Bus Fuel Highway / Workplace Retail and Commercial and Home Car fleets Commercial Depot Retail hospitality street parking Corridors Fleet Depot Long stops, 4-8 hours 1-8 hours Short stops, 30-90 mins 15-60 mins 5-30 mins Use case 7.4 to 22 kW Up to 22 kW Up to 50 kW Up to 100 kW Up to 350 kW Power output Up to 75 miles in 1 hour 75 miles in 1 hour 75 miles in 30 min 155 miles in 30 min 250 miles in 15 min Range added Charging stations that cover all industry segments – from residential and workplace, to commercial and corridor DC fast charging TPG PACE BENEFICIAL FINANCE CORP. 20EVBox Smart Charging Stations RESIDENTIAL (AC) COMMERCIAL (AC) FLEET / PUBLIC (DC) EVBox EVBox EVBox EVBox EVBox EVBox EVBox Elvi BusinessLine PublicLine Iqon Troniq 50 Troniq 100 Ultroniq Bus Fuel Highway / Workplace Retail and Commercial and Home Car fleets Commercial Depot Retail hospitality street parking Corridors Fleet Depot Long stops, 4-8 hours 1-8 hours Short stops, 30-90 mins 15-60 mins 5-30 mins Use case 7.4 to 22 kW Up to 22 kW Up to 50 kW Up to 100 kW Up to 350 kW Power output Up to 75 miles in 1 hour 75 miles in 1 hour 75 miles in 30 min 155 miles in 30 min 250 miles in 15 min Range added Charging stations that cover all industry segments – from residential and workplace, to commercial and corridor DC fast charging TPG PACE BENEFICIAL FINANCE CORP. 20

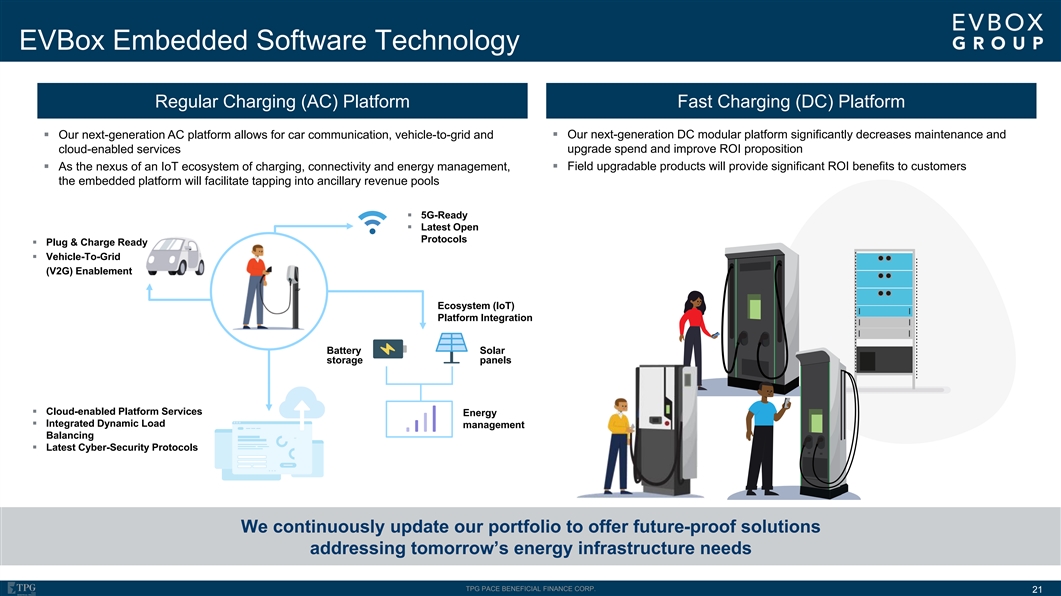

EVBox Embedded Software Technology Regular Charging (AC) Platform Fast Charging (DC) Platform ▪ Our next-generation AC platform allows for car communication, vehicle-to-grid and ▪ Our next-generation DC modular platform significantly decreases maintenance and upgrade spend and improve ROI proposition cloud-enabled services ▪ As the nexus of an IoT ecosystem of charging, connectivity and energy management, ▪ Field upgradable products will provide significant ROI benefits to customers the embedded platform will facilitate tapping into ancillary revenue pools ▪ 5G-Ready ▪ Latest Open Protocols ▪ Plug & Charge Ready ▪ Vehicle-To-Grid (V2G) Enablement Ecosystem (IoT) Platform Integration Battery Solar storage panels ▪ Cloud-enabled Platform Services Energy ▪ Integrated Dynamic Load management Balancing ▪ Latest Cyber-Security Protocols We continuously update our portfolio to offer future-proof solutions addressing tomorrow’s energy infrastructure needs 21 TPG PACE BENEFICIAL FINANCE CORP. 21EVBox Embedded Software Technology Regular Charging (AC) Platform Fast Charging (DC) Platform ▪ Our next-generation AC platform allows for car communication, vehicle-to-grid and ▪ Our next-generation DC modular platform significantly decreases maintenance and upgrade spend and improve ROI proposition cloud-enabled services ▪ As the nexus of an IoT ecosystem of charging, connectivity and energy management, ▪ Field upgradable products will provide significant ROI benefits to customers the embedded platform will facilitate tapping into ancillary revenue pools ▪ 5G-Ready ▪ Latest Open Protocols ▪ Plug & Charge Ready ▪ Vehicle-To-Grid (V2G) Enablement Ecosystem (IoT) Platform Integration Battery Solar storage panels ▪ Cloud-enabled Platform Services Energy ▪ Integrated Dynamic Load management Balancing ▪ Latest Cyber-Security Protocols We continuously update our portfolio to offer future-proof solutions addressing tomorrow’s energy infrastructure needs 21 TPG PACE BENEFICIAL FINANCE CORP. 21

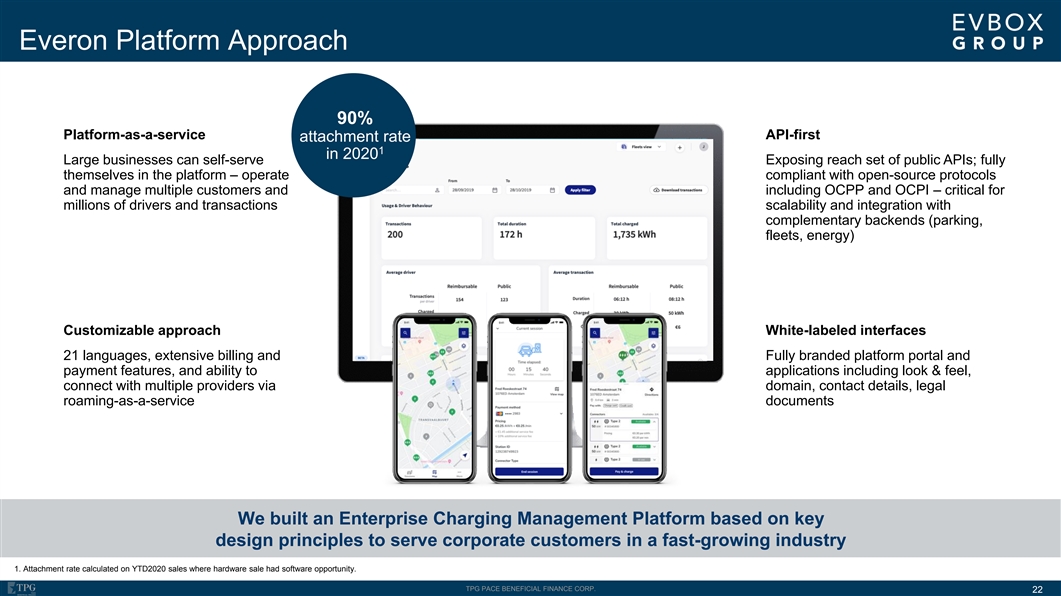

Everon Platform Approach 90% Platform-as-a-service API-first attachment rate 1 in 2020 Large businesses can self-serve Exposing reach set of public APIs; fully themselves in the platform – operate compliant with open-source protocols and manage multiple customers and including OCPP and OCPI – critical for millions of drivers and transactions scalability and integration with complementary backends (parking, fleets, energy) Customizable approach White-labeled interfaces 21 languages, extensive billing and Fully branded platform portal and payment features, and ability to applications including look & feel, connect with multiple providers via domain, contact details, legal roaming-as-a-service documents We built an Enterprise Charging Management Platform based on key design principles to serve corporate customers in a fast-growing industry 1. Attachment rate calculated on YTD2020 sales where hardware sale had software opportunity. TPG PACE BENEFICIAL FINANCE CORP. 22Everon Platform Approach 90% Platform-as-a-service API-first attachment rate 1 in 2020 Large businesses can self-serve Exposing reach set of public APIs; fully themselves in the platform – operate compliant with open-source protocols and manage multiple customers and including OCPP and OCPI – critical for millions of drivers and transactions scalability and integration with complementary backends (parking, fleets, energy) Customizable approach White-labeled interfaces 21 languages, extensive billing and Fully branded platform portal and payment features, and ability to applications including look & feel, connect with multiple providers via domain, contact details, legal roaming-as-a-service documents We built an Enterprise Charging Management Platform based on key design principles to serve corporate customers in a fast-growing industry 1. Attachment rate calculated on YTD2020 sales where hardware sale had software opportunity. TPG PACE BENEFICIAL FINANCE CORP. 22

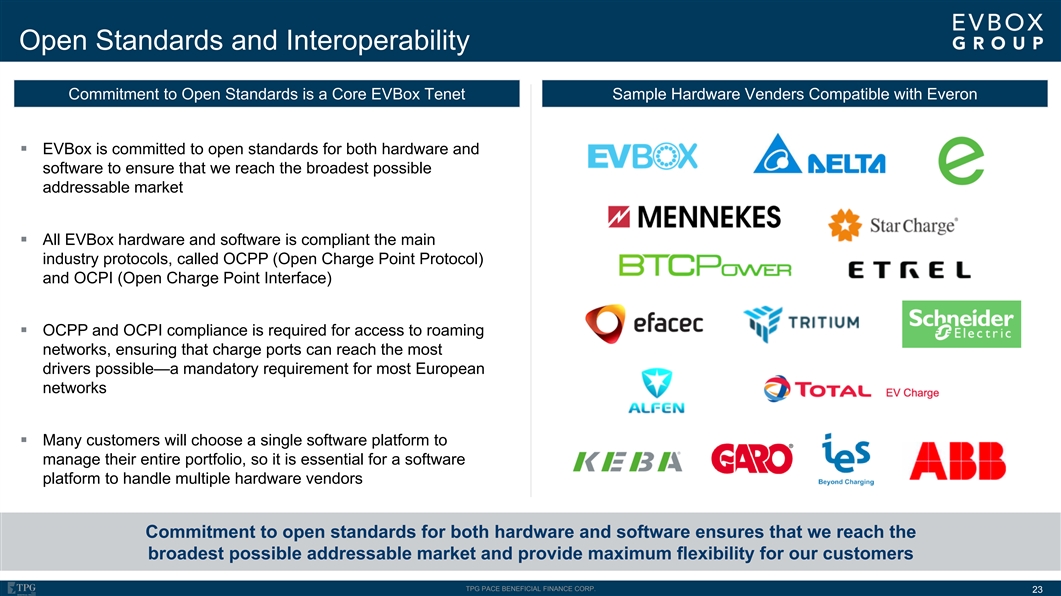

Open Standards and Interoperability Commitment to Open Standards is a Core EVBox Tenet Sample Hardware Venders Compatible with Everon ▪ EVBox is committed to open standards for both hardware and software to ensure that we reach the broadest possible addressable market ▪ All EVBox hardware and software is compliant the main industry protocols, called OCPP (Open Charge Point Protocol) and OCPI (Open Charge Point Interface) ▪ OCPP and OCPI compliance is required for access to roaming networks, ensuring that charge ports can reach the most drivers possible—a mandatory requirement for most European networks (previously G2mobility) ▪ Many customers will choose a single software platform to manage their entire portfolio, so it is essential for a software platform to handle multiple hardware vendors Commitment to open standards for both hardware and software ensures that we reach the broadest possible addressable market and provide maximum flexibility for our customers TPG PACE BENEFICIAL FINANCE CORP. 23Open Standards and Interoperability Commitment to Open Standards is a Core EVBox Tenet Sample Hardware Venders Compatible with Everon ▪ EVBox is committed to open standards for both hardware and software to ensure that we reach the broadest possible addressable market ▪ All EVBox hardware and software is compliant the main industry protocols, called OCPP (Open Charge Point Protocol) and OCPI (Open Charge Point Interface) ▪ OCPP and OCPI compliance is required for access to roaming networks, ensuring that charge ports can reach the most drivers possible—a mandatory requirement for most European networks (previously G2mobility) ▪ Many customers will choose a single software platform to manage their entire portfolio, so it is essential for a software platform to handle multiple hardware vendors Commitment to open standards for both hardware and software ensures that we reach the broadest possible addressable market and provide maximum flexibility for our customers TPG PACE BENEFICIAL FINANCE CORP. 23

Exponential Shipment Growth Cumulative EVBox Charge Ports Shipped ~210,000 ~7x Growth 111,478 71,101 50,021 39,081 28,516 2015 2016 2017 2018 2019 2020 TPG PACE BENEFICIAL FINANCE CORP. 24Exponential Shipment Growth Cumulative EVBox Charge Ports Shipped ~210,000 ~7x Growth 111,478 71,101 50,021 39,081 28,516 2015 2016 2017 2018 2019 2020 TPG PACE BENEFICIAL FINANCE CORP. 24

Potential for Robust Growth as Revenue Diversifies EVBox Revenue Type EVBox Revenue Geography EVBox Charge Ports Shipped € Millions € Millions Annual in ‘000s Hardware Software & Services Europe North America ~430 € 372 € 372 65% CAGR ~275 74% 74% CAGR CAGR € 225 € 225 ~135 € 120 € 120 ~95 € 70 € 70 2020 2021 2022 2023 2020 2021 2022 2023 2020 2021 2022 2023 Note: Projections are TPG Pace Estimates. Forward projections are shown on a U.S. GAAP basis, with respect to projections and historical financials see page 2 “Use of Projections” and “Historical Dutch GAAP numbers and US GAAP Audit” under “Important Information” and page 39 “Note on Historical Financial Statements” TPG PACE BENEFICIAL FINANCE CORP. 25Potential for Robust Growth as Revenue Diversifies EVBox Revenue Type EVBox Revenue Geography EVBox Charge Ports Shipped € Millions € Millions Annual in ‘000s Hardware Software & Services Europe North America ~430 € 372 € 372 65% CAGR ~275 74% 74% CAGR CAGR € 225 € 225 ~135 € 120 € 120 ~95 € 70 € 70 2020 2021 2022 2023 2020 2021 2022 2023 2020 2021 2022 2023 Note: Projections are TPG Pace Estimates. Forward projections are shown on a U.S. GAAP basis, with respect to projections and historical financials see page 2 “Use of Projections” and “Historical Dutch GAAP numbers and US GAAP Audit” under “Important Information” and page 39 “Note on Historical Financial Statements” TPG PACE BENEFICIAL FINANCE CORP. 25

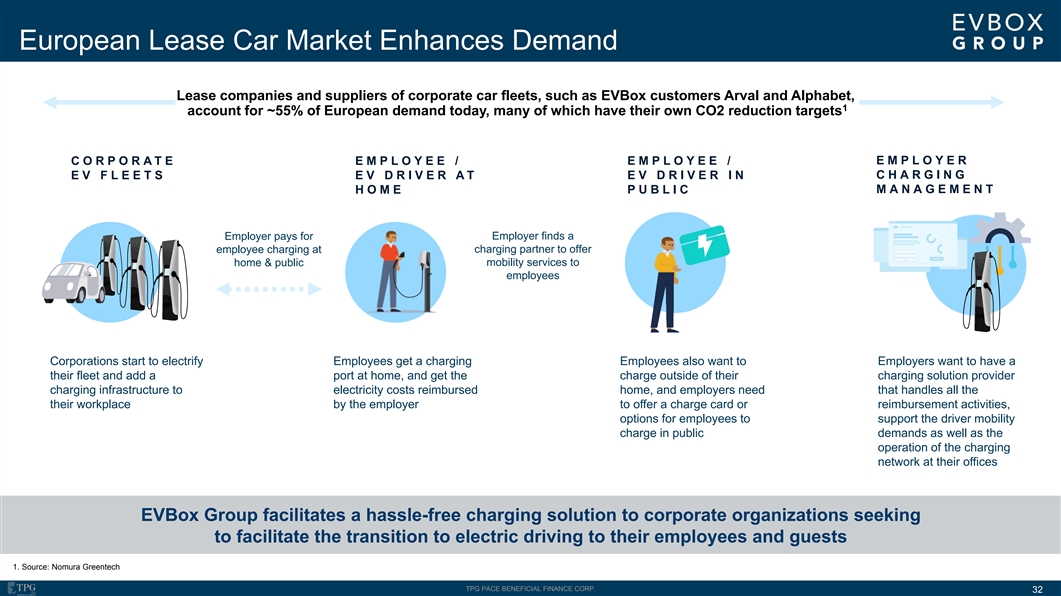

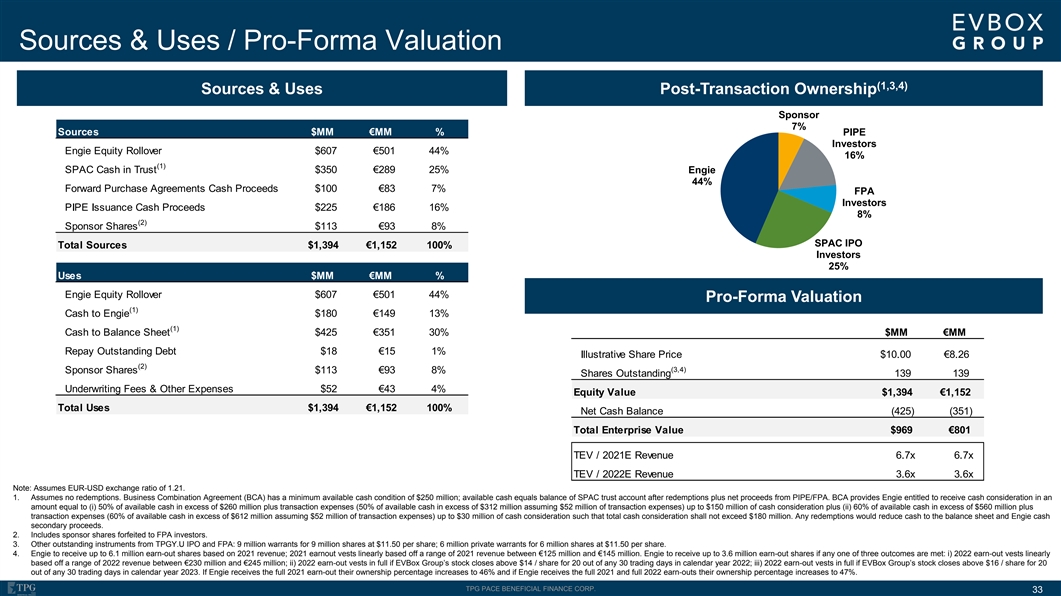

EVBox is Competitively Differentiated in the EV Services Market Current geographic mix Primarily Europe Primarily North America Interoperable software ✓û White-label and multi-tenant platform ✓û Ultra-fast charging (HPC) capabilities – up to 350 kW ✓û 2021E Revenue $145MM (€120MM) $198MM Revenue growth (’20’–’22E CAGR) 79% 60% Gross Profit margin (’23E) 38% 37% EBITDA breakeven year 2023E 2024E Announcement Current Current Share Price $10.00 $24.34 $44.50 1 Enterprise Value $1.0 Billion $3.2 Billion $15.6 Billion 2021E EV / Revenue 6.7x 21.7x 79.0x 2022E EV / Revenue 3.6x 11.6x 45.2x EVBox’s business, financial, and valuation profiles are highly attractive Source: Company investor presentations; Factset as of 1/122021. Note: Assumes EUR-USD exchange ratio of 1.21. Chargepoint financials based on “approximate calendar year” 2020E, 2021E and 2022E . 1. Chargepoint EV includes dilution from 39.2 million private warrants ($6.74 strike price), 16 million SBE warrants ($11.50 strike price) and 21.6 million vested options ($0.61 strike price) using treasury share method as well as assumed vesting of 27.9 million earn-out shares. TPG PACE BENEFICIAL FINANCE CORP. 26EVBox is Competitively Differentiated in the EV Services Market Current geographic mix Primarily Europe Primarily North America Interoperable software ✓û White-label and multi-tenant platform ✓û Ultra-fast charging (HPC) capabilities – up to 350 kW ✓û 2021E Revenue $145MM (€120MM) $198MM Revenue growth (’20’–’22E CAGR) 79% 60% Gross Profit margin (’23E) 38% 37% EBITDA breakeven year 2023E 2024E Announcement Current Current Share Price $10.00 $24.34 $44.50 1 Enterprise Value $1.0 Billion $3.2 Billion $15.6 Billion 2021E EV / Revenue 6.7x 21.7x 79.0x 2022E EV / Revenue 3.6x 11.6x 45.2x EVBox’s business, financial, and valuation profiles are highly attractive Source: Company investor presentations; Factset as of 1/122021. Note: Assumes EUR-USD exchange ratio of 1.21. Chargepoint financials based on “approximate calendar year” 2020E, 2021E and 2022E . 1. Chargepoint EV includes dilution from 39.2 million private warrants ($6.74 strike price), 16 million SBE warrants ($11.50 strike price) and 21.6 million vested options ($0.61 strike price) using treasury share method as well as assumed vesting of 27.9 million earn-out shares. TPG PACE BENEFICIAL FINANCE CORP. 26