CERTAIN CONFIDENTIAL PORTIONS OF THIS EXHIBIT HAVE BEEN OMITTED AND REPLACED WITH [ XYZ ] . SUCH IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT (I) IS NOT MATERIAL AND (II) IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. Exhibit (c)(9)

[ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

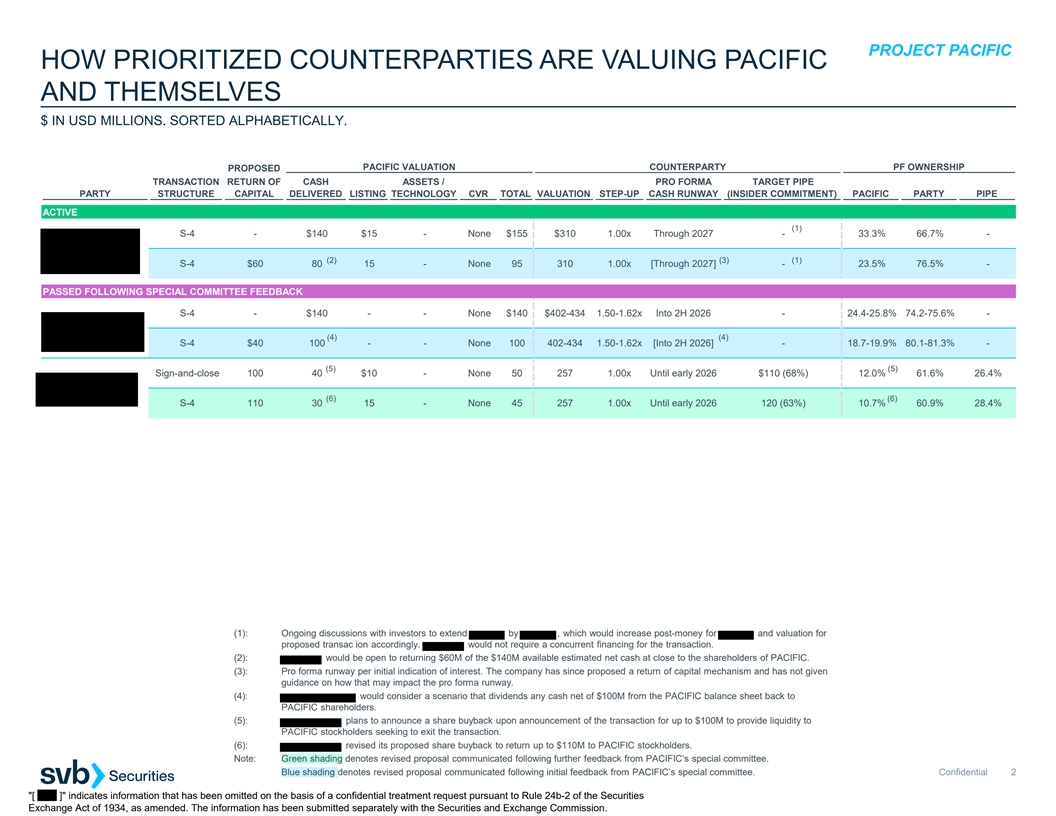

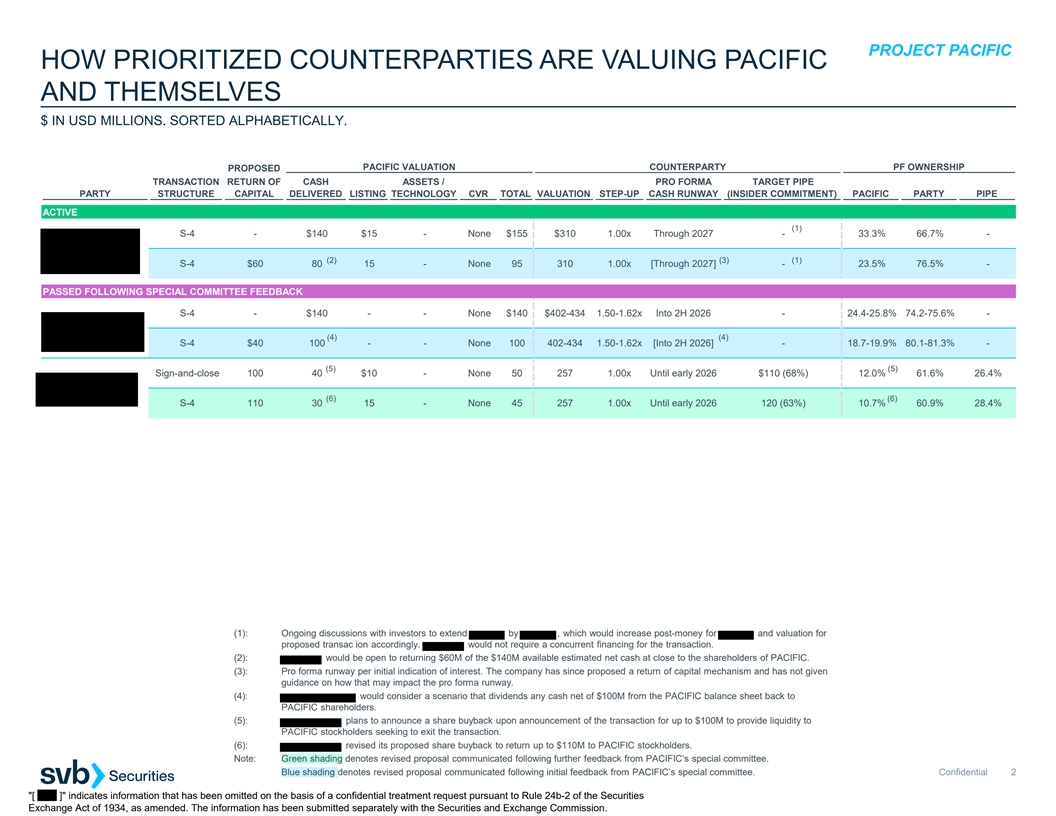

PROJECT PACIFIC HOW PRIORITIZED COUNTERPARTIES ARE VALUING PACIFIC AND THEMSELVES $ IN USD MILLIONS. SORTED ALPHABETICALLY. PACIFIC VALUATION COUNTERPARTY PF OWNERSHIP PROPOSED TRANSACTION RETURN OF CASH ASSETS / PRO FORMA TARGET PIPE PARTY STRUCTURE CAPITAL DELIVERED LISTING TECHNOLOGY CVR TOTAL VALUATION STEP-UP CASH RUNWAY (INSIDER COMMITMENT) PACIFIC PARTY PIPE ACTIVE (1) S-4 - $140 $15 - None $155 $310 1.00x Through 2027 - 33.3% 66.7% - (2) (3) (1) S-4 $60 80 15 - None 95 310 1.00x [Through 2027] - 23.5% 76.5% - PASSED FOLLOWING SPECIAL COMMITTEE FEEDBACK S-4 - $140 - - None $140 $402-434 1.50-1.62x Into 2H 2026 - 24.4-25.8% 74.2-75.6% - (4) (4) S-4 $40 100 - - None 100 402-434 1.50-1.62x [Into 2H 2026] - 18.7-19.9% 80.1-81.3% - (5) (5) Sign-and-close 100 40 $10 - None 50 257 1.00x Until early 2026 $110 (68%) 12.0% 61.6% 26.4% (6) (6) S-4 110 30 15 - None 45 257 1.00x Until early 2026 120 (63%) 10.7% 60.9% 28.4% (1): Ongoing discussions with investors to extend by , which would increase post-money for and valuation for proposed transac ion accordingly. would not require a concurrent financing for the transaction. (2): would be open to returning $60M of the $140M available estimated net cash at close to the shareholders of PACIFIC. (3): Pro forma runway per initial indication of interest. The company has since proposed a return of capital mechanism and has not given guidance on how that may impact the pro forma runway. (4): would consider a scenario that dividends any cash net of $100M from the PACIFIC balance sheet back to PACIFIC shareholders. (5): plans to announce a share buyback upon announcement of the transaction for up to $100M to provide liquidity to PACIFIC stockholders seeking to exit the transaction. (6): revised its proposed share buyback to return up to $110M to PACIFIC stockholders. Note: Green shading denotes revised proposal communicated following further feedback from PACIFIC’s special committee. Blue shading denotes revised proposal communicated following initial feedback from PACIFIC’s special committee. Confidential 2 [ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

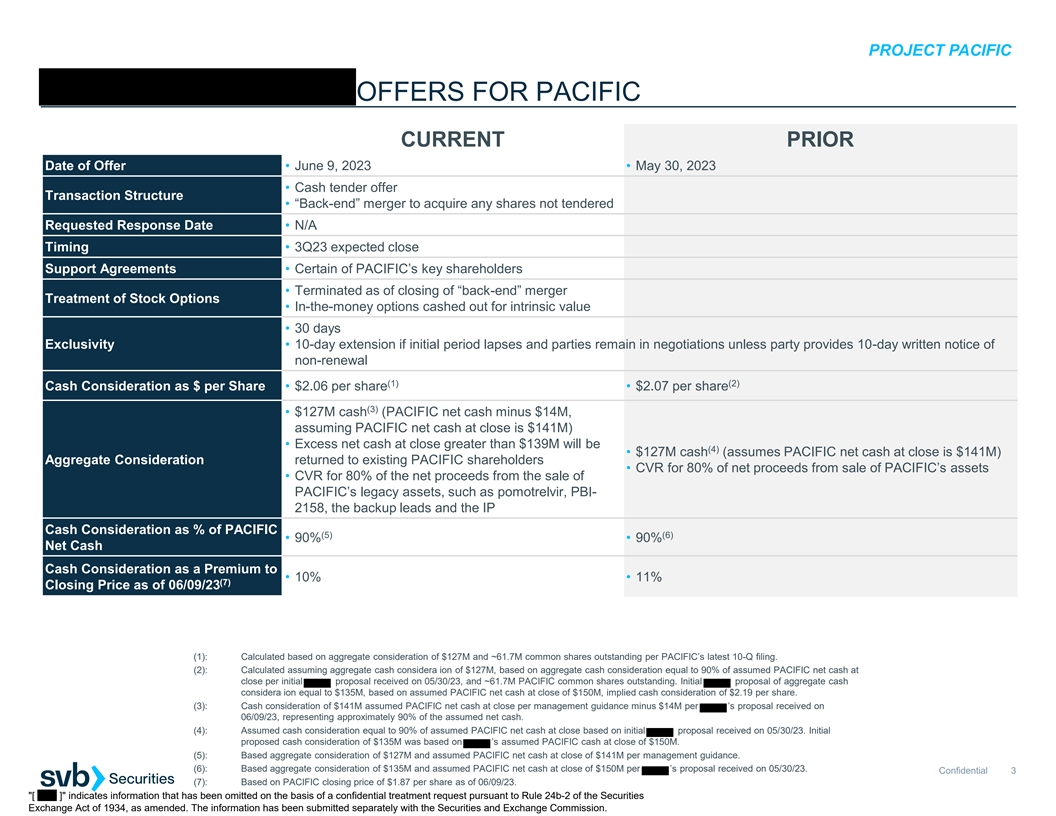

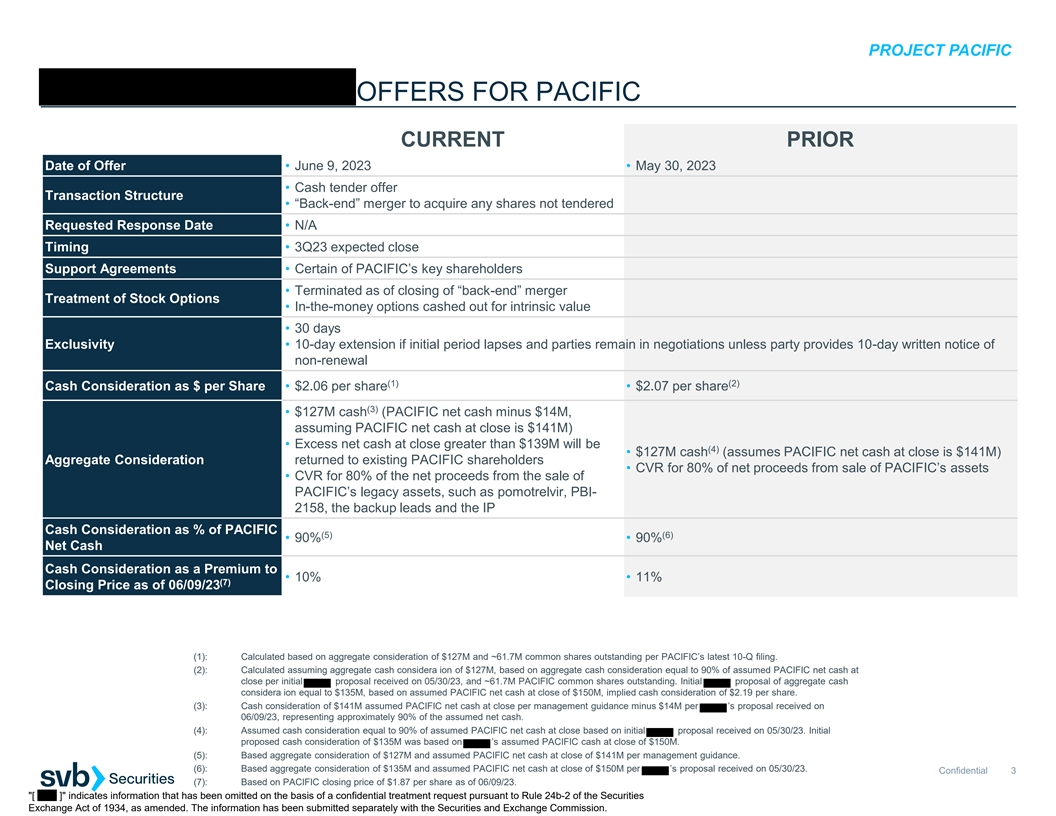

PROJECT PACIFIC OFFERS FOR PACIFIC CURRENT PRIOR Date of Offer • June 9, 2023 • May 30, 2023 • Cash tender offer Transaction Structure • “Back-end” merger to acquire any shares not tendered Requested Response Date • N/A Timing • 3Q23 expected close Support Agreements • Certain of PACIFIC’s key shareholders • Terminated as of closing of “back-end” merger Treatment of Stock Options • In-the-money options cashed out for intrinsic value • 30 days Exclusivity • 10-day extension if initial period lapses and parties remain in negotiations unless party provides 10-day written notice of non-renewal (1) (2) Cash Consideration as $ per Share • $2.06 per share • $2.07 per share (3) • $127M cash (PACIFIC net cash minus $14M, assuming PACIFIC net cash at close is $141M) • Excess net cash at close greater than $139M will be (4) • $127M cash (assumes PACIFIC net cash at close is $141M) Aggregate Consideration returned to existing PACIFIC shareholders • CVR for 80% of net proceeds from sale of PACIFIC’s assets • CVR for 80% of the net proceeds from the sale of PACIFIC’s legacy assets, such as pomotrelvir, PBI- 2158, the backup leads and the IP Cash Consideration as % of PACIFIC (5) (6) • 90% • 90% Net Cash Cash Consideration as a Premium to • 10% • 11% (7) Closing Price as of 06/09/23 (1): Calculated based on aggregate consideration of $127M and ~61.7M common shares outstanding per PACIFIC’s latest 10-Q filing. (2): Calculated assuming aggregate cash considera ion of $127M, based on aggregate cash consideration equal to 90% of assumed PACIFIC net cash at close per initial proposal received on 05/30/23, and ~61.7M PACIFIC common shares outstanding. Initial proposal of aggregate cash considera ion equal to $135M, based on assumed PACIFIC net cash at close of $150M, implied cash consideration of $2.19 per share. (3): Cash consideration of $141M assumed PACIFIC net cash at close per management guidance minus $14M per ’s proposal received on 06/09/23, representing approximately 90% of the assumed net cash. (4): Assumed cash consideration equal to 90% of assumed PACIFIC net cash at close based on initial proposal received on 05/30/23. Initial proposed cash consideration of $135M was based on ’s assumed PACIFIC cash at close of $150M. (5): Based aggregate consideration of $127M and assumed PACIFIC net cash at close of $141M per management guidance. (6): Based aggregate consideration of $135M and assumed PACIFIC net cash at close of $150M per ’s proposal received on 05/30/23. Confidential 3 (7): Based on PACIFIC closing price of $1.87 per share as of 06/09/23. [ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

PROJECT PACIFIC FORESITE CAPITAL’S OFFERS FOR PACIFIC CURRENT PRIOR Date of Offer • June 10, 2023 • June 5, 2023 Transaction Structure • Cash tender offer for outstanding shares not currently owned by FORESITE • June 12, 2023, 5pm ET (2 days from offer date) • June 8, 2023, 5pm ET (3 days from offer date) Requested Response Date Timing • N/A Support Agreements • N/A Treatment of Stock Options • N/A Exclusivity • N/A Cash Consideration as $ per Share • $2.09 per share • $1.93 per share (1) • $129M cash (PACIFIC net cash minus $12M, (2) assuming PACIFIC net cash at close is $141M) • $119M cash (assumes PACIFIC net cash at close is $141M) Aggregate Consideration • CVR for 90% of the net proceeds payable from any • CVR for 80% of the net proceeds payable from any license or license or disposition involving Pomotrelvir within one disposition involving Pomotrelvir within one year of closing year of closing Cash Consideration as % of PACIFIC • 91% • 84% (3) Net Cash Cash Consideration as a Premium to • 12% • 3% (4) Closing Price as of 06/09/23 (1): Based on assumed $141M PACIFIC net cash at close less $12M per FORESITE’s proposal dated 06/10/23. Cash tender to be equal to aggregate considera ion of $129M multiplied by the percentage of common shares not owned by FORESITE and its affiliates, ~16.8M shares (~27.2% of common shares outstanding). (2): Based on offer price of $1.93 per share and ~61.7M common shares outstanding per PACIFIC’s latest 10-Q filing, including ~16.8M shares (~27.2% of common shares outstanding) owned by FORESITE and its affiliates at the offer date. (3): Based on $141M assumed PACIFIC net cash at close per FORESITE proposal. Confidential 4 (4): Based on PACIFIC closing price of $1.87 per share as of 06/09/23.

PROJECT PACIFIC DISCOUNTS TO NET CASH IMPLIED BY RECENT FINANCIAL BUYERS’ PROPOSALS ($ in millions, except per share values) Terms of Proposal Cash Consideration Non-Contingent Offer Target As a % of Premium to Ann. Financial Cash per Equity Total per Aggregate Contingent Net Cash Net Cash Unaffected Offer (1) Date Company Buyer Share per Share Share Value Value Rights at Close at Close Price Accepted 80% of the net proceeds payable from any (2) 05/30/23 $8.00 - $8.00 $53 license or disposition of the MEI's clinical $76 70% 11% O assets 80% of the net proceeds payable from any 05/22/23 5.75 - 5.75 480 570 84% 55% O license or disposition of Atea’s programs Echo Lake (3) 03/21/23 1.60 - 1.60 58 None 87 67% 90% O Capital 80% of the net proceeds for ten years post- closing from any license or disposition of (4) 03/14/23 1.85 - 1.85 96 Jounce’s programs effected within two years 115 85% 75% P of closing and 100% of the potential aggregate value of certain potential cost savings Mean: 76% 58% Median: 77% 65% 25th Percentile: 69% 44% 75th Percentile: 84% 78% (1): Estimated net cash at close per offer filing unless otherwise noted. (2): Expected net cash of ~$93M at 06/30/23 per the S-4 filing, net of ~$17M of total minimum operating lease payments (carrying value of $13M due to present value discounting) as of 03/31/23. (3): $90M cash and cash equivalents net of $3M total liabilities as of 03/31/23. (4): Represents final offer accepted on 03/27/23, increased from the 03/14/23 offer of $1.80 per share + CVR. Note: Includes unsolicited offers from financial buyers for biopharma companies trading below net cash. Excludes unsolicited offers for companies which total liabilities exceeded cash and cash equivalents at he time of the offer. Source: Company press releases and filings. Confidential 5

APPENDIX

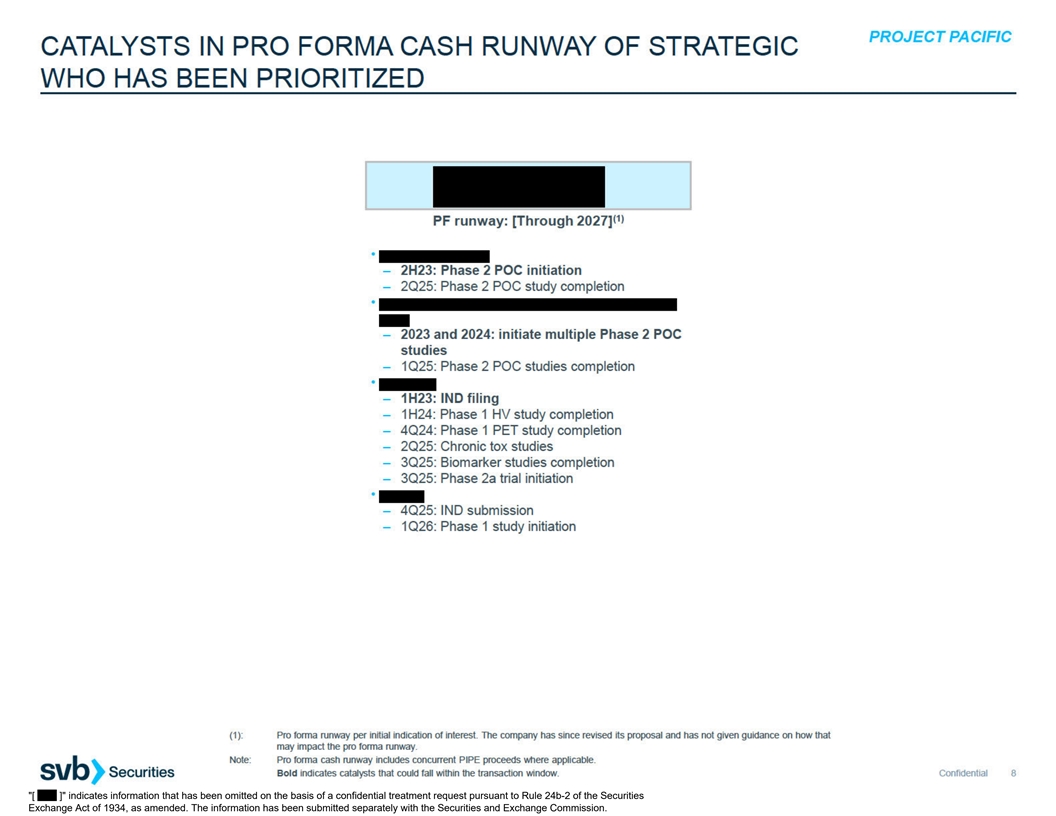

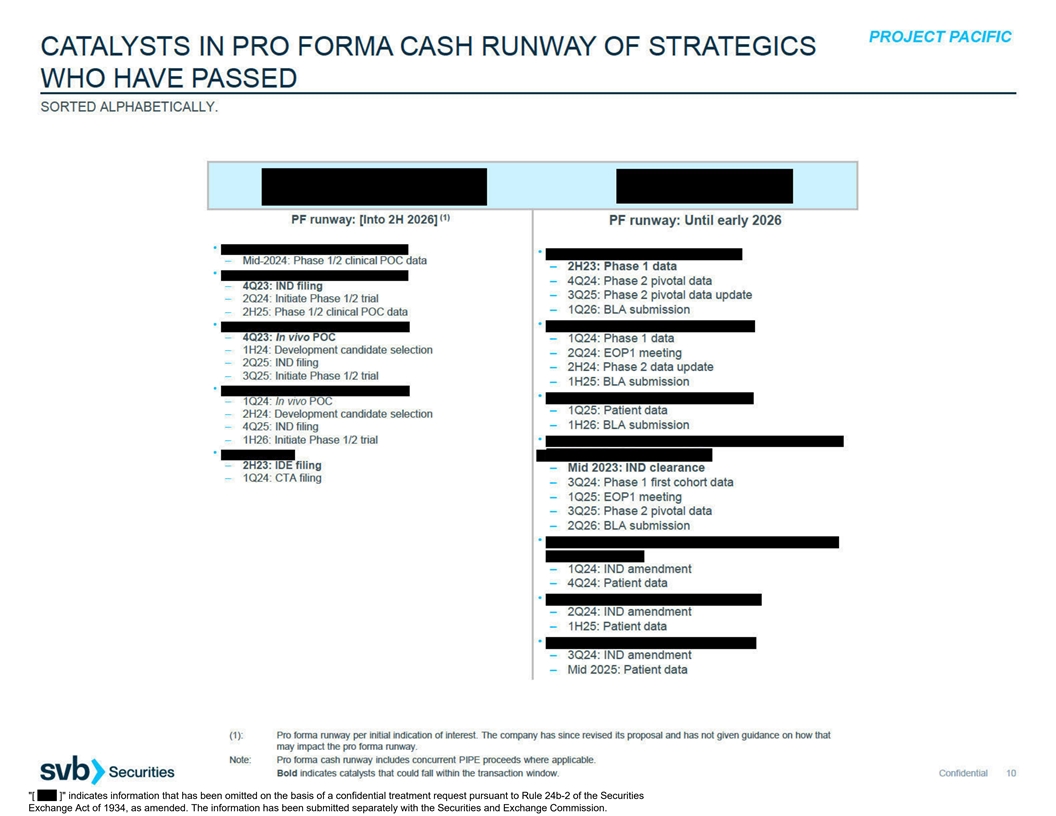

A. CATALYSTS IN PRO FORMA CASH RUNWAY OF STRATEGICS THAT HAVE SUBMITTED INDICATIONS OF INTEREST

[ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

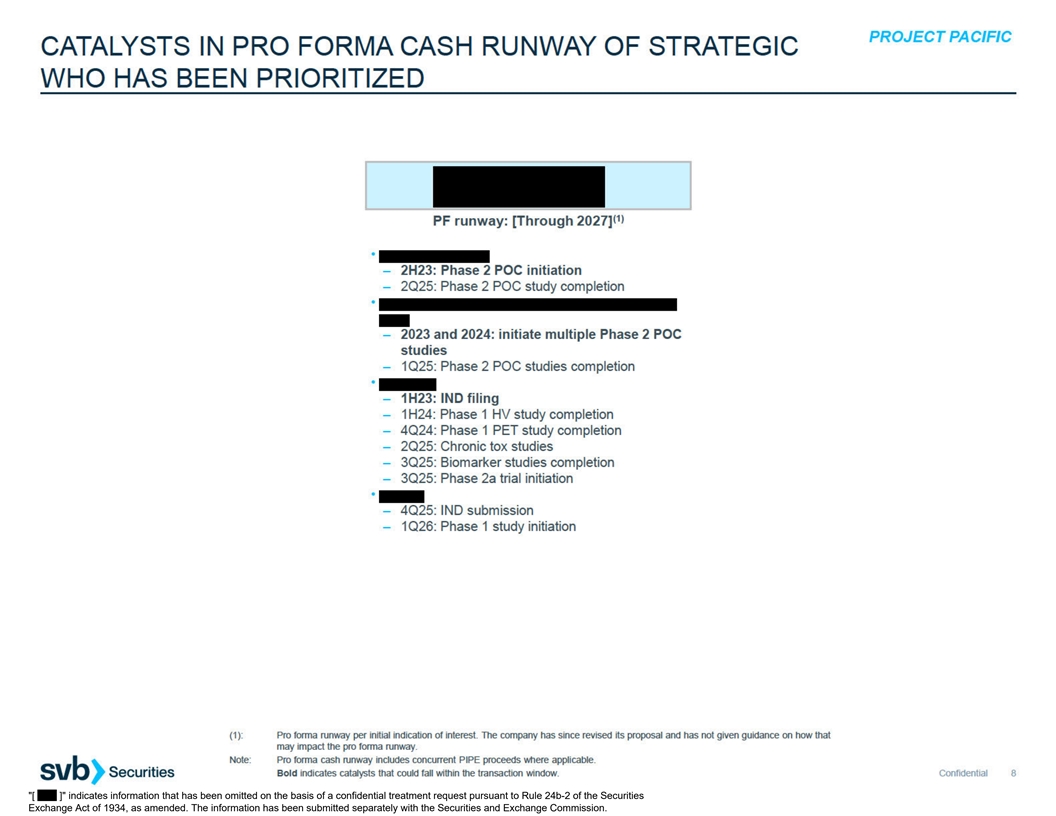

B. INITIAL INDICATIONS OF INTEREST FROM STRATEGIC WHO HAS BEEN PRIORITIZED

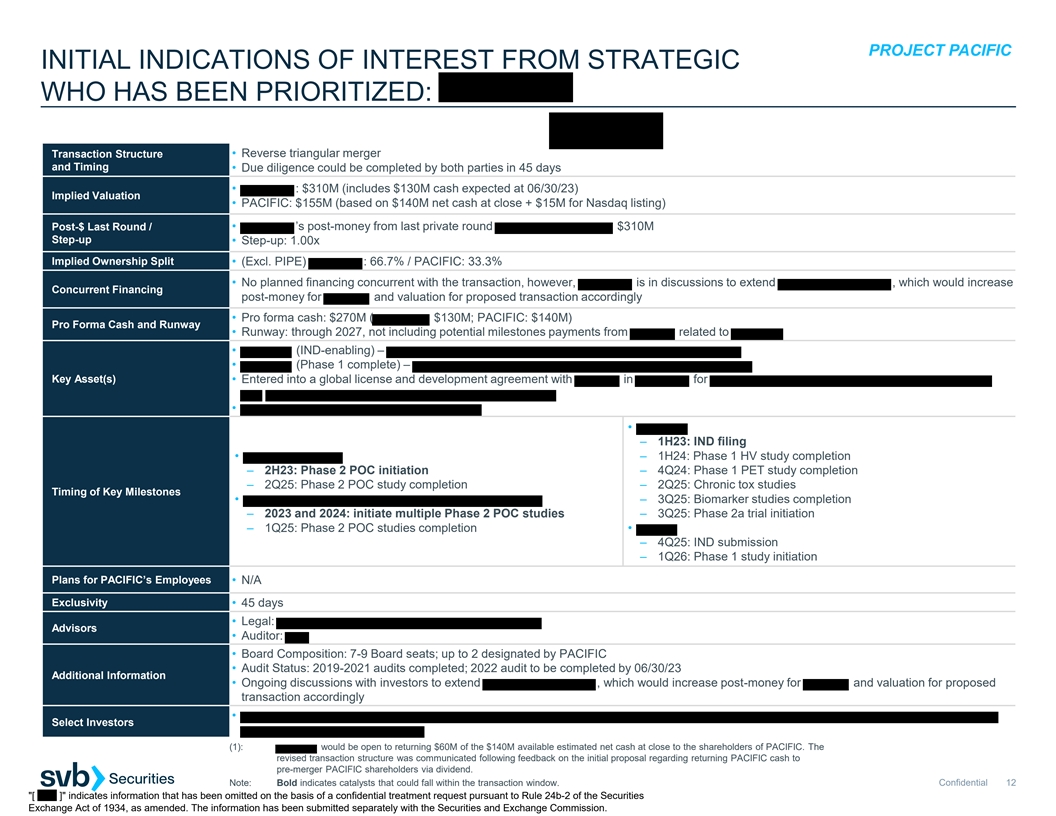

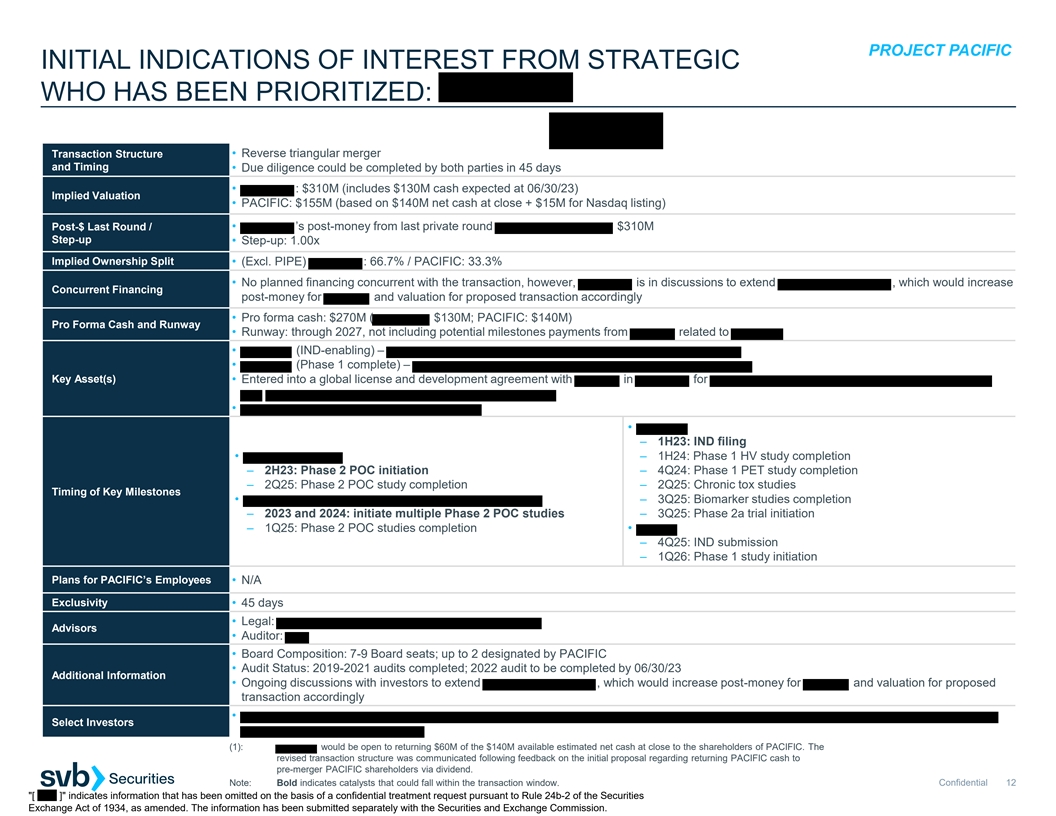

PROJECT PACIFIC INITIAL INDICATIONS OF INTEREST FROM STRATEGIC WHO HAS BEEN PRIORITIZED: Transaction Structure • Reverse triangular merger and Timing • Due diligence could be completed by both parties in 45 days • : $310M (includes $130M cash expected at 06/30/23) Implied Valuation • PACIFIC: $155M (based on $140M net cash at close + $15M for Nasdaq listing) Post-$ Last Round / • ’s post-money from last private round $310M Step-up • Step-up: 1.00x Implied Ownership Split • (Excl. PIPE) : 66.7% / PACIFIC: 33.3% • No planned financing concurrent with the transaction, however, is in discussions to extend , which would increase Concurrent Financing post-money for and valuation for proposed transaction accordingly • Pro forma cash: $270M ( $130M; PACIFIC: $140M) Pro Forma Cash and Runway • Runway: through 2027, not including potential milestones payments from related to • (IND-enabling) – • (Phase 1 complete) – Key Asset(s) • Entered into a global license and development agreement with in for • • – 1H23: IND filing • – 1H24: Phase 1 HV study completion – 2H23: Phase 2 POC initiation – 4Q24: Phase 1 PET study completion – 2Q25: Phase 2 POC study completion – 2Q25: Chronic tox studies Timing of Key Milestones • – 3Q25: Biomarker studies completion – 2023 and 2024: initiate multiple Phase 2 POC studies – 3Q25: Phase 2a trial initiation – 1Q25: Phase 2 POC studies completion • – 4Q25: IND submission – 1Q26: Phase 1 study initiation Plans for PACIFIC’s Employees • N/A Exclusivity • 45 days • Legal: Advisors • Auditor: • Board Composition: 7-9 Board seats; up to 2 designated by PACIFIC • Audit Status: 2019-2021 audits completed; 2022 audit to be completed by 06/30/23 Additional Information • Ongoing discussions with investors to extend , which would increase post-money for and valuation for proposed transaction accordingly • Select Investors (1): would be open to returning $60M of the $140M available estimated net cash at close to the shareholders of PACIFIC. The revised transaction structure was communicated following feedback on the initial proposal regarding returning PACIFIC cash to pre-merger PACIFIC shareholders via dividend. Note: Bold indicates catalysts that could fall within the transaction window. Confidential 12 [ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

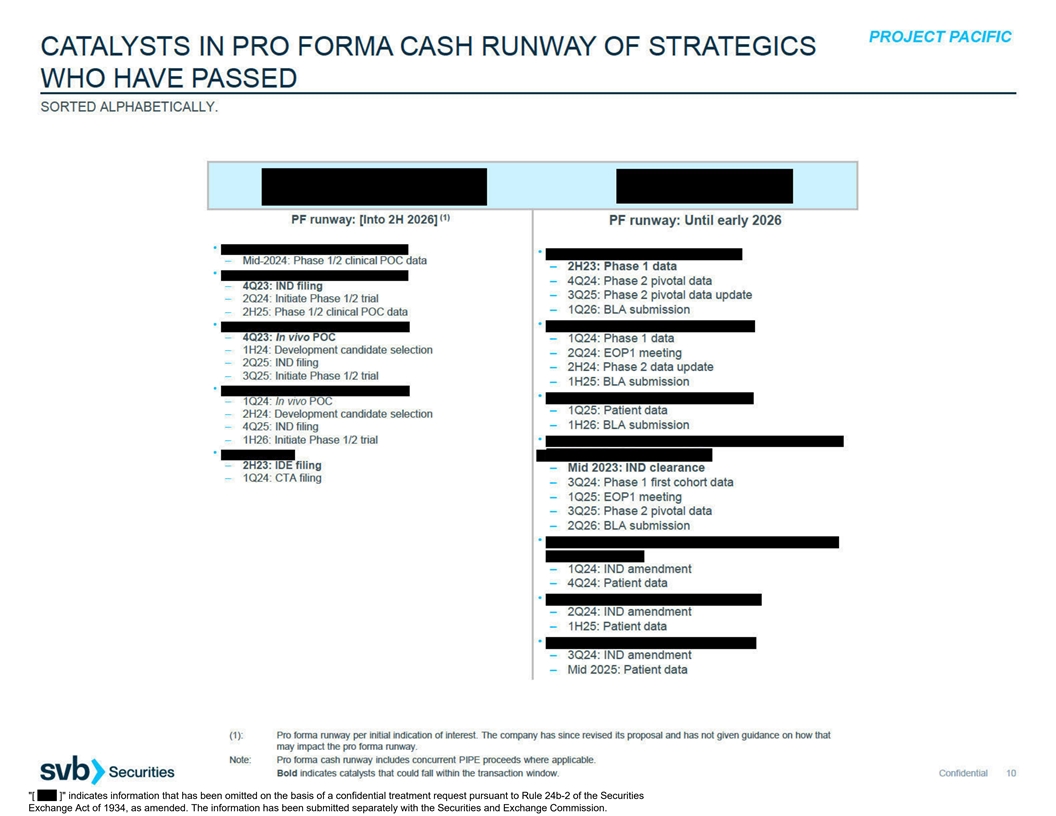

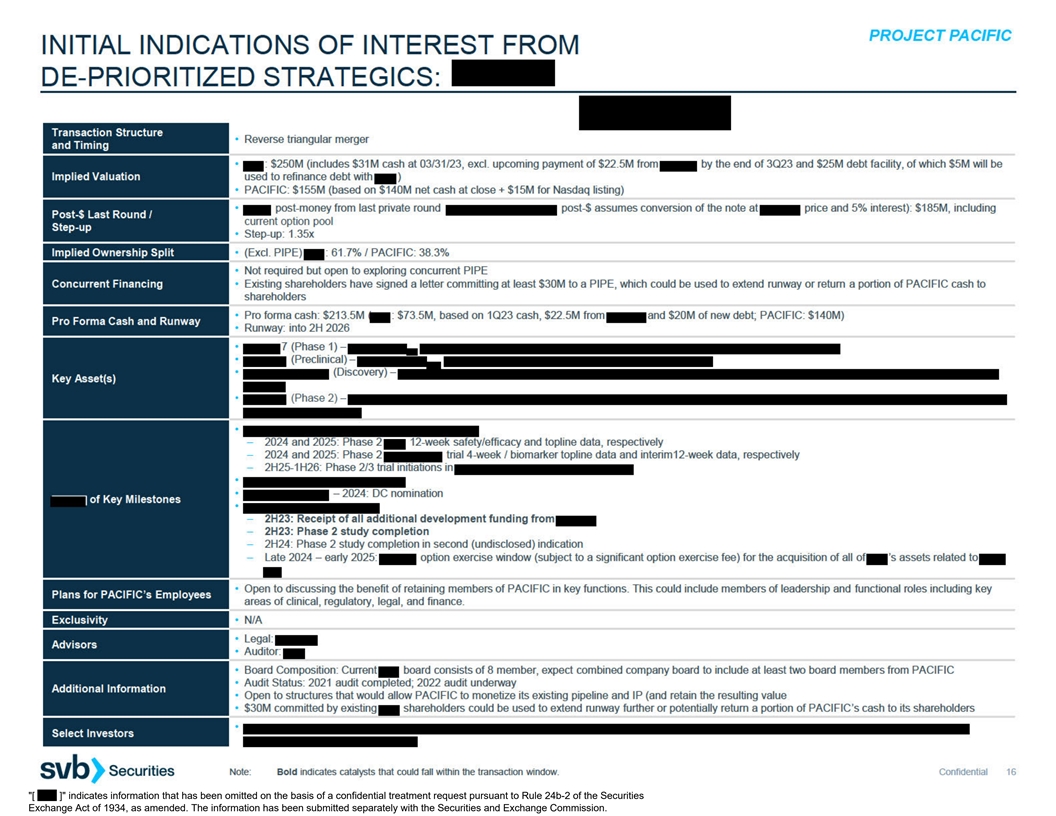

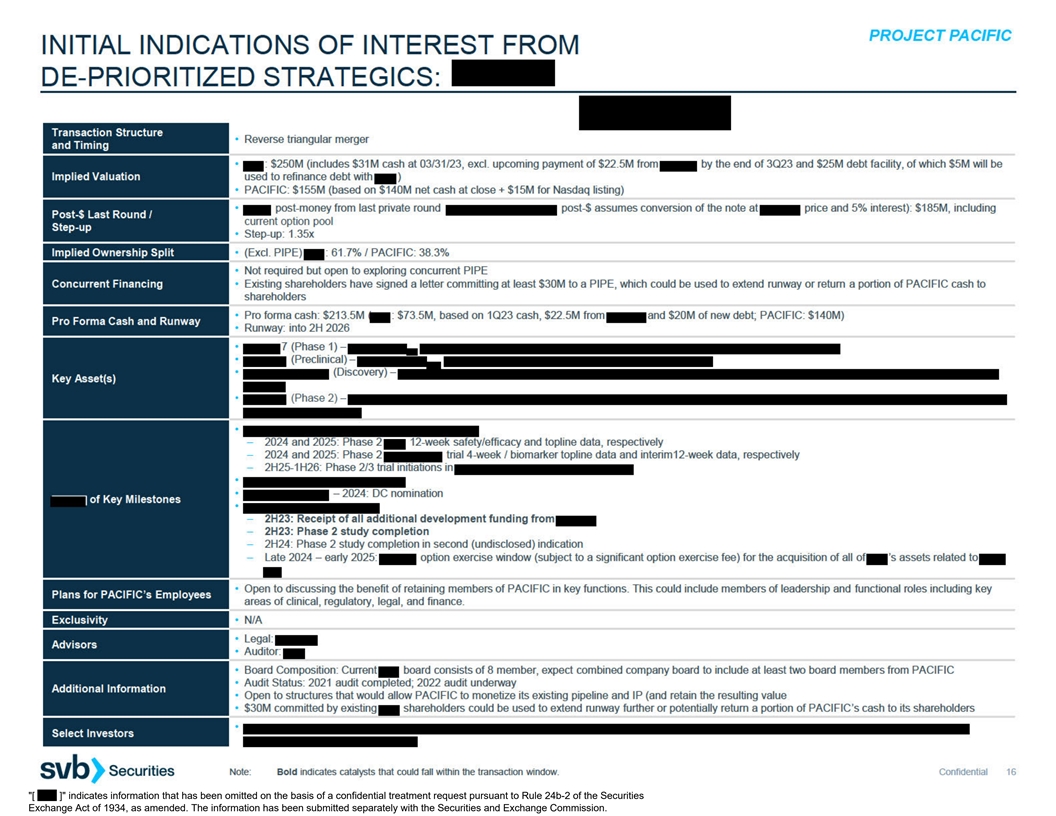

C. INITIAL INDICATIONS OF INTEREST FROM DE-PRIORITIZED STRATEGICS

[ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

[ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

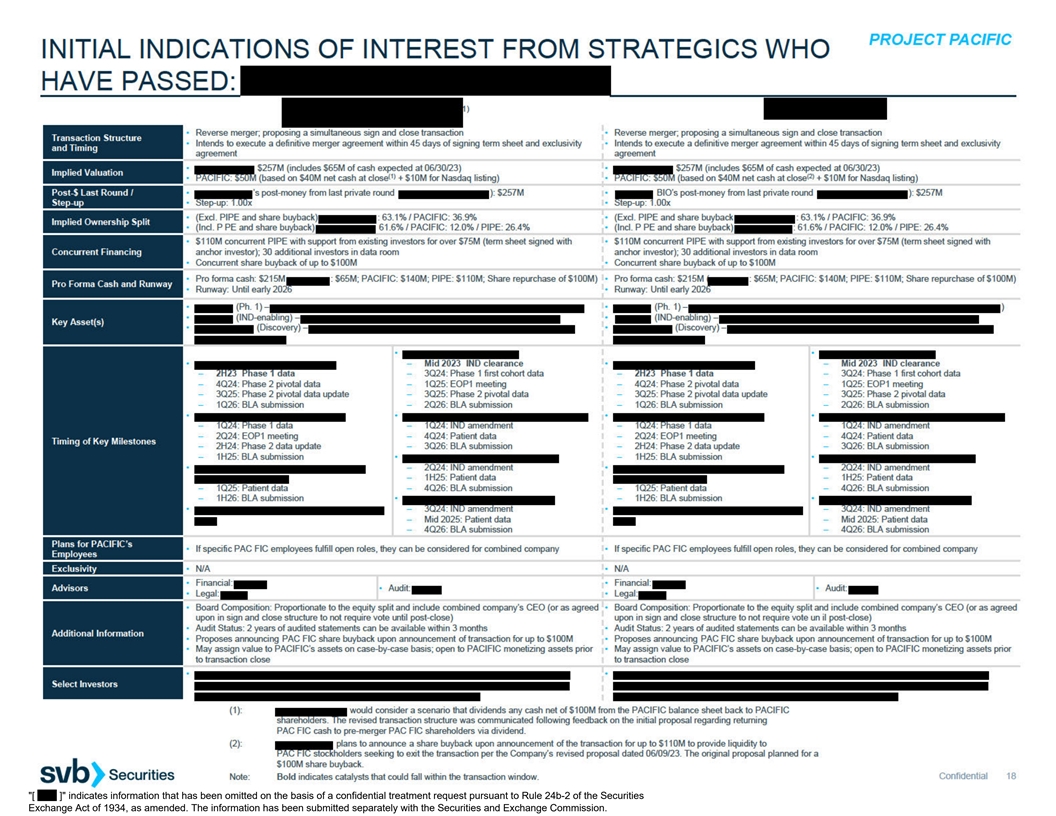

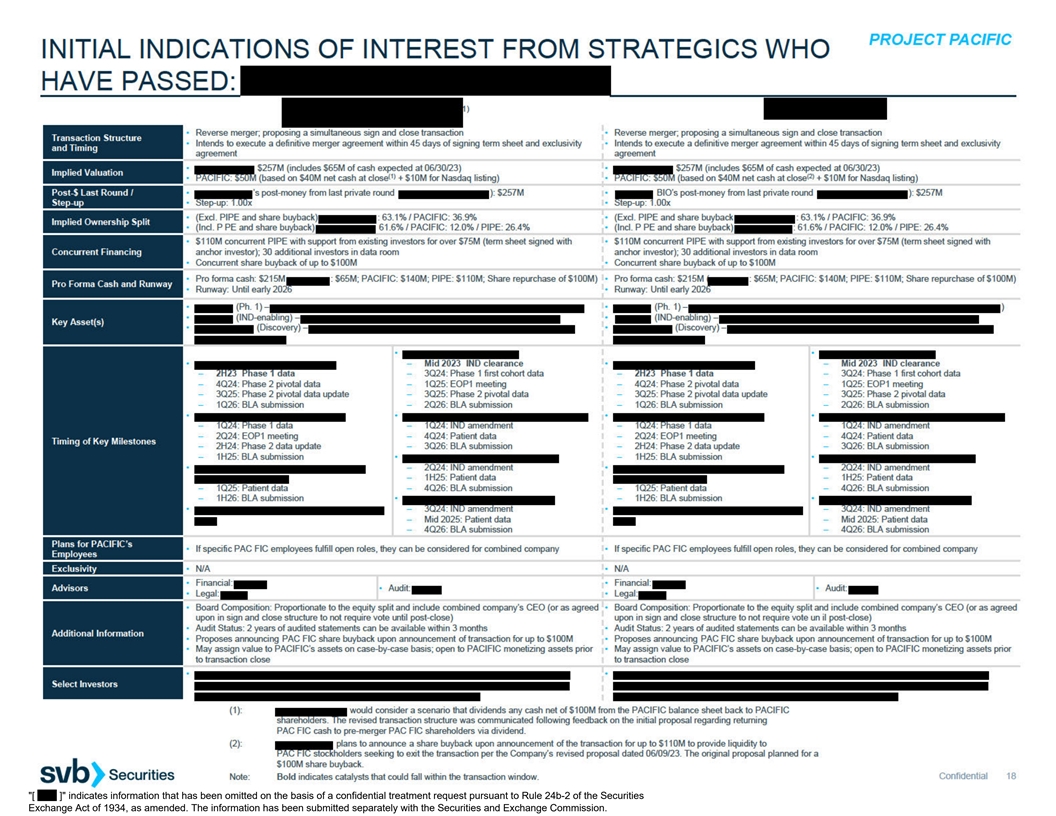

D. INITIAL INDICATION OF INTEREST FROM STRATEGIC WHO HAS PASSED

[ ] indicates information that has been omitted on the basis of a confidential treatment request pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended. The information has been submitted separately with the Securities and Exchange Commission.

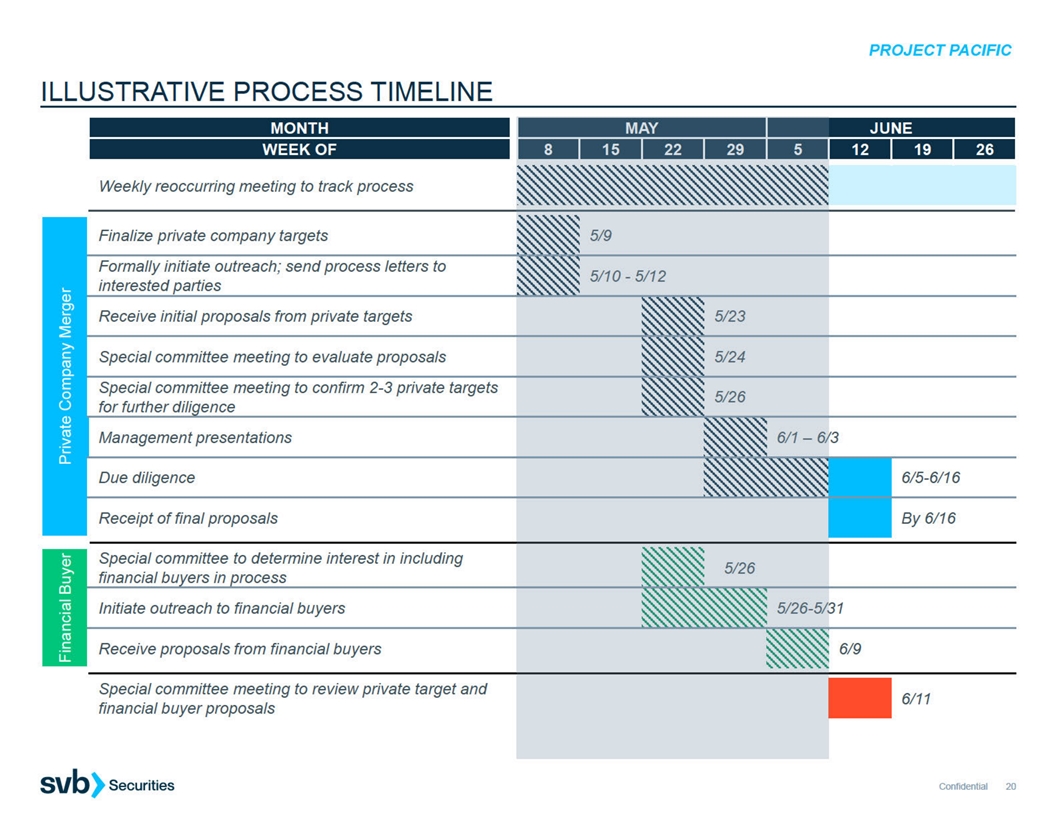

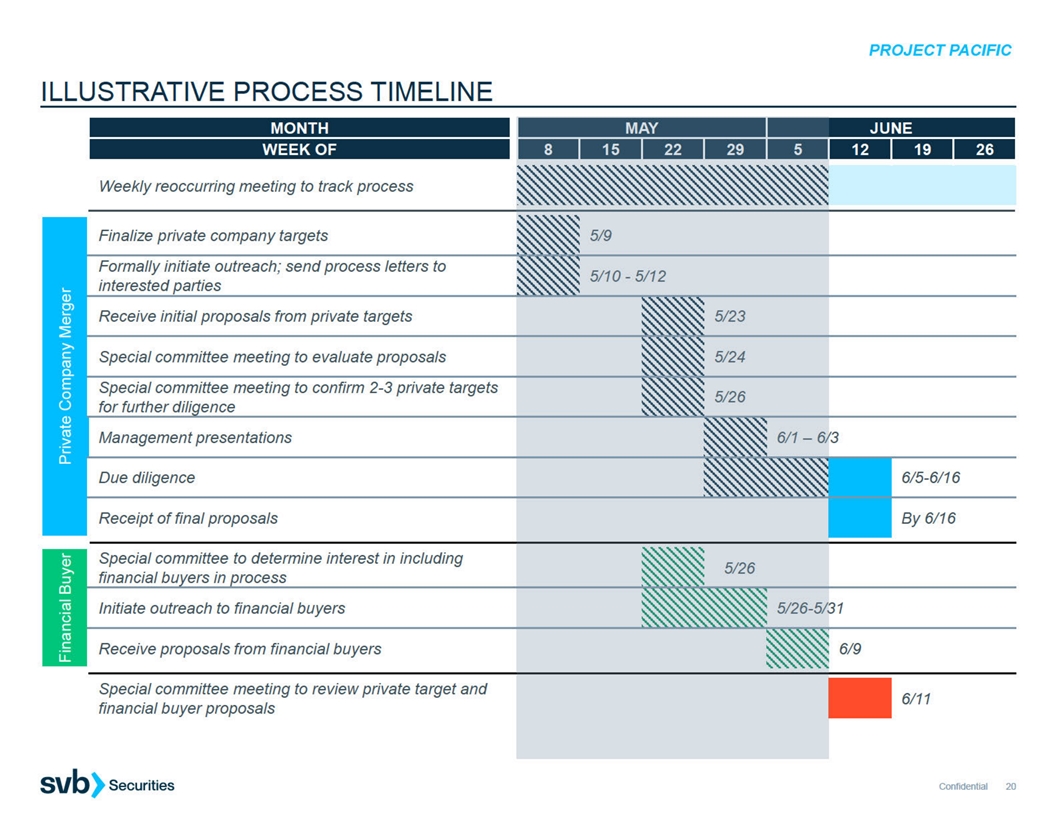

E. ILLUSTRATIVE PROCESS TIMELINE