UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

|

FORM 10-Q |

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 2005 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ________________ to ________________ |

Commission File Number: 1-768 |

CATERPILLAR INC. (Exact name of registrant as specified in its charter) |

Delaware (State or other jurisdiction of incorporation) | 37-0602744 (IRS Employer I.D. No.) |

100 NE Adams Street, Peoria, Illinois (Address of principal executive offices) | 61629 (Zip Code) |

Registrant's telephone number, including area code: (309) 675-1000 |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [ X ] No Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]. Indicate by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes [ X ] No [ ] |

| At September 30, 2005, 680,208,493 shares of common stock of the Registrant were outstanding. |

Page 1

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

Caterpillar Inc. Consolidated Statement of Results of Operations (Unaudited) (Dollars in millions except per share data) |

| | Three Months Ended |

| | September 30, |

| | 2005 | | 2004 |

| |

| |

|

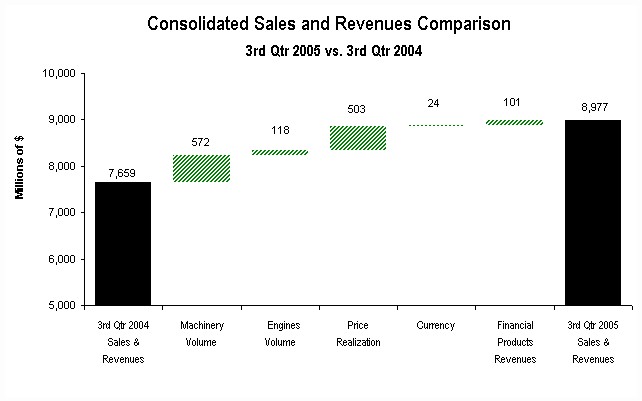

Sales and revenues: | | | | | | | |

| | Sales of Machinery and Engines | $ | 8,392 | | | $ | 7,175 | |

| | Revenues of Financial Products | | 585 | | | | 484 | |

| | |

|

|

| |

|

|

|

| | Total sales and revenues | | 8,977 | | | | 7,659 | |

| | | | | | | | | |

Operating costs: | | | | | | | |

| | Cost of goods sold | | 6,547 | | | | 5,745 | |

| | Selling, general and administrative expenses | | 775 | | | | 701 | |

| | Research and development expenses | | 285 | | | | 240 | |

| | Interest expense of Financial Products | | 197 | | | | 130 | |

| | Other operating expenses | | 233 | | | | 180 | |

| | |

|

|

| |

|

|

|

| | Total operating costs | | 8,037 | | | | 6,996 | |

| | |

|

|

| |

|

|

|

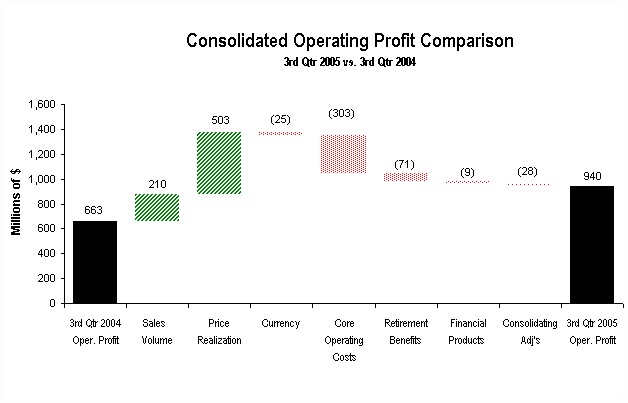

Operating profit | | 940 | | | | 663 | |

| | | | | | | | | |

| | Interest expense excluding Financial Products | | 68 | | | | 60 | |

| | Other income (expense) | | 80 | | | | 60 | |

| | |

|

|

| |

|

|

|

Consolidated profit before taxes | | 952 | | | | 663 | |

| | | | | | | | | |

| | Provision for income taxes | | 303 | | | | 182 | |

| | |

|

|

| |

|

|

|

| | Profit of consolidated companies | | 649 | | | | 481 | |

| | | | | | | | | |

| | Equity in profit (loss) of unconsolidated affiliated companies | | 18 | | | | 17 | |

| | |

|

|

| |

|

|

|

Profit | $ | 667 | | | $ | 498 | |

| |

|

|

| |

|

|

|

Profit per common share | $ | .98 | | | $ | .73 | |

| | | | | | | | | |

Profit per common share - diluted 1 | $ | .94 | | | $ | .70 | |

| | | | | | | | | |

Weighted average common shares outstanding (millions) | | | | | | | |

| | - Basic | | 678.8 | | | | 683.6 | |

| | - Diluted 1 | | 710.7 | | | | 706.0 | |

| | | | | | | | |

Cash dividends declared per common share | $ | - | | | $ | - | |

| | | | | | | | | |

| (1) Diluted by assumed exercise of stock options, using the treasury stock method. |

See accompanying notes to Consolidated Financial Statements. |

Caterpillar Inc. Consolidated Statement of Results of Operations (Unaudited) (Dollars in millions except per share data) |

| | Nine Months Ended |

| | September 30, |

| | 2005 | | 2004 |

| |

| |

|

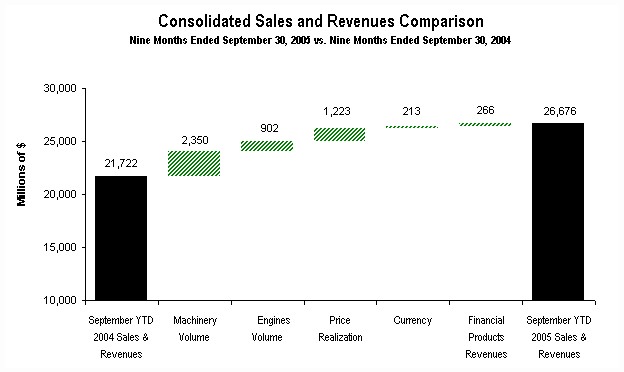

Sales and revenues: | | | | | | | |

| | Sales of Machinery and Engines | $ | 24,965 | | | $ | 20,277 | |

| | Revenues of Financial Products | | 1,711 | | | | 1,445 | |

| | |

|

|

| |

|

|

|

| | Total sales and revenues | | 26,676 | | | | 21,722 | |

| | | | | | | | | |

Operating costs: | | | | | | | |

| | Cost of goods sold | | 19,652 | | | | 16,009 | |

| | Selling, general and administrative expenses | | 2,308 | | | | 2,118 | |

| | Research and development expenses | | 794 | | | | 685 | |

| | Interest expense of Financial Products | | 551 | | | | 370 | |

| | Other operating expenses | | 654 | | | | 539 | |

| | |

|

|

| |

|

|

|

| | Total operating costs | | 23,959 | | | | 19,721 | |

| | |

|

|

| |

|

|

|

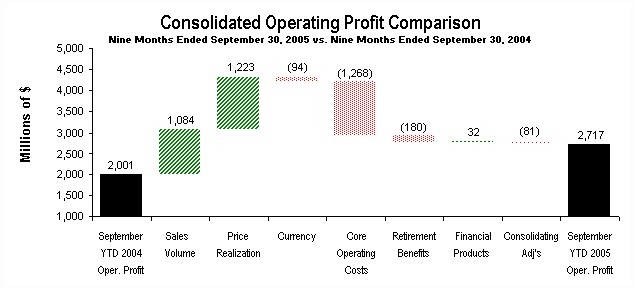

Operating profit | | 2,717 | | | | 2,001 | |

| | | | | | | | | |

| | Interest expense excluding Financial Products | | 198 | | | | 176 | |

| | Other income (expense) | | 278 | | | | 171 | |

| | |

|

|

| |

|

|

|

| | | | | | | | | |

Consolidated profit before taxes | | 2,797 | | | | 1,996 | |

| | | | | | | | | |

| | Provision for income taxes | | 850 | | | | 549 | |

| | |

|

|

| |

|

|

|

| | Profit of consolidated companies | | 1,947 | | | | 1,447 | |

| | | | | | | | | |

| | Equity in profit (loss) of unconsolidated affiliated companies | | 61 | | | | 37 | |

| | |

|

|

| |

|

|

|

Profit | $ | 2,008 | | | $ | 1,484 | |

| |

|

|

| |

|

|

|

Profit per common share | $ | 2.95 | | | $ | 2.17 | |

| | | | | | | | | |

Profit per common share - diluted 1 | $ | 2.84 | | | $ | 2.10 | |

| | | | | | | | | |

Weighted average common shares outstanding (millions) | | | | | | | |

| | - Basic | | 680.5 | | | | 684.5 | |

| | - Diluted 1 | | 707.4 | | | | 708.4 | |

| | | | | | | | |

Cash dividends declared per common share | $ | .46 | | | $ | .39 | |

| | | | | | | | | |

| (1) Diluted by assumed exercise of stock options, using the treasury stock method. |

See accompanying notes to Consolidated Financial Statements. |

Caterpillar Inc. Consolidated Statement of Changes in Stockholders' Equity For the Nine Months Ended (Unaudited) (Dollars in millions) |

| | September 30, 2005 | | September 30, 2004 |

| |

| |

|

Common stock: | | | | | | | | | | | | | | | |

| | Balance at beginning of period | $ | 1,231 | | | | | | | $ | 1,059 | | | | | |

| | Common shares issued from treasury stock | | 252 | | | | | | | | 73 | | | | | |

| | Impact of 2-for-1 stock split | | 338 | | | | | | | | - | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

| | Balance at end of period | | 1,821 | | | | | | | | 1,132 | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

| | | | | | | | | | | | | | | | | |

Treasury stock: | | | | | | | | | | | | | | | |

| | Balance at beginning of period | | (3,277 | ) | | | | | | | (2,914 | ) | | | | |

| | Shares issued: 2005 -16,391,795; 2004 - 5,541,832 | | 277 | | | | | | | | 76 | | | | | |

| | Shares repurchased: 2005 - 22,057,200; 2004 - 10,594,000 | | (1,039 | ) | | | | | | | (400 | ) | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

| | Balance at end of period | | (4,039 | ) | | | | | | | (3,238 | ) | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

Profit employed in the business: | | | | | | | | | | | | | | | |

| | Balance at beginning of period | | 9,937 | | | | | | | | 8,450 | | | | | |

| | Profit | | 2,008 | | | $ | 2,008 | | | | 1,484 | | | $ | 1,484 | |

| | Dividends declared | | (309 | ) | | | | | | | (267 | ) | | | | |

| | Impact of 2-for-1 stock split | | (338 | ) | | | | | | | - | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

| | Balance at end of period | | 11,298 | | | | | | | | 9,667 | | | | | |

| | |

|

|

| | | | | |

|

|

| | | | |

Accumulated other comprehensive income: | | | | | | | | | | | | | | | |

| | Foreign currency translation adjustment: | | | | | | | | | | | | | | | |

| | | Balance at beginning of period | | 489 | | | | | | | | 348 | | | | | |

| | | Aggregate adjustment for period | | (141 | ) | | | (141 | ) | | | 5 | | | | 5 | |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | | Balance at end of period | | 348 | | | | | | | | 353 | | | | | |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | Minimum pension liability adjustment - consolidated companies: | | | | | | | | | | | | | | | |

| | | Balance at beginning of period

(net of tax of: 2005-$485; 2004-$460) | | (993 | ) | | | | | | | (934 | ) | | | | |

| | | Aggregate adjustment for period

(net of tax of: 2005-$24) | | (46 | ) | | | (46 | ) | | | - | | | | - | |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | | Balance at end of period

(net of tax of: 2005-$509; 2004-$460) | | (1,039 | ) | | | | | | | (934 | ) | | | | |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | Minimum pension liability adjustment - unconsolidated companies: | | | | | | | | | | | | | | | |

| | | Balance at beginning of period | | (48 | ) | | | | | | | (48 | ) | | | | |

| | | Aggregate adjustment for period | | 1 | | | | 1 | | | | (1 | ) | | | (1 | ) |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | | Balance at end of period | | (47 | ) | | | | | | | (49 | ) | | | | |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | Derivative financial instruments: | | | | | | | | | | | | | | | |

| | | Balance at beginning of period

(net of tax of: 2005-$58; 2004-$54) | | 110 | | | | | | | | 104 | | | | | |

| | | Gains/(losses) deferred during period

(net of tax of: 2005-$2; 2004-$4) | | (5 | ) | | | (5 | ) | | | 8 | | | | 8 | |

| | | (Gains)/losses reclassified to earnings during period

(net of tax of: 2005-$40; 2004-$17) | | (75 | ) | | | (75 | ) | | | (33 | ) | | | (33 | ) |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | | Balance at end of period

(net of tax of: 2005-$16; 2004-$41) | | 30 | | | | | | | | 79 | | | | | |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | Available-for-sale securities: | | | | | | | | | | | | | | | |

| | | Balance at beginning of period

(net of tax of: 2005-$10; 2004-$7) | | 18 | | | | | | | | 13 | | | | | |

| | | Gains/(losses) deferred during period

(net of tax of: 2005-$2; 2004-$1) | | 4 | | | | 4 | | | | (2 | ) | | | (2 | ) |

| | | (Gains)/losses reclassified to earnings during period

(net of tax of 2005-$1; 2004-$0) | | (2 | ) | | | (2 | ) | | | - | | | | | |

| | | |

|

|

| | | | | |

|

|

| | | | |

| | | Balance at end of period

(net of tax of: 2005-$11; 2004-$6) | | 20 | | | | | | | | 11 | | | | | |

| | | |

|

|

| | | | | |

|

|

| | | | |

Total accumulated other comprehensive income | | (688 | ) | | | | | | | (540 | ) | | | | |

| |

|

|

| | | | | |

|

|

| | | | |

| | Comprehensive income | | | | | $ | 1,744 | | | | | | | $ | 1,461 | |

| | | | | | |

|

|

| | | | | |

|

|

|

Stockholders' equity at end of period | $ | 8,392 | | | | | | | $ | 7,021 | | | | | |

| |

|

|

| | | | | |

|

|

| | | | |

See accompanying notes to Consolidated Financial Statements. |

Caterpillar Inc. Consolidated Statement of Financial Position (Unaudited) (Dollars in millions) |

| | | | September 30, 2005 | | December 31, 2004 |

| | | |

| |

|

Assets | | | | | | | |

| | Current assets: | | | | | | | |

| | | Cash and short-term investments | $ | 967 | | | $ | 445 | |

| | | Receivables - trade and other | | 7,319 | | | | 7,463 | |

| | | Receivables - finance | | 5,725 | | | | 5,182 | |

| | | Deferred and refundable income taxes | | 581 | | | | 398 | |

| | | Prepaid expenses | | 1,301 | | | | 1,369 | |

| | | Inventories | | 5,469 | | | | 4,675 | |

| | | |

|

|

| |

|

|

|

| | Total current assets | | 21,362 | | | | 19,532 | |

| | | | | | | | | |

| | Property, plant and equipment - net | | 7,817 | | | | 7,682 | |

| | Long-term receivables - trade and other | | 893 | | | | 764 | |

| | Long-term receivables - finance | | 10,336 | | | | 9,903 | |

| | Investments in unconsolidated affiliated companies | | 563 | | | | 517 | |

| | Deferred income taxes | | 707 | | | | 674 | |

| | Intangible assets | | 462 | | | | 315 | |

| | Goodwill | | 1,451 | | | | 1,450 | |

| | Other assets | | 2,274 | | | | 2,258 | |

| | |

|

|

| |

|

|

|

Total assets | $ | 45,865 | | | $ | 43,095 | |

| |

|

|

| |

|

|

|

Liabilities | | | | | | | |

| | Current liabilities: | | | | | | | |

| | | Short-term borrowings: | | | | | | | |

| | | | Machinery and Engines | | 603 | | | | 93 | |

| | | | Financial Products | | 5,361 | | | | 4,064 | |

| | | Accounts payable | | 3,425 | | | | 3,580 | |

| | | Accrued expenses | | 2,508 | | | | 2,261 | |

| | | Accrued wages, salaries and employee benefits | | 1,735 | | | | 1,730 | |

| | | Customer advances | | 554 | | | | 447 | |

| | | Dividends payable | | - | | | | 141 | |

| | | Deferred and current income taxes payable | | 583 | | | | 259 | |

| | | Long-term debt due within one year: | | | | | | | �� |

| | | | Machinery and Engines | | 234 | | | | 6 | |

| | | | Financial Products | | 3,850 | | | | 3,525 | |

| | |

|

|

| |

|

|

|

| | Total current liabilities | | 18,853 | | | | 16,106 | |

| | | | | | | | | | | |

| | Long-term debt due after one year: | | | | | | | |

| | | Machinery and Engines | | 3,406 | | | | 3,663 | |

| | | Financial Products | | 11,578 | | | | 12,174 | |

| | Liability for postemployment benefits | | 2,827 | | | | 2,986 | |

| | Deferred income taxes and other liabilities | | 809 | | | | 699 | |

| | |

|

|

| |

|

|

|

Total liabilities | | 37,473 | | | | 35,628 | |

| |

|

|

| |

|

|

|

Stockholders' equity | | | | | | | |

| | Common stock of $1.00 par: | | | | | | | |

| | | Authorized shares: 900,000,000 Issued shares: (9/30/05 and 12/31/04 - 814,894,624) at paid in amount | | 1,821 | | | | 1,231 | |

| | Treasury stock (9/30/05 - 134,686,131; 12/31/04 - 129,020,726) at cost | | (4,039 | ) | | | (3,277 | ) |

| | Profit employed in the business | | 11,298 | | | | 9,937 | |

| | Accumulated other comprehensive income | | (688 | ) | | | (424 | ) |

| | |

|

|

| |

|

|

|

Total stockholders' equity | | 8,392 | | | | 7,467 | |

| |

|

|

| |

|

|

|

Total liabilities and stockholders' equity | $ | 45,865 | | | $ | 43,095 | |

| |

|

|

| |

|

|

|

See accompanying notes to Consolidated Financial Statements. |

Caterpillar Inc. Consolidated Statement of Cash Flow (Unaudited) (Millions of dollars) |

| | | Nine Months Ended |

| | | September 30, |

| | | 2005 | | 2004 |

| | |

| |

|

Cash flow from operating activities: | | | | | | | |

| | Profit | $ | 2,008 | | | $ | 1,484 | |

| | Adjustments for non-cash items: | | | | | | | |

| | | Depreciation and amortization | | 1,113 | | | | 1,055 | |

| | | Other | | (89 | ) | | | (83 | ) |

| | Changes in assets and liabilities: | | | | | | | |

| | | Receivables - trade and other (see non-cash item below) | | (521 | ) | | | (7,110 | ) |

| | | Inventories | | (794 | ) | | | (1,225 | ) |

| | | Accounts payable and accrued expenses | | 313 | | | | 728 | |

| | | Other assets - net | | 69 | | | | 76 | |

| | | Other liabilities - net | | 31 | | | | (2 | ) |

| | | |

|

|

| |

|

|

|

Net cash provided by (used for) operating activities | | 2,130 | | | | (5,077 | ) |

| |

|

|

| |

|

|

|

| | | | | | | | | |

Cash flow from investing activities: | | | | | | | |

| | Capital expenditures - excluding equipment leased to others | | (709 | ) | | | (519 | ) |

| | Expenditures for equipment leased to others | | (965 | ) | | | (827 | ) |

| | Proceeds from disposals of property, plant and equipment | | 447 | | | | 378 | |

| | Additions to finance receivables | | (7,310 | ) | | | (6,423 | ) |

| | Collections of finance receivables | | 4,889 | | | | 4,617 | |

| | Proceeds from the sale of finance receivables | | 916 | | | | 647 | |

| | Collections of retained interests in securitized trade receivables | | - | | | | 5,722 | |

| | Investments and acquisitions (net of cash acquired) | | (12 | ) | | | (284 | ) |

| | Other - net | | 80 | | | | (40 | ) |

| | |

|

|

| |

|

|

|

Net cash provided by (used for) investing activities | | (2,664 | ) | | | 3,271 | |

| |

|

|

| |

|

|

|

| | | | | | | | | |

Cash flow from financing activities: | | | | | | | |

| | Dividends paid | | (449 | ) | | | (395 | ) |

| | Common stock issued, including treasury shares reissued | | 412 | | | | 137 | |

| | Treasury shares purchased | | (1,039 | ) | | | (400 | ) |

| | Proceeds from long-term debt issued | | 4,358 | | | | 4,532 | |

| | Payments on long-term debt | | (3,324 | ) | | | (2,615 | ) |

| | Short-term borrowings - net | | 1,085 | | | | 563 | |

| | |

|

|

| |

|

|

|

Net cash provided by financing activities | | 1,043 | | | | 1,822 | |

| |

|

|

| |

|

|

|

Effect of exchange rate changes on cash | | 13 | | | | 59 | |

| |

|

|

| |

|

|

|

Increase in cash and short-term investments | | 522 | | | | 75 | |

| | | | | | | | |

Cash and short-term investments at beginning of period | | 445 | | | | 342 | |

| |

|

|

| |

|

|

|

Cash and short-term investments at end of period | $ | 967 | | | $ | 417 | |

| |

|

|

| |

|

|

|

| All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. |

Non-cash operating and investing activities:

Trade receivables of $0 and $6,786 million were exchanged for retained interests in securitized trade receivables during the nine months ended September 30, 2005 and 2004, respectively. |

See accompanying notes to Consolidated Financial Statements. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited) |

1. | A. Financial Statement Presentation In the opinion of management, all adjustments, consisting only of normal recurring adjustments necessary for a fair statement of (a) the consolidated results of operations for the three and nine month periods ended September 30, 2005 and 2004, (b) the changes in stockholders' equity for the nine month periods ended September 30, 2005 and 2004, (c) the consolidated financial position at September 30, 2005 and December 31, 2004, and (d) the consolidated statement of cash flow for the nine month periods ended September 30, 2005 and 2004, have been made. Certain amounts for prior periods have been reclassified to conform to the current period financial statement presentation. In the fourth quarter of 2004, we changed how we classify cash flows related to trade receivables securitized through Cat Financial and wholesale inventory receivables financed by Cat Financial. Amounts reported in our Consolidated Statement of Cash Flow for the nine months ended September 30, 2004 have been reclassified to conform to this presentation. These reclassifications had no impact on the “Increase in Cash and Short-term Investments” on the Consolidated Statement of Cash Flow. Consolidated cash flow for the nine months ended September 30, 2004 has been reclassified as follows: |

| | | Nine Months Ended September 30, 2004

|

| | (Millions of dollars) | Previous Classification1 | | Change | | As Reclassified |

| | |

| |

| |

|

| | Consolidated Statement of Cash Flow | | | | | | | | | | | |

| | Receivables - trade and other | $ | (461 | ) | | $ | (6,649 | ) | | $ | (7,110 | ) |

| | Net cash provided by (used for) operating activities | | 1,535 | | | | (6,612 | ) | | | (5,077 | ) |

| | Additions to finance receivables | | (16,493 | ) | | | 10,070 | | | | (6,423 | ) |

| | Collections of finance receivables | | 13,010 | | | | (8,393 | ) | | | 4,617 | |

| | Proceeds from sale of finance receivables | | 1,434 | | | | (787 | ) | | | 647 | |

| | Collections of retained interests in securitized trade receivables_ | | - | | | | 5,722 | | | | 5,722 | |

| | Net cash provided by (used for) investing activities | | (3,341 | ) | | | 6,612 | | | | 3,271 | |

| | (1) Certain amounts do not agree to prior period reported amounts due to unrelated reclassifications. |

| | On June 8, 2005, Caterpillar’s Board of Directors approved a 2-for-1 stock split in the form of a 100 percent stock dividend. The stock split shares were distributed on July 13, 2005 to stockholders of record at the close of business on June 22, 2005. The capital accounts, share data, and earnings per share data in these Consolidated Financial Statements reflect the stock split, applied retroactively, to all periods presented. Comprehensive income is comprised of profit, as well as gains and losses from currency translation, derivative instruments designated as cash flow hedges and available-for-sale securities and adjustments in the minimum pension liability. Total comprehensive income for the three months ended September 30, 2005 and 2004 was $645 million and $507 million, respectively. Total comprehensive income for the nine months ended September 30, 2005 and 2004 was $1.744 billion and $1.461 billion, respectively. The difference from profit primarily consists of foreign currency translation adjustments and gains on derivative instruments that were reclassified to earnings. The December 31, 2004 financial position data included herein is derived from the audited consolidated financial statements included in the Company's annual report on Form 10-K for the year ended December 31, 2004. |

| | B. Nature of Operations We operate in three principal lines of business: |

| | (1) | Machinery - A principal line of business which includes the design, manufacture, marketing and sales of construction, mining and forestry machinery - track and wheel tractors, track and wheel loaders, pipelayers, motor graders, wheel tractor-scrapers, track and wheel excavators, backhoe loaders, log skidders, log loaders, off-highway trucks, articulated trucks, paving products, telescopic handlers, skid steer loaders and related parts. Also includes logistics services for other companies. |

| | (2) | Engines - A principal line of business including the design, manufacture, marketing and sales of engines for Caterpillar machinery, electric power generation systems; on-highway vehicles and locomotives; marine, petroleum, construction, industrial, agricultural and other applications; and related parts. Reciprocating engines meet power needs ranging from 5 to over 22,000 horsepower (4 to over 16 200 kilowatts). Turbines range from 1,200 to 20,500 horsepower (900 to 15 000 kilowatts). |

| | (3) | Financial Products - A principal line of business consisting primarily of Caterpillar Financial Services Corporation (Cat Financial), Caterpillar Insurance Holdings, Inc. (Cat Insurance), Caterpillar Power Ventures Corporation (Cat Power Ventures) and their respective subsidiaries. Cat Financial provides a wide range of financing alternatives to customers and dealers for Caterpillar machinery and engines, Solar gas turbines, as well as other equipment and marine vessels. Cat Financial also extends loans to customers and dealers. Cat Insurance provides various forms of insurance to customers and dealers to help support the purchase and lease of our equipment. Cat Power Ventures is an active investor in independent power projects using Caterpillar power generation equipment and services. |

| | Our Machinery and Engines operations are highly integrated. Throughout the Notes, Machinery and Engines represents the aggregate total of these principal lines of business. |

| | C. Stock-Based Compensation We currently use the intrinsic value method of accounting for stock-based employee compensation in accordance with Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees." Therefore, no compensation expense is recognized in association with our options. In 2004, we switched from using the Black-Scholes option-pricing model to the binomial option-pricing model in order to calculate the fair value of our options. We believe this model more accurately reflects the value of the options than the Black-Scholes option-pricing model. Grants made prior to 2004 continue to be valued using the Black-Scholes model. |

| | The table below illustrates the effect on profit and earnings per share if we had applied the fair value method of Statement of Financial Accounting Standards (SFAS 123), “Accounting for Stock-Based Compensation” for the three and nine month periods ending September 30, 2005 and 2004. |

| | | Three Months Ended September 30, |

| | |

|

| | (Dollars in millions except per share data) | 2005 | | 2004 |

| | |

| |

|

| | Profit, as reported | $ | 667 | | | $ | 498 | |

| | Deduct: Total stock-based employee compensation expense determined

under fair value based method for all awards, net of related tax effects | | (6 | ) | | | (58 | ) |

| | |

|

|

| |

|

|

|

| | Pro forma profit | $ | 661 | | | $ | 440 | |

| | |

|

|

| |

|

|

|

| | Profit per share of common stock: | | | | | | | |

| | | As reported: | | | | | | | |

| | | | Basic | $ | .98 | | | $ | .73 | |

| | | | Diluted | $ | .94 | | | $ | .70 | |

| | | Pro forma: | | | | | | | |

| | | | Basic | $ | .97 | | | $ | .64 | |

| | | | Diluted | $ | .93 | | | $ | .62 | |

| | | Nine Months Ended September 30, |

| | |

|

| | (Dollars in millions except per share data) | 2005 | | 2004 |

| | |

| |

|

| | Profit, as reported | $ | 2,008 | | | $ | 1,484 | |

| | Deduct: Total stock-based employee compensation expense determined

under fair value based method for all awards, net of related tax effects | | (129 | ) | | | (103 | ) |

| | |

|

|

| |

|

|

|

| | Pro forma profit | $ | 1,879 | | | $ | 1,381 | |

| | |

|

|

| |

|

|

|

| | Profit per share of common stock: | | | | | | | |

| | | As reported: | | | | | | | |

| | | | Basic | $ | 2.95 | | | $ | 2.17 | |

| | | | Diluted | $ | 2.84 | | | $ | 2.10 | |

| | | Pro forma: | | | | | | | |

| | | | Basic | $ | 2.76 | | | $ | 2.02 | |

| | | | Diluted | $ | 2.66 | | | $ | 1.95 | |

| | Pro forma profit for the nine months ended September 30, 2005 reflects immediate vesting of the 2005 stock option grant. (See Note 3 for further discussion.) |

2. | The results for the three and nine month periods ended September 30, 2005 are not necessarily indicative of the results for the entire year 2005. |

3. | New Accounting Pronouncements |

| | In November 2004, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 151 (SFAS 151), “Inventory Costs - an amendment of ARB No. 43, Chapter 4.” SFAS 151 discusses the general principles applicable to the pricing of inventory. Paragraph 5 of ARB 43, Chapter 4 provides guidance on allocating certain costs to inventory. This Statement amends ARB 43, Chapter 4, to clarify that abnormal amounts of idle facility expense, freight, handling costs, and wasted materials (spoilage) should be recognized as current-period charges. In addition, this Statement requires that allocation of fixed production overheads to the costs of conversion be based on the normal capacity of production facilities. As required by SFAS 151, we will adopt this new accounting standard on January 1, 2006. The adoption of SFAS 151 is not expected to have a material impact on our financial statements. |

| | In December 2004, the FASB issued FASB Staff Position No. 109-1, “Application of FASB Statement No. 109, Accounting for Income Taxes, to the Tax Deduction on Qualified Production Activities Provided by the American Jobs Creation Act of 2004”, (FSP 109-1). FSP 109-1 provides accounting guidance for companies that will be eligible for a tax deduction resulting from “qualified production activities income” as defined in the American Jobs Creation Act of 2004 (the Act). FSP 109-1 requires this deduction be treated as a special deduction in accordance with SFAS 109, which does not require a revaluation of our U.S. deferred tax assets. We applied the guidance in FSP 109-1 upon recognition of this tax deduction beginning January 1, 2005. The application of FSP 109-1 did not have a material impact on our financial statements. In December 2004, the FASB issued FASB Staff Position No. 109-2, “Accounting and Disclosure Guidance for the Foreign Earnings Repatriation Provision within the American Jobs Creation Act of 2004”, (FSP 109-2). FSP 109-2 provides accounting guidance for the one-time tax deduction of 85% of non-U.S. earnings that are repatriated in excess of a base amount as defined in the Act. SFAS 109 requires a company to reflect in the period of enactment the effect of a new tax law. Due to the lack of clarification on certain provisions within the Act, FSP 109-2 allowed companies time beyond the financial reporting period of enactment to evaluate the effect of the Act. In the second quarter of 2005, we completed our evaluation and recognized a provision for income taxes of $49 million under the provisions of the Act. We expect to repatriate earnings of approximately $1.4 billion in 2005, which includes $500 million subject to the preferential treatment allowed by the Act. We have provided U.S. tax on earnings of non-U.S. subsidiaries that were not considered indefinitely reinvested prior to our evaluation of the Act. In connection with our current repatriation plan, we now intend to indefinitely reinvest earnings of a few selected non-U.S. subsidiaries and have reversed the associated deferred tax liability of $38 million. The net impact of these items was an $11 million increase to our second quarter provision for income taxes. |

| | In December 2004, the FASB issued Statement of Financial Accounting Standards No. 153 (SFAS 153), “Exchanges of Non-monetary Assets - an amendment of APB Opinion No. 29.” SFAS 153 addresses the measurement of exchanges of non-monetary assets. It eliminates the exception from fair value measurement for non-monetary exchanges of similar productive assets in paragraph 21(b) of APB Opinion No. 29 “Accounting for Non-monetary Transactions” and replaces it with an exception for exchanges that do not have commercial substance. A non-monetary exchange has commercial substance if the future cash flows of the entity are expected to change significantly as a result of the exchange. As required by SFAS 153, we have adopted this new accounting standard effective July 1, 2005. The adoption of SFAS 153 did not have a material impact on our financial statements. |

| | In December 2004, the FASB issued Statement of Financial Accounting Standards No. 123R (revised 2004) “Share-Based Payment,” (SFAS 123R). SFAS 123R requires that the cost resulting from all share-based payment transactions be recognized in the financial statements. SFAS 123R also establishes fair value as the measurement method in accounting for share-based payments with employees. The FASB required the provisions of SFAS 123R be adopted for interim or annual periods beginning after June 15, 2005. In April 2005, the SEC adopted a new rule amending the compliance dates for SFAS 123R. In accordance with this rule, we will adopt this new accounting standard effective January 1, 2006. We will transition to the new guidance using the modified prospective method. In anticipation of delaying vesting until three years after the grant date for future grants, the 2004 employee stock option grant (issued in June) fully vested on December 31, 2004. In order to better align our employee stock option program with the overall market, the number of options granted in 2005 (issued in February) was significantly reduced from the previous year. In response to this decrease, we elected to immediately vest the 2005 option grant. Based on the same assumptions used to value our 2005 stock option grant (including number of options granted and exercise price of options), we expect the application of the expensing provisions of SFAS 123R will result in a pretax expense of approximately $100 million in 2006. As a result of the vesting decisions discussed above, a full complement of expense related to stock options will not be recognized in our results of operations until 2009. We estimate our pretax expense associated with our stock option grants will range from approximately $110 million in 2007 to approximately $160 million in 2009. |

| | In June 2005, the FASB issued Statement of Financial Accounting Standards No. 154 (SFAS 154), “Accounting Changes and Error Corrections.” SFAS 154 changes the requirements for the accounting for and reporting of a change in accounting principle. This Statement requires retrospective applications to prior periods’ financial statements of a voluntary change in accounting principle unless it is impracticable. In addition, this Statement requires that a change in depreciation, amortization, or depletion for long-lived, non-financial assets be accounted for as a change in accounting estimate effected by a change in accounting principle. This new accounting standard is effective January 1, 2006. The adoption of SFAS 154 is not expected to have a material impact on our financial statements. |

4. | Derivative Instruments and Hedging Activities |

| | Our earnings and cash flow are subject to fluctuations due to changes in foreign currency exchange rates, interest rates and commodity prices. Our Risk Management Policy (policy) allows for the use of derivative financial instruments to prudently manage foreign currency exchange rate, interest rate and commodity price exposure. Our policy specifies that derivatives are not to be used for speculative purposes. Derivatives that we use are primarily foreign currency forward and option contracts, interest rate swaps and commodity forward and option contracts. Our derivative activities are subject to the management, direction and control of our senior financial officers. Risk management practices, including the use of financial derivative instruments, are presented to the Audit Committee of the Board of Directors at least annually. Foreign Currency Exchange Rate Risk Foreign currency exchange rate movements create a degree of risk by affecting the U.S. dollar value of sales made and costs incurred in foreign currencies. Movements in foreign currency rates also affect our competitive position as these changes may affect business practices and/or pricing strategies of non-U.S. based competitors. Additionally, we have balance sheet positions denominated in foreign currency thereby creating exposure to movements in exchange rates. |

| | Our Machinery and Engines operations purchase, manufacture and sell products in many locations around the world. As we have a diversified revenue and cost base, we manage our future foreign currency cash flow exposure on a net basis. We use foreign currency forward and option contracts to manage unmatched foreign currency cash inflow and outflow. Our objective is to minimize the risk of exchange rate movements that would reduce the U.S. dollar value of our foreign currency cash flow. Our policy allows for managing anticipated foreign currency cash flow for up to four years. |

| | We generally designate as cash flow hedges at inception of the contract any Australian dollar, Brazilian real, British pound, Canadian dollar, euro, Japanese yen, Mexican peso, Singapore dollar, Chinese yuan, New Zealand dollar or Swiss franc forward or option contracts that exceed 90 days in duration. Designation is performed on a specific exposure basis to support hedge accounting. The remainder of Machinery and Engines foreign currency contracts are undesignated. We also designate as fair value hedges specific euro forward contracts used to hedge firm commitments. |

| | As of September 30, 2005, $10 million of deferred net gains included in equity (“Accumulated other comprehensive income” in the Consolidated Statement of Financial Position) are expected to be reclassified to current earnings (“Other income (expense)”) over the next 12 months when earnings are negatively affected by the hedged transactions. As of September 30, 2004, this projected reclassification was a gain of $62 million. These amounts were based on September 30, 2005 and September 30, 2004 exchange rates, respectively. The actual amount recorded in other income/expense will vary based on exchange rates at the time the hedged transactions impact earnings. There were no circumstances where hedge treatment was discontinued during the three or nine month periods ended September 30, 2005 or 2004. In managing foreign currency risk for our Financial Products operations, our objective is to minimize earnings volatility resulting from conversion and the re-measurement of net foreign currency balance sheet positions. Our policy allows the use of foreign currency forward contracts to offset the risk of currency mismatch between our receivables and debt. All such foreign currency forward contracts are undesignated. |

| | Gains / (losses) included in current earnings [Other income (expense)] on undesignated contracts: |

| | | Three Months Ended September 30, |

| | |

|

| | (Millions of dollars) | 2005 | | 2004 |

| | |

| |

|

| | Machinery and Engines: | | | | | | | |

| | | On undesignated contracts | $ | 9 | | | $ | - | |

| | | | | | | | | | | |

| | Financial Products: | | | | | | | |

| | | On undesignated contracts | $ | 16 | | | $ | 2 | |

| | | | | | | | | | | |

| | Gains / (losses) included in current earnings [Other income (expense)] on undesignated contracts: |

| | | Nine Months Ended September 30, |

| | |

|

| | (Millions of dollars) | 2005 | | 2004 |

| | |

| |

|

| | Machinery and Engines: | | | | | | | |

| | | On undesignated contracts | $ | 25 | | | $ | (3 | ) |

| | | | | | | | | | | |

| | Financial Products: | | | | | | | |

| | | On undesignated contracts | $ | 49 | | | $ | 19 | |

| | | | | | | | | | | |

| | Gains on the Financial Products contracts above are substantially offset by balance sheet translation losses. Interest Rate Risk Interest rate movements create a degree of risk by affecting the amount of our interest payments and the value of our fixed rate debt. Our practice is to use interest rate swap agreements and forward rate agreements to manage our exposure to interest rate changes and lower the cost of borrowed funds. Machinery and Engines operations generally use fixed rate debt as a source of funding. Our objective is to minimize the cost of borrowed funds. Our policy allows us to enter into fixed-to-floating interest rate swaps and forward rate agreements to meet that objective with the intent to designate as fair value hedges at inception of the contract all fixed-to-floating interest rate swaps. Designation as a hedge of the fair value of our fixed rate debt is performed to support hedge accounting. During 2001, our Machinery and Engines operations liquidated all fixed-to-floating interest rate swaps. Deferred gains on liquidated fixed-to-floating interest rate swaps, which were previously designated as fair value hedges, are being amortized to earnings ratably over the remaining life of the hedged debt. We designate as cash flow hedges at inception of the contract all forward rate agreements. Designation as a hedge of the anticipated issuance of debt is performed to support hedge accounting. Machinery and Engines forward rate agreements are 100% effective. |

| | Financial Products operations have a match funding policy that addresses interest rate risk by aligning the interest rate profile (fixed or floating rate) of their debt portfolio with the interest rate profile of their receivables portfolio within pre-determined ranges on an on-going basis. In connection with that policy, we use interest rate derivative instruments to modify the debt structure to match assets within the receivables portfolio. This match funding reduces the volatility of margins between interest-bearing assets and interest-bearing liabilities, regardless of which direction interest rates move. This is accomplished by changing the characteristics of existing debt instruments or entering into new agreements in combination with the issuance of new debt. Our policy allows us to use floating-to-fixed, fixed-to-floating, and floating-to-floating interest rate swaps to meet the match funding objective. To support hedge accounting, we designate fixed-to-floating interest rate swaps as fair value hedges of the fair value of our fixed rate debt at the inception of the contract. Financial Products practice is to designate most floating-to-fixed interest rate swaps as cash flow hedges of the variability of future cash flows at inception of the swap contract. Designation as a hedge of the variability of cash flow is performed to support hedge accounting. Financial Products liquidated fixed-to-floating interest rate swaps during 2005, 2004, and 2002. As a result, the gain ($16 million as of September 30, 2005) is being amortized to earnings ratably over the remaining life of the hedged debt. |

| | Gains / (losses) included in current earnings [Other income (expense)]: |

| | | Three Months Ended September 30, |

| | (Millions of dollars) | 2005 | | 2004 |

| | |

| |

|

| | Fixed-to-floating interest rate swaps | | | | | | | |

| | | Machinery and Engines: | | | | | | | |

| | | | Gain/(loss) on liquidated swaps | $ | 1 | | | $ | 1 | |

| | | Financial Products: | | | | | | | |

| | | | Gain/(loss) on designated interest rate derivatives | | (53 | ) | | | 42 | |

| | | | Gain/(loss) on hedged debt | | 53 | | | | (42 | ) |

| | | | Gain/(loss) on liquidated swaps - included in interest expense | | 1 | | | | - | |

| | | | |

|

|

| |

|

|

|

| | | | | $ | 2 | | | $ | 1 | |

| | | | |

|

|

| |

|

|

|

| | Gains / (losses) included in current earnings [Other income (expense)]: |

| | | Nine Months Ended September 30, |

| | (Millions of dollars) | 2005 | | 2004 |

| | |

| |

|

| | Fixed-to-floating interest rate swaps | | | | | | | |

| | | Machinery and Engines: | | | | | | | |

| | | | Gain/(loss) on liquidated swaps | $ | 3 | | | $ | 3 | |

| | | Financial Products: | | | | | | | |

| | | | Gain/(loss) on designated interest rate derivatives | | (50 | ) | | | 3 | |

| | | | Gain/(loss) on hedged debt | | 50 | | | | (3 | ) |

| | | | Gain/(loss) on liquidated swaps - included in interest expense | | 3 | | | | 1 | |

| | | | |

|

|

| |

|

|

|

| | | | | $ | 6 | | | $ | 4 | |

| | | | |

|

|

| |

|

|

|

| | As of September 30, 2005, $7 million of deferred net gains included in equity (“Accumulated other comprehensive income” in the Consolidated Statement of Financial Position), related to Financial Products floating-to-fixed interest rate swaps, are expected to be reclassified to current earnings (“Interest expense of Financial Products”) over the next 12 months. As of September 30, 2004, this projected reclassification was a net loss of $10 million. There were no circumstances where hedge treatment was discontinued during the three or nine months ended September 30, 2005 or 2004. |

| | Commodity Price Risk Commodity price movements create a degree of risk by affecting the price we must pay for certain raw materials. Our policy is to use commodity forward and option contracts to manage the commodity risk and reduce the cost of purchased materials. Our Machinery and Engines operations purchase aluminum, copper and nickel embedded in the components we purchase from suppliers. Our suppliers pass on to us price changes in the commodity portion of the component cost. In addition, we are also subjected to price changes on natural gas purchased for operational use. Our objective is to minimize volatility in the price of these commodities. Our policy allows us to enter into commodity forward and option contracts to lock in the purchase price of a portion of these commodities within a four-year horizon. All such commodity forward and option contracts are undesignated. Gains on the undesignated contracts of $5 million and $6 million were recorded in current earnings ("Other income (expense)") for the three and nine months ended September 30, 2005. Gains on the undesignated contracts of $6 million and $11 million were recorded in current earnings ("Other income (expense)") for the three and nine months ended September 30, 2004. |

Page 12

5. | Inventories Inventories (principally "last-in, first-out" method) are comprised of the following: |

| | (Millions of dollars) | September 30, | | December 31, |

| | | 2005 | | 2004 |

| | |

| |

|

| | Raw materials | $ | 1,628 | | | $ | 1,592 | |

| | Work-in-process | | 925 | | | | 664 | |

| | Finished goods | | 2,685 | | | | 2,209 | |

| | Supplies | | 231 | | | | 210 | |

| | |

|

|

| |

|

|

|

| | Total inventories | $ | 5,469 | | | $ | 4,675 | |

| | |

|

|

| |

|

|

|

6. | Investments in Unconsolidated Affiliated Companies |

| | Our investments in affiliated companies accounted for by the equity method consist primarily of a 50 percent interest in Shin Caterpillar Mitsubishi Ltd. (SCM) located in Japan. Combined financial information of the unconsolidated affiliated companies accounted for by the equity method (generally on a three month lag, e.g., SCM results reflect the periods ending June 30) was as follows: |

| | | Results of Operations | | Results of Operations |

| | | Three Months Ended | | Nine Months Ended |

| | | September 30, | | September 30, |

| | (Millions of dollars) | 2005 | | 2004 | | 2005 | | 2004 |

| | |

| |

| |

| |

|

| | Sales | $ | 1,077 | | | $ | 986 | | | $ | 3,100 | | | $ | 2,699 | |

| | Cost of sales | | 844 | | | | 743 | | | | 2,410 | | | | 2,070 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | Gross profit | $ | 233 | | | $ | 243 | | | $ | 690 | | | $ | 629 | |

| | | | | | | | | | | | | | | | | |

| | Profit (loss) | $ | 41 | | | $ | 35 | | | $ | 132 | | | $ | 81 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | Caterpillar's profit (loss) | $ | 18 | | | $ | 17 | | | $ | 61 | | | $ | 37 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | Financial Position |

| | | September 30, | | December 31, |

| | (Millions of dollars) | 2005 | | 2004 |

| | |

| |

|

| | Assets: | | | |

| | Current assets | $ | 1,736 | | $ | 1,540 | |

| | Property, plant and equipment - net | | 1,160 | | | 1,097 | |

| | Other assets | | 225 | | | 145 | |

| | |

|

| |

|

|

|

| | | | 3,121 | | | 2,782 | |

| Liabilities: | | | | | | |

| | Current liabilities | | 1,444 | | | 1,345 | |

| | Long-term debt due after one year | | 356 | | | 276 | |

| | Other liabilities | | 223 | | | 214 | |

| | |

|

| |

|

|

|

| | | | 2,023 | | | 1,835 | |

| | |

|

| |

|

|

|

| | Ownership | $ | 1,098 | | $ | 947 | |

| | |

|

| |

|

|

|

| | Caterpillar's investments in unconsolidated affiliated companies | | | | | | |

| | Investments in equity method companies | $ | 535 | | $ | 487 | |

| | Plus: Investments in cost method companies | | 28 | | | 30 | |

| | |

|

| |

|

|

|

| | Total investments in unconsolidated affiliated companies | $ | 563 | | $ | 517 | |

| | |

|

| |

|

|

|

7. | Intangible Assets and Goodwill |

| | A. Intangible assets Intangible assets are comprised of the following: |

| | (Millions of dollars) | September 30, | | December 31, |

| | | 2005 | | 2004 |

| | |

| |

|

| | Intellectual property | $ | 212 | | | $ | 213 | |

| | Pension-related | | 283 | | | | 120 | |

| | Other | | 73 | | | | 73 | |

| |

|

|

| |

|

|

|

| | Total intangible assets - gross | | 568 | | | | 406 | |

| | Less: Accumulated amortization of finite lived intangible assets | | (106 | ) | | | (91 | ) |

| | |

|

|

| |

|

|

|

| | Intangible assets - net | $ | 462 | | | $ | 315 | |

| | |

|

|

| |

|

|

|

| | Amortization expense for the three and nine months ended September 30, 2005 was $6 million and $16 million, respectively. Amortization expense for the three and nine months ended September 30, 2004 was $5 million and $16 million, respectively. Amortization expense related to intangible assets is expected to be: |

| | (Millions of dollars) |

| | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | Thereafter |

| |

| |

| |

| |

| |

| |

|

| | $ | 23 | | | $ | 22 | | | $ | 19 | | | $ | 17 | | | $ | 16 | | | $ | 97 | |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | B. Goodwill |

| | During the three and nine months ended September 30, 2005, no goodwill was acquired, impaired or disposed. During the third quarter of 2004 we acquired assets with related goodwill of $55 million. No goodwill was impaired or disposed of during the three or nine months ended September 30, 2004. On an annual basis, we test goodwill for impairment in accordance with Statement of Financial Accounting Standards No. 142 “Goodwill and Other Intangible Assets.” |

8. | Available-For-Sale Securities |

| | Caterpillar Insurance and Caterpillar Investment Management Ltd. have investments in certain debt and equity securities that are classified as available-for-sale in accordance with Statement of Financial Accounting Standards No. 115 (SFAS 115) and recorded at fair value based upon quoted market prices. These fair values are included in "Other assets" in the Consolidated Statement of Financial Position. Unrealized gains and losses arising from the revaluation of available-for-sale securities are included, net of applicable deferred income taxes, in equity ("Accumulated other comprehensive income" in the Consolidated Statement of Financial Position). Realized gains and losses on sales of investments are generally determined using the FIFO method for debt instruments and the specific identification method for equity securities. Realized gains and losses are included in "Other income (expense)" in the Consolidated Statement of Results of Operations. |

| | | September 30, 2005 |

| | |

|

| | | | | Unrealized | | |

| | | | | Pretax Net | | |

| | (Millions of dollars) | Cost Basis | | Gains (Losses) | | Fair Value |

| | |

| |

| |

|

| | Government debt | $ | 282 | | | $ | (4 | ) | | $ | 278 | |

| | Corporate bonds | | 415 | | | | (6 | ) | | | 409 | |

| | Equity securities | | 159 | | | | 37 | | | | 196 | |

| | |

|

|

| |

|

|

| |

|

|

|

| | Total | $ | 856 | | | $ | 27 | | | $ | 883 | |

| | |

|

|

| |

|

|

| |

|

|

|

| | | December 31, 2004 |

| | |

|

| | (Millions of dollars) | Cost Basis | | Unrealized Pretax Net Gains (Losses) | | Fair Value |

| |

| |

| | |

| |

| |

|

| | Government debt | $ | 239 | | | $ | (1 | ) | | $ | 238 | |

| | Corporate bonds | | 342 | | | | - | | | | 342 | |

| | Equity securities | | 203 | | | | 21 | | | | 224 | |

| | |

|

|

| |

|

|

| |

|

|

|

| | Total | $ | 784 | | | $ | 20 | | | $ | 804 | |

| | |

|

|

| |

|

|

| |

|

|

|

| Investments in an unrealized loss position that are not other-than-temporarily impaired: |

| | | September 30, 2005 |

| | |

|

| | | Less than 12 months (1) | | More than 12 months (1) | | Total |

| | |

| |

| |

|

| | (Millions of dollars) | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

| | |

| |

| |

| |

| |

| |

|

| | Government debt | $ | 167 | | | $ | 2 | | | $ | 75 | | | $ | 2 | | | $ | 242 | | | $ | 4 | |

| | Corporate bonds | | 233 | | | | 3 | | | | 97 | | | | 3 | | | | 330 | | | | 6 | |

| | Equity securities | | 31 | | | | 2 | | | | 2 | | | | - | | | | 33 | | | | 2 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | Total | $ | 431 | | | $ | 7 | | | $ | 174 | | | $ | 5 | | | $ | 605 | | | $ | 12 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (1) Indicates length of time that individual securities have been in a continuous unrealized loss position. |

| | The fair value of the available-for-sale debt securities at September 30, 2005, by contractual maturity, is shown below. Expected maturities will differ from contractual maturities because borrowers may have the right to prepay and creditors may have the right to call obligations. |

| | (Millions of dollars) | | Fair Value |

| | | |

|

| | Due in one year or less | | $ | 47 |

| | Due after one year through five years | | $ | 294 |

| | Due after five years through ten years | | $ | 75 |

| | Due after ten years | | $ | 271 |

| | | | | |

| | Proceeds from sales of investments in debt and equity securities during the three and nine months ended September 30, 2005 were $261 million and $443 million, respectively. Proceeds from sales of investments in debt and equity securities during the three and nine months ended September 30, 2004 were $208 million and $343 million, respectively. Gross gains of $5 million and $12 million, and gross losses of $2 million and $4 million, were included in current earnings for the three and nine months ended September 30, 2005, respectively. Gross gains of $2 million and $5 million, and gross losses of $2 million and $5 million, were included in current earnings for the three and nine months ended September 30, 2004, respectively. |

9. | Postretirement Benefits |

| | A. Pension and postretirement benefit costs |

| | In January 2005, amendments were made to both U.S. pension and other postretirement benefit plans due to the company and the United Auto Workers reaching a new six-year labor agreement that will expire on March 1, 2011. These plans were re-measured as of January 10, 2005 to account for the benefit changes. The result was a $7 million and $22 million increase in pension cost, and a $17 million and $52 million increase in other postretirement benefit cost for the three and nine months ended September 30, 2005, respectively. In addition, the Additional Minimum Pension Liability increased $233 million as a result of the re-measurement. The liability was offset by an increase in pension-related intangible assets of $164 million and a decrease in other comprehensive income (pre-tax) of $69 million. In April 2005, amendments were made to our U.S. salaried and management other postretirement benefit plan. The plan was re-measured, resulting in a reduction of $6 million and $12 million in other postretirement benefit cost for the three and nine months ended September 30, 2005, respectively. |

| | 2004 other postretirement benefit cost reflects the adoption of FASB Staff Position No. 106-2, “Accounting and Disclosure Requirements Related to the Medicare Prescription Drug, Improvement and Modernization Act of 2003” in the third quarter of 2004, retroactive to December 31, 2003. The impact of the anticipated federal subsidy for prescription drugs was a decrease in other postretirement benefit cost of $15 million and $37 million, for the three and nine months ended September 30, 2004, respectively. |

| | (Millions of Dollars) | U.S. Pension Benefits | | Non-U.S. Pension Benefits | | Other Postretirement Benefits |

| | |

| |

| |

|

| | | September 30, | | September 30, | | September 30, |

| | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 |

| | |

| |

| |

| |

| |

| |

|

| | For the three months ended: | | | | | | | | | | | | | | | | | | | | | | | |

| | Components of net periodic benefit cost: | | | | | | | | | | | | | | | | | | | | | | | |

| | | Service cost | $ | 37 | | | $ | 36 | | | $ | 14 | | | $ | 12 | | | $ | 21 | | | $ | 16 | |

| | | Interest cost | | 139 | | | | 137 | | | | 26 | | | | 22 | | | | 73 | | | | 66 | |

| | | Expected return on plan assets | | (178 | ) | | | (178 | ) | | | (26 | ) | | | (24 | ) | | | (22 | ) | | | (19 | ) |

| | | Amortization of: | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Net asset existing at adoption of

SFAS 87/106 | | - | | | | - | | | | 1 | | | | 1 | | | | - | | | | - | |

| | | | Prior service cost 1 | | 15 | | | | 11 | | | | 1 | | | | 2 | | | | (9 | ) | | | (12 | ) |

| | | | Net actuarial loss (gain) | | 49 | | | | 35 | | | | 12 | | | | 9 | | | | 23 | | | | 10 | |

| | | | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | Total cost included in results of operations | $ | 62 | | | $ | 41 | | | $ | 28 | | | $ | 22 | | | $ | 86 | | | $ | 61 | |

| | | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | Weighted-average assumptions

used to determine net cost: | | | | | | | | | | | | | | | | | | | | | | | |

| | Discount rate 2 | | 5.8/5.9 | % | | | 6.2 | % | | | 5.2 | % | | | 5.1 | % | | | 5.7-5.9 | % | | | 6.2 | % |

| | Expected return on plan assets | | 9.0 | % | | | 9.0 | % | | | 7.2 | % | | | 7.4 | % | | | 9.0 | % | | | 9.0 | % |

| | Rate of compensation increase | | 4.0 | % | | | 4.0 | % | | | 3.5 | % | | | 3.2 | % | | | 4.0 | % | | | 4.0 | % |

| | |

| | (1) Prior service costs for both pension and other postretirement benefits are generally amortized using the straight-line method over the average remaining service period to the full retirement eligibility date of employees expected to receive benefits from the plan amendment. For other postretirement benefit plans in which all or almost all of the plan’s participants are fully eligible for benefits under the plan, prior service costs are amortized using the straight-line method over the remaining life expectancy of those participants. |

| | (2) For U.S. plans impacted by the January 2005 plan amendments, a 5.8% discount rate was utilized for valuing the plan re-measurement. For the April 2005 amendment, a 5.7% discount rate was utilized for valuing the plan re-measurement. |

| | (Millions of Dollars) | U.S. Pension Benefits | | Non-U.S. Pension Benefits | | Other Postretirement Benefits |

| | |

| |

| |

|

| | | September 30, | | September 30, | | September 30, |

| | | 2005 | | 2004 | | 2005 | | 2004 | | 2005 | | 2004 |

| | |

| |

| |

| |

| |

| |

|

| | For the nine months ended: | | | | | | | | | | | | | | | | | | | | | | | |

| | Components of net periodic benefit cost: | | | | | | | | | | | | | | | | | | | | | | | |

| | | Service cost | $ | 112 | | | $ | 108 | | | $ | 44 | | | $ | 36 | | | $ | 65 | | | $ | 49 | |

| | | Interest cost | | 416 | | | | 411 | | | | 81 | | | | 66 | | | | 223 | | | | 200 | |

| | | Expected return on plan assets | | (534 | ) | | | (519 | ) | | | (78 | ) | | | (72 | ) | | | (65 | ) | | | (55 | ) |

| | | Amortization of: | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Net asset existing at adoption

of SFAS 87/106 | | - | | | | - | | | | 1 | | | | 3 | | | | 1 | | | | - | |

| | | | Prior service cost 1 | | 45 | | | | 33 | | | | 4 | | | | 6 | | | | (21 | ) | | | (36 | ) |

| | | | Net actuarial loss (gain) | | 148 | | | | 105 | | | | 37 | | | | 27 | | | | 64 | | | | 35 | |

| | | | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | Total cost included in results

of operations | $ | 187 | | | $ | 138 | | | $ | 89 | | | $ | 66 | | | $ | 267 | | | $ | 193 | |

| | | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | Weighted-average assumptions used to

determine net cost: | | | | | | | | | | | | | | | | | | | | | | | |

| | Discount rate 2 | | 5.8/5.9 | % | | | 6.2 | % | | | 5.2 | % | | | 5.1 | % | | | 5.7-5.9 | % | | | 6.2 | % |

| | Expected return on plan assets | | 9.0 | % | | | 9.0 | % | | | 7.2 | % | | | 7.4 | % | | | 9.0 | % | | | 9.0 | % |

| | Rate of compensation increase | | 4.0 | % | | | 4.0 | % | | | 3.5 | % | | | 3.2 | % | | | 4.0 | % | | | 4.0 | % |

| | |

| | (1) Prior service costs for both pension and other postretirement benefits are generally amortized using the straight-line method over the average remaining service period to the full retirement eligibility date of employees expected to receive benefits from the plan amendment. For other postretirement benefit plans in which all or almost all of the plan’s participants are fully eligible for benefits under the plan, prior service costs are amortized using the straight-line method over the remaining life expectancy of those participants. |

| | (2) For U.S. plans impacted by the January 2005 plan amendments, a 5.8% discount rate was utilized for valuing the plan re-measurement. For the April 2005 amendment, a 5.7% discount rate was utilized for valuing the plan re-measurement. |

| | We have no ERISA funding requirements in 2005 and do not expect to make any significant contributions to our U.S. pension plans this year. Contributions were made to non-U.S. pension plans during the three and nine months ended September 30, 2005 of $280 million and $370 million, respectively, and we do not anticipate significant additional contributions during the year. Also during 2005, a $200 million cash contribution was made to one of our other postretirement benefit plans, in addition to our funding of ongoing cash benefit payments of approximately $360 million. |

| | B. Defined contribution benefit costs |

| | Total company costs related to U.S. and non-U.S. defined contribution plans were as follows: |

| | | Three Months Ended September 30, |

| | (Millions of dollars) | 2005 | | 2004 |

| | |

| |

|

| | U.S. Plans | $ | 42 | | $ | 21 |

| | Non-U.S. Plans | | 1 | | | 3 |

| | |

|

| |

|

|

| | | $ | 43 | | $ | 24 |

| | |

|

| |

|

|

| | | Nine Months Ended September 30, |

| | (Millions of dollars) | 2005 | | 2004 |

| | |

| |

|

| | U.S. Plans | $ | 103 | | $ | 74 |

| | Non-U.S. Plans | | 14 | | | 9 |

| | |

|

| |

|

|

| | | $ | 117 | | $ | 83 |

| | |

|

| |

|

|

10. | Guarantees and Product Warranty |

| | We have guaranteed to repurchase loans of certain Caterpillar dealers from third party lenders in the event of default. These guarantees arose in conjunction with Cat Financial's relationship with third party dealers who sell Caterpillar equipment. These guarantees generally have one-year terms and are secured, primarily by dealer assets. Cat Financial has provided a limited indemnity to a third party bank for $41 million resulting from the assignment of certain leases to that bank. The indemnity is for the remote chance that the insurers of these leases would become insolvent. The indemnity expires December 15, 2012 and is unsecured. No loss has been experienced or is anticipated under any of these guarantees. At both September 30, 2005 and December 31, 2004, the recorded liabilities for these guarantees was $10 million. The maximum potential amount of future payments (undiscounted and without reduction for any amount that may possibly be recovered under recourse or collateralized provisions) we could be required to make under the guarantees are as follows: |

| | (Millions of dollars) | September 30, | | December 31, |

| | | 2005 | | 2004 |

| | |

| |

|

| | Guarantees with Caterpillar dealers | $ | 426 | | | $ | 364 | |

| | Guarantees - other | | 86 | | | | 62 | |

| | |

|

|

| |

|

|

|

| | Total guarantees | $ | 512 | | | $ | 426 | |

| | |

|

|

| |

|

|

|

| | Our product warranty liability is determined by applying historical claim rate experience to the current field population and dealer inventory. Historical claim rates are developed using a rolling average of actual warranty payments. Our product warranty liability also includes deferred revenue related to extended warranty contracts, which is recognized in income when the related costs are incurred. The amount of this deferred revenue was $118 million and $132 million at September 30, 2005 and December 31, 2004, respectively. |

| |

|

| | (Millions of dollars) | 2005 |

| | |

|

| | Warranty liability, January 1 | $ | 914 | |

| | Reduction in liability (payments) | | (524 | ) |

| | Increase in liability (new warranties) | | 587 | |

| | |

|

|

|

| | Warranty liability, September 30 | $ | 977 | |

| | |

|

|

|

|

|

| | (Millions of dollars) | 2004 |

| | |

|

| | Warranty liability, January 1 | $ | 695 | |

| | Reduction in liability (payments) | | (586 | ) |

| | Increase in liability (new warranties) | | 772 | |

| | Additional liability from acquisition | | 33 | |

| | |

|

|

|

| | Warranty liability, December 31 | $ | 914 | |

| | |

|

|

|

11. | Computations of Profit Per Share |

| | | Three Months Ended September 30, |

| | (Dollars in millions except per share data) | 2005 | | 2004 |

| | |

| |

|

| | I. | Profit for the period (A): | $ | 667 | | $ | 498 |

| | | |

|

| |

|

|

| | II. | Determination of shares (millions): | | | | | |

| | | Weighted average number of common shares outstanding (B) | | 678.8 | | | 683.6 |

| | | Shares issuable on exercise of stock options, net of shares assumed

to be purchased out of proceeds at average market price | | 31.9 | | | 22.4 |

| | | |

|

| |

|

|

| | | Average common shares outstanding for fully diluted computation (C) | | 710.7 | | | 706.0 |

| | | |

|

| |

|

|

| | III. | Profit per share of common stock: | | | | | |

| | | Assuming no dilution (A/B) | $ | 0.98 | | $ | 0.73 |

| | | Assuming full dilution (A/C) | $ | 0.94 | | $ | 0.70 |

| | | Nine Months Ended September 30, |

| | (Dollars in millions except per share data) | 2005 | | 2004 |

| | |

| |

|

| | I. | Profit for the period (A): | $ | 2,008 | | $ | 1,484 |

| | | |

|

| |

|

|

| | II. | Determination of shares (millions): | | | | | |

| | | Weighted average number of common shares outstanding (B) | | 680.5 | | | 684.5 |

| | | Shares issuable on exercise of stock options, net of shares assumed

to be purchased out of proceeds at average market price | | 26.9 | | | 23.9 |

| | | |

|

| |

|

|

| | | Average common shares outstanding for fully diluted computation (C) | | 707.4 | | | 708.4 |

| | | |

|

| |

|

|

| | III. | Profit per share of common stock: | | | | | |

| | | Assuming no dilution (A/B) | $ | 2.95 | | $ | 2.17 |

| | | Assuming full dilution (A/C) | $ | 2.84 | | $ | 2.10 |

12. | Environmental and Legal Matters |

| | The company is regulated by federal, state, and international environmental laws governing our use of substances and control of emissions in all our operations. Compliance with these existing laws has not had a material impact on our capital expenditures or earnings. |

| | We are cleaning up hazardous waste at a number of locations, often with other companies, pursuant to federal and state laws. When it is probable we will pay cleanup costs at a site and those costs can be estimated, the costs are charged against our earnings. In formulating that estimate, we do not consider amounts expected to be recovered from insurance companies and others. |

| | The amount recorded for environmental cleanup is not material and is included in "Accrued expenses" in the Consolidated Statement of Financial Position. If a range of liability estimates is available on a particular site, we accrue at the lower end of that range. We cannot estimate costs on sites in the very early stages of cleanup. Currently, we have several sites in the very early stages of cleanup, and there is no more than a remote chance that a material amount for cleanup will be required. We have disclosed certain individual legal proceedings in this filing. Additionally, we are involved in other unresolved legal actions that arise in the normal course of business. The most prevalent of these unresolved actions involve disputes related to product design, manufacture and performance liability (including claimed asbestos and welding fumes exposure), contracts, employment issues and intellectual property rights. Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of probable loss, we believe that these unresolved legal actions will not individually or in the aggregate have a material impact on our consolidated financial position, liquidity or results of operations. |

Page 19