- CAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Caterpillar (CAT) 8-KConsolidated Financial Statements

Filed: 14 May 09, 12:00am

TABLE OF CONTENTS | |

| STATEMENT 1 | Caterpillar Inc. | ||||||||||||

Consolidated Results of Operations for the Years Ended December 31 (Dollars in millions except per share data) | |||||||||||||

2008 | 2007 | 2006 | |||||||||||

| Sales and revenues: | |||||||||||||

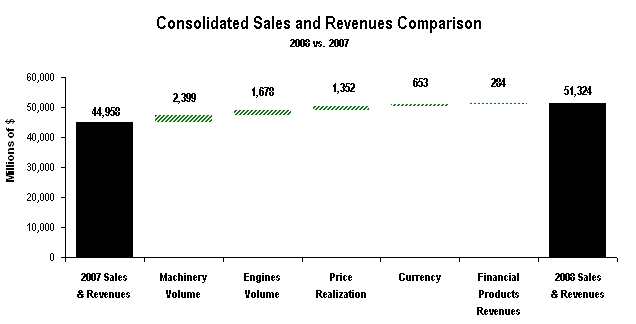

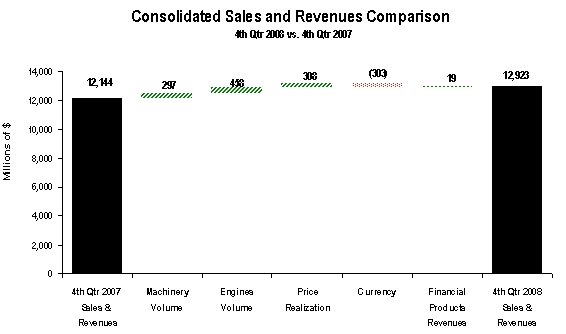

| Sales of Machinery and Engines | $ | 48,044 | $ | 41,962 | $ | 38,869 | |||||||

| Revenues of Financial Products | 3,280 | 2,996 | 2,648 | ||||||||||

| Total sales and revenues | 51,324 | 44,958 | 41,517 | ||||||||||

| Operating costs: | |||||||||||||

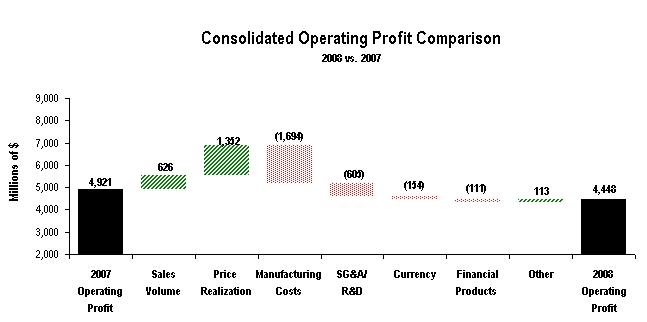

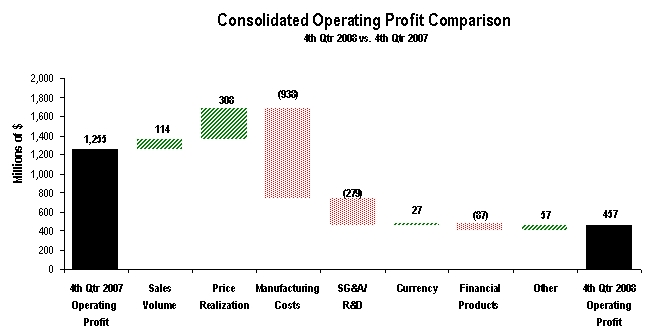

| Cost of goods sold | 38,415 | 32,626 | 29,549 | ||||||||||

| Selling, general and administrative expenses | 4,399 | 3,821 | 3,706 | ||||||||||

| Research and development expenses | 1,728 | 1,404 | 1,347 | ||||||||||

| Interest expense of Financial Products | 1,153 | 1,132 | 1,023 | ||||||||||

| Other operating (income) expenses | 1,181 | 1,054 | 971 | ||||||||||

| Total operating costs | 46,876 | 40,037 | 36,596 | ||||||||||

| Operating profit | 4,448 | 4,921 | 4,921 | ||||||||||

| Interest expense excluding Financial Products | 274 | 288 | 274 | ||||||||||

| Other income (expense) | 327 | 357 | 243 | ||||||||||

| Consolidated profit before taxes | 4,501 | 4,990 | 4,890 | ||||||||||

| Provision for income taxes | 953 | 1,485 | 1,405 | ||||||||||

| Profit of consolidated companies | 3,548 | 3,505 | 3,485 | ||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 37 | 73 | 81 | ||||||||||

| Profit of consolidated and affiliated companies | 3,585 | 3,578 | 3,566 | ||||||||||

| Less: Profit attributable to noncontrolling interests | 28 | 37 | 29 | ||||||||||

| Profit 1 | $ | 3,557 | $ | 3,541 | $ | 3,537 | |||||||

| Profit per common share | $ | 5.83 | $ | 5.55 | $ | 5.37 | |||||||

| Profit per common share – diluted 2 | $ | 5.66 | $ | 5.37 | $ | 5.17 | |||||||

| Weighted-average common shares outstanding (millions) | |||||||||||||

| - Basic | 610.5 | 638.2 | 658.7 | ||||||||||

| - Diluted 2 | 627.9 | 659.5 | 683.8 | ||||||||||

| Cash dividends declared per common share | $ | 1.62 | $ | 1.38 | $ | 1.15 | |||||||

1 | Profit attributable to common stockholders. |

| 2 | Diluted by assumed exercise of stock-based compensation awards, using the treasury stock method. |

| See accompanying notes to Consolidated Financial Statements. | |

| STATEMENT 2 | Caterpillar Inc. | ||||||||||||||

Consolidated Financial Position at December 31 (Dollars in millions) | |||||||||||||||

| 2008 | 2007 | 2006 | |||||||||||||

| Assets | |||||||||||||||

| Current assets: | |||||||||||||||

| Cash and short-term investments | $ | 2,736 | $ | 1,122 | $ | 530 | |||||||||

| Receivables – trade and other | 9,397 | 8,249 | 8,607 | ||||||||||||

| Receivables – finance | 8,731 | 7,503 | 6,804 | ||||||||||||

| Deferred and refundable income taxes | 1,223 | 816 | 733 | ||||||||||||

| Prepaid expenses and other current assets | 765 | 583 | 638 | ||||||||||||

| Inventories | 8,781 | 7,204 | 6,351 | ||||||||||||

| Total current assets | 31,633 | 25,477 | 23,663 | ||||||||||||

| Property, plant and equipment – net | 12,524 | 9,997 | 8,851 | ||||||||||||

| Long-term receivables – trade and other | 1,479 | 685 | 860 | ||||||||||||

| Long-term receivables – finance | 14,264 | 13,462 | 11,531 | ||||||||||||

| Investments in unconsolidated affiliated companies | 94 | 598 | 562 | ||||||||||||

| Noncurrent deferred and refundable income taxes | 3,311 | 1,553 | 1,949 | ||||||||||||

| Intangible assets | 511 | 475 | 387 | ||||||||||||

| Goodwill | 2,261 | 1,963 | 1,904 | ||||||||||||

| Other assets | 1,705 | 1,922 | 1,742 | ||||||||||||

| Total assets | $ | 67,782 | $ | 56,132 | $ | 51,449 | |||||||||

| Liabilities | |||||||||||||||

| Current liabilities: | |||||||||||||||

| Short-term borrowings: | |||||||||||||||

| Machinery and Engines | $ | 1,632 | $ | 187 | $ | 165 | |||||||||

| Financial Products | 5,577 | 5,281 | 4,990 | ||||||||||||

| Accounts payable | 4,827 | 4,723 | 4,085 | ||||||||||||

| Accrued expenses | 4,121 | 3,178 | 2,923 | ||||||||||||

| Accrued wages, salaries and employee benefits | 1,242 | 1,126 | 938 | ||||||||||||

| Customer advances | 1,898 | 1,442 | 921 | ||||||||||||

| Dividends payable | 253 | 225 | 194 | ||||||||||||

| Other current liabilities | 1,027 | 951 | 1,145 | ||||||||||||

| Long-term debt due within one year: | |||||||||||||||

| Machinery and Engines | 456 | 180 | 418 | ||||||||||||

| Financial Products | 5,036 | 4,952 | 4,043 | ||||||||||||

| Total current liabilities | 26,069 | 22,245 | 19,822 | ||||||||||||

| Long-term debt due after one year: | |||||||||||||||

| Machinery and Engines | 5,736 | 3,639 | 3,694 | ||||||||||||

| Financial Products | 17,098 | 14,190 | 13,986 | ||||||||||||

| Liability for postemployment benefits | 9,975 | 5,059 | 5,879 | ||||||||||||

| Other liabilities | 2,190 | 2,003 | 1,131 | ||||||||||||

| Total liabilities | 61,068 | 47,136 | 44,512 | ||||||||||||

| Commitments and contingencies (Notes 22 and 23) | |||||||||||||||

| Redeemable noncontrolling interest (Note 25) | 524 | — | — | ||||||||||||

| Stockholders’ equity | |||||||||||||||

| Common stock of $1.00 par: | |||||||||||||||

Authorized shares: 900,000,000 Issued shares: (2008, 2007 and 2006 – 814,894,624) at paid-in amount | 3,057 | 2,744 | 2,465 | ||||||||||||

Treasury stock (2008 – 213,367,983 shares; 2007 – 190,908,490 shares and 2006 – 169,086,448 shares) at cost | (11,217 | ) | (9,451 | ) | (7,352 | ) | |||||||||

| Profit employed in the business | 19,826 | 17,398 | 14,593 | ||||||||||||

| Accumulated other comprehensive income | (5,579 | ) | (1,808 | ) | (2,847 | ) | |||||||||

| Noncontrolling interests | 103 | 113 | 78 | ||||||||||||

| Total stockholders’ equity | 6,190 | 8,996 | 6,937 | ||||||||||||

| Total liabilities, redeemable noncontrolling interest and stockholders’ equity | $ | 67,782 | $ | 56,132 | $ | 51,449 | |||||||||

| See accompanying notes to Consolidated Financial Statements. |

| STATEMENT 3 | Caterpillar Inc. | |||||||||||||||||||||||||||||

Changes in Consolidated Stockholders’ Equity for the Years Ended December 31 | ||||||||||||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||||||||||||

Common stock | Treasury stock | Profit employed in the business | Accumulated other comprehensive income (loss) 1 | Noncontrolling interests | Total | Comprehensive income (loss) | ||||||||||||||||||||||||

| Balance at December 31, 2005 | $ | 1,859 | $ | (4,637 | ) | $ | 11,808 | $ | (598 | ) | $ | 59 | $ | 8,491 | ||||||||||||||||

| Profit | — | — | 3,537 | — | 29 | 3,566 | $ | 3,566 | ||||||||||||||||||||||

| Foreign currency translation | — | — | — | 169 | 2 | 171 | 171 | |||||||||||||||||||||||

| Minimum pension liability adjustment, net of tax of $97 | — | — | — | 229 | — | 229 | 229 | |||||||||||||||||||||||

| Derivative financial instruments and other | ||||||||||||||||||||||||||||||

| Gains (losses) deferred, net of tax of $40 | — | — | — | 73 | — | 73 | 73 | |||||||||||||||||||||||

| (Gains) losses reclassified to earnings, net of tax of $26 | — | — | — | (43 | ) | — | (43 | ) | (43 | ) | ||||||||||||||||||||

| Available-for-sale securities | ||||||||||||||||||||||||||||||

| Gains (losses) deferred, net of tax of $8 | — | — | — | 17 | — | 17 | 17 | |||||||||||||||||||||||

| (Gains) losses reclassified to earnings, net of tax of $12 | — | — | — | (23 | ) | — | (23 | ) | (23 | ) | ||||||||||||||||||||

| Incremental adjustment to adopt SFAS158, net of tax of $1,494 | — | — | — | (2,671 | ) | — | (2,671 | ) | — | |||||||||||||||||||||

| Dividends declared | — | — | (752 | ) | — | — | (752 | ) | — | |||||||||||||||||||||

| Distributions to noncontrolling interests | — | — | — | — | (10 | ) | (10 | ) | — | |||||||||||||||||||||

Common shares issued from treasury stock for stock-based compensation: 15,207,055 | 73 | 341 | — | — | — | 414 | — | |||||||||||||||||||||||

| Stock-based compensation expense | 137 | — | — | — | — | 137 | — | |||||||||||||||||||||||

| Tax benefits from stock-based compensation | 170 | — | — | — | — | 170 | — | |||||||||||||||||||||||

| Shares repurchased: 45,608,000 | — | (3,208 | ) | — | — | — | (3,208 | ) | — | |||||||||||||||||||||

| Shares issued for Progress Rail Services, Inc. Acquisition: 5,341,902 | 226 | 152 | — | — | — | 378 | — | |||||||||||||||||||||||

| Change in ownership for noncontrolling interests | — | — | — | — | (2 | ) | (2 | ) | — | |||||||||||||||||||||

| Balance at December 31, 2006 | $ | 2,465 | $ | (7,352 | ) | $ | 14,593 | $ | (2,847 | ) | $ | 78 | $ | 6,937 | $ | 3,990 | ||||||||||||||

| Adjustment to adopt FIN 48 | — | — | 141 | — | — | 141 | ||||||||||||||||||||||||

| Balance at January 1, 2007 | $ | 2,465 | $ | (7,352 | ) | $ | 14,734 | $ | (2,847 | ) | $ | 78 | $ | 7,078 | ||||||||||||||||

| Profit | — | — | 3,541 | — | 37 | 3,578 | $ | 3,578 | ||||||||||||||||||||||

| Foreign currency translation | — | — | — | 278 | 1 | 279 | 279 | |||||||||||||||||||||||

| Pension and other postretirement benefits | ||||||||||||||||||||||||||||||

| Current year actuarial gain (loss), net of tax of $271 | — | — | — | 537 | — | 537 | 537 | |||||||||||||||||||||||

| Amortization of actuarial (gain) loss, net of tax of $123 | — | — | — | 228 | — | 228 | 228 | |||||||||||||||||||||||

| Current year prior service cost, net of tax of $1 | — | — | — | (2 | ) | — | (2 | ) | (2 | ) | ||||||||||||||||||||

| Amortization of prior service cost, net of tax of $10 | — | — | — | 17 | — | 17 | 17 | |||||||||||||||||||||||

| Amortization of transition asset/obligation, net of tax of $1 | — | — | — | 2 | — | 2 | 2 | |||||||||||||||||||||||

| Derivative financial instruments and other | ||||||||||||||||||||||||||||||

| Gains (losses) deferred, net of tax of $27 | — | — | — | 51 | — | 51 | 51 | |||||||||||||||||||||||

| (Gains) losses reclassified to earnings, net of tax of $45 | — | — | — | (80 | ) | — | (80 | ) | (80 | ) | ||||||||||||||||||||

| Available-for-sale securities | ||||||||||||||||||||||||||||||

| Gains (losses) deferred, net of tax of $8 | — | — | — | 14 | — | 14 | 14 | |||||||||||||||||||||||

| (Gains) losses reclassified to earnings, net of tax of $3 | — | — | — | (6 | ) | — | (6 | ) | (6 | ) | ||||||||||||||||||||

| Dividends declared | — | — | (877 | ) | — | (877 | ) | — | ||||||||||||||||||||||

| Distributions to noncontrolling interests | — | — | — | — | (20 | ) | (20 | ) | — | |||||||||||||||||||||

Common shares issued from treasury stock for stock-based compensation: 11,710,958 | 22 | 306 | — | — | — | 328 | — | |||||||||||||||||||||||

| Stock-based compensation expense | 146 | — | — | — | — | 146 | — | |||||||||||||||||||||||

| Tax benefits from stock-based compensation | 167 | — | — | — | — | 167 | — | |||||||||||||||||||||||

| Shares repurchased: 33,533,000 | — | (2,405 | ) | — | — | — | (2,405 | ) | — | |||||||||||||||||||||

| Shares repurchase derivative contracts | (56 | ) | — | — | — | — | (56 | ) | — | |||||||||||||||||||||

| Change in ownership for noncontrolling interests | — | — | — | — | 17 | 17 | — | |||||||||||||||||||||||

| Balance at December 31, 2007 | $ | 2,744 | $ | (9,451 | ) | $ | 17,398 | $ | (1,808 | ) | $ | 113 | $ | 8,996 | $ | 4,618 | ||||||||||||||

STATEMENT 3 | Caterpillar Inc. | ||||||||||||||||||||||||||||

Changes in Consolidated Stockholders’ Equity for the Years Ended December 31 | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

Common stock | Treasury stock | Profit employed in the business | Accumulated other comprehensive income (loss) 1 | Noncontrolling interests | Total | Comprehensive income (loss) | |||||||||||||||||||||||

| Balance at December 31, 2007 | $ | 2,744 | $ | (9,451 | ) | $ | 17,398 | $ | (1,808 | ) | $ | 113 | $ | 8,996 | |||||||||||||||

Adjustment to adopt measurement date provisions of FAS 158, net of tax 2 | — | — | (33 | ) | 17 | — | (16 | ) | |||||||||||||||||||||

| Balance at January 1, 2008 | $ | 2,744 | $ | (9,451 | ) | $ | 17,365 | $ | (1,791 | ) | $ | 113 | $ | 8,980 | |||||||||||||||

| Profit | — | — | 3,557 | — | 28 | 3,585 | $ | 3,585 | |||||||||||||||||||||

| Foreign currency translation, net of tax of $133 | — | — | — | (488 | ) | 23 | (465 | ) | (465 | ) | |||||||||||||||||||

| Pension and other postretirement benefits | |||||||||||||||||||||||||||||

| Current year actuarial gain (loss), net of tax of $1,854 | — | — | — | (3,415 | ) | (30 | ) | (3,445 | ) | (3,445 | ) | ||||||||||||||||||

| Amortization of actuarial (gain) loss, net of tax of $84 | — | — | — | 150 | 1 | 151 | 151 | ||||||||||||||||||||||

| Current year prior service cost, net of tax of $5 | — | — | — | (9 | ) | — | (9 | ) | (9 | ) | |||||||||||||||||||

| Amortization of transition asset/obligation, net of tax of $1 | — | — | — | 2 | — | 2 | 2 | ||||||||||||||||||||||

| Derivative financial instruments and other | |||||||||||||||||||||||||||||

| Gains (losses) deferred, net of tax of $54 | — | — | — | 78 | — | 78 | 78 | ||||||||||||||||||||||

| (Gains) losses reclassified to earnings, net of tax of $6 | — | — | — | (9 | ) | 2 | (7 | ) | (7 | ) | |||||||||||||||||||

| Available-for-sale securities | |||||||||||||||||||||||||||||

| Gains (losses) deferred, net of tax of $67 | — | — | — | (125 | ) | — | (125 | ) | (125 | ) | |||||||||||||||||||

| (Gains) losses reclassified to earnings, net of tax of $15 | — | — | — | 28 | — | 28 | 28 | ||||||||||||||||||||||

| Dividends declared | — | — | (981 | ) | — | — | (981 | ) | — | ||||||||||||||||||||

| Distributions to noncontrolling interests | — | — | — | — | (10 | ) | (10 | ) | — | ||||||||||||||||||||

Common shares issued from treasury stock for stock-based compensation: 4,807,533 | 7 | 128 | — | — | — | 135 | — | ||||||||||||||||||||||

| Stock-based compensation expense | 194 | — | — | — | — | 194 | — | ||||||||||||||||||||||

| Tax benefits from stock-based compensation | 56 | — | — | — | — | 56 | — | ||||||||||||||||||||||

Shares repurchased: 27,267,026 3 | — | (1,894 | ) | — | — | — | (1,894 | ) | — | ||||||||||||||||||||

| Stock repurchase derivative contracts | 56 | — | — | — | — | 56 | — | ||||||||||||||||||||||

Cat Japan share redemption 4 | — | — | (115 | ) | — | 2 | (113 | ) | — | ||||||||||||||||||||

| Change in ownership for noncontrolling interests | — | — | — | — | (26 | ) | (26 | ) | — | ||||||||||||||||||||

| Balance at December 31, 2008 | $ | 3,057 | $ | (11,217 | ) | $ | 19,826 | $ | (5,579 | ) | $ | 103 | $ | 6,190 | $ | (207 | ) | ||||||||||||

| 1 | Pension and other postretirement benefits include net adjustments for Cat Japan Ltd, while they were an unconsolidated affiliate, of $(9) million and $(6) million in 2007 and 2006, respectively. The ending balances are $(52) million and $(43) million as of December 31, 2007 and 2006, respectively. See Note 25 regarding the Cat Japan share redemption. |

| 2 | Adjustments to profit employed in the business and pension and other postemployment benefits were net of tax of $(17) million and $9 million, respectively. |

| 3 | Amount consists of $1,800 million of cash-settled purchases and $94 million of derivative contracts. |

| 4 | See Note 25 regarding the Cat Japan share redemption. |

| See accompanying notes to Consolidated Financial Statements. | |

| STATEMENT 4 | Caterpillar Inc. | |||||||||||||||

Consolidated Statement of Cash Flow for the Years Ended December 31 (Millions of dollars) | ||||||||||||||||

| 2008 | 2007 | 2006 | ||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||

| Profit | $ | 3,557 | $ | 3,541 | $ | 3,537 | ||||||||||

| Adjustments for non-cash items: | ||||||||||||||||

| Depreciation and amortization | 1,980 | 1,797 | 1,602 | |||||||||||||

| Other | 383 | 199 | 197 | |||||||||||||

| Changes in assets and liabilities: | ||||||||||||||||

Receivables – trade and other | (545 | ) | 899 | (148 | ) | |||||||||||

| Inventories | (833 | ) | (745 | ) | (827 | ) | ||||||||||

| Accounts payable and accrued expenses | 656 | 618 | 670 | |||||||||||||

| Customer advances | 286 | 576 | 511 | |||||||||||||

| Other assets – net | (470 | ) | 66 | (262 | ) | |||||||||||

| Other liabilities – net | (217 | ) | 1,004 | 529 | ||||||||||||

| Net cash provided by (used for) operating activities | 4,797 | 7,955 | 5,809 | |||||||||||||

| Cash flow from investing activities: | ||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (2,445 | ) | (1,700 | ) | (1,593 | ) | ||||||||||

| Expenditures for equipment leased to others | (1,566 | ) | (1,340 | ) | (1,082 | ) | ||||||||||

Proceeds from disposals of property, plant and equipment | 982 | 408 | 572 | |||||||||||||

| Additions to finance receivables | (14,031 | ) | (13,946 | ) | (10,522 | ) | ||||||||||

| Collections of finance receivables | 9,717 | 10,985 | 8,094 | |||||||||||||

| Proceeds from sale of finance receivables | 949 | 866 | 1,067 | |||||||||||||

| Investments and acquisitions (net of cash acquired) | (117 | ) | (229 | ) | (513 | ) | ||||||||||

| Proceeds from release of security deposit | — | 290 | — | |||||||||||||

| Proceeds from sale of available-for-sale securities | 357 | 282 | 539 | |||||||||||||

| Investments in available-for-sale securities | (339 | ) | (485 | ) | (681 | ) | ||||||||||

| Other – net | 197 | 461 | 323 | |||||||||||||

| Net cash provided by (used for) investing activities | (6,296 | ) | (4,408 | ) | (3,796 | ) | ||||||||||

| Cash flow from financing activities: | ||||||||||||||||

| Dividends paid | (953 | ) | (845 | ) | (726 | ) | ||||||||||

| Distribution to noncontrolling interests | (10 | ) | (20 | ) | (10 | ) | ||||||||||

| Common stock issued, including treasury shares reissued | 135 | 328 | 414 | |||||||||||||

| Payment for stock repurchase derivative contracts | (38 | ) | (56 | ) | — | |||||||||||

| Treasury shares purchased | (1,800 | ) | (2,405 | ) | (3,208 | ) | ||||||||||

| Excess tax benefit from stock-based compensation | 56 | 155 | 169 | |||||||||||||

| Proceeds from debt issued (original maturities greater than three months): | ||||||||||||||||

| — Machinery and Engines | 1,673 | 224 | 1,445 | |||||||||||||

| — Financial Products | 16,257 | 10,815 | 9,824 | |||||||||||||

| Payments on debt (original maturities greater than three months): | ||||||||||||||||

| — Machinery and Engines | (296 | ) | (598 | ) | (839 | ) | ||||||||||

| — Financial Products | (14,143 | ) | (10,290 | ) | (9,536 | ) | ||||||||||

Short-term borrowings (original maturities three months or less) – net | 2,074 | (297 | ) | (136 | ) | |||||||||||

| Net cash provided by (used for) financing activities | 2,955 | (2,989 | ) | (2,603 | ) | |||||||||||

| Effect of exchange rate changes on cash | 158 | 34 | 12 | |||||||||||||

| Increase (decrease) in cash and short-term investments | 1,614 | 592 | (578 | ) | ||||||||||||

| Cash and short-term investments at beginning of period | 1,122 | 530 | 1,108 | |||||||||||||

| Cash and short-term investments at end of period | $ | 2,736 | $ | 1,122 | $ | 530 | ||||||||||

| All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. | |

| Non-cash activities: | |

| On June 19, 2006, Caterpillar acquired 100 percent of the equity in Progress Rail Services, Inc. A portion of the acquisition was financed with 5.3 million shares of Caterpillar stock with a fair value of $379 million as of the acquisition date. See Note 25 for further discussion. | |

| See accompanying notes to Consolidated Financial Statements. | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | ||

1. | Operations and summary of significant accounting policies | |

A. | Nature of operations | |

We operate in three principal lines of business: | ||

(1) | Machinery— A principal line of business which includes the design, manufacture, marketing and sales of construction, mining and forestry machinery—track and wheel tractors, track and wheel loaders, pipelayers, motor graders, wheel tractor-scrapers, track and wheel excavators, backhoe loaders, log skidders, log loaders, off-highway trucks, articulated trucks, paving products, skid steer loaders and related parts. Also includes logistics services for other companies and the design, manufacture, remanufacture, maintenance and services of rail-related products. | |

(2) | Engines— A principal line of business including the design, manufacture, marketing and sales of engines for Caterpillar machinery; electric power generation systems; on-highway vehicles and locomotives; marine, petroleum, construction, industrial, agricultural and other applications; and related parts. Also includes remanufacturing of Caterpillar engines and a variety of Caterpillar machine and engine components and remanufacturing services for other companies. Reciprocating engines meet power needs ranging from 10 to 21,700 horsepower (8 to over 16 000 kilowatts). Turbines range from 1,600 to 30,000 horsepower (1 200 to 22 000 kilowatts). | |

(3) | Financial Products— A principal line of business consisting primarily of Caterpillar Financial Services Corporation (Cat Financial), Caterpillar Insurance Holdings, Inc. (Cat Insurance), Caterpillar Power Ventures Corporation (Cat Power Ventures) and their respective subsidiaries. Cat Financial provides a wide range of financing alternatives to customers and dealers for Caterpillar machinery and engines, Solar gas turbines as well as other equipment and marine vessels. Cat Financial also extends loans to customers and dealers. Cat Insurance provides various forms of insurance to customers and dealers to help support the purchase and lease of our equipment. Cat Power Ventures is an investor in independent power projects using Caterpillar power generation equipment and services. | |

Our Machinery and Engines operations are highly integrated. Throughout the Notes, Machinery and Engines represents the aggregate total of these principal lines of business. Our products are sold primarily under the brands "Caterpillar," "CAT," design versions of "CAT" and "Caterpillar," "Solar Turbines," “MaK," "Perkins," "FG Wilson," "Olympian" and “Progress Rail.” We conduct operations in our Machinery and Engines lines of business under highly competitive conditions, including intense price competition. We place great emphasis on the high quality and performance of our products and our dealers' service support. Although no one competitor is believed to produce all of the same types of machines and engines that we do, there are numerous companies, large and small, which compete with us in the sale of each of our products. Machines are distributed principally through a worldwide organization of dealers (dealer network), 52 located in the United States and 128 located outside the United States. Worldwide, these dealers serve 182 countries and operate 3,537 places of business, including 1,467 dealer rental outlets. Reciprocating engines are sold principally through the dealer network and to other manufacturers for use in products manufactured by them. Some of the reciprocating engines manufactured by Perkins are also sold through a worldwide network of 131 distributors located in 172 countries. The FG Wilson branded electric power generation systems are sold through a worldwide network of 157 dealers located in 180 countries. Our dealers do not deal exclusively with our products; however, in most cases sales and servicing of our products are the dealers' principal business. Turbines and large medium speed reciprocating engines are sold through sales forces employed by the company. At times, these employees are assisted by independent sales representatives. Manufacturing activities of the Machinery and Engines lines of business are conducted in 99 plants in the United States; 13 in the United Kingdom; nine in Italy; eight in China and Mexico; five each in Canada and France; four in Brazil; three each in Australia, India and Poland; two each in Germany, Indonesia, Japan, the Netherlands and Northern Ireland; and one each in Belgium, Hungary, Malaysia, Nigeria, Russia, South Africa, Sweden, Switzerland and Tunisia. Thirteen parts distribution centers are located in the United States and 16 are located outside the United States. The Financial Products line of business also conducts operations under highly competitive conditions. Financing for users of Caterpillar products is available through a variety of competitive sources, principally commercial banks and finance and leasing companies. We emphasize prompt and responsive service to meet customer requirements and offer various financing plans designed to increase the opportunity for sales of our products and generate financing income for our company. Financial Products activity is conducted primarily in the United States, with additional offices in Asia, Australia, Canada, Europe and Latin America. | ||

B. | Basis of consolidation |

The financial statements include the accounts of Caterpillar Inc. and its subsidiaries. Investments in companies that are owned 20% to 50% or are less than 20% owned and for which we have significant influence are accounted for by the equity method (see Note 11). We consolidate all variable interest entities where Caterpillar Inc. is the primary beneficiary. For variable interest entities, we assess whether we are the primary beneficiary as prescribed by FASB Interpretation 46R, “Consolidation of Variable Interest Entities, an Interpretation of Accounting Research Bulletin No. 51” (FIN 46R). The primary beneficiary of a variable interest entity is the party that absorbs a majority of the entity’s expected losses, receives a majority of its expected residual returns, or both. Certain amounts for prior years have been reclassified to conform with the current-year financial statement presentation. Shipping and handling costs are included in Cost of goods sold in Statement 1. Other operating expense primarily includes Cat Financial's depreciation of equipment leased to others, Cat Insurance’s underwriting expenses, gains (losses) on disposal of long-lived assets, long-lived asset impairment charges and employee separation charges. Prepaid expenses and other current assets in Statement 2 include prepaid rent, prepaid insurance and other prepaid items. In addition, at December 31, 2008, this line included a security deposit of $232 million related to a deposit obligation due in 2009, while at December 31, 2006, this line included a security deposit of $249 million related to a deposit obligation due in 2007. See Note 16 for further discussion. | |

C. | Sales and revenue recognition |

Sales of Machinery and Engines are generally recognized when title transfers and the risks and rewards of ownership have passed to customers or independently owned and operated dealers. Typically, where product is produced and sold in the same country, title and risk of ownership transfer when the product is shipped. Products that are exported from a country for sale typically pass title and risk of ownership at the border of the destination country. No right of return exists on sales of equipment. Replacement part returns are estimable and accrued at the time a sale is recognized. We provide discounts to dealers and original equipment manufacturers (OEM) through merchandising programs that are administered by our marketing divisions. We have numerous programs that are designed to promote the sale of our products. The most common dealer programs provide a discount when the dealer sells a product to a targeted end user. OEM programs provide discounts designed to encourage the use of our engines. The cost of these discounts is estimated based on historical experience and known changes in merchandising programs and is reported as a reduction to sales when the product sale is recognized. Our standard invoice terms are established by marketing region. When a sale is made to a dealer, the dealer is responsible for payment even if the product is not sold to an end customer and must make payment within the standard terms to avoid interest costs. Interest at or above prevailing market rates is charged on any past due balance. Our policy is to not forgive this interest. In 2008 terms were extended to not more than one year for $544 million of receivables, which represent approximately 1% of consolidated sales. In 2007 and 2006, terms were extended to not more than one year for $219 million and $49 million of receivables, respectively, which represent less than 1% of consolidated sales. |

| Sales with payment terms of two months or more were as follows: | |||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||

| 2008 | 2007 | 2006 | |||||||||||||||||||||||

| Payment Terms (months) | Sales | Percent of Sales | Sales | Percent of Sales | Sales | Percent of Sales | |||||||||||||||||||

| 2 | $ | 4,130 | 8.6 | % | $ | 2,830 | 6.8 | % | $ | 2,557 | 6.6 | % | |||||||||||||

| 3 | 2,786 | 5.8 | % | 2,067 | 4.9 | % | 711 | 1.8 | % | ||||||||||||||||

| 4 | 866 | 1.8 | % | 526 | 1.3 | % | 336 | 0.9 | % | ||||||||||||||||

| 5 | 1,062 | 2.2 | % | 965 | 2.3 | % | 1,222 | 3.1 | % | ||||||||||||||||

| 6 | 561 | 1.2 | % | 4,549 | 10.8 | % | 8,583 | 22.1 | % | ||||||||||||||||

| 7-12 | 4,469 | 9.3 | % | 293 | 0.7 | % | 274 | 0.7 | % | ||||||||||||||||

| $ | 13,874 | 28.9 | % | $ | 11,230 | 26.8 | % | $ | 13,683 | 35.2 | % | ||||||||||||||

Revenues of Financial Products primarily represent the following Cat Financial revenues: | ||

| · | Retail (end-customer) finance revenue on finance leases and installment sale contracts is recognized over the term of the contract at a constant rate of return on the scheduled outstanding principal balance. Revenue on retail notes is recognized based on the daily balance of retail receivables outstanding and the applicable effective interest rate. | |

| · | Operating lease revenue is recorded on a straight-line basis in the period earned over the life of the contract. | |

| · | Wholesale (dealer) finance revenue on installment contracts and finance leases is recognized over the term of the contract at a constant rate of return on the scheduled outstanding principal balance. Revenue on wholesale notes is recognized based on the daily balance of wholesale receivables outstanding and the applicable effective interest rate. | |

| · | Loan origination and commitment fees are deferred and then amortized to revenue using the interest method over the life of the finance receivables. | |

Recognition of income is suspended when collection of future income is not probable. Accrual is resumed, and previously suspended income is recognized, when the receivable becomes contractually current and/or collection doubts are removed. Cat Financial provides wholesale inventory financing to dealers. See Notes 7 and 8 for more information. Sales and revenue recognition items are presented net of sales and other related taxes. | ||

D. | Inventories | |

Inventories are stated at the lower of cost or market. Cost is principally determined using the last-in, first-out (LIFO) method. The value of inventories on the LIFO basis represented about 70% of total inventories at December 31, 2008, and about 75% of total inventories at December 31, 2007 and 2006. If the FIFO (first-in, first-out) method had been in use, inventories would have been $3,183 million, $2,617 million and $2,403 million higher than reported at December 31, 2008, 2007 and 2006, respectively. | ||

E. | Securitized receivables | |

We periodically sell finance receivables in securitization transactions. When finance receivables are securitized, we retain interests in the receivables in the form of subordinated certificates, an interest in future cash flows (excess), reserve accounts and servicing rights. The retained interests are recorded in “Other assets” at fair value. We estimate fair value based on the present value of future expected cash flows using key assumptions for credit losses, prepayment rates and discount rates. See Note 8 and Note 19 for more information. | ||

F. | Depreciation and amortization | |

Depreciation of plant and equipment is computed principally using accelerated methods. Depreciation on equipment leased to others, primarily for Financial Products, is computed using the straight-line method over the term of the lease. The depreciable basis is the original cost of the equipment less the estimated residual value of the equipment at the end of the lease term. In 2008, 2007 and 2006, Cat Financial depreciation on equipment leased to others was $724 million, $671 million and $631 million, respectively, and was included in "Other operating expenses" in Statement 1. In 2008, 2007 and 2006 consolidated depreciation expense was $1,907 million, $1,725 million and $1,554 million, respectively. Amortization of purchased intangibles is computed principally using the straight-line method, generally not to exceed a period of 20 years. | ||

G. | Foreign currency translation | |

| The functional currency for most of our Machinery and Engines consolidated companies is the U.S. dollar. The functional currency for most of our Financial Products and equity basis companies is the respective local currency. Gains and losses resulting from the translation of foreign currency amounts to the functional currency are included in "Other income (expense)" in Statement 1. Gains and losses resulting from translating assets and liabilities from the functional currency to U.S. dollars are included in "Accumulated other comprehensive income" in Statement 2. | ||

H. | Derivative financial instruments |

Our earnings and cash flow are subject to fluctuations due to changes in foreign currency exchange rates, interest rates and commodity prices. In addition, the amount of Caterpillar stock that can be repurchased under our stock repurchase program is impacted by movements in the price of the stock. Our Risk Management Policy (policy) allows for the use of derivative financial instruments to prudently manage foreign currency exchange rate, interest rate, commodity price and Caterpillar stock price exposures. Our policy specifies that derivatives are not to be used for speculative purposes. Derivatives that we use are primarily foreign currency forward and option contracts, interest rate swaps, commodity forward and option contracts and stock repurchase contracts. Our derivative activities are subject to the management, direction and control of our senior financial officers. Risk management practices, including the use of financial derivative instruments, are presented to the Audit Committee of the Board of Directors at least annually. Payments for stock repurchase derivatives are accounted for as a reduction in stockholders’ equity. All other derivatives are recognized on the Consolidated Financial Position at their fair value. On the date the derivative contract is entered, we designate the derivative as (1) a hedge of the fair value of a recognized asset or liability ("fair value" hedge), (2) a hedge of a forecasted transaction or the variability of cash flow to be paid ("cash flow" hedge), or (3) an "undesignated" instrument. Changes in the fair value of a derivative that is qualified, designated and highly effective as a fair value hedge, along with the gain or loss on the hedged liability that is attributable to the hedged risk, are recorded in current earnings. Changes in the fair value of a derivative that is qualified, designated and highly effective as a cash flow hedge are recorded in other comprehensive income until earnings are affected by the forecasted transaction or the variability of cash flow and are then reported in current earnings. Changes in the fair value of undesignated derivative instruments and the ineffective portion of designated derivative instruments are reported in current earnings. Cash flows from designated derivative financial instruments are classified within the same category as the item being hedged on Statement 4. Cash flows from undesignated derivative financial instruments are included in the investing category on Statement 4. We formally document all relationships between hedging instruments and hedged items, as well as the risk-management objective and strategy for undertaking various hedge transactions. This process includes linking all derivatives that are designated as fair value hedges to specific assets and liabilities on the Consolidated Financial Position and linking cash flow hedges to specific forecasted transactions or variability of cash flow. We also formally assess, both at the hedge's inception and on an ongoing basis, whether the derivatives that are used in hedging transactions are highly effective in offsetting changes in fair values or cash flow of hedged items. When it is determined that a derivative is not highly effective as a hedge or that it has ceased to be a highly effective hedge, we discontinue hedge accounting prospectively, in accordance with Statement of Financial Accounting Standards No. 133 (SFAS 133), "Accounting for Derivative Instruments and Hedging Activities." See Note 3 for more information. | |

I. | Income taxes |

The provision for income taxes is determined using the asset and liability approach for accounting for income taxes in accordance with Statement of Financial Accounting Standards No. 109 (SFAS 109), "Accounting for Income Taxes." Tax laws require items to be included in tax filings at different times than the items are reflected in the financial statements. A current liability is recognized for the estimated taxes payable for the current year. Deferred taxes represent the future tax consequences expected to occur when the reported amounts of assets and liabilities are recovered or paid. Deferred taxes are adjusted for enacted changes in tax rates and tax laws. Valuation allowances are recorded to reduce deferred tax assets when it is more likely than not that a tax benefit will not be realized. | |

J. | Estimates in financial statements |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect reported amounts. The more significant estimates include: residual values for leased assets, fair values for goodwill impairment tests, impairment of available-for-sale securities, warranty liability, stock-based compensation and reserves for product liability and insurance losses, postemployment benefits, post-sale discounts, credit losses and income taxes. |

K. | New accounting standards |

SFAS 155 – In February 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 155 (SFAS 155), “Accounting for Certain Hybrid Financial Instruments – an amendment of FASB Statements No. 133 and 140.” SFAS 155 allows financial instruments that have embedded derivatives to be accounted for as a whole, eliminating the need to separate the derivative from its host, if the holder elects to account for the whole instrument on a fair value basis. This new accounting standard was effective January 1, 2007. The adoption of SFAS 155 did not have a material impact on our financial statements. |

SFAS 156 – In March 2006, the FASB issued Statement of Financial Accounting Standards No. 156 (SFAS 156), “Accounting for Servicing of Financial Assets – an amendment of FASB Statement No. 140.” SFAS 156 requires that all separately recognized servicing rights be initially measured at fair value, if practicable. In addition, this Statement permits an entity to choose between two measurement methods (amortization method or fair value measurement method) for each class of separately recognized servicing assets and liabilities. This new accounting standard was effective January 1, 2007. The adoption of SFAS 156 did not have a material impact on our financial statements. FIN 48 – In June 2006, the FASB issued FIN 48 “Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement No. 109” to create a single model to address accounting for uncertainty in tax positions. FIN 48 clarifies that a tax position must be more likely than not of being sustained before being recognized in the financial statements. As required, we adopted the provisions of FIN 48 as of January 1, 2007. The following table summarizes the effect of the initial adoption of FIN 48. See Note 5 for additional information. | ||||||||||||

| Initial adoption of FIN 48 | ||||||||||||

| (Millions of dollars) | January 1, 2007 Prior to FIN 48 Adjustment | FIN 48 Adjustment | January 1, 2007 Post FIN 48 Adjustment | |||||||||

| Deferred and refundable income taxes | $ | 733 | $ | 82 | $ | 815 | ||||||

| Noncurrent deferred and refundable income taxes | 1,949 | 211 | 2,160 | |||||||||

| Other current liabilities | 1,145 | (530 | ) | 615 | ||||||||

| Other liabilities | 1,131 | 682 | 1,813 | |||||||||

| Profit employed in the business | 14,593 | 141 | 14,734 | |||||||||

SFAS 157 – In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157 (SFAS 157), “Fair Value Measurements.” SFAS 157 provides a common definition of fair value and a framework for measuring assets and liabilities at fair values when a particular standard prescribes it. In addition, the Statement expands disclosures about fair value measurements. In February 2008, the FASB issued final Staff Positions that (1) deferred the effective date of this Statement for one year for certain nonfinancial assets and nonfinancial liabilities (see below) and (2) removed certain leasing transactions from the scope of the Statement. We applied this new accounting standard to all other fair value measurements effective January 1, 2008. The adoption of SFAS 157 did not have a material impact on our financial statements. See Note 19 for additional information. FSP 157-2 – In February 2008, the FASB issued FASB Staff Position on Statement 157 "Effective Date of FASB Statement No. 157" (FSP 157-2). FSP 157-2 delays the effective date of SFAS 157 for nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed on a recurring basis, to fiscal years beginning after November 15, 2008. Our significant nonfinancial assets and liabilities that could be impacted by this deferral include assets and liabilities initially measured at fair value in a business combination and goodwill tested annually for impairment. The adoption of FSP 157-2 is not expected to have a material impact on our financial statements. FSP 157-3 – In October 2008, the FASB issued FASB Staff Position on Statement 157 "Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active” (FSP 157-3). FSP 157-3 clarifies how SFAS 157 should be applied when valuing securities in markets that are not active by illustrating key considerations in determining fair value. It also reaffirms the notion of fair value as the exit price as of the measurement date. FSP 157-3 was effective upon issuance, which included periods for which financial statements have not yet been issued. This new accounting standard has been adopted for our financial statements starting July 1, 2008. The adoption of FSP 157-3 did not have a material impact on our financial statements. SFAS 158 – In September 2006, the FASB issued Statement of Financial Accounting Standards No. 158 (SFAS 158), “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106 and 132R.” SFAS 158 requires recognition of the overfunded or underfunded status of pension and other postretirement benefit plans on the balance sheet. Under SFAS 158, gains and losses, prior service costs and credits and any remaining transition amounts under SFAS 87 and SFAS 106 that have not yet been recognized through net periodic benefit cost are recognized in Accumulated other comprehensive income (loss), net of tax effects, until they are amortized as a component of net periodic benefit cost. Also, the measurement date – the date at which the benefit obligation and plan assets are measured – is required to be the company’s fiscal year-end. As required by SFAS 158, we adopted the balance sheet recognition provisions at December 31, 2006. SFAS 87 required the recognition of an additional minimum liability (AML) if the market value of plan assets was less than the accumulated benefit obligation at the end of the measurement date. The AML was eliminated upon the adoption of SFAS 158. The following summarizes the effect of the required changes in the AML, as well as the impact of the initial adoption of SFAS 158, as of December 31, 2006. See Note 14 for additional information regarding postemployment benefits. | ||||||||||||

| Initial adoption of SFAS 158 | ||||||||||||||||

| (Millions of dollars) | December 31, 2006 Prior to AML and SFAS 158 Adjustments | AML Adjustment per SFAS 87 | SFAS 158 Adjustment | December 31, 2006 Post AML and SFAS 158 Adjustments | ||||||||||||

| Prepaid expenses and other current assets | $ | 2,467 | $ | — | $ | (1,829 | ) | $ | 638 | |||||||

| Investments in unconsolidated affiliated companies | 568 | — | (6 | ) | 562 | |||||||||||

| Deferred income taxes | 552 | (97 | ) | 1,494 | 1,949 | |||||||||||

| Intangible assets | 639 | (60 | ) | (192 | ) | 387 | ||||||||||

| Accrued wages, salaries and employee benefits | 1,440 | — | (502 | ) | 938 | |||||||||||

| Liability for postemployment benefits | 3,625 | (386 | ) | 2,640 | 5,879 | |||||||||||

| Accumulated other comprehensive income | (405 | ) | 229 | (2,671 | ) | (2,847 | ) | |||||||||

| We adopted the year-end measurement date effective January 1, 2008 using the “one measurement” approach. Under the one measurement approach, net periodic benefit cost for the period between any early measurement date and the end of the fiscal year that the measurement provisions are applied is allocated proportionately between amounts to be recognized as an adjustment of Profit employed in the business and net periodic benefit cost for the fiscal year. Previously, we used a November 30th measurement date for our U.S. pension and other postretirement benefit plans and September 30th for our non-U.S. plans. The following summarizes the effect of adopting the year-end measurement date provisions as of January 1, 2008. See Note 14 for additional information. |

| Adoption of SFAS 158 year-end measurement date | January 1, 2008 | January 1, 2008 | ||||||||||

| (Millions of dollars) | Prior to SFAS 158 Adjustment | SFAS 158 Adjustment | Post SFAS 158 Adjustment | |||||||||

| Noncurrent deferred and refundable income taxes | $ | 1,553 | $ | 8 | $ | 1,561 | ||||||

| Liability for postemployment benefits | 5,059 | 24 | 5,083 | |||||||||

| Accumulated other comprehensive income | (1,808 | ) | 17 | (1,791 | ) | |||||||

| Profit employed in the business | 17,398 | (33 | ) | 17,365 | ||||||||

SFAS 159 – In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159 (SFAS 159), “The Fair Value Option for Financial Assets and Financial Liabilities – including an amendment of SFAS No. 115.” SFAS 159 creates a fair value option under which an entity may irrevocably elect fair value as the initial and subsequent measurement attribute for certain financial assets and liabilities on a contract by contract basis, with changes in fair values recognized in earnings as these changes occur. We adopted this new accounting standard on January 1, 2008. We have not elected to measure any financial assets or financial liabilities at fair value which were not previously required to be measured at fair value. Therefore, the adoption of SFAS 159 did not have a material impact on our financial statements. |

SFAS 141R and SFAS 160 – In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (revised 2007) (SFAS 141R), “Business Combinations,” and No. 160 (SFAS 160), “Noncontrolling Interests in Consolidated Financial Statements – an amendment of ARB No. 51.” SFAS 141R requires the acquiring entity in a business combination to recognize the assets acquired and liabilities assumed. Further, SFAS 141R also changes the accounting for acquired in-process research and development assets, contingent consideration, partial acquisitions and transaction costs. Under SFAS 160, all entities are required to report noncontrolling (minority) interests in subsidiaries as equity in the consolidated financial statements. In addition, transactions between an entity and noncontrolling interests will be treated as equity transactions. SFAS 141R and SFAS 160 will become effective for fiscal years beginning after December 15, 2008. We will adopt these new accounting standards on January 1, 2009. We do not expect the adoption to have a material impact on our financial statements. See Note 29 for further details. |

SFAS 161 – In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161 (SFAS 161), “Disclosures about Derivative Instruments and Hedging Activities – an amendment of FASB Statement No. 133.” SFAS 161 expands disclosures for derivative instruments by requiring entities to disclose the fair value of derivative instruments and their gains or losses in tabular format. SFAS 161 also requires disclosure of information about credit risk-related contingent features in derivative agreements, counterparty credit risk, and strategies and objectives for using derivative instruments. SFAS 161 will become effective for fiscal years beginning after November 15, 2008. We will adopt this new accounting standard on January 1, 2009. We do not expect the adoption to have a material impact on our financial statements. |

SFAS 162 – In May 2008, the FASB issued Statement of Financial Accounting Standards No. 162 (SFAS 162), “The Hierarchy of Generally Accepted Accounting Principles.” SFAS 162 identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with U.S. GAAP. SFAS 162 was effective November 16, 2008. This Statement did not result in a change in our current practice. |

SFAS 163 – In May 2008, the FASB issued Statement of Financial Accounting Standards No. 163 (SFAS 163), “Accounting for Financial Guarantee Insurance Contracts – an interpretation of FASB Statement No. 60.” SFAS 163 requires that an insurance enterprise recognize a claim liability prior to an event of default (insured event) when there is evidence that credit deterioration has occurred in an insured financial obligation. It also requires disclosure about (1) the risk-management activities used by an insurance enterprise to evaluate credit deterioration in its insured financial obligations and (2) the insurance enterprise’s surveillance or watch list. SFAS 163 will become effective for fiscal years beginning after December 15, 2008. We will adopt this new accounting standard on January 1, 2009. We do not expect the adoption to have a material impact on our financial statements. |

FSP FAS 140-4 and FIN 46R-8 – In December 2008, the FASB issued FASB Staff Position on Statement 140 and FIN 46R "Disclosures by Public Entities (Enterprises) about Transfers of Financial Assets and Interests in Variable Interest Entities" (FSP FAS 140-4 and FIN 46R-8). This FSP expands the disclosure requirements in SFAS 140 and FIN 46R by requiring additional information about companies’ involvement with variable interest entities (VIEs) and their continuing involvement with transferred financial assets. This new accounting standard has been adopted for our financial statements ended December 31, 2008. The adoption of FSP FAS 140-4 and FIN 46R-8 did not have a material impact on our financial statements. |

FSP FAS 132R-1 – In December 2008, the FASB issued FASB Staff Position on Statement 132R, "Employers’ Disclosures about Postretirement Benefit Plan Assets" (FSP FAS 132(R)-1). This FSP expands the disclosure set forth in SFAS 132R by adding required disclosures about (1) how investment allocation decisions are made by management, (2) major categories of plan assets, and (3) significant concentration of risk. Additionally, the FSP requires an employer to disclose information about the valuation of plan assets similar to that required under SFAS 157. This new accounting standard will become effective for fiscal years ending after December 15, 2009. We will adopt this new accounting standard on January 1, 2009. We do not expect the adoption to have a material impact on our financial statements. |

FSP EITF 99-20-1 – In January 2009, the FASB issued FASB Staff Position on EITF Issue No. 99-20, "Amendments to the Impairment Guidance of EITF Issue No. 99-20" (FSP EITF 99-20-1). FSP EITF 99-20-1 aligns the impairment guidance in EITF Issue No. 99-20 with that in Statement of Financial Accounting Standards No. 115 (SFAS 115), "Accounting for Certain Investments in Debt and Equity Securities." It changes how companies determine whether an other-than-temporary impairment exists for certain beneficial interests by allowing management to exercise more judgment. This new accounting standard has been adopted for our financial statements ended December 31, 2008. The adoption of FSP EITF 99-20-1 did not have a material impact on our financial statements. |

L. | Goodwill |

Goodwill represents the excess of the cost of an acquisition over the fair value of the net assets acquired. We account for goodwill in accordance with Statement of Financial Accounting Standards No. 142 "Goodwill and Other Intangible Assets," which requires that we test goodwill for impairment, at the reporting unit level, annually and when events or circumstances indicate the fair value of a reporting unit may be below its carrying value. A reporting unit is an operating segment or sub-segment to which goodwill is assigned when initially recorded. We assign goodwill to reporting units based on our integration plans and the expected synergies resulting from the business combination. Because Caterpillar is a highly integrated company, the businesses we acquire are sometimes combined with or integrated into existing reporting units. We perform our annual goodwill impairment test as of October 1 and monitor for interim triggering events on an ongoing basis. Goodwill is reviewed for impairment utilizing a two-step process. The first step requires us to compare the fair value of each reporting unit, which we compute using a discounted cash flow analysis, to the respective carrying value, which includes goodwill. If the fair value of the reporting unit exceeds its carrying value, the goodwill is not considered impaired. If the carrying value is higher than the fair value, there is an indication that an impairment may exist and the second step is required. In step two, the implied fair value of goodwill is calculated as the excess of the fair value of a reporting unit over the fair values assigned to its assets and liabilities. If the implied fair value of goodwill is less than the carrying value of the reporting unit’s goodwill, the difference is recognized as an impairment loss. |

M. | Stock-based compensation |

| On January 1, 2006, we adopted Statement of Financial Accounting Standards No. 123 (revised 2004) (SFAS 123R), “Share-Based Payment” using the modified prospective transition method. SFAS 123R requires all stock–based payments to be recognized in the financial statements based on the grant date fair value of the award. Under the modified prospective transition method, we were required to record stock-based compensation expense for all awards granted after the date of adoption and for the unvested portion of previously granted awards outstanding as of the date of adoption. See Note 2 for additional information regarding stock-based compensation. |

2. | Stock-based compensation |

Stock Incentive Plans In 1996, stockholders approved the Stock Option and Long-Term Incentive Plan (the 1996 Plan), which expired in April of 2006. The 1996 Plan reserved 144 million shares of common stock for issuance (128 million under this plan and 16 million under prior plans). On June 14, 2006, stockholders approved the 2006 Caterpillar Long-Term Incentive Plan (the 2006 Plan). The 2006 non-employee Directors’ grant was issued from this plan. The 2006 Plan reserves 37.6 million shares for issuance (20 million under the 2006 Plan and 17.6 million transferred from the 1996 Plan). The plans primarily provide for the granting of stock options, stock-settled stock appreciation rights (SARs) and restricted stock units (RSUs) to Officers and other key employees, as well as non-employee Directors. Stock options permit a holder to buy Caterpillar stock at the stock's price when the option was granted. SARs permit a holder the right to receive the value in shares of the appreciation in Caterpillar stock that occurred from the date the right was granted up to the date of exercise. A restricted stock unit (RSU) is an agreement to issue shares of Caterpillar stock at the time of vesting. | |

Our long-standing practices and policies specify all stock-based compensation awards are approved by the Compensation Committee (the Committee) of the Board of Directors on the date of grant. The stock-based award approval process specifies the number of awards granted, the terms of the award and the grant date. The same terms and conditions are consistently applied to all employee grants, including Officers. The Committee approves all individual Officer grants. The number of stock-based compensation awards included in an individual’s award is determined based on the methodology approved by the Committee. Prior to 2007, the terms of the 1996 Stock Option and Long-Term Incentive Plan (which expired in April of 2006) provided for the exercise price methodology to be the average of the high and low price of our stock on the date of grant. In 2007, under the terms of the Caterpillar Inc. 2006 Long-Term Incentive Plan (approved by stockholders in June of 2006), the Compensation Committee approved the exercise price methodology to be the closing price of the Company stock on the date of the grant. Common stock issued from Treasury stock under the plans totaled 4,807,533 for 2008, 11,710,958 for 2007 and 15,207,055 for 2006. In 2007, in order to align our stock award program with the overall market, we adjusted our 2007 grant by reducing the overall number of employee awards and utilizing RSUs in addition to the SARs and option awards. The 2008, 2007 and 2006 awards generally vest three years after the date of grant. At grant, SARs and option awards have a term life of ten years. Upon separation from service, if the participant is 55 years of age or older with more than ten years of service, the participant meets the criteria for a “Long Service Separation." If the “Long Service Separation” criteria are met, the vested options/SARs will have a life that is the lesser of 10 years from the original grant date or five years from the separation date. Our stock-based compensation plans allow for the immediate vesting upon separation for employees who meet the criteria for a “Long Service Separation” and who have fulfilled the requisite service period of six months. With the adoption of SFAS 123R, compensation expense is recognized over the period from the grant date to the end date of the requisite service period for employees who meet the immediate vesting upon retirement requirements. For those employees who become eligible for immediate vesting upon retirement subsequent to the requisite service period and prior to the completion of the vesting period, compensation expense is recognized over the period from grant date to the date eligibility is achieved. | |

| SFAS 123R requires companies to estimate the fair value of options/SARs on the date of grant using an option-pricing model. In 2008, 2007 and 2006, the fair value of the option/SAR grant was estimated using a lattice-based option-pricing model. The lattice-based option-pricing model considers a range of assumptions related to volatility, risk-free interest rate and historical employee behavior. Expected volatility was based on historical and current implied volatilities from traded options on our stock. The risk-free rate was based on U.S. Treasury security yields at the time of grant. The weighted-average dividend yield was based on historical information. The expected life was determined from the lattice-based model. The lattice-based model incorporated exercise and post vesting forfeiture assumptions based on analysis of historical data. The following table provides the assumptions used in determining the fair value of the stock-based awards for the years ended December 31, 2008, 2007 and 2006, respectively. |

| Grant Year | ||||||||||||

| 2008 | 2007 | 2006 | ||||||||||

| Weighted-average dividend yield | 1.89 | % | 1.68 | % | 1.79 | % | ||||||

| Weighted-average volatility | 27.14 | % | 26.04 | % | 26.79 | % | ||||||

| Range of volatilities | 27.13-28.99 | % | 26.03-26.62 | % | 26.56-26.79 | % | ||||||

| Range of risk-free interest rates | 1.60-3.64 | % | 4.40-5.16 | % | 4.34-4.64 | % | ||||||

| Weighted-average expected lives | 8 years | 8 years | 8 years | |||||||||

| The fair value of the RSU grant was determined by reducing the stock price on the day of grant by the present value of the estimated dividends to be paid during the vesting period. The estimated dividends are based on Caterpillar’s weighted-average dividend yield. |

The amount of stock-based compensation expense capitalized for the years ended December 31, 2008, 2007 and 2006 did not have a significant impact on our financial statements. At December 31, 2008, there was $136 million of total unrecognized compensation cost from stock-based compensation arrangements granted under the plans, which is related to non-vested stock-based awards. The compensation expense is expected to be recognized over a weighted-average period of approximately 1.8 years. Please refer to Tables I and II below for additional information on our stock-based awards. |

TABLE I—Financial Information Related to Stock-based Compensation | |||||||||||||||||||||||||

| 2008 | 2007 | 2006 | |||||||||||||||||||||||

| Shares | Weighted- Average Exercise Price | Shares | Weighted- Average Exercise Price | Shares | Weighted- Average Exercise Price | ||||||||||||||||||||

| Stock options/SARs activity: | |||||||||||||||||||||||||

| Outstanding at beginning of year | 60,855,854 | $ | 42.18 | 68,880,667 | $ | 38.60 | 74,860,582 | $ | 32.23 | ||||||||||||||||

Granted to officers and key employees1 | 4,886,601 | $ | 73.20 | 4,350,974 | $ | 63.04 | 9,720,340 | $ | 72.05 | ||||||||||||||||

Granted to outside directors1 | — | $ | — | 75,829 | $ | 63.04 | 91,000 | $ | 66.77 | ||||||||||||||||

| Exercised | (5,006,435 | ) | $ | 30.04 | (12,062,847 | ) | $ | 29.41 | (15,491,627 | ) | $ | 28.66 | |||||||||||||

| Forfeited / expired | (337,946 | ) | $ | 46.45 | (388,769 | ) | $ | 41.64 | (299,628 | ) | $ | 54.13 | |||||||||||||

| Outstanding at end of year | 60,398,074 | $ | 45.68 | 60,855,854 | $ | 42.18 | 68,880,667 | $ | 38.60 | ||||||||||||||||

| Exercisable at year-end | 43,083,319 | $ | 35.81 | 47,533,561 | $ | 34.65 | 59,374,295 | $ | 33.27 | ||||||||||||||||

| RSUs activity: | |||||||||||||||||||||||||

| Outstanding at beginning of year | 1,253,326 | N/A | 2 | N/A | |||||||||||||||||||||

| Granted to officers and key employees | 1,490,645 | 1,282,020 | N/A | ||||||||||||||||||||||

| Granted to outside directors | 20,878 | — | N/A | ||||||||||||||||||||||

| Vested | (61,158 | ) | (9,715 | ) | N/A | ||||||||||||||||||||

| Forfeited | (30,217 | ) | (18,979 | ) | N/A | ||||||||||||||||||||

| Outstanding at end of year | 2,673,474 | 1,253,326 | N/A | ||||||||||||||||||||||

| Stock options/SARs outstanding and exercisable: | |||||||||||||||||||||||||||||

| Outstanding | Exercisable | ||||||||||||||||||||||||||||

| Exercise | # Outstanding | Weighted- Average Remaining Contractual | Weighted- Average Exercise | Aggregate Intrinsic | # Outstanding | Weighted- Average Remaining Contractual | Weighted- Average Exercise | Aggregate Intrinsic | |||||||||||||||||||||

| Prices | at 12/31/08 | Life (Years) | Price | Value3 | at 12/31/08 | Life (Years) | Price | Value3 | |||||||||||||||||||||

| $ | 19.20 - 22.76 | 1,712,753 | 1.47 | $ | 19.36 | $ | 43 | 1,712,753 | 1.47 | $ | 19.36 | $ | 43 | ||||||||||||||||

| $ | 25.36 - 26.77 | 7,540,290 | 3.08 | $ | 25.90 | 139 | 7,540,290 | 3.08 | $ | 25.90 | 139 | ||||||||||||||||||

| $ | 27.14 - 29.43 | 8,561,614 | 4.42 | $ | 27.16 | 148 | 8,561,614 | 4.42 | $ | 27.16 | 148 | ||||||||||||||||||

| $ | 31.17 - 45.64 | 23,950,025 | 5.50 | $ | 41.31 | 74 | 23,950,025 | 5.50 | $ | 41.31 | 74 | ||||||||||||||||||

| $ | 63.04 - 73.20 | 18,633,392 | 7.91 | $ | 70.22 | — | 1,318,637 | 7.41 | $ | 70.19 | — | ||||||||||||||||||

| 60,398,074 | $ | 45.68 | $ | 404 | 43,083,319 | $ | 35.81 | $ | 404 | ||||||||||||||||||||

| 1 | Of the 4,886,601 awards granted during the year ended December 31, 2008, 4,476,095 were SARs. Of the 4,426,803 awards granted during the year ended December 31, 2007, 4,195,188 were SARs. Of the 9,811,340 awards granted during the year ended December 31, 2006, 9,479,534 were SARs. | ||||||||||||||||||||||||||||

| 2 | 2007 was the first year stock-based compensation awards included RSUs. | ||||||||||||||||||||||||||||

| 3 | The difference between a stock award's exercise price and the underlying stock's market price at December 31, 2008, for awards with market price greater than the exercise price. Amounts are in millions of dollars. | ||||||||||||||||||||||||||||

| The computations of weighted-average exercise prices and aggregate intrinsic values are not applicable to RSUs since an RSU represents an agreement to issue shares of stock at the time of vesting. At December 31, 2008, there were 2,673,474 outstanding RSUs with a weighted average remaining contractual life of 1.7 years. |

| TABLE II— Additional Stock-based Award Information | |||||||||||||

| (Dollars in millions except per share data) | 2008 | 2007 | 2006 | ||||||||||

| Stock Options/SARs activity: | |||||||||||||

| Weighted-average fair value per share of stock awards granted | $ | 22.32 | $ | 20.73 | $ | 23.44 | |||||||

| Intrinsic value of stock awards exercised | $ | 232 | $ | 547 | $ | 637 | |||||||

| Fair value of stock awards vested | $ | 30 | $ | 14 | $ | 40 | |||||||

| Cash received from stock awards exercised | $ | 130 | $ | 322 | $ | 411 | |||||||

| RSUs activity: | |||||||||||||

| Weighted-average fair value per share of stock awards granted | $ | 69.17 | $ | 59.94 | N/A | ||||||||

| Fair value of stock awards vested | $ | 4 | $ | 1 | N/A | ||||||||

| The following table summarizes the effect of the adoption of SFAS 123R: |

| (Dollars in millions except per share data) | 2006 | |||

| Stock-based compensation expense, before tax | $ | 137 | ||

| Stock-based compensation expense, after tax | $ | 92 | ||

| Income tax benefit recognized in net income | $ | 45 | ||

| Decrease in profit per share of common stock, basic | $ | .14 | ||

| Decrease in profit per share of common stock, diluted | $ | .09 | ||

Before tax stock-based compensation expense for 2008 and 2007 was $194 million and $146 million, with a corresponding income tax benefit of $62 million and $48 million, respectively. In accordance with Staff Accounting Bulletin No. 107 “Share-based payment,” we classify stock-based compensation within cost of goods sold, selling, general and administrative expenses and research and development expenses corresponding to the same line item as the cash compensation paid to respective employees, officers and non-employee directors. We currently use shares that have been repurchased through our stock repurchase program to satisfy share award exercises. In November 2005, the FASB issued FASB Staff Position No. FAS 123R-3 “Transition Election Related to Accounting for Tax Effects of Share-Based Payment Awards.” In the third quarter of 2006, we elected to adopt the alternative transition method provided in the FASB Staff Position for calculating the tax effects of stock-based compensation. The alternative transition method includes simplified methods to determine the beginning balance of the additional paid-in capital (APIC) pool related to the tax effects of stock-based compensation, and to determine the subsequent impact on the APIC pool and the Statement of Cash Flow of the tax effects of stock-based awards that were fully vested and outstanding upon the adoption of SFAS 123R. The tax benefits realized from stock awards exercised for December 31, 2008, 2007 and 2006 were $60 million, $167 million and $170 million, respectively. We use the direct only method and tax law ordering approach to calculate the tax effects of stock-based compensation. In certain jurisdictions, tax deductions for exercises of stock-based awards did not generate a cash benefit. A tax benefit of approximately $24 million will be recorded in APIC when these deductions reduce our future income taxes payable. |

| 3. | Derivative financial instruments and risk management |

A. | Foreign currency exchange rate risk |

| Foreign currency exchange rate movements create a degree of risk by affecting the U.S. dollar value of sales made and costs incurred in foreign currencies. Movements in foreign currency rates also affect our competitive position as these changes may affect business practices and/or pricing strategies of non-U.S.-based competitors. Additionally, we have balance sheet positions denominated in foreign currency, thereby creating exposure to movements in exchange rates. |

Our Machinery and Engines operations purchase, manufacture and sell products in many locations around the world. As we have a diversified revenue and cost base, we manage our future foreign currency cash flow exposure on a net basis. We use foreign currency forward and option contracts to manage unmatched foreign currency cash inflow and outflow. Our objective is to minimize the risk of exchange rate movements that would reduce the U.S. dollar value of our foreign currency cash flow. Our policy allows for managing anticipated foreign currency cash flow for up to five years. We generally designate as cash flow hedges at inception of the contract any Australian dollar, Brazilian real, British pound, Canadian dollar, Chinese yuan, euro, Japanese yen, Mexican peso, Singapore dollar, New Zealand dollar or Swiss franc forward or option contracts that meet the requirements for hedge accounting. Designation is performed on a specific exposure basis to support hedge accounting. The remainder of Machinery and Engines foreign currency contracts are undesignated. We designate as fair value hedges specific euro forward contracts used to hedge firm commitments. As of December 31, 2008, $43 million (net of tax) of deferred net gains included in equity (“Accumulated other comprehensive income (loss)” in Statement 2), are expected to be reclassified to current earnings (“Other income (expense)” in Statement 1) over the next twelve months. The actual amount recorded in “Other income (expense)” will vary based on exchange rates at the time the hedged transactions impact earnings. In managing foreign currency risk for our Financial Products operations, our objective is to minimize earnings volatility resulting from conversion and the remeasurement of net foreign currency balance sheet positions. Our policy allows the use of foreign currency forward and option contracts to offset the risk of currency mismatch between our receivables and debt. All such foreign currency forward and option contracts are undesignated. |

| Gains (losses) included in current earnings [Other income (expense)] on undesignated contracts: | ||||||||||||

(Millions of dollars) | 2008 | 2007 | 2006 | |||||||||

| Machinery and Engines | $ | 26 | $ | 24 | $ | 23 | ||||||

| Financial Products | 33 | (89 | ) | (19 | ) | |||||||

| $ | 59 | $ | (65 | ) | $ | 4 | ||||||

| Gains and losses on the Financial Products contracts above are designed to offset balance sheet translation gains and losses. |

| B. | Interest rate risk |

Interest rate movements create a degree of risk by affecting the amount of our interest payments and the value of our fixed-rate debt. Our practice is to use interest rate swap agreements to manage our exposure to interest rate changes and, in some cases, lower the cost of borrowed funds. Machinery and Engines operations generally use fixed rate debt as a source of funding. Our objective is to minimize the cost of borrowed funds. Our policy allows us to enter into fixed-to-floating interest rate swaps and forward rate agreements to meet that objective with the intent to designate as fair value hedges at inception of the contract all fixed-to-floating interest rate swaps. Designation as a hedge of the fair value of our fixed rate debt is performed to support hedge accounting. During 2001, our Machinery and Engines operations liquidated all existing fixed-to-floating interest rate swaps. The gain ($2 million at December 31, 2008) is being amortized to earnings ratably over the remaining life of the hedged debt. During 2006 and 2007, we entered into $400 million (notional amount) of interest rate swaps designated as fair value hedges of our fixed rate long-term debt. During the first quarter 2008, our Machinery and Engines operations liquidated all of these fixed-to-floating interest rate swaps. The gain ($18 million remaining at December 31, 2008) is being amortized to earnings ratably over the remaining life of the hedged debt. During the fourth quarter 2008, we entered into $750 million (notional amount) of forward starting swaps designated as cash flow hedges of our anticipated long-term debt offering which occurred in December 2008. At the issuance of the debt, Caterpillar settled the forward starting swaps. The loss ($29 million at December 31, 2008) is being amortized to earnings ratably over the remaining term of the debt (10 years). Financial Products operations have a match-funding policy that addresses interest rate risk by aligning the interest rate profile (fixed or floating rate) of Cat Financial’s debt portfolio with the interest rate profile of their receivables portfolio within predetermined ranges on an ongoing basis. In connection with that policy, we use interest rate derivative instruments to modify the debt structure to match assets within the receivables portfolio. This match funding reduces the volatility of margins between interest-bearing assets and interest-bearing liabilities, regardless of which direction interest rates move. |

Our policy allows us to use fixed-to-floating, floating-to-fixed and floating-to-floating interest rate swaps to meet the match-funding objective. To support hedge accounting, we designate fixed-to-floating interest rate swaps as fair value hedges of the fair value of our fixed-rate debt at the inception of the swap contract. Financial Products' practice is to designate most floating-to-fixed interest rate swaps as cash flow hedges of the variability of future cash flows at the inception of the swap contract. Financial Products liquidated fixed-to-floating interest rate swaps during 2006, 2005 and 2004, which resulted in deferred net gains. These gains ($4 million remaining at December 31, 2008) are being amortized to earnings ratably over the remaining term of the hedged debt. |

Gains (losses) included in current earnings [Other income (expense)]: | ||||||||||||||

| (Millions of dollars) | 2008 | 2007 | 2006 | |||||||||||

| Fixed-to-floating interest rate swaps | ||||||||||||||

| Machinery and Engines: | ||||||||||||||

| Gain (loss) on designated interest rate derivatives | $ | 18 | $ | 26 | $ | 2 | ||||||||

| Gain (loss) on hedged debt | (9 | ) | (10 | ) | (1 | ) | ||||||||

| Gain (loss) amortization on liquidated swaps | 5 | 3 | 3 | |||||||||||

| Financial Products: | ||||||||||||||

| Gain (loss) on designated interest rate derivatives | 471 | 103 | (44 | ) | ||||||||||

| Gain (loss) on hedged debt | (474 | ) | (103 | ) | 44 | |||||||||

| Gain (loss) amortization on liquidated swaps—included in interest expense | 1 | 2 | 6 | |||||||||||

| $ | 12 | $ | 21 | $ | 10 | |||||||||

| As of December 31, 2008, $51 million (net of tax) of deferred net losses included in equity ("Accumulated other comprehensive income (loss)" in Statement 2), related to Financial Products floating-to-fixed interest rate swaps, are expected to be reclassified to current earnings ("Interest expense of Financial Products" in Statement 1) over the next 12 months. |

C. | Commodity price risk |