- CAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Caterpillar (CAT) 8-KCaterpillar Reports First-Quarter 2018 Results

Filed: 24 Apr 18, 12:00am

| First Quarter | |||||||

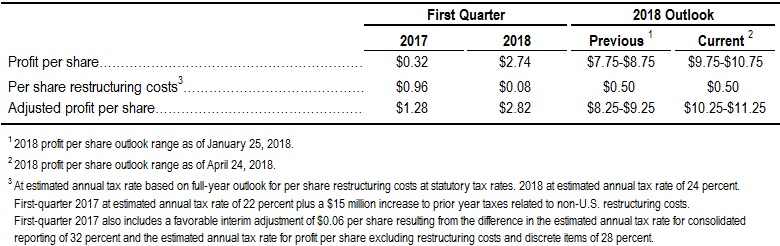

| ($ in billions except profit per share) | 2018 | 2017 | ● | First-quarter sales and revenues up 31 percent | |||

| Sales and Revenues | $12.9 | $9.8 | ● | Significant increase in profit per share; adjusted profit per share more than doubled | |||

| Profit Per Share | $2.74 | $0.32 | ● | Raised full-year profit per share outlook | |||

| Adjusted Profit Per Share | $2.82 | $1.28 | ● | Repurchased $500 million of common stock | |||

| • | Better than expected sales volume is the primary driver of the raised profit outlook, with higher volume expected across the three primary segments when compared with the prior outlook. |

| • | Improved price realization is expected to be partially offset by material cost increases primarily driven by higher commodity prices. |

| • | Despite the anticipated increase in volume, the company expects period costs, excluding short-term incentive compensation expense, to be in line with the prior outlook. |

| • | Short-term incentive compensation expense is now expected to be about $1.4 billion, nearly the same as 2017. |

| • | The outlook assumes continued global economic growth. Any potential impacts from future geopolitical risks and increased trade restrictions have not been included in the outlook. |

| • | The outlook does not include a mark-to-market gain or loss for remeasurement of pension and other postemployment benefit (OPEB) plans or changes to provisional estimates recorded in 2017 for U.S. tax reform. |

| • | Glossary of terms is included on pages 15-16; first occurrence of terms shown in bold italics. |

| • | Information on non-GAAP financial measures is included on page 17. |

| • | Caterpillar will conduct a teleconference and live webcast, with a slide presentation, beginning at 10 a.m. Central Time on Tuesday, April 24, 2018, to discuss its 2018 first-quarter financial results. The accompanying slides will be available before the webcast on the Caterpillar website at http://www.caterpillar.com/investors/events-and-presentations. |

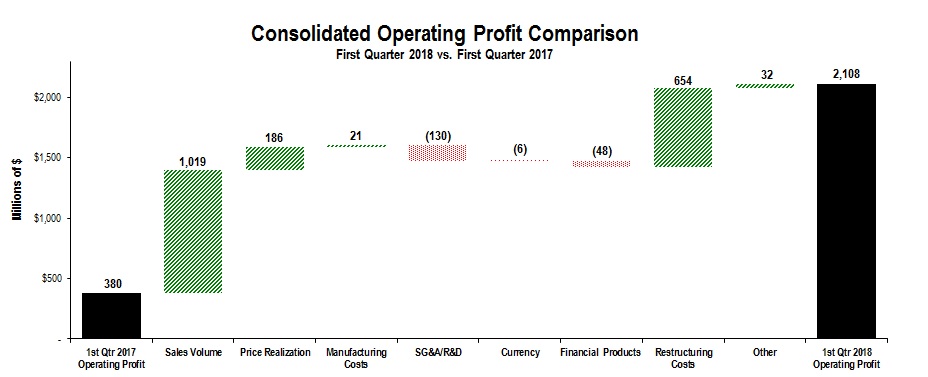

The chart above graphically illustrates reasons for the change in Consolidated Operating Profit between the first quarter of 2017 (at left) and the first quarter of 2018 (at right). Items favorably impacting operating profit appear as upward stair steps with the corresponding dollar amounts above each bar, while items negatively impacting operating profit appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Caterpillar management utilizes these charts internally to visually communicate with the company’s board of directors and employees. The bar entitled Other includes consolidating adjustments and Machinery, Energy & Transportation other operating (income) expenses.

The chart above graphically illustrates reasons for the change in Consolidated Operating Profit between the first quarter of 2017 (at left) and the first quarter of 2018 (at right). Items favorably impacting operating profit appear as upward stair steps with the corresponding dollar amounts above each bar, while items negatively impacting operating profit appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Caterpillar management utilizes these charts internally to visually communicate with the company’s board of directors and employees. The bar entitled Other includes consolidating adjustments and Machinery, Energy & Transportation other operating (income) expenses.| ▪ | Interest expense excluding Financial Products in the first quarter of 2018 was $101 million, a decrease of $22 million from the first quarter of 2017, primarily due to an early debt retirement in the fourth quarter of 2017. |

| ▪ | Other income/expense in the first quarter of 2018 was income of $127 million, compared with income of $32 million in the first quarter of 2017. The favorable change was primarily due to pension and OPEB plans, including the absence of restructuring costs and higher expected return on plan assets (see Q&A #7 for additional information). Also contributing to the favorable change were lower net losses from currency translation and hedging in the first quarter of 2018 than in the first quarter of 2017. |

| ▪ | The provision for income taxes in the first quarter of 2018 reflects an estimated annual tax rate of 24 percent, compared to 32 percent for the first quarter of 2017, excluding the discrete items discussed in the following paragraph. The decrease is primarily due to the reduction in the U.S. corporate tax rate beginning January 1, 2018, along with other changes in the geographic mix of profits from a tax perspective. |

| March 31 | ||||||||

| 2018 | 2017 | Increase | ||||||

| Full-time employment | 99,700 | 95,300 | 4,400 | |||||

| Flexible workforce | 19,100 | 12,600 | 6,500 | |||||

| Total | 118,800 | 107,900 | 10,900 | |||||

| Geographic Summary | ||||||||

| U.S. workforce | 51,500 | 46,500 | 5,000 | |||||

| Non-U.S. workforce | 67,300 | 61,400 | 5,900 | |||||

| Total | 118,800 | 107,900 | 10,900 | |||||

| North America | Latin America | EAME | Asia/Pacific | External Sales and Revenues | Inter-Segment | Total Sales and Revenues | |||||||||||||||||||||||||||||||||||

| (Millions of dollars) | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | |||||||||||||||||||||||||||

| First Quarter 2018 | |||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 2,620 | 37% | $ | 344 | 38% | $ | 1,067 | 31% | $ | 1,628 | 46% | $ | 5,659 | 38% | 18 | 100% | $ | 5,677 | 38% | |||||||||||||||||||||

| Resource Industries | 798 | 33% | 360 | 34% | 520 | 25% | 530 | 37% | 2,208 | 32% | 101 | 11% | 2,309 | 31% | |||||||||||||||||||||||||||

| Energy & Transportation | 2,225 | 29% | 280 | 2% | 1,092 | 21% | 679 | 48% | 4,276 | 27% | 943 | 21% | 5,219 | 26% | |||||||||||||||||||||||||||

| All Other Segments | 15 | 88% | — | —% | 4 | (75%) | 18 | 38% | 37 | —% | 79 | (17%) | 116 | (12%) | |||||||||||||||||||||||||||

| Corporate Items and Eliminations | (28 | ) | 1 | (3 | ) | — | (30 | ) | (1,141 | ) | (1,171 | ) | |||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | $ | 5,630 | 33% | $ | 985 | 24% | $ | 2,680 | 25% | $ | 2,855 | 44% | $ | 12,150 | 33% | $ | — | —% | $ | 12,150 | 33% | ||||||||||||||||||||

| Financial Products Segment | $ | 512 | 5% | $ | 74 | (11%) | $ | 101 | 1% | $ | 106 | 16% | $ | 793 | 4% | $ | — | —% | $ | 793 | 4% | ||||||||||||||||||||

| Corporate Items and Eliminations | (49 | ) | (13 | ) | (5 | ) | (17 | ) | (84 | ) | — | (84 | ) | ||||||||||||||||||||||||||||

| Financial Products Revenues | $ | 463 | 3% | $ | 61 | (12%) | $ | 96 | —% | $ | 89 | 13% | $ | 709 | 2% | $ | — | —% | $ | 709 | 2% | ||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 6,093 | 31% | $ | 1,046 | 21% | $ | 2,776 | 24% | $ | 2,944 | 43% | $ | 12,859 | 31% | $ | — | —% | $ | 12,859 | 31% | ||||||||||||||||||||

| First Quarter 2017 | |||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 1,913 | $ | 250 | $ | 812 | $ | 1,116 | $ | 4,091 | $ | 9 | $ | 4,100 | |||||||||||||||||||||||||||

| Resource Industries | 598 | 269 | 416 | 387 | 1,670 | 91 | 1,761 | ||||||||||||||||||||||||||||||||||

| Energy & Transportation | 1,722 | 275 | 900 | 459 | 3,356 | 780 | 4,136 | ||||||||||||||||||||||||||||||||||

| All Other Segments | 8 | — | 16 | 13 | 37 | 95 | 132 | ||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (23 | ) | — | (2 | ) | 1 | (24 | ) | (975 | ) | (999 | ) | |||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | $ | 4,218 | $ | 794 | $ | 2,142 | $ | 1,976 | $ | 9,130 | $ | — | $ | 9,130 | |||||||||||||||||||||||||||

| Financial Products Segment | $ | 486 | $ | 83 | $ | 100 | $ | 91 | $ | 760 | $ | — | $ | 760 | |||||||||||||||||||||||||||

| Corporate Items and Eliminations | (38 | ) | (14 | ) | (4 | ) | (12 | ) | (68 | ) | — | (68 | ) | ||||||||||||||||||||||||||||

| Financial Products Revenues | $ | 448 | $ | 69 | $ | 96 | $ | 79 | $ | 692 | $ | — | $ | 692 | |||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 4,666 | $ | 863 | $ | 2,238 | $ | 2,055 | $ | 9,822 | $ | — | $ | 9,822 | |||||||||||||||||||||||||||

| (Millions of dollars) | First Quarter 2017 | Sales Volume | Price Realization | Currency | Inter-Segment / Other | First Quarter 2018 | $ Change | % Change | |||||||||||||||||||||

| Construction Industries | $ | 4,100 | $ | 1,340 | $ | 59 | $ | 169 | $ | 9 | $ | 5,677 | $ | 1,577 | 38% | ||||||||||||||

| Resource Industries | 1,761 | 424 | 86 | 28 | 10 | 2,309 | 548 | 31% | |||||||||||||||||||||

| Energy & Transportation | 4,136 | 769 | 41 | 110 | 163 | 5,219 | 1,083 | 26% | |||||||||||||||||||||

| All Other Segments | 132 | (1 | ) | — | 1 | (16 | ) | 116 | (16 | ) | (12%) | ||||||||||||||||||

| Corporate Items and Eliminations | (999 | ) | (6 | ) | — | — | (166 | ) | (1,171 | ) | (172 | ) | |||||||||||||||||

| Machinery, Energy & Transportation | $ | 9,130 | $ | 2,526 | $ | 186 | $ | 308 | $ | — | $ | 12,150 | $ | 3,020 | 33% | ||||||||||||||

| Financial Products Segment | $ | 760 | $ | — | $ | — | $ | — | $ | 33 | $ | 793 | $ | 33 | 4% | ||||||||||||||

| Corporate Items and Eliminations | (68 | ) | — | — | — | (16 | ) | (84 | ) | (16 | ) | ||||||||||||||||||

| Financial Products Revenues | $ | 692 | $ | — | $ | — | $ | — | $ | 17 | $ | 709 | $ | 17 | 2% | ||||||||||||||

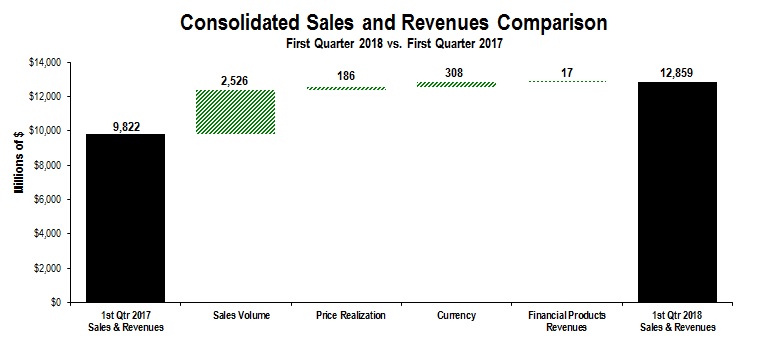

| Consolidated Sales and Revenues | $ | 9,822 | $ | 2,526 | $ | 186 | $ | 308 | $ | 17 | $ | 12,859 | $ | 3,037 | 31% | ||||||||||||||

| (Millions of dollars) | First Quarter 2018 | First Quarter 2017 | $ Change | % Change | ||||||||||

| Construction Industries | $ | 1,117 | $ | 634 | $ | 483 | 76 | % | ||||||

| Resource Industries | 378 | 160 | 218 | 136 | % | |||||||||

| Energy & Transportation | 874 | 545 | 329 | 60 | % | |||||||||

| All Other Segments | 57 | (14 | ) | 71 | n/a | |||||||||

| Corporate Items and Eliminations | (371 | ) | (1,060 | ) | 689 | |||||||||

| Machinery, Energy & Transportation | $ | 2,055 | $ | 265 | $ | 1,790 | 675 | % | ||||||

| Financial Products Segment | $ | 141 | $ | 183 | $ | (42 | ) | (23 | %) | |||||

| Corporate Items and Eliminations | (2 | ) | 3 | (5 | ) | |||||||||

| Financial Products | $ | 139 | $ | 186 | $ | (47 | ) | (25 | %) | |||||

| Consolidating Adjustments | (86 | ) | (71 | ) | (15 | ) | ||||||||

| Consolidated Operating Profit | $ | 2,108 | $ | 380 | $ | 1,728 | 455 | % | ||||||

| (Millions of dollars) | ||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||

| First Quarter 2017 | Sales Volume | Price Realization | Currency | Inter-Segment | First Quarter 2018 | $ Change | % Change | |||||||||||||

| Total Sales | $4,100 | $1,340 | $59 | $169 | $9 | $5,677 | $1,577 | 38 | % | |||||||||||

| Sales by Geographic Region | ||||||||||||||||||||

| First Quarter 2018 | First Quarter 2017 | $ Change | % Change | |||||||||||||||||

| North America | $2,620 | $1,913 | $707 | 37 | % | |||||||||||||||

| Latin America | 344 | 250 | 94 | 38 | % | |||||||||||||||

| EAME | 1,067 | 812 | 255 | 31 | % | |||||||||||||||

| Asia/Pacific | 1,628 | 1,116 | 512 | 46 | % | |||||||||||||||

| External Sales | $5,659 | $4,091 | $1,568 | 38 | % | |||||||||||||||

| Inter-Segment | 18 | 9 | 9 | 100 | % | |||||||||||||||

| Total Sales | $5,677 | $4,100 | $1,577 | 38 | % | |||||||||||||||

| Segment Profit | ||||||||||||||||||||

| First Quarter 2018 | First Quarter 2017 | Change | % Change | |||||||||||||||||

| Segment Profit | $1,117 | $634 | $483 | 76 | % | |||||||||||||||

| Segment Profit Margin | 19.7 | % | 15.5 | % | 4.2 | pts | 27 | % | ||||||||||||

| ▪ | Sales volume increased primarily due to the impact of favorable changes in dealer inventories and higher end-user demand for construction equipment. Dealer inventories increased significantly more in the first quarter of 2018 than in the first quarter of 2017. The company believes the increase in dealer inventories is reflective of current end-user demand. |

| ▪ | In North America, the sales increase was mostly due to the impact of favorable changes in dealer inventories, which increased significantly more in the first quarter of 2018 than in the first quarter of 2017. In addition, sales increased due to higher end-user demand for construction equipment, primarily due to non-residential, infrastructure and oil and gas construction activities, including pipelines. |

| ▪ | Sales in Asia/Pacific were higher across the region, with about half due to improved end-user demand in China stemming from increased building construction and infrastructure investment. In addition, the impact of changes in dealer inventories was favorable as dealer inventories decreased more in the first quarter of 2017 than in the first quarter of 2018. The favorable impact of a stronger Chinese yuan also contributed to the increase. |

| ▪ | Sales increased in EAME primarily due to the impact of favorable changes in dealer inventories, the impact from a stronger euro and higher end-user demand for construction equipment. Dealer inventories increased more in the first quarter of 2018 than in the first quarter of 2017. |

| ▪ | Although construction activity remained weak in Latin America, sales were higher as end-user demand increased from low levels due to stabilizing economic conditions in several countries in the region. |

| (Millions of dollars) | ||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||

| First Quarter 2017 | Sales Volume | Price Realization | Currency | Inter-Segment | First Quarter 2018 | $ Change | % Change | |||||||||||||

| Total Sales | $1,761 | $424 | $86 | $28 | $10 | $2,309 | $548 | 31 | % | |||||||||||

| Sales by Geographic Region | ||||||||||||||||||||

| First Quarter 2018 | First Quarter 2017 | $ Change | % Change | |||||||||||||||||

| North America | $798 | $598 | $200 | 33 | % | |||||||||||||||

| Latin America | 360 | 269 | 91 | 34 | % | |||||||||||||||

| EAME | 520 | 416 | 104 | 25 | % | |||||||||||||||

| Asia/Pacific | 530 | 387 | 143 | 37 | % | |||||||||||||||

| External Sales | $2,208 | $1,670 | $538 | 32 | % | |||||||||||||||

| Inter-Segment | 101 | 91 | 10 | 11 | % | |||||||||||||||

| Total Sales | $2,309 | $1,761 | $548 | 31 | % | |||||||||||||||

| Segment Profit | ||||||||||||||||||||

| First Quarter 2018 | First Quarter 2017 | Change | % Change | |||||||||||||||||

| Segment Profit | $378 | $160 | $218 | 136 | % | |||||||||||||||

| Segment Profit Margin | 16.4 | % | 9.1 | % | 7.3 | pts | 80 | % | ||||||||||||

| (Millions of dollars) | ||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||

| First Quarter 2017 | Sales Volume | Price Realization | Currency | Inter-Segment | First Quarter 2018 | $ Change | % Change | |||||||||||||

| Total Sales | $4,136 | $769 | $41 | $110 | $163 | $5,219 | $1,083 | 26 | % | |||||||||||

| Sales by Application | ||||||||||||||||||||

| First Quarter 2018 | First Quarter 2017 | $ Change | % Change | |||||||||||||||||

| Oil and Gas | $1,215 | $809 | $406 | 50 | % | |||||||||||||||

| Power Generation | 969 | 716 | 253 | 35 | % | |||||||||||||||

| Industrial | 906 | 777 | 129 | 17 | % | |||||||||||||||

| Transportation | 1,186 | 1,054 | 132 | 13 | % | |||||||||||||||

| External Sales | $4,276 | $3,356 | $920 | 27 | % | |||||||||||||||

| Inter-Segment | 943 | 780 | 163 | 21 | % | |||||||||||||||

| Total Sales | $5,219 | $4,136 | $1,083 | 26 | % | |||||||||||||||

| Segment Profit | ||||||||||||||||||||

| First Quarter 2018 | First Quarter 2017 | Change | % Change | |||||||||||||||||

| Segment Profit | $874 | $545 | $329 | 60 | % | |||||||||||||||

| Segment Profit Margin | 16.7 | % | 13.2 | % | 3.5 | pts | 27 | % | ||||||||||||

| ▪ | Oil and Gas - Sales increased primarily due to higher demand in North America for gas compression, production and well servicing applications. Higher energy prices and growth in U.S. onshore oil and gas drove increased sales for reciprocating engines and related aftermarket parts. Sales in North America were also positively impacted by the timing of turbine project deliveries. |

| ▪ | Power Generation - Sales improved across all regions, with the largest increase in EAME primarily due to the timing of several large projects and favorable impacts from currency. In addition, sales in North America increased due to higher sales for turbines and aftermarket parts for reciprocating engines. |

| ▪ | Industrial - Sales were higher across all regions except Latin America, primarily due to improving global economic conditions supporting higher engine sales into industrial end-user applications. Sales in EAME were also positively impacted by favorable currency. |

| ▪ | Transportation - Sales were higher in Asia/Pacific and North America for rail services, driven primarily by growth in Australia and increased rail traffic in North America. Marine sales were higher primarily in Asia/Pacific due to timing of deliveries. |

| (Millions of dollars) | ||||||||||||||||

| Revenues by Geographic Region | ||||||||||||||||

| First Quarter 2018 | First Quarter 2017 | $ Change | % Change | |||||||||||||

| North America | $512 | $486 | $26 | 5 | % | |||||||||||

| Latin America | 74 | 83 | (9) | (11 | %) | |||||||||||

| EAME | 101 | 100 | 1 | 1 | % | |||||||||||

| Asia/Pacific | 106 | 91 | 15 | 16 | % | |||||||||||

| Total | $793 | $760 | $33 | 4 | % | |||||||||||

| Segment Profit | ||||||||||||||||

| First Quarter 2018 | First Quarter 2017 | $ Change | % Change | |||||||||||||

| Segment Profit | $141 | $183 | ($42) | (23 | %) | |||||||||||

| Q1: | Can you discuss changes in dealer inventories during the first quarter of 2018? |

| A: | Dealers generally increase inventories during the first quarter in preparation for the spring selling season. Dealer machine and engine inventories increased about $1.2 billion in the first quarter of 2018, compared to an increase of about $200 million in the first quarter of 2017. The increase in the first quarter of 2018 was primarily in Construction Industries. We believe the increase in dealer inventories is reflective of current end-user demand. |

| Q2: | Can you discuss changes to your order backlog by segment? |

| A: | At the end of the first quarter of 2018, the order backlog was about $17.5 billion, an increase of about $1.7 billion from the end of 2017. The increase was in Energy & Transportation and Construction Industries, while Resource Industries was about flat. |

| Q3: | Can you comment on expense related to your 2018 short-term incentive compensation plans and the impact on the 2018 outlook? |

| A: | Short-term incentive compensation expense is directly related to financial and operational performance, measured against targets set annually. First-quarter 2018 expense was about $360 million, compared to first-quarter 2017 expense of about $235 million. |

| Q4: | In January, you commented that significant increases in demand could impact your growth potential in 2018 due to supplier constraints. Can you provide an update? |

| A: | We continue to work with our global suppliers to respond to significant increases in demand. Although constraints remain for some parts and components, we are seeing improvements in material flows. |

| Q5: | Can you give us an update on the quality of Cat Financial’s asset portfolio? How are write-offs, past dues and allowance for credit losses performing? |

| A: | Cat Financial’s core asset portfolio continues to perform well overall. Write-offs during the first quarter of 2018 were $30 million, or 0.45 percent of average retail portfolio, which is about the same level as our 10-year average of 0.44 percent for the first quarter. This total compares with write-offs of $15 million during the first quarter of 2017, which was an unusually low quarterly write-off period based on Cat Financial’s historical performance. The increase from a year ago was driven by higher write-offs in the Latin America and Cat Power Finance portfolios. Past dues increased during the first quarter to 3.17 percent, which is slightly above the first-quarter historical average of 3.09 percent, and was impacted by higher delinquencies in Cat Power Finance and Latin America. The provision for credit losses was higher in the first quarter of 2018 by $51 million, primarily due to higher provision expense in Cat Power Finance and on a small number of transactions in our mining portfolio. In addition, higher write-offs compared with a low quarter for write-offs in the first quarter of 2017 were also a contributor. |

| Q6: | Can you comment on your balance sheet and cash priorities? |

| A: | Our cash and liquidity positions remain strong with an enterprise cash balance of $7.9 billion as of March 31, 2018. ME&T operating cash flow for the first quarter of 2018 was $948 million, compared with $1.5 billion in 2017. The decrease was primarily due to higher short-term incentive compensation payments in the first quarter of 2018, compared with the first quarter of 2017. We repurchased $500 million of common stock in the first quarter of 2018. |

| Q7: | Your 2017 operating costs and other income/expense changed from what you reported last year. Can you explain the change? |

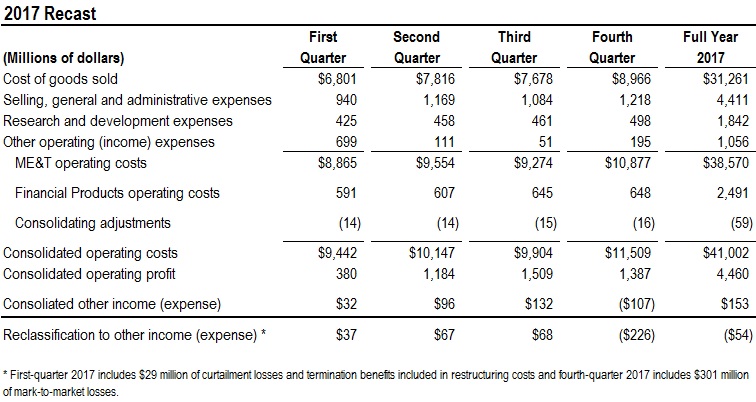

| A: | Effective January 1, 2018, we adopted a new U.S. GAAP accounting standard related to pension and OPEB costs. Components of pension and OPEB costs, other than service costs, have been reclassified from operating costs to other income/expense. The change was made to prior periods and the table below provides the recast 2017 amounts by quarter. This change had a small impact on 2017 profit for the segments within ME&T, which has also been recast to be consistent with the revised classification. There was no impact on Financial Products. |

| 1. | Adjusted Profit Per Share - Profit per share excluding restructuring costs for 2018 and 2017. |

| 2. | All Other Segments - Primarily includes activities such as: business strategy, product management and development, manufacturing of filters and fluids, undercarriage, ground engaging tools, fluid transfer products, precision seals, rubber sealing and connecting components primarily for Cat® products; parts distribution; integrated logistics solutions, distribution services responsible for dealer development and administration including a wholly owned dealer in Japan, dealer portfolio management and ensuring the most efficient and effective distribution of machines, engines and parts; digital investments for new customer and dealer solutions that integrate data analytics with state-of-the-art digital technologies while transforming the buying experience. |

| 3. | Consolidating Adjustments - Elimination of transactions between Machinery, Energy & Transportation and Financial Products. |

| 4. | Construction Industries - A segment primarily responsible for supporting customers using machinery in infrastructure, forestry and building construction applications. Responsibilities include business strategy, product design, product management and development, manufacturing, marketing and sales and product support. The product portfolio includes asphalt pavers, backhoe loaders, compactors, cold planers, compact track and multi-terrain loaders, mini, small, medium and large track excavators, forestry excavators, feller bunchers, harvesters, knuckleboom loaders, motor graders, pipelayers, road reclaimers, site prep tractors, skidders, skid steer loaders, telehandlers, small and medium track-type tractors, track-type loaders, wheel excavators, compact, small and medium wheel loaders and related parts and work tools. |

| 5. | Currency - With respect to sales and revenues, currency represents the translation impact on sales resulting from changes in foreign currency exchange rates versus the U.S. dollar. With respect to operating profit, currency represents the net translation impact on sales and operating costs resulting from changes in foreign currency exchange rates versus the U.S. dollar. Currency only includes the impact on sales and operating profit for the Machinery, Energy & Transportation lines of business excluding restructuring costs; currency impacts on Financial Products’ revenues and operating profit are included in the Financial Products’ portions of the respective analyses. With respect to other income/expense, currency represents the effects of forward and option contracts entered into by the company to reduce the risk of fluctuations in exchange rates (hedging) and the net effect of changes in foreign currency exchange rates on our foreign currency assets and liabilities for consolidated results (translation). |

| 6. | EAME - A geographic region including Europe, Africa, the Middle East and the Commonwealth of Independent States (CIS). |

| 7. | Earning Assets - Assets consisting primarily of total finance receivables net of unearned income, plus equipment on operating leases, less accumulated depreciation at Cat Financial. |

| 8. | Energy & Transportation - A segment primarily responsible for supporting customers using reciprocating engines, turbines, diesel-electric locomotives and related parts across industries serving Oil and Gas, Power Generation, Industrial and Transportation applications, including marine and rail-related businesses. Responsibilities include business strategy, product design, product management and development, manufacturing, marketing and sales and product support of turbine machinery and integrated systems and solutions and turbine-related services, reciprocating engine-powered generator sets, integrated systems used in the electric power generation industry, reciprocating engines and integrated systems and solutions for the marine and oil and gas industries; reciprocating engines supplied to the industrial industry as well as Cat machinery; the remanufacturing of Cat engines and components and remanufacturing services for other companies; the business strategy, product design, product management and development, manufacturing, remanufacturing, leasing and service of diesel-electric locomotives and components and other rail-related products and services and product support of on-highway vocational trucks for North America. |

| 9. | Financial Products Segment - Provides financing alternatives to customers and dealers around the world for Caterpillar products, as well as financing for vehicles, power generation facilities and marine vessels that, in most cases, incorporate Caterpillar products. Financing plans include operating and finance leases, installment sale contracts, working capital loans and wholesale financing plans. The segment also provides insurance and risk management products and services that help customers and dealers manage their business risk. Insurance and risk management products offered include physical damage insurance, inventory protection plans, extended service coverage for machines and engines, and dealer property and casualty insurance. The various forms of financing, insurance and risk management products offered to customers and dealers help support the purchase and lease of our equipment. Financial Products segment profit is determined on a pretax basis and includes other income/expense items. |

| 10. | Latin America - A geographic region including Central and South American countries and Mexico. |

| 11. | Machinery, Energy & Transportation (ME&T) - Represents the aggregate total of Construction Industries, Resource Industries, Energy & Transportation, All Other Segments and related corporate items and eliminations. |

| 12. | Machinery, Energy & Transportation Other Operating (Income) Expenses - Comprised primarily of gains/losses on disposal of long-lived assets, gains/losses on divestitures and legal settlements and accruals. Restructuring costs classified as other operating expenses on the Results of Operations are presented separately on the Operating Profit Comparison. |

| 13. | Manufacturing Costs - Manufacturing costs exclude the impacts of currency and restructuring costs (see definition below) and represent the volume-adjusted change for variable costs and the absolute dollar change for period manufacturing costs. Variable manufacturing costs are defined as having a direct relationship with the volume of production. This includes material costs, direct labor and other costs that vary directly with production volume such as freight, power to operate machines and supplies that are consumed in the manufacturing process. Period manufacturing costs support production but are defined as generally not having a direct relationship to short-term changes in volume. Examples include machinery and equipment repair, depreciation on manufacturing assets, facility support, procurement, factory scheduling, manufacturing planning and operations management. |

| 14. | Pension and Other Postemployment Benefit (OPEB) - The company’s defined-benefit pension and postretirement benefit plans. |

| 15. | Price Realization - The impact of net price changes excluding currency and new product introductions. Price realization includes geographic mix of sales, which is the impact of changes in the relative weighting of sales prices between geographic regions. |

| 16. | Resource Industries - A segment primarily responsible for supporting customers using machinery in mining, quarry and aggregates, waste and material handling applications. Responsibilities include business strategy, product design, product management and development, manufacturing, marketing and sales and product support. The product portfolio includes large track-type tractors, large mining trucks, hard rock vehicles, longwall miners, electric rope shovels, draglines, hydraulic shovels, rotary drills, large wheel loaders, off-highway trucks, articulated trucks, wheel tractor scrapers, wheel dozers, landfill compactors, soil compactors, hard rock continuous mining systems, select work tools, machinery components, electronics and control systems and related parts. In addition to equipment, Resource Industries also develops and sells technology products and services to provide customers fleet management, equipment management analytics and autonomous machine capabilities. Resource Industries also manages areas that provide services to other parts of the company, including integrated manufacturing and research and development. |

| 17. | Restructuring Costs - Primarily costs for employee separation, long-lived asset impairments and contract terminations. These costs are included in Other operating (income) expenses except for defined-benefit plan curtailment losses and special termination benefits, which are included in Other income (expense). Restructuring costs also include other exit-related costs primarily for accelerated depreciation, inventory write-downs, equipment relocation and project management costs and LIFO inventory decrement benefits from inventory liquidations at closed facilities, primarily included in Cost of goods sold. |

| 18. | Sales Volume - With respect to sales and revenues, sales volume represents the impact of changes in the quantities sold for Machinery, Energy & Transportation as well as the incremental sales impact of new product introductions, including emissions-related product updates. With respect to operating profit, sales volume represents the impact of changes in the quantities sold for Machinery, Energy & Transportation combined with product mix as well as the net operating profit impact of new product introductions, including emissions-related product updates. Product mix represents the net operating profit impact of changes in the relative weighting of Machinery, Energy & Transportation sales with respect to total sales. The impact of sales volume on segment profit includes inter-segment sales. |

| Three Months Ended March 31, | |||||||

| 2018 | 2017 | ||||||

| Sales and revenues: | |||||||

| Sales of Machinery, Energy & Transportation | $ | 12,150 | $ | 9,130 | |||

| Revenues of Financial Products | 709 | 692 | |||||

| Total sales and revenues | 12,859 | 9,822 | |||||

| Operating costs: | |||||||

| Cost of goods sold | 8,566 | 6,801 | |||||

| Selling, general and administrative expenses | 1,276 | 1,061 | |||||

| Research and development expenses | 443 | 425 | |||||

| Interest expense of Financial Products | 166 | 159 | |||||

| Other operating (income) expenses | 300 | 996 | |||||

| Total operating costs | 10,751 | 9,442 | |||||

| Operating profit | 2,108 | 380 | |||||

| Interest expense excluding Financial Products | 101 | 123 | |||||

| Other income (expense) | 127 | 32 | |||||

| Consolidated profit before taxes | 2,134 | 289 | |||||

| Provision (benefit) for income taxes | 472 | 90 | |||||

| Profit of consolidated companies | 1,662 | 199 | |||||

| Equity in profit (loss) of unconsolidated affiliated companies | 5 | (5 | ) | ||||

| Profit of consolidated and affiliated companies | 1,667 | 194 | |||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | 2 | |||||

Profit 1 | $ | 1,665 | $ | 192 | |||

| Profit per common share | $ | 2.78 | $ | 0.33 | |||

Profit per common share — diluted 2 | $ | 2.74 | $ | 0.32 | |||

| Weighted-average common shares outstanding (millions) | |||||||

| – Basic | 598.0 | 587.5 | |||||

– Diluted 2 | 608.0 | 593.2 | |||||

| Cash dividends declared per common share | $ | — | $ | — | |||

1 | Profit attributable to common shareholders. |

2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. |

| March 31, 2018 | December 31, 2017 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and short-term investments | $ | 7,888 | $ | 8,261 | |||

| Receivables – trade and other | 7,894 | 7,436 | |||||

| Receivables – finance | 8,772 | 8,757 | |||||

| Prepaid expenses and other current assets | 1,856 | 1,772 | |||||

| Inventories | 10,947 | 10,018 | |||||

| Total current assets | 37,357 | 36,244 | |||||

| Property, plant and equipment – net | 13,912 | 14,155 | |||||

| Long-term receivables – trade and other | 1,004 | 990 | |||||

| Long-term receivables – finance | 13,359 | 13,542 | |||||

| Noncurrent deferred and refundable income taxes | 1,687 | 1,693 | |||||

| Intangible assets | 2,163 | 2,111 | |||||

| Goodwill | 6,376 | 6,200 | |||||

| Other assets | 2,156 | 2,027 | |||||

| Total assets | $ | 78,014 | $ | 76,962 | |||

| Liabilities | |||||||

| Current liabilities: | |||||||

| Short-term borrowings: | |||||||

| Machinery, Energy & Transportation | $ | 7 | $ | 1 | |||

| Financial Products | 5,726 | 4,836 | |||||

| Accounts payable | 6,938 | 6,487 | |||||

| Accrued expenses | 3,551 | 3,220 | |||||

| Accrued wages, salaries and employee benefits | 1,474 | 2,559 | |||||

| Customer advances | 1,399 | 1,426 | |||||

| Dividends payable | — | 466 | |||||

| Other current liabilities | 1,890 | 1,742 | |||||

| Long-term debt due within one year: | |||||||

| Machinery, Energy & Transportation | 8 | 6 | |||||

| Financial Products | 6,409 | 6,188 | |||||

| Total current liabilities | 27,402 | 26,931 | |||||

| Long-term debt due after one year: | |||||||

| Machinery, Energy & Transportation | 7,980 | 7,929 | |||||

| Financial Products | 15,185 | 15,918 | |||||

| Liability for postemployment benefits | 8,233 | 8,365 | |||||

| Other liabilities | 3,942 | 4,053 | |||||

| Total liabilities | 62,742 | 63,196 | |||||

| Shareholders’ equity | |||||||

| Common stock | 5,640 | 5,593 | |||||

| Treasury stock | (17,347 | ) | (17,005 | ) | |||

| Profit employed in the business | 27,929 | 26,301 | |||||

| Accumulated other comprehensive income (loss) | (1,016 | ) | (1,192 | ) | |||

| Noncontrolling interests | 66 | 69 | |||||

| Total shareholders’ equity | 15,272 | 13,766 | |||||

| Total liabilities and shareholders’ equity | $ | 78,014 | $ | 76,962 | |||

| Three Months Ended March 31, | |||||||

| 2018 | 2017 | ||||||

| Cash flow from operating activities: | |||||||

| Profit of consolidated and affiliated companies | $ | 1,667 | $ | 194 | |||

| Adjustments for non-cash items: | |||||||

| Depreciation and amortization | 681 | 710 | |||||

| Other | 148 | 302 | |||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||

| Receivables – trade and other | (326 | ) | (353 | ) | |||

| Inventories | (803 | ) | (444 | ) | |||

| Accounts payable | 486 | 732 | |||||

| Accrued expenses | 66 | 132 | |||||

| Accrued wages, salaries and employee benefits | (1,110 | ) | 360 | ||||

| Customer advances | (46 | ) | 234 | ||||

| Other assets – net | 165 | (261 | ) | ||||

| Other liabilities – net | 7 | (64 | ) | ||||

| Net cash provided by (used for) operating activities | 935 | 1,542 | |||||

| Cash flow from investing activities: | |||||||

| Capital expenditures – excluding equipment leased to others | (412 | ) | (204 | ) | |||

| Expenditures for equipment leased to others | (345 | ) | (305 | ) | |||

| Proceeds from disposals of leased assets and property, plant and equipment | 258 | 234 | |||||

| Additions to finance receivables | (2,621 | ) | (2,122 | ) | |||

| Collections of finance receivables | 2,671 | 2,272 | |||||

| Proceeds from sale of finance receivables | 69 | 17 | |||||

| Investments and acquisitions (net of cash acquired) | (340 | ) | (18 | ) | |||

| Proceeds from sale of businesses and investments (net of cash sold) | 12 | — | |||||

| Proceeds from sale of securities | 89 | 89 | |||||

| Investments in securities | (197 | ) | (65 | ) | |||

| Other – net | 16 | 9 | |||||

| Net cash provided by (used for) investing activities | (800 | ) | (93 | ) | |||

| Cash flow from financing activities: | |||||||

| Dividends paid | (467 | ) | (452 | ) | |||

| Common stock issued, including treasury shares reissued | 149 | (19 | ) | ||||

| Treasury shares purchased | (500 | ) | — | ||||

| Proceeds from debt issued (original maturities greater than three months) | 1,541 | 2,715 | |||||

| Payments on debt (original maturities greater than three months) | (2,409 | ) | (1,978 | ) | |||

| Short-term borrowings – net (original maturities three months or less) | 1,151 | 618 | |||||

| Other – net | (3 | ) | (6 | ) | |||

| Net cash provided by (used for) financing activities | (538 | ) | 878 | ||||

| Effect of exchange rate changes on cash | 10 | 9 | |||||

| Increase (decrease) in cash and short-term investments and restricted cash | (393 | ) | 2,336 | ||||

| Cash and short-term investments and restricted cash at beginning of period | 8,320 | 7,199 | |||||

| Cash and short-term investments and restricted cash at end of period | $ | 7,927 | $ | 9,535 | |||

| All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 12,150 | $ | 12,150 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 709 | — | 811 | (102 | ) | 2 | |||||||||||

| Total sales and revenues | 12,859 | 12,150 | 811 | (102 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 8,566 | 8,566 | — | — | |||||||||||||

| Selling, general and administrative expenses | 1,276 | 1,087 | 189 | — | |||||||||||||

| Research and development expenses | 443 | 443 | — | — | |||||||||||||

| Interest expense of Financial Products | 166 | — | 173 | (7 | ) | 4 | |||||||||||

| Other operating (income) expenses | 300 | (1 | ) | 310 | (9 | ) | 3 | ||||||||||

| Total operating costs | 10,751 | 10,095 | 672 | (16 | ) | ||||||||||||

| Operating profit | 2,108 | 2,055 | 139 | (86 | ) | ||||||||||||

| Interest expense excluding Financial Products | 101 | 112 | — | (11 | ) | 4 | |||||||||||

| Other income (expense) | 127 | 54 | (2 | ) | 75 | 5 | |||||||||||

| Consolidated profit before taxes | 2,134 | 1,997 | 137 | — | |||||||||||||

| Provision (benefit) for income taxes | 472 | 441 | 31 | — | |||||||||||||

| Profit of consolidated companies | 1,662 | 1,556 | 106 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 5 | 5 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 102 | — | (102 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 1,667 | 1,663 | 106 | (102 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | (2 | ) | 4 | — | ||||||||||||

Profit 7 | $ | 1,665 | $ | 1,665 | $ | 102 | $ | (102 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 9,130 | $ | 9,130 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 692 | — | 777 | (85 | ) | 2 | |||||||||||

| Total sales and revenues | 9,822 | 9,130 | 777 | (85 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 6,801 | 6,801 | — | — | |||||||||||||

| Selling, general and administrative expenses | 1,061 | 940 | 126 | (5 | ) | 3 | |||||||||||

| Research and development expenses | 425 | 425 | — | — | |||||||||||||

| Interest expense of Financial Products | 159 | — | 163 | (4 | ) | 4 | |||||||||||

| Other operating (income) expenses | 996 | 699 | 302 | (5 | ) | 3 | |||||||||||

| Total operating costs | 9,442 | 8,865 | 591 | (14 | ) | ||||||||||||

| Operating profit | 380 | 265 | 186 | (71 | ) | ||||||||||||

| Interest expense excluding Financial Products | 123 | 144 | — | (21 | ) | 4 | |||||||||||

| Other income (expense) | 32 | (16 | ) | (2 | ) | 50 | 5 | ||||||||||

| Consolidated profit before taxes | 289 | 105 | 184 | — | |||||||||||||

| Provision (benefit) for income taxes | 90 | 34 | 56 | — | |||||||||||||

| Profit of consolidated companies | 199 | 71 | 128 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | (5 | ) | (5 | ) | — | — | |||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 126 | — | (126 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 194 | 192 | 128 | (126 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | — | 2 | — | |||||||||||||

Profit 7 | $ | 192 | $ | 192 | $ | 126 | $ | (126 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | ||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | |||||||||||||

| Cash flow from operating activities: | ||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 1,667 | $ | 1,663 | $ | 106 | $ | (102 | ) | 2 | ||||||

| Adjustments for non-cash items: | ||||||||||||||||

| Depreciation and amortization | 681 | 468 | 213 | — | ||||||||||||

| Undistributed profit of Financial Products | — | (102 | ) | — | 102 | 3 | ||||||||||

| Other | 148 | 62 | (6 | ) | 92 | 4 | ||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||

| Receivables - trade and other | (326 | ) | 90 | — | (416 | ) | 4, 5 | |||||||||

| Inventories | (803 | ) | (803 | ) | — | — | ||||||||||

| Accounts payable | 486 | 505 | (19 | ) | — | |||||||||||

| Accrued expenses | 66 | 43 | 23 | — | ||||||||||||

| Accrued wages, salaries and employee benefits | (1,110 | ) | (1,083 | ) | (27 | ) | — | |||||||||

| Customer advances | (46 | ) | (46 | ) | — | — | ||||||||||

| Other assets – net | 165 | 173 | 28 | (36 | ) | 4 | ||||||||||

| Other liabilities – net | 7 | (22 | ) | (7 | ) | 36 | 4 | |||||||||

| Net cash provided by (used for) operating activities | 935 | 948 | 311 | (324 | ) | |||||||||||

| Cash flow from investing activities: | ||||||||||||||||

| Capital expenditures - excluding equipment leased to others | (412 | ) | (321 | ) | (92 | ) | 1 | 4 | ||||||||

| Expenditures for equipment leased to others | (345 | ) | (2 | ) | (346 | ) | 3 | 4 | ||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 258 | 54 | 207 | (3 | ) | 4 | ||||||||||

| Additions to finance receivables | (2,621 | ) | — | (2,955 | ) | 334 | 5 | |||||||||

| Collections of finance receivables | 2,671 | — | 3,171 | (500 | ) | 5 | ||||||||||

| Net intercompany purchased receivables | — | — | (489 | ) | 489 | 5 | ||||||||||

| Proceeds from sale of finance receivables | 69 | — | 69 | — | ||||||||||||

| Net intercompany borrowings | — | 107 | — | (107 | ) | 6 | ||||||||||

| Investments and acquisitions (net of cash acquired) | (340 | ) | (340 | ) | — | — | ||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 12 | 12 | — | — | ||||||||||||

| Proceeds from sale of securities | 89 | 5 | 84 | — | ||||||||||||

| Investments in securities | (197 | ) | (18 | ) | (179 | ) | — | |||||||||

| Other – net | 16 | 19 | (3 | ) | — | |||||||||||

| Net cash provided by (used for) investing activities | (800 | ) | (484 | ) | (533 | ) | 217 | |||||||||

| Cash flow from financing activities: | ||||||||||||||||

| Dividends paid | (467 | ) | (467 | ) | — | — | ||||||||||

| Common stock issued, including treasury shares reissued | 149 | 149 | — | — | ||||||||||||

| Treasury shares purchased | (500 | ) | (500 | ) | — | — | ||||||||||

| Net intercompany borrowings | — | — | (107 | ) | 107 | 6 | ||||||||||

| Proceeds from debt issued (original maturities greater than three months) | 1,541 | — | 1,541 | — | ||||||||||||

| Payments on debt (original maturities greater than three months) | (2,409 | ) | (1 | ) | (2,408 | ) | — | |||||||||

| Short-term borrowings – net (original maturities three months or less) | 1,151 | 6 | 1,145 | — | ||||||||||||

| Other – net | (3 | ) | (3 | ) | — | — | ||||||||||

| Net cash provided by (used for) financing activities | (538 | ) | (816 | ) | 171 | 107 | ||||||||||

| Effect of exchange rate changes on cash | 10 | 6 | 4 | — | ||||||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | (393 | ) | (346 | ) | (47 | ) | — | |||||||||

| Cash and short-term investments and restricted cash at beginning of period | 8,320 | 7,416 | 904 | — | ||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 7,927 | $ | 7,070 | $ | 857 | $ | — | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ profit after tax due to equity method of accounting. |

3 | Elimination of non-cash adjustment for the undistributed earnings from Financial Products. |

4 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. |

5 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. |

6 | Elimination of net proceeds and payments to/from Machinery, Energy & Transportation and Financial Products. |

| Supplemental Consolidating Data | ||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | |||||||||||||

| Cash flow from operating activities: | ||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 194 | $ | 192 | $ | 128 | $ | (126 | ) | 2 | ||||||

| Adjustments for non-cash items: | ||||||||||||||||

| Depreciation and amortization | 710 | 491 | 219 | — | ||||||||||||

| Undistributed profit of Financial Products | — | (126 | ) | — | 126 | 3 | ||||||||||

| Other | 302 | 302 | (47 | ) | 47 | 4 | ||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||

| Receivables - trade and other | (353 | ) | (8 | ) | 52 | (397 | ) | 4, 5 | ||||||||

| Inventories | (444 | ) | (444 | ) | — | — | ||||||||||

| Accounts payable | 732 | 734 | 6 | (8 | ) | 4 | ||||||||||

| Accrued expenses | 132 | 130 | 2 | — | ||||||||||||

| Accrued wages, salaries and employee benefits | 360 | 364 | (4 | ) | — | |||||||||||

| Customer advances | 234 | 234 | — | — | ||||||||||||

| Other assets – net | (261 | ) | (196 | ) | (25 | ) | (40 | ) | 4 | |||||||

| Other liabilities – net | (64 | ) | (149 | ) | 45 | 40 | 4 | |||||||||

| Net cash provided by (used for) operating activities | 1,542 | 1,524 | 376 | (358 | ) | |||||||||||

| Cash flow from investing activities: | ||||||||||||||||

| Capital expenditures - excluding equipment leased to others | (204 | ) | (203 | ) | (1 | ) | — | |||||||||

| Expenditures for equipment leased to others | (305 | ) | (6 | ) | (302 | ) | 3 | 4 | ||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 234 | 41 | 194 | (1 | ) | 4 | ||||||||||

| Additions to finance receivables | (2,122 | ) | — | (2,535 | ) | 413 | 5 | |||||||||

| Collections of finance receivables | 2,272 | — | 2,788 | (516 | ) | 5 | ||||||||||

| Net intercompany purchased receivables | — | — | (459 | ) | 459 | 5 | ||||||||||

| Proceeds from sale of finance receivables | 17 | — | 17 | — | ||||||||||||

| Net intercompany borrowings | — | 50 | (1,500 | ) | 1,450 | 6 | ||||||||||

| Investments and acquisitions (net of cash acquired) | (18 | ) | (18 | ) | — | — | ||||||||||

| Proceeds from sale of securities | 89 | 6 | 83 | — | ||||||||||||

| Investments in securities | (65 | ) | (2 | ) | (63 | ) | — | |||||||||

| Other – net | 9 | (1 | ) | 10 | — | |||||||||||

| Net cash provided by (used for) investing activities | (93 | ) | (133 | ) | (1,768 | ) | 1,808 | |||||||||

| Cash flow from financing activities: | ||||||||||||||||

| Dividends paid | (452 | ) | (452 | ) | — | — | ||||||||||

| Common stock issued, including treasury shares reissued | (19 | ) | (19 | ) | — | — | ||||||||||

| Net intercompany borrowings | — | 1,500 | (50 | ) | (1,450 | ) | 6 | |||||||||

| Proceeds from debt issued (original maturities greater than three months) | 2,715 | 360 | 2,355 | — | ||||||||||||

| Payments on debt (original maturities greater than three months) | (1,978 | ) | (4 | ) | (1,974 | ) | — | |||||||||

| Short-term borrowings – net (original maturities three months or less) | 618 | 226 | 392 | — | ||||||||||||

| Other – net | (6 | ) | (6 | ) | — | — | ||||||||||

| Net cash provided by (used for) financing activities | 878 | 1,605 | 723 | (1,450 | ) | |||||||||||

| Effect of exchange rate changes on cash | 9 | 3 | 6 | — | ||||||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 2,336 | 2,999 | (663 | ) | — | |||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 7,199 | 5,259 | 1,940 | — | ||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 9,535 | $ | 8,258 | $ | 1,277 | $ | — | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ profit after tax due to equity method of accounting. |

3 | Elimination of non-cash adjustment for the undistributed earnings from Financial Products. |

4 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. |

5 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. |

6 | Elimination of net proceeds and payments to/from Machinery, Energy & Transportation and Financial Products. |