- CAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Caterpillar (CAT) 8-K3Q 2019 Earnings Release

Filed: 23 Oct 19, 6:32am

| Third Quarter | Highlights: | |||||

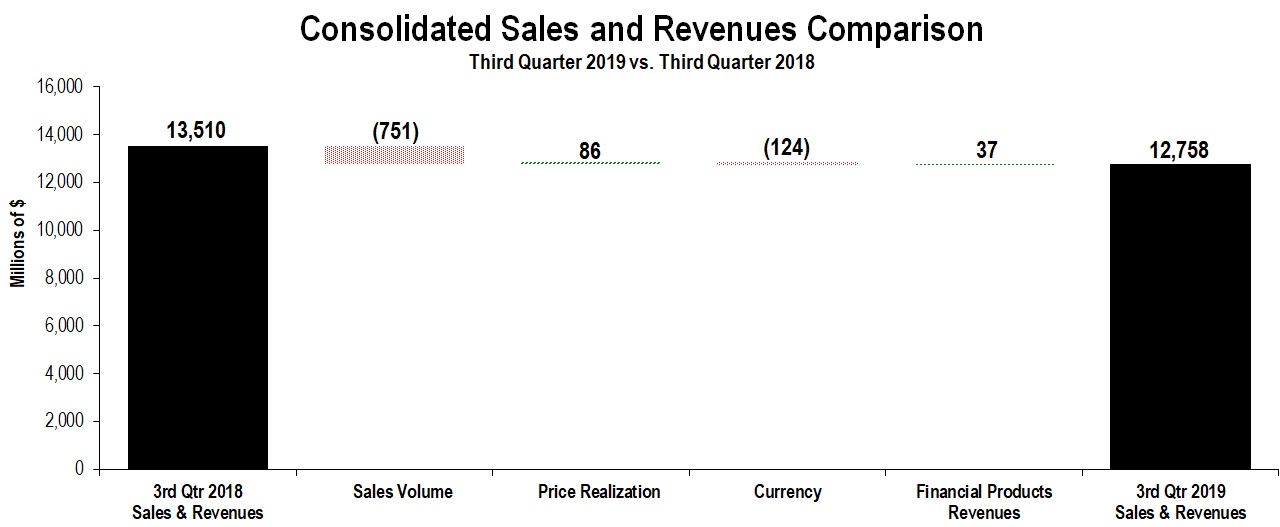

| ($ in billions except profit per share) | 2019 | 2018 | ● | Sales and revenues down 6%; profit per share down 8% | ||

| Sales and Revenues | $12.8 | $13.5 | ● | Returned about $1.8 billion in share repurchases and dividends | ||

| Profit Per Share | $2.66 | $2.88 | ● | Full-year profit per share outlook range lowered to $10.90 to $11.40 | ||

| Sales and Revenues by Segment | |||||||||||||||||||||||||||||

| (Millions of dollars) | Third Quarter 2018 | Sales Volume | Price Realization | Currency | Inter-Segment / Other | Third Quarter 2019 | $ Change | % Change | |||||||||||||||||||||

| Construction Industries | $ | 5,683 | $ | (358 | ) | $ | 26 | $ | (47 | ) | $ | (15 | ) | $ | 5,289 | $ | (394 | ) | (7%) | ||||||||||

| Resource Industries | 2,638 | (389 | ) | 50 | (20 | ) | 32 | 2,311 | (327 | ) | (12%) | ||||||||||||||||||

| Energy & Transportation | 5,555 | 31 | 11 | (57 | ) | (88 | ) | 5,452 | (103 | ) | (2%) | ||||||||||||||||||

| All Other Segment | 113 | (9 | ) | — | (1 | ) | 8 | 111 | (2 | ) | (2%) | ||||||||||||||||||

| Corporate Items and Eliminations | (1,226 | ) | (26 | ) | (1 | ) | 1 | 63 | (1,189 | ) | 37 | ||||||||||||||||||

| Machinery, Energy & Transportation | 12,763 | (751 | ) | 86 | (124 | ) | — | 11,974 | (789 | ) | (6%) | ||||||||||||||||||

| Financial Products Segment | 845 | — | — | — | 20 | 865 | 20 | 2% | |||||||||||||||||||||

| Corporate Items and Eliminations | (98 | ) | — | — | — | 17 | (81 | ) | 17 | ||||||||||||||||||||

| Financial Products Revenues | 747 | — | — | — | 37 | 784 | 37 | 5% | |||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 13,510 | $ | (751 | ) | $ | 86 | $ | (124 | ) | $ | 37 | $ | 12,758 | $ | (752 | ) | (6%) | |||||||||||

| Sales and Revenues by Geographic Region | |||||||||||||||||||||||||||||||||||||||||

| North America | Latin America | EAME | Asia/Pacific | External Sales and Revenues | Inter-Segment | Total Sales and Revenues | |||||||||||||||||||||||||||||||||||

| (Millions of dollars) | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | |||||||||||||||||||||||||||

| Third Quarter 2019 | |||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 2,728 | 3% | $ | 413 | 12% | $ | 1,048 | (6%) | $ | 1,086 | (29%) | $ | 5,275 | (7%) | $ | 14 | (52%) | $ | 5,289 | (7%) | ||||||||||||||||||||

| Resource Industries | 789 | (7%) | 349 | (18%) | 396 | (31%) | 645 | (6%) | 2,179 | (14%) | 132 | 32% | 2,311 | (12%) | |||||||||||||||||||||||||||

| Energy & Transportation | 2,129 | (8%) | 378 | 15% | 1,224 | 4% | 831 | 10% | 4,562 | —% | 890 | (9%) | 5,452 | (2%) | |||||||||||||||||||||||||||

| All Other Segment | 1 | (93%) | 6 | —% | 8 | 100% | 12 | (33%) | 27 | (27%) | 84 | 11% | 111 | (2%) | |||||||||||||||||||||||||||

| Corporate Items and Eliminations | (62 | ) | 1 | (7 | ) | (1 | ) | (69 | ) | (1,120 | ) | (1,189 | ) | ||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 5,585 | (3%) | 1,147 | 2% | 2,669 | (7%) | 2,573 | (14%) | 11,974 | (6%) | — | —% | 11,974 | (6%) | |||||||||||||||||||||||||||

| Financial Products Segment | 560 | —% | 79 | 16% | 102 | 1% | 124 | 6% | 865 | 2% | — | —% | 865 | 2% | |||||||||||||||||||||||||||

| Corporate Items and Eliminations | (43 | ) | (15 | ) | (8 | ) | (15 | ) | (81 | ) | — | (81 | ) | ||||||||||||||||||||||||||||

| Financial Products Revenues | 517 | 4% | 64 | 14% | 94 | (1%) | 109 | 10% | 784 | 5% | — | —% | 784 | 5% | |||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 6,102 | (3%) | $ | 1,211 | 2% | $ | 2,763 | (7%) | $ | 2,682 | (13%) | $ | 12,758 | (6%) | $ | — | —% | $ | 12,758 | (6%) | ||||||||||||||||||||

| Third Quarter 2018 | |||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 2,646 | $ | 369 | $ | 1,109 | $ | 1,530 | $ | 5,654 | $ | 29 | $ | 5,683 | |||||||||||||||||||||||||||

| Resource Industries | 849 | 427 | 574 | 688 | 2,538 | 100 | 2,638 | ||||||||||||||||||||||||||||||||||

| Energy & Transportation | 2,309 | 330 | 1,180 | 758 | 4,577 | 978 | 5,555 | ||||||||||||||||||||||||||||||||||

| All Other Segment | 15 | — | 4 | 18 | 37 | 76 | 113 | ||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (40 | ) | 1 | (5 | ) | 1 | (43 | ) | (1,183 | ) | (1,226 | ) | |||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 5,779 | 1,127 | 2,862 | 2,995 | 12,763 | — | 12,763 | ||||||||||||||||||||||||||||||||||

| Financial Products Segment | 559 | 68 | 101 | 117 | 845 | — | 845 | ||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (62 | ) | (12 | ) | (6 | ) | (18 | ) | (98 | ) | — | (98 | ) | ||||||||||||||||||||||||||||

| Financial Products Revenues | 497 | 56 | 95 | 99 | 747 | — | 747 | ||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 6,276 | $ | 1,183 | $ | 2,957 | $ | 3,094 | $ | 13,510 | $ | — | $ | 13,510 | |||||||||||||||||||||||||||

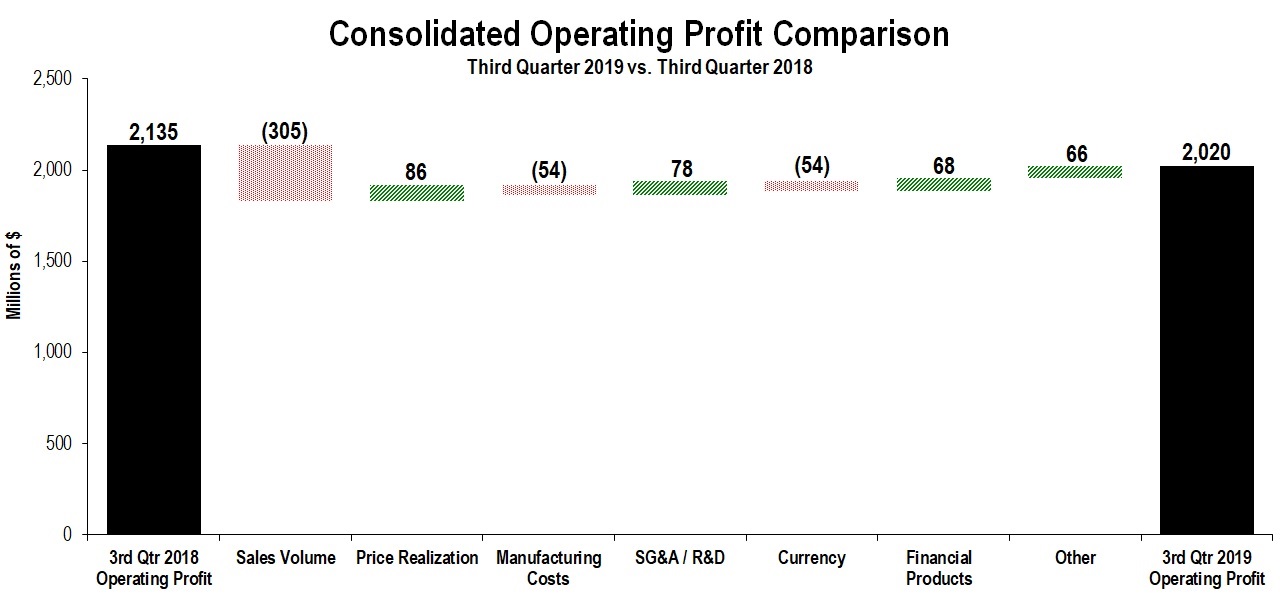

| Profit by Segment | ||||||||||||||

| (Millions of dollars) | Third Quarter 2019 | Third Quarter 2018 | $ Change | % Change | ||||||||||

| Construction Industries | $ | 940 | $ | 1,058 | $ | (118 | ) | (11 | %) | |||||

| Resource Industries | 311 | 414 | (103 | ) | (25 | %) | ||||||||

| Energy & Transportation | 1,021 | 973 | 48 | 5 | % | |||||||||

| All Other Segment | (21 | ) | (10 | ) | (11 | ) | (110 | %) | ||||||

| Corporate Items and Eliminations | (363 | ) | (371 | ) | 8 | |||||||||

| Machinery, Energy & Transportation | 1,888 | 2,064 | (176 | ) | (9 | %) | ||||||||

| Financial Products Segment | 218 | 201 | 17 | 8 | % | |||||||||

| Corporate Items and Eliminations | 21 | (30 | ) | 51 | ||||||||||

| Financial Products | 239 | 171 | 68 | 40 | % | |||||||||

| Consolidating Adjustments | (107 | ) | (100 | ) | (7 | ) | ||||||||

| Consolidated Operating Profit | $ | 2,020 | $ | 2,135 | $ | (115 | ) | (5 | %) | |||||

| CONSTRUCTION INDUSTRIES | |||||||||||||||||||||||||||||||

| (Millions of dollars) | |||||||||||||||||||||||||||||||

| Segment Sales | |||||||||||||||||||||||||||||||

| Third Quarter 2018 | Sales Volume | Price Realization | Currency | Inter-Segment | Third Quarter 2019 | $ Change | % Change | ||||||||||||||||||||||||

| Total Sales | $ | 5,683 | $ | (358 | ) | $ | 26 | $ | (47 | ) | $ | (15 | ) | $ | 5,289 | $ | (394 | ) | (7 | %) | |||||||||||

| Sales by Geographic Region | |||||||||||||||||||||||||||||||

| Third Quarter 2019 | Third Quarter 2018 | $ Change | % Change | ||||||||||||||||||||||||||||

| North America | $ | 2,728 | $ | 2,646 | $ | 82 | 3 | % | |||||||||||||||||||||||

| Latin America | 413 | 369 | 44 | 12 | % | ||||||||||||||||||||||||||

| EAME | 1,048 | 1,109 | (61 | ) | (6 | %) | |||||||||||||||||||||||||

| Asia/Pacific | 1,086 | 1,530 | (444 | ) | (29 | %) | |||||||||||||||||||||||||

| External Sales | 5,275 | 5,654 | (379 | ) | (7 | %) | |||||||||||||||||||||||||

| Inter-segment | 14 | 29 | (15 | ) | (52 | %) | |||||||||||||||||||||||||

| Total Sales | $ | 5,289 | $ | 5,683 | $ | (394 | ) | (7 | %) | ||||||||||||||||||||||

| Segment Profit | |||||||||||||||||||||||||||||||

| Third Quarter 2019 | Third Quarter 2018 | Change | % Change | ||||||||||||||||||||||||||||

| Segment Profit | $ | 940 | $ | 1,058 | $ | (118 | ) | (11 | %) | ||||||||||||||||||||||

| Segment Profit Margin | 17.8 | % | 18.6 | % | (0.8 | pts) | |||||||||||||||||||||||||

| ▪ | In North America, sales increased primarily due to favorable price realization and higher demand for equipment, mostly to support road and non-residential building construction activities. |

| ▪ | Sales were higher in Latin America, but construction activities remained at low levels. |

| ▪ | In EAME, the sales decrease was primarily due to currency impacts related to the euro. Unfavorable price realization and lower sales volume also contributed to the decrease. |

| ▪ | Sales in Asia/Pacific were lower across most of the region primarily due to lower demand in China, including unfavorable changes in dealer inventories, amid continued competitive pressures. |

| RESOURCE INDUSTRIES | |||||||||||||||||||||||||||||||

| (Millions of dollars) | |||||||||||||||||||||||||||||||

| Segment Sales | |||||||||||||||||||||||||||||||

| Third Quarter 2018 | Sales Volume | Price Realization | Currency | Inter-Segment | Third Quarter 2019 | $ Change | % Change | ||||||||||||||||||||||||

| Total Sales | $ | 2,638 | $ | (389 | ) | $ | 50 | $ | (20 | ) | $ | 32 | $ | 2,311 | $ | (327 | ) | (12 | %) | ||||||||||||

| Sales by Geographic Region | |||||||||||||||||||||||||||||||

| Third Quarter 2019 | Third Quarter 2018 | $ Change | % Change | ||||||||||||||||||||||||||||

| North America | $ | 789 | $ | 849 | $ | (60 | ) | (7 | %) | ||||||||||||||||||||||

| Latin America | 349 | 427 | (78 | ) | (18 | %) | |||||||||||||||||||||||||

| EAME | 396 | 574 | (178 | ) | (31 | %) | |||||||||||||||||||||||||

| Asia/Pacific | 645 | 688 | (43 | ) | (6 | %) | |||||||||||||||||||||||||

| External Sales | 2,179 | 2,538 | (359 | ) | (14 | %) | |||||||||||||||||||||||||

| Inter-segment | 132 | 100 | 32 | 32 | % | ||||||||||||||||||||||||||

| Total Sales | $ | 2,311 | $ | 2,638 | $ | (327 | ) | (12 | %) | ||||||||||||||||||||||

| Segment Profit | |||||||||||||||||||||||||||||||

| Third Quarter 2019 | Third Quarter 2018 | Change | % Change | ||||||||||||||||||||||||||||

| Segment Profit | $ | 311 | $ | 414 | $ | (103 | ) | (25 | %) | ||||||||||||||||||||||

| Segment Profit Margin | 13.5 | % | 15.7 | % | (2.2 | pts) | |||||||||||||||||||||||||

| ENERGY & TRANSPORTATION | |||||||||||||||||||||||||||||||

| (Millions of dollars) | |||||||||||||||||||||||||||||||

| Segment Sales | |||||||||||||||||||||||||||||||

| Third Quarter 2018 | Sales Volume | Price Realization | Currency | Inter-Segment | Third Quarter 2019 | $ Change | % Change | ||||||||||||||||||||||||

| Total Sales | $ | 5,555 | $ | 31 | $ | 11 | $ | (57 | ) | $ | (88 | ) | $ | 5,452 | $ | (103 | ) | (2 | %) | ||||||||||||

| Sales by Application | |||||||||||||||||||||||||||||||

| Third Quarter 2019 | Third Quarter 2018 | $ Change | % Change | ||||||||||||||||||||||||||||

| Oil and Gas | $ | 1,246 | $ | 1,362 | $ | (116 | ) | (9 | %) | ||||||||||||||||||||||

| Power Generation | 1,123 | 1,102 | 21 | 2 | % | ||||||||||||||||||||||||||

| Industrial | 980 | 863 | 117 | 14 | % | ||||||||||||||||||||||||||

| Transportation | 1,213 | 1,250 | (37 | ) | (3 | %) | |||||||||||||||||||||||||

| External Sales | 4,562 | 4,577 | (15 | ) | — | % | |||||||||||||||||||||||||

| Inter-segment | 890 | 978 | (88 | ) | (9 | %) | |||||||||||||||||||||||||

| Total Sales | $ | 5,452 | $ | 5,555 | $ | (103 | ) | (2 | %) | ||||||||||||||||||||||

| Segment Profit | |||||||||||||||||||||||||||||||

| Third Quarter 2019 | Third Quarter 2018 | Change | % Change | ||||||||||||||||||||||||||||

| Segment Profit | $ | 1,021 | $ | 973 | $ | 48 | 5 | % | |||||||||||||||||||||||

| Segment Profit Margin | 18.7 | % | 17.5 | % | 1.2 | pts | |||||||||||||||||||||||||

| ▪ | Oil and Gas – Sales decreased for reciprocating engines in North America primarily due to lower demand in well servicing applications. This was partially offset by higher sales of turbines and turbine-related services. |

| ▪ | Power Generation – Sales increased mostly due to higher deliveries in North America for large diesel reciprocating engines and turbines, partially offset by lower sales of reciprocating engines in EAME. |

| ▪ | Industrial – Sales improved primarily in EAME and Asia/Pacific driven by higher end-user demand. |

| ▪ | Transportation – Sales were lower primarily due to timing of locomotive deliveries. |

| FINANCIAL PRODUCTS SEGMENT | |||||||||||||||||||||||

| (Millions of dollars) | |||||||||||||||||||||||

| Revenues by Geographic Region | |||||||||||||||||||||||

| Third Quarter 2019 | Third Quarter 2018 | $ Change | % Change | ||||||||||||||||||||

| North America | $ | 560 | $ | 559 | $ | 1 | — | % | |||||||||||||||

| Latin America | 79 | 68 | 11 | 16 | % | ||||||||||||||||||

| EAME | 102 | 101 | 1 | 1 | % | ||||||||||||||||||

| Asia/Pacific | 124 | 117 | 7 | 6 | % | ||||||||||||||||||

| Total Revenues | $ | 865 | $ | 845 | $ | 20 | 2 | % | |||||||||||||||

| Segment Profit | |||||||||||||||||||||||

| Third Quarter 2019 | Third Quarter 2018 | Change | % Change | ||||||||||||||||||||

| Segment Profit | $ | 218 | $ | 201 | $ | 17 | 8 | % | |||||||||||||||

| – | Glossary of terms is included on the Caterpillar website at http://www.caterpillar.com/investors/. |

| – | Information on non-GAAP financial measures is included in the appendix on page 21. |

| – | Caterpillar will conduct a teleconference and live webcast, with a slide presentation, beginning at 7:30 a.m. Central Time on Wednesday, October 23, 2019, to discuss its 2019 third-quarter financial results. The accompanying slides will be available before the webcast on the Caterpillar website at http://www.caterpillar.com/investors/events-and-presentations. |

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Sales and revenues: | |||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 11,974 | $ | 12,763 | $ | 38,369 | $ | 38,192 | |||||||

| Revenues of Financial Products | 784 | 747 | 2,287 | 2,188 | |||||||||||

| Total sales and revenues | 12,758 | 13,510 | 40,656 | 40,380 | |||||||||||

| Operating costs: | |||||||||||||||

| Cost of goods sold | 8,569 | 9,022 | 27,513 | 27,010 | |||||||||||

| Selling, general and administrative expenses | 1,251 | 1,299 | 3,879 | 4,015 | |||||||||||

| Research and development expenses | 431 | 479 | 1,307 | 1,384 | |||||||||||

| Interest expense of Financial Products | 189 | 185 | 571 | 533 | |||||||||||

| Other operating (income) expenses | 298 | 390 | 946 | 1,028 | |||||||||||

| Total operating costs | 10,738 | 11,375 | 34,216 | 33,970 | |||||||||||

| Operating profit | 2,020 | 2,135 | 6,440 | 6,410 | |||||||||||

| Interest expense excluding Financial Products | 103 | 102 | 309 | 305 | |||||||||||

| Other income (expense) | 88 | 102 | 316 | 350 | |||||||||||

| Consolidated profit before taxes | 2,005 | 2,135 | 6,447 | 6,455 | |||||||||||

| Provision (benefit) for income taxes | 518 | 415 | 1,470 | 1,377 | |||||||||||

| Profit of consolidated companies | 1,487 | 1,720 | 4,977 | 5,078 | |||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 7 | 7 | 20 | 21 | |||||||||||

| Profit of consolidated and affiliated companies | 1,494 | 1,727 | 4,997 | 5,099 | |||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | — | 2 | — | |||||||||||

Profit 1 | $ | 1,494 | $ | 1,727 | $ | 4,995 | $ | 5,099 | |||||||

| Profit per common share | $ | 2.69 | $ | 2.92 | $ | 8.84 | $ | 8.57 | |||||||

Profit per common share — diluted 2 | $ | 2.66 | $ | 2.88 | $ | 8.75 | $ | 8.45 | |||||||

| Weighted-average common shares outstanding (millions) | |||||||||||||||

| – Basic | 556.3 | 592.1 | 565.2 | 595.3 | |||||||||||

– Diluted 2 | 561.2 | 599.4 | 570.8 | 603.8 | |||||||||||

1 | Profit attributable to common shareholders. |

2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. |

| September 30, 2019 | December 31, 2018 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and short-term investments | $ | 7,906 | $ | 7,857 | |||

| Receivables – trade and other | 8,275 | 8,802 | |||||

| Receivables – finance | 9,192 | 8,650 | |||||

| Prepaid expenses and other current assets | 1,607 | 1,765 | |||||

| Inventories | 12,180 | 11,529 | |||||

| Total current assets | 39,160 | 38,603 | |||||

| Property, plant and equipment – net | 12,842 | 13,574 | |||||

| Long-term receivables – trade and other | 1,193 | 1,161 | |||||

| Long-term receivables – finance | 12,412 | 13,286 | |||||

| Noncurrent deferred and refundable income taxes | 1,372 | 1,439 | |||||

| Intangible assets | 1,630 | 1,897 | |||||

| Goodwill | 6,142 | 6,217 | |||||

| Other assets | 3,242 | 2,332 | |||||

| Total assets | $ | 77,993 | $ | 78,509 | |||

| Liabilities | |||||||

| Current liabilities: | |||||||

| Short-term borrowings: | |||||||

| -- Machinery, Energy & Transportation | $ | — | $ | — | |||

| -- Financial Products | 4,268 | 5,723 | |||||

| Accounts payable | 6,141 | 7,051 | |||||

| Accrued expenses | 3,727 | 3,573 | |||||

| Accrued wages, salaries and employee benefits | 1,518 | 2,384 | |||||

| Customer advances | 1,309 | 1,243 | |||||

| Dividends payable | — | 495 | |||||

| Other current liabilities | 2,188 | 1,919 | |||||

| Long-term debt due within one year: | |||||||

| -- Machinery, Energy & Transportation | 25 | 10 | |||||

| -- Financial Products | 8,025 | 5,820 | |||||

| Total current liabilities | 27,201 | 28,218 | |||||

| Long-term debt due after one year: | |||||||

| -- Machinery, Energy & Transportation | 9,134 | 8,005 | |||||

| -- Financial Products | 16,454 | 16,995 | |||||

| Liability for postemployment benefits | 5,900 | 7,455 | |||||

| Other liabilities | 4,311 | 3,756 | |||||

| Total liabilities | 63,000 | 64,429 | |||||

| Shareholders’ equity | |||||||

| Common stock | 5,951 | 5,827 | |||||

| Treasury stock | (23,693 | ) | (20,531 | ) | |||

| Profit employed in the business | 34,477 | 30,427 | |||||

| Accumulated other comprehensive income (loss) | (1,783 | ) | (1,684 | ) | |||

| Noncontrolling interests | 41 | 41 | |||||

| Total shareholders’ equity | 14,993 | 14,080 | |||||

| Total liabilities and shareholders’ equity | $ | 77,993 | $ | 78,509 | |||

| Nine Months Ended September 30, | |||||||

| 2019 | 2018 | ||||||

| Cash flow from operating activities: | |||||||

| Profit of consolidated and affiliated companies | $ | 4,997 | $ | 5,099 | |||

| Adjustments for non-cash items: | |||||||

| Depreciation and amortization | 1,933 | 2,065 | |||||

| Other | 627 | 630 | |||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||

| Receivables – trade and other | 427 | (725 | ) | ||||

| Inventories | (676 | ) | (1,822 | ) | |||

| Accounts payable | (669 | ) | 496 | ||||

| Accrued expenses | 114 | (32 | ) | ||||

| Accrued wages, salaries and employee benefits | (858 | ) | (418 | ) | |||

| Customer advances | 169 | 59 | |||||

| Other assets – net | 3 | 394 | |||||

| Other liabilities – net | (1,589 | ) | (1,271 | ) | |||

| Net cash provided by (used for) operating activities | 4,478 | 4,475 | |||||

| Cash flow from investing activities: | |||||||

| Capital expenditures – excluding equipment leased to others | (723 | ) | (921 | ) | |||

| Expenditures for equipment leased to others | (1,133 | ) | (1,208 | ) | |||

| Proceeds from disposals of leased assets and property, plant and equipment | 812 | 732 | |||||

| Additions to finance receivables | (9,453 | ) | (9,092 | ) | |||

| Collections of finance receivables | 9,144 | 8,032 | |||||

| Proceeds from sale of finance receivables | 183 | 416 | |||||

| Investments and acquisitions (net of cash acquired) | (6 | ) | (357 | ) | |||

| Proceeds from sale of businesses and investments (net of cash sold) | 3 | 14 | |||||

| Proceeds from sale of securities | 281 | 363 | |||||

| Investments in securities | (425 | ) | (417 | ) | |||

| Other – net | (37 | ) | 24 | ||||

| Net cash provided by (used for) investing activities | (1,354 | ) | (2,414 | ) | |||

| Cash flow from financing activities: | |||||||

| Dividends paid | (1,564 | ) | (1,444 | ) | |||

| Common stock issued, including treasury shares reissued | 59 | 292 | |||||

| Common shares repurchased | (3,283 | ) | (2,000 | ) | |||

| Proceeds from debt issued (original maturities greater than three months) | 8,827 | 7,073 | |||||

| Payments on debt (original maturities greater than three months) | (6,062 | ) | (5,642 | ) | |||

| Short-term borrowings – net (original maturities three months or less) | (1,006 | ) | (465 | ) | |||

| Other – net | (2 | ) | (32 | ) | |||

| Net cash provided by (used for) financing activities | (3,031 | ) | (2,218 | ) | |||

| Effect of exchange rate changes on cash | (47 | ) | (117 | ) | |||

| Increase (decrease) in cash and short-term investments and restricted cash | 46 | (274 | ) | ||||

| Cash and short-term investments and restricted cash at beginning of period | 7,890 | 8,320 | |||||

| Cash and short-term investments and restricted cash at end of period | $ | 7,936 | $ | 8,046 | |||

| All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 11,974 | $ | 11,974 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 784 | — | 920 | (136 | ) | 2 | |||||||||||

| Total sales and revenues | 12,758 | 11,974 | 920 | (136 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 8,569 | 8,569 | — | — | |||||||||||||

| Selling, general and administrative expenses | 1,251 | 1,095 | 163 | (7 | ) | 3 | |||||||||||

| Research and development expenses | 431 | 431 | — | — | |||||||||||||

| Interest expense of Financial Products | 189 | — | 198 | (9 | ) | 4 | |||||||||||

| Other operating (income) expenses | 298 | (9 | ) | 320 | (13 | ) | 3 | ||||||||||

| Total operating costs | 10,738 | 10,086 | 681 | (29 | ) | ||||||||||||

| Operating profit | 2,020 | 1,888 | 239 | (107 | ) | ||||||||||||

| Interest expense excluding Financial Products | 103 | 103 | — | — | |||||||||||||

| Other income (expense) | 88 | (27 | ) | 8 | 107 | 5 | |||||||||||

| Consolidated profit before taxes | 2,005 | 1,758 | 247 | — | |||||||||||||

| Provision (benefit) for income taxes | 518 | 457 | 61 | — | |||||||||||||

| Profit of consolidated companies | 1,487 | 1,301 | 186 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 7 | 7 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 180 | — | (180 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 1,494 | 1,488 | 186 | (180 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | (6 | ) | 6 | — | ||||||||||||

Profit 7 | $ | 1,494 | $ | 1,494 | $ | 180 | $ | (180 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 12,763 | $ | 12,763 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 747 | — | 867 | (120 | ) | 2 | |||||||||||

| Total sales and revenues | 13,510 | 12,763 | 867 | (120 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 9,022 | 9,022 | — | — | |||||||||||||

| Selling, general and administrative expenses | 1,299 | 1,135 | 169 | (5 | ) | 3 | |||||||||||

| Research and development expenses | 479 | 479 | — | — | |||||||||||||

| Interest expense of Financial Products | 185 | — | 194 | (9 | ) | 4 | |||||||||||

| Other operating (income) expenses | 390 | 63 | 333 | (6 | ) | 3 | |||||||||||

| Total operating costs | 11,375 | 10,699 | 696 | (20 | ) | ||||||||||||

| Operating profit | 2,135 | 2,064 | 171 | (100 | ) | ||||||||||||

| Interest expense excluding Financial Products | 102 | 114 | — | (12 | ) | 4 | |||||||||||

| Other income (expense) | 102 | (5 | ) | 19 | 88 | 5 | |||||||||||

| Consolidated profit before taxes | 2,135 | 1,945 | 190 | — | |||||||||||||

| Provision (benefit) for income taxes | 415 | 376 | 39 | — | |||||||||||||

| Profit of consolidated companies | 1,720 | 1,569 | 151 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 7 | 7 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 145 | — | (145 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 1,727 | 1,721 | 151 | (145 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | (6 | ) | 6 | — | ||||||||||||

Profit 7 | $ | 1,727 | $ | 1,727 | $ | 145 | $ | (145 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 38,369 | $ | 38,369 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 2,287 | — | 2,684 | (397 | ) | 2 | |||||||||||

| Total sales and revenues | 40,656 | 38,369 | 2,684 | (397 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 27,513 | 27,515 | — | (2 | ) | 3 | |||||||||||

| Selling, general and administrative expenses | 3,879 | 3,324 | 564 | (9 | ) | 3 | |||||||||||

| Research and development expenses | 1,307 | 1,307 | — | — | |||||||||||||

| Interest expense of Financial Products | 571 | — | 599 | (28 | ) | 4 | |||||||||||

| Other operating (income) expenses | 946 | 2 | 974 | (30 | ) | 3 | |||||||||||

| Total operating costs | 34,216 | 32,148 | 2,137 | (69 | ) | ||||||||||||

| Operating profit | 6,440 | 6,221 | 547 | (328 | ) | ||||||||||||

| Interest expense excluding Financial Products | 309 | 318 | — | (9 | ) | 4 | |||||||||||

| Other income (expense) | 316 | (71 | ) | 68 | 319 | 5 | |||||||||||

| Consolidated profit before taxes | 6,447 | 5,832 | 615 | — | |||||||||||||

| Provision (benefit) for income taxes | 1,470 | 1,294 | 176 | — | |||||||||||||

| Profit of consolidated companies | 4,977 | 4,538 | 439 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 20 | 20 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 422 | — | (422 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 4,997 | 4,980 | 439 | (422 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | (15 | ) | 17 | — | ||||||||||||

Profit 7 | $ | 4,995 | $ | 4,995 | $ | 422 | $ | (422 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | |||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | ||||||||||||||

| Sales and revenues: | |||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 38,192 | $ | 38,192 | $ | — | $ | — | |||||||||

| Revenues of Financial Products | 2,188 | — | 2,527 | (339 | ) | 2 | |||||||||||

| Total sales and revenues | 40,380 | 38,192 | 2,527 | (339 | ) | ||||||||||||

| Operating costs: | |||||||||||||||||

| Cost of goods sold | 27,010 | 27,010 | — | — | |||||||||||||

| Selling, general and administrative expenses | 4,015 | 3,445 | 581 | (11 | ) | 3 | |||||||||||

| Research and development expenses | 1,384 | 1,384 | — | — | |||||||||||||

| Interest expense of Financial Products | 533 | — | 558 | (25 | ) | 4 | |||||||||||

| Other operating (income) expenses | 1,028 | 100 | 949 | (21 | ) | 3 | |||||||||||

| Total operating costs | 33,970 | 31,939 | 2,088 | (57 | ) | ||||||||||||

| Operating profit | 6,410 | 6,253 | 439 | (282 | ) | ||||||||||||

| Interest expense excluding Financial Products | 305 | 337 | — | (32 | ) | 4 | |||||||||||

| Other income (expense) | 350 | 76 | 24 | 250 | 5 | ||||||||||||

| Consolidated profit before taxes | 6,455 | 5,992 | 463 | — | |||||||||||||

| Provision (benefit) for income taxes | 1,377 | 1,274 | 103 | — | |||||||||||||

| Profit of consolidated companies | 5,078 | 4,718 | 360 | — | |||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 21 | 21 | — | — | |||||||||||||

| Equity in profit of Financial Products’ subsidiaries | — | 345 | — | (345 | ) | 6 | |||||||||||

| Profit of consolidated and affiliated companies | 5,099 | 5,084 | 360 | (345 | ) | ||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | (15 | ) | 15 | — | ||||||||||||

Profit 7 | $ | 5,099 | $ | 5,099 | $ | 345 | $ | (345 | ) | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ revenues earned from Machinery, Energy & Transportation. |

3 | Elimination of net expenses recorded by Machinery, Energy & Transportation paid to Financial Products. |

4 | Elimination of interest expense recorded between Financial Products and Machinery, Energy & Transportation. |

5 | Elimination of discount recorded by Machinery, Energy & Transportation on receivables sold to Financial Products and of interest earned between Machinery, Energy & Transportation and Financial Products. |

6 | Elimination of Financial Products’ profit due to equity method of accounting. |

7 | Profit attributable to common shareholders. |

| Supplemental Consolidating Data | ||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | |||||||||||||

| Cash flow from operating activities: | ||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 4,997 | $ | 4,980 | $ | 439 | $ | (422 | ) | 2 | ||||||

| Adjustments for non-cash items: | ||||||||||||||||

| Depreciation and amortization | 1,933 | 1,283 | 650 | — | ||||||||||||

| Undistributed profit of Financial Products | — | (422 | ) | — | 422 | 3 | ||||||||||

| Other | 627 | 395 | (111 | ) | 343 | 4 | ||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||

| Receivables – trade and other | 427 | 125 | (16 | ) | 318 | 4, 5 | ||||||||||

| Inventories | (676 | ) | (702 | ) | — | 26 | 4 | |||||||||

| Accounts payable | (669 | ) | (651 | ) | 6 | (24 | ) | 4 | ||||||||

| Accrued expenses | 114 | 105 | 11 | (2 | ) | 4 | ||||||||||

| Accrued wages, salaries and employee benefits | (858 | ) | (865 | ) | 7 | — | ||||||||||

| Customer advances | 169 | 171 | — | (2 | ) | 4 | ||||||||||

| Other assets – net | 3 | (47 | ) | 47 | 3 | 4 | ||||||||||

| Other liabilities – net | (1,589 | ) | (1,740 | ) | 144 | 7 | 4 | |||||||||

| Net cash provided by (used for) operating activities | 4,478 | 2,632 | 1,177 | 669 | ||||||||||||

| Cash flow from investing activities: | ||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (723 | ) | (709 | ) | (14 | ) | — | |||||||||

| Expenditures for equipment leased to others | (1,133 | ) | (21 | ) | (1,151 | ) | 39 | 4 | ||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 812 | 149 | 766 | (103 | ) | 4 | ||||||||||

| Additions to finance receivables | (9,453 | ) | — | (10,633 | ) | 1,180 | 5 | |||||||||

| Collections of finance receivables | 9,144 | — | 10,166 | (1,022 | ) | 5 | ||||||||||

| Net intercompany purchased receivables | — | — | 763 | (763 | ) | 5 | ||||||||||

| Proceeds from sale of finance receivables | 183 | — | 183 | — | ||||||||||||

| Net intercompany borrowings | — | 721 | 1 | (722 | ) | 6 | ||||||||||

| Investments and acquisitions (net of cash acquired) | (6 | ) | (6 | ) | — | — | ||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 3 | 3 | — | — | ||||||||||||

| Proceeds from sale of securities | 281 | 16 | 265 | — | ||||||||||||

| Investments in securities | (425 | ) | (16 | ) | (409 | ) | — | |||||||||

| Other – net | (37 | ) | 1 | (38 | ) | — | ||||||||||

| Net cash provided by (used for) investing activities | (1,354 | ) | 138 | (101 | ) | (1,391 | ) | |||||||||

| Cash flow from financing activities: | ||||||||||||||||

| Dividends paid | (1,564 | ) | (1,564 | ) | — | — | ||||||||||

| Common stock issued, including treasury shares reissued | 59 | 59 | — | — | ||||||||||||

| Common shares repurchased | (3,283 | ) | (3,283 | ) | — | — | ||||||||||

| Net intercompany borrowings | — | (1 | ) | (721 | ) | 722 | 6 | |||||||||

| Proceeds from debt issued > 90 days | 8,827 | 1,479 | 7,348 | — | ||||||||||||

| Payments on debt > 90 days | (6,062 | ) | (8 | ) | (6,054 | ) | — | |||||||||

| Short-term borrowings – net < 90 days | (1,006 | ) | — | (1,006 | ) | — | ||||||||||

| Other – net | (2 | ) | (2 | ) | — | — | ||||||||||

| Net cash provided by (used for) financing activities | (3,031 | ) | (3,320 | ) | (433 | ) | 722 | |||||||||

| Effect of exchange rate changes on cash | (47 | ) | (38 | ) | (9 | ) | — | |||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 46 | (588 | ) | 634 | — | |||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 7,890 | 6,994 | 896 | — | ||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 7,936 | $ | 6,406 | $ | 1,530 | $ | — | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ profit after tax due to equity method of accounting. |

3 | Elimination of non-cash adjustment for the undistributed earnings from Financial Products. |

4 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. |

5 | Reclassification of Financial Products' cash flow activity from investing to operating for receivables that arose from the sale of inventory. |

6 | Elimination of net proceeds and payments to/from Machinery, Energy & Transportation and Financial Products. |

| Supplemental Consolidating Data | ||||||||||||||||

| Consolidated | Machinery, Energy & Transportation 1 | Financial Products | Consolidating Adjustments | |||||||||||||

| Cash flow from operating activities: | ||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 5,099 | $ | 5,084 | $ | 360 | $ | (345 | ) | 2 | ||||||

| Adjustments for non-cash items: | ||||||||||||||||

| Depreciation and amortization | 2,065 | 1,410 | 655 | — | ||||||||||||

| Undistributed profit of Financial Products | — | (345 | ) | — | 345 | 3 | ||||||||||

| Other | 630 | 327 | 36 | 267 | 4 | |||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||

| Receivables – trade and other | (725 | ) | 19 | (33 | ) | (711 | ) | 4, 5 | ||||||||

| Inventories | (1,822 | ) | (1,774 | ) | — | (48 | ) | 4 | ||||||||

| Accounts payable | 496 | 544 | (55 | ) | 7 | 4 | ||||||||||

| Accrued expenses | (32 | ) | (63 | ) | 31 | — | ||||||||||

| Accrued wages, salaries and employee benefits | (418 | ) | (403 | ) | (15 | ) | — | |||||||||

| Customer advances | 59 | 59 | — | — | ||||||||||||

| Other assets – net | 394 | 343 | (9 | ) | 60 | 4 | ||||||||||

| Other liabilities – net | (1,271 | ) | (1,321 | ) | 110 | (60 | ) | 4 | ||||||||

| Net cash provided by (used for) operating activities | 4,475 | 3,880 | 1,080 | (485 | ) | |||||||||||

| Cash flow from investing activities: | ||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (921 | ) | (822 | ) | (99 | ) | — | |||||||||

| Expenditures for equipment leased to others | (1,208 | ) | (23 | ) | (1,258 | ) | 73 | 4 | ||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 732 | 122 | 632 | (22 | ) | 4 | ||||||||||

| Additions to finance receivables | (9,092 | ) | — | (10,151 | ) | 1,059 | 5, 7 | |||||||||

| Collections of finance receivables | 8,032 | — | 9,135 | (1,103 | ) | 5 | ||||||||||

| Net intercompany purchased receivables | — | — | (484 | ) | 484 | 5 | ||||||||||

| Proceeds from sale of finance receivables | 416 | — | 416 | — | ||||||||||||

| Net intercompany borrowings | — | 66 | — | (66 | ) | 6 | ||||||||||

| Investments and acquisitions (net of cash acquired) | (357 | ) | (357 | ) | — | — | ||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 14 | 20 | — | (6 | ) | 7 | ||||||||||

| Proceeds from sale of securities | 363 | 154 | 209 | — | ||||||||||||

| Investments in securities | (417 | ) | (21 | ) | (396 | ) | — | |||||||||

| Other – net | 24 | 25 | (2 | ) | 1 | 8 | ||||||||||

| Net cash provided by (used for) investing activities | (2,414 | ) | (836 | ) | (1,998 | ) | 420 | |||||||||

| Cash flow from financing activities: | ||||||||||||||||

| Dividends paid | (1,444 | ) | (1,444 | ) | — | — | ||||||||||

| Common stock issued, including treasury shares reissued | 292 | 292 | 1 | (1 | ) | 8 | ||||||||||

| Common shares repurchased | (2,000 | ) | (2,000 | ) | — | — | ||||||||||

| Net intercompany borrowings | — | — | (66 | ) | 66 | 6 | ||||||||||

| Proceeds from debt issued > 90 days | 7,073 | 47 | 7,026 | — | ||||||||||||

| Payments on debt > 90 days | (5,642 | ) | (6 | ) | (5,636 | ) | — | |||||||||

| Short-term borrowings – net < 90 days | (465 | ) | 14 | (479 | ) | — | ||||||||||

| Other – net | (32 | ) | (32 | ) | — | — | ||||||||||

| Net cash provided by (used for) financing activities | (2,218 | ) | (3,129 | ) | 846 | 65 | ||||||||||

| Effect of exchange rate changes on cash | (117 | ) | (106 | ) | (11 | ) | — | |||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | (274 | ) | (191 | ) | (83 | ) | — | |||||||||

| Cash and short-term investments and restricted cash at beginning of period | 8,320 | 7,416 | 904 | — | ||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 8,046 | $ | 7,225 | $ | 821 | $ | — | ||||||||

1 | Represents Caterpillar Inc. and its subsidiaries with Financial Products accounted for on the equity basis. |

2 | Elimination of Financial Products’ profit after tax due to equity method of accounting. |

3 | Elimination of non-cash adjustment for the undistributed earnings from Financial Products. |

4 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. |

5 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. |

6 | Elimination of net proceeds and payments to/from Machinery, Energy & Transportation and Financial Products. |

7 | Elimination of proceeds received from Financial Products related to Machinery, Energy & Transportation's sale of businesses and investments. |

8 | Elimination of change in investment and common stock related to Financial Products. |

| Third Quarter | Full-Year Outlook | ||||||||

| 2018 | 2019 | Previous1 | Current2 | ||||||

| Profit per share | $2.88 | $2.66 | $12.06-$13.06 | $10.90-$11.40 | |||||

| Per share U.S. tax reform impact | — | — | ($0.31) | ($0.31) | |||||

Per share restructuring costs3 | $0.14 | — | — | — | |||||

| Per share deferred tax balance adjustment | ($0.16) | — | — | — | |||||

| Adjusted profit per share | $2.86 | $2.66 | $11.75-$12.75 | $10.59-$11.09 | |||||

1 Profit per share outlook range as of July 24, 2019. | |||||||||

2 Profit per share outlook range as of October 23, 2019. | |||||||||

3 2018 restructuring costs at an estimated annual tax rate of 24%. 2019 restructuring costs are not material. | |||||||||