- CAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Caterpillar (CAT) 8-K3Q 2020 Earnings Release

Filed: 27 Oct 20, 6:30am

| Third Quarter | |||||||||||||||||||||||

| ($ in billions except profit per share) | 2020 | 2019 | |||||||||||||||||||||

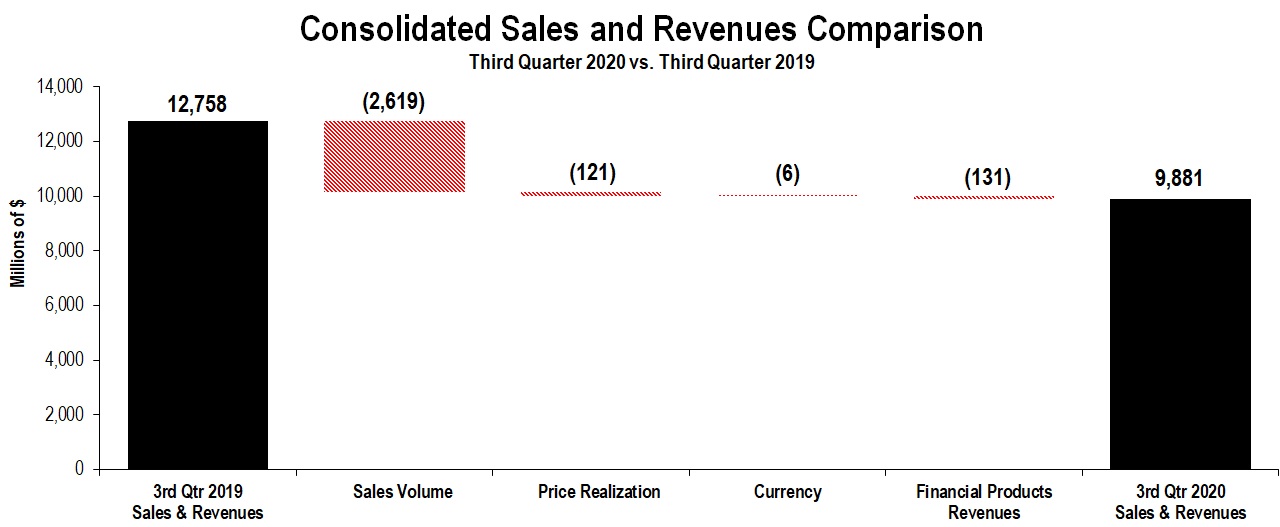

| Sales and Revenues | $9.9 | $12.8 | ● | Third-quarter sales and revenues decreased 23%; profit per share declined 54% | |||||||||||||||||||

| Profit Per Share | $1.22 | $2.66 | ● | Strong balance sheet; $9.3 billion of enterprise cash | |||||||||||||||||||

| Sales and Revenues by Segment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Third Quarter 2019 | Sales Volume | Price Realization | Currency | Inter-Segment / Other | Third Quarter 2020 | $ Change | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 5,289 | $ | (1,150) | $ | (60) | $ | (17) | $ | (6) | $ | 4,056 | $ | (1,233) | (23%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 2,310 | (425) | (46) | (4) | (19) | 1,816 | (494) | (21%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 5,452 | (1,086) | (16) | 15 | (204) | 4,161 | (1,291) | (24%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 111 | (3) | 1 | — | (3) | 106 | (5) | (5%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (1,188) | 45 | — | — | 232 | (911) | 277 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 11,974 | (2,619) | (121) | (6) | — | 9,228 | (2,746) | (23%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 865 | — | — | — | (141) | 724 | (141) | (16%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (81) | — | — | — | 10 | (71) | 10 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 784 | — | — | — | (131) | 653 | (131) | (17%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 12,758 | $ | (2,619) | $ | (121) | $ | (6) | $ | (131) | $ | 9,881 | $ | (2,877) | (23%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales and Revenues by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | Latin America | EAME | Asia/Pacific | External Sales and Revenues | Inter-Segment | Total Sales and Revenues | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 1,781 | (35%) | $ | 230 | (44%) | $ | 796 | (24%) | $ | 1,241 | 14% | $ | 4,048 | (23%) | $ | 8 | (43%) | $ | 4,056 | (23%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 487 | (38%) | 269 | (23%) | 384 | (3%) | 564 | (13%) | 1,704 | (22%) | 112 | (15%) | 1,816 | (21%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 1,584 | (26%) | 221 | (42%) | 1,113 | (9%) | 557 | (33%) | 3,475 | (24%) | 686 | (23%) | 4,161 | (24%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 10 | 900% | 1 | (83%) | 1 | (88%) | 13 | 8% | 25 | (7%) | 81 | (4%) | 106 | (5%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (22) | (2) | — | — | (24) | (887) | (911) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 3,840 | (31%) | 719 | (37%) | 2,294 | (14%) | 2,375 | (8%) | 9,228 | (23%) | — | —% | 9,228 | (23%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 448 | (20%) | 63 | (20%) | 100 | (2%) | 113 | (9%) | 724 | (16%) | — | —% | 724 | (16%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (37) | (10) | (10) | (14) | (71) | — | (71) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 411 | (21%) | 53 | (17%) | 90 | (4%) | 99 | (9%) | 653 | (17%) | — | —% | 653 | (17%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 4,251 | (30%) | $ | 772 | (36%) | $ | 2,384 | (14%) | $ | 2,474 | (8%) | $ | 9,881 | (23%) | $ | — | —% | $ | 9,881 | (23%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2019 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 2,728 | $ | 413 | $ | 1,048 | $ | 1,086 | $ | 5,275 | $ | 14 | $ | 5,289 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 789 | 349 | 396 | 645 | 2,179 | 131 | 2,310 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 2,129 | 378 | 1,224 | 831 | 4,562 | 890 | 5,452 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 1 | 6 | 8 | 12 | 27 | 84 | 111 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (62) | 1 | (7) | (1) | (69) | (1,119) | (1,188) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 5,585 | 1,147 | 2,669 | 2,573 | 11,974 | — | 11,974 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 560 | 79 | 102 | 124 | 865 | — | 865 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (43) | (15) | (8) | (15) | (81) | — | (81) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 517 | 64 | 94 | 109 | 784 | — | 784 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 6,102 | $ | 1,211 | $ | 2,763 | $ | 2,682 | $ | 12,758 | $ | — | $ | 12,758 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit (Loss) by Segment | ||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Third Quarter 2020 | Third Quarter 2019 | $ Change | % Change | ||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 585 | $ | 940 | $ | (355) | (38 | %) | ||||||||||||||||||||||||||||||||||||

| Resource Industries | 167 | 311 | (144) | (46 | %) | |||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 492 | 1,021 | (529) | (52 | %) | |||||||||||||||||||||||||||||||||||||||

| All Other Segment | 27 | (21) | 48 | n/a | ||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (346) | (363) | 17 | |||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 925 | 1,888 | (963) | (51 | %) | |||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 142 | 218 | (76) | (35 | %) | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (15) | 21 | (36) | |||||||||||||||||||||||||||||||||||||||||

| Financial Products | 127 | 239 | (112) | (47 | %) | |||||||||||||||||||||||||||||||||||||||

| Consolidating Adjustments | (67) | (107) | 40 | |||||||||||||||||||||||||||||||||||||||||

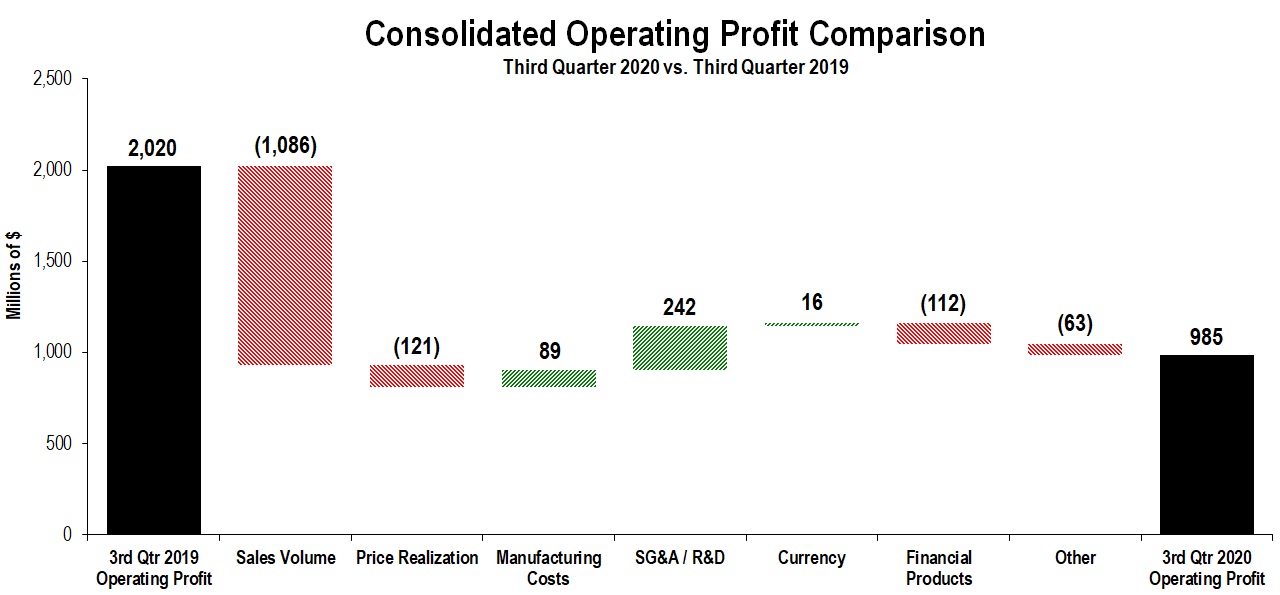

| Consolidated Operating Profit | $ | 985 | $ | 2,020 | $ | (1,035) | (51 | %) | ||||||||||||||||||||||||||||||||||||

| CONSTRUCTION INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2019 | Sales Volume | Price Realization | Currency | Inter-Segment | Third Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 5,289 | $ | (1,150) | $ | (60) | $ | (17) | $ | (6) | $ | 4,056 | $ | (1,233) | (23 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | Third Quarter 2019 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 1,781 | $ | 2,728 | $ | (947) | (35 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Latin America | 230 | 413 | (183) | (44 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EAME | 796 | 1,048 | (252) | (24 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 1,241 | 1,086 | 155 | 14 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 4,048 | 5,275 | (1,227) | (23 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 8 | 14 | (6) | (43 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 4,056 | $ | 5,289 | $ | (1,233) | (23 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | Third Quarter 2019 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 585 | $ | 940 | $ | (355) | (38 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 14.4 | % | 17.8 | % | (3.4 pts) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RESOURCE INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2019 | Sales Volume | Price Realization | Currency | Inter-Segment | Third Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 2,310 | $ | (425) | $ | (46) | $ | (4) | $ | (19) | $ | 1,816 | $ | (494) | (21 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | Third Quarter 2019 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 487 | $ | 789 | $ | (302) | (38 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Latin America | 269 | 349 | (80) | (23 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EAME | 384 | 396 | (12) | (3 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 564 | 645 | (81) | (13 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 1,704 | 2,179 | (475) | (22 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 112 | 131 | (19) | (15 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 1,816 | $ | 2,310 | $ | (494) | (21 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | Third Quarter 2019 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 167 | $ | 311 | $ | (144) | (46 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 9.2 | % | 13.5 | % | (4.3 pts) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ENERGY & TRANSPORTATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2019 | Sales Volume | Price Realization | Currency | Inter-Segment | Third Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 5,452 | $ | (1,086) | $ | (16) | $ | 15 | $ | (204) | $ | 4,161 | $ | (1,291) | (24 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales by Application | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | Third Quarter 2019 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oil and Gas | $ | 734 | $ | 1,246 | $ | (512) | (41 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Power Generation | 1,034 | 1,123 | (89) | (8 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Industrial | 730 | 980 | (250) | (26 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transportation | 977 | 1,213 | (236) | (19 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 3,475 | 4,562 | (1,087) | (24 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 686 | 890 | (204) | (23 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 4,161 | $ | 5,452 | $ | (1,291) | (24 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | Third Quarter 2019 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 492 | $ | 1,021 | $ | (529) | (52 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 11.8 | % | 18.7 | % | (6.9 pts) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL PRODUCTS SEGMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | Third Quarter 2019 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 448 | $ | 560 | $ | (112) | (20 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Latin America | 63 | 79 | (16) | (20 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| EAME | 100 | 102 | (2) | (2 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 113 | 124 | (11) | (9 | %) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 724 | $ | 865 | $ | (141) | (16 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter 2020 | Third Quarter 2019 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 142 | $ | 218 | $ | (76) | (35 | %) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Third Quarter | ||||||||||||||||||||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||||||||||||||||||||

| Profit per share | $ | 1.22 | $ | 2.66 | ||||||||||||||||||||||||||||||||||

Per share remeasurement losses of pension obligations1 | $ | 0.12 | $ | — | ||||||||||||||||||||||||||||||||||

| Adjusted profit per share | $ | 1.34 | $ | 2.66 | ||||||||||||||||||||||||||||||||||

1 At statutory tax rates. | ||||||||||||||||||||||||||||||||||||||

| Note: On March 26, 2020, the company withdrew its previous financial outlook due to the continued global economic uncertainty related to the COVID-19 pandemic. | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||||||||||||||

| Sales and revenues: | |||||||||||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 9,228 | $ | 11,974 | $ | 28,452 | $ | 38,369 | |||||||||||||||||||||||||||

| Revenues of Financial Products | 653 | 784 | 2,061 | 2,287 | |||||||||||||||||||||||||||||||

| Total sales and revenues | 9,881 | 12,758 | 30,513 | 40,656 | |||||||||||||||||||||||||||||||

| Operating costs: | |||||||||||||||||||||||||||||||||||

| Cost of goods sold | 6,919 | 8,569 | 21,298 | 27,513 | |||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 1,126 | 1,251 | 3,426 | 3,879 | |||||||||||||||||||||||||||||||

| Research and development expenses | 344 | 431 | 1,041 | 1,307 | |||||||||||||||||||||||||||||||

| Interest expense of Financial Products | 137 | 189 | 461 | 571 | |||||||||||||||||||||||||||||||

| Other operating (income) expenses | 370 | 298 | 1,114 | 946 | |||||||||||||||||||||||||||||||

| Total operating costs | 8,896 | 10,738 | 27,340 | 34,216 | |||||||||||||||||||||||||||||||

| Operating profit | 985 | 2,020 | 3,173 | 6,440 | |||||||||||||||||||||||||||||||

| Interest expense excluding Financial Products | 136 | 103 | 384 | 309 | |||||||||||||||||||||||||||||||

| Other income (expense) | 14 | 88 | 265 | 316 | |||||||||||||||||||||||||||||||

| Consolidated profit before taxes | 863 | 2,005 | 3,054 | 6,447 | |||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 187 | 518 | 839 | 1,470 | |||||||||||||||||||||||||||||||

| Profit of consolidated companies | 676 | 1,487 | 2,215 | 4,977 | |||||||||||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | (5) | 7 | 8 | 20 | |||||||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | 671 | 1,494 | 2,223 | 4,997 | |||||||||||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 3 | — | 5 | 2 | |||||||||||||||||||||||||||||||

Profit 1 | $ | 668 | $ | 1,494 | $ | 2,218 | $ | 4,995 | |||||||||||||||||||||||||||

| Profit per common share | $ | 1.23 | $ | 2.69 | $ | 4.08 | $ | 8.84 | |||||||||||||||||||||||||||

Profit per common share — diluted 2 | $ | 1.22 | $ | 2.66 | $ | 4.05 | $ | 8.75 | |||||||||||||||||||||||||||

| Weighted-average common shares outstanding (millions) | |||||||||||||||||||||||||||||||||||

| – Basic | 542.3 | 556.3 | 543.9 | 565.2 | |||||||||||||||||||||||||||||||

– Diluted 2 | 546.4 | 561.2 | 547.8 | 570.8 | |||||||||||||||||||||||||||||||

| 1 | Profit attributable to common shareholders. | ||||

| 2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. | ||||

| September 30, 2020 | December 31, 2019 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and short-term investments | $ | 9,315 | $ | 8,284 | |||||||

| Receivables – trade and other | 6,969 | 8,568 | |||||||||

| Receivables – finance | 8,966 | 9,336 | |||||||||

| Prepaid expenses and other current assets | 1,831 | 1,739 | |||||||||

| Inventories | 11,453 | 11,266 | |||||||||

| Total current assets | 38,534 | 39,193 | |||||||||

| Property, plant and equipment – net | 12,232 | 12,904 | |||||||||

| Long-term receivables – trade and other | 1,149 | 1,193 | |||||||||

| Long-term receivables – finance | 12,209 | 12,651 | |||||||||

| Noncurrent deferred and refundable income taxes | 1,440 | 1,411 | |||||||||

| Intangible assets | 1,363 | 1,565 | |||||||||

| Goodwill | 6,304 | 6,196 | |||||||||

| Other assets | 3,510 | 3,340 | |||||||||

| Total assets | $ | 76,741 | $ | 78,453 | |||||||

| Liabilities | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings: | |||||||||||

| -- Machinery, Energy & Transportation | $ | — | $ | 5 | |||||||

| -- Financial Products | 2,660 | 5,161 | |||||||||

| Accounts payable | 5,193 | 5,957 | |||||||||

| Accrued expenses | 3,510 | 3,750 | |||||||||

| Accrued wages, salaries and employee benefits | 1,069 | 1,629 | |||||||||

| Customer advances | 1,209 | 1,187 | |||||||||

| Dividends payable | — | 567 | |||||||||

| Other current liabilities | 1,978 | 2,155 | |||||||||

| Long-term debt due within one year: | |||||||||||

| -- Machinery, Energy & Transportation | 1,397 | 16 | |||||||||

| -- Financial Products | 7,962 | 6,194 | |||||||||

| Total current liabilities | 24,978 | 26,621 | |||||||||

| Long-term debt due after one year: | |||||||||||

| -- Machinery, Energy & Transportation | 9,742 | 9,141 | |||||||||

| -- Financial Products | 16,365 | 17,140 | |||||||||

| Liability for postemployment benefits | 6,254 | 6,599 | |||||||||

| Other liabilities | 4,408 | 4,323 | |||||||||

| Total liabilities | 61,747 | 63,824 | |||||||||

| Shareholders’ equity | |||||||||||

| Common stock | 6,204 | 5,935 | |||||||||

| Treasury stock | (25,315) | (24,217) | |||||||||

| Profit employed in the business | 35,508 | 34,437 | |||||||||

| Accumulated other comprehensive income (loss) | (1,448) | (1,567) | |||||||||

| Noncontrolling interests | 45 | 41 | |||||||||

| Total shareholders’ equity | 14,994 | 14,629 | |||||||||

| Total liabilities and shareholders’ equity | $ | 76,741 | $ | 78,453 | |||||||

| Nine Months Ended September 30, | |||||||||||||||||

| 2020 | 2019 | ||||||||||||||||

| Cash flow from operating activities: | |||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 2,223 | $ | 4,997 | |||||||||||||

| Adjustments for non-cash items: | |||||||||||||||||

| Depreciation and amortization | 1,815 | 1,933 | |||||||||||||||

| Net gain on remeasurement of pension obligations | (55) | — | |||||||||||||||

| Provision (benefit) for deferred income taxes | (38) | (13) | |||||||||||||||

| Other | 919 | 627 | |||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||||||||||||

| Receivables – trade and other | 1,473 | 427 | |||||||||||||||

| Inventories | (139) | (676) | |||||||||||||||

| Accounts payable | (596) | (669) | |||||||||||||||

| Accrued expenses | (286) | 114 | |||||||||||||||

| Accrued wages, salaries and employee benefits | (547) | (858) | |||||||||||||||

| Customer advances | 13 | 169 | |||||||||||||||

| Other assets – net | (15) | 19 | |||||||||||||||

| Other liabilities – net | (512) | (1,592) | |||||||||||||||

| Net cash provided by (used for) operating activities | 4,255 | 4,478 | |||||||||||||||

| Cash flow from investing activities: | |||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (686) | (723) | |||||||||||||||

| Expenditures for equipment leased to others | (805) | (1,133) | |||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 550 | 812 | |||||||||||||||

| Additions to finance receivables | (9,278) | (9,453) | |||||||||||||||

| Collections of finance receivables | 9,656 | 9,144 | |||||||||||||||

| Proceeds from sale of finance receivables | 37 | 183 | |||||||||||||||

| Investments and acquisitions (net of cash acquired) | (93) | (6) | |||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 13 | 3 | |||||||||||||||

| Proceeds from sale of securities | 239 | 281 | |||||||||||||||

| Investments in securities | (512) | (425) | |||||||||||||||

| Other – net | (80) | (37) | |||||||||||||||

| Net cash provided by (used for) investing activities | (959) | (1,354) | |||||||||||||||

| Cash flow from financing activities: | |||||||||||||||||

| Dividends paid | (1,683) | (1,564) | |||||||||||||||

| Common stock issued, including treasury shares reissued | 110 | 59 | |||||||||||||||

| Common shares repurchased | (1,130) | (3,283) | |||||||||||||||

| Proceeds from debt issued (original maturities greater than three months) | 9,418 | 8,827 | |||||||||||||||

| Payments on debt (original maturities greater than three months) | (6,789) | (6,062) | |||||||||||||||

| Short-term borrowings – net (original maturities three months or less) | (2,138) | (1,006) | |||||||||||||||

| Other – net | (1) | (2) | |||||||||||||||

| Net cash provided by (used for) financing activities | (2,213) | (3,031) | |||||||||||||||

| Effect of exchange rate changes on cash | (56) | (47) | |||||||||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 1,027 | 46 | |||||||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 8,292 | 7,890 | |||||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 9,319 | $ | 7,936 | |||||||||||||

| All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. | ||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 9,228 | $ | 9,228 | $ | — | $ | — | ||||||||||||||||||||||||||||||

| Revenues of Financial Products | 653 | — | 740 | (87) | 1 | |||||||||||||||||||||||||||||||||

| Total sales and revenues | 9,881 | 9,228 | 740 | (87) | ||||||||||||||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||||||||||||||

| Cost of goods sold | 6,919 | 6,921 | — | (2) | 2 | |||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 1,126 | 943 | 189 | (6) | 2 | |||||||||||||||||||||||||||||||||

| Research and development expenses | 344 | 344 | — | — | ||||||||||||||||||||||||||||||||||

| Interest expense of Financial Products | 137 | — | 137 | — | ||||||||||||||||||||||||||||||||||

| Other operating (income) expenses | 370 | 95 | 287 | (12) | 2 | |||||||||||||||||||||||||||||||||

| Total operating costs | 8,896 | 8,303 | 613 | (20) | ||||||||||||||||||||||||||||||||||

| Operating profit | 985 | 925 | 127 | (67) | ||||||||||||||||||||||||||||||||||

| Interest expense excluding Financial Products | 136 | 136 | — | — | ||||||||||||||||||||||||||||||||||

| Other income (expense) | 14 | (62) | 9 | 67 | 3 | |||||||||||||||||||||||||||||||||

| Consolidated profit before taxes | 863 | 727 | 136 | — | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 187 | 133 | 54 | — | ||||||||||||||||||||||||||||||||||

| Profit of consolidated companies | 676 | 594 | 82 | — | ||||||||||||||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | (5) | (4) | — | (1) | 4 | |||||||||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | 671 | 590 | 82 | (1) | ||||||||||||||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 3 | — | 4 | (1) | 5 | |||||||||||||||||||||||||||||||||

Profit 6 | $ | 668 | $ | 590 | $ | 78 | $ | — | ||||||||||||||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 11,974 | $ | 11,974 | $ | — | $ | — | ||||||||||||||||||||||||||||||

| Revenues of Financial Products | 784 | — | 920 | (136) | 1 | |||||||||||||||||||||||||||||||||

| Total sales and revenues | 12,758 | 11,974 | 920 | (136) | ||||||||||||||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||||||||||||||

| Cost of goods sold | 8,569 | 8,569 | — | — | ||||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 1,251 | 1,095 | 163 | (7) | 2 | |||||||||||||||||||||||||||||||||

| Research and development expenses | 431 | 431 | — | — | ||||||||||||||||||||||||||||||||||

| Interest expense of Financial Products | 189 | — | 198 | (9) | 3 | |||||||||||||||||||||||||||||||||

| Other operating (income) expenses | 298 | (9) | 320 | (13) | 2 | |||||||||||||||||||||||||||||||||

| Total operating costs | 10,738 | 10,086 | 681 | (29) | ||||||||||||||||||||||||||||||||||

| Operating profit | 2,020 | 1,888 | 239 | (107) | ||||||||||||||||||||||||||||||||||

| Interest expense excluding Financial Products | 103 | 103 | — | — | ||||||||||||||||||||||||||||||||||

| Other income (expense) | 88 | (27) | 8 | 107 | 4 | |||||||||||||||||||||||||||||||||

| Consolidated profit before taxes | 2,005 | 1,758 | 247 | — | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 518 | 457 | 61 | — | ||||||||||||||||||||||||||||||||||

| Profit of consolidated companies | 1,487 | 1,301 | 186 | — | ||||||||||||||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 7 | 12 | — | (5) | 5 | |||||||||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | 1,494 | 1,313 | 186 | (5) | ||||||||||||||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | (1) | 6 | (5) | 6 | |||||||||||||||||||||||||||||||||

Profit 7 | $ | 1,494 | $ | 1,314 | $ | 180 | $ | — | ||||||||||||||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 7 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 28,452 | $ | 28,452 | $ | — | $ | — | ||||||||||||||||||||||||||||||

| Revenues of Financial Products | 2,061 | — | 2,350 | (289) | 1 | |||||||||||||||||||||||||||||||||

| Total sales and revenues | 30,513 | 28,452 | 2,350 | (289) | ||||||||||||||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||||||||||||||

| Cost of goods sold | 21,298 | 21,302 | — | (4) | 2 | |||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 3,426 | 2,867 | 572 | (13) | 2 | |||||||||||||||||||||||||||||||||

| Research and development expenses | 1,041 | 1,041 | — | — | ||||||||||||||||||||||||||||||||||

| Interest expense of Financial Products | 461 | — | 462 | (1) | 3 | |||||||||||||||||||||||||||||||||

| Other operating (income) expenses | 1,114 | 227 | 927 | (40) | 2 | |||||||||||||||||||||||||||||||||

| Total operating costs | 27,340 | 25,437 | 1,961 | (58) | ||||||||||||||||||||||||||||||||||

| Operating profit | 3,173 | 3,015 | 389 | (231) | ||||||||||||||||||||||||||||||||||

| Interest expense excluding Financial Products | 384 | 383 | — | 1 | 3 | |||||||||||||||||||||||||||||||||

| Other income (expense) | 265 | 60 | (7) | 212 | 4 | |||||||||||||||||||||||||||||||||

| Consolidated profit before taxes | 3,054 | 2,692 | 382 | (20) | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 839 | 720 | 119 | — | ||||||||||||||||||||||||||||||||||

| Profit of consolidated companies | 2,215 | 1,972 | 263 | (20) | ||||||||||||||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 8 | 18 | — | (10) | 5 | |||||||||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | 2,223 | 1,990 | 263 | (30) | ||||||||||||||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 5 | 2 | 13 | (10) | 6 | |||||||||||||||||||||||||||||||||

Profit 7 | $ | 2,218 | $ | 1,988 | $ | 250 | $ | (20) | ||||||||||||||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 7 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 38,369 | $ | 38,369 | $ | — | $ | — | ||||||||||||||||||||||||||||||

| Revenues of Financial Products | 2,287 | — | 2,684 | (397) | 1 | |||||||||||||||||||||||||||||||||

| Total sales and revenues | 40,656 | 38,369 | 2,684 | (397) | ||||||||||||||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||||||||||||||

| Cost of goods sold | 27,513 | 27,515 | — | (2) | 2 | |||||||||||||||||||||||||||||||||

| Selling, general and administrative expenses | 3,879 | 3,324 | 564 | (9) | 2 | |||||||||||||||||||||||||||||||||

| Research and development expenses | 1,307 | 1,307 | — | — | ||||||||||||||||||||||||||||||||||

| Interest expense of Financial Products | 571 | — | 599 | (28) | 3 | |||||||||||||||||||||||||||||||||

| Other operating (income) expenses | 946 | 2 | 974 | (30) | 2 | |||||||||||||||||||||||||||||||||

| Total operating costs | 34,216 | 32,148 | 2,137 | (69) | ||||||||||||||||||||||||||||||||||

| Operating profit | 6,440 | 6,221 | 547 | (328) | ||||||||||||||||||||||||||||||||||

| Interest expense excluding Financial Products | 309 | 318 | — | (9) | 3 | |||||||||||||||||||||||||||||||||

| Other income (expense) | 316 | (71) | 68 | 319 | 4 | |||||||||||||||||||||||||||||||||

| Consolidated profit before taxes | 6,447 | 5,832 | 615 | — | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for income taxes | 1,470 | 1,294 | 176 | — | ||||||||||||||||||||||||||||||||||

| Profit of consolidated companies | 4,977 | 4,538 | 439 | — | ||||||||||||||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 20 | 36 | — | (16) | 5 | |||||||||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | 4,997 | 4,574 | 439 | (16) | ||||||||||||||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | 1 | 17 | (16) | 6 | |||||||||||||||||||||||||||||||||

Profit 7 | $ | 4,995 | $ | 4,573 | $ | 422 | $ | — | ||||||||||||||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 7 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||||||||||||||

| Cash and short-term investments | $ | 9,315 | $ | 8,512 | $ | 803 | $ | — | ||||||||||||||||||||||||||||||

| Receivables – trade and other | 6,969 | 2,484 | 497 | 3,988 | 1,2 | |||||||||||||||||||||||||||||||||

| Receivables – finance | 8,966 | — | 13,120 | (4,154) | 2 | |||||||||||||||||||||||||||||||||

| Prepaid expenses and other current assets | 1,831 | 1,372 | 634 | (175) | 3 | |||||||||||||||||||||||||||||||||

| Inventories | 11,453 | 11,453 | — | — | ||||||||||||||||||||||||||||||||||

| Total current assets | 38,534 | 23,821 | 15,054 | (341) | ||||||||||||||||||||||||||||||||||

| Property, plant and equipment – net | 12,232 | 8,156 | 4,076 | — | ||||||||||||||||||||||||||||||||||

| Long-term receivables – trade and other | 1,149 | 294 | 181 | 674 | 1,2 | |||||||||||||||||||||||||||||||||

| Long-term receivables – finance | 12,209 | — | 12,900 | (691) | 2 | |||||||||||||||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 1,440 | 1,979 | 101 | (640) | 4 | |||||||||||||||||||||||||||||||||

| Intangible assets | 1,363 | 1,363 | — | — | ||||||||||||||||||||||||||||||||||

| Goodwill | 6,304 | 6,304 | — | — | ||||||||||||||||||||||||||||||||||

| Other assets | 3,510 | 2,887 | 1,815 | (1,192) | 5 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 76,741 | $ | 44,804 | $ | 34,127 | $ | (2,190) | ||||||||||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | $ | 2,660 | $ | — | $ | 2,660 | $ | — | ||||||||||||||||||||||||||||||

| Short-term borrowings with consolidated companies | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Accounts payable | 5,193 | 5,174 | 187 | (168) | 6 | |||||||||||||||||||||||||||||||||

| Accrued expenses | 3,510 | 3,131 | 379 | — | ||||||||||||||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 1,069 | 1,055 | 14 | — | ||||||||||||||||||||||||||||||||||

| Customer advances | 1,209 | 1,209 | — | — | ||||||||||||||||||||||||||||||||||

| Dividends payable | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other current liabilities | 1,978 | 1,509 | 666 | (197) | 4,7 | |||||||||||||||||||||||||||||||||

| Long-term debt due within one year | 9,359 | 1,397 | 7,962 | — | ||||||||||||||||||||||||||||||||||

| Total current liabilities | 24,978 | 13,475 | 11,868 | (365) | ||||||||||||||||||||||||||||||||||

| Long-term debt due after one year | 26,107 | 9,757 | 16,365 | (15) | 8 | |||||||||||||||||||||||||||||||||

| Liability for postemployment benefits | 6,254 | 6,253 | 1 | — | ||||||||||||||||||||||||||||||||||

| Other liabilities | 4,408 | 3,739 | 1,384 | (715) | 4 | |||||||||||||||||||||||||||||||||

| Total liabilities | 61,747 | 33,224 | 29,618 | (1,095) | ||||||||||||||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||||||||||||||

| Common stock | 6,204 | 6,204 | 919 | (919) | 9 | |||||||||||||||||||||||||||||||||

| Treasury stock | (25,315) | (25,315) | — | — | ||||||||||||||||||||||||||||||||||

| Profit employed in the business | 35,508 | 31,285 | 4,214 | 9 | 9 | |||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (1,448) | (636) | (812) | — | ||||||||||||||||||||||||||||||||||

| Noncontrolling interests | 45 | 42 | 188 | (185) | 9 | |||||||||||||||||||||||||||||||||

| Total shareholders’ equity | 14,994 | 11,580 | 4,509 | (1,095) | ||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 76,741 | $ | 44,804 | $ | 34,127 | $ | (2,190) | ||||||||||||||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. | ||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. | ||||

| 3 | Elimination of ME&T's insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. | ||||

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. | ||||

| 6 | Elimination of payables between ME&T and Financial Products. | ||||

| 7 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 8 | Elimination of debt between ME&T and Financial Products. | ||||

| 9 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||||||||||||||

| Cash and short-term investments | $ | 8,284 | $ | 7,299 | $ | 985 | $ | — | ||||||||||||||||||||||||||||||

| Receivables – trade and other | 8,568 | 3,737 | 451 | 4,380 | 1,2 | |||||||||||||||||||||||||||||||||

| Receivables – finance | 9,336 | — | 14,489 | (5,153) | 2 | |||||||||||||||||||||||||||||||||

| Prepaid expenses and other current assets | 1,739 | 1,290 | 529 | (80) | 3 | |||||||||||||||||||||||||||||||||

| Inventories | 11,266 | 11,266 | — | — | ||||||||||||||||||||||||||||||||||

| Total current assets | 39,193 | 23,592 | 16,454 | (853) | ||||||||||||||||||||||||||||||||||

| Property, plant and equipment – net | 12,904 | 8,606 | 4,298 | — | ||||||||||||||||||||||||||||||||||

| Long-term receivables – trade and other | 1,193 | 348 | 152 | 693 | 1,2 | |||||||||||||||||||||||||||||||||

| Long-term receivables – finance | 12,651 | — | 13,354 | (703) | 2 | |||||||||||||||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 1,411 | 2,002 | 117 | (708) | 4 | |||||||||||||||||||||||||||||||||

| Intangible assets | 1,565 | 1,565 | — | — | ||||||||||||||||||||||||||||||||||

| Goodwill | 6,196 | 6,196 | — | — | ||||||||||||||||||||||||||||||||||

| Other assets | 3,340 | 2,953 | 1,572 | (1,185) | 5 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 78,453 | $ | 45,262 | $ | 35,947 | $ | (2,756) | ||||||||||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | $ | 5,166 | $ | 5 | $ | 5,161 | $ | — | ||||||||||||||||||||||||||||||

| Short-term borrowings with consolidated companies | — | — | 600 | (600) | 6 | |||||||||||||||||||||||||||||||||

| Accounts payable | 5,957 | 5,918 | 212 | (173) | 7 | |||||||||||||||||||||||||||||||||

| Accrued expenses | 3,750 | 3,415 | 335 | — | ||||||||||||||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 1,629 | 1,580 | 49 | — | ||||||||||||||||||||||||||||||||||

| Customer advances | 1,187 | 1,187 | — | — | ||||||||||||||||||||||||||||||||||

| Dividends payable | 567 | 567 | — | — | ||||||||||||||||||||||||||||||||||

| Other current liabilities | 2,155 | 1,689 | 566 | (100) | 4,8 | |||||||||||||||||||||||||||||||||

| Long-term debt due within one year | 6,210 | 16 | 6,194 | — | ||||||||||||||||||||||||||||||||||

| Total current liabilities | 26,621 | 14,377 | 13,117 | (873) | ||||||||||||||||||||||||||||||||||

| Long-term debt due after one year | 26,281 | 9,151 | 17,140 | (10) | 6 | |||||||||||||||||||||||||||||||||

| Liability for postemployment benefits | 6,599 | 6,599 | — | — | ||||||||||||||||||||||||||||||||||

| Other liabilities | 4,323 | 3,681 | 1,430 | (788) | 4 | |||||||||||||||||||||||||||||||||

| Total liabilities | 63,824 | 33,808 | 31,687 | (1,671) | ||||||||||||||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||||||||||||||

| Common stock | 5,935 | 5,935 | 919 | (919) | 9 | |||||||||||||||||||||||||||||||||

| Treasury stock | (24,217) | (24,217) | — | — | ||||||||||||||||||||||||||||||||||

| Profit employed in the business | 34,437 | 30,434 | 3,997 | 6 | 9 | |||||||||||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (1,567) | (739) | (828) | — | ||||||||||||||||||||||||||||||||||

| Noncontrolling interests | 41 | 41 | 172 | (172) | 9 | |||||||||||||||||||||||||||||||||

| Total shareholders’ equity | 14,629 | 11,454 | 4,260 | (1,085) | ||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 78,453 | $ | 45,262 | $ | 35,947 | $ | (2,756) | ||||||||||||||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. | ||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. | ||||

| 3 | Elimination of ME&T’s insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. | ||||

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. | ||||

| 6 | Elimination of debt between ME&T and Financial Products. | ||||

| 7 | Elimination of payables between ME&T and Financial Products. | ||||

| 8 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 9 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 2,223 | $ | 1,990 | $ | 263 | $ | (30) | 1, 5 | |||||||||||||||||||||||||||||

| Adjustments for non-cash items: | ||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 1,815 | 1,217 | 598 | — | ||||||||||||||||||||||||||||||||||

| Net gain on remeasurement of pension obligations | (55) | (55) | — | — | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | (38) | (5) | (33) | — | ||||||||||||||||||||||||||||||||||

| Other | 919 | 494 | 167 | 258 | 2 | |||||||||||||||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||||||||||||||

| Receivables – trade and other | 1,473 | 616 | (54) | 911 | 2, 3 | |||||||||||||||||||||||||||||||||

| Inventories | (139) | (130) | — | (9) | 2 | |||||||||||||||||||||||||||||||||

| Accounts payable | (596) | (599) | (6) | 9 | 2 | |||||||||||||||||||||||||||||||||

| Accrued expenses | (286) | (314) | 28 | — | ||||||||||||||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | (547) | (512) | (35) | — | ||||||||||||||||||||||||||||||||||

| Customer advances | 13 | 13 | — | — | ||||||||||||||||||||||||||||||||||

| Other assets – net | (15) | (136) | 26 | 95 | 2 | |||||||||||||||||||||||||||||||||

| Other liabilities – net | (512) | (514) | 83 | (81) | 2 | |||||||||||||||||||||||||||||||||

| Net cash provided by (used for) operating activities | 4,255 | 2,065 | 1,037 | 1,153 | ||||||||||||||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (686) | (687) | (11) | 12 | 2 | |||||||||||||||||||||||||||||||||

| Expenditures for equipment leased to others | (805) | 2 | (823) | 16 | 2 | |||||||||||||||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 550 | 119 | 451 | (20) | 2 | |||||||||||||||||||||||||||||||||

| Additions to finance receivables | (9,278) | — | (10,234) | 956 | 3 | |||||||||||||||||||||||||||||||||

| Collections of finance receivables | 9,656 | — | 10,822 | (1,166) | 3 | |||||||||||||||||||||||||||||||||

| Net intercompany purchased receivables | — | — | 971 | (971) | 3 | |||||||||||||||||||||||||||||||||

| Proceeds from sale of finance receivables | 37 | — | 37 | — | ||||||||||||||||||||||||||||||||||

| Net intercompany borrowings | — | 599 | 6 | (605) | 4 | |||||||||||||||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (93) | (93) | — | — | ||||||||||||||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 13 | 13 | — | — | ||||||||||||||||||||||||||||||||||

| Proceeds from sale of securities | 239 | 17 | 222 | — | ||||||||||||||||||||||||||||||||||

| Investments in securities | (512) | (15) | (497) | — | ||||||||||||||||||||||||||||||||||

| Other – net | (80) | (21) | (59) | — | ||||||||||||||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (959) | (66) | 885 | (1,778) | ||||||||||||||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||||||||||||||

| Dividends paid | (1,683) | (1,683) | (20) | 20 | 5 | |||||||||||||||||||||||||||||||||

| Common stock issued, including treasury shares reissued | 110 | 110 | — | — | ||||||||||||||||||||||||||||||||||

| Common shares repurchased | (1,130) | (1,130) | — | — | ||||||||||||||||||||||||||||||||||

| Net intercompany borrowings | — | (6) | (599) | 605 | 4 | |||||||||||||||||||||||||||||||||

| Proceeds from debt issued > 90 days | 9,418 | 1,991 | 7,427 | — | ||||||||||||||||||||||||||||||||||

| Payments on debt > 90 days | (6,789) | (18) | (6,771) | — | ||||||||||||||||||||||||||||||||||

| Short-term borrowings – net < 90 days | (2,138) | (5) | (2,133) | — | ||||||||||||||||||||||||||||||||||

| Other – net | (1) | (1) | — | — | ||||||||||||||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (2,213) | (742) | (2,096) | 625 | ||||||||||||||||||||||||||||||||||

| Effect of exchange rate changes on cash | (56) | (47) | (9) | — | ||||||||||||||||||||||||||||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 1,027 | 1,210 | (183) | — | ||||||||||||||||||||||||||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 8,292 | 7,302 | 990 | — | ||||||||||||||||||||||||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 9,319 | $ | 8,512 | $ | 807 | $ | — | ||||||||||||||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | ||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | ||||

| 5 | Elimination of dividend activity between Financial Products and ME&T. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 4,997 | $ | 4,574 | $ | 439 | $ | (16) | 1 | |||||||||||||||||||||||||||||

| Adjustments for non-cash items: | ||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 1,933 | 1,283 | 650 | — | ||||||||||||||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | (13) | 9 | (22) | — | ||||||||||||||||||||||||||||||||||

| Other | 627 | 379 | (111) | 359 | 2 | |||||||||||||||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||||||||||||||

| Receivables – trade and other | 427 | 125 | (16) | 318 | 2, 3 | |||||||||||||||||||||||||||||||||

| Inventories | (676) | (702) | — | 26 | 2 | |||||||||||||||||||||||||||||||||

| Accounts payable | (669) | (651) | 6 | (24) | 2 | |||||||||||||||||||||||||||||||||

| Accrued expenses | 114 | 105 | 11 | (2) | 2 | |||||||||||||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | (858) | (865) | 7 | — | ||||||||||||||||||||||||||||||||||

| Customer advances | 169 | 171 | — | (2) | 2 | |||||||||||||||||||||||||||||||||

| Other assets – net | 19 | (66) | 63 | 22 | 2 | |||||||||||||||||||||||||||||||||

| Other liabilities – net | (1,592) | (1,730) | 150 | (12) | 2 | |||||||||||||||||||||||||||||||||

| Net cash provided by (used for) operating activities | 4,478 | 2,632 | 1,177 | 669 | ||||||||||||||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (723) | (709) | (14) | — | ||||||||||||||||||||||||||||||||||

| Expenditures for equipment leased to others | (1,133) | (21) | (1,151) | 39 | 2 | |||||||||||||||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 812 | 149 | 766 | (103) | 2 | |||||||||||||||||||||||||||||||||

| Additions to finance receivables | (9,453) | — | (10,633) | 1,180 | 3 | |||||||||||||||||||||||||||||||||

| Collections of finance receivables | 9,144 | — | 10,166 | (1,022) | 3 | |||||||||||||||||||||||||||||||||

| Net intercompany purchased receivables | — | — | 763 | (763) | 3 | |||||||||||||||||||||||||||||||||

| Proceeds from sale of finance receivables | 183 | — | 183 | — | ||||||||||||||||||||||||||||||||||

| Net intercompany borrowings | — | 721 | 1 | (722) | 4 | |||||||||||||||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (6) | (6) | — | — | ||||||||||||||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 3 | 3 | — | — | ||||||||||||||||||||||||||||||||||

| Proceeds from sale of securities | 281 | 16 | 265 | — | ||||||||||||||||||||||||||||||||||

| Investments in securities | (425) | (16) | (409) | — | ||||||||||||||||||||||||||||||||||

| Other – net | (37) | 1 | (38) | — | ||||||||||||||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (1,354) | 138 | (101) | (1,391) | ||||||||||||||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||||||||||||||

| Dividends paid | (1,564) | (1,564) | — | — | ||||||||||||||||||||||||||||||||||

| Common stock issued, including treasury shares reissued | 59 | 59 | — | — | ||||||||||||||||||||||||||||||||||

| Common shares repurchased | (3,283) | (3,283) | — | — | ||||||||||||||||||||||||||||||||||

| Net intercompany borrowings | — | (1) | (721) | 722 | 4 | |||||||||||||||||||||||||||||||||

| Proceeds from debt issued > 90 days | 8,827 | 1,479 | 7,348 | — | ||||||||||||||||||||||||||||||||||

| Payments on debt > 90 days | (6,062) | (8) | (6,054) | — | ||||||||||||||||||||||||||||||||||

| Short-term borrowings – net < 90 days | (1,006) | — | (1,006) | — | ||||||||||||||||||||||||||||||||||

| Other – net | (2) | (2) | — | — | ||||||||||||||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (3,031) | (3,320) | (433) | 722 | ||||||||||||||||||||||||||||||||||

| Effect of exchange rate changes on cash | (47) | (38) | (9) | — | ||||||||||||||||||||||||||||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 46 | (588) | 634 | — | ||||||||||||||||||||||||||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 7,890 | 6,994 | 896 | — | ||||||||||||||||||||||||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 7,936 | $ | 6,406 | $ | 1,530 | $ | — | ||||||||||||||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | ||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | ||||