Exhibit 99.1

Caterpillar Inc.

4Q 2020 Earnings Release

January 29, 2021

FOR IMMEDIATE RELEASE

Caterpillar Reports Fourth-Quarter and Full-Year 2020 Results

| ● | Caterpillar reports strong operational performance | ||||

| ● | Fourth-quarter 2020 profit per share of $1.42; adjusted profit per share of $2.12 | ||||

| ● | Full-year operating profit margin percentage of 10.9%; adjusted operating profit margin of 11.8%, within 2019 Investor Day target range | ||||

| ● | Returned $3.4 billion to shareholders through dividends and share repurchases in 2020 | ||||

| Fourth Quarter | Full Year | |||||||||||||||||||

| ($ in billions except profit per share) | 2020 | 2019 | 2020 | 2019 | ||||||||||||||||

| Sales and Revenues | $11.2 | $13.1 | $41.7 | $53.8 | ||||||||||||||||

| Profit Per Share | $1.42 | $1.97 | $5.46 | $10.74 | ||||||||||||||||

| Adjusted Profit Per Share | $2.12 | $2.71 | $6.56 | $11.40 | ||||||||||||||||

DEERFIELD, Ill. – Caterpillar Inc. (NYSE: CAT) today announced fourth-quarter and full-year results for 2020.

Sales and revenues for the fourth quarter of 2020 were $11.2 billion, a 15% decrease compared with $13.1 billion in the fourth quarter of 2019. Operating profit margin was 12.3% for the fourth quarter of 2020, compared with 14.1% for the fourth quarter of 2019. Fourth-quarter 2020 profit per share was $1.42, compared with $1.97 profit per share in the fourth quarter of 2019. Adjusted profit per share in the fourth quarter of 2020 was $2.12, compared with fourth-quarter 2019 adjusted profit per share of $2.71. Fourth-quarter 2020 adjusted profit per share of $2.12 reflects strong operational performance and a lower effective tax rate.

Full-year sales and revenues in 2020 were $41.7 billion, down 22% compared with $53.8 billion in 2019. The sales decline reflected lower end-user demand and dealers reducing their inventories by $2.9 billion in 2020. Operating profit margin was 10.9% for 2020, compared with 15.4% for 2019. Full-year profit was $5.46 per share in 2020, compared with profit of $10.74 per share in 2019. Adjusted profit per share in 2020 was $6.56, compared with adjusted profit per share of $11.40 in 2019.

“I’m proud of our global team’s continued resilience in safely navigating COVID-19 while continuing to provide the essential products and services the world needs,” said Caterpillar Chairman and CEO Jim Umpleby. “Our fourth-quarter and full-year results reflect the team’s agility in a challenging environment while executing our strategy for long-term profitable growth. We achieved the adjusted operating profit margin established during our 2019 Investor Day while continuing to invest in products and services. We are well-positioned for the future and will emerge from the pandemic as an even stronger company.”

(more)

2

In 2020, adjusted profit per share excluded mark-to-market losses for remeasurement of pension and other postemployment benefit (OPEB) plans and restructuring costs. In 2019, adjusted profit per share excluded mark-to-market losses for remeasurement of pension and OPEB plans, restructuring costs and a discrete tax benefit related to U.S. tax reform. Please see in the appendix on page 14 a reconciliation of GAAP to non-GAAP financial measures.

For the full year of 2020, enterprise operating cash flow was $6.3 billion. During the year, the company paid dividends of $2.2 billion and repurchased $1.1 billion of Caterpillar common stock. Liquidity remains strong with an enterprise cash balance of $9.4 billion at the end of 2020.

(more)

3

CONSOLIDATED RESULTS

Consolidated Sales and Revenues

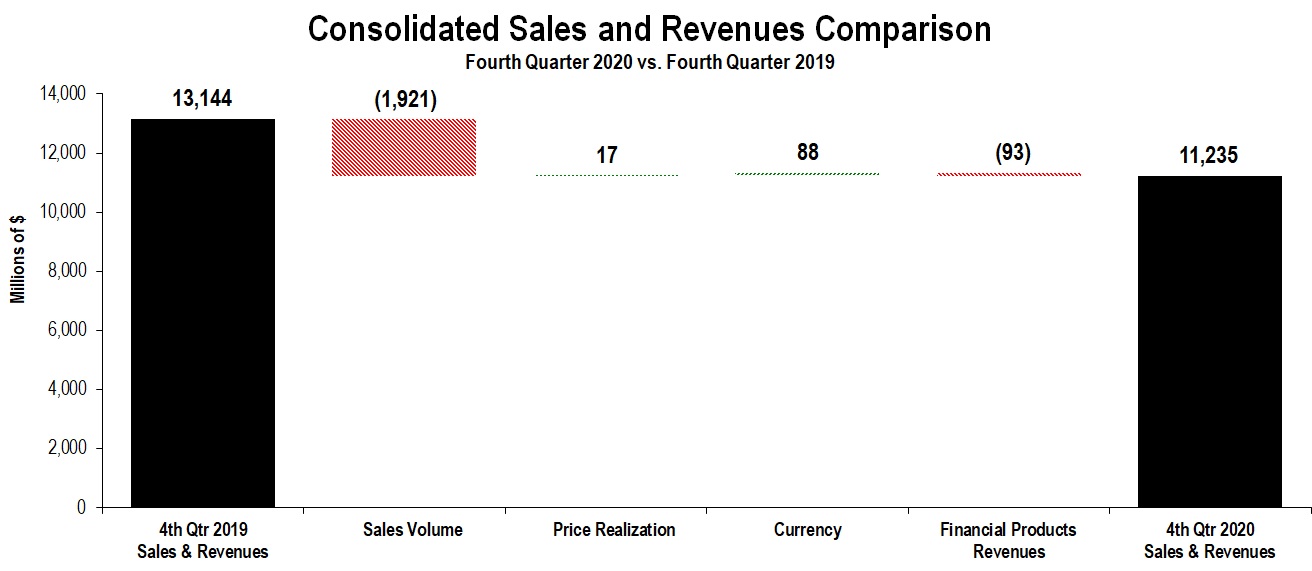

The chart above graphically illustrates reasons for the change in consolidated sales and revenues between the fourth quarter of 2019 (at left) and the fourth quarter of 2020 (at right). Caterpillar management utilizes these charts internally to visually communicate with the company’s Board of Directors and employees.

Total sales and revenues for the fourth quarter of 2020 were $11.235 billion, a decrease of $1.909 billion, or 15%, compared with $13.144 billion in the fourth quarter of 2019. The decline was mostly due to lower sales volume driven by lower end-user demand for equipment and services and the impact from changes in dealer inventories. Dealers decreased inventories more during the fourth quarter of 2020 than during the fourth quarter of 2019.

Sales were lower across the three primary segments, with the largest decline in Energy & Transportation.

| Sales and Revenues by Segment | |||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Fourth Quarter 2019 | Sales Volume | Price Realization | Currency | Inter-Segment / Other | Fourth Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 5,020 | $ | (526) | $ | (3) | $ | 30 | $ | (13) | $ | 4,508 | $ | (512) | (10%) | ||||||||||||||||||||||||||||||||

| Resource Industries | 2,395 | (237) | 7 | 7 | 8 | 2,180 | (215) | (9%) | |||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 5,949 | (1,197) | 12 | 49 | (2) | 4,811 | (1,138) | (19%) | |||||||||||||||||||||||||||||||||||||||

| All Other Segment | 143 | 3 | (1) | 1 | (9) | 137 | (6) | (4%) | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (1,121) | 36 | 2 | 1 | 16 | (1,066) | 55 | ||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 12,386 | (1,921) | 17 | 88 | — | 10,570 | (1,816) | (15%) | |||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 846 | — | — | — | (103) | 743 | (103) | (12%) | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (88) | — | — | — | 10 | (78) | 10 | ||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 758 | — | — | — | (93) | 665 | (93) | (12%) | |||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 13,144 | $ | (1,921) | $ | 17 | $ | 88 | $ | (93) | $ | 11,235 | $ | (1,909) | (15%) | ||||||||||||||||||||||||||||||||

(more)

4

| Sales and Revenues by Geographic Region | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | Latin America | EAME | Asia/Pacific | External Sales and Revenues | Inter-Segment | Total Sales and Revenues | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 1,895 | (16%) | $ | 324 | (21%) | $ | 848 | —% | $ | 1,417 | (4%) | $ | 4,484 | (10%) | $ | 24 | (35%) | $ | 4,508 | (10%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 596 | (29%) | 394 | 26% | 412 | (22%) | 651 | 8% | 2,053 | (10%) | 127 | 7% | 2,180 | (9%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 1,705 | (25%) | 265 | (25%) | 1,353 | (14%) | 707 | (25%) | 4,030 | (22%) | 781 | —% | 4,811 | (19%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 5 | 150% | — | —% | 9 | 80% | 18 | (18%) | 32 | 10% | 105 | (8%) | 137 | (4%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (27) | 1 | (2) | (1) | (29) | (1,037) | (1,066) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 4,174 | (22%) | 984 | (9%) | 2,620 | (11%) | 2,792 | (8%) | 10,570 | (15%) | — | —% | 10,570 | (15%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 464 | (16%) | 64 | (14%) | 94 | (8%) | 121 | 4% | 743 | (12%) | — | —% | 743 | (12%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (41) | (10) | (10) | (17) | (78) | — | (78) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 423 | (16%) | 54 | (10%) | 84 | (10%) | 104 | 3% | 665 | (12%) | — | —% | 665 | (12%) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 4,597 | (21%) | $ | 1,038 | (9%) | $ | 2,704 | (11%) | $ | 2,896 | (8%) | $ | 11,235 | (15%) | $ | — | —% | $ | 11,235 | (15%) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 2,249 | $ | 409 | $ | 850 | $ | 1,475 | $ | 4,983 | $ | 37 | $ | 5,020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 834 | 313 | 526 | 603 | 2,276 | 119 | 2,395 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 2,287 | 354 | 1,578 | 947 | 5,166 | 783 | 5,949 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 2 | — | 5 | 22 | 29 | 114 | 143 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (50) | — | (5) | (13) | (68) | (1,053) | (1,121) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 5,322 | 1,076 | 2,954 | 3,034 | 12,386 | — | 12,386 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 554 | 74 | 102 | 116 | 846 | — | 846 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (50) | (14) | (9) | (15) | (88) | — | (88) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 504 | 60 | 93 | 101 | 758 | — | 758 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 5,826 | $ | 1,136 | $ | 3,047 | $ | 3,135 | $ | 13,144 | $ | — | $ | 13,144 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(more)

5

Consolidated Operating Profit

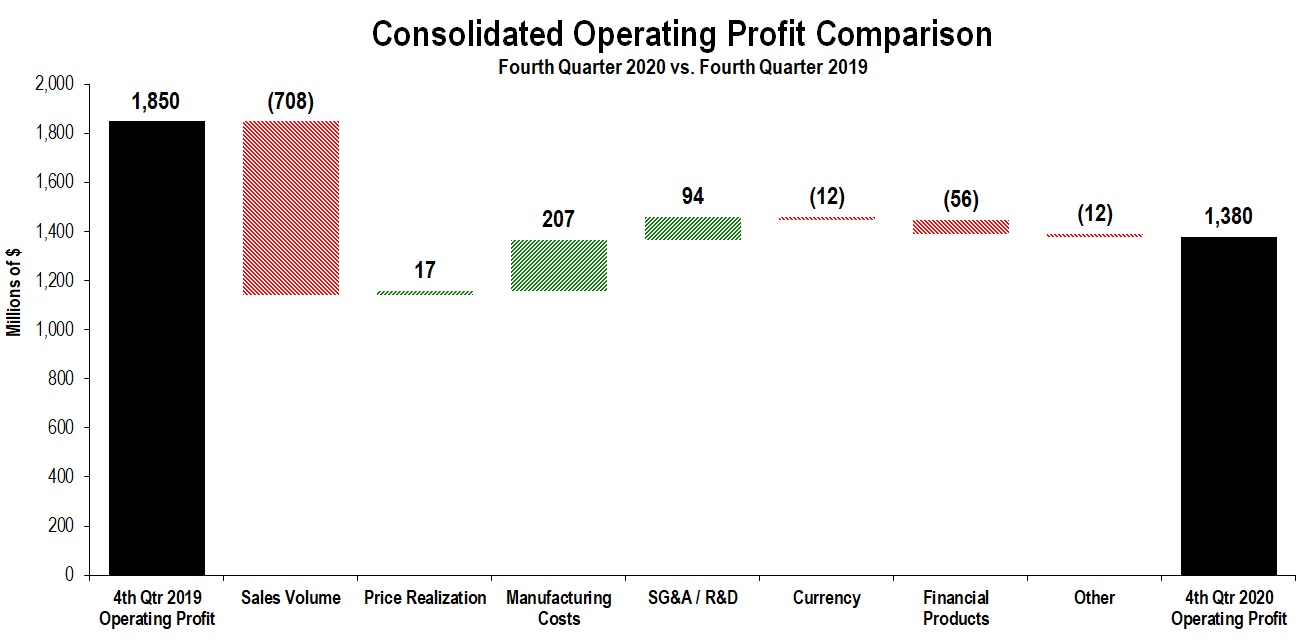

The chart above graphically illustrates reasons for the change in consolidated operating profit between the fourth quarter of 2019 (at left) and the fourth quarter of 2020 (at right). Caterpillar management utilizes these charts internally to visually communicate with the company’s Board of Directors and employees. The bar titled Other includes consolidating adjustments and Machinery, Energy & Transportation’s other operating (income) expenses.

Operating profit for the fourth quarter of 2020 was $1.380 billion, a decrease of $470 million, or 25%, compared with $1.850 billion in the fourth quarter of 2019. The decrease was primarily the result of lower sales volume partially offset by lower manufacturing costs and selling, general and administrative (SG&A) and research and development (R&D) expenses. In addition, operating profit declined due to lower profit from Financial Products.

Manufacturing costs were lower due to favorable impact from cost absorption, lower material and period manufacturing costs, partially offset by higher warranty expense. Cost absorption was favorable as inventory decreased more in the fourth quarter of 2019 than in the fourth quarter of 2020.

SG&A/R&D expenses and period manufacturing costs benefited from reduced short-term incentive compensation expense and other cost reductions related to lower sales volumes, partially offset by higher labor and benefits costs.

(more)

6

| Profit (Loss) by Segment | |||||||||||||||||||||||

| (Millions of dollars) | Fourth Quarter 2020 | Fourth Quarter 2019 | $ Change | % Change | |||||||||||||||||||

| Construction Industries | $ | 630 | $ | 659 | $ | (29) | (4 | %) | |||||||||||||||

| Resource Industries | 273 | 261 | 12 | 5 | % | ||||||||||||||||||

| Energy & Transportation | 687 | 1,165 | (478) | (41 | %) | ||||||||||||||||||

| All Other Segment | (3) | (11) | 8 | 73 | % | ||||||||||||||||||

| Corporate Items and Eliminations | (281) | (325) | 44 | ||||||||||||||||||||

| Machinery, Energy & Transportation | 1,306 | 1,749 | (443) | (25 | %) | ||||||||||||||||||

| Financial Products Segment | 195 | 210 | (15) | (7 | %) | ||||||||||||||||||

| Corporate Items and Eliminations | (47) | (6) | (41) | ||||||||||||||||||||

| Financial Products | 148 | 204 | (56) | (27 | %) | ||||||||||||||||||

| Consolidating Adjustments | (74) | (103) | 29 | ||||||||||||||||||||

| Consolidated Operating Profit | $ | 1,380 | $ | 1,850 | $ | (470) | (25 | %) | |||||||||||||||

Other Profit/Loss and Tax Items

•Other income (expense) in the fourth quarter of 2020 was an expense of $309 million, compared with an expense of $373 million in the fourth quarter of 2019. The change was primarily driven by lower pension and OPEB costs including lower mark-to-market losses for remeasurement of pension and OPEB plans and impacts from gains (losses) on marketable securities at Insurance Services, partially offset by unfavorable impacts from foreign currency exchange gains (losses). The favorable impact of gains (losses) on marketable securities reflected unrealized gains in the fourth quarter of 2020, compared with unrealized losses in the fourth quarter of 2019 and the absence of realized gains that occurred in the fourth quarter of 2019.

•The provision for income taxes for the fourth quarter of 2020 reflected an annual effective tax rate of approximately 28%, compared with 25% for the fourth quarter of 2019, excluding the discrete items discussed below. The increase from 2019 was primarily related to changes in the geographic mix of profits from a tax perspective.

In the fourth quarter of 2020, the company recorded a $96 million tax benefit due to the change from the third quarter estimated annual tax rate of 31%, compared to a $64 million tax benefit for the reduction in the annual effective tax rate in the fourth quarter of 2019. In addition, the company recorded a tax benefit of $92 million related to $438 million of pension and OPEB mark-to-market losses in the fourth quarter of 2020, compared to a $105 million tax benefit related to $468 million of mark-to-market losses in the fourth quarter of 2019. Finally, the company recorded a tax benefit of $28 million in the fourth quarter of 2020, compared to $13 million in the fourth quarter of 2019, for the settlement of stock-based compensation awards with associated tax deductions in excess of cumulative U.S. GAAP compensation expense.

(more)

7

| CONSTRUCTION INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 5,020 | $ | (526) | $ | (3) | $ | 30 | $ | (13) | $ | 4,508 | $ | (512) | (10 | %) | ||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | Fourth Quarter 2019 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 1,895 | $ | 2,249 | $ | (354) | (16 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 324 | 409 | (85) | (21 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 848 | 850 | (2) | — | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 1,417 | 1,475 | (58) | (4 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 4,484 | 4,983 | (499) | (10 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 24 | 37 | (13) | (35 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 4,508 | $ | 5,020 | $ | (512) | (10 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | Fourth Quarter 2019 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 630 | $ | 659 | $ | (29) | (4 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 14.0 | % | 13.1 | % | 0.9 | pts | ||||||||||||||||||||||||||||||||||||||||||||

Construction Industries’ total sales were $4.508 billion in the fourth quarter of 2020, a decrease of $512 million, or 10%, compared with $5.020 billion in the fourth quarter of 2019. The decrease was due to lower sales volume, driven by the impact from changes in dealer inventories and slightly lower end-user demand. Dealers decreased inventories more during the fourth quarter of 2020 than during the fourth quarter of 2019.

▪In North America, sales decreased mostly due to lower sales volume driven by the impact from changes in dealer inventories and lower end-user demand. The lower end-user demand was primarily the result of weaker pipeline and road construction. Dealers decreased inventories more during the fourth quarter of 2020 than during the fourth quarter of 2019.

▪Sales declined in Latin America primarily due to the unfavorable currency impacts from a weaker Brazilian real and lower sales volume.

▪In EAME, sales were about flat as lower sales volume across several countries in the region was offset by favorable price realization and favorable currency impacts from a stronger euro. Lower sales volume was driven by lower end-user demand, partially offset by the impact of changes in dealer inventories. Dealers decreased inventories more during the fourth quarter of 2019 than during the fourth quarter of 2020.

▪Sales decreased in Asia/Pacific primarily due to lower sales volume and unfavorable price realization, partially offset by favorable currency impacts from both a stronger Chinese yuan and Australian dollar. The decrease in sales was mainly driven by China, where higher end-user demand was more than offset by unfavorable impacts from changes in dealer inventories. This was partially offset by higher demand in several other countries.

Construction Industries’ profit was $630 million in the fourth quarter of 2020, a decrease of $29 million, or 4%, compared with $659 million in the fourth quarter of 2019. The decrease was mainly due to lower sales volume and higher warranty expense, partially offset by favorable impact of cost absorption and lower SG&A/R&D expenses. Cost absorption was favorable as inventory increased during the fourth quarter of 2020, compared with a decrease

(more)

8

during the fourth quarter of 2019. SG&A/R&D expenses benefited from reduced short-term incentive compensation expense and other cost reductions related to lower sales volumes.

(more)

9

| RESOURCE INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 2,395 | $ | (237) | $ | 7 | $ | 7 | $ | 8 | $ | 2,180 | $ | (215) | (9 | %) | ||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | Fourth Quarter 2019 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 596 | $ | 834 | $ | (238) | (29 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 394 | 313 | 81 | 26 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 412 | 526 | (114) | (22 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 651 | 603 | 48 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 2,053 | 2,276 | (223) | (10 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 127 | 119 | 8 | 7 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 2,180 | $ | 2,395 | $ | (215) | (9 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | Fourth Quarter 2019 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 273 | $ | 261 | $ | 12 | 5 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 12.5 | % | 10.9 | % | 1.6 | pts | ||||||||||||||||||||||||||||||||||||||||||||

Resource Industries’ total sales were $2.180 billion in the fourth quarter of 2020, a decrease of $215 million, or 9%, compared with $2.395 billion in the fourth quarter of 2019. The decrease was due to lower end-user demand for equipment and aftermarket parts. End-user demand was lower for heavy construction and quarry and aggregates and was also lower in mining, but to a lesser extent.

Resource Industries’ profit was $273 million in the fourth quarter of 2020, an increase of $12 million, or 5%, compared with $261 million in the fourth quarter of 2019. The increase was mainly due to favorable manufacturing costs and lower SG&A/R&D expenses which was mostly offset by lower sales volume. Favorable manufacturing costs reflected favorable variable labor and burden, impact of cost absorption, period manufacturing costs and material costs. Cost absorption was favorable as inventory decreased in the fourth quarter of 2019 compared with being about flat in the fourth quarter of 2020. SG&A/R&D expenses, along with period manufacturing costs, benefited from lower short-term incentive compensation expense, other cost-reduction actions implemented and benefits from prior restructuring programs.

(more)

10

| ENERGY & TRANSPORTATION | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2019 | Sales Volume | Price Realization | Currency | Inter-Segment | Fourth Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 5,949 | $ | (1,197) | $ | 12 | $ | 49 | $ | (2) | $ | 4,811 | $ | (1,138) | (19 | %) | ||||||||||||||||||||||||||||||||||

| Sales by Application | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | Fourth Quarter 2019 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Oil and Gas | $ | 1,079 | $ | 1,523 | $ | (444) | (29 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Power Generation | 1,180 | 1,294 | (114) | (9 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Industrial | 736 | 908 | (172) | (19 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Transportation | 1,035 | 1,441 | (406) | (28 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 4,030 | 5,166 | (1,136) | (22 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 781 | 783 | (2) | — | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 4,811 | $ | 5,949 | $ | (1,138) | (19 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | Fourth Quarter 2019 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 687 | $ | 1,165 | $ | (478) | (41 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 14.3 | % | 19.6 | % | (5.3 | pts) | ||||||||||||||||||||||||||||||||||||||||||||

Energy & Transportation’s total sales were $4.811 billion in the fourth quarter of 2020, a decrease of $1.138 billion, or 19%, compared with $5.949 billion in the fourth quarter of 2019. Sales declined across all applications.

▪Oil and Gas – Sales decreased mainly due to lower demand in North America for reciprocating engines used in gas compression and well servicing. In addition, sales were lower for turbines and turbine-related services.

▪Power Generation – Sales decreased primarily due to lower sales volume in small reciprocating engines, turbines and turbine-related services and engine aftermarket parts.

▪Industrial – Sales decreased due to lower demand across all regions.

▪Transportation – Sales declined in rail due to lower rail services and locomotives deliveries, primarily in North America. Marine sales were also lower.

Energy & Transportation’s profit was $687 million in the fourth quarter of 2020, a decrease of $478 million, or 41%, compared with $1.165 billion in the fourth quarter of 2019. The decrease was due to lower sales volume, partially offset by lower SG&A/R&D expenses and period manufacturing costs. SG&A/R&D expenses and period manufacturing costs were mostly impacted by a reduction in short-term incentive compensation expense and other cost-reduction actions implemented in response to lower sales volumes.

(more)

11

| FINANCIAL PRODUCTS SEGMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | Fourth Quarter 2019 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 464 | $ | 554 | $ | (90) | (16 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 64 | 74 | (10) | (14 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 94 | 102 | (8) | (8 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 121 | 116 | 5 | 4 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 743 | $ | 846 | $ | (103) | (12 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fourth Quarter 2020 | Fourth Quarter 2019 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 195 | $ | 210 | $ | (15) | (7 | %) | ||||||||||||||||||||||||||||||||||||||||||

Financial Products’ segment revenues were $743 million in the fourth quarter of 2020, a decrease of $103 million, or 12%, from the fourth quarter of 2019. The decrease was primarily because of lower average financing rates across all regions and lower average earning assets in North America.

Financial Products’ segment profit was $195 million in the fourth quarter of 2020, compared with $210 million in the fourth quarter of 2019. The decrease was primarily due to higher provision for credit losses, an unfavorable impact from returned or repossessed equipment and lower average earning assets at Cat Financial. These unfavorable impacts were partially offset by a reduction in SG&A expenses primarily due to lower short-term incentive compensation and a favorable impact from equity securities in Insurance Services.

At the end of 2020, past dues at Cat Financial were 3.49%, compared with 3.14% at the end of 2019. Past dues increased primarily due to the impact of the COVID-19 pandemic, partially offset by decreases in the Caterpillar Power Finance, EAME and Latin American portfolios. Write-offs, net of recoveries, were $222 million for 2020, compared with $237 million for 2019. As of December 31, 2020, Cat Financial's allowance for credit losses totaled $479 million, or 1.77% of finance receivables, compared with $424 million, or 1.50% of finance receivables at December 31, 2019.

Corporate Items and Eliminations

Expense for corporate items and eliminations was $328 million in the fourth quarter of 2020, a decrease of $3 million from the fourth quarter of 2019.

(more)

12

Notes

i.Glossary of terms is included on the Caterpillar website at https://investors.caterpillar.com/overview/default.aspx.

ii.End-user demand is demonstrated by the company’s Rolling 3 Month Retail Sales Statistics filed in a Form 8-K on Friday, January 29, 2021.

iii.Information on non-GAAP financial measures is included in the appendix on page 14.

iv.Some amounts within this report are rounded to the millions or billions and may not add.

v.Caterpillar will conduct a teleconference and live webcast, with a slide presentation, beginning at 7:30 a.m. Central Time on Friday, January 29, 2021, to discuss its 2020 fourth-quarter and full-year results. The accompanying slides will be available before the webcast on the Caterpillar website at https://investors.caterpillar.com/events-presentations/default.aspx.

About Caterpillar

With 2020 sales and revenues of $41.7 billion, Caterpillar Inc. is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Since 1925, we’ve been driving sustainable progress and helping customers build a better world through innovative products and services. Throughout the product life cycle, we offer services built on cutting-edge technology and decades of product expertise. These products and services, backed by our global dealer network, provide exceptional value to help our customers succeed. We do business on every continent, principally operating through three primary segments – Construction Industries, Resource Industries, and Energy & Transportation – and providing financing and related services through our Financial Products segment. Visit us at caterpillar.com or join the conversation on our social media channels at caterpillar.com/social-media.

Caterpillar’s latest financial results are also available online:

https://investors.caterpillar.com/overview/default.aspx

https://investors.caterpillar.com/financials/quarterly-results/default.aspx (live broadcast/replays of quarterly conference call)

Caterpillar investor relations contact: Jennifer Driscoll, +1 224-551-4382 or Driscoll_Jennifer@cat.com

Caterpillar media contact: Kate Kenny, +1 309-361-9333 or Kenny_Kate@cat.com

(more)

13

Forward-Looking Statements

Certain statements in this press release relate to future events and expectations and are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “estimate,” “will be,” “will,” “would,” “expect,” “anticipate,” “plan,” “forecast,” “target,” “guide,” “project,” “intend,” “could,” “should” or other similar words or expressions often identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements, including, without limitation, statements regarding our outlook, projections, forecasts or trend descriptions. These statements do not guarantee future performance and speak only as of the date they are made, and we do not undertake to update our forward-looking statements.

Caterpillar’s actual results may differ materially from those described or implied in our forward-looking statements based on a number of factors, including, but not limited to: (i) global and regional economic conditions and economic conditions in the industries we serve; (ii) commodity price changes, material price increases, fluctuations in demand for our products or significant shortages of material; (iii) government monetary or fiscal policies; (iv) political and economic risks, commercial instability and events beyond our control in the countries in which we operate; (v) international trade policies and their impact on demand for our products and our competitive position, including the imposition of new tariffs or changes in existing tariff rates; (vi) our ability to develop, produce and market quality products that meet our customers’ needs; (vii) the impact of the highly competitive environment in which we operate on our sales and pricing; (viii) information technology security threats and computer crime; (ix) inventory management decisions and sourcing practices of our dealers and our OEM customers; (x) a failure to realize, or a delay in realizing, all of the anticipated benefits of our acquisitions, joint ventures or divestitures; (xi) union disputes or other employee relations issues; (xii) adverse effects of unexpected events; (xiii) disruptions or volatility in global financial markets limiting our sources of liquidity or the liquidity of our customers, dealers and suppliers; (xiv) failure to maintain our credit ratings and potential resulting increases to our cost of borrowing and adverse effects on our cost of funds, liquidity, competitive position and access to capital markets; (xv) our Financial Products segment’s risks associated with the financial services industry; (xvi) changes in interest rates or market liquidity conditions; (xvii) an increase in delinquencies, repossessions or net losses of Cat Financial’s customers; (xviii) currency fluctuations; (xix) our or Cat Financial’s compliance with financial and other restrictive covenants in debt agreements; (xx) increased pension plan funding obligations; (xxi) alleged or actual violations of trade or anti-corruption laws and regulations; (xxii) additional tax expense or exposure, including the impact of U.S. tax reform; (xxiii) significant legal proceedings, claims, lawsuits or government investigations; (xxiv) new regulations or changes in financial services regulations; (xxv) compliance with environmental laws and regulations; (xxvi) the duration and geographic spread of, business disruptions caused by, and the overall global economic impact of, the COVID-19 pandemic; and (xxvii) other factors described in more detail in Caterpillar’s Forms 10-Q, 10-K and other filings with the Securities and Exchange Commission.

(more)

14

APPENDIX

NON-GAAP FINANCIAL MEASURES

The following definitions are provided for the non-GAAP financial measures. These non-GAAP financial measures have no standardized meaning prescribed by U.S. GAAP and therefore are unlikely to be comparable to the calculation of similar measures for other companies. Management does not intend these items to be considered in isolation or as a substitute for the related GAAP measures.

Adjusted Profit

The company believes it is important to separately quantify the profit impact of three significant items in order for the company’s results to be meaningful to readers. These items consist of (i) pension and OPEB mark-to-market losses resulting from plan remeasurements, (ii) restructuring costs, which were incurred to generate longer-term benefits, and (iii) U.S. tax reform impact in 2019. The company does not consider these items indicative of earnings from ongoing business activities and believes the non-GAAP measure provides investors with useful perspective on underlying business results and trends and aids with assessing the company’s period-over-period results.

Reconciliations of adjusted results to the most directly comparable GAAP measure are as follows:

| (Dollars in millions except per share data) | Operating Profit | Operating Profit Margin | Profit Before Taxes | Provision (Benefit) for Income Taxes | Effective Tax Rate | Profit | Profit per Share | |||||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2020 - US GAAP | $ | 1,380 | 12.3 | % | $ | 941 | $ | 167 | 17.7 | % | $ | 780 | $ | 1.42 | ||||||||||||||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | — | — | % | 438 | 92 | 21.0 | % | 346 | $ | 0.63 | ||||||||||||||||||||||||||||||||||

| Restructuring costs | 58 | 0.5 | % | 58 | 18 | 31.0 | % | 40 | $ | 0.07 | ||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2020 - Adjusted | $ | 1,438 | 12.8 | % | $ | 1,437 | $ | 277 | 19.3 | % | $ | 1,166 | $ | 2.12 | ||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2019 - US GAAP | $ | 1,850 | 14.1 | % | $ | 1,365 | $ | 276 | 20.2 | % | $ | 1,098 | $ | 1.97 | ||||||||||||||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | — | — | % | 468 | 105 | 22.4 | % | 363 | $ | 0.65 | ||||||||||||||||||||||||||||||||||

| Restructuring costs | 54 | 0.4 | % | 54 | 10 | 19.0 | % | 44 | $ | 0.08 | ||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, 2019 - Adjusted | $ | 1,904 | 14.5 | % | $ | 1,887 | $ | 391 | 20.7 | % | $ | 1,505 | $ | 2.71 | ||||||||||||||||||||||||||||||

| Twelve Months Ended December 31, 2020 - US GAAP | $ | 4,553 | 10.9 | % | $ | 3,995 | $ | 1,006 | 25.2 | % | $ | 2,998 | $ | 5.46 | ||||||||||||||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | — | — | % | 383 | 82 | 21.4 | % | 301 | $ | 0.55 | ||||||||||||||||||||||||||||||||||

| Restructuring costs | 354 | 0.8 | % | 354 | 53 | 15.0 | % | 301 | $ | 0.55 | ||||||||||||||||||||||||||||||||||

| Twelve Months Ended December 31, 2020 - Adjusted | $ | 4,907 | 11.8 | % | $ | 4,732 | $ | 1,141 | 24.1 | % | $ | 3,600 | $ | 6.56 | ||||||||||||||||||||||||||||||

| Twelve Months Ended December 31, 2019 - US GAAP | $ | 8,290 | 15.4 | % | $ | 7,812 | $ | 1,746 | 22.4 | % | $ | 6,093 | $ | 10.74 | ||||||||||||||||||||||||||||||

| Pension/OPEB mark-to-market (gains) losses | — | — | % | 468 | 105 | 22.4 | % | 363 | $ | 0.64 | ||||||||||||||||||||||||||||||||||

| Restructuring costs | 236 | 0.4 | % | 236 | 45 | 19.0 | % | 191 | $ | 0.34 | ||||||||||||||||||||||||||||||||||

| U.S. tax reform impact | — | — | % | — | 178 | — | % | (178) | $ | (0.31) | ||||||||||||||||||||||||||||||||||

| Twelve Months Ended December 31, 2019 - Adjusted | $ | 8,526 | 15.8 | % | $ | 8,516 | $ | 2,074 | 24.4 | % | $ | 6,469 | $ | 11.40 | ||||||||||||||||||||||||||||||

(more)

15

Supplemental Consolidating Data

The company is providing supplemental consolidating data for the purpose of additional analysis. The data has been grouped as follows:

Consolidated – Caterpillar Inc. and its subsidiaries.

Machinery, Energy & Transportation (ME&T) – The company defines ME&T as it is presented in the supplemental data as Caterpillar Inc. and its subsidiaries, excluding Financial Products. ME&T’s information relates to the design, manufacturing and marketing of its products.

Financial Products – The company defines Financial Products as it is presented in the supplemental data as its finance and insurance subsidiaries, primarily Caterpillar Financial Services Corporation (Cat Financial) and Caterpillar Insurance Holdings Inc. (Insurance Services). Financial Products’ information relates to the financing to customers and dealers for the purchase and lease of Caterpillar and other equipment.

Consolidating Adjustments – Eliminations of transactions between ME&T and Financial Products.

The nature of the ME&T and Financial Products businesses is different, especially with regard to the financial position and cash flow items. Caterpillar management utilizes this presentation internally to highlight these differences. The company believes this presentation will assist readers in understanding its business.

Pages 16 to 26 reconcile ME&T and Financial Products to Caterpillar Inc. consolidated financial information.

(more)

16

Caterpillar Inc.

Condensed Consolidated Statement of Results of Operations

(Unaudited)

(Dollars in millions except per share data)

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Sales and revenues: | |||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 10,570 | $ | 12,386 | $ | 39,022 | $ | 50,755 | |||||||||||||||

| Revenues of Financial Products | 665 | 758 | 2,726 | 3,045 | |||||||||||||||||||

| Total sales and revenues | 11,235 | 13,144 | 41,748 | 53,800 | |||||||||||||||||||

| Operating costs: | |||||||||||||||||||||||

| Cost of goods sold | 7,784 | 9,117 | 29,082 | 36,630 | |||||||||||||||||||

| Selling, general and administrative expenses | 1,216 | 1,283 | 4,642 | 5,162 | |||||||||||||||||||

| Research and development expenses | 374 | 386 | 1,415 | 1,693 | |||||||||||||||||||

| Interest expense of Financial Products | 128 | 183 | 589 | 754 | |||||||||||||||||||

| Other operating (income) expenses | 353 | 325 | 1,467 | 1,271 | |||||||||||||||||||

| Total operating costs | 9,855 | 11,294 | 37,195 | 45,510 | |||||||||||||||||||

| Operating profit | 1,380 | 1,850 | 4,553 | 8,290 | |||||||||||||||||||

| Interest expense excluding Financial Products | 130 | 112 | 514 | 421 | |||||||||||||||||||

| Other income (expense) | (309) | (373) | (44) | (57) | |||||||||||||||||||

| Consolidated profit before taxes | 941 | 1,365 | 3,995 | 7,812 | |||||||||||||||||||

| Provision (benefit) for income taxes | 167 | 276 | 1,006 | 1,746 | |||||||||||||||||||

| Profit of consolidated companies | 774 | 1,089 | 2,989 | 6,066 | |||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 6 | 8 | 14 | 28 | |||||||||||||||||||

| Profit of consolidated and affiliated companies | 780 | 1,097 | 3,003 | 6,094 | |||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | (1) | 5 | 1 | |||||||||||||||||||

Profit 1 | $ | 780 | $ | 1,098 | $ | 2,998 | $ | 6,093 | |||||||||||||||

| Profit per common share | $ | 1.43 | $ | 2.00 | $ | 5.51 | $ | 10.85 | |||||||||||||||

Profit per common share — diluted 2 | $ | 1.42 | $ | 1.97 | $ | 5.46 | $ | 10.74 | |||||||||||||||

| Weighted-average common shares outstanding (millions) | |||||||||||||||||||||||

| – Basic | 544.5 | 550.3 | 544.1 | 561.6 | |||||||||||||||||||

– Diluted 2 | 549.5 | 556.1 | 548.6 | 567.5 | |||||||||||||||||||

| 1 | Profit attributable to common shareholders. | ||||

| 2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. | ||||

(more)

17

Caterpillar Inc.

Condensed Consolidated Statement of Financial Position

(Unaudited)

(Millions of dollars)

| December 31, 2020 | December 31, 2019 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and short-term investments | $ | 9,352 | $ | 8,284 | |||||||

| Receivables – trade and other | 7,317 | 8,568 | |||||||||

| Receivables – finance | 9,463 | 9,336 | |||||||||

| Prepaid expenses and other current assets | 1,930 | 1,739 | |||||||||

| Inventories | 11,402 | 11,266 | |||||||||

| Total current assets | 39,464 | 39,193 | |||||||||

| Property, plant and equipment – net | 12,401 | 12,904 | |||||||||

| Long-term receivables – trade and other | 1,185 | 1,193 | |||||||||

| Long-term receivables – finance | 12,222 | 12,651 | |||||||||

| Noncurrent deferred and refundable income taxes | 1,523 | 1,411 | |||||||||

| Intangible assets | 1,308 | 1,565 | |||||||||

| Goodwill | 6,394 | 6,196 | |||||||||

| Other assets | 3,827 | 3,340 | |||||||||

| Total assets | $ | 78,324 | $ | 78,453 | |||||||

| Liabilities | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings: | |||||||||||

| -- Machinery, Energy & Transportation | $ | 10 | $ | 5 | |||||||

| -- Financial Products | 2,005 | 5,161 | |||||||||

| Accounts payable | 6,128 | 5,957 | |||||||||

| Accrued expenses | 3,642 | 3,750 | |||||||||

| Accrued wages, salaries and employee benefits | 1,096 | 1,629 | |||||||||

| Customer advances | 1,108 | 1,187 | |||||||||

| Dividends payable | 562 | 567 | |||||||||

| Other current liabilities | 2,017 | 2,155 | |||||||||

| Long-term debt due within one year: | |||||||||||

| -- Machinery, Energy & Transportation | 1,420 | 16 | |||||||||

| -- Financial Products | 7,729 | 6,194 | |||||||||

| Total current liabilities | 25,717 | 26,621 | |||||||||

| Long-term debt due after one year: | |||||||||||

| -- Machinery, Energy & Transportation | 9,749 | 9,141 | |||||||||

| -- Financial Products | 16,250 | 17,140 | |||||||||

| Liability for postemployment benefits | 6,872 | 6,599 | |||||||||

| Other liabilities | 4,358 | 4,323 | |||||||||

| Total liabilities | 62,946 | 63,824 | |||||||||

| Shareholders’ equity | |||||||||||

| Common stock | 6,230 | 5,935 | |||||||||

| Treasury stock | (25,178) | (24,217) | |||||||||

| Profit employed in the business | 35,167 | 34,437 | |||||||||

| Accumulated other comprehensive income (loss) | (888) | (1,567) | |||||||||

| Noncontrolling interests | 47 | 41 | |||||||||

| Total shareholders’ equity | 15,378 | 14,629 | |||||||||

| Total liabilities and shareholders’ equity | $ | 78,324 | $ | 78,453 | |||||||

(more)

18

Caterpillar Inc.

Condensed Consolidated Statement of Cash Flow

(Unaudited)

(Millions of dollars)

| Twelve Months Ended December 31, | |||||||||||

| 2020 | 2019 | ||||||||||

| Cash flow from operating activities: | |||||||||||

| Profit of consolidated and affiliated companies | $ | 3,003 | $ | 6,094 | |||||||

| Adjustments for non-cash items: | |||||||||||

| Depreciation and amortization | 2,432 | 2,577 | |||||||||

| Actuarial (gain) loss on pension and postretirement benefits | 384 | 468 | |||||||||

| Provision (benefit) for deferred income taxes | (74) | 28 | |||||||||

| Other | 1,000 | 675 | |||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||||||

| Receivables – trade and other | 1,442 | 171 | |||||||||

| Inventories | (34) | 274 | |||||||||

| Accounts payable | 98 | (1,025) | |||||||||

| Accrued expenses | (366) | 172 | |||||||||

| Accrued wages, salaries and employee benefits | (544) | (757) | |||||||||

| Customer advances | (126) | (10) | |||||||||

| Other assets – net | (201) | (93) | |||||||||

| Other liabilities – net | (687) | (1,662) | |||||||||

| Net cash provided by (used for) operating activities | 6,327 | 6,912 | |||||||||

| Cash flow from investing activities: | |||||||||||

| Capital expenditures – excluding equipment leased to others | (978) | (1,056) | |||||||||

| Expenditures for equipment leased to others | (1,137) | (1,613) | |||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 772 | 1,153 | |||||||||

| Additions to finance receivables | (12,385) | (12,777) | |||||||||

| Collections of finance receivables | 12,646 | 12,183 | |||||||||

| Proceeds from sale of finance receivables | 42 | 235 | |||||||||

| Investments and acquisitions (net of cash acquired) | (111) | (47) | |||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 25 | 41 | |||||||||

| Proceeds from sale of securities | 345 | 529 | |||||||||

| Investments in securities | (638) | (552) | |||||||||

| Other – net | (66) | (24) | |||||||||

| Net cash provided by (used for) investing activities | (1,485) | (1,928) | |||||||||

| Cash flow from financing activities: | |||||||||||

| Dividends paid | (2,243) | (2,132) | |||||||||

| Common stock issued, including treasury shares reissued | 229 | 238 | |||||||||

| Common shares repurchased | (1,130) | (4,047) | |||||||||

| Proceeds from debt issued (original maturities greater than three months) | 10,431 | 9,841 | |||||||||

| Payments on debt (original maturities greater than three months) | (8,237) | (8,297) | |||||||||

| Short-term borrowings – net (original maturities three months or less) | (2,804) | (138) | |||||||||

| Other – net | (1) | (3) | |||||||||

| Net cash provided by (used for) financing activities | (3,755) | (4,538) | |||||||||

| Effect of exchange rate changes on cash | (13) | (44) | |||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 1,074 | 402 | |||||||||

| Cash and short-term investments and restricted cash at beginning of period | 8,292 | 7,890 | |||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 9,366 | $ | 8,292 | |||||||

| All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. | ||

(more)

19

Caterpillar Inc.

Supplemental Data for Results of Operations

For the Three Months Ended December 31, 2020

(Unaudited)

(Millions of dollars)

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 10,570 | $ | 10,570 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 665 | — | 760 | (95) | 1 | |||||||||||||||||||||

| Total sales and revenues | 11,235 | 10,570 | 760 | (95) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 7,784 | 7,786 | — | (2) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 1,216 | 1,048 | 174 | (6) | 2 | |||||||||||||||||||||

| Research and development expenses | 374 | 374 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 128 | — | 129 | (1) | 3 | |||||||||||||||||||||

| Other operating (income) expenses | 353 | 56 | 309 | (12) | 2 | |||||||||||||||||||||

| Total operating costs | 9,855 | 9,264 | 612 | (21) | ||||||||||||||||||||||

| Operating profit | 1,380 | 1,306 | 148 | (74) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 130 | 130 | — | — | ||||||||||||||||||||||

| Other income (expense) | (309) | (122) | 39 | (226) | 4 | |||||||||||||||||||||

| Consolidated profit before taxes | 941 | 1,054 | 187 | (300) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 167 | 133 | 34 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 774 | 921 | 153 | (300) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 6 | 11 | — | (5) | 5 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 780 | 932 | 153 | (305) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | — | 3 | 2 | (5) | 6 | |||||||||||||||||||||

Profit 7 | $ | 780 | $ | 929 | $ | 151 | $ | (300) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 7 | Profit attributable to common shareholders. | ||||

(more)

20

Caterpillar Inc.

Supplemental Data for Results of Operations

For the Three Months Ended December 31, 2019

(Unaudited)

(Millions of dollars)

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 12,386 | $ | 12,386 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 758 | — | 887 | (129) | 1 | |||||||||||||||||||||

| Total sales and revenues | 13,144 | 12,386 | 887 | (129) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 9,117 | 9,119 | — | (2) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 1,283 | 1,120 | 173 | (10) | 2 | |||||||||||||||||||||

| Research and development expenses | 386 | 386 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 183 | — | 187 | (4) | 3 | |||||||||||||||||||||

| Other operating (income) expenses | 325 | 12 | 323 | (10) | 2 | |||||||||||||||||||||

| Total operating costs | 11,294 | 10,637 | 683 | (26) | ||||||||||||||||||||||

| Operating profit | 1,850 | 1,749 | 204 | (103) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 112 | 111 | — | 1 | 3 | |||||||||||||||||||||

| Other income (expense) | (373) | (464) | 12 | 79 | 4 | |||||||||||||||||||||

| Consolidated profit before taxes | 1,365 | 1,174 | 216 | (25) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 276 | 218 | 58 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 1,089 | 956 | 158 | (25) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 8 | 13 | — | (5) | 5 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 1,097 | 969 | 158 | (30) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | (1) | (1) | 5 | (5) | 6 | |||||||||||||||||||||

Profit 7 | $ | 1,098 | $ | 970 | $ | 153 | $ | (25) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 7 | Profit attributable to common shareholders. | ||||

(more)

21

Caterpillar Inc.

Supplemental Data for Results of Operations

For the Twelve Months Ended December 31, 2020

(Unaudited)

(Millions of dollars)

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 39,022 | $ | 39,022 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 2,726 | — | 3,110 | (384) | 1 | |||||||||||||||||||||

| Total sales and revenues | 41,748 | 39,022 | 3,110 | (384) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 29,082 | 29,088 | — | (6) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 4,642 | 3,915 | 746 | (19) | 2 | |||||||||||||||||||||

| Research and development expenses | 1,415 | 1,415 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 589 | — | 591 | (2) | 3 | |||||||||||||||||||||

| Other operating (income) expenses | 1,467 | 283 | 1,236 | (52) | 2 | |||||||||||||||||||||

| Total operating costs | 37,195 | 34,701 | 2,573 | (79) | ||||||||||||||||||||||

| Operating profit | 4,553 | 4,321 | 537 | (305) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 514 | 513 | — | 1 | 3 | |||||||||||||||||||||

| Other income (expense) | (44) | (62) | 32 | (14) | 4 | |||||||||||||||||||||

| Consolidated profit before taxes | 3,995 | 3,746 | 569 | (320) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 1,006 | 853 | 153 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 2,989 | 2,893 | 416 | (320) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 14 | 29 | — | (15) | 5 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 3,003 | 2,922 | 416 | (335) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 5 | 5 | 15 | (15) | 6 | |||||||||||||||||||||

Profit 7 | $ | 2,998 | $ | 2,917 | $ | 401 | $ | (320) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 7 | Profit attributable to common shareholders. | ||||

(more)

22

Caterpillar Inc.

Supplemental Data for Results of Operations

For the Twelve Months Ended December 31, 2019

(Unaudited)

(Millions of dollars)

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 50,755 | $ | 50,755 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 3,045 | — | 3,571 | (526) | 1 | |||||||||||||||||||||

| Total sales and revenues | 53,800 | 50,755 | 3,571 | (526) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 36,630 | 36,634 | — | (4) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 5,162 | 4,444 | 737 | (19) | 2 | |||||||||||||||||||||

| Research and development expenses | 1,693 | 1,693 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 754 | — | 786 | (32) | 3 | |||||||||||||||||||||

| Other operating (income) expenses | 1,271 | 14 | 1,297 | (40) | 2 | |||||||||||||||||||||

| Total operating costs | 45,510 | 42,785 | 2,820 | (95) | ||||||||||||||||||||||

| Operating profit | 8,290 | 7,970 | 751 | (431) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 421 | 429 | — | (8) | 3 | |||||||||||||||||||||

| Other income (expense) | (57) | (535) | 80 | 398 | 4 | |||||||||||||||||||||

| Consolidated profit before taxes | 7,812 | 7,006 | 831 | (25) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 1,746 | 1,512 | 234 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 6,066 | 5,494 | 597 | (25) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 28 | 49 | — | (21) | 5 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 6,094 | 5,543 | 597 | (46) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 1 | — | 22 | (21) | 6 | |||||||||||||||||||||

Profit 7 | $ | 6,093 | $ | 5,543 | $ | 575 | $ | (25) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 7 | Profit attributable to common shareholders. | ||||

(more)

23

Caterpillar Inc.

Supplemental Data for Financial Position

At December 31, 2020

(Unaudited)

(Millions of dollars)

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||

| Cash and short-term investments | $ | 9,352 | $ | 8,822 | $ | 530 | $ | — | ||||||||||||||||||

| Receivables – trade and other | 7,317 | 3,846 | 397 | 3,074 | 1,2 | |||||||||||||||||||||

| Receivables – finance | 9,463 | — | 13,681 | (4,218) | 2 | |||||||||||||||||||||

| Prepaid expenses and other current assets | 1,930 | 1,376 | 624 | (70) | 3 | |||||||||||||||||||||

| Inventories | 11,402 | 11,402 | — | — | ||||||||||||||||||||||

| Total current assets | 39,464 | 25,446 | 15,232 | (1,214) | ||||||||||||||||||||||

| Property, plant and equipment – net | 12,401 | 8,309 | 4,092 | — | ||||||||||||||||||||||

| Long-term receivables – trade and other | 1,185 | 363 | 164 | 658 | 1,2 | |||||||||||||||||||||

| Long-term receivables – finance | 12,222 | — | 12,895 | (673) | 2 | |||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 1,523 | 2,058 | 110 | (645) | 4 | |||||||||||||||||||||

| Intangible assets | 1,308 | 1,308 | — | — | ||||||||||||||||||||||

| Goodwill | 6,394 | 6,394 | — | — | ||||||||||||||||||||||

| Other assets | 3,827 | 3,158 | 1,871 | (1,202) | 5 | |||||||||||||||||||||

| Total assets | $ | 78,324 | $ | 47,036 | $ | 34,364 | $ | (3,076) | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||

| Short-term borrowings | $ | 2,015 | $ | 10 | $ | 2,005 | $ | — | ||||||||||||||||||

| Short-term borrowings with consolidated companies | — | — | 1,000 | (1,000) | 6 | |||||||||||||||||||||

| Accounts payable | 6,128 | 6,060 | 212 | (144) | 7 | |||||||||||||||||||||

| Accrued expenses | 3,642 | 3,099 | 543 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 1,096 | 1,081 | 15 | — | ||||||||||||||||||||||

| Customer advances | 1,108 | 1,108 | — | — | ||||||||||||||||||||||

| Dividends payable | 562 | 562 | — | — | ||||||||||||||||||||||

| Other current liabilities | 2,017 | 1,530 | 580 | (93) | 4,8 | |||||||||||||||||||||

| Long-term debt due within one year | 9,149 | 1,420 | 7,729 | — | ||||||||||||||||||||||

| Total current liabilities | 25,717 | 14,870 | 12,084 | (1,237) | ||||||||||||||||||||||

| Long-term debt due after one year | 25,999 | 9,764 | 16,250 | (15) | 6 | |||||||||||||||||||||

| Liability for postemployment benefits | 6,872 | 6,872 | — | — | ||||||||||||||||||||||

| Other liabilities | 4,358 | 3,691 | 1,385 | (718) | 4 | |||||||||||||||||||||

| Total liabilities | 62,946 | 35,197 | 29,719 | (1,970) | ||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||

| Common stock | 6,230 | 6,230 | 919 | (919) | 9 | |||||||||||||||||||||

| Treasury stock | (25,178) | (25,178) | — | — | ||||||||||||||||||||||

| Profit employed in the business | 35,167 | 31,091 | 4,065 | 11 | 9 | |||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (888) | (352) | (536) | — | ||||||||||||||||||||||

| Noncontrolling interests | 47 | 48 | 197 | (198) | 9 | |||||||||||||||||||||

| Total shareholders’ equity | 15,378 | 11,839 | 4,645 | (1,106) | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 78,324 | $ | 47,036 | $ | 34,364 | $ | (3,076) | ||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. | ||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. | ||||

| 3 | Elimination of ME&T's insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. | ||||

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. | ||||

| 6 | Elimination of debt between ME&T and Financial Products. | ||||

| 7 | Elimination of payables between ME&T and Financial Products. | ||||

| 8 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 9 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. | ||||

(more)

24

Caterpillar Inc.

Supplemental Data for Financial Position

At December 31, 2019

(Unaudited)

(Millions of dollars)

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||

| Cash and short-term investments | $ | 8,284 | $ | 7,299 | $ | 985 | $ | — | ||||||||||||||||||

| Receivables – trade and other | 8,568 | 3,737 | 451 | 4,380 | 1,2 | |||||||||||||||||||||

| Receivables – finance | 9,336 | — | 14,489 | (5,153) | 2 | |||||||||||||||||||||

| Prepaid expenses and other current assets | 1,739 | 1,290 | 529 | (80) | 3 | |||||||||||||||||||||

| Inventories | 11,266 | 11,266 | — | — | ||||||||||||||||||||||

| Total current assets | 39,193 | 23,592 | 16,454 | (853) | ||||||||||||||||||||||

| Property, plant and equipment – net | 12,904 | 8,606 | 4,298 | — | ||||||||||||||||||||||

| Long-term receivables – trade and other | 1,193 | 348 | 152 | 693 | 1,2 | |||||||||||||||||||||

| Long-term receivables – finance | 12,651 | — | 13,354 | (703) | 2 | |||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 1,411 | 2,002 | 117 | (708) | 4 | |||||||||||||||||||||

| Intangible assets | 1,565 | 1,565 | — | — | ||||||||||||||||||||||

| Goodwill | 6,196 | 6,196 | — | — | ||||||||||||||||||||||

| Other assets | 3,340 | 2,953 | 1,572 | (1,185) | 5 | |||||||||||||||||||||

| Total assets | $ | 78,453 | $ | 45,262 | $ | 35,947 | $ | (2,756) | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||

| Short-term borrowings | $ | 5,166 | $ | 5 | $ | 5,161 | $ | — | ||||||||||||||||||

| Short-term borrowings with consolidated companies | — | — | 600 | (600) | 6 | |||||||||||||||||||||

| Accounts payable | 5,957 | 5,918 | 212 | (173) | 7 | |||||||||||||||||||||

| Accrued expenses | 3,750 | 3,415 | 335 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 1,629 | 1,580 | 49 | — | ||||||||||||||||||||||

| Customer advances | 1,187 | 1,187 | — | — | ||||||||||||||||||||||

| Dividends payable | 567 | 567 | — | — | ||||||||||||||||||||||

| Other current liabilities | 2,155 | 1,689 | 566 | (100) | 4,8 | |||||||||||||||||||||

| Long-term debt due within one year | 6,210 | 16 | 6,194 | — | ||||||||||||||||||||||

| Total current liabilities | 26,621 | 14,377 | 13,117 | (873) | ||||||||||||||||||||||

| Long-term debt due after one year | 26,281 | 9,151 | 17,140 | (10) | 6 | |||||||||||||||||||||

| Liability for postemployment benefits | 6,599 | 6,599 | — | — | ||||||||||||||||||||||

| Other liabilities | 4,323 | 3,681 | 1,430 | (788) | 4 | |||||||||||||||||||||

| Total liabilities | 63,824 | 33,808 | 31,687 | (1,671) | ||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||

| Common stock | 5,935 | 5,935 | 919 | (919) | 9 | |||||||||||||||||||||

| Treasury stock | (24,217) | (24,217) | — | — | ||||||||||||||||||||||

| Profit employed in the business | 34,437 | 30,434 | 3,997 | 6 | 9 | |||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (1,567) | (739) | (828) | — | ||||||||||||||||||||||

| Noncontrolling interests | 41 | 41 | 172 | (172) | 9 | |||||||||||||||||||||

| Total shareholders’ equity | 14,629 | 11,454 | 4,260 | (1,085) | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 78,453 | $ | 45,262 | $ | 35,947 | $ | (2,756) | ||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. | ||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. | ||||

| 3 | Elimination of ME&T’s insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. | ||||

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. | ||||

| 6 | Elimination of debt between ME&T and Financial Products. | ||||

| 7 | Elimination of payables between ME&T and Financial Products. | ||||

| 8 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 9 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. | ||||

(more)

25

Caterpillar Inc.

Supplemental Data for Cash Flow

For the Twelve Months Ended December 31, 2020

(Unaudited)

(Millions of dollars)

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 3,003 | $ | 2,922 | $ | 416 | $ | (335) | 1, 5 | |||||||||||||||||

| Adjustments for non-cash items: | ||||||||||||||||||||||||||

| Depreciation and amortization | 2,432 | 1,630 | 802 | — | ||||||||||||||||||||||

| Actuarial (gain) loss on pension and postretirement benefits | 384 | 384 | — | — | ||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | (74) | (85) | 11 | — | ||||||||||||||||||||||

| Other | 1,000 | 613 | 98 | 289 | 2 | |||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||

| Receivables – trade and other | 1,442 | 395 | 50 | 997 | 2, 3 | |||||||||||||||||||||

| Inventories | (34) | (29) | — | (5) | 2 | |||||||||||||||||||||

| Accounts payable | 98 | 51 | 18 | 29 | 2 | |||||||||||||||||||||

| Accrued expenses | (366) | (364) | (2) | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | (544) | (510) | (34) | — | ||||||||||||||||||||||

| Customer advances | (126) | (126) | — | — | ||||||||||||||||||||||

| Other assets – net | (201) | (133) | (71) | 3 | 2 | |||||||||||||||||||||

| Other liabilities – net | (687) | (694) | (23) | 30 | 2 | |||||||||||||||||||||

| Net cash provided by (used for) operating activities | 6,327 | 4,054 | 1,265 | 1,008 | ||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (978) | (976) | (14) | 12 | 2 | |||||||||||||||||||||

| Expenditures for equipment leased to others | (1,137) | (18) | (1,139) | 20 | 2 | |||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 772 | 147 | 651 | (26) | 2 | |||||||||||||||||||||

| Additions to finance receivables | (12,385) | — | (13,525) | 1,140 | 3 | |||||||||||||||||||||

| Collections of finance receivables | 12,646 | — | 14,077 | (1,431) | 3 | |||||||||||||||||||||

| Net intercompany purchased receivables | — | — | 1,043 | (1,043) | 3 | |||||||||||||||||||||

| Proceeds from sale of finance receivables | 42 | — | 42 | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | (401) | 7 | 394 | 4 | |||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (111) | (111) | — | — | ||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 25 | 25 | — | — | ||||||||||||||||||||||

| Proceeds from sale of securities | 345 | 24 | 321 | — | ||||||||||||||||||||||

| Investments in securities | (638) | (21) | (617) | — | ||||||||||||||||||||||

| Other – net | (66) | (11) | (55) | — | ||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (1,485) | (1,342) | 791 | (934) | ||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||

| Dividends paid | (2,243) | (2,243) | (320) | 320 | 5 | |||||||||||||||||||||

| Common stock issued, including treasury shares reissued | 229 | 229 | — | — | ||||||||||||||||||||||

| Common shares repurchased | (1,130) | (1,130) | — | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | (7) | 401 | (394) | 4 | |||||||||||||||||||||

| Proceeds from debt issued > 90 days | 10,431 | 1,991 | 8,440 | — | ||||||||||||||||||||||

| Payments on debt > 90 days | (8,237) | (26) | (8,211) | — | ||||||||||||||||||||||

| Short-term borrowings – net < 90 days | (2,804) | 5 | (2,809) | — | ||||||||||||||||||||||

| Other – net | (1) | (1) | — | — | ||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (3,755) | (1,182) | (2,499) | (74) | ||||||||||||||||||||||

| Effect of exchange rate changes on cash | (13) | (10) | (3) | — | ||||||||||||||||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 1,074 | 1,520 | (446) | — | ||||||||||||||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 8,292 | 7,302 | 990 | — | ||||||||||||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 9,366 | $ | 8,822 | $ | 544 | $ | — | ||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | ||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | ||||

| 5 | Elimination of dividend activity between Financial Products and ME&T. | ||||

(more)

26

Caterpillar Inc.

Supplemental Data for Cash Flow

For the Twelve Months Ended December 31, 2019

(Unaudited)

(Millions of dollars)

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 6,094 | $ | 5,543 | $ | 597 | $ | (46) | 1,5 | |||||||||||||||||

| Adjustments for non-cash items: | ||||||||||||||||||||||||||

| Depreciation and amortization | 2,577 | 1,713 | 864 | — | ||||||||||||||||||||||

| Actuarial (gain) loss on pension and postretirement benefits | 468 | 468 | — | — | ||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | 28 | 15 | 13 | — | ||||||||||||||||||||||

| Other | 675 | 435 | (215) | 455 | 2 | |||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||

| Receivables – trade and other | 171 | 4 | 15 | 152 | 2, 3 | |||||||||||||||||||||

| Inventories | 274 | 250 | — | 24 | 2 | |||||||||||||||||||||

| Accounts payable | (1,025) | (983) | 20 | (62) | 2 | |||||||||||||||||||||

| Accrued expenses | 172 | 187 | (13) | (2) | 2 | |||||||||||||||||||||

| Accrued wages, salaries and employee benefits | (757) | (772) | 15 | — | ||||||||||||||||||||||

| Customer advances | (10) | (8) | — | (2) | 2 | |||||||||||||||||||||

| Other assets – net | (93) | (166) | 38 | 35 | 2 | |||||||||||||||||||||

| Other liabilities – net | (1,662) | (1,815) | 169 | (16) | 2 | |||||||||||||||||||||

| Net cash provided by (used for) operating activities | 6,912 | 4,871 | 1,503 | 538 | ||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (1,056) | (1,036) | (20) | — | ||||||||||||||||||||||

| Expenditures for equipment leased to others | (1,613) | (38) | (1,616) | 41 | 2 | |||||||||||||||||||||