- CAT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Caterpillar (CAT) 8-K2Q 2021 Earnings Release

Filed: 30 Jul 21, 6:30am

| Second Quarter | |||||||||||

| ($ in billions except profit per share) | 2021 | 2020 | |||||||||

| Sales and Revenues | $12.9 | $10.0 | |||||||||

| Profit Per Share | $2.56 | $0.84 | |||||||||

| Adjusted Profit Per Share | $2.60 | $1.27 | |||||||||

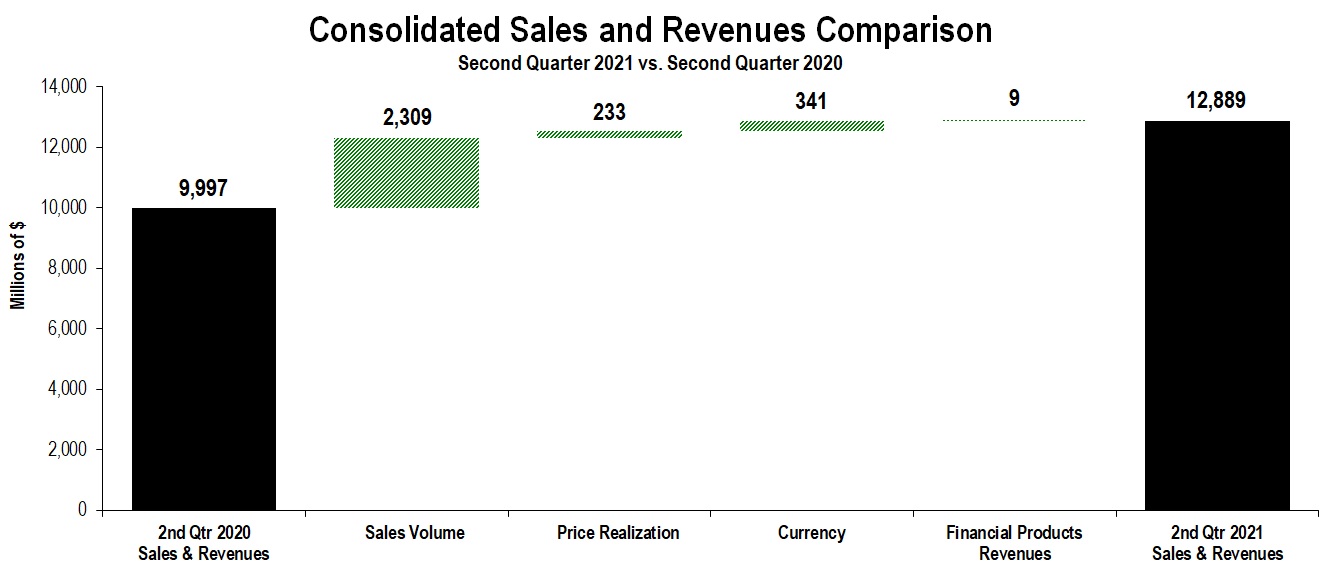

| ● | Second-quarter 2021 sales and revenues increased 29% to $12.9 billion | ||||

| ● | Second-quarter 2021 profit per share of $2.56; adjusted profit per share of $2.60 | ||||

| ● | Strong balance sheet; returned $0.8 billion to shareholders through dividends and share repurchases | ||||

| Sales and Revenues by Segment | |||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | Second Quarter 2020 | Sales Volume | Price Realization | Currency | Inter-Segment / Other | Second Quarter 2021 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 4,048 | $ | 1,171 | $ | 238 | $ | 162 | $ | 37 | $ | 5,656 | $ | 1,608 | 40% | ||||||||||||||||||||||||||||||||

| Resource Industries | 1,826 | 712 | (17) | 66 | (8) | 2,579 | 753 | 41% | |||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 4,149 | 456 | 12 | 111 | 247 | 4,975 | 826 | 20% | |||||||||||||||||||||||||||||||||||||||

| All Other Segment | 115 | 4 | — | 2 | 7 | 128 | 13 | 11% | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (828) | (34) | — | — | (283) | (1,145) | (317) | ||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 9,310 | 2,309 | 233 | 341 | — | 12,193 | 2,883 | 31% | |||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 763 | — | — | — | 11 | 774 | 11 | 1% | |||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (76) | — | — | — | (2) | (78) | (2) | ||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 687 | — | — | — | 9 | 696 | 9 | 1% | |||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 9,997 | $ | 2,309 | $ | 233 | $ | 341 | $ | 9 | $ | 12,889 | $ | 2,892 | 29% | ||||||||||||||||||||||||||||||||

| Sales and Revenues by Geographic Region | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North America | Latin America | EAME | Asia/Pacific | External Sales and Revenues | Inter-Segment | Total Sales and Revenues | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | $ | % Chg | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 2,498 | 56% | $ | 430 | 103% | $ | 1,291 | 38% | $ | 1,384 | 8% | $ | 5,603 | 39% | $ | 53 | 231% | $ | 5,656 | 40% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 799 | 58% | 487 | 80% | 525 | 39% | 660 | 19% | 2,471 | 45% | 108 | (7%) | 2,579 | 41% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 1,992 | 10% | 250 | 27% | 1,196 | 29% | 682 | 14% | 4,120 | 16% | 855 | 41% | 4,975 | 20% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 11 | 57% | 1 | —% | 4 | (20%) | 18 | 20% | 34 | 21% | 94 | 8% | 128 | 11% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (31) | (1) | (1) | (2) | (35) | (1,110) | (1,145) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 5,269 | 34% | 1,167 | 72% | 3,015 | 34% | 2,742 | 12% | 12,193 | 31% | — | —% | 12,193 | 31% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 488 | (1%) | 65 | 8% | 96 | —% | 125 | 10% | 774 | 1% | — | —% | 774 | 1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (38) | (11) | (9) | (20) | (78) | — | (78) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 450 | —% | 54 | 6% | 87 | —% | 105 | 6% | 696 | 1% | — | —% | 696 | 1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 5,719 | 30% | $ | 1,221 | 67% | $ | 3,102 | 33% | $ | 2,847 | 12% | $ | 12,889 | 29% | $ | — | —% | $ | 12,889 | 29% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction Industries | $ | 1,604 | $ | 212 | $ | 933 | $ | 1,283 | $ | 4,032 | $ | 16 | $ | 4,048 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resource Industries | 507 | 270 | 379 | 554 | 1,710 | 116 | 1,826 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy & Transportation | 1,816 | 197 | 929 | 599 | 3,541 | 608 | 4,149 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Segment | 7 | 1 | 5 | 15 | 28 | 87 | 115 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | 2 | (1) | — | (2) | (1) | (827) | (828) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery, Energy & Transportation | 3,936 | 679 | 2,246 | 2,449 | 9,310 | — | 9,310 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Segment | 493 | 60 | 96 | 114 | 763 | — | 763 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Items and Eliminations | (43) | (9) | (9) | (15) | (76) | — | (76) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Products Revenues | 450 | 51 | 87 | 99 | 687 | — | 687 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Sales and Revenues | $ | 4,386 | $ | 730 | $ | 2,333 | $ | 2,548 | $ | 9,997 | $ | — | $ | 9,997 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

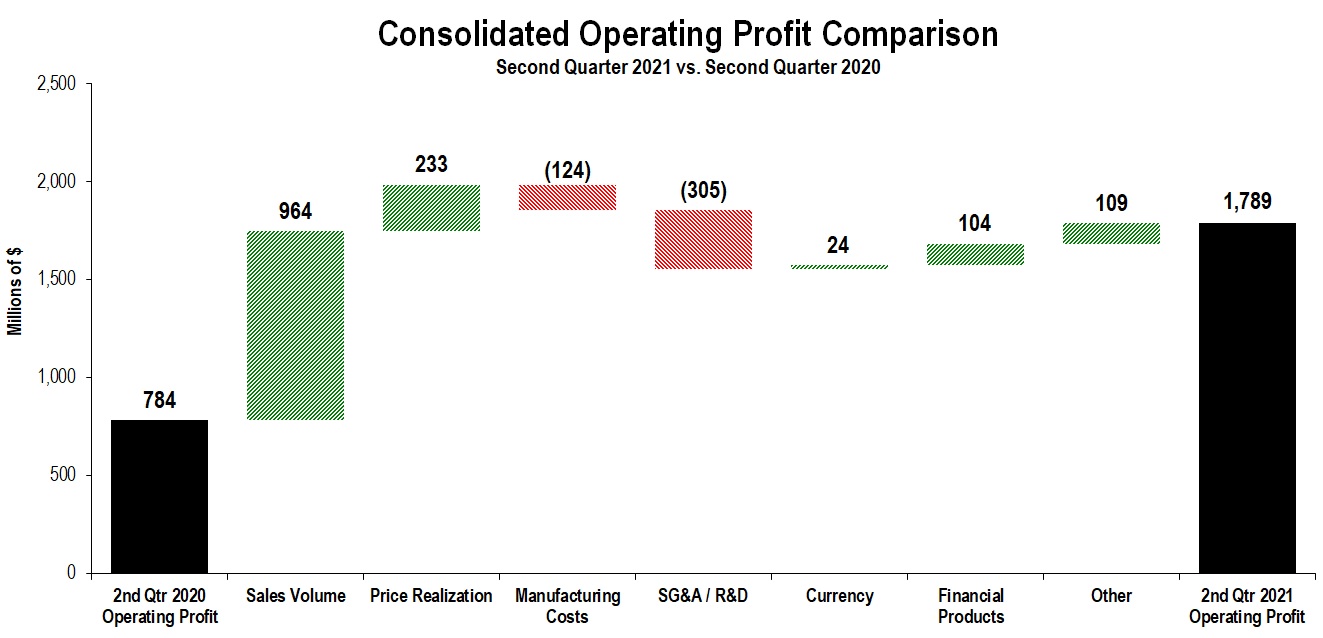

| Profit (Loss) by Segment | |||||||||||||||||||||||

| (Millions of dollars) | Second Quarter 2021 | Second Quarter 2020 | $ Change | % Change | |||||||||||||||||||

| Construction Industries | $ | 1,024 | $ | 518 | $ | 506 | 98 | % | |||||||||||||||

| Resource Industries | 361 | 152 | 209 | 138 | % | ||||||||||||||||||

| Energy & Transportation | 731 | 624 | 107 | 17 | % | ||||||||||||||||||

| All Other Segment | (10) | (3) | (7) | (233 | %) | ||||||||||||||||||

| Corporate Items and Eliminations | (453) | (542) | 89 | ||||||||||||||||||||

| Machinery, Energy & Transportation | 1,653 | 749 | 904 | 121 | % | ||||||||||||||||||

| Financial Products Segment | 243 | 148 | 95 | 64 | % | ||||||||||||||||||

| Corporate Items and Eliminations | (29) | (38) | 9 | ||||||||||||||||||||

| Financial Products | 214 | 110 | 104 | 95 | % | ||||||||||||||||||

| Consolidating Adjustments | (78) | (75) | (3) | ||||||||||||||||||||

| Consolidated Operating Profit | $ | 1,789 | $ | 784 | $ | 1,005 | 128 | % | |||||||||||||||

| CONSTRUCTION INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2020 | Sales Volume | Price Realization | Currency | Inter-Segment | Second Quarter 2021 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 4,048 | $ | 1,171 | $ | 238 | $ | 162 | $ | 37 | $ | 5,656 | $ | 1,608 | 40 | % | ||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | Second Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 2,498 | $ | 1,604 | $ | 894 | 56 | % | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 430 | 212 | 218 | 103 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 1,291 | 933 | 358 | 38 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 1,384 | 1,283 | 101 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 5,603 | 4,032 | 1,571 | 39 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 53 | 16 | 37 | 231 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 5,656 | $ | 4,048 | $ | 1,608 | 40 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | Second Quarter 2020 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 1,024 | $ | 518 | $ | 506 | 98 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 18.1 | % | 12.8 | % | 5.3 | pts | ||||||||||||||||||||||||||||||||||||||||||||

| RESOURCE INDUSTRIES | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2020 | Sales Volume | Price Realization | Currency | Inter-Segment | Second Quarter 2021 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 1,826 | $ | 712 | $ | (17) | $ | 66 | $ | (8) | $ | 2,579 | $ | 753 | 41 | % | ||||||||||||||||||||||||||||||||||

| Sales by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | Second Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 799 | $ | 507 | $ | 292 | 58 | % | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 487 | 270 | 217 | 80 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 525 | 379 | 146 | 39 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 660 | 554 | 106 | 19 | % | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 2,471 | 1,710 | 761 | 45 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 108 | 116 | (8) | (7 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 2,579 | $ | 1,826 | $ | 753 | 41 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | Second Quarter 2020 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 361 | $ | 152 | $ | 209 | 138 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 14.0 | % | 8.3 | % | 5.7 | pts | ||||||||||||||||||||||||||||||||||||||||||||

| ENERGY & TRANSPORTATION | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Segment Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2020 | Sales Volume | Price Realization | Currency | Inter-Segment | Second Quarter 2021 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 4,149 | $ | 456 | $ | 12 | $ | 111 | $ | 247 | $ | 4,975 | $ | 826 | 20 | % | ||||||||||||||||||||||||||||||||||

| Sales by Application | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | Second Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Oil and Gas | $ | 1,137 | $ | 1,027 | $ | 110 | 11 | % | ||||||||||||||||||||||||||||||||||||||||||

| Power Generation | 1,052 | 895 | 157 | 18 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Industrial | 899 | 678 | 221 | 33 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Transportation | 1,032 | 941 | 91 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||

| External Sales | 4,120 | 3,541 | 579 | 16 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Inter-segment | 855 | 608 | 247 | 41 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $ | 4,975 | $ | 4,149 | $ | 826 | 20 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | Second Quarter 2020 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 731 | $ | 624 | $ | 107 | 17 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit Margin | 14.7 | % | 15.0 | % | (0.3 | pts) | ||||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL PRODUCTS SEGMENT | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Millions of dollars) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues by Geographic Region | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | Second Quarter 2020 | $ Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| North America | $ | 488 | $ | 493 | $ | (5) | (1 | %) | ||||||||||||||||||||||||||||||||||||||||||

| Latin America | 65 | 60 | 5 | 8 | % | |||||||||||||||||||||||||||||||||||||||||||||

| EAME | 96 | 96 | — | — | % | |||||||||||||||||||||||||||||||||||||||||||||

| Asia/Pacific | 125 | 114 | 11 | 10 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 774 | $ | 763 | $ | 11 | 1 | % | ||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2021 | Second Quarter 2020 | Change | % Change | |||||||||||||||||||||||||||||||||||||||||||||||

| Segment Profit | $ | 243 | $ | 148 | $ | 95 | 64 | % | ||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions except per share data) | Operating Profit | Operating Profit Margin | Profit Before Taxes | Provision (Benefit) for Income Taxes | Effective Tax Rate | Profit | Profit per Share | |||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2021 - U.S. GAAP | $ | 1,789 | 13.9 | % | $ | 1,870 | $ | 470 | 25.1 | % | $ | 1,413 | $ | 2.56 | ||||||||||||||||||||||||||||||

| Restructuring costs | 25 | 0.2 | % | 25 | 3 | 15.0 | % | 22 | $ | 0.04 | ||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2021 - Adjusted | $ | 1,814 | 14.1 | % | $ | 1,895 | $ | 473 | 25.0 | % | $ | 1,435 | $ | 2.60 | ||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2020 - U.S. GAAP | $ | 784 | 7.8 | % | $ | 678 | $ | 227 | 33.5 | % | $ | 458 | $ | 0.84 | ||||||||||||||||||||||||||||||

| Restructuring costs | 147 | 1.5 | % | 147 | 15 | 10.2 | % | 132 | $ | 0.24 | ||||||||||||||||||||||||||||||||||

| Remeasurement losses of pension obligations | — | — | % | 122 | 21 | 17.2 | % | 101 | $ | 0.19 | ||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2020 - Adjusted | $ | 931 | 9.3 | % | $ | 947 | $ | 263 | 27.8 | % | $ | 691 | $ | 1.27 | ||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Sales and revenues: | |||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 12,193 | $ | 9,310 | $ | 23,384 | $ | 19,224 | |||||||||||||||

| Revenues of Financial Products | 696 | 687 | 1,392 | 1,408 | |||||||||||||||||||

| Total sales and revenues | 12,889 | 9,997 | 24,776 | 20,632 | |||||||||||||||||||

| Operating costs: | |||||||||||||||||||||||

| Cost of goods sold | 8,881 | 7,113 | 16,893 | 14,379 | |||||||||||||||||||

| Selling, general and administrative expenses | 1,364 | 1,179 | 2,603 | 2,300 | |||||||||||||||||||

| Research and development expenses | 446 | 341 | 820 | 697 | |||||||||||||||||||

| Interest expense of Financial Products | 116 | 149 | 241 | 324 | |||||||||||||||||||

| Other operating (income) expenses | 293 | 431 | 616 | 744 | |||||||||||||||||||

| Total operating costs | 11,100 | 9,213 | 21,173 | 18,444 | |||||||||||||||||||

| Operating profit | 1,789 | 784 | 3,603 | 2,188 | |||||||||||||||||||

| Interest expense excluding Financial Products | 120 | 135 | 262 | 248 | |||||||||||||||||||

| Other income (expense) | 201 | 29 | 526 | 251 | |||||||||||||||||||

| Consolidated profit before taxes | 1,870 | 678 | 3,867 | 2,191 | |||||||||||||||||||

| Provision (benefit) for income taxes | 470 | 227 | 945 | 652 | |||||||||||||||||||

| Profit of consolidated companies | 1,400 | 451 | 2,922 | 1,539 | |||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 14 | 8 | 23 | 13 | |||||||||||||||||||

| Profit of consolidated and affiliated companies | 1,414 | 459 | 2,945 | 1,552 | |||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 1 | 1 | 2 | 2 | |||||||||||||||||||

Profit 1 | $ | 1,413 | $ | 458 | $ | 2,943 | $ | 1,550 | |||||||||||||||

| Profit per common share | $ | 2.58 | $ | 0.84 | $ | 5.38 | $ | 2.85 | |||||||||||||||

Profit per common share — diluted 2 | $ | 2.56 | $ | 0.84 | $ | 5.33 | $ | 2.83 | |||||||||||||||

| Weighted-average common shares outstanding (millions) | |||||||||||||||||||||||

| – Basic | 547.9 | 541.5 | 547.1 | 544.5 | |||||||||||||||||||

– Diluted 2 | 552.1 | 544.5 | 551.8 | 548.2 | |||||||||||||||||||

| 1 | Profit attributable to common shareholders. | ||||

| 2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. | ||||

| June 30, 2021 | December 31, 2020 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and short-term investments | $ | 10,831 | $ | 9,352 | |||||||

| Receivables – trade and other | 7,840 | 7,317 | |||||||||

| Receivables – finance | 9,523 | 9,463 | |||||||||

| Prepaid expenses and other current assets | 2,080 | 1,930 | |||||||||

| Inventories | 12,672 | 11,402 | |||||||||

| Total current assets | 42,946 | 39,464 | |||||||||

| Property, plant and equipment – net | 12,014 | 12,401 | |||||||||

| Long-term receivables – trade and other | 1,206 | 1,185 | |||||||||

| Long-term receivables – finance | 12,590 | 12,222 | |||||||||

| Noncurrent deferred and refundable income taxes | 1,455 | 1,523 | |||||||||

| Intangible assets | 1,176 | 1,308 | |||||||||

| Goodwill | 6,372 | 6,394 | |||||||||

| Other assets | 3,938 | 3,827 | |||||||||

| Total assets | $ | 81,697 | $ | 78,324 | |||||||

| Liabilities | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings: | |||||||||||

| -- Machinery, Energy & Transportation | $ | 4 | $ | 10 | |||||||

| -- Financial Products | 3,421 | 2,005 | |||||||||

| Accounts payable | 6,921 | 6,128 | |||||||||

| Accrued expenses | 3,556 | 3,642 | |||||||||

| Accrued wages, salaries and employee benefits | 1,759 | 1,096 | |||||||||

| Customer advances | 1,157 | 1,108 | |||||||||

| Dividends payable | 608 | 562 | |||||||||

| Other current liabilities | 2,126 | 2,017 | |||||||||

| Long-term debt due within one year: | |||||||||||

| -- Machinery, Energy & Transportation | 50 | 1,420 | |||||||||

| -- Financial Products | 7,906 | 7,729 | |||||||||

| Total current liabilities | 27,508 | 25,717 | |||||||||

| Long-term debt due after one year: | |||||||||||

| -- Machinery, Energy & Transportation | 9,752 | 9,749 | |||||||||

| -- Financial Products | 16,452 | 16,250 | |||||||||

| Liability for postemployment benefits | 6,581 | 6,872 | |||||||||

| Other liabilities | 4,524 | 4,358 | |||||||||

| Total liabilities | 64,817 | 62,946 | |||||||||

| Shareholders’ equity | |||||||||||

| Common stock | 6,293 | 6,230 | |||||||||

| Treasury stock | (25,240) | (25,178) | |||||||||

| Profit employed in the business | 36,934 | 35,167 | |||||||||

| Accumulated other comprehensive income (loss) | (1,154) | (888) | |||||||||

| Noncontrolling interests | 47 | 47 | |||||||||

| Total shareholders’ equity | 16,880 | 15,378 | |||||||||

| Total liabilities and shareholders’ equity | $ | 81,697 | $ | 78,324 | |||||||

| Six Months Ended June 30, | |||||||||||

| 2021 | 2020 | ||||||||||

| Cash flow from operating activities: | |||||||||||

| Profit of consolidated and affiliated companies | $ | 2,945 | $ | 1,552 | |||||||

| Adjustments for non-cash items: | |||||||||||

| Depreciation and amortization | 1,173 | 1,222 | |||||||||

| Net gain on remeasurement of pension obligations | — | (132) | |||||||||

| Provision (benefit) for deferred income taxes | 68 | (32) | |||||||||

| Other | (20) | 674 | |||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | |||||||||||

| Receivables – trade and other | (343) | 1,176 | |||||||||

| Inventories | (1,179) | (145) | |||||||||

| Accounts payable | 893 | (655) | |||||||||

| Accrued expenses | 22 | (253) | |||||||||

| Accrued wages, salaries and employee benefits | 618 | (648) | |||||||||

| Customer advances | 49 | (2) | |||||||||

| Other assets – net | (47) | (7) | |||||||||

| Other liabilities – net | (133) | (229) | |||||||||

| Net cash provided by (used for) operating activities | 4,046 | 2,521 | |||||||||

| Cash flow from investing activities: | |||||||||||

| Capital expenditures – excluding equipment leased to others | (419) | (472) | |||||||||

| Expenditures for equipment leased to others | (681) | (526) | |||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 636 | 382 | |||||||||

| Additions to finance receivables | (6,203) | (6,712) | |||||||||

| Collections of finance receivables | 5,580 | 6,801 | |||||||||

| Proceeds from sale of finance receivables | 27 | 31 | |||||||||

| Investments and acquisitions (net of cash acquired) | (398) | (49) | |||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 28 | 13 | |||||||||

| Proceeds from sale of securities | 276 | 151 | |||||||||

| Investments in securities | (500) | (369) | |||||||||

| Other – net | (63) | 7 | |||||||||

| Net cash provided by (used for) investing activities | (1,717) | (743) | |||||||||

| Cash flow from financing activities: | |||||||||||

| Dividends paid | (1,126) | (1,125) | |||||||||

| Common stock issued, including treasury shares reissued | 123 | (10) | |||||||||

| Common shares repurchased | (251) | (1,130) | |||||||||

| Proceeds from debt issued (original maturities greater than three months) | 4,906 | 6,159 | |||||||||

| Payments on debt (original maturities greater than three months) | (5,966) | (4,629) | |||||||||

| Short-term borrowings – net (original maturities three months or less) | 1,460 | (477) | |||||||||

| Other – net | (2) | (1) | |||||||||

| Net cash provided by (used for) financing activities | (856) | (1,213) | |||||||||

| Effect of exchange rate changes on cash | 3 | (66) | |||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 1,476 | 499 | |||||||||

| Cash and short-term investments and restricted cash at beginning of period | 9,366 | 8,292 | |||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 10,842 | $ | 8,791 | |||||||

| All short-term investments, which consist primarily of highly liquid investments with original maturities of three months or less, are considered to be cash equivalents. | ||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 12,193 | $ | 12,193 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 696 | — | 796 | (100) | 1 | |||||||||||||||||||||

| Total sales and revenues | 12,889 | 12,193 | 796 | (100) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 8,881 | 8,884 | — | (3) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 1,364 | 1,210 | 159 | (5) | 2 | |||||||||||||||||||||

| Research and development expenses | 446 | 446 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 116 | — | 116 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 293 | — | 307 | (14) | 2 | |||||||||||||||||||||

| Total operating costs | 11,100 | 10,540 | 582 | (22) | ||||||||||||||||||||||

| Operating profit | 1,789 | 1,653 | 214 | (78) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 120 | 120 | — | — | ||||||||||||||||||||||

| Other income (expense) | 201 | 445 | 28 | (272) | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 1,870 | 1,978 | 242 | (350) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 470 | 415 | 55 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 1,400 | 1,563 | 187 | (350) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 14 | 17 | — | (3) | 4 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 1,414 | 1,580 | 187 | (353) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 1 | 1 | 3 | (3) | 5 | |||||||||||||||||||||

Profit 6 | $ | 1,413 | $ | 1,579 | $ | 184 | $ | (350) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 9,310 | $ | 9,310 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 687 | — | 780 | (93) | 1 | |||||||||||||||||||||

| Total sales and revenues | 9,997 | 9,310 | 780 | (93) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 7,113 | 7,114 | — | (1) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 1,179 | 984 | 201 | (6) | 2 | |||||||||||||||||||||

| Research and development expenses | 341 | 341 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 149 | — | 149 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 431 | 122 | 320 | (11) | 2 | |||||||||||||||||||||

| Total operating costs | 9,213 | 8,561 | 670 | (18) | ||||||||||||||||||||||

| Operating profit | 784 | 749 | 110 | (75) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 135 | 135 | — | — | ||||||||||||||||||||||

| Other income (expense) | 29 | (57) | 31 | 55 | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 678 | 557 | 141 | (20) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 227 | 190 | 37 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 451 | 367 | 104 | (20) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 8 | 13 | — | (5) | 4 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 459 | 380 | 104 | (25) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 1 | 1 | 5 | (5) | 5 | |||||||||||||||||||||

Profit 6 | $ | 458 | $ | 379 | $ | 99 | $ | (20) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 23,384 | $ | 23,384 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 1,392 | — | 1,584 | (192) | 1 | |||||||||||||||||||||

| Total sales and revenues | 24,776 | 23,384 | 1,584 | (192) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 16,893 | 16,897 | — | (4) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 2,603 | 2,324 | 283 | (4) | 2 | |||||||||||||||||||||

| Research and development expenses | 820 | 820 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 241 | — | 241 | — | ||||||||||||||||||||||

| Other operating (income) expenses | 616 | 26 | 621 | (31) | 2 | |||||||||||||||||||||

| Total operating costs | 21,173 | 20,067 | 1,145 | (39) | ||||||||||||||||||||||

| Operating profit | 3,603 | 3,317 | 439 | (153) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 262 | 262 | — | — | ||||||||||||||||||||||

| Other income (expense) | 526 | 676 | 47 | (197) | 3 | |||||||||||||||||||||

| Consolidated profit before taxes | 3,867 | 3,731 | 486 | (350) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 945 | 827 | 118 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 2,922 | 2,904 | 368 | (350) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 23 | 29 | — | (6) | 4 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 2,945 | 2,933 | 368 | (356) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | 2 | 6 | (6) | 5 | |||||||||||||||||||||

Profit 6 | $ | 2,943 | $ | 2,931 | $ | 362 | $ | (350) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Sales and revenues: | ||||||||||||||||||||||||||

| Sales of Machinery, Energy & Transportation | $ | 19,224 | $ | 19,224 | $ | — | $ | — | ||||||||||||||||||

| Revenues of Financial Products | 1,408 | — | 1,610 | (202) | 1 | |||||||||||||||||||||

| Total sales and revenues | 20,632 | 19,224 | 1,610 | (202) | ||||||||||||||||||||||

| Operating costs: | ||||||||||||||||||||||||||

| Cost of goods sold | 14,379 | 14,381 | — | (2) | 2 | |||||||||||||||||||||

| Selling, general and administrative expenses | 2,300 | 1,924 | 383 | (7) | 2 | |||||||||||||||||||||

| Research and development expenses | 697 | 697 | — | — | ||||||||||||||||||||||

| Interest expense of Financial Products | 324 | — | 325 | (1) | 3 | |||||||||||||||||||||

| Other operating (income) expenses | 744 | 132 | 640 | (28) | 2 | |||||||||||||||||||||

| Total operating costs | 18,444 | 17,134 | 1,348 | (38) | ||||||||||||||||||||||

| Operating profit | 2,188 | 2,090 | 262 | (164) | ||||||||||||||||||||||

| Interest expense excluding Financial Products | 248 | 247 | — | 1 | 3 | |||||||||||||||||||||

| Other income (expense) | 251 | 122 | (16) | 145 | 4 | |||||||||||||||||||||

| Consolidated profit before taxes | 2,191 | 1,965 | 246 | (20) | ||||||||||||||||||||||

| Provision (benefit) for income taxes | 652 | 587 | 65 | — | ||||||||||||||||||||||

| Profit of consolidated companies | 1,539 | 1,378 | 181 | (20) | ||||||||||||||||||||||

| Equity in profit (loss) of unconsolidated affiliated companies | 13 | 22 | — | (9) | 5 | |||||||||||||||||||||

| Profit of consolidated and affiliated companies | 1,552 | 1,400 | 181 | (29) | ||||||||||||||||||||||

| Less: Profit (loss) attributable to noncontrolling interests | 2 | 2 | 9 | (9) | 6 | |||||||||||||||||||||

Profit 7 | $ | 1,550 | $ | 1,398 | $ | 172 | $ | (20) | ||||||||||||||||||

| 1 | Elimination of Financial Products’ revenues earned from ME&T. | ||||

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. | ||||

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. | ||||

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. | ||||

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. | ||||

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. | ||||

| 7 | Profit attributable to common shareholders. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||

| Cash and short-term investments | $ | 10,831 | $ | 10,028 | $ | 803 | $ | — | ||||||||||||||||||

| Receivables – trade and other | 7,840 | 3,169 | 455 | 4,216 | 1,2 | |||||||||||||||||||||

| Receivables – finance | 9,523 | — | 13,863 | (4,340) | 2 | |||||||||||||||||||||

| Prepaid expenses and other current assets | 2,080 | 1,756 | 479 | (155) | 3 | |||||||||||||||||||||

| Inventories | 12,672 | 12,672 | — | — | ||||||||||||||||||||||

| Total current assets | 42,946 | 27,625 | 15,600 | (279) | ||||||||||||||||||||||

| Property, plant and equipment – net | 12,014 | 8,035 | 3,979 | — | ||||||||||||||||||||||

| Long-term receivables – trade and other | 1,206 | 375 | 176 | 655 | 1,2 | |||||||||||||||||||||

| Long-term receivables – finance | 12,590 | — | 13,273 | (683) | 2 | |||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 1,455 | 1,980 | 103 | (628) | 4 | |||||||||||||||||||||

| Intangible assets | 1,176 | 1,176 | — | — | ||||||||||||||||||||||

| Goodwill | 6,372 | 6,372 | — | — | ||||||||||||||||||||||

| Other assets | 3,938 | 3,250 | 1,899 | (1,211) | 5 | |||||||||||||||||||||

| Total assets | $ | 81,697 | $ | 48,813 | $ | 35,030 | $ | (2,146) | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||

| Short-term borrowings | $ | 3,425 | $ | 4 | $ | 3,421 | $ | — | ||||||||||||||||||

| Short-term borrowings with consolidated companies | — | — | — | — | ||||||||||||||||||||||

| Accounts payable | 6,921 | 6,830 | 215 | (124) | 6 | |||||||||||||||||||||

| Accrued expenses | 3,556 | 3,191 | 365 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 1,759 | 1,719 | 40 | — | ||||||||||||||||||||||

| Customer advances | 1,157 | 1,157 | — | — | ||||||||||||||||||||||

| Dividends payable | 608 | 608 | — | — | ||||||||||||||||||||||

| Other current liabilities | 2,126 | 1,658 | 646 | (178) | 4,7 | |||||||||||||||||||||

| Long-term debt due within one year | 7,956 | 50 | 7,906 | — | ||||||||||||||||||||||

| Total current liabilities | 27,508 | 15,217 | 12,593 | (302) | ||||||||||||||||||||||

| Long-term debt due after one year | 26,204 | 9,780 | 16,452 | (28) | 8 | |||||||||||||||||||||

| Liability for postemployment benefits | 6,581 | 6,580 | 1 | — | ||||||||||||||||||||||

| Other liabilities | 4,524 | 3,851 | 1,374 | (701) | 4 | |||||||||||||||||||||

| Total liabilities | 64,817 | 35,428 | 30,420 | (1,031) | ||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||

| Common stock | 6,293 | 6,293 | 919 | (919) | 9 | |||||||||||||||||||||

| Treasury stock | (25,240) | (25,240) | — | — | ||||||||||||||||||||||

| Profit employed in the business | 36,934 | 32,846 | 4,077 | 11 | 9 | |||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (1,154) | (563) | (591) | — | ||||||||||||||||||||||

| Noncontrolling interests | 47 | 49 | 205 | (207) | 9 | |||||||||||||||||||||

| Total shareholders’ equity | 16,880 | 13,385 | 4,610 | (1,115) | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 81,697 | $ | 48,813 | $ | 35,030 | $ | (2,146) | ||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. | ||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. | ||||

| 3 | Elimination of ME&T's insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. | ||||

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. | ||||

| 6 | Elimination of payables between ME&T and Financial Products. | ||||

| 7 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 8 | Elimination of debt between ME&T and Financial Products. | ||||

| 9 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||||

| Cash and short-term investments | $ | 9,352 | $ | 8,822 | $ | 530 | $ | — | ||||||||||||||||||

| Receivables – trade and other | 7,317 | 3,846 | 397 | 3,074 | 1,2 | |||||||||||||||||||||

| Receivables – finance | 9,463 | — | 13,681 | (4,218) | 2 | |||||||||||||||||||||

| Prepaid expenses and other current assets | 1,930 | 1,376 | 624 | (70) | 3 | |||||||||||||||||||||

| Inventories | 11,402 | 11,402 | — | — | ||||||||||||||||||||||

| Total current assets | 39,464 | 25,446 | 15,232 | (1,214) | ||||||||||||||||||||||

| Property, plant and equipment – net | 12,401 | 8,309 | 4,092 | — | ||||||||||||||||||||||

| Long-term receivables – trade and other | 1,185�� | 363 | 164 | 658 | 1,2 | |||||||||||||||||||||

| Long-term receivables – finance | 12,222 | — | 12,895 | (673) | 2 | |||||||||||||||||||||

| Noncurrent deferred and refundable income taxes | 1,523 | 2,058 | 110 | (645) | 4 | |||||||||||||||||||||

| Intangible assets | 1,308 | 1,308 | — | — | ||||||||||||||||||||||

| Goodwill | 6,394 | 6,394 | — | — | ||||||||||||||||||||||

| Other assets | 3,827 | 3,158 | 1,871 | (1,202) | 5 | |||||||||||||||||||||

| Total assets | $ | 78,324 | $ | 47,036 | $ | 34,364 | $ | (3,076) | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||||

| Short-term borrowings | $ | 2,015 | $ | 10 | $ | 2,005 | $ | — | ||||||||||||||||||

| Short-term borrowings with consolidated companies | — | — | 1,000 | (1,000) | 6 | |||||||||||||||||||||

| Accounts payable | 6,128 | 6,060 | 212 | (144) | 7 | |||||||||||||||||||||

| Accrued expenses | 3,642 | 3,099 | 543 | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 1,096 | 1,081 | 15 | — | ||||||||||||||||||||||

| Customer advances | 1,108 | 1,108 | — | — | ||||||||||||||||||||||

| Dividends payable | 562 | 562 | — | — | ||||||||||||||||||||||

| Other current liabilities | 2,017 | 1,530 | 580 | (93) | 4,8 | |||||||||||||||||||||

| Long-term debt due within one year | 9,149 | 1,420 | 7,729 | — | ||||||||||||||||||||||

| Total current liabilities | 25,717 | 14,870 | 12,084 | (1,237) | ||||||||||||||||||||||

| Long-term debt due after one year | 25,999 | 9,764 | 16,250 | (15) | 6 | |||||||||||||||||||||

| Liability for postemployment benefits | 6,872 | 6,872 | — | — | ||||||||||||||||||||||

| Other liabilities | 4,358 | 3,691 | 1,385 | (718) | 4 | |||||||||||||||||||||

| Total liabilities | 62,946 | 35,197 | 29,719 | (1,970) | ||||||||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||||||||

| Common stock | 6,230 | 6,230 | 919 | (919) | 9 | |||||||||||||||||||||

| Treasury stock | (25,178) | (25,178) | — | — | ||||||||||||||||||||||

| Profit employed in the business | 35,167 | 31,091 | 4,065 | 11 | 9 | |||||||||||||||||||||

| Accumulated other comprehensive income (loss) | (888) | (352) | (536) | — | ||||||||||||||||||||||

| Noncontrolling interests | 47 | 48 | 197 | (198) | 9 | |||||||||||||||||||||

| Total shareholders’ equity | 15,378 | 11,839 | 4,645 | (1,106) | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 78,324 | $ | 47,036 | $ | 34,364 | $ | (3,076) | ||||||||||||||||||

| 1 | Elimination of receivables between ME&T and Financial Products. | ||||

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. | ||||

| 3 | Elimination of ME&T’s insurance premiums that are prepaid to Financial Products. | ||||

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. | ||||

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. | ||||

| 6 | Elimination of debt between ME&T and Financial Products. | ||||

| 7 | Elimination of payables between ME&T and Financial Products. | ||||

| 8 | Elimination of prepaid insurance in Financial Products’ other liabilities. | ||||

| 9 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. | ||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 2,945 | $ | 2,933 | $ | 368 | $ | (356) | 1, 5 | |||||||||||||||||

| Adjustments for non-cash items: | ||||||||||||||||||||||||||

| Depreciation and amortization | 1,173 | 772 | 401 | — | ||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | 68 | 111 | (43) | — | ||||||||||||||||||||||

| Other | (20) | 74 | (169) | 75 | 2 | |||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||

| Receivables – trade and other | (343) | (206) | 11 | (148) | 2, 3 | |||||||||||||||||||||

| Inventories | (1,179) | (1,180) | — | 1 | 2 | |||||||||||||||||||||

| Accounts payable | 893 | 871 | 2 | 20 | 2 | |||||||||||||||||||||

| Accrued expenses | 22 | 93 | (71) | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | 618 | 593 | 25 | — | ||||||||||||||||||||||

| Customer advances | 49 | 49 | — | — | ||||||||||||||||||||||

| Other assets – net | (47) | (154) | 15 | 92 | 2 | |||||||||||||||||||||

| Other liabilities – net | (133) | (157) | 97 | (73) | 2 | |||||||||||||||||||||

| Net cash provided by (used for) operating activities | 4,046 | 3,799 | 636 | (389) | ||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (419) | (417) | (7) | 5 | 2 | |||||||||||||||||||||

| Expenditures for equipment leased to others | (681) | (13) | (670) | 2 | 2 | |||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 636 | 49 | 595 | (8) | 2 | |||||||||||||||||||||

| Additions to finance receivables | (6,203) | — | (6,680) | 477 | 3 | |||||||||||||||||||||

| Collections of finance receivables | 5,580 | — | 6,095 | (515) | 3 | |||||||||||||||||||||

| Net intercompany purchased receivables | — | — | (78) | 78 | 3 | |||||||||||||||||||||

| Proceeds from sale of finance receivables | 27 | — | 27 | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | 1,000 | 2 | (1,002) | 4 | |||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (398) | (398) | — | — | ||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 28 | 28 | — | — | ||||||||||||||||||||||

| Proceeds from sale of securities | 276 | 35 | 241 | — | ||||||||||||||||||||||

| Investments in securities | (500) | (225) | (275) | — | ||||||||||||||||||||||

| Other – net | (63) | 26 | (89) | — | ||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (1,717) | 85 | (839) | (963) | ||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||

| Dividends paid | (1,126) | (1,126) | (350) | 350 | 5 | |||||||||||||||||||||

| Common stock issued, including treasury shares reissued | 123 | 123 | — | — | ||||||||||||||||||||||

| Common shares repurchased | (251) | (251) | — | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | (2) | (1,000) | 1,002 | 4 | |||||||||||||||||||||

| Proceeds from debt issued > 90 days | 4,906 | 494 | 4,412 | — | ||||||||||||||||||||||

| Payments on debt > 90 days | (5,966) | (1,902) | (4,064) | — | ||||||||||||||||||||||

| Short-term borrowings – net < 90 days | 1,460 | (6) | 1,466 | — | ||||||||||||||||||||||

| Other – net | (2) | (2) | — | — | ||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (856) | (2,672) | 464 | 1,352 | ||||||||||||||||||||||

| Effect of exchange rate changes on cash | 3 | (5) | 8 | — | ||||||||||||||||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 1,476 | 1,207 | 269 | — | ||||||||||||||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 9,366 | 8,822 | 544 | — | ||||||||||||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 10,842 | $ | 10,029 | $ | 813 | $ | — | ||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | |||||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | |||||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | |||||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | |||||||

| 5 | Elimination of dividend activity between Financial Products and ME&T. | |||||||

| Supplemental Consolidating Data | ||||||||||||||||||||||||||

| Consolidated | Machinery, Energy & Transportation | Financial Products | Consolidating Adjustments | |||||||||||||||||||||||

| Cash flow from operating activities: | ||||||||||||||||||||||||||

| Profit of consolidated and affiliated companies | $ | 1,552 | $ | 1,400 | $ | 181 | $ | (29) | 1, 5 | |||||||||||||||||

| Adjustments for non-cash items: | ||||||||||||||||||||||||||

| Depreciation and amortization | 1,222 | 805 | 417 | — | ||||||||||||||||||||||

| Net gain on remeasurement of pension obligations | (132) | (132) | — | — | ||||||||||||||||||||||

| Provision (benefit) for deferred income taxes | (32) | 40 | (72) | — | ||||||||||||||||||||||

| Other | 674 | 338 | 145 | 191 | 2 | |||||||||||||||||||||

| Changes in assets and liabilities, net of acquisitions and divestitures: | ||||||||||||||||||||||||||

| Receivables – trade and other | 1,176 | 539 | (77) | 714 | 2, 3 | |||||||||||||||||||||

| Inventories | (145) | (137) | — | (8) | 2 | |||||||||||||||||||||

| Accounts payable | (655) | (664) | (5) | 14 | 2 | |||||||||||||||||||||

| Accrued expenses | (253) | (237) | (16) | — | ||||||||||||||||||||||

| Accrued wages, salaries and employee benefits | (648) | (614) | (34) | — | ||||||||||||||||||||||

| Customer advances | (2) | (2) | — | — | ||||||||||||||||||||||

| Other assets – net | (7) | 30 | 30 | (67) | 2 | |||||||||||||||||||||

| Other liabilities – net | (229) | (391) | 84 | 78 | 2 | |||||||||||||||||||||

| Net cash provided by (used for) operating activities | 2,521 | 975 | 653 | 893 | ||||||||||||||||||||||

| Cash flow from investing activities: | ||||||||||||||||||||||||||

| Capital expenditures – excluding equipment leased to others | (472) | (465) | (7) | — | ||||||||||||||||||||||

| Expenditures for equipment leased to others | (526) | 1 | (540) | 13 | 2 | |||||||||||||||||||||

| Proceeds from disposals of leased assets and property, plant and equipment | 382 | 104 | 283 | (5) | 2 | |||||||||||||||||||||

| Additions to finance receivables | (6,712) | — | (7,352) | 640 | 3 | |||||||||||||||||||||

| Collections of finance receivables | 6,801 | — | 7,442 | (641) | 3 | |||||||||||||||||||||

| Net intercompany purchased receivables | — | — | 920 | (920) | 3 | |||||||||||||||||||||

| Proceeds from sale of finance receivables | 31 | — | 31 | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | 500 | 2 | (502) | 4 | |||||||||||||||||||||

| Investments and acquisitions (net of cash acquired) | (49) | (49) | — | — | ||||||||||||||||||||||

| Proceeds from sale of businesses and investments (net of cash sold) | 13 | 13 | — | — | ||||||||||||||||||||||

| Proceeds from sale of securities | 151 | 12 | 139 | — | ||||||||||||||||||||||

| Investments in securities | (369) | (10) | (359) | — | ||||||||||||||||||||||

| Other – net | 7 | (15) | 22 | — | ||||||||||||||||||||||

| Net cash provided by (used for) investing activities | (743) | 91 | 581 | (1,415) | ||||||||||||||||||||||

| Cash flow from financing activities: | ||||||||||||||||||||||||||

| Dividends paid | (1,125) | (1,125) | (20) | 20 | 5 | |||||||||||||||||||||

| Common stock issued, including treasury shares reissued | (10) | (10) | — | — | ||||||||||||||||||||||

| Common shares repurchased | (1,130) | (1,130) | — | — | ||||||||||||||||||||||

| Net intercompany borrowings | — | (2) | (500) | 502 | 4 | |||||||||||||||||||||

| Proceeds from debt issued > 90 days | 6,159 | 1,991 | 4,168 | — | ||||||||||||||||||||||

| Payments on debt > 90 days | (4,629) | (12) | (4,617) | — | ||||||||||||||||||||||

| Short-term borrowings – net < 90 days | (477) | 8 | (485) | — | ||||||||||||||||||||||

| Other – net | (1) | (1) | — | — | ||||||||||||||||||||||

| Net cash provided by (used for) financing activities | (1,213) | (281) | (1,454) | 522 | ||||||||||||||||||||||

| Effect of exchange rate changes on cash | (66) | (54) | (12) | — | ||||||||||||||||||||||

| Increase (decrease) in cash and short-term investments and restricted cash | 499 | 731 | (232) | — | ||||||||||||||||||||||

| Cash and short-term investments and restricted cash at beginning of period | 8,292 | 7,302 | 990 | — | ||||||||||||||||||||||

| Cash and short-term investments and restricted cash at end of period | $ | 8,791 | $ | 8,033 | $ | 758 | $ | — | ||||||||||||||||||

| 1 | Elimination of equity profit earned from Financial Products' subsidiaries partially owned by ME&T subsidiaries. | ||||

| 2 | Elimination of non-cash adjustments and changes in assets and liabilities related to consolidated reporting. | ||||

| 3 | Reclassification of Financial Products’ cash flow activity from investing to operating for receivables that arose from the sale of inventory. | ||||

| 4 | Elimination of net proceeds and payments to/from ME&T and Financial Products. | ||||

| 5 | Elimination of dividend activity between Financial Products and ME&T. | ||||