Q2 2022 Letter to Shareholders August 2, 2022

Dear Shareholders During Q2, we continued our journey towards realizing our mission to solve the trucking industry's most pressing challenges by enabling reliable, low-cost freight capacity as a service while embarking on a new standard for safety and fuel efficiency. For the remainder of 2022 and into 2023, we will continue to drive towards this goal by preparing for Driver Out operations in the Texas Triangle. As we prepare for Driver Out operations, we will continue to do so in a measured manner as we aim to strike a balance between hitting our technology milestones and prudent spending, which is reflected in our updated guidance. We are excited about the progress we’ve made and look forward to continuing to share new developments with you as we, and all stakeholders work towards realizing our mission. 2 TuSimple Letter to Shareholders Q2 Highlights ▪ Announced leadership changes with the addition of two key positions as we continue transitioning from testing to commercialization and, ultimately wide deployment of autonomous trucking technology ▪ Expanded our patent portfolio with 37 new patents as we continue to focus on technologies to support efficient commercial AV operations ▪ Announced our partnership with global logistics leader, Hegelmann Group ▪ Enhanced our government affairs and advocacy efforts ▪ Updated 2022 adjusted EBITDA, stock-based compensation, CapEx and ending cash balance guidance TuSimple Drives Toward L4 Driver Out Commercialization The Path to Driver Out Commercialization by End of 2023 Day and night operations Additional Driver Out routes, including in Texas Removing the support vehicles Hauling customer freight on driverless runs Significant reductions in cost per mile, with clear line of sight to cost parity with human-driven trucks

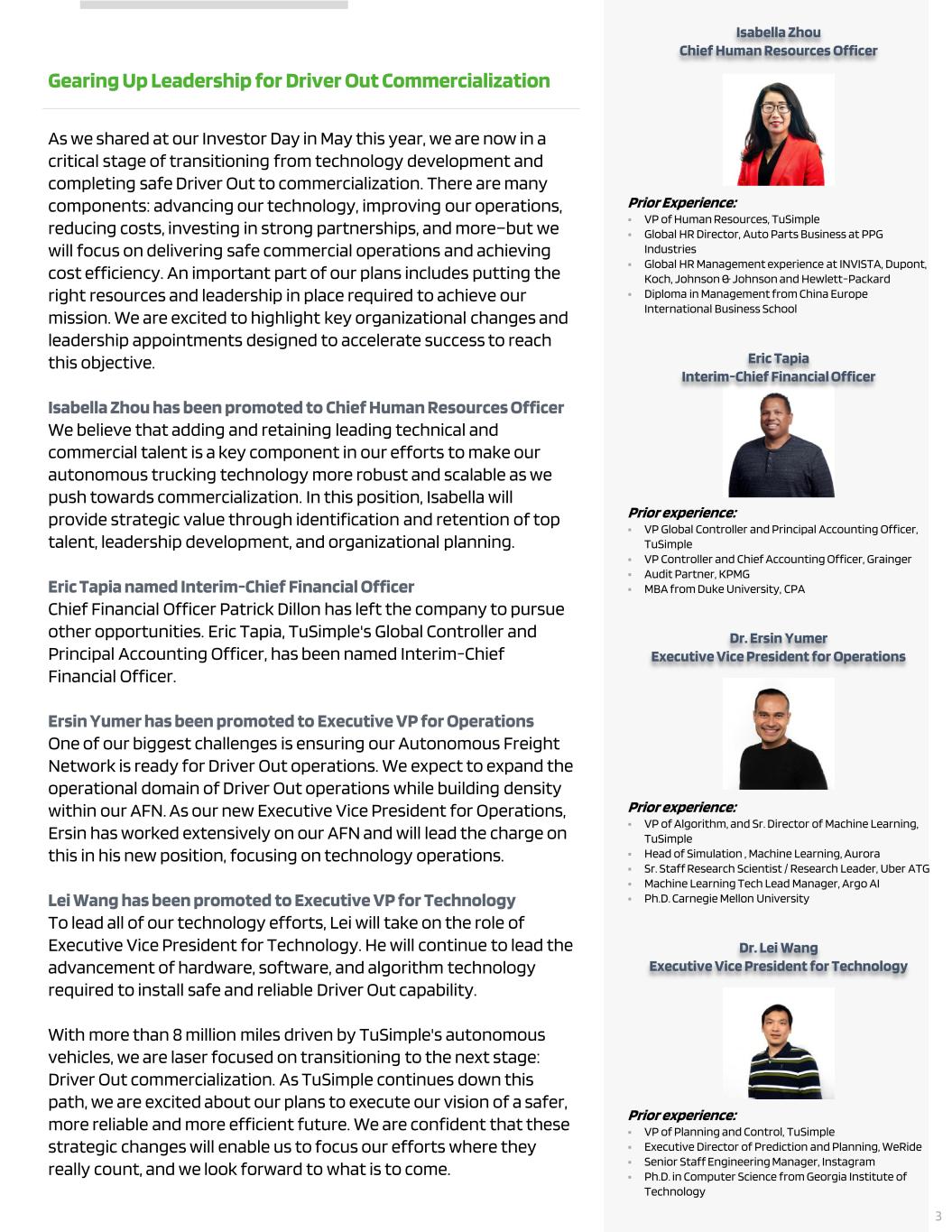

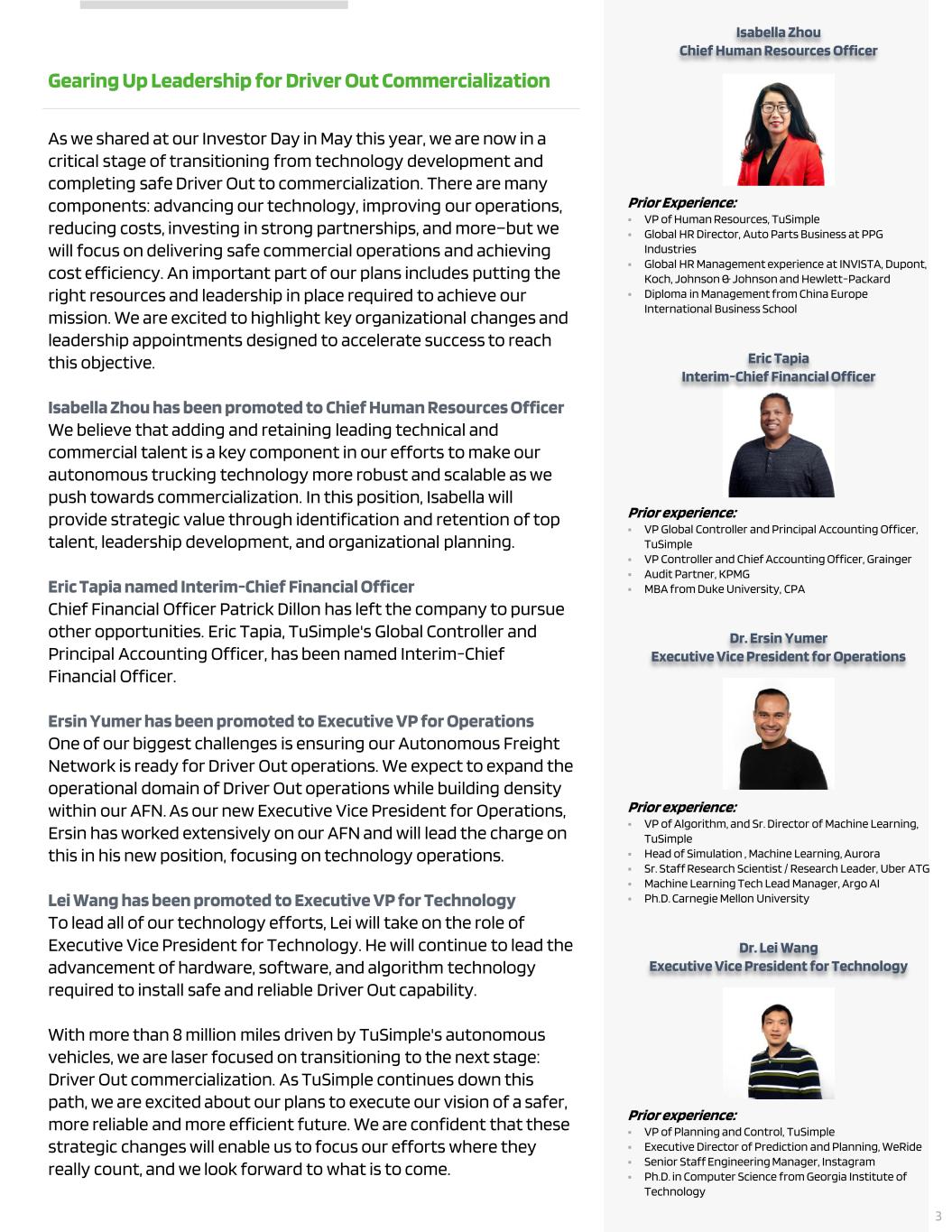

As we shared at our Investor Day in May this year, we are now in a critical stage of transitioning from technology development and completing safe Driver Out to commercialization. There are many components: advancing our technology, improving our operations, reducing costs, investing in strong partnerships, and more–but we will focus on delivering safe commercial operations and achieving cost efficiency. An important part of our plans includes putting the right resources and leadership in place required to achieve our mission. We are excited to highlight key organizational changes and leadership appointments designed to accelerate success to reach this objective. Isabella Zhou has been promoted to Chief Human Resources Officer We believe that adding and retaining leading technical and commercial talent is a key component in our efforts to make our autonomous trucking technology more robust and scalable as we push towards commercialization. In this position, Isabella will provide strategic value through identification and retention of top talent, leadership development, and organizational planning. Eric Tapia named Interim-Chief Financial Officer Chief Financial Officer Patrick Dillon has left the company to pursue other opportunities. Eric Tapia, TuSimple's Global Controller and Principal Accounting Officer, has been named Interim-Chief Financial Officer. Ersin Yumer has been promoted to Executive VP for Operations One of our biggest challenges is ensuring our Autonomous Freight Network is ready for Driver Out operations. We expect to expand the operational domain of Driver Out operations while building density within our AFN. As our new Executive Vice President for Operations, Ersin has worked extensively on our AFN and will lead the charge on this in his new position, focusing on technology operations. Lei Wang has been promoted to Executive VP for Technology To lead all of our technology efforts, Lei will take on the role of Executive Vice President for Technology. He will continue to lead the advancement of hardware, software, and algorithm technology required to install safe and reliable Driver Out capability. With more than 8 million miles driven by TuSimple's autonomous vehicles, we are laser focused on transitioning to the next stage: Driver Out commercialization. As TuSimple continues down this path, we are excited about our plans to execute our vision of a safer, more reliable and more efficient future. We are confident that these strategic changes will enable us to focus our efforts where they really count, and we look forward to what is to come. Gearing Up Leadership for Driver Out Commercialization Eric Tapia Interim-Chief Financial Officer Prior experience: ▪ VP Global Controller and Principal Accounting Officer, TuSimple ▪ VP Controller and Chief Accounting Officer, Grainger ▪ Audit Partner, KPMG ▪ MBA from Duke University, CPA Dr. Ersin Yumer Executive Vice President for Operations Prior experience: ▪ VP of Algorithm, and Sr. Director of Machine Learning, TuSimple ▪ Head of Simulation , Machine Learning, Aurora ▪ Sr. Staff Research Scientist / Research Leader, Uber ATG ▪ Machine Learning Tech Lead Manager, Argo AI ▪ Ph.D. Carnegie Mellon University Isabella Zhou Chief Human Resources Officer Prior Experience: ▪ VP of Human Resources, TuSimple ▪ Global HR Director, Auto Parts Business at PPG Industries ▪ Global HR Management experience at INVISTA, Dupont, Koch, Johnson & Johnson and Hewlett-Packard ▪ Diploma in Management from China Europe International Business School Dr. Lei Wang Executive Vice President for Technology Prior experience: ▪ VP of Planning and Control, TuSimple ▪ Executive Director of Prediction and Planning, WeRide ▪ Senior Staff Engineering Manager, Instagram ▪ Ph.D. in Computer Science from Georgia Institute of Technology 3

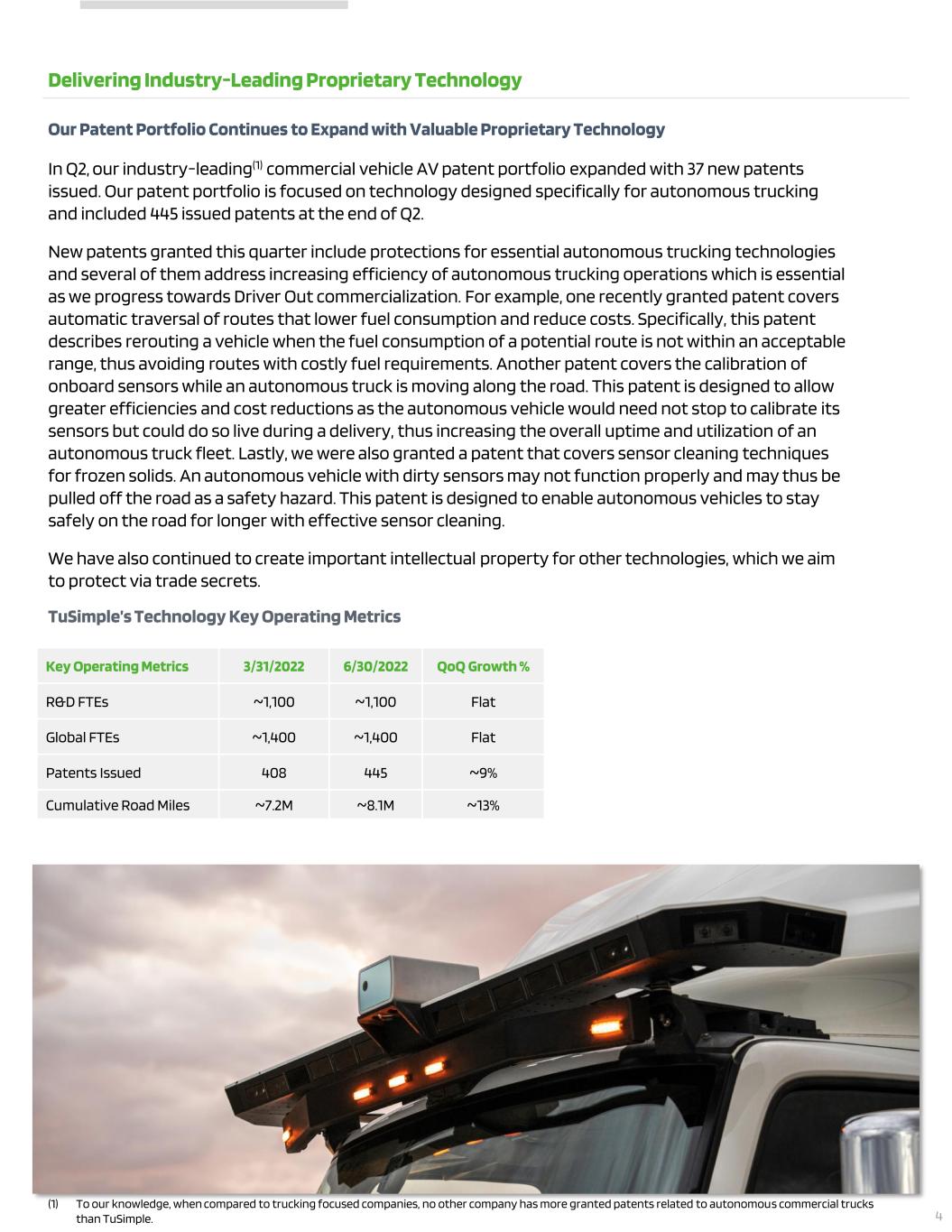

Our Patent Portfolio Continues to Expand with Valuable Proprietary Technology In Q2, our industry-leading(1) commercial vehicle AV patent portfolio expanded with 37 new patents issued. Our patent portfolio is focused on technology designed specifically for autonomous trucking and included 445 issued patents at the end of Q2. New patents granted this quarter include protections for essential autonomous trucking technologies and several of them address increasing efficiency of autonomous trucking operations which is essential as we progress towards Driver Out commercialization. For example, one recently granted patent covers automatic traversal of routes that lower fuel consumption and reduce costs. Specifically, this patent describes rerouting a vehicle when the fuel consumption of a potential route is not within an acceptable range, thus avoiding routes with costly fuel requirements. Another patent covers the calibration of onboard sensors while an autonomous truck is moving along the road. This patent is designed to allow greater efficiencies and cost reductions as the autonomous vehicle would need not stop to calibrate its sensors but could do so live during a delivery, thus increasing the overall uptime and utilization of an autonomous truck fleet. Lastly, we were also granted a patent that covers sensor cleaning techniques for frozen solids. An autonomous vehicle with dirty sensors may not function properly and may thus be pulled off the road as a safety hazard. This patent is designed to enable autonomous vehicles to stay safely on the road for longer with effective sensor cleaning. We have also continued to create important intellectual property for other technologies, which we aim to protect via trade secrets. Delivering Industry-Leading Proprietary Technology 4 Key Operating Metrics 3/31/2022 6/30/2022 QoQ Growth % R&D FTEs ~1,100 ~1,100 Flat Global FTEs ~1,400 ~1,400 Flat Patents Issued 408 445 ~9% Cumulative Road Miles ~7.2M ~8.1M ~13% TuSimple’s Technology Key Operating Metrics (1) To our knowledge, when compared to trucking focused companies, no other company has more granted patents related to autonomous commercial trucks than TuSimple.

5 Partnering with Global Logistics Leader, Hegelmann Group In July we announced our partnership with Hegelmann Group, a major European transport and logistics provider, that operates a fleet of over 5,000 vehicles, including an initial reservation of purpose-built SAE Level 4 autonomous trucks for operation in North America. The trucks will be equipped with TuSimple’s advanced autonomous driving system and will be based on a world-class global vehicle platform developed by Navistar. Hegelmann’s partnership with TuSimple signals the symbiotic path of both partners to offer innovative solutions that address the ongoing driver shortage while lowering greenhouse gas emissions and improving vehicle and environmental safety. Strengthening Our Relationship with Reservation Partners In Q2, we added 10 reservations with an existing partner, building commercial success on the back of our technology advancements. Our new reservations brings us to a total of 7,485 reservations as of June 30, 2022. We continue to work closely with our reservation partners, identifying and testing autonomy on their lanes best suited for autonomous freight operations. TuSimple’s Commercial Key Operating Metrics Continuing to Grow Our Commercial Footprint 4.6 5.4 6.3 7.2 8.1 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 17% 17% 14% 13% ~1.8x YoY Cumulative Road Miles (Millions) Note: (%) ’s may not foot due to rounding 880 946 1,017 1,014 1,169 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 8% 8% 0% 15% ~1.3x YoY Quarterly Revenue Miles (Thousands) 8,500 9,900 11,200 11,200 11,400 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 16% 13% 0% 2% ~1.3x YoY Cumulative Unique Mapped Miles Unique Mapped Miles expected to be relatively flat In 2022, as our mapping teams focus on collaborative mapping and enhancing our map development and maintenance automation. Q1’22 to Q2’22 revenue miles growth driven by increased utilization of assets through reduced empty miles and increased lane density in our ODD. Key Operating Metrics Q1’22 Q2’22 QoQ Growth % Total Truck Reservations(1) EOQ 7,475 7,485 Flat Total Mapped Miles(2) EOQ ~11,200 ~11,400 2% Quarterly Revenue Miles(3) ~1,014,000 ~1,169,000 15% (1) Reservations are non-binding. Typically, each reservation requires a $500 truck deposit, however, the deposit requirement has been waived for our equity investors that currently hold reservations. (2) Unique Mapped Miles are the cumulative unique miles on the AFN on which we have built a map compatible with our autonomous driving software. Unique Mapped Miles expected to be relatively flat In 2022, as our mapping teams focus on collaborative mapping and enhancing our map development and maintenance automation. (3) Q1'22 to Q2'22 revenue mile growth driven by increased utilization of assets through reduced empty miles and increased lane density in our ODD's

6 Strengthening Our Government Affairs Efforts Thomas Jensen Joins to Lead Government Affairs In an effort to bolster our company's federal and state advocacy efforts, Tom Jensen recently joined the company as our Vice President of Government Affairs. Prior to TuSimple, Tom served as UPS's top multimodal transportation advocate for more than 20 years and has extensive experience lobbying at both the federal and state levels. Tom has worked closely with the US Department of Transportation, Congress, state governments and has served in a variety of leadership capacities with major transportation, trucking and logistics advocacy organizations such as the US Chamber of Commerce, the American Trucking Associations and the International Warehouse & Logistics Association. State Regulatory Map Continues to Trend Positively for Autonomous Truck Commercialization From a regulatory perspective, TuSimple continues to help lead industry efforts to establish a state-based legislative and regulatory framework that will provide for a safe and efficient commercial autonomous vehicle goods movement ecosystem. In Q2, Kansas and West Virginia enacted legislation granting L4 trucking authority. At present, 44 states allow Driver In operations while 28 permit Driver Out deployment. We also joined other technology innovators, business leaders, and autonomous vehicle stakeholders in writing to California Governor Gavin Newsom, requesting the state move forward with the establishment of a regulatory scheme for autonomous trucking operations. California remains a critically important state from an economic and supply chain perspective, and while the state first enacted enabling legislation allowing for the establishment of state regulations in 2012, the pace of innovation has far surpassed the establishment of a state regulatory scheme. 28 States Explicitly Allow Driver Out AV Operations | No State or Federal Rule Prohibiting Driver Out AV Regulatory Landscape Allow Driver Out AV Allow Driver In AV In Progress 44 states Allow Driver In AV 28 states Allow Driver Out AV 50 states Cohesive AV operations framework laid out in US DOT 4.0 AV Regulations Partners fom Coast o Coast Seattle Portland San Francisco Los Angeles /Long Beach San Diego Phoenix Tucson El Paso San Antonio Houston New Orleans Tampa Jacksonville Atlanta Greensboro Norfolk Philadelphia Boston Cleveland Cincinnati Nashville Memphis Oklahoma City Kansas City Denver Salt Lake City Minneapolis Chicago Laredo Dallas St. Louis Orlando Charlotte

$43.5 $29.7 $31.9 $32.2 $22.0 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 (32%) 7% 1% (32)% Revenue Growth Driven by Improved Utilization Total revenue was $2.6 million in Q2 2022, up 73% year-over-year and 13% sequentially. Growth was driven by increased utilization of our existing assets and year-over-year price increases. Our focus for the remainder of 2022 is to support our customers’ transportation needs while at the same time focusing our organization towards Driver Out commercialization. R&D Investment Continues, Spending Growth Moderates In Q2, we spent $85.5 million on R&D, up 13% year-over-year. Our largest portion of R&D expense was $60.8 million related to R&D personnel, including stock-based compensation expense of $22.4 million. We are highly focused on spending goals to advance our L4 technology while at the same time doing so in the most efficient manner as possible. Efficiently Supporting Operations Our Q2 Selling, General, and Administrative (SG&A) expense totaled $22.0 million, a $21.5 million year-over-year decrease. Our most significant SG&A expense was $16.2 million in compensation costs, including $2.8 million in stock-based compensation. Stock-based Compensation (SBC) Expense Our SBC expense was $25.2 million in Q2 2022. Loss from Operations and Adjusted EBITDA(1) In Q2, our Loss from Operations was ($110.7) million and our Adjusted EBITDA was ($82.7) million. Capital Investment for Driver Out Operations In Q2, TuSimple invested a total of $3.8 million in purchases of property and equipment and had $1.1 million of purchases of property and equipment included in liabilities at the end of the period. We continue to seek capital-light ways to expand our AFN including preparing for Driver Out operations in Texas. Revenue ($ million) Our Financials: Balancing Investment and Efficiency SG&A Expense ($ million) R&D Expense ($ million) Note: (%) ’s may not foot due to rounding (1) Adjusted EBITDA is calculated by adding back stock-based compensation expense, depreciation, and amortization, nonrecurring restructuring expense, and capital lease interest expense to loss from operations. See the section titled “Non-GAAP Financial Measures” for more information. SG&A Stock-Based Compensation ($ million) $27 $10 $10 $10 $3 $25 $22 $22 $17 $22 R&D Stock-Based Compensation ($ million) $1.5 $1.8 $2.1 $2.3 $2.6 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 20% 10% 13% ~1.7x YoY 15% $75.9 $84.5 $82.4 $78.2 $85.5 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 11% (2%) (5%) 9% 7

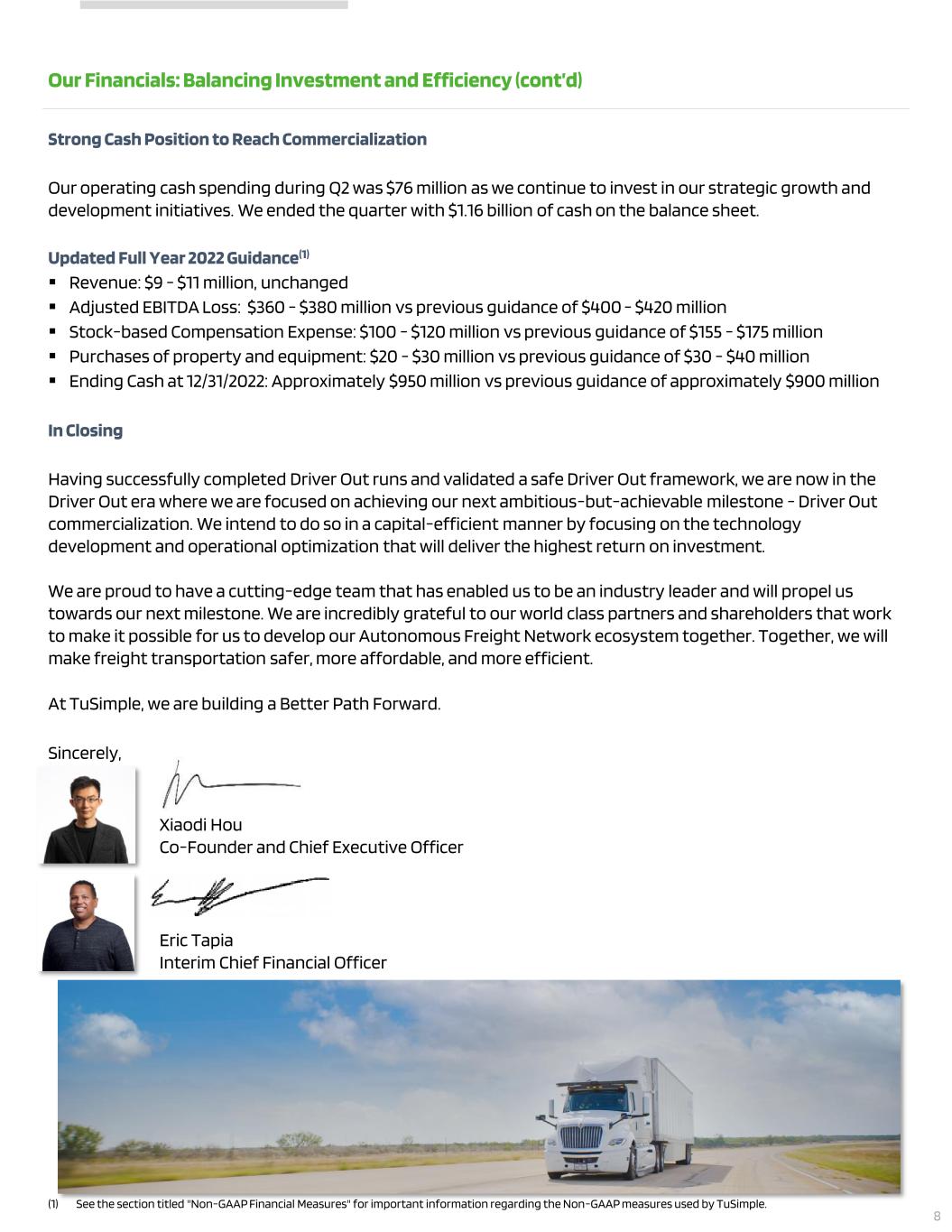

Strong Cash Position to Reach Commercialization Our operating cash spending during Q2 was $76 million as we continue to invest in our strategic growth and development initiatives. We ended the quarter with $1.16 billion of cash on the balance sheet. Updated Full Year 2022 Guidance(1) ▪ Revenue: $9 - $11 million, unchanged ▪ Adjusted EBITDA Loss: $360 - $380 million vs previous guidance of $400 - $420 million ▪ Stock-based Compensation Expense: $100 - $120 million vs previous guidance of $155 - $175 million ▪ Purchases of property and equipment: $20 - $30 million vs previous guidance of $30 - $40 million ▪ Ending Cash at 12/31/2022: Approximately $950 million vs previous guidance of approximately $900 million In Closing Having successfully completed Driver Out runs and validated a safe Driver Out framework, we are now in the Driver Out era where we are focused on achieving our next ambitious-but-achievable milestone - Driver Out commercialization. We intend to do so in a capital-efficient manner by focusing on the technology development and operational optimization that will deliver the highest return on investment. We are proud to have a cutting-edge team that has enabled us to be an industry leader and will propel us towards our next milestone. We are incredibly grateful to our world class partners and shareholders that work to make it possible for us to develop our Autonomous Freight Network ecosystem together. Together, we will make freight transportation safer, more affordable, and more efficient. At TuSimple, we are building a Better Path Forward. Sincerely, Our Financials: Balancing Investment and Efficiency (cont’d) 8 Eric Tapia Interim Chief Financial Officer Xiaodi Hou Co-Founder and Chief Executive Officer (1) See the section titled "Non-GAAP Financial Measures" for important information regarding the Non-GAAP measures used by TuSimple.

Disclaimer This letter and any accompanying oral presentation contain forward-looking statements. All statements other than statements of historical fact contained in this letter, including statements as to future results of operations and financial position, planned products and services, business strategy and plans, launch dates of products or services, the trajectory of our Driver Out Pilot Program, our timeline to commercialization, expected safety benefits of our autonomous semi-trucks, objectives of management for future operations of TuSimple Holdings Inc. and its subsidiaries (the "Company", “we”, “our” and “us”), market size and growth opportunities, competitive position and technological and market trends, are forward-looking statements. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements by terms such as “will”, “expect,” “plan,” “anticipate,” “intend,” “target,” “project,” “predict,” “potential,” “explore” or “continue” or the negative of these terms or other similar words. The Company has based these forward-looking statements largely on its current expectations and assumptions and on information available as of the date of this letter. The Company assumes no obligation to update any forward-looking statements after the date of this letter, except as required by law. The forward-looking statements contained in this letter and the accompanying oral presentation are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause actual results or outcomes to be materially different from any future results or outcomes expressed or implied by the forward-looking statements. These risks, uncertainties, assumptions and other factors include, but are not limited to, those related to autonomous driving being an emerging technology, the development of our technology and products, the Company’s limited operating history in a new market, the regulations governing autonomous vehicles, the Company’s dependence on its senior management team, reliance on third-party suppliers, potential product liability or warranty claims and the protection of the Company’s intellectual property. Moreover, the Company operates in a competitive and rapidly changing environment, and new risks may emerge from time to time. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all. It is not possible for the Company to predict all risks, nor can the Company assess the impact of all factors on its business or the markets in which it operates or the extent to which any factor, or combination of factors, may cause actual results or outcomes to differ materially from those contained in any forward-looking statements the Company may make. You should carefully consider the foregoing factors and the other risks and uncertainties described under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q. These SEC filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. This letter also contains estimates, forecasts and other statistical data relating to market size and growth and other industry data. These data involve several assumptions and limitations, and you are cautioned not to give undue weight to such estimates. The Company has not independently verified the statistical and other industry data generated by independent parties and contained in this letter and, accordingly, it cannot guarantee their accuracy or completeness. In addition, assumptions and estimates of the Company’s future performance and the future performance of the markets in which the Company competes are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results or outcomes to differ materially from those expressed in the estimates. Non-GAAP Financial Measures TuSimple has not reconciled its expectations for non-GAAP adjusted EBITDA because the stock-based compensation expense excluded from such items cannot be reasonably calculated or predicated at this time. The effect of the excluded stock-based compensation may be significant. TuSimple believes the non-GAAP measures calculated herein provide meaningful information to assist investors in understanding financial results and assessing prospects for future performance as they provide a better baseline for analyzing the ongoing performance of its business by excluding items that may not be indicative of core operating results. Because non-GAAP financial measures are not standardized, it may not be possible to compare these measures with other companies’ non-GAAP measures having the same or similar names. Thus, TuSimple’s non-GAAP measures should be considered in addition to, not as a substitute for, or in isolation from, the company’s GAAP results. TuSimple encourages investors and others to review its financial information in its entirety, not to rely on any single financial measure, and to view its non-GAAP measures in conjunction with GAAP financial measures. About TuSimple TuSimple is a global autonomous driving technology company headquartered in San Diego, California, with operations in Arizona, Texas, Europe, and China. Founded in 2015, TuSimple is developing a commercial-ready, fully autonomous (SAE Level 4) driving solution for long-haul heavy-duty trucks. TuSimple aims to transform the $4 trillion global truck freight industry through the company's leading AI technology, which makes it possible for trucks to drive safely autonomously, operate nearly continuously, and reduce fuel consumption by 10%+ relative to manually driven trucks. Global achievements include the world's first fully autonomous, 'driver-out' semi-truck run on open public roads, and development of the world's first Autonomous Freight Network (AFN). TuSimple Conference Call Webcast – 2 p.m. PT Aug 2, 2022 We will host a teleconference call at 2:00 PM Pacific time/5:00 PM Eastern time on Aug 2nd to discuss these results. Parties interested in participating via telephone may register on our investor relations website. 9

TuSimple Consolidated Balance Sheets TuSimple Holdings Inc. Condensed Consolidated Balance Sheets (in thousands, except share data) (unaudited) December 31, June 30, 2021 2022 ASSETS Current assets: Cash and cash equivalents $ 1,337,586 $ 1,156,418 Accounts receivable, net 1,599 2,700 Prepaid expenses and other current assets 13,995 22,110 Total current assets 1,353,180 1,181,228 Property and equipment, net 36,053 31,405 Operating lease right-of-use assets — 41,641 Other assets 7,090 4,478 Total assets 1,396,323 1,258,752 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable 4,544 3,733 Amounts due to joint development partners 7,394 5,129 Accrued expenses and other current liabilities 41,698 34,529 Short-term debt 1,524 1,583 Capital lease liabilities, current 766 — Operating lease liabilities, current — 2,905 Total current liabilities 55,926 47,879 Capital lease liabilities, noncurrent 2,872 — Operating lease liabilities, noncurrent — 41,156 Long-term debt 5,543 4,495 Other liabilities 5,004 4,127 Total liabilities 69,345 97,657 Stockholders’ equity (deficit): Preferred stock, $0.0001 par value; 100,000,000 shares authorized as of December 31, 2021 and June 30, 2022; zero shares issued and outstanding as of December 31, 2021 and June 30, 2022 — — Common stock, $0.0001 par value; 4,876,000,000 Class A shares authorized as of December 31, 2021 and June 30, 2022; 197,833,195 and 200,192,530 Class A shares issued and outstanding as of December 31, 2021 and June 30, 2022, respectively; 24,000,000 Class B shares authorized as of December 31, 2021 and June 30, 2022; 24,000,000 Class B shares issued and outstanding as of December 31, 2021 and June 30, 2022 22 22 Additional paid-in-capital 2,464,730 2,520,300 Accumulated other comprehensive income (loss) 77 (1,069) Accumulated deficit (1,137,851) (1,358,158) Total stockholders’ equity (deficit) 1,326,978 1,161,095 Total liabilities, redeemable convertible preferred stock and stockholders’ equity (deficit) $ 1,396,323 $ 1,258,752 10

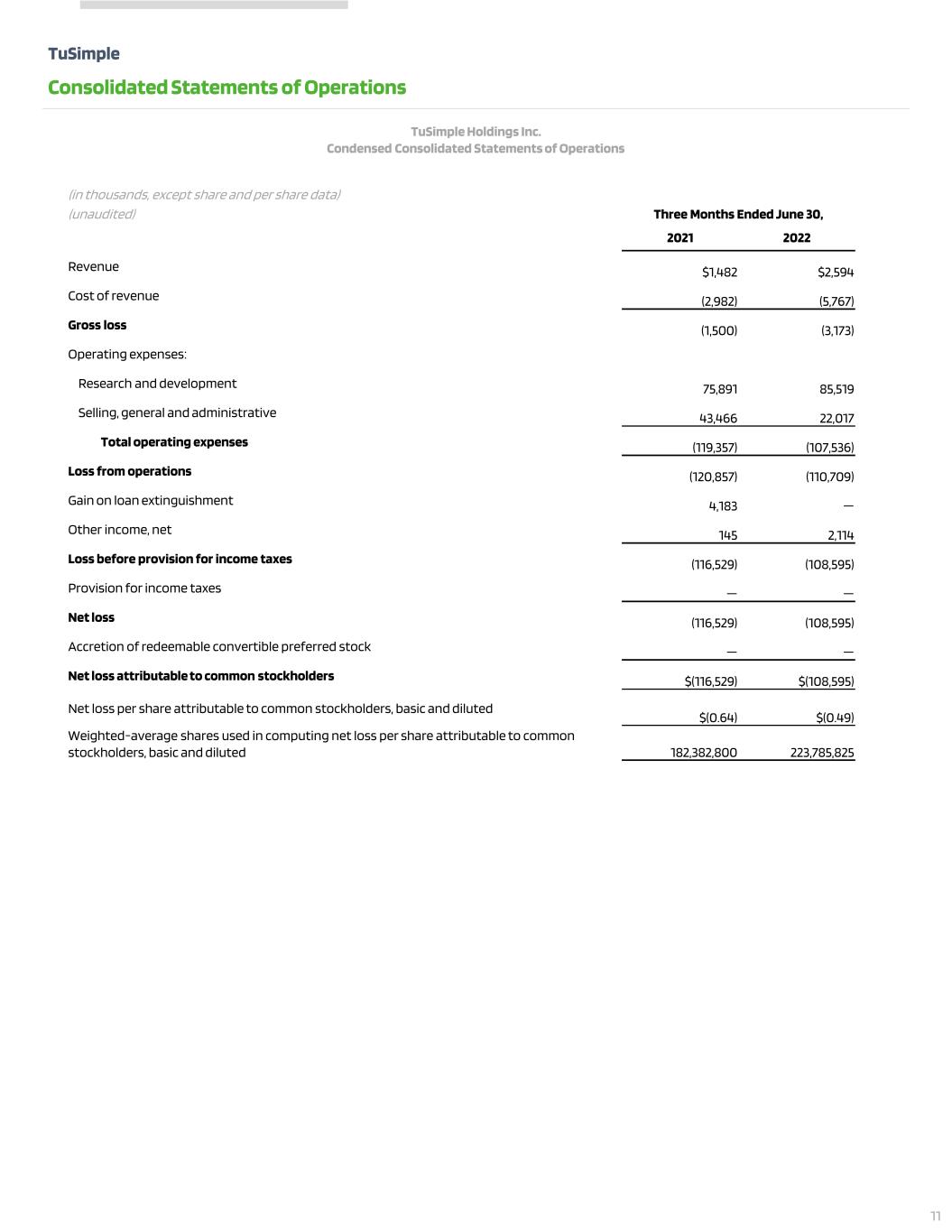

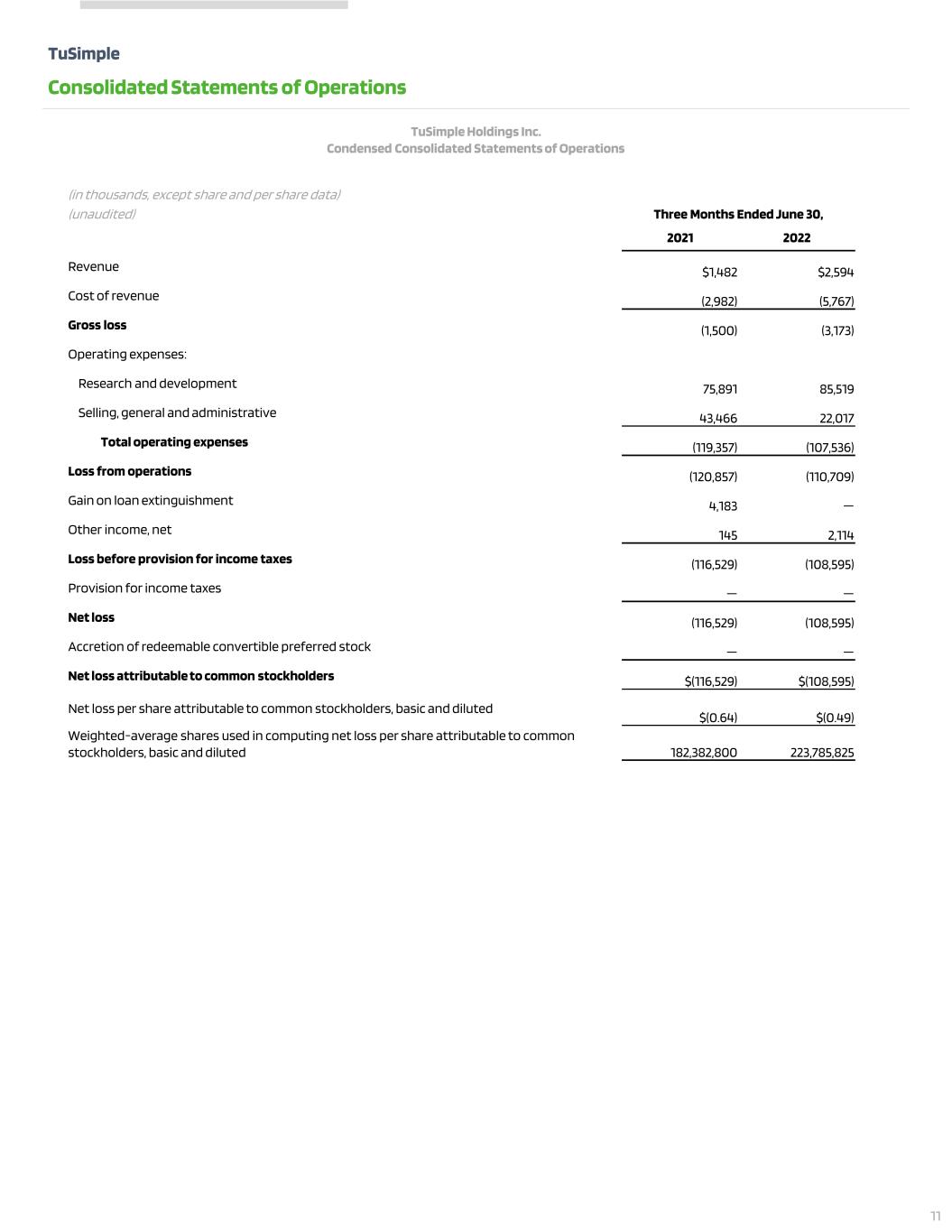

TuSimple Holdings Inc. Condensed Consolidated Statements of Operations (in thousands, except share and per share data) (unaudited) Three Months Ended June 30, 2021 2022 Revenue $1,482 $2,594 Cost of revenue (2,982) (5,767) Gross loss (1,500) (3,173) Operating expenses: Research and development 75,891 85,519 Selling, general and administrative 43,466 22,017 Total operating expenses (119,357) (107,536) Loss from operations (120,857) (110,709) Gain on loan extinguishment 4,183 — Other income, net 145 2,114 Loss before provision for income taxes (116,529) (108,595) Provision for income taxes — — Net loss (116,529) (108,595) Accretion of redeemable convertible preferred stock — — Net loss attributable to common stockholders $(116,529) $(108,595) Net loss per share attributable to common stockholders, basic and diluted $(0.64) $(0.49) Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted 182,382,800 223,785,825 TuSimple Consolidated Statements of Operations 11

TuSimple Consolidated Statements of Cash Flows TuSimple Holdings Inc. Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Six Months Ended June 30, 2021 2022 Cash flows from operating activities: Net loss $ (501,689) $ (220,498) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation 58,798 52,678 Depreciation and amortization 4,409 5,461 Change in fair value of warrants liability 326,900 — Gain on loan extinguishment (4,183) — Other adjustments — 81 Changes in operating assets and liabilities: Accounts receivable (130) (1,203) Prepaid expenses and other current assets (11,995) (6,380) Operating lease right-of-use assets — 2,608 Other assets (752) 2,708 Accounts payable 532 549 Amounts due to joint development partners 5,299 (2,265) Accrued expenses and other current liabilities 5,947 (8,578) Operating lease liabilities — (2,231) Other liabilities 1,449 411 Net cash used in operating activities (115,415) (176,659) Cash flows from investing activities: Purchases of property and equipment (5,928) (5,041) Purchases of intangible assets (179) (132) Proceeds from disposal of property and equipment 100 25 Net cash used in investing activities (6,007) (5,148) Cash flows from financing activities: Proceeds from issuance of redeemable convertible preferred stock, net of offering costs 54,693 — Proceeds from exercise of warrants for redeemable convertible preferred stock 183,007 — Proceeds from issuance of common stock under the Employee Stock Purchase Plan — 1,292 Proceeds from exercised stock options 253 1,558 Proceeds from issuance of common stock upon initial public offering, net of offering costs 1,030,965 — Proceeds from issuance of common stock related to private placement 35,000 — Return of guarantee deposit on related party loan 3,715 — Principal payments on related party loan (4,398) — Payment of third-party costs in connection with initial public offering (2,328) — Principal payments on capital lease obligations (382) — Principal payments on finance lease obligations — (587) Principal payments on loans (237) (747) Net cash provided by financing activities 1,300,288 1,516 Effect of exchange rate changes on cash, cash equivalents, and restricted cash 118 (877) Net increase (decrease) in cash, cash equivalents, and restricted cash 1,178,984 (181,168) Cash, cash equivalents, and restricted cash - beginning of period 312,351 1,339,092 Cash, cash equivalents, and restricted cash - end of period $ 1,491,335 $ 1,157,924 12

TuSimple Consolidated Statements of Cash Flows TuSimple Holdings Inc. Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Six Months Ended June 30, 2021 2022 Reconciliation of cash, cash equivalents, and restricted cash to the condensed consolidated balance sheets: Cash and cash equivalents $1,489,829 $ 1,156,418 Restricted cash included in prepaid expenses and other current assets 1,506 1,506 Total cash and cash equivalents, and restricted cash $1,491,335 $1,157,924 Supplemental disclosure of cash flow information: Cash paid for interest $386 $ 546 Supplemental schedule of non-cash investing and financing activities: Acquisitions of property and equipment included in current liabilities 1,807 1,103 Accretion of redeemable convertible preferred stock 4,135 — Vesting of early exercised stock options 42 42 Exercise of liability-classified warrants 369,352 — Conversion of redeemable convertible preferred stock to common stock upon initial public offering 1,282,916 — Issuance costs incurred in connection with initial public offering included in current liabilities 1,263 — 13

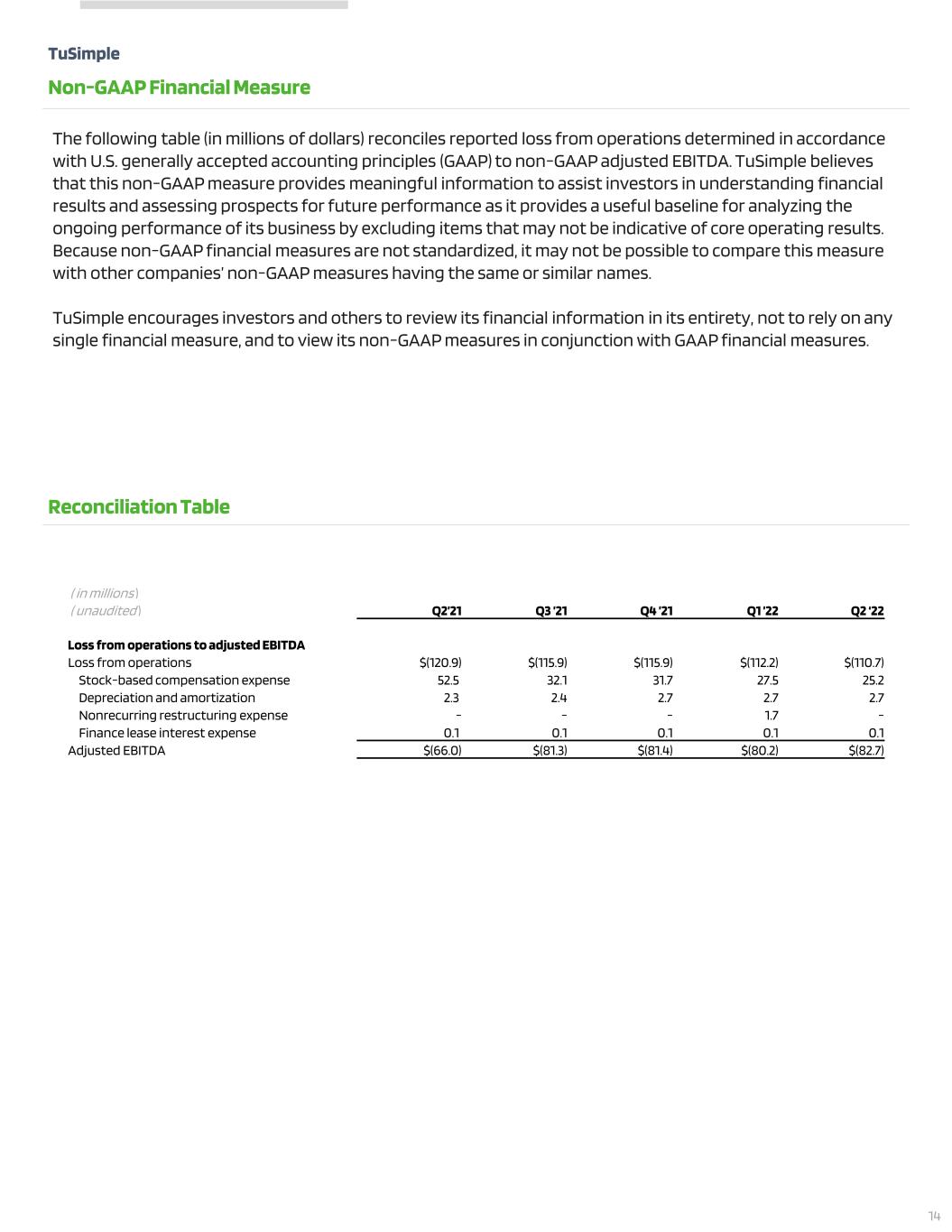

( in millions ) ( unaudited ) Q2’21 Q3 ’21 Q4 ’21 Q1 ’22 Q2 ‘22 Loss from operations to adjusted EBITDA Loss from operations $(120.9) $(115.9) $(115.9) $(112.2) $(110.7) Stock-based compensation expense 52.5 32.1 31.7 27.5 25.2 Depreciation and amortization 2.3 2.4 2.7 2.7 2.7 Nonrecurring restructuring expense - - - 1.7 - Finance lease interest expense 0.1 0.1 0.1 0.1 0.1 Adjusted EBITDA $(66.0) $(81.3) $(81.4) $(80.2) $(82.7) TuSimple Non-GAAP Financial Measure The following table (in millions of dollars) reconciles reported loss from operations determined in accordance with U.S. generally accepted accounting principles (GAAP) to non-GAAP adjusted EBITDA. TuSimple believes that this non-GAAP measure provides meaningful information to assist investors in understanding financial results and assessing prospects for future performance as it provides a useful baseline for analyzing the ongoing performance of its business by excluding items that may not be indicative of core operating results. Because non-GAAP financial measures are not standardized, it may not be possible to compare this measure with other companies’ non-GAAP measures having the same or similar names. TuSimple encourages investors and others to review its financial information in its entirety, not to rely on any single financial measure, and to view its non-GAAP measures in conjunction with GAAP financial measures. Reconciliation Table 14

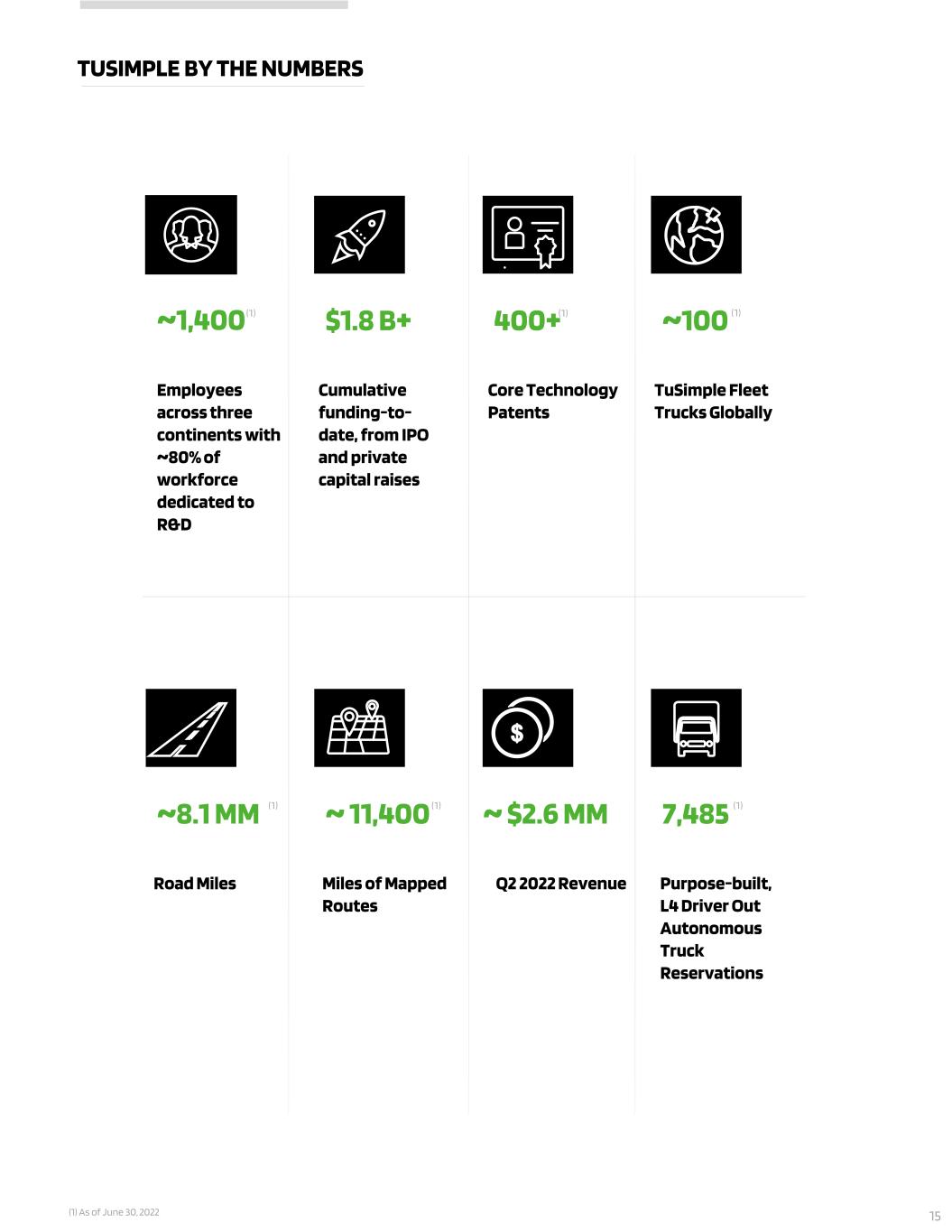

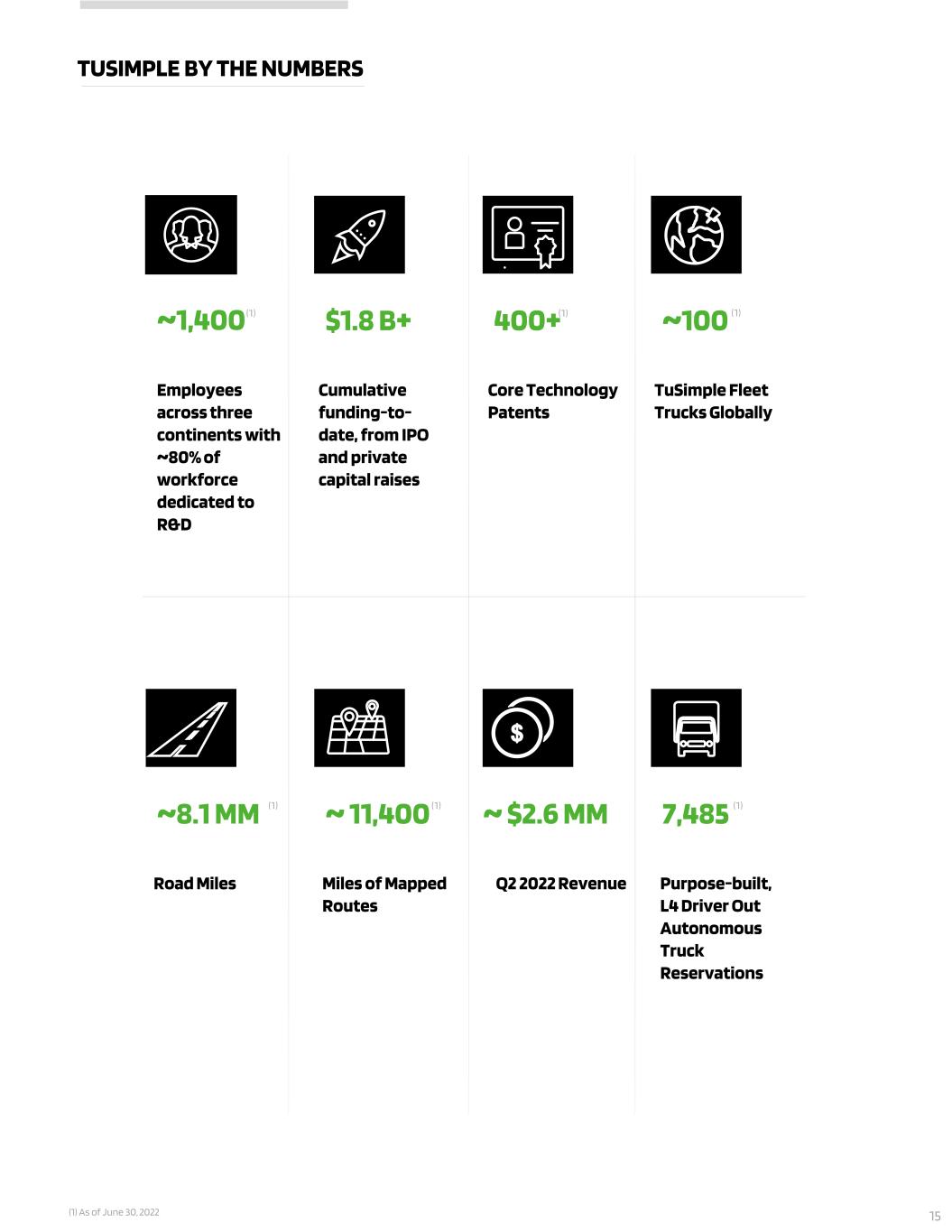

~1,400 Employees across three continents with ~80% of workforce dedicated to R&D TUSIMPLE BY THE NUMBERS $1.8 B+ Cumulative funding-to- date, from IPO and private capital raises ~ 11,400 400+ ~100 Miles of Mapped Routes Core Technology Patents TuSimple Fleet Trucks Globally 7,485 Purpose-built, L4 Driver Out Autonomous Truck Reservations ~8.1 MM Road Miles ~ $2.6 MM Q2 2022 Revenue (1) As of June 30, 2022 (1) (1) (1) (1)(1) (1) 15