1 Blue Owl Capital Inc. Reports Third Quarter 2021 Results New York, New York, November 9, 2021 – Blue Owl Capital Inc. (“Blue Owl”) (NYSE:OWL) today reported its financial results for the third quarter ended September 30, 2021. GAAP net loss attributable to Blue Owl Capital Inc. was $53.3 million, or $0.16 per basic and $0.16 per diluted Class A Share, for the quarter ended September 30, 2021. Distributable Earnings were $142.8 million, or $0.11 per Adjusted Share, and Fee-Related Earnings were $141.9 million, or $0.11 per Adjusted Share, for the quarter ended September 30, 2021. "Blue Owl's strong financial results for the third quarter of 2021 demonstrate the power of our permanent capital, which drives 97% percent of our management fees and enhances the trajectory of our AUM and earnings growth. Blue Owl’s assets under management exceeded $70 billion for the third quarter, an increase of 13% from the prior quarter, reflecting record gross originations of $8.8 billion in our Direct Lending business and robust appreciation in our GP Solutions business." said Doug Ostrover, CEO of Blue Owl. “We have seen strong investor interest in our differentiated yield-oriented investment solutions and we continue to raise capital across a broad and expanding mix of distribution channels. Furthermore, we are looking forward to having the Oak Street team join Blue Owl. We believe that Oak Street will add a very complementary investment capability and create the potential for incremental synergies across the Blue Owl ecosystem." Dividend Blue Owl declared a quarterly dividend of $0.09 per Class A Share, payable on November 30, 2021, to shareholders of record at the close of business on November 22, 2021. Quarterly Investor Call Details Blue Owl will host its third quarter 2021 investor call via public webcast on November 9, 2021 at 8:30 a.m. ET. To register, please visit the Investor Resources section of Blue Owl’s website at www.blueowl.com. For those unable to listen to the live broadcast, there will be a webcast replay available on the Investor Resources section of Blue Owl’s website. Investor Contact Ann Dai Head of Investor Relations owlir@blueowl.com Media Contact Prosek Partners David Wells / Josh Clarkson Pro-blueowl@prosek.com

Blue Owl Capital Inc. Third Quarter 2021 Earnings November 9, 2021

3 About Blue Owl Blue Owl is an alternative asset manager that provides investors access to Direct Lending and GP Capital Solutions strategies through a variety of products. The firm’s breadth of offerings and permanent capital base enables it to offer a differentiated, holistic platform of capital solutions to participants throughout the private market ecosystem, including alternative asset managers and private middle market corporations. The firm had approximately $70.5 billion of assets under management as of September 30, 2021. Blue Owl’s management team is comprised of seasoned investment professionals with more than 25 years of experience building alternative investment businesses. Blue Owl has approximately 300 employees across its Direct Lending and GP Capital Solutions divisions and has seven offices globally. For more information, please visit us at www.blueowl.com. Forward-Looking Statements Certain statements made in this presentation are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Blue Owl’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Any such forward-looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and speak only as of the date of this presentation. Blue Owl assumes no obligation to update or revise any such forward-looking statements except as required by law. Important factors, among others, that may affect actual results or outcomes include the inability to recognize the anticipated benefits of the recently completed business combination; costs related to the recently completed business combination; Blue Owl’s ability to manage growth; Blue Owl’s ability to execute its business plan and meet its projections; potential litigation involving Blue Owl; changes in applicable laws or regulations; the possibility that Blue Owl may be adversely affected by other economic, business, and competitive factors; the impact of the continuing COVID-19 pandemic on Blue Owl’s business as well as those factors described in the “Risk Factors” section of our filings with the Securities and Exchange Commission (“SEC”). The information contained in this presentation is summary information that is intended to be considered in the context of Blue Owl’s SEC filings and other public announcements that Blue Owl may make, by press release or otherwise, from time to time. Blue Owl also uses its website to distribute company information, including assets under management and performance information, and such information may be deemed material. Accordingly, investors should monitor Blue Owl’s website (www.blueowl.com). Blue Owl undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this presentation. These materials contain information about Blue Owl and its affiliates and certain of their respective personnel and affiliates, information about their respective historical performance and general information about the market. You should not view information related to the past performance of Blue Owl or information about the market, as indicative of future results, the achievement of which cannot be assured. Disclosures Copyright© Blue Owl Capital Inc. 2021. All rights reserved.

4 Non-GAAP Financial Measures; Other Financial and Operational Data This presentation includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. Blue Owl believes that the use of these non-GAAP financial measures provides an additional tool for investors and potential investors to use in evaluating its ongoing operating results and trends. These non-GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. See the footnotes on the slides where these measures are discussed. Exact net IRRs and multiples cannot be calculated for individual investments held by Blue Owl’s products, or a subset of such investments, due to the lack of a mechanism to precisely allocate fees, taxes, transaction costs, expenses and general partner carried interest. Valuations are as of the dates provided herein and do not take into account subsequent events, including the continued impact of COVID-19, which can be expected to have an adverse effect on certain entities identified or contemplated herein. For the definitions of certain terms used in this presentation, please refer to the "Defined Terms" slide in the appendix. Important Notice No representations or warranties, express or implied are given in, or in respect of, this presentation. To the fullest extent permitted by law, in no circumstances will Blue Owl or any of its subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. This presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Blue Owl. Viewers of this presentation should each make their own evaluation of Blue Owl and of the relevance and adequacy of the information contained herein and should make sure other investigations as they deem necessary. This communication does not constitute an offer to sell, or the solicitation of an offer to buy or sell, any securities, investment funds, vehicles or accounts, investment advice or any other service by Blue Owl or any of its affiliates or subsidiaries. Nothing in this presentation constitutes the provision of tax, accounting, financial, investment, regulatory, legal or other advice by Blue Owl or its advisors. Industry and Market Data This presentation may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s and Fitch Ratings. Such information has not been independently verified and, accordingly, Blue Owl makes no representation or warranty in respect of this information. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice. Disclosures

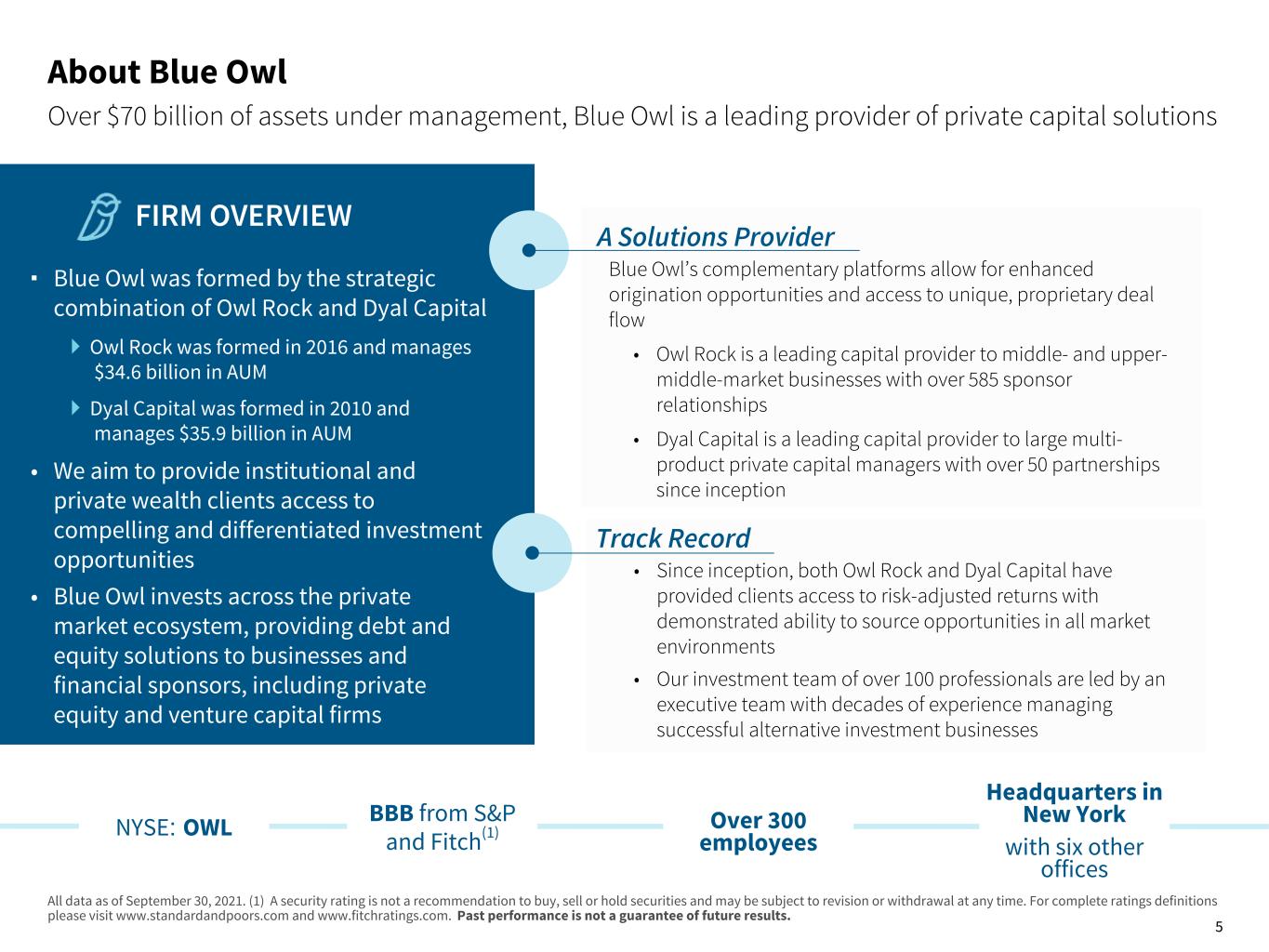

5 Blue Owl’s complementary platforms allow for enhanced origination opportunities and access to unique, proprietary deal flow • Owl Rock is a leading capital provider to middle- and upper- middle-market businesses with over 585 sponsor relationships • Dyal Capital is a leading capital provider to large multi- product private capital managers with over 50 partnerships since inception ▪ Blue Owl was formed by the strategic combination of Owl Rock and Dyal Capital } Owl Rock was formed in 2016 and manages $34.6 billion in AUM } Dyal Capital was formed in 2010 and manages $35.9 billion in AUM • We aim to provide institutional and private wealth clients access to compelling and differentiated investment opportunities • Blue Owl invests across the private market ecosystem, providing debt and equity solutions to businesses and financial sponsors, including private equity and venture capital firms All data as of September 30, 2021. (1) A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. For complete ratings definitions please visit www.standardandpoors.com and www.fitchratings.com. Past performance is not a guarantee of future results. About Blue Owl FIRM OVERVIEW Over $70 billion of assets under management, Blue Owl is a leading provider of private capital solutions A Solutions Provider Track Record NYSE: OWL Over 300 employees BBB from S&P and Fitch(1) Headquarters in New York with six other offices • Since inception, both Owl Rock and Dyal Capital have provided clients access to risk-adjusted returns with demonstrated ability to source opportunities in all market environments • Our investment team of over 100 professionals are led by an executive team with decades of experience managing successful alternative investment businesses

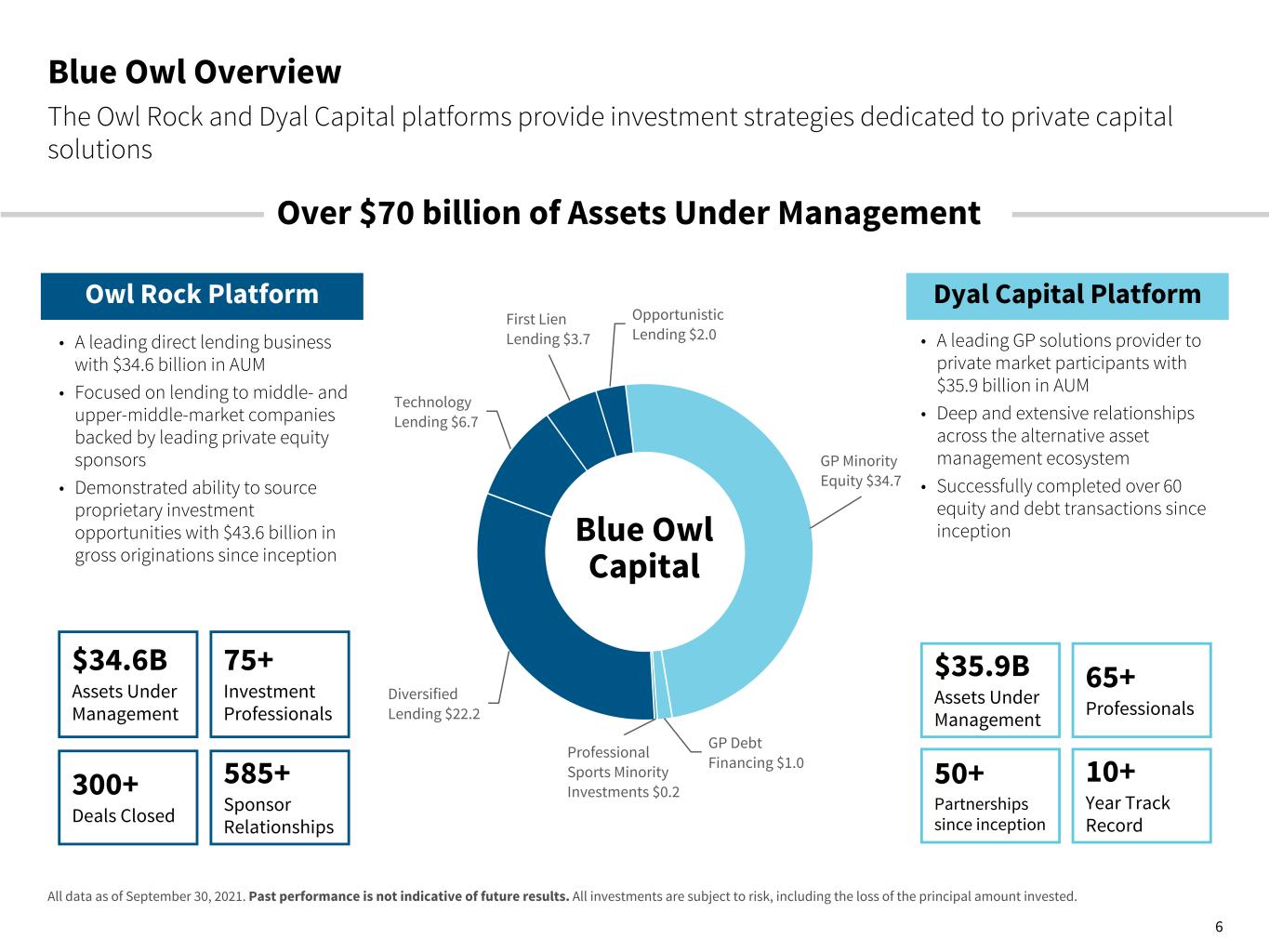

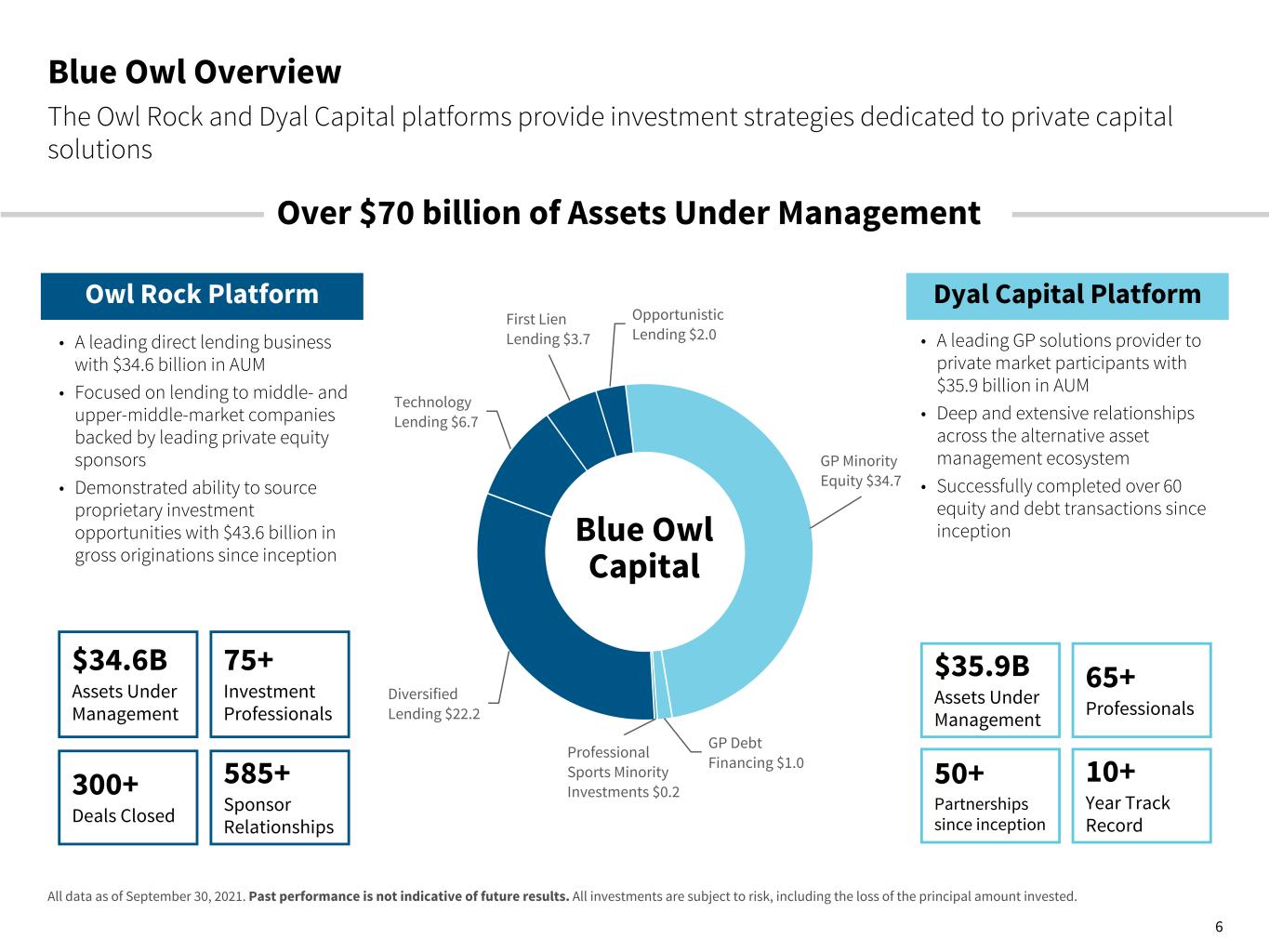

6 Opportunistic Lending $2.0 GP Minority Equity $34.7 GP Debt Financing $1.0 Professional Sports Minority Investments $0.2 Diversified Lending $22.2 Technology Lending $6.7 First Lien Lending $3.7 Blue Owl Capital Blue Owl Overview The Owl Rock and Dyal Capital platforms provide investment strategies dedicated to private capital solutions • A leading GP solutions provider to private market participants with $35.9 billion in AUM • Deep and extensive relationships across the alternative asset management ecosystem • Successfully completed over 60 equity and debt transactions since inception • A leading direct lending business with $34.6 billion in AUM • Focused on lending to middle- and upper-middle-market companies backed by leading private equity sponsors • Demonstrated ability to source proprietary investment opportunities with $43.6 billion in gross originations since inception Dyal Capital PlatformOwl Rock Platform All data as of September 30, 2021. Past performance is not indicative of future results. All investments are subject to risk, including the loss of the principal amount invested. $35.9B Assets Under Management 65+ Professionals 50+ Partnerships since inception 10+ Year Track Record $34.6B Assets Under Management 75+ Investment Professionals 300+ Deals Closed 585+ Sponsor Relationships Over $70 billion of Assets Under Management

7 Blue Owl: A Leading Next Generation Alternative Asset Manager A Business Built for Predictable, FRE Centric Growth Market leading Permanent Capital base with approximately $64.4 billion in Permanent Capital AUM Fee-Related Earnings drives 100%+ of DE Proven, experienced leadership with demonstrated track record Industry leading embedded growth profile Highly attractive, robust profit margins Conservative capital structure

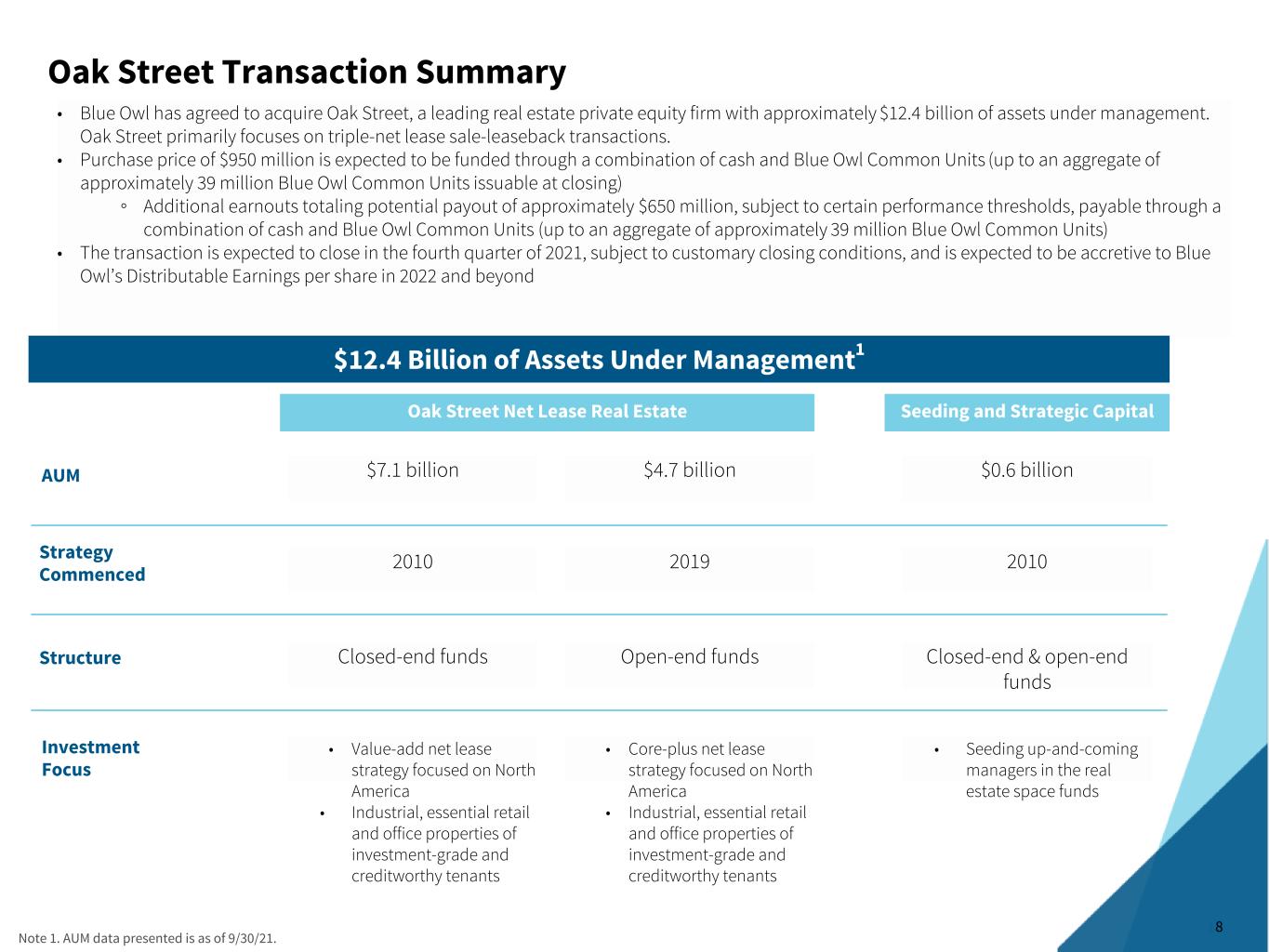

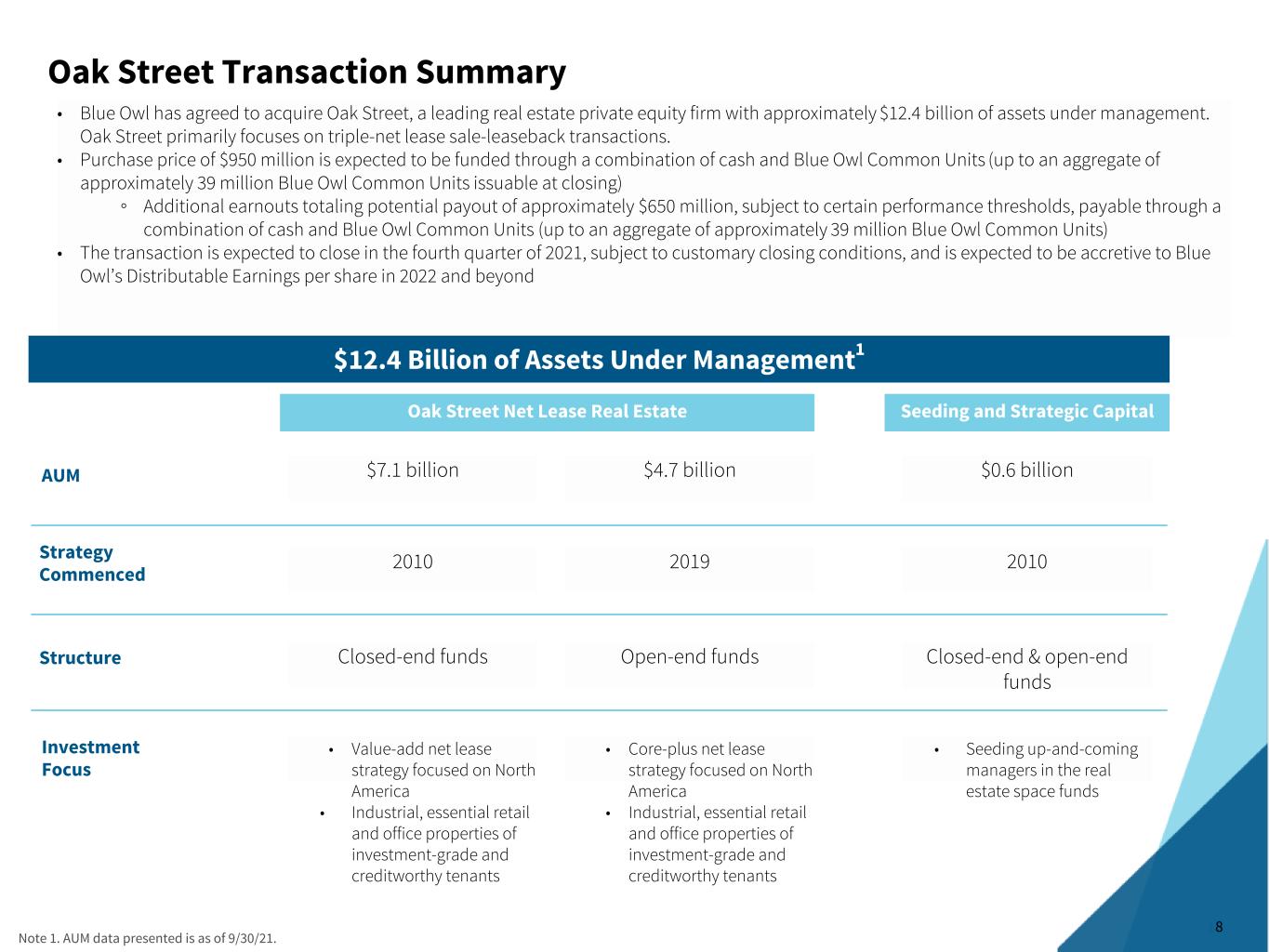

8 Investment Focus Oak Street Transaction Summary • Blue Owl has agreed to acquire Oak Street, a leading real estate private equity firm with approximately $12.4 billion of assets under management. Oak Street primarily focuses on triple-net lease sale-leaseback transactions. • Purchase price of $950 million is expected to be funded through a combination of cash and Blue Owl Common Units (up to an aggregate of approximately 39 million Blue Owl Common Units issuable at closing) ◦ Additional earnouts totaling potential payout of approximately $650 million, subject to certain performance thresholds, payable through a combination of cash and Blue Owl Common Units (up to an aggregate of approximately 39 million Blue Owl Common Units) • The transaction is expected to close in the fourth quarter of 2021, subject to customary closing conditions, and is expected to be accretive to Blue Owl’s Distributable Earnings per share in 2022 and beyond $12.4 Billion of Assets Under Management1 Oak Street Net Lease Real Estate Note 1. AUM data presented is as of 9/30/21. Seeding and Strategic Capital AUM Strategy Commenced Structure $7.1 billion $4.7 billion $0.6 billion 2010 2019 2010 Closed-end funds Open-end funds Closed-end & open-end funds • Value-add net lease strategy focused on North America • Industrial, essential retail and office properties of investment-grade and creditworthy tenants • Core-plus net lease strategy focused on North America • Industrial, essential retail and office properties of investment-grade and creditworthy tenants • Seeding up-and-coming managers in the real estate space funds

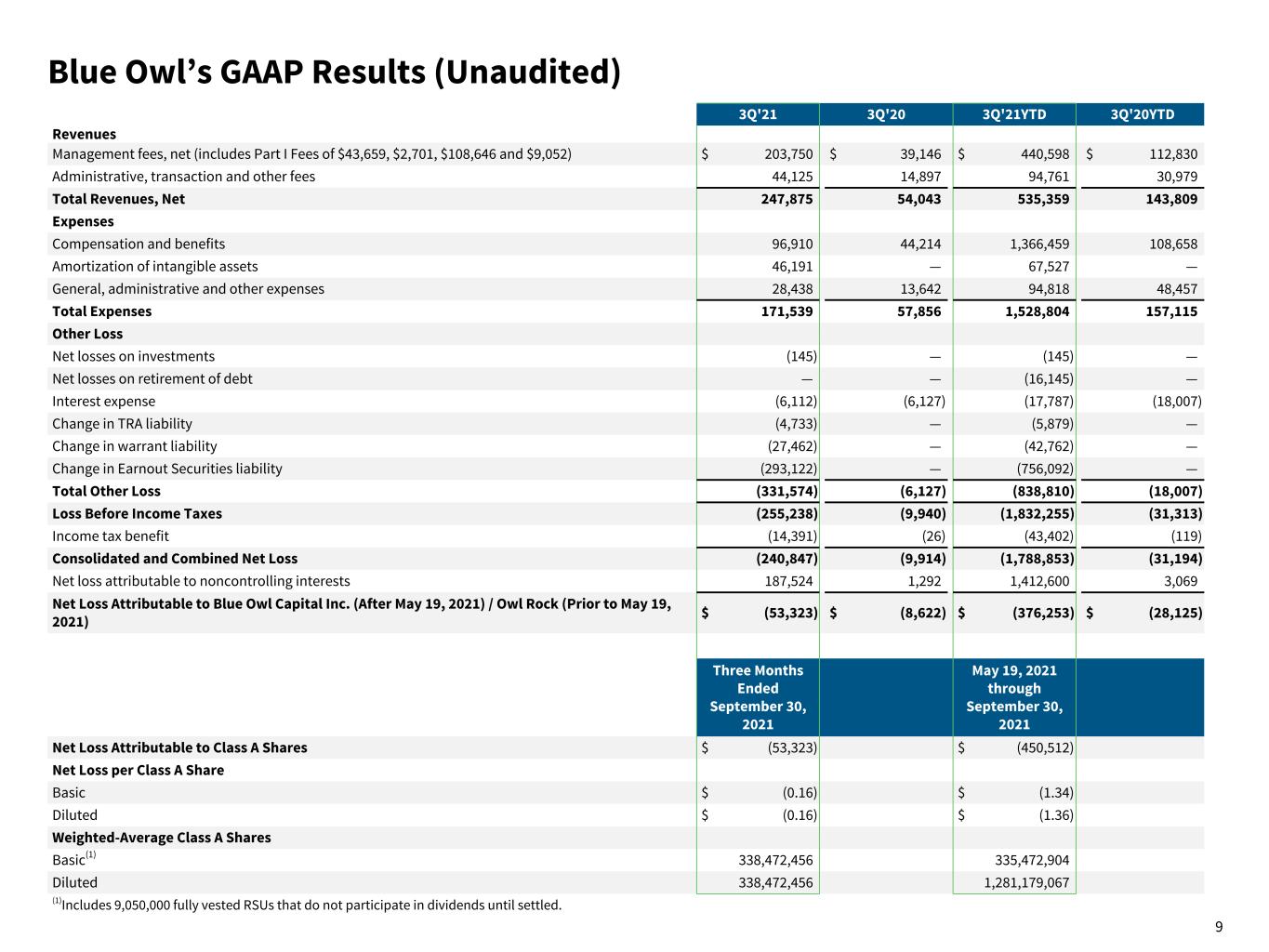

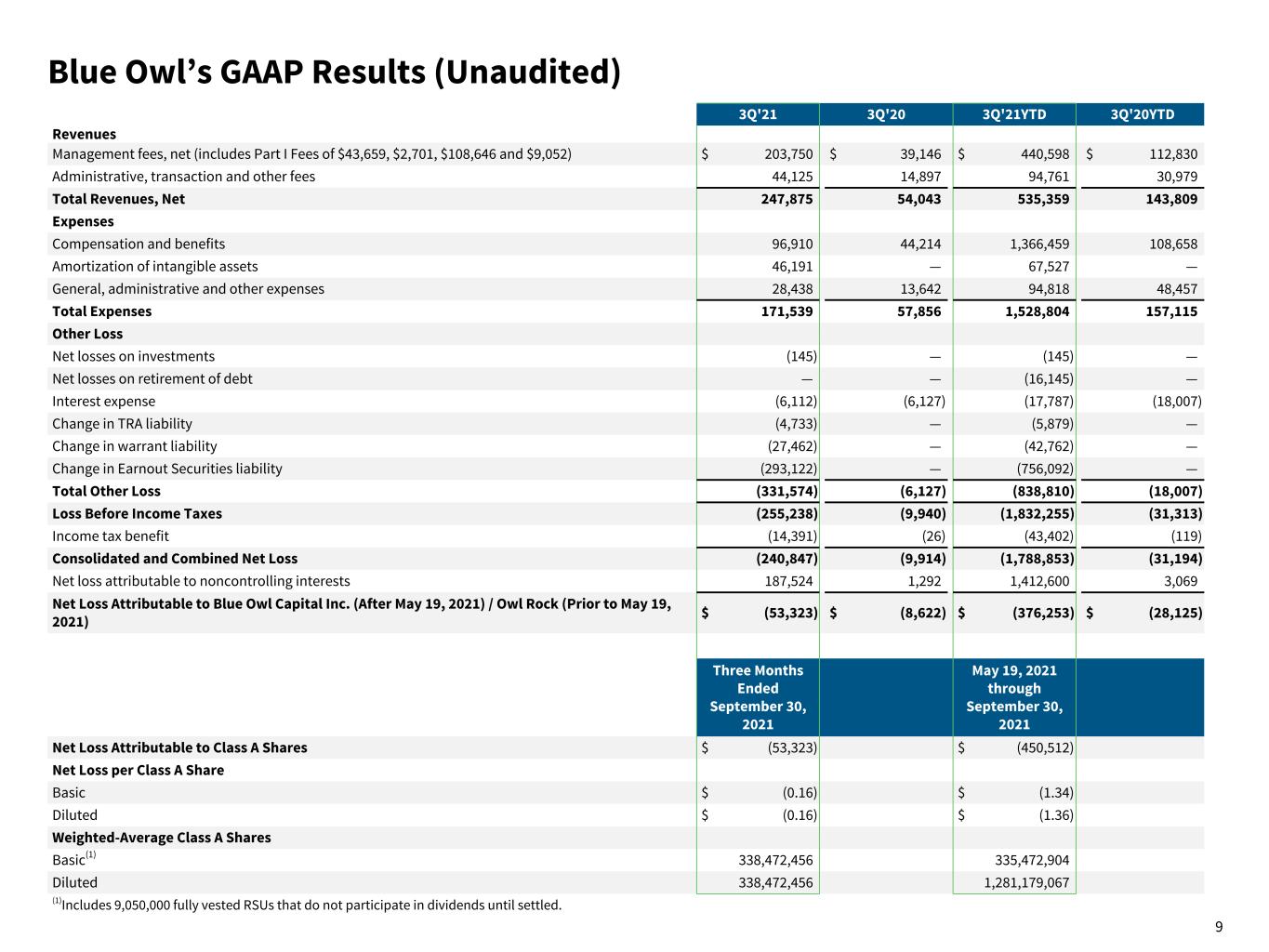

9 ($ in thousands, except per share data) 3Q'21 3Q'20 3Q'21YTD 3Q'20YTD Revenues Management fees, net (includes Part I Fees of $43,659, $2,701, $108,646 and $9,052) $ 203,750 $ 39,146 $ 440,598 $ 112,830 Administrative, transaction and other fees 44,125 14,897 94,761 30,979 Total Revenues, Net 247,875 54,043 535,359 143,809 Expenses Compensation and benefits 96,910 44,214 1,366,459 108,658 Amortization of intangible assets 46,191 — 67,527 — General, administrative and other expenses 28,438 13,642 94,818 48,457 Total Expenses 171,539 57,856 1,528,804 157,115 Other Loss Net losses on investments (145) — (145) — Net losses on retirement of debt — — (16,145) — Interest expense (6,112) (6,127) (17,787) (18,007) Change in TRA liability (4,733) — (5,879) — Change in warrant liability (27,462) — (42,762) — Change in Earnout Securities liability (293,122) — (756,092) — Total Other Loss (331,574) (6,127) (838,810) (18,007) Loss Before Income Taxes (255,238) (9,940) (1,832,255) (31,313) Income tax benefit (14,391) (26) (43,402) (119) Consolidated and Combined Net Loss (240,847) (9,914) (1,788,853) (31,194) Net loss attributable to noncontrolling interests 187,524 1,292 1,412,600 3,069 Net Loss Attributable to Blue Owl Capital Inc. (After May 19, 2021) / Owl Rock (Prior to May 19, 2021) $ (53,323) $ (8,622) $ (376,253) $ (28,125) Three Months Ended September 30, 2021 May 19, 2021 through September 30, 2021 Net Loss Attributable to Class A Shares $ (53,323) $ (450,512) Net Loss per Class A Share Basic $ (0.16) $ (1.34) Diluted $ (0.16) $ (1.36) Weighted-Average Class A Shares Basic(1) 338,472,456 335,472,904 Diluted 338,472,456 1,281,179,067 (1)Includes 9,050,000 fully vested RSUs that do not participate in dividends until settled. Blue Owl’s GAAP Results (Unaudited)

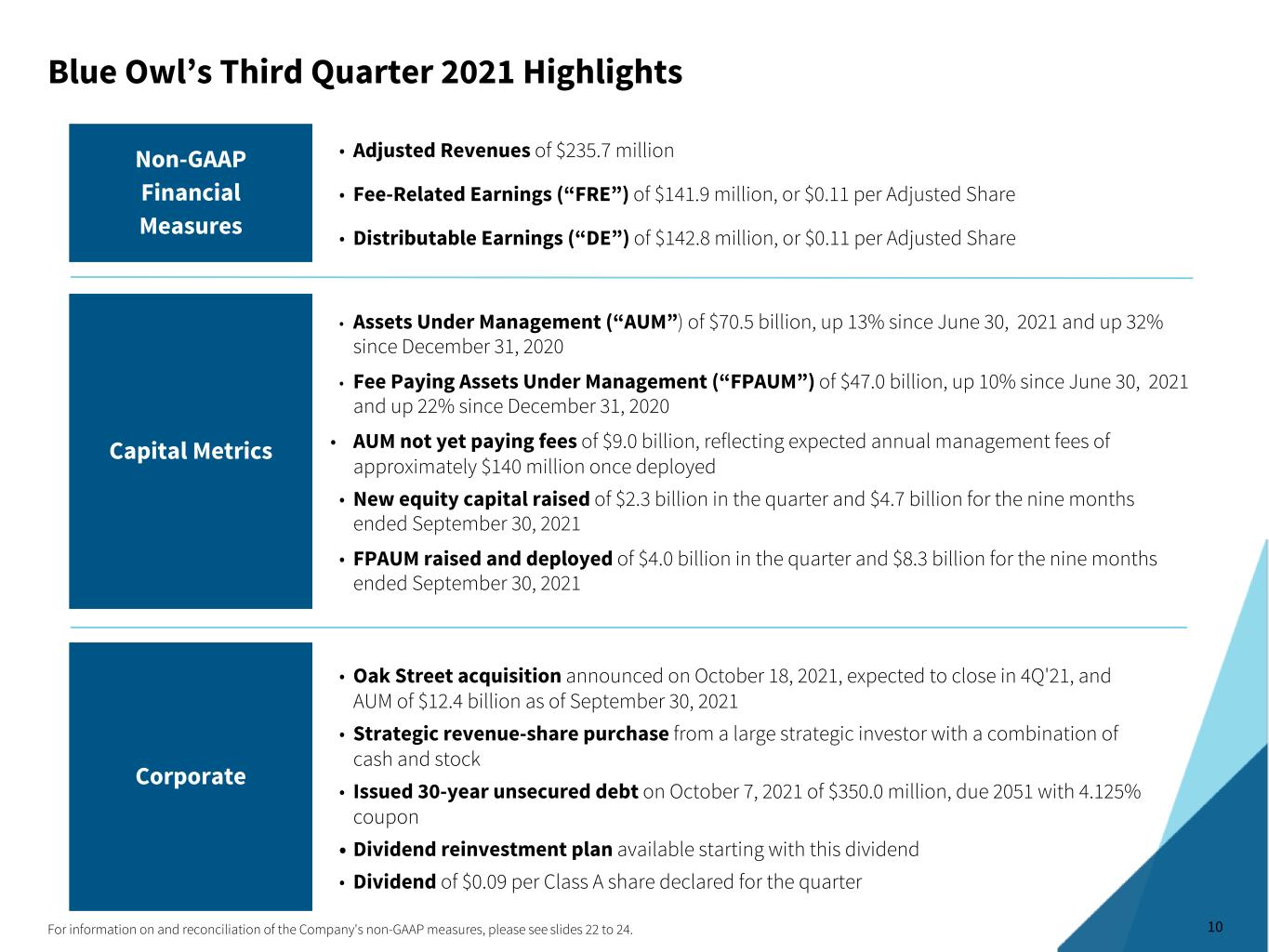

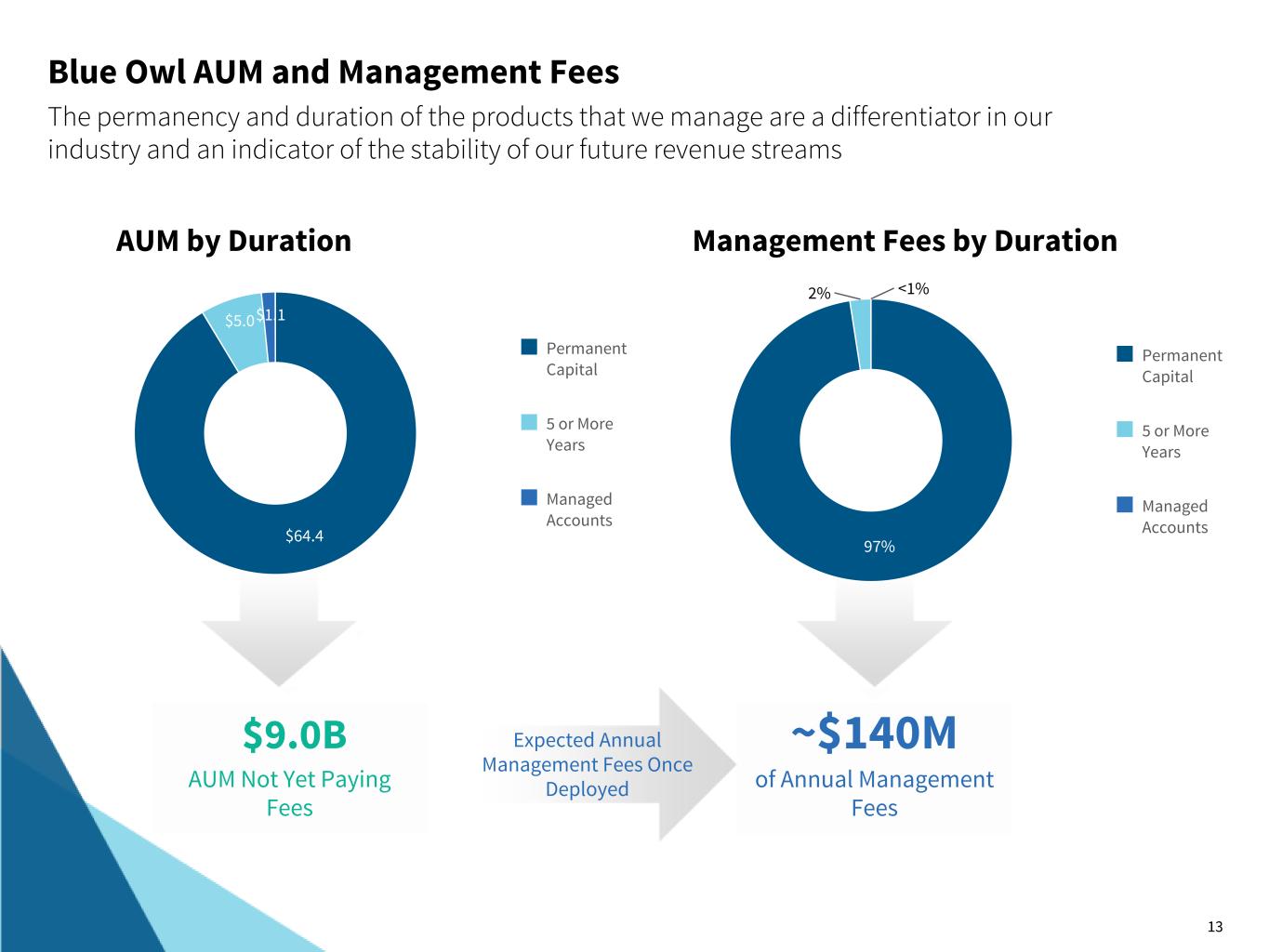

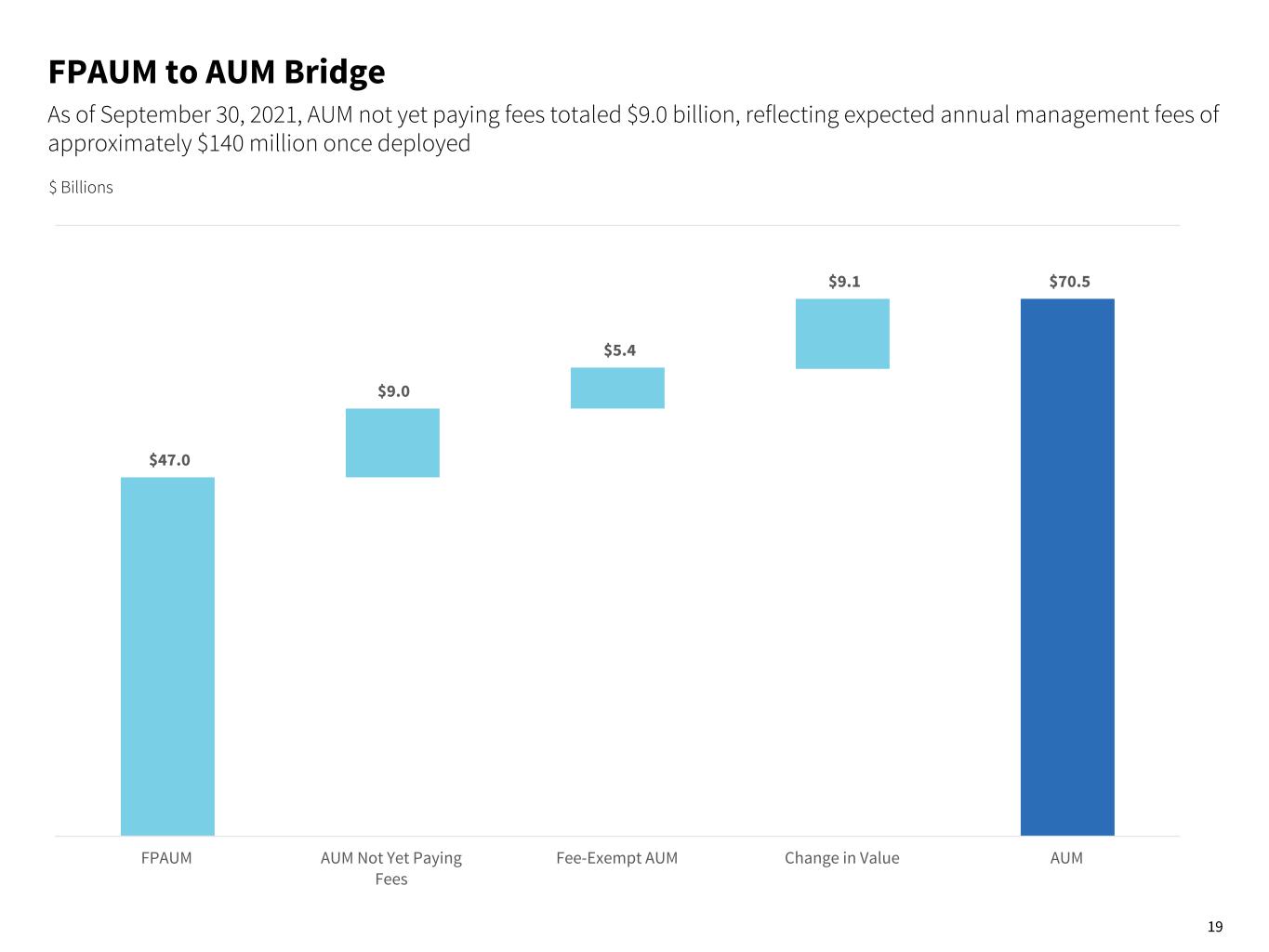

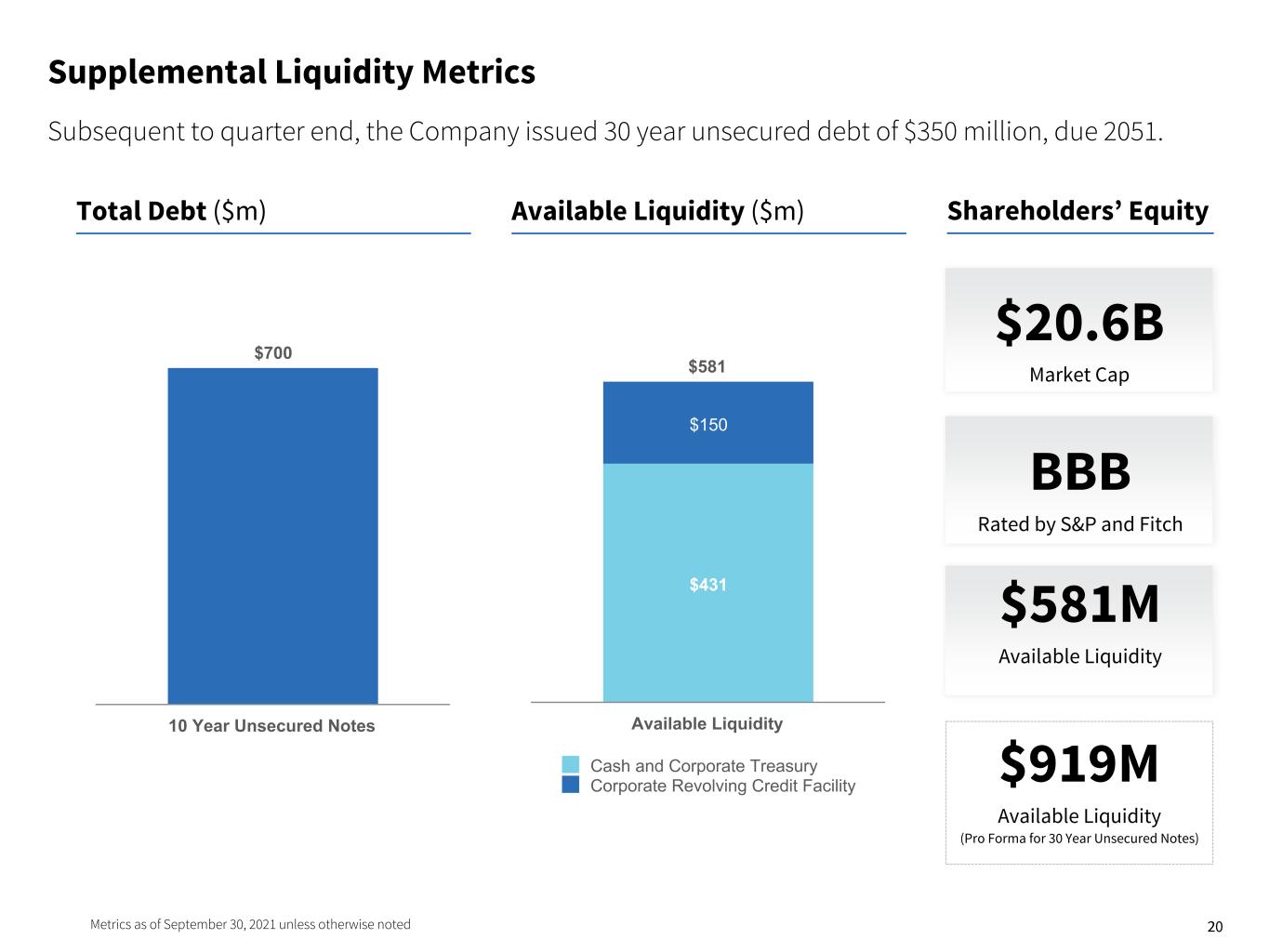

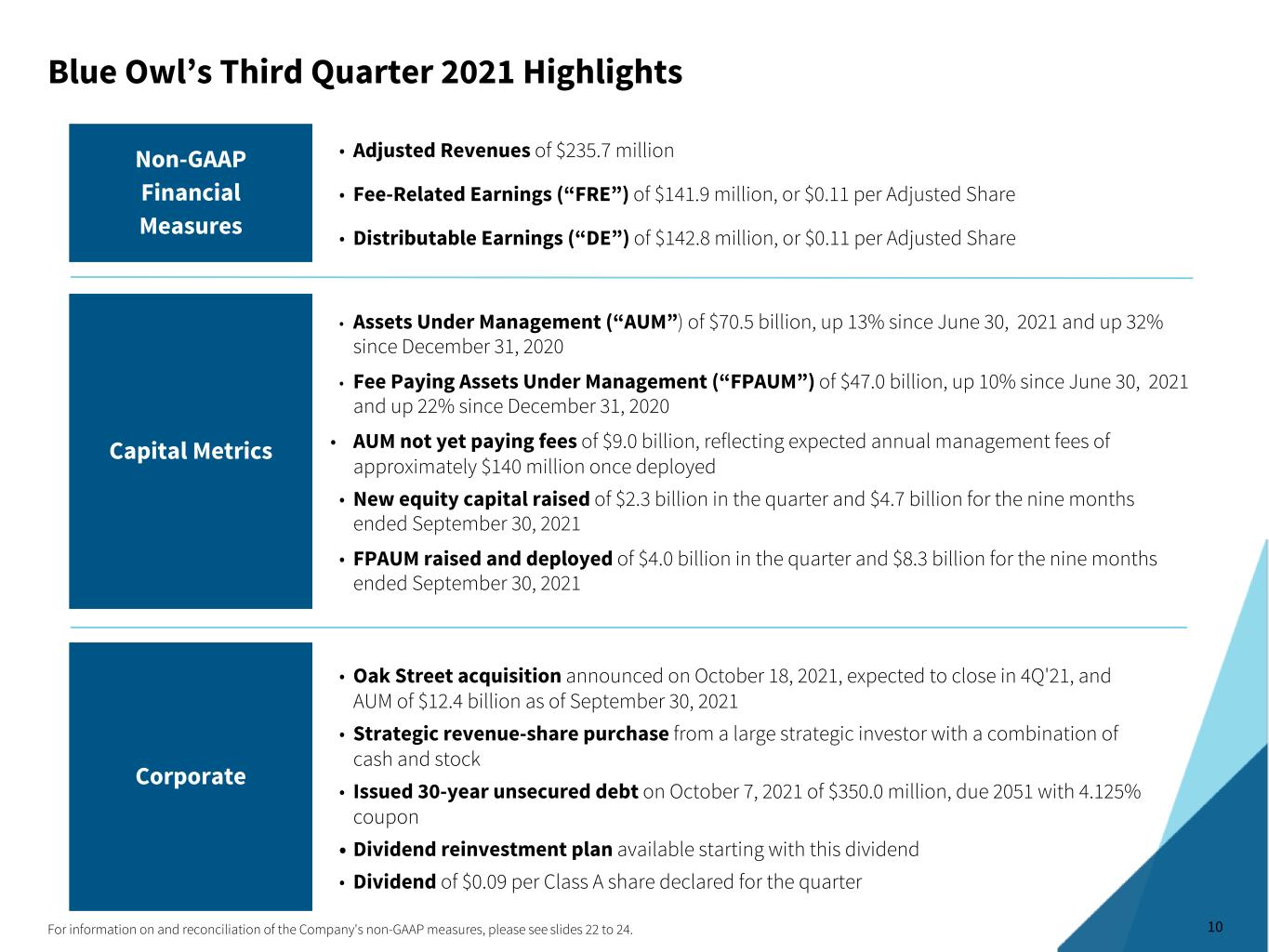

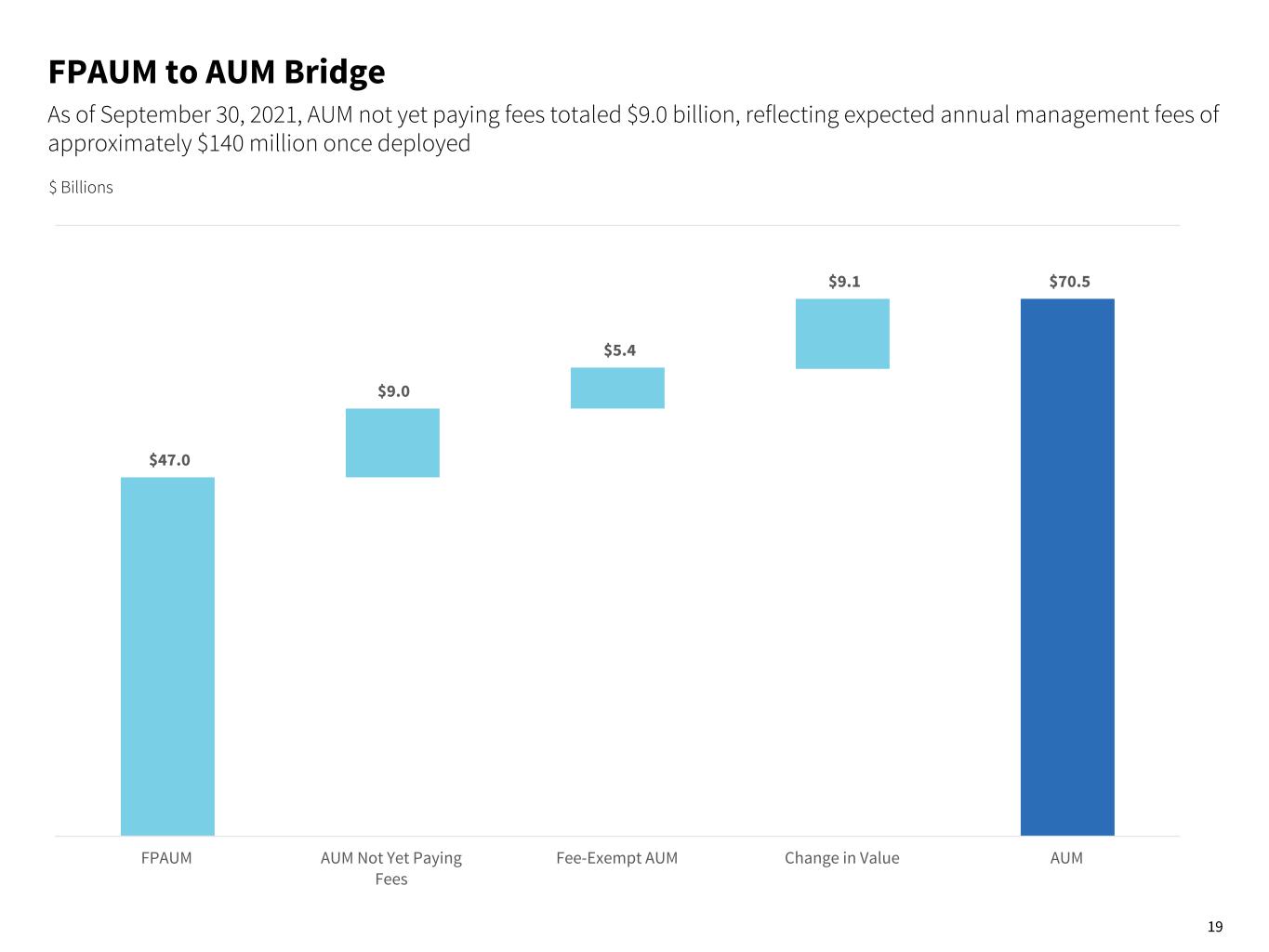

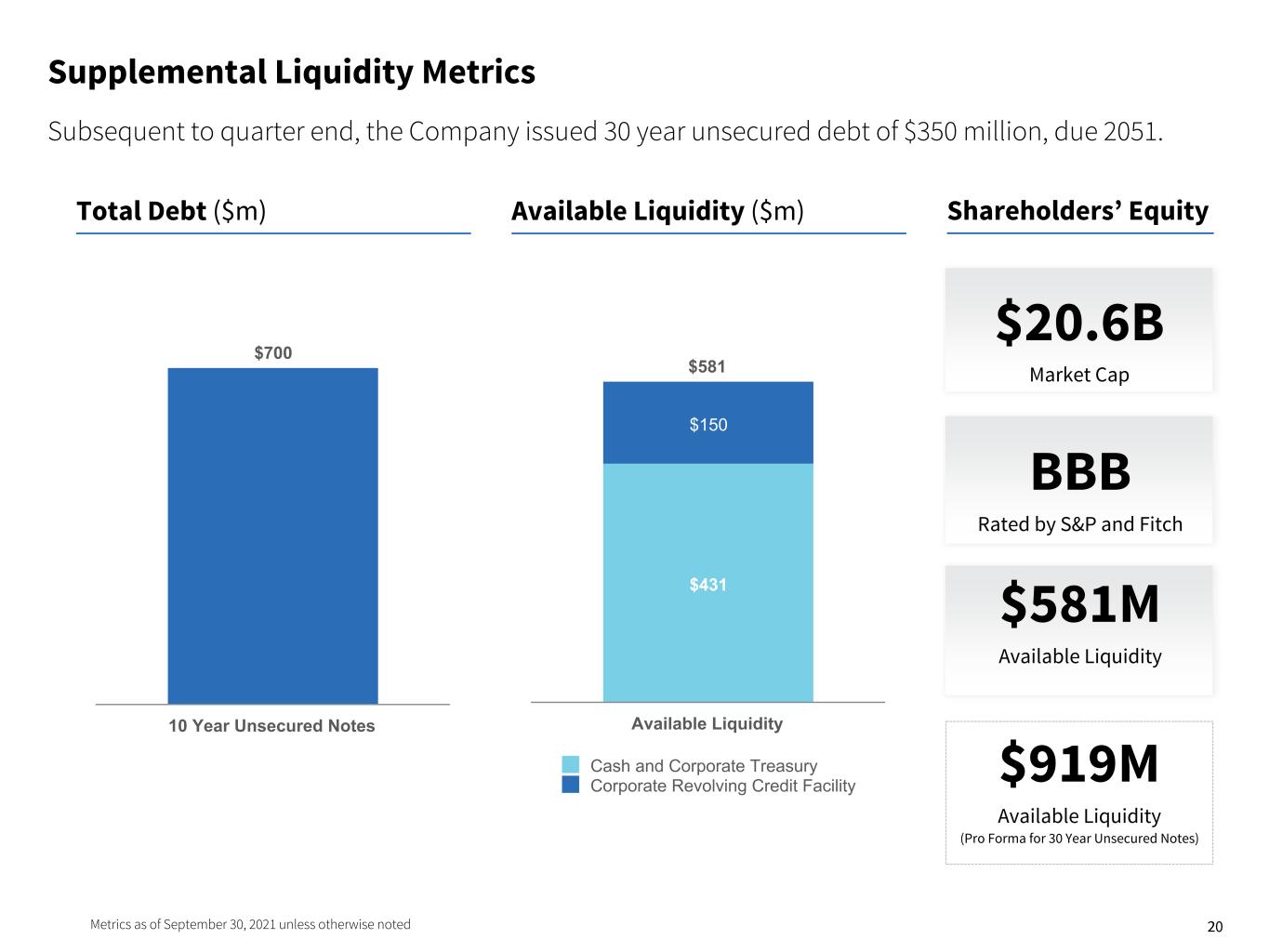

10For information on and reconciliation of the Company's non-GAAP measures, please see slides 22 to 24. • Oak Street acquisition announced on October 18, 2021, expected to close in 4Q'21, and AUM of $12.4 billion as of September 30, 2021 • Strategic revenue-share purchase from a large strategic investor with a combination of cash and stock • Issued 30-year unsecured debt on October 7, 2021 of $350.0 million, due 2051 with 4.125% coupon • Dividend reinvestment plan available starting with this dividend • Dividend of $0.09 per Class A share declared for the quarter Blue Owl’s Third Quarter 2021 Highlights Non-GAAP Financial Measures Capital Metrics Corporate • Adjusted Revenues of $235.7 million • Fee-Related Earnings (“FRE”) of $141.9 million, or $0.11 per Adjusted Share • Distributable Earnings (“DE”) of $142.8 million, or $0.11 per Adjusted Share • Assets Under Management (“AUM”) of $70.5 billion, up 13% since June 30, 2021 and up 32% since December 31, 2020 • Fee Paying Assets Under Management (“FPAUM”) of $47.0 billion, up 10% since June 30, 2021 and up 22% since December 31, 2020 • AUM not yet paying fees of $9.0 billion, reflecting expected annual management fees of approximately $140 million once deployed • New equity capital raised of $2.3 billion in the quarter and $4.7 billion for the nine months ended September 30, 2021 • FPAUM raised and deployed of $4.0 billion in the quarter and $8.3 billion for the nine months ended September 30, 2021

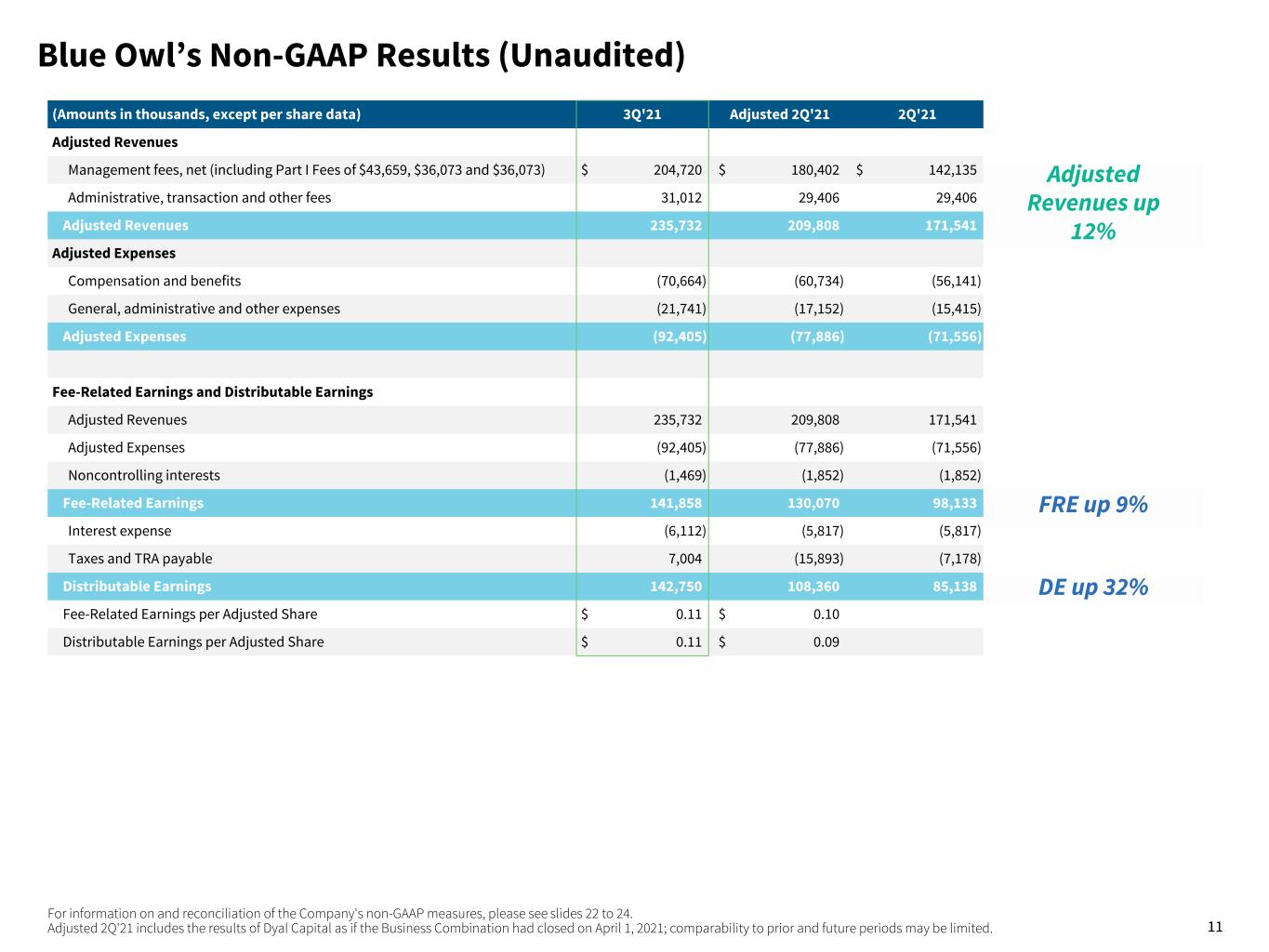

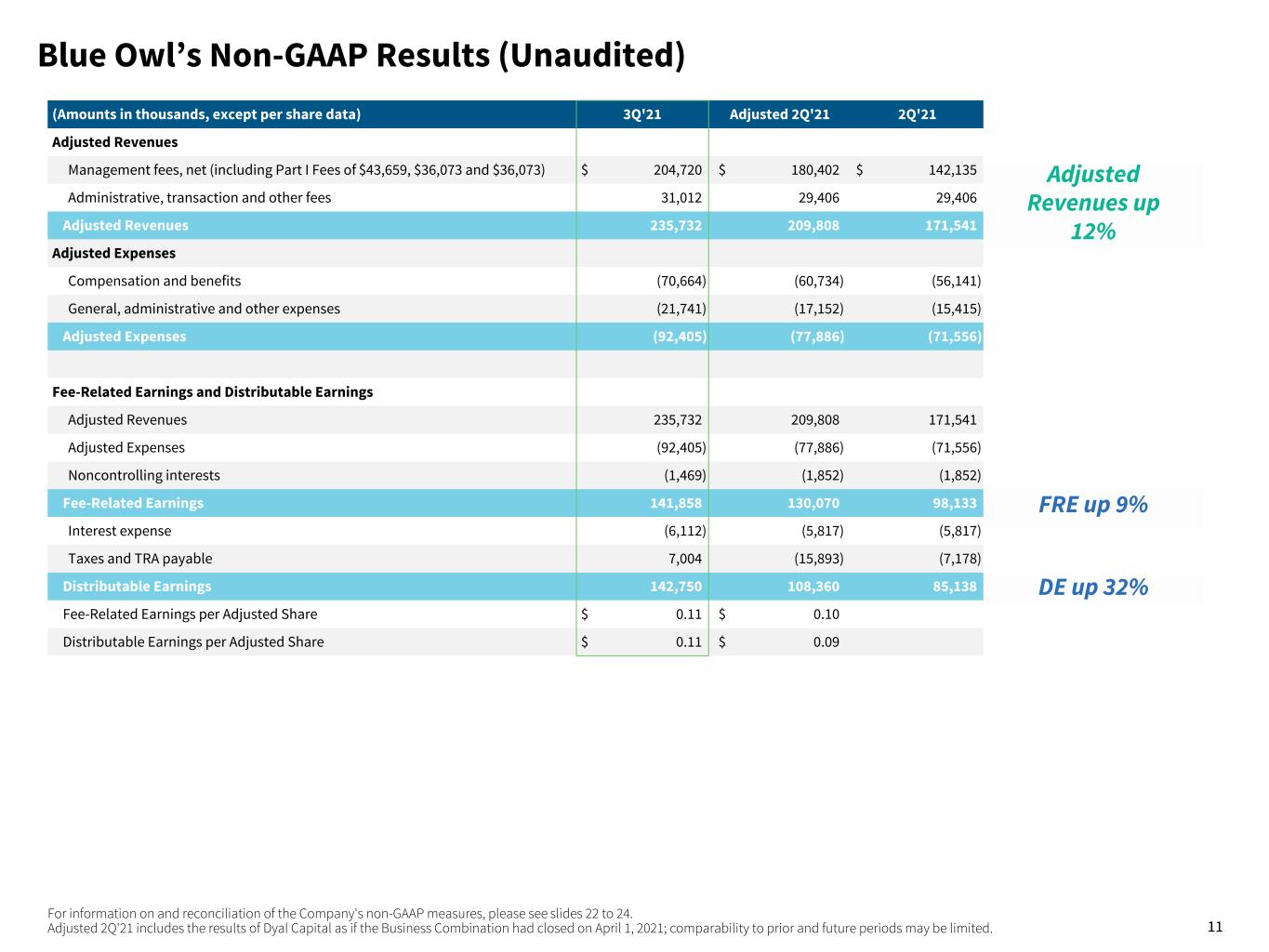

11 Blue Owl’s Non-GAAP Results (Unaudited) For information on and reconciliation of the Company's non-GAAP measures, please see slides 22 to 24. Adjusted 2Q'21 includes the results of Dyal Capital as if the Business Combination had closed on April 1, 2021; comparability to prior and future periods may be limited. (Amounts in thousands, except per share data) 3Q'21 Adjusted 2Q'21 2Q'21 Adjusted Revenues Management fees, net (including Part I Fees of $43,659, $36,073 and $36,073) $ 204,720 $ 180,402 $ 142,135 Administrative, transaction and other fees 31,012 29,406 29,406 Adjusted Revenues 235,732 209,808 171,541 Adjusted Expenses Compensation and benefits (70,664) (60,734) (56,141) General, administrative and other expenses (21,741) (17,152) (15,415) Adjusted Expenses (92,405) (77,886) (71,556) Fee-Related Earnings and Distributable Earnings Adjusted Revenues 235,732 209,808 171,541 Adjusted Expenses (92,405) (77,886) (71,556) Noncontrolling interests (1,469) (1,852) (1,852) Fee-Related Earnings 141,858 130,070 98,133 Interest expense (6,112) (5,817) (5,817) Taxes and TRA payable 7,004 (15,893) (7,178) Distributable Earnings 142,750 108,360 85,138 Fee-Related Earnings per Adjusted Share $ 0.11 $ 0.10 Distributable Earnings per Adjusted Share $ 0.11 $ 0.09 Adjusted Revenues up 12% FRE up 9% DE up 32%

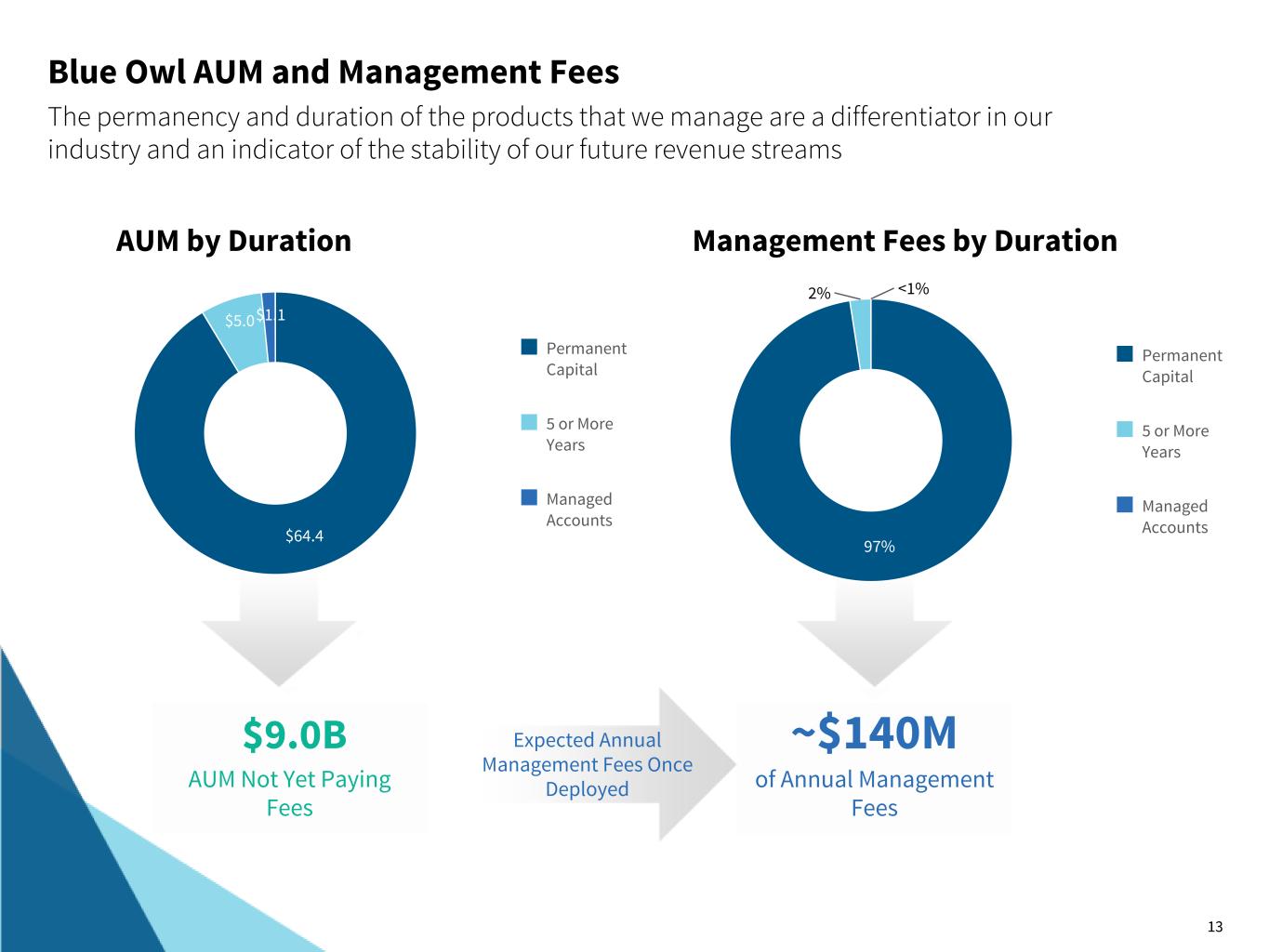

12 • AUM of $70.5 billion, increased 13% during the quarter and 32% since December 31, 2020 • The increase in AUM during the third quarter was primarily driven by robust deployment activity in Direct Lending, portfolio appreciation in GP Capital Solutions, and new capital commitments across the platform • FPAUM of $47.0 billion, increased 10% during the quarter and 22% since December 31, 2020 • The increase in FPAUM during the third quarter was primarily driven by $2.8 billion of commitments across the platform and capital deployments in Direct Lending strategies • Permanent Capital grew $7.5 billion, or 13%, to $64.4 billion, generating 97% of third quarter management fees • AUM Not Yet Paying Fees totaled $9.0 billion, reflecting expected annual management fees of approximately $140 million once deployed Assets Under Management AUM Fee-Paying AUM Permanent Capital Direct Lending GP Capital Solutions Figures may not sum due to rounding. $ Billions 58.0 62.4 70.5 27.8 31.2 34.6 30.2 31.2 35.9 1Q'21 2Q'21 3Q'21 40.1 47.0 21.5 24.2 27.2 18.6 18.7 19.7 1Q'21 2Q'21 3Q'21 53.1 56.9 64.4 22.9 25.7 28.5 30.2 31.2 35.9 1Q'21 2Q'21 3Q'21 42.8

13 Blue Owl AUM and Management Fees The permanency and duration of the products that we manage are a differentiator in our industry and an indicator of the stability of our future revenue streams AUM by Duration Management Fees by Duration $9.0B AUM Not Yet Paying Fees ~$140M of Annual Management Fees 97% 2% <1% Permanent Capital 5 or More Years Managed Accounts Expected Annual Management Fees Once Deployed $64.4 $5.0$1.1 Permanent Capital 5 or More Years Managed Accounts

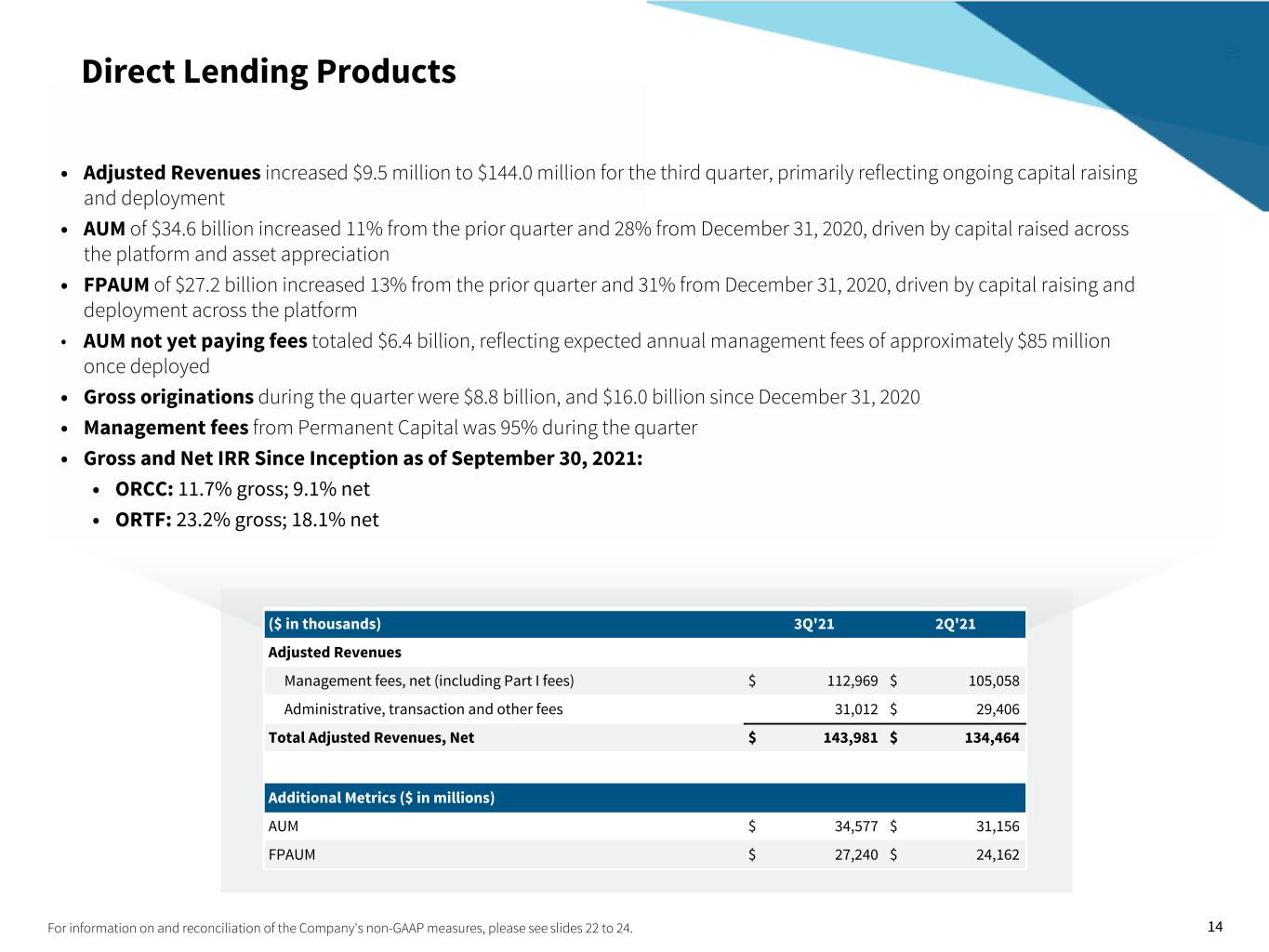

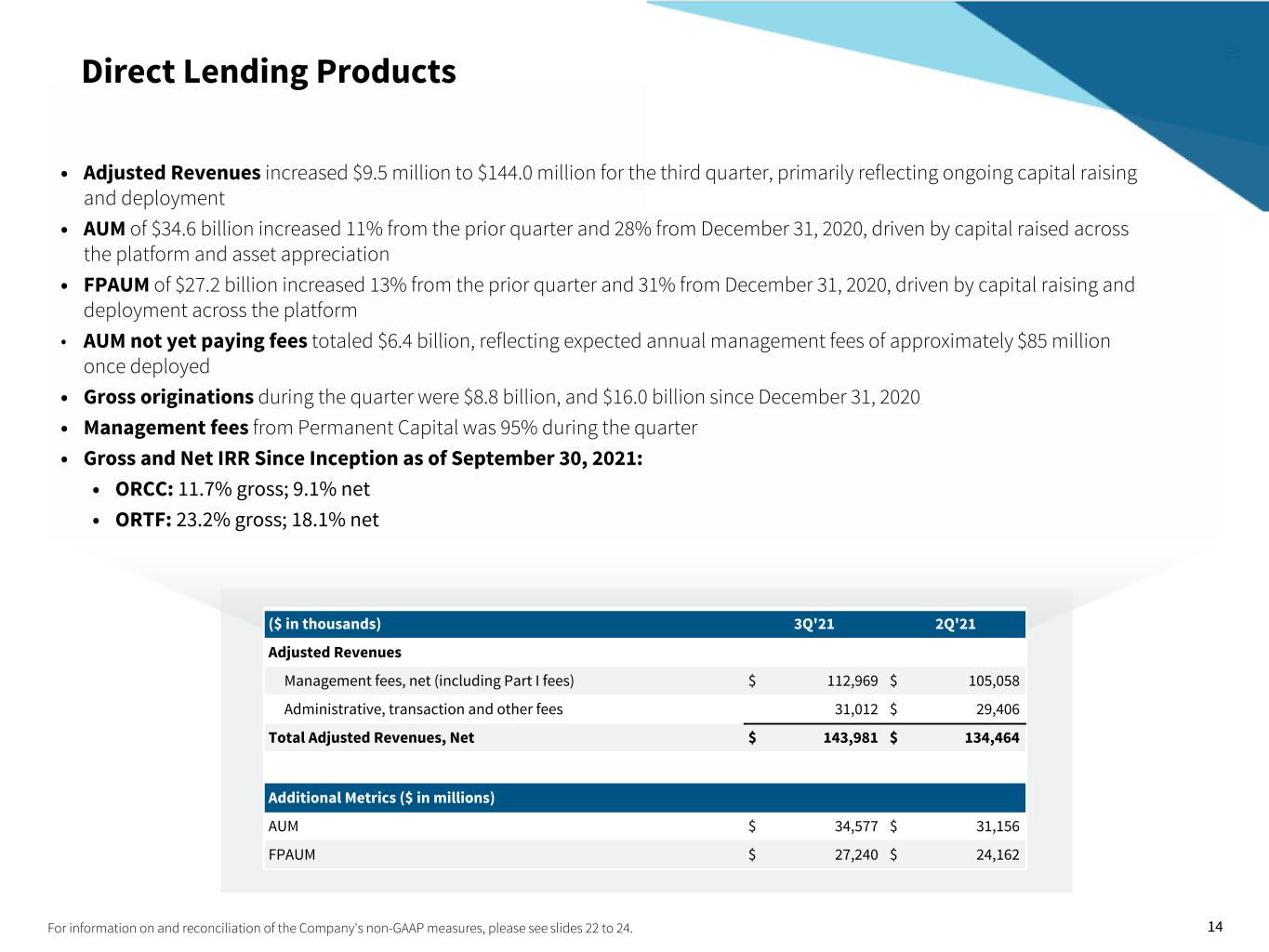

14For information on and reconciliation of the Company's non-GAAP measures, please see slides 22 to 24. Direct Lending Products • Adjusted Revenues increased $9.5 million to $144.0 million for the third quarter, primarily reflecting ongoing capital raising and deployment • AUM of $34.6 billion increased 11% from the prior quarter and 28% from December 31, 2020, driven by capital raised across the platform and asset appreciation • FPAUM of $27.2 billion increased 13% from the prior quarter and 31% from December 31, 2020, driven by capital raising and deployment across the platform • AUM not yet paying fees totaled $6.4 billion, reflecting expected annual management fees of approximately $85 million once deployed • Gross originations during the quarter were $8.8 billion, and $16.0 billion since December 31, 2020 • Management fees from Permanent Capital was 95% during the quarter • Gross and Net IRR Since Inception as of September 30, 2021: • ORCC: 11.7% gross; 9.1% net • ORTF: 23.2% gross; 18.1% net ($ in thousands) 3Q'21 2Q'21 Adjusted Revenues Management fees, net (including Part I fees) $ 112,969 $ 105,058 Administrative, transaction and other fees 31,012 $ 29,406 Total Adjusted Revenues, Net $ 143,981 $ 134,464 Additional Metrics ($ in millions) AUM $ 34,577 $ 31,156 FPAUM $ 27,240 $ 24,162

15 40 47 52 94 99 125 155 200 260 319 411 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Market Landscape 101.7 145.4 215.3 339.9 Jul-21 Aug-21 Sep-21 Oct-21 Retail Fund Raise Direct Lending Continues to Expand Faster Than the Larger Alternatives Industry $ Billions 2.1 5.1 8.8 1Q'21 2Q'21 3Q'21 $1.5 trillion of Private Equity Dry Powder $3+ trillion of Private Markets Dry Powder ??? trillion of debt to be refinanced In the context of the broader private markets industry, Direct Lending constitutes a relatively small but growing market share Compound Annual Growth Rate: 26% Direct Lending Industry AUM ($ Billions) (Includes Dry Powder and Invested Capital) Data Source: Preqin. As of October 2020 Past performance is not a guarantee of future results. There can be no assurance that historical trends will continue during the life of any market or investment. $ Millions Direct Lending Gross Originations

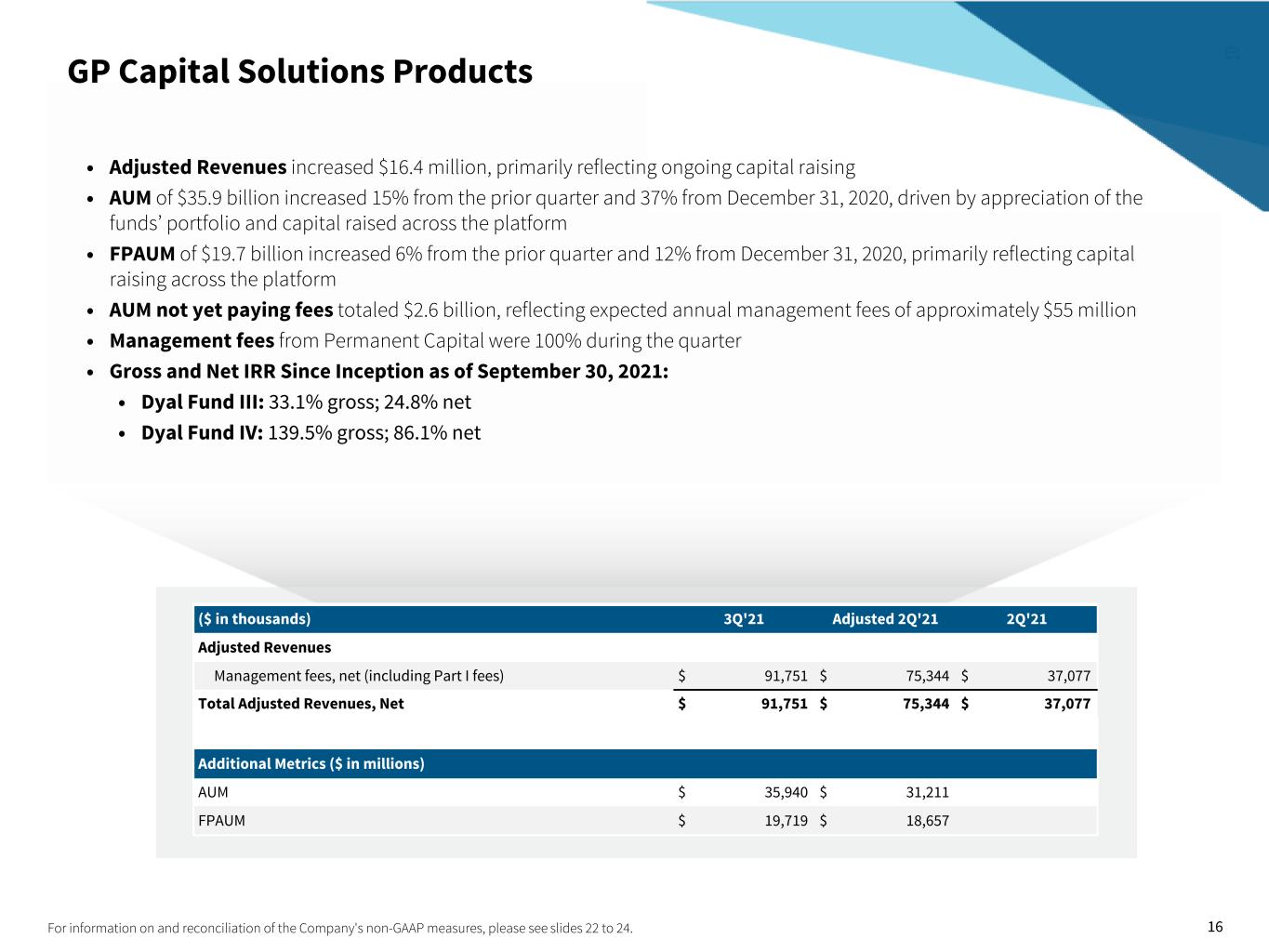

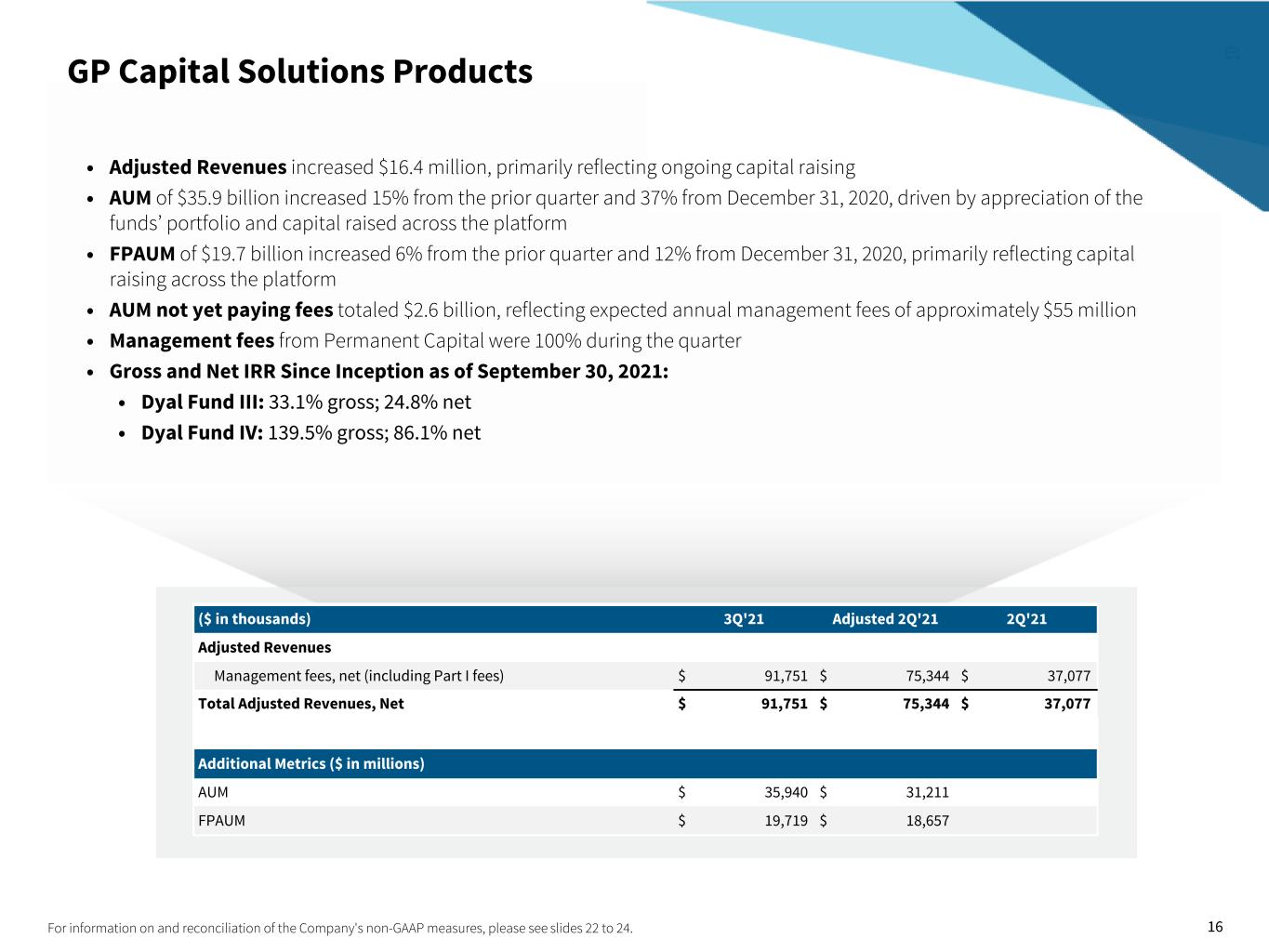

16 GP Capital Solutions Products • Adjusted Revenues increased $16.4 million, primarily reflecting ongoing capital raising • AUM of $35.9 billion increased 15% from the prior quarter and 37% from December 31, 2020, driven by appreciation of the funds’ portfolio and capital raised across the platform • FPAUM of $19.7 billion increased 6% from the prior quarter and 12% from December 31, 2020, primarily reflecting capital raising across the platform • AUM not yet paying fees totaled $2.6 billion, reflecting expected annual management fees of approximately $55 million • Management fees from Permanent Capital were 100% during the quarter • Gross and Net IRR Since Inception as of September 30, 2021: • Dyal Fund III: 33.1% gross; 24.8% net • Dyal Fund IV: 139.5% gross; 86.1% net For information on and reconciliation of the Company's non-GAAP measures, please see slides 22 to 24. ($ in thousands) 3Q'21 Adjusted 2Q'21 2Q'21 Adjusted Revenues Management fees, net (including Part I fees) $ 91,751 $ 75,344 $ 37,077 Total Adjusted Revenues, Net $ 91,751 $ 75,344 $ 37,077 Additional Metrics ($ in millions) AUM $ 35,940 $ 31,211 FPAUM $ 19,719 $ 18,657

Supplemental Information

18 AUM and FPAUM Rollforwards Three Months Ended September 30, 2021 Nine Months Ended September 30, 2021 ($ in millions) Direct Lending GP Capital Solutions Total Direct Lending GP Capital Solutions Total AUM Beginning Balance $ 31,156 $ 31,211 $ 62,367 $ 27,101 $ 26,220 $ 53,321 New capital raised 724 1,598 2,322 1,708 2,990 4,698 Change in debt 2,422 — 2,422 5,153 — 5,153 Distributions (239) (249) (488) (616) (453) (1,069) Change in value 514 3,380 3,894 1,231 7,183 8,414 Ending Balance $ 34,577 $ 35,940 $ 70,517 $ 34,577 $ 35,940 $ 70,517 FPAUM Beginning Balance $ 24,162 $ 18,657 $ 42,819 $ 20,862 $ 17,608 $ 38,470 New capital raised / deployed 2,808 1,177 3,985 5,796 2,460 8,256 Distributions (212) (115) (327) (571) (349) (920) Change in value 482 — 482 1,153 — 1,153 Ending Balance $ 27,240 $ 19,719 $ 46,959 $ 27,240 $ 19,719 $ 46,959

19 FPAUM to AUM Bridge As of September 30, 2021, AUM not yet paying fees totaled $9.0 billion, reflecting expected annual management fees of approximately $140 million once deployed $ Billions $47.0 $9.0 $5.4 $9.1 $70.5 FPAUM AUM Not Yet Paying Fees Fee-Exempt AUM Change in Value AUM

20Metrics as of September 30, 2021 unless otherwise noted BBB Rated by S&P and Fitch $20.6B Market Cap $581M Available Liquidity Total Debt ($m) Available Liquidity ($m) Shareholders’ Equity Supplemental Liquidity Metrics $700 10 Year Unsecured Notes $581 $431 $150 Cash and Corporate Treasury Corporate Revolving Credit Facility Available Liquidity 79D0E6 2B6DB6 $919M Available Liquidity (Pro Forma for 30 Year Unsecured Notes) Subsequent to quarter end, the Company issued 30 year unsecured debt of $350 million, due 2051.

Appendix

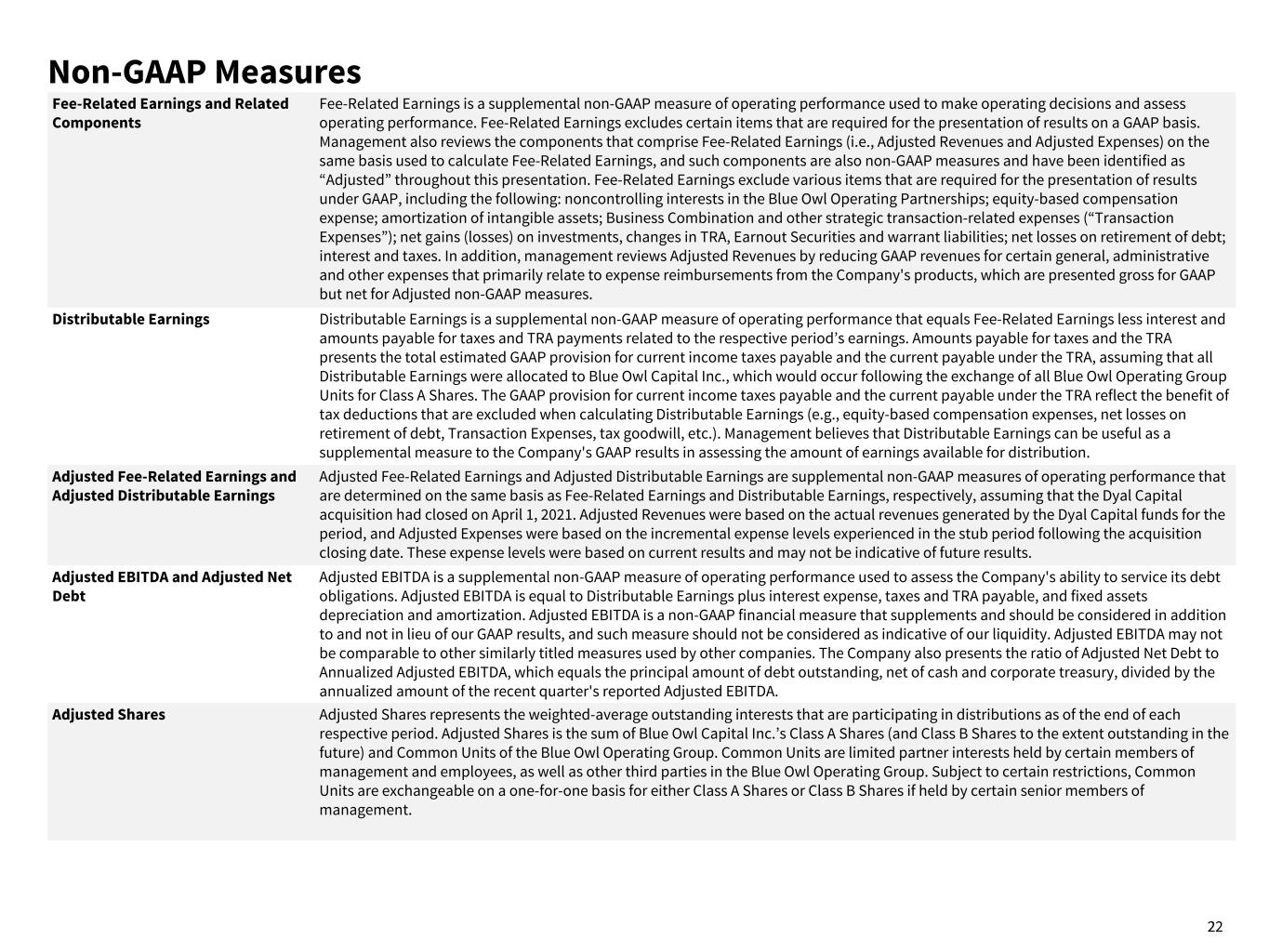

22 Non-GAAP Measures Fee-Related Earnings and Related Components Fee-Related Earnings is a supplemental non-GAAP measure of operating performance used to make operating decisions and assess operating performance. Fee-Related Earnings excludes certain items that are required for the presentation of results on a GAAP basis. Management also reviews the components that comprise Fee-Related Earnings (i.e., Adjusted Revenues and Adjusted Expenses) on the same basis used to calculate Fee-Related Earnings, and such components are also non-GAAP measures and have been identified as ���Adjusted” throughout this presentation. Fee-Related Earnings exclude various items that are required for the presentation of results under GAAP, including the following: noncontrolling interests in the Blue Owl Operating Partnerships; equity-based compensation expense; amortization of intangible assets; Business Combination and other strategic transaction-related expenses (“Transaction Expenses”); net gains (losses) on investments, changes in TRA, Earnout Securities and warrant liabilities; net losses on retirement of debt; interest and taxes. In addition, management reviews Adjusted Revenues by reducing GAAP revenues for certain general, administrative and other expenses that primarily relate to expense reimbursements from the Company's products, which are presented gross for GAAP but net for Adjusted non-GAAP measures. Distributable Earnings Distributable Earnings is a supplemental non-GAAP measure of operating performance that equals Fee-Related Earnings less interest and amounts payable for taxes and TRA payments related to the respective period’s earnings. Amounts payable for taxes and the TRA presents the total estimated GAAP provision for current income taxes payable and the current payable under the TRA, assuming that all Distributable Earnings were allocated to Blue Owl Capital Inc., which would occur following the exchange of all Blue Owl Operating Group Units for Class A Shares. The GAAP provision for current income taxes payable and the current payable under the TRA reflect the benefit of tax deductions that are excluded when calculating Distributable Earnings (e.g., equity-based compensation expenses, net losses on retirement of debt, Transaction Expenses, tax goodwill, etc.). Management believes that Distributable Earnings can be useful as a supplemental measure to the Company's GAAP results in assessing the amount of earnings available for distribution. Adjusted Fee-Related Earnings and Adjusted Distributable Earnings Adjusted Fee-Related Earnings and Adjusted Distributable Earnings are supplemental non-GAAP measures of operating performance that are determined on the same basis as Fee-Related Earnings and Distributable Earnings, respectively, assuming that the Dyal Capital acquisition had closed on April 1, 2021. Adjusted Revenues were based on the actual revenues generated by the Dyal Capital funds for the period, and Adjusted Expenses were based on the incremental expense levels experienced in the stub period following the acquisition closing date. These expense levels were based on current results and may not be indicative of future results. Adjusted EBITDA and Adjusted Net Debt Adjusted EBITDA is a supplemental non-GAAP measure of operating performance used to assess the Company's ability to service its debt obligations. Adjusted EBITDA is equal to Distributable Earnings plus interest expense, taxes and TRA payable, and fixed assets depreciation and amortization. Adjusted EBITDA is a non-GAAP financial measure that supplements and should be considered in addition to and not in lieu of our GAAP results, and such measure should not be considered as indicative of our liquidity. Adjusted EBITDA may not be comparable to other similarly titled measures used by other companies. The Company also presents the ratio of Adjusted Net Debt to Annualized Adjusted EBITDA, which equals the principal amount of debt outstanding, net of cash and corporate treasury, divided by the annualized amount of the recent quarter's reported Adjusted EBITDA. Adjusted Shares Adjusted Shares represents the weighted-average outstanding interests that are participating in distributions as of the end of each respective period. Adjusted Shares is the sum of Blue Owl Capital Inc.’s Class A Shares (and Class B Shares to the extent outstanding in the future) and Common Units of the Blue Owl Operating Group. Common Units are limited partner interests held by certain members of management and employees, as well as other third parties in the Blue Owl Operating Group. Subject to certain restrictions, Common Units are exchangeable on a one-for-one basis for either Class A Shares or Class B Shares if held by certain senior members of management.

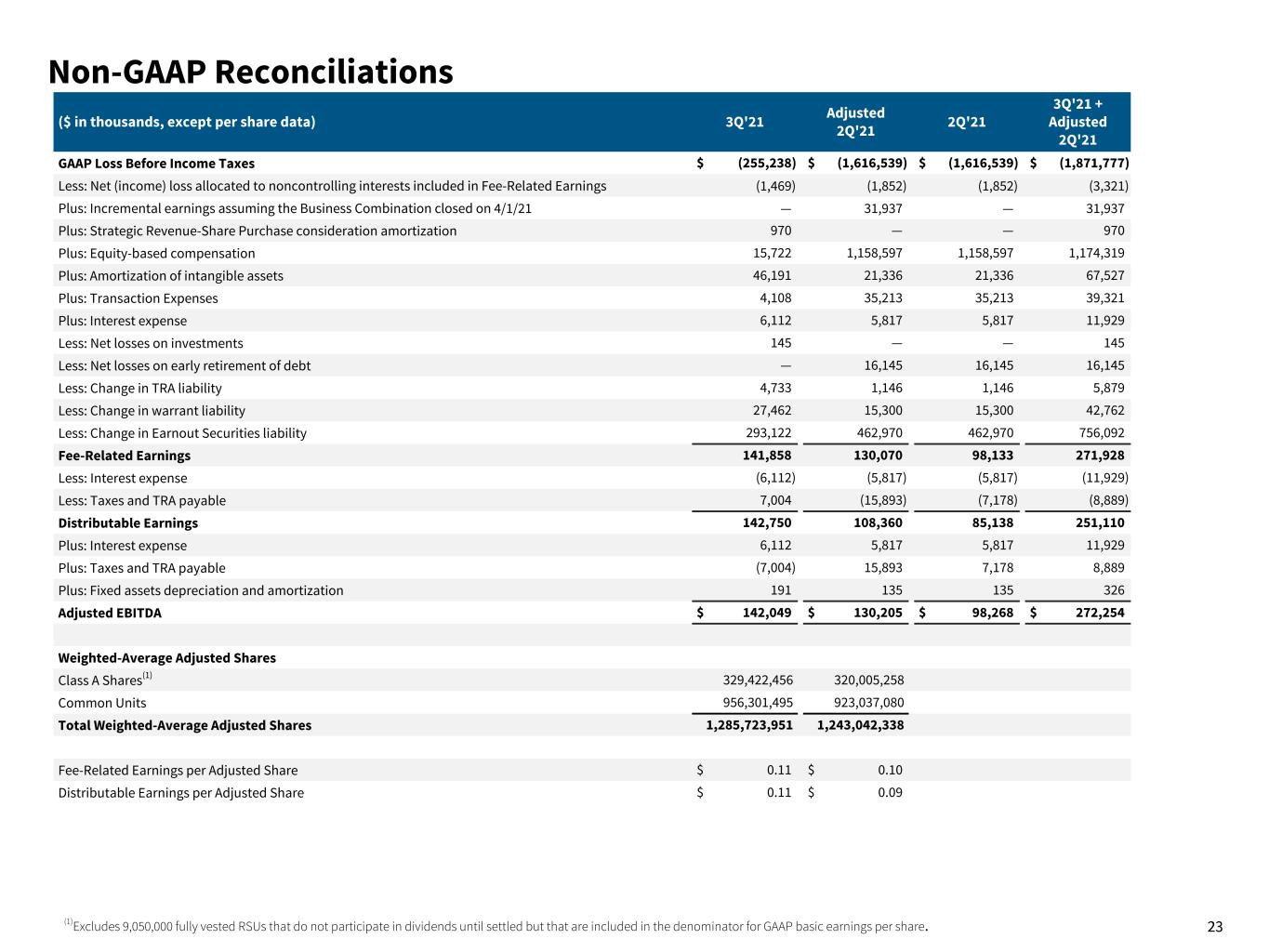

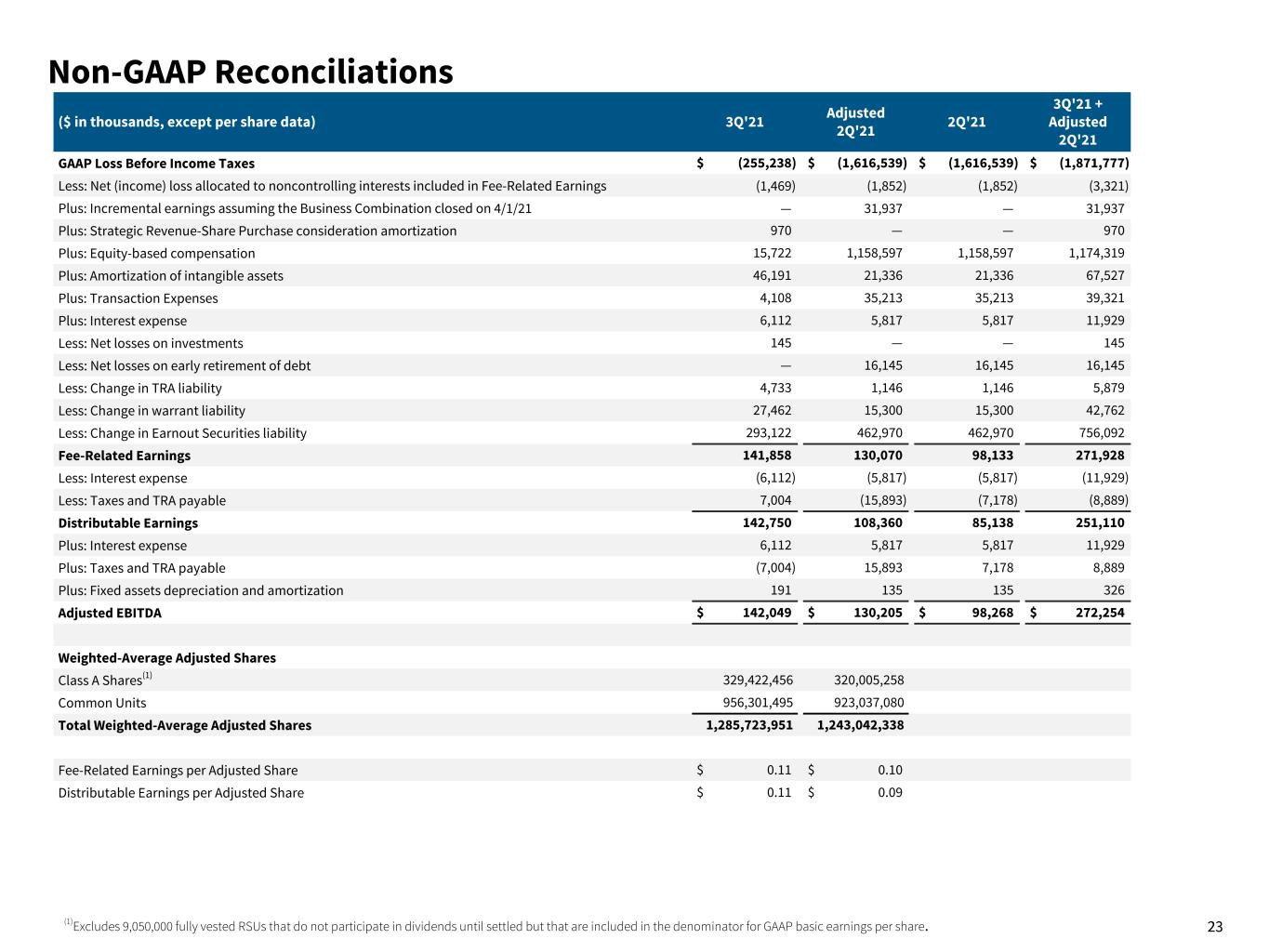

23 Non-GAAP Reconciliations($ in thousands, except per share data) 3Q'21 Adjusted 2Q'21 2Q'21 3Q'21 + Adjusted 2Q'21 GAAP Loss Before Income Taxes $ (255,238) $ (1,616,539) $ (1,616,539) $ (1,871,777) Less: Net (income) loss allocated to noncontrolling interests included in Fee-Related Earnings (1,469) (1,852) (1,852) (3,321) Plus: Incremental earnings assuming the Business Combination closed on 4/1/21 — 31,937 — 31,937 Plus: Strategic Revenue-Share Purchase consideration amortization 970 — — 970 Plus: Equity-based compensation 15,722 1,158,597 1,158,597 1,174,319 Plus: Amortization of intangible assets 46,191 21,336 21,336 67,527 Plus: Transaction Expenses 4,108 35,213 35,213 39,321 Plus: Interest expense 6,112 5,817 5,817 11,929 Less: Net losses on investments 145 — — 145 Less: Net losses on early retirement of debt — 16,145 16,145 16,145 Less: Change in TRA liability 4,733 1,146 1,146 5,879 Less: Change in warrant liability 27,462 15,300 15,300 42,762 Less: Change in Earnout Securities liability 293,122 462,970 462,970 756,092 Fee-Related Earnings 141,858 130,070 98,133 271,928 Less: Interest expense (6,112) (5,817) (5,817) (11,929) Less: Taxes and TRA payable 7,004 (15,893) (7,178) (8,889) Distributable Earnings 142,750 108,360 85,138 251,110 Plus: Interest expense 6,112 5,817 5,817 11,929 Plus: Taxes and TRA payable (7,004) 15,893 7,178 8,889 Plus: Fixed assets depreciation and amortization 191 135 135 326 Adjusted EBITDA $ 142,049 $ 130,205 $ 98,268 $ 272,254 Weighted-Average Adjusted Shares Class A Shares(1) 329,422,456 320,005,258 Common Units 956,301,495 923,037,080 Total Weighted-Average Adjusted Shares 1,285,723,951 1,243,042,338 Fee-Related Earnings per Adjusted Share $ 0.11 $ 0.10 Distributable Earnings per Adjusted Share $ 0.11 $ 0.09 Non-GAAP Reconciliations (1)Excludes 9,050,000 fully vested RSUs that do not participate in dividends until settled but that are included in the denominator for GAAP basic earnings per share.

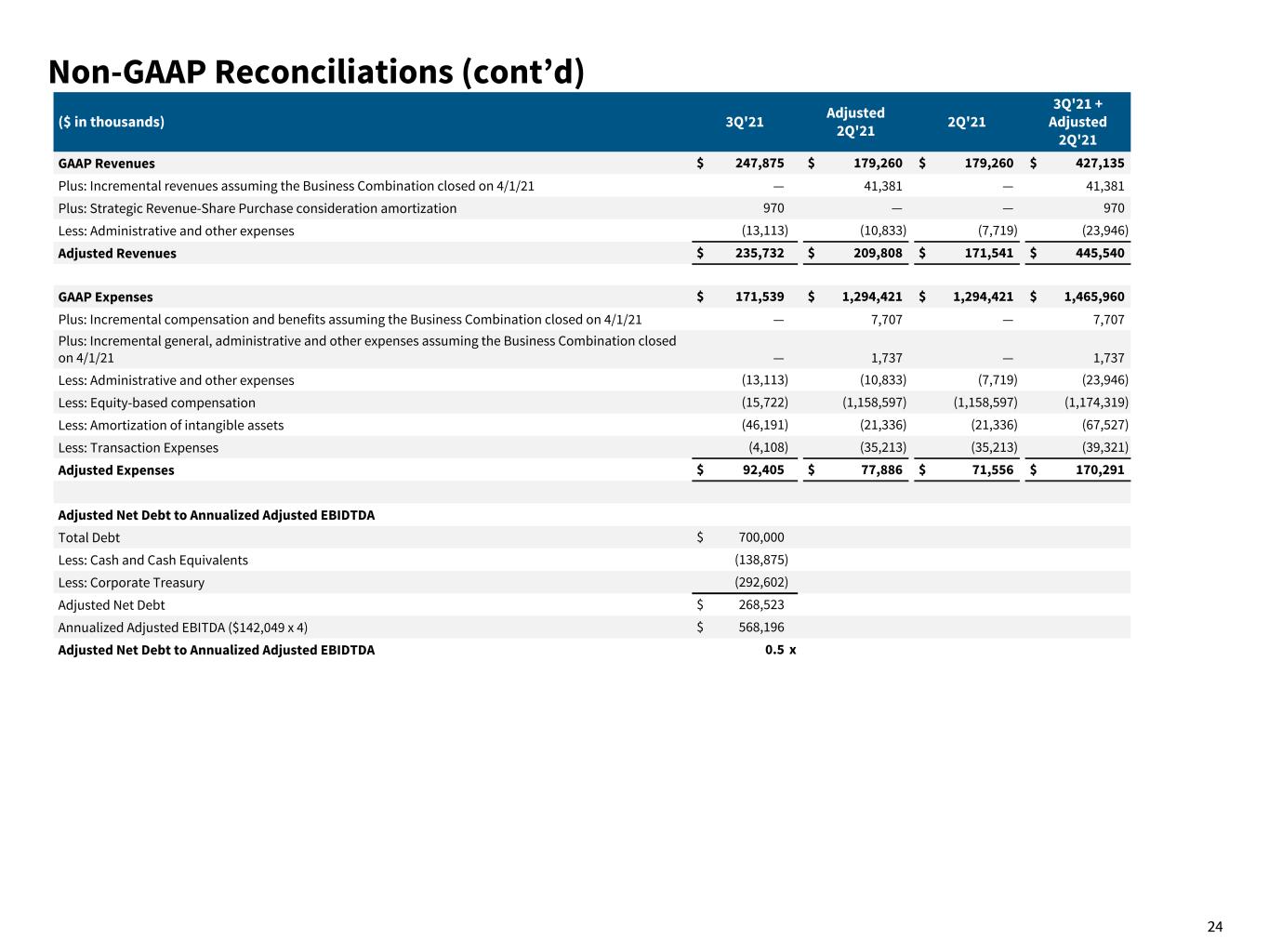

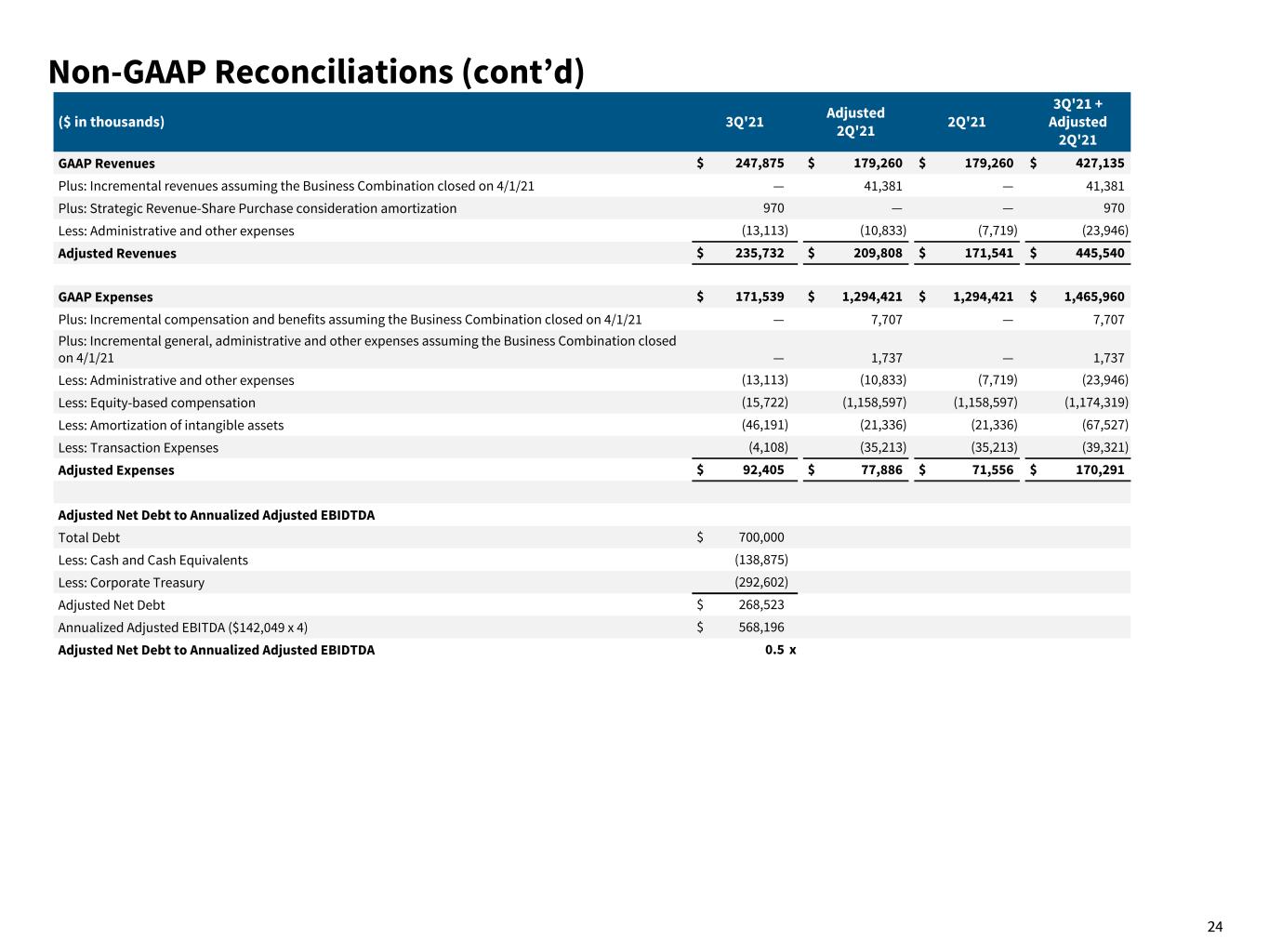

24 Non-GAAP Reconciliations($ in thousands) 3Q'21 Adjusted 2Q'21 2Q'21 3Q'21 + Adjusted 2Q'21 GAAP Revenues $ 247,875 $ 179,260 $ 179,260 $ 427,135 Plus: Incremental revenues assuming the Business Combination closed on 4/1/21 — 41,381 — 41,381 Plus: Strategic Revenue-Share Purchase consideration amortization 970 — — 970 Less: Administrative and other expenses (13,113) (10,833) (7,719) (23,946) Adjusted Revenues $ 235,732 $ 209,808 $ 171,541 $ 445,540 GAAP Expenses $ 171,539 $ 1,294,421 $ 1,294,421 $ 1,465,960 Plus: Incremental compensation and benefits assuming the Business Combination closed on 4/1/21 — 7,707 — 7,707 Plus: Incremental general, administrative and other expenses assuming the Business Combination closed on 4/1/21 — 1,737 — 1,737 Less: Administrative and other expenses (13,113) (10,833) (7,719) (23,946) Less: Equity-based compensation (15,722) (1,158,597) (1,158,597) (1,174,319) Less: Amortization of intangible assets (46,191) (21,336) (21,336) (67,527) Less: Transaction Expenses (4,108) (35,213) (35,213) (39,321) Adjusted Expenses $ 92,405 $ 77,886 $ 71,556 $ 170,291 Adjusted Net Debt to Annualized Adjusted EBIDTDA Total Debt $ 700,000 Less: Cash and Cash Equivalents (138,875) Less: Corporate Treasury (292,602) Adjusted Net Debt $ 268,523 Annualized Adjusted EBITDA ($142,049 x 4) $ 568,196 Adjusted Net Debt to Annualized Adjusted EBIDTDA 0.5 x Non-GAAP Reconciliations (cont’d)

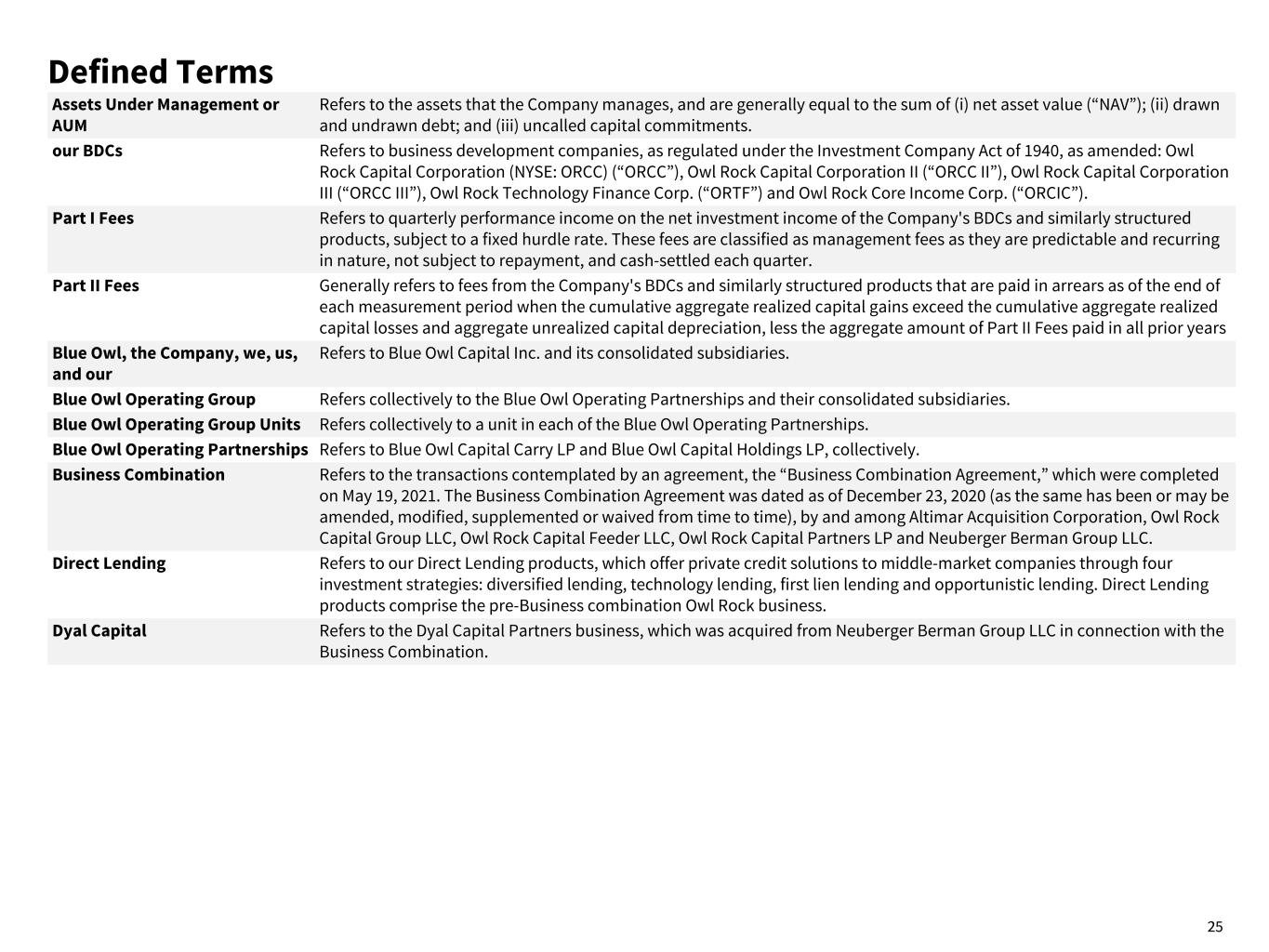

25 Defined Terms Assets Under Management or AUM Refers to the assets that the Company manages, and are generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; and (iii) uncalled capital commitments. our BDCs Refers to business development companies, as regulated under the Investment Company Act of 1940, as amended: Owl Rock Capital Corporation (NYSE: ORCC) (“ORCC”), Owl Rock Capital Corporation II (“ORCC II”), Owl Rock Capital Corporation III (“ORCC III”), Owl Rock Technology Finance Corp. (“ORTF”) and Owl Rock Core Income Corp. (“ORCIC”). Part I Fees Refers to quarterly performance income on the net investment income of the Company's BDCs and similarly structured products, subject to a fixed hurdle rate. These fees are classified as management fees as they are predictable and recurring in nature, not subject to repayment, and cash-settled each quarter. Part II Fees Generally refers to fees from the Company's BDCs and similarly structured products that are paid in arrears as of the end of each measurement period when the cumulative aggregate realized capital gains exceed the cumulative aggregate realized capital losses and aggregate unrealized capital depreciation, less the aggregate amount of Part II Fees paid in all prior years Blue Owl, the Company, we, us, and our Refers to Blue Owl Capital Inc. and its consolidated subsidiaries. Blue Owl Operating Group Refers collectively to the Blue Owl Operating Partnerships and their consolidated subsidiaries. Blue Owl Operating Group Units Refers collectively to a unit in each of the Blue Owl Operating Partnerships. Blue Owl Operating Partnerships Refers to Blue Owl Capital Carry LP and Blue Owl Capital Holdings LP, collectively. Business Combination Refers to the transactions contemplated by an agreement, the “Business Combination Agreement,” which were completed on May 19, 2021. The Business Combination Agreement was dated as of December 23, 2020 (as the same has been or may be amended, modified, supplemented or waived from time to time), by and among Altimar Acquisition Corporation, Owl Rock Capital Group LLC, Owl Rock Capital Feeder LLC, Owl Rock Capital Partners LP and Neuberger Berman Group LLC. Direct Lending Refers to our Direct Lending products, which offer private credit solutions to middle-market companies through four investment strategies: diversified lending, technology lending, first lien lending and opportunistic lending. Direct Lending products comprise the pre-Business combination Owl Rock business. Dyal Capital Refers to the Dyal Capital Partners business, which was acquired from Neuberger Berman Group LLC in connection with the Business Combination.

26 Defined Terms (cont’d) Fee-Paying AUM or FPAUM Refers to the AUM on which management fees are earned. For the Company's BDCs, FPAUM is generally equal to total assets (including assets acquired with debt, but excluding cash). For the Company's other Direct Lending products, FPAUM is generally equal to NAV or investment cost. FPAUM also includes uncalled committed capital for products where the Company earns management fees on such uncalled committed capital. For the Company's GP Capital Solutions products, FPAUM for the GP minority equity investments strategy is generally equal to capital commitments during the investment period and the cost of unrealized investments after the investment period. For GP Capital Solutions’ other strategies, FPAUM is generally equal to investment cost. GP Capital Solutions Refers to the Company's GP Capital Solutions products, which primarily focus on acquiring equity stakes in, or providing debt financing to, large, multi-product private equity and private credit platforms through three existing and one emerging investment strategies: GP minority equity investments, GP debt financing, professional sports minority investments and co- investments and structured equity. GP Capital Solutions products comprise the pre-Business Combination Dyal Capital business. Gross IRR Refers to an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees (including Part I Fees) and Part II Fees, as applicable. For GP Capital Solutions, performance metrics are presented on a Net IRR Refers to an annualized since inception net internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Net IRRs are calculated after giving effect to fees, as applicable, and all other expenses. An individual investor’s IRR may be different to the reported IRR based on the timing of capital transactions. For GP Capital Solutions, performance metrics are presented on a quarter lag. Oak Street Refers to Oak Street Real Estate Capital, LLC and its investment advisory business. Owl Rock Refers collectively to the combined businesses of Owl Rock Capital Group LLC (excluding certain assets) and Blue Owl Securities LLC (formerly, Owl Rock Capital Securities LLC), which was the predecessor of Blue Owl for accounting and financial reporting purposes. Partner Manager Refers to alternative asset management firms in which the GP Capital Solution products invest. Permanent Capital Refers to AUM in the Company's products that do not have ordinary redemption provisions or a requirement to exit investments and return the proceeds to investors after a prescribed period of time Tax Receivable Agreement or TRA Refers to the Tax Receivable Agreement, dated as of May 19, 2021.