The information in this Prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 30, 2021

PRELIMINARY PROSPECTUS

T-Mobile USA, Inc.

OFFER TO EXCHANGE ITS

3.500% Senior Secured Notes due 2025, 1.500% Senior Secured Notes due 2026,

3.750% Senior Secured Notes due 2027, 2.050% Senior Secured Notes due 2028,

3.875% Senior Secured Notes due 2030, 2.550% Senior Secured Notes due 2031,

2.250% Senior Secured Notes due 2031, 4.375% Senior Secured Notes due 2040,

3.000% Senior Secured Notes due 2041, 4.500% Senior Secured Notes due 2050,

3.300% Senior Secured Notes due 2051 and 3.600% Senior Secured Notes due 2060

that have been registered under the Securities Act of 1933, as amended (the “Securities Act”),

FOR AN EQUAL AMOUNT OF ITS OUTSTANDING

3.500% Senior Secured Notes due 2025, 1.500% Senior Secured Notes due 2026,

3.750% Senior Secured Notes due 2027, 2.050% Senior Secured Notes due 2028,

3.875% Senior Secured Notes due 2030, 2.550% Senior Secured Notes due 2031,

2.250% Senior Secured Notes due 2031, 4.375% Senior Secured Notes due 2040,

3.000% Senior Secured Notes due 2041, 4.500% Senior Secured Notes due 2050,

3.300% Senior Secured Notes due 2051 and 3.600% Senior Secured Notes due 2060,

as applicable, that were issued and sold in transactions exempt from registration under the Securities Act.

T-Mobile USA, Inc., a Delaware corporation (“T-Mobile USA” or the “Issuer”) and a direct wholly-owned subsidiary of T-Mobile US, Inc. (“T-Mobile US” or “Parent”), hereby offers to exchange, upon the terms and conditions set forth in this prospectus and the accompanying letter of transmittal, up to $3,000,000,000 in aggregate principal amount of its 3.500% Senior Secured Notes due 2025 (the “2025 Exchange Notes”), $1,000,000,000 in aggregate principal amount of its 1.500% Senior Secured Notes due 2026 (the “2026 Exchange Notes”), $4,000,000,000 in aggregate principal amount of its 3.750% Senior Secured Notes due 2027 (the “2027 Exchange Notes”), $1,750,000,000 in aggregate principal amount of its 2.050% Senior Secured Notes due 2028 (the “2028 Exchange Notes”), $7,000,000,000 in aggregate principal amount of its 3.875% Senior Secured Notes due 2030 (the “2030 Exchange Notes”), $2,500,000,000 in aggregate principal amount of its 2.550% Senior Secured Notes due 2031 (the “February 2031 Exchange Notes”), $1,000,0000,000 in aggregate principal amount of its 2.250% Senior Secured Notes due 2031 (the “November 2031 Exchange Notes”), $2,000,000,000 in aggregate principal amount of its 4.375% Senior Secured Notes due 2040 (the “2040 Exchange Notes”), $2,500,000,000 in aggregate principal amount of its 3.000% Senior Secured Notes due 2041 (the “2041 Exchange Notes”), $3,000,000,000 in aggregate principal amount of its 4.500% Senior Secured Notes due 2050 (the “2050 Exchange Notes”), $3,000,000,000 in aggregate principal amount of its 3.300% Senior Secured Notes due 2051 (the “2051 Exchange Notes”), and $1,000,000,000 in aggregate principal amount of its 3.600% Senior Secured Notes due 2060 (the “2060 Exchange Notes” and, together with the 2025 Exchange Notes, the 2026 Exchange Notes, the 2027 Exchange Notes, the 2028 Exchange Notes, the 2030 Exchange Notes, the February 2031 Exchange Notes, the November 2031 Exchange Notes, the 2040 Exchange Notes, the 2041 Exchange Notes, the 2050 Exchange Notes and the 2051 Exchange Notes, the “Exchange Notes”) for an equal amount of its outstanding 3.500% Senior Secured Notes due 2025 (the “2025 Original Notes”), 1.500% Senior Secured Notes due 2026 (the “2026 Original Notes”), 3.750% Senior Secured Notes due 2027 (the “2027 Original Notes”), 2.050% Senior Secured Notes due 2028 (the “2028 Original Notes”), 3.875% Senior Secured Notes due 2030 (the “2030 Original Notes”), 2.550% Senior Secured Notes due 2031 (the “February 2031 Original Notes”), 2.250% Senior Secured Notes due 2031 (the “November 2031 Original Notes”), 4.375% Senior Secured Notes due 2040 (the “2040 Original Notes”), 3.000% Senior Secured Notes due 2041 (the “2041 Original Notes”), 4.500% Senior Secured Notes due 2050 (the “2050 Original Notes”), 3.300% Senior Secured Notes due 2051 (the “2051 Original Notes”) and 3.600% Senior Secured Notes due 2060 (the “2060 Original Notes” and together with the 2025 Original Notes, the 2026 Original Notes, the 2027 Original Notes, the 2028 Original Notes, the 2030 Original Notes, the February 2031 Original Notes, the November 2031 Original Notes, the 2040 Original Notes, the 2041 Original Notes, the 2050 Original Notes and the 2051 Original Notes, the “Original Notes”). We refer to the Original Notes and the Exchange Notes, collectively, as the “Notes.”

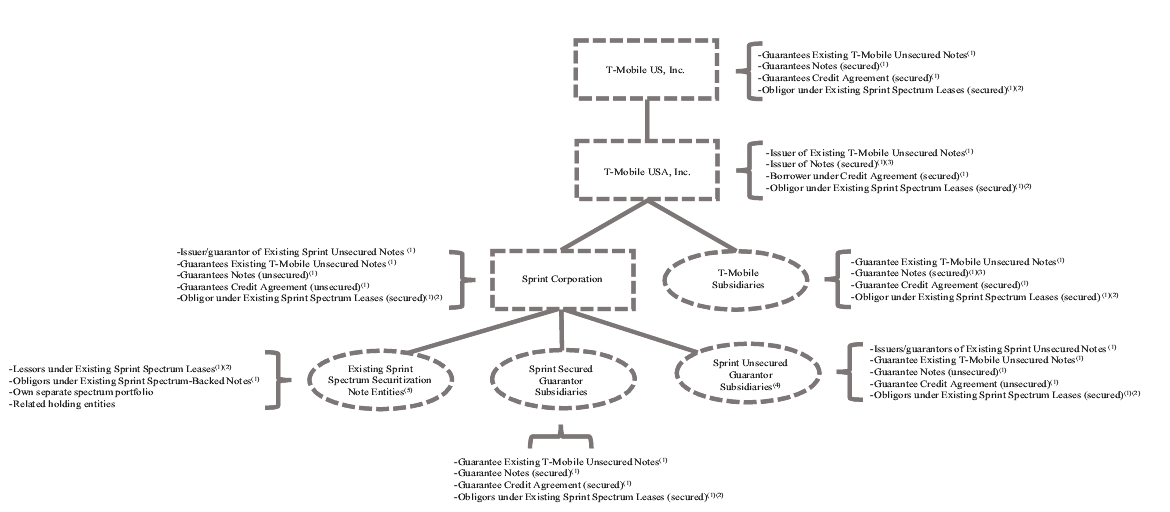

The Issuer’s obligations under the Original Notes are, and under the Exchange Notes will be, guaranteed (such guarantees, the “Guarantees”) by T-Mobile US and each wholly-owned subsidiary of the Issuer that is not an Excluded Subsidiary and is or becomes an obligor of the Credit Agreement (as defined herein) or issues or guarantees certain capital markets debt securities, other than certain Excluded Subsidiaries that do not guarantee the Original Notes and will not guarantee the Exchange Notes, and any future direct or indirect subsidiary of T-Mobile US or any subsidiary thereof that owns capital stock of the Issuer. The Guarantees are provided (in the case of the Original Notes) and will be provided (in the case of the Exchange Notes) on a senior secured basis except for the Unsecured Guarantees of Sprint Corporation, Sprint Communications, Inc. and Sprint Capital Corporation (the “Unsecured Guarantors”), which are provided (in the case of the Original Notes) and will be provided (in the case of Exchange Notes) on a senior unsecured basis (the “Unsecured Guarantees”).