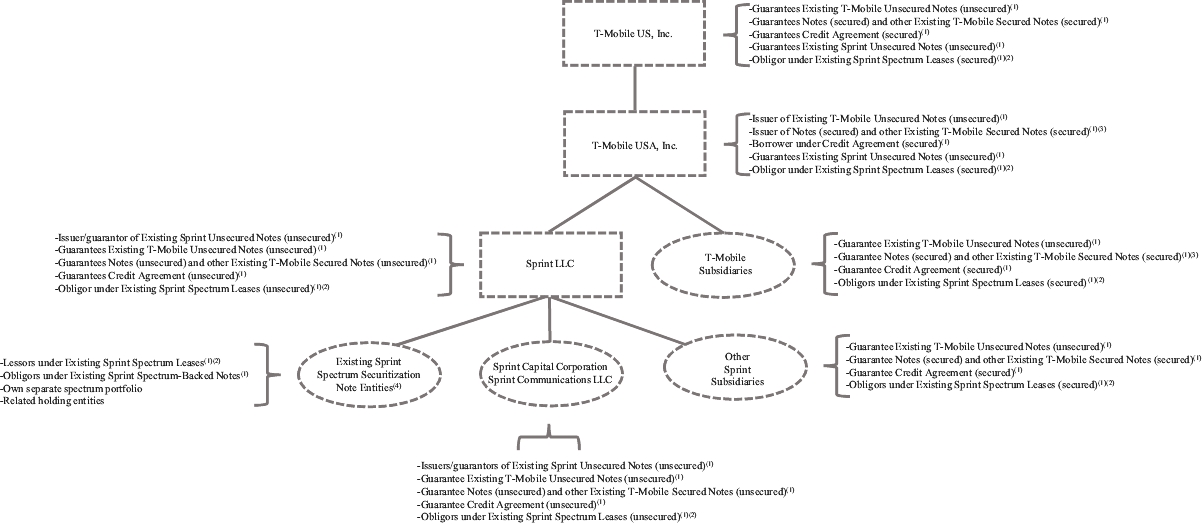

“Existing Sprint Spectrum Note Entities” means, collectively, each of Sprint Spectrum Depositor LLC, Sprint Spectrum Depositor II LLC, Sprint Spectrum Depositor III LLC, Sprint Intermediate HoldCo LLC, Sprint Intermediate HoldCo II LLC, Sprint Intermediate HoldCo III LLC, Sprint Spectrum PledgeCo LLC, Sprint Spectrum PledgeCo II LLC, Sprint Spectrum PledgeCo III LLC, Sprint Spectrum Co LLC, Sprint Spectrum Co II LLC, Sprint Spectrum Co III LLC, Sprint Spectrum License Holder LLC, Sprint Spectrum License Holder II LLC and Sprint Spectrum License Holder III LLC, their successors and assigns and any Subsidiary of the foregoing.

“Existing Sprint Spectrum Transaction” means the transactions contemplated by the Existing Sprint Spectrum Financing Documents, including the issuance of any Existing Sprint Spectrum-Backed Notes.

“Existing Sprint Spectrum-Backed Notes” means the Existing Sprint Spectrum Issuers’ Series 2018-1 4.738% Senior Secured Notes, Class A-1, Series 2018-1 5.152% Senior Secured Notes, Class A-2, Series 2016-1 3.360% Senior Secured Notes, Class A-1 (the amount remaining outstanding under which was repaid in full on August 20, 2021), and any other note or series of notes issued under the Existing Sprint Spectrum Indenture from time to time.

“Existing Sprint Unsecured Notes” means (i) the 6.875% Notes due 2028 issued pursuant to the Sprint Capital Corporation Indenture, as supplemented by that certain Officers’ Certificate dated as of November 16, 1998, (ii) the 8.750% Notes due 2032 issued pursuant to the Sprint Capital Corporation Indenture, as supplemented by that certain Officers’ Certificate dated as of March 8, 2002, (iii) the 11.500% Notes due 2021 issued pursuant to the Sprint Communications Indenture, as supplemented by that certain First Supplemental Indenture dated as of November 9, 2011, between Sprint Communications (formerly known as Sprint Nextel Corporation) and The Bank of New York Trust Company, N.A., as trustee (which were repaid at maturity on November 15, 2021), (iv) the 7.000% Notes due 2020 issued pursuant to the Sprint Communications Indenture, as supplemented by that certain Fifth Supplemental Indenture dated as of August 14, 2012, between Sprint Communications (formerly known as Sprint Nextel Corporation), and The Bank of New York Trust Company, N.A., as trustee (which were repaid at maturity on August 15, 2020), (v) the 6.000% Notes due 2022 issued pursuant to the Sprint Communications Indenture, as supplemented by that certain Sixth Supplemental Indenture dated as of November 14, 2012, between Sprint Communications (formerly known as Sprint Nextel Corporation), and The Bank of New York Trust Company, N.A., as trustee, (vi) the 7.250% Notes due 2021 issued pursuant to the Sprint Indenture, as supplemented by that certain First Supplemental Indenture dated as of September 11, 2013, among Sprint, Sprint Communications, as guarantor, and the Bank of New York Mellon Trust Company, N.A., as trustee (which were repaid at maturity on September 15, 2021), (vii) the 7.875% Notes due 2023 issued pursuant to the Sprint Indenture, as supplemented by that certain Second Supplemental Indenture dated as of September 11, 2013, among Sprint, Sprint Communications, as guarantor, and the Bank of New York Mellon Trust Company, N.A., as trustee, (viii) the 7.125% Notes due 2024 issued pursuant to the Sprint Indenture, as supplemented by that certain Third Supplemental Indenture dated as of December 12, 2013, among Sprint, Sprint Communications, as guarantor, and the Bank of New York Mellon Trust Company, N.A., as trustee, (ix) the 7.625% Notes due 2025 issued pursuant to the Sprint Indenture, as supplemented by that certain Fourth Supplemental Indenture dated as of February 24, 2015, among Sprint, Sprint Communications, as guarantor, and the Bank of New York Mellon Trust Company, N.A., as trustee, and (x) the 7.625% Notes due 2026 issued pursuant to the Sprint Indenture, as supplemented by that certain Fifth Supplemental Indenture dated as of February 22, 2018, among Sprint, Sprint Communications, as guarantor, and the Bank of New York Mellon Trust Company, N.A., as trustee.

“Existing T-Mobile Secured Notes” means the U.S. dollar-denominated senior secured notes issued by the Issuer on April 9, 2020, June 24, 2020, October 6, 2020, October 28, 2020, August 13, 2021 and December 6, 2021, as amended, restated, modified, renewed, refunded, replaced (whether upon or after termination or otherwise) or refinanced (including, in each case, by means of sales of debt securities) in whole or in part from time to time.

“Existing T-Mobile Unsecured Notes” means (i) the 6.000% Senior Notes due 2023 issued pursuant to the Indenture, dated as of April 28, 2013, among the Issuer, the guarantors party thereto and Deutsche Bank Trust Company Americas, as trustee (the “April 2013 Base Indenture”), as supplemented by that certain Seventeenth Supplemental Indenture dated as of September 5, 2014, among T-Mobile USA, Inc., the guarantors named therein and Deutsche Bank Trust Company Americas, as trustee (which were redeemed on May 23, 2021), (ii) the 6.500% Senior Notes due 2024 issued pursuant to the April 2013 Base Indenture, as supplemented by that certain Fifteenth Supplemental Indenture dated as of November 21, 2013, among T-Mobile USA, Inc., the guarantors named therein and Deutsche Bank Trust Company Americas, as trustee (which were redeemed on July 4, 2020), (iii) the 6.375% Senior Notes due 2025 issued pursuant to the April 2013 Base Indenture, as supplemented by that certain Eighteenth Supplemental Indenture dated as of September 5, 2014, among T-Mobile USA, Inc., the guarantors named therein and