Exhibit 99.1

I N V E S T O R P R E S E N T A T I O N AN INNOVATIVE AI - BASED FUSION AND PERCEPTION SOFTWARE SOLUTION FOR ADAS / AD INCREASED PERFORMANCE, SCALABILITY AND FLEXIBILITY AT LOW COST

This management presentation (the “Presentation”) has been prepared by LeddarTech Inc . (“LeddarTech” or the “Company”) in order to assist parties interested in the Company in conducting their own evaluation of the Company . The Presentation does not purport to contain all information that may be required or desired by an interested party in investigating the Company, its business or prospects, and it shall not be deemed to be an indication of the state of affairs of the Company historically, at its stated date or in the future . Portions of this Presentation have been prepared based on information received from the Company and other sources considered reliable ; however, the Company has not independently verified that such information is correct . Neither the Company nor Prospector Capital Corp . (“Prospector”), nor any of their respective affiliates or any of their control persons, officers, directors or employees, make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation . No representation or warranty, expressed or implied, is accepted as to the completeness or accuracy of any information in the Presentation or any other information provided in conjunction with an evaluation of the Company . Only those particular representations and warranties that may be made in relation to any legally binding written definitive agreement signed by the parties relating to the Company, and subject to such limitations and restrictions as may be agreed, shall have any legal effect . Conditions and information reported in the Presentation may change without any notice, and the Company and its affiliates and related persons disclaim any responsibility or liability to update the information contained in this Presentation . In addition, all of the market data included in this Presentation involves a number of assumptions, limitations, projections and estimates and research . Such market data is necessarily subject to a high degree of uncertainty and risk and there can be no guarantee as to the accuracy or reliability of such assumptions . Caution Regarding Forward - Looking Information This Presentation contains statements which constitute forward - looking statements . Forward - looking statements include statements that are predictive in nature, depend upon future events or conditions, or include words such as “expects”, “anticipates”, “plan”, “believes”, “estimates”, “intends”, targets”, “projects”, “forecasts”, “schedule”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could” . These forward - looking statements are not descriptive of historical matters and may refer to management’s expectations or plans . These statements include but are not limited to statements concerning the Company’s business objectives and plans including the Company’s corporate strategy and strategic priorities ; the Company’s future financial performance and prospects ; future industry trends ; future technological developments ; and the Company’s expectations for sales of its products and services . These statements are based upon the Company’s current expectations and assumptions and, while considered reasonable, involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward - looking statements . By their nature, forward - looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future, which are beyond the Company’s ability to predict or control including, but not limited to, risks associated with : changes in the mix of products and services sold which, due to associated margins, can impact the Company’s financial results ; economic cycles including downturns which can result from adverse general economic conditions ; competition ; the risk that unforeseen factors may arise that result in the Company not being able to achieve its operating income, cash flow and other business model targets ; the Company’s reliance on external sources of funding and the potential adverse effects of disruptions in any of these arrangements ; and the Company’s ability to attract and retain key personnel necessary for its business ; as well as other risks highlighted under the section Summary Risk Factors in this Presentation . Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward - looking statements, including statements regarding projected business, operating or financial results, contained in this Presentation . Such statements are based on a number of assumptions which may prove to be incorrect including, but not limited to, the following assumptions : there is no material deterioration in the business and economic conditions in the marketplace for the Company’s products and services ; the Company’s expectations regarding market and technology trends ; the Company is able to execute its strategy without delays or disruptions ; the Company’s expectations relating to the needs and direction of the marketplace for its products and services ; the Company is able to introduce products and services and capitalize on new opportunities generally as expected ; the Company’s expectations relating to its future operating expenses, as well as the capital required to conduct its business in the future, are not materially incorrect ; customer acceptance and demand for the Company’s products and services remains generally as anticipated ; and the Company is able to continue to retain and attract key employees . Readers are cautioned that the foregoing list of important factors and assumptions is not exhaustive . Forward - looking statements are not guarantees of future performance . Events o r circumstances could cause the Company’s actual results to differ materially from those estimated o r projected and expressed in, o r implied by, these forward - looking statements, and any estimated, forecasted and projected financial results contained i n this Presentation should not be considered to be a presentation of actual results that wi l l be achieved o r realized . Consequently, readers should not place any undue reliance on these forward - looking statements . Forward - looking statements are provided for the purpose of providing information about management’s current expectations and plans relating to the future . Readers are cautioned that such information may not be appropriate for ot h er purposes . In addition, these forward - looking statements relate to the date on which they are made . None of the Company and its affiliates and related persons undertakes any duty, intention o r obligation to update o r revise any forward - looking statements o r the foregoing list of factors, whether as a result of new information, future events o r otherwise, after the date on which the statements are made o r to reflect the occurrence of unanticipated events . 2

Market and Industry Data Certain market, industry and other data used herein have been obtained or derived from third - party sources and publications as well as from research reports prepared for other purposes . Although the information from these third - party sources is believed to be reliable, none of the Company or its management has independently verified the data obtained from these sources, and no assurances can be made regarding the accuracy or completeness of such data . Forecasts and other forward - looking information obtained from these sources are subject to the same qualifications and the additional uncertainties regarding the other forward - looking statements contained herein . Trademarks In addition to trademarks, service marks, trade names, copyrights and logos of LeddarTech contained herein, this Presentation contains trademarks, service marks, trade names, copyrights and logos of other companies, which are the property of their respective owners . Unless otherwise stated, the use of these other trademarks, service marks, trade names, copyrights and logos herein does not imply an affiliation with, or endorsement of the information contained herein by, the owners of such trademarks, service marks, trade names, copyrights and logos . Additional Information About the Proposed Business Combination and Where To Find It In connection with the proposed business combination, the parties wi l l prepare and file a registration statement on Form F - 4 (the “Registration Statement”) with the Securities and Exchange Commission (“SEC”), which wi l l include a document that wi l l serve as a proxy statement of Prospector and a prospectus of LeddarTech Holdings Inc, and after the Registration Statement is declared effective, a definitive proxy statement wi l l be distributed to Prospector’s shareholders i n connection with Prospector’s solicitation of proxies for the vote by Prospector’s shareholders i n connection with the proposed business combination and ot h er matters described therein . Investors and security holders are urged to read carefully and i n their entirety the Registration Statement when it becomes available, any amendments o r supplements to the Registration Statement, and ot h er documents filed by Prospector o r LeddarTech Holdings Inc . with the SEC i n connection with the proposed business combination because these documents wi l l contain important information . Investors and security holders wi l l be able to obt a in free copies of the Registration Statement, when available, and ot h er relevant documents filed o r that wi l l be filed by Prospector o r LeddarTech Holdings Inc . , with the SEC through the website maintained by the SEC at www . sec . gov . Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued in the proposed business combination or determined if this Presentation is truthful or complete . Participants in the Solicitation Prospector and certain of its directors, executive officers and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from Prospector’s shareholders in connection with the proposed business combination . Information about the directors and executive officers of Prospector can be found in the Annual Report on Form 10 - K for the fiscal year ended December 31 , 2022 , which was filed with the SEC on March 31 , 2023 . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Prospector’s shareholders in connection with the proposed business combination and will be set forth in the Registration Statement when it is filed with the SEC . The Company, LeddarTech Holdings Inc . and certain of their respective directors, executive officers and employees also may be deemed to be participants in the solicitations of proxies in connection with the proposed business combination . Information regarding these persons who may, under SEC rules, be deemed participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Registration Statement . No Offer or Solicitation This Presentation does not constitute an offer to sell o r the solicitation of an offer to buy any securities, o r a solicitation of any vote o r approval, nor shall there be any sale of securities i n any jurisdiction i n which such offer, solicitation o r sale would be unlawful prior to registration o r qualification under the securities laws of any such jurisdiction . 3

Introduction

Video Introduction (Placeholder) https://bit.ly/3PySNHv

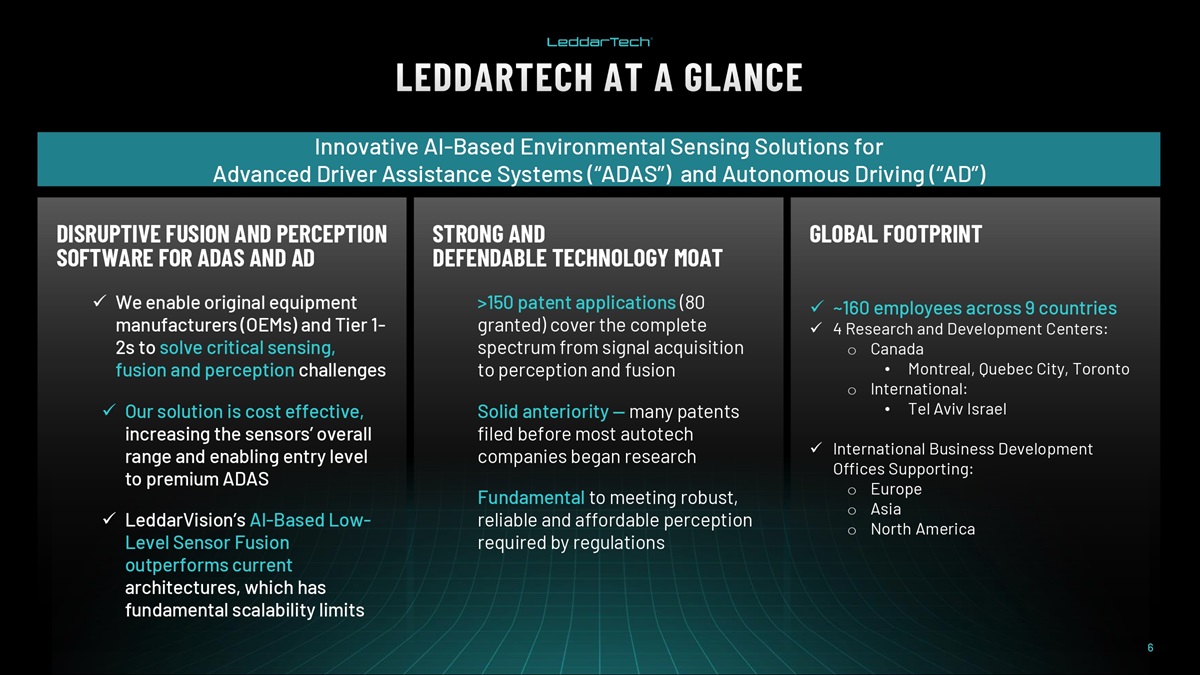

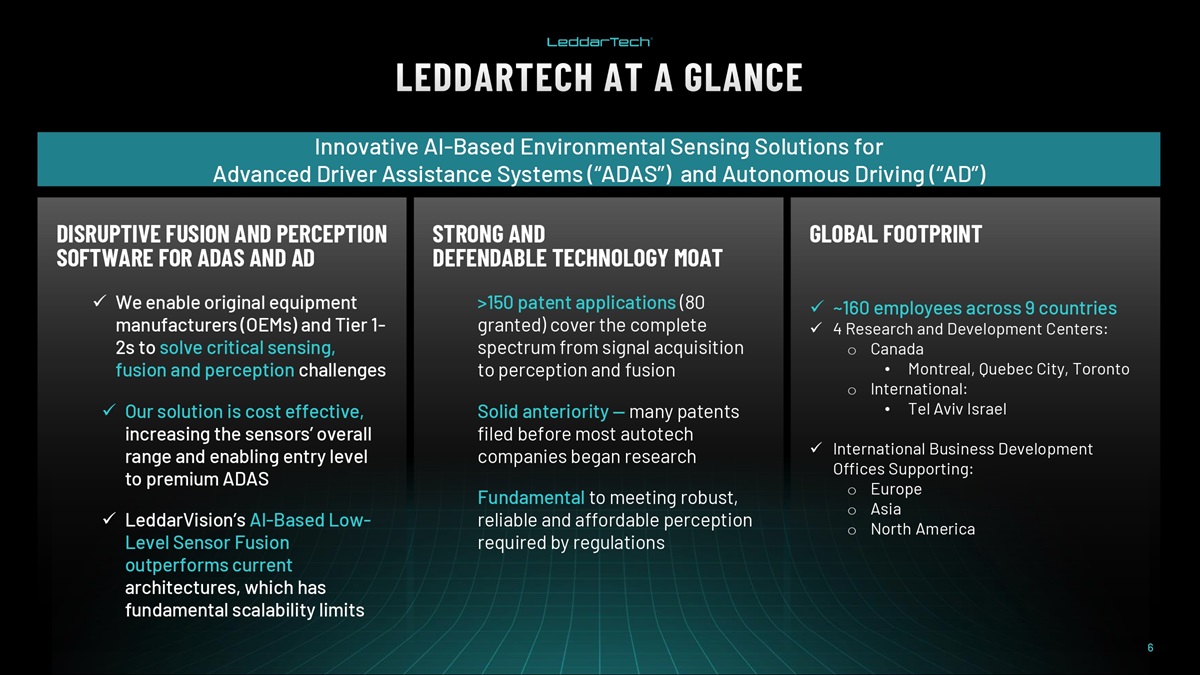

DISRUPTIVE FUSION AND PERCEPTION SOFTWARE FOR ADAS AND AD x We enable original equipment manufacturers (OEMs) and Tier 1 - 2s to solve critical sensing, fusion and perception challenges x Our solution is cost effective, increasing the sensors’ overall range and enabling entry level to premium ADAS x LeddarVision’s AI - Based Low - Level Sensor Fusion outperforms current architectures, which has fundamental scalability limits GLOBAL FOOTPRINT 6 x ~160 employees across 9 countries x 4 Research and Development Centers: o Canada • Montreal, Quebec City, Toronto o International: • Tel Aviv Israel x International Business Development Offices Supporting: o Europe o Asia o North America STRONG AND DEFENDABLE TECHNOLOGY MOAT >150 patent applications (80 granted) cover the complete spectrum from signal acquisition to perception and fusion Solid anteriority — many patents filed before most autotech companies began research Fundamental to meeting robust, reliable and affordable perception required by regulations Innovative AI - Based Environmental Sensing Solutions for Advanced Driver Assistance Systems (“ADAS”) and Autonomous Driving (“AD”)

35 + years of experience in senior management positions and with public companies CEO of three companies, with experience completing two IPOs and a LBO Track record of establishing performance - based culture Previously worked at Atrium Innovations and Unipex Group Extensive experience in successful M&A, complex financing and companies with global footprints Joined in 2012 25+ years of experience in the electronics and automotive sector with public company officer experience Extensive sensing, AD, AI, IoT and automotive knowledge Previously worked at IDT, Analog Devices, Future Electronics and ZMD Several successful startup exits, leveraged buyout and patents Joined in 2017 30 + years of experience and a LiDAR industry subject matter expert R&D background with proven track record Personally involved with 24 patents globally Joined in 2010 CHARLES BOULANGER Retiring Chief Executive Officer FRANTZ SAINTELLEMY C.M. Incoming Chief Executive Officer & President PIERRE OLIVIER Chief Technology Officer DAVID TORRALBO Chief Legal Officer 20+ years of experience in corporate securities law and an expert in public and private M&A Private and public company CLO roles Graduate of University of Ottawa (LL.L & LL.B), McGill University, and a member of the Quebec Bar Joined in 2022 Global Presence: ~ 160 employees across nine countries & three continents 20+ years of experience in financial leadership roles Private and public company VP and CFO roles Graduate of the University of Southern California and Carnegie Mellon University Joined in 2023 CHRIS STEWART Chief Financial Officer 7

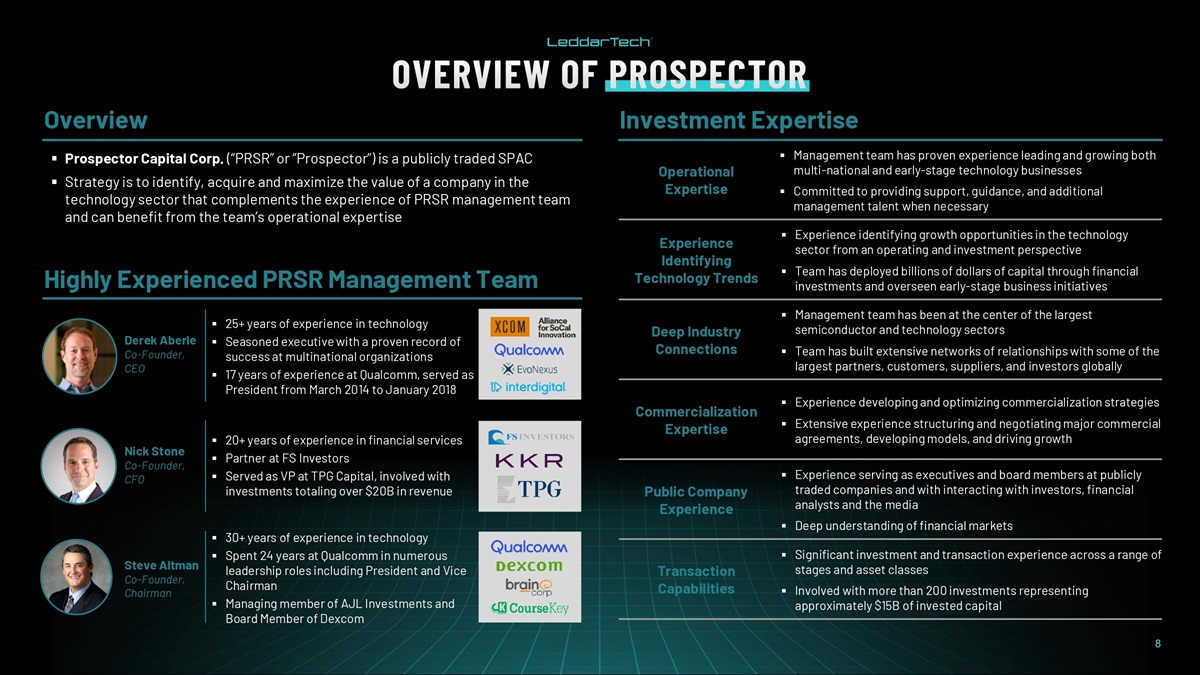

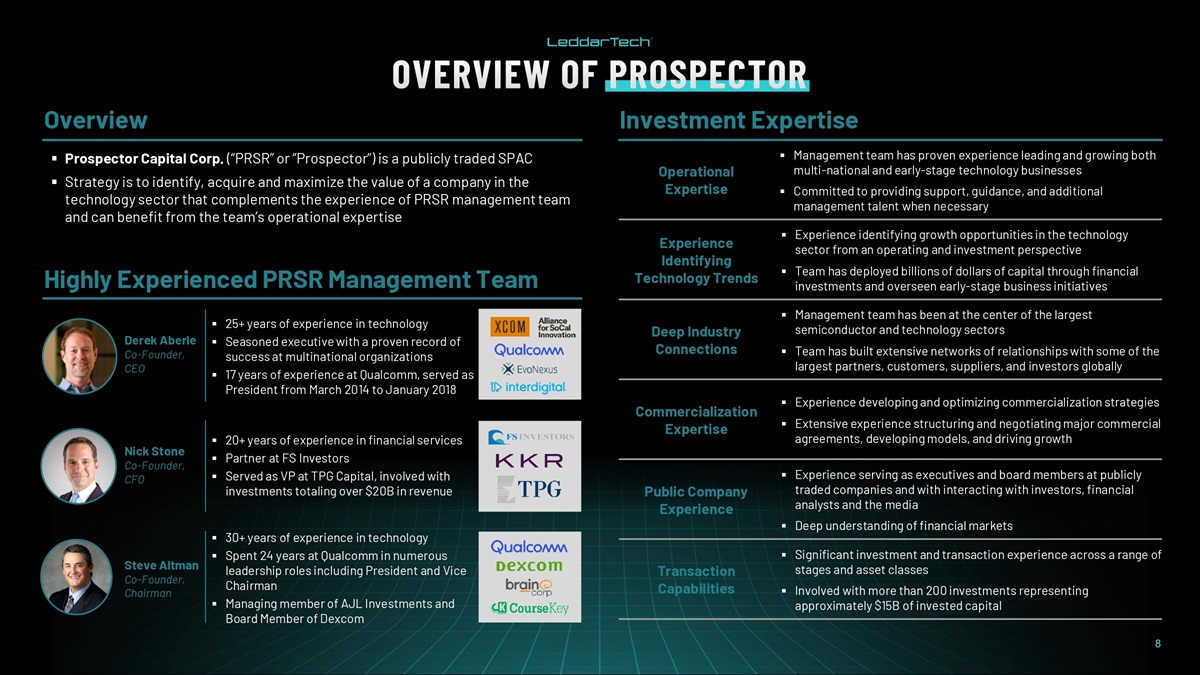

Overview ▪ Prospector Capital Corp. (“PRSR” or “Prospector”) is a publicly traded SPAC ▪ Strategy is to identify, acquire and maximize the value of a company in the technology sector that complements the experience of PRSR management team and can benefit from the team’s operational expertise Highly Experienced PRSR Management Team ▪ 25+ years of experience in technology ▪ Seasoned executive with a proven record of success at multinational organizations ▪ 17 years of experience at Qualcomm, served as President from March 2014 to January 2018 Derek Aberle Co - Founder, CEO Steve Altman Co - Founder, Chairman Nick Stone Co - Founder, CFO ▪ 20+ years of experience in financial services ▪ Partner at FS Investors ▪ Served as VP at TPG Capital, involved with investments totaling over $20B in revenue Investment Expertise Operational Expertise Deep Industry Connections Experience Identifying Technology Trends Commercialization Expertise Public Company Experience Transaction Capabilities ▪ Management team has proven experience leading and growing both multi - national and early - stage technology businesses ▪ Committed to providing support, guidance, and additional management talent when necessary ▪ Experience identifying growth opportunities in the technology sector from an operating and investment perspective ▪ Team has deployed billions of dollars of capital through financial investments and overseen early - stage business initiatives ▪ Management team has been at the center of the largest semiconductor and technology sectors ▪ Team has built extensive networks of relationships with some of the largest partners, customers, suppliers, and investors globally ▪ Experience developing and optimizing commercialization strategies ▪ Extensive experience structuring and negotiating major commercial agreements, developing models, and driving growth ▪ Experience serving as executives and board members at publicly traded companies and with interacting with investors, financial analysts and the media ▪ Deep understanding of financial markets ▪ Significant investment and transaction experience across a range of stages and asset classes ▪ Involved with more than 200 investments representing approximately $15B of invested capital ▪ 30+ years of experience in technology ▪ Spent 24 years at Qualcomm in numerous leadership roles including President and Vice Chairman ▪ Managing member of AJL Investments and Board Member of Dexcom 8

66% 20% 14% LeddarTech Existing Shareholders PRSR Public Shareholders 9 Key Assumptions ▪ $336M pro forma enterprise value to the market at close ▪ $200M pre - money equity value to existing LeddarTech shareholders at close (a) — Additional consideration to LeddarTech existing shareholders of up to 5.0M earnout shares vesting up to 7 years post - close equally over 5 tranches: share price triggers of (1) $12.00, (2) $14.00, (3) $16.00, (4) milestone of signing first customer contract with an OEM for 150K or more units/year, and (5) sending invoice for product delivery to a customer needing 150K or more units/year (a) ▪ PRSR public shareholders will receive 1.0 PRSR Class A shares (which will become 1.0 Amalco share) for each SPAC Class A share not redeemed at close ▪ $37M net proceeds to balance sheet assumes: $44M structured PIPE, $24M SPAC cash in trust (b) , $16.3M estimated transaction expenses, $8M prefunded cash, $7M partial paydown of debt (b) ▪ Assuming $44M structured PIPE commitment, LeddarTech existing shareholders will retain ~66% ownership of the pro forma company at close (a)(b) ▪ LeddarTech existing shareholders will be locked up for up to 4 years post - close and 6 months post - close for those existing investors that participate pro - rata in PIPE. Sponsor and affiliates contributing more than its pro - rata to the PIPE and will be subject to the 6 month lock up. (h) ($USD in Millions, except share price. Assumes 1.3248x CAD to USD exchange rate) (a) Excludes 5.0M LeddarTech (“LT”) earnout shares. $200M valuation includes aggregate in - the - money ESOP and C - Options. LT earnout price triggers hit when share price exceeds threshold for 20/30 trading days post - close. (b) Assumes 0% redemptions of current $24M trust and includes interest. PRSR public shareholders will receive 1.0 additional Amalco shares for each SPAC Class A share not redeemed at close. Assumes trust proceeds retained exceeding $17.0M will be used to pay down existing debt. (c) Numbers may not tie due to rounding. (d) Reflects $44M convertible notes, which bear interest of 12%, have a 5 - year term and are convertible at $10.00 per share. (e) Per LT consolidated financial statements, assumes existing net debt balance of $38M as of 06/30/2023. (f) LT existing shareholders, Sponsor, and structured PIPE investors may have overlapping owners and currently reflect only distinct ownership by each security. (g) Assumes 75% of founder shares vesting at close, 25% of founder shares and 25% of private placement warrants moved to earnout at $12.00, $14.00, $16.00 triggered when share price exceeds these thresholds for 20/30 trading days post - close. (h) Financing shares not subject to lock - up. (a) Sponso (g r ) (b) PRSR public shareholders will receive 1.0 PRSR Class A shares (which will become 1.0 Amalco share) for each SPAC Class A share not redeemed at close Ownership PF Shares 65.6% 20.0 LeddarTech Existing Shareholders (a) 20.0% 6.1 Sponsor (g) 14.4% 4.4 PRSR Public Shareholders (b) 100.0% 30.5 Pro Forma Total Shares Outstanding $305 Total Equity Value ($10.00 per share) (37) Less: Pro Forma Cash (e) 68 Plus: Pro Forma Debt (e) $336 Pro Forma TEV Capital Structure & Ownership Breakdown (e) Sources & Uses (c) Sources $200 Common Stock Issued to LeddarTech (a) 45 Rollover of Existing Debt (e) 44 Structured PIPE (d) 24 Cash from PRSR Trust (b) $313 Total Sources Uses $200 Common Stock Issued to LeddarTech (a) 45 Rollover of Existing Debt (e) 37 Cash to PF Balance Sheet 8 Cash Used from Tranche A PIPE Funding (as of 06/30/2023) 7 Partial Paydown of Existing Debt (b) (e) 16 Estimated Transaction Expenses $313 Total Uses

1. Tier1 Consultancy. 2. Tier1s have significant expertise, resources and capabilities (including servicing) to support OEMs, greatly reducing risk. They also have existing business relationships as qualified and trusted suppliers. LARGE & FAST - GROWING TOTAL ADDRESSABLE MARKET $32 billion potential addressable market (1) (2035) with value - added solutions leveraging the benefits of AI - based low - level fusion Market powered by the near - term need to unify data from the proliferation of sensors as ADAS systems evolve from L1 to L3 and above DISRUPTIVE FUSION AND PERCEPTION SOFTWARE SOLVING FUNDAMENTAL IN DUSTRY CHALLENGES Unique, proprietary AI - based low - level fusion and perception designed to enable high performance, low - cost ADAS systems while providing the independence from hardware needed for software platforms to be used across vehicle models, upgrades and roadmap EARLY MOVER MARKET POSITION AND TECHNOLOGY LEAD OPPORTUNITY Seven years experience with AI - based low - level fusion, with strong anteriority on fundamental IP PURE - PLAY SOFTWARE FOR AUTO • High - margins, scalable per vehicle royalty license model • Tier 1 go - to - market partners model supports commercialization 2 • Automotive car model sales & production cycles provide potential for high visibility on recurring software royalty revenues WORLD - CLASS TEAM Unique team of software, AI and machine learning expertise and know - how built over many years supported by experienced management and board Industry leading perception software solution for ADAS and AD based on proprietary AI - based low - level fusion technology 10

The Problems We Solve

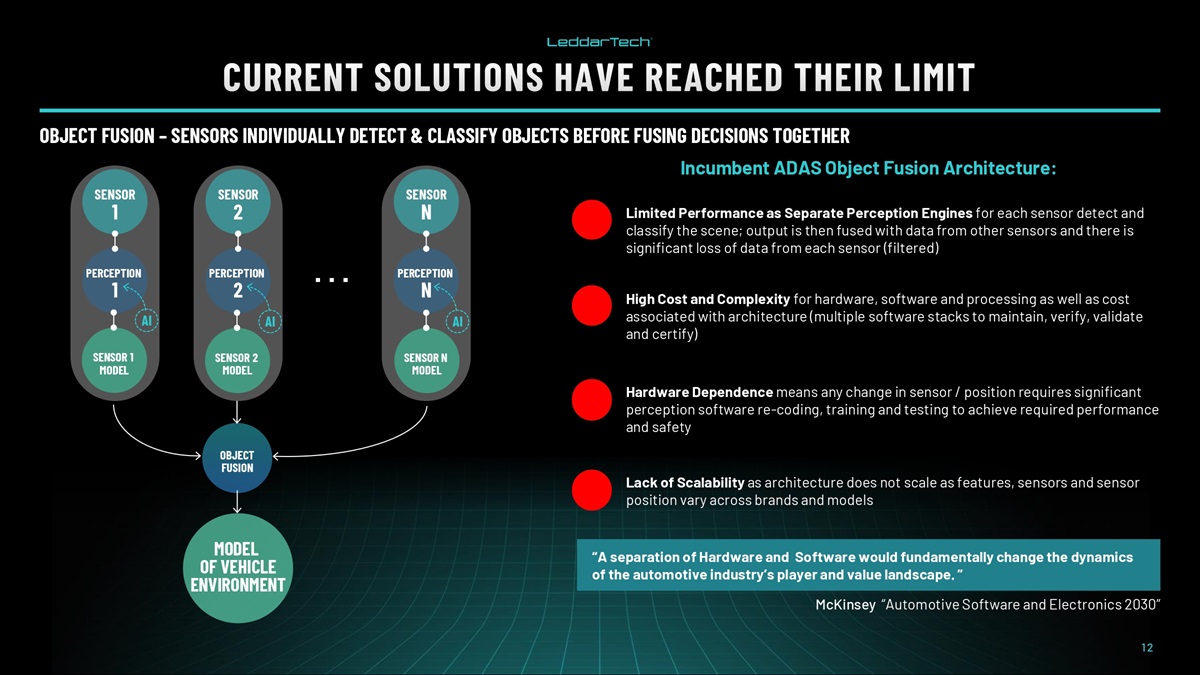

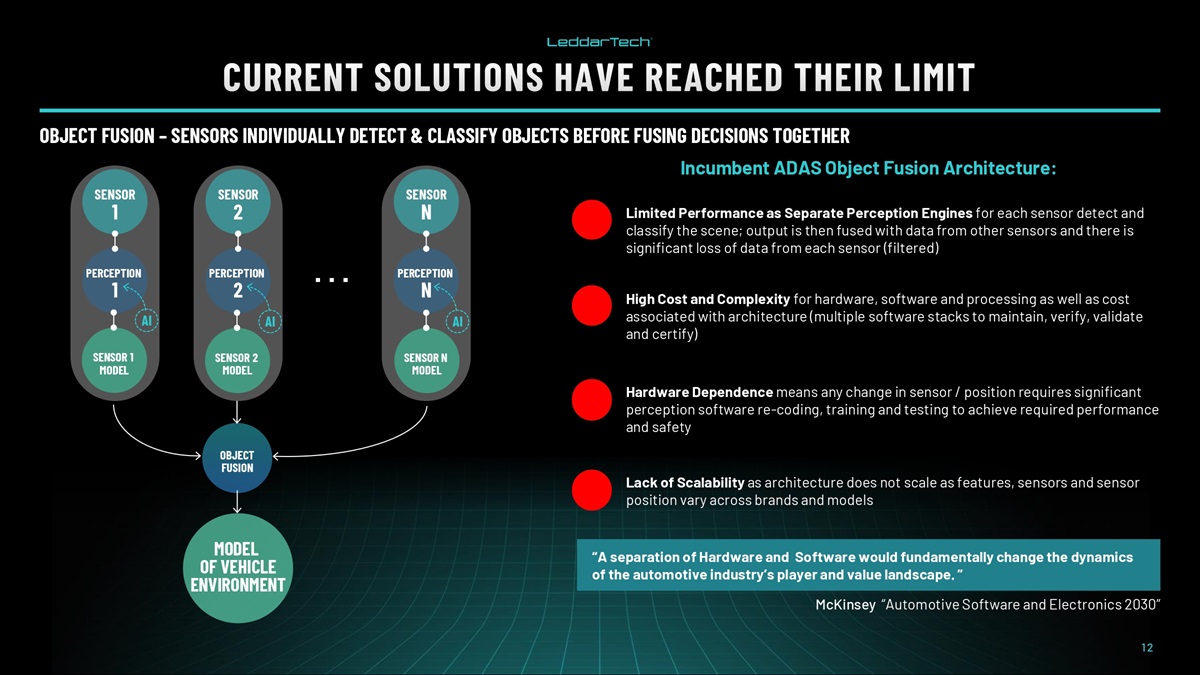

OBJECT FUSION – SENSORS INDIVIDUALLY DETECT & CLASSIFY OBJECTS BEFORE FUSING DECISIONS TOGETHER Incumbent ADAS Object Fusion Architecture: Limited Performance as Separate Perception Engines for each sensor detect and classify the scene; output is then fused with data from other sensors and there is significant loss of data from each sensor (filtered) MODEL OF VEHICLE ENVIRONMENT SENSOR 1 SENSOR 2 PERCEPTION 2 SENSOR N OBJECT FUSION AI PERCEPTION 1 AI PERCEPTION N AI SENSOR N MODEL SENSOR 2 MODEL SENSOR 1 MODEL “A separation of Hardware and Software would fundamentally change the dynamics of the automotive industry’s player and value landscape. ” 2 High Cost and Complexity for hardware, software and processing as well as cost associated with architecture (multiple software stacks to maintain, verify, validate and certify) 3 Hardware Dependence means any change in sensor / position requires significant perception software re - coding, training and testing to achieve required performance and safety 4 Lack of Scalability as architecture does not scale as features, sensors and sensor position vary across brands and models McKinsey “Automotive Software and Electronics 2030” … 12

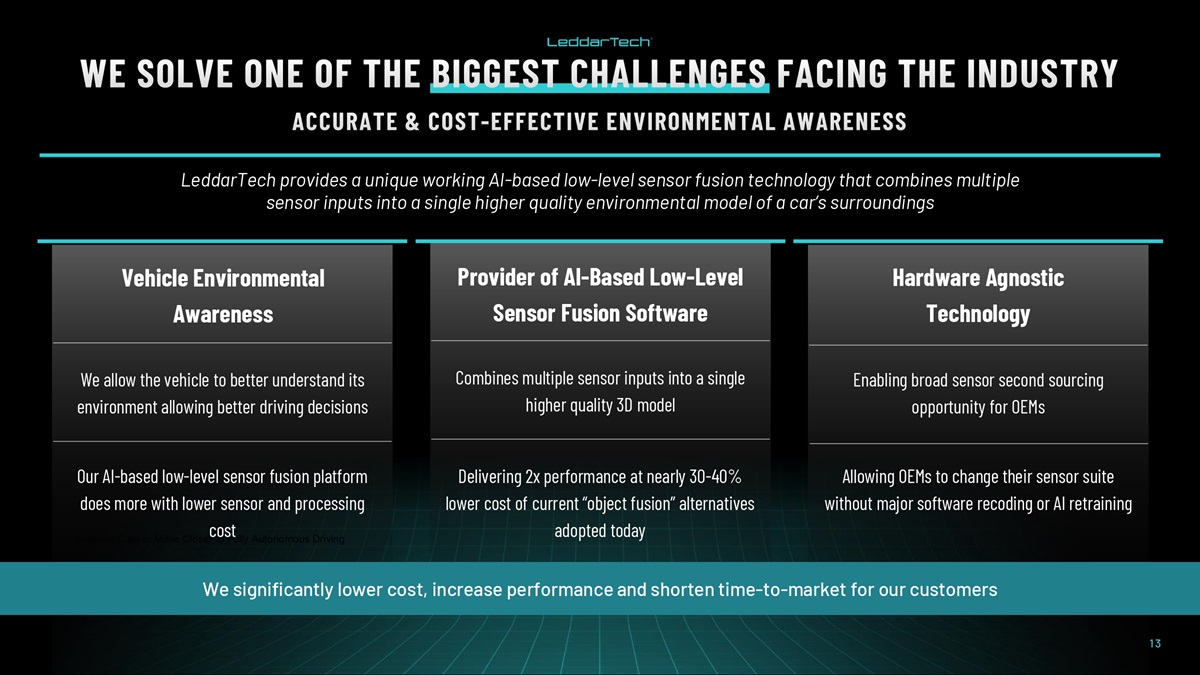

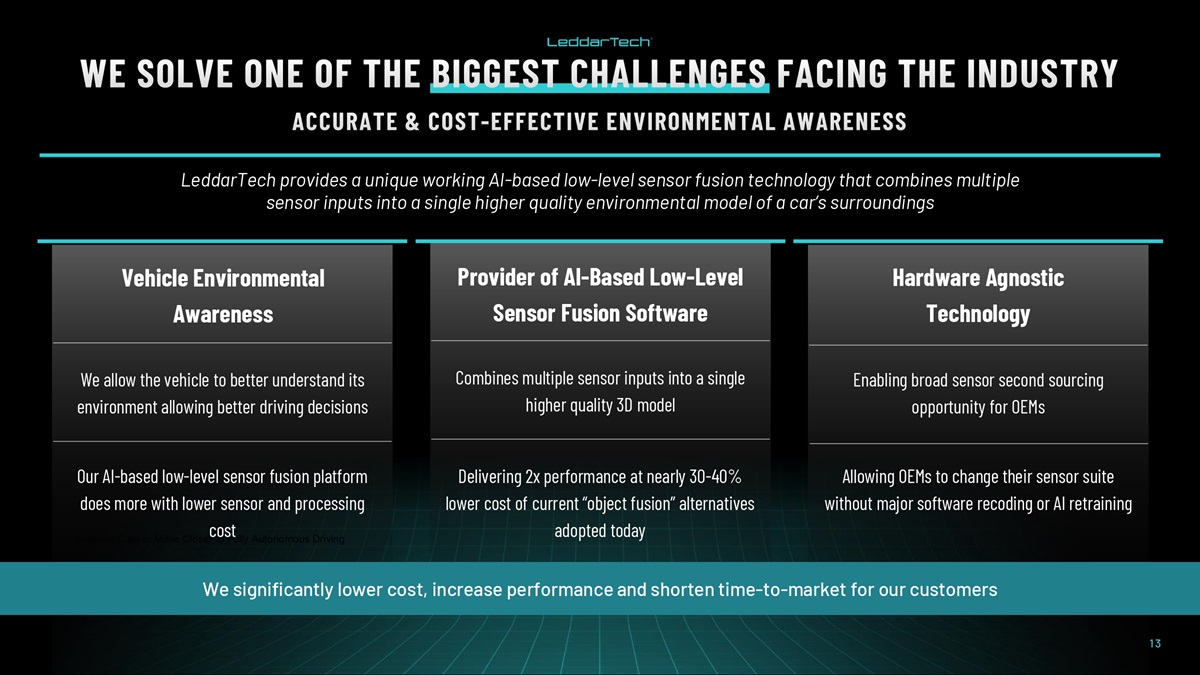

Allowing Cars to Move Closer to Fully Autonomous Driving Provider of AI - Based Low - Level Sensor Fusion Software Combines multiple sensor inputs into a single higher quality 3D model Delivering 2x performance at nearly 30 - 40% lower cost of current “object fusion” alternatives adopted today Hardware Agnostic Technology Enabling broad sensor second sourcing opportunity for OEMs Allowing OEMs to change their sensor suite without major software recoding or AI retraining We allow the vehicle to better understand its environment allowing better driving decisions Our AI - based low - level sensor fusion platform does more with lower sensor and processing 13 cost Vehicle Environmental Awareness LeddarTech provides a unique working AI - based low - level sensor fusion technology that combines multiple sensor inputs into a single higher quality environmental model of a car’s surroundings We significantly lower cost, increase performance and shorten time - to - market for our customers

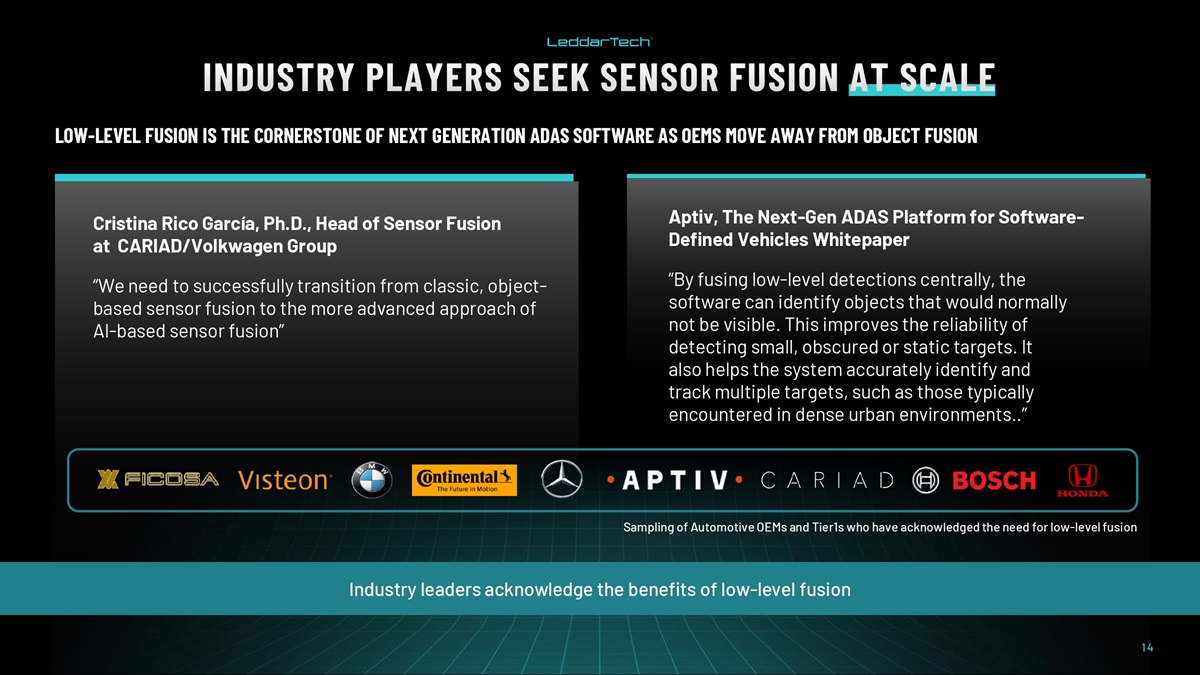

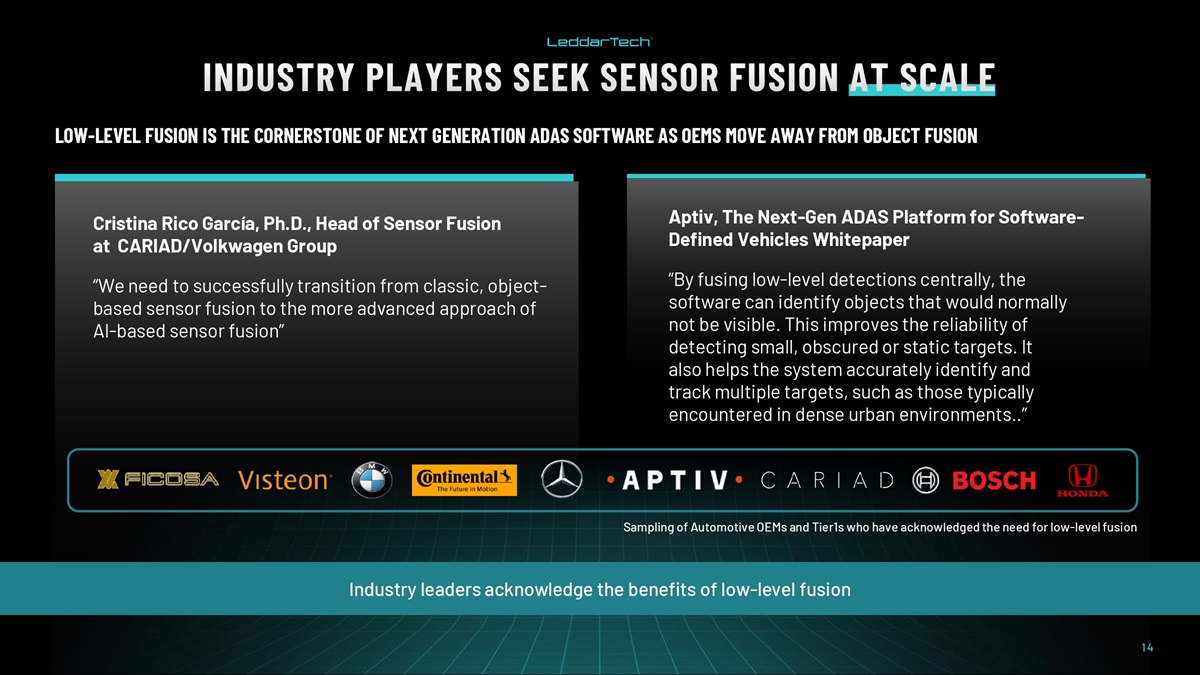

Aptiv, The Next - Gen ADAS Platform for Software - Defined Vehicles Whitepaper “By fusing low - level detections centrally, the software can identify objects that would normally not be visible. This improves the reliability of detecting small, obscured or static targets. It also helps the system accurately identify and track multiple targets, such as those typically encountered in dense urban environments..” Cristina Rico García, Ph.D., Head of Sensor Fusion at CARIAD/Volkwagen Group “We need to successfully transition from classic, object - based sensor fusion to the more advanced approach of AI - based sensor fusion” Industry leaders acknowledge the benefits of low - level fusion LOW - LEVEL FUSION IS THE CORNERSTONE OF NEXT GENERATION ADAS SOFTWARE AS OEMS MOVE AWAY FROM OBJECT FUSION Sampling of Automotive OEMs and Tier1s who have acknowledged the need for low - level fusion 14

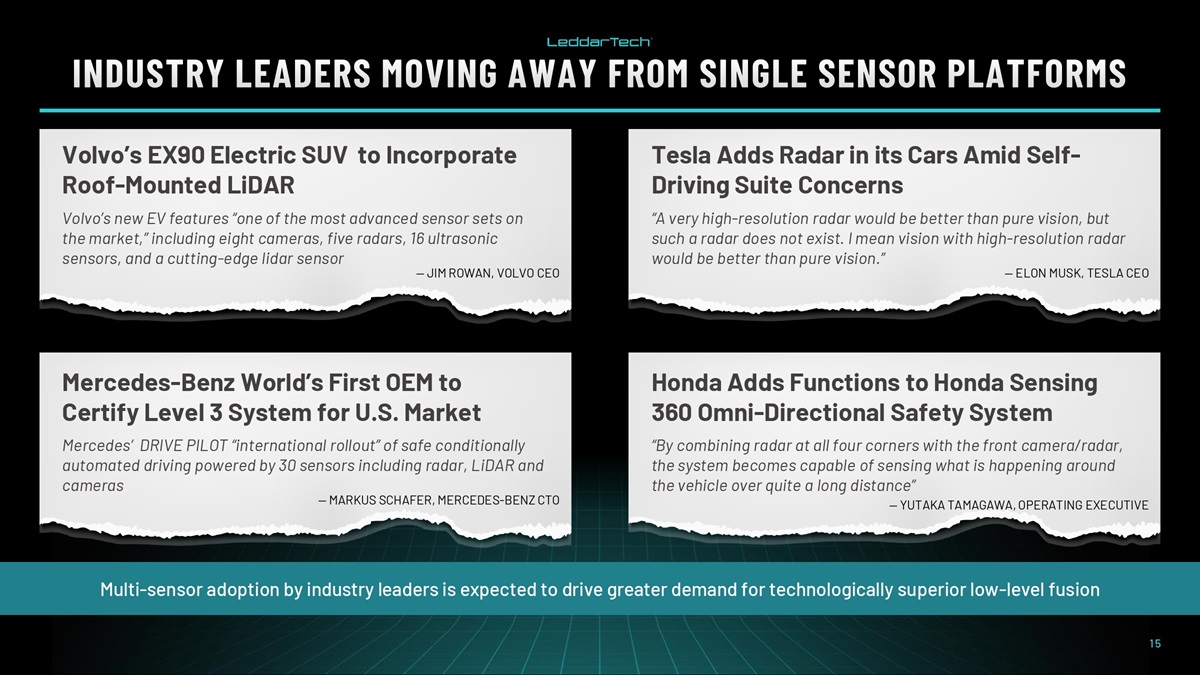

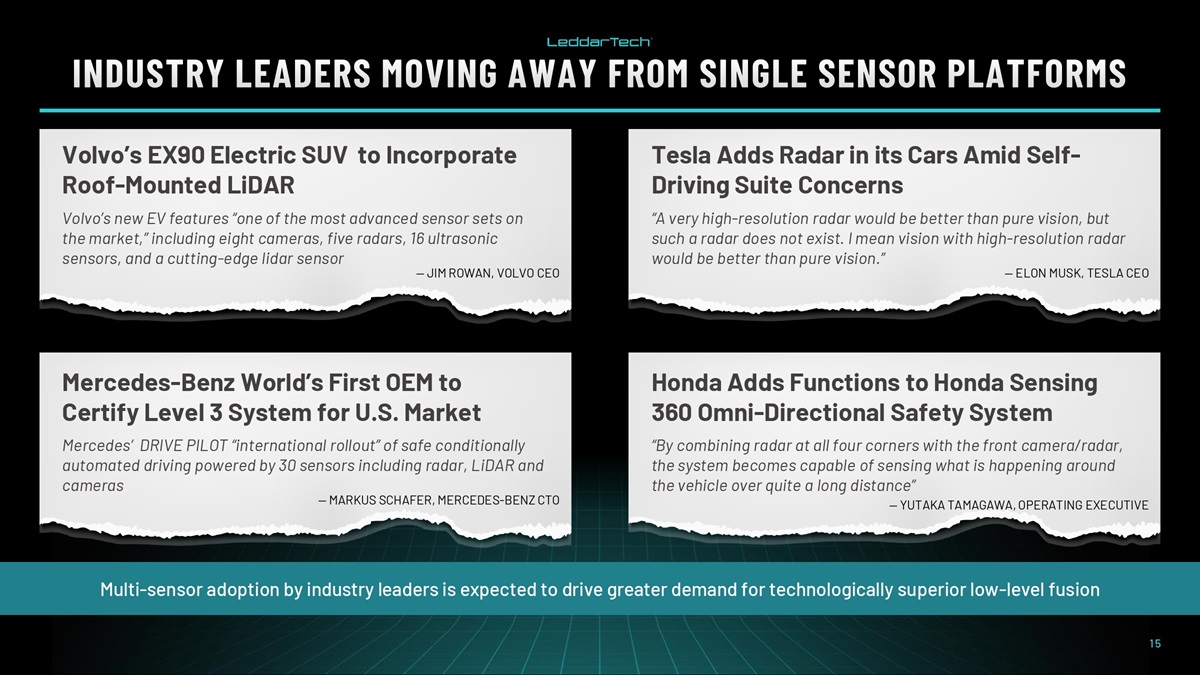

Multi - sensor adoption by industry leaders is expected to drive greater demand for technologically superior low - level fusion Volvo’s EX90 Electric SUV to Incorporate Roof - Mounted LiDAR 15 Volvo’s new EV features “one of the most advanced sensor sets on the market,” including eight cameras, five radars, 16 ultrasonic sensors, and a cutting - edge lidar sensor — JIM ROWAN, VOLVO CEO Tesla Adds Radar in its Cars Amid Self - Driving Suite Concerns “A very high - resolution radar would be better than pure vision, but such a radar does not exist. I mean vision with high - resolution radar would be better than pure vision.” — ELON MUSK, TESLA CEO Mercedes - Benz World’s First OEM to Certify Level 3 System for U.S. Market Mercedes’ DRIVE PILOT “international rollout” of safe conditionally automated driving powered by 30 sensors including radar, LiDAR and cameras — MARKUS SCHAFER, MERCEDES - BENZ CTO Honda Adds Functions to Honda Sensing 360 Omni - Directional Safety System “By combining radar at all four corners with the front camera/radar, the system becomes capable of sensing what is happening around the vehicle over quite a long distance” — YUTAKA TAMAGAWA, OPERATING EXECUTIVE

The LeddarVision Solution

PERCEPTION MODEL OF VEHICLE ENVIRONMENT AI 1 2 … N SENSOR SENSOR SENSOR LOW - LEVEL FUSION Raw data from multiple sensors fused together ABSTRACT 3D DATA Benefits of Low - Level Fusion Architecture: High Perception Performance with nearly 2x range and greater reliability, as each sensor complements each other’s strength, also resulting in less degradation in difficult weather conditions and improved safety. 1 2 Lower Computing & Maintenance Costs from leaner architecture and savings on 3 D sensors and on - sensor processors . 3 Hardware Agnostic Solution provides go - to - market flexibility shorter development cycles. Demonstrated 6 - week integration of new camera and 4D RADAR. 4 Improved Scalability from ability to integrate with multiple sensors which results in a single software platform supporting multiple brands and models . LeddarTech low - level fused 3D data 17

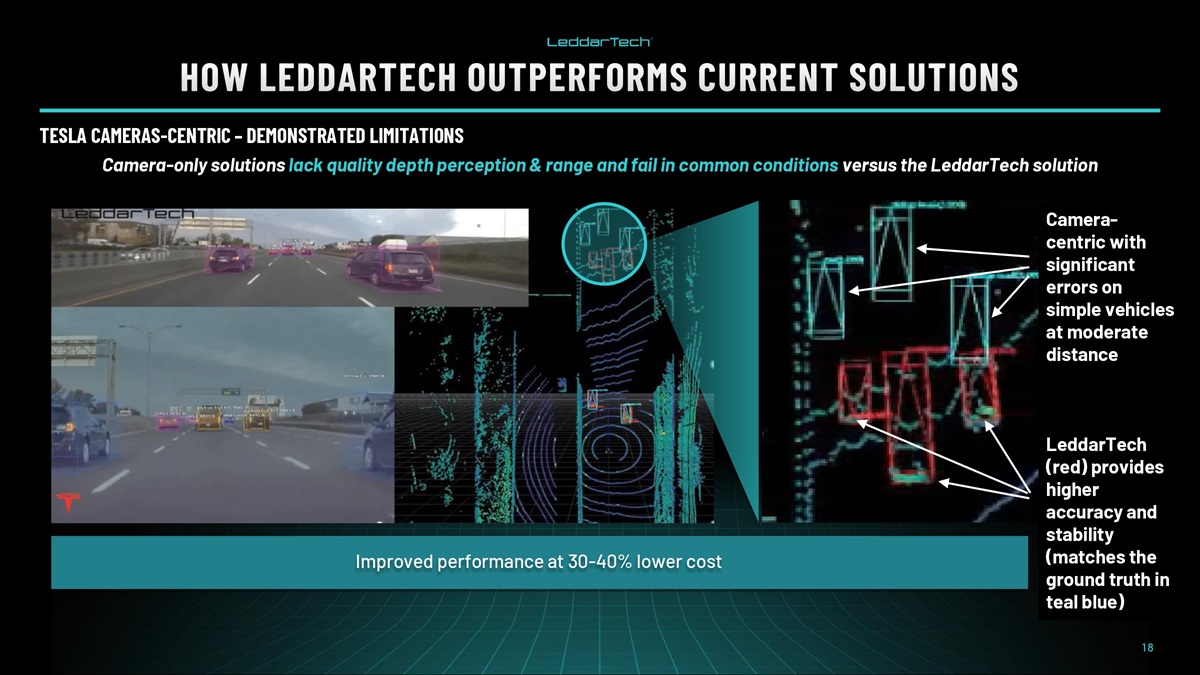

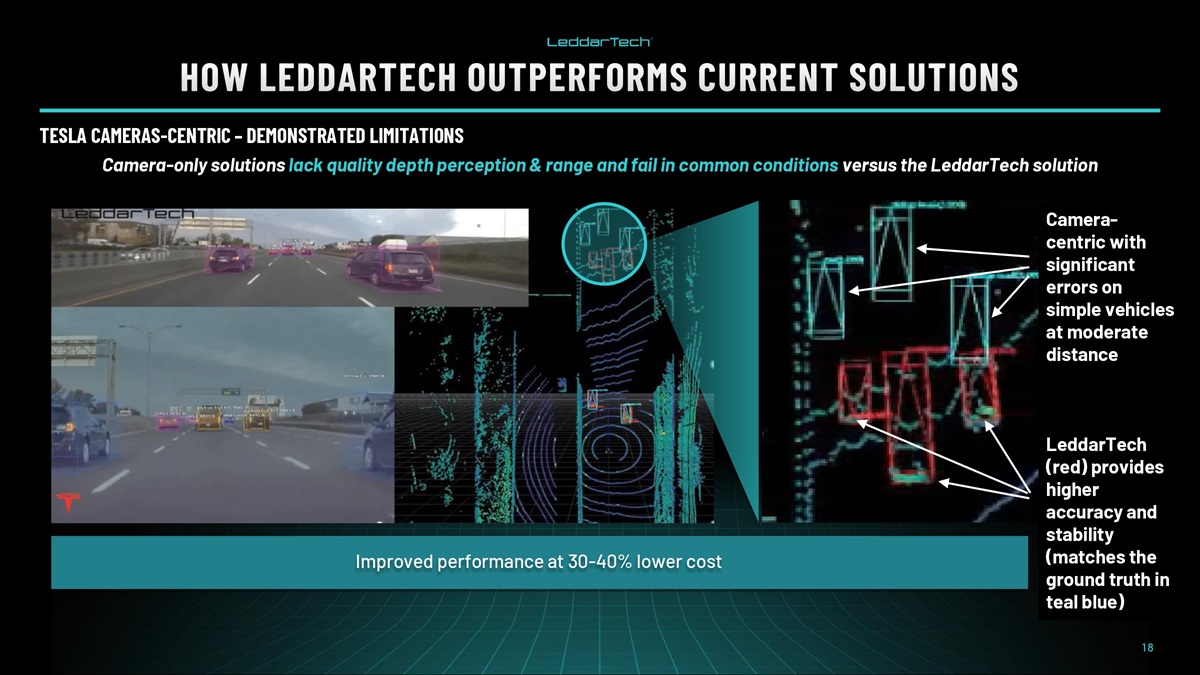

Improved performance at 30 - 40% lower cost TESLA CAMERAS - CENTRIC – DEMONSTRATED LIMITATIONS Camera - only solutions lack quality depth perception & range and fail in common conditions versus the LeddarTech solution Camera - centric with significant errors on simple vehicles at moderate distance LeddarTech (red) provides higher accuracy and stability (matches the ground truth in teal blue) 18

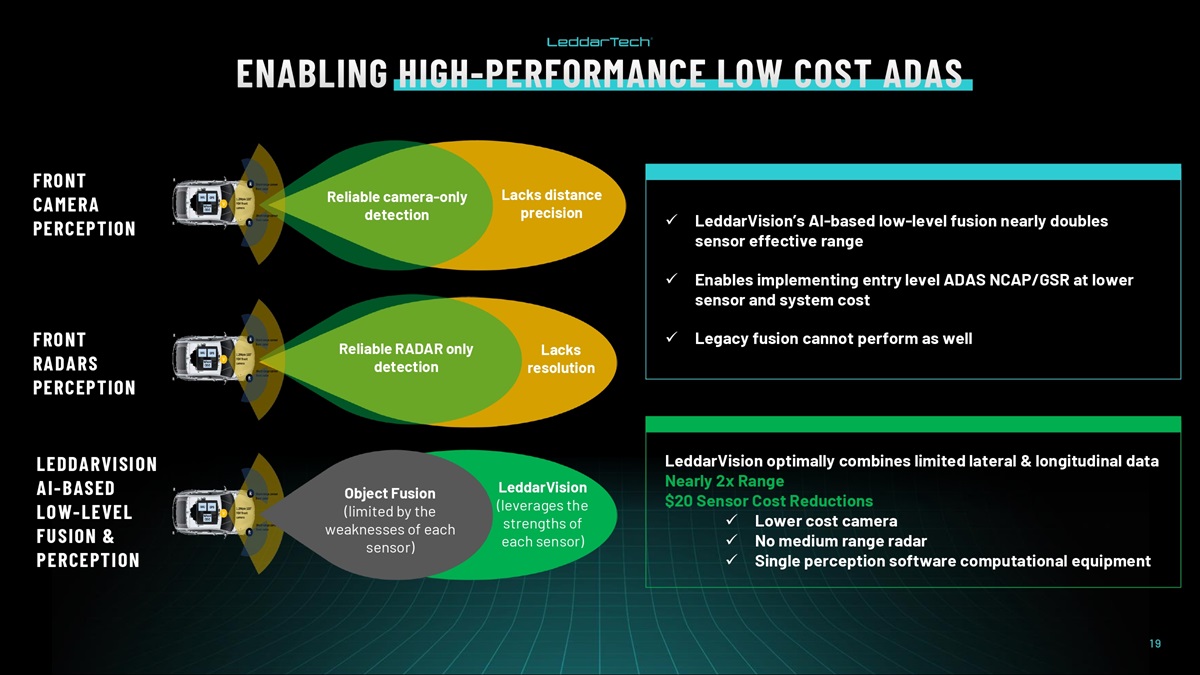

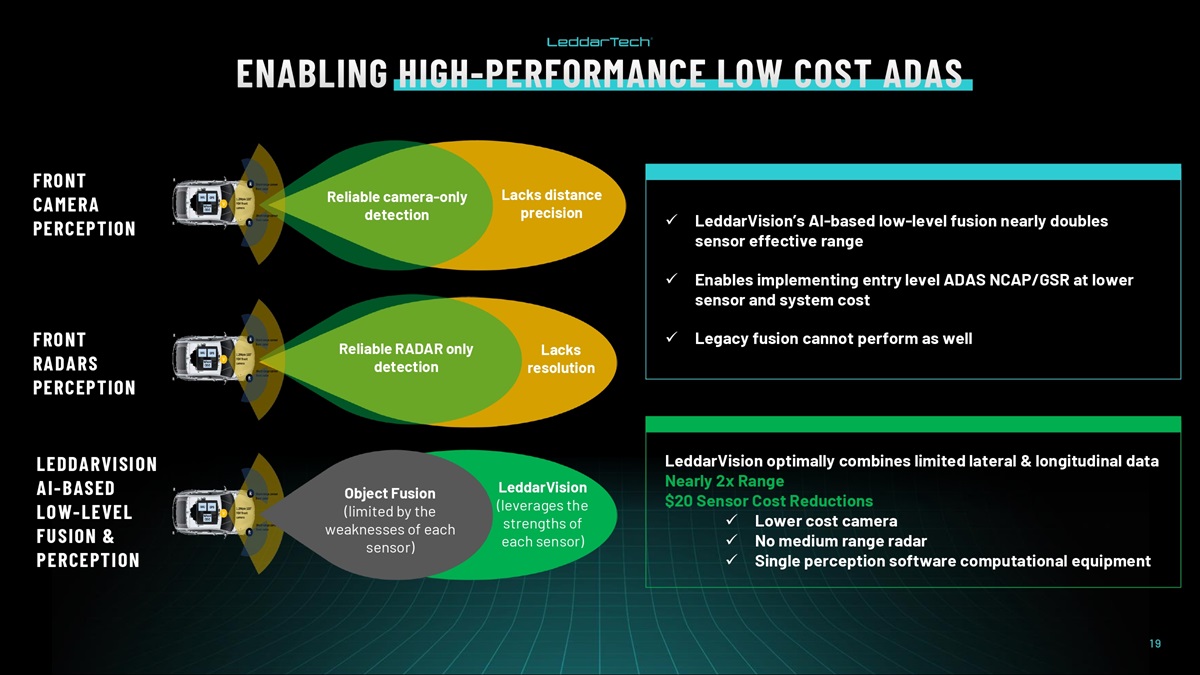

FRONT CAMERA PERCEPTION FRONT RADARS PERCEPTION Reliable camera - only detection Reliable RADAR only detection LEDDARVISION AI - BASED LOW - LEVEL FUSION & PERCEPTION LeddarVision (leverages the strengths of each sensor) LeddarVision optimally combines limited lateral & longitudinal data Nearly 2x Range $20 Sensor Cost Reductions x Lower cost camera x No medium range radar x Single perception software computational equipment x LeddarVision’s AI - based low - level fusion nearly doubles sensor effective range x Enables implementing entry level ADAS NCAP/GSR at lower sensor and system cost x Legacy fusion cannot perform as well 19 Object Fusion (limited by the weaknesses of each sensor) Lacks distance precision Lacks resolution

PERCEPTION ABSTRACT 3D IMAGE LOW - LEVEL FUSION MODEL OF VEHICLE ENVIRONMENT The LeddarVision low - level fusion algorithm creates a standardized 3d model from any sensor set LeddarVision perception requires limited retraining on new configurations or modifications Perception is processed on a single 3d model, significantly reducing system computation costs (savings increase as more sensors are added) HARDWARE INDEPENDENCE ENABLES A SINGLE ADAS SOFTWARE PLATFORM FOR ALL VEHICLE MODELS, UPGRADES AND ROADMAP PRODUCTS COVER COMPLETE VEHICLE MODEL LINEUPS & ROADMAP Entry - Level L2 Front B Sample Available Premium Surround L2+ B Sample: Q4 2023 Parking L2/L2+ A Sample: Q4 2023 1 2 3 20

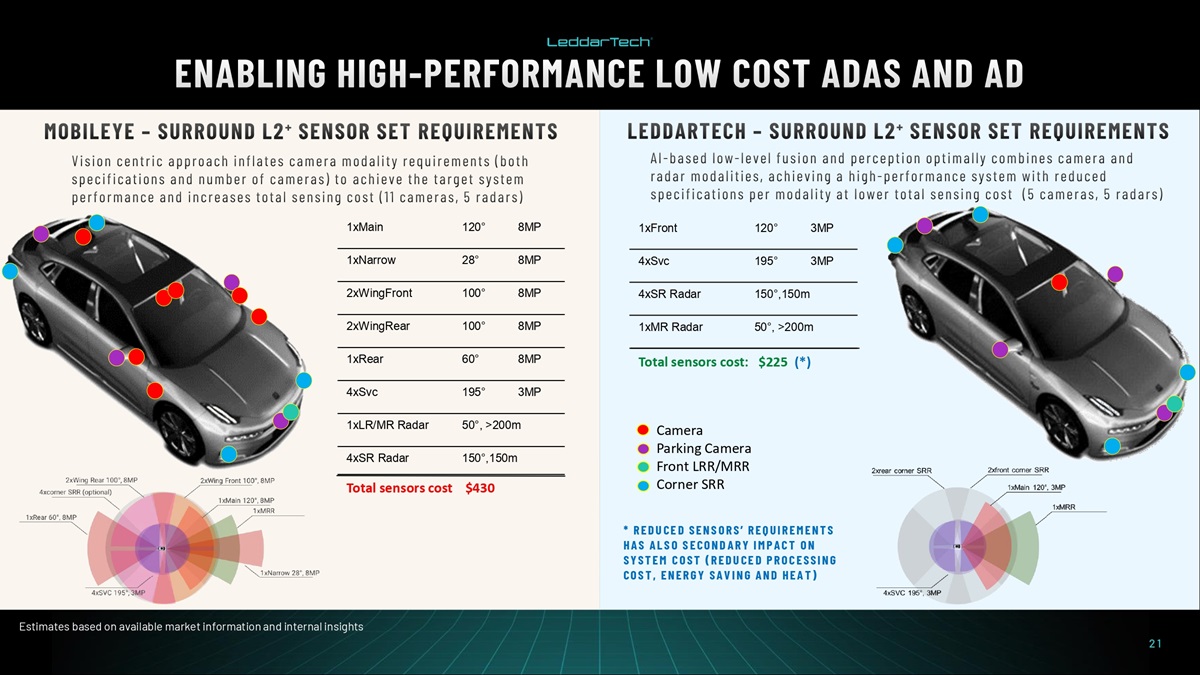

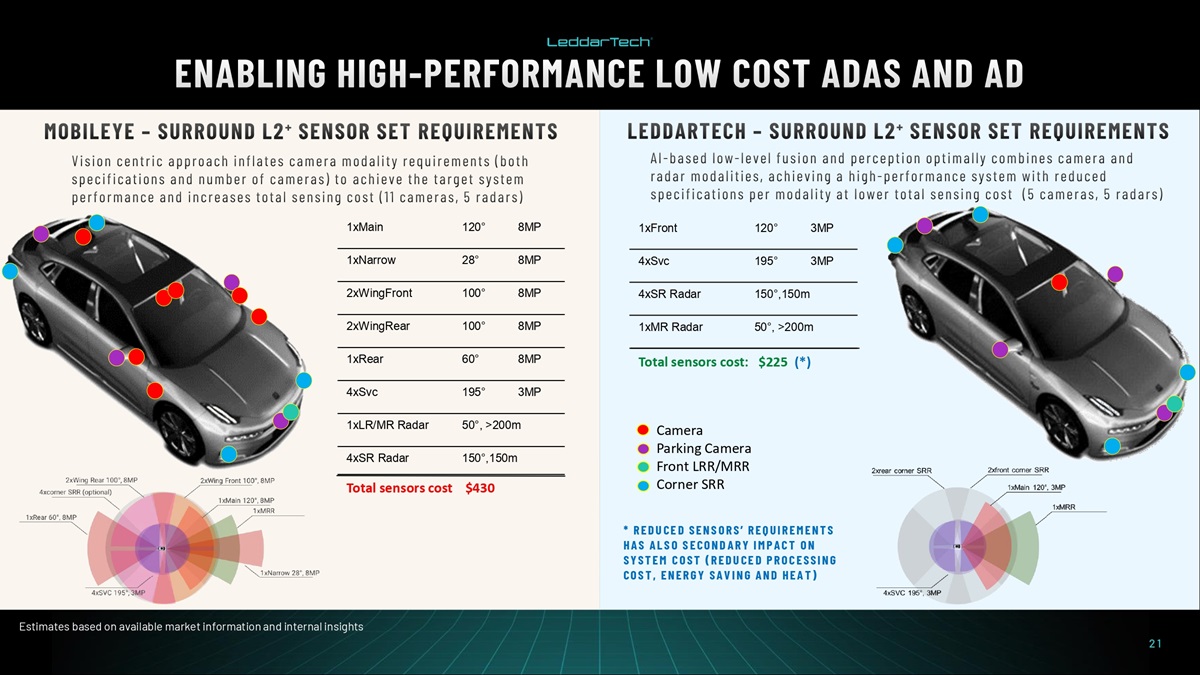

Camera Parking Camera Front LRR/MRR Corner SRR * R E D U C E D S E N S O R S ’ R E Q U I REM EN TS H A S A L S O S E C O N D A R Y I M P A C T O N S Y S T E M C O S T ( R E D U C E D P R O C E S S I N G C O S T , E N E R G Y S A V I N G A N D H E A T ) Estimates based on available market information and internal insights 8MP 120 ƒ 1xMain 8MP 28 ƒ 1xNarrow 8MP 100 ƒ 2xWingFront 8MP 100 ƒ 2xWingRear 8MP 60 ƒ 1xRear 3MP 195 ƒ 4xSvc 50 ƒ , >200m 1xLR/MR Radar 150 ƒ ,150m 4xSR Radar Total sensors cost $430 3MP 120 ƒ 1xFront 3MP 195 ƒ 4xSvc 150 ƒ ,150m 4xSR Radar 50 ƒ , >200m 1xMR Radar Total sensors cost: $225 (*) 21

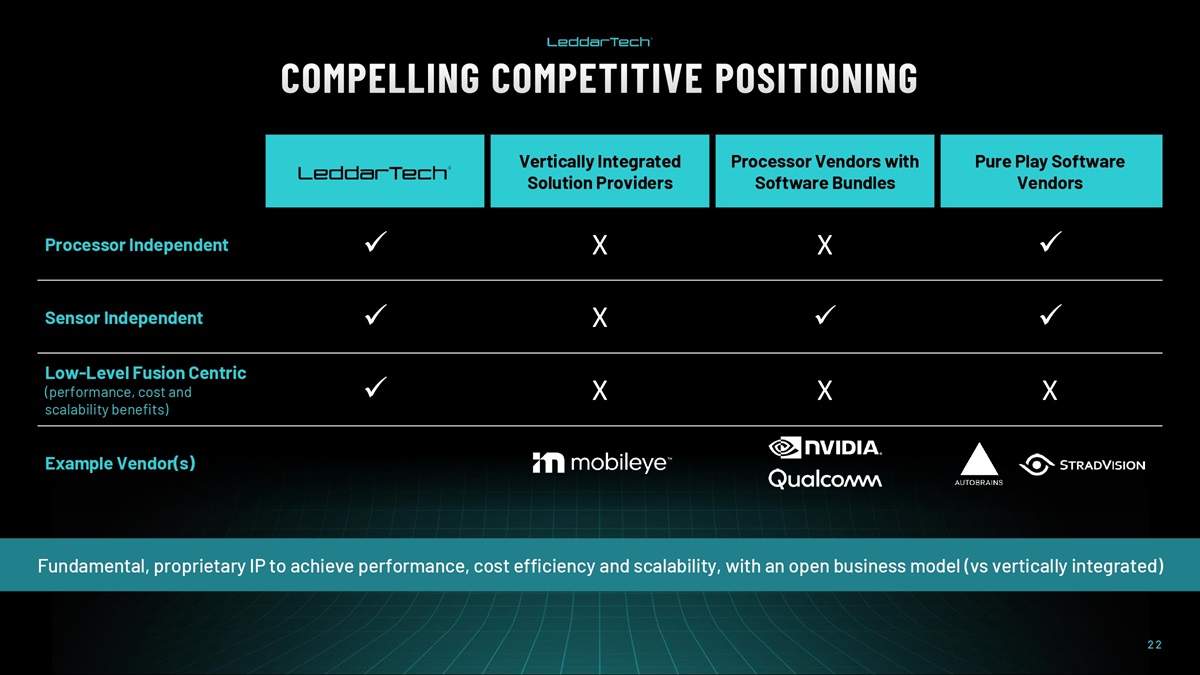

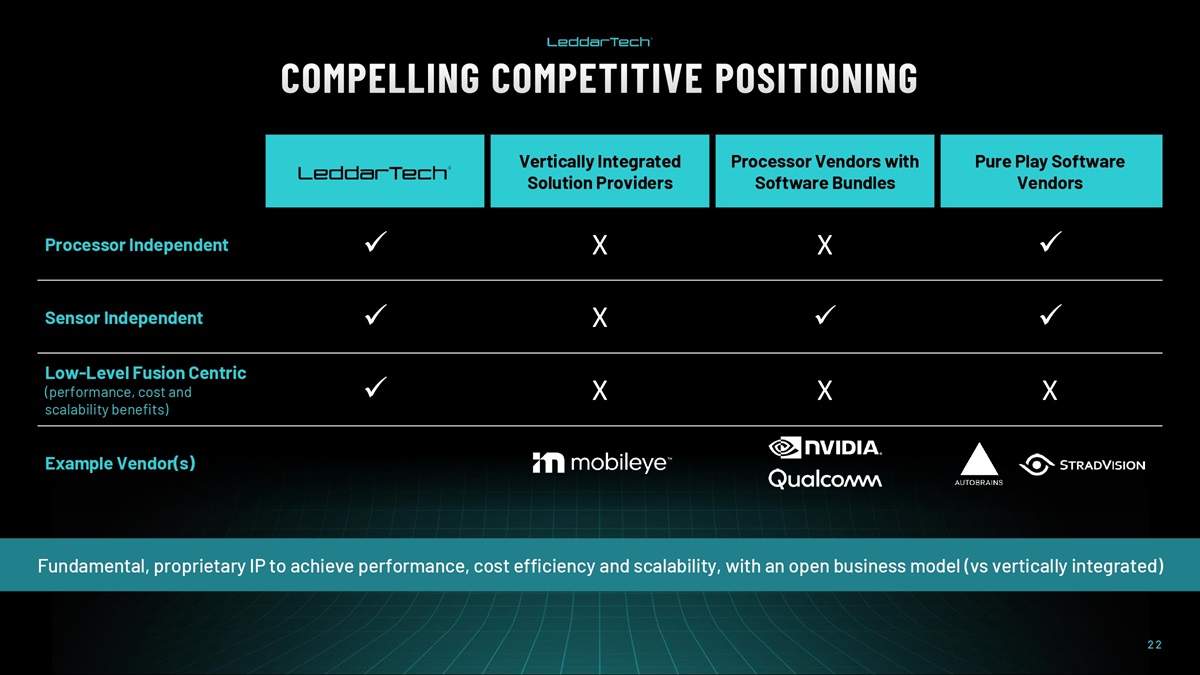

Pure Play Software Vendors Processor Vendors with Software Bundles Vertically Integrated Solution Providers x X X x Processor Independent x x X x Sensor Independent X X X x Low - Level Fusion Centric (performance, cost and scalability benefits) Example Vendor(s) Fundamental, proprietary IP to achieve performance, cost efficiency and scalability, with an open business model (vs vertically integrated) 22

FUNDAMENTAL IP Fundamental proprietary fusion IP is core to the benefits of superior performance, flexibility and scalability at lower cost Solid anteriority — many patents filed before most autotech companies began research COMPANY PORTFOLIO OF 150+ PATENTS From signal acquisition to perception and fusion 153 PATENTS (Granted and Pending) 80 AWARDED 73 PENDING 1 2 Citations of the company’s patents from industry leaders (subset shown here) confirm the importance and anteriority of the company’s IP 25% Acquisition 22% Processing 21% Perception 14% Automotive 18% Transportation and Industrial 68% Software 23

Market Opportunity

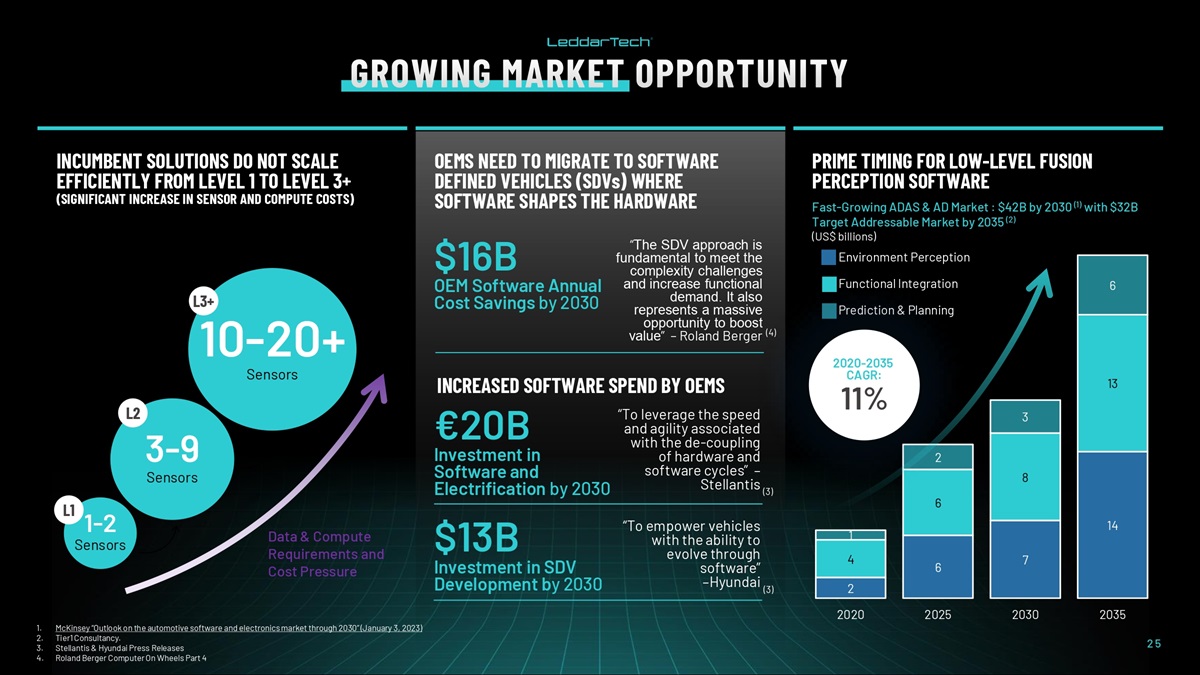

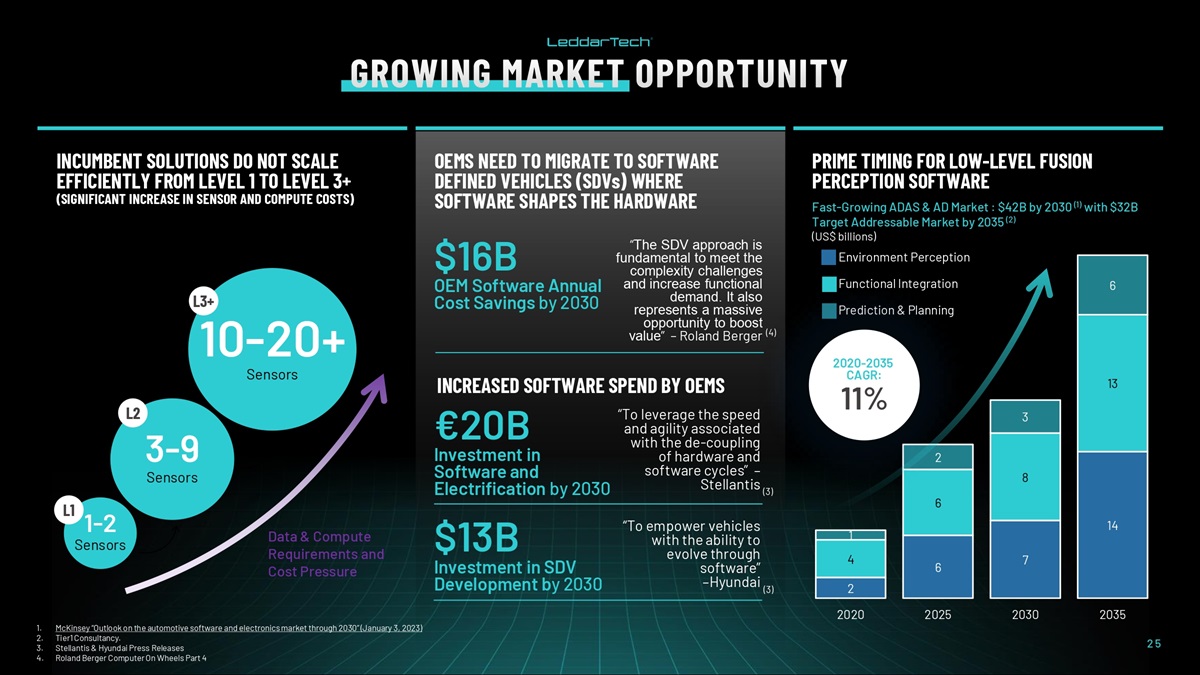

6 7 14 6 8 13 1 4 2 2 3 6 2020 2025 2030 2035 Environment Perception Functional Integration Prediction & Planning PRIME TIMING FOR LOW - LEVEL FUSION PERCEPTION SOFTWARE Fast - Growing ADAS & AD Market : $42B by 2030 (1) with $32B Target Addressable Market by 2035 (2) (US$ billions) 1. McKinsey “Outlook on the automotive software and electronics market through 2030” (January 3, 2023) 2. Tier1 Consultancy. 3. Stellantis & Hyundai Press Releases 4. Roland Berger Computer On Wheels Part 4 OEMS NEED TO MIGRATE TO SOFTWARE DEFINED VEHICLES (SDVs) WHERE SOFTWARE SHAPES THE HARDWARE INCUMBENT SOLUTIONS DO NOT SCALE EFFICIENTLY FROM LEVEL 1 TO LEVEL 3+ (SIGNIFICANT INCREASE IN SENSOR AND COMPUTE COSTS) 2020 - 2035 CAGR: 11% INCREASED SOFTWARE SPEND BY OEMS “To leverage the speed and agility associated with the de - coupling of hardware and software cycles” – Stellantis €20B Investment in Software and Electrification by 2030 “To empower vehicles with the ability to evolve through software” – Hyundai $ 13B Investment in SDV Development b y 2030 (3) (3) 1 - 2 Sensors L1 3 - 9 Sensors L2 L3+ 10 - 20+ Sensors Data & Compute Requirements and Cost Pressure “ The SDV approach is fundamental to meet the complexity challenges and increase functional demand. It also represents a massive opportunity to boost value ” – Roland Berger $16B OEM Software Annual Cost Savings by 2030 (4) 25

26 Ramp Up Period Year 1 Year 2 Year 3 Year 4 Year 5 Typical Automotive Car Model Sales and Production Cycle Generates Multi - Year Revenues for Suppliers Year 6 Year 7 Year 8 Year 9 Year 10 Ramp Down Period 1) Status of October 31, 2023 18 16 1 Prime Period

LeddarTech’s software, IP and data offerings support high - margin revenue streams Revenue Model LeddarTech Revenue Streams Pricing Model Frequency & Relative Value Engineering Services Software License Fee Royalty Fee Software Maintenance Data Per project fee Per project fee Per vehicle royalty 5% of annual royalty fee revenue Upside One - time One - time One - time per vehicle produced Recurring SaaS / recurring 27 Applicable to Each Customer Program in Passenger Car, Commercial Vehicle and Off - Road Vehicle Markets $ $$ $$$ $ tbd

Valuation

$348 1 $2,608 $1,476 $1,243 $417 $298 $247 $192 $153 $142 $61 1. Market cap includes dilutive impact of convertible pipe on an as - converted basis. Market Cap Median: $272M ($ in millions) Source: Company Filings as of November 6, 2023

1. Tier1 Consultancy. 2. Tier1s have significant expertise, resources and capabilities (including servicing) to support OEMs, greatly reducing risk. They also have existing business relationships as qualified and trusted suppliers. LARGE & FAST - GROWING TOTAL ADDRESSABLE MARKET $32 billion potential addressable market (1) (2035) with value - added solutions leveraging the benefits of AI - based low - level fusion Market powered by the near - term need to unify data from the proliferation of sensors as ADAS systems evolve from L1 to L3 and above DISRUPTIVE FUSION AND PERCEPTION SOFTWARE SOLVING FUNDAMENTAL IN DUSTRY CHALLENGES Unique, proprietary AI - based low - level fusion and perception designed to enable high performance, low - cost ADAS systems while providing the independence from hardware needed for software platforms to be used across vehicle models, upgrades and roadmap EARLY MOVER MARKET POSITION AND TECHNOLOGY LEAD OPPORTUNITY Seven years experience with AI - based low - level fusion, with strong anteriority on fundamental IP PURE - PLAY SOFTWARE FOR AUTO • High - margins, scalable per vehicle royalty license model • Tier 1 go - to - market partners model supports commercialization 2 • Automotive car model sales & production cycles provide potential for high visibility on recurring software royalty revenues WORLD - CLASS TEAM Unique team of software, AI and machine learning expertise and know - how built over many years supported by experienced management and board Industry leading perception software solution for ADAS and AD based on proprietary AI - based low - level fusion technology 30

Appendix

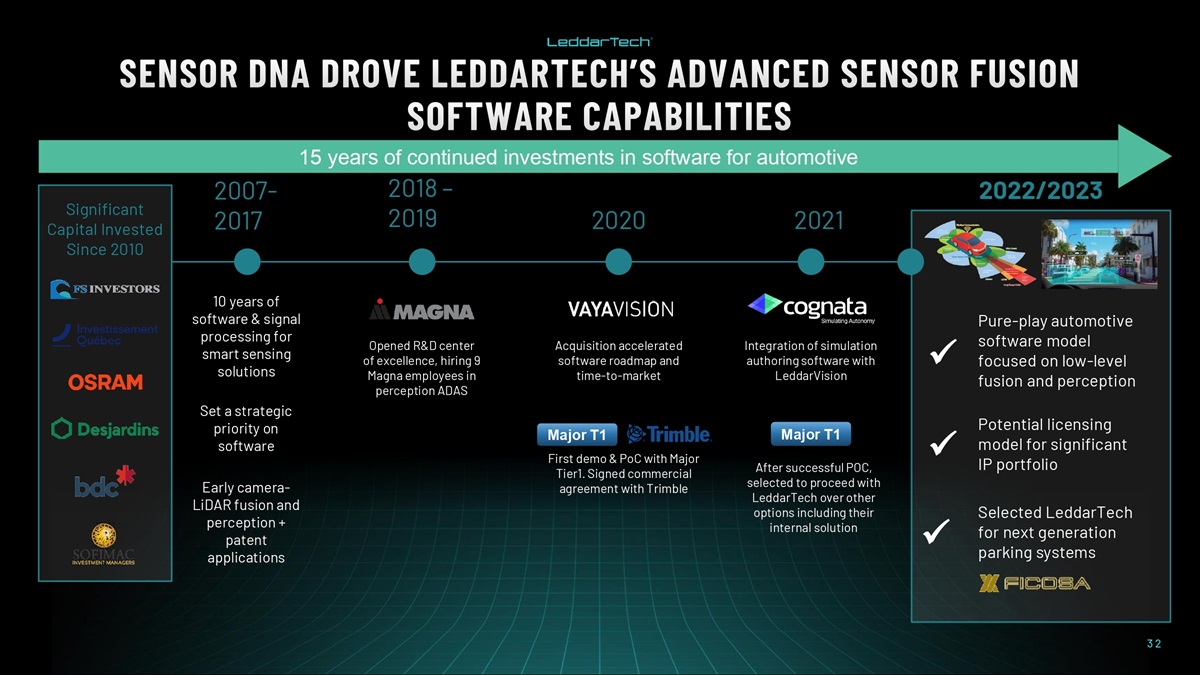

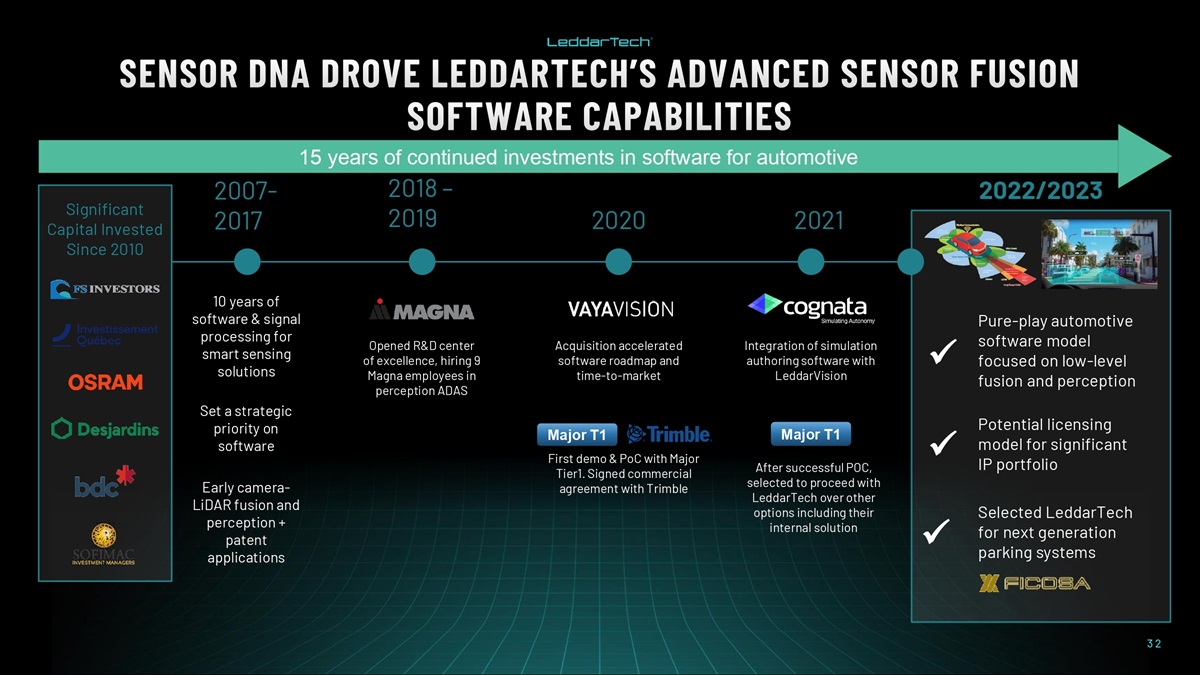

Significant Capital Invested Since 2010 Acquisition accelerated software roadmap and time - to - market Integration of simulation authoring software with LeddarVision x Potential licensing model for significant IP portfolio x Pure - play automotive software model focused on low - level fusion and perception 15 years of continued investments in software for automotive Selected LeddarTech for next generation parking systems x First demo & PoC with Major Tier1. Signed commercial agreement with Trimble 2007 - 2022/2023 2017 2020 2021 10 years of software & signal processing for smart sensing solutions Set a strategic priority on software 2018 – 2019 Opened R&D center of excellence, hiring 9 Magna employees in perception ADAS After successful POC, selected to proceed with LeddarTech over other options including their internal solution Early camera - LiDAR fusion and perception + patent applications Major T1 Major T1 32

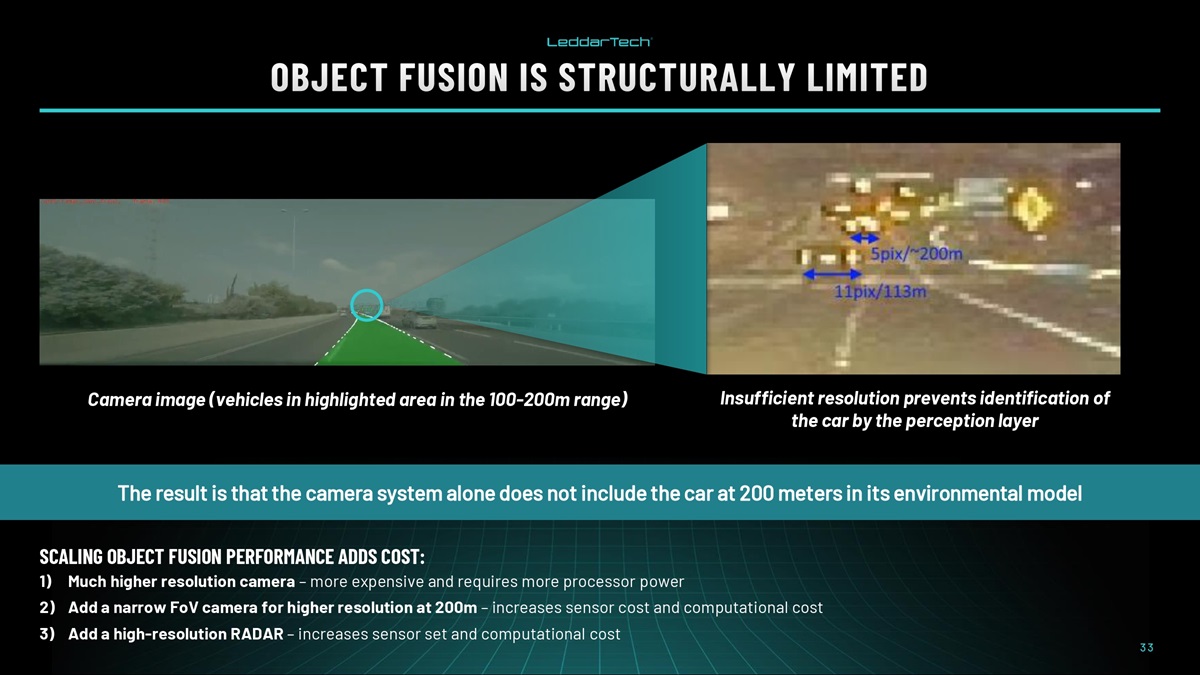

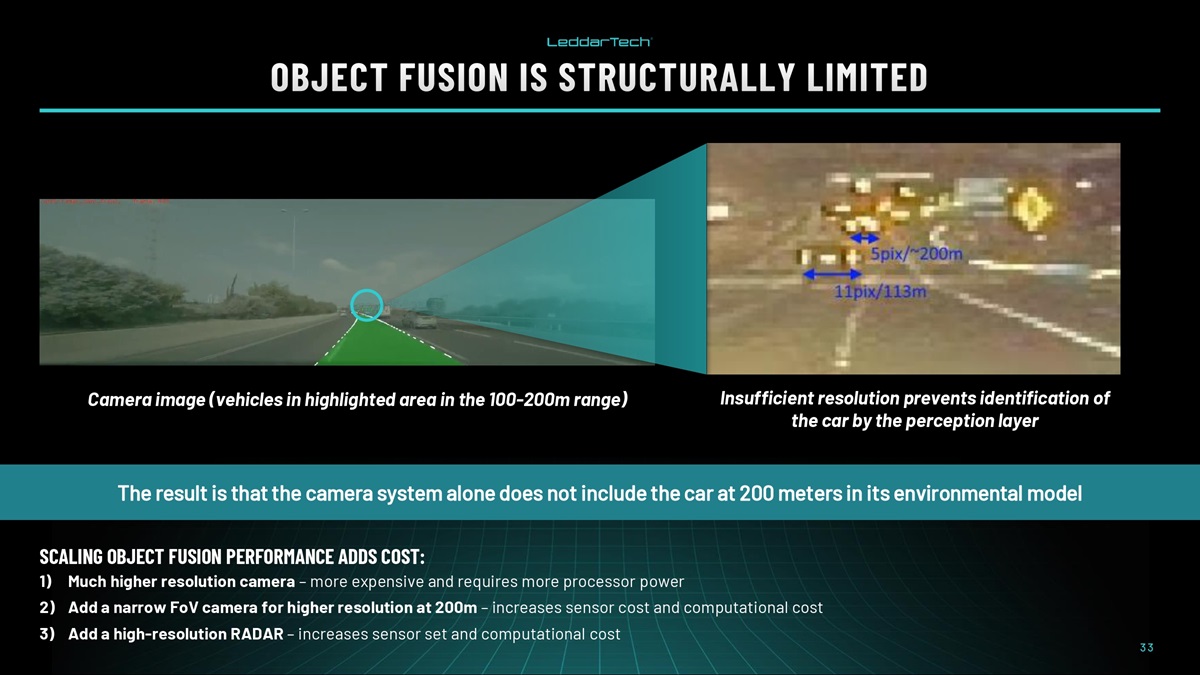

Insufficient resolution prevents identification of the car by the perception layer The result is that the camera system alone does not include the car at 200 meters in its environmental model SCALING OBJECT FUSION PERFORMANCE ADDS COST: 1) Much higher resolution camera – more expensive and requires more processor power 2) Add a narrow FoV camera for higher resolution at 200m – increases sensor cost and computational cost 3) Add a high - resolution RADAR – increases sensor set and computational cost Camera image (vehicles in highlighted area in the 100 - 200m range) 33

• Disaggregation of hardware from software enabling OEM sourcing flexibility • Allows OEMs to change or upgrade sensors without major recoding and AI retraining of their fusion software • Facilitates “over - the - air” and “backwards compatible” upgrades to meet NCAP requirements • Efficiently solves the fusion problem for OEMs as sensors proliferate in the vehicle* 34 * Based on various customer public publications (e.g. slide 14)

“ LeddarTech has the best sensor fusion and perception technology in the industry today .” VP Prod. Planning – Major Korean Tier 1 “ We have attempted to create this technology ourselves and failed. This is a hard problem to address.” “We have scoured the market to look for another provider of this software, and we cannot find anyone. ” “We have benchmarked LeddarTech’s technology with our proprietary dataset and this is best - “We need a solution today and no hardware solution , regardless of price, can meet our needs . ” CTO – Leading Off - Road System Supplier in - class. ” Global Dir. Innovation – Major German Tier 1 “This strategic alliance with LeddarTech allows us to continue to revolutionize the in - vehicle experience ” Josep Maria Forcadell, Chief Technology Officer at Ficosa “ LeddarTech sensor fusion and perception software allows to get much more out of our RADARs than we ever imagined possible .” CEO and Cofounder – Leading Radar Player 35

All references to the “Company,” “we,” “us” or “our” refer to LeddarTech Inc . prior to the Business Combination and to the Surviving Company following the Business Combination . The risks presented below are certain of the general risks related to the business of the Company, Prospector and the Business Combination, and such list is not exhaustive . The list below has been prepared solely for purposes of inclusion in this Presentation and not for any other purpose . Investors are encouraged to perform their own investigation with respect to the business, prospects, financial condition and operating results of the Company and our business, prospects, financial condition and operating results following the completion of the Business Combination . The occurrence of one or more of the events or circumstances identified in these risk factors, alone or in combination with other events or circumstances, may adversely affect the ability to complete or realize the anticipated benefits of the Business Combination, and may have a material adverse effect on the business, cash flow, financial condition and results of operations of the Company following the Business Combination . The Company may face additional risks and uncertainties that are not currently known, or that are currently deemed immaterial, which may also impair the Company’s business, prospects, financial condition or operating results . Risks relating to the business of the Company and the Business Combination will be disclosed in future documents filed or furnished by the Company and/or Prospector with the SEC, including the documents filed or furnished in connection with the Business Combination. Investors are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the Business Combination, as these materials will contain important information about the Company and the Business Combination. The risks presented in such filings will be consistent with those that would be required for a public company in its SEC filings, including with respect to the business and securities of the Company and the Business Combination, and may differ significantly from, and will be more extensive than, those presented below. Risks Related to Our Business • Our recent transition from a sensory hardware - focused development business model to a sensory software - focused development business model means that effectively we are a “pre - revenue” business, and the transition makes evaluating our business and future prospects difficult and may increase the risk of your investment. • We have an unproven business model in a new market and face significant challenges in a rapidly evolving industry. Our prospects may be considered speculative and any failure to commercialize our strategic plans would have an adverse effect on our operating results and business, harm our reputation and could result in substantial liabilities that exceed our resources. • We have incurred significant operating losses and net cash outflows since inception, and it is uncertain when, if ever, we will generate meaningful revenue and profitability under our new business model. • We have not achieved any OEM design wins, and while we have invested significant time, funds and efforts seeking OEM and Tier 1 selection of our solutions, our solutions ultimately may not be chosen for use in production models. If we fail to achieve OEM design wins after incurring substantial expenditures in these efforts, our future business, results of operations and financial condition would be adversely affected. • Even if we achieve OEM design wins, prospective customers may not purchase our solutions in any certain quantity, at any certain price or at all, and there may be significant delays between the time we achieve either a Tier 1 design and integration win or an OEM design win and the time a contract for production is agreed to and we are able to realize revenue. Any failure to obtain OEM and Tier 1 customers for our solutions and services, whether following Tier 1 design and integration wins, OEM design wins or otherwise, would materially adversely affect our business, results of operations and financial condition. • Our financial statements contain disclosure regarding the significant doubt about our ability to continue as a going concern. Our ability to execute our business plan, to fund our operations and to continue as a going concern depends on our ability to raise capital and the continuous support of our creditors. • The Surviving Company will likely have limited sources of available liquidity following completion of the Business Combination and if it does not raise additional capital is expected to operate under an alternative operating plan. If the Surviving Company does not secure additional sources of capital in connection with the Business Combination, it will need to reduce its operating costs to ensure sufficient liquidity for its operations and to comply with the requirements of its debt obligations. A reduction in the Surviving Company’s operating costs may materially adversely affect the Surviving Company in a number of ways. • The Surviving Company’s liquidity position will be further constrained by the requirement to maintain a minimum cash balance of at least $5.0 million following completion of the Business Combination. If the Surviving Company is not able to maintain compliance with the minimum cash balance requirements, its debt obligations may be declared due and payable at a time when the Surviving Company does not have sufficient resources to repay such debt obligations. • Any significant reduction in headcount as part of the implementation of the Company’s cost management plan may have a material adverse effect on the Surviving Company’s operations and future prospects • We invest significantly in research and development, and to the extent our research and development efforts are unsuccessful, our competitive position would be negatively impacted and our business, results of operations and financial condition would be adversely affected. • We have incurred material charges in connection with our decision to exit our modules and components business, and may incur additional charges related to the related exit activities in the future. 36

Risks Related to Our Business (cont’d) • Our historical financial information, historical financial results and operating and business history, which were achieved under our prior sensory hardware - focused business model, may not be representative of our future results under a sensory software - focused business model. • If we are unable to develop and introduce new solutions and improve existing solutions in a cost - effective and timely manner, then our competitive position would be negatively impacted and our business, results of operations, and financial condition would be adversely affected. • We operate in a highly competitive, dynamic and rapidly changing market and compete against a large number of established competitors and new market entrants, some of whom have substantially greater resources. • We expect that a substantial portion of future revenue will come from a small number of OEMs and Tier 1 customers, and the loss of or a significant reduction in sales to, one or more of major Tier 1 customers and/or the discontinued incorporation of our solutions by one or more major OEMs in their vehicle models, would materially adversely affect our business, results of operations and financial condition. • We have entered into strategic collaborations, but not yet signed formal agreements, with two Tier 1 suppliers. If we fail to sign formal agreements with those prospective customers, or to subsequently achieve an OEM design win with such customers, our future business, results of operations and financial condition would be adversely affected. • Product integration could face complications or unpredictable difficulties, which may adversely impact customer adoption of our products and our financial performance. • Our business may suffer from claims relating to, among other things, actual or alleged defects in our solutions. If our solutions actually or allegedly fail to perform as expected, publicity related to these claims could harm our reputation and decrease demand for our solutions or increase regulatory scrutiny of our solutions. • If we are unable to overcome our limited sensory fusion solutions sales history and are unable establish and maintain confidence in our long - term business prospects among our customer prospects and within our industry or are subject to negative publicity, then our future business, results of operations and financial condition would be adversely affected. • We are highly dependent on the services of our senior executive officers and loss of key personnel could impair our success. • If we are unable to attract, retain, and motivate key employees, then our business, results of operations, and financial condition would be adversely affected. • As part of growing our business, we may make acquisitions. If we fail to successfully select, execute or integrate our acquisitions, then our business, results of operations and financial condition could be materially adversely affected, and our stock price could decline. • Continued pricing pressures and customer cost reduction initiatives may result in lower than anticipated margins, or losses, which may adversely affect our business. • The Company will need to raise additional funds to meet its capital requirements before or soon after completion of the Business Combination, and such funds may not be available on commercially reasonable terms, or at all, which could materially and adversely affect the Surviving Company’s business, results of operations or financial condition and its ability to continue as a going concern. • We are affected by fluctuations in currency exchange rates, including those in connection with recent inflationary trends in the United States, Canada, and globally. • Global or regional conditions can adversely affect our business, results of operations, and financial condition. • Catastrophic events can adversely affect our business, results of operations, and financial condition. • Disruptions in financial markets may adversely impact the availability and cost of credit and have other adverse effects on us and the market price of our stock. 37

Risks Related to Our Intellectual Property Rights • We may not be able to adequately protect, defend or enforce our intellectual property rights, and our efforts to do so may be costly. • We may become subject to claims and litigation brought by third parties alleging infringement by us of their intellectual property rights. • In addition to patented technology, we rely on our unpatented proprietary technology, trade secrets, processes and know - how that can be more difficult to protect or enforce, which could allow competitors to independently develop or commercialize superior technology, software and products • We use certain software and data governed by open - source licenses, which under certain circumstances could adversely affect our business, results of operations, and financial condition. • Our subsidiary has received Israeli government grants for certain of its research and development activities and it may receive additional grants in the future. The terms of those grants restrict our ability to transfer technologies outside of Israel, and we may be required to pay penalties in such cases or upon the sale of our company. Risks Related to Privacy, Data and Cybersecurity • Interruptions to our information technology systems and networks and cybersecurity incidents could adversely affect our business, results of operations, and financial condition. • Security breaches and other disruptions of our in - vehicle systems and related data could impact the safety of our end users and reduce confidence in us and our solutions. • Failures or perceived failures to comply with privacy, data protection, and information security requirements, or theft, loss, or misuse of personal information about our employees, customers, end users, or other third parties, or other information, could increase our expenses, damage our reputation, or result in legal or regulatory proceedings. Risks Related to Our Industry • The current uncertain economic environment and inflationary conditions may adversely affect global vehicle production and demand for our solutions. • ADAS and AD systems rely on a complex set of technologies, and there is no assurance that the rate of acceptance and adoption of these technologies will increase in the near future or that a market for fully autonomous vehicles will fully develop. • We operate in an industry that is new and rapidly evolving. The market and industry projections included in this Presentation are subject to significant uncertainty. If markets for sensor fusion products develop more slowly than we expect, or long - term end - customer adoption rates and demand are slower than we expect, our operating results and growth prospects could be harmed. Regulatory and Compliance Risks • We are subject to a variety of laws and regulations that affect our operations and that could adversely affect our business, results of operations, and financial condition. • Our business, results of operations and financial condition may be adversely affected by changes in automotive safety regulations regarding autonomous driving, which may increase our costs or delay or halt adoption of our sensor fusion solutions. • If we fail to comply with the laws and regulations relating to the collection of sales tax and payment of income taxes in the various jurisdictions in which we do business, we could be exposed to unexpected costs, expenses, penalties and fees as a result of our non - compliance, which could harm our business. • Unanticipated changes in effective tax rates or adverse outcomes resulting from examination of our income or other tax returns could adversely affect our financial condition and results of operations. • We are subject to risks related to trade policies, sanctions, and import and export controls. • The current conflict between Ukraine and Russia has exacerbated market instability and disrupted the global economy. 38

Risks Related to Ownership of Surviving Company Common Shares Following the Business Combination and the Surviving Company Operating as a Public Company • The Surviving Company does not intend to pay cash dividends for the foreseeable future. • If analysts do not publish research about the Surviving Company’s business or if they publish inaccurate or unfavorable research, the Surviving Company’s stock price and trading volume could decline. • Future resales of Surviving Company Common Shares after the consummation of the Business Combination may cause the market price of the Surviving Company’s securities to drop significantly, even if the Surviving Company’s business is doing well. • We need to raise additional capital to address our liquidity needs and to realize our operational goals. The issuance of additional shares of the Company common shares would result in dilution of future Surviving Company shareholders and could have a negative impact on the market price of Surviving Company Common Shares. • The actual market value of the Surviving Company Common Shares will not be known until after completion of the Business Combination, and an active market for the Surviving Company’s securities may not materialize, which would adversely affect the liquidity and price of the Surviving Company’s securities. • If the benefits of the Business Combination do not meet the expectations of investors, shareholders or financial analysts, the market price of the Surviving Company’s securities may decline. • Recent market volatility could impact the stock price and trading volume of the Surviving Company’s securities. • The obligations associated with being a public company will involve significant expenses and will require significant resources and management attention. • We have identified material weaknesses in our internal control over financial reporting, and we may identify additional material weaknesses in the future. • The Surviving Company will be an emerging growth company subject to reduced disclosure requirements, and there is a risk that availing itself of such reduced disclosure requirements will make its ordinary shares less attractive to investors and may make it more difficult to compare our performance with other public companies. • Because the Surviving Company will become a public reporting company by means other than a traditional underwritten initial public offering, the Surviving Company’s shareholders may face additional risks and uncertainties. • Prospector and the Company have no history operating as a combined company. The unaudited pro forma condensed combined consolidated financial information may not be an indication of the Surviving Company’s financial condition or results of operations following the Business Combination, and accordingly, shareholders have limited financial information on which to evaluate the Surviving Company and their investment decisions. • The fairness opinion obtained by the Prospector Board will not reflect changes, circumstances, developments or events that may have occurred or may occur after the date of the opinion. • Following the Business Combination, the Surviving Company will qualify as a foreign private issuer within the meaning of the rules under the Exchange Act, and, as such, will be exempt from certain provisions applicable to United States domestic public companies. The Surviving Company could lose its status as a foreign private issuer in the future, causing it to incur substantial costs, time and resources. • As a foreign private issuer, the Surviving Company will be permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq listing standards; these practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq listing standards. • The by - laws of the Surviving Company that will be in effect upon the Closing will designate the Superior Court of Justice of the Province of Québec, Canada and the appellate courts therefrom as the exclusive forum for certain litigation that may be initiated by the Surviving Company’s shareholders, which could limit the Surviving Company’s shareholders’ ability to obtain a favorable judicial forum for disputes with the Surviving Company. 39

Risks Related to Prospector and the Business Combination • The Sponsor has agreed to vote in favor of the Business Combination, regardless of how our public shareholders vote. • The announcement of the proposed Business Combination could disrupt the Company’s relationships with its customers, suppliers, business partners and others, as well as its operating results and business generally. • If the conditions to the Business Combination Agreement are not met, the Business Combination may not occur. • Prospector may be able to complete the Business Combination even if a substantial majority of Prospector’s shareholders redeem their Prospector Class A Shares or vote against the Business Combination. • Prospector is an emerging growth company subject to reduced disclosure requirements, and there is a risk that availing itself of such reduced disclosure requirements will make its ordinary shares less attractive to investors and may make it more difficult to compare Prospector’s performance with other public companies. • If Prospector is deemed to be an investment company under the Investment Company Act of 1940, as amended, it may be required to institute burdensome compliance requirements and its activities may be restricted, which may make it difficult to complete the Business Combination or cause the parties to abandon their efforts to complete the Business Combination. • Prospector’s ability to complete an initial business combination with a U.S. target company may be impacted if such initial business combination is subject to U.S. foreign investment regulations and review by a U.S. government entity, such as the Committee on Foreign Investment in the United States (“CFIUS”), and ultimately prohibited. • If Prospector is unable to complete the Business Combination or another initial business combination by December 31, 2023, Prospector will cease all operations except for the purpose of winding up, redeeming 100% of the outstanding public shares, and, subject to the approval of its remaining shareholders and Prospector’s board of directors, dissolving and liquidating. • Because Prospector is incorporated under the laws of the Cayman Islands, in the event the Business Combination is not completed, Prospector’s shareholders may face difficulties in protecting their interests, and their abilities to protect their rights through the U.S. federal courts may be limited. • If Prospector is unable to consummate its business combination by December 31, 2023, Prospector’s public shareholders may be forced to wait until December 31, 2023 before redemption from Prospector’s Trust Account. • Prospector and the Company will incur significant transaction and transition costs in connection with the Business Combination. • Subsequent to the consummation of the Business Combination, the Surviving Company may be exposed to unknown or contingent liabilities and may be required to subsequently take write - downs or write - offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition, results of operations and its share price, which could cause you to lose some or all of your investment. • The historical financial results of the Company and unaudited pro forma financial information may not be indicative of what the Surviving Company’s actual financial position or results of operations would have been. • After the Business Combination, our assets may not be sufficient to pay taxes or expenses, dividends or make distributions or loans to enable us to pay any dividends on Surviving Company Common Shares or satisfy our other financial obligations. • Prospector/Surviving Company may be or may become a passive foreign investment company (“PFIC”), which could result in adverse U.S. federal income tax consequences to U.S. Holders • The Business Combination has a specified Minimum Proceeds Condition. While redemptions by Prospector’s public shareholders are not expected to cause the parties to be unable to meet the Minimum Proceeds Condition, any failure of the PIPE Investors to fund their Tranche B - 2 purchase concurrently with the closing of the Business Combination will make it more difficult for Prospector to complete the Business Combination as contemplated. • During the pendency of the Business Combination, Prospector will not be able to enter into a business combination with another party because of restrictions in the Business Combination Agreement. Furthermore, certain provisions of the Business Combination Agreement will discourage third parties from submitting alternative takeover proposals, including proposals that may be superior to the arrangements contemplated by the Business Combination Agreement. • If third parties bring claims against Prospector, the proceeds held in the Trust Account could be reduced and the per share redemption amount received by shareholders may be less than $10.00 per share. 40

Risks Related to Prospector and the Business Combination (cont’d) • Prospector’s directors may decide not to enforce the indemnification obligations of their Sponsor, resulting in a reduction in the amount of funds in the Trust Account available for distribution to our public shareholders. • Prospector may not have sufficient funds to satisfy any indemnification claims from Prospector’s directors and executive officers. • If Prospector is unable to consummate its initial business combination, after Prospector distributes the proceeds in Prospector’s trust account to Prospector shareholders, and Prospector files a winding - up or bankruptcy petition or an involuntary winding - up or bankruptcy petition is filed against Prospector that is not dismissed, a bankruptcy court may seek to recover such proceeds, and Prospector’s board of directors may be viewed as having breached their fiduciary duties to Prospector creditors, thereby exposing the members of Prospector’s board to claims of punitive damage. • If Prospector is unable to consummate its initial business combination, and if a winding - up or bankruptcy petition or an involuntary winding - up or bankruptcy petition is filed against Prospector and it is not dismissed, the claims of creditors in such proceeding may have priority over the claims of Prospector shareholders and the per share amount that would otherwise be received by Prospector shareholders in connection with Prospector’s liquidation may be reduced. • Prospector’s shareholders may be held liable for claims by third parties against Prospector to the extent of distributions received by them upon redemption of their shares if no business combination occurs. • The public shareholders will experience immediate dilution as a consequence of the issuance of Surviving Company Common Shares as consideration in the Business Combination and the PIPE Financing and due to future issuances pursuant to the Incentive Plan, and may experience future dilution in the event of the vesting and conversion of the Surviving Company Earnout Non - Voting Special Shares. • Warrants will become exercisable for Surviving Company Common Shares, which would increase the number of shares eligible for future resale in the public market and result in dilution to our shareholders. • Even if the Business Combination is consummated, the public warrants may never be in the money, and they may expire worthless and the terms of the warrants may be amended in a manner adverse to a holder if holders of at least 65% of the then outstanding public warrants approve of such amendment. • Prospector may redeem your unexpired warrants prior to their exercise at a time that is disadvantageous to you, thereby making your warrants worthless. • There can be no assurance that the Surviving Company Common Shares that will be issued in connection with the Business Combination will be approved for listing on Nasdaq following the Closing, or that the Surviving Company will be able to comply with the continued listing rules of Nasdaq. • The process of taking a company public by means of a business combination with a special purpose acquisition company is different from taking a company public through an initial public offering and may create risks for our unaffiliated investors. • Prospector, and following our initial business combination, the post - business combination company, may face litigation and other risks as a result of Prospector’s material weaknesses in its internal control over financial reporting. 41

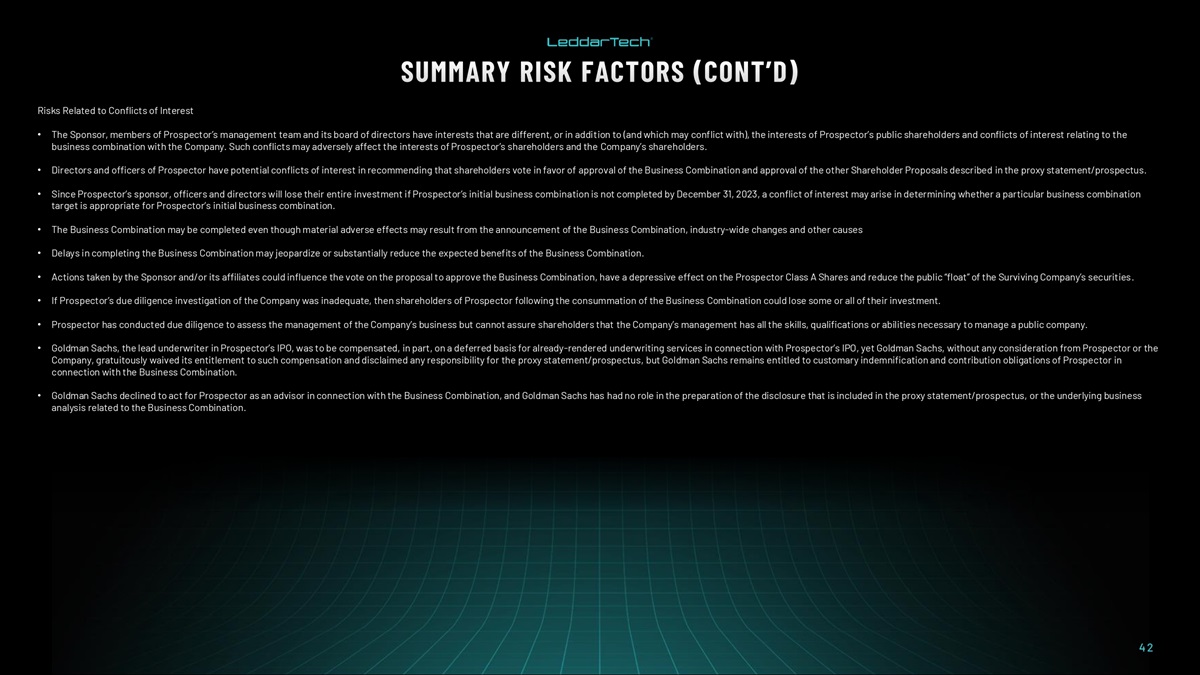

Risks Related to Conflicts of Interest • The Sponsor, members of Prospector’s management team and its board of directors have interests that are different, or in addition to (and which may conflict with), the interests of Prospector’s public shareholders and conflicts of interest relating to the business combination with the Company. Such conflicts may adversely affect the interests of Prospector’s shareholders and the Company’s shareholders. • Directors and officers of Prospector have potential conflicts of interest in recommending that shareholders vote in favor of approval of the Business Combination and approval of the other Shareholder Proposals described in the proxy statement/prospectus. • Since Prospector’s sponsor, officers and directors will lose their entire investment if Prospector’s initial business combination is not completed by December 31, 2023, a conflict of interest may arise in determining whether a particular business combination target is appropriate for Prospector’s initial business combination. • The Business Combination may be completed even though material adverse effects may result from the announcement of the Business Combination, industry - wide changes and other causes • Delays in completing the Business Combination may jeopardize or substantially reduce the expected benefits of the Business Combination. • Actions taken by the Sponsor and/or its affiliates could influence the vote on the proposal to approve the Business Combination, have a depressive effect on the Prospector Class A Shares and reduce the public “float” of the Surviving Company’s securities. • If Prospector’s due diligence investigation of the Company was inadequate, then shareholders of Prospector following the consummation of the Business Combination could lose some or all of their investment. • Prospector has conducted due diligence to assess the management of the Company’s business but cannot assure shareholders that the Company’s management has all the skills, qualifications or abilities necessary to manage a public company. • Goldman Sachs, the lead underwriter in Prospector’s IPO, was to be compensated, in part, on a deferred basis for already - rendered underwriting services in connection with Prospector’s IPO, yet Goldman Sachs, without any consideration from Prospector or the Company, gratuitously waived its entitlement to such compensation and disclaimed any responsibility for the proxy statement/prospectus, but Goldman Sachs remains entitled to customary indemnification and contribution obligations of Prospector in connection with the Business Combination. • Goldman Sachs declined to act for Prospector as an advisor in connection with the Business Combination, and Goldman Sachs has had no role in the preparation of the disclosure that is included in the proxy statement/prospectus, or the underlying business analysis related to the Business Combination. 42

LEDDARTECH HEAD OFFICE 4535 boulevard Wilfrid - Hamel, Suite 240 Québec (Québec) G1P 2J7 Canada