- LICY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

POS AM Filing

Li-Cycle (LICY) POS AMProspectus update (post-effective amendment)

Filed: 15 Feb 22, 6:30pm

Ontario | 4955 | Not Applicable | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Paul M. Tiger Andrea M. Basham Freshfields Bruckhaus Deringer US LLP 601 Lexington Avenue New York, NY 10022 (212) 277-4000 | Jonathan Grant Fraser Bourne McCarthy Tétrault LLP 66 Wellington Street West, Suite 5300, TD Bank Tower Box 48 Toronto, Ontario M5K 1E6 Tel: (416) 362-1812 |

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

PRELIMINARYPROSPECTUS | SUBJECT TO COMPLETION, DATED FEBRUARY 1 5 , 2022 |

| 1 | ||||

| 12 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 39 | ||||

| 53 | ||||

| 76 | ||||

| 83 | ||||

| 96 | ||||

| 101 | ||||

| 106 | ||||

| 110 | ||||

| 113 | ||||

| 115 | ||||

| 119 | ||||

| 121 | ||||

| 125 | ||||

| 129 | ||||

| 130 | ||||

| 130 | ||||

| 131 | ||||

| 132 | ||||

| F-1 | ||||

| • | we work closely with a reliable network of logistics partners to support customers in transporting their batteries to our facilities; |

| • | we offer our customers a home for the secure destruction of materials containing IP-sensitive design information, such as research and development batteries and battery materials. We have adopted procedures to protect the privacy and confidentiality of our customers’ trade secrets; and |

| • | in addition to providing advice on packaging and support with procurement, we provide spare battery storage, manage comprehensive battery replacement campaigns and customize programs and services to individual customers’ needs. |

| • | not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002; |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | not being required to hold a nonbinding advisory vote on executive compensation or seek shareholder approval of any golden parachute payments not previously approved. |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the Securities and Exchange Commission (the “SEC”) of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form8-K, upon the occurrence of specified significant events. |

| • | Li-Cycle’s success will depend on its ability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third-party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries. |

| • | Li-Cycle may not be able to successfully implement its global growth strategy, on a timely basis or at all, and may be unable to manage future global growth effectively. Expanding internationally involves risks that could delay our expansion plans and/or prohibit us from entering markets in certain jurisdictions, which could have a material adverse effect on results of operations. |

| • | The development of Li-Cycle’s Rochester Hub, Spoke Capital Projects and other future projects is subject to risks and Li-Cycle cannot guarantee that these projects will be completed in a timely manner, that costs will not be significantly higher than estimated, or that the completed projects will meet expectations with respect to productivity or the specifications of their end products, among others. |

| • | Li-Cycle may engage in strategic transactions that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in the incurrence of debt or other liabilities, or prove not to be successful. |

| • | Failure to materially increase recycling capacity and efficiency could have a material adverse effect on Li-Cycle’s business, results of operations or financial condition. Li-Cycle is and will be dependent on its recycling facilities. If one or more of its current or future facilities become inoperative, capacity constrained or if operations are disrupted, Li-Cycle’s business, results of operations or financial condition could be materially adversely affected. |

| • | Li-Cycle may in the future need to raise additional funds to meet its capital requirements and such funds may not be available to Li-Cycle on commercially reasonable terms or at all, which could materially adversely affect Li-Cycle’s business, results of operations or financial condition. |

| • | Li-Cycle has a history of losses and expects to incur significant expenses for the foreseeable future, and there is no guarantee it will achieve or sustain profitability. |

| • | Problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations could materially affect Li-Cycle’s revenues and business. |

| • | Li-Cycle’s business is subject to operational risks that could disrupt our business, some of which may not be insured or fully covered by insurance. |

| • | Li-Cycle’s revenue depends on maintaining and increasing feedstock supply commitments as well as securing new customers and off-take agreements. |

| • | A decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies, could materially harm Li-Cycle’s financial results and ability to grow its business. |

| • | Decreases and fluctuations in benchmark prices for the metals contained in Li-Cycle’s products could significantly impact Li-Cycle’s revenues and results of operations. In addition to commodity prices, Li-Cycle’s revenues are primarily driven by the volume and composition of lithium-ion battery feedstock materials processed at its facilities (including manufacturing scrap, spent batteries and third-party purchased black mass) and changes in the volume or composition of feedstock processed could significantly impact Li-Cycle’s revenues and results of operations. |

| • | The development of an alternative chemical make-up of lithium-ion batteries or battery alternatives could adversely affect Li-Cycle’s revenues and results of operations. |

| • | Li-Cycle’s projected revenues for the Rochester Hub are derived significantly from a single customer. |

| • | Li-Cycle’s heavy reliance on the experience and expertise of its management may cause adverse impacts on it if a management member departs. |

| • | Li-Cycle relies on third-party consultants for its regulatory compliance and Li-Cycle could be adversely impacted if the consultants do not correctly inform Li-Cycle of the legal changes. Further, Li-Cycle is subject to the risk of litigation or regulatory proceedings, which could impact its financial results. |

| • | Li-Cycle may not be able to complete its recycling processes as quickly as customers may require, which could cause it to lose supply contracts and could harm its reputation. Li-Cycle operates in an emerging, competitive industry and if it is unable to compete successfully its revenue and profitability will be adversely affected. |

Issuer | Li-Cycle Holdings Corp. |

Securities that may be offered and sold from time to time by the selling shareholder | Up to 11,021,923 common shares issuable upon conversion of the Spring Creek Capital Convertible Note or pursuant to any other term of the Spring Creek Capital Convertible Note, including as a result of any of the PIK provisions of the Spring Creek Capital Convertible Note, which was issued to the selling shareholder in a transaction exempt from registration pursuant to Section 4(a)(2) of the Securities Act. |

Offering prices | The securities offered by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the selling shareholder may determine. See “ Plan of Distribution |

Common shares outstanding before this offering | 168,891,877 common shares (as of February 11, 2022). |

Common shares outstanding after this offering | 179,913,800 common shares (as of February 11, 2022). |

Registration rights granted to the selling shareholder | We are registering the offer and sale of securities covered by this prospectus to satisfy certain registration rights we have granted to the selling shareholder. See the section titled “ Description of Securities — Registration Rights |

Dividend policy | We have not paid any cash dividends on our common shares to date and do not intend to pay cash dividends for the foreseeable future. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements, any future debt agreements and general financial condition. The payment of any cash dividends will be within the discretion of our board of directors at such time. See “ Dividend Policy |

Use of proceeds | We will not receive any proceeds from the sale of shares by the selling shareholder. See “ Use of Proceeds |

Market for our common shares | Our common shares are listed on The New York Stock Exchange under the symbol “LICY”. |

Risk factors | Investing in our securities involves substantial risks. See “ Risk Factors |

| • | Li-Cycle’s success will depend on its ability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third-party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries. |

| • | Li-Cycle may not be able to successfully implement its global growth strategy, on a timely basis or at all, and may be unable to manage future global growth effectively. Expanding internationally involves risks that could delay our expansion plans and/or prohibit us from entering markets in certain jurisdictions, which could have a material adverse effect on results of operations. |

| • | The development of Li-Cycle’s Rochester Hub, Spoke Capital Projects and other future projects is subject to risks and Li-Cycle cannot guarantee that these projects will be completed in a timely manner, that costs will not be significantly higher than estimated, or that the completed projects will meet expectations with respect to productivity or the specifications of their end products, among others. |

| • | Li-Cycle may engage in strategic transactions that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in the incurrence of debt or other liabilities, or prove not to be successful. |

| • | Failure to materially increase recycling capacity and efficiency could have a material adverse effect on Li-Cycle’s business, results of operations or financial condition. Li-Cycle is and will be dependent on its recycling facilities. If one or more of its current or future facilities become inoperative, capacity constrained or if operations are disrupted, Li-Cycle’s business, results of operations or financial condition could be materially adversely affected. |

| • | Li-Cycle may in the future need to raise additional funds to meet its capital requirements and such funds may not be available to Li-Cycle on commercially reasonable terms or at all, which could materially adversely affect Li-Cycle’s business, results of operations or financial condition. |

| • | Li-Cycle has a history of losses and expects to incur significant expenses for the foreseeable future, and there is no guarantee it will achieve or sustain profitability. |

| • | Problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations could materially affect Li-Cycle’s revenues and business. |

| • | Li-Cycle’s business is subject to operational risks that could disrupt our business, some of which may not be insured or fully covered by insurance. |

| • | Li-Cycle’s revenue depends on maintaining and increasing feedstock supply commitments as well as securing new customers and off-take agreements. |

| • | A decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies, could materially harm Li-Cycle’s financial results and ability to grow its business. |

| • | Decreases and fluctuations in benchmark prices for the metals contained in Li-Cycle’s products could significantly impact Li-Cycle’s revenues and results of operations. In addition to commodity prices, Li-Cycle’s revenues are primarily driven by the volume and composition of lithium-ion battery feedstock materials processed at its facilities (including manufacturing scrap, spent batteries andthird-party purchased black mass) and changes in the volume or composition of feedstock processed could significantly impact Li-Cycle’s revenues and results of operations. |

| • | The development of an alternative chemical make-up of lithium-ion batteries or battery alternatives could adversely affect Li-Cycle’s revenues and results of operations. |

| • | Li-Cycle’s projected revenues for the Rochester Hub are derived significantly from a single customer. |

| • | Li-Cycle’s heavy reliance on the experience and expertise of its management may cause adverse impacts on it if a management member departs. |

| • | Li-Cycle relies on third-party consultants for its regulatory compliance and Li-Cycle could be adversely impacted if the consultants do not correctly inform Li-Cycle of the legal changes. Further, Li-Cycle is subject to the risk of litigation or regulatory proceedings, which could impact its financial results. |

| • | Li-Cycle may not be able to complete its recycling processes as quickly as customers may require, which could cause it to lose supply contracts and could harm its reputation. Li-Cycle operates in an emerging, competitive industry and if it is unable to compete successfully its revenue and profitability will be adversely affected. |

| • | Increases in income tax rates, changes in income tax laws or disagreements with tax authorities could adversely affect Li-Cycle’s business, financial condition or results of operations. |

| • | Li-Cycle’s operating and financial results may vary significantly from period to period due to fluctuations in its operating costs and other factors. |

| • | Fluctuations in foreign currency exchange rates could result in declines in reported sales and net earnings. |

| • | Unfavorable economic conditions, including the consequences of the global COVID-19 pandemic, may have a material adverse effect on Li-Cycle’s business, results of operations and financial condition. |

| • | Natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, cyber incidents, boycotts and geo-political events could materially adversely affect Li-Cycle’s business, results of operations or financial condition. |

| • | Failure to protect or enforce Li-Cycle’s intellectual property could adversely affect its business, and Li-Cycle may be subject to intellectual property rights claims by third parties, which could be costly to defend, could require us to pay significant damages and could limit the Company’s ability to use certain technologies. |

| • | Li-Cycle has identified material weaknesses in its internal control over financial reporting. If its remediation of such material weaknesses is not effective, or if it fails to develop and maintain a proper and effective internal control over financial reporting, its ability to produce timely and accurate financial statements or comply with applicable laws and regulations could be impaired. |

| • | Our by-laws provide, subject to limited exceptions, that the Superior Court of Justice of the Province of Ontario and the appellate courts therefrom are the sole and exclusive forum for certain shareholder litigation matters, which could limit shareholders’ ability to obtain a favorable judicial forum for disputes. |

| • | Our common shares have only recently become publicly traded, and the market price of our common shares may be volatile. The trading price of our common shares could be subject to wide fluctuations. Sales of substantial amounts of our common shares after the expiration of applicable lock-up periods, or the perception that such sales will occur, could adversely affect the market price of our common shares. |

| • | NYSE may delist our common shares, which could limit investors’ ability to engage in transactions in our common shares and subject us to additional trading restrictions. Because Li-Cycle has historically operated as a private company, we have limited experience complying with public company obligations and fulfilling these obligations is expensive and time consuming and may divert management’s attention from the day-to-day operation of our business. |

| • | As a “foreign private issuer” under the rules and regulations of the SEC, we are permitted to, and will, file less or different information with the SEC than a company incorporated in the United States or otherwise subject to these rules, and will follow certain home country corporate governance practices in lieu of certain NYSE requirements applicable to U.S. issuers. |

| • | Failure to develop and maintain effective internal control over financial reporting could have a material adverse effect on our business, results of operations and stock price. |

| • | As an “emerging growth company,” the Company cannot be certain if reduced disclosure and governance requirements applicable to “emerging growth companies” will make its shares less attractive to investors. |

| • | We may issue additional shares or other equity securities without shareholder approval, which would dilute the ownership interests of existing shareholders and may depress the market price of our common shares. The issuance of our common shares in connection with the conversion of the Spring Creek Capital Convertible Note would cause substantial dilution, and could materially affect the trading price of our common shares. The Company becoming a PFIC could also have adverse consequences for U.S. Holders. We do not currently intend to pay dividends, which could affect your ability to achieve a return on your investment. |

| • | The Company’s ability to meet expectations and projections in any research or reports published by securities or industry analysts, or a lack of coverage by securities or industry analysts, could result in a depressed market price and limited liquidity for its shares. |

| • | The Company may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition, results of operations and share price, which could cause you to lose some or all of your investment. |

| • | Economically recycle and recover lithium-ion batteries and lithium-ion battery materials and meet customers’ business needs; |

| • | Effectively introduce methods for higher recovery rates of lithium-ion batteries and solutions to recycling; |

| • | Complete the construction of its future facilities, including the Rochester Hub, and the Spoke Capital Projects at a reasonable cost on a timely basis; |

| • | Invest and keep pace in technology, research and development efforts, and the expansion and defense of its intellectual property portfolio; |

| • | Secure and maintain required strategic supply arrangements; |

| • | Secure and maintain leases for future Spoke & Hub facilities at competitive rates and in favorable locations; |

| • | Apply for and obtain the permits necessary to operate Spoke & Hub facilities on a timely basis; |

| • | Effectively compete in the markets in which it operates; and |

| • | Attract and retain management or other employees who possess specialized knowledge and technical skills. |

| • | political, civil and economic instability; |

| • | corruption risks; |

| • | trade, customs and tax risks; |

| • | currency exchange rates and currency controls; |

| • | limitations on the repatriation of funds; |

| • | insufficient infrastructure; |

| • | restrictions on exports, imports and foreign investment; |

| • | increases in working capital requirements related to long supply chains; |

| • | changes in labor laws and regimes and disagreements with the labor force; |

| • | difficulty in protecting intellectual property rights and complying with data privacy and protection laws and regulations; and |

| • | different and less established legal systems. |

| • | equipment failures; |

| • | personnel shortage; |

| • | labor disputes; or |

| • | transportation disruptions. |

| • | the COVID-19 pandemic and its impact on the markets and economies in which we operate; |

| • | our actual or anticipated operating performance and the operating performance of our competitors; |

| • | failure of securities analysts to initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow our company, or our failure to meet the estimates or the expectations of investors; |

| • | any major change in our board of directors, management, or key personnel; |

| • | market conditions in our industry; |

| • | general economic conditions such as recessions, interest rates, fuel prices, international currency fluctuations; |

| • | rumors and market speculation involving us or other companies in our industry; |

| • | announcements by us or our competitors of significant innovations, new products, services or capabilities, acquisitions, strategic investments, partnerships, joint venture or capital commitments; |

| • | the legal and regulatory landscape and changes in the application of existing laws or adoption of new laws that impact our business; |

| • | legal and regulatory claims, litigation, or pre-litigation disputes and other proceedings; |

| • | other events or factors, including those resulting from war, incidents of terrorism, or responses to these events; and |

| • | sales or expected sales of our common shares by us, our officers, directors, significant shareholders, and employees. |

| • | a limited availability of market quotations for our securities; |

| • | a limited amount of news and analyst coverage for the Company; and |

| • | a decreased ability to obtain capital or pursue acquisitions by issuing additional equity or convertible securities. |

| • | our existing shareholders’ proportionate ownership will decrease; |

| • | the amount of cash available per share, including for payment of dividends in the future, may decrease; |

| • | the relative voting strength of each previously outstanding share may be diminished; and |

| • | the market price of our common shares may decline. |

| • | discuss future expectations; |

| • | contain projections of future results of operations or financial condition; or |

| • | state other “forward-looking” information. |

| • | changes adversely affecting the industry in which we operate; |

| • | our ability to achieve our business strategies or to manage our growth; |

| • | general economic conditions; |

| • | the effects of the COVID-19 pandemic on the global economy, on the markets in which we compete and on our business; |

| • | our ability to maintain the listing of our securities on NYSE; |

| • | our ability to retain our key employees; |

| • | our ability to recognize the anticipated benefits of the Business Combination; and |

| • | the outcome of any legal proceedings or arbitrations that may be instituted against us or in which we may be involved. |

(US$) | As at October 31, 2021 | |||

Cash & cash equivalents | $ | 596,858,298 | ||

Other current assets | $ | 14,890,651 | ||

Non-current assets | $ | 53,399,223 | ||

Total assets | $ | 665,148,172 | ||

Accounts payable and accrued liabilities | $ | 18,701,116 | ||

Lease liabilities | $ | 29,364,869 | ||

Loans payable | $ | 39,748 | ||

Restoration provisions | $ | 334,233 | ||

Convertible debt | $ | 100,877,838 | ||

Warrant liability | $ | 82,109,334 | ||

Total liabilities | $ | 231,427,138 | ||

Share capital | $ | 672,079,154 | ||

Contributed surplus | $ | 3,026,721 | ||

Accumulated deficit | $ | (241,088,229 | ) | |

Accumulated other comprehensive income | $ | (296,612 | ) | |

Total shareholders’ equity | $ | 433,721,034 | ||

Total liabilities and shareholders’ equity | $ | 665,148,172 | ||

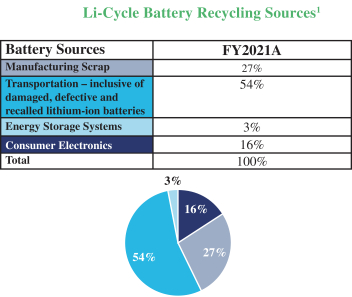

| 1. | Measured by weight of battery materials |

| • | we work closely with a reliable network of logistics partners to support customers in transporting their batteries to our facilities; |

| • | we offer our customers a home for the secure destruction of materials containing IP-sensitive design information, such as research and development batteries and battery materials. We have adopted procedures to protect the privacy and confidentiality of our customers’ trade secrets; and |

| • | in addition to providing advice on packaging and support with procurement, we provide spare battery storage, manage comprehensive battery replacement campaigns and customize programs and services to individual customers’ needs. |

Lease period | ||||||||||||||||

Country | Location | Gross Floor Area (square foot) | Use | Start End | ||||||||||||

Canada | Millhaven, Ontario | 46,639 | Construction of new spokes | 7/1/2021 | 6/30/2024 | |||||||||||

Canada | Toronto, Ontario | 31,762 | Office | 6/1/2021 | 5/31/2031 | |||||||||||

United States of America | Cottondale, Alabama | 120,000 | Storage | 11/1/2021 | 12/31/2023 | |||||||||||

United States of America | North Port, Alabama | 108,469 | Plant | 4/1/2022 | 3/31/2042 | |||||||||||

United States of America | Gilbert, Arizona | 138,949 | Plant | 10/1/2021 | 2/28/2032 | |||||||||||

United States of America | Mesa, Arizona | 69,016 | Storage | 9/1/2021 | 11/30/2026 | |||||||||||

United States of America | Greece, New York | 63,901 | Plant | 7/1/2019 | 6/30/2029 | |||||||||||

United States of America | Webster, New York | 37,231 | Storage | 4/1/2020 | 3/31/2025 | |||||||||||

United States of America | Rochester, New York | 2,309,000 | Land | 12/1/2021 | 11/30/2041 | |||||||||||

United States of America | Rochester, New York | 98,500 | Storage | 11/1/2021 | 12/31/2022 | |||||||||||

Country | Location | Gross Floor Area (square foot) | Use | |||||||||

Canada | Kingston, Ontario | 1,307,000 | Land | |||||||||

| 1 | Adjusted EBITDA is a non-IFRS financial measure and does not have a standardized meaning under IFRS. See“Non-IFRS Measures” in this MD&A for more details, including a reconciliation to the most comparable IFRS financial measure. |

| • | Li-Cycle’s shareholders prior to the Business Combination have the greatest voting interest in the combined entity relative to other shareholders (including following the redemptions discussed under “— Liquidity and Capital Resources — Sources of Liquidity”); |

| • | The largest individual minority shareholder of the combined entity is an existing shareholder of Li-Cycle; |

| • | The Company’s senior management is the senior management of Li-Cycle; |

| • | Li-Cycle is the larger entity based on historical total assets and revenues; and |

| • | Li-Cycle’s operations comprise the ongoing operations of the Company. |

| • | political, civil and economic instability; |

| • | corruption risks; |

| • | trade, customs and tax risks; |

| • | currency exchange rates and currency controls; |

| • | limitations on the repatriation of funds; |

| • | insufficient infrastructure; |

| • | restrictions on exports, imports and foreign investment; |

| • | increases in working capital requirements related to long supply chains; |

| • | changes in labor laws and regimes and disagreements with the labor force; |

| • | difficulty in protecting intellectual property rights; and |

| • | different and less established legal systems. |

Three months ended October 31, | $ Change | % Change | Year Ended October 31, October 31, | $ Change | % Change | |||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||||||||

(amounts in thousands, except per share data) | ||||||||||||||||||||||||||||||||

Revenues | 4,391 | 469 | 3,922 | 836 | % | 7,375 | 792 | 6,583 | 831 | % | ||||||||||||||||||||||

Product sales | 4,248 | 370 | 3,878 | 1049 | % | 6,930 | 555 | 6,376 | 1149 | % | ||||||||||||||||||||||

Recycling Services | 143 | 99 | 44 | 44 | % | 444 | 237 | 207 | 87 | % | ||||||||||||||||||||||

Operating expenses | 18,558 | 4,966 | 13,592 | 274 | % | 39,232 | 9,934 | 29,298 | 295 | % | ||||||||||||||||||||||

Employee salaries and benefits, net | 4,987 | 1,404 | 3,584 | 255 | % | 12,710 | 2,819 | 9,891 | 351 | % | ||||||||||||||||||||||

Professional fees | 3,470 | 1,402 | 2,068 | 147 | % | 7,689 | 2,962 | 4,726 | 160 | % | ||||||||||||||||||||||

Share-based compensation | 2,675 | 112 | 2,563 | 2284 | % | 3,983 | 333 | 3,650 | 1097 | % | ||||||||||||||||||||||

Raw materials and supplies | 1,406 | 200 | 1,206 | 602 | % | 3,410 | 592 | 2,818 | 476 | % | ||||||||||||||||||||||

Office, administrative and travel | 2,095 | 217 | 1,878 | 866 | % | 3,149 | 477 | 2,672 | 561 | % | ||||||||||||||||||||||

Depreciation | 1,069 | 378 | 691 | 183 | % | 2,899 | 1,095 | 1,804 | 165 | % | ||||||||||||||||||||||

Research and development, net | 734 | 796 | (62 | ) | (8 | )% | 2,663 | 777 | 1,886 | 243 | % | |||||||||||||||||||||

Freight and shipping | 445 | 80 | 365 | 459 | % | 1,033 | 137 | 896 | 654 | % | ||||||||||||||||||||||

Plant facilities | 355 | 167 | 188 | 112 | % | 1,031 | 391 | 640 | 164 | % | ||||||||||||||||||||||

Marketing | 508 | 177 | 331 | 187 | % | 974 | 366 | 608 | 166 | % | ||||||||||||||||||||||

Change in Finished Goods Inventory | 813 | 33 | 780 | 2379 | % | (308 | ) | (14 | ) | (294 | ) | 2095 | % | |||||||||||||||||||

Other (income) expenses | 190,802 | (63 | ) | 190,865 | (302380 | )% | 194,702 | 134 | 194,568 | 145093 | % | |||||||||||||||||||||

Listing Fee | 152,719 | — | 152,719 | 100 | % | 152,719 | — | 152,719 | 100 | % | ||||||||||||||||||||||

Fair value loss on financial instruments | 35,821 | 84 | 35,737 | 42315 | % | 38,254 | 84 | 38,170 | 45196 | % | ||||||||||||||||||||||

Interest expense | 2,120 | 189 | 1,931 | 1022 | % | 3,053 | 530 | 2,523 | 476 | % | ||||||||||||||||||||||

Foreign exchange (gain) loss | 222 | (336 | ) | 558 | (166 | )% | 758 | (446 | ) | 1,204 | (270 | )% | ||||||||||||||||||||

Interest income | (81 | ) | — | (81 | ) | 35792 | % | (82 | ) | (34 | ) | (48 | ) | 140 | % | |||||||||||||||||

Net loss | (204,969 | ) | (4,433 | ) | (200,535 | ) | 4523 | % | (226,559 | ) | (9,276 | ) | (217,283 | ) | 2342 | % | ||||||||||||||||

Foreign currency translation adjustment | 0 | 58 | (58 | ) | (100 | )% | 0 | (219 | ) | 219 | (100 | )% | ||||||||||||||||||||

Comprehensive loss | (204,969 | ) | (4,375 | ) | (200,593 | ) | 4585 | % | (226,559 | ) | (9,495 | ) | (217,065 | ) | 2286 | % | ||||||||||||||||

Basic and diluted loss per share | (1.31 | ) | (0.05 | ) | (1.26 | ) | 2405 | % | (2.06 | ) | (0.11 | ) | (1.94 | ) | 1689 | % | ||||||||||||||||

Weighted average number of common shares outstanding | 155,887 | 83,361 | 72,525 | 87 | % | 110,119 | 82,572 | 27,547 | 33 | % | ||||||||||||||||||||||

Year ended October 31, | $ Change | % Change | ||||||||||||||

2020 | 2019 | |||||||||||||||

(amounts in thousands, except per share data) | ||||||||||||||||

Revenues | 792 | 48 | 744 | 1545 | % | |||||||||||

Product sales | 555 | — | 555 | 100 | % | |||||||||||

Recycling Services | 237 | 48 | 189 | 393 | % | |||||||||||

Operating expenses | 9,934 | 4,112 | 5,822 | 142 | % | |||||||||||

Employee salaries and benefits, net | 2,819 | 608 | 2,211 | 364 | % | |||||||||||

Professional fees | 2,962 | 547 | 2,416 | 442 | % | |||||||||||

Share-based compensation | 333 | 97 | 235 | 242 | % | |||||||||||

Raw materials and supplies | 592 | — | 592 | 100 | % | |||||||||||

Office, administrative and travel | 477 | 493 | (17 | ) | (3 | )% | ||||||||||

Depreciation | 1,095 | 184 | 911 | 496 | % | |||||||||||

Research and development, net | 777 | 2,112 | (1,335 | ) | (63 | )% | ||||||||||

Freight and shipping | 137 | 6 | 131 | 2268 | % | |||||||||||

Plant facilities | 391 | — | 391 | 100 | % | |||||||||||

Marketing | 366 | 66 | 300 | 456 | % | |||||||||||

Change in Finished Goods Inventory | (14 | ) | — | (14 | ) | 100 | % | |||||||||

Other (income) expenses | 134 | 37 | 97 | 265 | % | |||||||||||

Fair value loss on financial instruments | 84 | — | 84 | 100 | % | |||||||||||

Interest expense | 530 | 60 | 469 | 778 | % | |||||||||||

Foreign exchange (gain) loss | (446 | ) | — | (446 | ) | 100 | % | |||||||||

Interest income | (34 | ) | (24 | ) | (11 | ) | 46 | % | ||||||||

Net loss | (9,276 | ) | (4,101 | ) | (5,175 | ) | 126 | % | ||||||||

Foreign currency translation adjustment | (219 | ) | (37 | ) | (182 | ) | 488 | % | ||||||||

Comprehensive loss | (9,495 | ) | (4,138 | ) | (5,357 | ) | 129 | % | ||||||||

Basic and diluted loss per share | (0.11 | ) | (0.06 | ) | (0.06 | ) | 100 | % | ||||||||

Weighted average number of common shares outstanding | 82,572 | 71,891 | 10,680 | 15 | % | |||||||||||

Three months ended October 31, | Twelve months ended October 31, | |||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2019 | ||||||||||||||||

(dollar amounts in thousands) | ||||||||||||||||||||

Net loss | (204,969 | ) | (4,433 | ) | (226,559 | ) | (9,276 | ) | (4,101 | ) | ||||||||||

Depreciation | 1,069 | 378 | 2,899 | 1,095 | 184 | |||||||||||||||

Interest expense (income) | 2,040 | 189 | 2,970 | 495 | 37 | |||||||||||||||

Foreign exchange (gain) loss | 222 | (336 | ) | 758 | (446 | ) | — | |||||||||||||

Fair value loss on financial instruments (1) | 35,821 | 84 | 38,254 | 84 | — | |||||||||||||||

Listing Fee | 152,719 | — | 152,719 | — | — | |||||||||||||||

Forfeited SPAC transaction cost | — | — | 2,000 | — | — | |||||||||||||||

Share-based compensation (2) | 1,588 | — | 1,588 | — | — | |||||||||||||||

Adjusted EBITDA loss | (11,510 | ) | (4,119 | ) | (25,370 | ) | (8,047 | ) | (3,880 | ) | ||||||||||

| (1) | Fair value loss on financial instruments relates to warrants, convertible debt, and restricted share units liability |

| (2) | Share-based compensation relates to accelerated vesting of existing stock options upon completion of the Business Combination. |

Three months ended October 31, | Twelve months ended October 31, | |||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2019 | ||||||||||||||||

(in thousands) | (in thousands) | |||||||||||||||||||

Cash flows used in operating activities | $ | (11,311 | ) | $ | (1,770 | ) | $ | (27,877 | ) | $ | (7,429 | ) | $ | (4,568 | ) | |||||

Cash flows used in investing activities | (6,153 | ) | (1,364 | ) | (18,203 | ) | (5,108 | ) | (998 | ) | ||||||||||

Cash flows from financing activities | 611,972 | (85 | ) | 642,276 | 9,417 | 7,164 | ||||||||||||||

Net change in cash | $ | 594,508 | $ | (3,219 | ) | $ | 596,195 | $ | (3,120 | ) | $ | 1,598 | ||||||||

Payment due by period (in thousands) | ||||||||||||||||||||

Contractual Obligations | Total | Less than 1 year | 1 - 3 years | 3 - 5 years | More than 5 years | |||||||||||||||

Accounts payable and accrued liabilities | $ | 18,701 | $ | 18,701 | $ | — | $ | — | — | |||||||||||

Lease liabilities | 35,935 | 4,518 | 8,420 | 6,687 | 16,310 | |||||||||||||||

Loan payable | 41 | 6 | 13 | 14 | 7 | |||||||||||||||

Restoration provisions | 302 | — | 85 | 55 | 163 | |||||||||||||||

Convertible Debt | 142,682 | — | — | 142,682 | — | |||||||||||||||

Total as of October 31, 2021 | 197,661 | 23,225 | 8,518 | 149,438 | 16,480 | |||||||||||||||

| (1) | On December 1, 2021, Li-Cycle Corp. entered into an additional warehouse lease for the Kingston Spoke. The lease covers approximately 8,600 square feet of additional space within the existing building used as a warehousing space for the Kingston Spoke. The lease has a term of 2 years and increases the Company’s contractual obligations by undiscounted cash flows of approximately $128,000 over the term of the lease. |

| • | 168,891,877 common shares, which are listed on the New York Stock Exchange under the symbol “LICY.” |

| • | 5,328,278 stock options to purchase 5,328,278 common shares. |

| • | up to 11,021,923 common shares issuable upon conversion of the Spring Creek Capital Convertible Note. |

Directors and Executive Officers | Age | Position/Title | ||

Ajay Kochhar | 30 | Director and President and Chief Executive Officer | ||

Tim Johnston | 36 | Director and Executive Chairman | ||

Mark Wellings | 58 | Director | ||

Rick Findlay | 64 | Director | ||

Anthony Tse | 51 | Director | ||

Alan Levande | 65 | Director | ||

Scott Prochazka | 55 | Director | ||

Bruce MacInnis | 63 | Chief Financial Officer (until January 31, 2022) | ||

Debbie Simpson | 55 | Chief Financial Officer (as of February 1, 2022) | ||

Kunal Phalpher | 38 | Chief Strategy Officer | ||

Chris Biederman | 36 | Chief Technology Officer | ||

Carl DeLuca | 54 | General Counsel and Corporate Secretary | ||

Lauren Choate | 63 | Chief People Officer | ||

Richard Storrie | 55 | Regional President, Americas | ||

Dawei Li | 39 | Regional President, APAC |

| • | Ajay Kochhar, Chief Executive Officer; |

| • | Tim Johnston, Executive Chairman; |

| • | Bruce MacInnis, Chief Financial Officer; |

| • | Kunal Phalpher, Chief Strategy Officer; and |

| • | Chris Biederman, Chief Technology Officer. |

| • | provide market-competitive compensation opportunities in order to attract and retain talented, high-performing and experienced executive officers, whose knowledge, skills and performance are critical to our success; |

| • | motivate these executive officers to achieve our business objectives; |

| • | align the interests of our executive officers with those of our shareholders by tying a meaningful portion of compensation directly to the long-term value and growth of our business; |

| • | continue to foster an entrepreneurial and results-driven culture; and |

| • | provide the appropriate balance of short and long-term incentives to encourage appropriate levels of risk-taking and prudent decision-making by the executive team. |

Name and Principal Position | Year | Salary (2) ($) | Share Awards (3) ($) | Option Awards (4) ($) | Non-Equity Incentive Plan Compensation (5) ($) | Pension Value ($) | All Other Compensation (6) ($) | Total Compensation ($) | ||||||||||||||||||||||||

Ajay Kochhar Chief Executive Officer | 2021 | 286,850 | 1,181,500 | 1,181,500 | 200,055 | — | 12,092 | 2,861,997 | ||||||||||||||||||||||||

Tim Johnston Executive Chairman | 2021 | 286,850 | 1,181,500 | 1,181,500 | 200,055 | — | 713 | 2,850,618 | ||||||||||||||||||||||||

Bruce MacInnis (7) Chief Financial Officer | 2021 | 220,916 | — | 2,077,000 | — | — | 445,286 | 2,743,202 | ||||||||||||||||||||||||

Kunal Phalpher Chief Strategy Officer | 2021 | 215,246 | 450,000 | 450,000 | 110,141 | — | 10,103 | 1,235,490 | ||||||||||||||||||||||||

Chris Biederman Chief Technology Officer | 2021 | 200,525 | 450,000 | 450,000 | 103,902 | — | 886 | 1,205,313 | ||||||||||||||||||||||||

| (1) | In the above table, all compensation is disclosed in U.S. dollars. A portion of the Salary and/or All Other Compensation for each NEO was paid in Canadian dollars. Those Canadian dollar amounts have been converted to U.S. dollars using the Bank of Canada’s average exchange rate between November 1, 2020 and October 31, 2021 (being the period of Fiscal 2021) of CA$1.00=U.S$0.7955. |

| (2) | Represents the actual base salary earned in Fiscal 2021. As at October 31, 2021, the annual base salary of each of our NEOs is as follows: $450,000 for Mr. Kochhar, $450,000 for Mr. Johnston, $325,000 for Mr. MacInnis, $300,000 for Mr. Phalpher and $300,000 for Mr. Biederman |

| (3) | Represents the grant date fair value of RSUs granted under our Long-Term Incentive Plan in connection with the closing of the Business Combination. The RSUs were granted in connection with the closing of the Business Combination with effect on December 10, 2021, being the date following the effectiveness of a registration statement on Form S-8 filed by the Company with the SEC to register the common shares issuable thereunder. |

| (4) | The grant date fair value of options awarded was calculated using the Black-Scholes Merton option pricing model, a common and widely-accepted valuation methodology. For the key assumptions used to determine the stock option value for the Fiscal 2021 grants using the Black-Scholes Merton option pricing model, see Note 12 in our financial statements for the year ended October 31, 2021. |

| (5) | See “Short-Term Incentives”, above. |

| (6) | Represents the value of employer’s contribution to employee’s registered retirement savings plan contributions and employee benefits coverage (such as health insurance and life insurance). The Company generally contributes 5% of each NEO’s base salary into a defined contribution registered retirement savings plan, subject to Revenue Canada maximums. |

| (7) | Following the entering into of the Retirement Agreement (as described below under “Employment Arrangements, Termination and Change in Control Benefits—Bruce MacInnis”), the Company and Mr. MacInnis mutually agreed that Mr. MacInnis’ retirement date would be January 31, 2022, and the Company agreed to accelerate and settle certain payments to Mr. MacInnis under the terms of the Retirement Agreement in an aggregate amount of $444,647, which amounts would be repayable to the Company if Mr. MacInnis’ employment were terminated by the Company for just cause or by Mr. MacInnis by way of voluntary resignation at any time prior to the retirement date. Mr. MacInnis retired on January 31, 2022. |

Compensation Element | RSU Award Value | Cash Value | ||||||

Standard Retainer | ||||||||

Director | $ | 100,000 | $ | 50,000 | ||||

Additional Retainers | ||||||||

Lead Director | — | $ | 25,000 | |||||

Audit Committee Chair | — | $ | 15,000 | |||||

Other Committee Chair | — | $ | 10,000 | |||||

Director | Fees Earned or Paid in Cash (1) ($) | Stock Awards (2) ($) | Option Awards | Non-Equity Incentive Plan Compensation | Pension Value | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

Rick Findlay | 37,215 | 311,124 | — | — | — | — | 348,339 | |||||||||||||||||||||

Alan Levande | 11,277 | 280,822 | — | — | — | — | 292,099 | |||||||||||||||||||||

Scott Prochazka | 14,660 | 280,822 | — | — | — | — | 295,482 | |||||||||||||||||||||

Anthony Tse | 35,077 | 311,124 | — | — | — | 56,400 | (3) | 402,601 | ||||||||||||||||||||

Mark Wellings | 42,853 | 311,124 | — | — | — | — | 353,977 | |||||||||||||||||||||

| (1) | A portion of the Fees Earned or Paid in Cash for Rick Findlay, Anthony Tse and Mark Wellings represents fees paid to each of them for services as directors of Li-Cycle Corp. prior to the Business Combination, which fees were paid in Canadian dollars prior to January 1, 2021 and paid in U.S. dollars thereafter. Those Canadian dollar amounts have been converted to U.S. dollars using the Bank of Canada’s average exchange rate on between November 1, 2020 and December 31, 2020 (being the period when fees were paid in Canadian dollars) of CA$1.00=U.S.$0.7732. Following the Business Combination, the Fees Earned or Paid in Cash were as follows: Rick Findlay $13,533, Alan Levande $11,277, Scott Prochazka $14,660, Anthony Tse $11,277, and Mark Wellings $19,171. |

| (2) | In connection with the closing of the Business Combination, each non-employee director received an RSU grant with a value of $280,822 (consisting of an annual award (pro rated) of $80,822 and a one-time “on-boarding” award of $200,000). The RSUs were granted with effect on December 10, 2021, being the date following the effectiveness of a registration statement on FormS-8 filed by the Company with the SEC to register the common shares issuable thereunder. The annual RSU award vests ratably over a three-year period starting on August 10, 2022, and theone-time “on-boarding” RSU award vests ratably over atwo-year period starting on August 10, 2022, subject to the participant’s continued service on the Board. Prior to the Business Combination, Rick Findlay, Anthony Tse and Mark Wellings served as directors ofLi-Cycle Corp. In this regard, they each received an RSU grant with a value of CA$39,246 on December 1, 2020. These Canadian dollar amounts have been converted to U.S. dollars using the Bank of Canada’s exchange rate on December 1, 2020 (being the date of grant) of CA$1.00=U.S.$0.7721. |

| (3) | This amount represents aggregate fees paid to Anthony Tse in Fiscal 2021 under the terms of a consulting agreement dated July 19, 2019 between Li-Cycle Corp. and Mr. Tse pursuant to which Mr. Tse provided consulting services toLi-Cycle Corp. in relation to the proposed expansion of its operations in Asia. The agreement has since been terminated. See the section entitled “Certain Relationships and Related Party Transactions |

Name and Principal Position | Number of Shares Owned (#) | Percentage of Total Shares Outstanding (%) (1) | Special Voting Rights | RSUs | Number of Securities Underlying Options | Option Exercise Price ($) | Option Expiration Date | |||||||||||||||||||||

Ajay Kochhar, President and Chief Executive Officer (2) | 24,908,409 | 14.75 | % | None | 165,813 | 159,640 | $ | 0.02 | April 11, 2023 | |||||||||||||||||||

| 139,685 | $ | 0.37 | July 19, 2024 | |||||||||||||||||||||||||

| 176,871 | $ | 10.93 | August 10, 2031 | |||||||||||||||||||||||||

| 92,105 | $ | 7.58 | January 31, 2032 | |||||||||||||||||||||||||

Tim Johnston, Executive Chairman (3) | 11,092,964 | 6.57 | % | None | 165,813 | 399,100 | $ | 0.02 | September 12, 2022 | |||||||||||||||||||

| 159,640 | $ | 0.02 | April 11, 2023 | |||||||||||||||||||||||||

| 199,550 | $ | 0.37 | July 19, 2024 | |||||||||||||||||||||||||

| 176,871 | $ | 10.93 | August 10, 2031 | |||||||||||||||||||||||||

| 92,105 | $ | 7.58 | January 31, 2032 | |||||||||||||||||||||||||

Debbie Simpson, Chief Financial Officer | — | — | None | 432,261 | 58,219 | $ | 7.58 | January 31, 2032 | ||||||||||||||||||||

Kunal Phalpher, Chief Commercial Officer | 304,272 | 0.18 | % | None | 56,012 | 159,640 | $ | 0.02 | April 11, 2023 | |||||||||||||||||||

| 139,685 | $ | 0.37 | July 19, 2024 | |||||||||||||||||||||||||

| 67,365 | $ | 10.93 | August 10, 2031 | |||||||||||||||||||||||||

| 23,684 | $ | 7.58 | January 31, 2032 | |||||||||||||||||||||||||

Chris Biederman, Chief Technology Officer | 106,141 | 0.06 | % | None | 56,012 | 67,365 | $ | 10.93 | August 10, 2031 | |||||||||||||||||||

| 23,684 | $ | 7.58 | January 31, 2032 | |||||||||||||||||||||||||

| (1) | The ownership percentage set out in this column is based on a total of 168,891,877 outstanding common shares as of February 11, 2022, in each case rounded down to the nearest hundredth. |

| (2) | The number of shares owned include 45,797 common shares owned directly by Mr. Kochhar and 24,862,612 common shares owned by 2829908 Delaware LLC, a Delaware limited liability company, which is a wholly-owned subsidiary of Maplebriar Holdings Inc., a corporation organized under the laws of the Province of Ontario (“Maplebriar Holdings”), having a sole shareholder, The Kochhar Family Trust, an irrevocable trust established under the laws of the Province of Ontario, Canada (the “Trust”). Mr. Kochhar is one of three trustees of the Trust, along with Mr. Kochhar’s brother and father, and the beneficiaries of the Trust are principally relatives of Mr. Kochhar. There is an oral agreement among Mr. Kochhar, the Trust, Maplebriar Holdings and 2829908 Delaware LLC that grants Mr. Kochhar the sole power to control the voting and disposition of the common shares of the Company held by 2829908 Delaware LLC. Mr. Kochhar is a Director and the President and Chief Executive Officer of the Company. |

| (3) | The number of shares owned include 45,797 common shares owned directly by Mr. Johnston and 11,047,167 common shares owned by Keperra Holdings Ltd., a Guernsey corporation (“Keperra”). Mr. Johnston is the sole shareholder of Keperra. Artemis Nominees Limited is a nominee company that holds legal title to 100 shares of Keperra as nominee of and trustee for Mr. Johnston. Mr. Johnston is a Director and the Executive Chairman of the Company. |

| • | each person known by us to be the beneficial owner of more than 5% of our issued and outstanding common shares; |

| • | each of our executive officers and directors; and |

| • | all our executive officers and directors as a group. |

Name and Address of Beneficial Owner | Number of Common Shares Beneficially Owned | Percentage of Outstanding Common Shares (1) | ||||||

Directors and Executive Officers | ||||||||

Ajay Kochhar (2) | 25,207,734 | 14.9 | % | |||||

Tim Johnston (3) | 11,851,254 | 7.0 | % | |||||

Mark Wellings (4) | 274,541 | * | ||||||

Rick Findlay (5) | 822,415 | * | ||||||

Anthony Tse (6) | 227,844 | * | ||||||

Alan Levande (7) | 933,660 | * | ||||||

Scott Prochazka (8) | 30,000 | * | ||||||

Debbie Simpson (9) | 0 | * | ||||||

Kunal Phalpher (10) | 603,597 | * | ||||||

Chris Biederman (11) | 106,141 | * | ||||||

All directors and executive officers as a group (10 individuals) | 40,057,186 | 23.7 | % | |||||

Five Percent or Greater Shareholders | ||||||||

TechMet Limited (12) | 12,969,674 | 7.7 | % | |||||

Louis M. Bacon (13) | 9,805,398 | 5.8 | % | |||||

CEC Aventurine Holdings, LLC (14) | 9,568,024 | 5.7 | % | |||||

| * | Less than 1 percent |

| (1) | Based upon a total of 168,891,877 common shares outstanding as of February 11, 2022. |

| (2) | Ajay Kochhar’s 25,207,734 shares beneficially owned include (1) 45,797 common shares owned directly by Mr. Kochhar, (2) 24,862,612 common shares owned by 2829908 Delaware LLC, a Delaware limited liability company, which is a wholly-owned subsidiary of Maplebriar Holdings Inc., a corporation organized under the laws of the Province of Ontario (“Maplebriar Holdings”), having a sole shareholder, The Kochhar Family Trust, an irrevocable trust established under the laws of the Province of Ontario, Canada (the “Trust”), and (3) 299,325 common shares subject to stock options held by Mr. Kochhar which includes options to acquire (i) 159,640 common shares at a price of US$0.02 per share until April 11, 2023, and (ii) 139,685 common shares at a price of US$0.36 per share until July 19, 2024. There is an oral agreement among Mr. Kochhar, the Trust, Maplebriar Holding, and 2829908 Delaware LLC, that grants Mr. Kochhar the sole power to control the voting and disposition of the common shares of the Company held by 2829908 Delaware LLC. Mr. Kochhar is one of three trustees of the Trust, along with Mr. Kochhar’s brother and father, and the beneficiaries of the Trust are principally relatives of Mr. Kochhar. There is an oral agreement among Mr. Kochhar, the Trust, Maplebriar Holdings and 2829908 Delaware LLC that grants Mr. Kochhar the sole power to control the voting and disposition of the common shares held by 2829908 Delaware LLC. Mr. Kochhar is a Director and the President and Chief Executive Officer of the Company. |

| (3) | Tim Johnston’s 11,851,254 shares beneficially owned include (1) 45,797 common shares owned directly by Mr. Johnston, (2) 11,047,167 common shares owned by Keperra Holdings Ltd., a Guernsey corporation (“Keperra”) and (3) 758,290 common shares subject to vested stock options, which includes options to acquire (i) 399,100 common shares at a price of US$0.02 per share until September 12, 2022, (ii) 159,640 common shares at a price of US$0.02 per share until April 11, 2023, and (iii) 199,550 common shares at a price of US$0.36 per share until July 19, 2024. Mr. Johnston is the sole shareholder of Keperra. Artemis Nominees Limited is a nominee company that holds legal title to 100 shares of Keperra as nominee of and trustee for Mr. Johnston. Mr. Johnston is a Director and the Executive Chairman of the Company. |

| (4) | Mark Wellings’ 274,541 shares beneficially owned include (1) 7,304 common shares owned directly by Mr. Wellings, (2) 180,234 common shares owned by ZCR Corp., a holding company wholly owned by Mr. Wellings, 18,000 of which were purchased through the PIPE Financing, and (3) vested options to acquire 87,003 common shares at a price of US$0.37 per share until July 19, 2024. Mr. Wellings is a director of the Company. |

| (5) | Rick Findlay’s 822,415 shares beneficially owned include (1) 523,090 owned directly, including 13,000 acquired through the PIPE Financing and (2) 299,325 common shares subject to stock options, which includes vested options to acquire (i) 159,640 common shares at a price of US$0.02 per share until April 11, 2023 and (ii) 139,685 common shares at a price of US$0.37 per share until July 19, 2024. Mr. Findlay is a Director of the Company. |

| (6) | Anthony Tse beneficially owns 227,844 common shares. Mr. Tse is a Director of the Company. |

| (7) | Alan Levande beneficially owns 933,660 common shares. Mr. Levande was previously the Chief Executive Officer and Chairman of the board of directors of Peridot prior to the consummation of the Business Combination and is currently a Director of the Company. |

| (8) | Scott Prochazka beneficially owns 30,000 common shares directly. Mr. Prochazka previously served as a Director of Peridot and is currently a Director of the Company. |

| (9) | Debbie Simpson is the Chief Financial Officer of the Company. |

| (10) | Kunal Phalpher beneficially owns 603,597 common shares consisting of (1) 304,272 common shares owned directly by Mr. Phalpher, and (2) 299,325 common shares subject to vested stock options, which includes options to acquire (i) 159,640 common shares at a price of US$0.02 per share until April 11, 2023 and (ii) 139,685 common shares at a price of US$0.37 per share until July 19, 2024. Mr. Phalpher is the Chief Strategy Officer of the Company. |

| (11) | Chris Biederman beneficially owns 106,141 common shares which he owns directly. Mr. Biederman is the Chief Technology Officer of the Company. |

| (12) | According to a Schedule 13G filed with the SEC on August 17, 2021, as of August 17, 2021, TechMet Limited beneficially owned 12,969,674 common shares. The business address of TechMet Limited is Suite 22, 20 lower Baggott Street, Dublin 2, D02 X658 Ireland. |

| (13) | According to an amendment no. 1 to a Schedule 13G filed with the SEC on February 14, 2022, as of February 14, 2022, Louis M. Bacon beneficially owned 9,805,398 common shares consisting of (1) 2,000,000 common shares held by MMF LT, LLC, a Delaware limited liability company (“MMF”) and (2) 7,805,398 common shares held by Moore Strategic Ventures, LLC, a Delaware limited liability company (“MSV”). Kendall Capital Markets, LLC, a Delaware limited liability company (“KCM”) and MSV may be deemed to be the beneficial owner of the 7,805,398 common shares held by MSV. Each of Moore Capital Management, LP, a Delaware limited partnership (“MCM”), Moore Global Investments, LLC, a Delaware limited liability company (“MGI”), Moore Capital Advisors, L.L.C., a Delaware limited liability company (“MCA”), MMF and Mr. Bacon may be deemed to be the beneficial owner of 2,000,000 Shares held by MMF. Mr. Bacon controls the general partner of MCM, is the chairman and director of MCA, and is the indirect majority owner of MMF. MCM, the investment manager of MMF, has voting and investment control over the shares held by MMF. MGI and MCA are the sole owners of MMF. KCM, the investment manager of MSV, has voting and investment control over the shares held by MSV. Louis M. Bacon controls KCM and may be deemed the beneficial owner of the shares held by MSV. The business address of MCM, MMF, MGI, MCA, MSV, KCM, and Mr. Bacon is Eleven Times Square, New York, New York 10036. |

| (14) | CEC Aventurine Holdings, LLC holdings include common shares held by Peridot Acquisition Sponsor, LLC. CEC Aventurine Holdings, LLC is an affiliate of Peridot Acquisition Sponsor, LLC. The business address of CEC Aventurine Holdings, LLC is 2229 San Felipe Street, Suite 1450, Houston, TX 77019. CEC Aventurine Holdings is controlled by Carnelian Energy Capital III, L.P. (“Carnelian Fund III”), its sole member. Carnelian Fund III is controlled by its general partner, Carnelian Energy Capital GP III, L.P. (“Carnelian L.P.”) and Carnelian L.P. is controlled by its general partner Carnelian Energy Capital Holdings, LLC (“Carnelian Holdings”). Tomas Ackerman and Daniel Goodman are the controlling members of Carnelian Holdings. Accordingly, Tomas Ackerman and Daniel Goodman have voting and investment control of the common shares held by CEC Aventurine Holdings, LLC. |

Name of Selling Shareholder | Securities Beneficially Owned prior to this Offering Common Shares | Maximum Number of Securities to Be Sold in this Offering Common Shares | Securities Beneficially Owned after this Offering Common Shares | |||||||||

Spring Creek Capital, LLC (1) | 7,466,017 | 11,021,923 | 0 | |||||||||

| (1) | The number of securities shown as beneficially owned by Spring Creek Capital, LLC prior to this offering consists of the minimum number of shares that Spring Creek Capital, LLC is entitled to receive upon conversion of the note based on a conversion price of $13.43 per share. See “Summary — Background of the Offering” for a description of the terms of the Spring Creek Capital Convertible Note. The maximum number of securities to be sold in this offering as shown in this prospectus includes common shares issuable pursuant to the PIK provisions of the Spring Creek Capital Convertible Note. The address for Spring Creek Capital, LLC identified in this footnote is 4111 East 37th Street North, Wichita, Kansas 67220. |

| • | purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus; |

| • | ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| • | block trades in which the broker-dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | an over-the-counter distribution in accordance with the rules of NYSE; |

| • | through trading plans entered into by a selling shareholder pursuant to Rule 10b5-1 under the Exchange Act that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans; |

| • | to or through broker-dealers; |

| • | in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, |

| • | at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents; |

| • | directly to purchasers, including through a specific bidding, auction or other process or in privately negotiated transactions; |

| • | in options transactions; |

| • | through a combination of any of the above methods of sale; or |

| • | any other method permitted pursuant to applicable law. |

| • | the specific securities to be offered and sold; |

| • | the names of the selling shareholders; |

| • | the respective purchase prices and public offering prices, the proceeds to be received from the sale, if any, and other material terms of the offering; |

| • | settlement of short sales entered into after the date of this prospectus; |

| • | the names of any participating agents or broker-dealers; and |

| • | any applicable commissions, discounts, concessions and other items constituting compensation from the selling shareholders. |

| • | the issuer of the securities that was formerly a shell company has ceased to be a shell company; |

| • | the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act; |

| • | the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and |

| • | at least one year has elapsed from the time that the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company. |

| • | 1% of the total number of common shares then outstanding, which was 1,688,918 common shares as of February 11, 2022; or |

| • | the average weekly reported trading volume of the common shares during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale. |

USD | ||||

SEC registration fee | $ | 13,578.82 | ||

FINRA filing fee | $ | 22,472.20 | ||

Legal fees and expenses | * | |||

Accounting fees and expenses | * | |||

Printing expenses | * | |||

Transfer agent fees and expenses | * | |||

Miscellaneous expenses | * | |||

Total | $ | * | ||

| * | The fees are calculated based on the securities offered and the number of issuances and accordingly cannot be defined at this time. |

Page | ||||

Consolidated Financial Statements of Li-Cycle Holdings Corp. as of and for the years ended October 31, 2021, 2020, and 2019 | ||||

| F-1 | ||||

| F-2 | ||||

| F-3 | ||||

| F-4 | ||||

| F-5 | ||||

| F-6 | ||||

| Deloitte LLP Bay Adelaide East 8 Adelaide Street West Suite 200 Toronto ON M5H 0A9 Canada Tel: 416-601-6150 Fax: 416-601-6151 www.deloitte.ca | |||||

October 31, 2021 | October 31, 2020 | |||||||||||

| Notes | $ | $ | ||||||||||

Assets | ||||||||||||

Current assets | ||||||||||||

Cash and c ash equivalents | 23 | 596,858,298 | 663,557 | |||||||||

Accounts receivable | 4 | 4,072,701 | 571,300 | |||||||||

Other receivables | 4 | 973,145 | 318,929 | |||||||||

Prepayments and deposits | 5 | 8,646,998 | 963,951 | |||||||||

Inventory | 6 | 1,197,807 | 179,994 | |||||||||

611,748,949 | 2,697,731 | |||||||||||

Non-current assets | ||||||||||||

Plant and equipment | 7 | 26,389,463 | 5,602,580 | |||||||||

Right-of-use | 14 | 27,009,760 | 3,859,088 | |||||||||

53,399,223 | 9,461,668 | |||||||||||

665,148,172 | 12,159,399 | |||||||||||

Liabilities | ||||||||||||

Current liabilities | ||||||||||||

Accounts payable and accrued liabilities | 17 | 18,701,116 | 4,364,372 | |||||||||

Restricted share units | 12 | 0 | 171,849 | |||||||||

Lease liabilities | 15 | 2,868,795 | 591,355 | |||||||||

Loans payable | 9 | 7,752 | 1,468,668 | |||||||||

21,577,663 | 6,596,244 | |||||||||||

Non-current liabilities | ||||||||||||

Lease liabilities | 15 | 26,496,074 | 3,021,815 | |||||||||

Loans payable | 9 | 31,996 | 779,210 | |||||||||

Convertible debt | 10 | 100,877,838 | 0 | |||||||||

Warrants | 11 | 82,109,334 | 0 | |||||||||

Restoration provisions | 16 | 334,233 | 321,400 | |||||||||

209,849,475 | 4,122,425 | |||||||||||

231,427,138 | 10,718,669 | |||||||||||

Shareholders’ equity | ||||||||||||

Share capital | 12 | 672,079,154 | 15,441,600 | |||||||||

Contributed surplus | 12 | 3,026,721 | 824,683 | |||||||||

Accumulated deficit | (241,088,229 | ) | (14,528,941 | ) | ||||||||

Accumulated other comprehensive loss | (296,612 | ) | (296,612 | ) | ||||||||

433,721,034 | 1,440,730 | |||||||||||

665,148,172 | 12,159,399 | |||||||||||

Year ended October 31, | ||||||||||||||

2021 | 2020 | 2019 | ||||||||||||

| Notes | $ | $ | $ | |||||||||||

Revenue | ||||||||||||||

Product sales | 6,930,475 | 554,914 | 0 | |||||||||||

Recycling services | 444,401 | 237,340 | 48,160 | |||||||||||

7,374,876 | 792,254 | 48,160 | ||||||||||||

Expenses | ||||||||||||||

Employee salaries and benefits, net | 12,709,823 | 2,819,195 | 607,820 | |||||||||||

Professional fees | 7,688,520 | 2,962,261 | 546,647 | |||||||||||

Share-based compensation | 12 | 3,982,943 | 332,634 | 97,258 | ||||||||||

Raw materials and supplies | 3,410,014 | 591,881 | 0 | |||||||||||

Office, administrative and travel | 3,148,871 | 476,733 | 493,304 | |||||||||||

Depreciation | 7,14 | 2,899,345 | 1,095,250 | 183,862 | ||||||||||

Research and development, net | 2,662,572 | 776,668 | 2,111,658 | |||||||||||

Freight and shipping | 1,033,149 | 137,010 | 5,785 | |||||||||||

Plant facilities | 1,030,947 | 390,687 | 0 | |||||||||||

Marketing | 973,695 | 365,820 | 65,840 | |||||||||||

Change in Finished Goods Inventory | (307,817 | ) | (14,022 | ) | 0 | |||||||||

39,232,062 | 9,934,117 | 4,112,174 | ||||||||||||

Loss from operations | (31,857,186 | ) | (9,141,863 | ) | (4,064,014 | ) | ||||||||

Other (income) expense | ||||||||||||||

Listing Fee | 1 | 152,719,009 | 0 | 0 | ||||||||||

Fair value loss on financial instruments | 10, 11, 12 | 38,254,469 | 84,454 | 0 | ||||||||||

Interest expense | 3,052,882 | 529,700 | 60,329 | |||||||||||

Foreign exchange (gain) loss | 758,223 | (445,652 | ) | 0 | ||||||||||

Interest income | (82,481 | ) | (34,403 | ) | (23,561 | ) | ||||||||

194,702,102 | 134,099 | 36,768 | ||||||||||||

Net loss | (226,559,288 | ) | (9,275,962 | ) | (4,100,782 | ) | ||||||||

Other comprehensive income (loss) | ||||||||||||||

Foreign currency translation | 0 | (218,726 | ) | (37,182 | ) | |||||||||

Comprehensive loss | (226,559,288 | ) | (9,494,688 | ) | (4,137,964 | ) | ||||||||

Loss per common share - basic and diluted | 19 | (2.06 | ) | (0.11 | ) | (0.06 | ) | |||||||

| Number of common shares | Share capital | Contributed surplus | Accumulated deficit | Accumulated other comprehensive income (loss) | Total | |||||||||||||||||||||||

| Notes | $ | $ | $ | $ | $ | |||||||||||||||||||||||

Balance, October 31, 2018 | 70,825,919 | 2,969,191 | 26,523 | (1,152,197 | ) | (40,704 | ) | 1,802,813 | ||||||||||||||||||||

Stock option expense | 12 | — | — | 97,258 | — | 97,258 | ||||||||||||||||||||||

Shares issued for cash | 12 | 5,303,760 | 5,379,860 | — | — | 5,379,860 | ||||||||||||||||||||||

Shares issuable for non-cash costs | 12 | 337,958 | 118,759 | — | — | 118,759 | ||||||||||||||||||||||

Comprehensive loss | — | — | — | (4,100,782 | ) | (37,182 | ) | (4,137,964 | ) | |||||||||||||||||||

Balance, October 31, 2019 | 76,467,637 | 8,467,810 | 123,781 | (5,252,979 | ) | (77,886 | ) | 3,260,726 | ||||||||||||||||||||

Stock option expense | 12 | — | — | 245,847 | — | — | 245,847 | |||||||||||||||||||||

Shares issued for cash | 12 | 6,357,423 | 6,481,381 | — | — | — | 6,481,381 | |||||||||||||||||||||

Shares issuable for non-cash costs | 12 | — | — | 455,055 | — | — | 455,055 | |||||||||||||||||||||

Conversion of convertible debt | 12 | 536,231 | 492,409 | — | — | — | 492,409 | |||||||||||||||||||||

Comprehensive loss | — | — | — | (9,275,962 | ) | (218,726 | ) | (9,494,688 | ) | |||||||||||||||||||

Balance, October 31, 2020 | 83,361,291 | 15,441,600 | 824,683 | (14,528,941 | ) | (296,612 | ) | 1,440,730 | ||||||||||||||||||||

Series C Class A shares issued for cash | 12 | 11,220,218 | 21,620,000 | — | — | — | 21,620,000 | |||||||||||||||||||||

Shares issued for non-cash costs | 12 | 478,920 | 455,055 | (455,055 | ) | — | — | — | ||||||||||||||||||||

Exercise of stock options | 12 | 2,055,476 | 891,162 | (722,057 | ) | — | — | 169,105 | ||||||||||||||||||||

Restricted Share Units settled in shares | 12 | 392,276 | 3,922,754 | — | — | — | 3,922,754 | |||||||||||||||||||||

Public shares issued for cash | 12 | 65,671,374 | 629,748,295 | — | — | — | 629,748,295 | |||||||||||||||||||||

Exercise of warrants | 11 | 100 | 288 | 1,150 | 1,438 | |||||||||||||||||||||||

Stock option expense | 12 | — | — | 2,689,913 | — | — | 2,689,913 | |||||||||||||||||||||

Restricted Share Units expense | 12 | — | — | 688,087 | — | — | 688,087 | |||||||||||||||||||||

Comprehensive loss | — | — | — | (226,559,288 | ) | — | (226,559,288 | ) | ||||||||||||||||||||

Balance, October 31, 2021 | 163,179,655 | 672,079,154 | 3,026,721 | (241,088,229 | ) | (296,612 | ) | 433,721,034 | ||||||||||||||||||||

| Year ended October 31, | ||||||||||||||||

2021 | 2020 | 2019 | ||||||||||||||

| Notes | $ | $ | $ | |||||||||||||

Operating activities | ||||||||||||||||

Net loss for the year | (226,559,288 | ) | (9,275,962 | ) | (4,100,782 | ) | ||||||||||

Items not affecting cash | ||||||||||||||||

Share-based compensation | 12 | 3,982,943 | 332,634 | 97,258 | ||||||||||||

Listing fee | 152,719,009 | 0 | 0 | |||||||||||||

Depreciation | 7,14 | 2,899,350 | 1,095,250 | 183,862 | ||||||||||||

Amortization of government grants | (92,926 | ) | (2,226,910 | ) | (640,350 | ) | ||||||||||

Loss on disposal of assets | 13,399 | 106,946 | 0 | |||||||||||||

Foreign exchange (gain) loss on translation | 677,479 | (390,901 | ) | (33,845 | ) | |||||||||||

Fair value loss on financial instruments | 10,11,12 | 38,254,469 | 84,454 | 0 | ||||||||||||

Share-based professional fees | 12 | 0 | 455,055 | 0 | ||||||||||||

Interest and accretion on convertible debt | 10 | 1,129,680 | 9,931 | 60,337 | ||||||||||||

(26,975,885 | ) | (9,809,503 | ) | (4,433,520 | ) | |||||||||||

Changes in non-cash working capital items | ||||||||||||||||

Accounts receivable | (3,501,401 | ) | (538,854 | ) | (29,630 | ) | ||||||||||

Other receivables | (654,216 | ) | 471,304 | (466,915 | ) | |||||||||||

Prepayments and deposits | (7,990,108 | ) | (633,824 | ) | (215,537 | ) | ||||||||||

Inventory | (1,017,813 | ) | (133,438 | ) | (46,556 | ) | ||||||||||

Accounts payable and accrued liabilities | 12,262,063 | 3,215,386 | 624,090 | |||||||||||||

(27,877,360 | ) | (7,428,929 | ) | (4,568,068 | ) | |||||||||||

Investing activity | ||||||||||||||||

Purchases of plant and equipment | 7 | (18,220,339 | ) | (5,107,663 | ) | (998,069 | ) | |||||||||

Proceeds from disposal of plant and equipment | 16,866 | — | — | |||||||||||||

(18,203,473 | ) | (5,107,663 | ) | (998,069 | ) | |||||||||||

Financing activities | ||||||||||||||||

Proceeds from private share issuance, net of share issue costs | 12 | 21,620,000 | 6,481,381 | 5,379,860 | ||||||||||||

Proceeds from public share issuance, net of share issue costs | 12 | 525,329,273 | 0 | 0 | ||||||||||||

Proceeds from exercise of stock options | 12 | 169,105 | — | — | ||||||||||||

Proceeds from exercise of warrants | 11 | 1,150 | ||||||||||||||

Proceeds from convertible debt | 10 | 98,400,263 | 0 | 0 | ||||||||||||

Proceeds from loans payable | 9 | 10,091,220 | 2,153,110 | 86,572 | ||||||||||||

Proceeds from government grants | 92,926 | 1,182,599 | 1,697,794 | |||||||||||||

Repayment of lease liabilities | (884,024 | ) | (387,508 | ) | 0 | |||||||||||

Repayment of loans payable | (12,544,339 | ) | (12,881 | ) | 0 | |||||||||||

642,275,574 | 9,416,701 | 7,164,226 | ||||||||||||||

Net change in cash and cash equivalents | 596,194,741 | (3,119,891 | ) | 1,598,089 | ||||||||||||

Cash and cash equivalents, beginning of period | 663,557 | 3,783,449 | 2,185,360 | |||||||||||||

Cash and cash equivalents, end of period | 596,858,298 | 663,557 | 3,783,449 | |||||||||||||

Non-cash investing activities | ||||||||||||||||

Accrual for purchase of plant and equipment | 2,074,681 | 0 | 0 | |||||||||||||

Non cash purchase of plant and equipment | 2,084,235 | 0 | 0 | |||||||||||||

Non-cash financing activities | ||||||||||||||||

Equity issued for non-cash costs | 0 | 947,464 | 118,759 | |||||||||||||

1. | Nature of operations and business combination |

| (i) | Nature of Operations |

| (ii) | Business Combination |

2021 | ||||

$ | ||||

Fair value of consideration transferred: | ||||

Common shares | 656,713,740 | |||

Total fair value of consideration transferred | 656,713,740 | |||

Fair value of assets acquired and liabilities assumed: | ||||

Cash and cash equivalents | 581,862,621 | |||

Warrants | (48,299,987 | ) | ||

Other payables | (29,567,903 | ) | ||

Total fair value of assets acquired and liabilities assumed | 503,994,731 | |||

Excess of fair value of consideration transferred over fair value of assets acquired and liabilities assumed, recognized as Listing Fee | 152,719,009 | |||

Gross proceeds | 581,862,621 | |||

Transaction-related costs | (26,965,445 | ) | ||

Other payables acquired | (29,567,903 | ) | ||

Net proceeds | 525,329,273 | |||

2. | Significant accounting policies |

(a) | Statement of compliance |

(b) | Basis of consolidation |

Company | Location | Ownership interest | ||||

Li-Cycle U.S. Holdings Inc. | Delaware, U.S. | 100 | % | |||

Li-Cycle Inc. | Delaware, U.S. | 100 | % | |||

Li-Cycle North America Hub, Inc. | Delaware, U.S. | 100 | % | |||

Li-Cycle Americas Corp. | Ontario, Canada | 100 | % | |||

Li-Cycle Corp. | Ontario, Canada | 100 | % | |||

Li-Cycle Europe AG | Switzerland | 100 | % | |||

Li-Cycle APAC PTE LTD. | Singapore | 100 | % | |||

(c) | Basis of preparation |

| (i) | Assets and liabilities were translated at the closing rate at end of each reporting period; |

| (ii) | Items recognized in the statement of loss and comprehensive loss were translated at the exchange rate at the time of transaction; |

| (iii) | Equity items have been translated using the historical rate at the time of transaction; |

| (iv) | All resulting exchange differences were recognized in other comprehensive loss. |

(d) | Cash and cash equivalents |

(e) | Inventories |

(f) | Convertible debt instruments |

(g) | Loss per share |

(h) | Plant and equipment |

Computers | 3 years | |

Vehicles | 5 years | |

Plant equipment | 5 years | |

Storage containers | 10 years | |

Leasehold improvements | Shorter of term of lease or estimated useful life |

(i) | Financial instruments |

| (i) | those to be measured subsequently at fair value, either through profit or loss (“FVTPL”) or through other comprehensive income (“FVTOCI”); and |

| (ii) | those to be measured subsequently at amortized cost. |

| (i) | amortized cost; |

| (ii) | FVTPL, if the Company has made an irrevocable election at the time of recognition, or when required (for items such as instruments held for trading or derivatives); or, |

| (iii) | FVTOCI, when the change in fair market value is attributable to changes in the Company’s credit risk. |

Financial Instrument | Measurement | |

Cash and cash equivalents | Amortized cost | |

Trade accounts receivables | FVTPL | |

Other accounts receivables | Amortized cost | |

Accounts payable and accrued liabilities | Amortized cost | |

Restricted share units | FVTPL | |

Warrants | FVTPL | |

Loans payable | Amortized cost | |

Lease liabilities | Amortized cost | |

Convertible debt | Amortized cost | |

Conversion feature of convertible debt | FVTPL | |

(j) | Foreign currencies |

(k) | Government assistance and investment tax credits |

(l) | Impairment of long-term non-financial assets |

(m) | Income taxes |

(n) | Provisions |

(o) | Related party transactions |

(p) | Research and development expense |

| • | the technical feasibility of completing the intangible asset so that it will be available for use or sale; |

| • | the intention to complete the intangible asset and use or sell it; |

| • | the ability to use or sell the intangible asset; |

| • | how the intangible asset will generate probable future economic benefits; |

| • | the availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset; and |

| • | the ability to measure reliably the expenditure attributable to the intangible asset during its development. |