Exhibit 4.1

Annual Information Form

For the year ended December 31, 2021

(Expressed in United States Dollars)

Dated as of March 30, 2022

| TABLE OF CONTENTS | |

| GENERAL MATTERS | 3 |

| FORWARD-LOOKING INFORMATION | 3 |

| MARKET AND INDUSTRY DATA | 4 |

| EXCHANGE RATE INFORMATION | 5 |

| COMMODITY PRICE INFORMATION | 5 |

| THE COMPANY | 6 |

| THREE-YEAR HISTORY | 6 |

| DESCRIPTION OF OUR BUSINESS | 13 |

| ENVIRONMENT, SOCIAL AND GOVERNANCE | 27 |

| RISK FACTORS | 31 |

| TECHNICAL AND THIRD PARTY INFORMATION | 60 |

| DIVIDENDS | 98 |

| CAPITAL STRUCTURE | 99 |

| MARKET FOR SECURITIES | 100 |

| DIRECTORS AND OFFICERS | 101 |

| LEGAL PROCEEDINGS & REGULATORY ACTIONS | 107 |

| INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 107 |

| REGISTRAR AND TRANSFER AGENT | 107 |

| MATERIAL CONTRACTS | 108 |

| INTERESTS OF EXPERTS | 108 |

| ADDITIONAL INFORMATION | 108 |

| AUDIT COMMITTEE INFORMATION | 108 |

| APPENDIX A – AUDIT COMMITTEE CHARTER | 110 |

GENERAL MATTERS

Unless otherwise noted or the context otherwise indicates, the terms “Triple Flag”, the “Company”, “our”, “us” and “we” refer to Triple Flag Precious Metals Corp. and its subsidiaries. For reporting purposes, the Company presents its financial statements in United States dollars and in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). All dollar amounts in this Annual Information Form (“AIF”) are expressed in United States dollars, except as otherwise indicated. References to “US$”, “$” or “dollars” are to United States dollars and references to “C$” are to Canadian dollars. Certain totals, subtotals and percentages in this AIF may not reconcile due to rounding.

The information contained in this AIF is as of December 31, 2021, unless otherwise indicated. More current information may be available on our website at www.tripleflagpm.com or on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com. In addition, we maintain supporting materials on our website which may assist in reviewing (but are not to be considered part of) this AIF including Triple Flag’s most recent Asset Handbook and Sustainability Report (which contains a discussion of our sustainability approach and governance).

FORWARD-LOOKING INFORMATION

This AIF contains “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “prospects”, “strategy”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or terminology which states that certain actions, events or results “may”, “could”, “would”, “might”, “will”, “will be taken”, “occur” or “be achieved”. Our assessments of, and expectations for future periods described in this AIF are considered forward-looking information. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding possible future events or circumstances.

The forward-looking information included in this AIF is based on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. The forward-looking statements contained in this AIF are also based upon the ongoing operation of the properties in which we hold a stream, royalty or other similar interest by the owners or operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the owners or operators of such underlying properties; and the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production. These assumptions include, but are not limited to, the following: assumptions in respect of current and future market conditions and the execution of our business strategies, that operations, or ramp-up where applicable, at properties in which we hold a royalty, stream or other interest, continue without further interruption through the period, and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated, intended or implied. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. Forward-looking information is also subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but are not limited to, those set forth under the caption “Risk Factors”. For clarity, Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability and inferred resources are considered too geologically speculative for the application of economic considerations.

Although we have attempted to identify important risk factors that could cause actual results or future events to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this AIF represents our expectations as of the date of this AIF and is subject to change after such date. We disclaim any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable securities laws. All of the forward-looking information contained in this AIF is expressly qualified by the foregoing cautionary statements.

MARKET AND INDUSTRY DATA

This AIF makes reference to certain industry metrics, including Gold Equivalent Ounces (“GEOs”), which is an operating metric used in our industry. GEOs are a non-IFRS measure and are based on stream and royalty interests and are calculated on a quarterly basis by dividing all revenue from such interests for the quarter by the average gold price during such quarter. The gold price is determined based on the London Bullion Market Association (“LBMA”) PM fix. For periods longer than one quarter, GEOs are summed for each quarter in the period.

Market and industry data presented throughout this AIF were obtained from third-party sources, industry reports and publications, websites and other publicly available information, as well as industry and other data prepared by us or on our behalf, on the basis of our knowledge of the markets in which we operate, including information provided by other industry participants. These third-party sources include Skarn Associates Limited (“Skarn Associates”), S&P Global Market Intelligence, S&P Global Market Intelligence; SNL Metals & Mining Data and Wood Mackenzie Inc. (“Wood Mackenzie”). We believe that the market and industry data presented throughout this AIF are accurate and, with respect to data prepared by us or on our behalf, that our opinions, estimates and assumptions are currently appropriate and reasonable, but there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market and industry data presented throughout this AIF are not guaranteed and the Company does not make any representation as to the accuracy of such data. Actual outcomes may vary materially from those forecast in such reports or publications, and the prospect for material variation can be expected to increase as the length of the forecast period increases. Although we believe it to be reliable, the Company has not independently verified any of the data from third-party sources referred to in this AIF, analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying market, economic and other assumptions relied upon by such sources. Market and industry data are subject to variations and cannot be verified due to limits on the availability and reliability of data inputs, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey.

EXCHANGE RATE INFORMATION

The following table sets forth the high and low rates of exchange for one U.S. dollar expressed in Canadian dollars during each of the indicated periods; the average rate of exchange for those periods; and the rate of exchange in effect at the end of those periods, based on the exchange rate published by the Bank of Canada.

| | | For the year ended December 31 | |

| | | 20211 | | | 20201 | | | 20191 | |

| High | | | 1.2942 | | | | 1.4496 | | | | 1.3600 | |

| Low | | | 1.2040 | | | | 1.2718 | | | | 1.2988 | |

| Average rate for the period | | | 1.2535 | | | | 1.3415 | | | | 1.3269 | |

| Rate at the end of the period | | | 1.2678 | | | | 1.2732 | | | | 1.2988 | |

| 1. | Based on the daily rate published by the Bank of Canada. |

On March 30, 2022, the exchange rate for one U.S. dollar expressed in Canadian dollars as reported by the Bank of Canada, was 1.2470.

COMMODITY PRICE INFORMATION

The following tables set forth the average gold and silver prices for the periods indicated.

| | | For the year ended December 31 | |

| Average Metal Prices/Exchange Rates | | 2021 | | | 2020 | | | 2019 | |

| Gold (USD$/oz)1 | | | 1,799 | | | | 1,770 | | | | 1,393 | |

| Silver (USD$/oz)2 | | | 25.14 | | | | 20.55 | | | | 16.21 | |

| 1. | Based on the LBMA PM fix. |

On March 30, 2022, the LBMA PM fix for gold was $1,934/oz and the LBMA fix for silver was $24.76/oz.

THE COMPANY

The Company was incorporated on October 10, 2019 under the Canada Business Corporations Act (“CBCA”) with the name Triple Flag Precious Metals Corp. and amalgamated with its wholly-owned subsidiary, Triple Flag Mining Finance Ltd., on November 8, 2019. Triple Flag is domiciled in Canada and the address of its registered office is 161 Bay Street, Suite 4535, Toronto, Ontario, M5J 2S1, Canada.

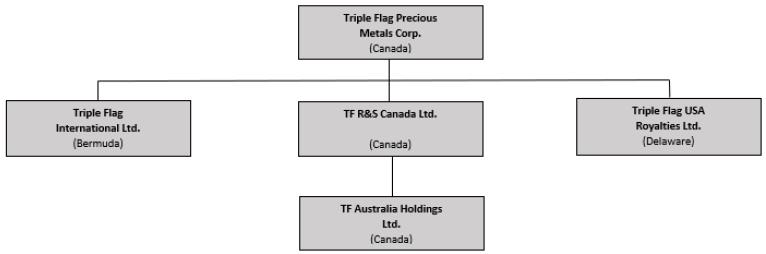

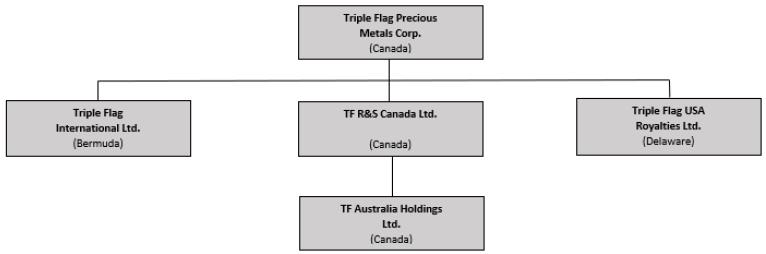

The following chart lists our material wholly-owned subsidiaries and their applicable governing jurisdictions As at December 31, 2021, the Company owned, either directly or indirectly, 100% of the voting and non-voting securities of its material subsidiaries noted below.

THREE-YEAR HISTORY

Subsequent to December 31, 2021

Beaufor Royalty

On February 4, 2022, the Company entered into a royalty purchase agreement with a third party to acquire a 2% net smelter returns royalty (with a milestone-based stepdown to 1%) on Monarch Mining Corporation’s (“Monarch”) Beaufor Mine gold project in Quebec (the “Beaufor Royalty”) for C$6.75 million. In connection with this transaction, the Company entered into a binding agreement with Monarch to provide Monarch with additional funding of C$4.5 million in consideration for increasing the royalty rate to 2.75% and eliminating the step-down. The transaction will be recorded during the first quarter of 2022.

Talon Royalty Buydown and Disposition of Equity Interest

On February 15, 2022, Talon Nickel (USA) LLC (“Talon”) exercised its right to reduce the royalty rate under the Tamarack royalty agreement from 3.5% to 1.85% of Talon’s interest in the Tamarack project in exchange for a payment of $4.5 million. The Company acquired its royalty on the Tamarack project for $5 million in March 2019. The transaction will be recorded during the first quarter of 2022.

On December 3, 2021, we acquired five million common shares of Talon Metals Corp. (the “Talon Shares”) for C$413,000 pursuant to the exercise of our five million common share purchase warrants (the “Talon Warrants”). Subsequent to year-end, we sold five million Talon Shares for C$3.7 million. The disposition will be recorded during the first quarter of 2022.

For the year ended December 31, 2021

Gunnison Stream Amendment

On December 22, 2021, the Company and Excelsior Mining Corp. (including its subsidiaries, “Excelsior”), agreed to an amendment of the Stream Agreement between the Company and Excelsior, thereby helping to facilitate certain transactions. Pursuant to the amendment, the Company and Excelsior agreed to remove Excelsior’s buydown option and concurrently agreed to re-price Triple Flag’s 3.5 million common share purchase warrants to C$0.54 per common share (from the prior exercise price of C$1.50 per common share). This amendment was reflected in our results for the year ended December 31, 2021 and did not have a material impact on our financial statements.

Acquisition of Chilean Royalty Portfolio

On December 21, 2021, we entered into an agreement with Azufres Atacama SCM to acquire 2% net smelter return (“NSR”) royalties on each of the Aster 2, Aster 3 and Helada properties that are proximal to Gold Fields Limited’s (“Gold Fields”) Salares Norte project in Chile for $4.9 million. These properties cover prospective exploration ground that Gold Fields has been exploring. The Salares Norte project is currently under construction with anticipated first production in 2023. The royalties include buydown provisions that would reduce the amount of each NSR royalty from 2% to 1%. The amount to be received by the Company if the buydown provisions are exercised would be $2 million for the Aster 2 royalty and $4 million for each of the Aster 3 and Helada royalties.

Normal Course Issuer Bid

In October 2021, we established a normal course issuer bid (“NCIB”) program. Under the program, the Company may acquire up to 2,000,000 of its common shares from time to time in accordance with the NCIB procedures of the Toronto Stock Exchange (“TSX”). Repurchases under the NCIB program are authorized until October 13, 2022. Daily purchases are limited to 8,218 common shares, representing 25% of the average daily trading volume of the common shares on the TSX for the period from May 20, 2021 to October 5, 2021 (being 32,872 common shares), except where purchases are made in accordance with the “block purchase exemption” of the TSX rules. All common shares that are repurchased by the Company under the NCIB program will be cancelled. As at December 31, 2021, the Company had purchased 155,978 of its common shares under the NCIB for $1.7 million.

In December 2021, we established an Automatic Share Purchase Plan (“ASPP”) with the designated broker responsible for the NCIB program. The ASPP is intended to allow us to purchase common shares under the NCIB program at times when we would ordinarily not be permitted to purchase them due to regulatory restrictions and customary self-imposed blackout periods. Pursuant to the ASPP, prior to entering into a blackout period, the Company may instruct the designated broker to make purchases under the NCIB in accordance with the terms of the ASPP. Such purchases will be made by the designated broker in its sole discretion based on parameters established by us prior to the blackout period in accordance with the rules of the TSX, applicable securities laws and the terms of the ASPP.

Dividend Reinvestment Plan

In October 2021, we announced that we had implemented a Dividend Reinvestment Plan (the “DRIP”). Participation in the DRIP is optional and will not affect shareholders’ cash dividends, unless they elect to participate in the DRIP. At the Company’s discretion, reinvestment will be made by acquiring common shares from the open market or issuing shares from treasury. The plan is effective for dividends declared by the Company, beginning with dividends declared in November 2021.

Initial Public Offering

We closed our initial public offering (“IPO”) on May 26, 2021. We sold an aggregate of 19,230,770 treasury common shares at an offering price of $13.00 per share. On June 29, 2021, the underwriters of the IPO exercised an over-allotment option granted to purchase a further 1,058,553 treasury common shares at the initial offering price of $13.00 per share. The common shares are listed on the TSX in both Canadian and U.S. dollars under the symbols TSX:TFPM and TSX:TFPM.U, respectively. Total proceeds from the IPO, net of underwriter fees and various issuance costs, were $245.1 million, which proceeds were used to fund the repayment of existing indebtedness incurred pursuant to the Credit Facility.

IAMGOLD Royalty Portfolio Purchase

On January 12, 2021, we entered into an agreement to purchase a royalty portfolio from IAMGOLD. On March 26, 2021, we entered into an amendment agreement with IAMGOLD, pursuant to which we agreed to acquire a royalty portfolio consisting of 34 royalties on various exploration and development properties for an aggregate acquisition price of $45.7 million. The acquisition of 33 royalties for $35.7 million closed effective March 26, 2021. The acquisition of the remaining royalty, Antofagasta’s Polo Sur project located in Chile, closed on April 16, 2021, following satisfaction of certain corporate actions in Chile. Transaction costs incurred of $393 thousand were capitalized at the acquisition date.

For the year ended December 31, 2020

Buriticá Gold Stream Buyback

On September 22, 2020, we received an irrevocable notice from the operator of the Buriticá mine, Zijin Mining Group Co. Ltd.’s (“Zijin Mining”), to exercise the buyback option it had on the Buriticá gold stream. On December 29, 2020, we received a cash payment of $78.0 million, calculated as $80 million less adjustments based on gold ounces delivered to us during the fourth quarter of 2020 and recorded a gain of $30.9 million on the disposition of the Buriticá gold stream. The Buriticá silver stream was not affected and is not subject to any reduction.

Credit Facility Amendment

On September 21, 2020, we increased our existing four-year credit facility (the “Credit Facility”) from $400 million to $500 million, with an additional uncommitted accordion of $100 million, for a total availability of up to $600 million. Under the amendment, the applicable interest rate margin of the facility was reduced by 25 basis points across all tiers. All other significant terms of the Credit Facility remain unchanged, including its maturity date of August 30, 2023.

Northparkes Gold and Silver Stream

On July 10, 2020, we entered into an agreement with China Molybdenum Company Limited (“CMOC”) and certain of its subsidiaries, to receive gold and silver deliveries determined by reference to gold and silver production of the Northparkes mine located in New South Wales, Australia. Northparkes is currently owned 80% by CMOC and 20% by Sumitomo Corporation and Sumitomo Metal Mining Co., Ltd. On July 17, 2020, we paid an upfront cash advance amount of $550 million to a subsidiary of CMOC and will make additional ongoing payments equal to 10% of the spot gold price at the time of delivery for each ounce delivered in exchange for gold deliveries equal to 54% of Northparkes’ payable gold production until 630,000 ounces have been delivered to us, and 27% of payable gold production thereafter. In addition, we will make ongoing payments equal to 10% of the spot silver price for silver deliveries equal to 80% of Northparkes’ payable silver production until 9,000,000 ounces have been delivered to us, and 40% of payable silver production thereafter, in each case for production within all concentrate shipments following the July 1, 2020 effective date. Transaction costs incurred of $4 million were capitalized at the acquisition date. The parties have agreed to fixed payability factors of 93% for gold and 90% for silver. The stream has been recorded as a mineral interest.

Nevada Copper Amendment

On March 27, 2020, we entered into an agreement with Nevada Copper consisting of several components totaling $35 million in near-term funding and a contingent payment of $5 million. The first component was a stream amendment whereby Triple Flag International Ltd. (“TF International”) agreed to advance an additional deposit of $15 million to Nevada Copper, bringing the total amount of funding for the Pumpkin Hollow underground stream to $85 million. As consideration for the additional advance of $15 million, the parties agreed to increase the stream rate for gold and silver to 97.5% from 90% and reduce the variable gold and silver price payable by us on delivery of gold and silver from 10% to 5% of the relevant spot price. The first $10 million was funded on May 1, 2020 and the balance is being funded through re-investment of 50% of the first $10 million of cash flow generated from the stream from May 1, 2020 onwards. Funding through reinvestment of cash flows generated is being recorded at the funding date as a mineral interest.

The second component of the agreement was the purchase of a 0.7% NSR royalty on the open pit portion of the Pumpkin Hollow copper project for $17 million, which was paid on March 27, 2020. The third component of the agreement was the purchase of a 2% NSR royalty on the Tedeboy Area for $3 million and a contingent payment of $5 million. The $3 million was paid on March 27, 2020 and the contingent payment of $5 million will be funded upon commencement of commercial production. The additional deposit and royalties have been recorded as mineral interests. The contingent payment will be recorded as a mineral interest at the funding date.

Stornoway Credit Bid Transaction

On March 24, 2020, Stornoway suspended operations following an order by the Quebec Government public health authorities as a measure to combat the COVID-19 pandemic. Renard remained on care and maintenance following the lifting of this Government order effective April 15, 2020. In September 2020, the Stornoway board approved a restart plan and Renard re-commenced production on September 1, 2020. Further to this restart plan, the shareholders of Stornoway increased the working capital facility by up to C$30 million (up to C$3.75 million for Triple Flag) in a senior secured working capital facility, resulting in our attributable portion of the working capital facility increasing from C$2.6 million to C$6.35 million, of which C$0.78 million (net of repayments of C$1.43 million) has been advanced as of December 31, 2021.

RBPlat Gold Stream

On October 13, 2019, we entered into an agreement with RBPlat, a company headquartered in South Africa and listed on the Johannesburg Stock Exchange (“JSE”), its direct and indirect subsidiaries Royal Bafokeng Resources Proprietary Limited and Maseve Investments 11 Proprietary Limited, pursuant to which TF International agreed to purchase a 70% gold stream on the RBPlat PGM Operations in exchange for an upfront cash advance of $145 million and ongoing payments of 5% of the spot gold price for each ounce of gold delivered under the agreement. Under the terms of the agreement, we will receive 70% of the payable gold until 261,000 ounces are delivered, and 42% of payable gold thereafter. The parties have agreed to a fixed payability ratio of 85%, and to a gold recovery floor mechanism whereby for the first five calendar years commencing at closing, if gold recoveries at the RBPlat PGM processing facilities are less than 66%, we will be entitled to receive an additional delivery of gold representing the amount of gold that would have been delivered in such year had gold recoveries been 66%. Transaction costs include capitalized costs of $115 thousand. The transaction closed on January 23, 2020.

For the year ended December 31, 2019

Steppe Gold Stream Agreement Amendment

On September 30, 2019, we entered into an agreement (the “Steppe Gold Amendment”) with Steppe Gold to amend the terms of our existing gold and silver streams. Under the terms of the Steppe Gold Amendment, we advanced an additional deposit of $5 million to Steppe Gold, bringing the total amount of funding to $28 million. As consideration for the additional advance of $5 million, the parties agreed to reduce the variable gold and silver price payable by TF International on delivery of gold and silver from 30% to 17% of the relevant spot price and agreed to eliminate the seven-day quotational period mechanic. As additional consideration, Steppe West LLC, a wholly-owned subsidiary of Steppe Gold, granted a 3% NSR royalty on minerals derived from the Uudam Khundii property owned by Corundum Geo LLC, an 80% owned subsidiary of Steppe West LLC. The Steppe Gold Amendment was funded on October 2, 2019.

Disposal of Brucejack Offtake

On September 15, 2019, we entered into an agreement with Pretium Exploration Inc., a subsidiary of Pretium Resources, regarding the sale of our interest in the Brucejack gold offtake agreement for a cash purchase price of $41.3 million. The transaction closed on September 30, 2019 and resulted in a gain of $26.4 million.

Stornoway Credit Bid Transaction

On September 8, 2019, we entered into a letter of intent (“LOI”) with Stornoway Diamond Corporation (“SWY”) and its subsidiaries Stornoway Diamonds (Canada) Inc. (“SDCI”), FCDC Sales and Marketing Inc. (“FCDC”) and Ashton Mining of Canada Inc. (“Ashton”, and together with SWY, SDCI and FCDC, collectively the “Stornoway Companies”) alongside other secured creditors (collectively, the “Participating Secured Creditors”) under the bridge financing agreement entered into with the Stornoway Companies on June 10, 2019. Under the terms of the LOI, Triple Flag and the Participating Secured Creditors confirmed their intention to acquire, through an entity formed for this purpose (“AcquisitionCo”), substantially all of the assets and properties of the Stornoway Companies, and assume the debts and liabilities owing to the Participating Secured Creditors and other first-ranking creditors of the Stornoway Companies as well as the ongoing obligations related to the operation of the Renard mine, subject to certain limited exceptions (the “Credit Bid Transaction”). Pursuant to the Credit Bid Transaction, we maintained our 4% diamond stream on the Renard mine and will continue to receive stream deliveries, and agreed to reinvest our proceeds from the stream for a period of one year from the closing date of the Credit Bid Transaction, which period has been extended until April 30, 2022. In connection with the Credit Bid Transaction, Stornoway applied to the Superior Court of Quebec (Commercial Division) (the “Superior Court of Quebec”) on September 9, 2019 for protection under the Companies’ Creditors Arrangement Act (Canada) in order to restructure its business and financial affairs (the “CCAA Proceedings”). Concurrent with entering into the LOI, Triple Flag and the Participating Secured Creditors entered into a definitive and binding working capital facility agreement with, inter alios, SDCI, FCDC and Ashton providing for a working capital facility in an initial amount of C$20 million (C$2.6 million attributable to Triple Flag), which facility is secured by a priority lien over the assets of the Stornoway Companies and can be increased for additional amounts at the option of the Participating Secured Creditors.

On October 6, 2019, AcquisitionCo and the Stornoway Companies entered into a definitive purchase agreement with respect to the Credit Bid Transaction. On October 7, 2019, the Stornoway Companies obtained an approval and vesting order from the Superior Court of Quebec issued in connection with the CCAA Proceedings and the Credit Bid Transaction. Closing of the Credit Bid Transaction occurred on November 1, 2019. We currently hold a 13% equity interest in Stornoway Diamond Corporation and a 4.0% diamond stream on the Renard mine.

Credit Facility Amendment

On August 30, 2019, we increased the Credit Facility from $200 million to $400 million, with an additional uncommitted accordion of $100 million, for a total availability of up to $500 million. All significant terms of the Credit Facility were unchanged and a new four-year term began on August 30, 2019.

Pumpkin Hollow Stream Amendment

On May 6, 2019, we entered into an amendment to the Pumpkin Hollow Stream whereby Nevada Copper’s buy down option was amended to permit Nevada Copper to reduce the stream percentage from 90% to 75% in exchange for $15.4 million, subject to certain adjustments (previously Nevada Copper had a buy down option to reduce the stream percentage from 90% to 55% in exchange for $36 million). The buy-down option expired unexercised on February 20, 2020.

Buriticá Gold and Silver Stream

On March 15, 2019, we entered into an agreement with Continental Gold Inc. (“Continental”), a TSX-listed company, to acquire a subordinated secured 2.1% gold and a 100% fixed ratio silver stream on the Buriticá project in exchange for $100 million paid by TF International, plus ongoing payments of 10% of the gold spot price for each ounce of gold purchased and 5% of the silver spot price for each ounce of silver purchased. TF International agreed to purchase from Continental gold equivalent to 2.1% of the payable gold produced from Buritica´ over its life-of-mine and silver equivalent to 100% of reference silver calculated using a fixed ratio to payable gold (the fixed ratio being 1.84 ounces of silver for each ounce of payable gold produced from the Buritica´ project over its life-of-mine). The $100 million was funded on June 25, 2019. On March 4, 2020, Continental was acquired by Zijin Mining. As described above, on December 29, 2020, we received a cash payment of $78.0 million and recorded a gain of $30.9 million on the disposition of the gold stream.

Talon Metals Corp.

On March 7, 2019, we acquired a 3.5% NSR royalty from Talon Nickel (USA) LLC (“Talon”), a wholly-owned subsidiary of Talon Metals Corp, a TSX-listed company, on Talon’s participating interest in the Tamarack Project for total consideration of $5 million. The royalty is payable from Talon’s participating interest in the Tamarack project. The royalty agreement contains a put right pursuant to which Triple Flag has, in certain instances, an option to cause Talon to repurchase the entire royalty for a cash payment of $8.6 million. If Triple Flag does not exercise the put right, Talon has a one-time option to reduce the percentage of the royalty to 1.85% in exchange for $4.5 million. In connection with the royalty agreement, Talon issued to us five million warrants exercisable to acquire five million common shares of Talon Metals Corp. on or before March 7, 2022 at an exercise price of C$0.0826 per share. In December 2021, we exercised the warrants and acquired five million common shares of Talon for C$413,000.

GoldSpot Discoveries Corp.

On January 30, 2019, we paid $2.2 million (C$2.9 million) for the acquisition of 175,227 subscription receipts entitling us to receive common shares of GoldSpot Inc. (“GoldSpot”). These shares were subsequently exchanged for 7,248,686 common shares of GoldSpot Discoveries Corp. (previously known as Duckworth Capital Corp.) pursuant to the terms of an amalgamation agreement between, among others, GoldSpot and Duckworth Capital Corp. In addition, we entered into a mineral interest purchase agreement with GoldSpot pursuant to which, in exchange for $75,735, we were granted a 50% interest in certain mineral interests held or to be acquired by GoldSpot, and certain rights with respect to future mineral interests that are acquired by GoldSpot.

DESCRIPTION OF OUR BUSINESS

Overview

Triple Flag is a gold-focused streaming and royalty company offering bespoke financing solutions to the metals and mining industry. Our mission is to be a sought-after, long-term funding partner to mining companies throughout the commodity cycle, while generating attractive returns for our investors.

From our inception in 2016 to our current position as an emerging senior streaming and royalty company, we have invested in excess of $1.7 billion of capital and systematically developed a long-life, low-cost, high-quality, diversified portfolio of streams and royalties providing exposure primarily to gold and silver.

We currently have 79 assets, consisting of 9 streams and 70 royalties. These investments are in mining assets at various stages of the mine life cycle.

| Asset Count | | | |

| Producing | | | 15 | |

| Development & Exploration | | | 64 | |

| Total | | | 79 | |

Our portfolio is underpinned by a stable base of cash flow generating streams and royalties and is designed to grow intrinsically over time through exposure to potential mine life extensions, exploration success, new mine builds and throughput expansions. In addition, we are focused on further enhancing portfolio quality by executing accretive investments to increase the scale and quality of our portfolio of precious metal streams and royalties. We believe we have a differentiated approach to deal origination and due diligence, that enables us to increase the applicability of stream and royalty financing to an underserved mining sector, expanding the application of this form of financing through bespoke deal generation for miners and create a high-quality, gold-focused portfolio of streams and royalties for our investors. We focus on “per share” metrics with the objective of pursuing accretive new investments with careful management of the capital structure to effectively compete for quality assets without incurring long-term financial leverage.

Triple Flag was founded with the vision of becoming a leading streaming and royalty company. We are equipped with a highly experienced management team and board of directors (“Board”), as well as significant financial capital in order to assemble a sizeable portfolio of high-quality, cash-generating streaming and royalty assets. We believe we are well positioned to continue growth by virtue of combining our existing high-quality portfolio with our highly-experienced management team and Board, our differentiated approach and ongoing access to capital to pursue the best available deals.

We aim to create shareholder value by increasing our net asset value per share and free cash flow per share, along with Mineral Resources and Mineral Reserves per share over the long term. To achieve this, our portfolio, which is underpinned by a stable base of cash flow generating streams and royalties, is designed to grow intrinsically over time through exposure to potential mine life extensions, exploration success, new mine builds and throughput expansions. In addition, we are focused on further enhancing portfolio quality by executing accretive investments to increase the scale and quality of our portfolio of precious metal streams and royalties. We believe we have a differentiated approach to deal origination and due diligence, with a focus on “per share” metrics and the objective that accretive new investments are pursued with careful management of the capital structure to effectively compete for quality assets without incurring long-term financial leverage.

We assess investment opportunities using a combination of measures and primarily focus on assets which:

| ● | are located in mining-friendly jurisdictions with lower geopolitical risk; |

| ● | are in production, construction or advanced-stage development as opposed to those in exploration; |

| ● | are positioned in the first half of the cost curve; |

| ● | have embedded growth prospects, represented by the potential for ongoing life extension or expansion and rights of first refusal; and |

| ● | demonstrate a high degree of counterparty quality. |

We balance our portfolio focus of cash generating mines and construction-ready, fully permitted projects (with development times of typically less than two years to cash flow), with prudent investments in earlier stages of the mine life cycle to maintain a robust exploration and development pipeline. Although our target investment geographies are the Americas and Australia, we will pursue assets globally for appropriate risk-adjusted returns where we can ensure adequate commercial protections and the asset and counterparty quality justifies it. We target long-term portfolio precious metals content of at least 90% with an emphasis on gold and may occasionally consider exposure to base metals, with our non-precious metals investments focused on metals aligned with decarbonization and electrification. Our strategy does not include making standalone equity investments in mining assets or companies and excludes investments in fossil fuels.

Good environmental, social and governance (“ESG”) practices are core to our identity. We believe that ESG is critical to the long-term success of our organization, the mining industry and society as a whole. Although we do not operate any mining assets, we believe we can make a positive impact by investing in streams and royalties on mines and projects where we believe ESG is well managed by our counterparties. ESG is a key filter and gating item, and our investment due diligence process includes an extensive assessment of our counterparties’ environmental, social governance, health and safety management practices and local stakeholder engagement in addition to a review of geology, exploration, Mineral Reserve and Mineral Resource modelling, mine design and scheduling, geotechnics, mineral processing, tailings, permitting and legal, regulatory, tax and financial considerations.

We have a differentiated approach to assessing new investment opportunities and supplement our core team with highly specific third-party experts drawn from an extensive global network. The expertise employed and due diligence are tailored for each investment. We operate with a lean core team of professionals to in order to cultivate the nimble and analysis-driven culture required to identify new opportunities and efficiently structure creative solutions for our mining partners, while maintaining low overhead costs. Our objective is to uncover underpriced assets through detailed due diligence and to leverage our extensive mining industry experience and expertise and global networks to uncover and develop potentially valuable investment propositions and apply judgment to ascertain the outlook for any mining asset. We undertake a detailed review of each asset with a view to identifying risks and assessing its overall quality as well as its pro forma impact on, and strategic fit within our portfolio. We believe this differentiated approach has enabled excellence in analysis and provided us with the ability to effectively uncover both the true potential and inherent risks of each opportunity. We believe this has created a competitive advantage as evidenced by the systematic development of our portfolio over the past five years, while applying the discipline to decline otherwise superficially attractive opportunities. We believe our business model is scalable, enabling us to pursue our growth-oriented strategy while maintaining a lean organization. Furthermore, through the Northparkes stream acquisition in 2020 (as described below), we have showcased our ability to effectively conduct extensive and comprehensive due diligence on a large asset with an adjusted approach for restrictions related to COVID-19.

We pride ourselves on our adaptability and flexibility in structuring financing solutions that are customized to meet the needs of our mining partners, while seeking acceptable risk-adjusted returns and contractual protections. We seek to be a valued finance partner by strengthening balance sheets, enhancing liquidity and funding the acquisition and development of new mines. As a result of this partnership approach and our senior leadership’s extensive industry relationships, a high proportion of our deal opportunities are developed from bilateral discussions rather than auction processes. In addition to transactions negotiated on a bilateral basis, we have also been successful in winning auctions when our due diligence processes support our conclusions that they are compelling and will be accretive to our portfolio. In particular, when participating in auctions we calibrate our bid to reflect the discounted cash flow of due diligenced mine plans and a review of internal rates of return and net asset value under various upside and downside scenarios based on applied probabilities, sensitivity analysis to commodity prices, stress testing and deal sizing modelled under low price scenarios over the mine life.

Triple Flag was formed in April 2016. Led by Shaun Usmar, our Founder and Chief Executive Officer, and with the support of our principal shareholders, Triple Flag Mining Elliott and Management Co-Invest LP (“Co-Invest LP”) and Triple Flag Co-Invest Luxembourg Investment Company S.ár.l (“Co-Invest Luxco”, together with Co-Invest LP, the “Principal Shareholders”) we have successfully completed 18 transactions since inception.

Our initial transaction was the December 2016 acquisition of a silver stream on Cerro Lindo, a polymetallic mine in Peru operated by Nexa Resources SA (“Nexa”). We have since added several assets to our portfolio, including an NSR royalty interest in Agnico Eagle Mines Limited’s (formerly Kirkland Lake Gold Ltd. (“Kirkland”)) Fosterville mine in Australia, a gold stream on RBPlat’s PGM Operations in South Africa, a gold and silver stream on China Molybdenum Company Limited’s (“CMOC”) Northparkes mine in Australia, a gold and silver stream on Steppe Gold Ltd.’s (“Steppe Gold”) Altan Tsagaan Ovoo (“ATO”) mine in Mongolia, an NSR royalty interest in Alamos Gold Inc.’s (“Alamos Gold”) Young-Davidson mine in Canada, a copper stream on Excelsior Mining Corp.’s (“Excelsior”) Gunnison mine in Arizona, a gold and silver stream on Nevada Copper Corp.’s (“Nevada Copper”) Pumpkin Hollow mine in Nevada and a silver stream on Zijin Mining’s Buriticá mine in Colombia. In the first quarter of 2021, we acquired a royalty portfolio from IAMGOLD Corporation and certain of its subsidiaries (together, “IAMGOLD”) consisting of 34 royalties on various exploration and development properties, including 19 prospective properties in the Abitibi region, for an aggregate acquisition price of $45.7 million. In December of 2021, we acquired a royalty portfolio from Azufres Atacama SCM for $4.9 million.

Outlook

The following contains forward looking statements about our 2022 guidance and our long-term production outlook. For a description of material factors that could cause our actual results to differ materially from the forward-looking information below, please see the “Forward-Looking Information” section of this AIF and the “Risk Factors” section of this AIF filed with the Canadian securities regulatory authorities on www.sedar.com. GEOs as presented is a non-IFRS financial performance measure with no standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. For further information and a detailed reconciliation of GEOs to the most directly comparable IFRS measure, please see the “Non-IFRS Financial Performance Measures – Gold Equivalent Ounces (“GEOs”)” section included in the Management’s Discussion & Analysis of the Company’s 2021 Annual Report which is available on our SEDAR profile at www.sedar.com, and which disclosures are incorporated by reference herein.

In 2022, we expect attributable royalty income and stream sales to total 90,000 to 95,000 GEOs, compared to 83,602 GEOs in 2021. Sales are expected to be weighted towards the back end of 2022.

| | | 2022 |

| GEOs Sales | | 90,000 to 95,000 GEOs |

| | | Gold: 50% to 55% |

| GEOs by Commodity Weighting | | Silver: 40% to 45% |

| | | Other1: 5 % to 10% |

| Depletion | | $59 million to $63 million |

| | | $16 million to $17 million comprising: |

| General & Administrative Costs | | ● Cash G&A: $11 million to $12 million |

| | | ● Non-Cash G&A: $5 million |

| Australian Cash Tax Rate 2 | | 25% |

| 1. | ‘Other’ refers to copper and diamonds. |

| 2. | Australian Cash Taxes are payable for Triple Flag’s Australian royalty interests, specifically Fosterville, Dargues, Henty and Stawell. |

Production over the five-year period ending in 2027 is expected to average 110,000 GEOs per year, a significant increase over current production levels primarily due to continued production growth from Northparkes, Buriticá, Pumpkin Hollow, Gunnison, Dargues, and the resumption of leaching at ATO. The 5,000 GEOs per annum increase, compared to the 2021 outlook for the 5-year period ending in 2026, is due to the addition of ore feed from Northparkes E31 open pit, which is expected to allow Northparkes to fully utilize the 7.6 million tonne per annum processing capacity earlier than originally expected. Processing of E31 ore is expected to commence in 2023.

Over the 10-year period ending in 2032, we expect average production of 105,000 GEOs per year, benefiting from mining of the high-grade E22 block cave at Northparkes, which is expected to commence production in 2026. Centerra Gold’s Kemess project and Talon Metal’s Tamarack project are not included in Triple Flag’s five-year outlook but are included in the 10-year outlook. Long-term GEOs are based on $1,600/oz gold, $21/oz silver and $3.50/lb copper. Above and beyond the long-term production outlook, we believe there is considerable optionality related to potential life of mine extensions, expansions and exploration from our 15 producing mines and 64 exploration and development assets in the portfolio, before factoring in potential future transactions that would add to our growth profile.

The majority of the production expected over the 5- and 10-year outlook is derived from mines that are currently in production and supported by Mineral Reserve estimates. The long-term production outlook requires minimal capital expenditures by the asset operators and a number of the development projects have been permitted, providing a low-risk outlook.

| | | | | | | | 5-year Outlook | | | 10-year Outlook | |

| | | | | | | | Annual Average | | | Annual Average | |

| | | 2021 | | | 2022 Guidance | | (2023 - 2027) | | | (2023 - 2032) | |

| Gold Equivalent Ounces | | 83,602 | | | 90,000 to 95,000 | | 110,000 | | | 105,000 | |

Our outlook on stream and royalty interests is based on assumptions, including the public statements and other disclosures by the third-party owners and operators of the properties on which we have stream and royalty interests (subject to our assessment thereof).

Our 2022 guidance and long-term expected GEOs are based on publicly available forecasts of the owners or operators of our stream and royalty properties. When publicly available forecasts on properties are not available, we obtain internal forecasts from the owners or operators, or use our own best estimate. We conduct our own independent analysis of this information to reflect our expectations based on an operator’s historical performance and track record of replenishing Mineral Reserves and the operator’s publicly disclosed guidance on future production, the conversion of Mineral Resources to Mineral Reserves, drill results, our view on opportunities for mine plan optimization and other factors. In estimating GEOs for 2022, we used commodity prices of $1,800/oz gold, $23.50/oz silver, $4.20/lb copper and $110/carat diamond for the remainder of 2022. In estimating 5- and 10-year average GEOs, we used commodity prices of $1,600/oz gold, $21.00/oz silver, $3.50/lb copper, $110/ct diamond and $6.50/lb nickel.

Streaming and Royalty Business

In a stream, the holder makes an upfront deposit and ongoing payments in exchange for a percentage of specified metals (often a by-product of the mine) determined with reference to metals produced from a mine, at a pre-agreed price or percentage of market price. A royalty is a payment to a royalty holder by an operator or owner of a mining property and is typically based on a percentage of the minerals produced or the revenues or profits generated from the property. Stream interests and, typically, royalty interests, are established through a contract between the holder and the property owner. Streams and royalties are not typically working interests in a property and, therefore, the holder is generally not responsible for contributing additional funds for any purpose, including operating or capital costs or environmental or reclamation liabilities.

Stream interests and revenue-based royalty interests (as opposed to profit-based royalty interests) have no direct exposure to operating and capital costs incurred at the property level. As a result, a holder of such stream or revenue-based royalty is typically insulated from inflation in operating and capital costs, as well as care and maintenance costs associated with temporary mine suspensions. However, since streams and royalties are usually structured for the entire life-of-mine and as a percentage of metal production, the holders benefit from the upside provided by exploration success, mine life extensions and operational expansions within the areas covered by the streams and royalties, typically without sharing in the costs that operators incur to realize such upside. A streaming and royalty business model also facilitates greater diversification than is typical for mining companies. Streaming and royalty companies generally hold a portfolio of assets (often diversified by mine, jurisdiction, operator and commodity), whereas mining companies generally are dependent on only one or a few key mines.

Our streaming and royalty business model offers advantages relative to mining companies and bullion

| | | Triple Flag | | Mining Companies | | Bullion |

| Exposure to: | | | | | |  |

| Metal Prices | |  | |  | |  |

| Earnings & Dividends1 | |  | |  | |  |

| Reserves Replacement2 | |  | |  | |  |

| Operational Expansions or Advancement of Development Projects2 | |  | |  | | |

| Limited exposure to: | | | | | | |

| Margin Compression3 | |  | |  | |  |

| Capital and Operating Costs4 | |  | |  | |  |

| Environmental and Mine Closure Costs | |  | |  | |  |

| 1. | We have declared and paid dividends each quarter since the second quarter of 2021. Any determination to pay dividends in the future will be at the discretion of our Board and will depend on many factors, including, among others, our financial condition, current and anticipated cash requirements, contractual restrictions and financing agreement covenants, including those under our Credit Facility, solvency tests imposed by applicable corporate law and other factors that our Board may deem relevant. See “Risk Factors — Risks Related to Ownership of Our Common Shares — Our ability to pay dividends will be dependent on our financial condition and other restrictions”. |

| 2. | These items depend on the operating and capital allocation decisions of the owner or operator of the property. See “Risk Factors — We have limited or no control over the operation of the properties in which we hold an interest and the operators’ failure to perform or decision to cease or suspend operations will affect our revenue”. |

| 3. | “Margin Compression” represents a decline in asset margin as a result of declining metals prices, potential operating cost inflation or both. |

| 4. | Including care and maintenance costs. |

Summary of Our Asset Portfolio

We own a portfolio of 79 streams and royalties, including 9 streams and 70 royalties. These investments are in mining assets at various stages of the mine life cycle, including 15 producing mines (including four of which are in ramp-up to nameplate capacity) and 64 development and exploration-stage projects.

Our Material Properties

Northparkes Mine — New South Wales, Australia

On July 10, 2020, TF International entered into a metal purchase and sale agreement, effective as of July 1, 2020, (the “Northparkes Stream Agreement”) with CMOC Metals Holding Limited, CMOC Mining Pty Limited and CMOC Mining Services Pty Limited (subsidiaries of CMOC) and CMOC, pursuant to which, in exchange for total upfront cash consideration of $550 million paid by us, plus a payment equal to 10% of the spot gold price and spot silver price for each ounce of gold and silver purchased, we agreed to purchase from CMOC Metals Holding Limited: (i) gold equivalent to 54% of the payable gold produced from the Northparkes mine until such time as an aggregate of 630,000 ounces have been delivered to us, and thereafter 27% of payable gold, and (ii) silver equivalent to 80% of the payable silver produced from the Northparkes mine until such time as an aggregate of nine million ounces of silver have been delivered to us, and 40% of the silver thereafter for the remainder of the life of the mine. Our stream interest covers an area of approximately 1,094.4 square kilometers. Under the terms of the agreement, Triple Flag was granted a right of first refusal (“ROFR”) over future streaming agreements, royalty agreements or similar transactions related to minerals produced at the Northparkes mine. The parties’ obligations under the stream are unsecured.

The Northparkes mine has historically disclosed net reserve growth after giving effect to depletion. As reported by S&P Global Market Intelligence; SNL Metals & Mining Data and Wood Mackenzie, at the end of 2001 gold contained in Proven and Probable Mineral Reserves totaled 998 thousand ounces (“koz”), compared with 955 koz at the end of 2020; during the same period the Northparkes mine produced 996 koz of gold, recovered in concentrate, equating to Mineral Reserves depletion of approximately 1,382 koz of gold (assuming, based on publicly disclosed annual recoveries, an average metallurgical recovery of 72% per Wood Mackenzie). Over this period, gold Mineral Reserves addition of approximately 1,339 koz has offset Mineral Reserves depletion by approximately 1.0 times, leaving the December 31, 2020 Mineral Reserves disclosed by CMOC approximately unchanged.

Cerro Lindo Mine — Chincha Province, Peru

On December 20, 2016, TF International entered into a metal purchase and sale agreement with Milpo UK Limited and Compania Minera Milpo S.A.A. (subsidiaries of Nexa), pursuant to which, in exchange for total upfront cash consideration of $250 million paid by us, plus a payment equal to 10% of the monthly average silver price for each ounce of silver purchased, we agreed to purchase from Milpo UK Limited silver equivalent to 65% of the payable silver produced from the Cerro Lindo mine until such time as an aggregate of 19.5 million ounces of silver have been delivered to us, and 25% of the silver thereafter for the remainder of the life of the mine. Our stream interest covers an area of approximately 90.7 square kilometers. Under the terms of the agreement, we were granted a ROFR over future streaming agreements, royalty agreements or similar transactions related to minerals produced at the Cerro Lindo mine, including the Cerro Lindo north area. The parties’ obligations under the stream are unsecured.

The Cerro Lindo mine has historically disclosed net reserve growth after giving effect to depletion. As reported by S&P Global Market Intelligence; SNL Metals & Mining Data, at the end of 2009 silver contained in Proven and Probable Mineral Reserves totaled 27.5 million ounces (“Moz”), compared with 35.5 Moz at the end of 2020; during the same period the Cerro Lindo mine produced 30.8 Moz of silver, recovered in concentrate, equating to Mineral Reserves depletion of approximately 45.6 Moz of silver (based on publicly disclosed annual recoveries, an average metallurgical recovery of 68% per S&P Global Market Intelligence; SNL Metals & Mining Data). Over this period, silver Mineral Reserves addition of approximately 53.6 Moz has offset Mineral Reserve depletion by approximately 1.2 times, resulting in the December 31, 2020 Mineral Reserves disclosed by Nexa being higher than that disclosed at the end of 2009. Similarly, as reported by S&P Global Market Intelligence; SNL Metals & Mining Data, as at December 31, 2015 the last Mineral Reserves statement date prior to our acquisition of the Cerro Lindo stream in 2016, the Proven and Probable Mineral Reserves for the Cerro Lindo mine measured as total tonnages was approximately 46 Mt, compared to approximately 52 Mt as at December 31, 2020. For our disclosure of Mineral Reserves in respect of the Cerro Lindo mine and scientific and technical information with respect to the Cerro Lindo mine, see “Cerro Lindo Mining and Technical Information”.

RBPlat PGM Operations — North West Province, South Africa

On October 13, 2019, TF International entered into a metals purchase and sale agreement (the “RBPlat Stream Agreement”) with RBPlat and its direct and indirect subsidiaries Royal Bafokeng Resources Proprietary Limited (“RBR”) and Maseve Investments 11 Proprietary Limited pursuant to which Triple Flag agreed to purchase from RBR 70% of the payable gold produced from the RBPlat PGM Operations over their life-of-mine, for total upfront cash consideration of $145 million, plus a payment equal to 5% of the gold spot price for each ounce of gold delivered under the agreement. Following the date on which 261,000 ounces of gold have been delivered to us, our stream percentage will be reduced to 42% of the payable gold for the remaining life of the mine. The parties have agreed to a fixed payability ratio of 85% and a gold recovery floor mechanism whereby for the first five calendar years commencing at closing, if gold recoveries at the RBPlat PGM processing facilities are less than 66%, then Triple Flag will be entitled to receive an additional delivery of gold representing the amount of gold that would have been delivered in such year had gold recoveries been 66%. In connection with the agreement, RBPlat provided Triple Flag with a limited recourse guarantee and granted Triple Flag certain security interests over certain assets related to the RBPlat PGM Operations until the date on which 261,000 ounces of gold have been delivered to Triple Flag. Triple Flag’s security interests are subordinated to the interests of the senior lenders to RBPlat. Triple Flag funded the upfront deposit on January 23, 2020. Our stream interest covers an area of approximately 104.3 square kilometers. Triple Flag was granted a ROFR over future streaming agreements, royalty agreements and similar transactions related to minerals produced at the RBPlat PGM Operations, including the Styldrift II development project and neighboring royalty concessions held by Impala Platinum Holdings Limited (“Impala”).

Other Select Properties

Fosterville Mine — Victoria, Australia

Triple Flag owns a 2.0% NSR royalty (the “Fosterville Royalty”) in the mineral properties comprising the Fosterville mine in Victoria, Australia. The Fosterville Royalty is payable to Triple Flag on all gold recovered or produced from the Fosterville mine and sold (or deemed to have been sold) by or for Fosterville Gold Mine Pty Ltd. Our royalty interest covers an area of approximately 508.4 square kilometers.

Triple Flag acquired the Fosterville Royalty as part of a portfolio of royalties acquired from Centerra Gold Inc. and its subsidiaries for an aggregate purchase price of $155 million pursuant to a purchase and sale agreement (the “Royalty Purchase Agreement”) dated May 16, 2018, between, among others AuRico Metals Inc., AuRico Canadian Royalties Holdings Inc., TF R&S Canada Ltd. (“TF R&S”) and TF International. Under the terms of the Royalty Purchase Agreement, TF R&S acquired, among other assets, all of the issued and outstanding shares in the capital of TF Australia Holdings Ltd. (“TF Australia Holdings”), the holder of the Fosterville Royalty. The parties’ obligations under the Fosterville Royalty are unsecured.

Principally by virtue of the discovery of the Swan Zone, the Fosterville mine has disclosed net reserve growth after giving effect to depletion. As reported by S&P Global Market Intelligence; SNL Metals & Mining Data, at the end of August 2006 gold contained in Proven and Probable Mineral Reserves totaled 1,004 koz, compared with 1,970 koz at the end of 2020; during the same period the Fosterville mine produced 2,891 koz of gold, equating to Mineral Reserves depletion of approximately 3,116 koz (assuming, based on publicly disclosed annual recoveries, an average metallurgical recovery of 93% per S&P Global Market Intelligence; SNL Metals & Mining Data). Over this period, gold Mineral Reserves addition of approximately 4,082 koz has offset Mineral Reserves depletion by approximately 1.3 times, resulting in the December 31, 2020 Mineral Reserves disclosed by Kirkland higher than that disclosed at the end of August 2006. As reported by S&P Global Market Intelligence; SNL Metals & Mining Data, as at December 31, 2017, the last Mineral Reserves statement date prior to our acquisition of the Fosterville royalty in 2018, gold contained in Proven and Probable Mineral Reserves totaled 1,859 koz, compared to 1,970 koz as at December 31, 2020.

Buriticá Mine — Antioquia Department, Colombia

On March 15, 2019, TF International entered into a metals purchase and sale agreement (the “Buriticá Stream Agreement”) with Continental Gold Inc. (“Continental Gold”) and its direct and indirect subsidiaries, Continental Gold Limited, Continental Gold Limited acting through its Colombian Branch Continental Gold Limited Sucursal Colombia, CGL International Holdings Limited, CGL Greater Buriticá Holdings Limited, CGL Gran Buriticá S.A.S. and Costa S.O.M. (the “Continental Subsidiaries”), as amended on June 25, 2019, pursuant to which, in exchange for total upfront cash consideration of $100 million paid by Triple Flag, plus a payment equal to 10% of the gold spot price for each ounce of gold purchased and 5% of the silver spot price for each ounce of silver purchased, Triple Flag agreed to purchase from Continental Gold gold equivalent to 2.1% of the payable gold produced from the Buriticá mine over its life-of-mine and silver equivalent to 100% of reference silver calculated using a fixed ratio to payable gold (the fixed ratio being 1.84 ounces of reference silver for each ounce of payable gold produced from the Buriticá mine over its life-of-mine). In connection with the agreement, each of the Continental Subsidiaries provided Triple Flag with corporate guarantees and Triple Flag was granted certain security interests over assets related to the Buriticá mine. Triple Flag’s security interests were subordinated to the interests of a lender to Continental Gold, and Continental Gold is permitted, under its agreement with Triple Flag, to incur up to $375 million of secured project finance indebtedness. Continental Gold was acquired by Zijin Mining on March 4, 2020. Zijin Mining had a one-time option until December 31, 2021 to repurchase 100% of the gold stream in exchange for a payment of $80 million, subject to certain adjustments. Effective December 31, 2020, Zijin Mining exercised such repurchase option for $78 million. Triple Flag continues to purchase from Continental Gold silver equivalent to 100% of reference silver calculated using a fixed ratio to payable gold (the fixed ratio being 1.84 ounces of reference silver for each ounce of payable gold produced from the Buriticá mine over its life-of-mine), but, effective as of December 31, 2020, ceased to purchase gold equivalent to 2.1% of the payable gold produced from the Buriticá mine over its life-of-mine.

Gunnison Mine — Arizona, United States

On October 30, 2018, TF International entered into a copper purchase and sale agreement with Excelsior, Excelsior Mining Arizona, Inc. and Excelsior Mining JCM, Inc. pursuant to which, in exchange for an upfront deposit of $65 million and ongoing payments equal to 25% of the copper spot price for each tonne of copper purchased, Triple Flag agreed to purchase from Excelsior Mining Arizona, Inc. a percentage of refined copper produced from the Gunnison mine over its life-of-mine ranging from 16.5% to 3.5% depending on the Gunnison mine’s total production capacity, with the stream participation percentage decreasing as the Gunnison mine’s production capacity increases, through its currently projected three-phase development, as follows: (i) from 16.5% in stage one, which has an anticipated capacity of 25 million pounds per year (“Mlbspa”); (ii) to 5.75% in stage two, which has an anticipated capacity of 75 Mlbspa; and (iii) 3.5% in stage three, which has an anticipated capacity of 125 Mlbspa.

In addition, Triple Flag has the option to increase its stream participation percentage by paying an additional deposit of an amount determined by Triple Flag of up to $65 million. This option is exercisable by Triple Flag within 90 days of receipt of a notice indicating that the Excelsior board of directors has made a positive construction decision with respect to an expansion of the Gunnison mine where, following completion of such expansion, the Gunnison mine will have a nameplate capacity of salable copper cathodes production on an annualized basis of at least 50 Mlbspa. The increase in the stream percentage will be relative to the proportion of the additional deposit. Excelsior had a buy down option to reduce Triple Flag’s stream participation percentage which was removed in December 2021.

The chart below illustrates Triple Flag’s effective stream participation percentage in these anticipated capacity scenarios:

| Stage 1 | | | Stage 2 (75 Mlbspa) | | Stage 3 (125 Mlbspa) |

| | | | No additional

deposit | | | Additional

deposit | | | No additional

deposit | | | Additional

deposit | |

| 16.50 | % | | 5.75 | % | | 11.00 | % | | 3.50 | % | | 6.60 | % |

Under the terms of the agreement, Triple Flag was granted a ROFR over future streaming agreements, royalty agreements or similar transactions related to minerals produced at the Gunnison mine. In connection with the agreement, Excelsior also agreed to guarantee the obligations of Excelsior Mining Arizona, Inc. and Excelsior Mining JCM, Inc. pursuant to the agreement. On October 23, 2019, the parties made certain non-material amendments to the agreement. The parties’ obligations under the stream are unsecured.

On January 28, 2021, Excelsior announced the first sale of copper cathode from the Gunnison mine. On May 7, 2021, Excelsior disclosed that fluid flow rates have resulted in slower than anticipated ramp up to nameplate capacity of 25 Mlbspa. Excelsior is working to restart the Johnson Camp Mine which, once operational, is expected to provide cash flow while the raffinate neutralization plant is being designed and built for Excelsior’s flagship asset, the Gunnison Copper Mine.

Pumpkin Hollow Mine — Nevada, United States

On December 21, 2017, TF International entered into a metals purchase and sale agreement (the “Pumpkin Hollow Stream Agreement”) with Nevada Copper and Nevada Copper, Inc., pursuant to which, in exchange for total upfront cash consideration of $70 million, plus a payment equal to 10% of the gold spot price for each ounce of gold purchased and 10% of the silver spot price for each ounce of silver purchased, Triple Flag agreed to purchase from Nevada Copper, Inc. gold equivalent to 90% of reference gold calculated using a fixed ratio to payable copper (the fixed ratio being 162.5 ounces of reference gold for each million pounds of payable copper produced from the underground portion of the Pumpkin Hollow mine over its life-of-mine), and silver equivalent to 90% of reference silver calculated using a fixed ratio to payable copper (the fixed ratio being 3,131 ounces of reference silver for each million pounds of payable copper produced from the underground portion of the Pumpkin Hollow mine over its life-of-mine). Under the terms of the agreement, Triple Flag was granted a ROFR over future streaming agreements, royalty agreements or similar transactions related to minerals produced at the underground portion of the Pumpkin Hollow mine, as well as from certain other areas of the Pumpkin Hollow mine. In connection with the agreement, Nevada Copper and certain of its subsidiaries provided Triple Flag with corporate guarantees and Triple Flag was granted certain security interests over assets related to the Pumpkin Hollow mine. On March 27, 2020, in connection with a financing transaction related to the Pumpkin Hollow mine, TF International, Nevada Copper and Nevada Copper Inc. further amended the Pumpkin Hollow Stream Agreement to provide for an additional $15 million in payments by Triple Flag, comprised of a $10 million payment funded on May 1, 2020 and an additional $5 million to be paid through the reinvestment of 50% of the first $10 million of cash flow generated from the stream after May 1, 2020. As consideration for the additional advance of $15 million, the parties agreed to increase the stream rate for gold and silver to 97.5% of reference gold and 97.5% of reference silver, respectively, and to reduce the variable gold price and variable silver price to 5% of the gold spot price and 5% of the silver spot price, respectively. Concurrent with execution of the amendment agreement, Triple Flag USA Royalties Ltd. entered into royalty agreements with Nevada Copper pursuant to which Nevada Copper granted Triple Flag (i) a 0.70% NSR royalty in respect of the open pit portion of the Pumpkin Hollow mine in exchange for a purchase price of $17 million, which was funded on March 27, 2020, and (ii) a 2.00% NSR royalty in respect of Nevada Copper’s Tedeboy exploration project in exchange for a purchase price of $3 million, which was funded on March 27, 2020, and an additional contingent payment of $5 million to be paid upon commercial production commencing in respect of the Tedeboy project. On December 8, 2020, the parties made certain non-material amendments to the Pumpkin Hollow Stream Agreement.

ATO Mine — Dornod Province, Mongolia

On August 11, 2017, TF International entered into a metals purchase and sale agreement (the “ATO Stream Agreement”) with Steppe Gold, Steppe Investments Limited and Steppe Gold LLC (collectively, the “Steppe Entities”) pursuant to which, in exchange for total upfront cash consideration of $23 million, payable in stages, plus a payment equal to 30% of the gold spot price for each ounce of gold purchased and 30% of the silver spot price for each ounce of silver purchased (in each case subject to a seven-day quotational period), Triple Flag agreed to purchase from Steppe Investments Limited gold and silver equivalent to 25% of the payable gold and 50% of the payable silver produced from the ATO mine over its life-of-mine, subject to certain annual maximums. Pursuant to the amendment described below, the ongoing payment obligations for gold and silver have each been reduced to 17% and are no longer subject to a quotational period. Following the date on which Triple Flag has been delivered 46,000 ounces of gold, its gold delivery entitlement is limited to 7,125 ounces of gold per twelve-month period. Similarly, following the date on which Triple Flag has been delivered 375,000 ounces of silver, its silver delivery entitlement is limited to 59,315 ounces per twelve-month period. Under the terms of the agreement, Triple Flag was granted a ROFR over future streaming agreements, royalty agreements or similar transactions related to minerals produced at the ATO mine and certain other properties which may be subsequently acquired by the Steppe Entities in Mongolia. In connection with the agreement, the Steppe Entities also provided Triple Flag with corporate guarantees and Triple Flag was granted certain security interests over assets related to the ATO mine.

On September 30, 2019, TF International and the Steppe Entities executed an amendment to the ATO Stream Agreement, pursuant to which Triple Flag agreed to fund an additional deposit of $5 million in exchange for a reduction to the variable gold and variable silver prices payable in connection with purchases of gold and silver under the ATO Stream Agreement. In particular, the amendment reduced Triple Flag’s ongoing payment obligations from 30% of the gold spot price to 17% of the gold spot price for each ounce of gold purchased and from 30% of the silver spot price to 17% of the silver spot price for each ounce of silver purchased. The amendment also eliminated the seven-day quotational period mechanic in favor of a pure spot price mechanic. Concurrent with execution of the amendment agreement, TF R&S, Steppe Gold Ltd. and Steppe West LLC entered into a royalty agreement pursuant to which Steppe West LLC granted Triple Flag a 3.0% NSR royalty on the Uudam Khundii project in Mongolia.

On July 6, 2020, Steppe Gold announced that it had achieved commercial production in the second quarter of 2020 with all operations and facilities running to plan and all relevant metrics met.

On March 24, 2021, Steppe Gold announced that a feasibility study had been completed with respect to its Phase 2 fresh rock expansion, which is targeting annual production of 150,000 GEOs.

During the second quarter of 2021, Steppe Gold began experiencing challenges with its gold production at the ATO mine due to COVID-19 supply chain issues, which continued during the third quarter of 2021. ATO’s full year 2021 gold production was negatively impacted by ongoing COVID-19 related supply disruptions of key reagents. Relatively high rates of COVID-19 cases in Mongolia resulted in robust restrictions at the Mongolia-China border for certain goods, causing supply disruptions for ATO that Steppe Gold considers to be temporary in nature, representing a deferral of production from 2021 to 2022.

Young-Davidson Mine — Ontario, Canada

Triple Flag owns a 1.5% NSR royalty (the “Young-Davidson Royalty”) in certain mineral properties comprising the Young-Davidson mine in Ontario, Canada. The Young-Davidson Royalty is payable to Triple Flag on all ores, minerals and mineral products mined, produced, extracted, derived or otherwise recovered from the Young-Davidson mine.

Triple Flag acquired the Young-Davidson Royalty from AuRico Canadian Royalties Holdings Inc. as part of a portfolio of royalties acquired from Centerra Gold Inc. and its subsidiaries for an aggregate purchase price of $155 million pursuant to the terms of the Royalty Purchase Agreement and the royalty assignment and assumption agreement (Young-Davidson) dated June 27, 2018 between AuRico Canadian Royalties Holdings Inc. and TF R&S. The parties’ obligations under the Young-Davidson Royalty are unsecured.

Young-Davidson completed its planned lower mine expansion in 2020. As a result of the completion, underground mining rates increased during 2020. Based on guidance published by Alamos Gold on December 9, 2020, production from Young-Davidson is expected to increase to 190 — 205 koz in 2021 from 136 koz in 2020, resulting in an updated reserve life of 14 years.

Other Investments

GoldSpot Equity Investment

On January 30, 2019, TF R&S entered into a mineral interest purchase agreement with GoldSpot Discoveries Inc. (“GoldSpot Inc.”) pursuant to which it acquired certain royalty and future royalty interests from GoldSpot Inc. in exchange for C$100,000. Additionally, on January 30, 2019, TF R&S entered into a subscription agreement with GoldSpot Inc. pursuant to which it acquired 175,227 subscription receipts entitling it to receive common shares of GoldSpot Inc. for an aggregate purchase price of approximately C$2.9 million. These shares were subsequently exchanged for 7,248,686 common shares of GoldSpot Discoveries Corp. (previously known as Duckworth Capital Corp.) (“GoldSpot”) pursuant to the terms of an amalgamation agreement between, among others, GoldSpot Inc. and Duckworth Capital Corp. GoldSpot is an artificial intelligence (“AI”) and machine learning company which applies AI-driven analysis to seldomly-combined data sets in order to increase efficiencies and success rates in mineral exploration. In exchange for its services to customers, GoldSpot obtains a royalty in mineral interests held by those customers. Pursuant to the mineral interest purchase agreement, Triple Flag has a ROFR over 50% of all royalties generated as part of GoldSpot’s business, providing Triple Flag with access to greenfield projects that have the benefit of GoldSpot’s technology. As part of the arrangement, Triple Flag gains exposure to exploration technologies and GoldSpot’s team of over 20 geologists, geophysicists and data scientists. The partnership enables Triple Flag to leverage GoldSpot’s team and networks in the junior mining/exploration market to act as a source of deal flow, without the typical general and administrative expense associated with attempting to build a comparable in-house capability.

Other Equity Interests

Our strategy does not include making stand-alone equity investments in mining assets or companies. However, our assets include certain equity interests in publicly traded companies that we have acquired in connection with, and ancillary to, the acquisition of streams, royalties or other similar interests. We may sell down these positions from time to time as and when market conditions permit.

The following table lists our investments as of December 31, 2021:

| | | Number of | | | Number of | | | Original Cost | | | Fair Value | |

| Company | | shares held | | | warrants held | | | ($ thousands) | | | ($ thousands) | |

| Excelsior Mining Corp1 | | | 13,818,977 | | | | 3,500,000 | | | | 10,000 | | | | 4,571 | |

| GoldSpot Discoveries Corp2 | | | 6,444,786 | | | | - | | | | 1,953 | | | | 4,711 | |

| Talon Metals Corp3 | | | 5,000,000 | | | | - | | | | 322 | | | | 2,397 | |

| Nevada Copper Corp4 | | | 2,500,000 | | | | 1,500,000 | | | | 10,033 | | | | 1,389 | |

| Steppe Gold Ltd 5 | | | 580,000 | | | | 4,380,000 | | | | 895 | | | | 604 | |