united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23611

James Alpha Funds Trust

(Exact name of registrant as specified in charter)

515 Madison Avenue, 24th Floor, New York, NY 10022

(Address of principal executive offices) (Zip code)

Emile R. Molineaux, Gemini Fund Services, LLC

80 Arkay Drive, Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 623-266-4567

Date of fiscal year end: 11/30

Date of reporting period: 11/30/21

Amended to update trust name.

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

|

| |

| |

| JAMES ALPHA FUNDS TRUST |

| |

| |

| |

| |

| CLASS A, C, I AND R6 SHARES |

| |

| |

| |

| |

| |

| |

| |

| ANNUAL REPORT |

| NOVEMBER 30, 2021 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| THIS REPORT IS AUTHORIZED FOR DISTRIBUTION ONLY TO SHAREHOLDERS AND TO OTHERS WHO HAVE RECEIVED A COPY OF THE PROSPECTUS. |

James Alpha Funds Trust d/b/a Easterly Funds Trust

ANNUAL REPORT TO SHAREHOLDERS

January 26, 2022

Dear Shareholder:

We are pleased to provide you with this annual report on the investment strategies and performance of the funds in the James Alpha Funds Trust d/b/a Easterly Funds Trust (the “Trust”). This report covers the twelve months from December 1, 2020 through November 30, 2021.

We believe that successful investing requires discipline and patience. Try to stay focused on your long-term investment goals. Don’t let short-term stock and bond market fluctuations or investment manias change your long-term investment strategy. In our opinion, the Easterly Funds are managed by some of the world’s leading institutional investment advisory firms. It is our belief that combining the strength of the Trust’s performance with a well-designed asset allocation plan can help you to achieve your long-term investment goals.

ECONOMIC OVERVIEW

As measured by Real Gross Domestic Product (GDP), the value of the production of goods and services in the United States increased by an annualized growth rate (AGR) of 4.9% during the third quarter of 2021, a significant growth rate driven by technical ‘base effects’ from Q3 2020. The primary driver of strong performance in the markets in the past 12 months has been the continued recovery in the post-Covid world. Successful vaccination programs, continued support from both monetary and fiscal sources, and consumers who are ready to spend have all supported a robust recovery. New Home Sales were down from their cycle high (around 1 million) to an annualized 744 thousand units in November 2021, still far above average from the past decade. The auto industry suffered a massive decline in sales during the first half of 2020, experienced a cycle high in April 2021 (where an annualized 18.5 million auto sales occurred; a five year high), but has been on a decline each month since. The unemployment rate declined from 14.7% in April 2020 to 4.2% in November 2021. The unemployment claims is an important leading indicator in our work, specifically the 4-week sum of weekly Initial Claims data. That number has dropped to 879 thousand from a pandemic peak of over 21 million claims. For perspective, the historic average from 1967 to present is about 1.5 million. The overall economy in 2021 could be characterized as a ‘boom’ economy, with expanding equity valuations, rising interest rates, and shortages of good and services across the economy driven by robust consumer demand and lingering supply chain issues that have been morphing since the beginning of the pandemic. This market has been largely controlled by the Federal Reserve, who have signaled their commitment to support economic demand through extremely easy monetary policy and continued massive liquidity injections. The Fed’s language around inflation in the past year has meaningfully changed from an absolute target to an inflation averaging target where they have let inflation run hot (above target) in order to achieve a long-term average of their target of 2%. The Fed continues to sustain historic emergency measures even with the strong economic backdrop.

Monetary Policy: The Federal Reserve has remained extraordinarily accommodative since the beginning of the pandemic, but with falling unemployment, strong demand, and persistently high inflation, the tone at the Fed has begun to shift towards reining in their emergency measures. In its most recent FOMC statement, the Committee stated that they “should be prepared to adjust the pace of asset purchases and raise the target range of the federal funds rate sooner than participants currently anticipated if inflation continued to run higher than levels consistent with the Committee’s objectives”. They also said they would “not hesitate to take appropriate actions to address inflation pressures that posed risks to its longer-run price stability and employment objectives”. This constitutes a major pivot as the median forecast now shows balance sheet tapering finishing in March 2022 (previous forecast was for summer of 2022). In

terms of the benchmark Fed Funds rate, the Committee’s updated projection (i.e., the Dot Plot) signaled that rate hikes may come sooner than expected with the median forecast showing one rate hike in 2022 and three more hikes in 2023. Market participants / traders are pricing in three rate hikes over the next twelve months.

Interest Rates: Treasury yields bottomed in August 2020 and have generally increased ever since, although the rise has been volatile. In the twelve months since the end of November 2020, the yield curve has steepened with the 5-year treasury rate moving from 0.36% to 1.16%, the 10-year rate going from 0.84% to 1.44%, and the 30-year rate going from 1.57% to 1.79%. Ultra-short-term rates are largely unchanged; however, there has been a sizeable tick up in the 2-year rate (from 0.15% to 0.57%). With the Fed setting the stage for tapering their asset purchases (and raising the Fed Funds rate soon thereafter), we believe the environment is supportive of rates and yields will remain steady to higher over the next 12 months.

Equity Valuations: Equity markets have rebounded strongly off the pandemic lows with the S&P 500 up 27.9% since the end of November 2020. During 2021, the S&P 500 achieved a new record high close on 67 separate trading sessions with a maximum drawdown of only 5.2%. Depending on the metric, valuations range anywhere from fairly valued to strongly overvalued. As an example, Warren Buffett’s favorite indicator is the ratio of total equity market cap to GDP (termed “the Buffett Indicator”) is near a record high level of 202% with the previous record high of 143% set in March 2000, indicating the market is strongly overvalued. However, the S&P 500 is currently trading at a forward P/E ratio of approximately 22.2 times, which is only modestly above its 30-year average of 21.2 times.

Inflation: Inflation, as measured by the consumer price index (CPI) was up 6.81% y-o-y in November 2021, a rate not seen since the early 1980’s. For the last year and a half, the Fed’s objective has been to run the economy hot through ultra-easy monetary policy with the intention of spurring inflation above their target to achieve a long-term average of 2%. Inflation data has come in much higher than forecast throughout 2021, which the Fed has called ‘transitory’ due to shortages and supply chain issues. Recently, they have stopped using the term ‘transitory’ with Powell now calling inflation pressures ‘frustrating’, a possible signal of future monetary tightening if inflation persists above forecast into next year.

COMPARING THE FUND PERFORMANCE TO BENCHMARKS

When reviewing the performance of the funds against their benchmarks, it is important to note that the Trust is designed to help investors to implement an asset allocation strategy to meet their individual needs as well as select individual investments within each asset category among the myriad of choices available. Each Easterly Fund was formed to represent an asset class, and each portfolio’s institutional money manager was selected based on their experience managing money within that class.

Therefore, we believe that Easterly Funds may be able to help investors to properly implement their asset allocation decisions and keep their investments within the risk parameters that they establish with their investment consultants. We feel that without the intended asset class consistency of the Easterly Funds, even the most carefully crafted allocation strategy could be negated. Furthermore, we believe the benchmarks do not necessarily provide precise standards against which to measure the portfolios, in that the characteristics of the benchmarks can vary widely at different points in time from the Easterly Funds (e.g., characteristics such as: average market capitalizations, price-to-earnings and price-to-book ratios, bond quality ratings and maturities, etc.). In addition, the benchmarks can potentially have a survivor bias built into them (i.e., the performance of only funds that are still in existence may remain part of the benchmark’s performance while funds that do not exist anymore may be removed from the benchmark’s performance).

ELECTRONIC DELIVERY AVAILABLE

This report can be delivered to you electronically. Electronic delivery can help simplify your record keeping. With electronic delivery, you’ll receive an email with a link to your James Alpha Funds Trust quarterly statement, daily confirmations and/or semi-annual and annual reports each time one is available. You have the ability to choose which items you want delivered electronically. Choose one item or all items. It’s up to you. Please call our Customer Service Department toll-free at (833) 999-2636 for instructions on how to establish electronic delivery.

Investors should consider the investment objectives, risks, charges and expenses of the Easterly Funds carefully. This and other information about the Easterly Funds is contained in your prospectus, which should be read carefully. To obtain an additional copy of the prospectus, please call 888.814.8180. Past performance is not indicative of future results. Investments in stocks, bonds and mutual funds are not guaranteed and the principal value and investment return can fluctuate. Consequently, investors may receive back less than invested.

The S&P 500 is an unmanaged, capitalization-weighted index. It is not possible to invest directly in the S&P 500.

The security holdings discussed may not be representative of the Funds’ current or future investments. Fund holdings are subject to change and should not be considered to be investment advice. Any statements not of a factual nature constitute opinions which are subject to change without notice. Information contained herein was obtained from recognized statistical services and other sources believed to be reliable and we therefore cannot make any representation as to its completeness or accuracy. The Easterly Funds are distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

14360851-UFD-01272022

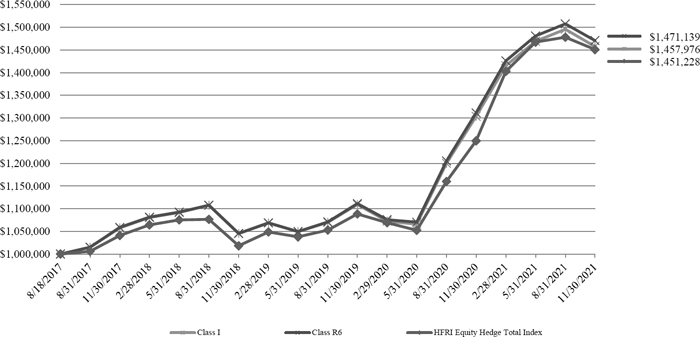

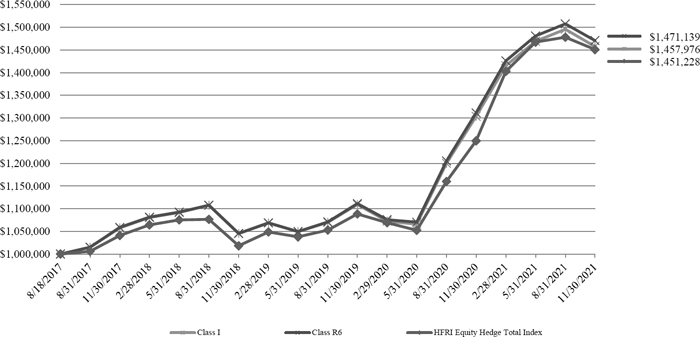

Easterly EHS Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2021

The Fund’s performance figures* for each of the periods ended November 30, 2021, compared to its benchmarks:

| | | Annualized | Annualized |

| | 1 Year Return | 3 Year Return | Since Inception* |

| Class I | 11.81% | 11.73% | 9.20% |

| Class R6 | 12.18% | 12.07% | 9.43% |

| HFRI Equity Hedge Total Index(a) | 16.13% | 12.26% | 8.79% |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The total operating expense ratio as stated in the fee table to the Portfolio’s prospectus dated March 22, 2021, is 4.96% and 4.53% for the I and R6 Classes, respectively.

| (a) | HFRI Equity Hedge Total Index: Investment Managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. EH managers would typically maintain at least 50% exposure to, and may in some cases be entirely invested in, equities, both long and short. The returns for the Index have been calculated from July 31, 2017. |

| * | Inception date is August 18, 2017. |

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $1,000,000 INVESTED IN THE

EASTERLY EHS FUND VS. BENCHMARKS

| Top 10 Holdings by Industry | | % of Net Assets | |

| Equity | | | 63.5 | % |

| Fixed Income | | | 25.3 | % |

| Commodity | | | 0.6 | % |

| Specialty | | | 0.1 | % |

| Other/Cash & Equivalents | | | 10.5 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

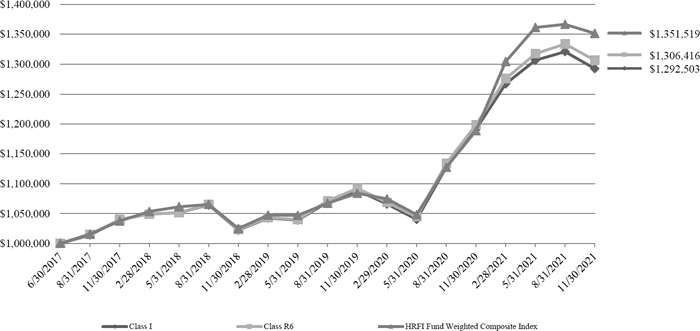

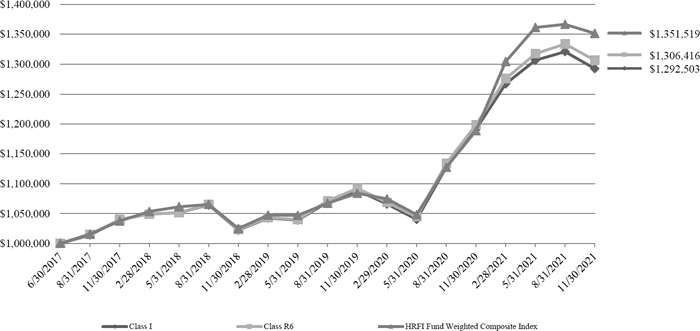

Easterly Total Hedge Portfolio

PORTFOLIO REVIEW (Unaudited)

November 30, 2021

The Fund’s performance figures* for each of the periods ended November 30, 2021, compared to its benchmarks:

| | | Annualized | Annualized |

| | 1 Year Return | 3 Year Return | Since Inception* |

| Class I | 8.51% | 8.14% | 5.98% |

| Class R6 | 9.01% | 8.49% | 6.24% |

| HRFI Fund Weighted Composite Index(a) | 13.72% | 9.38% | 6.86% |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The total operating expense ratio as stated in the fee table to the Portfolio’s prospectus dated March 22, 2021, is 2.69% and 2.69% for the I and R6 Classes, respectively.

| (a) | The HFRI Fund Weighted Composite Index is a global, equal-weighted index of appx. 1,900 single-manager funds that report to HFR Database. Constituent funds report monthly net of all fees performance in US Dollar and have a minimum of $50 Million under management or a twelve (12) month track record of active performance. The HFRI Fund Weighted Composite Index does not include Funds of Hedge Funds. |

| * | Inception date is June 30, 2017. |

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $1,000,000 INVESTED IN THE

EASTERLY TOTAL HEDGE PORTFOLIO VS. BENCHMARKS

| Top 10 Holdings by Industry | | % of Net Assets | |

| Fixed Income | | | 44.9 | % |

| Equity | | | 34.1 | % |

| Alternative | | | 9.4 | % |

| Commodity | | | 1.9 | % |

| Mixed Allocation | | | 0.7 | % |

| Specialty | | | 0.2 | % |

| Other/Cash & Equivalents | | | 8.8 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

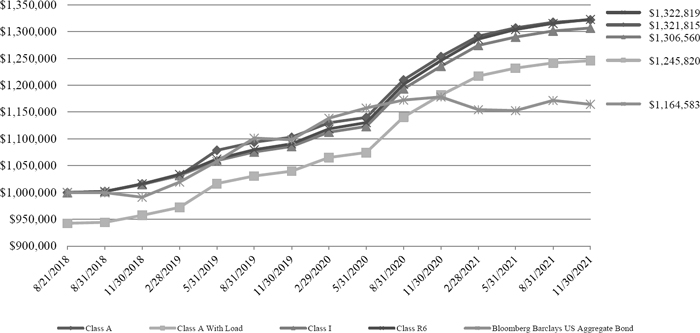

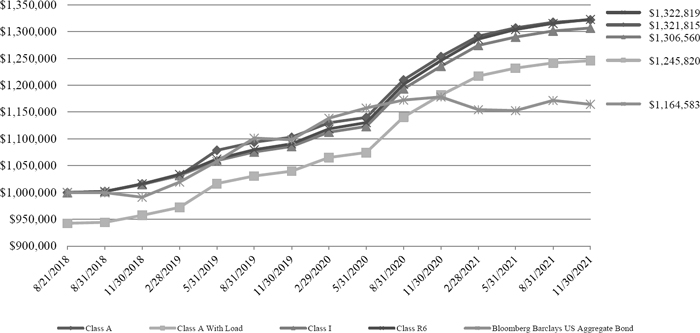

Easterly Structured Credit Value Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2021

The Fund’s performance figures* for each of the periods ended November 30, 2021, compared to its benchmarks:

| | | | Annualized |

| | 1 Year Return | 3 Year Return | Since Inception* |

| Class A | 5.44% | 9.17% | 8.89% |

| Class A With Load | -0.60% | 7.03% | 6.94% |

| Class C | 4.71% | 7.82% | 7.66% |

| Class I | 5.74% | 8.78% | 8.50% |

| Class R6 | 6.16% | 9.19% | 8.91% |

| Bloomberg Barclays US Aggregate Bond Index(a) | -1.15% | 5.52% | 4.76% |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The total operating expense ratio as stated in the fee table to the Portfolio’s prospectus dated March 22, 2021, is 1.80%, 2.60%, 1.58%%, and 1.59% for the A, C, I and R6 Classes, respectively.

| (a) | The Barclays Aggregate Bond Index is an unmanaged index which represents the U.S. investmen-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark. |

| * | Inception date is August 21, 2018. |

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $1,000,000 INVESTED IN THE

EASTERLY STRUCTURED CREDIT VALUE FUND VS. BENCHMARKS

| Top 10 Holdings by Industry | | % of Net Assets | |

| Collateralized Mortgage Obligations | | | 28.8 | % |

| Non Agency CMBS | | | 16.2 | % |

| CLO | | | 7.4 | % |

| CDO | | | 5.7 | % |

| Banking | | | 5.3 | % |

| Institutional Financial Services | | | 5.2 | % |

| Specialty Finance | | | 4.5 | % |

| U.S. Treasury Bills | | | 4.4 | % |

| Home Equity | | | 3.5 | % |

| Residential Mortgage | | | 2.5 | % |

| Other/Cash & Equivalents | | | 16.5 | % |

| | | | 100.0 | % |

Please refer to the Portfolio of Investments for a more detailed breakdown of the Fund’s assets.

EASTERLY EHS FUND

SCHEDULE OF INVESTMENTS

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 66.9% | | | | |

| | | | | COMMODITY - 0.6% | | | | |

| | 68 | | | KraneShares Global Carbon Strategy ETF(a) | | $ | 3,252 | |

| | 27 | | | SPDR Gold Shares(a) | | | 4,468 | |

| | | | | | | | 7,720 | |

| | | | | EQUITY - 63.5% | | | | |

| | 50 | | | Alerian MLP ETF | | | 1,584 | |

| | 335 | | | ALPS Medical Breakthroughs ETF(a) | | | 14,372 | |

| | 125 | | | Columbia India Consumer ETF | | | 6,999 | |

| | 8 | | | Consumer Discretionary Select Sector SPDR Fund | | | 1,636 | |

| | 640 | | | ETFMG Travel Tech ETF | | | 15,040 | |

| | 10 | | | First Trust Dow Jones Internet Index Fund(a) | | | 2,298 | |

| | 576 | | | First Trust Financial AlphaDEX Fund | | | 25,955 | |

| | 150 | | | First Trust MultiCap Growth AlphaDEX Fund | | | 18,498 | |

| | 250 | | | First Trust Small Cap Growth AlphaDEX Fund | | | 18,365 | |

| | 17 | | | Global X MSCI China Consumer Discretionary ETF | | | 480 | |

| | 144 | | | Global X MSCI Nigeria ETF | | | 1,460 | |

| | 228 | | | Goldman Sachs Hedge Industry VIP ETF | | | 23,041 | |

| | 593 | | | Invesco S&P 500 Equal Weight ETF, N | | | 91,078 | |

| | 56 | | | Invesco S&P 500 Pure Value ETF | | | 4,272 | |

| | 1,139 | | | Invesco S&P SmallCap Energy ETF | | | 8,053 | |

| | 64 | | | Invesco S&P SmallCap Health Care ETF(a) | | | 11,037 | |

| | 42 | | | Invesco S&P SmallCap Information Technology ETF | | | 6,139 | |

| | 12 | | | Invesco S&P SmallCap Utilities & Communication | | | 772 | |

| | 31 | | | Invesco Water Resources ETF | | | 1,778 | |

| | 176 | | | iShares Biotechnology ETF | | | 27,142 | |

| | 50 | | | iShares China Large-Cap ETF | | | 1,910 | |

| | 20 | | | iShares Expanded Tech-Software Sector ETF(a) | | | 8,298 | |

| | 169 | | | iShares Latin America 40 ETF | | | 4,021 | |

| | 165 | | | iShares Micro-Cap ETF | | | 23,072 | |

| | 77 | | | iShares MSCI Brazil ETF | | | 2,232 | |

| | 40 | | | iShares MSCI China Small-Cap ETF | | | 2,071 | |

| | 15 | | | iShares MSCI EAFE ETF, EQUITY | | | 1,153 | |

| | 27 | | | iShares MSCI Emerging Markets ETF, EQUITY | | | 1,319 | |

| | 166 | | | iShares MSCI Emerging Markets Small-Cap ETF | | | 9,930 | |

| | 444 | | | iShares MSCI Frontier and Sele | | | 15,216 | |

See accompanying notes to financial statements.

EASTERLY EHS FUND

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 66.9% (Continued) | | | | |

| | | | | EQUITY - 63.5% (Continued) | | | | |

| | 476 | | | iShares MSCI India Small-Cap ETF | | $ | 28,231 | |

| | 53 | | | iShares MSCI Indonesia ETF | | | 1,236 | |

| | 47 | | | iShares MSCI Ireland ETF | | | 2,463 | |

| | 107 | | | iShares MSCI Japan ETF | | | 7,097 | |

| | 19 | | | iShares MSCI Japan Small-Cap ETF | | | 1,417 | |

| | 6 | | | iShares MSCI South Africa ETF | | | 269 | |

| | 43 | | | iShares MSCI Taiwan ETF | | | 2,782 | |

| | 20 | | | iShares MSCI Thailand ETF | | | 1,457 | |

| | 652 | | | iShares MSCI UAE ETF | | | 10,810 | |

| | 158 | | | iShares MSCI United Kingdom Small-Cap ETF | | | 7,056 | |

| | 81 | | | iShares Russell 1000 Growth ETF | | | 24,290 | |

| | 88 | | | iShares Russell 1000 Value ETF | | | 13,963 | |

| | 162 | | | iShares Russell 2000 ETF, EQUITY | | | 35,343 | |

| | 51 | | | iShares Russell 2000 Growth ETF | | | 14,897 | |

| | 327 | | | iShares Russell 2000 Value ETF | | | 52,473 | |

| | 73 | | | iShares Russell Mid-Cap Growth ETF | | | 8,388 | |

| | 300 | | | iShares Russell Mid-Cap Value ETF | | | 34,679 | |

| | 15 | | | iShares U.S. Financial Services ETF | | | 2,820 | |

| | 19 | | | iShares U.S. Healthcare Providers ETF | | | 4,946 | |

| | 21 | | | iShares US Financials ETF | | | 1,774 | |

| | 9 | | | iShares US Pharmaceuticals ETF | | | 1,685 | |

| | 203 | | | KraneShares CSI China Internet ETF | | | 8,942 | |

| | 61 | | | Materials Select Sector SPDR Fund | | | 5,164 | |

| | 72 | | | SPDR FactSet Innovative Technology ETF | | | 14,668 | |

| | 41 | | | SPDR S&P 500 ETF Trust | | | 18,678 | |

| | 321 | | | SPDR S&P Emerging Asia Pacific ETF | | | 39,629 | |

| | 2 | | | SPDR S&P Oil & Gas Exploration & Production ETF | | | 195 | |

| | 43 | | | SPDR S&P Regional Banking ETF | | | 3,002 | |

| | 862 | | | VanEck Africa Index ETF | | | 17,382 | |

| | 407 | | | VanEck Brazil Small-Cap ETF | | | 6,502 | |

| | 167 | | | VanEck Egypt Index ETF | | | 4,359 | |

| | 21 | | | VanEck Israel ETF | | | 1,009 | |

| | 365 | | | VanEck Russia ETF | | | 10,322 | |

| | 122 | | | VanEck Russia Small-Cap ETF | | | 4,335 | |

See accompanying notes to financial statements.

EASTERLY EHS FUND

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 66.9% (Continued) | | | | |

| | | | | EQUITY - 63.5% (Continued) | | | | |

| | 9 | | | VanEck Semiconductor ETF | | $ | 2,744 | |

| | 446 | | | VanEck Vectors ChinaAMC SME-Ch | | | 24,222 | |

| | 453 | | | VanEck Vietnam ETF | | | 9,400 | |

| | 401 | | | Vanguard FTSE Emerging Markets ETF | | | 19,725 | |

| | 140 | | | Vanguard Total World Stock ETF | | | 14,598 | |

| | 72 | | | WisdomTree Emerging Markets SmallCap Dividend Fund | | | 3,694 | |

| | 244 | | | WisdomTree Japan Hedged SmallCap Equity Fund | | | 10,180 | |

| | 435 | | | Xtrackers Harvest CSI 300 China A-Shares ETF | | | 16,739 | |

| | 28 | | | Xtrackers Harvest CSI 500 China A-Shares ETF | | | 1,155 | |

| | 76 | | | Xtrackers MSCI All China Equity ETF | | | 3,034 | |

| | | | | | | | 846,975 | |

| | | | | FIXED INCOME - 2.7% | | | | |

| | 300 | | | Invesco Financial Preferred ETF | | | 5,514 | |

| | 366 | | | SPDR Bloomberg Convertible Securities ETF | | | 30,726 | |

| | | | | | | | 36,240 | |

| | | | | SPECIALTY - 0.1% | | | | |

| | 15 | | | ProShares Short VIX Short-Term Futures ETF(a) | | | 806 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $915,447) | | | 891,741 | |

| | | | | | | | | |

| | | | | EXCHANGE-TRADED NOTES — 0.0% | | | | |

| | | | | SPECIALTY - 0.0% | | | | |

| | 11 | | | iPath Series B S&P 500 VIX Short-Term Futures ETN(a) | | | 280 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED NOTES (Cost $223) | | | 280 | |

| | | | | | | | | |

| | | | | OPEN END FUNDS — 22.6% | | | | |

| | | | | FIXED INCOME - 22.6% | | | | |

| | 26,962 | | | Easterly Structured Credit Value Fund, Class R6(b) | | | 300,628 | |

| | | | | | | | | |

| | | | | TOTAL OPEN END FUNDS (Cost $301,699) | | | 300,628 | |

See accompanying notes to financial statements.

EASTERLY EHS FUND

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| | | | | TOTAL INVESTMENTS - 89.5% (Cost $1,217,369) | | $ | 1,192,649 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 10.5% | | | 139,520 | |

| | | | | NET ASSETS - 100.0% | | $ | 1,332,169 | |

| EAFE | - Europe, Australasia and Far East |

| | |

| ETF | - Exchange-Traded Fund |

| | |

| MSCI | - Morgan Stanley Capital International |

| | |

| SPDR | - Standard & Poor’s Depositary Receipt |

| | | | | | | | | | | | | Unrealized | |

| Foreign Currency | | Settlement Date | | Counterparty | | Local Currency | | | U.S. Dollar Value | | | Appreciation/(Depreciation) | |

| To Buy: | | | | | | | | | | | | | | | | |

| Mexican Peso | | 12/22/2021 | | Brown Brothers Harriman | | | 47,206 | | | $ | 2,187 | | | $ | (79 | ) |

| | | | | | | | | | | $ | 2,187 | | | $ | (79 | ) |

| | | | | | | | | | | | | | | | | |

| To Sell: | | | | | | | | | | | | | | | | |

| Australian Dollar | | 12/22/2021 | | Brown Brothers Harriman | | | 3,694 | | | $ | 2,620 | | | $ | 68 | |

| British Pound | | 12/22/2021 | | Brown Brothers Harriman | | | 19,434 | | | | 25,726 | | | | 433 | |

| Canadian Dollar | | 12/22/2021 | | Brown Brothers Harriman | | | 6,320 | | | | 4,928 | | | | 97 | |

| Euro | | 12/22/2021 | | Brown Brothers Harriman | | | 15,177 | | | | 17,100 | | | | 71 | |

| Japanese Yen | | 12/22/2021 | | Brown Brothers Harriman | | | 3,036,234 | | | | 26,754 | | | | (227 | ) |

| | | | | | | | | | | $ | 77,128 | | | $ | 442 | |

| | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | $ | 363 | |

| (a) | Non-income producing security. |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 70.6% | | | | |

| | | | | ALTERNATIVE - 4.0% | | | | |

| | 146 | | | AlphaClone Alternative Alpha ETF | | $ | 11,984 | |

| | 10,988 | | | iM DBi Managed Futures Strategy ETF | | | 311,839 | |

| | 6,048 | | | IQ Merger Arbitrage ETF | | | 195,471 | |

| | 24,103 | | | ProShares Merger ETF | | | 995,016 | |

| | | | | | | | 1,514,310 | |

| | | | | COMMODITY - 1.9% | | | | |

| | 120 | | | Invesco DB Agriculture Fund(a) | | | 2,323 | |

| | 162 | | | Invesco Optimum Yield Diversified Commodity | | | 3,284 | |

| | 104 | | | iShares GSCI Commodity Dynamic | | | 3,547 | |

| | 22,464 | | | iShares S&P GSCI Commodity Indexed Trust(a) | | | 358,525 | |

| | 843 | | | KraneShares Global Carbon Strategy ETF(a) | | | 40,321 | |

| | 1,131 | | | ProShares UltraShort Bloomberg Crude Oil(a) | | | 18,922 | |

| | 462 | | | SPDR Gold Shares(a) | | | 76,461 | |

| | 4,623 | | | United States Commodity Index Fund(a) | | | 187,278 | |

| | 2,783 | | | United States Natural Gas Fund, L.P.(a) | | | 41,968 | |

| | | | | | | | 732,629 | |

| | | | | EQUITY - 34.1% | | | | |

| | 17 | | | AdvisorShares STAR Global Buy-Write ETF | | | 685 | |

| | 5,024 | | | Alerian MLP ETF | | | 159,160 | |

| | 82 | | | ARK Innovation ETF | | | 8,667 | |

| | 1 | | | CI Active Utility & Infrastructure ETF | | | 10 | |

| | 1,697 | | | Columbia India Consumer ETF | | | 95,015 | |

| | 48 | | | Consumer Discretionary Select Sector SPDR Fund | | | 9,813 | |

| | 1,042 | | | Core Alternative ETF | | | 30,594 | |

| | 142 | | | Direxion NASDAQ-100 Equal Weighted Index Shares | | | 12,198 | |

| | 2,475 | | | Energy Select Sector SPDR Fund | | | 135,110 | |

| | 8,955 | | | ETFMG Travel Tech ETF | | | 210,443 | |

| | 139 | | | First Trust Dow Jones Internet Index Fund(a) | | | 31,945 | |

| | 9,365 | | | First Trust Financial AlphaDEX Fund | | | 421,987 | |

| | 2,096 | | | First Trust MultiCap Growth AlphaDEX Fund | | | 258,479 | |

| | 3,497 | | | First Trust Small Cap Growth AlphaDEX Fund | | | 256,890 | |

| | 890 | | | Global SuperDividend US ETF | | | 17,693 | |

| | 202 | | | Global X MSCI Argentina ETF | | | 5,874 | |

| | 213 | | | Global X MSCI China Consumer Discretionary ETF | | | 6,015 | |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 70.6% (Continued) | | | | |

| | | | | EQUITY - 34.1% (Continued) | | | | |

| | 2,014 | | | Global X MSCI Nigeria ETF | | $ | 20,422 | |

| | 6,743 | | | Global X SuperDividend ETF | | | 82,332 | |

| | 3,279 | | | Goldman Sachs Hedge Industry VIP ETF | | | 331,364 | |

| | 59 | | | Invesco DWA Consumer Cyclicals Momentum ETF | | | 5,599 | |

| | 191 | | | Invesco DWA Energy Momentum ETF | | | 5,856 | |

| | 1,178 | | | Invesco DWA Financial Momentum ETF | | | 64,401 | |

| | 683 | | | Invesco KBW High Dividend Yield Financial ETF | | | 13,701 | |

| | 427 | | | Invesco KBW Property & Casualty ETF | | | 31,871 | |

| | 786 | | | Invesco S&P 500 Pure Value ETF | | | 59,956 | |

| | 24,210 | | | Invesco S&P SmallCap Energy ETF | | | 171,165 | |

| | 123 | | | Invesco S&P SmallCap Financials ETF | | | 7,186 | |

| | 902 | | | Invesco S&P SmallCap Health Care ETF(a) | | | 155,550 | |

| | 633 | | | Invesco S&P SmallCap Information Technology ETF | | | 92,526 | |

| | 102 | | | Invesco S&P SmallCap Utilities & Communication | | | 6,559 | |

| | 456 | | | Invesco Water Resources ETF | | | 26,147 | |

| | 262 | | | IQ US Real Estate Small Cap ETF | | | 6,659 | |

| | 2,583 | | | iShares Biotechnology ETF | | | 398,350 | |

| | 748 | | | iShares China Large-Cap ETF | | | 28,566 | |

| | 367 | | | iShares EURO STOXX Mid UCITS ETF | | | 28,560 | |

| | 218 | | | iShares Expanded Tech-Software Sector ETF(a) | | | 90,448 | |

| | 128 | | | iShares Exponential Technologies ETF | | | 8,294 | |

| | 6 | | | iShares Global Financials ETF | | | 466 | |

| | 206 | | | iShares Global Materials ETF | | | 17,901 | |

| | 78 | | | iShares Global Timber & Forestry ETF | | | 6,586 | |

| | 2,462 | | | iShares Latin America 40 ETF | | | 58,571 | |

| | 2,655 | | | iShares Micro-Cap ETF | | | 371,249 | |

| | 461 | | | iShares Mortgage Real Estate ETF | | | 16,287 | |

| | 770 | | | iShares MSCI All Country Asia ex Japan ETF | | | 64,133 | |

| | 1,371 | | | iShares MSCI Australia ETF | | | 33,535 | |

| | 1,208 | | | iShares MSCI Brazil ETF | | | 35,020 | |

| | 287 | | | iShares MSCI Chile ETF | | | 7,261 | |

| | 1,164 | | | iShares MSCI China Small-Cap ETF | | | 60,255 | |

| | 337 | | | iShares MSCI EAFE ETF, EQUITY | | | 25,895 | |

| | 388 | | | iShares MSCI Emerging Markets ETF, EQUITY | | | 18,950 | |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 70.6% (Continued) | | | | |

| | | | | EQUITY - 34.1% (Continued) | | | | |

| | 2,325 | | | iShares MSCI Emerging Markets Small-Cap ETF | | $ | 139,082 | |

| | 6,469 | | | iShares MSCI Frontier and Sele | | | 221,693 | |

| | 1,832 | | | iShares MSCI Global Multifactor ETF | | | 68,608 | |

| | 1,035 | | | iShares MSCI Hong Kong ETF | | | 24,105 | |

| | 6,657 | | | iShares MSCI India Small-Cap ETF | | | 394,827 | |

| | 735 | | | iShares MSCI Indonesia ETF | | | 17,140 | |

| | 674 | | | iShares MSCI Ireland ETF | | | 35,326 | |

| | 4,636 | | | iShares MSCI Japan ETF | | | 307,506 | |

| | 1,789 | | | iShares MSCI Japan Small-Cap ETF | | | 133,380 | |

| | 79 | | | iShares MSCI South Africa ETF | | | 3,546 | |

| | 606 | | | iShares MSCI Taiwan ETF | | | 39,202 | |

| | 238 | | | iShares MSCI Thailand ETF | | | 17,343 | |

| | 9,130 | | | iShares MSCI UAE ETF | | | 151,375 | |

| | 3 | | | iShares MSCI United Kingdom ETF | | | 96 | |

| | 2,770 | | | iShares MSCI United Kingdom Small-Cap ETF | | | 123,708 | |

| | 1,136 | | | iShares Russell 1000 Growth ETF | | | 340,664 | |

| | 1,237 | | | iShares Russell 1000 Value ETF | | | 196,275 | |

| | 3,511 | | | iShares Russell 2000 ETF, EQUITY | | | 765,995 | |

| | 832 | | | iShares Russell 2000 Growth ETF | | | 243,019 | |

| | 6,623 | | | iShares Russell 2000 Value ETF | | | 1,062,793 | |

| | 1,090 | | | iShares Russell Mid-Cap Growth ETF | | | 125,252 | |

| | 5,095 | | | iShares Russell Mid-Cap Value ETF | | | 588,982 | |

| | 734 | | | iShares S&P Mid-Cap 400 Growth ETF | | | 60,269 | |

| | 803 | | | iShares S&P/TSX Capped Materials Index ETF | | | 11,036 | |

| | 5 | | | iShares S&P/TSX Global Gold Index ETF | | | 70 | |

| | 1,329 | | | iShares STOXX Europe 600 Banks UCITS ETF DE | | | 20,524 | |

| | 56 | | | iShares STOXX Europe 600 Basic Resources UCITS ETF | | | 3,537 | |

| | 137 | | | iShares STOXX Europe 600 Insurance UCITS ETF DE | | | 4,705 | |

| | 54 | | | iShares STOXX Europe 600 Utilities UCITS ETF DE | | | 2,339 | |

| | 216 | | | iShares U.S. Financial Services ETF | | | 40,612 | |

| | 266 | | | iShares U.S. Healthcare Providers ETF | | | 69,240 | |

| | 85 | | | iShares U.S. Medical Devices ETF | | | 5,251 | |

| | 57 | | | iShares US Consumer Discretionary ETF | | | 4,726 | |

| | 300 | | | iShares US Financials ETF | | | 25,344 | |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 70.6% (Continued) | | | | |

| | | | | EQUITY - 34.1% (Continued) | | | | |

| | 3,183 | | | KraneShares CSI China Internet ETF | | $ | 140,211 | |

| | 850 | | | Materials Select Sector SPDR Fund | | | 71,953 | |

| | 55 | | | SPDR Dow Jones Global Real Estate ETF | | | 2,934 | |

| | 1,008 | | | SPDR FactSet Innovative Technology ETF | | | 205,350 | |

| | 145 | | | SPDR S&P 500 ETF Trust | | | 66,056 | |

| | 4,450 | | | SPDR S&P Emerging Asia Pacific ETF | | | 549,386 | |

| | 1,188 | | | SPDR S&P Insurance ETF | | | 45,382 | |

| | 200 | | | SPDR S&P Metals & Mining ETF | | | 8,236 | |

| | 27 | | | SPDR S&P Oil & Gas Exploration & Production ETF | | | 2,630 | |

| | 610 | | | SPDR S&P Regional Banking ETF | | | 42,584 | |

| | 31 | | | SPDR S&P Retail ETF | | | 2,912 | |

| | 12,400 | | | VanEck Africa Index ETF | | | 250,046 | |

| | 5,691 | | | VanEck Brazil Small-Cap ETF | | | 90,913 | |

| | 2,340 | | | VanEck Egypt Index ETF | | | 61,074 | |

| | 194 | | | VanEck Israel ETF | | | 9,321 | |

| | 608 | | | VanEck Mortgage REIT Income ETF | | | 11,053 | |

| | 2 | | | VanEck Rare Earth/Strategic Metals ETF | | | 246 | |

| | 9,430 | | | VanEck Russia ETF | | | 266,680 | |

| | 1,630 | | | VanEck Russia Small-Cap ETF | | | 57,914 | |

| | 6,246 | | | VanEck Vectors ChinaAMC SME-Ch | | | 339,220 | |

| | 6,345 | | | VanEck Vietnam ETF | | | 131,659 | |

| | 6,395 | | | Vanguard FTSE Emerging Markets ETF | | | 314,570 | |

| | 238 | | | Vanguard Real Estate ETF | | | 25,404 | |

| | 2,014 | | | Vanguard Total World Stock ETF | | | 210,000 | |

| | 962 | | | WisdomTree Emerging Markets SmallCap Dividend Fund | | | 49,351 | |

| | 854 | | | WisdomTree International SmallCap Dividend Fund | | | 60,198 | |

| | 4,448 | | | WisdomTree Japan Hedged SmallCap Equity Fund | | | 185,584 | |

| | 6,154 | | | Xtrackers Harvest CSI 300 China A-Shares ETF | | | 236,806 | |

| | 761 | | | Xtrackers Harvest CSI 500 China A-Shares ETF | | | 31,391 | |

| | 1,173 | | | Xtrackers MSCI All China Equity ETF | | | 46,820 | |

| | | | | | | | 12,775,653 | |

| | | | | FIXED INCOME - 29.8% | | | | |

| | 3 | | | Direxion Daily 20 Year Plus Treasury Bull 3x | | | 91 | |

| | 39 | | | First Trust Emerging Markets Local Currency Bond | | | 1,207 | |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 70.6% (Continued) | | | | |

| | | | | FIXED INCOME - 29.8% (Continued) | | | | |

| | 3,182 | | | First Trust Municipal High Income ETF | | $ | 178,319 | |

| | 53,250 | | | First Trust Senior Loan ETF | | | 2,528,844 | |

| | 1,670 | | | Global X SuperIncome Preferred ETF | | | 19,405 | |

| | 44,458 | | | High Yield ETF | | | 1,399,093 | |

| | 4,619 | | | Highland/iBoxx Senior Loan ETF | | | 73,188 | |

| | 5,118 | | | Invesco Financial Preferred ETF | | | 94,069 | |

| | 36,544 | | | Invesco Global Short Term High Yield Bond ETF | | | 781,676 | |

| | 997 | | | Invesco Senior Loan ETF | | | 21,735 | |

| | 2,929 | | | Invesco Variable Rate Preferred ETF | | | 75,041 | |

| | 759 | | | iShares 7-10 Year Treasury Bond ETF | | | 87,892 | |

| | 16,007 | | | iShares Barclays USD Asia High Yield Bond Index | | | 139,101 | |

| | 24 | | | iShares CMBS ETF | | | 1,288 | |

| | 122 | | | iShares Convertible Bond ETF | | | 11,855 | |

| | 16 | | | iShares Core U.S. Aggregate Bond ETF | | | 1,836 | |

| | 403 | | | iShares Floating Rate Bond ETF | | | 20,444 | |

| | 5,256 | | | iShares iBoxx High Yield Corporate Bond ETF | | | 450,124 | |

| | 2,360 | | | iShares JP Morgan EM Corporate Bond ETF | | | 120,030 | |

| | 1,906 | | | iShares JPMorgan USD Emerging Markets Bond ETF | | | 204,838 | |

| | 1,071 | | | iShares MBS ETF | | | 115,207 | |

| | 315 | | | iShares National Muni Bond ETF | | | 36,735 | |

| | 738 | | | iShares Preferred & Income Securities ETF | | | 28,347 | |

| | 1,757 | | | PIMCO Enhanced Short Maturity Active ETF | | | 178,669 | |

| | 21,233 | | | SPDR Blackstone Senior Loan ET | | | 963,129 | |

| | 6,050 | | | SPDR Bloomberg Barclays Euro High Yield Bond UCITS | | | 385,902 | |

| | 8,945 | | | SPDR Bloomberg Convertible Securities ETF | | | 750,933 | |

| | 170 | | | SPDR Bloomberg High Yield Bond ETF | | | 18,161 | |

| | 19,426 | | | SPDR Doubleline Total Return Tactical ETF | | | 930,700 | |

| | 22,053 | | | VanEck Emerging Markets High Yield Bond ETF | | | 490,459 | |

| | 14,365 | | | VanEck Fallen Angel High Yield Bond ETF | | | 465,713 | |

| | 8,800 | | | VanEck International High Yield Bond ETF | | | 210,408 | |

| | 535 | | | Vanguard Mortgage-Backed Securities ETF | | | 28,376 | |

| | 4,463 | | | Vanguard Total International Bond Index Fund, ETF SHARES | | | 255,417 | |

| | 3,384 | | | WisdomTree Emerging Markets Local Debt Fund | | | 100,743 | |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | EXCHANGE-TRADED FUNDS — 70.6% (Continued) | | | | |

| | | | | FIXED INCOME - 29.8% (Continued) | | | | |

| | 1,251 | | | WisdomTree Interest Rate Hedged High Yield Bond | | $ | 27,272 | |

| | | | | | | | 11,196,247 | |

| | | | | MIXED ALLOCATION - 0.7% | | | | |

| | 3,714 | | | iShares Morningstar Multi-Asset Income ETF | | | 88,282 | |

| | 945 | | | SPDR SSgA Income Allocation ETF | | | 33,110 | |

| | 5,091 | | | SPDR SSgA Multi-Asset Real Return ETF | | | 145,093 | |

| | | | | | | | 266,485 | |

| | | | | SPECIALTY - 0.1% | | | | |

| | 1,197 | | | Invesco DB US Dollar Index Bullish Fund(a) | | | 30,763 | |

| | 198 | | | ProShares Short VIX Short-Term Futures ETF(a) | | | 10,644 | |

| | | | | | | | 41,407 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $27,290,191) | | | 26,526,731 | |

| | | | | | | | | |

| | | | | EXCHANGE-TRADED NOTES — 0.1% | | | | |

| | | | | COMMODITY - 0.0% | | | | |

| | 68 | | | iPath Series B Bloomberg Coffee Subindex Total(a) | | | 4,284 | |

| | 61 | | | iPath Series B Bloomberg Grains Subindex Total(a) | | | 3,891 | |

| | | | | | | | 8,175 | |

| | | | | SPECIALTY - 0.1% | | | | |

| | 585 | | | iPath Series B S&P 500 VIX Short-Term Futures ETN(a) | | | 14,894 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE-TRADED NOTES (Cost $22,622) | | | 23,069 | |

| | | | | | | | | |

| | | | | OPEN END FUNDS — 20.5% | | | | |

| | | | | ALTERNATIVE - 5.4% | | | | |

| | 119,446 | | | Easterly Hedged Equity Fund, Class R6(b) | | | 1,396,321 | |

| | 60,875 | | | Kellner Merger Fund, Institutional Class | | | 639,186 | |

| | 624 | | | Merger Fund (The), Class V | | | 10,807 | |

| | | | | | | | 2,046,314 | |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| Shares | | | | | Fair Value | |

| | | | | OPEN END FUNDS — 20.5% (Continued) | | | | |

| | | | | FIXED INCOME - 15.1% | | | | |

| | 508,773 | | | Easterly Structured Credit Value Fund, Class R6(b) | | $ | 5,672,814 | |

| | | | | | | | | |

| | | | | TOTAL OPEN END FUNDS (Cost $7,691,989) | | | 7,719,128 | |

| Contracts | | | | | Broker/Counterparty | | Expiration Date | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | INDEX OPTIONS PURCHASED - 0.1% | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.1% | | | | | | | | | | | | | | | | |

| | 1,467 | | | S&P 500 Index (European Style) | | GS | | 12/01/2021 | | $ | 4,588.90 | | | $ | 6,731,920 | | | $ | 39,829 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $9,088) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 91.3% (Cost $35,013,890) | | | | | | | | | | | | | | $ | 34,308,757 | |

| | | | | PUT OPTIONS WRITTEN - (0.1)% (Proceeds - $9,088) | | | | | | | | | | | | | | | (37,194 | ) |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES- 8.8% | | | | | | | | | | | | | | | 3,325,724 | |

| | | | | NET ASSETS - 100.0% | | | | | | | | | | | | | | $ | 37,597,287 | |

| | | | | | | | | | | | | | | | | | | | | |

| Contracts | | | | | Counterparty | | Expiration Date | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | WRITTEN INDEX OPTIONS - (0.1)% | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS WRITTEN - (0.1)% | | | | | | | | | | | | | | | | |

| | 1,141 | | | S&P 500 Index (European Style) | | GS | | 12/01/2021 | | $ | 4,479.25 | | | $ | 5,110,824 | | | $ | 3,395 | |

| | 1,842 | | | S&P 500 Index (European Style) | | GS | | 12/01/2021 | | | 4,567.91 | | | | 8,414,090 | | | | 33,799 | |

| | | | | TOTAL PUT OPTIONS WRITTEN (Proceeds - $9,088) | | | | | | | | | | | | | | | 37,194 | |

| | | | | | | | | | | | | Unrealized | |

| Foreign Currency | | Settlement Date | | Counterparty | | Local Currency | | | U.S. Dollar Value | | | Appreciation/(Depreciation) | |

| To Sell: | | | | | | | | | | | | | | | | |

| Australian Dollar | | 12/22/2021 | | Brown Brothers Harriman | | | 123,512 | | | $ | 87,605 | | | $ | 2,280 | |

| British Pound | | 12/22/2021 | | Brown Brothers Harriman | | | 326,616 | | | | 432,355 | | | | 7,280 | |

| Canadian Dollar | | 12/22/2021 | | Brown Brothers Harriman | | | 123,093 | | | | 95,987 | | | | 1,877 | |

| Euro | | 12/22/2021 | | Brown Brothers Harriman | | | 296,208 | | | | 333,732 | | | | 1,392 | |

| Japanese Yen | | 12/22/2021 | | Brown Brothers Harriman | | | 83,412,858 | | | | 734,992 | | | | (6,223 | ) |

| Mexican Peso | | 12/22/2021 | | Brown Brothers Harriman | | | 287,412 | | | | 13,315 | | | | 482 | |

| Swiss Franc | | 12/22/2021 | | Brown Brothers Harriman | | | 2,792 | | | | 3,020 | | | | (15 | ) |

| | | | | | | | | | | $ | 1,701,006 | | | $ | 7,073 | |

| | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | $ | 7,073 | |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

| GS | Goldman Sachs |

| | |

| EAFE | - Europe, Australasia and Far East |

| | |

| ETF | - Exchange-Traded Fund |

| | |

| LP | - Limited Partnership |

| | |

| MSCI | - Morgan Stanley Capital International |

| | |

| REIT | - Real Estate Investment Trust |

| | |

| SPDR | - Standard & Poor’s Depositary Receipt |

| (a) | Non-income producing security. |

See accompanying notes to financial statements.

| EASTERLY TOTAL HEDGE PORTFOLIO |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2021 |

| TOTAL RETURN SWAP - 0.0% |

| |

| | | | | | | | | | | | | | | | | Unrealized | |

| | | | | | | | | | | | | | | | | Appreciation/ | |

| Notional Amount | | | Reference Entity | | Shares | | | Counterparty | | Maturity Date | | Pay/Receive Fixed Rate | | Variable Rate | | (Depreciation) | |

| | 205,619 | | | S&P 500 Equal Weighted Index | | | 33 | | | Goldman Sachs | | 5/20/2022 | | Pay | | 0.1196 | | $ | — | |

| | 1,439,329 | | | S&P 500 Equal Weighted Index | | | 231 | | | Goldman Sachs | | 5/20/2022 | | Pay | | 0.1196 | | $ | — | |

| | | | | | | | | | | | | | | | | | | $ | — | |

| | | Unrealized | |

| | | Appreciation/ | |

| TOTAL RETURN SWAP - 0.0% | | (Depreciation) | |

| | | | |

| The Deutsche Bank Total Return Swap provides exposure to the daily, total returns of the Easterly Index, a proprietary index of the London Branch of Deutsche Bank AG. The number of shares is 56,900 and requires the fund to pay interest at the rate of 0.38% on the Notional Value outstanding. The Easterly Index features a basket of commodity trading advisor (“CTA”) programs selected by Easterly Funds, LLC from an approved list of third-party managers offered through Deutsche Bank AG on its DB Select platform. The Easterly Index comprises a diversified collection of strategy and style types, including trend following, short-term trading, discretionary, global macro, and sector specialists. According to the terms of the swap, Easterly Funds, LLC can modify the Easterly Index as frequently as daily, on a T+1 basis, by adjusting the notional value of the Easterly Index, or by adding, deleting, or re-weighting the constituent CTA programs. The swap became effective on August 2, 2018, and expires on July 30, 2024. (Notional Value $6,337,613) | | $ | 7,365 | |

| | | $ | 7,365 | |

| TOTAL RETURN SWAP - (0.0)% | | | | |

| The Goldman Sachs Calls-vs-Calls US Series 2 Total Return Strategy is designed to extract dislocated call premiums from S&P 500 constituents; the strategy sells call options on a daily basis across top 100 constituents of the SPX where the term structure is most inverted. The stocks are picked with constraints on leverage, beta towards SPX and tracking error. The strategy also purchases an ATM call option on SPX to mitigate market risk. The number of shares is 7,713 and requires the fund to pay interest at the rate of 0.20% on the Notional Value outstanding. The swap became effective on May 28, 2021 and expires on February 4, 2022. (Notional Value $927,470) | | $ | — | |

| | | $ | — | |

| TOTAL RETURN SWAP - (0.0)% | | | | |

| | | | | |

| The Goldman Sachs i-Select III Series 88 Excess Return Strategy (“GS i-Select”) is a synthetic rules-based proprietary strategy created by Goldman Sachs International as strategy sponsor. The GS i- Select Index includes strategies of the GS Risk Premia Universe that were selected by Easterly . The GS i-Select Index is actively managed by Easterly . The Index features 15 Portfolio Constituents that Easterly Funds, LLC determines the daily waiting of each constituent within the GS i-Select Index. The GS i-Select Index is comprised a diversified collection of strategy and style types, including equity, interest rates, FX, commodities, and credit based strategies such as imbalance, volatility carry, carry, momentum, low beta, and quality. According to the terms of the GS i-Select Index, Easterly Funds, LLC can modify the GS i-Select Index as frequently as daily, by adjusting the notional value of the GS i-Select Index, or by adding, deleting, or re-weighting the constituent Indexes in the GS i-Select Index. The number of shares is 18,117 and requires the fund to pay interest at the rate of 0.25% on the Notional Value outstanding. The swap became effective on May 28, 2021 and expires on February 9, 2022. (Notional Value $1,805,563) | | $ | — | |

| | | $ | — | |

| TOTAL RETURN SWAP - (0.0)% | | | | |

| | | | | |

| The Goldman Sachs Intraday Momentum ES Series 1 Excess Return Strategy aims to capture intraday trend risk premium on the S&P 500. There is empirical evidence that the returns in the earlier part of the day tend to continue in the same direction in the subsequent part of the day, across several markets, including equities. The strategy attempts to monetize this historical tendency for intraday trends from the previous close to extend unto the following close: 1) Every day after the open, the strategy buys futures if markets are rising since the previous close; conversely, it sells futures if markets are falling since previous close. 2) The strategy monitors market moves every 30-minutes to reactively modify its positioning if a new trend appears. 3) All positions are exited at the close. The number of shares is 8,295 and requires the fund to pay interest at the rate of 0.20% on the Notional Value outstanding. The swap became effective on August 2, 2021 and expires on February 4, 2022. (Notional Value $941,817) | | $ | (1,285 | ) |

| | | $ | (1,285 | ) |

| | | | | |

| TOTAL RETURN SWAP - 0.1% | | | | |

| | | | | |

| Goldman Sachs Long Gamma US Series 10 Excess Return Strategy attempts to provide protection in tail scenarios through a levered position in delta-hedged put options. The strategy buys 12m 10- delta S&P Put options and delta-hedges them to attempt to neutralize the inherent short market exposure in typical markets. The strategy takes a long position in volatility and is best-positioned for left-tail events with very high realized volatility. The number of shares is 8,739 and requires the fund to pay interest at the rate of 0.20% on the Notional Value outstanding. The swap became effective on August 2, 2021 and expires on February 4, 2022. (Notional Value $1,228,811) | | $ | 20,616 | |

| | | $ | 20,616 | |

| TOTAL RETURN SWAP - 0.1% | | | | |

| | | | | |

| The Goldman Sachs Systematic Skew US Series 1D Total Return Strategy is designed to capture the spot-volatility covariance risk premium in equity markets, while minimizing exposure to volatility risk. The strategy sells 3m 15d puts and buys 3m 40d calls (delta and gamma hedged) that target a constant exposure to skew, with performance driven by Vanna. The strategy also buys 5d tail puts for added risk management. The number of shares is 6,979 and requires the fund to pay interest at the rate of 0.20% on the Notional Value outstanding. The swap became effective on August 30, 2021 and expires on February 4, 2022. (Notional Value $995,792) | | $ | — | |

| | | $ | — | |

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

Easterly Deutsche Bank Swap Top 50 Holdings

FUTURES CONTRACTS*

| | | | | | | | | | | | | | Unrealized | | | Percentage of Total | |

| Number of | | | | | | | Notional Value at | | | | | | Appreciation/ | | | Return Swap | |

| Contracts | | | Open Long Future Contracts | | Counterparty | | November 30, 2021 | | | Expiration | | | (Depreciation) | | | Unrealized Gain/Loss | |

| | 5 | | | 3 month Euro (EURIBOR) | | Deutsche Bank | | | 1,333,710 | | | | 12/18/2023 | | | $ | (1,936 | ) | | | (26.29 | )% |

| | 1 | | | 10 Year Italian Bond | | Deutsche Bank | | | 173,250 | | | | 12/8/2021 | | | | 2,624 | | | | 35.63 | % |

| | 1 | | | 10 Year Japanese Government Bond | | Deutsche Bank | | | 824,747 | | | | 12/13/2021 | | | | 805 | | | | 10.93 | % |

| | 2 | | | 30 Year US Treasury Bonds | | Deutsche Bank | | | 269,188 | | | | 3/22/2022 | | | | 2,255 | | | | 30.62 | % |

| | 1 | | | DAX Index Future | | Deutsche Bank | | | 266,196 | | | | 12/17/2021 | | | | (311 | ) | | | (4.22 | )% |

| | 48 | | | DJ EURO STOXX Banks Future | | Deutsche Bank | | | 256,557 | | | | 12/17/2021 | | | | (2,547 | ) | | | (34.58 | )% |

| | 2 | | | E-Mini Nasdaq-100 | | Deutsche Bank | | | 674,319 | | | | 12/17/2021 | | | | 3,917 | | | | 53.18 | % |

| | 5 | | | EURO STOXX 50 Index Future | | Deutsche Bank | | | 223,319 | | | | 12/17/2021 | | | | (7,040 | ) | | | (95.59 | )% |

| | 2 | | | Euro-BUND | | Deutsche Bank | | | 378,749 | | | | 12/8/2021 | | | | 871 | | | | 11.83 | % |

| | 2 | | | FTSE 100 Index Future | | Deutsche Bank | | | 194,766 | | | | 12/17/2021 | | | | (838 | ) | | | (11.38 | )% |

| | 1 | | | S&P Canada 60 Index Future | | Deutsche Bank | | | 195,539 | | | | 12/16/2021 | | | | 2,023 | | | | 27.47 | % |

| | 5 | | | S&P CNX Nifty Index Future | | Deutsche Bank | | | 163,823 | | | | 12/30/2021 | | | | (4,349 | ) | | | (59.05 | )% |

| | 1 | | | Ultra Long-Term T Bond | | Deutsche Bank | | | 191,947 | | | | 3/22/2022 | | | | 6,796 | | | | 92.27 | % |

| | | | | | | | | | | | | | | | | | 2,270 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Unrealized | | | | Percentage of Total | |

| | Number of | | | | | | | | Notional Value at | | | | | | | | Appreciation/ | | | | Return Swap | |

| | Contracts | | | Open Short Future Contracts | | Counterparty | | | November 30, 2021 | | | | Expiration | | | | (Depreciation) | | | | Unrealized Gain | |

| | (10 | ) | | 2 Year Euro-Schatz | | Deutsche Bank | | | 1,268,198 | | | | 12/8/2021 | | | | (4,733 | ) | | | (64.26 | )% |

| | (2 | ) | | 2 Year Euro-Schatz | | Deutsche Bank | | | 207,154 | | | | 3/8/2022 | | | | 63 | | | | 0.86 | % |

| | (1 | ) | | 2 Year US Treasury Notes | | Deutsche Bank | | | 280,355 | | | | 3/31/2022 | | | | (231 | ) | | | (3.14 | )% |

| | (2 | ) | | 3 Month SONIA Index Futures | | Deutsche Bank | | | 529,402 | | | | 12/19/2023 | | | | (136 | ) | | | (1.85 | )% |

| | (2 | ) | | 3 Month Sterling | | Deutsche Bank | | | 250,345 | | | | 9/20/2023 | | | | (249 | ) | | | (3.38 | )% |

| | (2 | ) | | 3 Month Sterling | | Deutsche Bank | | | 250,599 | | | | 9/18/2024 | | | | (516 | ) | | | (7.01 | )% |

| | (11 | ) | | 3 Year Australian Treasury Bond | | Deutsche Bank | | | 921,354 | | | | 12/15/2021 | | | | 10,108 | | | | 137.24 | % |

| | (5 | ) | | 5 Year US Treasury Notes | | Deutsche Bank | | | 612,394 | | | | 3/31/2022 | | | | (1,146 | ) | | | (15.56 | )% |

| | (4 | ) | | 10 Year US Treasury Notes | | Deutsche Bank | | | 473,665 | | | | 3/22/2022 | | | | (742 | ) | | | (10.07 | )% |

| | (3 | ) | | AUD/USD | | Deutsche Bank | | | 179,159 | | | | 12/13/2021 | | | | 2,119 | | | | 28.77 | % |

| | (3 | ) | | CAD/USD | | Deutsche Bank | | | 233,519 | | | | 12/14/2021 | | | | 1,494 | | | | 20.29 | % |

| | (5 | ) | | EUR/USD | | Deutsche Bank | | | 647,046 | | | | 12/13/2021 | | | | 3,942 | | | | 53.52 | % |

| | (1 | ) | | Eurodollar | | Deutsche Bank | | | 212,216 | | | | 9/19/2022 | | | | (247 | ) | | | (3.35 | )% |

| | (2 | ) | | Eurodollar | | Deutsche Bank | | | 458,945 | | | | 9/18/2023 | | | | (997 | ) | | | (13.54 | )% |

| | (1 | ) | | Eurodollar | | Deutsche Bank | | | 212,596 | | | | 3/18/2024 | | | | (201 | ) | | | (2.73 | )% |

| | (2 | ) | | Eurodollar | | Deutsche Bank | | | 564,199 | | | | 6/17/2024 | | | | 2,002 | | | | 27.18 | % |

| | (1 | ) | | Eurodollar | | Deutsche Bank | | | 224,925 | | | | 9/16/2024 | | | | (441 | ) | | | (5.99 | )% |

| | (3 | ) | | GBP/USD | | Deutsche Bank | | | 277,419 | | | | 12/13/2021 | | | | 3,947 | | | | 53.59 | % |

| | (1 | ) | | Hang Seng Index | | Deutsche Bank | | | 180,247 | | | | 12/30/2021 | | | | 2,416 | | | | 32.80 | % |

| | (4 | ) | | JPY/USD | | Deutsche Bank | | | 474,459 | | | | 12/13/2021 | | | | (21 | ) | | | (0.29 | )% |

| | (1 | ) | | Long Gilt Future | | Deutsche Bank | | | 233,825 | | | | 3/29/2022 | | | | (173 | ) | | | (2.35 | )% |

| | | | | | | | | | | | | | | | | | 16,258 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL FUTURES CONTRACTS | | | $ | 18,528 | | | | | |

| PURCHASED CALL OPTIONS* |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Percentage of Total | |

| | | | | | Notional Value at | | | | | | | | | | | | Return Swap | |

| Description | | | Counterparty | | November 30, 2021 | | | Expiration | | | Strike Price | | | Unrealized Appreciation | | | Unrealized Gain | |

| | JPY/CAD | | | Deutsche Bank | | | 693,548 | | | | 12/1/2021 | | | | 95.00 | | | $ | — | | | | 0.00 | % |

| | JPY/USD | | | Deutsche Bank | | | 277,419 | | | | 12/9/2021 | | | | 112.00 | | | | 4,284 | | | | 58.17 | % |

| | JPY/USD | | | Deutsche Bank | | | 346,774 | | | | 12/13/2021 | | | | 116.75 | | | | 79 | | | | 1.07 | % |

| | USD/EUR | | | Deutsche Bank | | | 277,419 | | | | 12/6/2021 | | | | 1.22 | | | | — | | | | 0.00 | % |

| | USD/EUR | | | Deutsche Bank | | | 520,161 | | | | 1/3/2022 | | | | 1.21 | | | | 23 | | | | 0.31 | % |

| | USD/EUR | | | Deutsche Bank | | | 277,419 | | | | 1/6/2022 | | | | 1.19 | | | | 63 | | | | 0.86 | % |

| | USD/EUR | | | Deutsche Bank | | | 208,064 | | | | 1/19/2022 | | | | 1.24 | | | | 7 | | | | 0.10 | % |

| | | | | | | | | | | | | | | | | | | | 4,456 | | | | | |

| WRITTEN CALL OPTIONS* |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Percentage of Total | |

| | | | | | Notional Value at | | | | | | | | | | | | Return Swap | |

| Description | | | Counterparty | | November 30, 2021 | | | Expiration | | | Strike Price | | | Unrealized Appreciation | | | Unrealized Gain | |

| | JPY/USD | | | Deutsche Bank | | | 554,838 | | | | 12/9/2021 | | | | 114.00 | | | | (2,037 | ) | | | (27.66 | )% |

| | JPY/USD | | | Deutsche Bank | | | 277,419 | | | | 12/9/2021 | | | | 114.00 | | | | (1,095 | ) | | | (14.87 | )% |

| | USD/GBP | | | Deutsche Bank | | | 174,774 | | | | 1/3/2022 | | | | 1.41 | | | | (7 | ) | | | (0.10 | )% |

| | | | | | | | | | | | | | | | | | | $ | (3,139 | ) | | | | |

| FORWARD CURRENCY CONTRACTS +* |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Unrealized | | | Percentage of Total | |

| Settlement | | | | | | | | | | | | | | | | | | Appreciation / | | | Return Swap | |

| Date | | Units to Receive/Deliver | | | Counterparty | | In Exchange For | | US Dollar Value | | | (Depreciation) | | | Unrealized Gain/Loss | |

| To Buy: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/7/2021 | | | (211,527 | ) | | Deutsche Bank | | CHF | | | 230,252 | | | | USD | | | | 231,066 | | | | 814 | | | | 11.05 | % |

| 12/7/2021 | | | (230,825 | ) | | Deutsche Bank | | USD | | | 308,454 | | | | AUD | | | | 296,605 | | | | (11,850 | ) | | | (160.90 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | (11,036 | ) | | | | |

| To Sell: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/2/2021 | | | 420,911 | | | Deutsche Bank | | CHF | | | (457,055 | ) | | | USD | | | | 456,488 | | | | (567 | ) | | | (7.70 | )% |

| 12/2/2021 | | | 65,262,355 | | | Deutsche Bank | | JPY | | | (577,553 | ) | | | USD | | | | 574,860 | | | | (2,694 | ) | | | (36.58 | )% |

| 12/7/2021 | | | 17,485,731 | | | Deutsche Bank | | JPY | | | (154,239 | ) | | | USD | | | | 154,042 | | | | (197 | ) | | | (2.67 | )% |

| 12/7/2021 | | | 3,447,543 | | | Deutsche Bank | | MXN | | | (169,565 | ) | | | USD | | | | 160,313 | | | | (9,252 | ) | | | (125.62 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | (12,710 | ) | | | | |

| | | | TOTAL FORWARD CURRENCY CONTRACTS | | | | | | | | | | | | | |

| | | | | | | | | All Other Investments | | | | 11,266 | | | | | |

| | | | | | | | | Total Unrealized Appreciation of Swap | | | $ | 7,365 | | | | | |

| + | Foreign currency transactions are done by notional and not by contracts |

| * | Non-income producing securities |

Currency Abbreviations:

AUD - Australian Dollar

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

CAD - Canadian Dollar

CHF - Swiss Franc

CNH - Chinese Yuan Renminbi

EUR - Euro

GBP - Great Britain Pound

JPY - Japanese Yen

MXN - Mexican Peso

USD - U.S. Dollar

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

Goldman Sachs Calls-vs-Calls US Series 2 Total Return Strategy Top 50 Holdings

| PURCHASED CALL OPTIONS |

| |

| Number of | | | | | | | Notional Value at | | | | | | | | | | |

| Contracts | | | Open Purchased Call Options | | Counterparty | | November 30, 2021 | | | Expiration | | | Exercise Price | | | Market Value | |

| | 6 | | | S&P 500 Index | | Goldman Sachs | | | 28,108 | | | | 12/17/2021 | | | $ | 4,350 | | | $ | 1,537 | |

| | 8 | | | S&P 500 Index | | Goldman Sachs | | | 38,366 | | | | 12/17/2021 | | | $ | 4,360 | | | | 2,025 | |

| | 11 | | | S&P 500 Index | | Goldman Sachs | | | 51,730 | | | | 12/17/2021 | | | $ | 4,365 | | | | 2,682 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 24,978 | | | | 12/17/2021 | | | $ | 4,400 | | | | 1,136 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 22,238 | | | | 12/17/2021 | | | $ | 4,435 | | | | 874 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 21,207 | | | | 12/17/2021 | | | $ | 4,450 | | | | 779 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 24,770 | | | | 12/17/2021 | | | $ | 4,470 | | | | 827 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 24,476 | | | | 12/17/2021 | | | $ | 4,485 | | | | 757 | |

| | 3 | | | S&P 500 Index | | Goldman Sachs | | | 15,861 | | | | 12/17/2021 | | | $ | 4,515 | | | | 415 | |

| | 3 | | | S&P 500 Index | | Goldman Sachs | | | 15,860 | | | | 12/17/2021 | | | $ | 4,525 | | | | 391 | |

| | 4 | | | S&P 500 Index | | Goldman Sachs | | | 17,207 | | | | 12/17/2021 | | | $ | 4,535 | | | | 399 | |

| | 7 | | | S&P 500 Index | | Goldman Sachs | | | 31,312 | | | | 12/17/2021 | | | $ | 4,540 | | | | 702 | |

| | 4 | | | S&P 500 Index | | Goldman Sachs | | | 18,540 | | | | 12/17/2021 | | | $ | 4,545 | | | | 402 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 24,062 | | | | 12/17/2021 | | | $ | 4,550 | | | | 505 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 21,239 | | | | 12/17/2021 | | | $ | 4,565 | | | | 400 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 22,451 | | | | 12/17/2021 | | | $ | 4,570 | | | | 407 | |

| | 15 | | | S&P 500 Index | | Goldman Sachs | | | 69,882 | | | | 12/17/2021 | | | $ | 4,595 | | | | 1,036 | |

| | 6 | | | S&P 500 Index | | Goldman Sachs | | | 26,563 | | | | 12/17/2021 | | | $ | 4,605 | | | | 360 | |

| | 6 | | | S&P 500 Index | | Goldman Sachs | | | 28,043 | | | | 12/17/2021 | | | $ | 4,610 | | | | 363 | |

| | 6 | | | S&P 500 Index | | Goldman Sachs | | | 29,323 | | | | 12/17/2021 | | | $ | 4,625 | | | | 327 | |

| | 16 | | | S&P 500 Index | | Goldman Sachs | | | 75,351 | | | | 12/17/2021 | | | $ | 4,645 | | | | 676 | |

| | 16 | | | S&P 500 Index | | Goldman Sachs | | | 71,504 | | | | 12/17/2021 | | | $ | 4,655 | | | | 569 | |

| | 7 | | | S&P 500 Index | | Goldman Sachs | | | 31,636 | | | | 12/17/2021 | | | $ | 4,675 | | | | 194 | |

| | 18 | | | S&P 500 Index | | Goldman Sachs | | | 80,389 | | | | 12/17/2021 | | | $ | 4,680 | | | | 459 | |

| | 20 | | | S&P 500 Index | | Goldman Sachs | | | 89,132 | | | | 12/17/2021 | | | $ | 4,685 | | | | 473 | |

| | 21 | | | S&P 500 Index | | Goldman Sachs | | | 94,034 | | | | 12/17/2021 | | | $ | 4,690 | | | | 463 | |

| | 20 | | | S&P 500 Index | | Goldman Sachs | | | 89,518 | | | | 12/17/2021 | | | $ | 4,695 | | | | 408 | |

| | 27 | | | S&P 500 Index | | Goldman Sachs | | | 123,399 | | | | 12/17/2021 | | | $ | 4,700 | | | | 520 | |

| | 13 | | | S&P 500 Index | | Goldman Sachs | | | 59,078 | | | | 12/17/2021 | | | $ | 4,705 | | | | 230 | |

| | 4 | | | S&P 500 Index | | Goldman Sachs | | | 19,764 | | | | 1/21/2022 | | | $ | 4,360 | | | | 1,258 | |

| | 7 | | | S&P 500 Index | | Goldman Sachs | | | 29,841 | | | | 1/21/2022 | | | $ | 4,370 | | | | 1,848 | |

| | 4 | | | S&P 500 Index | | Goldman Sachs | | | 17,598 | | | | 1/21/2022 | | | $ | 4,555 | | | | 569 | |

| | 6 | | | S&P 500 Index | | Goldman Sachs | | | 27,106 | | | | 1/21/2022 | | | $ | 4,605 | | | | 687 | |

| | 6 | | | S&P 500 Index | | Goldman Sachs | | | 29,142 | | | | 1/21/2022 | | | $ | 4,665 | | | | 521 | |

| | 9 | | | S&P 500 Index | | Goldman Sachs | | | 40,527 | | | | 1/21/2022 | | | $ | 4,690 | | | | 612 | |

| | 7 | | | S&P 500 Index | | Goldman Sachs | | | 31,964 | | | | 1/21/2022 | | | $ | 4,700 | | | | 450 | |

| | 8 | | | S&P 500 Index | | Goldman Sachs | | | 38,243 | | | | 1/21/2022 | | | $ | 4,705 | | | | 519 | |

| | 9 | | | S&P 500 Index | | Goldman Sachs | | | 39,088 | | | | 1/21/2022 | | | $ | 4,710 | | | | 511 | |

| | 3 | | | S&P 500 Index | | Goldman Sachs | | | 14,785 | | | | 2/18/2022 | | | $ | 4,610 | | | | 470 | |

| | 3 | | | S&P 500 Index | | Goldman Sachs | | | 15,807 | | | | 2/18/2022 | | | $ | 4,665 | | | | 392 | |

| | 6 | | | S&P 500 Index | | Goldman Sachs | | | 28,784 | | | | 2/18/2022 | | | $ | 4,690 | | | | 631 | |

| | 3 | | | S&P 500 Index | | Goldman Sachs | | | 15,569 | | | | 2/18/2022 | | | $ | 4,700 | | | | 324 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 22,189 | | | | 2/18/2022 | | | $ | 4,705 | | | | 450 | |

| | 5 | | | S&P 500 Index | | Goldman Sachs | | | 20,829 | | | | 2/18/2022 | | | $ | 4,710 | | | | 411 | |

| | | | | | | | | | | | | | | | | | | | | | 29,969 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| WRITTEN CALL OPTIONS |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Number of | | | | | | | | Notional Value at | | | | | | | | | | | | | |

| | Contracts | | | Open Written Call Options | | Counterparty | | | November 30, 2021 | | | | Expiration | | | | Exercise Price | | | | Market Value | |

| | 43 | | | Accenture plc | | Goldman Sachs | | | 15,326 | | | | 12/17/2021 | | | $ | 370 | | | $ | 221 | |

| | 510 | | | Cisco Systems, Inc. | | Goldman Sachs | | | 27,942 | | | | 12/17/2021 | | | $ | 58 | | | | 154 | |

| | 45 | | | Deere & Company | | Goldman Sachs | | | 15,419 | | | | 12/17/2021 | | | $ | 360 | | | | 212 | |

| | 152 | | | Medtronic plc | | Goldman Sachs | | | 16,201 | | | | 12/17/2021 | | | $ | 120 | | | | 10 | |

| | 299 | | | Pfizer, Inc. | | Goldman Sachs | | | 16,062 | | | | 12/17/2021 | | | $ | 50 | | | | 1,253 | |

| | 119 | | | Walmart, Inc. | | Goldman Sachs | | | 16,680 | | | | 12/17/2021 | | | $ | 150 | | | | 38 | |

| | | | | | | | | | | | | | | | | | | | | | 1,888 | |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

Goldman Sachs i-Select III Series 88 Excess Return Strategy Top 50 Holdings

| FUTURES CONTRACTS* |

| | | | | | | | | | | | |

| Number of | | | | | | | Notional Value at | | | | |

| Contracts | | | Open Long Future Contracts | | Counterparty | | November 30, 2021 | | | Expiration | |

| | 1 | | | CBOT 2 Year US Treasury Note Future | | Goldman Sachs | | $ | 122,642 | | | | 3/31/2022 | |

| | 1 | | | CBOT 5 Year US Treasury Note | | Goldman Sachs | | | 103,265 | | | | 3/31/2022 | |

| | 1 | | | CBOT Corn Future | | Goldman Sachs | | | 28,058 | | | | 5/13/2022 | |

| | 1 | | | CBOT Soybean Future | | Goldman Sachs | | | 47,959 | | | | 5/13/2022 | |

| | 0 | | | CBOT US Long Bond Future | | Goldman Sachs | | | 33,159 | | | | 3/22/2022 | |

| | 1 | | | CBOT Wheat Future | | Goldman Sachs | | | 42,146 | | | | 5/13/2022 | |

| | 2 | | | CME E-Mini NASDAQ 100 Index Future | | Goldman Sachs | | | 26,232 | | | | 12/17/2021 | |

| | 6 | | | CME E-Mini Standard & Poor’s 500 Index Future | | Goldman Sachs | | | 25,471 | | | | 12/17/2021 | |

| | 0 | | | CME Live Cattle Future | | Goldman Sachs | | | 12,261 | | | | 4/29/2022 | |

| | 0 | | | COMEX Gold 100 Troy Ounces Future | | Goldman Sachs | | | 10,360 | | | | 2/24/2022 | |

| | 0 | | | Cotton No.2 Future | | Goldman Sachs | | | 20,725 | | | | 5/6/2022 | |

| | 0 | | | Eurex 10 Year Euro BUND Future | | Goldman Sachs | | | 8,983 | | | | 12/8/2021 | |

| | 0 | | | Eurex 10 Year Euro BUND Future | | Goldman Sachs | | | 17,681 | | | | 3/8/2022 | |

| | 0 | | | Eurex 2 Year Euro SCHATZ Future | | Goldman Sachs | | | 54,393 | | | | 12/8/2021 | |

| | 1 | | | Eurex 2 Year Euro SCHATZ Future | | Goldman Sachs | | | 108,743 | | | | 3/8/2022 | |

| | 1 | | | Eurex 5 Year Euro BOBL Future | | Goldman Sachs | | | 97,091 | | | | 12/8/2021 | |

| | 0 | | | Eurex 5 Year Euro BOBL Future | | Goldman Sachs | | | 12,471 | | | | 12/8/2021 | |

| | 0 | | | Eurex 5 Year Euro BOBL Future | | Goldman Sachs | | | 24,813 | | | | 3/8/2022 | |

| | 2 | | | Eurex EURO STOXX 50 Future | | Goldman Sachs | | | 7,374 | | | | 12/17/2021 | |

| | 2 | | | Eurex Swiss Market New Index Future | | Goldman Sachs | | | 24,580 | | | | 12/17/2021 | |

| | 29 | | | Euronext Amsterdam Index Future | | Goldman Sachs | | | 25,498 | | | | 12/17/2021 | |

| | 2 | | | Euronext CAC 40 Index Future | | Goldman Sachs | | | 12,139 | | | | 12/17/2021 | |

| | 0 | | | FTSE/MIB Index Future 12/17/2021 | | Goldman Sachs | | | 8,892 | | | | 12/17/2021 | |

| | 0 | | | ICE Gas Oil Future | | Goldman Sachs | | | 7,522 | | | | 1/12/2022 | |

| | 0 | | | Live Cattle Future | | Goldman Sachs | | | 14,473 | | | | 6/30/2022 | |

| | 0 | | | Live Cattle Future | | Goldman Sachs | | | 7,618 | | | | 8/31/2022 | |

| | 0 | | | LME Copper Future | | Goldman Sachs | | | 7,587 | | | | 1/17/2022 | |

| | 0 | | | LME Copper Future | | Goldman Sachs | | | 18,754 | | | | 1/17/2022 | |

| | 0 | | | LME Copper Future | | Goldman Sachs | | | 22,870 | | | | 2/14/2022 | |

| | 0 | | | LME Copper Future | | Goldman Sachs | | | 7,555 | | | | 2/14/2022 | |

| | 0 | | | LME Nickel Future | | Goldman Sachs | | | 21,097 | | | | 1/17/2022 | |

| | 0 | | | LME Nickel Future | | Goldman Sachs | | | 7,739 | | | | 1/17/2022 | |

| | 0 | | | LME Nickel Future | | Goldman Sachs | | | 25,730 | | | | 2/14/2022 | |

| | 0 | | | LME Nickel Future | | Goldman Sachs | | | 9,438 | | | | 2/14/2022 | |

| | 0 | | | LME Primary Aluminum Future | | Goldman Sachs | | | 7,630 | | | | 1/17/2022 | |

| | 0 | | | LME Zinc Future | | Goldman Sachs | | | 7,389 | | | | 1/17/2022 | |

| | 26 | | | Montreal Exchange S&P/TSX 60 Index Future | | Goldman Sachs | | | 25,302 | | | | 12/17/2021 | |

| | 0 | | | NYBOT CSC C Coffee Future | | Goldman Sachs | | | 8,419 | | | | 3/21/2022 | |

| | 1 | | | NYBOT CSC Number 11 World Sugar Future | | Goldman Sachs | | | 22,092 | | | | 4/29/2022 | |

| | 0 | | | NYBOT CTN Number 2 Cotton Future | | Goldman Sachs | | | 7,352 | | | | 3/9/2022 | |

| | 0 | | | NYMEX Henry Hub Natural Gas Futures | | Goldman Sachs | | | 7,427 | | | | 12/29/2021 | |

| | 0 | | | NYMEX Henry Hub Natural Gas Futures | | Goldman Sachs | | | 9,987 | | | | 3/29/2022 | |

| | 0 | | | NYMEX Henry Hub Natural Gas Futures | | Goldman Sachs | | | 12,100 | | | | 4/27/2022 | |

| | 56 | | | OML Stockholm OMXS30 Index Future | | Goldman Sachs | | | 13,921 | | | | 12/17/2021 | |

| | 2 | | | SFE S&P ASX Share Price Index 200 Future | | Goldman Sachs | | | 11,236 | | | | 12/16/2021 | |

| | 0 | | | TSE Japanese 10 Year Bond Futures | | Goldman Sachs | | | 60,543 | | | | 12/9/2021 | |

| | 620 | | | TSE TOPIX (Tokyo Price Index) Future | | Goldman Sachs | | | 10,355 | | | | 12/10/2021 | |

| | | | | | | | | | | | | | | |

| Number of | | | | | | | Notional Value at | | | | | | | |

| Contracts | | | Open Credit Default Swaps | | Counterparty | | November 30, 2021 | | | Expiration | | | Value | |

| | 59,087 | | | Markit CDX North America High Yield Index | | Goldman Sachs | | | 59,087 | | | | 12/20/2026 | | | $ | 1,331 | |

| | 8,687 | | | Markit CDX North America Investment Grade Index | | Goldman Sachs | | | 8,687 | | | | 12/20/2026 | | | | 750 | |

| | 15,444 | | | Markit iTraxx Europe Index | | Goldman Sachs | | | 17,384 | | | | 12/20/2026 | | | | 405 | |

| | | | | | | | | | | | | | | | | | 2,486 | |

| * | The GS i-Select invests in 15 Portfolio Constituents which do not trade individual futures, therefore the Futures do not have any individual unrealized gains/losses. |

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

Goldman Sachs Intraday Momentum ES Series 1 Excess Return Strategy Top 50 Holdings

See accompanying notes to financial statements.

EASTERLY TOTAL HEDGE PORTFOLIO

SCHEDULE OF INVESTMENTS (Continued)

November 30, 2021

Goldman Sachs Long Gamma US Series 10 Total Return Strategy Top 50 Holdings

| Number of | | | | | | | Notional Value at | | | | | | | | | | |

| Contracts | | | Open Long Equity Forwards | | Counterparty | | November 30, 2021 | | | Expiration | | | Exercise Price | | | Market Value | |

| | 27 | | | S&P 500 Index | | Goldman Sachs | | | 124,095 | | | | 3/18/2022 | | | $ | 4,660 | | | $ | 2,745 | |

| | 20 | | | S&P 500 Index | | Goldman Sachs | | | 93,445 | | | | 4/14/2022 | | | $ | 4,660 | | | | 2,107 | |

| | 22 | | | S&P 500 Index | | Goldman Sachs | | | 100,009 | | | | 5/20/2022 | | | $ | 4,660 | | | | 2,336 | |

| | 35 | | | S&P 500 Index | | Goldman Sachs | | | 161,956 | | | | 6/17/2022 | | | $ | 4,650 | | | | 3,546 | |

| | 16 | | | S&P 500 Index | | Goldman Sachs | | | 73,618 | | | | 8/19/2022 | | | $ | 4,650 | | | | 1,674 | |

| | 28 | | | S&P 500 Index | | Goldman Sachs | | | 128,932 | | | | 9/16/2022 | | | $ | 4,650 | | | | 2,995 | |

| | 17 | | | S&P 500 Index | | Goldman Sachs | | | 77,114 | | | | 10/21/2022 | | | $ | 4,650 | | | | 1,807 | |

| | 15 | | | S&P 500 Index | | Goldman Sachs | | | 70,015 | | | | 11/18/2022 | | | $ | 4,650 | | | | 1,672 | |

| | 37 | | | S&P 500 Index | | Goldman Sachs | | | 168,478 | | | | 12/16/2022 | | | $ | 4,650 | | | | 4,110 | |

| | | | | | | | | | | | | | | | | | | | | | 22,992 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| PURCHASED PUT OPTIONS |

| | | | | | | | | | | | | | | | | | |

| Number of | | | | | | | Notional Value at | | | | | | | | | | |

| Contracts | | | Open Purchased Put Options | | Counterparty | | November 30, 2021 | | | Expiration | | | Exercise Price | | | Market Value | |

| | 16 | | | S&P 500 Index | | Goldman Sachs | | | 72,337 | | | | 12/17/2021 | | | $ | 1,775 | | | $ | 2 | |

| | 18 | | | S&P 500 Index | | Goldman Sachs | | | 80,629 | | | | 12/17/2021 | | | $ | 1,800 | | | | 2 | |

| | 15 | | | S&P 500 Index | | Goldman Sachs | | | 69,147 | | | | 12/17/2021 | | | $ | 2,075 | | | | 3 | |

| | 19 | | | S&P 500 Index | | Goldman Sachs | | | 87,507 | | | | 12/17/2021 | | | $ | 2,100 | | | | 4 | |

| | 37 | | | S&P 500 Index | | Goldman Sachs | | | 169,319 | | | | 12/17/2021 | | | $ | 2,125 | | | | 8 | |

| | 30 | | | S&P 500 Index | | Goldman Sachs | | | 136,540 | | | | 12/17/2021 | | | $ | 2,150 | | | | 7 | |

| | 29 | | | S&P 500 Index | | Goldman Sachs | | | 130,429 | | | | 12/17/2021 | | | $ | 2,175 | | | | 6 | |

| | 23 | | | S&P 500 Index | | Goldman Sachs | | | 103,368 | | | | 12/17/2021 | | | $ | 2,200 | | | | 5 | |

| | 27 | | | S&P 500 Index | | Goldman Sachs | | | 123,847 | | | | 12/17/2021 | | | $ | 2,250 | | | | 7 | |

| | 18 | | | S&P 500 Index | | Goldman Sachs | | | 82,239 | | | | 12/17/2021 | | | $ | 2,425 | | | | 7 | |

| | 26 | | | S&P 500 Index | | Goldman Sachs | | | 119,661 | | | | 12/17/2021 | | | $ | 2,450 | | | | 10 | |