UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23617

TCW ETF Trust

On behalf of the following series:

TCW Artificial Intelligence ETF (Ticker: AIFD)

TCW Compounders ETF (Ticker: GRW)

TCW Transform 500 ETF (Ticker: VOTE)

TCW Transform Supply Chain ETF (Ticker: SUPP)

TCW Transform Systems ETF (Ticker: NETZ)

(Exact name of Registrant as specified in charter)

515 South Flower Street, Los Angeles, CA 90071

(Address of principal executive offices) (Zip code)

Peter Davidson, Esq. Vice President and Secretary 515 South Flower Street, Los Angeles, CA 90071 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (213) 244-0000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

EXPLANATORY NOTE: Registrant is filing this amendment to its Form N-CSR for the fiscal year ended October 30, 2024 originally filed with the Securities and Exchange Commission on January 2, 2025. (Accession Number 0001829126-25-000010). The purpose of this amendment is to disclose the February 15, 2024 Special Meeting of Shareholders to Approve Trustees. This disclosure was inadvertently omitted in the original report. Except as set forth above, this amendment does not amend, update or change any other items or disclosures found in the original Form N-CSR filing.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports To Shareholders.

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). |

TCW Artificial Intelligence ETF

Ticker: AIFD | Listing Exchange: New York Stock Exchange LLC

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Artificial Intelligence ETF for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Products/ETFs/AIFD/. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

TCW Artificial Intelligence ETFFootnote Reference1 | $99 | 0.81% |

How did the Fund perform last year and what affected its performance?

The TCW Artificial Intelligence ETF (AIFD) is an actively-managed, conviction-weighted, concentrated ETF that seeks to invest in companies that are leading the development and commercialization of artificial intelligence. The Fund will generally invest in companies that fall into one of the following three buckets:

- AI Enablers, the physical infrastructure on which AI models are built, trained, and run;

- AI Systems, the model and/or application of AI;

- AI Adopters, companies that use commercial AI to create a disruption in their industry.

The Fund seeks to invest in companies with a “meaningful and measurable” effect from AI. The effect will be meaningful if it is material to fundamentals, and measurable if the market can observe the impact. Although the fund has high exposure to technology, this investment philosophy allows us to focus on businesses in all economic sectors.

From November 1, 2023 through October 31, 2024 (the “Reporting Period”), the Fund’s net asset value (“NAV”) return was 46.77%. The Russell 3000 Growth Benchmark returned 43.42%. This is inclusive of a drawdown of nearly 20% and 13% for AIFD and the index, respectively. Concerns that the Fed waited too long to cut rates to avoid a recession sent growth and tech stocks sharply lower from mid-July through early August. Outside of this period, performance relative to the benchmark was strong and continues to be driven by the increasing demand for artificial intelligence services.

For the 1-year period, Information Technology and Communication Services (which constitute the vast majority of the Fund's holdings) each generated double-digit total returns. Top performers included NVIDIA and Arista Networks.

On the other hand, bottom performers included Mobileye, Samsung, and BILL Holdings. We exited BILL Holdings during the period.

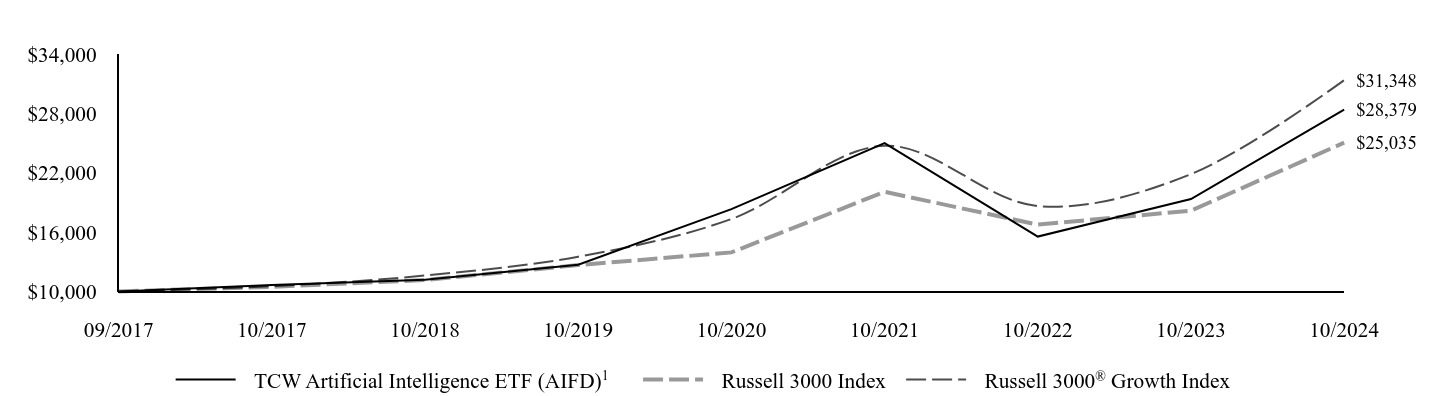

(based on Net Asset Value)

| TCW Artificial Intelligence ETF (AIFD)Footnote Reference1 | Russell 3000 Index | Russell 3000® Growth Index |

|---|

| 09/2017 | $10,000 | $10,000 | $10,000 |

| 10/2017 | $10,640 | $10,467 | $10,537 |

| 10/2018 | $11,182 | $11,158 | $11,612 |

| 10/2019 | $12,702 | $12,663 | $13,509 |

| 10/2020 | $18,313 | $13,948 | $17,318 |

| 10/2021 | $24,995 | $20,071 | $24,733 |

| 10/2022 | $15,544 | $16,756 | $18,630 |

| 10/2023 | $19,336 | $18,160 | $21,857 |

| 10/2024 | $28,379 | $25,035 | $31,348 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

| Footnote | Description |

Footnote1 | For periods before May 6, 2024, reflects the performance of the predecessor mutual fund, the TCW Artificial Intelligence Equity Fund (Class I), which had substantially similar objectives, strategies and policies but was subject to different expenses, which would have produced different results. |

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | Since Inception (09/01/2017) |

|---|

| TCW Artificial Intelligence ETF (AIFD) | 46.77% | 17.44% | 15.67% |

| Russell 3000 Index | 37.86% | 14.60% | 13.66% |

Russell 3000® Growth Index | 43.42% | 18.34% | 17.28% |

- Total Net Assets$55,412,142

- # of Portfolio Holdings35

- Portfolio Turnover Rate25%

- Total Advisory Fees Paid$372,627

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Semiconductors & Semiconductor Equipment | 27.4% |

| Software | 22.0% |

| Interactive Media & Services | 12.8% |

| Communications Equipment | 9.9% |

| Electrical Equipment | 5.2% |

| Broadline Retail | 5.0% |

| Technology Hardware, Storage & Peripherals | 3.9% |

| Automobiles | 3.7% |

Other Security TypesFootnote Reference* | 10.2% |

| Liabilities in Excess of Other Assets | (0.1)% |

| Footnote | Description |

Footnote* | Please refer to the Fund's Annual Financial Statements which are available on the Fund's website at www.tcw.com/Products/ETFs/AIFD/ for a complete listing of all categories. |

Top 10 Holdings (as a % of Net Assets)

| NVIDIA Corp. | 9.1% |

| Arista Networks, Inc. | 7.1% |

| Meta Platforms, Inc., Class A | 6.0% |

| Amazon.com, Inc. | 5.0% |

| Alphabet, Inc., Class A | 5.0% |

| Palo Alto Networks, Inc. | 4.8% |

| Microsoft Corp. | 4.3% |

| ServiceNow, Inc. | 4.2% |

| Micron Technology, Inc. | 3.8% |

| Tesla, Inc. | 3.7% |

Changes in or Disagreements with Accountants

Accountant Change: Effective June 10, 2024, Cohen & Company, Ltd. ("Cohen") was dismissed as the independent registered public accounting firm of the TCW Transform 500 ETF, TCW Transform Systems ETF, TCW Transform Supply Chain ETF, TCW Artificial Intelligence ETF and TCW Compounders ETF. The Audit Committee of the Board of Trustees (the "Board") recommended, and the Board approved, the replacement of Cohen with Deloitte & Touche LLP, effective June 10, 2024, for the Funds listed above, and all Funds that would subsequently join the TCW ETF Trust.

Disagreements: During the fiscal years ended October 31, 2022, October 31, 2023, and during the subsequent interim period through June 10, 2024: (i) there were no disagreements between the Funds and Cohen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which would have, if not resolved to the satisfaction of Cohen, caused it to make reference to the subject matter of the disagreements in its report on the financial statements of the Funds for such years or interim period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including

but not limited to the Fund's prospectus, financial information, holdings,

and proxy voting information, please visit www.tcw.com/Products/ETFs/AIFD/.

Phone: 800-FUND-TCW (800-386-3829)

TCW Artificial Intelligence ETF

Annual Shareholder Report — October 31, 2024

Ticker: GRW | Listing Exchange: New York Stock Exchange LLC

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Compounders ETF for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Products/ETFs/GRW/. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

TCW Compounders ETFFootnote Reference1 | $92 | 0.76% |

How did the Fund perform last year and what affected its performance?

The objective of the TCW Compounders ETF is to preserve and grow capital over the long-term. Our thesis is that investing in market-leading businesses with durable competitive advantages, essential or hard-to-replicate products or services, and exceptionally skilled management teams will drive significant risk-adjusted compounding performance over the long term.

From November 1, 2023 through October 31, 2024 (the “Reporting Period”), the Fund’s net asset value (“NAV”) return was 41.77%. The Russell 1000 Benchmark returned 38.07%.

At a sector level, the Fund saw its largest contributions from Information Technology, Industrials, and Financials. Smallest contributions to performance came from the Fund’s investments within Consumer Discretionary, Health Care, and Materials. Top contributors in the period included Constellation Software, Broadcom, and HEICO. There were no detractors in the period.

Broadly, equities had a strong year as the Fed’s “soft landing” looked increasingly achievable. In early September, the Fed announced a 50 bps (basis points) rate cut, which investors welcomed. In many respects the U.S. equity market is enjoying a “Goldilocks” confluence of factors whereby the Fed appears to be loosening monetary policy at the same time GDP growth, employment, and corporate earnings remain steady. While the economy is generally on solid footing, there are plenty of bricks in the proverbial “wall of worry” with U.S. equities currently trading well above their historical average and signs of slowing growth.

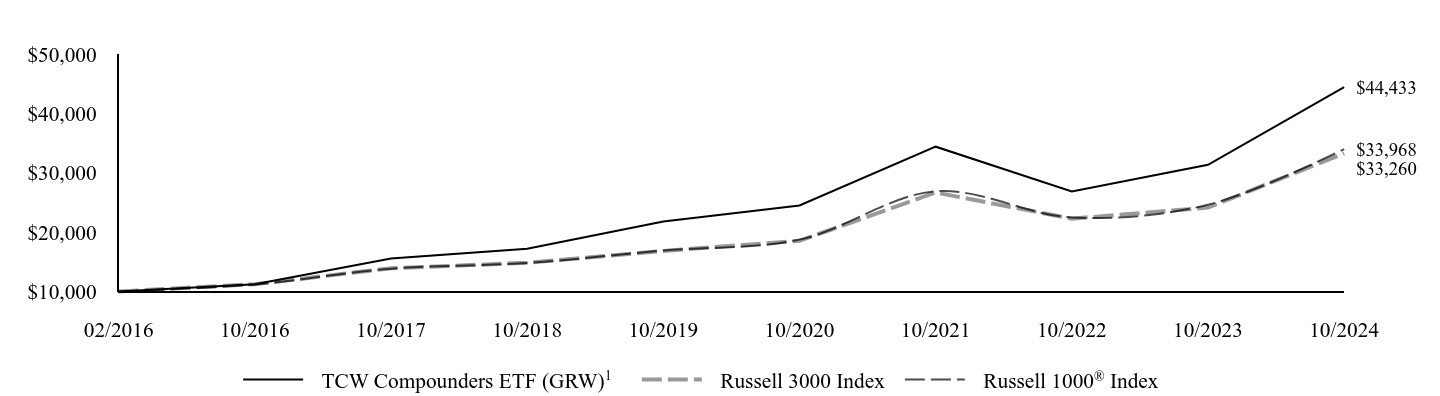

(based on Net Asset Value)

| TCW Compounders ETF (GRW)Footnote Reference1 | Russell 3000 Index | Russell 1000® Index |

|---|

| 02/2016 | $10,000 | $10,000 | $10,000 |

| 10/2016 | $11,230 | $11,217 | $11,184 |

| 10/2017 | $15,544 | $13,907 | $13,831 |

| 10/2018 | $17,191 | $14,824 | $14,796 |

| 10/2019 | $21,796 | $16,824 | $16,889 |

| 10/2020 | $24,480 | $18,531 | $18,725 |

| 10/2021 | $34,386 | $26,666 | $26,872 |

| 10/2022 | $26,838 | $22,261 | $22,471 |

| 10/2023 | $31,341 | $24,127 | $24,602 |

| 10/2024 | $44,433 | $33,260 | $33,968 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

| Footnote | Description |

Footnote1 | For periods before May 6, 2024, reflects the performance of the predecessor mutual fund, the TCW New America Premier Equities Fund (Class I), which had substantially similar objectives, strategies and policies but was subject to different expenses, which would have produced different results. |

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | Since Inception (02/01/2016) |

|---|

| TCW Compounders ETF (GRW) | 41.77% | 15.31% | 18.59% |

| Russell 3000 Index | 37.86% | 14.60% | 14.72% |

Russell 1000® Index | 38.07% | 15.00% | 15.00% |

- Total Net Assets$168,514,046

- # of Portfolio Holdings21

- Portfolio Turnover Rate40%

- Total Advisory Fees Paid$1,327,606

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Software | 27.5% |

| Aerospace & Defense | 15.7% |

| Financial Services | 13.1% |

| Commercial Services & Supplies | 8.5% |

| Capital Markets | 7.5% |

| Professional Services | 4.8% |

| Semiconductors & Semiconductor Equipment | 4.6% |

| Electrical Equipment | 4.0% |

Other Security TypesFootnote Reference* | 13.4% |

| Other Assets in Excess of Liabilities | 0.9% |

| Footnote | Description |

Footnote* | Please refer to the Fund's Annual Financial Statements which are available on the Fund's website at www.tcw.com/Products/ETFs/GRW/ for a complete listing of all categories. |

Top 10 Holdings (as a % of Net Assets)

| Constellation Software, Inc. | 16.0% |

| HEICO Corp. | 9.2% |

| Fiserv, Inc. | 8.7% |

| Waste Connections, Inc. | 8.5% |

| Microsoft Corp. | 7.5% |

| TransDigm Group, Inc. | 4.9% |

| Wolters Kluwer NV | 4.8% |

| Broadcom, Inc. | 4.6% |

| Visa, Inc., Class A | 4.4% |

| S&P Global, Inc. | 4.1% |

Changes in or Disagreements with Accountants

Accountant Change: Effective June 10, 2024, Cohen & Company, Ltd. ("Cohen") was dismissed as the independent registered public accounting firm of the TCW Transform 500 ETF, TCW Transform Systems ETF, TCW Transform Supply Chain ETF, TCW Artificial Intelligence ETF and TCW Compounders ETF. The Audit Committee of the Board of Trustees (the "Board") recommended, and the Board approved, the replacement of Cohen with Deloitte & Touche LLP, effective June 10, 2024, for the Funds listed above, and all Funds that would subsequently join the TCW ETF Trust.

Disagreements: During the fiscal years ended October 31, 2022, October 31, 2023, and during the subsequent interim period through June 10, 2024: (i) there were no disagreements between the Funds and Cohen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which would have, if not resolved to the satisfaction of Cohen, caused it to make reference to the subject matter of the disagreements in its report on the financial statements of the Funds for such years or interim period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including

but not limited to the Fund's prospectus, financial information, holdings,

and proxy voting information, please visit www.tcw.com/Products/ETFs/GRW/.

Phone: 800-FUND-TCW (800-386-3829)

Annual Shareholder Report — October 31, 2024

Ticker: VOTE | Listing Exchange: New York Stock Exchange LLC

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Transform 500 ETF for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Products/ETFs/VOTE/. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| TCW Transform 500 ETF | $6 | 0.05% |

How did the Fund perform last year and what affected its performance?

The TCW Transform 500 ETF seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® US Large Cap Select IndexSM (the “Underlying Index”), which measures the performance of the 500 largest U.S. stocks by market capitalization, as determined by Morningstar, Inc. The Underlying Index consists of securities from a broad range of industries. As of October 31, 2024, the Underlying Index is represented by securities of companies in sectors including Information Technology, Health Care, Financials, Consumer Discretionary, Communication Services, Industrials, Consumer Staples, Energy, Materials, Utilities and Real Estate. The components of the Underlying Index are likely to change over time and the Underlying Index and the Fund are rebalanced on a quarterly basis. To the extent that the securities in the Underlying Index are concentrated in one or more industries or groups of industries, the Fund may concentrate in such industries or groups of industries.

From November 1, 2023 through October 31, 2024 (the “Reporting Period”), the Fund’s net asset value (“NAV”) return was 38.48%. The Underlying Index returned 38.53% during the same Reporting Period.

The Fund posted positive NAV performance in ten of the twelve months during the Reporting Period, with returns ranging from -4.06% to 9.43%.

All the eleven sectors in the Fund delivered positive returns during the Reporting Period. Information Technology was the strongest performing sector.

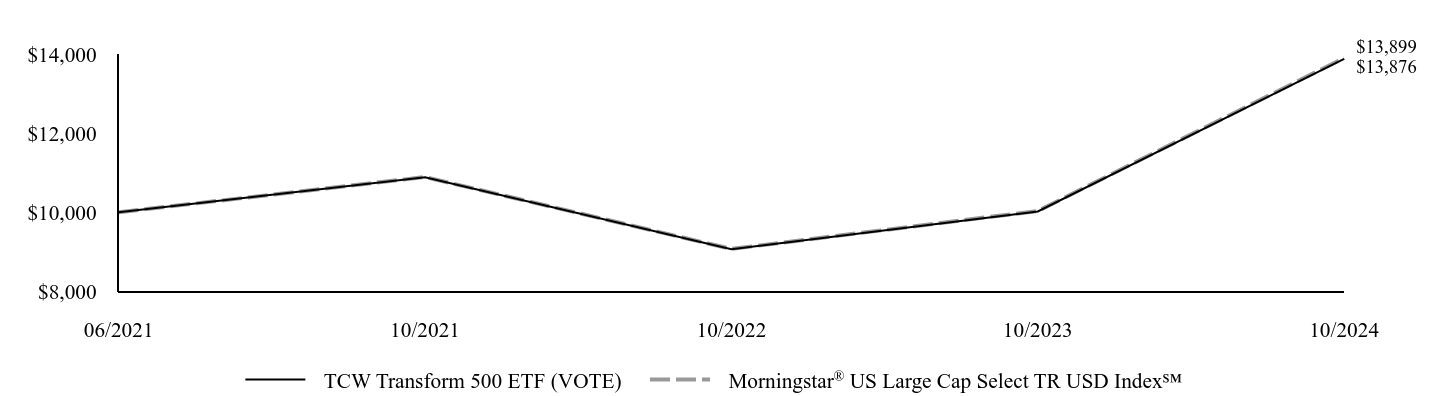

(based on Net Asset Value)

| TCW Transform 500 ETF (VOTE) | Morningstar® US Large Cap Select TR USD Index℠ |

|---|

| 06/2021 | $10,000 | $10,000 |

| 10/2021 | $10,887 | $10,890 |

| 10/2022 | $9,067 | $9,074 |

| 10/2023 | $10,020 | $10,033 |

| 10/2024 | $13,876 | $13,899 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | Since Inception (06/22/2021) |

|---|

| TCW Transform 500 ETF (VOTE) | 38.48% | 10.25% |

Morningstar® US Large Cap Select TR USD Index℠ | 38.53% | 10.30% |

- Total Net Assets$679,400,560

- # of Portfolio Holdings506

- Portfolio Turnover Rate3%

- Total Advisory Fees Paid$317,077

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Semiconductors & Semiconductor Equipment | 11.1% |

| Software | 10.5% |

| Technology Hardware, Storage & Peripherals | 7.0% |

| Interactive Media & Services | 6.5% |

| Financial Services | 4.3% |

| Broadline Retail | 3.9% |

| Pharmaceuticals | 3.5% |

| Banks | 3.3% |

Other Security TypesFootnote Reference* | 49.8% |

| Other Assets in Excess of Liabilities | 0.1% |

| Footnote | Description |

Footnote* | Please refer to the Fund's Annual Financial Statements which are available on the Fund's website at www.tcw.com/Products/ETFs/VOTE/ for a complete listing of all categories. |

Top 10 Holdings (as a % of Net Assets)

| Apple, Inc. | 6.6% |

| NVIDIA Corp. | 6.4% |

| Microsoft Corp. | 6.2% |

| Amazon.com, Inc. | 3.6% |

| Meta Platforms, Inc., Class A | 2.5% |

| Alphabet, Inc., Class A | 2.0% |

| Alphabet, Inc., Class C | 1.8% |

| Berkshire Hathaway, Inc., Class B | 1.7% |

| Broadcom, Inc. | 1.6% |

| Eli Lilly & Co. | 1.4% |

Changes in or Disagreements with Accountants

Accountant Change: Effective June 10, 2024, Cohen & Company, Ltd. ("Cohen") was dismissed as the independent registered public accounting firm of the TCW Transform 500 ETF, TCW Transform Systems ETF, TCW Transform Supply Chain ETF, TCW Artificial Intelligence ETF and TCW Compounders ETF. The Audit Committee of the Board of Trustees (the "Board") recommended, and the Board approved, the replacement of Cohen with Deloitte & Touche LLP, effective June 10, 2024, for the Funds listed above, and all Funds that would subsequently join the TCW ETF Trust.

Disagreements: During the fiscal years ended October 31, 2022, October 31, 2023, and during the subsequent interim period through June 10, 2024: (i) there were no disagreements between the Funds and Cohen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which would have, if not resolved to the satisfaction of Cohen, caused it to make reference to the subject matter of the disagreements in its report on the financial statements of the Funds for such years or interim period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including

but not limited to the Fund's prospectus, financial information, holdings,

and proxy voting information, please visit www.tcw.com/Products/ETFs/VOTE/.

Phone: 800-FUND-TCW (800-386-3829)

Annual Shareholder Report — October 31, 2024

TCW Transform Supply Chain ETF

Ticker: SUPP | Listing Exchange: New York Stock Exchange LLC

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Transform Supply Chain ETF for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Products/ETFs/SUPP/. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| TCW Transform Supply Chain ETF | $90 | 0.75% |

How did the Fund perform last year and what affected its performance?

The TCW Transform Supply Chain ETF (SUPP) is a high-conviction, actively-managed ETF that seeks to invest in companies that we believe will benefit from the companies’ relocalization of their supply chains to North America. SUPP’s thesis is that this intricate transformation of global supply chains, driven by a lack of global supply chain resiliency exposed by disruptions like the COVID-19 pandemic, trade wars, geopolitical conflicts, and natural disasters, requires trillions of dollars in investment. We see this as an incredible opportunity to invest in the enablers and beneficiaries of this transformation.

From November 1, 2023 through October 31, 2024 (the “Reporting Period”), the Fund’s net asset value (“NAV”) return was 38.84%. The Benchmark returned 38.06% during the same Reporting Period.

During the year, the portfolio’s semiconductor investments outperformed on the back of optimism for the role of the industry in key structural themes such as artificial intelligence, investment in state-of-the-art factories, and the electrification of our society at large. Taiwan Semiconductor (TSMC), NVIDIA (NVDA), and Lam Research (LRCX) were among the top-performing investments. Trane Technologies also outperformed, benefitting from rapidly-growing data center construction as these facilities require state-of-the-art thermal management solutions.

On the other hand, select portfolio investments with idiosyncratic challenges, such as WillScot Holdings and Norfolk Southern, hurt performance during the period.

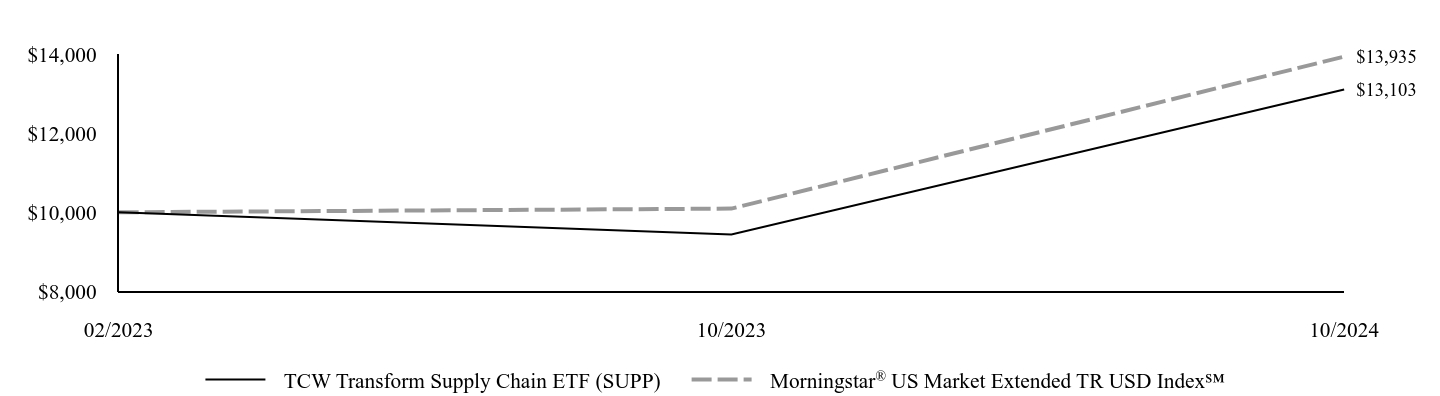

(based on Net Asset Value)

| TCW Transform Supply Chain ETF (SUPP) | Morningstar® US Market Extended TR USD Index℠ |

|---|

| 02/2023 | $10,000 | $10,000 |

| 10/2023 | $9,437 | $10,093 |

| 10/2024 | $13,103 | $13,935 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | Since Inception (02/14/2023) |

|---|

| TCW Transform Supply Chain ETF (SUPP) | 38.84% | 17.12% |

Morningstar® US Market Extended TR USD Index℠ | 38.06% | 21.41% |

- Total Net Assets$21,512,303

- # of Portfolio Holdings23

- Portfolio Turnover Rate35%

- Total Advisory Fees Paid$115,217

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Commercial Services & Supplies | 17.8% |

| Semiconductors & Semiconductor Equipment | 16.5% |

| Construction Materials | 12.5% |

| Ground Transportation | 8.6% |

| Building Products | 8.1% |

| Aerospace & Defense | 6.7% |

| Construction & Engineering | 6.6% |

| Trading Companies & Distributors | 5.9% |

Other Security TypesFootnote Reference* | 15.9% |

| Other Assets in Excess of Liabilities | 1.4% |

| Footnote | Description |

Footnote* | Please refer to the Fund's Annual Financial Statements which are available on the Fund's website at www.tcw.com/Products/ETFs/SUPP/ for a complete listing of all categories. |

Top 10 Holdings (as a % of Net Assets)

| Waste Connections, Inc. | 9.1% |

| Martin Marietta Materials, Inc. | 7.1% |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 7.0% |

| TransDigm Group, Inc. | 6.7% |

| WillScot Holdings Corp. | 6.6% |

| Vulcan Materials Co. | 5.4% |

| PTC, Inc. | 5.2% |

| Ferguson Enterprises, Inc. | 4.9% |

| NVIDIA Corp. | 4.9% |

| Canadian Pacific Kansas City Ltd. | 4.9% |

Changes in or Disagreements with Accountants

Accountant Change: Effective June 10, 2024, Cohen & Company, Ltd. ("Cohen") was dismissed as the independent registered public accounting firm of the TCW Transform 500 ETF, TCW Transform Systems ETF, TCW Transform Supply Chain ETF, TCW Artificial Intelligence ETF and TCW Compounders ETF. The Audit Committee of the Board of Trustees (the "Board") recommended, and the Board approved, the replacement of Cohen with Deloitte & Touche LLP, effective June 10, 2024, for the Funds listed above, and all Funds that would subsequently join the TCW ETF Trust.

Disagreements: During the fiscal years ended October 31, 2022, October 31, 2023, and during the subsequent interim period through June 10, 2024: (i) there were no disagreements between the Funds and Cohen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which would have, if not resolved to the satisfaction of Cohen, caused it to make reference to the subject matter of the disagreements in its report on the financial statements of the Funds for such years or interim period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including

but not limited to the Fund's prospectus, financial information, holdings,

and proxy voting information, please visit www.tcw.com/Products/ETFs/SUPP/.

Phone: 800-FUND-TCW (800-386-3829)

TCW Transform Supply Chain ETF

Annual Shareholder Report — October 31, 2024

TCW Transform Systems ETF

Ticker: NETZ | Listing Exchange: New York Stock Exchange LLC

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Transform Systems ETF for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Products/ETFs/NETZ/. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| TCW Transform Systems ETF | $92 | 0.75% |

How did the Fund perform last year and what affected its performance?

The TCW Transform Systems ETF (NETZ) is a high-conviction, actively-managed ETF that seeks to invest in companies that we believe will benefit from global transformation in the systems supporting how energy and power are sourced, produced, and consumed. Government policy and public demand are shifting the global economy towards more efficient and lower net-emission energy systems. This large-scale systems change is creating unique opportunities in the public markets, particularly in “brown” old-economy businesses that require huge investments as the way consumers source and use energy and power changes.

From November 1, 2023 through October 31, 2024 (the “Reporting Period”), the Fund’s net asset value (“NAV”) return was 45.37%. The Morningstar® US Market Extended TR USD Index returned 38.06% during the same Reporting Period.

During the year, the portfolio benefited from an increased awareness of the scarcity of reliable power and adequate electric grid stability to support the electrification of our economy. Top performing investments included Vertiv and GE Verona. The portfolio also benefitted from investments in the aerospace sector, particularly in companies in the aftermarket value chain, such as GE Aerospace (GE) and Safran. The global airline fleet is at record levels of age, and the supply chain continues to hold back the delivery of new aircraft. As such, we believe our aftermarket investments will benefit for many years.

On the other hand, the portfolio’s investments in the traditional energy sector hurt performance during the period as declining oil prices amid fears of a global economic slowdown weighed on the energy sector.

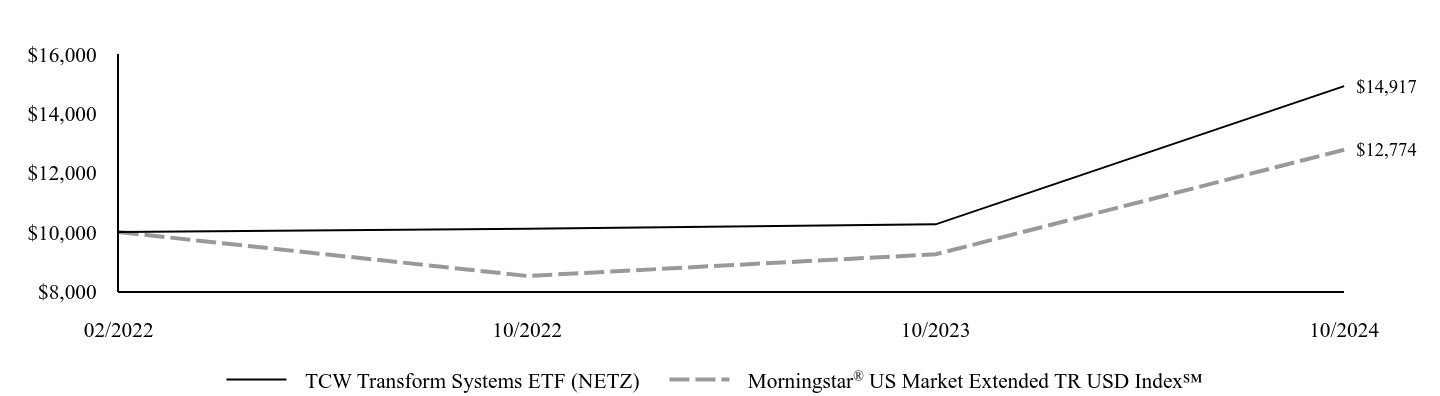

(based on Net Asset Value)

| TCW Transform Systems ETF (NETZ) | Morningstar® US Market Extended TR USD Index℠ |

|---|

| 02/2022 | $10,000 | $10,000 |

| 10/2022 | $10,108 | $8,521 |

| 10/2023 | $10,261 | $9,252 |

| 10/2024 | $14,917 | $12,774 |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or sale of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | Since Inception (02/02/2022) |

|---|

| TCW Transform Systems ETF (NETZ) | 45.37% | 15.69% |

Morningstar® US Market Extended TR USD Index℠ | 38.06% | 9.33% |

- Total Net Assets$225,281,093

- # of Portfolio Holdings26

- Portfolio Turnover Rate28%

- Total Advisory Fees Paid$1,030,025

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Aerospace & Defense | 21.1% |

| Electrical Equipment | 16.6% |

| Oil, Gas & Consumable Fuels | 14.8% |

| Commercial Services & Supplies | 12.9% |

| Ground Transportation | 8.2% |

| Software | 6.5% |

| Building Products | 5.0% |

| Semiconductors & Semiconductor Equipment | 4.3% |

Other Security TypesFootnote Reference* | 10.3% |

| Other Assets in Excess of Liabilities | 0.3% |

| Footnote | Description |

Footnote* | Please refer to the Fund's Annual Financial Statements which are available on the Fund's website at www.tcw.com/Products/ETFs/NETZ/ for a complete listing of all categories. |

Top 10 Holdings (as a % of Net Assets)

| Republic Services, Inc., Class A | 9.1% |

| General Electric Co. | 8.6% |

| Safran S.A. | 7.4% |

| Microsoft Corp. | 6.5% |

| Vertiv Holdings Co., Class A | 6.3% |

| GE Vernova, Inc. | 5.3% |

| Airbus SE | 5.2% |

| Trane Technologies plc | 5.0% |

| Diamondback Energy, Inc. | 4.9% |

| Exxon Mobil Corp. | 4.9% |

Changes in or Disagreements with Accountants

Accountant Change: Effective June 10, 2024, Cohen & Company, Ltd. ("Cohen") was dismissed as the independent registered public accounting firm of the TCW Transform 500 ETF, TCW Transform Systems ETF, TCW Transform Supply Chain ETF, TCW Artificial Intelligence ETF and TCW Compounders ETF. The Audit Committee of the Board of Trustees (the "Board") recommended, and the Board approved, the replacement of Cohen with Deloitte & Touche LLP, effective June 10, 2024, for the Funds listed above, and all Funds that would subsequently join the TCW ETF Trust.

Disagreements: During the fiscal years ended October 31, 2022, October 31, 2023, and during the subsequent interim period through June 10, 2024: (i) there were no disagreements between the Funds and Cohen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which would have, if not resolved to the satisfaction of Cohen, caused it to make reference to the subject matter of the disagreements in its report on the financial statements of the Funds for such years or interim period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including

but not limited to the Fund's prospectus, financial information, holdings,

and proxy voting information, please visit www.tcw.com/Products/ETFs/NETZ/.

Phone: 800-FUND-TCW (800-386-3829)

TCW Transform Systems ETF

Annual Shareholder Report — October 31, 2024

Item 2. Code Of Ethics.

| (a) | As of the period ended October 31, 2024, the Registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR that applies to its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party (the “Code of Ethics”).. |

| (c) | During the period covered by this report, no substantive amendments were made to the Code of Ethics. |

| (d) | During the period covered by this report, there have been no waivers granted under the Code of Ethics. |

| (f) | The registrant’s Code of Ethics is filed herewith pursuant to Item 19(a)(1) of this Form. |

Item 3. Audit Committee Financial Expert.

The Board of Trustees of the Registrant has determined that Victoria B. Rogers, Robert Rooney, and Michael Swell possess the attributes identified in Instruction (b) of Item 3 to Form N-CSR to qualify as an “audit committee financial expert,” and has designated each individual as the Registrant’s audit committee financial experts. Ms. Rogers, Mr. Rooney, and Mr. Swell are “independent” Trustees pursuant to paragraph (a)(2) of Item 3 to Form N-CSR.

Item 4. Principal Accountant Fees And Services.

The following fees paid to Cohen & Company, Ltd., the Registrant’s former principal accounting firm, are for services rendered for the fiscal year ended October 31, 2023, and fees paid to Deloitte & Touche LLP, the Registrant’s current principal accounting firm, are for services rendered for the fiscal year ended October 31, 2024.

The aggregate fees billed for the fiscal years ended October 31, 2024, and October 31, 2023, for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements was $71,500 and $43,500, respectively.

The aggregate fees billed for the fiscal years ended October 31, 2024, and October 31, 2023, for assurance and related services rendered to the Registrant by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item was $0 and $0, respectively.

The aggregate fees billed for the fiscal years ended October 31, 2024, and October 31, 2023, for professional services rendered to the Registrant by the principal accountant for tax compliance, tax advice and tax planning was $18,480 and $9,000, respectively. These services consisted of (i) review or preparation of U.S. federal, state, local and excise tax returns; (ii) U.S. federal, state and local entity tax planning, advice and assistance regarding statutory, regulatory or administrative developments, and (iii) tax advice regarding tax qualification.

The aggregate fees billed for the fiscal years ended October 31, 2024, and October 31, 2023, for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item was $0 and $0, respectively.

| e) | (1) Pursuant to the Registrant’s Audit Committee Charter that has been adopted by the audit committee, the audit committee shall approve all audit and permissible non-audit services to be provided to the Registrant and all permissible non-audit services to be provided to its investment adviser or any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the Registrant if the engagement relates directly to the operations and financial reporting of the Registrant. The audit committee has delegated to its Chairman the approval of such services subject to reports to the full audit committee at its next subsequent meeting. |

(2) The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X, with respect to: Audit-Related Fees were 0%; Tax Fees were 0%; and Other Fees were 0% for the fiscal years ended October 31, 2023 and October 31, 2024, respectively.

| g) | The aggregate non-audit fees billed by the Registrant’s accountant for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant were $331,979 for the period ending October 31, 2024 and $9,000 for the period ending October 31, 2023. |

Item 5. Audit Committee Of Listed Registrants.

| (a) | The Registrant is an issuer as defined in Section 10A-3 of the Securities Exchange Act of 1934 and has a separately-designated standing Audit Committee in accordance with Section 3(a)(58)(A) of such Act. All of the Board’s independent Trustees are members of the Audit Committee. |

Item 6. Investments.

| | (a) | A Schedule of Investments in securities of unaffiliated issuers as of the close of the Reporting Period is included as part of the report to shareholders filed under Item 7(a) of this Form N-CSR. |

| | | |

| | (b) | Not Applicable. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Companies.

| (a) | The Registrant’s Financial Statements are attached herewith. |

[This Page Intentionally Left Blank]

| Table of Contents |

|

Schedule of Investments TCW Artificial Intelligence ETF |

|

October 31, 2024

| Investments | | Shares | | | Value | |

| COMMON STOCKS - 99.0% | | | | | | | | |

| | | | | | | | | |

| Automobile Components - 0.5% | | | | | | | | |

| Mobileye Global, Inc., Class A* | | | 20,012 | | | $ | 272,363 | |

| | | | | | | | | |

| Automobiles - 3.7% | | | | | | | | |

| Tesla, Inc.* | | | 8,308 | | | | 2,075,754 | |

| | | | | | | | | |

| Broadline Retail - 5.0% | | | | | | | | |

| Amazon.com, Inc.* | | | 14,962 | | | | 2,788,917 | |

| | | | | | | | | |

| Communications Equipment - 9.9% | | | | | | | | |

| Arista Networks, Inc.* | | | 10,172 | | | | 3,930,868 | |

| Motorola Solutions, Inc. | | | 3,427 | | | | 1,539,922 | |

| | | | | | | | 5,470,790 | |

| Electrical Equipment - 5.2% | | | | | | | | |

| Eaton Corp. plc | | | 3,673 | | | | 1,217,893 | |

| Vertiv Holdings Co., Class A | | | 15,047 | | | | 1,644,487 | |

| | | | | | | | 2,862,380 | |

| Electronic Equipment, Instruments & Components - 1.8% | | | | | | | | |

| Cognex Corp. | | | 24,457 | | | | 983,905 | |

| | | | | | | | | |

| Interactive Media & Services - 12.8% | | | | | | | | |

| Alphabet, Inc., Class A | | | 16,167 | | | | 2,766,335 | |

| Meta Platforms, Inc., Class A | | | 5,823 | | | | 3,305,019 | |

| Pinterest, Inc., Class A* | | | 32,886 | | | | 1,045,446 | |

| | | | | | | | 7,116,800 | |

| IT Services - 2.0% | | | | | | | | |

| International Business Machines Corp. | | | 5,383 | | | | 1,112,774 | |

| | | | | | | | | |

| Machinery - 2.3% | | | | | | | | |

| Deere & Co. | | | 1,947 | | | | 787,932 | |

| Symbotic, Inc., Class A* | | | 18,331 | | | | 509,418 | |

| | | | | | | | 1,297,350 | |

| Media - 2.5% | | | | | | | | |

| Trade Desk, Inc. (The), Class A* | | | 11,530 | | | | 1,386,021 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment - 27.4% | | | | | | | | |

| Advanced Micro Devices, Inc.* | | | 4,477 | | | | 645,001 | |

| ASML Holding NV | | | 1,823 | | | | 1,226,059 | |

| Broadcom, Inc. | | | 3,171 | | | | 538,341 | |

| Lam Research Corp. | | | 13,480 | | | | 1,002,238 | |

| Marvell Technology, Inc. | | | 14,066 | | | | 1,126,827 | |

| Micron Technology, Inc. | | | 21,179 | | | | 2,110,487 | |

| NVIDIA Corp. | | | 37,922 | | | | 5,034,525 | |

| ON Semiconductor Corp.* | | | 14,175 | | | | 999,196 | |

| QUALCOMM, Inc. | | | 6,224 | | | | 1,013,080 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | | 7,596 | | | | 1,447,342 | |

| | | | | | | | 15,143,096 | |

| Investments | | Shares | | | Value | |

| Software - 22.0% | | | | | | | | |

| Cadence Design Systems, Inc.* | | | 2,922 | | | $ | 806,823 | |

| CyberArk Software Ltd.* | | | 5,659 | | | | 1,564,827 | |

| Datadog, Inc., Class A* | | | 9,202 | | | | 1,154,299 | |

| Microsoft Corp. | | | 5,844 | | | | 2,374,709 | |

| Palo Alto Networks, Inc.* | | | 7,380 | | | | 2,659,235 | |

| Salesforce, Inc. | | | 4,329 | | | | 1,261,341 | |

| ServiceNow, Inc.* | | | 2,468 | | | | 2,302,619 | |

| | | | | | | | 12,123,853 | |

| Technology Hardware, Storage & Peripherals - 3.9% | | | | | | | | |

| Apple, Inc. | | | 6,157 | | | | 1,390,928 | |

| Samsung Electronics Co. Ltd. | | | 746 | | | | 790,014 | |

| | | | | | | | 2,180,942 | |

Total Common Stocks

(Cost $41,360,144) | | | | | | | 54,814,945 | |

| | | | | | | | | |

| | | Principal | | | | |

| Short-Term Investments - 1.1% | | | | | | | | |

| Time Deposit - 1.1% | | | | | | | | |

Citibank, New York 4.18%11/1/2024

(Cost $625,998) | | $ | 625,998 | | | | 625,998 | |

| | | | | | | | | |

Total Investments - 100.1%

(Cost $41,986,142) | | | | | | $ | 55,440,943 | |

| Liabilities in Excess of Other Assets - (0.1%) | | | | | | | (28,801 | ) |

| Net Assets - 100.0% | | | | | | $ | 55,412,142 | |

| * | Non-income producing security. |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Artificial Intelligence ETF |  |

October 31, 2024

Fair Value Measurement

The Fund discloses the fair market value of its investments in a hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of the Fund (observable inputs) and (2) the Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs).

The three levels defined by the hierarchy are as follows:

| ● | Level 1 — Quoted prices in active markets for identical assets that the Fund has the ability to access. |

| ● | Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| ● | Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the fair valuations according to the inputs used as of October 31, 2024 in valuing the Fund’s investments.

| | | Level 1* | | | Level 2* | | | Level 3* | | | Total | |

| Investments | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | |

| Common Stocks** | | $ | 54,814,945 | | | $ | - | | | $ | - | | | $ | 54,814,945 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Time Deposit | | | 625,998 | | | | - | | | | - | | | | 625,998 | |

| Total Investments | | $ | 55,440,943 | | | $ | - | | | $ | - | | | $ | 55,440,943 | |

| * | Please refer to Note 2. |

| ** | Please refer to the Schedule of Investments to view securities segregated by industry. |

See accompanying Notes to Financial Statements.

Schedule of Investments TCW Compounders ETF |  |

October 31, 2024

| Investments | | Shares | | | Value | |

| COMMON STOCKS - 96.0% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense - 15.7% | | | | | | | | |

| General Electric Co. | | | 14,884 | | | $ | 2,556,774 | |

| HEICO Corp. | | | 63,359 | | | | 15,519,786 | |

| TransDigm Group, Inc. | | | 6,384 | | | | 8,313,883 | |

| | | | | | | | 26,390,443 | |

| Capital Markets - 7.5% | | | | | | | | |

| MSCI, Inc., Class A | | | 10,029 | | | | 5,728,565 | |

| S&P Global, Inc. | | | 14,225 | | | | 6,833,121 | |

| | | | | | | | 12,561,686 | |

| Chemicals - 3.8% | | | | | | | | |

| Linde plc | | | 14,112 | | | | 6,437,189 | |

| | | | | | | | | |

| Commercial Services & Supplies - 8.5% | | | | | | | | |

| Waste Connections, Inc. | | | 80,659 | | | | 14,256,478 | |

| | | | | | | | | |

| Electrical Equipment - 4.0% | | | | | | | | |

| AMETEK, Inc. | | | 37,050 | | | | 6,792,747 | |

| | | | | | | | | |

| Financial Services - 13.1% | | | | | | | | |

| Fiserv, Inc.* | | | 74,416 | | | | 14,726,927 | |

| Visa, Inc., Class A | | | 25,604 | | | | 7,421,319 | |

| | | | | | | | 22,148,246 | |

| Life Sciences Tools & Services - 1.9% | | | | | | | | |

| Danaher Corp. | | | 13,066 | | | | 3,209,794 | |

| | | | | | | | | |

| Media - 2.2% | | | | | | | | |

| Trade Desk, Inc. (The), Class A* | | | 31,442 | | | | 3,779,643 | |

| | | | | | | | | |

| Professional Services - 4.8% | | | | | | | | |

| Wolters Kluwer NV | | | 48,097 | | | | 8,093,519 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment - 4.6% | | | | | | | | |

| Broadcom, Inc. | | | 45,257 | | | | 7,683,281 | |

| | | | | | | | | |

| Software - 27.5% | | | | | | | | |

| Constellation Software, Inc. | | | 8,921 | | | | 26,903,892 | |

| Fair Isaac Corp.* | | | 2,569 | | | | 5,120,300 | |

| Microsoft Corp. | | | 31,066 | | | | 12,623,669 | |

| Roper Technologies, Inc. | | | 3,127 | | | | 1,681,482 | |

| | | | | | | | 46,329,343 | |

| Specialty Retail - 2.4% | | | | | | | | |

| Murphy USA, Inc. | | | 8,216 | | | | 4,013,105 | |

| | | | | | | | | |

Total Common Stocks

(Cost $93,740,551) | | | | | | | 161,695,474 | |

| Investments | | Shares | | | Value | |

| WARRANTS - 0.0%† | | | | | | | | |

| Software - 0.0%† | | | | | | | | |

Constellation Software, Inc.* ††

(Cost $0) | | | 14,592 | | | $ | 0 | ** |

| | | | | | | | | |

| | | Principal | | | | |

| Short-Term Investments - 3.1% | | | | | | | | |

| Time Deposit - 3.1% | | | | | | | | |

Citibank, New York 4.18% 11/1/2024

(Cost $5,308,183) | | $ | 5,308,183 | | | | 5,308,183 | |

| | | | | | | | | |

Total Investments - 99.1%

(Cost $99,048,734) | | | | | | $ | 167,003,657 | |

| Other Assets Less Liabilities - 0.9% | | | | | | | 1,510,389 | |

| Net Assets - 100.0% | | | | | | $ | 168,514,046 | |

| * | Non-income producing security. |

| ** | Amount rounds to less than $0.50. |

| † | Represents less than 0.05%. |

| †† | For fair value measurement disclosure purposes, security is categorized as Level 3. Security is valued using significant unobservable inputs. |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Compounders ETF |  |

October 31, 2024

Fair Value Measurement

The Fund discloses the fair market value of its investments in a hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of the Fund (observable inputs) and (2) the Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs).

The three levels defined by the hierarchy are as follows:

| ● | Level 1 — Quoted prices in active markets for identical assets that the Fund has the ability to access. |

| ● | Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| ● | Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the fair valuations according to the inputs used as of October 31, 2024 in valuing the Fund’s investments.

| | | Level 1* | | | Level 2* | | | Level 3* | | | Total | |

| Investments | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | |

| Common Stocks** | | $ | 161,695,474 | | | $ | - | | | $ | - | | | $ | 161,695,474 | |

| Warrants** | | | - | | | | - | | | | 0 | *** | | | 0 | *** |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Time Deposit | | | 5,308,183 | | | | - | | | | - | | | | 5,308,183 | |

| Total Investments | | $ | 167,003,657 | | | $ | - | | | $ | 0 | *** | | $ | 167,003,657 | |

| * | Please refer to Note 2. |

| ** | Please refer to the Schedule of Investments to view securities segregated by industry. |

| *** | Amount rounds to less than $0.50. |

See accompanying Notes to Financial Statements.

Schedule of Investments TCW Transform 500 ETF |  |

October 31, 2024

| Investments | | Shares | | | Value | |

| COMMON STOCKS - 99.9% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense - 1.9% | | | | | | | | |

| Axon Enterprise, Inc.* | | | 990 | | | $ | 419,265 | |

| Boeing Co.* | | | 8,504 | | | | 1,269,732 | |

| General Dynamics Corp. | | | 3,422 | | | | 997,889 | |

| General Electric Co. | | | 15,003 | | | | 2,577,216 | |

| HEICO Corp. | | | 585 | | | | 143,296 | |

| HEICO Corp., Class A | | | 1,065 | | | | 204,491 | |

| Howmet Aerospace, Inc. | | | 5,639 | | | | 562,321 | |

| L3Harris Technologies, Inc. | | | 2,620 | | | | 648,371 | |

| Lockheed Martin Corp. | | | 2,931 | | | | 1,600,473 | |

| Northrop Grumman Corp. | | | 2,024 | | | | 1,030,256 | |

| RTX Corp. | | | 18,398 | | | | 2,225,974 | |

| Textron, Inc. | | | 2,643 | | | | 212,550 | |

| TransDigm Group, Inc. | | | 777 | | | | 1,011,887 | |

| | | | | | | | 12,903,721 | |

| Air Freight & Logistics - 0.4% | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 1,945 | | | | 231,455 | |

| FedEx Corp. | | | 3,112 | | | | 852,221 | |

| United Parcel Service, Inc., Class B | | | 10,116 | | | | 1,356,151 | |

| | | | | | | | 2,439,827 | |

| Automobile Components - 0.0%† | | | | | | | | |

| Aptiv plc* | | | 3,342 | | | | 189,926 | |

| | | | | | | | | |

| Automobiles - 1.6% | | | | | | | | |

| Ford Motor Co. | | | 54,475 | | | | 560,548 | |

| General Motors Co. | | | 15,571 | | | | 790,384 | |

| Tesla, Inc.* | | | 38,536 | | | | 9,628,219 | |

| | | | | | | | 10,979,151 | |

| Banks - 3.3% | | | | | | | | |

| Bank of America Corp. | | | 93,493 | | | | 3,909,877 | |

| Citigroup, Inc. | | | 26,360 | | | | 1,691,521 | |

| Citizens Financial Group, Inc. | | | 6,289 | | | | 264,893 | |

| Fifth Third Bancorp | | | 9,414 | | | | 411,204 | |

| First Citizens BancShares, Inc., Class A | | | 172 | | | | 333,224 | |

| Huntington Bancshares, Inc. | | | 20,018 | | | | 312,081 | |

| JPMorgan Chase & Co. | | | 39,409 | | | | 8,745,644 | |

| M&T Bank Corp. | | | 2,298 | | | | 447,375 | |

| PNC Financial Services Group, Inc. (The) | | | 5,512 | | | | 1,037,744 | |

| Regions Financial Corp. | | | 12,710 | | | | 303,388 | |

| Truist Financial Corp. | | | 18,472 | | | | 795,220 | |

| US Bancorp | | | 21,539 | | | | 1,040,549 | |

| Wells Fargo & Co. | | | 47,179 | | | | 3,062,861 | |

| | | | | | | | 22,355,581 | |

| Investments | | Shares | | | Value | |

| Beverages - 1.2% | | | | | | | | |

| Brown-Forman Corp., Class B | | | 4,128 | | | $ | 181,756 | |

| Coca-Cola Co. | | | 54,180 | | | | 3,538,497 | |

| Constellation Brands, Inc., Class A | | | 2,245 | | | | 521,603 | |

| Keurig Dr Pepper, Inc. | | | 15,073 | | | | 496,655 | |

| Monster Beverage Corp.* | | | 9,758 | | | | 514,051 | |

| PepsiCo, Inc. | | | 19,062 | | | | 3,165,817 | |

| | | | | | | | 8,418,379 | |

| Biotechnology - 1.9% | | | | | | | | |

| AbbVie, Inc. | | | 24,481 | | | | 4,990,941 | |

| Alnylam Pharmaceuticals, Inc.* | | | 1,738 | | | | 463,333 | |

| Amgen, Inc. | | | 7,421 | | | | 2,375,907 | |

| Biogen, Inc.* | | | 2,007 | | | | 349,218 | |

| BioMarin Pharmaceutical, Inc.* | | | 2,604 | | | | 171,578 | |

| Gilead Sciences, Inc. | | | 17,272 | | | | 1,534,099 | |

| Incyte Corp.* | | | 2,265 | | | | 167,882 | |

| Moderna, Inc.* | | | 4,646 | | | | 252,557 | |

| Regeneron Pharmaceuticals, Inc.* | | | 1,466 | | | | 1,228,801 | |

| Vertex Pharmaceuticals, Inc.* | | | 3,569 | | | | 1,698,773 | |

| | | | | | | | 13,233,089 | |

| Broadline Retail - 3.9% | | | | | | | | |

| Amazon.com, Inc.* | | | 131,339 | | | | 24,481,589 | |

| Coupang, Inc., Class A* | | | 16,627 | | | | 428,810 | |

| eBay, Inc. | | | 7,019 | | | | 403,663 | |

| MercadoLibre, Inc.* | | | 677 | | | | 1,379,171 | |

| | | | | | | | 26,693,233 | |

| Building Products - 0.6% | | | | | | | | |

| Builders FirstSource, Inc.* | | | 1,686 | | | | 288,980 | |

| Carlisle Cos, Inc. | | | 642 | | | | 271,072 | |

| Carrier Global Corp. | | | 11,633 | | | | 845,952 | |

| Johnson Controls International plc | | | 9,262 | | | | 699,744 | |

| Lennox International, Inc. | | | 442 | | | | 266,336 | |

| Masco Corp. | | | 3,050 | | | | 243,726 | |

| Trane Technologies plc | | | 3,125 | | | | 1,156,749 | |

| | | | | | | | 3,772,559 | |

| Capital Markets - 3.2% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 1,376 | | | | 702,173 | |

| Ares Management Corp., Class A | | | 2,567 | | | | 430,435 | |

| Bank of New York Mellon Corp. (The) | | | 10,215 | | | | 769,802 | |

| Blackrock, Inc. | | | 2,059 | | | | 2,019,941 | |

| Blackstone, Inc. | | | 10,008 | | | | 1,678,842 | |

| Carlyle Group, Inc. (The) | | | 2,992 | | | | 149,690 | |

| Charles Schwab Corp. (The) | | | 19,894 | | | | 1,409,092 | |

| CME Group, Inc., Class A | | | 4,986 | | | | 1,123,645 | |

| Coinbase Global, Inc., Class A* | | | 2,735 | | | | 490,249 | |

| FactSet Research Systems, Inc. | | | 526 | | | | 238,836 | |

| Goldman Sachs Group, Inc. (The) | | | 4,483 | | | | 2,321,252 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2024

| Investments | | Shares | | | Value | |

| Intercontinental Exchange, Inc. | | | 7,929 | | | $ | 1,235,893 | |

| KKR & Co., Inc. | | | 9,193 | | | | 1,270,840 | |

| LPL Financial Holdings, Inc. | | | 1,035 | | | | 292,056 | |

| Moody’s Corp. | | | 2,196 | | | | 997,072 | |

| Morgan Stanley | | | 17,328 | | | | 2,014,380 | |

| MSCI, Inc., Class A | | | 1,096 | | | | 626,035 | |

| Nasdaq, Inc. | | | 5,366 | | | | 396,655 | |

| Northern Trust Corp. | | | 2,828 | | | | 284,271 | |

| Raymond James Financial, Inc. | | | 2,616 | | | | 387,744 | |

| S&P Global, Inc. | | | 4,339 | | | | 2,084,281 | |

| State Street Corp. | | | 4,168 | | | | 386,790 | |

| T Rowe Price Group, Inc. | | | 3,075 | | | | 337,820 | |

| | | | | | | | 21,647,794 | |

| Chemicals - 1.3% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 3,081 | | | | 956,743 | |

| Celanese Corp., Class A | | | 1,510 | | | | 190,215 | |

| CF Industries Holdings, Inc. | | | 2,520 | | | | 207,220 | |

| Corteva, Inc. | | | 9,657 | | | | 588,304 | |

| Dow, Inc. | | | 9,716 | | | | 479,776 | |

| DuPont de Nemours, Inc. | | | 5,791 | | | | 480,595 | |

| Ecolab, Inc. | | | 3,524 | | | | 865,953 | |

| International Flavors & Fragrances, Inc. | | | 3,536 | | | | 351,584 | |

| Linde plc | | | 6,652 | | | | 3,034,309 | |

| LyondellBasell Industries NV, Class A | | | 3,584 | | | | 311,270 | |

| PPG Industries, Inc. | | | 3,268 | | | | 406,899 | |

| Sherwin-Williams Co. | | | 3,244 | | | | 1,163,850 | |

| Westlake Corp. | | | 469 | | | | 61,880 | |

| | | | | | | | 9,098,598 | |

| Commercial Services & Supplies - 0.6% | | | | | | | | |

| Cintas Corp. | | | 4,800 | | | | 987,888 | |

| Copart, Inc.* | | | 12,103 | | | | 622,941 | |

| Republic Services, Inc., Class A | | | 2,841 | | | | 562,518 | |

| Rollins, Inc. | | | 4,083 | | | | 192,473 | |

| Veralto Corp. | | | 3,276 | | | | 334,774 | |

| Waste Management, Inc. | | | 5,093 | | | | 1,099,325 | |

| | | | | | | | 3,799,919 | |

| Communications Equipment - 0.8% | | | | | | | | |

| Arista Networks, Inc.* | | | 3,557 | | | | 1,374,567 | |

| Cisco Systems, Inc. (Delaware) | | | 55,886 | | | | 3,060,876 | |

| Motorola Solutions, Inc. | | | 2,303 | | | | 1,034,853 | |

| | | | | | | | 5,470,296 | |

| Construction & Engineering - 0.1% | | | | | | | | |

| EMCOR Group, Inc. | | | 653 | | | | 291,284 | |

| Quanta Services, Inc. | | | 2,018 | | | | 608,689 | |

| | | | | | | | 899,973 | |

| Investments | | Shares | | | Value | |

| Construction Materials - 0.3% | | | | | | | | |

| CRH plc | | | 9,519 | | | $ | 908,398 | |

| Martin Marietta Materials, Inc. | | | 856 | | | | 507,043 | |

| Vulcan Materials Co. | | | 1,840 | | | | 504,031 | |

| | | | | | | | 1,919,472 | |

| Consumer Finance - 0.6% | | | | | | | | |

| American Express Co. | | | 7,837 | | | | 2,116,618 | |

| Capital One Financial Corp. | | | 5,271 | | | | 858,066 | |

| Discover Financial Services | | | 3,461 | | | | 513,716 | |

| Synchrony Financial | | | 5,566 | | | | 306,909 | |

| | | | | | | | 3,795,309 | |

| Consumer Staples Distribution & Retail - 1.9% | | | | | | | | |

| Costco Wholesale Corp. | | | 6,152 | | | | 5,377,954 | |

| Dollar General Corp. | | | 3,038 | | | | 243,162 | |

| Dollar Tree, Inc.* | | | 2,859 | | | | 184,806 | |

| Kroger Co. | | | 9,376 | | | | 522,900 | |

| Sysco Corp. | | | 6,900 | | | | 517,155 | |

| Target Corp. | | | 6,395 | | | | 959,506 | |

| Walmart, Inc. | | | 60,115 | | | | 4,926,424 | |

| | | | | | | | 12,731,907 | |

| Containers & Packaging - 0.2% | | | | | | | | |

| Amcor plc | | | 20,043 | | | | 223,079 | |

| Avery Dennison Corp. | | | 1,113 | | | | 230,424 | |

| Ball Corp. | | | 4,368 | | | | 258,804 | |

| International Paper Co. | | | 4,752 | | | | 263,926 | |

| Packaging Corp. of America | | | 1,233 | | | | 282,283 | |

| | | | | | | | 1,258,516 | |

| Distributors - 0.1% | | | | | | | | |

| Genuine Parts Co. | | | 1,941 | | | | 222,633 | |

| Pool Corp. | | | 522 | | | | 188,776 | |

| | | | | | | | 411,409 | |

| Diversified REITs - 0.0%† | | | | | | | | |

| WP Carey, Inc. | | | 3,015 | | | | 167,996 | |

| | | | | | | | | |

| Diversified Telecommunication Services - 0.7% | | | | | | | | |

| AT&T, Inc. | | | 99,146 | | | | 2,234,751 | |

| Verizon Communications, Inc. | | | 58,288 | | | | 2,455,673 | |

| | | | | | | | 4,690,424 | |

| Electric Utilities - 1.6% | | | | | | | | |

| American Electric Power Co., Inc. | | | 7,373 | | | | 728,084 | |

| Avangrid, Inc. | | | 995 | | | | 35,531 | |

| Constellation Energy Corp. | | | 4,364 | | | | 1,147,557 | |

| Duke Energy Corp. | | | 10,689 | | | | 1,232,121 | |

| Edison International | | | 5,316 | | | | 438,038 | |

| Entergy Corp. | | | 2,925 | | | | 452,732 | |

| Evergy, Inc. | | | 3,183 | | | | 192,381 | |

| Eversource Energy | | | 4,846 | | | | 319,109 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2024

| Investments | | Shares | | | Value | |

| Exelon Corp. | | | 13,798 | | | $ | 542,261 | |

| FirstEnergy Corp. | | | 7,029 | | | | 294,023 | |

| NextEra Energy, Inc. | | | 28,422 | | | | 2,252,443 | |

| NRG Energy, Inc. | | | 2,883 | | | | 260,623 | |

| PG&E Corp. | | | 29,598 | | | | 598,472 | |

| PPL Corp. | | | 10,227 | | | | 332,991 | |

| Southern Co. | | | 15,120 | | | | 1,376,374 | |

| Xcel Energy, Inc. | | | 7,649 | | | | 511,030 | |

| | | | | | | | 10,713,770 | |

| Electrical Equipment - 0.8% | | | | | | | | |

| AMETEK, Inc. | | | 3,196 | | | | 585,955 | |

| Eaton Corp. plc | | | 5,537 | | | | 1,835,959 | |

| Emerson Electric Co. | | | 7,896 | | | | 854,900 | |

| GE Vernova, Inc.* | | | 3,799 | | | | 1,146,006 | |

| Hubbell, Inc., Class B | | | 740 | | | | 316,002 | |

| Rockwell Automation, Inc. | | | 1,588 | | | | 423,535 | |

| Vertiv Holdings Co., Class A | | | 5,004 | | | | 546,887 | |

| | | | | | | | 5,709,244 | |

| Electronic Equipment, Instruments & Components - 0.6% | | | | | | | | |

| Amphenol Corp., Class A | | | 16,571 | | | | 1,110,589 | |

| CDW Corp. | | | 1,854 | | | | 348,978 | |

| Corning, Inc. | | | 10,724 | | | | 510,355 | |

| Jabil, Inc. | | | 1,523 | | | | 187,466 | |

| Keysight Technologies, Inc.* | | | 2,410 | | | | 359,114 | |

| TE Connectivity plc | | | 4,240 | | | | 625,061 | |

| Teledyne Technologies, Inc.* | | | 651 | | | | 296,413 | |

| Trimble, Inc.* | | | 3,381 | | | | 204,551 | |

| Zebra Technologies Corp., Class A* | | | 708 | | | | 270,435 | |

| | | | | | | | 3,912,962 | |

| Energy Equipment & Services - 0.2% | | | | | | | | |

| Baker Hughes Co., Class A | | | 13,955 | | | | 531,406 | |

| Halliburton Co. | | | 12,267 | | | | 340,287 | |

| Schlumberger NV | | | 19,790 | | | | 792,985 | |

| | | | | | | | 1,664,678 | |

| Entertainment - 1.3% | | | | | | | | |

| Electronic Arts, Inc. | | | 3,381 | | | | 510,024 | |

| Liberty Media Corp.-Liberty Formula One, Class A* | | | 307 | | | | 22,792 | |

| Liberty Media Corp.-Liberty Formula One, Class C* | | | 2,912 | | | | 232,494 | |

| Live Nation Entertainment, Inc.* | | | 2,055 | | | | 240,723 | |

| Netflix, Inc.* | | | 5,951 | | | | 4,499,135 | |

| ROBLOX Corp., Class A* | | | 7,249 | | | | 374,918 | |

| Take-Two Interactive Software, Inc.* | | | 2,260 | | | | 365,487 | |

| Walt Disney Co. | | | 25,180 | | | | 2,422,316 | |

| Warner Bros Discovery, Inc.* | | | 30,965 | | | | 251,745 | |

| | | | | | | | 8,919,634 | |

| Investments | | Shares | | | Value | |

| Financial Services - 4.3% | | | | | | | | |

| Apollo Global Management, Inc. | | | 5,508 | | | $ | 789,076 | |

| Berkshire Hathaway, Inc., Class B* | | | 24,968 | | | | 11,258,572 | |

| Block, Inc., Class A* | | | 7,670 | | | | 554,694 | |

| Corebridge Financial, Inc. | | | 3,208 | | | | 101,918 | |

| Corpay, Inc.* | | | 957 | | | | 315,542 | |

| Fidelity National Information Services, Inc. | | | 7,776 | | | | 697,740 | |

| Fiserv, Inc.* | | | 7,928 | | | | 1,568,951 | |

| Global Payments, Inc. | | | 3,510 | | | | 364,022 | |

| Mastercard, Inc., Class A | | | 11,363 | | | | 5,676,841 | |

| PayPal Holdings, Inc.* | | | 14,161 | | | | 1,122,967 | |

| Visa, Inc., Class A | | | 23,162 | | | | 6,713,506 | |

| | | | | | | | 29,163,829 | |

| Food Products - 0.7% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 6,607 | | | | 364,772 | |

| Bunge Global S.A. | | | 1,957 | | | | 164,427 | |

| Campbell Soup Co. | | | 2,749 | | | | 128,241 | |

| Conagra Brands, Inc. | | | 6,623 | | | | 191,670 | |

| General Mills, Inc. | | | 7,729 | | | | 525,727 | |

| Hershey Co. | | | 2,045 | | | | 363,151 | |

| Hormel Foods Corp. | | | 4,016 | | | | 122,689 | |

| J M Smucker Co. | | | 1,468 | | | | 166,633 | |

| Kellanova | | | 3,653 | | | | 294,614 | |

| Kraft Heinz Co. | | | 12,216 | | | | 408,747 | |

| McCormick & Co., Inc. | | | 3,480 | | | | 272,275 | |

| Mondelez International, Inc., Class A | | | 18,596 | | | | 1,273,455 | |

| Tyson Foods, Inc., Class A | | | 3,899 | | | | 228,442 | |

| | | | | | | | 4,504,843 | |

| Gas Utilities - 0.0%† | | | | | | | | |

| Atmos Energy Corp. | | | 2,086 | | | | 289,495 | |

| | | | | | | | | |

| Ground Transportation - 0.9% | | | | | | | | |

| CSX Corp. | | | 27,098 | | | | 911,577 | |

| JB Hunt Transport Services, Inc. | | | 1,154 | | | | 208,435 | |

| Norfolk Southern Corp. | | | 3,136 | | | | 785,348 | |

| Old Dominion Freight Line, Inc. | | | 2,630 | | | | 529,472 | |

| Uber Technologies, Inc.* | | | 27,883 | | | | 2,008,971 | |

| Union Pacific Corp. | | | 8,444 | | | | 1,959,599 | |

| | | | | | | | 6,403,402 | |

| Health Care Equipment & Supplies - 2.3% | | | | | | | | |

| Abbott Laboratories | | | 24,048 | | | | 2,726,322 | |

| Align Technology, Inc.* | | | 1,038 | | | | 212,821 | |

| Baxter International, Inc. | | | 7,016 | | | | 250,471 | |

| Becton Dickinson & Co. | | | 4,026 | | | | 940,433 | |

| Boston Scientific Corp.* | | | 20,288 | | | | 1,704,598 | |

| Cooper Cos, Inc. (The)* | | | 2,743 | | | | 287,137 | |

| Dexcom, Inc.* | | | 5,507 | | | | 388,133 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2024

| Investments | | Shares | | | Value | |

| Edwards Lifesciences Corp.* | | | 8,344 | | | $ | 559,131 | |

| GE HealthCare Technologies, Inc. | | | 5,444 | | | | 475,533 | |

| Hologic, Inc.* | | | 3,226 | | | | 260,887 | |

| IDEXX Laboratories, Inc.* | | | 1,143 | | | | 465,110 | |

| Insulet Corp.* | | | 967 | | | | 223,890 | |

| Intuitive Surgical, Inc.* | | | 4,890 | | | | 2,463,778 | |

| Medtronic plc | | | 17,785 | | | | 1,587,311 | |

| ResMed, Inc. | | | 2,036 | | | | 493,669 | |

| STERIS plc | | | 1,368 | | | | 303,491 | |

| Stryker Corp. | | | 4,988 | | | | 1,777,125 | |

| Zimmer Biomet Holdings, Inc. | | | 2,849 | | | | 304,615 | |

| | | | | | | | 15,424,455 | |

| Health Care Providers & Services - 2.2% | | | | | | | | |

| Cardinal Health, Inc. | | | 3,374 | | | | 366,146 | |

| Cencora, Inc. | | | 2,367 | | | | 539,865 | |

| Centene Corp.* | | | 7,269 | | | | 452,568 | |

| Cigna Group (The) | | | 3,865 | | | | 1,216,741 | |

| CVS Health Corp. | | | 17,388 | | | | 981,726 | |

| Elevance Health, Inc. | | | 3,216 | | | | 1,304,924 | |

| HCA Healthcare, Inc. | | | 2,587 | | | | 928,060 | |

| Humana, Inc. | | | 1,669 | | | | 430,318 | |

| Labcorp Holdings, Inc. | | | 1,176 | | | | 268,446 | |

| McKesson Corp. | | | 1,804 | | | | 903,064 | |

| Molina Healthcare, Inc.* | | | 801 | | | | 257,297 | |

| Quest Diagnostics, Inc. | | | 1,538 | | | | 238,129 | |

| UnitedHealth Group, Inc. | | | 12,749 | | | | 7,196,812 | |

| | | | | | | | 15,084,096 | |

| Health Care REITs - 0.3% | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 2,155 | | | | 240,390 | |

| Ventas, Inc. | | | 5,579 | | | | 365,369 | |

| Welltower, Inc. | | | 8,446 | | | | 1,139,196 | |

| | | | | | | | 1,744,955 | |

| Health Care Technology - 0.1% | | | | | | | | |

| Veeva Systems, Inc., Class A* | | | 2,050 | | | | 428,102 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure - 2.0% | | | | | | | | |

| Airbnb, Inc., Class A* | | | 5,902 | | | | 795,531 | |

| Booking Holdings, Inc. | | | 466 | | | | 2,179,133 | |

| Carnival Corp.* | | | 13,857 | | | | 304,854 | |

| Chipotle Mexican Grill, Inc., Class A* | | | 18,895 | | | | 1,053,774 | |

| Darden Restaurants, Inc. | | | 1,669 | | | | 267,073 | |

| Domino’s Pizza, Inc. | | | 482 | | | | 199,418 | |

| DoorDash, Inc., Class A* | | | 4,255 | | | | 666,759 | |

| DraftKings, Inc., Class A* | | | 6,599 | | | | 233,077 | |

| Expedia Group, Inc.* | | | 1,755 | | | | 274,324 | |

| Hilton Worldwide Holdings, Inc. | | | 3,399 | | | | 798,255 | |

| Las Vegas Sands Corp. | | | 5,627 | | | | 291,760 | |

| Marriott International, Inc., Class A | | | 3,212 | | | | 835,184 | |

| Investments | | Shares | | | Value | |

| McDonald’s Corp. | | | 10,011 | | | $ | 2,924,313 | |

| MGM Resorts International* | | | 3,338 | | | | 123,072 | |

| Royal Caribbean Cruises Ltd. | | | 3,255 | | | | 671,669 | |

| Starbucks Corp. | | | 15,747 | | | | 1,538,482 | |

| Yum! Brands, Inc. | | | 3,888 | | | | 509,950 | |

| | | | | | | | 13,666,628 | |

| Household Durables - 0.4% | | | | | | | | |

| DR Horton, Inc. | | | 4,128 | | | | 697,632 | |

| Garmin Ltd. | | | 2,133 | | | | 423,081 | |

| Lennar Corp., Class A | | | 3,271 | | | | 557,051 | |

| Lennar Corp., Class B | | | 137 | | | | 21,964 | |

| NVR, Inc.* | | | 42 | | | | 384,418 | |

| PulteGroup, Inc. | | | 2,911 | | | | 377,062 | |

| | | | | | | | 2,461,208 | |

| Household Products - 1.1% | | | | | | | | |

| Church & Dwight Co., Inc. | | | 3,416 | | | | 341,293 | |

| Clorox Co. | | | 1,715 | | | | 271,913 | |

| Colgate-Palmolive Co. | | | 11,327 | | | | 1,061,453 | |

| Kimberly-Clark Corp. | | | 4,679 | | | | 627,828 | |

| Procter & Gamble Co. | | | 32,722 | | | | 5,405,020 | |

| | | | | | | | 7,707,507 | |

| Independent Power & Renewable Electricity Producers - 0.1% | | | | | | | | |

| Vistra Corp. | | | 4,486 | | | | 560,571 | |

| | | | | | | | | |

| Industrial Conglomerates - 0.4% | | | | | | | | |

| 3M Co. | | | 7,660 | | | | 984,080 | |

| Honeywell International, Inc. | | | 9,027 | | | | 1,856,674 | |

| | | | | | | | 2,840,754 | |

| Industrial REITs - 0.2% | | | | | | | | |

| Prologis, Inc. | | | 12,808 | | | | 1,446,536 | |

| | | | | | | | | |

| Insurance - 2.1% | | | | | | | | |

| Aflac, Inc. | | | 6,998 | | | | 733,320 | |

| Allstate Corp. (The) | | | 3,624 | | | | 675,948 | |

| American International Group, Inc. | | | 8,992 | | | | 682,313 | |

| Aon plc, Class A | | | 3,006 | | | | 1,102,811 | |

| Arch Capital Group Ltd.* | | | 5,166 | | | | 509,161 | |

| Arthur J Gallagher & Co. | | | 3,013 | | | | 847,256 | |

| Brown & Brown, Inc. | | | 3,393 | | | | 355,044 | |

| Chubb Ltd. | | | 5,210 | | | | 1,471,512 | |

| Cincinnati Financial Corp. | | | 2,147 | | | | 302,362 | |

| Erie Indemnity Co., Class A | | | 349 | | | | 156,645 | |

| Everest Group Ltd. | | | 602 | | | | 214,077 | |

| Hartford Financial Services Group, Inc. (The) | | | 4,079 | | | | 450,485 | |

| Loews Corp. | | | 2,575 | | | | 203,322 | |

| Markel Group, Inc.* | | | 177 | | | | 272,936 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2024

| Investments | | Shares | | | Value | |

| Marsh & McLennan Cos, Inc. | | | 6,836 | | | $ | 1,491,889 | |

| MetLife, Inc. | | | 8,274 | | | | 648,847 | |

| Principal Financial Group, Inc. | | | 3,233 | | | | 266,399 | |

| Progressive Corp. (The) | | | 8,104 | | | | 1,967,895 | |

| Prudential Financial, Inc. | | | 5,002 | | | | 612,645 | |

| Travelers Cos, Inc. (The) | | | 3,160 | | | | 777,170 | |

| W R Berkley Corp. | | | 4,265 | | | | 243,830 | |

| Willis Towers Watson plc | | | 1,427 | | | | 431,225 | |

| | | | | | | | 14,417,092 | |

| Interactive Media & Services - 6.5% | | | | | | | | |

| Alphabet, Inc., Class A | | | 81,237 | | | | 13,900,463 | |

| Alphabet, Inc., Class C | | | 72,171 | | | | 12,463,210 | |

| Meta Platforms, Inc., Class A | | | 30,385 | | | | 17,245,919 | |

| Pinterest, Inc., Class A* | | | 8,262 | | | | 262,649 | |

| Snap, Inc., Class A* | | | 15,003 | | | | 182,436 | |

| | | | | | | | 44,054,677 | |

| IT Services - 1.3% | | | | | | | | |

| Accenture plc, Class A | | | 8,693 | | | | 2,997,521 | |

| Akamai Technologies, Inc.* | | | 2,111 | | | | 213,380 | |

| Cloudflare, Inc., Class A* | | | 4,170 | | | | 365,751 | |