UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23617

TCW ETF Trust

On behalf of the following series:

TCW Transform 500 ETF (Ticker: VOTE)

TCW Transform Systems ETF (Ticker: NETZ)

TCW Transform Supply Chain ETF (Ticker: SUPP)

(Exact name of registrant as specified in charter)

515 South Flower Street, Los Angeles, CA 90071

(Address of principal executive offices) (Zip Code)

Jennifer Grancio TCW Investment Management Company LLC 515 South Flower Street Los Angeles, CA 90071 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (213) 244-0000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). |

Table of Contents |  |

This report should be read in conjunction with the TCW ETF Trust’s (the “Trust”) prospectus.

The views expressed in the Shareholder Letter are those of TCW Investment Management Company LLC (“TCW” or the “Adviser”) as of October 31, 2023. Management’s Discussion of Fund Performance presents information about the TCW ETFs’ holdings that is believed to be accurate, and the views of the Funds’ portfolio managers, as of October 31, 2023. The Shareholder Letter and Management’s Discussion of Fund Performance may not necessarily reflect the views or holdings on the date this Annual Report is first published or anytime thereafter. The information in the Shareholder Letter and Management’s Discussion of Fund Performance may change, and the Funds disclaim any obligation to advise shareholders of any such changes. Certain information was obtained from sources that TCW believes to be reliable; however, TCW does not guarantee the accuracy or completeness of any information obtained from any third party.

Portfolio holdings will change and should not be considered as investment advice or a recommendation to buy, sell or hold any particular security. Please visit etf.tcw.com for the most current list of portfolio holdings for the TCW ETFs.

Shareholder Letter |  |

Dear Fellow Shareholder,

We’ve come a long way since we launched the Transform ETFs in 2021. Our three funds have been recognized across the industry, earning awards every year since their inception. As you know, TCW acquired the business earlier this year, which we see as validation of our unique approach to generating alpha.

Through all these developments, one thing has been consistent: we believe that investors must be active owners and that they should invest in the major economic transformations currently taking place. This is the guiding principle of our business and how we work to deliver returns. As always, we are grateful to have you with us on this journey.

Active Ownership with VOTE

We started the business with the TCW Transform 500 ETF (VOTE) because we believe that even passive investors need to be active owners. We vote shares and engage in two-way conversations with companies to help them grow.

We’re proud of what VOTE has accomplished in a few short years, growing to more than $600 million AUM from a wide variety of investors. We’re excited to continue to grow VOTE as a better index fund that can sit at the center of a portfolio.

Large-Scale Systems Change

Our thesis for value creation has always been to identify massive economic shifts and the companies that we believe are most likely to benefit from them. Right now, our active funds offer exposure to two enormous transformations: the profound shift of how the world sources, produces, and uses energy (TCW Transform Systems ETF, NETZ), and the relocalization of supply chains to North America (TCW Transform Supply Chain ETF, SUPP).

The planet’s energy and power systems – and the businesses that are the greatest consumers of energy – are undergoing dramatic change. Businesses that produce energy more efficiently and energy-intensive businesses that use it more efficiently (like agriculture and aerospace) will drive enormous value. This transformation will require unprecedented investment – more than $5 trillion annually by some estimates1 – and leading old-economy scale businesses and the most efficient energy consumers stand to profit most from this transformation.

Separately, but on a similar scale, global supply chains are transitioning as the pre-pandemic model of manufacturing goods abroad shifts to a model where goods are manufactured in North America. This shift is already happening with $859 billion in capex (capital expenditure) announcements between January 2021 and 3Q23.2

These transformations are nondiscretionary and already under way, backed by trillions of government spending in the U.S. alone.3 Accordingly, we believe our funds offer investors very compelling opportunities to drive alpha in the years ahead.

Active Management

These transformations are extremely complex and developing rapidly. Driving the greatest returns from these megatrends requires active management. Our investment team looks at hundreds of companies in the universe of these transformations and, through rigorous fundamental research combined with quantitative and thematic data, aims to identify the leaders that will create alpha. We closely monitor our investments so that we can react quickly when we have new insights or when facts change, in a way passive funds can’t.

Our concentrated portfolios allow us to develop unique insights into the businesses we own. These unique insights enable us to pick the companies we expect will generate alpha.4

| 1. | Goldman Sachs Research, Green Capex, October 2021. |

| 2. | Eaton 3Q23 Earnings Presentation |

| 3. | EY, Infrastructure Bill; NACO, American Rescue Plan Act Funding Breakdown, April 2021 |

| 4. | A measure of active return on investment in excess of benchmark index. |

Shareholder Letter (Continued) |  |

Your Partnership

Thank you for your continued partnership and the trust you have placed in us to manage your assets. We greatly appreciate it.

On the following pages, you’ll find information about your investments in our funds. If you have any questions, please contact your financial advisor or reach out to us directly.

Jennifer Grancio

Head of Global Wealth

The TCW Group

Effective October 13, 2023, TCW acquired the ETF business from Engine No. 1 and the Funds’ adviser became TCW Investment Management Company LLC. Prior to that date, the Funds’ adviser was Fund Management at Engine No. 1 LLC.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

© 2023 TCW Group. All rights reserved.

Management’s Discussion of Fund Performance (Unaudited) |  |

Investment Results: TCW Transform 500 ETF (VOTE)

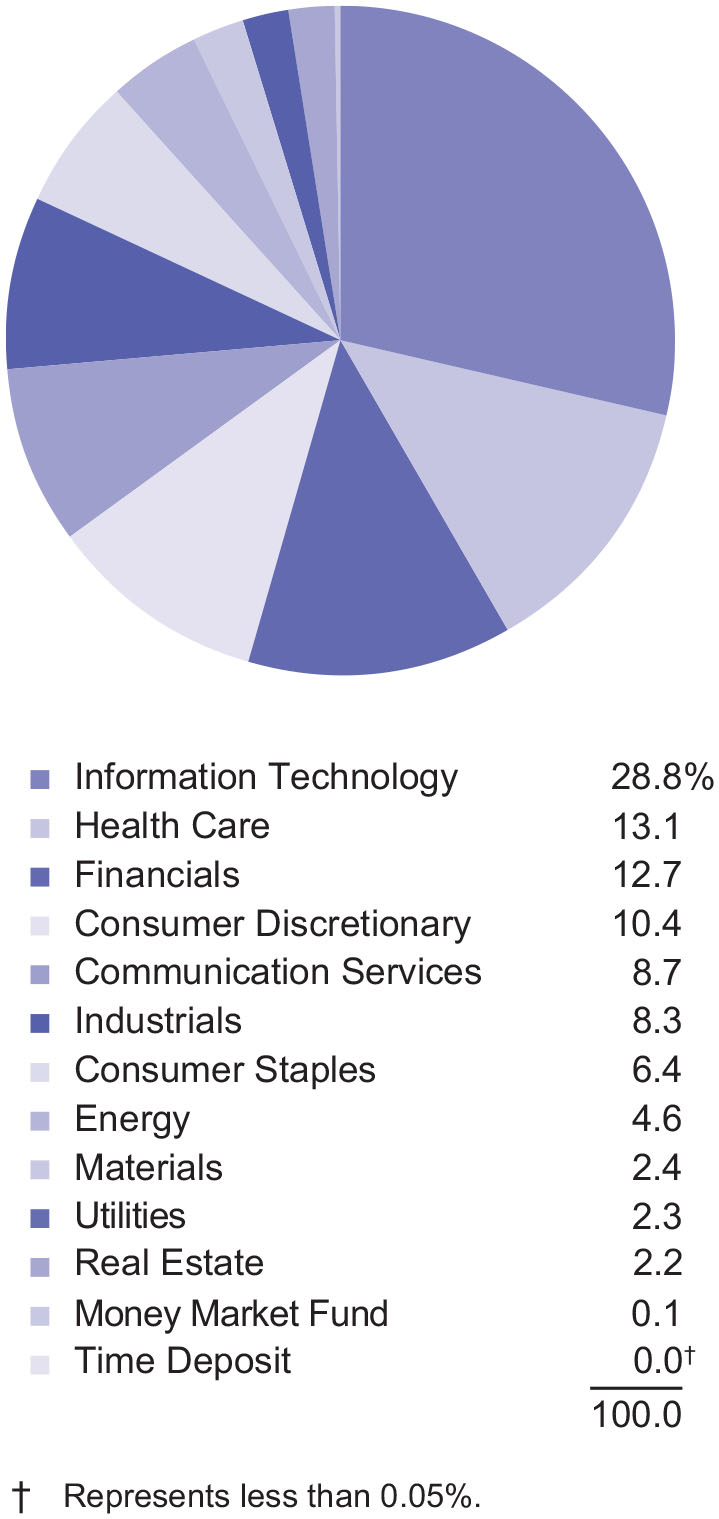

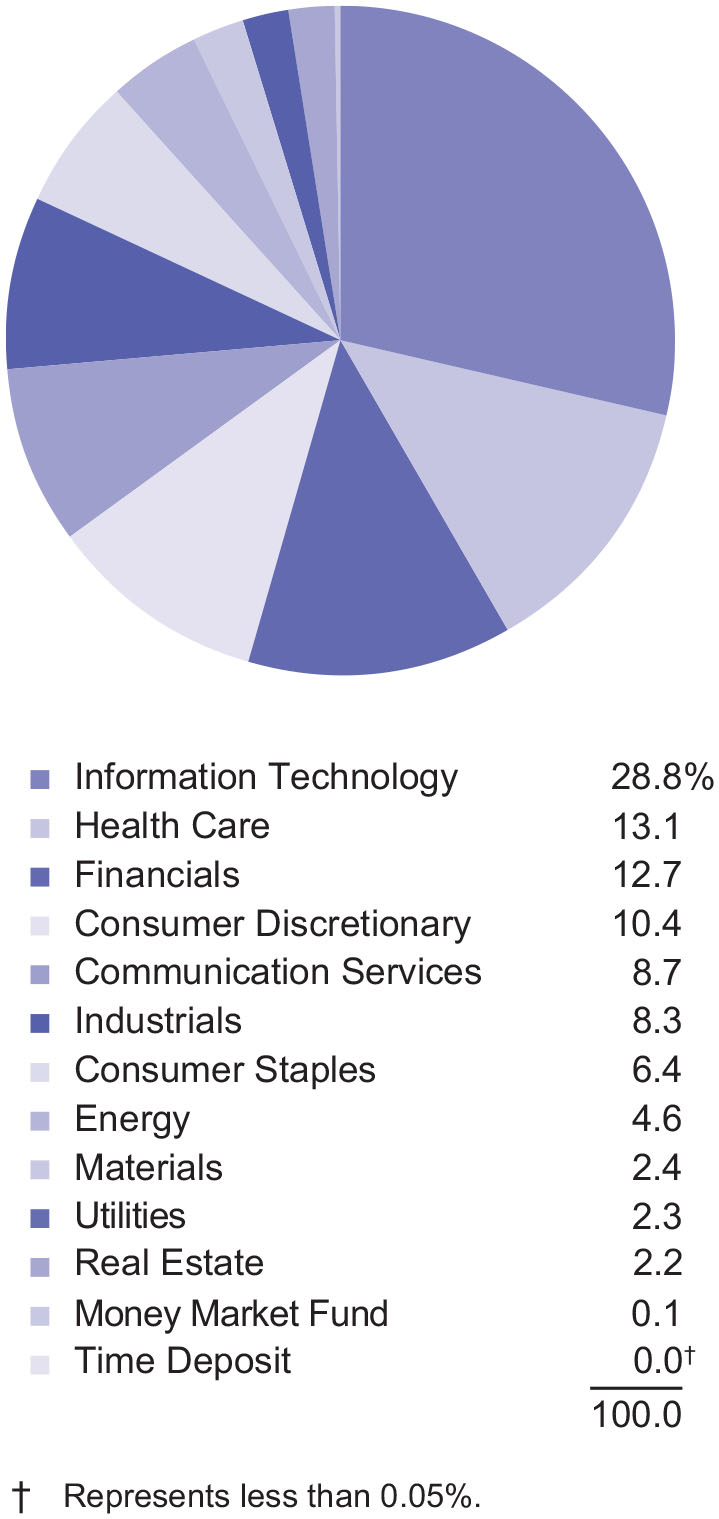

The TCW Transform 500 ETF seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® US Large Cap Select IndexSM (the “Underlying Index”), which measures the performance of the 500 largest U.S. stocks by market capitalization, as determined by Morningstar, Inc. The Underlying Index consists of securities from a broad range of industries. As of October 31, 2023, the Underlying Index is represented by securities of companies in sectors including Information Technology, Health Care, Financials, Consumer Discretionary, Communication Services, Industrials, Consumer Staples, Energy, Materials, Utilities and Real Estate. The components of the Underlying Index are likely to change over time and the Underlying Index and the Fund are rebalanced on a quarterly basis. To the extent that the securities in the Underlying Index are concentrated in one or more industries or groups of industries, the Fund may concentrate in such industries or groups of industries.

From November 1, 2022 through October 31, 2023 (the “Reporting Period”), the Fund’s market value return was 10.47% and its net asset value (“NAV”) return was 10.51%. The Underlying Index returned 10.57% during the same Reporting Period. The Fund’s market value per share as of the market close of the last trading day of the Reporting Period was $48.72.

The Fund posted positive NAV performance in seven of the twelve months during the Reporting Period, with returns ranging from -5.90% to 6.61%.

The best NAV performance months for the Fund were June and January, finishing up 6.61% and 6.43%, respectively. The worst NAV performance months for the Fund were December and September, finishing down -5.90% and -4.66%, respectively.

Six of the eleven sectors in the Fund delivered positive returns during the Reporting Period. Information Technology, Communication Services, and Consumer Discretionary were among the strongest performing sectors. Health Care, Consumer Staples, and Energy were among the weakest performing sectors and underperformed the market during the Reporting Period.

Management’s Discussion of Fund Performance (Continued) (Unaudited) |  |

Investment Results: TCW Transform 500 ETF (VOTE) (Continued)

Average Annual Total Returns as of 10/31/23

| | | 1 Year | | Since

Inception* |

| TCW Transform 500 ETF (VOTE) | | | | |

| Net Asset Value | | 10.51% | | 0.08% |

| Market Value | | 10.47% | | 0.06% |

| Morningstar® US Large Cap Select IndexSM | | 10.57% | | 0.14% |

The Fund’s Average Annual Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Growth of an Assumed $10,000 Investment Since Inception* Through 10/31/23 (At Net Asset Value)

| * | VOTE’s inception date is 6/22/21. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit etf.tcw.com.

As stated in the current prospectus, the expense ratio is 0.05%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on inception date. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance.

NAV returns are based on the dollar value of a single share of the Fund, calculated by taking the Fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV return is based on the NAV of the Fund, and the market value return is based on the market price per share of the Fund. The NAV is typically calculated at 4:00 p.m. Eastern Time on each business day the New York Stock Exchange (“NYSE”) is open for trading. Market value returns are based on the closing price at 4:00 p.m. Eastern time on the Cboe BZX Exchange, Inc. Market value performance does not represent the returns you would receive if you traded shares at other times. Market value and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV.

The returns in the graphs and tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs, taxes, or other expenses that would be incurred by the Fund or brokerage commissions on transactions in Fund shares. Such fees, expenses and taxes reduce Fund returns. One cannot invest directly in an index.

Management’s Discussion of Fund Performance (Continued) (Unaudited) |  |

Investment Results: TCW Transform Systems ETF (NETZ)

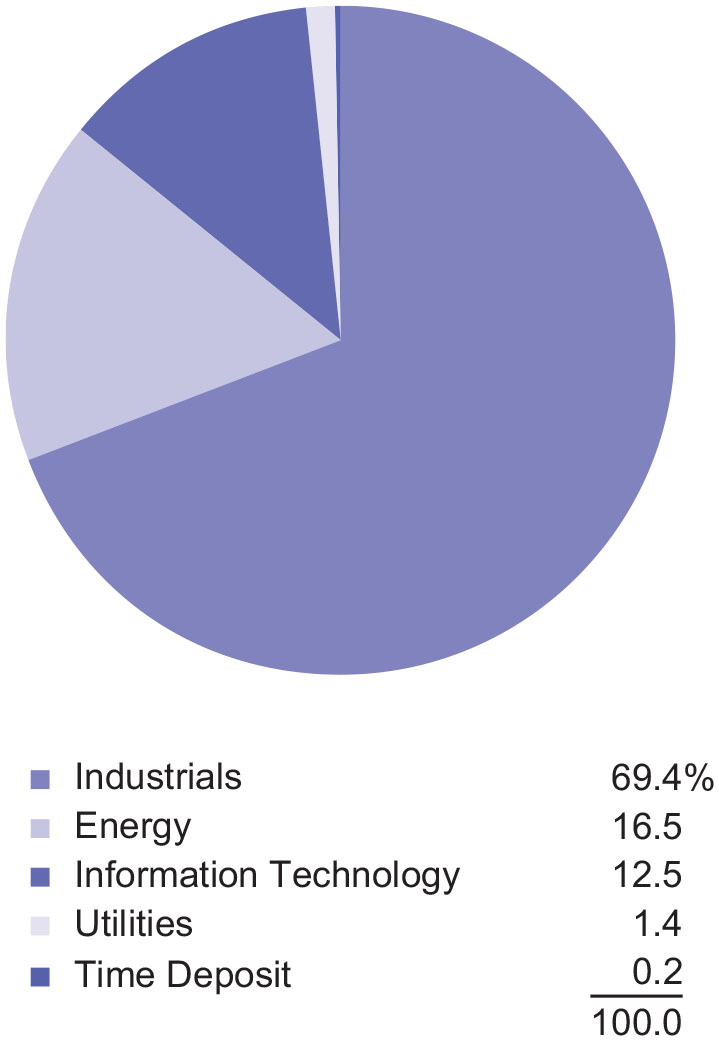

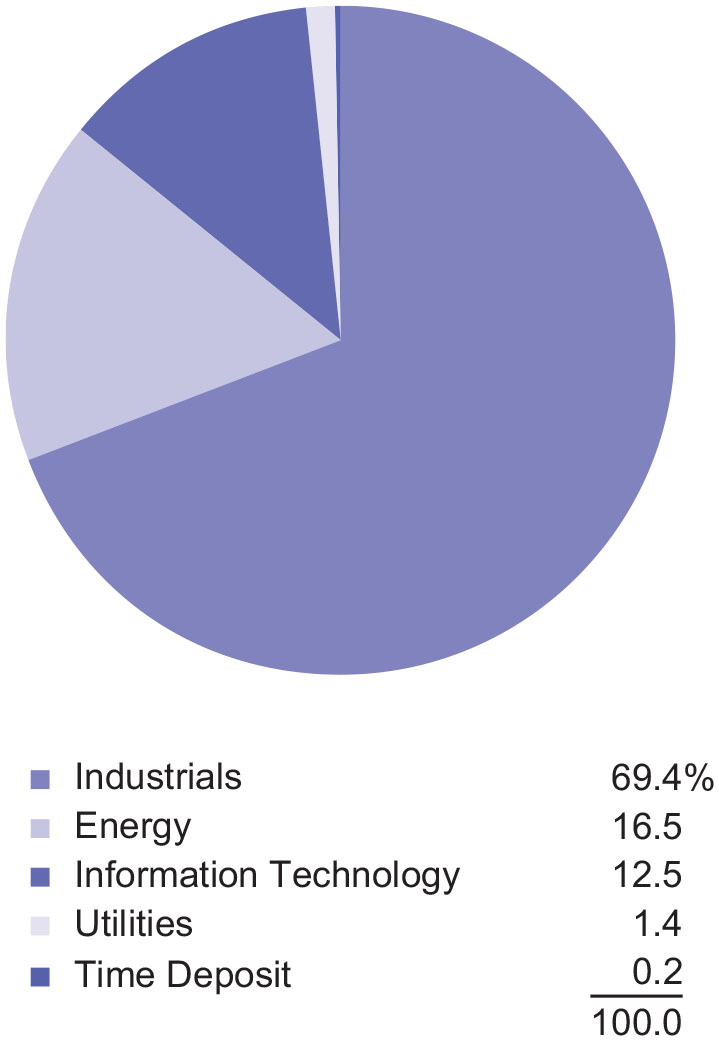

The TCW Transform Systems ETF is an actively managed exchange-traded fund that seeks to invest in companies that are creating value by transforming themselves and others to meet the growing demands of climate change. Target companies are primarily those that the Adviser believes are transitioning towards more sustainable business practices, products, or services, as well as companies that are providing enabling technologies to help others transition. Effective March 1, 2024, the Fund will seek to invest in companies that the Adviser believes will benefit from global transformation in the systems supporting how energy and power are sourced, produced, and consumed. Government policy and public demand are shifting the global economy towards more efficient and lower net-emission energy systems. This large-scale systems change is creating unique opportunities in the public markets, particularly in “brown” or “grey” old-economy businesses that require huge investments as the way consumers source and use energy and power changes. The Adviser expects the Fund portfolio, starting March 1, 2024, will include companies that will lead or win in the transition, where efficiency and alternative approaches are highly valued. The portfolio may also include companies that are enablers of these shifts. Target companies are (and following March 1, 2024 will continue to be) generally chosen from companies included in the Morningstar® US Market Extended TR USD Index® (the “Benchmark”) but may be selected from a universe of U.S. and non-U.S. listed equity securities. The Morningstar® US Market Extended TR USD Index® measures the performance of U.S. securities and targets 99.5% market capitalization coverage of the investable universe. It is a diversified broad market index and does not incorporate sustainability criteria. The Adviser expects to hold between 20-40 equities within the Fund’s portfolio.

From November 1, 2022 through October 31, 2023 (the “Reporting Period”), the Fund’s market value return was 1.55% and its net asset value (“NAV”) return was 1.52%. The Benchmark returned 8.58% during the same Reporting Period. The Fund’s market value per share as of the market close of the last trading day of the Reporting Period was $50.53.

The Fund posted positive NAV performance in five of the twelve months during the Reporting Period, with returns ranging from -8.07% to 8.66%.

The best NAV performance months for the Fund were June and January, finishing up 8.66% and 5.64%, respectively. The worst NAV performance months for the Fund were December and September, finishing down -8.07% and -3.84%, respectively.

Three of the six sectors in the Fund delivered positive returns during the Reporting Period. Industrials, Information Technology, and Utilities were among the strongest performing sectors. Energy, Materials, and Consumer Discretionary were among the weakest performing sectors and underperformed the market during the Reporting Period.

Management’s Discussion of Fund Performance (Continued) (Unaudited) |  |

Investment Results: TCW Transform Systems ETF (NETZ) (Continued)

Average Annual Total Returns as of 10/31/23

| | | 1 Year | | Since

Inception* |

| TCW Transform Systems ETF (NETZ) | | | | |

| Net Asset Value | | 1.52% | | 1.49% |

| Market Value | | 1.55% | | 1.54% |

| Morningstar® US Market Extended TR USD IndexSM | | 8.58% | | -4.36% |

The Fund’s Average Annual Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Growth of an Assumed $10,000 Investment Since Inception* Through 10/31/23 (At Net Asset Value)

| * | NETZ’s inception date is 2/2/22. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit etf.tcw.com.

As stated in the current prospectus, the expense ratio is 0.75%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on inception date. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance.

NAV returns are based on the dollar value of a single share of the Fund, calculated by taking the Fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV return is based on the NAV of the Fund, and the market value return is based on the market price per share of the Fund. The NAV is typically calculated at 4:00 p.m. Eastern Time on each business day the New York Stock Exchange (“NYSE”) is open for trading. Market value returns are based on the closing price at 4:00 p.m. Eastern time on the Cboe BZX Exchange, Inc. Market value performance does not represent the returns you would receive if you traded shares at other times. Market value and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV.

The returns in the graphs and tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs, taxes, or other expenses that would be incurred by the Fund or brokerage commissions on transactions in Fund shares. Such fees, expenses and taxes reduce Fund returns. One cannot invest directly in an index.

Management’s Discussion of Fund Performance (Continued) (Unaudited) |  |

Investment Results: TCW Transform Supply Chain ETF (SUPP)

The TCW Transform Supply Chain ETF is an actively managed exchange-traded fund that invests in U.S.-listed equity, American depositary receipt securities, and non-U.S. developed and emerging market-listed securities, which over time may vary as market and investment opportunities change. The Fund may also enter into currency-related spot transactions when it transacts in equities denominated in foreign currencies or invest in certain derivative instruments, such as currency futures or forwards that will help the Adviser manage risk associated with foreign currency exposure, if any, or futures contracts. The Fund’s investments may include micro-, small-, medium- and large-capitalization equities of companies. The Adviser expects to hold between 20-40 equities within the Fund’s portfolio. The Adviser expects to invest in the equities of companies that it deems are creating value through supply chain transformation. A supply chain is defined as a network between a company and its suppliers to produce and distribute a specific product to the final buyer. Portfolio companies are primarily those that the Adviser believes are creating value or minimizing risks as it relates to their supply chains or the supply chains of others. Companies are generally chosen from the Morningstar® US Market Extended TR USD IndexSM (the “Benchmark”) but may be selected from a universe of U.S. and non-U.S. listed equity securities that span across sectors, including but not limited to consumer discretionary, industrials, markets, and technology. The Morningstar® US Market Extended TR USD IndexSM is a broad-based free-float market capitalization weighted index comprised of U.S. large, mid, and small capitalization equity securities that span all sectors of the U.S. economy. It does not incorporate environmental, social and governance criteria into its methodology, nor is it an index comprised of equities of companies that could be considered as aiding the supply chain.

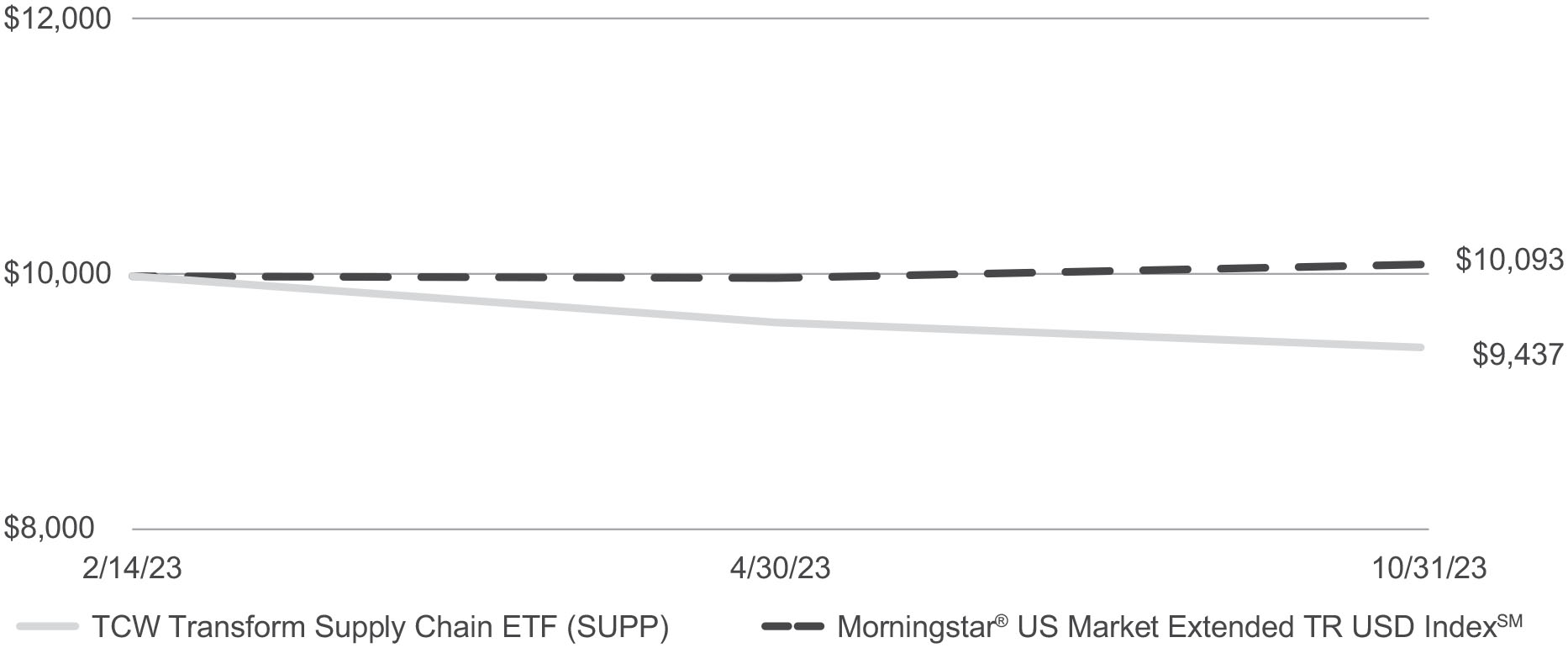

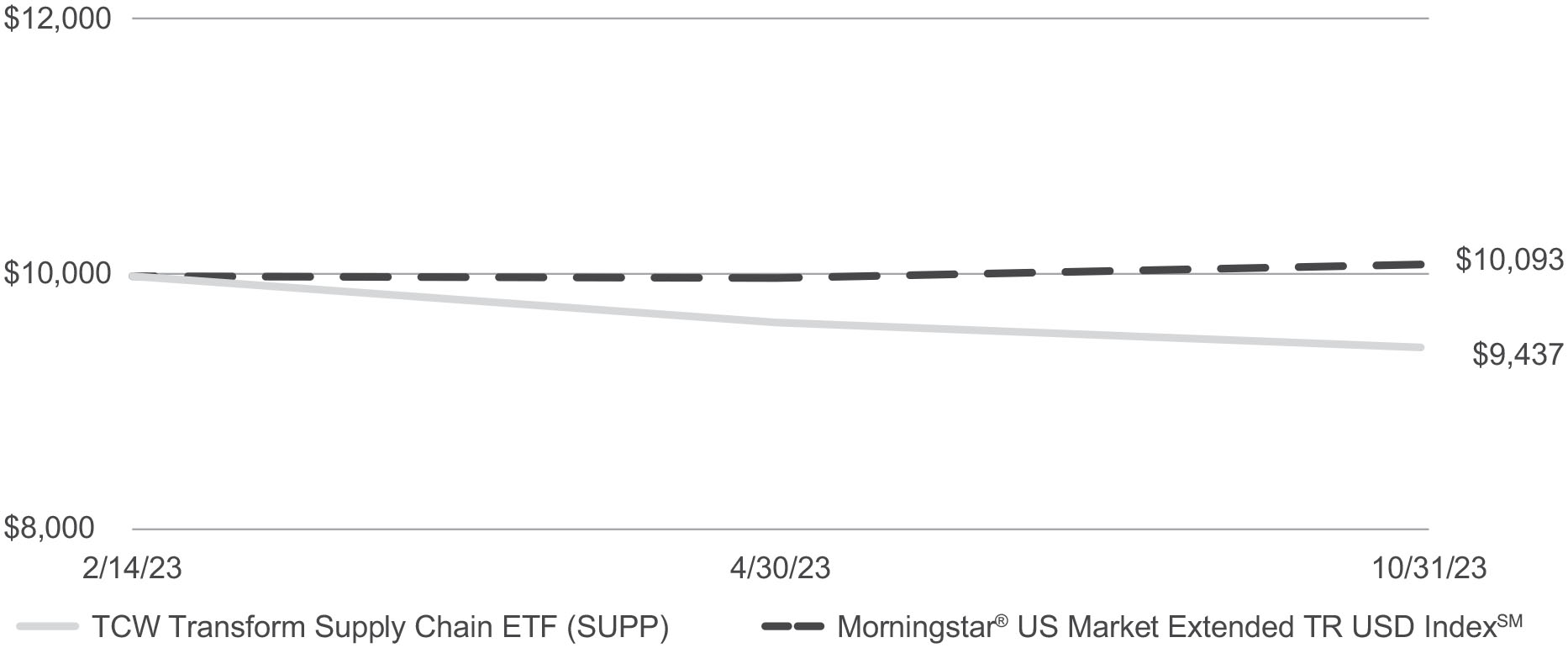

From February 14, 2023, the Fund’s inception date, through October 31, 2023 (the “Reporting Period”), the Fund’s market value return was -5.63% and its net asset value (“NAV”) return was -5.63%. The Benchmark returned 0.93% during the same Reporting Period. The Fund’s market value per share as of the market close of the last trading day of the Reporting Period was $47.07.

The Fund posted positive NAV performance in three of the eight full months it was in existence during the Reporting Period, with returns ranging from -5.42% to 9.39%.

The best NAV performance months for the Fund were June and July, finishing up 9.39% and 1.57%, respectively. The worst NAV performance months for the Fund were September and October, finishing down -5.42% and -4.65%, respectively.

One of the five sectors in the Fund delivered positive returns during the Reporting Period. Information Technology was the strongest performing sector. Health Care, Consumer Discretionary, Industrials, and Materials were among the weakest performing sectors and underperformed the market during the Reporting Period.

Management’s Discussion of Fund Performance (Continued) (Unaudited) |  |

Investment Results: TCW Transform Supply Chain ETF (SUPP) (Continued)

Cumulative Total Returns as of 10/31/23

| | | Since

Inception* |

| TCW Transform Supply Chain ETF (SUPP) | | |

| Net Asset Value | | -5.63% |

| Market Value | | -5.63% |

| Morningstar® US Market Extended TR USD IndexSM | | 0.93% |

The Fund’s Cumulative Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Growth of an Assumed $10,000 Investment Since Inception* Through 10/31/23 (At Net Asset Value)

| * | SUPP’s inception date is 2/14/23. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit etf.tcw.com.

As stated in the current prospectus, the expense ratio is 0.75%. Please refer to the Financial Highlights herein for the most recent expense ratio information.

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on inception date. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance.

NAV returns are based on the dollar value of a single share of the Fund, calculated by taking the Fund’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV return is based on the NAV of the Fund, and the market value return is based on the market price per share of the Fund. The NAV is typically calculated at 4:00 p.m. Eastern Time on each business day the New York Stock Exchange (“NYSE”) is open for trading. Market value returns are based on the closing price at 4:00 p.m. Eastern time on the Cboe BZX Exchange, Inc. Market value performance does not represent the returns you would receive if you traded shares at other times. Market value and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV.

The returns in the graphs and tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Index returns reflect the reinvestment of dividends but do not reflect any management fees, transaction costs, taxes, or other expenses that would be incurred by the Fund or brokerage commissions on transactions in Fund shares. Such fees, expenses and taxes reduce Fund returns. One cannot invest directly in an index.

Shareholder Expense Examples (Unaudited) |  |

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs for purchasing and selling shares (including brokerage commissions); and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The examples below are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from May 1, 2023 until October 31, 2023.

Actual Expenses

The first line under each Fund in the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line under each Fund in the tables below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate your actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line of the tables for the Funds are useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value

5/1/2023 | | Ending

Account Value

10/31/2023 | | Annualized

Expense Ratios

for the Period | | Expenses Paid

During the

Period(a) | |

| TCW Transform 500 ETF | | | | | | | | | |

| Actual | | $1,000.00 | | $1,018.83 | | 0.05% | | $0.25 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,024.95 | | 0.05% | | $0.26 | |

| | | | | | | | | | |

| TCW Transform Systems ETF | | | | | | | | | |

| Actual | | $1,000.00 | | $1,025.84 | | 0.75% | | $3.83 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.42 | | 0.75% | | $3.82 | |

| | | | | | | | | | |

| TCW Transform Supply Chain ETF | | | | | | | | | |

| Actual | | $1,000.00 | | $979.86 | | 0.75% | | $3.74 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,021.42 | | 0.75% | | $3.82 | |

| (a) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184 (the number of days in the one-half year period), then divided by 365. |

Sector Diversification (as a percentage of total investments) October 31, 2023 |  |

| TCW Transform 500 ETF (VOTE) | | TCW Transform Systems ETF (NETZ) |

| |  |

| | | |

| TCW Transform Supply Chain ETF (SUPP) | | |

| | |

Schedule of Investments TCW Transform 500 ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| COMMON STOCKS - 99.9% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense - 1.6% | | | | | | | | |

| Axon Enterprise, Inc.* | | | 1,055 | | | $ | 215,737 | |

| Boeing Co.* | | | 8,510 | | | | 1,589,838 | |

| General Dynamics Corp. | | | 3,401 | | | | 820,695 | |

| HEICO Corp. | | | 599 | | | | 94,888 | |

| HEICO Corp., Class A | | | 1,136 | | | | 144,420 | |

| Howmet Aerospace, Inc. | | | 5,870 | | | | 258,867 | |

| L3Harris Technologies, Inc. | | | 2,836 | | | | 508,807 | |

| Lockheed Martin Corp. | | | 3,364 | | | | 1,529,409 | |

| Northrop Grumman Corp. | | | 2,136 | | | | 1,006,974 | |

| RTX Corp. | | | 21,849 | | | | 1,778,290 | |

| Textron, Inc. | | | 2,971 | | | | 225,796 | |

| TransDigm Group, Inc.* | | | 830 | | | | 687,315 | |

| | | | | | | | 8,861,036 | |

| Air Freight & Logistics - 0.5% | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 2,221 | | | | 242,644 | |

| FedEx Corp. | | | 3,475 | | | | 834,348 | |

| United Parcel Service, Inc., Class B | | | 10,858 | | | | 1,533,692 | |

| | | | | | | | 2,610,684 | |

| Automobile Components - 0.1% | | | | | | | | |

| Aptiv plc* | | | 4,244 | | | | 370,077 | |

| | | | | | | | | |

| Automobiles - 1.8% | | | | | | | | |

| Ford Motor Co. | | | 59,018 | | | | 575,426 | |

| General Motors Co. | | | 20,658 | | | | 582,556 | |

| Lucid Group, Inc.* | | | 13,295 | | | | 54,775 | |

| Tesla, Inc.* | | | 41,455 | | | | 8,325,822 | |

| | | | | | | | 9,538,579 | |

| Banks - 2.9% | | | | | | | | |

| Bank of America Corp. | | | 103,782 | | | | 2,733,618 | |

| Citigroup, Inc. | | | 28,906 | | | | 1,141,498 | |

| Citizens Financial Group, Inc. | | | 7,093 | | | | 166,189 | |

| Fifth Third Bancorp | | | 10,228 | | | | 242,506 | |

| First Citizens BancShares, Inc., Class A | | | 179 | | | | 247,152 | |

| Huntington Bancshares, Inc. | | | 21,713 | | | | 209,530 | |

| JPMorgan Chase & Co. | | | 43,402 | | | | 6,035,483 | |

| M&T Bank Corp. | | | 2,491 | | | | 280,860 | |

| PNC Financial Services Group, Inc. (The) | | | 5,976 | | | | 684,073 | |

| Regions Financial Corp. | | | 14,072 | | | | 204,466 | |

| Truist Financial Corp. | | | 20,005 | | | | 567,342 | |

| US Bancorp | | | 23,372 | | | | 745,099 | |

| Wells Fargo & Co. | | | 54,932 | | | | 2,184,646 | |

| | | | | | | | 15,442,462 | |

| Investments | | Shares | | | Value | |

| Beverages - 1.6% | | | | | | | | |

| Brown-Forman Corp., Class B | | | 2,750 | | | $ | 154,440 | |

| Coca-Cola Co. | | | 58,433 | | | | 3,300,880 | |

| Constellation Brands, Inc., Class A | | | 2,422 | | | | 567,111 | |

| Keurig Dr Pepper, Inc. | | | 15,092 | | | | 457,740 | |

| Monster Beverage Corp.* | | | 11,171 | | | | 570,838 | |

| PepsiCo, Inc. | | | 20,667 | | | | 3,374,509 | |

| | | | | | | | 8,425,518 | |

| Biotechnology - 2.2% | | | | | | | | |

| AbbVie, Inc. | | | 26,497 | | | | 3,740,847 | |

| Alnylam Pharmaceuticals, Inc.* | | | 1,874 | | | | 284,473 | |

| Amgen, Inc. | | | 8,032 | | | | 2,053,783 | |

| Biogen, Inc.* | | | 2,175 | | | | 516,650 | |

| BioMarin Pharmaceutical, Inc.* | | | 2,823 | | | | 229,933 | |

| Exact Sciences Corp.* | | | 2,717 | | | | 167,340 | |

| Gilead Sciences, Inc. | | | 18,710 | | | | 1,469,483 | |

| Incyte Corp.* | | | 2,793 | | | | 150,626 | |

| Moderna, Inc.* | | | 4,973 | | | | 377,749 | |

| Regeneron Pharmaceuticals, Inc.* | | | 1,604 | | | | 1,250,944 | |

| Seagen, Inc.* | | | 2,111 | | | | 449,242 | |

| Vertex Pharmaceuticals, Inc.* | | | 3,874 | | | | 1,402,814 | |

| | | | | | | | 12,093,884 | |

| Broadline Retail - 3.6% | | | | | | | | |

| Amazon.com, Inc.* | | | 136,313 | | | | 18,141,898 | |

| Coupang, Inc., Class A* | | | 17,147 | | | | 291,499 | |

| eBay, Inc. | | | 7,989 | | | | 313,408 | |

| MercadoLibre, Inc.* | | | 692 | | | | 858,592 | |

| | | | | | | | 19,605,397 | |

| Building Products - 0.4% | | | | | | | | |

| Builders FirstSource, Inc.* | | | 1,877 | | | | 203,692 | |

| Carrier Global Corp. | | | 12,569 | | | | 599,039 | |

| Johnson Controls International plc | | | 10,206 | | | | 500,298 | |

| Masco Corp. | | | 3,373 | | | | 175,700 | |

| Trane Technologies plc | | | 3,432 | | | | 653,143 | |

| | | | | | | | 2,131,872 | |

| Capital Markets - 2.8% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 1,538 | | | | 483,809 | |

| Ares Management Corp., Class A | | | 2,474 | | | | 243,912 | |

| Bank of New York Mellon Corp. (The) | | | 11,695 | | | | 497,038 | |

| BlackRock, Inc., Class A | | | 2,105 | | | | 1,288,849 | |

| Blackstone, Inc. | | | 10,653 | | | | 983,805 | |

| Carlyle Group, Inc. (The) | | | 3,236 | | | | 89,119 | |

| Charles Schwab Corp. (The) | | | 22,315 | | | | 1,161,273 | |

| CME Group, Inc., Class A | | | 5,399 | | | | 1,152,471 | |

| FactSet Research Systems, Inc. | | | 572 | | | | 247,041 | |

| Goldman Sachs Group, Inc. (The) | | | 4,949 | | | | 1,502,566 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| Intercontinental Exchange, Inc. | | | 8,594 | | | $ | 923,339 | |

| KKR & Co., Inc. | | | 9,717 | | | | 538,322 | |

| LPL Financial Holdings, Inc. | | | 1,144 | | | | 256,851 | |

| Moody’s Corp. | | | 2,369 | | | | 729,652 | |

| Morgan Stanley | | | 19,153 | | | | 1,356,415 | |

| MSCI, Inc., Class A | | | 1,185 | | | | 558,787 | |

| Nasdaq, Inc. | | | 5,088 | | | | 252,365 | |

| Northern Trust Corp. | | | 3,105 | | | | 204,651 | |

| Raymond James Financial, Inc. | | | 2,817 | | | | 268,854 | |

| S&P Global, Inc. | | | 4,888 | | | | 1,707,426 | |

| State Street Corp. | | | 4,781 | | | | 308,996 | |

| T Rowe Price Group, Inc. | | | 3,366 | | | | 304,623 | |

| | | | | | | | 15,060,164 | |

| Chemicals - 1.6% | | | | | | | | |

| Air Products & Chemicals, Inc. | | | 3,334 | | | | 941,655 | |

| Albemarle Corp. | | | 1,762 | | | | 223,386 | |

| Celanese Corp., Class A | | | 1,503 | | | | 172,109 | |

| CF Industries Holdings, Inc. | | | 2,896 | | | | 231,043 | |

| Corteva, Inc. | | | 10,655 | | | | 512,932 | |

| Dow, Inc. | | | 10,558 | | | | 510,374 | |

| DuPont de Nemours, Inc. | | | 6,889 | | | | 502,070 | |

| Eastman Chemical Co. | | | 1,780 | | | | 133,019 | |

| Ecolab, Inc. | | | 3,808 | | | | 638,754 | |

| FMC Corp. | | | 1,869 | | | | 99,431 | |

| International Flavors & Fragrances, Inc. | | | 3,829 | | | | 261,712 | |

| Linde plc | | | 7,325 | | | | 2,799,322 | |

| LyondellBasell Industries NV, Class A | | | 3,844 | | | | 346,883 | |

| Mosaic Co. | | | 4,982 | | | | 161,815 | |

| PPG Industries, Inc. | | | 3,537 | | | | 434,237 | |

| Sherwin-Williams Co. | | | 3,550 | | | | 845,646 | |

| Westlake Corp. | | | 483 | | | | 55,719 | |

| | | | | | | | 8,870,107 | |

| Commercial Services & Supplies - 0.5% | | | | | | | | |

| Cintas Corp. | | | 1,298 | | | | 658,242 | |

| Copart, Inc.* | | | 13,040 | | | | 567,501 | |

| Republic Services, Inc., Class A | | | 3,086 | | | | 458,240 | |

| Rollins, Inc. | | | 4,219 | | | | 158,677 | |

| Waste Management, Inc. | | | 5,534 | | | | 909,402 | |

| | | | | | | | 2,752,062 | |

| Communications Equipment - 0.9% | | | | | | | | |

| Arista Networks, Inc.* | | | 3,762 | | | | 753,792 | |

| Cisco Systems, Inc. (Delaware) | | | 61,173 | | | | 3,188,948 | |

| Motorola Solutions, Inc. | | | 2,510 | | | | 698,935 | |

| | | | | | | | 4,641,675 | |

| Investments | | Shares | | | Value | |

| Construction & Engineering - 0.1% | | | | | | | | |

| Quanta Services, Inc. | | | 2,180 | | | $ | 364,322 | |

| | | | | | | | | |

| Construction Materials - 0.1% | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 928 | | | | 379,496 | |

| Vulcan Materials Co. | | | 1,995 | | | | 391,998 | |

| | | | | | | | 771,494 | |

| Consumer Finance - 0.4% | | | | | | | | |

| American Express Co. | | | 8,732 | | | | 1,275,134 | |

| Capital One Financial Corp. | | | 5,727 | | | | 580,088 | |

| Discover Financial Services | | | 3,753 | | | | 308,046 | |

| Synchrony Financial | | | 6,281 | | | | 176,182 | |

| | | | | | | | 2,339,450 | |

| Consumer Staples Distribution & Retail - 1.8% | | | | | | | | |

| Costco Wholesale Corp. | | | 6,653 | | | | 3,675,383 | |

| Dollar General Corp. | | | 3,291 | | | | 391,761 | |

| Dollar Tree, Inc.* | | | 3,143 | | | | 349,156 | |

| Kroger Co. | | | 9,910 | | | | 449,617 | |

| Sysco Corp. | | | 7,584 | | | | 504,260 | |

| Target Corp. | | | 6,932 | | | | 767,996 | |

| Walgreens Boots Alliance, Inc. | | | 10,759 | | | | 226,800 | |

| Walmart, Inc. | | | 21,423 | | | | 3,500,732 | |

| | | | | | | | 9,865,705 | |

| Containers & Packaging - 0.2% | | | | | | | | |

| Amcor plc | | | 22,086 | | | | 196,345 | |

| Avery Dennison Corp. | | | 1,210 | | | | 210,625 | |

| Ball Corp. | | | 4,724 | | | | 227,460 | |

| Crown Holdings, Inc. | | | 1,814 | | | | 146,208 | |

| International Paper Co. | | | 5,190 | | | | 175,059 | |

| | | | | | | | 955,697 | |

| Distributors - 0.1% | | | | | | | | |

| Genuine Parts Co. | | | 2,107 | | | | 271,508 | |

| LKQ Corp. | | | 4,012 | | | | 176,207 | |

| Pool Corp. | | | 586 | | | | 185,041 | |

| | | | | | | | 632,756 | |

| Diversified REITs - 0.0%† | | | | | | | | |

| WP Carey, Inc. | | | 3,206 | | | | 172,002 | |

| | | | | | | | | |

| Diversified Telecommunication Services - 0.7% | | | | | | | | |

| AT&T, Inc. | | | 107,332 | | | | 1,652,913 | |

| Verizon Communications, Inc. | | | 63,117 | | | | 2,217,300 | |

| | | | | | | | 3,870,213 | |

| Electric Utilities - 1.5% | | | | | | | | |

| American Electric Power Co., Inc. | | | 7,731 | | | | 584,000 | |

| Avangrid, Inc. | | | 1,045 | | | | 31,214 | |

| Constellation Energy Corp. | | | 4,824 | | | | 544,726 | |

| Duke Energy Corp. | | | 11,571 | | | | 1,028,546 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| Edison International | | | 5,748 | | | $ | 362,469 | |

| Entergy Corp. | | | 3,174 | | | | 303,403 | |

| Evergy, Inc. | | | 3,450 | | | | 169,533 | |

| Eversource Energy | | | 5,237 | | | | 281,698 | |

| Exelon Corp. | | | 14,942 | | | | 581,841 | |

| FirstEnergy Corp. | | | 7,741 | | | | 275,580 | |

| NextEra Energy, Inc. | | | 30,381 | | | | 1,771,212 | |

| PG&E Corp.* | | | 31,386 | | | | 511,592 | |

| PPL Corp. | | | 11,066 | | | | 271,892 | |

| Southern Co. | | | 16,373 | | | | 1,101,903 | |

| Xcel Energy, Inc. | | | 8,279 | | | | 490,696 | |

| | | | | | | | 8,310,305 | |

| Electrical Equipment - 0.6% | | | | | | | | |

| AMETEK, Inc. | | | 3,465 | | | | 487,768 | |

| Eaton Corp. plc | | | 5,991 | | | | 1,245,589 | |

| Emerson Electric Co. | | | 8,579 | | | | 763,274 | |

| Hubbell, Inc., Class B | | | 802 | | | | 216,620 | |

| Rockwell Automation, Inc. | | | 1,724 | | | | 453,084 | |

| | | | | | | | 3,166,335 | |

| Electronic Equipment, Instruments & Components - 0.6% | | | | | | | | |

| Amphenol Corp., Class A | | | 8,958 | | | | 721,567 | |

| CDW Corp. | | | 2,013 | | | | 403,405 | |

| Corning, Inc. | | | 11,519 | | | | 308,248 | |

| Jabil, Inc. | | | 1,966 | | | | 241,425 | |

| Keysight Technologies, Inc.* | | | 2,679 | | | | 326,972 | |

| TE Connectivity Ltd. | | | 4,715 | | | | 555,663 | |

| Teledyne Technologies, Inc.* | | | 708 | | | | 265,210 | |

| Trimble, Inc.* | | | 3,727 | | | | 175,654 | |

| Zebra Technologies Corp., Class A* | | | 768 | | | | 160,842 | |

| | | | | | | | 3,158,986 | |

| Energy Equipment & Services - 0.4% | | | | | | | | |

| Baker Hughes Co., Class A | | | 15,151 | | | | 521,497 | |

| Halliburton Co. | | | 13,490 | | | | 530,697 | |

| Schlumberger NV | | | 21,336 | | | | 1,187,562 | |

| | | | | | | | 2,239,756 | |

| Entertainment - 1.2% | | | | | | | | |

| Electronic Arts, Inc. | | | 3,700 | | | | 458,023 | |

| Liberty Media Corp.-Liberty Formula One, Class A* | | | 361 | | | | 20,776 | |

| Liberty Media Corp.-Liberty Formula One, Class C* | | | 3,124 | | | | 202,092 | |

| Live Nation Entertainment, Inc.* | | | 2,127 | | | | 170,203 | |

| Netflix, Inc.* | | | 6,652 | | | | 2,738,561 | |

| ROBLOX Corp., Class A* | | | 7,229 | | | | 229,954 | |

| Take-Two Interactive Software, Inc.* | | | 2,372 | | | | 317,255 | |

| Walt Disney Co.* | | | 27,469 | | | | 2,241,196 | |

| | | | | | | | 6,378,060 | |

| Investments | | Shares | | | Value | |

| Financial Services - 4.4% | | | | | | | | |

| Apollo Global Management, Inc. | | | 6,555 | | | $ | 507,619 | |

| Berkshire Hathaway, Inc., Class B* | | | 27,378 | | | | 9,344,932 | |

| Block, Inc., Class A* | | | 8,248 | | | | 331,982 | |

| Fidelity National Information Services, Inc. | | | 8,893 | | | | 436,735 | |

| Fiserv, Inc.* | | | 9,154 | | | | 1,041,268 | |

| FleetCor Technologies, Inc.* | | | 1,111 | | | | 250,164 | |

| Global Payments, Inc. | | | 3,904 | | | | 414,683 | |

| Mastercard, Inc., Class A | | | 12,490 | | | | 4,700,612 | |

| PayPal Holdings, Inc.* | | | 16,488 | | | | 854,078 | |

| Visa, Inc., Class A | | | 24,123 | | | | 5,671,317 | |

| | | | | | | | 23,553,390 | |

| Food Products - 0.9% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 8,050 | | | | 576,138 | |

| Bunge Ltd. | | | 2,262 | | | | 239,727 | |

| Campbell Soup Co. | | | 2,950 | | | | 119,210 | |

| Conagra Brands, Inc. | | | 7,174 | | | | 196,281 | |

| General Mills, Inc. | | | 8,783 | | | | 573,003 | |

| Hershey Co. | | | 2,250 | | | | 421,538 | |

| Hormel Foods Corp. | | | 4,352 | | | | 141,658 | |

| J M Smucker Co. | | | 1,531 | | | | 174,289 | |

| Kellanova | | | 3,963 | | | | 200,013 | |

| Kraft Heinz Co. | | | 11,990 | | | | 377,205 | |

| Lamb Weston Holdings, Inc. | | | 2,188 | | | | 196,482 | |

| McCormick & Co., Inc. | | | 3,774 | | | | 241,159 | |

| Mondelez International, Inc., Class A | | | 20,426 | | | | 1,352,404 | |

| Tyson Foods, Inc., Class A | | | 4,285 | | | | 198,610 | |

| | | | | | | | 5,007,717 | |

| Gas Utilities - 0.0%† | | | | | | | | |

| Atmos Energy Corp. | | | 2,228 | | | | 239,866 | |

| | | | | | | | | |

| Ground Transportation - 1.0% | | | | | | | | |

| CSX Corp. | | | 30,115 | | | | 898,933 | |

| JB Hunt Transport Services, Inc. | | | 1,228 | | | | 211,056 | |

| Norfolk Southern Corp. | | | 3,409 | | | | 650,403 | |

| Old Dominion Freight Line, Inc. | | | 1,343 | | | | 505,854 | |

| Uber Technologies, Inc.* | | | 30,681 | | | | 1,327,874 | |

| Union Pacific Corp. | | | 9,152 | | | | 1,900,047 | |

| | | | | | | | 5,494,167 | |

| Health Care Equipment & Supplies - 2.4% | | | | | | | | |

| Abbott Laboratories | | | 26,051 | | | | 2,463,122 | |

| Align Technology, Inc.* | | | 1,070 | | | | 197,511 | |

| Baxter International, Inc. | | | 7,594 | | | | 246,273 | |

| Becton Dickinson & Co. | | | 4,356 | | | | 1,101,110 | |

| Boston Scientific Corp.* | | | 21,978 | | | | 1,125,054 | |

| Cooper Cos, Inc. (The) | | | 744 | | | | 231,942 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| Dexcom, Inc.* | | | 5,822 | | | $ | 517,168 | |

| Edwards Lifesciences Corp.* | | | 9,126 | | | | 581,509 | |

| GE HealthCare Technologies, Inc. | | | 5,872 | | | | 390,899 | |

| Hologic, Inc.* | | | 3,680 | | | | 243,506 | |

| IDEXX Laboratories, Inc.* | | | 1,247 | | | | 498,139 | |

| Insulet Corp.* | | | 1,051 | | | | 139,331 | |

| Intuitive Surgical, Inc.* | | | 5,276 | | | | 1,383,473 | |

| Medtronic plc | | | 19,988 | | | | 1,410,353 | |

| ResMed, Inc. | | | 2,205 | | | | 311,390 | |

| STERIS plc | | | 1,482 | | | | 311,190 | |

| Stryker Corp. | | | 5,075 | | | | 1,371,367 | |

| Teleflex, Inc. | | | 706 | | | | 130,434 | |

| Zimmer Biomet Holdings, Inc. | | | 3,135 | | | | 327,325 | |

| | | | | | | | 12,981,096 | |

| Health Care Providers & Services - 3.1% | | | | | | | | |

| Cardinal Health, Inc. | | | 3,822 | | | | 347,802 | |

| Cencora, Inc. | | | 2,503 | | | | 463,430 | |

| Centene Corp.* | | | 8,124 | | | | 560,394 | |

| Cigna Group (The) | | | 4,442 | | | | 1,373,466 | |

| CVS Health Corp. | | | 19,282 | | | | 1,330,651 | |

| Elevance Health, Inc. | | | 3,537 | | | | 1,591,969 | |

| HCA Healthcare, Inc. | | | 3,019 | | | | 682,717 | |

| Humana, Inc. | | | 1,860 | | | | 974,063 | |

| Laboratory Corp. of America Holdings | | | 1,328 | | | | 265,241 | |

| McKesson Corp. | | | 2,026 | | | | 922,559 | |

| Molina Healthcare, Inc.* | | | 877 | | | | 291,997 | |

| Quest Diagnostics, Inc. | | | 1,682 | | | | 218,828 | |

| UnitedHealth Group, Inc. | | | 13,908 | | | | 7,448,569 | |

| | | | | | | | 16,471,686 | |

| Health Care REITs - 0.2% | | | | | | | | |

| Healthpeak Properties, Inc. | | | 8,222 | | | | 127,852 | |

| Ventas, Inc. | | | 6,039 | | | | 256,416 | |

| Welltower, Inc. | | | 7,784 | | | | 650,820 | |

| | | | | | | | 1,035,088 | |

| Health Care Technology - 0.1% | | | | | | | | |

| Veeva Systems, Inc., Class A* | | | 2,187 | | | | 421,457 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure - 2.1% | | | | | | | | |

| Airbnb, Inc., Class A* | | | 6,401 | | | | 757,174 | |

| Booking Holdings, Inc.* | | | 536 | | | | 1,495,204 | |

| Carnival Corp.* | | | 15,113 | | | | 173,195 | |

| Chipotle Mexican Grill, Inc., Class A* | | | 413 | | | | 802,129 | |

| Darden Restaurants, Inc. | | | 1,816 | | | | 264,282 | |

| Domino’s Pizza, Inc. | | | 527 | | | | 178,648 | |

| DoorDash, Inc., Class A* | | | 4,497 | | | | 337,050 | |

| Expedia Group, Inc.* | | | 2,070 | | | | 197,250 | |

| Hilton Worldwide Holdings, Inc. | | | 3,923 | | | | 594,452 | |

| Investments | | Shares | | | Value | |

| Las Vegas Sands Corp. | | | 4,933 | | | $ | 234,120 | |

| Marriott International, Inc., Class A | | | 3,761 | | | | 709,174 | |

| McDonald’s Corp. | | | 10,940 | | | | 2,868,141 | |

| MGM Resorts International | | | 4,221 | | | | 147,397 | |

| Royal Caribbean Cruises Ltd.* | | | 3,538 | | | | 299,775 | |

| Starbucks Corp. | | | 17,194 | | | | 1,585,975 | |

| Yum! Brands, Inc. | | | 4,207 | | | | 508,458 | |

| | | | | | | | 11,152,424 | |

| Household Durables - 0.3% | | | | | | | | |

| DR Horton, Inc. | | | 4,574 | | | | 477,526 | |

| Garmin Ltd. | | | 2,296 | | | | 235,409 | |

| Lennar Corp., Class A | | | 3,791 | | | | 404,424 | |

| Lennar Corp., Class B | | | 199 | | | | 19,623 | |

| NVR, Inc.* | | | 48 | | | | 259,806 | |

| PulteGroup, Inc. | | | 3,295 | | | | 242,479 | |

| | | | | | | | 1,639,267 | |

| Household Products - 1.4% | | | | | | | | |

| Church & Dwight Co., Inc. | | | 3,691 | | | | 335,660 | |

| Clorox Co. | | | 1,856 | | | | 218,451 | |

| Colgate-Palmolive Co. | | | 12,407 | | | | 932,014 | |

| Kimberly-Clark Corp. | | | 5,078 | | | | 607,532 | |

| Procter & Gamble Co. | | | 35,388 | | | | 5,309,261 | |

| | | | | | | | 7,402,918 | |

| Independent Power & Renewable Electricity Producers - 0.0%† | | | | | | | | |

| AES Corp. (The) | | | 10,068 | | | | 150,013 | |

| | | | | | | | | |

| Industrial Conglomerates - 0.8% | | | | | | | | |

| 3M Co. | | | 8,283 | | | | 753,339 | |

| General Electric Co. | | | 16,342 | | | | 1,775,231 | |

| Honeywell International, Inc. | | | 9,967 | | | | 1,826,553 | |

| | | | | | | | 4,355,123 | |

| Industrial REITs - 0.3% | | | | | | | | |

| Prologis, Inc. | | | 13,866 | | | | 1,397,000 | |

| | | | | | | | | |

| Insurance - 2.2% | | | | | | | | |

| Aflac, Inc. | | | 8,114 | | | | 633,785 | |

| Allstate Corp. (The) | | | 3,923 | | | | 502,654 | |

| American International Group, Inc. | | | 10,689 | | | | 655,343 | |

| Aon plc, Class A | | | 3,048 | | | | 943,051 | |

| Arch Capital Group Ltd.* | | | 5,594 | | | | 484,888 | |

| Arthur J Gallagher & Co. | | | 3,237 | | | | 762,281 | |

| Brown & Brown, Inc. | | | 3,534 | | | | 245,330 | |

| Chubb Ltd. | | | 6,169 | | | | 1,323,991 | |

| Cincinnati Financial Corp. | | | 2,357 | | | | 234,922 | |

| Everest Group Ltd. | | | 652 | | | | 257,944 | |

| Hartford Financial Services Group, Inc. (The) | | | 4,589 | | | | 337,062 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| Markel Group, Inc.* | | | 199 | | | $ | 292,633 | |

| Marsh & McLennan Cos, Inc. | | | 7,412 | | | | 1,405,686 | |

| MetLife, Inc. | | | 9,488 | | | | 569,375 | |

| Principal Financial Group, Inc. | | | 3,340 | | | | 226,051 | |

| Progressive Corp. (The) | | | 8,789 | | | | 1,389,453 | |

| Prudential Financial, Inc. | | | 5,454 | | | | 498,714 | |

| Travelers Cos, Inc. (The) | | | 3,439 | | | | 575,826 | |

| W R Berkley Corp. | | | 3,058 | | | | 206,170 | |

| Willis Towers Watson plc | | | 1,576 | | | | 371,763 | |

| | | | | | | | 11,916,922 | |

| Interactive Media & Services - 5.8% | | | | | | | | |

| Alphabet, Inc., Class A* | | | 89,069 | | | | 11,051,681 | |

| Alphabet, Inc., Class C* | | | 75,765 | | | | 9,493,355 | |

| Match Group, Inc.* | | | 4,172 | | | | 144,351 | |

| Meta Platforms, Inc., Class A* | | | 33,365 | | | | 10,051,873 | |

| Pinterest, Inc., Class A* | | | 8,737 | | | | 261,062 | |

| Snap, Inc., Class A* | | | 15,233 | | | | 152,482 | |

| | | | | | | | 31,154,804 | |

| IT Services - 1.5% | | | | | | | | |

| Accenture plc, Class A | | | 9,468 | | | | 2,812,849 | |

| Akamai Technologies, Inc.* | | | 2,280 | | | | 235,592 | |

| Cloudflare, Inc., Class A* | | | 4,391 | | | | 248,926 | |

| Cognizant Technology Solutions Corp., Class A | | | 7,585 | | | | 489,005 | |

| EPAM Systems, Inc.* | | | 870 | | | | 189,286 | |

| Gartner, Inc.* | | | 1,183 | | | | 392,803 | |

| GoDaddy, Inc., Class A* | | | 2,201 | | | | 161,179 | |

| International Business Machines Corp. | | | 13,675 | | | | 1,977,952 | |

| MongoDB, Inc., Class A* | | | 1,061 | | | | 365,610 | |

| Snowflake, Inc., Class A* | | | 4,896 | | | | 710,556 | |

| VeriSign, Inc.* | | | 1,347 | | | | 268,942 | |

| | | | | | | | 7,852,700 | |

| Life Sciences Tools & Services - 1.3% | | | | | | | | |

| Agilent Technologies, Inc. | | | 4,432 | | | | 458,136 | |

| Avantor, Inc.* | | | 10,142 | | | | 176,775 | |

| Bio-Rad Laboratories, Inc., Class A* | | | 316 | | | | 86,988 | |

| Danaher Corp. | | | 9,869 | | | | 1,895,045 | |

| Illumina, Inc.* | | | 2,379 | | | | 260,310 | |

| IQVIA Holdings, Inc.* | | | 2,749 | | | | 497,102 | |

| Mettler-Toledo International, Inc.* | | | 329 | | | | 324,131 | |

| Revvity, Inc. | | | 1,863 | | | | 154,350 | |

| Thermo Fisher Scientific, Inc. | | | 5,792 | | | | 2,576,108 | |

| Waters Corp.* | | | 887 | | | | 211,576 | |

| West Pharmaceutical Services, Inc. | | | 1,109 | | | | 352,984 | |

| | | | | | | | 6,993,505 | |

| Investments | | Shares | | | Value | |

| Machinery - 1.6% | | | | | | | | |

| Caterpillar, Inc. | | | 7,660 | | | $ | 1,731,542 | |

| Cummins, Inc. | | | 2,129 | | | | 460,503 | |

| Deere & Co. | | | 4,091 | | | | 1,494,687 | |

| Dover Corp. | | | 2,100 | | | | 272,895 | |

| Fortive Corp. | | | 5,284 | | | | 344,940 | |

| IDEX Corp. | | | 1,134 | | | | 217,059 | |

| Illinois Tool Works, Inc. | | | 4,130 | | | | 925,616 | |

| Ingersoll Rand, Inc. | | | 6,072 | | | | 368,449 | |

| Otis Worldwide Corp. | | | 6,184 | | | | 477,467 | |

| PACCAR, Inc. | | | 7,848 | | | | 647,695 | |

| Parker-Hannifin Corp. | | | 1,925 | | | | 710,152 | |

| Stanley Black & Decker, Inc. | | | 2,304 | | | | 195,955 | |

| Westinghouse Air Brake Technologies Corp. | | | 2,692 | | | | 285,406 | |

| Xylem, Inc./NY | | | 3,616 | | | | 338,241 | |

| | | | | | | | 8,470,607 | |

| Media - 0.8% | | | | | | | | |

| Charter Communications, Inc., Class A* | | | 1,527 | | | | 615,076 | |

| Comcast Corp., Class A | | | 61,782 | | | | 2,550,979 | |

| Fox Corp., Class A | | | 3,816 | | | | 115,968 | |

| Fox Corp., Class B | | | 1,977 | | | | 55,178 | |

| Liberty Broadband Corp., Class A* | | | 248 | | | | 20,663 | |

| Liberty Broadband Corp., Class C* | | | 1,718 | | | | 143,127 | |

| Omnicom Group, Inc. | | | 2,966 | | | | 222,183 | |

| Paramount Global, Class B | | | 7,228 | | | | 78,641 | |

| Sirius XM Holdings, Inc.†† | | | 9,819 | | | | 42,025 | |

| Trade Desk, Inc. (The), Class A* | | | 6,700 | | | | 475,432 | |

| | | | | | | | 4,319,272 | |

| Metals & Mining - 0.5% | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 21,517 | | | | 726,844 | |

| Newmont Corp. | | | 17,300 | | | | 648,231 | |

| Nucor Corp. | | | 3,733 | | | | 551,700 | |

| Reliance Steel & Aluminum Co. | | | 879 | | | | 223,600 | |

| Southern Copper Corp. | | | 1,274 | | | | 90,327 | |

| Steel Dynamics, Inc. | | | 2,338 | | | | 249,020 | |

| | | | | | | | 2,489,722 | |

| Multi-Utilities - 0.7% | | | | | | | | |

| Ameren Corp. | | | 3,944 | | | | 298,600 | |

| CenterPoint Energy, Inc. | | | 9,486 | | | | 254,984 | |

| CMS Energy Corp. | | | 4,383 | | | | 238,172 | |

| Consolidated Edison, Inc. | | | 5,180 | | | | 454,752 | |

| Dominion Energy, Inc. | | | 12,555 | | | | 506,218 | |

| DTE Energy Co. | | | 3,096 | | | | 298,392 | |

| Public Service Enterprise Group, Inc. | | | 7,493 | | | | 461,943 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| Sempra | | | 9,444 | | | $ | 661,364 | |

| WEC Energy Group, Inc. | | | 4,738 | | | | 385,626 | |

| | | | | | | | 3,560,051 | |

| Office REITs - 0.0%† | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 2,337 | | | | 217,645 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels - 4.2% | | | | | | | | |

| APA Corp. | | | 4,614 | | | | 183,268 | |

| Cheniere Energy, Inc. | | | 3,614 | | | | 601,442 | |

| Chevron Corp. | | | 26,637 | | | | 3,881,809 | |

| ConocoPhillips | | | 17,977 | | | | 2,135,667 | |

| Coterra Energy, Inc. | | | 11,371 | | | | 312,703 | |

| Devon Energy Corp. | | | 9,617 | | | | 447,864 | |

| Diamondback Energy, Inc. | | | 2,687 | | | | 430,780 | |

| EOG Resources, Inc. | | | 8,742 | | | | 1,103,678 | |

| EQT Corp. | | | 5,433 | | | | 230,251 | |

| Exxon Mobil Corp. | | | 59,748 | | | | 6,324,325 | |

| Hess Corp. | | | 4,149 | | | | 599,116 | |

| Kinder Morgan, Inc. | | | 29,117 | | | | 471,695 | |

| Marathon Oil Corp. | | | 9,088 | | | | 248,193 | |

| Marathon Petroleum Corp. | | | 6,005 | | | | 908,256 | |

| Occidental Petroleum Corp. | | | 9,963 | | | | 615,813 | |

| ONEOK, Inc. | | | 8,746 | | | | 570,239 | |

| Phillips 66 | | | 6,683 | | | | 762,330 | |

| Pioneer Natural Resources Co. | | | 3,500 | | | | 836,500 | |

| Targa Resources Corp. | | | 3,354 | | | | 280,428 | |

| Texas Pacific Land Corp. | | | 95 | | | | 175,365 | |

| Valero Energy Corp. | | | 5,303 | | | | 673,481 | |

| Williams Cos, Inc. (The) | | | 18,259 | | | | 628,110 | |

| | | | | | | | 22,421,313 | |

| Passenger Airlines - 0.1% | | | | | | | | |

| Delta Air Lines, Inc. | | | 9,668 | | | | 302,125 | |

| Southwest Airlines Co. | | | 8,940 | | | | 198,736 | |

| United Airlines Holdings, Inc.* | | | 4,926 | | | | 172,459 | |

| | | | | | | | 673,320 | |

| Personal Care Products - 0.1% | | | | | | | | |

| Estee Lauder Cos, Inc. (The), Class A | | | 3,482 | | | | 448,725 | |

| | | | | | | | | |

| Pharmaceuticals - 4.0% | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 31,359 | | | | 1,615,929 | |

| Eli Lilly & Co. | | | 11,971 | | | | 6,631,096 | |

| Johnson & Johnson | | | 36,148 | | | | 5,362,194 | |

| Merck & Co., Inc. | | | 38,091 | | | | 3,911,946 | |

| Pfizer, Inc. | | | 84,752 | | | | 2,590,021 | |

| Royalty Pharma plc, Class A | | | 5,802 | | | | 155,900 | |

| Viatris, Inc. | | | 18,010 | | | | 160,289 | |

| Zoetis, Inc., Class A | | | 6,911 | | | | 1,085,027 | |

| | | | | | | | 21,512,402 | |

| Investments | | Shares | | | Value | |

| Professional Services - 0.7% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 6,186 | | | $ | 1,349,909 | |

| Broadridge Financial Solutions, Inc. | | | 1,777 | | | | 303,227 | |

| Equifax, Inc. | | | 1,842 | | | | 312,348 | |

| Jacobs Solutions, Inc. | | | 1,889 | | | | 251,804 | |

| Leidos Holdings, Inc. | | | 2,062 | | | | 204,385 | |

| Paychex, Inc. | | | 4,814 | | | | 534,595 | |

| Paycom Software, Inc. | | | 740 | | | | 181,278 | |

| SS&C Technologies Holdings, Inc. | | | 3,238 | | | | 162,710 | |

| TransUnion | | | 2,906 | | | | 127,515 | |

| Verisk Analytics, Inc., Class A | | | 2,178 | | | | 495,190 | |

| | | | | | | | 3,922,961 | |

| Real Estate Management & Development - 0.1% | | | | | | | | |

| CBRE Group, Inc., Class A* | | | 4,653 | | | | 322,639 | |

| CoStar Group, Inc.* | | | 6,129 | | | | 449,930 | |

| | | | | | | | 772,569 | |

| Residential REITs - 0.3% | | | | | | | | |

| AvalonBay Communities, Inc. | | | 2,133 | | | | 353,524 | |

| Equity Residential | | | 5,180 | | | | 286,609 | |

| Essex Property Trust, Inc. | | | 962 | | | | 205,791 | |

| Invitation Homes, Inc. | | | 8,633 | | | | 256,314 | |

| Mid-America Apartment Communities, Inc. | | | 1,752 | | | | 206,999 | |

| Sun Communities, Inc. | | | 1,868 | | | | 207,796 | |

| | | | | | | | 1,517,033 | |

| Retail REITs - 0.2% | | | | | | | | |

| Realty Income Corp. | | | 10,638 | | | | 504,028 | |

| Simon Property Group, Inc. | | | 4,912 | | | | 539,780 | |

| | | | | | | | 1,043,808 | |

| Semiconductors & Semiconductor Equipment - 7.2% | | | | | | | | |

| Advanced Micro Devices, Inc.* | | | 24,257 | | | | 2,389,315 | |

| Analog Devices, Inc. | | | 7,528 | | | | 1,184,380 | |

| Applied Materials, Inc. | | | 12,608 | | | | 1,668,669 | |

| Broadcom, Inc. | | | 6,197 | | | | 5,213,970 | |

| Enphase Energy, Inc.* | | | 2,047 | | | | 162,900 | |

| Entegris, Inc. | | | 2,247 | | | | 197,826 | |

| First Solar, Inc.* | | | 1,604 | | | | 228,490 | |

| Intel Corp. | | | 62,870 | | | | 2,294,755 | |

| KLA Corp. | | | 2,052 | | | | 963,824 | |

| Lam Research Corp. | | | 2,001 | | | | 1,177,028 | |

| Marvell Technology, Inc. | | | 12,910 | | | | 609,610 | |

| Microchip Technology, Inc. | | | 8,169 | | | | 582,368 | |

| Micron Technology, Inc. | | | 16,443 | | | | 1,099,543 | |

| Monolithic Power Systems, Inc. | | | 717 | | | | 316,728 | |

| NVIDIA Corp. | | | 37,083 | | | | 15,122,447 | |

| NXP Semiconductors NV | | | 3,869 | | | | 667,132 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| ON Semiconductor Corp.* | | | 6,478 | | | $ | 405,782 | |

| Qorvo, Inc.* | | | 1,472 | | | | 128,682 | |

| QUALCOMM, Inc. | | | 16,752 | | | | 1,825,800 | |

| Skyworks Solutions, Inc. | | | 2,394 | | | | 207,656 | |

| Teradyne, Inc. | | | 2,316 | | | | 192,853 | |

| Texas Instruments, Inc. | | | 13,630 | | | | 1,935,596 | |

| | | | | | | | 38,575,354 | |

| Software - 11.3% | | | | | | | | |

| Adobe, Inc.* | | | 6,842 | | | | 3,640,354 | |

| ANSYS, Inc.* | | | 1,302 | | | | 362,295 | |

| Aspen Technology, Inc.* | | | 425 | | | | 75,544 | |

| Atlassian Corp., Class A* | | | 2,278 | | | | 411,498 | |

| Autodesk, Inc.* | | | 3,205 | | | | 633,404 | |

| Cadence Design Systems, Inc.* | | | 4,080 | | | | 978,588 | |

| Crowdstrike Holdings, Inc., Class A* | | | 3,364 | | | | 594,654 | |

| Datadog, Inc., Class A* | | | 4,484 | | | | 365,311 | |

| DocuSign, Inc., Class A* | | | 3,046 | | | | 118,428 | |

| Fair Isaac Corp.* | | | 373 | | | | 315,510 | |

| Fortinet, Inc.* | | | 9,788 | | | | 559,580 | |

| Gen Digital, Inc. | | | 8,463 | | | | 140,994 | |

| HubSpot, Inc.* | | | 751 | | | | 318,251 | |

| Intuit, Inc. | | | 4,205 | | | | 2,081,265 | |

| Microsoft Corp. | | | 111,541 | | | | 37,713,127 | |

| Oracle Corp. | | | 23,631 | | | | 2,443,445 | |

| Palantir Technologies, Inc., Class A* | | | 28,565 | | | | 422,762 | |

| Palo Alto Networks, Inc.* | | | 4,591 | | | | 1,115,705 | |

| PTC, Inc.* | | | 1,785 | | | | 250,650 | |

| Roper Technologies, Inc. | | | 1,603 | | | | 783,178 | |

| Salesforce, Inc.* | | | 14,622 | | | | 2,936,535 | |

| ServiceNow, Inc.* | | | 3,064 | | | | 1,782,788 | |

| Splunk, Inc.* | | | 2,287 | | | | 336,555 | |

| Synopsys, Inc.* | | | 2,283 | | | | 1,071,732 | |

| Tyler Technologies, Inc.* | | | 630 | | | | 234,927 | |

| Unity Software, Inc.* | | | 3,623 | | | | 91,916 | |

| VMware, Inc., Class A*†† | | | 3,297 | | | | 480,208 | |

| Workday, Inc., Class A* | | | 3,090 | | | | 654,184 | |

| Zoom Video Communications, Inc., Class A* | | | 3,762 | | | | 225,645 | |

| Zscaler, Inc.* | | | 1,312 | | | | 208,201 | |

| | | | | | | | 61,347,234 | |

| Specialized REITs - 1.1% | | | | | | | | |

| American Tower Corp. | | | 6,997 | | | | 1,246,794 | |

| Crown Castle, Inc. | | | 6,510 | | | | 605,300 | |

| Digital Realty Trust, Inc. | | | 4,546 | | | | 565,341 | |

| Equinix, Inc. | | | 1,405 | | | | 1,025,144 | |

| Extra Space Storage, Inc. | | | 3,172 | | | | 328,587 | |

| Investments | | Shares | | | Value | |

| Iron Mountain, Inc. | | | 4,379 | | | $ | 258,668 | |

| Public Storage | | | 2,377 | | | | 567,414 | |

| SBA Communications Corp., Class A | | | 1,627 | | | | 339,441 | |

| VICI Properties, Inc., Class A | | | 15,214 | | | | 424,471 | |

| Weyerhaeuser Co. | | | 10,969 | | | | 314,701 | |

| | | | | | | | 5,675,861 | |

| Specialty Retail - 2.0% | | | | | | | | |

| AutoZone, Inc.* | | | 271 | | | | 671,302 | |

| Best Buy Co., Inc. | | | 2,913 | | | | 194,647 | |

| Burlington Stores, Inc.* | | | 970 | | | | 117,399 | |

| CarMax, Inc.* | | | 2,373 | | | | 144,967 | |

| Home Depot, Inc. (The) | | | 15,092 | | | | 4,296,540 | |

| Lowe’s Cos, Inc. | | | 8,799 | | | | 1,676,825 | |

| O’Reilly Automotive, Inc.* | | | 907 | | | | 843,909 | |

| Ross Stores, Inc. | | | 5,115 | | | | 593,187 | |

| TJX Cos, Inc. (The) | | | 17,255 | | | | 1,519,648 | |

| Tractor Supply Co. | | | 1,635 | | | | 314,836 | |

| Ulta Beauty, Inc.* | | | 747 | | | | 284,839 | |

| | | | | | | | 10,658,099 | |

| Technology Hardware, Storage & Peripherals - 7.3% | | | | | | | | |

| Apple, Inc. | | | 220,629 | | | | 37,676,813 | |

| Dell Technologies, Inc., Class C | | | 3,803 | | | | 254,459 | |

| Hewlett Packard Enterprise Co. | | | 19,376 | | | | 298,003 | |

| HP, Inc. | | | 13,025 | | | | 342,947 | |

| NetApp, Inc. | | | 3,160 | | | | 229,985 | |

| Seagate Technology Holdings plc | | | 2,898 | | | | 197,789 | |

| Western Digital Corp.* | | | 4,806 | | | | 192,961 | |

| | | | | | | | 39,192,957 | |

| Textiles, Apparel & Luxury Goods - 0.5% | | | | | | | | |

| Lululemon Athletica, Inc.* | | | 1,735 | | | | 682,688 | |

| NIKE, Inc., Class B | | | 18,391 | | | | 1,890,043 | |

| | | | | | | | 2,572,731 | |

| Tobacco - 0.6% | | | | | | | | |

| Altria Group, Inc. | | | 26,645 | | | | 1,070,330 | |

| Philip Morris International, Inc. | | | 23,305 | | | | 2,077,873 | |

| | | | | | | | 3,148,203 | |

| Trading Companies & Distributors - 0.3% | | | | | | | | |

| Fastenal Co. | | | 8,575 | | | | 500,266 | |

| Ferguson plc | | | 3,069 | | | | 460,964 | |

| United Rentals, Inc. | | | 1,026 | | | | 416,833 | |

| WW Grainger, Inc. | | | 669 | | | | 488,256 | |

| | | | | | | | 1,866,319 | |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| Water Utilities - 0.1% | | | | | | | | |

| American Water Works Co., Inc. | | | 2,923 | | | $ | 343,891 | |

| | | | | | | | | |

| Wireless Telecommunication Services - 0.2% | | | | | | | | |

| T-Mobile US, Inc.* | | | 7,769 | | | | 1,117,648 | |

| | | | | | | | | |

Total Common Stocks

(Cost $552,005,003) | | | | | | | 537,715,466 | |

| | | | | | | | | |

| Securities Lending Reinvestment††† | | | | | | | | |

| Money Market Fund - 0.1% | | | | | | | | |

Fidelity Investments Money Market Treasury Portfolio - Institutional Class, 5.27%††††

(Cost $425,118) | | | 425,118 | | | | 425,118 | |

| | | Principal | | | | |

| Short-Term Investments - 0.0%† | | | | | | | | |

| Time Deposit - 0.0%† | | | | | | | | |

Sumitomo Mitsui Banking Corp., Tokyo 4.68% 11/1/2023

(Cost $261,056) | | $ | 261,056 | | | | 261,056 | |

| | | | | | | | | |

Total Investments - 100.0%

(Cost $552,691,177) | | | | | | $ | 538,401,640 | |

| Liabilities in Excess of Other Assets - 0.0%† | | | | | | | (234,580 | ) |

| Net Assets - 100.0% | | | | | | $ | 538,167,060 | |

| * | Non-income producing security. |

| † | Represents less than 0.05%. |

| †† | The security or a portion of this security is on loan at October 31, 2023. The total value of securities on loan at October 31, 2023 was $412,609, collateralized in the form of cash with a value of $425,118 that was reinvested in the securities shown in the Securities Lending Reinvestment section of the Schedule of Investments. The total value of collateral is $425,118. |

| ††† | The security was purchased with cash collateral held from securities on loan at October 31, 2023. The total value of securities purchased was $425,118. |

| †††† | 7-day net yield. |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform 500 ETF |  |

October 31, 2023

Futures Contracts Purchased

TCW Transform 500 ETF had the following open long futures contracts as of October 31, 2023:

| | | Number of

Contracts | | Expiration

Date | | Trading

Currency | | Notional

Amount | | Value and

Unrealized

Depreciation |

| S&P 500 Micro E-Mini Index | | 21 | | 12/15/2023 | | USD | | $442,286 | | $(10,277) |

Fair Value Measurement

The Fund discloses the fair market value of its investments in a hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of the Fund (observable inputs) and (2) the Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs).

The three levels defined by the hierarchy are as follows:

| ● | Level 1 — Quoted prices in active markets for identical assets that the Fund has the ability to access. |

| ● | Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| ● | Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs as of October 31, 2023 for the Fund based upon the three levels defined above:

| TCW Transform 500 ETF | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Investments | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | |

| Common Stocks* | | $ | 537,715,466 | | | $ | - | | | $ | - | | | $ | 537,715,466 | |

| Money Market Fund | | | 425,118 | | | | - | | | | - | | | | 425,118 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Time Deposit | | | 261,056 | | | | - | | | | - | | | | 261,056 | |

| Total Investments | | $ | 538,401,640 | | | $ | - | | | $ | - | | | $ | 538,401,640 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Futures Contracts** | | $ | (10,277 | ) | | $ | - | | | $ | - | | | $ | (10,277 | ) |

| Total Other Financial Instruments | | $ | (10,277 | ) | | $ | - | | | $ | - | | | $ | (10,277 | ) |

| * | Please refer to the Schedule of Investments to view securities segregated by industry. |

| ** | Futures Contracts Purchased. |

See accompanying Notes to Financial Statements.

Schedule of Investments TCW Transform Systems ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| COMMON STOCKS - 96.2% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense - 12.9% | | | | | | | | |

| Airbus SE | | | 61,257 | | | $ | 8,184,969 | |

| Safran S.A. | | | 50,737 | | | | 7,892,742 | |

| | | | | | | | 16,077,711 | |

| Building Products - 2.0% | | | | | | | | |

| Trane Technologies plc | | | 12,896 | | | | 2,454,238 | |

| | | | | | | | | |

| Commercial Services & Supplies - 13.8% | | | | | | | | |

| Republic Services, Inc., Class A | | | 74,042 | | | | 10,994,496 | |

| Waste Management, Inc. | | | 37,083 | | | | 6,093,849 | |

| | | | | | | | 17,088,345 | |

| Construction & Engineering - 4.6% | | | | | | | | |

| WillScot Mobile Mini Holdings Corp.* | | | 146,538 | | | | 5,775,063 | |

| | | | | | | | | |

| Electrical Equipment - 11.4% | | | | | | | | |

| Hubbell, Inc., Class B | | | 5,658 | | | | 1,528,226 | |

| nVent Electric plc | | | 32,906 | | | | 1,583,766 | |

| Rockwell Automation, Inc. | | | 10,080 | | | | 2,649,125 | |

| Schneider Electric SE | | | 8,017 | | | | 1,229,835 | |

| Vertiv Holdings Co., Class A | | | 182,364 | | | | 7,161,433 | |

| | | | | | | | 14,152,385 | |

| Ground Transportation - 12.5% | | | | | | | | |

| Canadian Pacific Kansas City Ltd. | | | 79,369 | | | | 5,632,818 | |

| Union Pacific Corp. | | | 47,649 | | | | 9,892,409 | |

| | | | | | | | 15,525,227 | |

| Independent Power & Renewable Electricity Producers - 1.4% | | | | | | | | |

| Vistra Corp. | | | 53,962 | | | | 1,765,637 | |

| | | | | | | | | |

| Industrial Conglomerates - 6.6% | | | | | | | | |

| General Electric Co. | | | 75,901 | | | | 8,245,126 | |

| | | | | | | | | |

| Machinery - 3.0% | | | | | | | | |

| Caterpillar, Inc. | | | 4,329 | | | | 978,570 | |

| Deere & Co. | | | 4,880 | | | | 1,782,957 | |

| Sandvik AB | | | 58,955 | | | | 1,001,381 | |

| | | | | | | | 3,762,908 | |

| Oil, Gas & Consumable Fuels - 16.0% | | | | | | | | |

| Diamondback Energy, Inc. | | | 37,802 | | | | 6,060,416 | |

| Exxon Mobil Corp. | | | 57,154 | | | | 6,049,751 | |

| Occidental Petroleum Corp. | | | 97,946 | | | | 6,054,042 | |

| Pioneer Natural Resources Co. | | | 6,595 | | | | 1,576,205 | |

| | | | | | | | 19,740,414 | |

| Investments | | Shares | | | Value | |

| Semiconductors & Semiconductor Equipment - 5.1% | | | | | | | | |

| Applied Materials, Inc. | | | 35,059 | | | $ | 4,640,059 | |

| First Solar, Inc.* | | | 12,078 | | | | 1,720,511 | |

| | | | | | | | 6,360,570 | |

| Software - 6.9% | | | | | | | | |

| Microsoft Corp. | | | 25,442 | | | | 8,602,195 | |

| | | | | | | | | |

Total Common Stocks

(Cost $118,723,370) | | | | | | | 119,549,819 | |

| | | Principal | | | | |

| Short-Term Investments - 0.2% | | | | | | | | |

| Time Deposit - 0.2% | | | | | | | | |

Citibank, New York 4.68% 11/1/2023

(Cost $199,408) | | $ | 199,408 | | | | 199,408 | |

| | | | | | | | | |

Total Investments - 96.4%

(Cost $118,922,778) | | | | | | $ | 119,749,227 | |

| Other Assets Less Liabilities - 3.6% | | | | | | | 4,455,719 | |

| Net Assets - 100.0% | | | | | | $ | 124,204,946 | |

| * | Non-income producing security. |

TCW Transform Systems ETF invested, as a percentage of net assets, in the following countries as of October 31, 2023:

| United States | | | 73.7 | % |

| France | | | 13.9 | % |

| Canada | | | 4.5 | % |

| Ireland | | | 2.0 | % |

| United Kingdom | | | 1.3 | % |

| Sweden | | | 0.8 | % |

| Other(1) | | | 3.8 | % |

| Total | | | 100.0 | % |

| (1) | Includes cash, short term investments and net other assets (liabilities). |

See accompanying Notes to Financial Statements.

Schedule of Investments (Continued) TCW Transform Systems ETF |  |

October 31, 2023

Fair Value Measurement

The Fund discloses the fair market value of its investments in a hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of the Fund (observable inputs) and (2) the Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs).

The three levels defined by the hierarchy are as follows:

| ● | Level 1 — Quoted prices in active markets for identical assets that the Fund has the ability to access. |

| ● | Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| ● | Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs as of October 31, 2023 for the Fund based upon the three levels defined above:

| TCW Transform Systems ETF | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Investments | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | |

| Common Stocks* | | $ | 119,549,819 | | | $ | - | | | $ | - | | | $ | 119,549,819 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Time Deposit | | | 199,408 | | | | - | | | | - | | | | 199,408 | |

| Total Investments | | $ | 119,749,227 | | | $ | - | | | $ | - | | | $ | 119,749,227 | |

| * | Please refer to the Schedule of Investments to view securities segregated by industry. |

See accompanying Notes to Financial Statements.

Schedule of Investments TCW Transform Supply Chain ETF |  |

October 31, 2023

| Investments | | Shares | | | Value | |

| COMMON STOCKS - 96.4% | | | | | | | | |