ASYMsharesTM ASYMmetric S&P 500® ETF

Listed on NYSE Arca, Inc.

Ticker: ASPY CUSIP: 04651A101

Semi-Annual Report

| www.ASYMshares.com | June 30, 2022 |

Dear Shareholders,

We were honored by the industry recognition ASPY received in 2022. ASYMmetric ETFs won one award and was nominated for three at the 2022 With Intelligence Mutual Fund and ETF Industry Awards. ASYMmetric S&P 500® ETF (ASPY) won Newcomer Strategic Beta ETF of the Year. ASPY was shortlisted for Newcomer Alternative ETF of the Year and ASYMmetric ETFs was nominated for Best Diversity Equity and Inclusion (DEI) Initiative of the Year.

We were more pleased by ASPY’s performance since inception. ASYMsharesTM ASYMmetric S&P 500® ETF (NYSE: ASPY) delivered on its primary investment goal by producing ASYMmetric returns. ASYMmetric returns seek to deliver the following: positive returns in bear markets, capital preservation in uncertain markets, consistent positive returns across bull and bear markets, uncorrelated returns to the S&P 500®, lower volatility or less risky returns than the S&P 500®, and market or alpha generating returns relative to the S&P 500® across a market cycle.

ASYMmetric Risk Management TechnologyTM ability to produce ASYMmetric returns was put to the test since ASPY was launched. The S&P 500 experienced a bull market in 2021 and entered bear market territory in 2022. The following charts analyze ASPY’s performance in each market environment to see if the fund delivered ASYMmetric returns.

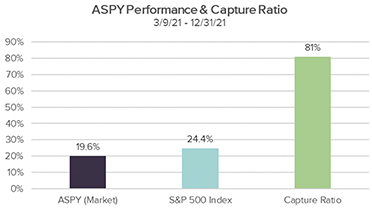

ASPY Bull Market Performance: 2021

Upside Capture

The S&P 500® experienced a strong bull market in 2021. ASYMmetric Risk Management TechnologyTM correctly identified the S&P 500® as being in a bull market or in a Risk-On environment and positioned ASPY to profit from bull market gains. In a Risk-On environment, ASPY is positioned to capture 75% of the gains of the S&P 500®. ASPY exceeded this goal by capturing 81% of the performance of the S&P 500® in 2021.

ASPY Bear Market Performance: 2022

Preservation of Capital

The S&P 500® tipped into bear market territory in June of 2022. ASYMmetric Risk Management TechnologyTM correctly measured the risk profile of the S&P 500® as Risk-Elevated. In a Risk-Elevated environment, the investment goal of ASPY is to preserve capital. ASPY achieved this goal by cutting the losses of the S&P 500® more than in half, delivering alpha of 12.6% over the index through the market low on 6/16/22.

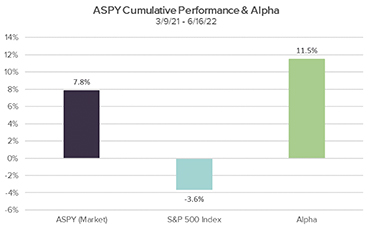

ASPY Market Cycle Performance: ‘21-’22

Alpha Generation with Less Risk

The returns on the S&P 500® were negative since the inception of ASPY through the bear market low on June 16, 2022. ASPY’s investment objective over a market cycle is to produce returns that are in line or better than the S&P 500® with less risk. ASPY delivered on this goal by producing positive returns of +7.8% when the S&P 500® was down -3.6%. ASPY generated alpha of 11.5% over the S&P 500® with a less risk. ASPY achieved its investment goal of delivering ASYMmetric returns. ASYMmetric Risk Management Technology™ passed its test.

ASPY Performance: 2022 YTD

ASYMshares™ ASYMmetric S&P 500® ETF (NYSE: ASPY) entered a Risk-Elevated environment for the first time in March 2022. Risk-Elevated environments occur when the market has broken down technically but realized volatility (PriceVolTM) has not spiked, an uncertain market. ASPY’s investment goal in an uncertain market is capital preservation. ASPY’s gross exposure was reduced, and net exposure was brought to market neutral in an attempt to preserve capital.

The change in net exposure to market neutral was effective. It cut ASPY’s losses to less than half of the S&P 500® through June 30, 2022. The majority of ASPY’s negative performance occurred during the first two months of 2022, as ASPY was Risk-On and therefore net long coming off of the bull market of 2021. ASYMmetric Risk Management TechnologyTM uses price based signals and is not designed to pick the market top or bottoms, but with a high degree of confidence will accurately identify the current market risk environment.

| | | | One | Since |

| | As of 6/30/22 | YTD | Year | Inception* |

| | ASYMmetric S&P 500® ETF – (Market) | -9.4% | -0.9% | 8.5% |

| | ASYMmetric S&P 500® ETF – (NAV) | -9.0% | 0.9% | 8.4% |

| | S&P 500® TR Index | -20.0% | -10.6% | -0.5% |

| | Alpha | 10.6% | 9.7% | 8.9% |

| | |

| *Since Inception performance is cumulative. Inception date 3/9/21. Expense ratio 0.95%

|

Performance quoted represents past performance, which is no guarantee of future results. Investment returns and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. For standardized performance, visit www.ASYMshares.com/aspy.

What makes ASPY truly different is that the strategy aims to generate positive returns over a market cycle that are equal to or better than the S&P 500® with less risk. ASPY is opening new horizons, beyond stock and bonds, by attempting to bring uncorrelated, low volatility, ASYMmetric returns to Main Street. If you are not already a shareholder, learn how ASPY may be able to lower the risk and improve the performance of your portfolio at www.ASYMshares.com.

Thank you for placing your trust in ASYMmetric ETFs.

Sincerely,

Darren Schuringa

President and CEO

Important Risk Information

This material must be preceded or accompanied by a prospectus.

There is no guarantee the protection sought by the fund will be achieved.

The fund has a limited operating history. Investment decisions should not be based on short term performance.

All investing involves risk, including possible loss of principal. The performance of the Fund will depend on the difference in the rates of return between its long positions and short positions. During a rising market, when most equity securities and long-only equity ETFs are increasing in value, the Fund’s short positions will likely cause the Fund to underperform the overall U.S. equity market. When the Fund shorts securities, including securities of another investment company, it borrows shares of that security or investment company, which it then sells. There is no guarantee the Fund will be able to borrow the shares it seeks to short in order to achieve its investment objective. The Fund’s investments are designed to respond to volatility based on a proprietary model developed by the Index Provider which may not be able to accurately predict the future volatility of the 500 largest capitalized equity securities publicly traded in the United States (the "Market"). If the Market is rapidly rising during periods when the Index Provider’s volatility model has predicted significant volatility, the Fund may be underexposed to the Market due to its short position and the Fund would not be expected to gain the full benefit of the rise in the Market. Additionally, in periods of rapidly changing volatility, the Fund may not be appropriately hedged or may not respond as expected to current volatility. The Fund is not actively managed and the Adviser would not sell a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the Index.

Volatility: A statistical measure of the dispersion of returns for a given security or market index. Volatility can either be measured by using the standard deviation or variance between returns from that same security or market index. Commonly, the higher the volatility, the riskier the security.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Any applicable brokerage commissions will reduce returns. Market price returns are based on the bid/ask spread at 4 p.m. ET. and do not represent the returns an investor would receive if shares were traded at other times.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. This and other information are in the prospectus and a summary prospectus, copies of which may be obtained at www.ASYMshares.com or 1-866-ASYM777. Read the prospectus carefully before investing.

Foreside Fund Services, LLC, distributor.

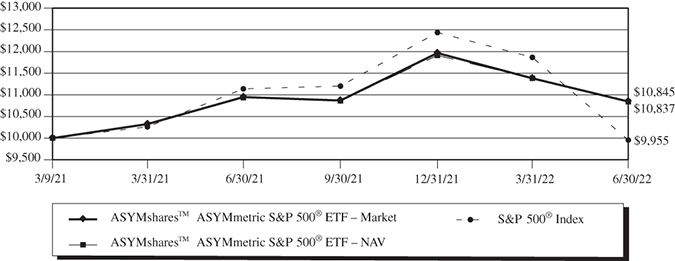

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects operating expenses in effect. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-866-279-6777. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (%) As of June 30, 2022

| | 6 Months | 1 Year | Since Inception(1) |

ASYMsharesTM ASYMmetric S&P 500® ETF – Market | -9.36% | -0.94% | 6.39% |

ASYMsharesTM ASYMmetric S&P 500® ETF – NAV | -9.00% | -0.86% | 6.33% |

S&P 500® Index(2) | -19.96% | -10.62% | -0.34% |

| (1) | March 9, 2021 |

| (2) | The Standard & Poor’s 500® Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

Expense Example (Unaudited)

June 30, 2022

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2022 – June 30, 2022).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values based on actual returns and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (01/01/2022) | (06/30/2022) | (01/01/2022 – 06/30/2022) |

| Actual(2) | $1,000.00 | $ 910.00 | $4.50 |

| Hypothetical (5% annual return before expenses) | $1,000.00 | $1,020.08 | $4.76 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the period since inception of 0.95%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the period since inception. |

| (2) | Based on the actual returns for the six-month period ended June 30, 2022 of -9.00%. |

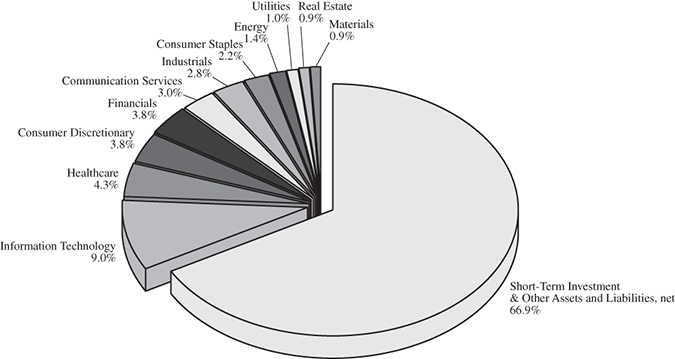

Allocation of Portfolio(1) (% of Net Assets) (Unaudited)

June 30, 2022

Top Ten Holdings(1) (Unaudited)

as of June 30, 2022

(% of Net Assets)

| Duke Energy Corporation | 1.0% |

| Crown Castle International Corp. | 0.9% |

| Newmont Corporation | 0.9% |

| Domino’s Pizza, Inc. | 0.8% |

| Activision Blizzard, Inc. | 0.8% |

| Verizon Communications Inc. | 0.8% |

| AT&T Inc. | 0.8% |

| O’Reilly Automotive, Inc. | 0.8% |

| McDonald’s Corporation | 0.8% |

| Hormel Foods Corporation | 0.8% |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Schedule of Investments (Unaudited)

June 30, 2022

| | | Shares | | | Value | |

| COMMON STOCKS – 33.1% | | | | | | |

| | | | | | | |

| Communication Services – 3.0% | | | | | | |

| Activision Blizzard, Inc. | | | 3,366 | | | $ | 262,077 | |

| AT&T, Inc. | | | 12,312 | | | | 258,060 | |

| Electronic Arts, Inc. | | | 1,893 | | | | 230,283 | |

| Verizon Communications, Inc. | | | 5,110 | | | | 259,333 | |

| | | | | | | | 1,009,753 | |

| Consumer Discretionary – 3.8% | | | | | | | | |

| Domino’s Pizza, Inc. | | | 713 | | | | 277,863 | |

| Hasbro, Inc. | | | 2,888 | | | | 236,469 | |

| McDonald’s Corp. | | | 1,028 | | | | 253,793 | |

| O’Reilly Automotive, Inc. (a) | | | 405 | | | | 255,863 | |

| Yum! Brands, Inc. | | | 2,134 | | | | 242,230 | |

| | | | | | | | 1,266,218 | |

| Consumer Staples – 2.2% | | | | | | | | |

| Clorox Co. | | | 1,773 | | | | 249,958 | |

| Hormel Foods Corp. | | | 5,295 | | | | 250,771 | |

| Kroger Co. | | | 4,864 | | | | 230,213 | |

| | | | | | | | 730,942 | |

| Energy – 1.4% | | | | | | | | |

| Baker Hughes Co. | | | 7,933 | | | | 229,026 | |

| The Williams Companies, Inc. | | | 7,701 | | | | 240,348 | |

| | | | | | | | 469,374 | |

| Financials – 3.8% | | | | | | | | |

| Assurant, Inc. | | | 1,260 | | | | 217,791 | |

| Cboe Global Markets, Inc. | | | 1,984 | | | | 224,569 | |

| MarketAxess Holdings, Inc. | | | 791 | | | | 202,504 | |

| Progressive Corp. | | | 1,828 | | | | 212,541 | |

| Allstate Corp. | | | 1,630 | | | | 206,570 | |

| Travelers Companies, Inc. | | | 1,245 | | | | 210,567 | |

| | | | | | | | 1,274,542 | |

| Health Care – 4.3% | | | | | | | | |

| Becton Dickinson and Co. | | | 958 | | | | 236,176 | |

| Bristol-Myers Squibb Co. | | | 3,241 | | | | 249,557 | |

| Incyte Corp. (a) | | | 3,221 | | | | 244,699 | |

| Merck & Co., Inc. | | | 2,656 | | | | 242,148 | |

| Organon & Co. | | | 6,442 | | | | 217,417 | |

| Quest Diagnostics, Inc. | | | 1,734 | | | | 230,587 | |

| | | | | | | | 1,420,584 | |

See Notes to the Financial Statements

Schedule of Investments (Unaudited) – Continued

June 30, 2022

| | | Shares | | | Value | |

| Industrials – 2.8% | | | | | | |

| Huntington Ingalls Industries, Inc. | | | 1,095 | | | $ | 238,513 | |

| Lockheed Martin Corp. | | | 523 | | | | 224,869 | |

| Northrop Grumman Corp. | | | 493 | | | | 235,935 | |

| Otis Worldwide Corp. | | | 3,101 | | | | 219,148 | |

| | | | | | | | 918,465 | |

| Information Technology – 9.0% | | | | | | | | |

| Automatic Data Processing, Inc. | | | 1,033 | | | | 216,971 | |

| Akamai Technologies, Inc. (a) | | | 2,279 | | | | 208,141 | |

| Broadridge Financial Solutions, Inc. | | | 1,575 | | | | 224,516 | |

| Citrix Systems, Inc. | | | 2,286 | | | | 222,131 | |

| Cognizant Technology Solutions Corp. – Class A | | | 3,083 | | | | 208,072 | |

| F5, Inc. (a) | | | 1,412 | | | | 216,093 | |

| Fiserv, Inc. (a) | | | 2,299 | | | | 204,542 | |

| Intel Corp. | | | 5,185 | | | | 193,971 | |

| International Business Machines Corp. | | | 1,658 | | | | 234,093 | |

| Jack Henry & Associates, Inc. | | | 1,223 | | | | 220,164 | |

| NortonLifeLock, Inc. | | | 9,513 | | | | 208,906 | |

| Oracle Corp. | | | 3,153 | | | | 220,300 | |

| VeriSign, Inc. (a) | | | 1,294 | | | | 216,525 | |

| Zebra Technologies Corp. – Class A (a) | | | 680 | | | | 199,886 | |

| | | | | | | | 2,994,311 | |

| Materials – 0.9% | | | | | | | | |

| Newmont Corp. | | | 4,896 | | | | 292,144 | |

| | | | | | | | | |

| Real Estate – 0.9% | | | | | | | | |

| Crown Castle International Corp. | | | 1,739 | | | | 292,813 | |

| | | | | | | | | |

| Utilities – 1.0% | | | | | | | | |

| Duke Energy Corp. | | | 3,153 | | | | 338,032 | |

| Total Common Stocks | | | | | | | | |

| (Cost $11,758,971) | | | | | | | 11,007,178 | |

See Notes to the Financial Statements

Schedule of Investments (Unaudited) – Continued

June 30, 2022

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENT – 63.0% | | | | | | |

| First American Treasury Obligations Fund, Class X, 1.32%^ | | | | | | |

| (Cost $20,954,214) | | | 20,954,214 | | | $ | 20,954,214 | |

| Total Investments – 96.1% | | | | | | | | |

| (Cost $32,713,185) | | | | | | | 31,961,392 | |

| Other Assets and Liabilities, Net – 3.9% | | | | | | | 1,292,244 | |

| Total Net Assets – 100.0% | | | | | | $ | 33,253,636 | |

| (a) | Non-income producing security. |

| ^ | The rate shown is the annualized seven day effective yield as of June 30, 2022. |

Schedule of Open Futures Contracts (Unaudited)

June 30, 2022

Futures Contracts Sold

| | Number of | | Notional | | Value/Unrealized |

Description | Contracts Sold | Expiration Date | Amount | Fair Value | Appreciation |

| Micro E-Mini S&P 500 Index | 371 | September 2022 | $7,029,523 | $58,896 | $205,463 |

See Notes to the Financial Statements

Statement of Assets and Liabilities (Unaudited)

June 30, 2022

| ASSETS: | | | |

| Investments, at fair value | | | |

| (cost $32,713,185) | | $ | 31,961,392 | |

| Cash | | | 58,899 | |

| Cash held as collateral for futures contracts | | | 1,234,288 | |

| Dividends & interest receivable | | | 24,375 | |

| Total assets | | | 33,278,954 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable to Adviser | | | 25,318 | |

| Total liabilities | | | 25,318 | |

| | | | | |

| NET ASSETS | | $ | 33,253,636 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 34,932,289 | |

| Total accumulated loss | | | (1,678,653 | ) |

| Net Assets | | $ | 33,253,636 | |

| | | | | |

Shares issued and outstanding(1) | | | 1,230,000 | |

| Net asset value, redemption price and offering price per share | | $ | 27.04 | |

| (1) | Unlimited shares authorized. |

See Notes to the Financial Statements

Statement of Operations (Unaudited)

Six Months Ended June 30, 2022

| INVESTMENT INCOME: | | | |

| Dividend and interest income | | $ | 175,450 | |

| Total investment income | | | 175,450 | |

| | | | | |

| EXPENSES: | | | | |

| Advisory fees (See Note 6) | | | 137,869 | |

| Total expenses | | | 137,869 | |

| | | | | |

| NET INVESTMENT INCOME | | | 37,581 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | |

| Net realized loss on investments | | | (1,211,494 | ) |

| Net realized gain on futures contracts | | | 202,946 | |

| Net change in unrealized appreciation/depreciation of investments | | | (1,835,358 | ) |

| Net change in unrealized appreciation/depreciation of futures contracts | | | 217,404 | |

| | | | | |

| Net realized and unrealized loss on investments | | | (2,626,502 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (2,588,921 | ) |

See Notes to the Financial Statements

Statement of Changes in Net Assets

| | | Period from | | | Period from | |

| | | January 1, 2022 | | | March 9, 2021(1) | |

| | | through | | | to | |

| | | June 30, 2022 | | | December 31, 2021 | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 37,581 | | | $ | 44,676 | |

| Net realized gain (loss) on investments | | | (1,211,494 | ) | | | 601,053 | |

| Net realized gain (loss) on futures contracts | | | 202,946 | | | | (57,199 | ) |

| Net change in unrealized appreciation/depreciation of investments | | | (1,835,358 | ) | | | 1,083,565 | |

| Net change in unrealized appreciation/depreciation of futures contracts | | | 217,404 | | | | (11,941 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (2,588,921 | ) | | | 1,660,154 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 39,936,063 | | | | 26,711,100 | |

| Payments for shares redeemed | | | (28,158,954 | ) | | | (4,355,302 | ) |

| Net increase in net assets resulting from capital share transactions | | | 11,777,109 | | | | 22,355,798 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | — | | | | (50,504 | ) |

| | | | | | | | | |

| Total Increase in Net Assets | | | 9,188,188 | | | | 23,965,448 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 24,065,448 | | | | 100,000 | |

| End of period | | $ | 33,253,636 | | | $ | 24,065,448 | |

| | | | | | | | | |

| TRANSACTIONS IN SHARES | | | | | | | | |

| Shares sold | | | 1,410,000 | | | | 960,000 | |

| Shares redeemed | | | (990,000 | ) | | | (154,000 | ) |

| Net increase | | | 420,000 | | | | 806,000 | |

| Shares Outstanding: | | | | | | | | |

| Beginning of period | | | 810,000 | | | | 4,000 | |

| End of period | | | 1,230,000 | | | | 810,000 | |

| (1) | Inception date of the Fund. |

See Notes to the Financial Statements

Financial Highlights

| | | Six Months | | | Period from | |

| | | Ended | | | March 9, 2021(1) | |

| | | June 30, 2022 | | | to | |

| | | (unaudited) | | | December 31, 2021 | |

PER COMMON SHARE DATA:(2) | | | | | | |

| Net asset value, beginning of period | | $ | 29.71 | | | $ | 25.00 | |

| | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | | | | |

| Net investment income | | | 0.03 | | | | 0.06 | |

| Net realized and unrealized gain (loss) on investments | | | (2.70 | ) | | | 4.72 | |

| Total from investment operations | | | (2.67 | ) | | | 4.77 | |

| | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | |

| Net investment income | | | — | | | | (0.06 | ) |

| Net realized gains | | | — | | | | — | |

| Total distributions | | | — | | | | (0.06 | ) |

| | | | | | | | | |

| Net asset value, end of period | | $ | 27.04 | | | $ | 29.71 | |

| | | | | | | | | |

TOTAL RETURN(3) | | | -9.00 | % | | | 19.09 | % |

| | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS | | | | | | | | |

| Net assets, end of period (in 000’s) | | $ | 33,254 | | | $ | 24,065 | |

| | | | | | | | | |

| Ratios to average net assets: | | | | | | | | |

Expenses(4) | | | 0.95 | % | | | 0.95 | % |

Net investment income(4) | | | 0.26 | % | | | 0.55 | % |

| | | | | | | | | |

Portfolio turnover rate(3)(5) | | | 181 | % | | | 41 | % |

| (1) | Inception date of the Fund. |

| (2) | For a Fund share outstanding for the entire period. |

| (3) | Not annualized. |

| (4) | Annualized. |

| (5) | Excludes the impact of in-kind transactions. |

See Notes to the Financial Statements

Notes to the Financial Statements (Unaudited)

June 30, 2022

1. ORGANIZATION

ASYMmetric ETFsTM Trust (the “Trust”) was organized as a Delaware statutory trust on August 7, 2020. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The ASYMsharesTM ASYMmetric S&P® 500 ETF (the “Fund”), is a diversified series with its own investment objectives and policies within the Trust. The Trust has evaluated the structure, objective and activities of the Fund and determined that it meets the characteristics of an investment company. As such, these financial statements have applied the guidance as set forth in the Accounting Standards Codification (“ASC”) 946, Financial Services Investment Companies.

The investment objective of the Fund seeks to track the total return performance, before fees and expenses, of the ASYMmetric 500 Index (the “Index”). The Index is based on proprietary ASYMmetric Risk Management Technology developed and maintained by ASYMmetric Investment Solutions, LLC (the “Index Provider”), an affiliate of ASYMmetric ETFs, LLC, the Fund’s investment adviser (the “Adviser”). The Fund commenced operations on March 9, 2021.

Shares of the Fund are listed and traded on the NYSE Arca, Inc. (the “NYSE”). Market prices for the shares may be different from their net asset value (“NAV”). The Fund issues and redeems shares on a continuous basis at NAV only in blocks of 30,000 shares, called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a specified universe, with cash included to balance to the Creation Unit total. Once created, shares generally trade in the secondary market at market prices that change throughout the day in amounts less than a Creation Unit. Except when aggregated in Creation Units, shares are not redeemable securities of the Fund. Shares of the Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participation Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the shares directly from the Fund. Rather, most retail investors may purchase shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

The Fund currently offers one class of shares, which have no front-end sales load, no deferred sales charge, and no redemption fee. A purchase (i.e. creation) transaction fee is imposed for the transfer and other transaction costs associated with the purchase of Creation Units. The standard fixed creation transaction fee for the Fund is $250, which is payable by the Authorized Participant. In addition, a variable fee may be charged on all cash transactions or substitutes for Creation Units of up to a maximum of three times the fixed transaction fee. Variable fees are imposed to compensate the Fund for the transaction costs associated with the cash transactions. Variable fees received by the Fund is displayed in the capital shares transaction section of the Statement of Changes in Net Assets. The Fund may issue an unlimited number of shares of beneficial interest, with no par value. All shares of the Fund have equal rights and privileges.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Notes to the Financial Statements (Unaudited) – Continued

June 30, 2022

Securities Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes – The Fund intends to meet the requirements of subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income or excise tax provision is required. As of June 30, 2022, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. During the period ended June 30, 2022, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. taxing authorities for the tax periods since the commencement of operations.

Securities Transactions, Income and Distributions – Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on an accrual basis, including amortization of premiums and accretion of discounts. Dividend income and distributions are recorded on the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Distributions received from the Fund’s investments generally are comprised of ordinary income and return of capital. The Fund allocates distributions between investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on information provided by each portfolio company and other industry sources. These estimates may subsequently be revised based on actual allocations received from the portfolio companies after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.

The Fund will make distributions of net investment income, if any, annually. The Fund will also distribute net realized capital gains, if any, annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

Futures Contracts – The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund uses futures contracts and options on futures contracts to gain exposure to, or hedge against, changes in the value of equities. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date. Upon entering into such contracts, the Fund is required to deposit with the broker, either in cash or securities, an initial margin deposit in an amount equal to a certain percentage of the contract amount. In addition, the Fund segregates liquid securities when purchasing or selling futures contracts to comply with Trust policies. Subsequent payments (variation margin) are made or received by the Fund each day, depending on the daily fluctuations in the value of the contract, and are recorded for financial statement purposes as unrealized gains or losses by the Fund. Upon entering into such contracts, the Fund bears the risk of interest or exchange rates or securities prices moving unexpectedly, in which case, the Fund may not achieve the anticipated benefits of the futures contracts and may realize a loss. With futures, there is minimal counterparty

Notes to the Financial Statements (Unaudited) – Continued

June 30, 2022

credit risk to the Fund since futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures, guarantees the futures against default. The use of futures contracts, and options on futures contracts, involves the risk of imperfect correlation in movements in the price of futures contracts and options thereon, interest rates and the underlying hedged assets.

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Share Valuation – The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the NYSE is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s net asset value per share.

Indemnifications – Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust may enter into contracts that provide general indemnification to other parties. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred and may not occur. However, the Trust has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Cash and Cash Equivalents – Cash and cash equivalents include short-term, liquid investments with an original maturity of three months or less and include money market fund accounts.

Illiquid Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Fund. Illiquid securities may be valued under methods approved by the Board of Trustees (the “Board”) as reflecting fair value. The Fund will not hold more than 15% of the value of its net assets in illiquid securities. At June 30, 2022, the Fund did not hold any illiquid securities.

Regulatory Update – In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes requirements for determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 will permit fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted related recordkeeping requirements and is rescinding previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. The Fund will be required to comply with the rules by September 8, 2022. Management is currently assessing the potential impact of the new rules on the Fund’s financial statements.

On October 28, 2020, the SEC adopted a new rule providing a comprehensive approach to the regulation of fund’s use of derivatives (“Rule 18f-4”). Rule 18f-4 requires a fund to adopt and implement a written derivatives risk management program. The program will institute a standardized risk management framework for funds, while

Notes to the Financial Statements (Unaudited) – Continued

June 30, 2022

also permitting principles-based tailoring to the fund's particular derivatives risks. Derivatives risks include leverage, market, counterparty, liquidity, operational, and legal risks. The program must include risk guidelines, stress testing, backtesting, internal reporting and escalation, and program review elements. The Fund will be required to comply with the rule by August 19, 2022. Management is currently assessing the potential impact of the new rules on the Fund's financial statements, if any.

Organizational and Offering Costs – All organization and offering costs for the Fund were covered by the Adviser, ASYMmetric ETFs, LLC.

3. SECURITIES VALUATION

The Fund has adopted fair value accounting standards, which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Quoted prices in active markets for identical assets or liabilities. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1. These inputs may include quoted prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| Level 3 – | Significant unobservable inputs for the asset or liability, representing the Fund’s view of assumptions a market participant would use in valuing the asset or liability. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Common Stock – Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices. Securities traded primarily on the Nasdaq Global Market System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Investment Companies – Investments in other mutual funds, including money market funds, are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Derivative Instruments – Listed derivative, including options, rights, warrants and futures that are actively traded are valued based on quoted prices from the exchange and are categorized in Level 1 of the fair value hierarchy.

Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board. These procedures consider many factors, including the type of security, size of holding, trading volume and news events. There can be no assurance that the Fund

Notes to the Financial Statements (Unaudited) – Continued

June 30, 2022

could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the Fund determines their net asset values per share. The Board of Trustees has established a Valuation Committee to administer, implement, and oversee the fair valuation process, and to make fair value decisions when necessary. The Board regularly reviews reports that describe any fair value determinations and methods.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following table is a summary of the inputs used to value the Fund’s securities by level within the fair value hierarchy as of June 30, 2022:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common stock | | $ | 11,007,178 | | | $ | — | | | $ | — | | | $ | 11,007,178 | |

| Short-term investment | | | 20,954,214 | | | | — | | | | — | | | | 20,954,214 | |

| Total investments in securities | | $ | 31,961,392 | | | $ | — | | | $ | — | | | $ | 31,961,392 | |

As of June 30, 2022, the Fund’s investments in other financial instruments* were classified as follows:

| Short Futures Contracts | | $ | 205,463 | | | $ | — | | | $ | — | | | $ | 205,463 | |

| Total investments in securities | | $ | 205,463 | | | $ | — | | | $ | — | | | $ | 205,463 | |

| * | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures contracts. Futures are presented at the unrealized appreciation (depreciation) on the instruments. |

Refer to the Fund’s Schedule of Investments for additional industry information.

4. DERIVATIVES TRANSACTIONS

The Fund may use derivatives for different purposes, such as a substitute for taking a position in the underlying asset and/or as part of a strategy designed to reduce exposure to other risks, such as equity, interest rate or currency risk. The various derivative instruments that the Fund may use are options, futures contracts and options on futures contracts and other derivative securities. The Fund may also use derivatives for leverage, in which case their use would involve leveraging risk. A Fund investing in a derivative instrument could lose more than the principal amount invested.

Accounting Standards Codification 815, Derivatives and Hedging (“ASC 815”) requires enhanced disclosures about the Fund’s use of, and accounting for, derivative instruments and the effect of derivative instruments on the Fund’s results of operations and financial position. Tabular disclosure regarding derivative fair value and gain/loss by contract type (e.g., interest rate contracts, foreign exchange contracts, credit contracts, etc.) is required and derivatives accounted for as hedging instruments under ASC 815 must be disclosed separately from those that do not qualify for hedge accounting. Even though the Fund may use derivatives in an attempt to achieve an economic hedge, the Fund’s derivatives are not accounted for as hedging instruments under ASC 815 because investment companies account for their derivatives at fair value and record any changes in fair value in current period earnings.

For the period ended June 30, 2022, the Fund’s average quarterly notional values are as follows:

| Fund | Short Futures Contracts | |

ASYMsharesTM ASYMmetric S&P® 500 ETF | $3,518,417 | |

Notes to the Financial Statements (Unaudited) – Continued

June 30, 2022

The locations on the Statement of Assets and Liabilities of the Fund’s derivative positions by type of exposure, all of which are not accounted for as hedging instruments under ASC 815, are as follows:

Values of Derivative Instruments as of June 30, 2022, on the Statement of Assets and Liabilities:

| | Assets | | Liabilities |

| Derivatives not accounted for as | | | | | |

| hedging instruments under ASC 815 | Location | Fair Value | | Location | Fair Value |

| | Net Assets – | | | Net Assets – | |

| | unrealized appreciation | | | unrealized depreciation | |

| Equity Contracts – Futures | on futures contracts** | $205,463 | | on futures contracts** | $ — |

| ** | Includes cumulative appreciation/depreciation on futures contracts as reported in the Schedule of Open Futures Contracts. Cash held as collateral for futures contracts on the Statement of Assets and Liabilities includes the daily change in variation margin as of June 30, 2022. |

The effect of Derivative Instruments on the Statement of Operations for the period ended June 30, 2022:

| Amount of Realized Gain (Loss) on Derivatives | |

| | | |

| Derivatives not accounted for as | | |

| hedging instruments under ASC 815 | Futures Contracts | |

| Equity Contracts | $202,946 | |

| | |

| Change in Unrealized Appreciation or (Depreciation) on Derivatives | |

| | | |

| Derivatives not accounted for as | | |

| hedging instruments under ASC 815 | Futures Contracts | |

| Equity Contracts | $217,404 | |

Balance Sheet Offsetting Information

The following table provides a summary of offsetting financial liabilities and derivatives and the effect of derivative instruments on the Statement of Assets and Liabilities as of June 30, 2022.

| | | | | | Gross | | | Net Amounts | | | Gross Amounts not offset in Statement of Assets and Liabilities | | | | |

| | | | | | Amounts | | | of Assets | | | | | | |

| | | | | | Offset in | | | Presented in | | | | | | |

| | | Gross | | | Statement | | | Statement | | | | | | Cash | | | | |

| | | Amounts | | | of Assets | | | of Assets | | | Financial | | | Collateral | | | Net | |

| | | Recognized | | | and Liabilities | | | and Liabilities | | | Instruments | | | Pledged | | | Amount | |

| Assets: | | | | | | | | | | | | | | | | | | |

| Equity Contracts | | | | | | | | | | | | | | | | | | |

| (Futures Contracts – | | | | | | | | | | | | | | | | | | |

| Phillips Capital) | | $ | 205,463 | | | $ | — | | | $ | 205,463 | | | $ | — | | | $ | 205,463 | | | $ | — | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity Contracts | | | | | | | | | | | | | | | | | | | | | | | | |

| (Futures Contracts – | | | | | | | | | | | | | | | | | | | | | | | | |

| Phillips Capital) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Notes to the Financial Statements (Unaudited) – Continued

June 30, 2022

During the ordinary course of business, the Fund may enter into transactions subject to enforceable netting agreements or other similar arrangements (“netting agreements”). Generally, the right to offset in netting agreements allows the Fund to offset any exposure to a specific counterparty with any collateral received or delivered to that counterparty based on the terms of the agreement. Generally, the fund manages its cash collateral and securities collateral on a counterparty basis. As of June 30, 2022, the Fund did not enter into any netting agreements which would require any portfolio securities to be netted.

5. GENERAL RISK

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively impact the Fund’s performance.

6. INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to an Investment Advisory Agreement (“Advisory Agreement”) between the Trust, on behalf of the Fund, and the Adviser, the Adviser provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the direction and control of the Board and the officers of the Trust. Under the Advisory Agreement, the Adviser agrees to pay all expenses of the Trust, except for (i) the fee payment under this Advisory Agreement, (ii) payments under the Fund’s 12b-1 plan, (iii) brokerage expenses, (iv) acquired fund fees and expenses, (v) taxes, (vi) interest (including borrowing costs and dividend expenses on securities sold short), and (vii) litigation expenses and other extraordinary expenses (including litigation to which the Trust or the Fund may be a party and indemnification of the Trustees and officers with respect thereto). For services provided to the Fund, the Fund pays the Adviser 0.95% at an annual rate based on the Fund’s average daily net assets.

The Adviser has engaged Toroso Investments, LLC (the “Sub-Adviser”) as the Sub-Adviser to the Fund. Subject to the supervision of the Adviser, the Sub-Adviser is primarily responsible for the day-to-day management of the Fund’s portfolio, including purchase, retention and sale of securities. Fees associated with these services are paid to the Sub-Adviser by the Adviser.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or the “Administrator”) acts as the Fund’s Administrator, Transfer Agent and Fund Accountant. U.S. Bank, N.A. (the “Custodian”) serves as the custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees and monitors the activities of the Fund’s custodian, transfer agent and accountants. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees associated with these services are paid by the Adviser. Foreside serves as the Fund’s distributor pursuant to a distribution agreement.

The Fund has adopted a Distribution and Service (12b-1) Plan (the “Plan”), pursuant to which payments of up to 0.25% of the average daily net assets may be made by the Fund. The Board of Trustees has not currently approved the commencement of any payments under the Plan.

A Trustee and certain officers of the Trust are also employees/officers of the Adviser and/or the Administrator.

Notes to the Financial Statements (Unaudited) – Continued

June 30, 2022

7. INVESTMENT TRANSACTIONS

The aggregate purchases and sales, excluding U.S. government securities, short-term investments and in-kind transactions, by the Fund for the period ended June 30, 2022, were as follows:

| | Purchases | Sales | |

ASYMsharesTM ASYMmetric S&P 500® ETF | $37,026,753 | $48,573,416 | |

During the period ended June 30, 2022, in-kind transactions associated with creation and redemptions were as follows:

| | Purchases | Sales | |

ASYMsharesTM ASYMmetric S&P 500® ETF | $28,597,055 | $26,974,368 | |

During the period ended June 30, 2022, net capital gains resulting from in-kind redemptions were as follows:

ASYMsharesTM ASYMmetric S&P 500® ETF | $2,320,527 | |

8. TAX INFORMATION

As of December 31, 2021, the Fund’s most recently completed fiscal year end, cost of investments and distributable earnings on a tax basis were as follows:

| Cost of Investments | | $ | 23,087,561 | |

| Gross tax unrealized appreciation | | $ | 1,505,688 | |

| Gross tax unrealized depreciation | | | (523,084 | ) |

| Net unrealized appreciation | | | 982,604 | |

| Undistributed ordinary income | | | — | |

| Undistributed long-term capital gain | | | — | |

| Other accumulated loss | | | (72,336 | ) |

| Distributable earnings | | $ | 910,268 | |

The basis of investments for tax and financial reporting purposes differs principally due to the deferral of losses on wash sales and C-corporation basis adjustments.

There were no distributions paid during the period ended June 30, 2022.

The tax character of distributions paid during the period ended December 31, 2021 were as follows:

| | | 2021 | | |

| Ordinary Income | | $ | 50,504 | | |

| Long-Term Capital Gain | | | — | | |

| Return of Capital | | | — | | |

The Fund intends to utilize provisions of the federal income tax laws which allow it to carry a realized capital loss forward and offset such losses against any future realized capital gains. At December 31, 2021, the Fund did not have any capital loss carryovers. A regulated investment company may elect for any taxable year to treat any

Notes to the Financial Statements (Unaudited) – Continued

June 30, 2022

portion of any qualified late year loss arising on the first day of the next taxable year. Qualified late year losses are certain capital losses which occur during the portion of the Fund’s taxable year subsequent to October 31. The Fund plans to defer $72,336 in post-October losses and does not plan to defer any late year losses.

9. SUBSEQUENT EVENTS

Management has performed an evaluation of subsequent events through the date the financial statements were issued and has determined that no additional items require recognition or disclosure.

Liquidity Risk Management Program (Unaudited)

Consistent with Rule 22e-4 under the 1940 Act, the Fund has established a liquidity risk management program to govern its approach to managing liquidity risk (the “Program”). The Fund’s Board of Trustees has approved the designation of the Fund’s investment adviser ASYMmetric ETFs, LLC, as the program administrator (the “Program Administrator”). The Program Administrator is responsible for implementing and monitoring the Program, and the Program’s principal objectives include assessing, managing and periodically reviewing the Fund’s liquidity risk, based on factors specific to the circumstances of the Fund. At a meeting of the Fund’s Board of Trustees held on June 3, 2022, the Trustees received a report from the Program Administrator addressing the operation of the Program and assessing its adequacy and effectiveness of implementation. The Program Administrator determined, and reported to the Board, that the Program is reasonably designed to assess and manage the Fund’s liquidity risk and has operated adequately and effectively to manage the Fund’s liquidity risk since the Program was approved in January 2021. The Program Administrator reported that during the period covered by the report, there were no liquidity events that impacted the Fund or its ability to timely meet redemptions without dilution to existing shareholders. There can be no assurance that the Program will achieve its objective in the future.

Please refer to the prospectus for more information regarding the Fund’s exposure to liquidity risk and other principal risks to which an investment in the Fund may be subject.

Additional Information (Unaudited)

June 30, 2022

AVAILABILITY OF FUND PORTFOLIO INFORMATION

The Fund files complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form N-PORT. The Fund’s Part F of Form N-PORT is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-732-0330. The Fund’s Part F of Form N-PORT may also be obtained by calling toll-free 1-866-ASYM777 or 1-866-279-6777.

AVAILABILITY OF PROXY VOTING INFORMATION

A description of the Fund’s Proxy Voting Policies and Procedures is available without charge, upon request, by calling 1-866-ASYM777 or 1-866-279-6777. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month period ended December 31, is available (1) without charge, upon request, by calling 1-866-ASYM777 or 1-866-279-6777, or (2) on the SEC’s website at www.sec.gov.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

Information regarding how often shares of the Fund trades on the Exchange at a price about (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund is available, free of charge, on the Fund’s website at asymshares.com.

Privacy Notice (Unaudited)

The Fund collects only relevant information about you that the law allows or requires us to have in order to conduct our business and properly service you. The Fund collects financial and personal information about you (“Personal Information”) directly (e.g., information on account applications and other forms, such as your name, address, and social security number, and information provided to access account information or conduct account transactions online, such as password, account number, e-mail address, and alternate telephone number), and indirectly (e.g., information about your transactions with us, such as transaction amounts, account balance and account holdings).

The Fund does not disclose any non-public personal information about its shareholders or former shareholders other than for everyday business purposes such as to process a transaction, service an account, to respond to court orders and legal investigations or as otherwise permitted by law. Third parties that may receive this information include companies that provide transfer agency, technology and administrative services to the Fund, as well as the Fund’s investment adviser who is an affiliate of the Fund. If you maintain a retirement/educational custodial account directly with the Fund, we may also disclose your Personal Information to the custodian for that account for shareholder servicing purposes. We limit access to your Personal Information provided to unaffiliated third parties to information necessary to carry out their assigned responsibilities to the Fund. All shareholder records will be disposed of in accordance with applicable law. The Trust maintains physical, electronic and procedural safeguards to protect Personal Information and requires its third parties service provides with access to such information to treat the Personal Information with the same high degree of confidentiality.

In the event that you hold shares of a Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank, credit union or trust company, the privacy policy of the your financial intermediary would govern how their non-public personal information would be shared with unaffiliated third parties.

With respect to the Fund, issues and redemptions of their shares at net asset value (“NAV”) occur only in large aggregations of a specified number of shares (e.g., 30,000) called “Creation Units.” Only Authorized Participants (“APs”) may acquire shares directly from an ETF, and only APs may tender their ETF shares for redemption directly to the ETF, at NAV. APs must be (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the NSCC, a clearing agency that is registered with the SEC; or (ii) a DTC participant. In addition, each AP must execute a Participant Agreement that has been agreed to by the Fund’s distributor, and that has been accepted by the Fund’s transfer agent, with respect to purchases and redemptions of Creation Units.

Because of this structure, the Fund does not have any information regarding any “consumers” as defined in Rule 3 of Regulation S-P with respect to any ETFs, and consequently are not required by Regulation S-P to deliver a notice of the Fund’s privacy policy to any ETF shareholders.

CONTACTS

BOARD OF TRUSTEES

Darren Schuringa

Vivienne Hsu

Winston Lowe

Suzanne Siracuse

William Thomas

INVESTMENT ADVISER

ASYMmetric ETFs, LLC

158 East 126th Street, Suite 304

New York, NY 10035

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

TRANSFER AGENT, FUND ACCOUNTANT

AND FUND ADMINISTRATOR

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, ME 04101

CUSTODIAN

U.S. Bank, N.A.

1555 North Rivercenter Drive

Milwaukee, WI 53212

FUND COUNSEL

K&L Gates LLP

599 Lexington Avenue

New York, NY

866-ASYM777

(866-279-6777)

This report must be accompanied or preceded by a prospectus.

The Fund’s Statement of Additional Information contains additional information about the Fund’s

trustees and is available without charge upon request by calling 1-866-ASYM777 or 1-866-279-6777.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustee.

Item 11. Controls and Procedures.

(a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

(b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 13. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not applicable for semi-annual reports. |

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) ASYMmetric ETFs Trust

By (Signature and Title)* /s/Darren Schuringa

Darren Schuringa, President

Date September 2, 2022

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/Darren Schuringa

Darren Schuringa, President

Date September 2, 2022

By (Signature and Title)* /s/Aaron Berson

Aaron Berson, Treasurer

Date September 6, 2022

* Print the name and title of each signing officer under his or her signature.