As filed with the Securities and Exchange Commission on April 11, 2022

Registration No. 333-262100

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

to

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GOLD ROYALTY CORP.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | | 1040 | | 98-1578275 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

1030 West Georgia Street, Suite 1830

Vancouver, BC V6E 2Y3

(604) 396-3066

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Ave., Suite 204

Newark, DE 19711

(302) 738-6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Rod Talaifar, Esq. Sangra Moller LLP 1000 Cathedral Place 925 West Georgia Street Vancouver, BC, Canada V6C 3L2 Tel: +1 604 662-8808 | | Rick A. Werner, Esq. Jason K. Zachary, Esq. Haynes and Boone, LLP 30 Rockefeller Plaza 26th Floor New York, NY 10112 Tel: +1 212 659-7300 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practical after the effective date of this registration statement and completion of the transactions described in the enclosed prospectus/offer to exchange.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☒

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus/offer to exchange may be changed. Gold Royalty may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus/offer to exchange is not an offer to sell these securities and Gold Royalty is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale of these securities is not permitted.

This document does not constitute an offer to buy or the solicitation of an offer to sell in Canada or to or from any person or company in Canada. The offer to persons or companies in Canada is being made pursuant to an offer and accompanying take-over bid circular that was sent to such persons and companies on January 11, 2022, as supplemented by a notice of change of terms of offer to purchase dated January 21, 2022 and a second notice of variation and change of terms of offer to purchase dated April 11, 2022, all in accordance with applicable Canadian securities laws.

The information contained in this prospectus/offer to exchange may be changed. A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus/offer to exchange is not an offer to sell these securities, and no person is soliciting an offer to buy these securities, nor shall there be any sale of these securities, in any jurisdiction where such offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No securities tendered to the Offer (as defined below) will be taken up until (a) more than 50% of the outstanding securities of the class sought (excluding those securities beneficially owned, or over which control or direction is exercised by the Offeror (as defined below) or its affiliates or any person acting jointly or in concert with the Offeror) have been tendered to the Offer, (b) the minimum deposit period under applicable securities laws has elapsed, and (c) any and all other conditions of the Offer have been complied with or waived, as applicable. If these criteria are met, the Offeror will take up securities deposited under the Offer in accordance with applicable securities laws and extend the Offer for an additional minimum period of 10 days to allow for further deposits of securities.

Shareholders (as defined below) in the United States should read the “Notice to United States Shareholders and Other Shareholders Outside Canada” on page (ii) of this prospectus/offer to exchange.

This document is important and requires your immediate attention. If you are in doubt as to how to deal with it, you should consult your investment dealer, broker, bank manager, accountant, lawyer or other professional advisor. If you have any questions or require assistance in connection with the Offer, please contact Laurel Hill Advisory Group, the information agent and depositary in connection with the Offer, by telephone at 1-877-452-7184 (North American Toll-Free Number) or 1-416-304-0211 (outside North America) or by email at assistance@laurelhill.com.

This prospectus/offer to exchange amends and supersedes information included in the prospectus/offer to exchange filed with the U.S. Securities and Exchange Commission on January 11, 2022.

The Offer has not been approved or disapproved by any securities regulatory authority nor has any securities regulatory authority passed upon the fairness or merits of the Offer, the securities offered pursuant to the Offer, or upon the adequacy of the information contained in this document. Any representation to the contrary is unlawful.

This document does not constitute an offer or a solicitation to any person in any jurisdiction in which any such offer or solicitation is unlawful. The Offer is not being made to, nor will deposits be accepted from, or on behalf of, Shareholders (as defined herein) in any jurisdiction in which the making or acceptance thereof would not be in compliance with the Laws (as defined herein) of such jurisdiction. However, the Offeror may, in its sole discretion, take such action as it may deem necessary to extend the Offer to Shareholders in any such jurisdiction.

This prospectus/offer to exchange does not constitute a solicitation of proxies for any meeting of shareholders of Elemental (as defined below). We are not asking you for a proxy and you are requested not to send to us a proxy. Any solicitation of proxies that the Offeror or Elemental might make will be made only pursuant to separate proxy solicitation materials complying with the requirements of applicable Canadian securities laws.

SUBJECT TO COMPLETION, DATED APRIL 11, 2022

GOLD ROYALTY CORP.

OFFER TO PURCHASE

all of the outstanding common shares of

ELEMENTAL ROYALTIES CORP.

on the basis of 0.27 of a common share of Gold Royalty Corp. for each common

share of Elemental Royalties Corp.

Gold Royalty Corp. (“Gold Royalty” or the “Offeror”) hereby offers to purchase (the “Offer”), on and subject to the terms and conditions of the Offer described herein, all of the outstanding common shares (the “Elemental Shares”) of Elemental Royalties Corp. (“Elemental”), together with the associated rights (the “SRP Rights”) issued under the Shareholder Rights Plan (as defined herein), other than any Elemental Shares held directly or indirectly by the Offeror or its affiliates, and which includes any Elemental Shares that may become issued and outstanding after the date of the Offer but before the Expiry Time (as defined herein) upon the exercise, exchange or conversion of any Convertible Securities (as defined herein).

The Offer will be open for acceptance until 5:00 p.m. (Toronto time) on April 27, 2022 unless the Offer is extended, accelerated, or withdrawn (the “Expiry Time”).

The Offer Consideration

Under the Offer, each holder of Elemental Shares (each, a “Shareholder” and collectively, the “Shareholders”) is entitled to receive 0.27 of a common share, without par value, in the capital of Gold Royalty (each whole common share, a “Gold Royalty Share”) in respect of each Elemental Share (the “Offer Consideration”).

A Shareholder depositing Elemental Shares will be deemed to have deposited all SRP Rights associated with such Elemental Shares. No additional payment will be made for the SRP Rights, and no part of the consideration to be paid by the Offeror will be allocated to the SRP Rights. See Section 1 of the Offer to Purchase, “The Offer”.

The Gold Royalty Shares are listed on the NYSE American LLC (“NYSE American”) under the symbol “GROY”. The Offeror has applied to the NYSE American to list the Gold Royalty Shares offered hereunder on the NYSE American. Listing of the Gold Royalty Shares offered hereunder will be subject to the Offeror fulfilling all of the applicable listing requirements of the NYSE American. The Elemental Shares are listed on the TSX Venture Exchange (the “TSX-V”) under the symbol “ELE” and are posted for trading on the OTCQX under the symbol “ELEMF”.

The Offer Premium

On December 17, 2021, the last trading day prior to the Offeror’s announcement of its intention to make an offer, the closing price of the Elemental Shares on the TSX-V was C$1.30, and the closing price of the Gold Royalty Shares on the NYSE American was US$5.15. Based upon such closing prices, the Offer Consideration has a value of approximately C$1.78 per Elemental Share, representing a premium of approximately 37% as of the close of trading on December 17, 2021. For the purposes of the Offer to Purchase, the Canadian dollar value of the Offer Consideration has been calculated using the daily exchange rate published by the Bank of Canada on December 17, 2021, being C$1.2846 per United States dollar, rounded to two decimal places. The closing price of the Gold Royalty Shares on April 8, 2022 was US$3.99 on the NYSE American.

Conditions

The Offer is subject to certain conditions which are described under Section 4 of the Offer to Purchase, “Conditions of the Offer”, including, without limitation: (i) there having been validly deposited pursuant to the Offer and not withdrawn at the Expiry Time that number of Elemental Shares, together with the associated SRP Rights, which constitutes more than 50% of the Elemental Shares outstanding, excluding those Elemental Shares beneficially owned, or over which control or direction is exercised, by the Offeror or by any persons acting jointly or in concert with the Offeror, if any (which condition cannot be waived by the Offeror); (ii) there having been validly deposited under the Offer and not withdrawn, at or prior to the Expiry Time, such number of Elemental Shares, together with the associated SRP Rights, that, together with the Elemental Shares held by the Offeror and its affiliates represents not less than 66 2/3% of the total number of outstanding Elemental Shares, calculated on a fully diluted basis; (iii) the Offeror having determined, in its reasonable judgment, that there does not exist and there shall not have occurred or been publicly disclosed since the date of the Offer, a Material Adverse Effect (as defined herein); and (iv) certain governmental and regulatory approvals having been obtained and/or waiting periods expired, as more particularly described herein. These and the other conditions of the Offer, which other conditions may be waived by the Offeror, are described under Section 4 of the Offer to Purchase, “Conditions of the Offer”. Subject to applicable Law, the Offeror reserves the right to withdraw the Offer and to not take up and pay for any Elemental Shares deposited under the Offer unless each of the conditions of the Offer is satisfied or waived, as applicable, by the Offeror at or before the Expiry Time. The Offer is not subject to the approval of the Offeror’s shareholders and is not subject to any financing or due diligence conditions.

For a discussion of risks and uncertainties to consider in assessing the Offer, see “Risk Factors Related to the Offer” in Section 21 of the Offer to Purchase and the risks described in the Annual Report on Form 20-F that is included in this Offer to Purchase and attached hereto as Schedule I to this Offer to Purchase.

Acceptance of the Offer

Registered Shareholders who wish to accept the Offer must properly complete and execute the accompanying letter of transmittal (the “Letter of Transmittal”) (printed on YELLOW paper) and deposit it, together with certificates or Direct Registration System (“DRS”) Advices representing their Elemental Shares and all other required documents, with the Depositary (as defined herein), at its office set out in the Letter of Transmittal in accordance with the instructions in the Letter of Transmittal. Alternatively, Shareholders may accept the Offer by: (a) following the procedures for book-entry transfer of Elemental Shares described under “Manner of Acceptance – Acceptance by Book-Entry Transfer” in Section 3 of the Offer to Purchase, if they are non-registered Shareholders; or (b) following the procedures for guaranteed delivery described under “Procedure for Guaranteed Delivery” in Section 16 of the Offer to Purchase, “Manner of Acceptance”, using the accompanying notice of guaranteed delivery (the “Notice of Guaranteed Delivery”) (printed on PINK paper) or CDS Online Letter of Guarantee (LOG) Option, if they are non-registered Shareholders. Shareholders will not be required to pay any fee or commission if they accept the Offer by depositing their Elemental Shares directly with the Depositary to accept the Offer. However, an investment advisor, stockbroker, bank, trust company or other nominee through whom a Shareholder owns Elemental Shares may charge a fee to tender any such Elemental Shares on behalf of the Shareholder. Shareholders should consult such nominee to determine whether any charges will apply.

Shareholders whose Elemental Shares are registered in the name of an investment advisor, broker, dealer, bank, trust company or other nominee should immediately contact that nominee for assistance if they wish to accept the Offer in order to take the necessary steps to be able to deposit such Elemental Shares under the Offer. Intermediaries likely have established tendering cut-off times that are prior to the Expiry Time. Shareholders must instruct their brokers or other intermediaries promptly if they wish to tender.

The Offeror has engaged Laurel Hill Advisory Group to act as the information agent (the “Information Agent”) and as depositary (the “Depositary”) for the Offer. CIBC World Markets Inc. has been engaged to act as financial advisor to the Offeror.

Questions and requests for assistance may be directed to the Information Agent, whose contact details are provided on the back page of this document. Additional copies of the Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery may be obtained without charge on request from the Information Agent at the address shown on the back page of this document and are accessible on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. These website addresses are provided for informational purposes only and no information contained on, or accessible from, such websites is incorporated by reference herein unless expressly incorporated by reference.

Shareholders with questions may contact the Offeror’s Information Agent and Depositary:

Laurel Hill Advisory Group

North American Toll-Free Phone: 1-877-452-7184

Outside of North America: 1-416-304-0211

E-mail: assistance@laurelhill.com

Shareholders should be aware that, during the period of the Offer, the Offeror or its affiliates, directly or indirectly, may bid for or make purchases of the securities to be distributed or to be exchanged, or certain related securities, as permitted by applicable Laws or regulations of Canada or its provinces or territories.

The information contained in this document speaks only as of the date of this document. The Offeror does not undertake to update any such information except as required by applicable Law. Information in the Offer to Purchase related to Elemental has been compiled from public sources. See “Certain Information Concerning Elemental and the Elemental Shares” in Section 24 of the Offer to Purchase.

No broker, dealer, salesperson or other person has been authorized to give any information or make any representation other than those contained in this document, and, if given or made, such information or representation must not be relied upon as having been authorized by the Offeror, the Depositary or the Information Agent.

One director of the Offeror, Warren Gilman resides outside of Canada. Each has appointed the Offeror as agent for service of process at 1030 West Georgia Street, Suite 1830, Vancouver, British Columbia V6E 2Y3. Shareholders are advised that it may not be possible for Shareholders to enforce judgments obtained in Canada against any person that resides outside of Canada, even if the party has appointed an agent for service of process.

The information contained in this document speaks only as of the date of this document. The Offeror does not undertake to update any such information except as required by applicable Law. Information in the Offer to Purchase related to Elemental has been compiled from public sources. See “Certain Information Concerning Elemental and the Elemental Shares” in Section 24 of the Offer to Purchase.

No broker, dealer, salesperson or other person has been authorized to give any information or make any representation other than those contained in this document, and, if given or made, such information or representation must not be relied upon as having been authorized by the Offeror, the Depositary or the Information Agent.

NOTICE TO UNITED STATES SHAREHOLDERS AND OTHER SHAREHOLDERS OUTSIDE CANADA

The Offeror has filed with the SEC a Registration Statement on Form F–4, as amended by this Amendment No. 1 (the “Registration Statement”), under the U.S. Securities Act of 1933, as amended (together with the rules and regulations promulgated thereunder, the “U.S. Securities Act”), which contains a prospectus relating to the Offer. SHAREHOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ SUCH DOCUMENTS, ALL DOCUMENTS INCLUDED HEREIN, INCLUDING THE ATTACHED SCHEDULES, AND ALL OTHER APPLICABLE DOCUMENTS WHEN THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO ANY SUCH DOCUMENTS, BECAUSE EACH CONTAINS OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE OFFEROR, ELEMENTAL AND THE OFFER. Materials filed with the United States Securities and Exchange Commission (the “SEC”) are available electronically without charge at the SEC’s website, www.sec.gov. All such materials may also be obtained without charge at the Offeror’s website, www.goldroyalty.com or by directing a written or oral request to the Information Agent and Depositary for the Offer, Laurel Hill Advisory Group, at 1-877-452-7184 toll free in North America, 1-416-304-0211 outside North America, or by e-mail at assistance@laurelhill.com, or to Chief Financial Officer of the Offeror at 1830-1030 West Georgia Street, Vancouver, British Columbia, telephone 604-396-3066.

The enforcement by Shareholders of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that each of the Offeror and Elemental is formed under the laws of a non-U.S. jurisdiction, that some or all of their respective officers and directors may reside outside of the United States, that some or all of the experts named herein may reside outside of the United States and that all or a substantial portion of the assets of the Offeror, Elemental and such other persons may be located outside the United States. Shareholders resident in the United States (“U.S. Shareholders”) may not be able to sue the Offeror, Elemental or their respective officers or directors in a non-U.S. court for violation of United States federal securities laws. It may be difficult to compel such parties to subject themselves to the jurisdiction of a court in the United States or to enforce a judgment obtained from a court of the United States.

THE OFFER CONSIDERATION HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER SECURITIES REGULATORY AUTHORITY, NOR HAS THE SEC OR ANY OTHER SUCH AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THE OFFER TO PURCHASE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Offer is being made for the securities of a Canadian company that does not have securities registered under Section 12 of the U.S. Securities Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “U.S. Exchange Act”). Accordingly, the Offer is not subject to Section 14(d) of the U.S. Exchange Act, or Regulation 14D promulgated by the SEC thereunder, except for any requirements thereunder applicable to exchange offers commenced before the effectiveness of the related registration statement. The Offer is being conducted in accordance with Section 14(e) of the U.S. Exchange Act and Regulation 14E as applicable to tender offers conducted under the Tier II “cross-border tender offer rules” adopted by the SEC. The Tier II exemption provides limited relief under Section 14(e) and Regulation 14E. The Offer is made in the United States with respect to a Canadian foreign private issuer also in accordance with Canadian provincial and federal corporate and take-over bid rules. Shareholders resident in the United States (“U.S. Shareholders”) should be aware that such requirements are different from those of the United States applicable to prospectuses and circulars for tender offers of United States domestic issuers registered under the U.S. Securities Act.

In accordance with applicable law, rules and regulations of the United States, Canada or its provinces or territories, including Rule 14e-5 under the U.S. Exchange Act, the Offeror or its affiliates and any advisor, broker or other person acting as agent for, or on behalf of, or in concert with the Offeror or its affiliates, directly or indirectly, may bid for, make purchases of, or make arrangements to, purchase Elemental Shares or certain related securities outside the Offer, including purchases in the open market at prevailing prices or in private transactions at negotiated prices. Such bids, purchases or arrangements to purchase cannot be made in the United States but may be made during the period of the Offer and through the expiration of the Offer. Any such purchases must comply with applicable Canadian laws, rules and regulations. To the extent information about such purchases or arrangements to purchase is made public in Canada, such information will be disclosed by means of a press release or other means reasonably calculated to inform U.S. Shareholders of such information.

Annual financial statements included herein have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board, and interim financial statements have been prepared in accordance with IFRS as applicable to the preparation of interim financial statements including International Accounting Standard 34, Interim Financial Reporting, and thus may not be comparable to financial statements of U.S. companies.

U.S. Shareholders should be aware that the disposition of their Elemental Shares, including the associated SRP Rights, and the acquisition of Gold Royalty Shares by them as described herein may have tax consequences both in the United States and in Canada. Shareholders should be aware that owning Gold Royalty Shares may subject them to tax consequences both in the United States and in Canada. Such consequences for Shareholders who are resident in, or citizens of the United States, may not be described fully herein and such Shareholders are encouraged to consult their tax advisors. See Section 36 of the Offer to Purchase, “Certain Canadian Federal Income Tax Considerations” and Section 37 of the Offer to Purchase, “Certain United States Federal Income Tax Considerations”.

This document does not generally address the income tax consequences of the Offer to Shareholders in any jurisdiction outside Canada or the United States. Shareholders in a jurisdiction outside Canada or the United States should be aware that the disposition of Elemental Shares, including the associated SRP Rights, may have tax consequences which may not be described herein. Accordingly, Shareholders outside Canada and the United States should consult their own tax advisors with respect to tax considerations applicable to them.

The Offer does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such offer or solicitation is unlawful.

CAUTIONARY NOTE REGARDING MINERAL RESERVES AND MINERAL RESOURCES

Gold Royalty is subject to the reporting requirements of the applicable Canadian and United States securities Laws. Gold Royalty’s previous filings under the applicable Canadian and United States securities Laws, including the Annual Report on Form 20-F for the year ended September 30, 2021, contain disclosure of mineral reserve and mineral resource estimates relating to the projects underlying Gold Royalty’s interests prepared in accordance with the requirements of Canadian securities Laws, which differ in many respects from the requirements of United States securities Laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” contained in such previous filings were based upon definitions applicable in Canada in accordance with Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43- 101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves (the “CIM Definition Standards”), adopted by the CIM Council, as amended. In addition, certain of the operators of the properties underlying the Offeror’s interests prepare mineral reserve and mineral resource estimates in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (“JORC”), which differs from NI 43-101 and the requirements of the SEC, and certain previous filings by Gold Royalty contain disclosure of mineral reserve and mineral resource estimates in accordance with JORC.

The SEC adopted amendments to its disclosure rules (the “SEC Modernization Rules”) to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Exchange Act, which are codified in Regulation S-K subpart 1300. Gold Royalty is required, to the extent it has access to the necessary information, to provide disclosure on its mineral properties under the SEC Modernization Rules in this Registration Statement.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to the corresponding CIM Definition Standards.

U.S. Shareholders are cautioned that while terms are substantially similar to CIM Definition Standards, there are differences in the definitions and standards under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Offeror may have previously reported as “proven reserves”, “probable reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 will be the same as the reserve or resource estimates prepared under the standards adopted under the SEC Modernization Rules.

U.S. Shareholders are also cautioned that while the SEC now recognizes “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Further, “inferred resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. Shareholders are also cautioned not to assume that all or any part of the inferred resources exist.

To the extent available, Gold Royalty has, in accordance with the SEC Modernization Rules, included in this Offer to Purchase and Schedule I-A attached to this Offer to Purchase certain information concerning its royalties and other interests and the projects underlying Gold Royalty’s interests. However, due to Gold Royalty’s lack of access to the technical information and supporting documentation relating to the projects underlying Gold Royalty’s royalty and other interests, Gold Royalty has, pursuant to the SEC Modernization Rules, not disclosed any mineral resources or mineral reserves regarding its royalties and other interests and the projects underlying such interests in this Offer to Purchase or Schedule I-A attached to this Offer to Purchase.

TECHNICAL AND THIRD-PARTY INFORMATION

The disclosure contained in this Offer to Purchase and the documents included herein respecting the Offeror’s royalty and other interests and projects underlying such interests has been prepared in accordance with the exemption set forth in Items 1303(a)(3) and 1304(a)(2) of SEC Regulation S-K included in the SEC Modernization Rules and is based on information publicly disclosed by the owners and operators of such properties. Specifically, as a royalty holder, Gold Royalty has limited, if any, access to properties included in its asset portfolio. Additionally, Gold Royalty may from time to time receive operating information from the owners and operators of the properties, which it is not permitted to disclose to the public. Gold Royalty is dependent on the operators of the properties and their qualified persons to provide information to it or on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which it holds interests and generally will have limited or no ability to independently verify such information. Although Gold Royalty does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate.

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Unless otherwise defined herein, capitalized terms have the meanings assigned to them in the Section entitled “Definitions”.

Certain statements contained in this Offer to Purchase constitute “forward-looking information” and “forward-looking statements” within the meaning of applicable Securities Laws (collectively, “forward-looking statements”). Forward-looking statements include statements that may relate to Gold Royalty’s plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs and other information that is not historical information. Forward-looking statements can often be identified by the use of terminology such as “subject to”, “believe”, “anticipate”, “plan”, “target”, “expect”, “intend”, “estimate”, “project”, “outlook”, “may”, “will”, “should”, “would”, “could”, “can”, the negatives thereof, variations thereon and similar expressions, or by discussions of strategy. In addition, any statements that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. In particular, forward-looking statements in this Offer to Purchase include, but are not limited to, statements about:

| | ● | anticipated timing, mechanics, completion and settlement of the Offer; | | ● | royalty and other payments to be made to the Offeror by the owners and operators of the projects underlying Gold Royalty’s royalties and other interests; |

| | ● | the market for and listing of the Gold Royalty Shares; | | ● | expectations regarding the royalty and other interests of the Offeror; |

| | | | | | |

| | ● | the value of the Gold Royalty Shares received as consideration under the Offer; | | ● | the plans of the operators of properties where Gold Royalty owns royalty interests; |

| | | | | | |

| | ● | the ability of the Offeror to complete the transactions contemplated by the Offer; | | ● | estimates of mineral resources and mineral reserves on the projects in which Gold Royalty has royalty interests; |

| | | | | | |

| | ● | reasons to accept the Offer; | | ● | estimates regarding future revenue, expenses and needs for additional financing; |

| | | | | | |

| | ● | the purpose of the Offer; | | | |

| | | | | | |

| | ● | the completion of any Compulsory Acquisition (as defined herein) or Subsequent Acquisition Transaction (as defined herein) and any commitment to acquire Elemental Shares; | | ● | adequacy of capital and financing needs; |

| | | | | | |

| | ● | the Offeror’s plans and objectives, including its acquisition and growth strategies; | | ● | Gold Royalty’s proposed credit facility; and |

| | | | | | |

| | ● | the Offeror’s future financial and operational performance; | | ● | expectations regarding the impacts of COVID-19 on the operators of the properties underlying Gold Royalty’s interests. |

These forward-looking statements are based on the opinions, estimates and assumptions of Gold Royalty in light of its management’s experience and perception of historical trends, current conditions and expected future developments, as well as other factors that Gold Royalty currently believes are appropriate and reasonable in the circumstances, including:

| | ● | that Elemental’s public disclosure is accurate; | | ● | that current gold, base metal and other commodity prices will be sustained, or will improve; |

| | | | | | |

| | ● | that the Offer and either a Compulsory Acquisition or Subsequent Acquisition Transaction will be completed; | | ● | that the proposed development of the Offeror’s royalty projects will be viable operationally and economically and will proceed as expected; |

| | | | | | |

| | ● | Gold Royalty’s management’s assessment of the successful integration of the business and assets of Elemental upon completion of the Offer; | | ● | that Gold Royalty and its proposed lender will complete definitive documentation and satisfy conditions to its proposed credit facility; |

| | | | | | |

| | ● | the expectations of growth by Gold Royalty upon completion of the Offer will be met; | | ● | that any additional financing required by Gold Royalty will be available on reasonable terms; |

| | | | | | |

| | ● | the viability of Elemental’s assets and projects on a basis consistent with Gold Royalty management’s current expectations; | | ● | that operators of the properties where Gold Royalty holds royalty interests will not experience any material accident, labour dispute or failure of equipment; |

| | | | | | |

| | ● | there being no significant risks relating to the mining operations underlying Elemental’s interests, including political risks and instability and risks related to international operations; | | ● | the other factors discussed under “Risk Factors Related to the Offer” in this Offer to Purchase and in the Offeror’s other disclosure documents available under its profile at www.sedar.com; |

| | | | | | |

| | ● | that the public disclosures of the operators regarding the properties underlying Gold Royalty’s interests are accurate; | | ● | Elemental’s public disclosure is accurate and that Elemental has not failed to disclose publicly any material information respecting Elemental, its business, operations, assets, material agreements, or otherwise; |

| | | | | | |

| | ● | the remaining conditions of the Offer will be satisfied on a timely basis in accordance with their terms; | | ● | that conditions to completing the proposed amended credit facility will be satisfied or waived; and |

| | | | | | |

| | ● | there will be no material changes to government and environmental regulations adversely affecting the Offeror’s or Elemental’s operations; | | ● | the impact of the current economic climate and financial, political and industry conditions on the Offeror’s operations, including its financial condition and asset value, will remain consistent with the Offeror’s current expectations. |

| | | | | | |

| | ● | the anticipated benefits of the Offer will materialize; | | | |

Despite a careful process to prepare and review the forward-looking statements, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct.

Forward-looking statements are necessarily based on a number of opinions, estimates and assumptions that the Offeror considered appropriate and reasonable as of the date such statements are made and are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied by such forward-looking statements, including but not limited to the following risk factors:

| | ● | failure to acquire a 100% interest in Elemental through the Offer; | | ● | the inaccuracy of Elemental’s public disclosure upon which the Offer is predicated; |

| | | | | | |

| | ● | the market value of the Gold Royalty Shares received as consideration under the Offer; | | ● | the triggering of change of control provisions in Elemental’s agreements leading to adverse consequences; |

| | | | | | |

| | ● | delays in completing the Offer; | | ● | the failure to obtain the required approvals or clearances from government authorities on a timely basis; |

| | | | | | |

| | ● | the reduced trading liquidity of Elemental Shares not deposited under the Offer; | | ● | dependence on third party operators; |

| | | | | | |

| | ● | a substantial majority of Gold Royalty’s current royalty interests are on exploration and development stage properties, which are non-producing and are subject to the risk that they may never achieve production; | | ● | risks related to mineral reserve estimates and mineral resource estimates completed by third-party owners and operators on the projects underlying Gold Royalty’s interests, including that such estimates may be subject to significant revision; |

| | | | | | |

| | ● | volatility in gold and other commodity prices; | | ● | title, permit or licensing disputes related to any of the properties in which Gold Royalty holds or may hold royalties, streams or similar interests; |

| | | | | | |

| ● | Gold Royalty has limited or no access to data or the operations underlying its interests; | | ● | potential conflicts of interests; |

| | | | | | |

| | ● | a significant portion of Gold Royalty’s revenues is derived from a small number of operating properties; | | ● | regulations and political or economic developments in any of the jurisdictions where properties in which Gold Royalty holds or may hold royalties, streams or similar interests are located; |

| | | | | | |

| | ● | Gold Royalty is subject to many of the risks faced by owners and operators of the properties underlying Gold Royalty’s interests; | | ● | the availability of any necessary financing in the future on acceptable terms or at all; |

| | | | | | |

| | ● | Gold Royalty may enter into acquisitions and other material transactions at any time; | | ● | litigation risks; |

| | | | | | |

| | ● | Gold Royalty’s future growth is to a large extent dependent on its acquisition strategy; | | ● | Gold Royalty holds investments in a concentrated number of equity securities and the fair values thereof are subject to loss in value; and |

| | ● | as a royalty holder, Gold Royalty may become subject to potential disputes with operators regarding the existence, enforceability or terms of its interests; | | ● | other risks including but not limited to the risk factors described in greater detail under the heading entitled “Risk Factors Related to the Offer” in this Offer to Purchase and in the Offeror’s other disclosure documents available under its profile at www.sedar.com. |

| | | | | | |

| | ● | certain of Gold Royalty’s royalty interests are subject to buy-back or other rights of third-parties; | | | |

| | | | | | |

| | ● | risks related to epidemics, pandemics or other public health crises, including COVID-19, and the potential impact thereof on Gold Royalty and the operators of the properties underlying its interests; | | | |

Although Gold Royalty believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements.

These factors should not be construed as exhaustive and should be read with other cautionary statements in this Offer to Purchase. Although Gold Royalty has attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other risk factors not presently known to Gold Royalty or that it presently believes are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking statements. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking statements, which speaks only as of the date made. The forward-looking statements contained in this Offer to Purchase represent Gold Royalty’s management’s expectations as of the date of such statements (or as the date they are otherwise stated to be made) and are subject to change after such date. However, Gold Royalty disclaims any intention or obligation or undertaking to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable Securities Laws.

Please carefully consider the risk factors set out under “Risk Factors Related to the Offer” in Section 21 of the Offer to Purchase. All of the forward-looking statements contained in this Offer to Purchase are expressly qualified by the foregoing cautionary statements.

NOTICE TO HOLDERS OF CONVERTIBLE SECURITIES

The Offer is made only for Elemental Shares and the accompanying SRP Rights and is not made for any warrants, options or any other rights to acquire Elemental Shares (collectively, “Convertible Securities”). Any holder of such Convertible Securities who wishes to accept the Offer should, to the extent permitted by the terms of the Convertible Security and applicable Law, exercise, exchange or convert such Convertible Securities in order to obtain certificates representing Elemental Shares and deposit those Elemental Shares under the Offer. Any such exercise, exchange or conversion must be completed sufficiently in advance of the Expiry Time to assure the holder of such Convertible Securities will have received certificate(s) or a DRS Advice representing the Elemental Shares issuable upon such exercise, exchange or conversion in time for deposit prior to the Expiry Time, or in sufficient time to comply with the procedures described under “Manner of Acceptance — Procedure for Guaranteed Delivery” in Section 3 of this Offer to Purchase.

The tax consequences to holders of Convertible Securities of exercising or not exercising such securities are not described in this Offer to Purchase. Holders of such Convertible Securities should consult their own tax advisors with respect to the potential income tax consequences to them in connection with the decision to exercise or not exercise such securities.

INFORMATION CONTAINED IN THE PROSPECTUS/OFFER TO EXCHANGE

Certain information contained in this document has been taken from or is based on documents that are expressly referred to in this document. All summaries of, and references to, documents that are specified in this document as having been attached hereto or filed, or that are contained in documents specified as having been filed, on SEDAR or with the SEC, are qualified in their entirety by reference to the complete text of those documents as attached hereto or filed, or as contained in documents filed, under the Offeror’s profile at www.sedar.com, in the United States at www.sec.gov and on the Offeror’s website at www.goldroyalty.com. Shareholders are urged to read carefully the full text of those documents. which may also be obtained on request without charge from the Information Agent for the Offer, Laurel Hill Advisory Group, at 1-877-452-7184 toll free in North America or at 1-416-304-0211 outside North America or by e-mail at assistance@laurelhill.com or to Chief Financial Officer of the Offeror at 1830-1030 West Georgia Street, Vancouver, British Columbia, telephone 604-396-3066.

As of the date hereof, the Offeror has not had access to the non-public books and records of Elemental and the Offeror is not in a position to independently assess or verify certain of the information in Elemental’s publicly filed documents, including its financial statements and reserves disclosure. Except as otherwise expressly indicated herein, the information concerning Elemental contained in this Offer to Purchase has been taken from or is based solely upon publicly available documents and records on file with the Canadian Securities Administrators and other public sources available at the time of the Offer. Elemental has not reviewed the prospectus/offer to exchange and has not confirmed the accuracy and completeness of the information in respect of Elemental contained herein. As a result, all historical information regarding Elemental included herein, including all Elemental financial and reserves information, and all pro forma financial and reserves information reflecting the pro forma effects of a combination of the Offeror and Elemental, has been derived, by necessity, from Elemental’s public reports and corporate filings as of April 8, 2022. Although the Offeror has no knowledge that would indicate that any statements contained herein concerning Elemental taken from, or based upon, such information contain any untrue statement of a material fact or omit to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made, neither the Offeror nor any of its directors or officers has verified, nor do they assume any responsibility for, the accuracy or completeness of such information or statements or for any failure by Elemental to disclose events or facts which may have occurred or which may affect the significance or accuracy of any such information or statements but which are unknown to the Offeror. The Offeror does not undertake any duty to update any such information, except as required by applicable Law. See Section 21 of the Offer to Purchase, “Risk Factors Related to the Offer – The Offeror has been unable to independently verify the accuracy and completeness of Elemental information in the Offer to Purchase”.

Information contained in this document is given as of April 11, 2022, unless otherwise specifically stated.

REPORTING CURRENCIES AND ACCOUNTING PRINCIPLES

Unless otherwise indicated, all references to “C$” or “dollars” in this Offer to Purchase refer to Canadian dollars and all references to “US$” in this Offer to Purchase refer to United States dollars. The financial statements included herein are reported in United States dollars and are prepared in accordance with IFRS.

EXCHANGE RATES

The following table sets forth for each period indicated: (i) the exchange rates in effect at the end of the periods indicated; (ii) the high and low exchange rates during each period; and (iii) the average exchange rates in effect during each period, in each case, as identified or calculated from the Bank of Canada rate in effect on each trading day during the relevant period. The high, low, average and closing exchange rates for United States dollars in terms of the Canadian dollar for each of the indicated periods, as quoted by the Bank of Canada, were as follows:

| | | Quarter ended December 31, 2021 | | | Year ended September 30, 2021 | | | Period from June 23, 2020 to September 30, 2020 | |

| High | | | 0.8111 | | | | 0.8306 | | | | 0.7668 | |

| Low | | | 0.7727 | | | | 0.7491 | | | | 0.7309 | |

| Average | | | 0.7936 | | | | 0.7915 | | | | 0.7494 | |

| Closing | | | 0.7889 | | | | 0.7849 | | | | 0.7497 | |

On April 8, 2022, the rate of exchange as reported by the Bank of Canada for one Canadian dollar expressed in U.S. dollars was US$0.7943.

SCHEDULES

The schedules hereto form an integral part of the prospectus/offer to exchange. Any statement contained in the prospectus/offer to exchange (including the schedules hereto) will be deemed to be modified or superseded for the purposes of the prospectus/offer to exchange to the extent that a statement contained herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed to be an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, in its unmodified or non-superseded form, to constitute a part of the prospectus/offer to exchange.

TABLE OF CONTENTS

| APPENDIX A | ADDITIONAL INFORMATION CONCERNING ELEMENTAL | A-1 |

| | | |

| SCHEDULE I: | GOLD ROYALTY CORP. ANNUAL REPORT ON FORM 20-F FOR YEAR ENDED SEPTEMBER 30, 2021, FILED WITH THE SEC ON DECEMBER 23, 2021 | I-1 |

| | | |

| SCHEDULE I-A: | GOLD ROYALTY CORP. SUPPLEMENTAL MINING PROPERTY DISCLOSURES | I-A-1 |

| | | |

| SCHEDULE II: | ELEMENTAL ROYALTIES CORP. ANNUAL INFORMATION FORM FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2020, DATED MAY 19, 2021 | II-1 |

| | | |

| SCHEDULE III: | ELEMENTAL ROYALTIES CORP. CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2021 AND 2020 | III-1 |

| | | |

| SCHEDULE IV: | ELEMENTAL ROYALTIES CORP. MANAGEMENT’S DISCUSSION AND ANALYSIS FOR YEAR ENDED DECEMBER 31, 2021 | IV-1 |

| | | |

| SCHEDULE V: | ELEMENTAL ROYALTIES CORP. NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING AND MANAGEMENT INFORMATION CIRCULAR WITH RESPECT TO THE ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 8, 2021 | V-1 |

| | | |

| SCHEDULE VI: | ELY GOLD ROYALTIES INC. CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019 | VI-1 |

| | | |

| SCHEDULE VII: | ELY GOLD ROYALTIES INC. CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2021 AND 2020 | VII-1 |

| | | |

| SCHEDULE VIII: | ABITIBI ROYALTIES INC. AUDITED CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019 | VIII-1 |

| | | |

| SCHEDULE IX: | ABITIBI ROYALTIES INC. CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2021 AND 2020 | IX-1 |

| | | |

| SCHEDULE X: | GOLDEN VALLEY MINES AND ROYALTIES LTD. (FORMERLY GOLDEN VALLEY MINES LTD.) CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2020 AND 2019 | X-1 |

| | | |

| SCHEDULE XI: | GOLDEN VALLEY MINES AND ROYALTIES LTD. CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 AND 2020 | XI-1 |

| | | |

| SCHEDULE XII: | GOLD ROYALTY CORP. NOTICE OF ANNUAL GENERAL MEETING AND MANAGEMENT INFORMATION CIRCULAR DATED DECEMBER 14, 2021 | XII-1 |

| | | |

| SCHEDULE XIII: | GOLD ROYALTY CORP. UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS | XIII-1 |

| | | |

| SCHEDULE XIV: | GOLD ROYALTY CORP. CONDENSED INTERIM CONSOLIDATE FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED DECEMBER 31, 2021 | XIV-1 |

| | | |

| SCHEDULE XV: | GOLD ROYALTY CORP. MANAGEMENT’S DISCUSSION AND ANALYSIS FOR THE THREE MONTHS ENDED DECEMBER 31, 2021 | XV-1 |

FREQUENTLY ASKED QUESTIONS

The following sets forth material information with respect to the Offer. The questions and answers below are not meant to be a substitute for the more detailed description and information contained in the Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery. You are urged to read the entire Offer to Purchase, the Letter of Transmittal and the Notice of Guaranteed Delivery carefully prior to making any decision regarding whether or not to tender your Elemental Shares. We have included cross-references in this Section to other Sections of the Offer to Purchase where you will find more complete descriptions of the topics mentioned below. Unless otherwise defined herein, capitalized terms have the meanings given to them in the Section entitled “Definitions”.

WHAT IS THE OFFER?

The Offeror is offering to purchase all issued and outstanding Elemental Shares, and the accompanying SRP Rights, on the basis of 0.27 of a Gold Royalty Share for each Elemental Share.

On December 17, 2021, the last trading day prior to the Offeror’s announcement of its intention to make an offer, the closing price of the Elemental Shares on the TSX-V was C$1.30, and the closing price of the Gold Royalty Shares on the NYSE American was US$5.15. Based upon the daily exchange rate posted by the Bank of Canada on December 17, 2021, and such closing prices of the Elemental Shares and Gold Royalty Shares on December 17, 2021, the Offer Consideration has a value of approximately C$1.78 per Elemental Share, representing a premium of approximately 37% as of the close of trading on December 17, 2021.

See “The Offer” in Section 1 of the Offer to Purchase.

WHO IS OFFERING TO PURCHASE MY ELEMENTAL SHARES?

Gold Royalty is making the Offer. The Offeror is a corporation organized under the Laws of Canada. The Offeror’s head and executive office is located at 1030 West Georgia Street, Suite 1830, Vancouver, British Columbia V6E 2Y3. See “Certain Information Concerning the Offeror and the Gold Royalty Shares” in Section 23 of the Offer to Purchase.

WHAT ARE THE GOLD ROYALTY SHARES?

The Gold Royalty Shares are common shares in the capital of Gold Royalty. Gold Royalty is a precious metals-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission is to acquire royalties, streams and similar interests at varying stages of the mine life cycle to build a balanced portfolio offering near, medium and longer-term attractive returns for its investors.

See “Certain Information Concerning the Offeror and the Gold Royalty Shares” in Section 23 of the Offer to Purchase and “Purpose of the Offer and Plans for Elemental” in Section 19 of the Offer to Purchase.

WHAT ARE THE CLASSES OF SECURITIES SOUGHT IN THE OFFER?

The Offeror is offering to purchase all the outstanding Elemental Shares (including any Elemental Shares to be issued upon exercise, exchange or conversion of the Convertible Securities prior to the Expiry Time). As of November 16, 2021, there were 68,991,221 Elemental Shares issued and outstanding. The Offer includes Elemental Shares that may become outstanding after the date of this Offer to Purchase, but before the expiration of the Offer, upon exercise, exchange or conversion of any Convertible Securities. The Offer is not being made for any Convertible Securities or other rights to acquire Elemental Shares.

See “The Offer” in Section 1 of the Offer to Purchase.

WHY ARE YOU MAKING THIS OFFER?

The Offeror is making the Offer because it wants to acquire control of, and ultimately the entire equity interest in, Elemental. If the Offeror completes the Offer, but does not then own 100% of the Elemental Shares, the Offeror currently intends to acquire any Elemental Shares not deposited to the Offer in a second-step transaction. This transaction would likely take the form of a Compulsory Acquisition or a Subsequent Acquisition Transaction.

See “Purpose of the Offer and Plans for Elemental” in Section 19 of the Offer to Purchase, “Reasons to Accept the Offer” in Section 20 of the Offer to Purchase and “Acquisition of Elemental Shares Not Deposited Pursuant to the Offer” in Section 33 of the Offer to Purchase.

WHY ACCEPT THE OFFER?

Gold Royalty believes that the Offer is compelling, and represents a superior alternative to continuing on the course set by the current Elemental Board and management of Elemental. Shareholders should consider the following factors in making a decision whether to accept the Offer:

| | ● | Significant Upfront Premium to Shareholders. The Offer represents a 37% premium to Shareholders based on the closing prices of each of the Offeror’s and Elemental’s shares on December 17, 2021. The Offer implies consideration of C$1.78 per share, which exceeds Elemental’s 2021 peak share price. |

| | | |

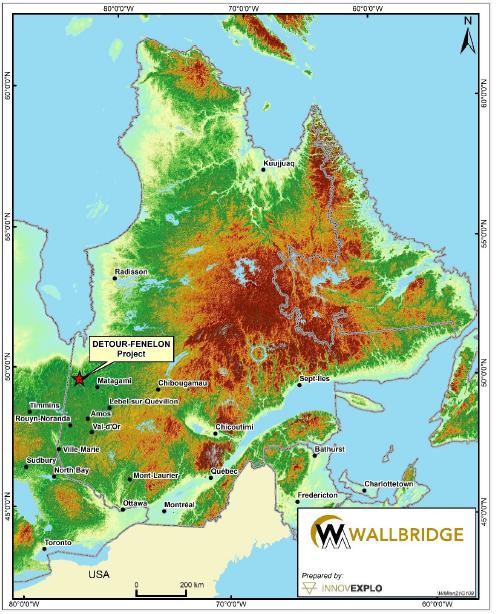

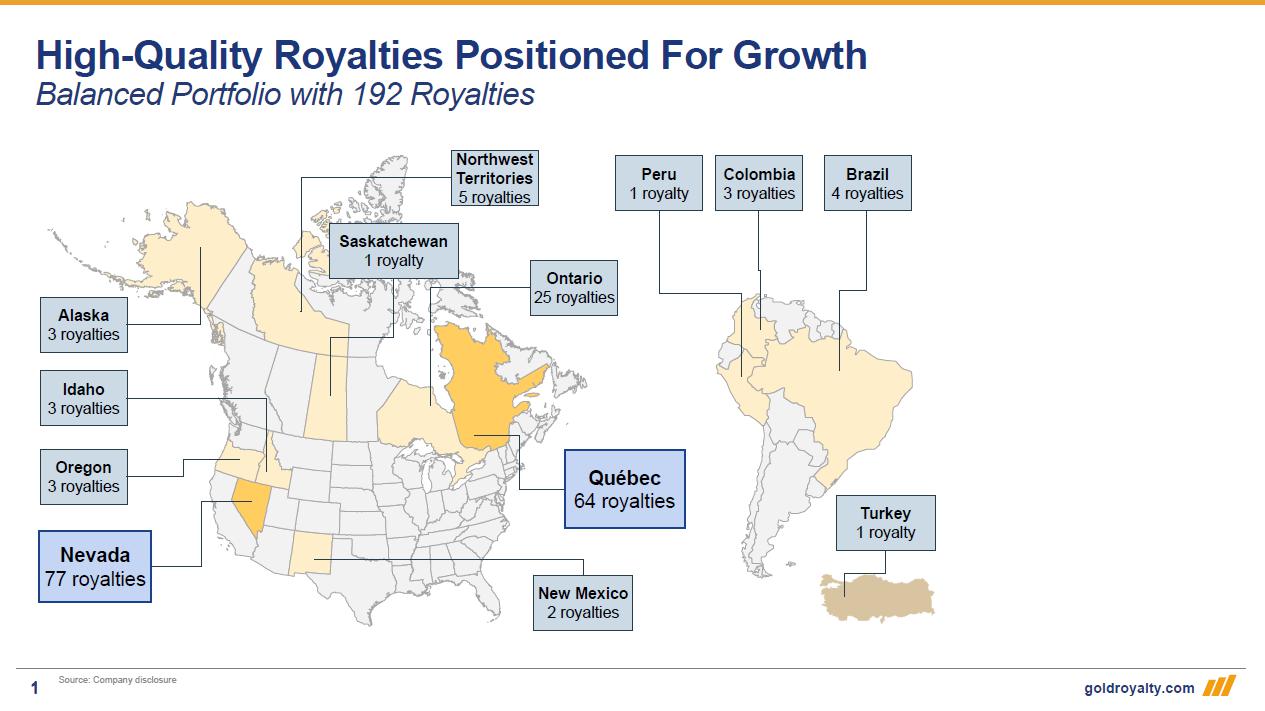

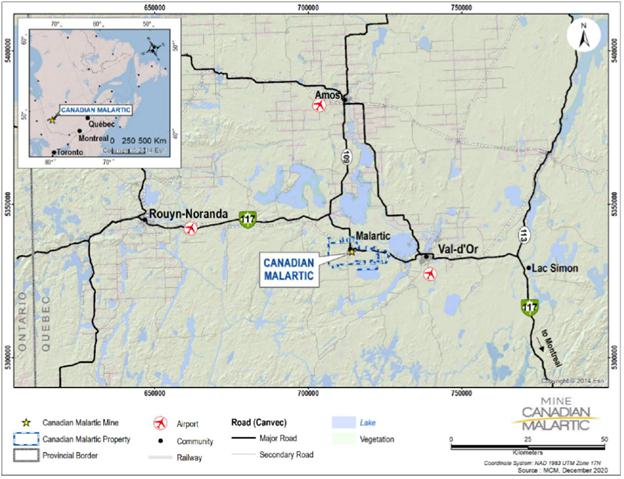

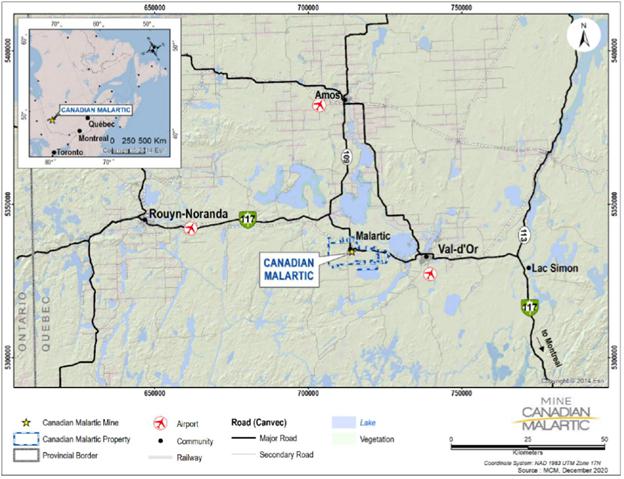

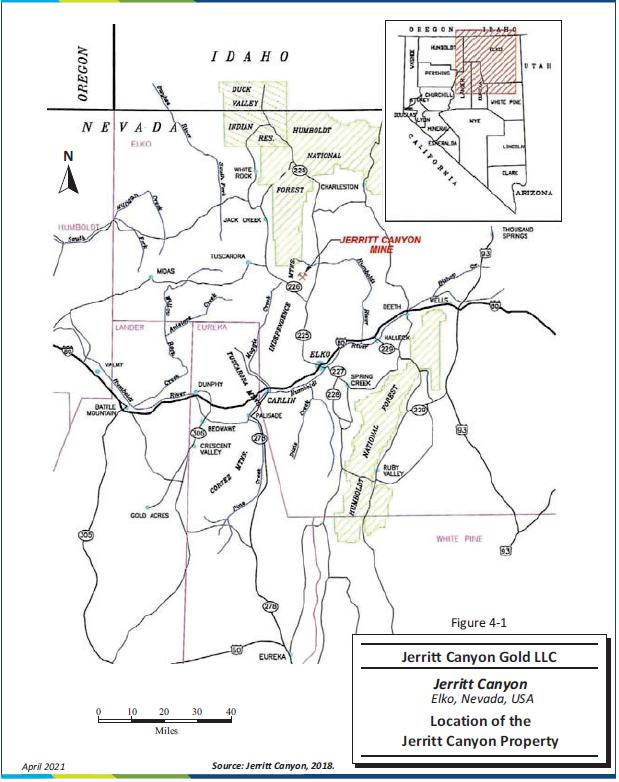

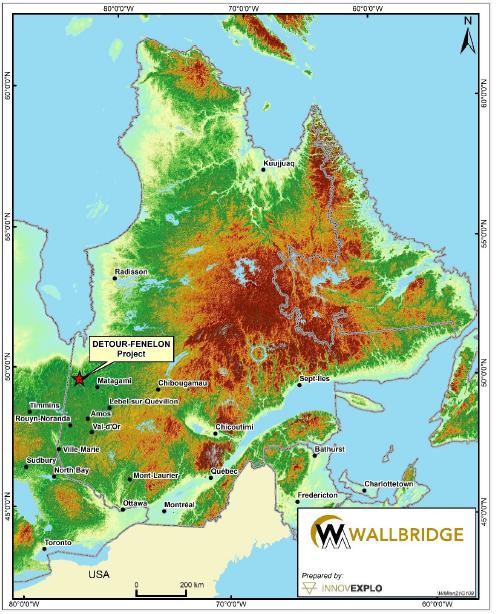

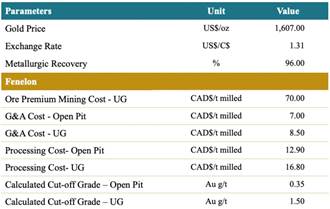

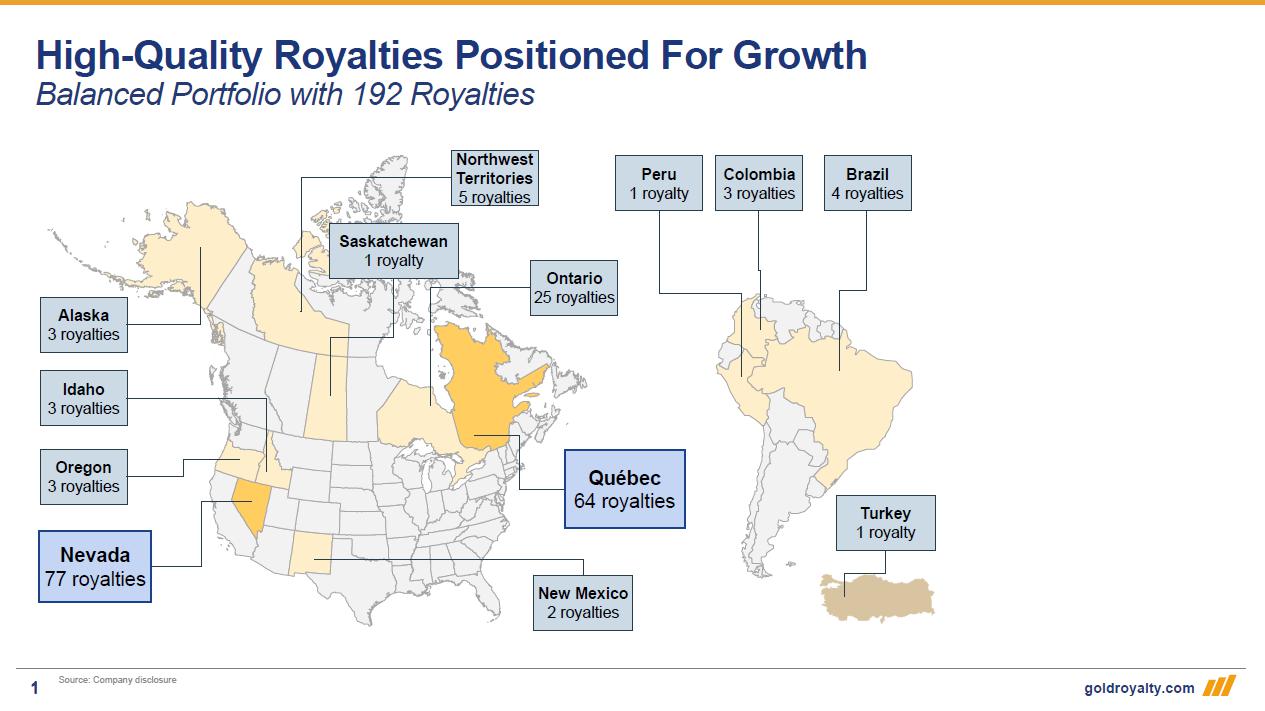

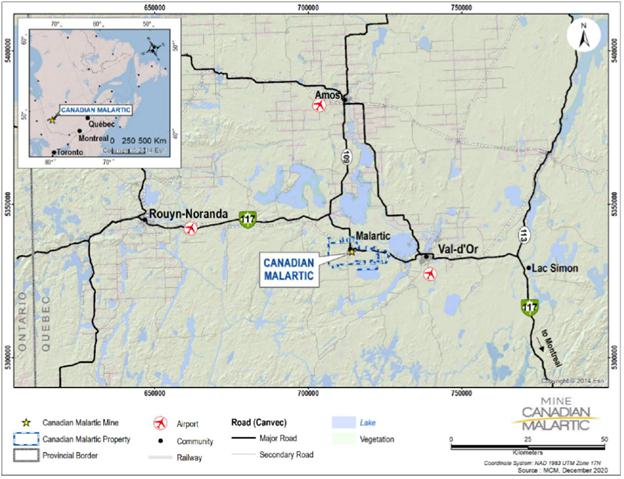

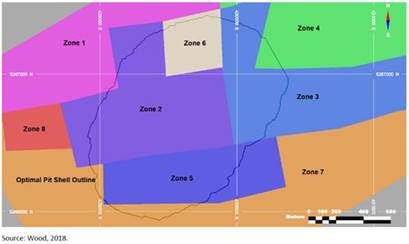

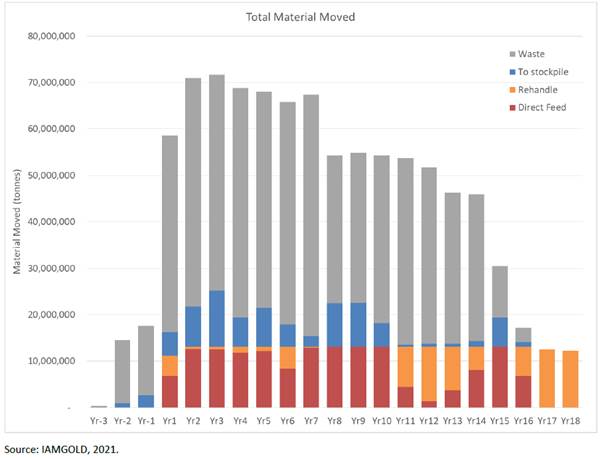

| | ● | The Combination of Gold Royalty and Elemental will create a Sector-Leading Portfolio of 203 Strategic Royalties. The combined entity will have a balanced portfolio of cash flowing, development and exploration royalty assets owned by premier operating partners and located in Tier 1 mining jurisdictions. This provides Shareholders with ownership in a larger, more diversified, higher quality portfolio of royalty assets anchored by cornerstone royalties on portions of the Canadian Malartic Property (Québec, Canada), Fenelon Gold Property (Québec, Canada), and Karlawinda Gold Project (Australia), as well as our recent royalty acquisition on the Côté Gold Project and expanded royalties on Monarch Mining Corporation’s Québec projects (Beaufor, Croinor Gold, McKenzie Break, and Swanson). In addition, the portfolio’s peer-leading near-term growth profile will be further complemented by a deep development and exploration pipeline, including Gold Royalty’s royalty on REN (Nevada, USA), Gold Royalty’s royalty generator model and future acquisitions. |

| | | |

| | ● | Enhanced Trading Liquidity. Gold Royalty averaged approximately US$3.2 million of daily trading liquidity over the six months ended December 17, 2021, as compared to approximately US$62,000 for Elemental over the same period. A combination with Gold Royalty is expected to allow Shareholders to realize an immediate premium in a more liquid vehicle. |

| | | |

| | ● | Strong Balance Sheet and Access to Capital. Gold Royalty is positioned with approximately US$44 million in total liquidity to complete the Offer (based on cash and marketable securities as at December 31, 2021, plus cash available under its credit facility, less acquisition costs for its recently completed Côté and Monarch royalty transactions). With an oversubscribed US$90 million initial public offering in March 2021, Gold Royalty has demonstrated the ability to access capital markets at an attractive cost of capital, providing the combined company with the critical mass to drive continued growth through acquisition. |

| | | |

| | ● | Management Track Record in Maximizing Shareholder Value. Gold Royalty has a management team with deep mining and capital markets expertise and an established track record of success in the royalty and mining industry. The Gold Royalty management team has demonstrated its ability, through the recent acquisitions of Ely Gold, Abitibi Royalties and Golden Valley, to successfully execute transformative acquisitions in an increasingly competitive market. |

| | | |

| | ● | Clear Path to Re–rate Through Increased Scale, Asset Quality and Precious Metals Focus. In combination with Elemental, Gold Royalty will be strategically positioned as a preeminent intermediate gold royalty company. In addition to the upfront premium, Shareholders may benefit from a potential valuation re-rating as a result of the combined company’s increased scale, portfolio diversification, trading liquidity, index inclusion within the GDXJ, and the potential for future growth both organically and through acquisition. |

WHAT DOES THE ELEMENTAL BOARD OF DIRECTORS THINK OF THE OFFER?

Under applicable Securities Laws, a directors’ circular must be prepared and delivered by Elemental’s board of directors to Shareholders no later than 15 days from the date of commencement of the Offer. The directors’ circular must include either a recommendation to accept or reject the Offer, and the reasons for such recommendation, or a statement that the board of directors of Elemental is unable to make or is not making a recommendation, and if no recommendation is made, the reasons for not making a recommendation. On January 26, 2022, Elemental issued a press release announcing its board of directors’ recommendation with respect to the Offer and filed a directors’ circular, dated January 24, 2022. The directors’ circular provided, among other things, that based upon the recommendation of a special committee of the Elemental board of directors, the Elemental board of directors concluded that the Offer is inadequate, does not reflect the full, strategic value of the Elemental Shares or Elemental’s assets and is not in the best interests of Elemental or its shareholders and has recommended that Elemental shareholders reject the Offer and not tender their Elemental Shares to the Offer.

See Section 16 of the Offer to Purchase, “Background to the Offer”, for a description of the Offeror’s interactions with Elemental leading up to the Offer.

WHAT ARE SOME OF THE SIGNIFICANT CONDITIONS OF THE OFFER?

The Offer is conditional upon the specified conditions being satisfied, or where permitted, waived at 5:00 p.m. (Toronto time) on April 27, 2022 or such earlier or later time during which Elemental Shares may be deposited under the Offer, excluding the 10-day Mandatory Extension Period or any extension thereafter, including:

| | 1. | there having been validly deposited pursuant to the Offer and not withdrawn at the Expiry Time that number of Elemental Shares, together with the associated SRP Rights, which constitutes more than 50% of the Elemental Shares outstanding, excluding those Elemental Shares beneficially owned, or over which control or direction is exercised by the Offeror or by any persons acting jointly or in concert with the Offeror, if any (which condition cannot be waived by the Offeror); |

| | | |

| | 2. | there having been validly deposited under the Offer and not withdrawn, at or prior to the Expiry Time, such number of Elemental Shares, together with the associated SRP Rights, that, together with the Elemental Shares held by the Offeror and its affiliates, represents not less than 66 2/3% of the total number of outstanding Elemental Shares, calculated on a fully diluted basis; |

| | | |

| | 3. | the Offeror having determined, in its reasonable judgment, that there does not exist and there shall not have occurred or been publicly disclosed since the date of the Offer, a Material Adverse Effect (as defined herein); and |

| | | |

| | 4. | certain Regulatory Approvals (as defined herein) having been obtained and/or waiting periods expired, |

each as more particularly described herein.

These and the other conditions of the Offer, which other conditions may be waived by the Offeror, are described under “Conditions of the Offer” in Section 4 of the Offer to Purchase. See “Regulatory Matters” under Section 32 of the Offer to Purchase.

Subject to applicable Law, the Offeror reserves the right to withdraw the Offer and to not take up and pay for any Elemental Shares deposited under the Offer unless each of the conditions of the Offer is satisfied or waived, as applicable, by the Offeror at or before the Expiry Time.

The Offer is not subject to the approval of the Offeror’s shareholders and is not subject to any financing or due diligence conditions.

HOW LONG DO I HAVE TO DECIDE WHETHER TO TENDER TO THE OFFER?

You have until the Expiry Date of the Offer to tender. The Offer is scheduled to expire at 5:00 p.m. (Toronto time), on April 27, 2022 unless it is extended or withdrawn. Subject to applicable Law, the Offeror may be required to extend the Offer for an additional period of 10 days following the Expiry Date and may extend the Offer for one or more additional periods.

See “Time for Acceptance” in Section 2 of the Offer to Purchase.

CAN GOLD ROYALTY EXTEND THE OFFER?

Yes. The Offeror may elect, in its sole discretion, to extend the Offer from time to time. In accordance with applicable Law, if the Offeror is obligated to take up the Elemental Shares deposited at the expiry of the initial deposit period, it will extend the period during which Elemental Shares may be deposited under the Offer for a 10-day Mandatory Extension Period following the expiry of the initial deposit period and may extend the deposit period after such 10-day Mandatory Extension Period for one or more Optional Extension Periods. If the Offeror extends the Offer, it will notify the Depositary and publicly announce such extension or acceleration and, if required by applicable Law, mail you a copy of the notice of variation.

See “Extension, Variation or Change in the Offer” in Section 5 of the Offer to Purchase.

HOW DO I ACCEPT THE OFFER AND TENDER MY ELEMENTAL SHARES?

If you are a registered Shareholder, you can accept the Offer by delivering to the Depositary before the Expiry Time: (a) the certificate(s) or DRS Advices representing the Elemental Shares in respect of which the Offer is being accepted; (b) a Letter of Transmittal in the form accompanying the Offer to Purchase properly completed and duly executed as required by the instructions set out in the Letter of Transmittal; and (c) all other documents required by the instructions set out in the Letter of Transmittal. If your Elemental Shares are registered in the name of a nominee (commonly referred to as “in street name” or “street form”), you should contact your broker, investment dealer, bank, trust company or other nominee for assistance in tendering your Elemental Shares under the Offer. You should request your nominee to effect the transaction by tendering through a book-entry transfer, which is detailed in the Offer to Purchase and thus have your Elemental Shares tendered by your nominee through CDS or DTC, as applicable.

If you cannot deliver all of the necessary documents to the Depositary in time, you may be able to complete and deliver to the Depositary the enclosed Notice of Guaranteed Delivery, provided you are able to comply fully with its terms.

Shareholders are invited to contact the Depositary for further information regarding how to accept the Offer.

See “Manner of Acceptance” in Section 3 of the Offer to Purchase.

IF I ACCEPT THE OFFER, WHEN WILL I RECEIVE THE OFFER CONSIDERATION?

If the conditions of the Offer are satisfied or waived, and if the Offeror consummates the Offer and takes up your Elemental Shares, the Offer Consideration for the Elemental Shares you tendered will be delivered to the Depositary as agent for you as a registered Shareholder or to your nominee as soon as possible and in any event no later than three Business Days after the Elemental Shares are taken up.

In accordance with applicable Law, if the Offeror is obligated to take up such Elemental Shares, the Offeror will extend the period during which Elemental Shares may be deposited under the Offer for the 10-day Mandatory Extension Period following the expiration of the initial deposit period and may extend the deposit period for Optional Extension Periods. Any Elemental Shares tendered during the 10-day Mandatory Extension Period and any Optional Extension Period will be taken up and paid for as soon as possible and in any event no later than 10 days after such tender.

See “Take up of and Payment for Deposited Shares” in Section 6 of the Offer to Purchase.

CAN I WITHDRAW MY PREVIOUSLY TENDERED ELEMENTAL SHARES?

Yes. You may withdraw Elemental Shares previously tendered by you at any time (i) before Elemental Shares deposited under the Offer are taken up by the Offeror, (ii) if your Elemental Shares have not been paid for by the Offeror within three Business Days after having been taken up by the Offeror, and (iii) in certain other circumstances.

See “Right to Withdraw Deposited Shares” in Section 7 of the Offer to Purchase.

HOW DO I WITHDRAW PREVIOUSLY TENDERED ELEMENTAL SHARES?

To withdraw Elemental Shares that have been tendered, you must deliver a written notice of withdrawal with the required information to the Depositary or your nominee if held in street form (i.e., non-registered holder) while you still have the right to withdraw the Elemental Shares.

See “Right to Withdraw Deposited Shares” in Section 7 of the Offer to Purchase.

IF I DO NOT TENDER BUT THE OFFER IS SUCCESSFUL, WHAT WILL HAPPEN TO MY ELEMENTAL SHARES?

If the conditions of the Offer are otherwise satisfied or waived and the Offeror takes up and pays for the Elemental Shares validly deposited under the Offer, the Offeror intends to acquire any Elemental Shares not deposited under the Offer: (i) by Compulsory Acquisition, if at least 90% of the outstanding Elemental Shares are validly tendered under the Offer, other than Elemental Shares held at the date of the Offer by, or by a nominee for, the Offeror or its affiliates and not withdrawn; or (ii) by a Subsequent Acquisition Transaction on the same terms as such Elemental Shares were acquired under the Offer, if a Compulsory Acquisition is not available or if the Offeror decides not to proceed with a Compulsory Acquisition.

See “Purpose of the Offer and Plans for Elemental” in Section 19 of the Offer to Purchase and “Acquisition of Elemental Shares Not Deposited Pursuant to the Offer” in Section 33 of the Offer to Purchase.

FOLLOWING THE OFFER, WILL ELEMENTAL CONTINUE AS A PUBLIC COMPANY?

Depending upon the number of Elemental Shares purchased pursuant to the Offer, it is possible the Elemental Shares will fail to meet the criteria for continued listing on the TSX-V. If this were to happen, the Elemental Shares could be delisted on the TSX-V and this could, in turn, adversely affect the market or result in a lack of an established market for the Elemental Shares.

If the Offeror acquires 100% of the Elemental Shares, and if permitted under applicable Securities Law, the Offeror intends to apply to delist the Elemental Shares from the TSX-V as soon as practicable after completion of the Offer or a Compulsory Acquisition or Subsequent Acquisition Transaction and, subject to applicable Securities Law, to cause Elemental to cease to be a reporting issuer under the Securities Laws of each province and territory of Canada in which Elemental is a reporting issuer.

See “Effect of the Offer on the Market for Elemental Shares; Stock Exchange Listing and Public Disclosure” in Section 25 of the Offer to Purchase.

WHAT WILL HAPPEN IF THE CONDITIONS OF THE OFFER ARE NOT SATISFIED?

If the conditions of the Offer are not satisfied or, where permitted, waived by the Offeror, the Offeror will not be obligated to take up, accept for payment or pay for any Elemental Shares tendered to the Offer. Subject to applicable Law, the Offeror reserves the right to withdraw or extend the Offer and to not take up and pay for any Elemental Shares deposited under the Offer unless each of the conditions of the Offer is satisfied or, where permitted, waived by the Offeror at or prior to the Expiry Time. Notwithstanding the foregoing, in no case will the Offeror waive the Statutory Minimum Condition.

DOES GOLD ROYALTY BELIEVE THAT THE NECESSARY REGULATORY APPROVALS TO COMPLETE THE OFFER WILL BE RECEIVED?

The Offeror believes that it will receive all requisite Regulatory Approvals within the initial bid period. A summary of the regulatory approvals required in connection with the Offer can be found in “Regulatory Matters” in Section 32 of the Offer to Purchase.

WILL I HAVE THE RIGHT TO HAVE MY ELEMENTAL SHARES APPRAISED?

No. Shareholders will not have dissenters’ or appraisal rights in connection with the Offer. However, Shareholders who do not tender their Elemental Shares to the Offer may have rights of dissent in the event that the Offeror acquires their Elemental Shares by way of a Compulsory Acquisition or Subsequent Acquisition Transaction. The completion of either a Compulsory Acquisition or a Subsequent Acquisition Transaction may result in registered Shareholders having the right to dissent and demand payment of the fair value of their Elemental Shares. If the statutory procedures governing dissent rights are available and are complied with, this right could lead to judicial determination of the fair value required to be paid to such dissenting Shareholders for their Elemental Shares.

See “Acquisition of Elemental Shares Not Deposited Pursuant to the Offer” in Section 33 of the Offer to Purchase.

WILL I HAVE TO PAY ANY FEES OR COMMISSIONS?

You will not have to pay any brokerage or similar fees or commissions if you are the owner of record of your Elemental Shares and you tender your Elemental Shares under the Offer by depositing the Elemental Shares directly with the Depositary to accept the Offer. However, an investment advisor, stockbroker, bank, trust company or other nominee through whom a Shareholder owns Elemental Shares may charge a fee to tender any such Elemental Shares on behalf of the Shareholder. Shareholders should consult such nominee to determine whether any charges will apply.

HOW WILL CANADIAN RESIDENTS AND NON-RESIDENTS OF CANADA BE TAXED FOR CANADIAN FEDERAL INCOME TAX PURPOSES?

A Resident Shareholder who holds Elemental Shares as capital property and who exchanges such Elemental Shares pursuant to the Offer will not realize a capital gain (or capital loss) on such shares in respect of the exchange unless such Resident Shareholder elects to report such gain (or loss) on such shares in its Canadian tax return for the year of disposition.

Similarly, a Non-Resident Shareholder who holds Elemental Shares as capital property and who exchanges such Elemental Shares pursuant to the Offer will not realize a capital gain (or capital loss) on such shares in respect of the exchange unless such Non-Resident Shareholder elects to report such gain (or loss) on such shares in its Canadian tax return for the year of disposition. In addition, a Non-Resident Shareholder who elects to report a capital gain (or capital loss) in its Canadian tax return for the year of disposition resulting from a disposition of Elemental Shares pursuant to the Offer will not be subject to tax under the Tax Act unless Elemental Shares constitute “taxable Canadian property” other than “treaty-protected property”.

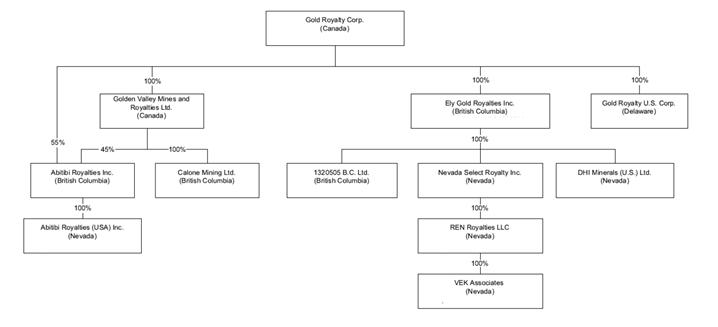

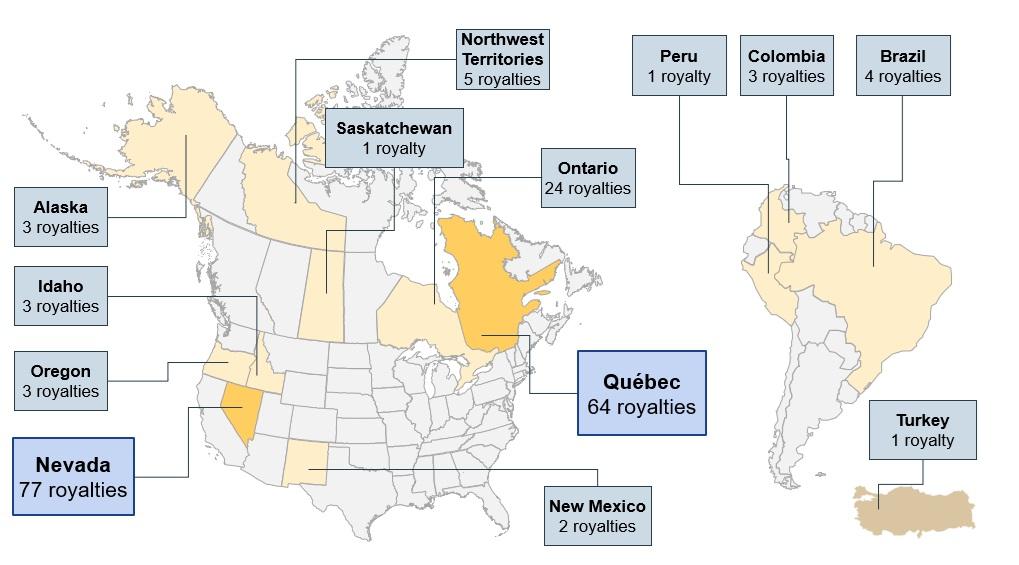

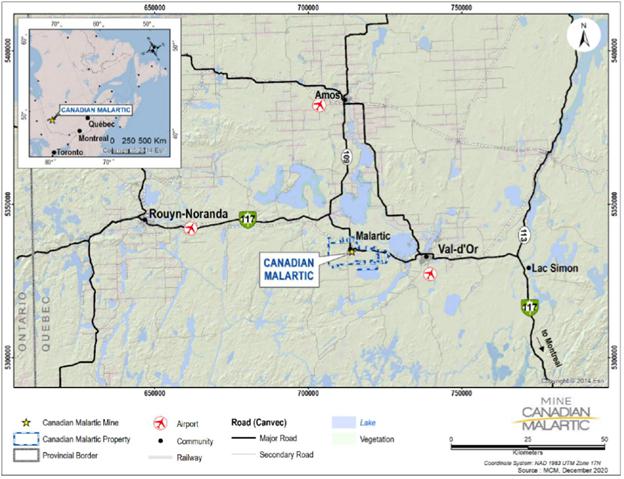

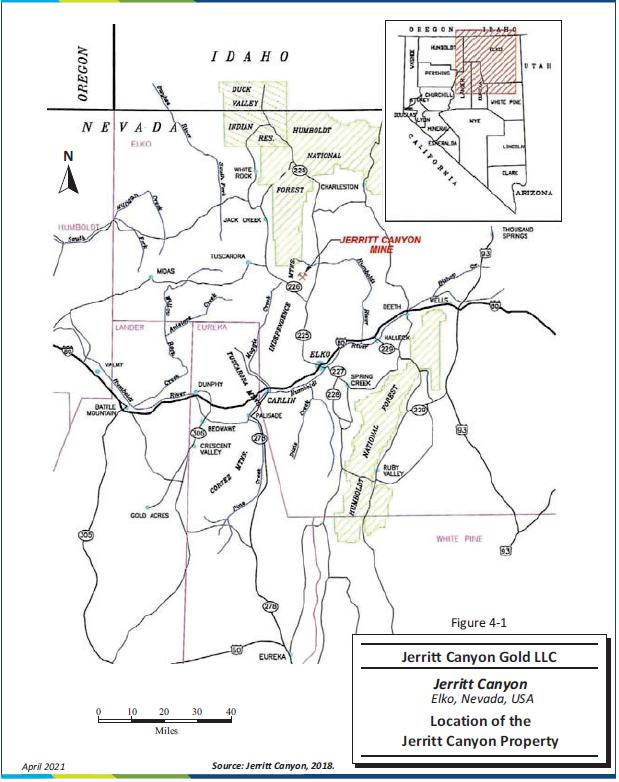

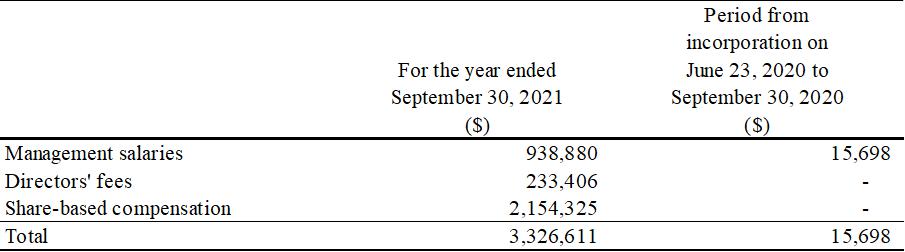

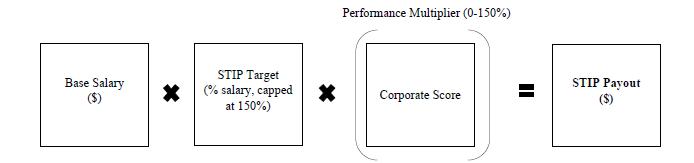

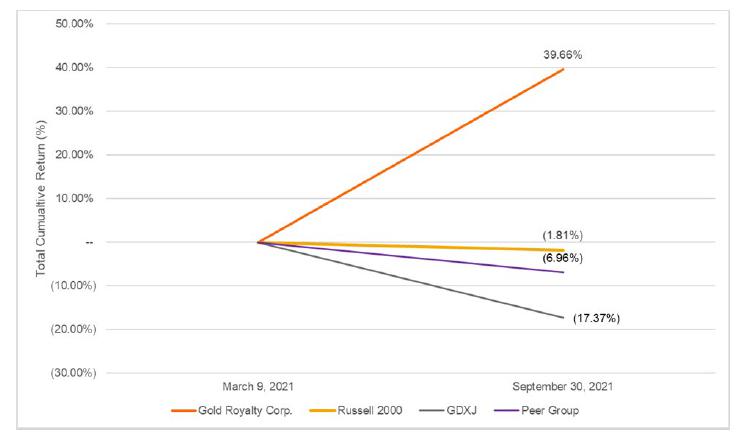

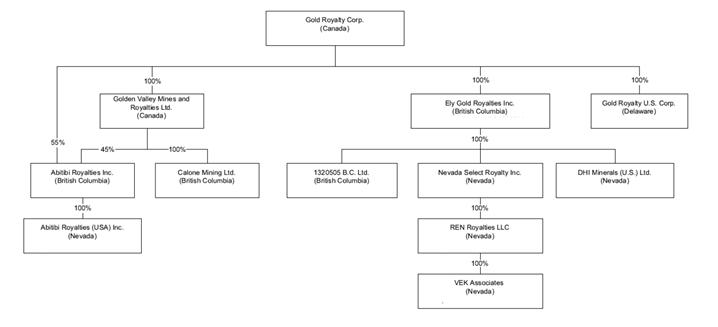

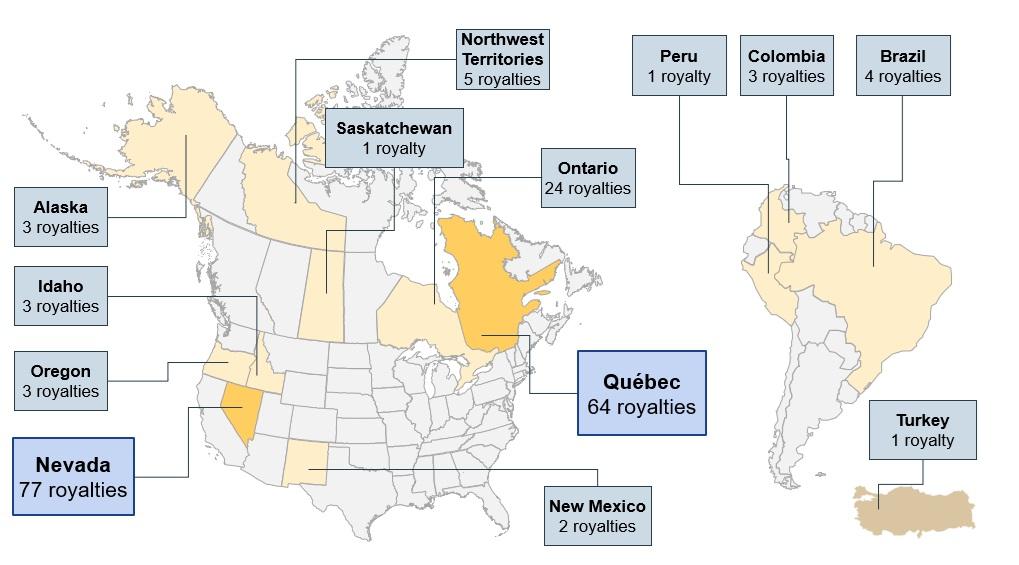

Depending on the manner and circumstances in which a Subsequent Acquisition Transaction is undertaken, the tax consequences applicable to a Shareholder who is disposing of Elemental Shares pursuant to a Subsequent Acquisition Transaction could differ in a materially adverse way from the tax consequences that would be applicable to such Shareholder if it were to dispose of Elemental Shares under the Offer. In the case of a Non-Resident Shareholder, a portion of the consideration received on the disposition of Elemental Shares pursuant to a Subsequent Acquisition Transaction could be subject to Canadian withholding tax.