June 24, 2022

U.S. Securities & Exchange Commission

Division of Corporation Finance

Office of Life Sciences

100 F Street, N.E.

Washington D.C. 20549

| | Re: | Impact BioMedical, Inc. |

| | | Amendment No. 1 to Registration Statement on Form S-1 |

| | | Filed September 29, 2021 |

| | | File No. 333-253037 |

Ladies and Gentlemen:

On behalf of Impact BioMedical, Inc. (the “Company”), this letter responds to comments provided by the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) to the undersigned on October 26, 2021 regarding the amendment to the Company’s Registration Statement on Form S-1, which was filed with the Commission on September 29, 2021 (“Amendment No. 1”).

The substance of the Staff’s comments has been restated below in bold/italicized text. The Company’s responses to the Staff’s comments are set out immediately under the restated comment. An amendment to the Registration Statement (“Amendment No. 2”) that reflects changes made in response to the Staff’s comments, along with changes made to update certain other information in the Registration Statement, has also been filed on this date (“Amendment No. 2”). Unless otherwise indicated, defined terms used herein have the meanings set forth in Amendment No. 2.

Amendment No. 1 to Form S-1 filed September 29, 2021

What are the U.S. federal income tax consequences to me of the Distribution?, page iv

| 1. | We note your disclosure that the U.S. federal income tax treatment of the issuance of the Impact Shares to DSS shareholder is unclear at this stage. Please clarify, if true, that DSS expects the Distribution to be treated as a taxable non-liquidating distribution to its stockholders as indicated on page 16. Please expand your disclosure on page 16 to indicate the basis for the uncertainty. |

Response: We note the Staff’s comment and respectfully advise the Staff that the Company has revised the Amendment No. 2 throughout to indicate that the Distribution will be treated as a taxable non-liquidating distribution to the DSS stockholders.

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 2

Business Overview, page 1

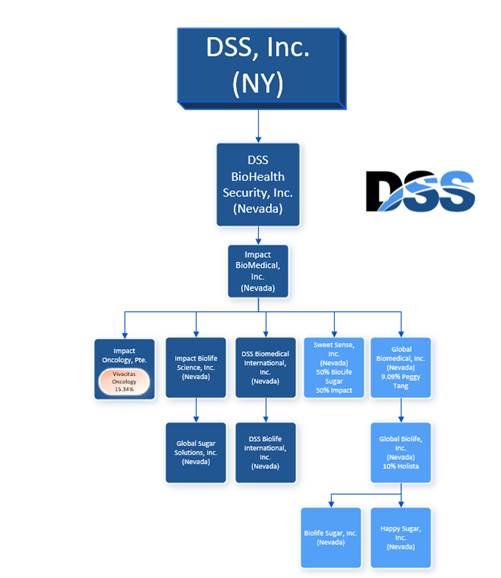

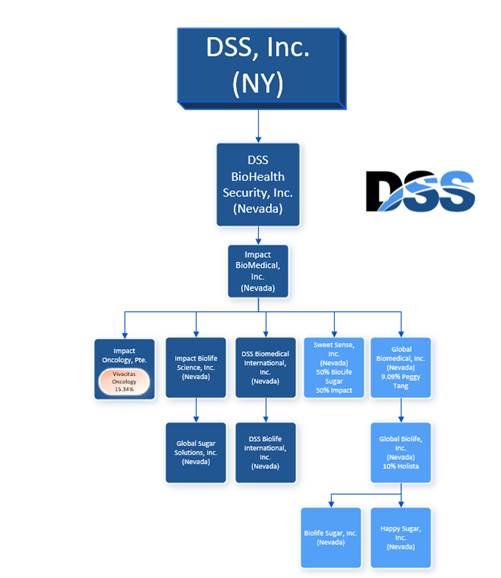

| 2. | We note your disclosure that you have five wholly owned subsidiaries and six partially owned subsidiaries. Please provide an organizational chart showing this ownership structure and indicate the minority interests held by any related party in your partially owned subsidiaries. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that Amendment No. 2 to the Registration Statement has been revised to include the following disclosure regarding the Company’s organization structure with the accompanying organizational chart

Below is a list of our principal subsidiaries:

| | ● | Impact Biolife Science, Inc.; |

| | ● | Global BioMedical, Inc.; |

| | ● | Global BioLife, Inc.; |

| | ● | Sweet Sense, Inc. |

Impact Biolife Science, Inc. We are the sole owner of the outstanding equity of Impact Biolife Science, Inc.

Global Biomedical, Inc. We are the sole owner of the outstanding equity of Global Biomedical, Inc.

Global BioLife, Inc. Through our wholly-owned subsidiary Global Biomedical, we own 90% of the outstanding equity of Global BioLife, Inc. The other equity owner is Holista CollTech Limited (“Holista”) (10%).

Sweet Sense, Inc. We are the owner of 50% of the outstanding equity of Sweet Sense. The other equity owner is BioLife Sugar, Inc. (“BioLife Sugar”). We own 90% of Biolife Sugar, Inc. and the other equity owner is Holista CollTech Limited (“Holista”) (10%).

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 3

Below is an organization chart showing our ownership structure and ownership interests.

Equivir, page 2

| 3. | Please disclose the regulatory status of Equivir in the United States or other appropriate jurisdictions. If this product candidate has not received Pre-Investigational New Drug Application by the FDA, please make that clear. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement throughout to include the following disclosure regarding Equivir’s regulatory status in Amendment No. 2:

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement throughout to include the following disclosure regarding Equivir’s regulatory status in Amendment No. 2:

“Equivir/Nemovir technology is a novel blend of eligible polyphenols (e.g. Myricetin, Hesperetin, Piperine). Myricetin is a member of the flavonoid class of polyphenolic compounds, with antioxidant properties. Hesperitin is a flavanone, and Piperine is an alkaloid, commonly found in black pepper. Polyphenols are sourced from fruits, vegetables, and other natural substances. Equivir was designed to be used as a health supplement and/or medication for human beings, and this intended use is subject to FDA regulation. The FDA must approve any drug or biologic product before it can be marketed in the United States. In addition, prior to being sold outside the United States, our Equivir technology must be approved by the regulatory agencies of foreign governments. Prior to filing a new drug application or biologics license application with the FDA, we would have to perform extensive clinical trials, and prior to beginning any clinical trial, we would need to perform extensive preclinical testing which could take several years and may require substantial expenditures. To date, we have conducted no preclinical testing or clinical trials (human or otherwise) on Equivir. Further, because we have not conducted any testing or studies on Equivir, we are not able to substantiate or demonstrate its benefits as a health supplement or seek FDA approval at this time. Currently, we have no plans to conduct any preclinical testing or clinical trials (human or otherwise) involving Equivir.

We intend to identify third parties or customers that are interested in purchasing, licensing or co-developing products that leverage Equivir. We have not entered into any such agreements to date, and there can be no guarantee that we will enter into any such agreements or that such agreements will be on terms that are favorable to the Company.

In addition, other Equivir analogues are under development and provisional patents have been filed”

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 4

| 4. | We note your disclosure that Global BioLife and Sweet Sense have engaged a consulting firm in the biopharmaceutical and life sciences industry to assist in your goal of licensing each of Linebacker and Equivir/Nemovir. Please identify the consulting firm and clarify whether your activities will be limited to licensing arrangements or whether you intend to conduct any pre-clinical or clinical studies on these candidates. Please also provide the disclosure required by Regulation S-K Item 101(h)(4)(viii) and (ix) in an appropriate location in your prospectus. |

Response: We note the Staff’s comment and respectfully advise the Staff that on July 17, 2019, Global BioLife entered into two “New Business Development Agreements” with BFS Innovations, Inc. (“BFS”), an independent, third-party Ohio corporation that specializes in new product development. The purpose of each of the New Business Development Agreements was for BFS to identify companies interested in purchasing, licensing or co-developing products leveraging the Company’s Linebacker and Equivir/Nemovir technologies, respectively. The agreements did not provide for or involve conducting pre-clinical or clinical studies. The term of each of the New Business Development Agreement’s was two years, and as such, both New Development Agreements expired on July 17, 2021. Neither agreement was renewed and have since expired. We have removed disclosure relating to the New Business Development Agreements from Amendment No. 2 to the Registration Statement.

Management’s Discussion and Analysis of Financial Condition and Results of Operations Results of operations for the year ended December 31, 2020 as compared to the year ended December 31, 2019, page 19

| 5. | We note your results of operations discussion for the year ended December 31, 2020 combines the results of the predecessor and successor companies. Please revise your MD&A to provide a separate discussion of the historical results of the predecessor and the successor periods for 2020. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the Management’s Discussion and Analysis of Financial Condition and Results of Operations in Amendment No. 2 to the Registration Statement.

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 5

| 6. | Additionally please revise your presentation to ensure that your combined results are prepared on a pro forma basis in accordance with Article 11 of Regulation S-X. You should clearly identify this information as being presented on a pro forma basis, explain to your readers how the pro forma presentation was derived, why you believe this presentation to be useful, and any potential risks associated with using such a presentation. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the Management’s Discussion and Analysis of Financial Condition and Results of Operations in Amendment No. 2 to the Registration Statement.

| 7. | We note your reference to allocation of costs from DSS shared resources. Please revise your disclosure to explain how these costs impacted your selling, general and administrative costs. Also tell us how these costs are allocated and why you are not required to disclose this agreement in your related party footnote. Refer to ASC 850-10-50. Please tell us your consideration of the guidance in Staff Accounting Bulletin Topic 1:B. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the Management’s Discussion and Analysis of Financial Condition and Results of Operations in Amendment No. 2 to the Registration Statement.

| 8. | We note that your research and development costs increased due to continued research and development of acquired product formulations. Please disclose the costs incurred during each period presented for each of your key research and development products/projects. If you do not track your research and development costs by project, please disclose that fact and explain why you do not maintain and evaluate research and development costs by project. Provide other quantitative or qualitative disclosure that provides more transparency as to the type of research and development expenses incurred (i.e., by nature or type of expense) which should reconcile to total research and development expense on the Consolidated Statements of Operations. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the Management’s Discussion and Analysis of Financial Condition and Results of Operations in Amendment No. 2 to the Registration Statement.

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 6

Liquidity and Capital Resources, page 19

| 9. | Please revise your discussion of future liquidity and capital resource requirements to analyze material cash requirements from known contractual and other obligations. Specify the type of obligation and the relevant period for the related cash requirements and discuss the anticipated source of funds needed to satisfy such obligations. Refer to Item 303(b)(1) of Regulation S-K. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the Liquidity and Capital Resources in Amendment No. 2 to the Registration Statement.

| 10. | Please revise your MD&A to provide a discussion of your critical accounting estimates. Refer to Item 303(b)(3) of Regulation S-K. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the Liquidity and Capital Resources in Amendment No. 2 to the Registration Statement.

| 11. | We note your disclosure that there was no goodwill impairment at December 31, 2020 or June 30, 2021. Please expand your disclosures to discuss your goodwill impairment testing given your recurring operating losses, negative working capital and negative operating cash flows. Your discussion should address: |

| | ● | the percentage by which fair value of your reporting unit exceeded its carrying value at the date of the most recent test; |

| | ● | a detailed description of the methods and key assumptions used and how the key assumptions were determined; |

| | ● | a discussion of the degree of uncertainty associated with the assumptions; and |

| | ● | a description of potential events and/or changes in circumstances that could reasonably be expected to negatively affect the key assumptions. |

Refer to Item 303(b)(3) of Regulation S-K. S-K.

Response: Response: We note the Staff’s comment and respectfully advise the Staff that we have revised Amendment No. 2 to the Registration Statement to reflect the goodwill valuation by an independent firm, effective as of March 31, 2022.

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 7

Business, page 21

| 12. | We note your statement on page 22 that Equivir has “broad antiviral efficacy against multiple types of infectious disease.” Determinations of efficacy are solely within the authority of the FDA. Please remove any references to efficacy. |

Response: We note the Staff’s comment and respectfully advise the Staff to refer to the Company’s response to Staff comment no. 3 above. We have revised the disclosure in Amendment No. 2 to remove any language referring to the efficacy of Equivir. The disclosure regarding Equivir has been revised in Amendment No. 2 as follows:

“Equivir/Nemovir technology is a novel blend of eligible polyphenols (e.g. Myricetin, Hesperetin, Piperine). Myricetin is a member of the flavonoid class of polyphenolic compounds, with antioxidant properties. Hesperitin is a flavanone, and Piperine is an alkaloid, commonly found in black pepper. Polyphenols are sourced from fruits, vegetables, and other natural substances. Equivir was designed to be used as a health supplement and/or medication for human beings, and this intended use is subject to FDA regulation. The FDA must approve any drug or biologic product before it can be marketed in the United States. In addition, prior to being sold outside the United States, our Equivir technology must be approved by the regulatory agencies of foreign governments. Prior to filing a new drug application or biologics license application with the FDA, we would have to perform extensive clinical trials, and prior to beginning any clinical trial, we would need to perform extensive preclinical testing which could take several years and may require substantial expenditures. To date, we have conducted no preclinical testing or clinical trials (human or otherwise) on Equivir. Further, because we have not conducted any testing or studies on Equivir, we are not able to substantiate or demonstrate its benefits as a health supplement or seek FDA approval at this time. Currently, we have no plans to conduct any preclinical testing or clinical trials (human or otherwise) involving Equivir.

We intend to identify third parties or customers that are interested in purchasing, licensing or co-developing products that leverage Equivir. We have not entered into any such agreements to date, and there can be no guarantee that we will enter into any such agreements or that such agreements will be on terms that are favorable to the Company.

In addition, other Equivir analogues are under development and provisional patents have been filed”

| 13. | We note your disclosure that Linebacker, 3F and Equivir have demonstrated “promising” results or may be “promising” candidates. Please revise your disclosure to focus on the specific factual details of the studies, including the studies conducted and the quantitative information regarding the range of results observed, that lead you to believe that the results are as disclosed. In your prospectus summary, and in this section, clarify whether these results are based on any human trials or were powered for statistical significance. Also, as safety and efficacy determinations are solely within the FDA’s authority, please refrain from referring to any results as “promising” since that may imply safety or efficacy or eventual FDA approval. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the disclosure throughout Amendment No. 2 to the Registration Statement to focus on the specific factual details of the studies (if any) conducted for Linebacker, 3F and Equivir. We further advise the Staff that we have revised Amendment No. 2 to disclose to investors that no preclinical testing or clinical studies have been conducted on these product candidates to date, that the Company currently has no plans to conduct any such test or studies and that without the successful completion of such tests and studies, we will not be able to seek FDA approval to market or sell these products. We have also revised the disclosure in Amendment No. 2 to inform investors that we currently have no plans to begin any preclinical testing or clinical trials involving these products.

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 8

| 14. | We note your disclosure of various collaborations, joint ventures and partnerships throughout your prospectus. Please include a description of the material terms of the following agreements in the prospectus, including the rights and obligations of the parties thereto, financial terms including amounts paid to date, aggregate milestone amounts to be paid or received, the royalty range and term, as applicable, term and termination provisions: |

| | ● | the joint venture with Quality Ingredients, LLC; |

| | ● | the Royalty Agreement, as amended, any collaboration agreement with Chemia Corporation; |

| | ● | the exclusive distribution agreement with BioMed; and |

| | ● | any agreements with GRDG related to research and development of biomedical products. |

With regard to the royalty range, please disclose a royalty range of not more than 10 percentage points.

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised Amendment No. 2 to the Registration Statement to include a description of the above agreements.

Business, page 51

| 15. | We note your disclosure that Equivir is a patented medication. Please expand your disclosure to clarify the specific products, product groups and technologies to which the patents relate, whether the patents are owned or licensed, the type of patent protection (composition of matter, use, or process), the patent expiration dates, and the jurisdictions of the patents. If the patent is licensed from a third party pursuant to a license agreement, please specify. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have advised revised Amendment No. 2 to the Registration Statement to include the following disclosure:

We strive to protect the intellectual property that we believe is important to our business, including seeking and maintaining patent protection intended to cover the composition of matter of our product candidates, their methods of use, their methods of production, related technologies and other inventions. In addition to patent protection, we also rely on trade secrets to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection, including certain aspects of technical know-how.

Our commercial success depends in part upon our ability to obtain and maintain patent and other proprietary protection for commercially important technologies, inventions and know-how related to our business, defend and enforce our intellectual property rights, particularly our patent rights, preserve the confidentiality of our trade secrets and operate without infringing valid and enforceable intellectual property rights of others.

The patent positions for companies like us are generally uncertain and can involve complex legal, scientific and factual issues. In addition, the coverage claimed in a patent application can be significantly reduced before a patent is issued, and its scope can be reinterpreted and even challenged after issuance. As a result, we cannot guarantee that any of our product candidates will be protectable or remain protected by enforceable patents. We cannot predict whether the patent applications we are currently pursuing will issue as patents in any particular jurisdiction or whether the claims of any issued patents will provide sufficient proprietary protection from competitors. Any patents that we hold may be challenged, circumvented or invalidated by third parties.

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 9

The following table shows our material patents and the expiration date of each patent as of September 30, 2021:

Product | | Patent No. | | Status | | Expiration Date | | Summary | | Ex US Status |

LineBacker | | U.S. 8,034,838 | | Granted | | 2029 | | Method/Composition for Treatment of Neurological Disorders with Modified Flavonoid Compound | | None |

| | U.S. 10,123,991 | | Granted | | 2036 | | Composition of Electrophilically Enhanced Phenolic Compounds(any chlorinated myricetin) for Treating Inflammatory Diseases and Disorders | | PCT/US17/32897 (Foreign Filed in AU, BR, CA, CN, EP, HK, IN, JP, KR, RU) |

| | U.S. 10,966,954 | | Granted | | 2036 | | Composition of Electrophilically Enhanced Phenolic Compounds(specific mono and di-chlorinated myricetin) for Treating Inflammatory Diseases and Disorders | | PCT/US2017/032897 (Foreign AU, BR, CN, EP, JP, KR, RU) (30 month date: Nov. 16, 2018) |

| | PCT/US21/22538 | | Pending | | N/A | | Method and Compositions for Treating, Preventing or Limiting the Occurrence of Viral Infection | | PCT/US21/22538 (30 month date: Sept. 16, 2022) |

| | 63,027,775 | | Expired | | N/A | | Method for Treating Viral Infections | | None |

Equivir Nemovir Equivir G | | U.S. 10,383,842; US 15/043,472 | | Granted | | 2036 | | Method/Composition for Preventing and Treating Viral Infections(Influenza) | | PCT/US2017/032897* (Foreign AU, BR, CN, EP, JP, KR, RU) (30 month date: Nov. 16, 2018) (* disclosure of both Linebacker and Equivir) |

| | US 11,033,528 | | Granted | | 2036 | | Method/Composition for Preventing and Treating Viral Infections(Ebola, Rhinovirus) | | PCT/US17/048892** (Foreign AU, CA, CN, JP, KR, EPO, RU) (** Equivir w/ gallic acid) (30 month date: Feb. 28, 2020) |

| | US 17/346,569 | | Pending | | N/A | | Method/Composition for Preventing and Treating Viral Infections (potentially Covid, others). | | N/A |

| | None | | Pending | | N/A | | Method/Composition with Gallic Acid for Preventing and Treating Viral Infections. | | N/A |

| Laetose | | 15/398,159 | | Pending | | N/A | | A composition including a select sugar source and myo-inositol that impacts the signaling of TNF-a and pro-inflammatory cytokines when metabolized, with ability to control blood glucose levels, treat diabetes and inflammatory diseases. | | PCT/US18/49965 Foreign Filed in AU, BR, CA, CN, EP, HK, IN, JP, KR and RU (30 month date: Mar. 7, 2020) |

| 3F (Anti-Viral) | | 16/212,966 | | Pending | | N/A | | Composition of natural elements for use as an antibacterial and antiviral agent | | PCT/US19/64254 Foreign Filed in AU, BR, CA, CN, EP, IN, JP, KR and RU (30 month Jun. 7, 2021 |

| 3F (DB Repellent) | | U.S. 16/593,693; U.S. 10,966,424 PCT/US520/54042 | | Granted | | 2039 | | Unique weight based composition/method of natural elements with DEET for use as insect repellent | | PCT Filed October 2, 2020 PCT/US20/54042) – 30 Month Date April 4, 2022 (currently no foreign national stage countries pending |

| 3F (Anti-Insect) | | None | | Pending | | N/A | | Unique weight-based composition/method of natural elements without DEET for use as insect repellent | | PCT/US20/17183 (Foreign Filed in CA, JP, CN, KR, EPO, RU) (30 month: Jun. 7, 2021) |

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 10

| 16. | In addition to the patent information for Equivir, please revise to provide all information required by Regulation S-K Item 101(h)(4)(vii) for Linebacker, Laetose and 3F. |

Response: We note the Staff’s comment and respectfully advises the Staff to refer to the Company’s response to Staff comment no. 15 and the related additional disclosure.

| 17. | Please provide any disclosures required by Regulation S-K Item 103. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have included the following disclosure in Amendment No. 2 to the Registration Statement:

“From time to time, we may be involved in various other claims and legal proceedings relating to claims arising out of our operations. We are not currently a party to any material legal proceedings.”

DSS Note, page 24

| 18. | We note the disclosure that DSS intends continue to fund the operations of the company through a year from the date the financial statements were available to be issued. Please clarify the end date of this arrangement and indicate whether there is any maximum amount that may be obtained from DSS under this note. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have included the following disclosure in Amendment No. 2 to the Registration Statement:

“On December 31, 2020, and later amended on December 31, 2021, the Company executed a Revolving Promissory Note (“Note”) with DSS which accrues interest at a rate of 4.25% and is due in full at the maturity date of December 31, 2022. The revolving nature of this Note permits for principal amounts borrowed to be repaid and reborrowed. In the case of default, at DSS’s option, (i) eighteen percent (18%) per annum, or (ii) such lesser rate of interest as Lender in its sole discretion may choose to charge; but never more than the Maximum Lawful Rate. As of December 31, 2021 and 2020, this Note had an outstanding balance of $12,523,615 and $1,059,229, respectively.

Although there is no formal written agreement to fund the Company, DSS may continue to fund the operations of the Company on an as needed basis to be decided by its board of directors.”

Management, page 27

| 19. | We note your disclosure that your research and development efforts are headed by Mr. Daryl Thompson in his capacity as Director of Scientific Initiatives in Global BioLife Inc. Please provide the disclosures for Mr. Thompson as required by Item 401(c) of Regulation S-K. |

Response: We note the Staff’s comment and respectfully advise the Staff that the Company has updated the Management’s Discussion and Analysis of Financial Condition and Results of Operations of Amendment No. 2 to the Registration Statement to provide the disclosure required by Item 401(c) of Regulation S-K as it pertains to Mr. Daryl Thompson. In addition, we have included the following disclosure regarding the services provided by Mr. Daryl Thompson:

Certain Relationships and Related Party Transactions, page 34

| 20. | We note your disclosure that prior to the execution of the Share Exchange Agreement, your ownership of a suite of antiviral and medical technologies was valued at $382 million through a required independent valuation that was completed by Destum Partners. Please file the consent of Destum Partners as required by Securities Act Rule 436. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised Amendment No. 2 to remove any reference to the Destum Partners’ valuation of our suite of antiviral and medical technologies.

Exhibit Index, page 40

| 21. | We note your disclosure on page 1 that Global BioLife has biomedical intellectual property, including intellectual property, assigned to it by one of its shareholders. We also note your disclosure on page 25 that certain services are provided to you and your subsidiaries by GRDG, a related party, pursuant to the Stockholders’ Agreement, dated as of December 2020. Please file these agreements as exhibits to your registration statement or tell us why that would not be required. |

Response: We note the Staff’s comment and respectfully advise the staff that we will file with Amendment No. 2 to the Registration Statement the Global BioLife, Inc. Stockholders’ Agreement between Global BioLife, Inc. and its stockholders, Global BioMedical, Inc. (our wholly-owned subsidiary), GRDG Sciences, LLC and Holista Cootech Limited.

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 11

Interim Financial Statements

Note 5 - Investments, page F-11

| 22. | Please tell us how you are accounting for your investment in Vivacitas Oncology Inc. and the applicable GAAP guidance used. In this respect we note that the company will be allocated two seats on the board of Vivacitas and the Seller is a related party. Revise your disclosure to provide any disclosure required by ASC 320-10-50, ASC 321-10-50, ASC 323-10-50, or any other applicable guidance. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the financial statements in the Amendment No. 2.

Annual Financial Statements

Note 1 - Nature of Operations and Basis of Presentation Nature of Operations, page F-20

| 23. | We note that you elected to apply pushdown accounting for the acquisition of Impact BioMedical and determined that the fair value of the consideration transferred was approximately $38,319,000. Please reconcile this with your disclosure on page 34 that states total consideration was $50 million. Also explain how the consideration amount was determined. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the financial statements in the Amendment No. 2.

| 24. | We also note that you determined that the fair value of certain developed technology and pending patents assets acquired was approximately $22,260,000. Please address the following: |

| | ● | explain how you determined the fair value of these assets including a description of the methodology and key assumptions used; |

| | ● | given that Alset International Limited is a related party, tell us how you considered SAB Topic 5G when determining the fair value; and |

| | ● | explain how you determined the useful lives of the intangible assets acquired. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised the financial statements in the Amendment No. 2.

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 12

General

| 25. | Since you appear to qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, please disclose that you are an emerging growth company and revise your registration statement to: |

| | ● | describe how and when a company may lose emerging growth company status; |

| | ● | briefly describe the various exemptions that are available to you, such as exemptions from Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934; and |

| | ● | state your election under Section 107(b) of the JOBS Act: |

| | ● | if you have elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b), include a statement that the election is irrevocable; or |

| | ● | if you have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b )(2), provide a risk factor explaining that this election allows you to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. Please state in your risk factor that, as a result of this election, your financial statements may not be comparable to companies that comply with public company effective dates. Include a similar statement in your critical accounting policy disclosures. |

Response: We note the Staff’s comment and respectfully advise the Staff that we have revised Amendment No. 2 to the Registration Statement to include the following disclosure:

“Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, (the “JOBS Act”). As such, we may take advantage of reduced disclosure and other requirements otherwise generally applicable to public companies, including:

| | ● | presentation of only two years of audited financial statements and related financial disclosure; |

| | ● | exemption from the requirement to have our registered independent public accounting firm attest to management’s assessment of our internal control over financial reporting; |

| | ● | exemption from compliance with the requirement of the Public Company Accounting Oversight Board, or PCAOB, regarding the communication of critical audit matters in the auditor’s report on the financial statements; |

| | ● | reduced disclosure about our executive compensation arrangements; and |

| | ● | exemption from the requirement to hold non-binding advisory votes on executive compensation or golden parachute arrangements. |

Division of Corporation Finance

Impact BioMedical, Inc.

June 24, 2022

Page 13

We will remain an emerging growth company until the earliest to occur of: (1) the last day of the fiscal year in which we have at least $1.07 billion in annual revenue; (2) the date we qualify as a “large accelerated filer,” with at least $700.0 million of equity securities held by non-affiliates; (3) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period; and (4) the last day of the fiscal year ending after the fifth anniversary of the IPO.

As a result of this status, we have taken advantage of reduced reporting requirements in this prospectus and may elect to take advantage of other reduced reporting requirements in our future filings with the SEC. In particular, in this prospectus, we have provided only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations, and we have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies unless it otherwise irrevocably elects not to avail itself of this exemption. We have elected to use this extended transition period for complying with new or revised accounting standards until we are no longer an emerging growth company or until we affirmatively and irrevocably opt out of the extended transition period. As a result, our consolidated financial statements may not be comparable to the financial statements of companies that comply with new or revised accounting pronouncements as of public company effective dates.”

| | Sincerely, |

| | |

| | Darrin M. Ocasio, Esq. |