August 2, 2022

U.S. Securities & Exchange Commission

Division of Corporation Finance

Office of Life Sciences

100 F Street, N.E.

Washington D.C. 20549

| | Re: | Impact BioMedical, Inc. |

| | | Amendment No. 3 to Registration Statement on Form S-1 |

| | | Filed July 11, 2022 |

| | | File No. 333-253037 |

Ladies and Gentlemen:

On behalf of Impact BioMedical, Inc. (the “Company”), this letter responds to comments provided by the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) to the undersigned on July 21, 2022, regarding the amendment to the Company’s Registration Statement on Form S-1, which was filed with the Commission on July 11, 2022 (“Amendment No. 3”).

The substance of the Staff’s comments has been restated below in bold/italicized text. The Company’s responses to the Staff’s comments are set out immediately under the restated comment. An amendment to the Registration Statement that reflects changes made in response to the Staff’s comments, along with changes made to update certain other information in the Registration Statement, has also been filed on this date (“Amendment No. 4”). Unless otherwise indicated, defined terms used herein have the meanings set forth in Amendment No. 4.

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 2

Amendment No. 3 to Form S-1 filed July 11, 2022

Summary

Business Overview, page 2

| 1. | Please revise your summary to present a balanced view of your company and its current stage of development by focusing on the most material aspects of your company. As currently written, your summary focuses on the positive aspects of your business and includes a lengthy recitation of disclosures appearing in the Management’s Discussion and Analysis and Business sections. Please balance the description of your strengths with equally prominent disclosure of the challenges you face and the risks and limitations that could harm your business or inhibit your strategic plans. Ensure that you discuss the risks and obstacles you face in developing your product candidates with the same level of detail as you use to discuss the positive aspects of your operations. For example, but without limitation, balance your discussion to disclose the following: that you have not conducted and do not have any current plans to conduct any pre-clinical testing for any of your product candidates; |

| ● | that you have no FDA approved products; |

| ● | that it may be several years before you seek FDA approval for any of your products; |

| ● | that you have not yet found any third-parties or customers that are interested in purchasing, licensing, or co-developing products that leverage any of your products; |

| ● | that you cannot guarantee that you will be able to find such third-parties or enter into such agreements; |

| ● | that you have not yet generated any revenue from your operations; and |

| ● | information regarding your history of net losses, negative class flows, and accumulated deficit over the last two years. |

Response: We note the Staff’s comment and respectfully advise the Staff that the Company’s primary business model is to perform analytical research combined with bench studies phase 1 testing. The Company utilizes state of the art science, research labs and global intellectual assets to quickly qualify, quantify, procure and test both applicable and accurate paradigms. Upon successful bench studies, lab testing and computer modeling demonstrating promising treatments by the compound, molecule, or process, the Company seeks a patent on the developed technology.

Thereafter, the Company seeks out a business partner that will license the technology and make the financial commitment to obtain the necessary FDA approval, including, if necessary, FDA review, for Phase I/II clinical trials, Phase II, and to commercialization.

Over the past 5 months, the Company has demonstrated this business model with the licensing of Equivir A and Equivir Y to ProPhase Labs. In addition, the Company also recently licensed Linebacker I and Linebacker II to ProPhase BioPharma, Inc. on July 18, 2022.

| 2. | We note your revisions in response to our prior comment 2. We also note that your wholly-owned subsidiary, DSS PureAir, Inc., was not included in the subsidiary chart. Please revise your chart to include all subsidiaries of Impact BioMedical, Inc. |

Response: We note the Staff’s comment and respectfully advise the Staff that DSS PureAir, Inc. is not a subsidiary of the Company. Accordingly, the Company has revised Amendment No. 4 throughout to remove references to DSS PureAir, Inc.

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 3

| 3. | We note what appear to be several apparent discrepancies in the beneficial ownership disclosures of your subsidiaries. For example, we note the following statements: |

| ● | On page 2, 18 and 27, you state that Impact Biomedical is the sole owner of Global Biomedical, Inc. and Impact Biolife Science, Inc. However, your subsidiary chart appears to indicate that Peggy Tang owns 9.09% of Global Biomedical, Inc., and on page 34, you state that GRDG is a stockholder of Impact BioLife. |

| ● | On pages 2, 18 and 27, you state that Impact Biomedical owns 90% of Global BioLife Inc.’s outstanding equity through Global Biomedical, Inc. However, you state on page 5 that you own 80% of Global BioLife through Global Biomedical and on page F-24 you state that the attributable interest as of March 31, 2022 in Global BioLife, Inc. was 81.8%. |

| ● | The subsidiary chart does not convey Impact’s 90% equity ownership and Holista’s 10% equity ownership of Biolife Sugar, Inc. |

| ● | You disclose that you are the owner of 50% of the outstanding equity of Sweet Sense, that the other equity owner is BioLife Sugar, Inc., and that you own 90% of Biolife Sugar, Inc. and the other equity owner is Holista CollTech Limited (10%). Please reconcile this disclosure to the information on page F-24 that the attributable interest as of March 31, 2022 in Sweet Sense, Inc. was 95.5%. |

Please revise your subsidiary chart and your disclosure throughout to address these apparent discrepancies in the equity interests of your subsidiaries.

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement to include a revised subsidiary chart and revised the Registration Statement to include the following disclosure in Amendment No. 4:

“Below is a list of our principal subsidiaries:

| | ● | Impact Biolife Science, Inc.; |

| | ● | Global BioMedical, Inc.; |

| | ● | Global BioLife, Inc.; |

| | ● | Sweet Sense, Inc. |

Impact Biolife Science, Inc. We are the sole owner of the outstanding equity of Impact Biolife Science, Inc.

Global Biomedical, Inc. We own 90.91% of Global Biomedical, Inc. outstanding equity, and the balance minority equity owner is Peggy Tang.

Global BioLife, Inc. Through our majority ownded subsidiary Global Biomedical, Inc., we own 90% of the outstanding equity of Global BioLife, Inc. The other equity owner is Holista CollTech Limited (“Holista”) (10%).

Sweet Sense, Inc. We are the owner of 50% of the outstanding equity of Sweet Sense. The other equity owner is BioLife Sugar, Inc. (“BioLife Sugar”).”

| 4. | We note the inclusion of several products in your Summary that are not discussed in your Business Section (i.e. Procombin, VanXin, Quantum, CRST 1, Keto Sweet, Solarin, and Bio Med). Given the limited amount of disclosure related to these programs, please explain why these programs are sufficiently material to your business to warrant inclusion in your Summary. If they are material, please expand your disclosure in your Business section to provide a more fulsome discussion of these programs, including a description of development activities conducted. Alternatively, remove any programs that are not currently material from your Summary on page 4. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company believes the programs are sufficiently material to its business to warrant inclusion in its summary except for Procombin, Solarin, Bio Med, and Keto Sweet and has revised the Registration Statement throughout to expand its disclosure in the business section to provide a more fulsome discussion of these programs in Amendment No. 4.

| 5. | We note your revision in response to our prior comment 12 and reissue. We note your statement that Equivir is a compound that is “believed to be successful in antiviral infection treatments” and your description of Equivir as “viral-fighting.” Efficacy and safety are determinations that are solely within the authority of the FDA. Please remove these and all other statements of efficacy. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement throughout to remove these and all other statements of efficacy in Amendment No. 4.

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 4

| 6. | We also note your statement on page 4 that Equivir is “a novel blend of FDA Generally Recognized as Safe (“GRAS”) eligible natural compounds which have demonstrated anti viral effects.” Please balance your disclosure here by stating that the FDA has not approved this product, that GRAS designation means that the FDA does not question the basis for a notifier’s GRAS determination, and that GRAS determination does not increase the likelihood that your product candidate will receive marketing approval. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement to include the following disclosure in Amendment No. 4:

“Equivir: A compound that is believed to be successful in antiviral infection treatments. Equivir/Nemovir technology is a novel blend of FDA Generally Recognized as Safe (“GRAS”) eligible natural componds which have demonstrated antiviral effects with additional potential application as health supplements or medication. These compounds are generally sourced from fruits, vegetables, and other natural substances. Please note, the FDA has not approved this product, GRAS designation means that the FDA does not question the basis for a notifier’s GRAS determination, and GRAS determination does not increase the likelihood that product candidates will receive marketing approval.”

| 7. | We note your disclosure on pages 20 and 21 that you have not conducted preclinical testing and have no plans to conduct any scientific testing relating to Linebacker, Laetose, or Equivir. Given the early stage of development of these programs, please explain why each program is sufficiently material to your business to warrant discussion in this prospectus. To the extent that these product candidates are material, please clearly state for each product candidate on page 4 that you have not conducted and have no current plans to conduct any preclinical testing for that product. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that each program is sufficiently material to the Company’s business to warrant discussion in the Registration Statement because the Company licenses and/or intends to these programs.

The Company has revised the Registration Statement to include the following disclosure in Amendment No. 4:

“Impact BioMedical has had several important and valuable products, technology, or compounds that are in continuing development and/or licensing stages. The Company has not conducted and has no current plans to conduct any preclinical testing for these products, technology, or compounds:”

Stockholders Agreement between Impact BioLife and the Impact BioLife Stockholders, page 6

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 5

| 8. | We note that the Company contracted for the same consideration and incurred the exact same expenses for 2020 and 2021 under the Stockholders Agreement between Global BioLife and the Global BioLife Stockholders as it did under the December 2020 Stockholders Agreement between Impact BioLife and the Impact BioLife Shareholders. Please clarify whether these terms are two separate payment obligations to GRDG, such that Impact BioMedical pays a total of $86,000 per month to GRDG, or whether they are one payment obligation, such that Impact BioMedical pays $43,000 per month. |

Response: We note the Staff’s comment and respectfully advise the Staff that they are one payment obligation, such that the Company pays $43,000 per month.

Summary of the Distribution

Tax Consequences to DS Stockholders, page 10

| 9. | We have reviewed your revisions in response to our prior comment 1. We note your statement on page 10 that DSS shareholders “will potentially” be subject to a taxable event on the distribution of the Impact Shares. Please revise to clarify that DSS expects the DSS shareholders to be subject to a taxable event on the distribution. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement to include the following disclosure in Amendment No. 4:

“DSS shareholders will be subject to a taxable event on the distribution of the Impact Shares. See “Material U.S. Federal Income Tax Consequences of the Distribution” for more information regarding the potential tax consequences to you of the Distribution.”

Management’s Discussion and Analysis of Financial Condition and Results of Operations Fiscal Year Ended December 31, 2021 compared to Year Ended December 31, 2020, page 23

| 10. | We note your disclosure that your results of operations for the year ended December 31, 2020 have been prepared on a combined proforma basis. However, it does not appear as though you have presented combined proforma information for the year ended December 31, 2020. Please revise the filing to delete reference to the combined pro forma basis or advise us accordingly. |

Response: We note the Staff’s comment and respectfully advise the Staff that the Company has revised the Registration Statement to delete reference to the combined pro forma basis for the year ended December 31, 2020 in Amendment No. 4.

| 11. | We note the significant increase in your income tax benefit. Please revise your results of operations discussion to include analysis of your income tax benefit. |

Response: We note the Staff’s comment and respectfully advise the Staff that the Company has revised the Registration Statement to include a section titled “Income tax benefit” in the Management’s Discussion and Analysis of Financial Condition and Results of Operation to Amendment No. 4.

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 6

Other Expense, page 24

| 12. | We note that through your distribution agreement with BioMed Technologies Asia Pacific Holdings Limited, you sold $82,664 of product during the year ended December 31, 2021, which was offset by costs of approximately $78,000. Please explain to us how you are accounting for this agreement under ASC 606, including your analysis of whether you are a principal or an agent in these transactions. |

Response: We note the Staff’s comment and respectfully advise the Staff that the Company noted its relationship under this agreement as an agent in the MD&A section of the S1. The Company is accounting for this agreement under ASC 606, as a one-time transaction and although the distribution agreement exists, no other transactions have occurred and thus this transaction has been netted as part of other income and is immaterial to the financial statements. The Company recognizes revenue when control of, and title to, the product sold transfers to the customer in accordance with applicable shipping terms, which can occur on the date of shipment or the date of receipt by the customer, depending on the customer and the agreed upon shipping terms.

Critical Accounting Policies

Goodwill, page 25

| 13. | We note your added disclosure in response to prior comment 11. Please revise your disclosure to provide more specific detail regarding your goodwill impairment testing. As you appear to only have done a qualitative analysis based on your disclosure in Note 6. Goodwill on page F-13, please address why no quantitative analysis was necessary in light of recurring operating losses, negative working capital and negative operating cash flows. In addition, as your business model appears to be to license, sell, or co-develop your technologies and your only significant agreement is with GRDG, which appears to be a related party, please tell us your consideration of how these factors were considered in determining your goodwill impairment analysis. If you performed a quantitative analysis, please address our prior comment 11, including the percentage by which the fair value of your reporting unit exceeded its carrying value at the date of the most recent test. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement to include the following disclosure in Amendment No. 4:

“In March 2021, the fair value of the assets acquired by DSS on August 21, 2020 was concluded, at which time $25,093,000 was allocated to goodwill. No additional quantitative testing was performed for the years ended December 31, 2020 as there were no changes in variables and inputs to the valuation model. During the fourth quarter of 2021, we used qualitative factors to determine whether it was more likely than not (likelihood of more than 50%) that the fair value of a reporting unit exceeded its carrying amount. No goodwill impairment was identified as a result of these tests.”

Further, at the time of filing, page 28 of the Registration Statement indicated that the Company is still looking for partners to purchase, license, or co-develop its technologies. The Company has since executed agreements for both Equivir and Linebacker products. The Company is also in discussions with third parties for two of its other technologies acquired at the Company. Also, although the Company has incurred historical losses, its funding arraignment with DSS provides the opportunity to continue business activities.

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 7

Business, page 27

| 14. | We note your response to our prior comment 13 and reissue in part. We note your statements that “natural compounds used in the Linebacker platform have demonstrated strong potential in treating and preventing a range of diseases . . .” and that “use of Laetose in a daily diet, compared to sugar, could result in 30% less sugar consumption and lower glycenmic index/load.” Given the early stage of these products, please explain your basis for these claims. Please also describe any discovery activities you have conducted for these and your other product candidates. |

Response: We note the Staff’s comment and respectfully advise the Staff that Linebacker is a natural compound of a polyphenol that has been altered to increase efficacy. The Company’s basis for the claim that use of Laetose in a daily diet, compared to sugar, could result in 30% less sugar consumption and lower glycenmic index/load is that Laetose has 30% less sugar.

| 15. | We note your revisions in response to our prior comment 14 and reissue in part. Please describe the material terms of your joint venture with Quality Ingredients, LLC and please file the Exclusive Distribution Agreement with BioMed as an exhibit. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company is no longer a member to a joint venture with Quality Ingredients, LLC. In connection with a Stock Purchase Agreement entered into on November 8, 2019, by and between the Company, BioLife Sugar, Inc., Quality Candy Company, LLC, and Quality Ingredients, LLC, the parties terminated the joint venture.

We note the Staff’s comment and respectfully advise the Staff that the Exclusive Distribution Agreement with BioMed has been filed in Amendment No. 4 as Exhibit 10.15.

Equivir, page 30

| 16. | If known, please describe the potential mechanism of action for Equivir. If not known or understood, please make that clear. |

Response: We note the Staff’s comment and respectfully advise the Staff that Equivir down regulates cytokine storm caused by COVID-19, inhibits viral replication mechanism, and down regulates ACE-2 binding receptors for viral entry.

DSS Note, page 32

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 8

| 17. | We note your revisions in response to our prior comment 18. We also note that while your disclosure states that the Revolving Promissory Note was amended on December 31, 2021, the Revolving Promissory Note you filed as Exhibit 10.6 appears to be dated June 30, 2021. Please revise to clarify whether this is the same promissory note and file the amended December 31, 2021 Revolving Promissory Note as an exhibit. Additionally, please provide a definition for the “Maximum Lawful Rate.” |

Response: We note the Staff’s comment and respectfully advise the Staff that the date of the Revolving Promissory Note is December 31, 2020, and later amended on December 31, 2021, and March 31, 2022. The Company has revised the exhibit index to the Registration Statement and has filed the agreements dated December 31, 2020, December 31, 2021, and March 31, 2022 with Amendment No. 4.

The Company also has revised the Registration Statement to remove the capitalization of of “Maximum Lawful Rate” as a defined term in Amendment No. 4. For purposes of the Revolving Promissory Note, as amended, “Maximum Lawful Rate” means the rate of interest from time to time which any lender is allowed to contract for, charge for, take, reserve, or receive under Texas law after taking into account, to the extent required by Texas law, any and all relevant payments or charges thereunder.

Intellectual Property, page 35

| 18. | We note your revisions in response to our prior comment 15. Please provide the expected expiration dates of your pending patent applications. Please also remove your expired Patent No. 63,027,775 from your chart. |

Response: We note the Staff’s comment and respectfully advise the Staff that for applicants that mature to patents, expiration dates are not yet known but are generally approximately 20 years from application filing. The Company has revised the Registration Statement to include a footnote reflecting such and removing Patent No. 63,027,775 from the chart in Amendment No. 4.

Management, page 38

| 19. | We reissue our prior comment 19. Please revise your management section to identify and disclose Mr. Daryl Thompson’s background to the same extent as your executive officers, as required by Item 401(c) of Regulation S-K. Please also clarify the role of Dr. Rajen M. Dato and to the extent that he is expected to make significant contributions to your business, please similarly identify and disclose his background to the same extent as your executive officers. |

Response: We note the Staff’s comment and respectfully advise the Staff that the Company has revised the Registration Statement to include Mr. Thompson in the management section of Amendment No. 4. Dr. Dato’s role is a silent partner in Global BioLife and the Company believes Dr. Dato does not make significant contributions to the Company to require his background disclosed to the same extent as in the case of executive officers.

Certain Relationships and Related Party Transactions, page 43

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 9

| 20. | We note your revisions in response to prior comment 20 and note that you continue to attribute the value of the acquired suite of technologies to an independent valuation expert. While management may elect to take full responsibility for valuation used, if you elect to refer to an expert, you may need to include their consent as an exhibit to registration statement. Please refer to Question 141.02 of the Compliance and Disclosure Interpretations on Securities Act Sections and file the consent of Destum Partners if required. |

Response: We note the Staff’s comment and respectfully advise the Staff that consistent with Question 141.02 of the Compliance and Disclosure Interpretations on Securities Act Sections, the Company has removed reference to a third party expert as there is no requirement to make reference to a third party expert simply because the registrant used or relied on the third party expert’s report or valuation or opinion in connection with the preparation of a Securities Act registration statement.

Report of Independent Registered Public Accounting Firm, page F-2

| 21. | We note that Freed Maxick CPAs, P.C. audited your December 31, 2020 financial statements and Turner, Stone & Company, LLP audited your December 31, 2021 financial statements. Please revise your filing to provide the information required by Item 304 of regulation S-K, Refer to Item 11 (i) of Form S-1. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement to include an Item 11 in Amendment No. 4.

Financial Statements for the years ended December 31, 2021

2. Summary of Significant Accounting and Reporting Policies Intangible Assets, page F-11

| 22. | Refer to prior comment number 24 and address the following. |

| ● | Please tell us supplementally how you addressed Staff Accounting Bulletin (SAB) Topic 5:G when determining how to record the developed technology and pending patents. In this regard, tell us your consideration of whether or not the parties involved in the transfer of the company, including Alset, are considered promoters of the offering and or a shareholders. We note that Mr. Chan is the Chairman of the Board and largest shareholder of DSS and is the Chief Executive Officer and largest shareholder of Alset International Ltd. If you do not believe SAB Topic 5G applies, please tell us why. |

| ● | You state beginning on page 28 that you do not plan to conduct preclinical testing or clinical trials or other testing of your platforms/technology and you intend to identify third parties or customers that are interested in purchasing, licensing or co-developing products for your product candidates. Please provide us an analysis as to why you believe the intangible assets were not impaired at each balance sheet date. |

| ● | If you continue to believe the intangible assets are not impaired at the balance sheet date, please provide the disclosures required by ASC 350-30-50 in your interim and annual financial statements. |

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 10

Response: We note the Staff’s comment and respectfully advise the Staff that management believes that Staff Accounting Bulletin (SAB) Topic 5:G does not apply in this case and instead relies on Staff Accounting Bulletin No. 97 which indicates that “the guidance in SAB Topic 5:G is not intended to modify the requirements of APB Opinion No. 16, “Business Combinations” (APB Opinion 16). Accordingly, the Company believes that the combination of two or more businesses should be accounted for in accordance with APB Opinion 16 and its interpretations.” Please see the accompanying memorandum attached hereto as Exhibit A, identifying this transaction as business combination. At the time of filing, page 28 of the Registration Statement indicated that the Company is still looking for partners to purchase, license, or co-develop its technologies. The Company has since executed agreements for both Equivir and Linebacker products. The Company is also in discussions with third parties for two of its other technologies acquired at the Company. For these reasons, impairment is of the definite-lived intangible assets is not deemed necessary by the Company. The Company has added a separate footnote was to the financial statements for ASC 350-30-50 for December 31, 2021, and March 31, 2022 financial statements. Please note, the Company only has one class of intangible assets.

Note 5. Investments, page F-12

| 23. | Refer to your response to prior comment number 22. You state on page F-13 that you entered an agreement to purchase 500,000 shares of Vivacitas common stock with an option to purchase 1,500,000 additional shares (Vivacitas Agreement #1). On March 18, 2021 you acquired Impact Oncology PTE Ltd., which owned 2,480,000 shares of common stock of Vivacitas along with the option to purchase an additional 250,000 shares of common stock. It appears you also acquired additional shares of Vivacitas on April 1, 2021 in connection with Vivacitas Agreement #2. On July 22, 2021, you exercised 1,000,000 of available options under the Vivacitas Agreement #1. You state that your equity position in Vivacitas was 90,000 shares or 16% as of December 31, 2021. Please address the following: |

| ● | Disclose the number of shares of Vivacitas you acquired in connection with the Vivacitas Agreement #2. |

| | | |

| ● | Tell us how you concluded you owned 90,000 shares as of December 31, 2021 in light of the disclosures noted above. In this regard, clarify if some of the shares acquired were sold during the period. |

| | | |

| ● | If you owned more than 16% of Vivacitas, please update your analysis of your accounting treatment of Vivacitas, particularly in light of your two seats on the board of directors. |

Response: We note the Staff’s comment and respectfully advise the Staff that footnote disclosure has revised in to reflect the shares in Amendment No. 4. Please note, that carrying value of the Company’s investment in Vivacitas is $35,000 less than the actual amount. Management has identified this discrepancy and deemed it immaterial to financial statements and not requiring adjustment. Although DSS, Inc. holds 2 board seats of Vivacitas, it does not hold a majority, nor does it have any impact on the day-to-day operations and decisions made by the management of Vivacitas. For those reasons, the Company believes it has properly recorded its investment at costs.

Exhibits

Division of Corporation Finance

Impact BioMedical, Inc.

August 2, 2022

Page 11

| 24. | We note that you have entered into a License Agreement with ProPhase Labs and a Licensing Proceeds Distribution Agreement with GRDG. Please describe the material terms of each agreement, including a description of each party’s rights and obligations, a quantification of any payment obligations including milestones and range of royalty payments, the contract term and any termination provisions. Please also file the agreements as exhibits or provide us with an analysis supporting a determination that you are not required to file them as an exhibit. |

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement to include the following disclosure of the Licensing Agreement with ProPhase Labs in Amendment No. 4 and have filed the Licensing Proceeds Distribution Agreement as Exhibit 10.18:

“On March 17, 2022, the Company entered into a License Agreement (the “License Agreement”) with ProPhase Labs, Inc. (“ProPhase”) and Global BioLife, Inc., pursuant to which ProPhase obtained a license to intellectual property rights of Global BioLife, Inc. in exchange for a royalty fee of five and one half percent (5.5%) of net sales. Pursuant to the License Agreement, Global BioLife, Inc. shall reimburse ProPhase for fifty percent (50%) of the development costs up to one million two hundred fifty dollars ($1,250,000). The term (the “Term”) of the License Agreement is the later of (a) the expiration date of the last to expire a valid claim comprising the licensed patents, or (b) twelve (12) years from the date of first commercial sale. ProPhase may terminate this Agreement for any or no reason upon thirty (30) days prior written notice to Global BioLife, Inc. In addition, At any time prior to expiration of the Term, either party may terminate the License Agreement for cause by providing written notice. “

Response: The Company notes the Staff’s comment and respectfully advises the Staff that the Company has revised the Registration Statement to include the following disclosure of the Licensing Proceeds Distribution Agreement with GRDG in Amendment No. 4 and have filed the Licensing Proceeds Distribution Agreement as Exhibit 10.20:

“On February 15, 2022, the Company entered into a Licensing Proceeds Distribution Agreement (the “Licensing Agreement”) with GRDG Sciences, LLC (“GRDG”), Global BioLife, Inc., and Impact BioLife Sciences, Inc., pursuant to which GRDG will receive 20% of the gross licensing or sale proceeds received by the Company from the licensing of improvements with patent and patent applications (the “Improvements”), and all research and technology, developed, made, owned, conceived, by GRDG in exchange for funding from the Company for research and technology development activities. The term of the Licensing Agreement is from February 15, 2022 through the later of (1) the date of the last to expire of a valid patent of intellectual property, or (2) the date of the last license or fee income generated from the Improvements.”

| 25. | Please file complete exhibits. For example, it appears that Exhibit B mentioned in Section 6.2 of Exhibit 10.13 appears to be missing. |

Response: We note the Staff’s comment and respectfully advise the Staff that Exhibit 10.13 has been refiled to include Exhibit B in Amendment No. 4.

| | Sincerely, |

| | |

| | Darrin M. Ocasio, Esq. |

EXHIBIT A

MEMORANDUM

| To | Accounting files |

| Date | September 2020 |

| Subject | DSS – Impact BioMedical Inc. Business Combination Accounting Memo |

| Company: | Document Security Systems, Inc. |

BACKGROUND

Document Security Systems, Inc. (“DSS”) is a publicly traded developer and marketer of secure document and product technologies on the New York Stock Exchange. DSS specializes in creating dynamic solutions that protect against fraud and ensure the well-being of consumers worldwide. The Company holds numerous patents for optical deterrent and authentication technologies that provide protection of printed information from unauthorized alterations, scanning and copying.

DSS entered into a Share Exchange Agreement (“SEA”) dated April 21, 2020 with Singapore eDevelopment Ltd. (“SED”), Global BioMedical Pte Ltd. (the “Seller”), DSS, and DSS BioHealth Security Inc. (the “Buyer”). Each SED, Seller, DSS, and Buyer is referred to as a “Party” and they are collectively referred to as the “Parties”.

The Seller owns all of the issued and outstanding shares of common stock of Impact BioMedical Inc. (the “Impact Shares”). SED owns all of the issued and outstanding shares of Seller. Pursuant to the SEA, the Buyer is purchasing the Impact Shares from the Seller, subject to the terms and conditions set forth therein.

As noted within Section 2.02 Purchase Price of the SEA, the aggregate purchase price for the Impact Shares shall be the equivalent of $50 million (the “Agreed Value”) payable via the issuance of 14.5 million newly issued shares of DSS common stock (nominally valued at $3,132,000) (the “DSS Common Shares”) and 46,868 newly issued shares of a new series of perpetual convertible preferred stock1 of DSS with a stated value of $46,868,000 (the “DSS Preferred Shares”). If the Impact Value (as defined within the SEA) is less than the Agreed Value, then the DSS Preferred Shares to be delivered to the Seller at Closing shall be adjusted downwards in accordance with the formula prescribed in the SEA. The valuation of the Impact Value and related adjustment, if any, are addressed separately from this memo.

Pursuant to the terms of the Certificate of Amendment of Certificate of Incorporation of Document Security Systems, Inc., a Beneficial Ownership Limitation was included to restrict the ownership percentage to 19.99% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of share of Common Stock issuable upon conversion of the Shares of Series A Preferred Stock to be converted.

Impact BioMedical Inc. (“Impact”) is committed to both funding research and developing intellectual property portfolio. Global BioLife, Inc. (“Global BioLife”), one of the Company’s subsidiaries and the main operating company of the group, focuses on research in three main areas: (i) development of a universal therapeutic drug platform; (ii) a new sugar substitute; and (iii) a multi-use fragrance.

As disclosed in the Company’s quarterly financial statements filed with the SEC, the Company owned approximately 127 million shares or 10% of SED. Further, the Chairman of DSS, Mr. Heng Fai Ambrose Chan, is the Executive Director and Chief Executive Officer of SED. Prior to the closing of the transaction, Mr. Chan owned approximately 16% of DSS either directly or indirectly and his ownership was greater than 60% of SED either directly or indirectly.

RELEVANT ACCOUNTING GUIDANCE

| ASC 805 | Business Combinations |

| PWC | Business Combinations and Noncontrolling Interests (June 2020) |

| Deloitte | A Roadmap to Accounting for Business Combinations (2019) |

ACCOUNTING ISSUES

Issue 1. Does the acquisition of Impact represent a common-control transaction under the accounting guidance?

Issue 2. Should the acquisition of Impact be accounted in accordance with business combinations or under asset acquisition accounting guidance?

1 The accounting considerations for the perpetual convertible preferred stock is outside of the scope of this memo and addressed elsewhere by the Company.

ACCOUNTING ANALYSIS

Issue 1. Does the acquisition of Impact represent a common-control transaction under the accounting guidance?

A common-control transaction is typically a transfer of net assets or an exchange of equity interests between entities under the control of the same parent. A common-control transaction does not meet the definition of a business combination because there is no change in control over the net assets acquired.

The term “control” has the same meaning as the term “controlling financial interest” in ASC 810-10-15-8, which states:

For legal entities other than limited partnerships, the usual condition for a controlling financial interest is ownership of a majority voting interest, and, therefore, as a general rule ownership by one reporting entity, directly or indirectly, of more than 50 percent of the outstanding voting shares of another entity is a condition pointing toward consolidation. The power to control may also exist with a lesser percentage of ownership, for example, by contract, lease, agreement with other stockholders, or by court decree.

Per ASC 805-50-15-6 The guidance in the Transactions between Entities under Common Control Subsections applies to combinations between entities or businesses under common control. The following are examples of those types of transactions:

| a. | An entity charters a newly formed entity and then transfers some or all of its net assets to that newly chartered entity. |

| b. | A parent transfers the net assets of a wholly owned subsidiary into the parent and liquidates the subsidiary. That transaction is a change in legal organization but not a change in the reporting entity. |

| c. | A parent transfers its controlling interest in several partially owned subsidiaries to a new wholly owned subsidiary. That also is a change in legal organization but not in the reporting entity. |

| d. | A parent exchanges its ownership interests or the net assets of a wholly owned subsidiary for additional shares issued by the parent’s less-than-wholly-owned subsidiary, thereby increasing the parent’s percentage of ownership in the less-than-wholly-owned subsidiary but leaving all of the existing noncontrolling interest outstanding. |

| e. | A parent’s less-than-wholly-owned subsidiary issues its shares in exchange for shares of another subsidiary previously owned by the same parent, and the noncontrolling shareholders are not party to the exchange. That is not a business combination from the perspective of the parent. |

| f. | A limited liability company is formed by combining entities under common control. |

| g. | Two or more not-for-profit entities (NFPs) that are effectively controlled by the same board members transfer their net assets to a new entity, dissolve the former entities, and appoint the same board members to the newly combined entity. |

Although DSS and SED have common ownership interests, neither Mr. Chan (nor any other shareholder) controls all the entities, and therefore the transaction does not represent a common-control transaction. Transfers of net assets or equity interests among entities that have common ownership are not common-control transactions. However, they may be accounted for similarly to common-control transactions if the transfer lacks economic substance. In prepared remarks at the 1997 Annual Conference on Current SEC Developments, Donna Coallier, then professional accounting fellow in the SEC’s Office of the Chief Accountant, addressed transactions between entities with a high degree of common ownership, stating2:

“When there is a transaction between entities with a high degree of common ownership, but that are not under common control, the staff assesses the transaction to determine whether the transaction lacks substance. FTB 85-5 provides an example of a similar assessment in an exchange between a parent and a minority shareholder in one of the parent’s partially owned subsidiaries. Paragraph 6 of FTB 85-5 states, in part:

[I]f the minority interest does not change and if in substance the only assets of the combined entity after the exchange are those of the partially owned subsidiary prior to the exchange, a change in ownership has not taken place, and the exchange should be accounted for based on the carrying amounts of the partially owned subsidiary’s assets and liabilities.

Similarly, in a transfer or exchange between entities with a high degree of common ownership, the staff compares the percentages owned by shareholders in the combined company to the percentages owned in each of the combining companies before the transaction. When the percentages have changed or the owned interests are not in substance the same before and after the transaction, the staff believes a substantive transaction has occurred and has objected to historical cost accounting.”

Per the Deloitte roadmap noted above, FASB Statement 141(R) nullified Technical Bulletin 85-5. However, in the absence of other authoritative guidance, we believe that it continues to provide relevant guidance on assessing whether a transaction lacks economic substance. On the basis of the guidance in paragraph 6 of Technical Bulletin 85-5 and the prepared remarks of the SEC staff, for a transaction between entities with common ownership to be accounted for in a manner consistent with a common-control transaction, entities are expected to have identical owners and the ownership percentages would need to be very similar both before and after the transaction to demonstrate that the transaction lacks economic substance.

2 Note – while this referenced speech is dated, the Company is not aware of any more recent guidance on this topic given by the SEC.

As discussed above, the Beneficial Ownership Limitation provision restrict the ability of the Holder (principally Mr. Chan) from owning greater than 19.99% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of share of Common Stock issuable upon conversion of the Shares of Series A Preferred Stock to be converted.

Therefore, the transaction is deemed to have commercial substance and a change of ownership has occurred.

Issue 2. Should the acquisition of Impact be accounted in accordance with business combinations or under asset acquisition accounting guidance?

ASC 805 reflects the overall principle that when an entity (the acquirer) takes control of another entity (the target), the fair value of the underlying exchange transaction is used to establish a new accounting basis of the acquired entity. Furthermore, because obtaining control leaves the acquirer responsible and accountable for all of the acquiree’s assets, liabilities and operations, the acquirer recognizes and measures the assets acquired and liabilities assumed at their full fair values as of the date control is obtained, regardless of the percentage ownership in the acquiree or how the acquisition was achieved. ASC 805 refers to this method as the Acquisition Method.

Under ASC 805, a business combination is a transaction or other event in which an acquirer obtains control of one or more businesses. The first step in identifying if the Acquisition Method applies to the transaction is the determination of whether the acquired activities and assets constitute a “business”. If the assets acquired are not a business, the reporting entity shall account for the transaction or other event as an asset acquisition.

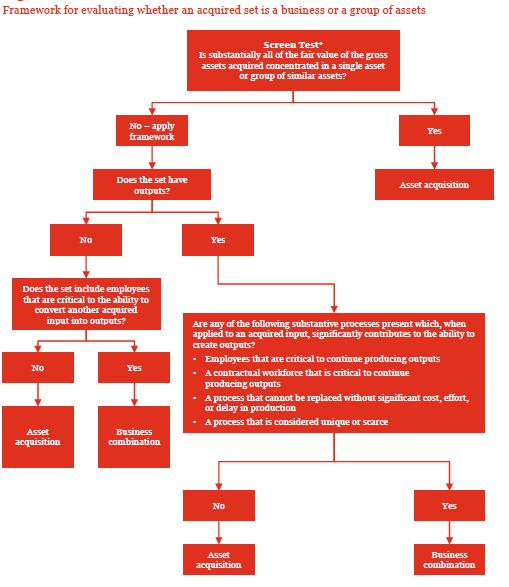

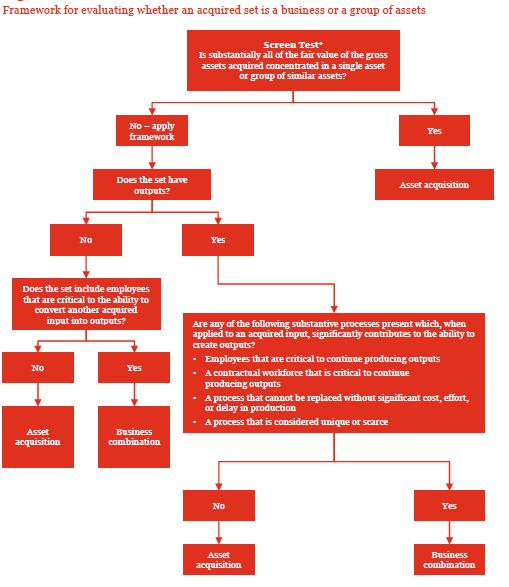

The guidance requires an entity to first evaluate whether substantially all of the fair value of the gross assets acquired (excluding cash and cash equivalents, deferred tax assets, and goodwill resulting from the effects of deferred tax liabilities) are concentrated in a single identifiable asset or a group of similar identifiable assets (see paragraph 805-10-55-5A). If that threshold is met, the set of assets and activities is not a business. If it’s not met, the entity evaluates whether the set meets the definition of a business.

ASC 805 provides an initial screen to determine if substantially all of the fair value of the gross assets acquired is concentrated in a single asset or group of similar assets. If the framework indicates that the acquired set is a business, an entity should be comfortable that the acquired set would not meet the threshold in the screen to be considered an asset acquisition. See below for this framework and screen test:

Extract from PWC guidance (June 2020)

Paragraph 805-10-55-3A defines a business as “an integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs, or other economic benefits directly to investors or other owners, members, or participants.”

As the initial step the Company should determine which elements have been acquired as part of the transaction.

The gross assets of Impact acquired by DSS are not concentrated into a single identifiable asset or a group of similar identifiable assets. Impact’s assets per their June 30, 2020 financial statements include cash and prepaid expenses. Not reflected within the Impact’s balance sheet are costs related to internally developed patents. Refer to Exhibit A – Patents and Projects for a detailed listing of the patents owned by Impact. No employees, other assets, or other activities were transferred as part of the transaction.

Impact’s patents and related research, historical know-how, designs, etc. were included in the transaction and are bifurcated into distinct assets groups based upon the nature of the project. The noted asset groups include: (i) Linebacker Series for Parkinson’s Disease, Huntington’s Disease, Respiratory Syncicial Virus, and COVID-19, (ii) Laetose (Smart Sugar, (iii) 3F as a mosquito avoidant and an anti-microbial, and (iv) Equivir for COVID-19 and Influenza. Management concludes that the asset groups are each separately identifiable intangible assets, collectively of which would be accounted for as a single asset in a business combination. Management then considered whether the asset groups are similar assets. The nature of the assets is similar in that each asset group has a collection of patents and historical know-how in the same major asset class. However, management concludes that each asset group has significantly different risks associated with creating outputs from each asset because each project has different risks associated with developing and marketing the product to customers. The products are intended to treat significantly different medical conditions, and each product has a significantly different potential customer base and expected market and regulatory risks associated with the assets. Thus, substantially all of the fair value of the gross assets acquired is not concentrated in a single identifiable asset or group of similar identifiable assets and further evaluation of whether the set has the minimum requirements to be considered a business.

As the next step, the Company should evaluate whether a set of activities acquired represents a business:

Pursuant to ASC 805-10-55-4 A business consists of inputs and processes applied to those inputs that have the ability to contribute to the creation of outputs. Although businesses usually have outputs, outputs are not required for an integrated set to qualify as a business. The three elements of a business are defined as follows:

a. Input. Any economic resource that creates or has the ability to contribute to the creation of, outputs when one or more processes are applied to it. Examples include long-lived assets (including intangible assets or rights to use long-lived assets), intellectual property, the ability to obtain access to necessary materials or rights, and employees.

b. Process. Any system, standard, protocol, convention, or rule that when applied to an input or inputs, creates or has the ability to contribute to the creation of outputs. Examples include strategic management processes, operational processes, and resource management processes. These processes typically are documented, but the intellectual capacity of an organized workforce having the necessary skills and experience following rules and conventions may provide the necessary processes that are capable of being applied to inputs to create outputs. Accounting, billing, payroll, and other administrative systems typically are not processes used to create outputs.

c. Output. The result of inputs and processes applied to those inputs that provide goods or services to customers, investment income (such as dividends or interest), or other revenues.

Although no direct employees were included in the transaction, the Company has inputs in the form of the intellectual property acquired. Further the Company contracts with third party laboratories to conduct research and development on behalf of the Company, which represent both an input as well as an operational process.

None of the asset groups identified above currently have any outputs, as noted in the June 30, 2020 financial statements, Impact did not generate any revenue. However, the Company is in the process of negotiations with third party manufacturers/distributors to license the Company’s intellectual property for production and distribution, generating licensing revenues to the Company.

Therefore, management evaluated the criteria in paragraph 805-10-55-5D to determine whether the set has both an input and a substantive process that together significantly contribute to the ability to create outputs.

Issue 1 Conclusion: The acquisition of Impact meets the definition of a business with inputs, processes and outputs (described above), and therefore, the transaction should be accounted in accordance with ASC 805: Business Combinations.